Rentokil Initial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rentokil Initial Bundle

Rentokil Initial's diverse service portfolio and global reach are significant strengths, allowing them to tap into various market needs. However, understanding the specific threats and weaknesses is crucial for navigating the competitive pest control and hygiene landscape.

Do you want to fully grasp Rentokil Initial's strategic positioning, including their competitive advantages and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Rentokil Initial's position as a global leader in pest control and hygiene services is a significant strength, with operations spanning 89 countries. This broad reach enables the company to tap into economies of scale, catering to a diverse range of multinational clients and creating robust, diversified revenue streams across various geographical markets. For instance, in 2023, Rentokil Initial reported revenue of £5.8 billion, a testament to its extensive global operations and market penetration.

Rentokil Initial boasts a diverse service portfolio that includes pest control, hygiene solutions, and workwear services. This broad offering creates a resilient business model, as the company isn't overly reliant on any single market segment. For example, in 2023, pest control and hygiene services continued to show strong demand, contributing significantly to the company's overall revenue growth.

The company's diversified services unlock significant cross-selling opportunities, allowing Rentokil Initial to act as a one-stop shop for businesses and residential customers. This comprehensive approach not only boosts customer loyalty but also widens the company's total addressable market. The synergistic relationship between these services strengthens the overall value proposition presented to clients, making it easier for them to consolidate their service needs with a single provider.

Rentokil Initial’s brand recognition is exceptionally strong, a testament to its century-long presence in the market, culminating in its 2025 centenary as the leading global pest control provider. This established reputation translates directly into customer trust and preference.

The company's global reach and consistent service quality have built significant brand equity, making it a preferred choice for both new clients and for retaining existing business relationships. This inherent trust allows for potential premium pricing strategies.

This powerful brand image acts as a significant differentiator in a competitive landscape, providing a substantial advantage when entering new markets or expanding its service offerings. Customers associate the Rentokil name with reliability and effectiveness.

Robust Recurring Revenue Model

Rentokil Initial benefits from a strong recurring revenue model, primarily driven by essential services like pest control and hygiene. This contractual basis ensures a predictable and stable income stream, a significant advantage in the financial markets. In Q1 2025, customer retention improved to 80.4%, underscoring the sticky nature of these service agreements and their contribution to financial resilience.

This robust recurring revenue translates into enhanced financial stability, enabling more effective long-term strategic planning and investment. The inherent predictability allows management to better forecast cash flows, support debt obligations, and fund growth initiatives with greater confidence.

- Predictable Cash Flows: Recurring service contracts provide a consistent and reliable revenue base.

- Financial Stability: The contractual nature insulates the company from short-term market volatility.

- High Customer Retention: Improved retention rates to 80.4% in Q1 2025 highlight customer loyalty and service stickiness.

- Investment Confidence: Stable revenue supports greater investor confidence and access to capital.

Proven M&A Strategy and Integration Capability

Rentokil Initial's proven M&A strategy and integration capability is a significant strength. The company has a robust history of successful acquisitions, demonstrating a consistent ability to identify and integrate businesses effectively. This strategic focus fuels inorganic growth and market expansion.

The company's acquisition pipeline is impressive, with over 200 deals completed since 2015. This includes the landmark acquisition of Terminix, a move that significantly bolsters its market position. Such a disciplined approach allows Rentokil Initial to consolidate fragmented markets and gain valuable access to new customer bases and technologies.

The integration of Terminix, a key strategic move, is progressing well and is slated for completion by the end of 2026. Significant integration milestones were achieved in 2024, indicating efficient execution of the post-acquisition plan. This ongoing success highlights their expertise in managing complex integrations and realizing synergies.

Key aspects of this strength include:

- Demonstrated track record: Over 200 acquisitions completed since 2015, including the substantial Terminix deal.

- Strategic market consolidation: Ability to effectively integrate acquired businesses to strengthen market share and operational efficiency.

- Successful integration execution: Terminix integration on track for completion by end of 2026, with key 2024 milestones met.

Rentokil Initial’s global leadership in pest control and hygiene services, operating in 89 countries, is a core strength. This extensive reach fosters economies of scale and diversified revenue streams, evidenced by its £5.8 billion revenue in 2023.

The company's broad service portfolio, encompassing pest control, hygiene, and workwear, creates a resilient business model. This diversification, with strong demand in pest control and hygiene services in 2023, reduces reliance on any single segment.

Cross-selling opportunities among its diverse services enhance customer loyalty and expand the total addressable market, positioning Rentokil Initial as a comprehensive solution provider.

Rentokil Initial's century-long brand presence, culminating in its 2025 centenary, signifies strong brand recognition and customer trust, translating into a preference for its services.

The company's robust recurring revenue model, driven by essential pest control and hygiene services, ensures predictable income. This is further supported by an 80.4% customer retention rate in Q1 2025.

Rentokil Initial's proven Merger & Acquisition (M&A) strategy, including over 200 deals since 2015 and the significant Terminix acquisition, highlights its capability for strategic growth and market consolidation. The Terminix integration is on track for completion by the end of 2026, with key 2024 milestones achieved.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Global Leadership & Reach | Operates in 89 countries, leveraging economies of scale. | £5.8 billion revenue in 2023; operations in 89 countries. |

| Diversified Service Portfolio | Offers pest control, hygiene, and workwear, ensuring business resilience. | Strong demand in pest control and hygiene services contributed to 2023 growth. |

| Cross-Selling Opportunities | Synergistic services create a one-stop shop, boosting loyalty. | Enhances value proposition and broadens addressable market. |

| Brand Recognition & Equity | A century-long presence builds customer trust and preference. | Centenary in 2025; association with reliability and effectiveness. |

| Recurring Revenue Model | Essential services provide predictable and stable income. | 80.4% customer retention in Q1 2025; contractual service agreements. |

| M&A Capability | Proven track record of successful acquisitions and integration. | Over 200 deals since 2015; Terminix acquisition on track for 2026 completion. |

What is included in the product

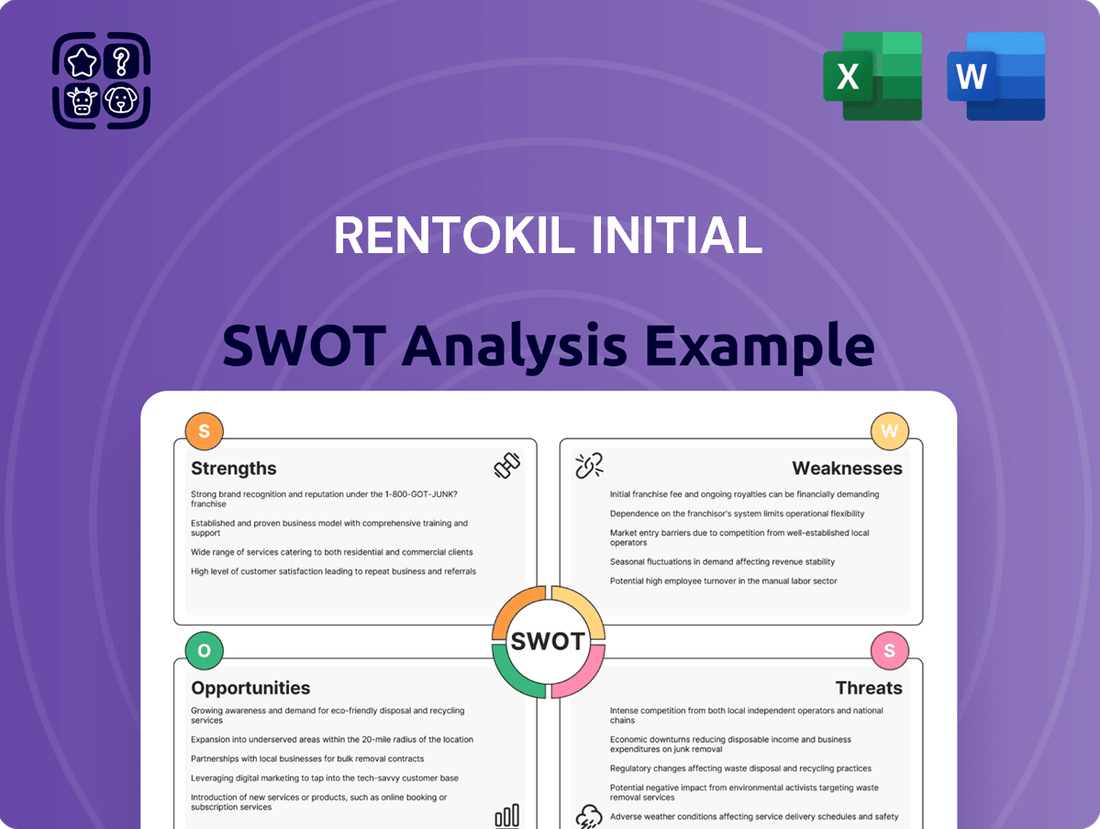

Delivers a strategic overview of Rentokil Initial’s internal and external business factors, examining its competitive position and market challenges.

Provides a clear, actionable framework to identify and address Rentokil Initial's strategic challenges and opportunities.

Weaknesses

While acquisitions are a core growth strategy, Rentokil Initial has faced significant integration hurdles, especially following the substantial Terminix acquisition. This has led to operational friction, notably impacting the North American business throughout 2024.

Evidence of these challenges surfaced in early 2025, with Rentokil reporting weak lead generation and sales conversion rates in North America. Management attributes these specific performance dips directly to ongoing integration complexities.

Successfully merging the operations, IT systems, and employee cultures of acquired companies, particularly one as large as Terminix, demands considerable management focus and financial resources. This intensive integration process can temporarily divert attention from core business improvements.

Rentokil Initial's reliance on business and residential clients makes it vulnerable to economic downturns. During recessions, companies often cut back on non-essential services, and individuals may delay or reduce spending on pest control and hygiene services. This can lead to slower revenue growth or even declines, as seen in periods of economic contraction where discretionary spending typically shrinks.

While core services like pest control are somewhat resilient, sustained economic hardship can pressure Rentokil Initial. Clients might seek to renegotiate contracts for better terms, delay payments, or postpone the adoption of new services, directly impacting the company's top and bottom lines. For instance, in 2023, while Rentokil reported strong revenue growth, a significant economic slowdown could temper future expansion and profitability projections.

Rentokil Initial's reliance on providing direct, on-site services like pest control and hygiene solutions inherently demands a substantial workforce and significant operational expenses. These costs encompass everything from fuel for their extensive vehicle fleet to the maintenance of specialized equipment and the ongoing investment in training for their technicians. This labor-intensive model means that fluctuations in labor costs, which saw average hourly wages in the UK increase by 6.3% in the year to April 2024 according to the ONS, directly impact profitability.

Managing these high operational costs is a persistent challenge, particularly in environments marked by rising inflation. For instance, the UK's Consumer Price Index (CPI) remained elevated, impacting the cost of fuel and supplies throughout 2024. Rentokil Initial must continuously seek efficiency improvements and explore technological integrations to offset these pressures and maintain healthy profit margins in its core service delivery.

Regulatory and Environmental Compliance Burden

Operating across numerous countries, Rentokil Initial faces a substantial regulatory and environmental compliance burden. This involves adhering to diverse and often changing rules concerning pest control chemicals, waste management, and hygiene protocols. For instance, in 2024, the European Union continued to implement stricter regulations on chemical usage, impacting product formulations and application methods.

Meeting these requirements necessitates considerable expenditure on staff training, securing necessary permits, and ensuring consistency with varied local legislation. This complexity increases operational challenges and exposes the company to potential legal repercussions for non-compliance. The company's commitment to reducing its carbon footprint, a key environmental objective, demands ongoing investment in sustainable practices and technologies.

- Evolving Chemical Regulations: Rentokil Initial must continually adapt its product lines and service protocols to comply with tightening regulations on pesticide and biocide use, such as those being reviewed by the US Environmental Protection Agency (EPA) in 2024.

- Waste Disposal Standards: Adherence to varying international and national waste disposal laws for chemical containers and treatment byproducts adds operational costs and logistical complexities.

- Hygiene and Safety Standards: Maintaining compliance with health and safety regulations in diverse markets, including those updated by the UK's Health and Safety Executive (HSE) in late 2023, requires rigorous training and auditing.

- Carbon Footprint Reduction: Investments in electric vehicle fleets and more sustainable chemical alternatives, ongoing in 2024 and projected for 2025, are essential to meet environmental targets but represent significant capital outlay.

Underperformance in North American Organic Growth

Rentokil Initial's performance in North America has been a notable weakness. Despite holding the position of the largest pest control operator in the United States, the company experienced a sluggish organic revenue growth of 1.5% in its North American operations throughout 2024. This figure fell short of expectations and lagged behind the broader market's growth rate.

This trend of underperformance persisted into the first quarter of 2025. Specifically, the pest control segment in North America reported an organic revenue growth of just 0.7%. The primary driver behind this slowdown has been identified as subdued lead flow, indicating challenges in generating new business opportunities.

The company has publicly recognized the need for strategic adjustments to address this issue. Rentokil Initial acknowledges that its current sales and marketing initiatives require refinement. The goal is to implement more effective strategies that will stimulate the necessary improvements in lead generation and ultimately drive stronger organic growth in the crucial North American market.

- 2024 North America Organic Revenue Growth (Pest Control): 1.5%

- Q1 2025 North America Organic Revenue Growth (Pest Control): 0.7%

- Key Challenge: Subdued lead flow impacting sales

- Acknowledged Need: Refinement of sales and marketing initiatives

Rentokil Initial's significant reliance on acquisitions, particularly the large Terminix deal, has led to considerable integration challenges. These integration issues, which began impacting operations in 2024 and continued into early 2025, have been cited as a direct cause for weak lead generation and sales conversion rates in North America, Rentokil's largest market.

The labor-intensive nature of its core pest control and hygiene services means Rentokil is susceptible to rising labor costs. For instance, average hourly wages in the UK rose by 6.3% in the year to April 2024, directly affecting profitability and requiring continuous efficiency improvements.

Furthermore, Rentokil faces a complex web of evolving regulatory and environmental compliance demands across its global operations. Adapting to stricter rules on chemical usage, waste disposal, and hygiene standards, such as those being reviewed by the US EPA in 2024, necessitates ongoing investment in training and technology.

| Weakness Area | Metric/Issue | Impact |

| Acquisition Integration | North America Organic Revenue Growth (Pest Control) 2024: 1.5% | Operational friction, subdued lead flow |

| Operational Costs | UK Average Hourly Wage Increase (Year to April 2024): 6.3% | Pressure on profit margins, need for efficiency |

| Regulatory Compliance | Evolving chemical and waste disposal regulations (e.g., US EPA in 2024) | Increased operational costs, potential legal risks |

Same Document Delivered

Rentokil Initial SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Get a look at the actual SWOT analysis file. The entire document will be available immediately after purchase.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

Rentokil Initial sees significant opportunity in emerging markets across Asia and South America. Urbanization and growing hygiene awareness in these regions are fueling demand for pest control services. For instance, Southeast Asia's pest control market was projected to grow at a compound annual growth rate of over 7% through 2025, presenting a substantial untapped potential for Rentokil.

Rentokil Initial can significantly expand its market reach by embracing advanced technologies. The company's commitment is evident in its pipeline of around 75 science and innovation projects, focusing on sustainable and digital solutions. This forward-thinking approach positions them to capitalize on the growing demand for tech-driven services.

The opening of their first North American Pest Control Innovation Centre in 2024 underscores this strategic focus. Innovations like IoT-enabled pest control and smart hygiene systems offer a clear path to enhanced service efficiency and new premium offerings. These advancements are crucial for staying ahead in a competitive landscape.

Global events over the past few years have dramatically amplified the focus on hygiene and sanitation for both individuals and businesses. This heightened awareness translates directly into a sustained demand for professional hygiene services, a sector that now accounts for a significant 20% of Rentokil's overall revenue. This presents a clear opportunity for Rentokil Initial to further leverage its expertise.

Rentokil Initial is well-positioned to capitalize on this growing market. By expanding its existing hygiene service portfolio and actively promoting higher sanitation standards, the company can reinforce the health benefits of its comprehensive solutions. Furthermore, favorable regulatory shifts aimed at bolstering food safety and enhancing workplace hygiene provide a supportive environment for growth.

Strategic Acquisitions and Consolidation

The pest control and hygiene sectors remain quite fragmented, presenting ongoing opportunities for Rentokil Initial to grow through strategic acquisitions. This fragmentation means there are many smaller companies that could be good fits for Rentokil. The company has a robust pipeline of potential bolt-on acquisitions, which are crucial for its expansion plans.

Consolidating smaller competitors is a key strategy for Rentokil Initial. This approach helps the company to:

- Expand Geographic Reach: Enter new regions or strengthen presence in existing ones by acquiring local players.

- Acquire Specialized Expertise: Gain access to niche services or advanced technologies through targeted acquisitions.

- Increase Market Share: Bolster its position in key markets, achieving greater economies of scale and competitive advantage.

In 2024, Rentokil Initial continued its acquisition strategy, notably completing the acquisition of The Target Group in the UK, a move expected to enhance its pest control offerings in the commercial sector. This aligns with their stated goal of pursuing bolt-on acquisitions that contribute to revenue growth and market consolidation, building on a history of successful integrations.

Focus on Sustainability and ESG Initiatives

The increasing focus on sustainability and Environmental, Social, and Governance (ESG) factors by consumers and regulators offers a significant opportunity for Rentokil Initial to enhance its brand reputation and market appeal. This growing demand for environmentally responsible services aligns perfectly with Rentokil's strategic goals.

Rentokil Initial's commitment to achieving net-zero carbon emissions by 2040, with an interim target of reducing emissions intensity by 20% by the end of 2025, positions it favorably. This proactive approach to climate change can attract environmentally conscious clients and investors alike.

The company can further capitalize on this trend by innovating and promoting eco-friendly pest control solutions and sustainable hygiene practices. This not only meets market demand but also provides a competitive edge.

- ESG Emphasis: Growing consumer and regulatory pressure on ESG performance.

- Net-Zero Target: Aiming for net-zero carbon emissions by 2040.

- Interim Goal: Target of 20% reduction in emissions intensity by end of 2025.

- Eco-Friendly Innovation: Developing and promoting sustainable pest control and hygiene solutions.

Rentokil Initial's strategic acquisition of The Target Group in 2024 bolstered its UK commercial pest control services, demonstrating a continued focus on bolt-on acquisitions. This fragmented market offers numerous opportunities for consolidation, allowing Rentokil to expand its geographic footprint and market share. The company's robust acquisition pipeline is a key driver for future growth and competitive positioning.

Threats

The pest control and hygiene sectors are incredibly competitive globally, featuring both established international companies and many smaller, local businesses all striving for a larger piece of the market. This high level of competition often translates into significant pricing pressure, compelling Rentokil Initial to offer competitive rates to avoid losing customers, especially in areas with many providers.

Rivals are increasingly employing aggressive marketing strategies and introducing novel services, which could potentially squeeze Rentokil Initial's profit margins if the company doesn't respond effectively. For instance, in 2023, the pest control industry saw a general trend of price sensitivity among commercial clients, with some larger contracts being awarded based on cost-effectiveness, impacting average revenue per customer for leading players.

Economic slowdowns and potential recessions pose a significant threat to Rentokil Initial. A severe downturn in their key markets could lead to reduced spending by commercial clients, impacting demand for pest control and hygiene services, especially those considered non-essential. For instance, if major economies like the UK or US experience a contraction, Rentokil's customer base, particularly in sectors sensitive to economic cycles, might scale back operations or delay necessary service renewals.

While Rentokil's diversified global presence and a substantial portion of recurring revenue from contracts offer a degree of resilience, prolonged economic hardship can still erode overall revenue and profitability. For example, if a recession forces widespread business closures, this directly reduces the pool of potential and existing customers, even for essential services. The company's ability to maintain pricing power might also be tested during periods of high inflation coupled with reduced consumer and business spending power.

Changes in environmental regulations, such as restrictions on certain pest control chemicals or enhanced health and safety standards, could lead to increased operational expenses for Rentokil Initial and potentially curtail its service capabilities. For example, in 2024, the European Union continued to review and potentially restrict the use of neonicotinoid pesticides, a common tool in pest management, which could force companies like Rentokil to invest in alternative, potentially more expensive, solutions.

Navigating the complex and ever-shifting regulatory environments across its global operations demands ongoing investment in research and development for innovative service methods and significant resources dedicated to compliance. This continuous adaptation represents a substantial financial and operational challenge, as seen with the increasing global focus on sustainable pest management practices that require new product formulations and training protocols.

Emergence of New Pests or Disease Vectors

The pest control sector faces a growing threat from novel or resistant pest species, exacerbated by shifting environmental conditions. For Rentokil Initial, this could mean existing treatment protocols becoming less effective, demanding swift innovation and significant investment in research and development. For example, reports in 2024 highlighted the increasing prevalence of certain insecticide-resistant cockroach strains in urban environments, a trend that could expand to other pest types.

Climate change is a significant driver, altering pest life cycles and expanding their geographical ranges. This means Rentokil Initial might encounter pests in regions where they were previously uncommon, requiring new strategies and possibly new product lines. The World Health Organization has also noted that changing climate patterns can increase the spread of disease-carrying insects, such as mosquitoes, which could heighten public demand for effective vector control services.

- Increased R&D Costs: Developing new pest control agents and methods to combat resistant species requires substantial financial commitment, impacting profitability if successful product pipelines are not maintained.

- Reduced Effectiveness of Existing Solutions: The emergence of resistant pests can diminish the efficacy of current service offerings, potentially leading to customer dissatisfaction and loss of market share.

- Heightened Regulatory Scrutiny: The spread of new disease vectors, often linked to pest activity, can trigger more stringent regulations on pest control practices and chemicals, increasing compliance burdens.

- Geographic Expansion of Pest Problems: Climate-driven migration of pests necessitates adaptive service models and potentially new operational footprints for companies like Rentokil Initial.

Supply Chain Disruptions and Input Cost Volatility

Rentokil Initial’s reliance on a global supply chain presents a significant threat, particularly concerning disruptions and fluctuating input costs. The company sources chemicals, equipment, and hygiene consumables worldwide, making it vulnerable to geopolitical instability, extreme weather events, or widespread health crises that can halt production or shipping. For instance, the lingering effects of global supply chain bottlenecks in 2023 continued to impact various industries, including those that supply Rentokil.

Volatility in the prices of raw materials, such as those used in pest control formulations or cleaning agents, and escalating transportation expenses, directly challenge Rentokil’s operational efficiency. These cost pressures can erode profit margins if not effectively managed or passed on to customers. In 2024, many companies experienced significant increases in shipping rates, with the average cost of shipping a 40-foot container seeing substantial year-over-year jumps in certain trade lanes, a trend Rentokil would have to navigate.

- Global Sourcing Vulnerability: Dependence on international suppliers for critical products like pesticides and specialized equipment exposes Rentokil to risks from trade disputes, political unrest, or natural disasters in sourcing regions.

- Input Cost Fluctuations: The price of key commodities and energy, essential for manufacturing and logistics, can be highly volatile, directly impacting Rentokil's cost of goods sold and overall profitability.

- Transportation & Logistics Challenges: Rising fuel costs and container shipping rates, as seen in late 2023 and early 2024, increase the expense of moving goods, potentially squeezing margins or necessitating price adjustments.

- Inventory Management Strain: Supply chain disruptions can lead to stockouts or necessitate higher safety stock levels, tying up capital and increasing warehousing costs for Rentokil.

Rentokil Initial faces intense competition globally, with rivals employing aggressive pricing and innovative service strategies that could pressure profit margins. For example, in 2023, commercial pest control contracts were increasingly awarded based on cost-effectiveness, impacting average revenue per customer for leading players. Economic downturns also pose a threat, potentially reducing client spending on services perceived as non-essential, as seen when major economies contract.

Regulatory changes, such as potential restrictions on certain pest control chemicals like neonicotinoids in the EU during 2024, could increase operational costs and necessitate investment in alternative, possibly more expensive, solutions. Furthermore, the emergence of pest resistance to existing treatments, evidenced by insecticide-resistant cockroach strains reported in 2024, demands continuous R&D investment and can reduce the effectiveness of current offerings.

The company's global supply chain is vulnerable to disruptions and cost fluctuations, with rising shipping rates in early 2024 impacting logistics expenses. Geopolitical instability or extreme weather can halt production or shipping, affecting the availability and cost of essential supplies. For instance, lingering 2023 supply chain bottlenecks continued to present challenges across various industries supplying Rentokil.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Rentokil Initial's official financial filings, comprehensive market research reports, and expert analyses from reputable industry publications.