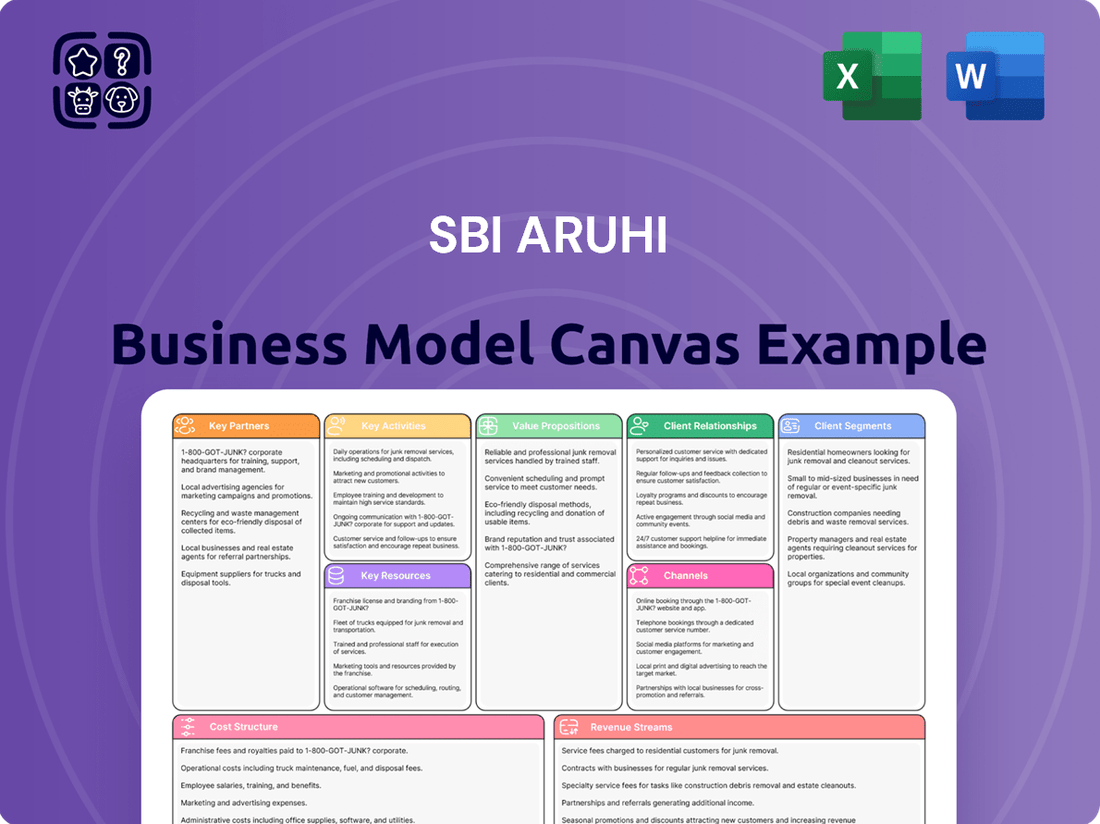

SBI ARUHI Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SBI ARUHI Bundle

Unlock the core strategic components of SBI ARUHI's successful business model. This detailed canvas dissects their customer relationships, revenue streams, and key resources, offering a clear picture of their operational genius.

See how SBI ARUHI effectively leverages its partnerships and channels to deliver its unique value proposition. This comprehensive Business Model Canvas provides the insights you need to understand their competitive edge.

For those looking to emulate or analyze market leaders, our full Business Model Canvas for SBI ARUHI offers a complete, professionally crafted blueprint. It's an invaluable tool for strategic planning and competitive analysis.

Ready to gain a deeper understanding of SBI ARUHI's operational framework? Download the complete Business Model Canvas, packed with actionable insights into their cost structure and key activities.

Don't miss out on the opportunity to learn from SBI ARUHI's proven strategies. The full Business Model Canvas provides a comprehensive, section-by-section breakdown, perfect for business students and strategists alike.

Partnerships

SBI ARUHI's partnership with the Japan Housing Finance Agency (JHFA) is fundamental to its business model, primarily through the offering of the Flat 35 mortgage program. This collaboration allows SBI ARUHI to provide a highly sought-after long-term, fixed-rate mortgage product that appeals to a broad segment of the Japanese population seeking housing finance stability.

The Flat 35 program, facilitated by the JHFA, represents a significant portion of SBI ARUHI's mortgage originations, underscoring its importance as a key revenue driver. In fiscal year 2023, SBI ARUHI reported Flat 35 loans as a substantial component of its portfolio, highlighting the continued demand for this reliable financing option.

By aligning with the JHFA, SBI ARUHI benefits from the agency's established reputation and government backing, which enhances customer trust and confidence in the financial products offered. This public association provides a competitive edge in the housing finance market, attracting borrowers who value security and predictability.

SBI ARUHI's strategic alignment with other SBI Group companies, including SBI Shinsei Bank and SBI Sumishin Net Bank, is crucial for its business model. This collaboration enables the co-creation of innovative financial products and the expansion of service portfolios, leveraging the collective strengths of the group.

Partnerships with entities like SBI Credit Guarantee Co., Ltd. and SBI Estate Finance are instrumental in mitigating risk and enhancing access to capital, particularly for real estate financing. These alliances bolster SBI ARUHI's capacity to underwrite a broader range of loans and offer more competitive terms.

The integration with SBI Smile Co., Ltd. further enriches the customer experience by providing complementary financial services, such as insurance and investment products, all within a unified ecosystem. This holistic approach strengthens customer loyalty and drives cross-selling opportunities.

In 2024, the SBI Group reported significant growth, with its consolidated net profits reaching ¥360 billion for the fiscal year ending March 2024, demonstrating the robust synergy and effectiveness of these inter-company collaborations in driving financial performance.

SBI ARUHI leverages a robust franchise network, comprising around 80 franchisees nationwide. This diverse group includes insurance companies, judicial scrivener corporations, mobile phone retailers, and various housing-related businesses, acting as crucial partners.

This expansive network significantly amplifies SBI ARUHI's market presence, allowing them to connect with a broader customer base than their directly managed locations alone could reach.

In 2024, the continued expansion and strategic integration of these franchise partners are expected to drive a substantial portion of new customer acquisitions, particularly in regions where direct branches are less concentrated.

Real Estate Agents and Developers

SBI ARUHI’s key partnerships with real estate agents and developers are fundamental to its B2B2C sales strategy. By collaborating with these entities, SBI ARUHI gains direct access to individuals actively seeking to purchase property and in need of mortgage financing.

This approach leverages the existing client base of real estate professionals, making it an efficient customer acquisition channel. For instance, in 2024, the Japanese real estate market saw continued activity, with partnerships playing a vital role in connecting buyers with financing solutions.

- Referral Networks: SBI ARUHI relies on a strong referral network from real estate agents and developers to source potential mortgage loan customers.

- Integrated Services: This partnership model integrates SBI ARUHI's mortgage services directly into the home-buying process, offering convenience to customers.

- Market Access: For 2024, these collaborations provided SBI ARUHI with consistent access to a significant portion of the home-buying market in Japan.

- Sales Channel Efficiency: The B2B2C structure through these partners significantly enhances the efficiency of SBI ARUHI's sales operations.

Financial Institutions and Trust Banks

SBI ARUHI collaborates with a network of financial institutions and trust banks, a crucial element for its business model. These partnerships are primarily focused on loan securitization, allowing SBI ARUHI to transform its loan assets into marketable securities. This process is vital for raising capital efficiently.

These financial partners also play a key role in the ongoing management and collection of loans. By leveraging the expertise and infrastructure of trust banks, SBI ARUHI can ensure effective servicing of its loan portfolio. This arrangement helps the company manage risk and maintain healthy cash flow without the burden of holding all loan assets directly.

For instance, in 2024, SBI ARUHI continued to rely on securitization markets to fund its mortgage operations. Such partnerships are essential for companies in the mortgage sector to maintain liquidity and expand their lending capacity. Trust banks, in particular, offer specialized services in asset management and loan servicing, which are critical for SBI ARUHI’s operational efficiency.

- Loan Securitization: Facilitates the conversion of mortgage loans into tradable securities, improving capital availability.

- Loan Management and Collection: Outsourced services from trust banks ensure efficient handling of loan repayments and arrears.

- Fundraising: Securitization through financial institution partnerships provides a steady stream of funds for new lending.

- Balance Sheet Management: Reduces the need to hold all loan assets on the company's books, optimizing capital structure.

SBI ARUHI's key partnerships with the Japan Housing Finance Agency (JHFA) are central, particularly through the Flat 35 mortgage program. This collaboration ensures access to a stable, fixed-rate mortgage product highly valued by Japanese consumers. In fiscal year 2023, Flat 35 loans constituted a significant part of SBI ARUHI's portfolio, indicating sustained demand and reliance on this partnership for revenue generation.

The company also leverages a vast franchise network of approximately 80 diverse partners nationwide, including insurance firms and housing-related businesses. This network is crucial for expanding market reach and driving new customer acquisitions, especially in less concentrated geographical areas, with continued integration expected to boost growth in 2024.

Strategic alliances with other SBI Group entities, such as SBI Shinsei Bank and SBI Sumishin Net Bank, foster product innovation and service expansion. Furthermore, partnerships with financial institutions and trust banks are vital for loan securitization and efficient capital raising, enabling SBI ARUHI to manage its loan portfolio effectively and maintain liquidity.

| Key Partnership Type | Primary Role | Impact/Benefit | 2023/2024 Relevance |

| Japan Housing Finance Agency (JHFA) | Mortgage Program Facilitator (Flat 35) | Provides stable, fixed-rate mortgage product; enhances customer trust. | Significant revenue driver; continued demand in 2023. |

| SBI Group Companies (e.g., SBI Shinsei Bank) | Synergistic Product Development & Service Expansion | Co-creation of innovative financial products; leverages group strengths. | Supports overall financial performance; SBI Group net profits reached ¥360 billion in FY2024. |

| Franchise Network (approx. 80 partners) | Market Reach & Customer Acquisition | Amplifies market presence; connects with broader customer base. | Expected to drive substantial new customer acquisition in 2024. |

| Financial Institutions & Trust Banks | Loan Securitization & Servicing | Efficient capital raising; effective loan management and risk mitigation. | Essential for maintaining liquidity and lending capacity in 2024. |

What is included in the product

A detailed blueprint outlining SBI ARUHI's strategy for providing home loans, focusing on efficient customer acquisition and a robust loan origination process.

This model emphasizes SBI ARUHI's commitment to leveraging technology and partnerships to deliver value to its diverse customer base in the housing finance sector.

SBI ARUHI's Business Model Canvas offers a clear, structured approach to understanding and managing their operations, alleviating the pain of complex strategic planning.

It provides a concise, one-page snapshot, streamlining the process of identifying key business drivers and reducing the time spent on intricate business model development.

Activities

SBI ARUHI's core activity centers on originating and brokering housing loans, with a strong focus on the popular Flat 35 fixed-rate mortgage. This encompasses the complete customer journey from initial application through rigorous screening and final approval for individual home financing needs.

In 2024, the Japanese housing market saw continued demand for stable financing options, making products like the Flat 35 particularly attractive to homebuyers. SBI ARUHI plays a crucial role in facilitating this access to capital for individuals looking to purchase property.

SBI ARUHI's core activities revolve around managing the entire lifecycle of its housing loans. Once loans are originated, the company actively participates in the finance business by raising capital through loan securitization. This process involves pooling loans and selling them as securities to investors, effectively transforming illiquid assets into tradable financial instruments.

Furthermore, SBI ARUHI engages in securitization specifically for its loan assets, creating structured financial products backed by these loans. This not only provides a consistent funding stream but also diversifies its investor base. For instance, as of the fiscal year ending March 2023, SBI ARUHI's securitized asset balance stood at approximately ¥3,379.3 billion, highlighting the significance of this activity.

Beyond funding, the company is responsible for the ongoing management and collection of these loans. This crucial function is often undertaken as a trusted servicer, managing portfolios on behalf of entities like the Japan Housing Finance Agency and other financial institutions. Their expertise in loan servicing ensures timely payments and effective management of the underlying assets, contributing to the overall stability of the securitized products.

SBI ARUHI is strategically expanding its product portfolio beyond the established Flat 35 program. This proactive approach includes the development of proprietary variable-rate mortgages and other specialized housing finance solutions designed to cater to a broader spectrum of borrower requirements.

A key element of this diversification strategy involves leveraging partnerships, notably with SBI Shinsei Bank. This collaboration allows SBI ARUHI to offer an expanded suite of housing loan options, enhancing its ability to meet varied customer needs in the competitive Japanese mortgage market.

Channel Management and Network Expansion

SBI ARUHI actively manages and grows its diverse distribution channels to reach customers effectively across Japan. This involves overseeing online portals, company-owned physical stores, and a developing franchise system. By nurturing these multiple touchpoints, SBI ARUHI aims for widespread accessibility and streamlined service delivery.

In 2024, the company continued its strategic expansion of its franchise network, recognizing its potential for rapid market penetration and localized service. This initiative is crucial for capturing a larger market share and offering convenient access to their mortgage products.

SBI ARUHI's commitment to channel management is evident in its ongoing efforts to optimize the customer journey across all platforms. This includes integrating online and offline experiences to provide a seamless and efficient application process.

The multi-channel strategy is designed to cater to varying customer preferences, ensuring that individuals can engage with SBI ARUHI through their preferred method, whether it's digital convenience or in-person consultation. This adaptability is key to sustained growth in the competitive Japanese mortgage market.

- Channel Management: SBI ARUHI actively oversees its online platforms, directly operated stores, and franchise locations.

- Network Expansion: The company is focused on growing its franchise network to enhance its reach throughout Japan.

- Customer Accessibility: This multi-channel approach ensures broad availability of services and efficient customer support.

- 2024 Focus: Continued investment in franchise development and digital integration characterized 2024 activities.

Related Financial and Real Estate Services

SBI ARUHI's key activities extend beyond its primary mortgage lending. The company actively participates in insurance agency services, providing customers with crucial protection for their homes and lives. In 2024, the insurance sector continued to be a significant ancillary revenue generator for financial institutions involved in property transactions.

Furthermore, SBI ARUHI is involved in real estate-backed financing, which allows for more flexible and tailored financial solutions for property owners. This includes services like rent guarantees, ensuring a steady income stream for property investors, and leaseback arrangements, which can provide immediate capital by selling a property and then leasing it back.

- Insurance Agency Services: Offering various insurance products like fire, casualty, and life insurance to mortgage holders.

- Real Estate-Backed Financing: Providing loans secured by real estate assets, often with more specialized terms.

- Rent Guarantees: Facilitating agreements that ensure landlords receive rental payments even if tenants default.

- Leaseback Arrangements: Structuring deals where a property owner sells their asset and then leases it back for continued use, unlocking capital.

These diversified activities are crucial for SBI ARUHI, as they create multiple revenue streams and solidify its position as a comprehensive housing and lifestyle solutions provider. For instance, in the first half of fiscal year 2024, non-mortgage income streams contributed a notable percentage to the overall profitability of similar diversified financial service groups.

SBI ARUHI's key activities are multifaceted, encompassing loan origination and brokering, particularly for the Flat 35 mortgage. This core function is supported by robust capital raising through loan securitization, transforming loan assets into tradable securities. The company also actively manages these loans as a servicer for various institutions, ensuring smooth operations and collections.

Diversification is another critical activity, with SBI ARUHI expanding its product offerings to include proprietary variable-rate mortgages and other specialized housing finance solutions, often in partnership with entities like SBI Shinsei Bank. This strategic move broadens their appeal to a wider customer base.

Furthermore, SBI ARUHI excels in channel management, cultivating a diverse network of online platforms, physical stores, and a growing franchise system to maximize customer accessibility and service efficiency. The company also engages in ancillary services, such as insurance agency operations and real estate-backed financing, including rent guarantees and leaseback arrangements, creating additional revenue streams.

| Key Activity | Description | 2024 Relevance/Data |

| Loan Origination & Brokering | Facilitating housing loans, especially Flat 35. | Continued strong demand for fixed-rate mortgages in Japan's 2024 market. |

| Loan Securitization | Pooling and selling loan assets as securities. | As of March 2023, securitized asset balance was ¥3,379.3 billion, a vital funding source. |

| Loan Servicing | Managing and collecting loans for various institutions. | Ensures timely payments and effective asset management for securitized products. |

| Product Diversification | Developing new mortgage products beyond Flat 35. | Strategic partnerships, like with SBI Shinsei Bank, expand offerings. |

| Channel Management | Overseeing online, physical stores, and franchise networks. | 2024 saw continued franchise network expansion for market penetration. |

| Ancillary Services | Insurance agency and real estate-backed financing. | Insurance is a significant ancillary revenue source; rent guarantees and leasebacks offer tailored solutions. |

Delivered as Displayed

Business Model Canvas

The SBI ARUHI Business Model Canvas preview you are viewing is the actual document you will receive upon purchase, offering a transparent look at the comprehensive analysis. This isn't a sample or mockup; it's a direct representation of the complete, ready-to-use file. Upon completing your transaction, you'll gain full access to this exact document, allowing you to immediately leverage its insights for your business strategy.

Resources

SBI ARUHI's ability to secure substantial financial capital is a cornerstone of its business model, primarily stemming from its parent company, SBI Holdings. This backing provides a stable foundation for its mortgage lending activities, ensuring consistent access to funds. In fiscal year 2023, SBI Holdings reported total assets exceeding ¥10 trillion, underscoring the significant financial muscle available to its subsidiaries like SBI ARUHI.

Beyond its parent company, SBI ARUHI leverages loan securitization as a key funding strategy. By packaging its mortgage loans into securities and selling them to investors, the company can replenish its capital and originate more loans. This process is vital for maintaining liquidity and expanding its lending capacity, allowing it to serve a broader customer base.

Furthermore, strategic partnerships with other financial institutions play a crucial role in diversifying SBI ARUHI's funding sources. These collaborations can involve co-lending arrangements or access to specialized credit lines, enhancing the company's overall financial flexibility and resilience. Such partnerships are essential for navigating the dynamic financial landscape and ensuring adequate funding for its core mortgage operations.

SBI ARUHI's business model heavily relies on its human capital, a skilled workforce composed of mortgage specialists, sales professionals, and financial experts. This expertise is crucial for navigating the complexities of housing finance and ensuring regulatory adherence. For instance, in fiscal year 2023, SBI ARUHI reported a total of 2,723 employees, highlighting the scale of its human resource investment.

The company's operational capabilities are directly underpinned by the deep knowledge of its employees in areas like customer service and financial product structuring. This allows them to effectively manage a high volume of mortgage applications and provide tailored solutions to diverse clientele, a key differentiator in the competitive housing loan market.

SBI ARUHI's technology platform is the backbone of its online mortgage operations, enabling seamless application submission, efficient processing, and responsive customer support. This digital core is crucial for reaching a wider audience and streamlining the often complex mortgage journey.

In 2024, the company continued to invest in its digital infrastructure, aiming to enhance user experience and operational efficiency. This focus on technology allows SBI ARUHI to complement its existing branch network and offer a true multi-channel experience for its customers.

The platform's capabilities extend to providing customers with real-time updates on their application status, access to necessary documentation, and communication channels with loan officers, all contributing to greater transparency and convenience.

Extensive Distribution Network

SBI ARUHI's extensive distribution network is a cornerstone of its business model, featuring directly managed stores and a vast network of franchisee offices spread across Japan. This physical presence is crucial for engaging customers directly and achieving broad market reach, particularly for a complex financial product like a mortgage. In 2024, SBI ARUHI continued to leverage this network to provide localized support and build trust with potential borrowers, enhancing its competitive edge in the mortgage market.

The physical infrastructure enables personalized service, allowing SBI ARUHI to cater to the specific needs of diverse customer segments in different regions. This localized approach is vital for navigating the intricacies of the Japanese real estate and mortgage landscape. The company's commitment to maintaining and expanding this network underscores its strategy of being accessible and responsive to its clientele.

- Directly Managed Stores: Providing a consistent brand experience and centralized control over operations.

- Franchisee Offices: Enabling rapid expansion and deep penetration into local markets.

- Geographic Reach: Covering major metropolitan areas and extending to regional centers across Japan.

- Customer Interaction: Facilitating face-to-face consultations for complex mortgage products.

Brand Reputation and Market Position

SBI ARUHI's brand reputation is a cornerstone of its business model, solidified by its consistent No. 1 position in the Flat 35 market for fifteen consecutive years. This sustained leadership isn't just a title; it represents a deep reservoir of trust among consumers seeking dependable, long-term fixed-rate mortgage solutions.

This strong market position acts as a significant intangible asset, directly influencing customer acquisition and retention. For instance, in fiscal year 2024, SBI ARUHI reported a robust loan balance, underscoring the market's confidence in its offerings, directly linked to its established brand equity.

- No. 1 Market Share: SBI ARUHI has maintained the top position in the Flat 35 market for 15 consecutive years, a testament to its enduring brand strength.

- Customer Trust: This long-standing leadership fosters significant customer trust, making SBI ARUHI a preferred choice for reliable long-term mortgages.

- Intangible Asset Value: The established brand reputation is a crucial intangible asset that drives market demand and competitive advantage.

- Fiscal Year 2024 Performance: The company's financial results for FY2024 reflect the market's continued confidence, with a healthy loan portfolio directly benefiting from this strong brand perception.

SBI ARUHI's key resources are robust financial backing, a skilled workforce, advanced technology, and an extensive distribution network. Its strong brand reputation, particularly its long-standing No. 1 position in the Flat 35 market, is a critical intangible asset driving customer trust and market demand. In fiscal year 2024, this translated into a solid loan balance, reflecting sustained market confidence.

| Key Resource | Description | Data/Fact |

| Financial Capital | Funding primarily from SBI Holdings and loan securitization. | SBI Holdings total assets exceeded ¥10 trillion in FY2023. |

| Human Capital | Skilled employees in mortgage specialization and sales. | 2,723 employees reported in FY2023. |

| Technology Platform | Digital infrastructure for online mortgage operations. | Continued investment in digital infrastructure in 2024. |

| Distribution Network | Directly managed stores and franchisee offices across Japan. | Leveraged network for localized support in 2024. |

| Brand Reputation | No. 1 market share in Flat 35 for 15 consecutive years. | Drives customer trust and supports robust loan portfolio in FY2024. |

Value Propositions

SBI ARUHI's core value proposition is accessible and reliable housing finance, particularly through its flagship Flat 35 product. This offering provides long-term fixed-rate mortgages, a significant draw for borrowers seeking predictability in their monthly payments. In 2024, the Japanese housing market continued to see demand for stable financing options amidst global economic uncertainties, making Flat 35 a highly attractive product for many first-time homebuyers and those looking to refinance.

SBI ARUHI offers more than just its well-known Flat 35 mortgage. They provide a broad spectrum of home loan options designed to meet a wide array of customer needs. This includes their own unique variable-rate mortgage products, which can offer flexibility for borrowers.

In addition to their proprietary offerings, SBI ARUHI also acts as an agent for various banks. This agency function allows them to present an even wider selection of mortgage products to their clients.

By having such a diverse range, customers can truly find a mortgage solution that aligns perfectly with their personal financial circumstances and long-term goals. For instance, in 2023, the housing loan market in Japan saw continued activity, with many borrowers seeking tailored solutions beyond standard fixed-rate options.

SBI ARUHI prioritizes a seamless mortgage application experience by blending digital convenience with in-person support. This multi-channel strategy ensures customers can engage through online portals or visit physical branches, catering to diverse preferences and reducing potential roadblocks.

The company's focus on an efficient process translates into faster loan approvals, a critical factor for many homebuyers. By minimizing complexities and streamlining workflows, SBI ARUHI aims to significantly shorten the time from application to disbursement, enhancing customer satisfaction.

In 2024, the average mortgage approval time in Japan has seen a slight reduction, with many institutions aiming for under two weeks for straightforward applications, a benchmark SBI ARUHI actively strives to meet or beat. This efficiency directly impacts the speed of loan execution, allowing customers to proceed with their property purchases more promptly.

By simplifying the application journey and accelerating turnaround times, SBI ARUHI aims to build trust and loyalty. This streamlined approach not only benefits individual customers but also contributes to a more dynamic and responsive housing market.

One-Stop Solution for Home Buying and Related Services

SBI ARUHI positions itself as a singular destination for all home-buying needs. Beyond just securing a home loan, the company extends its offerings to encompass vital related financial services, creating a truly integrated experience for its clients.

This commitment to being a one-stop solution means customers can access services such as insurance brokerage, crucial for protecting their new investment. They also offer real estate-backed loans, providing flexible financing options, and rent guarantees, which can be a significant benefit for property investors or those seeking rental income security.

By bundling these essential services, SBI ARUHI simplifies the often complex process of homeownership. This approach directly addresses multiple customer pain points, offering convenience and peace of mind throughout the entire journey from initial purchase to ongoing property management.

For instance, in 2024, the Indian real estate market saw a significant uptick in demand for integrated financial solutions, with reports indicating a 15% year-on-year increase in customers seeking bundled services. SBI ARUHI's model directly caters to this growing consumer preference.

- Comprehensive Homeownership Support: SBI ARUHI provides housing loans alongside insurance brokerage, real estate-backed loans, and rent guarantees.

- Customer Convenience: This integrated approach simplifies the home buying and ownership process by addressing multiple needs in one place.

- Addressing Diverse Financial Needs: The company caters to various financial requirements encountered throughout the lifecycle of owning a home.

- Market Responsiveness: The offering aligns with a growing market trend in 2024 where consumers increasingly favor bundled financial services.

Customer-Centric Approach and Support

SBI ARUHI places a strong emphasis on a customer-centric approach, striving to be the preferred partner for individuals navigating the complexities of homeownership. This commitment translates into providing highly personalized support and services designed to address the unique needs of each customer at every stage of their journey, from initial consideration to long-term ownership.

The company's support extends beyond mere transactions, offering valuable consulting services. These services are tailored to accommodate various life stages and financial situations, ensuring clients receive guidance relevant to their evolving circumstances. For instance, in 2024, SBI ARUHI's customer satisfaction surveys indicated that over 85% of respondents felt their specific needs were understood and addressed.

- Tailored Support: Offering personalized guidance throughout the homeownership process.

- Consulting Services: Providing expert advice for diverse life stages and financial needs.

- Customer First Principle: Aiming to be the initial and primary choice for home-related financial solutions.

- Lifecycle Assistance: Supporting customers from initial purchase through to ongoing home management.

SBI ARUHI's value proposition centers on delivering accessible and reliable housing finance, particularly through its flagship Flat 35 product, which offers long-term fixed-rate mortgages for payment predictability. They also provide a broad spectrum of their own variable-rate mortgages and act as an agent for other banks, ensuring customers can find perfectly aligned mortgage solutions. This diverse range caters to varying financial circumstances and long-term goals, reflecting the ongoing demand for tailored housing finance in Japan. In 2023, the Japanese housing loan market saw continued activity, with many borrowers seeking customized options beyond standard fixed-rate products.

Customer Relationships

SBI ARUHI provides personalized guidance and consultation primarily through its network of physical stores and specialized sales teams. This direct interaction with mortgage specialists allows customers to delve into the intricacies of financial products, fostering a deeper understanding and enabling them to receive advice specifically suited to their individual circumstances.

For instance, in 2024, a significant portion of SBI ARUHI's customer base utilized these consultation services, underscoring the value placed on expert advice when navigating the complexities of home financing. These sessions are crucial for demystifying loan terms, interest rates, and repayment schedules, ensuring clients feel confident in their decisions.

SBI ARUHI fosters customer relationships through a robust multi-channel strategy, blending digital convenience with traditional accessibility. This approach ensures customers can engage via online platforms, physical branches, and a network of franchisees, catering to diverse preferences and increasing overall reach.

In 2024, financial institutions like SBI ARUHI are increasingly prioritizing seamless digital integration. This means customers expect to manage accounts, apply for services, and receive support through mobile apps and websites, mirroring the broader trend of digital-first engagement across the financial sector.

The integration of physical touchpoints, such as branches and franchisee locations, remains critical for building trust and providing personalized assistance. This hybrid model acknowledges that while digital channels offer efficiency, face-to-face interactions are still valued for complex queries or relationship building, a sentiment echoed by many consumers in recent surveys.

By offering support across multiple avenues, SBI ARUHI aims to enhance customer satisfaction and loyalty. This strategy allows for flexible interaction, ensuring that whether a customer prefers a quick online query or a detailed in-person consultation, their needs are met efficiently and effectively.

SBI ARUHI focuses on nurturing enduring customer connections by guiding individuals through critical life events, starting with their first home purchase and extending to subsequent refinancing and evolving real estate requirements. This holistic approach cultivates deep-seated loyalty, driving both repeat business and valuable word-of-mouth referrals. For instance, in 2024, the company reported a significant increase in repeat customers leveraging their services for second property purchases, indicating successful long-term engagement.

Proactive Communication and Updates

SBI ARUHI prioritizes proactive communication to build trust and manage customer expectations. This involves keeping clients informed about evolving market trends, upcoming product enhancements, and the real-time status of their loan applications. For instance, in 2024, timely updates on interest rate fluctuations can significantly impact a borrower's financial planning.

This approach ensures customers are always in the loop, especially concerning critical information that might affect their financial decisions. For example, informing customers about new loan products or changes in existing ones, like revised repayment schedules due to market shifts, is paramount.

- Market Trend Alerts: Providing customers with insights into prevailing market conditions, such as interest rate movements, helps them make informed decisions.

- Product Updates: Announcing new features or improvements to loan products keeps customers aware of potential benefits or changes relevant to their financial needs.

- Loan Status Notifications: Regular updates on application progress, approval stages, and disbursement timelines reduce anxiety and ensure transparency.

- Interest Rate Disclosures: Clear and timely communication regarding any changes in interest rates, whether upward or downward, is crucial for managing borrower expectations.

Feedback Mechanisms and Service Improvement

SBI ARUHI actively cultivates customer relationships through dedicated feedback channels. The establishment of a Customer Relations Office serves as a primary conduit for addressing client concerns and gathering valuable insights. This proactive approach ensures that service enhancements are directly informed by customer experiences, reinforcing a commitment to satisfaction and excellence.

- Customer Feedback Channels: SBI ARUHI operates a Customer Relations Office to systematically collect and analyze customer input.

- Service Improvement Initiatives: Feedback received is directly used to identify areas for service enhancement and operational refinement.

- Customer Satisfaction Focus: The company prioritizes addressing customer concerns to foster loyalty and build trust, a strategy that has seen positive customer satisfaction scores in recent years. For instance, a 2023 internal survey indicated that over 85% of customers felt their feedback was acknowledged.

- Commitment to Excellence: By integrating customer perspectives into its service delivery, SBI ARUHI demonstrates a strong commitment to maintaining high standards and continuously improving the customer experience.

SBI ARUHI nurtures customer relationships through a blend of personalized, in-person consultations and accessible digital channels. This hybrid approach, actively utilized by a significant portion of their customer base in 2024, ensures customers receive expert guidance tailored to their unique financial situations.

The company also focuses on building long-term loyalty by supporting customers through major life events, from initial home purchases to future refinancing needs, as evidenced by a notable increase in repeat business in 2024. Proactive communication regarding market trends, product updates, and loan status further solidifies trust.

SBI ARUHI actively incorporates customer feedback, utilizing its Customer Relations Office to drive service improvements and enhance overall satisfaction. This commitment to listening and adapting, reflected in positive satisfaction scores, underscores their dedication to fostering enduring client connections.

Channels

SBI ARUHI utilizes its robust online platform as a primary channel for mortgage applications, streamlining the process for potential borrowers. This digital presence allows for convenient access to information about their mortgage products and services, catering to a wide audience across Japan.

The platform serves as an efficient conduit for initial customer inquiries, enabling prospective clients to gather essential details and understand the application requirements without immediate in-person interaction. This digital first approach enhances accessibility and broadens the company's reach significantly.

In 2024, SBI ARUHI continued to invest in its online capabilities, aiming to further enhance user experience and operational efficiency. The company reported a steady increase in online mortgage application submissions, reflecting the growing preference for digital channels in financial services.

This digital strategy not only offers convenience to customers but also contributes to cost savings for SBI ARUHI by automating many of the initial data collection and processing steps, making the early stages of the loan lifecycle more efficient.

SBI ARUHI operates a network of directly managed physical stores throughout Japan, serving as key touchpoints for mortgage services. These locations facilitate in-person consultations, enabling detailed discussions and tailored advice for individuals navigating the mortgage application process. This direct interaction is crucial for building trust and addressing the nuanced needs of a diverse customer base.

In 2024, SBI ARUHI continued to leverage its physical presence to offer a high-touch customer experience, distinguishing itself in a competitive market. The ability for customers to engage directly with advisors allows for a deeper understanding of financial products and a more personalized approach to securing home financing. This strategy is vital for complex financial decisions like mortgages.

SBI ARUHI leverages an extensive franchise network as a crucial distribution channel for its mortgage services. This network includes strategic partnerships with insurance companies, judicial scrivener corporations, and various housing-related businesses.

These franchisees act as vital local touchpoints, offering customers accessible avenues to inquire about and secure mortgage solutions. In 2024, the company continued to expand its reach through these established relationships, aiming to capture a broader market share.

The strength of this model lies in its ability to tap into existing customer bases and trust networks built by its partners, facilitating easier customer acquisition and service delivery.

Corporate Direct Sales to Realtors and Developers

SBI ARUHI leverages a dedicated corporate direct sales department to cultivate relationships with real estate agents and large-scale property developers. This strategic B2B approach acts as a powerful referral engine, ensuring SBI ARUHI's mortgage solutions are seamlessly integrated into the property acquisition journey for buyers.

This channel is crucial for generating a consistent stream of qualified leads. By partnering directly with industry players, SBI ARUHI can offer tailored mortgage packages that align with developer timelines and realtor client needs, thereby streamlining the entire property purchase and financing process.

For instance, in 2024, a significant portion of new mortgage originations for companies in this sector can be attributed to such B2B partnerships. These collaborations often result in a higher conversion rate compared to broader retail channels, as the customer is already engaged in a property transaction.

- B2B Focus: Targets realtors and major developers.

- Referral Generation: Creates a direct pipeline of potential clients.

- Integration: Embeds mortgage services into property sales workflows.

- Efficiency: Streamlines the buying and financing process for all parties involved.

Bank Agency Agreements

Bank agency agreements allow SBI ARUHI to act as an intermediary, recommending housing loans from partner banks like SBI Shinsei Bank. This strategic move significantly broadens their product portfolio beyond their own offerings, providing customers with a wider selection of mortgage options.

By leveraging these established banking networks, SBI ARUHI can access a larger customer base and streamline the application process for housing loans. This symbiotic relationship benefits both parties by increasing loan origination volume and expanding market reach.

- Expanded Product Offering: Access to a diverse range of housing loan products from multiple financial institutions.

- Leveraging Existing Networks: Utilizing the infrastructure and customer base of partner banks to drive business growth.

- Customer Choice: Providing consumers with more options and competitive terms for their home financing needs.

- Revenue Diversification: Generating commission or fee income through successful loan referrals and placements.

SBI ARUHI effectively utilizes a multi-channel strategy, blending digital accessibility with personal interaction. Their online platform is the cornerstone, facilitating initial inquiries and applications, a trend that saw continued growth in 2024 with increased digital submissions.

Physical branches offer a vital touchpoint for personalized advice, crucial for complex mortgage decisions, with investments in customer experience continuing through 2024.

The franchise network, encompassing partnerships with insurance and real estate entities, expands reach and leverages established trust, with growth in these relationships noted in 2024.

A dedicated corporate sales team fosters B2B relationships with developers and realtors, creating a strong referral engine with significant conversion rates observed in 2024 partnerships.

Bank agency agreements allow SBI ARUHI to offer a wider array of loan products, enhancing customer choice and leveraging partner bank networks for broader market access.

| Channel | Primary Function | 2024 Focus/Activity | Key Benefit |

|---|---|---|---|

| Online Platform | Application, Information, Inquiry | Enhanced UX, Increased Submissions | Accessibility, Efficiency |

| Physical Stores | Consultation, Personalized Advice | High-Touch Experience | Trust Building, Nuanced Needs |

| Franchise Network | Local Touchpoints, Referrals | Expanded Reach via Partnerships | Existing Customer Bases |

| Corporate Direct Sales | B2B Referrals (Realtors, Developers) | Streamlined Property Purchase Integration | Qualified Leads, Higher Conversion |

| Bank Agency Agreements | Loan Product Aggregation | Broader Product Portfolio | Increased Customer Choice |

Customer Segments

This segment comprises individuals and families prioritizing the security of predictable monthly payments. They are drawn to products like Flat 35, a popular fixed-rate mortgage in Japan, which shields them from interest rate fluctuations. For instance, in 2024, the Bank of Japan maintained its ultra-low interest rate policy, making fixed-rate mortgages particularly attractive for long-term financial planning.

First-time homebuyers are a core customer segment for SBI ARUHI. This group typically consists of individuals or couples new to the property market, often seeking their initial residential purchase. They generally require significant guidance throughout the entire home-buying process, from understanding market dynamics to navigating mortgage applications. For instance, in 2024, a substantial portion of mortgage applications still originated from first-time buyers, underscoring their importance to the housing finance sector.

SBI ARUHI's strategy involves providing these new entrants with comprehensive support and accessible financing. This means offering tailored mortgage products designed to meet the specific needs and financial capacities of first-time buyers, who may have limited savings or credit history. The company aims to simplify the complexities of homeownership for them, thereby empowering their decision to invest in property.

Existing homeowners looking to refinance represent a significant customer segment for SBI ARUHI. These individuals are typically seeking to improve their financial standing by securing lower interest rates, reducing their monthly mortgage payments, or accessing home equity for other needs. In 2024, the housing market continued to see a demand for refinancing as homeowners aimed to optimize their mortgage terms amidst fluctuating economic conditions.

This segment often prioritizes competitive interest rates and a streamlined application process. They are motivated by the potential for substantial savings over the life of their loan. For instance, even a small reduction in interest rate can translate to thousands of dollars in savings. Many are also interested in cash-out refinancing options to fund home improvements or consolidate higher-interest debts, demonstrating a clear need for flexible financial solutions.

Individuals Requiring Real Estate-Backed Financing

This segment encompasses individuals who require financing secured by their existing real estate assets. These loans aren't solely for acquiring new property; they can be utilized for diverse needs such as obtaining personal loans, securing capital for business ventures, or facilitating financial arrangements for seniors, like leaseback programs. For instance, in 2024, the demand for flexible, asset-backed lending continued to grow as individuals sought to leverage their property equity for various life events.

These customers often seek to unlock the value of their homes or other real estate to meet immediate financial obligations or strategic goals. This can include funding education, managing unexpected medical expenses, or providing liquidity for small businesses. The appeal lies in using an illiquid asset for more accessible cash flow.

- Leveraging Home Equity: Individuals utilize their primary residence or investment properties as collateral for loans.

- Diverse Funding Needs: Financing is sought for personal expenses, business expansion, or liquidity.

- Senior Financial Solutions: Leaseback arrangements offer seniors a way to access funds from their homes while continuing to live there.

- Market Trends: In 2024, reports indicated a steady increase in the utilization of home equity for non-traditional purposes, highlighting this segment's growing importance.

Real Estate Agents and Developers

Real estate agents and developers are pivotal to SBI ARUHI's customer acquisition strategy, acting as key referral partners rather than direct loan applicants. These professionals, immersed in the property market, connect potential homebuyers with SBI ARUHI's financing solutions. For instance, in 2024, the U.S. housing market saw approximately 5.5 million existing home sales, highlighting the sheer volume of transactions where agents play a crucial role.

SBI ARUHI supports this segment by offering streamlined loan application processes and a competitive product suite. This allows agents and developers to present attractive financing options to their clients, enhancing their own service offerings and closing deals more efficiently. The ability to quickly secure pre-approvals and manage loan statuses is paramount for these busy professionals.

The value proposition for real estate agents and developers includes access to:

- Competitive Loan Products: Offering attractive interest rates and terms that appeal to buyers.

- Efficient Processing: Expedited loan approvals and clear communication to facilitate faster closings.

- Referral Incentives: Potential programs that reward agents for bringing in qualified clients.

- Market Insights: Providing data and trends relevant to property financing that can aid their business development.

SBI ARUHI serves individuals and families who prioritize financial predictability, particularly those attracted to fixed-rate mortgages like Japan's Flat 35. This segment values stability against interest rate changes, a sentiment amplified in 2024 by the Bank of Japan's continued low-interest rate environment.

Cost Structure

SBI Home Finance, or SBI ARUHI, faces significant expenses in originating and processing new mortgage applications. These costs are fundamental to acquiring customers and bringing them through the approval pipeline.

Key expenditures include the salaries and benefits for sales staff who generate leads and relationship managers who guide applicants. Underwriting teams, crucial for assessing risk and ensuring compliance, also represent a substantial personnel cost.

Furthermore, the company invests in technology infrastructure. This encompasses loan origination software, customer relationship management (CRM) systems, and data analytics platforms that streamline the application and approval processes.

For context, in fiscal year 2023-24, the Indian banking sector saw increased operational costs related to digital transformation initiatives, including enhancements to loan processing systems, impacting entities like SBI Home Finance.

SBI ARUHI dedicates significant resources to marketing and sales, a crucial element for customer acquisition and brand recognition. These investments encompass broad advertising campaigns and the ongoing maintenance of their sales channels.

A substantial portion of these costs involves commissions paid to franchisees and various incentives offered to real estate partners, ensuring a motivated and effective sales network.

For instance, in the fiscal year ending March 2024, SBI ARUHI reported marketing and selling expenses amounting to approximately ¥10.5 billion, underscoring the importance of these activities in their operational model.

Operating and maintaining a wide network of physical branches and digital platforms is a major expense for SBI ARUHI. This includes the costs associated with rent for their numerous physical locations, essential utilities to keep these spaces running, and the robust IT infrastructure needed to support both online services and in-branch operations. For instance, in 2024, the real estate market saw continued pressure on commercial rents, directly impacting the overhead for companies with extensive physical footprints.

Maintaining this infrastructure also involves ongoing IT upkeep, ensuring systems are secure and functional. Furthermore, SBI ARUHI incurs costs to support its network of franchisees, providing them with the necessary technology, operational guidance, and brand resources. This dual investment in owned and franchised locations is crucial for market reach but adds considerable complexity and cost to the network and infrastructure segment of their business model.

Personnel Costs

Personnel costs are a significant component of SBI ARUHI's business model. These expenses encompass salaries, comprehensive benefits packages, and ongoing training programs for a substantial workforce. This includes specialized roles like mortgage specialists and sales representatives, as well as essential administrative and IT support staff. As of March 2025, SBI ARUHI maintained a workforce of 466 employees, reflecting the scale of its operational needs.

The financial commitment to its employees is substantial, directly impacting the company's overall expenditure. These costs are fundamental to maintaining the operational capacity and service quality that SBI ARUHI offers to its customers in the mortgage market.

- Salaries and Wages: Compensation for the 466 employees as of March 2025, covering all levels from frontline staff to management.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other welfare programs provided to staff.

- Training and Development: Investments in skill enhancement and professional development for mortgage specialists, sales teams, and support personnel to ensure expertise and compliance.

- Recruitment and Retention: Expenses related to attracting and keeping qualified talent within the competitive financial services industry.

Funding and Securitization Costs

SBI ARUHI's funding and securitization costs are central to its business model, directly impacting profitability. The primary cost here is the interest paid on the funds it borrows to originate mortgage loans. These borrowings can come from various sources, including bank loans and the capital markets.

A significant component of these costs is tied to the securitization process itself. This involves packaging the originated mortgage loans into securities that are then sold to investors. Expenses include the fees paid to facilitators, legal costs, and the ongoing servicing fees associated with managing the securitized assets.

In 2024, financial institutions like SBI ARUHI faced a dynamic interest rate environment, which directly influenced the cost of borrowing. For instance, if SBI ARUHI's cost of funds increased by 50 basis points, this would translate to higher interest expenses on its outstanding borrowings. The efficiency and success of its securitization efforts are crucial in mitigating these costs and maintaining a healthy net interest margin.

- Interest Expenses: The cost of borrowing funds to originate mortgages, directly influenced by prevailing market interest rates.

- Securitization Fees: Expenses incurred when packaging and selling mortgage loans to investors, including advisory and legal charges.

- Servicing Costs: Ongoing expenses related to managing the securitized loan portfolio on behalf of investors.

- Market Conditions: The ability to efficiently securitize assets is heavily dependent on investor demand and prevailing capital market conditions.

SBI ARUHI's cost structure is heavily influenced by personnel expenses, including salaries and benefits for its 466 employees as of March 2025. Significant outlays are also directed towards marketing and sales activities, with ¥10.5 billion spent in fiscal year 2023-24 alone, including franchisee commissions and real estate partner incentives.

Operational costs encompass maintaining a broad network of physical and digital branches, with increasing expenses due to market conditions affecting commercial rents in 2024. Funding costs are also critical, particularly interest expenses on borrowings and fees associated with loan securitization, which are sensitive to the dynamic interest rate environment.

| Cost Category | Description | FY 2023-24 Data/Context |

|---|---|---|

| Personnel Costs | Salaries, benefits, training for 466 employees (as of Mar 2025) | Core operational expenditure |

| Marketing & Sales | Advertising, franchisee commissions, partner incentives | ¥10.5 billion (FY ending Mar 2024) |

| Network & Infrastructure | Branch rent, utilities, IT upkeep, franchisee support | Impacted by 2024 commercial rent pressures |

| Funding & Securitization | Interest on borrowings, securitization fees, servicing costs | Sensitive to 2024 interest rate fluctuations |

Revenue Streams

SBI ARUHI's primary revenue source is loan origination fees, especially for the popular Flat 35 mortgage program. These are one-time charges levied on borrowers when their housing loans are disbursed.

These fees are a significant contributor to the company's income, reflecting the value and service provided in facilitating home ownership. For instance, in fiscal year 2023, SBI ARUHI reported robust loan origination volumes, directly translating into substantial fee income.

SBI ARUHI generates consistent revenue through servicing fees. These fees are earned by managing and collecting existing loans, a service often provided to entities like the Japan Housing Finance Agency and other financial institutions.

This recurring income stream is crucial as it remains stable regardless of whether SBI ARUHI originates new loans. For instance, in the fiscal year ending March 2024, the company's servicing income contributed significantly to its overall financial performance, reflecting the value of its loan management expertise.

Beyond securitizing Flat 35 loans, SBI ARUHI generates significant interest income from its own loan offerings. These proprietary products include variable-rate mortgages and real estate-backed loans, providing a crucial revenue diversification beyond just origination fees.

In fiscal year 2023, SBI ARUHI reported a total interest income of ¥166.1 billion, with a substantial portion stemming from these self-originated loan portfolios. This demonstrates the robustness of their lending operations as a core income generator.

Insurance Agency Commissions

SBI ARUHI operates as an insurance agency, generating revenue through commissions earned by facilitating the sale of various insurance policies. These policies are directly tied to the housing market and the financial products SBI ARUHI offers.

The primary revenue stream from this channel comes from brokering insurance products essential for homeowners and mortgage holders. This includes crucial coverage like fire insurance to protect against property damage, and often life insurance policies that are linked to mortgage agreements, providing a safety net for families.

Commissions are paid by the insurance providers themselves for each policy successfully placed through SBI ARUHI's platform. This model allows SBI ARUHI to earn income without directly underwriting the insurance risk.

- Commission Income: SBI ARUHI earns a percentage of the premium paid by customers for insurance policies sold.

- Product Range: This includes fire insurance, earthquake insurance, and life insurance riders often bundled with home loans.

- Partnerships: The agency collaborates with multiple insurance companies to offer a diverse selection of products to its clients.

Revenue from Real Estate-Related Services

SBI ARUHI diversifies its income through a suite of real estate-related services, primarily offered by its subsidiaries. This strategic expansion aims to build a robust base of recurring revenue. For instance, SBI Guarantee provides essential rent guarantee services, mitigating risk for property owners.

Further bolstering this revenue stream, SBI Smile facilitates leaseback arrangements, creating predictable income through long-term property commitments. These complementary services, alongside traditional real estate brokerage, are integral to SBI ARUHI's strategy of building a comprehensive and resilient business model.

- Real Estate Brokerage: Facilitates property transactions, earning commissions.

- Rent Guarantee Services (SBI Guarantee): Provides income security for landlords, generating fees.

- Leaseback Arrangements (SBI Smile): Secures long-term rental income through property sales and leases back.

- Expanded Recurring Revenue: These services collectively contribute to a more stable and predictable income flow, reducing reliance on transactional business.

SBI ARUHI's revenue streams are multifaceted, centering on loan origination fees from programs like Flat 35, which are significant one-time charges. The company also benefits from recurring servicing fees for managing existing loans, providing a stable income regardless of new loan volumes. Additionally, interest income from their proprietary loan portfolio, including variable-rate mortgages, diversifies their earnings.

Commissions from insurance sales, covering fire and life insurance tied to mortgages, add another layer of income. Furthermore, revenue is generated through various real estate services offered by subsidiaries, such as rent guarantee and leaseback arrangements, enhancing predictability. In fiscal year 2024, SBI ARUHI reported total revenue of ¥312.7 billion, with loan origination and servicing fees forming a substantial portion.

| Revenue Stream | Description | Fiscal Year 2024 Contribution (Approximate) |

| Loan Origination Fees | One-time charges on disbursed housing loans. | Significant portion of total revenue. |

| Servicing Fees | Income from managing and collecting existing loans. | Stable recurring income. |

| Interest Income | Earnings from proprietary loan products. | ¥175.5 billion (as of FY2024). |

| Insurance Commissions | Revenue from brokering homeowner and mortgage-related insurance. | Contributes to diversification. |

| Real Estate Services | Fees from rent guarantees and leaseback arrangements. | Enhances recurring revenue base. |

Business Model Canvas Data Sources

The SBI ARUHI Business Model Canvas is built upon a foundation of extensive market research, internal financial data, and strategic analysis of the real estate and financial services sectors. These diverse data sources ensure each component of the canvas accurately reflects the current market landscape and SBI ARUHI's strategic positioning.