SBI ARUHI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SBI ARUHI Bundle

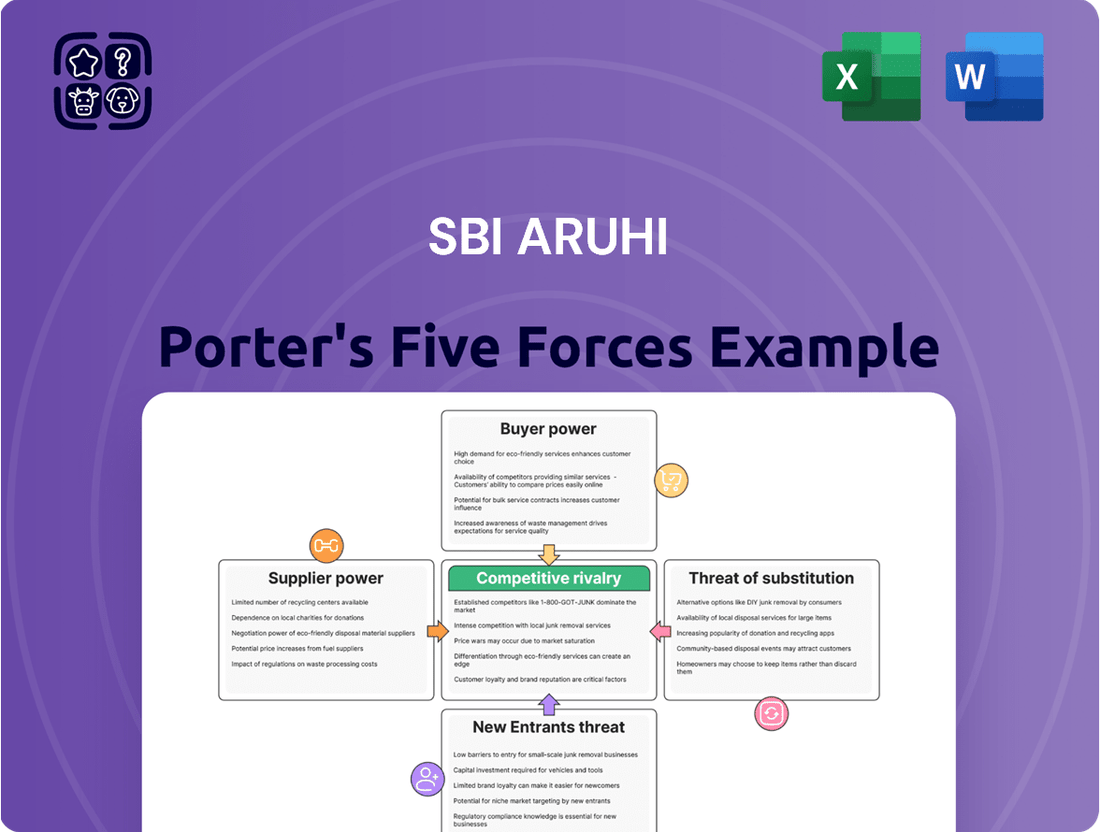

SBI ARUHI operates in a landscape shaped by several powerful forces. Understanding the intensity of buyer bargaining power, the threat of new entrants, and the influence of suppliers is crucial for navigating this market. Furthermore, the availability of substitutes and the level of rivalry among existing competitors significantly impact SBI ARUHI's strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore SBI ARUHI’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

SBI ARUHI's reliance on capital markets and financial institutions for mortgage funding means these suppliers hold significant bargaining power. The company sources funds through securitization, bond issuances, and bank loans, making its access to capital crucial. For instance, in fiscal year 2024, SBI ARUHI's total liabilities stood at approximately ¥4.1 trillion, indicating a substantial need for external financing.

The concentration or diversification of these capital sources directly impacts their leverage. If a few large financial institutions dominate SBI ARUHI's funding, they can more easily dictate terms, such as higher interest rates or stricter collateral requirements. Conversely, a broader, more diversified base of lenders and investors would dilute the bargaining power of any single supplier.

The bargaining power of technology and software providers for SBI ARUHI is influenced by the uniqueness of their offerings and the associated switching costs. Companies providing specialized loan origination systems or proprietary digital banking platforms can wield significant influence if few alternatives exist. For instance, a unique AI-driven underwriting platform that demonstrably improves loan processing efficiency would be a strong differentiator, increasing supplier leverage.

High switching costs in the IT infrastructure realm, such as migrating vast amounts of customer data or re-integrating complex legacy systems, further empower these suppliers. If SBI ARUHI relies on a particular cloud service provider or a core banking software that is deeply embedded in its operations, changing vendors becomes a costly and time-consuming endeavor, thereby strengthening the supplier's hand.

The number of viable alternative providers also plays a crucial role. A market with numerous, comparable software solutions diminishes supplier power. Conversely, if the market for advanced mortgage technology or specialized fintech solutions is concentrated, with only a few key players, SBI ARUHI faces a more challenging negotiation environment. In 2024, the fintech market continued to see consolidation, potentially increasing the bargaining power of dominant platform providers.

Data and information providers, such as credit bureaus and property valuation firms, wield significant bargaining power over SBI ARUHI. Their specialized data is crucial for risk assessment and loan approvals, making it difficult for SBI ARUHI to substitute these services easily. For instance, in 2024, the reliance on established credit scoring models, which are often proprietary and maintained by a limited number of entities, grants these suppliers considerable leverage.

The exclusivity and proprietary nature of much of this market intelligence mean that SBI ARUHI has limited alternatives, thereby strengthening the suppliers' negotiating position. The cost of accessing and integrating data from multiple sources can also be prohibitive, further cementing the power of existing providers in 2024. This dependence translates into higher costs for SBI ARUHI, impacting its operational expenses.

Human Capital and Specialized Talent

The bargaining power of suppliers, particularly concerning human capital and specialized talent in Japan's financial and mortgage sectors, presents a nuanced challenge for SBI ARUHI. The demand for skilled professionals such as loan officers, financial analysts, and IT specialists remains robust. In 2024, Japan continued to grapple with an aging population and a shrinking workforce, exacerbating talent scarcity across many industries, including finance.

This scarcity directly impacts SBI ARUHI's operational costs and efficiency. Competitive compensation packages are often necessary to attract and retain top talent, driving up labor expenses. For instance, reports from early 2024 indicated that the average salary for a financial analyst in Tokyo saw a noticeable increase compared to the previous year, reflecting this heightened competition.

- Talent Scarcity: Japan's demographic trends contribute to a limited pool of experienced financial professionals.

- Competitive Compensation: To secure specialized skills, companies like SBI ARUHI face pressure to offer higher salaries and attractive benefits.

- Impact on Costs: Increased labor costs can affect SBI ARUHI's profitability and its ability to invest in other areas of the business.

- Operational Efficiency: A shortage of skilled IT specialists, for example, could hinder the development and maintenance of crucial digital platforms, impacting overall efficiency.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers, such as specialized legal firms and consulting agencies, hold significant bargaining power over SBI ARUHI. These entities offer critical expertise in navigating Japan's intricate financial regulatory landscape, a highly specialized field. Their influence stems from the essential nature of their services, which are vital for SBI ARUHI's continued operation and adherence to laws like the Banking Act and Financial Instruments and Exchange Act. The complexity and constant evolution of these regulations mean that SBI ARUHI often relies heavily on these external specialists.

The bargaining power of these providers is amplified by the limited number of firms possessing deep knowledge of Japan's financial compliance requirements. For instance, in 2024, the number of specialized legal practices focusing exclusively on financial regulation remains concentrated. This specialization creates a barrier to entry, allowing these providers to command higher fees and dictate terms. SBI ARUHI's need for continuous compliance updates and potential audits means they cannot easily switch providers without incurring substantial transition costs and potential regulatory risks.

- Specialized Expertise: Providers possess niche knowledge crucial for navigating Japan's complex financial laws.

- Regulatory Dependence: SBI ARUHI's operations are contingent on compliance, making these services indispensable.

- Limited Alternatives: The market for highly specialized regulatory consulting is often concentrated, reducing provider options.

- High Switching Costs: Shifting between compliance providers can be costly and introduce operational risks.

SBI ARUHI's suppliers, particularly capital providers and technology vendors, exert considerable influence due to the specialized nature of their offerings and concentration in certain markets. Access to funding is critical, with total liabilities reaching ¥4.1 trillion in fiscal year 2024, highlighting dependence on financial institutions. Similarly, reliance on proprietary software and data providers, coupled with high switching costs, strengthens their bargaining position.

What is included in the product

This analysis unpacks the competitive intensity within the housing loan market for SBI ARUHI, examining buyer and supplier power, the threat of new entrants and substitutes, and the bargaining power of its rivals.

Effortlessly identify and address competitive threats with a visual breakdown of industry rivalry, supplier power, buyer power, threat of new entrants, and threat of substitutes.

Customers Bargaining Power

The bargaining power of customers, particularly regarding the availability of alternative mortgage providers, is a significant factor for SBI ARUHI in Japan. Borrowers have a relatively high degree of choice, with numerous banks, credit unions, and specialized housing loan companies competing for their business. This means customers can readily compare rates, terms, and services from various institutions.

In 2024, the Japanese mortgage market remained robust, with many financial institutions actively seeking new borrowers. For instance, major banks like Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group, alongside regional banks and government-backed institutions, offer competitive housing loan products. This widespread availability of alternatives empowers individual customers to switch providers if they find more favorable terms elsewhere, directly influencing SBI ARUHI's pricing and service strategies.

Customer price sensitivity to interest rates significantly impacts SBI ARUHI's bargaining power of customers. This means that even small shifts in mortgage interest rates or associated fees can strongly influence a customer's decision when selecting a lender.

Given the long-term commitment of a mortgage, even a seemingly minor difference in interest rates can lead to substantial variations in the total amount repaid over the loan's life. For instance, a quarter-point difference on a 30-year mortgage can amount to tens of thousands of dollars in extra payments.

This sensitivity compels customers to actively compare offers and seek out the most favorable terms available in the market. In 2024, with interest rate fluctuations being a key concern for homebuyers, this drive for optimal rates intensifies customer leverage.

Therefore, SBI ARUHI must remain competitive with its interest rate offerings to mitigate the substantial bargaining power customers wield due to their sensitivity to these financial variables.

For potential borrowers seeking home loans, the initial application process with multiple lenders involves minimal financial outlay and effort. This ease of comparison shopping, often facilitated by online platforms and readily available information, significantly empowers customers.

This low barrier to entry means individuals can easily explore and compare offers from various financial institutions, including SBI ARUHI. In 2024, the digital transformation in banking has further streamlined this process, making it even simpler for customers to gather quotes and terms from different providers without incurring substantial costs.

Consequently, customers can leverage this ability to negotiate more favorable interest rates, loan terms, and fees. Their bargaining power is amplified as lenders compete to attract these informed and easily switchable borrowers, directly impacting the profitability of loan origination.

Access to Market Information and Comparison Tools

Customers today have unprecedented access to market information, significantly boosting their bargaining power. Online aggregators and financial advisory platforms allow easy comparison of mortgage products, interest rates, and loan terms. This transparency directly challenges information asymmetry, a traditional advantage for lenders.

In 2024, the proliferation of digital comparison tools means a prospective borrower can easily vet multiple offers. For instance, a quick search on a leading mortgage comparison site in mid-2024 revealed a variance of over 0.5% in average interest rates for similar loan products across different lenders. This level of readily available data empowers customers to negotiate more favorable terms with SBI ARUHI.

- Enhanced Transparency: Online platforms make mortgage product details readily accessible.

- Easy Comparison: Customers can swiftly compare rates and terms from various providers.

- Reduced Information Asymmetry: Equalized information levels empower consumer negotiation.

- Increased Negotiation Leverage: Customers can demand better deals based on market offerings.

Standardization of Mortgage Products

The standardization of certain mortgage products, such as Japan's Flat 35, significantly shifts bargaining power towards customers. When offerings from different lenders become very similar in their core features, consumers naturally focus on other differentiators like price and the quality of service they receive.

This heightened focus on price and service means customers can more readily compare options and demand more favorable terms from lenders. For instance, with Flat 35, which has a government-backed framework, the underlying loan structure is largely uniform, intensifying competition on interest rates and associated fees. In 2024, the Bank of Japan's monetary policy continued to influence mortgage rates, making price a critical factor for borrowers evaluating standardized products.

- Standardization reduces product differentiation.

- Customers shift focus to price and service quality.

- Increased price sensitivity empowers customers.

- Lenders compete more intensely on terms and fees.

Customers in Japan, particularly those seeking mortgages, possess considerable bargaining power due to the competitive landscape and ease of information access. This power is amplified by their sensitivity to interest rates and the low cost of switching providers, forcing lenders like SBI ARUHI to offer attractive terms.

In 2024, the Japanese mortgage market saw continued competition among a wide array of financial institutions. This environment allows borrowers to easily compare offers, with readily available data on interest rates and loan terms facilitating informed decisions. For example, in mid-2024, comparison websites highlighted average interest rate differences of over 0.5% for similar mortgage products, directly empowering customers to negotiate better deals.

| Factor | Impact on SBI ARUHI | 2024 Context |

| Availability of Alternatives | High customer leverage | Numerous banks, credit unions, and specialized lenders actively competing. |

| Customer Price Sensitivity | Directly influences pricing strategy | Even minor interest rate differences lead to significant long-term cost variations for borrowers. |

| Low Switching Costs | Amplifies negotiation power | Easy comparison via online platforms and minimal initial outlay for applications. |

| Information Transparency | Reduces lender advantage | Online aggregators provide easy access to product details, rates, and terms. |

Preview Before You Purchase

SBI ARUHI Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of SBI ARUHI meticulously details the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Each force is thoroughly analyzed, providing actionable insights into SBI ARUHI's strategic positioning and potential vulnerabilities. You’re previewing the final version—precisely the same document that will be available to you instantly after buying, offering a complete understanding of the market dynamics affecting SBI ARUHI.

Rivalry Among Competitors

The Japanese housing loan market is characterized by a significant number of diverse competitors vying for market share. This landscape includes major commercial banks like Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group, which leverage extensive branch networks and established customer bases.

Alongside these giants, regional banks play a crucial role, often catering to local communities and offering more personalized services. For instance, as of early 2024, over 300 regional financial institutions operate across Japan, many of which actively participate in the mortgage sector.

Furthermore, specialized mortgage lenders and credit unions add another layer of competition. Companies like SBI ARUHI Corporation itself are key players in this specialized segment, focusing exclusively on home loans and often innovating with digital platforms and competitive rates. This broad spectrum of institutions, from national behemoths to niche providers, intensifies rivalry for every new mortgage application.

The Japanese housing loan market, a key area for SBI ARUHI, is characterized by a moderate growth rate, indicating a relatively mature landscape. In 2024, while precise figures for overall market expansion are still being finalized, trends suggest a steady but not explosive increase in demand for home financing. This maturity means that competition among lenders is indeed intense, often resembling a zero-sum game where market share gains are achieved by directly attracting customers from competitors rather than through broad market expansion.

SBI ARUHI's competitive edge in the mortgage market, particularly with its Flat 35 offerings, hinges on product and service differentiation. While many lenders offer similar basic mortgage products, SBI ARUHI aims to stand out through specialized services and potentially unique features within the Flat 35 framework, a government-backed scheme known for its fixed interest rates.

The ease with which competitors can replicate SBI ARUHI's offerings is a key consideration. If SBI ARUHI's differentiation is primarily based on service quality, such as faster processing times or more personalized customer support, these are harder for rivals to copy quickly. However, if the differentiation lies solely in the specific terms of their Flat 35 products, competitors may find it easier to match these features.

As of early 2024, the Japanese mortgage market remains competitive, with major banks and specialized housing loan providers vying for market share. SBI ARUHI's ability to attract and retain customers will depend on its continuous innovation in product features and service delivery that go beyond the standard Flat 35 offering. For instance, integrating digital tools for a smoother application process or offering flexible repayment options could create a distinct advantage.

The financial performance of SBI ARUHI in 2023 and projections for 2024 will reflect how well its differentiation strategy is working. A growing loan portfolio or an increase in market share for its specialized products would indicate successful differentiation. Competitors' responses, such as launching similar niche products or enhancing their customer service, will also shape the competitive landscape.

Price Competition and Interest Rate Wars

SBI ARUHI faces intense competitive rivalry, particularly through price competition and interest rate wars. Lenders frequently adjust their interest rates and fees to win over customers, leading to an environment where aggressive pricing can significantly squeeze profit margins. This forces SBI ARUHI to constantly monitor and react to rivals' pricing strategies to remain competitive.

The intensity of this price-based competition can lead to a race to the bottom, where the lowest interest rates and fees become the primary differentiator. For instance, in early 2024, reports indicated that several mortgage lenders were offering rates as low as 3.0% for certain loan products, a clear indication of aggressive pricing to capture market share. This environment demands that SBI ARUHI maintain operational efficiency and a strong value proposition beyond just price.

- Aggressive Pricing Strategies: Rivals frequently lower interest rates or fees to attract new borrowers.

- Margin Erosion: Such tactics can significantly reduce profit margins for all players in the market.

- Competitive Response: SBI ARUHI must be prepared to adjust its own pricing to avoid losing market share.

- Market Dynamics: The housing finance sector in 2024 continued to see fluctuations in lending rates, influenced by central bank policies and market demand, making price a critical competitive factor.

Marketing and Brand Strength

In Japan's mortgage market, brand recognition and robust marketing are crucial for attracting and retaining customers, significantly influencing competitive rivalry. SBI ARUHI faces established players with strong reputations, making differentiation and client acquisition a persistent challenge. For instance, in 2024, major banks like Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group continue to leverage decades of brand trust built through extensive branch networks and consistent marketing campaigns, often highlighting stability and long-term customer relationships.

The intensity of marketing efforts directly impacts SBI ARUHI's ability to stand out. Competitors frequently invest heavily in digital advertising, celebrity endorsements, and promotional offers, creating a high bar for new entrants or less established brands. This necessitates significant expenditure on marketing to build awareness and convey value propositions effectively.

Key aspects of marketing and brand strength influencing competition include:

- Brand Reputation: Long-standing institutions often benefit from ingrained customer loyalty and perceived reliability, making it harder for newer entities to gain traction.

- Marketing Spend: The substantial budgets allocated by major financial institutions for advertising and promotional activities create a high barrier to entry for customer acquisition.

- Digital Presence: Competitors actively engage customers through sophisticated online platforms and targeted digital marketing, requiring SBI ARUHI to match this to remain competitive.

- Customer Trust: Building trust in a market where financial security is paramount often relies on a proven track record and visible, consistent brand messaging.

The competitive rivalry in Japan's housing loan market is fierce, with numerous players, including large commercial banks, regional institutions, and specialized lenders like SBI ARUHI, all vying for customers. This intense competition often manifests as aggressive pricing, with lenders frequently adjusting interest rates, as seen with rates as low as 3.0% being offered by some in early 2024. This price-driven environment puts pressure on profit margins and compels SBI ARUHI to focus on operational efficiency and a value proposition that extends beyond just cost. Furthermore, established brands with significant marketing budgets, such as MUFG and SMBC, leverage their long-standing reputations and extensive networks, creating a challenge for SBI ARUHI in acquiring new clients and necessitating robust marketing strategies to build brand awareness and trust.

| Competitor Type | Key Players | Competitive Tactics | Impact on SBI ARUHI |

|---|---|---|---|

| Major Commercial Banks | MUFG, SMBC | Extensive branch networks, brand trust, aggressive marketing | High barrier to customer acquisition, need for strong brand differentiation |

| Regional Banks | Over 300 institutions (as of early 2024) | Local community focus, personalized service | Fragmented competition, opportunity for niche market focus |

| Specialized Lenders | SBI ARUHI, others | Digital platforms, competitive rates, product innovation (e.g., Flat 35) | Direct competition on product features and pricing, need for continuous innovation |

SSubstitutes Threaten

Renting presents a significant substitute for homeownership, particularly for those considering a mortgage in Japan. The attractiveness of long-term renting is influenced by factors such as the relative cost compared to mortgage payments, including property taxes and maintenance, and the flexibility it offers. For instance, in 2024, while mortgage rates remained relatively stable, the upfront costs associated with purchasing a home, such as down payments and various fees, can be substantial deterrents for many potential buyers.

Housing market trends in major Japanese cities continue to see high property values, making the prospect of homeownership financially challenging for a segment of the population. This can make the predictable monthly expense of rent a more appealing option than the long-term financial commitment and potential market fluctuations associated with owning a home. Lifestyle preferences also play a role; individuals prioritizing mobility for career changes or personal reasons may find renting a more suitable arrangement than being tied to a specific property.

The threat of substitutes for housing finance from personal loans or unsecured credit is relatively low but present for specific, smaller needs. Individuals might opt for personal loans, which often carry interest rates ranging from 10% to 25% or even higher, to fund minor home improvements or furnishing costs instead of a formal home loan. For instance, a personal loan of ₹5 lakh for renovations could have a significantly higher EMI compared to a proportional amount secured by a mortgage.

While these unsecured options offer speed and less stringent documentation, their higher cost and limited loan amounts make them unsuitable for substantial housing purchases or major construction. The average personal loan size in India, as of late 2023, typically falls well below the median home price, underscoring their role as a substitute for smaller, ancillary housing expenses rather than a direct replacement for mortgages.

The increasing popularity of equity release schemes and reverse mortgages presents a significant threat of substitutes for SBI ARUHI. These products allow existing homeowners, especially seniors, to access the equity in their homes without selling them, effectively bypassing the need for traditional forward mortgages. This trend could shrink the pool of potential new mortgage applicants, particularly in the 2024 market where such financial solutions are gaining traction.

For instance, in the UK, the equity release market saw substantial growth, with lenders advancing an estimated £6.3 billion to homeowners in 2023, a figure projected to continue rising. This indicates a strong consumer shift towards leveraging home equity as a financial resource, potentially diverting demand away from conventional mortgage products that SBI ARUHI offers.

Direct Financing from Developers or Private Lenders

The threat of substitutes for SBI ARUHI's mortgage services includes direct financing offered by property developers or private lenders. These alternatives allow buyers to bypass traditional financial institutions, potentially offering quicker approvals and more flexible terms, especially for those who might not qualify for standard bank loans.

In Japan, while traditional bank mortgages remain dominant, developer financing schemes, particularly for new condominium projects, have become more prevalent. These can involve developers partnering with specialized financial firms or using their own capital to offer attractive loan packages, sometimes with lower initial interest rates or reduced documentation requirements.

The terms of these direct financing options vary widely. Some may focus on short-term bridging loans or offer tailored repayment schedules. For instance, in 2024, certain new developments in Tokyo offered buyer incentives that included subsidized interest rates for the first few years, directly competing with SBI ARUHI's standard mortgage products.

The prevalence of these substitutes is influenced by market conditions and demand. During periods of high property demand or when credit conditions tighten for traditional banks, developer-backed or private lending solutions tend to see increased adoption. This competitive pressure necessitates that SBI ARUHI continually reassess its product offerings and customer service to remain competitive.

- Developer Financing: Property developers sometimes provide direct loans to buyers, often for new builds.

- Private Lenders: Non-bank financial institutions or private investors may offer mortgage-like products.

- Terms Variation: These substitutes can feature different interest rates, repayment structures, and eligibility criteria compared to traditional mortgages.

- Market Influence: Their attractiveness increases during property booms or when traditional lending becomes more restrictive.

Government-backed Housing Support Programs

Government-backed housing support programs can indeed present a threat of substitutes for traditional commercial mortgage providers like SBI ARUHI. These initiatives, designed to make homeownership more accessible, can reduce the demand for market-rate financing. For instance, in 2024, many countries continue to offer subsidized interest rates or down payment assistance, directly competing with the core offerings of mortgage lenders. These programs can make alternative financing structures more attractive to certain borrower segments, particularly first-time homebuyers or those with moderate incomes.

The impact of these programs is amplified when they offer significantly more favorable terms than commercial mortgages. Consider the following:

- Reduced Interest Rates: Government subsidies often translate into lower interest rates than those available in the open market, making them a direct substitute for a portion of SBI ARUHI's customer base.

- Down Payment Assistance: Programs that cover a substantial portion of the down payment lower the barrier to entry, diminishing the reliance on traditional mortgage lending for a segment of potential borrowers.

- Alternative Loan Structures: Some government initiatives may provide unique loan products or guarantees that offer different risk profiles or repayment options, acting as substitutes for conventional mortgage products.

- Focus on Specific Segments: These programs often target specific demographics or housing types, creating niche markets where commercial mortgages might be less competitive. For example, affordable housing initiatives could divert demand from standard home loans.

The threat of substitutes for SBI ARUHI's core mortgage business is multifaceted, encompassing renting, alternative financing, and government programs. Renting offers flexibility and predictable costs, especially when property purchase prices remain high, as seen in major Japanese cities in 2024. Personal loans, while costly, can substitute for smaller housing-related expenses, though they are not viable for large purchases. Equity release schemes and reverse mortgages are gaining traction, particularly among seniors, diverting demand from new mortgage origination.

Developer financing and private lenders also present a competitive alternative, sometimes offering quicker approvals and more flexible terms, especially during property market booms or when traditional lending tightens. For instance, some new developments in Tokyo in 2024 included subsidized interest rates for buyers, directly competing with SBI ARUHI's offerings. Government-backed housing support programs, featuring subsidized interest rates or down payment assistance, further reduce the need for market-rate commercial mortgages, particularly for first-time homebuyers.

| Substitute Type | Key Features | Impact on SBI ARUHI | Example (2024 Market Context) |

|---|---|---|---|

| Renting | Predictable monthly costs, flexibility, lower upfront expenses | Reduces demand for homeownership, especially for those deterred by high property values and down payments. | High property values in Tokyo make long-term renting attractive. |

| Equity Release/Reverse Mortgages | Accessing home equity without selling, primarily for seniors | Shrinks the pool of potential new mortgage applicants by offering alternatives for existing homeowners. | UK equity release market advanced an estimated £6.3 billion in 2023, a trend likely to continue. |

| Developer/Private Financing | Potentially faster approvals, flexible terms, direct arrangements | Offers competitive alternatives to traditional mortgages, especially when bank lending is restrictive. | New Tokyo developments offered subsidized interest rates in 2024. |

| Government Housing Programs | Subsidized rates, down payment assistance, unique loan structures | Attracts specific borrower segments (e.g., first-time buyers) with more favorable terms than market-rate mortgages. | Continued global trend of government initiatives for affordable housing. |

Entrants Threaten

Japan's financial sector, particularly housing loans, operates under a stringent regulatory framework. New entrants face complex licensing procedures and capital adequacy requirements, which can be substantial barriers. For instance, the Financial Services Agency (FSA) oversees these processes, demanding rigorous compliance and robust risk management systems from all financial institutions.

These high regulatory hurdles significantly deter potential new competitors from entering the housing loan market. The extensive documentation, compliance checks, and the need for substantial capital investment to meet regulatory standards, such as those outlined in the Banking Act, protect established players like SBI ARUHI from immediate threats. As of 2024, the continuous evolution of financial regulations, including those related to consumer protection and cybersecurity, further increases the cost and complexity of market entry.

The mortgage lending industry, particularly for specialized services like those offered by SBI ARUHI, presents a significant barrier to entry due to high capital requirements. Establishing a mortgage operation necessitates substantial funding not only for originating and holding loans but also for investing in robust IT systems and physical infrastructure. For instance, in 2024, the average cost to launch a new mortgage brokerage firm can range from $50,000 to over $200,000, depending on the scale and services offered.

Securing adequate and cost-effective funding is a critical hurdle for new entrants. Established players often benefit from existing investor relationships and a proven track record, allowing them to access capital at more favorable rates. In contrast, newer companies may struggle to attract the necessary funding or face higher borrowing costs, directly impacting their competitiveness against incumbents like SBI ARUHI.

In Japan's financial sector, especially for significant commitments like mortgages, brand recognition and customer trust are paramount. Newcomers face a steep uphill battle in establishing the credibility that established players, such as SBI ARUHI, have cultivated over time. This trust is not built overnight; it requires consistent service and a proven track record.

For instance, a 2024 survey indicated that over 70% of Japanese consumers prioritize reliability and established reputation when selecting financial institutions for long-term products. This strong preference creates a significant barrier for new entrants who lack the historical data and widespread positive associations that SBI ARUHI can leverage. The perceived safety and stability offered by well-known brands directly influence customer decisions.

Distribution Channels and Network Development

The threat of new entrants in the mortgage market, particularly for players like SBI ARUHI, is significantly mitigated by the substantial hurdle of establishing a robust distribution channel network. New companies must invest heavily and dedicate considerable time to replicate SBI ARUHI's extensive reach, which spans online portals, a physical branch presence, and strategic partnerships.

Building a multi-channel distribution system is a capital-intensive endeavor. For instance, in 2024, the average cost for a financial institution to open a new physical branch can range from $200,000 to over $1 million, depending on location and size. Beyond physical infrastructure, developing and maintaining sophisticated online platforms and forging reliable partnerships requires ongoing technological investment and relationship management.

Consider the following critical aspects that new entrants must overcome:

- Brand Recognition and Trust: Established players like SBI ARUHI benefit from years of building consumer trust, a factor difficult for newcomers to replicate quickly.

- Technological Infrastructure: Developing seamless online application processes, customer portals, and backend systems demands significant upfront and ongoing IT expenditure.

- Regulatory Compliance: Navigating the complex and evolving regulatory landscape for mortgage lending requires specialized expertise and resources, adding to the cost of entry.

- Capital Requirements: The mortgage industry is capital-intensive, requiring substantial funds for operations, loan origination, and maintaining liquidity, which can be a barrier for new, less capitalized firms.

Technological Innovation and Digital Disruption

Technological innovation, particularly in FinTech, poses a significant threat of new entrants to the mortgage market. Nimble startups can leverage digital platforms to streamline loan origination and servicing, potentially bypassing the established infrastructure of traditional lenders like SBI ARUHI. For instance, the rise of online mortgage brokers and digital lenders has already demonstrated the ability to offer more user-friendly and efficient application processes. This disruption allows new players to attract customers seeking speed and convenience, directly challenging incumbent market share.

The potential for FinTech to lower barriers to entry is substantial. These new entrants can operate with leaner overheads compared to traditional banks, enabling them to offer competitive rates or specialized products. Consider the growth in digital mortgage platforms, which have seen significant investment and adoption. In 2023, FinTech funding in the mortgage sector continued to be robust, with companies focusing on AI-powered underwriting and blockchain for faster transaction settlements, indicating a clear pathway for agile competitors to gain traction.

- Digital Mortgage Platforms: Companies like Better Mortgage and Rocket Mortgage have rapidly expanded their market presence by focusing on digital-first customer experiences and efficient processing.

- AI in Underwriting: The integration of artificial intelligence allows for faster and potentially more accurate risk assessment, a key area where traditional models can be slow.

- Blockchain Technology: Exploration of blockchain for mortgage securitization and title transfers promises to reduce costs and improve transparency, attracting new entrants focused on these efficiencies.

- Low Overhead Models: Tech-centric startups can often operate with fewer physical branches and a smaller employee base, translating into cost advantages that can be passed on to consumers or reinvested in innovation.

The threat of new entrants for SBI ARUHI in the Japanese housing loan market is significantly constrained by high regulatory barriers, substantial capital requirements, and the ingrained importance of brand trust. These factors, coupled with the need to establish extensive distribution networks, create formidable challenges for any new player attempting to enter the market. While FinTech innovations offer potential avenues for disruption, the established infrastructure and customer loyalty enjoyed by incumbents remain powerful deterrents.

| Barrier Type | Description | Impact on New Entrants | 2024/2025 Relevance |

|---|---|---|---|

| Regulatory Compliance | Stringent licensing, capital adequacy, and ongoing compliance demands from the FSA. | Increases cost and complexity, requiring specialized expertise. | Evolving regulations on consumer protection and cybersecurity add ongoing cost. |

| Capital Requirements | Significant upfront investment for operations, IT systems, and loan origination. | Demands substantial funding, making it difficult for less capitalized firms. | Launching a mortgage brokerage in 2024 can cost $50k-$200k+; robust IT is essential. |

| Brand Recognition & Trust | Established players like SBI ARUHI benefit from years of cultivated consumer trust. | Newcomers face a steep uphill battle to build credibility. | Over 70% of Japanese consumers prioritize reliability and reputation in 2024. |

| Distribution Channels | Need to replicate extensive networks (online, physical, partnerships). | Requires significant investment in time and capital. | Opening a physical branch can cost $200k-$1M+ in 2024; digital platforms also require heavy investment. |

| Access to Funding | Established players have better access to capital at favorable rates. | New firms may face higher borrowing costs, impacting competitiveness. | Proven track record is crucial for securing cost-effective funding. |

Porter's Five Forces Analysis Data Sources

Our SBI ARUHI Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available financial statements, investor presentations, and regulatory filings from SBI ARUHI itself. We supplement this with industry-specific reports from reputable market research firms and analysis from financial news outlets to capture a comprehensive view of the competitive landscape.