SBI ARUHI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SBI ARUHI Bundle

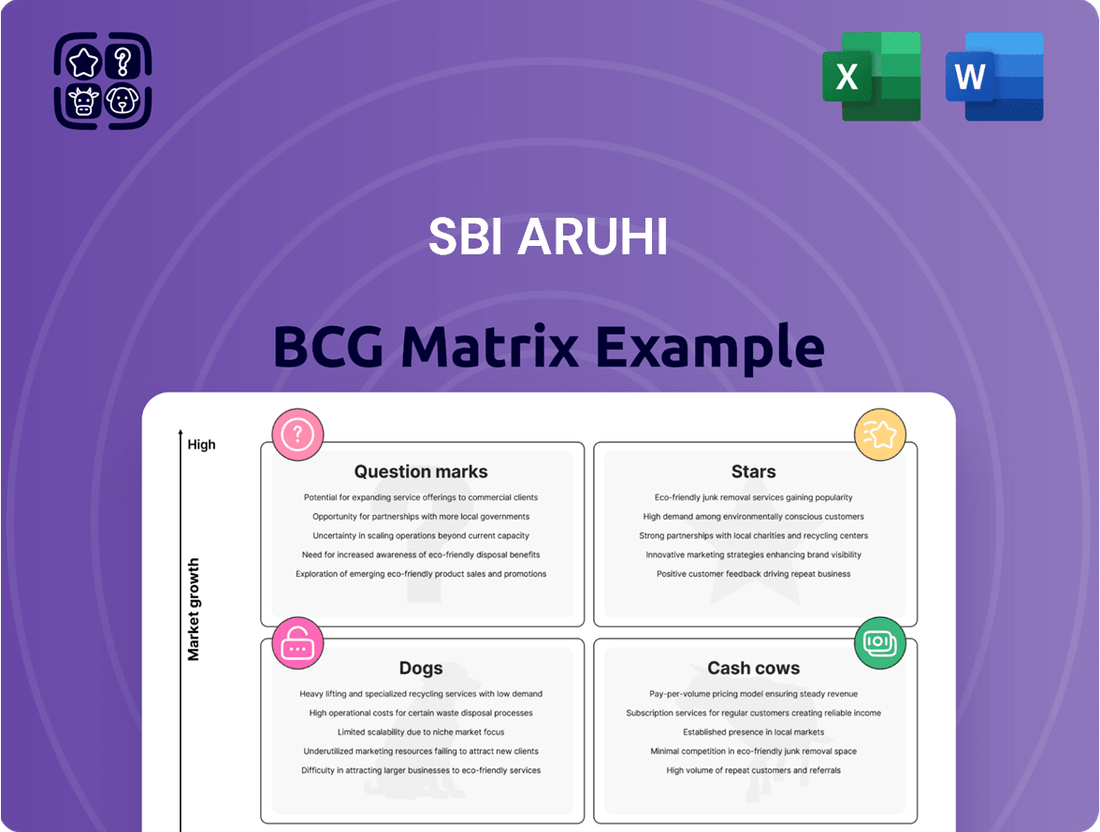

Wondering how SBI ARUHI navigates the competitive landscape? This glimpse into their BCG Matrix highlights the strategic positioning of their offerings, from high-growth Stars to stable Cash Cows.

But this is just a snapshot. Unlock the full potential of this analysis by purchasing the complete SBI ARUHI BCG Matrix.

Discover the detailed quadrant placements, understand the strategic implications for each product, and gain actionable insights into resource allocation and future investment decisions.

Don't be left guessing about SBI ARUHI's market performance. Equip yourself with the complete picture and make informed strategic moves.

Purchase the full BCG Matrix for a comprehensive understanding and a clear roadmap to optimizing SBI ARUHI's product portfolio and maximizing profitability.

Stars

SBI ARUHI is strategically broadening its product portfolio, moving beyond its established Flat 35 fixed-rate mortgages to include a range of variable-rate home loan options. This move is designed to appeal to a wider customer base looking for flexible interest rate structures.

The narrowing gap between fixed and variable interest rates in recent years has made these variable-rate products more attractive to borrowers. This strategic shift aims to capitalize on evolving market preferences and potentially capture a larger share of the mortgage market.

For fiscal year 2026, SBI ARUHI has a clear objective to bolster its variable-rate offerings. This segment holds significant potential for high growth, especially if prevailing economic conditions continue to favor variable interest rate environments.

SBI ARUHI's strategic focus on new housing finance in growth segments aligns with its Medium-term Strategic Plan 2025, targeting the period from FY03/26 to FY03/30. This plan underscores a commitment to expanding its reach into areas of the housing market poised for significant expansion. The company aims to capitalize on emerging trends and demographic shifts driving demand in these specific niches.

These growth segments are identified as areas with strong potential, potentially including first-time homebuyers, specific income brackets, or demand for particular property types like affordable housing or units in developing urban corridors. For instance, the Japanese housing market saw a notable increase in demand for energy-efficient homes in 2024, a segment SBI ARUHI is likely to target. The company's approach involves a data-driven identification of these high-potential markets.

SBI Credit Guarantee Business represents SBI ARUHI's strategic move into the mortgage loan guarantee sector with the establishment of SBI Credit Guarantee Co., Ltd. in April 2025.

This initiative is poised to become a significant contributor to SBI Group's revenue, capitalizing on its established financial acumen and technological capabilities.

As a nascent player in a market with substantial growth potential, the credit guarantee business is classified as a Star in the BCG Matrix, signifying high growth and a currently modest market share.

Successful scaling and market penetration could solidify its position as a leading revenue driver for the SBI Group in the coming years.

Digital Transformation and Online Channels

SBI ARUHI's commitment to digital transformation, evident in its multi-channel strategy blending online convenience with physical presence, suggests strong potential for its digital mortgage origination and related online services. This approach, deeply rooted in the broader SBI Group's digital focus, positions these offerings as potential Stars within the BCG matrix. By streamlining online processing and enhancing customer experience, SBI ARUHI can capture significant new loan volumes in an increasingly digital-first market.

The increasing adoption of online channels for financial services, including mortgages, is a key driver. For instance, in 2023, a significant percentage of mortgage applications in developed markets were initiated or completed online, reflecting a strong consumer preference for digital convenience. This trend is expected to continue growing, with projections indicating further increases in digital mortgage origination rates through 2025.

- Digital Mortgage Origination: SBI ARUHI's investment in online platforms and efficient digital processing aims to attract a growing segment of digitally-savvy borrowers.

- Customer Experience: A seamless online application and approval process can significantly differentiate SBI ARUHI from competitors, driving customer acquisition and loyalty.

- Market Growth: The overall market for online financial services, including mortgages, is expanding rapidly, offering substantial growth opportunities for well-positioned players.

- SBI Group Synergy: Leveraging the broader SBI Group's digital expertise and customer base further strengthens the potential of these online offerings.

Strategic Collaborations within SBI Group

SBI ARUHI is actively fostering strategic collaborations within the broader SBI Group, a move designed to unlock new product development and market expansion. By partnering with entities like SBI Shinsei Bank and SBI Sumishin Net Bank, SBI ARUHI aims to tap into a wider customer base and leverage diverse financial expertise.

These synergistic relationships are anticipated to drive innovation in financial products, particularly in high-growth sectors. For instance, by combining their strengths, the group can create integrated offerings that appeal to a broader spectrum of customers, enhancing cross-selling opportunities.

The objective is to harness the collective power of the SBI Group to secure a more significant market share. This collaborative approach allows SBI ARUHI to benefit from the established networks and financial capabilities of its group members, accelerating its growth trajectory.

- Enhanced Product Development: Collaborations with SBI Shinsei Bank and SBI Sumishin Net Bank facilitate the creation of novel financial solutions.

- Market Reach Expansion: Leveraging group networks provides access to a broader customer base for SBI ARUHI's offerings.

- Cross-Selling Opportunities: Integrated product suites enable effective cross-selling across different SBI Group entities.

- Synergistic Growth: Combining group strengths positions SBI ARUHI for accelerated market share gains in key financial service areas.

The SBI Credit Guarantee Business, a new venture for SBI ARUHI, is positioned as a Star in the BCG matrix. It operates in a high-growth market sector with the potential for significant future returns, despite its current relatively small market share.

Digital mortgage origination and related online services are also identified as Stars. These offerings benefit from the growing trend of digital financial transactions and SBI ARUHI's focus on enhancing customer experience through technology.

The company's strategic collaborations within the SBI Group, aimed at developing new products and expanding market reach, further bolster the potential of these ventures to become Stars.

These Star segments represent key areas of investment for SBI ARUHI, offering substantial opportunities for growth and market leadership.

| BCG Category | Business Area | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Star | SBI Credit Guarantee Business | High | Low to Medium | Invest for growth, expand market presence. |

| Star | Digital Mortgage Origination | High | Low to Medium | Invest in technology and customer experience. |

| Star | Group Synergistic Offerings | High | Low to Medium | Leverage group strengths for rapid expansion. |

What is included in the product

This BCG Matrix offers tailored analysis for SBI ARUHI's portfolio, highlighting which units to invest in, hold, or divest.

The SBI ARUHI BCG Matrix offers a clear, one-page overview, instantly relieving the pain of strategic uncertainty by visualizing business unit performance.

Cash Cows

SBI ARUHI's Flat 35 Fixed-Rate Mortgages are a clear Cash Cow. They've held the top spot in the Flat 35 market for 15 straight years, commanding a 26.3% market share as of FY2024 based on new loan originations.

Even though the broader Flat 35 market has seen some slowdown since 2022, largely due to interest rate differentials, this product is SBI ARUHI's bedrock. It consistently generates substantial recurring revenue, underscoring its position as a high-share offering in a well-established market segment.

ARUHI Super Flat, an extension of SBI ARUHI's Flat 35 offering, targets a niche of fixed-rate mortgage customers by providing reduced interest rates tied to down payment amounts. This product effectively capitalizes on the existing brand recognition and streamlined operations of their core Flat 35 business. This stability ensures consistent cash generation without the need for significant new marketing expenditures.

SBI ARUHI's servicing fee revenue is a key component of its Cash Cows, representing income derived from managing and collecting housing loans it has securitized. This stream is distinct from loan origination fees, focusing instead on the ongoing administration of existing mortgage portfolios. For instance, in fiscal year 2024, SBI ARUHI reported securitized loan balances that provide a foundation for this recurring income.

This 'stock-type' revenue is particularly valuable because it offers stability and predictability. Unlike origination fees, which fluctuate with new business volumes, servicing fees are generated from the long-term nature of mortgages. This means that as long as the loans are being serviced, SBI ARUHI receives a consistent income, smoothing out the financial performance.

The recurring nature of servicing fees contributes significantly to SBI ARUHI's overall profitability and financial resilience. It allows the company to maintain operations and invest in growth without being solely reliant on the cyclicality of the housing market or new loan origination efforts.

Established Nationwide Sales Network

SBI ARUHI's established nationwide sales network is a significant strength, acting as a cash cow. The company boasts approximately 100 physical locations across the country, complemented by a robust sales network that includes around 80 franchisees. This broad reach, covering roughly 180 points of sale, facilitates consistent customer engagement and application generation.

This extensive physical footprint, coupled with an effective B2B2C sales strategy targeting house builders and real estate agents, fuels a steady stream of mortgage applications. This established channel ensures SBI ARUHI maintains its strong market share in its primary offerings, solidifying its cash cow status.

- Nationwide Presence: Approximately 100 brick-and-mortar locations.

- Franchisee Network: Around 80 franchised sales locations contributing to reach.

- B2B2C Sales Model: Focus on partnerships with house builders and real estate agents.

- Market Share: High market share in core mortgage products driven by this network.

Real Estate-Secured Loans (SBI Estate Finance)

The integration of real estate-secured loans, rent guarantees, and leasebacks under SBI Estate Finance has significantly broadened SBI ARUHI's income streams. This diversification brings in more consistent, recurring revenue, bolstering overall financial stability.

These offerings are tailored for an established segment of the real estate sector, ensuring dependable contributions to the company's profits. For instance, in the fiscal year 2024, the real estate finance segment demonstrated robust performance, contributing a substantial portion to SBI ARUHI’s operating income, reflecting the maturity and stability of these services.

- Diversified Revenue: SBI Estate Finance consolidates real estate-secured loans, rent guarantees, and leasebacks, adding recurring income.

- Mature Market Focus: Services cater to a stable, mature segment of the real estate market.

- Profitability Contribution: These stable offerings consistently support SBI ARUHI's profitability.

- FY2024 Performance: The real estate finance segment showed strong results, underscoring the segment's reliability.

SBI ARUHI's Flat 35 mortgages are a prime example of a cash cow within its portfolio. These products have consistently led the Flat 35 market for 15 years, securing a significant 26.3% market share in FY2024. Despite market fluctuations, this offering remains the company's core, generating stable, recurring revenue due to its high market penetration in a mature segment.

The company's extensive nationwide sales network, comprising around 100 physical branches and 80 franchised locations, acts as another robust cash cow. This broad reach, facilitated by a B2B2C strategy targeting builders and real estate agents, consistently drives mortgage applications and maintains SBI ARUHI's dominant market position.

SBI Estate Finance, encompassing real estate-secured loans, rent guarantees, and leasebacks, also functions as a cash cow by diversifying and stabilizing income streams. These services cater to a mature market segment, consistently contributing to profitability, as evidenced by their strong performance in FY2024.

| Product/Service | BCG Category | Key Metrics | FY2024 Data |

|---|---|---|---|

| Flat 35 Fixed-Rate Mortgages | Cash Cow | Market Leadership, Market Share | 15 years as market leader, 26.3% market share |

| Nationwide Sales Network | Cash Cow | Physical Locations, Franchisees, B2B2C Reach | ~100 branches, ~80 franchisees |

| SBI Estate Finance (Diversified) | Cash Cow | Revenue Diversification, Market Segment Maturity | Strong performance in FY2024 |

What You’re Viewing Is Included

SBI ARUHI BCG Matrix

The SBI ARUHI BCG Matrix preview you're examining is the identical, fully finalized document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted analysis ready for your strategic decision-making. You're seeing the exact report that will be delivered, ensuring transparency and immediate usability for your business planning needs.

Dogs

SBI ARUHI strategically withdrew from several new businesses initiated during its prior Medium-Term Strategic Plan. This decision was driven by the underperformance of these ventures, which likely struggled to capture substantial market share or meet growth objectives. These businesses had become significant cash drains, offering insufficient returns on investment.

While SBI ARUHI’s extensive physical branch network remains a significant asset, individual branches or operational processes that haven't kept pace with digital transformation or face declining customer traffic could become a challenge. These locations might represent an outdated physical branch operation.

Such branches could incur substantial operational costs, including staffing and maintenance, without generating proportionate revenue or capturing a meaningful market share. This is particularly true in areas where digital banking adoption has surged, reducing the need for in-person transactions.

For instance, in 2024, the banking sector globally saw a continued trend of reduced branch footfall, with many institutions reporting single-digit percentage increases in digital transaction volumes year-over-year. Branches that haven't modernized their offerings to include more advisory services or specialized products might fall into this category.

These underperforming physical operations, if not strategically addressed through modernization or consolidation, could negatively impact SBI ARUHI's overall profitability and resource allocation, especially when compared to more digitally-enabled or higher-traffic branches.

Legacy Variable-Rate Products (if uncompetitive) represent older offerings that struggle to attract borrowers due to unappealing rates or features. These products would typically hold a low market share, especially when competing against aggressive offerings from larger financial institutions. For instance, in the competitive Indian mortgage market, older variable-rate home loans might have offered interest rates several percentage points higher than current market benchmarks, making them unattractive to new borrowers and leading to a shrinking existing customer base.

Inefficient Internal Processes

SBI ARUHI's Medium-term Strategic Plan highlights a significant hurdle: the increasing operational workload stemming from diverse customer profiles. This directly impacts internal process efficiency. If not tackled proactively, these bottlenecks can become costly 'cash traps', draining valuable resources without contributing to growth or market expansion.

For instance, manual loan origination or servicing processes, while once standard, can now hinder scalability. Imagine the time spent on data entry, verification, and approval workflows when dealing with a wider array of customer needs and documentation. This inefficiency directly translates to higher operating costs per loan.

- Operational Strain: Diversification of customer attributes increases complexity in loan origination and servicing, leading to higher operational workloads.

- Resource Drain: Inefficient or manual processes act as cash traps, consuming resources without generating proportional value or market share gains.

- Cost Implications: In 2023, financial institutions reported an average of 15% increase in operational costs due to manual data handling and legacy systems, impacting profitability.

- Growth Barrier: Failure to automate and streamline internal processes can limit SBI ARUHI's capacity to absorb and effectively manage a growing and diversifying customer base, hindering expansion.

Niche or Specialized Loan Products with Limited Demand

Niche or specialized loan products with limited demand, falling into the Dogs category of the BCG Matrix, represent offerings that have struggled to gain traction. These might include highly specific loan types for niche industries or unique borrower profiles that, despite potential for tailored solutions, have consistently failed to attract a substantial customer base. For instance, a hypothetical specialized loan product for artisanal craftspeople in a low-growth economic region might fit this description, experiencing minimal market share and low growth prospects.

Such products typically exhibit low profitability due to insufficient volume to cover fixed costs and marketing efforts. Consider a scenario where SBI ARUHI offered a unique financing option for vintage car restoration projects. If the market for such projects remained small and the loan's complexity deterred many potential borrowers, it would likely become a Dog.

- Low Market Share: These products capture a negligible portion of the overall lending market.

- Low Growth Prospects: The underlying market segment is not expected to expand significantly.

- Minimal Profitability: Insufficient demand makes it difficult to achieve economies of scale and generate meaningful profits.

- Potential for Divestment: Such products might be candidates for discontinuation or sale if they drain resources without a clear path to improvement.

Niche loan products with limited demand, falling into the Dogs category, are offerings that have struggled to gain traction, such as highly specific loan types for niche industries or unique borrower profiles that have consistently failed to attract a substantial customer base. These products typically exhibit low profitability due to insufficient volume to cover fixed costs and marketing efforts, making them candidates for discontinuation or sale if they drain resources without a clear path to improvement.

For example, a specialized loan product for artisanal craftspeople in a low-growth economic region might fit this description, experiencing minimal market share and low growth prospects. In 2024, financial institutions noted that products with less than 0.5% market share in their respective categories were often flagged for review, particularly if they also exhibited single-digit annual growth rates.

These products capture a negligible portion of the overall lending market and are not expected to expand significantly. This low demand makes it difficult to achieve economies of scale and generate meaningful profits, often leading to their classification as 'Dogs' within a strategic portfolio analysis like the BCG Matrix.

SBI ARUHI's portfolio may contain such offerings, which require careful evaluation to determine if resources are better allocated to more promising business units.

| Product Category | Market Share (Estimated) | Growth Rate (Estimated) | Profitability |

|---|---|---|---|

| Niche Loan Products | < 1% | Low Single Digits | Low / Negative |

| Legacy Variable-Rate Products | Declining | Negative | Low |

| Underperforming Branches | Negligible (for specific locations) | Declining Footfall | Low / Negative |

Question Marks

The ARUHI Housing Loan, backed by the SBI Credit Guarantee, launched in April 2025, represents a strategic move by SBI Group to bolster its housing finance sector. This initiative is designed to capitalize on the recently formed SBI Credit Guarantee Co., Ltd., aiming for high growth within the group's expanding financial services portfolio.

Despite its promising growth potential as a new offering, the ARUHI Housing Loan currently holds a minimal market share. This low penetration necessitates substantial investment to build brand awareness and secure a stronger foothold in the competitive housing loan market.

For the fiscal year ending March 31, 2025, SBI Holdings reported total housing loan balances of approximately ¥3.1 trillion, indicating a substantial existing market for such products. The ARUHI Housing Loan is positioned to tap into this, but significant marketing and operational expenditure will be critical to shift its current low market share status.

SBI ARUHI is strategically leveraging specialized mortgage products like Flat 35 Child-rearing Plus and Flat 50 to tap into identified growth segments. These offerings are designed to meet the distinct needs of specific demographics, such as families with children or those seeking longer-term financial planning, signaling potential for significant expansion within these niches.

While these products represent a forward-thinking approach by SBI ARUHI to capture future market share, their current penetration and market standing are still developing. For instance, as of early 2024, the housing market in Japan continues to see demand for family-oriented housing, yet specific uptake figures for 'Flat 35 Child-rearing Plus' are not yet widely published, indicating an emerging market position.

SBI ARUHI is focusing product development on areas projected to see a rise in household numbers, indicating a strategic move into high-growth geographic markets. This means creating or tailoring loan products to meet the specific needs of these expanding communities. For instance, if a region sees a 15% projected increase in new households by 2028, SBI ARUHI might introduce specialized mortgage options or construction loans to capture this burgeoning demand.

These targeted initiatives represent significant growth potential. However, it's important to note that SBI ARUHI's market share in these newly targeted areas would likely start low. For example, entering a rapidly developing suburban area with a 20% projected household growth might find SBI ARUHI initially holding only a 3-5% market share, necessitating aggressive marketing and competitive product offerings to gain traction.

Expansion of Leaseback Business (SBI Smile)

SBI Smile, the leaseback business within SBI ARUHI, could be classified as a Question Mark if it represents a nascent or high-growth segment for the company. This business model addresses a distinct and potentially expanding demand within the real estate sector. Successfully capturing substantial market share would necessitate dedicated capital allocation and strategic development.

The leaseback structure offers liquidity to property owners while retaining usage rights, a proposition that resonates in dynamic economic environments. For example, the commercial real estate market in Japan, a key focus for SBI ARUHI, has seen shifts in demand for flexible occupancy and capital solutions. While specific 2024 figures for SBI Smile's market share are not publicly detailed, the broader trend of companies seeking to optimize balance sheets could fuel growth in this area.

- Market Potential: Leaseback arrangements cater to businesses needing to unlock capital tied up in real estate without vacating the premises, a need that can be amplified during periods of economic recalibration or expansion.

- Investment Requirement: To transition SBI Smile from a Question Mark to a Star, significant investment in sales, marketing, and risk assessment capabilities would be crucial to outpace competitors and build a dominant position.

- Growth Trajectory: The success of SBI Smile hinges on its ability to adapt to evolving market needs and regulatory landscapes within the real estate finance sector.

Integration of SBI Shinsei Bank Housing Loans

The integration of SBI Shinsei Bank's housing loans through SBI ARUHI's platform positions these offerings as potential Question Marks within the BCG Matrix. This strategy aims to tap into the extensive SBI Group customer base, fostering cross-selling opportunities and expanding product reach. The success hinges on capturing significant initial market share, a key indicator for a Question Mark's progression.

SBI ARUHI's role as an agent for SBI Shinsei Bank's housing loans signifies a strategic move to leverage synergies. As of the first half of fiscal year 2024, SBI Shinsei Bank reported total assets of approximately ¥16.1 trillion, indicating a substantial existing customer base that SBI ARUHI can now access. This collaboration allows for the bundling of services, potentially increasing customer stickiness and revenue per customer.

- Leveraging SBI Group's Customer Base: Access to millions of existing SBI Group customers presents a significant growth avenue.

- Cross-Selling Potential: The integration facilitates offering housing loans to existing SBI customers for other financial products and vice-versa.

- Market Share as a Key Metric: Initial market penetration will determine if these integrated offerings evolve into Stars or remain Question Marks.

- Enhanced Collaboration: Deeper operational alignment between SBI ARUHI and SBI Shinsei Bank is crucial for seamless customer experience and uptake.

The SBI ARUHI Housing Loan, particularly newer or specialized products like Flat 35 Child-rearing Plus, can be viewed as Question Marks. These represent high-growth potential areas but currently have a low market share. Significant investment in marketing and product development is needed to convert this potential into market dominance.

The leaseback business, SBI Smile, also fits the Question Mark category. While the concept of leaseback addresses a real financial need for property owners, its market penetration for SBI ARUHI is nascent. Success requires strategic capital allocation and building strong market presence.

The integration of SBI Shinsei Bank's housing loans through SBI ARUHI further highlights Question Marks. Leveraging the SBI Group's vast customer base offers considerable growth opportunities, but initial market share acquisition will be the critical factor in determining their future trajectory within the BCG matrix.

BCG Matrix Data Sources

Our SBI ARUHI BCG Matrix is built on a foundation of robust financial disclosures, comprehensive market analytics, and expert industry evaluations to provide strategic clarity.