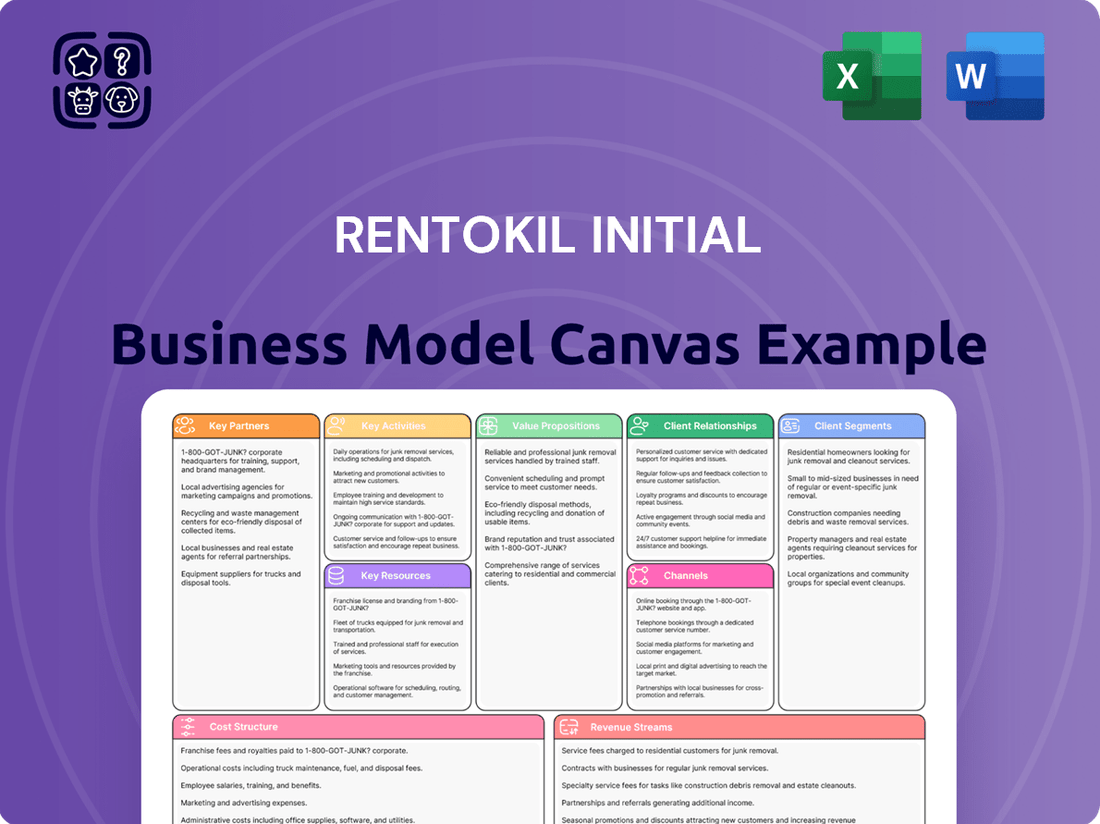

Rentokil Initial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rentokil Initial Bundle

Unlock the strategic blueprint behind Rentokil Initial's dominant position in pest control and hygiene services. This comprehensive Business Model Canvas dissects their customer segments, value propositions, and key revenue streams, revealing the core components of their success.

Discover how Rentokil Initial leverages strategic partnerships and a robust cost structure to deliver essential services globally. Understanding their operational model offers invaluable insights for anyone looking to emulate their market leadership.

This detailed canvas illuminates Rentokil Initial's approach to customer relationships and channels, crucial for maintaining their extensive client base. It's a practical tool for analyzing customer acquisition and retention strategies.

Explore the key activities and resources that power Rentokil Initial's consistent growth and innovation in a dynamic industry. This canvas provides a clear overview of their operational backbone.

Ready to gain a competitive edge? Download the full Business Model Canvas for Rentokil Initial to access a complete, actionable strategy that can inspire your own business planning.

Partnerships

Rentokil Initial actively engages in strategic acquisitions, often termed bolt-on acquisitions, to strengthen its presence and gain market share within the fragmented pest control and hygiene sectors. This approach allows the company to efficiently expand its geographic reach and deepen its penetration in key markets.

In 2024, Rentokil Initial's commitment to this strategy was evident with the successful acquisition of 36 new businesses. These acquisitions collectively contributed approximately £140 million in revenue, underscoring a robust merger and acquisition pipeline and a clear focus on building operational density in its existing service territories.

Rentokil Initial actively partners with technology providers to bolster its digital pest management capabilities and improve service delivery. These collaborations focus on developing advanced solutions like remote pest monitoring systems, which provide real-time data and proactive intervention strategies. In 2024, the company continued its rollout of the myRentokil digital reporting platform to newly acquired businesses, aiming for seamless integration and enhanced data accessibility across its global operations.

Rentokil Initial's supplier relationships are crucial for its operational success, particularly in securing pest control products and essential hygiene equipment. These partnerships are key to maintaining the quality and availability of the materials needed for their services.

By fostering strong ties with its suppliers, Rentokil Initial can ensure a consistent flow of goods, which is vital for meeting customer demand without disruption. This also allows for better negotiation on pricing and terms, positively impacting cost management.

Furthermore, these relationships are instrumental in driving sustainability initiatives, as Rentokil Initial works with suppliers to integrate environmentally friendly sourcing and production methods. In 2024, the company continued its focus on responsible sourcing, aiming to reduce the environmental footprint across its supply chain.

Industry Associations and Regulatory Bodies

Rentokil Initial's engagement with industry associations and regulatory bodies is fundamental to its business operations and reputation. These collaborations ensure the company remains compliant with evolving pest control and hygiene regulations, which is essential for maintaining its operational licenses across numerous global markets. For example, in 2024, adherence to stringent environmental and safety standards, often shaped by these industry groups, directly impacts service delivery and public trust.

These partnerships also foster an environment where best practices are shared and developed, elevating the overall quality and safety of pest control and hygiene services. Rentokil Initial's commitment to health and safety is significantly reinforced by its active participation in setting and upholding these industry benchmarks.

- Regulatory Compliance: Staying abreast of and adhering to local and international regulations, such as those set by the European Chemicals Agency (ECHA) for pesticide use, ensures continued market access and avoids potential penalties.

- Industry Best Practices: Collaborating with bodies like the British Pest Control Association (BPCA) or the National Pest Management Association (NPMA) allows for the adoption and promotion of advanced, safe, and effective pest management techniques.

- Public Health & Safety: Membership in organizations focused on public health, such as those addressing food safety standards, directly supports Rentokil Initial's mission to protect people and enhance lives.

- Innovation & Standards: Participation in industry working groups can influence the development of new standards and technologies, ensuring Rentokil Initial remains at the forefront of service innovation.

Local Service Providers

Rentokil Initial leverages key partnerships with local service providers, particularly in geographically challenging or less densely populated regions, to enhance its operational footprint. These collaborations are crucial for extending market reach and ensuring consistent service quality where establishing a direct presence might be inefficient or cost-prohibitive. This strategy allows Rentokil to offer its pest control and hygiene services to a wider customer base.

For example, by integrating local expertise and resources, Rentokil can achieve more responsive service delivery, addressing immediate customer needs promptly. This approach not only facilitates broader market penetration but also allows the company to adapt to specific regional demands and regulations. In 2024, such partnerships are vital for maintaining competitive advantage and operational agility in diverse markets.

- Extended Reach: Local partners enable Rentokil to service areas where direct operations are limited.

- Service Efficiency: Collaboration ensures timely and effective delivery of pest control and hygiene solutions.

- Market Penetration: Partnerships facilitate entry and growth in new or underserved territories.

- Adaptability: Local providers offer crucial insights into regional market dynamics and customer preferences.

Rentokil Initial's key partnerships are diverse, ranging from strategic acquisitions that bolster market share to collaborations with technology providers for enhanced digital services. The company also relies on strong supplier relationships for essential materials and engages with industry associations to uphold best practices and regulatory compliance. Furthermore, partnerships with local service providers are vital for extending operational reach into less accessible regions.

| Partnership Type | Strategic Importance | 2024 Impact/Focus |

|---|---|---|

| Acquisitions (Bolt-on) | Market share growth, geographic expansion | 36 businesses acquired, adding ~£140m revenue |

| Technology Providers | Digital capabilities, service innovation | Rollout of myRentokil platform, remote monitoring |

| Suppliers | Product availability, quality, cost management | Focus on responsible sourcing and sustainability |

| Industry Associations | Compliance, best practices, public health | Adherence to environmental/safety standards |

| Local Service Providers | Geographic reach, service efficiency | Extending operational footprint in diverse markets |

What is included in the product

A detailed Rentokil Initial Business Model Canvas that outlines their diverse pest control and hygiene services, focusing on recurring revenue streams and strong customer relationships across various market segments.

Rentokil Initial's Business Model Canvas addresses the pain point of businesses struggling with complex pest control, hygiene, and workwear needs by offering integrated, expert solutions.

This canvas provides a clear, actionable overview, simplifying how companies access and manage essential operational services, thereby reducing managerial overhead and risk.

Activities

Rentokil Initial's key activities in pest control services revolve around delivering comprehensive management solutions for both commercial and residential customers. This encompasses tackling common nuisances like rodents, insects, and even wildlife, ensuring environments are safe and pest-free.

The service delivery model involves meticulous inspection to identify the root cause of infestations, followed by targeted treatment strategies. Prevention is also a critical component, aiming to stop future pest problems before they start.

Advanced digital technologies are increasingly integrated into these operations. For instance, sensors and data analytics help in real-time monitoring and predictive pest control, enhancing efficiency and effectiveness. As of 2024, Rentokil Initial reported significant growth in its pest control division, driven by these technological advancements and expanded service offerings across its global markets.

Rentokil Initial's Hygiene and Wellbeing Services are crucial, focusing on delivering comprehensive washroom and workplace hygiene solutions. This includes specialized air care, essential hand hygiene products, and advanced disinfection services designed to create healthier environments.

The business actively provides deep cleaning and disinfection, a vital component for maintaining safety and compliance in various settings. Furthermore, their expertise extends to the critical area of clinical waste management, ensuring responsible and secure disposal.

In 2023, Rentokil Initial reported significant growth in its Hygiene division, contributing substantially to the group's overall performance. For instance, the company highlighted increased demand for its disinfection and hygiene services as businesses prioritized employee safety post-pandemic.

The company's commitment to innovation in hygiene is evident through its product development and service offerings, aiming to set industry standards for cleanliness and wellbeing. This strategic focus supports their mission to protect people and enhance environments.

Rentokil Initial's Workwear and Textile Services involved managing the rental, cleaning, and maintenance of textiles and workwear. This ensured businesses had clean, professional attire and linens. For example, in 2023, the company continued to operate this segment in various markets, providing essential services to sectors like hospitality and healthcare.

However, a significant strategic shift occurred with the divestment of its French Workwear division in late 2023. This move allowed Rentokil Initial to sharpen its focus on its core, high-growth businesses: pest control and hygiene services. This divestment aimed to streamline operations and allocate resources more effectively towards these key areas.

Research and Development

Rentokil Initial's commitment to Research and Development (R&D) is a cornerstone of its strategy, fueling the creation of cutting-edge pest control solutions and eco-friendly alternatives. This continuous investment ensures they stay ahead in a dynamic market. For instance, in 2023, the company highlighted its ongoing focus on innovation, particularly in developing more sustainable and digitally integrated service offerings.

Their R&D efforts are geared towards enhancing service effectiveness and operational efficiency. This includes exploring advanced digital tools and data analytics to optimize pest management strategies for clients. By prioritizing innovation, Rentokil Initial aims to solidify its competitive advantage and deliver superior value.

- Development of new, environmentally friendly pest control formulations.

- Integration of digital technologies for enhanced service delivery and customer insights.

- Research into advanced monitoring and detection systems for early pest identification.

- Continuous improvement of existing product efficacy and safety profiles.

Acquisition and Integration

A core operational focus for Rentokil Initial is the strategic identification, acquisition, and seamless integration of bolt-on businesses. This activity is crucial for bolstering market share and enhancing geographic presence across its service territories.

The successful integration of significant acquisitions, notably Terminix, is a testament to Rentokil's capability in harmonizing disparate systems, operational procedures, and sales infrastructures. This ensures that acquired entities quickly contribute to the group’s overall efficiency and market reach.

For instance, the acquisition of Terminix in 2022 was a transformative event, significantly expanding Rentokil's footprint in North America. This deal, valued at approximately $6.7 billion, represented a major step in their consolidation strategy.

- Market Expansion: Acquisitions fuel growth by entering new geographic regions or strengthening positions in existing ones.

- Synergy Realization: Integrating acquired operations allows for cost savings and operational efficiencies through shared resources and best practices.

- Terminix Integration: A key focus is aligning Terminix's IT systems, customer service platforms, and operational workflows with Rentokil's global standards.

- Bolt-on Acquisitions: Rentokil continually seeks smaller, complementary businesses to add specialized services or density in key markets.

Rentokil Initial's key activities are centered on delivering essential pest control and hygiene services. This involves comprehensive pest management for commercial and residential clients, utilizing inspections, targeted treatments, and preventive measures. They also provide extensive washroom and workplace hygiene solutions, including deep cleaning, disinfection, and clinical waste management.

A significant strategic activity is the ongoing integration of acquired businesses, most notably Terminix, which expanded their North American presence. This also includes seeking smaller, complementary bolt-on acquisitions to enhance market share and service offerings. Furthermore, Rentokil Initial actively invests in Research and Development to create innovative, eco-friendly pest control solutions and improve service efficiency through digital integration.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Pest Control Service Delivery | Comprehensive pest management for commercial and residential clients, including inspection, treatment, and prevention. | Growth driven by technological advancements and expanded global offerings. |

| Hygiene and Wellbeing Services | Providing washroom and workplace hygiene solutions, disinfection, and clinical waste management. | Increased demand for disinfection services continues post-pandemic. |

| Acquisition Integration | Integrating acquired businesses to expand market share and operational efficiencies. | Seamless integration of Terminix's systems and operations is a priority. |

| Research and Development | Developing innovative, sustainable pest control and hygiene solutions. | Focus on digital integration and enhanced service effectiveness. |

Full Version Awaits

Business Model Canvas

The Rentokil Initial Business Model Canvas you're previewing is the exact, comprehensive document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the final deliverable, showcasing the detailed breakdown of their operations. Upon completing your order, you'll gain full access to this same professionally structured and formatted Business Model Canvas, ready for your analysis or integration.

Resources

Rentokil Initial's global technician workforce, numbering over 50,000, is the bedrock of its service delivery. This vast network of skilled professionals operates across more than 90 countries, directly engaging with millions of customers each year to provide essential pest control and hygiene services.

The company's commitment to rigorous training is evident in its comprehensive onboarding programs and ongoing development initiatives. In 2024, significant investment continued in upskilling technicians, ensuring they possess the latest knowledge in pest identification, treatment methods, and safety protocols, directly impacting service excellence and customer satisfaction.

Retention of this vital talent pool is a strategic imperative. Rentokil Initial focuses on creating a supportive work environment, offering competitive compensation, and providing clear career progression pathways. This focus on employee well-being and growth is crucial for maintaining the high standards expected by their diverse customer base.

Rentokil Initial's proprietary technology, including advanced digital pest management solutions and remote monitoring systems, forms a core asset. These innovations allow for proactive rather than reactive pest control, significantly improving service delivery and client satisfaction.

The myRentokil digital reporting platform is a crucial component, offering customers real-time data and insights into pest activity and service outcomes. This transparency enhances customer experience and builds trust, driving retention.

In 2024, Rentokil Initial continued to invest heavily in its digital capabilities, aiming to further integrate IoT devices for enhanced remote monitoring. This focus on digital transformation is expected to drive operational efficiencies and create new revenue streams.

These technological assets are not just about efficiency; they are key differentiators in the market, enabling Rentokil Initial to offer a superior, data-driven service compared to traditional methods.

Rentokil Initial's extensive branch network and substantial fleet are foundational to its operational efficiency. This widespread infrastructure allows for timely and localized service delivery, a critical component in their pest control and hygiene solutions business. By strategically positioning these resources, the company ensures it can effectively reach and serve a diverse customer base across various regions.

The company actively optimizes its branch network, a strategy that includes the establishment of satellite branches. This move is designed to bring services even closer to customers, reducing response times and improving overall customer satisfaction. This granular approach to service deployment is key to maintaining their competitive edge in the market.

In 2023, Rentokil Initial operated across 80 countries, supported by a vast network of service centers. This global footprint is facilitated by a significant fleet of vehicles, which are essential for transporting technicians and equipment to customer sites. The scale of their operations underscores the importance of these physical assets in their business model.

Strong Brand Portfolio

Rentokil Initial's strong brand portfolio, featuring well-established names like Rentokil and Terminix, is a cornerstone of its business model, fostering significant market credibility and customer trust. These recognized brands allow the company to command premium pricing and attract a loyal customer base across diverse service sectors.

The company is actively refining its brand strategy to maximize the impact of both its national power brands and its valuable regional brands. This dual approach ensures broad market penetration while also catering to specific local market needs and preferences.

In 2023, Rentokil Initial reported a significant revenue contribution from its key brands, underscoring their market strength. For instance, the integration of Terminix, acquired in 2022 for approximately $6.7 billion, has substantially bolstered Rentokil's North American presence and brand equity.

- Brand Recognition: Rentokil and Terminix are highly recognizable names, synonymous with pest control and hygiene services, providing immediate customer trust.

- Market Credibility: The established reputation of these brands translates into increased customer confidence and willingness to engage services.

- Strategic Brand Alignment: Rentokil Initial is focusing on leveraging its national brands for broad appeal and regional brands for localized market penetration.

- Acquisition Synergies: The Terminix acquisition in 2023, a major milestone, significantly enhanced the brand portfolio and market reach, particularly in North America.

Intellectual Property and Expertise

Rentokil Initial's accumulated knowledge in pest biology and behavior is a cornerstone of its business model. This deep understanding allows them to develop highly targeted and effective pest control strategies, which is crucial for maintaining a strong competitive edge. For instance, their expertise in identifying specific insect life cycles helps optimize treatment schedules, leading to better outcomes for clients and reinforcing their reputation for efficacy.

Patented methods and proprietary technologies represent significant intellectual property for Rentokil Initial. These innovations, often stemming from extensive research and development, differentiate their service offerings and create barriers to entry for competitors. Their investment in R&D, which fuels these patented solutions, directly translates into superior service delivery and client satisfaction.

The company's deep expertise extends to hygiene protocols and service delivery, encompassing everything from food safety standards to workplace health. This holistic approach, built on years of practical experience and scientific understanding, allows Rentokil Initial to provide comprehensive solutions that go beyond basic pest control. Their ability to adapt and refine these protocols based on evolving industry regulations and scientific findings is a testament to their ongoing commitment to expertise.

These intellectual resources are not just theoretical; they translate into tangible benefits. In 2023, Rentokil Initial reported strong revenue growth, partly driven by the demand for their specialized and reliable services. This financial performance underscores the commercial value of their intellectual property and expertise in the global market.

- Accumulated Knowledge: Deep understanding of pest biology and behavior for targeted solutions.

- Patented Methods: Proprietary technologies and innovations that differentiate services.

- Hygiene Expertise: Comprehensive knowledge of protocols for food safety and workplace health.

- Service Delivery Excellence: Continuous refinement of service delivery based on experience and science.

Rentokil Initial's key resources are its extensive global technician workforce, proprietary technology, and a robust network of branches and fleet. The company's strong brand portfolio, including Rentokil and Terminix, coupled with deep expertise in pest biology and hygiene protocols, further solidify its market position.

| Key Resource | Description | 2023/2024 Impact |

| Skilled Workforce | Over 50,000 technicians globally, trained in advanced pest control and hygiene. | Continued investment in upskilling in 2024 to enhance service quality. |

| Proprietary Technology | Digital pest management solutions, remote monitoring, and myRentokil platform. | Focus on IoT integration in 2024 to drive efficiency and new revenue. |

| Infrastructure | Extensive branch network and a substantial fleet of vehicles. | Strategic establishment of satellite branches in 2023 to improve response times. |

| Brand Portfolio | Well-recognized brands like Rentokil and Terminix. | Terminix acquisition in 2022 significantly boosted North American presence and brand equity. |

| Intellectual Property | Deep knowledge of pest biology, patented methods, and hygiene expertise. | Drives specialized service offerings, contributing to strong revenue growth in 2023. |

Value Propositions

Rentokil Initial provides extensive protection against pests and hygiene risks for both businesses and households. This shields clients from significant health threats, potential damage to their brand reputation, and the financial strain that can arise from pest infestations and unsanitary environments. For instance, in 2024, the company continued to serve millions of customers globally, a testament to the widespread need for their services. Their comprehensive approach aims to prevent outbreaks and maintain safe, healthy spaces.

Customers deeply value Rentokil Initial's decades of experience in pest control and hygiene services, recognizing the profound expertise our technicians bring to every job. This long-standing presence translates into a reliable service delivery that clients can consistently count on. In 2024, our commitment to quality was reinforced by ongoing training programs for our global workforce, ensuring they remain at the forefront of industry best practices and innovative solutions.

The peace of mind Rentokil Initial offers is a direct result of our unwavering dedication to consistent, high-quality service execution. Our customers trust us to provide effective solutions that safeguard their environments, a trust that has been built over many years of dependable performance. This reliability is a cornerstone of our value proposition, making us a preferred partner for businesses seeking to maintain stringent hygiene and pest-free standards.

Rentokil Initial leverages innovation and digital solutions to provide cutting-edge pest management. Their advanced digital technologies, including remote monitoring and online reporting, significantly boost operational efficiency and transparency for clients.

These data-driven innovations translate into more effective pest control strategies. For instance, in 2023, Rentokil Initial reported a 9% organic revenue growth, partly driven by the adoption of these digital services, demonstrating their tangible impact on business performance.

Global Reach with Local Service

Rentokil Initial’s global reach, spanning over 90 countries as of 2024, allows it to deliver a unified, high-quality service standard across diverse markets. This expansive operational footprint is complemented by a dedicated local presence in each region, ensuring services are adapted to specific customer needs and regulatory environments.

This dual approach of global consistency and local tailoring enables Rentokil Initial to provide rapid and effective pest control and hygiene solutions, regardless of a client's location. For instance, their commitment to local expertise means understanding regional pest behaviors and environmental factors, leading to more targeted and efficient interventions.

- Global Presence: Operates in over 90 countries worldwide.

- Consistent Standards: Delivers a uniform service quality globally.

- Local Adaptation: Tailors solutions to specific regional needs and regulations.

- Rapid Response: Leverages local teams for quick and effective service delivery.

Health, Safety, and Environmental Assurance

Rentokil Initial champions Health, Safety, and Environmental Assurance by integrating sustainable practices and responsible product use into its core operations. This commitment resonates strongly with clients who increasingly prioritize environmental stewardship and the well-being of their employees.

The company's dedication to achieving net-zero carbon emissions by 2040 is a key differentiator, directly addressing growing regulatory and consumer demand for eco-conscious solutions. For instance, Rentokil Initial reported a 12% reduction in its Scope 1 and 2 GHG emissions intensity in 2023 compared to its 2019 baseline, showcasing tangible progress towards its ambitious targets.

This focus on sustainability and safety is not just an ethical stance but a strategic advantage, attracting businesses looking to enhance their own corporate social responsibility credentials. Clients benefit from services that not only protect their premises but also align with their broader ESG (Environmental, Social, and Governance) objectives.

- Environmental Stewardship: Commitment to net-zero emissions by 2040 and a reported 12% reduction in GHG intensity by 2023.

- Responsible Product Use: Emphasis on sustainable and safe pest control and hygiene solutions.

- Employee Wellbeing: Ensuring safe and healthy environments for both Rentokil Initial employees and its clients' stakeholders.

- Client Value: Appealing to businesses that prioritize ESG compliance and a positive brand image.

Rentokil Initial offers comprehensive pest control and hygiene services, safeguarding businesses and households from health risks and reputational damage. Their extensive global network, operating in over 90 countries as of 2024, ensures consistent, high-quality solutions tailored to local needs. This combination of global reach and local expertise allows for rapid, effective service delivery, providing clients with essential protection and peace of mind.

The company's value proposition is significantly enhanced by its commitment to innovation and digital solutions, improving operational efficiency and transparency. For example, their data-driven pest management strategies, which include remote monitoring, contributed to a 9% organic revenue growth in 2023. This technological integration not only optimizes pest control but also offers clients tangible benefits in managing their environments effectively.

Furthermore, Rentokil Initial champions Health, Safety, and Environmental Assurance through sustainable practices and responsible product use. Their goal of achieving net-zero carbon emissions by 2040, supported by a 12% reduction in GHG intensity by 2023, appeals to environmentally conscious clients. This focus on ESG objectives allows businesses to enhance their own corporate social responsibility credentials by partnering with Rentokil Initial.

| Value Proposition | Description | Key Data/Facts (2023-2024) |

|---|---|---|

| Comprehensive Protection | Shields clients from pests and hygiene risks, preventing health threats and reputational damage. | Serves millions of customers globally; recognized for expertise and reliable service delivery. |

| Innovation and Digital Solutions | Leverages advanced technologies for efficient and transparent pest management. | 9% organic revenue growth in 2023, partly driven by digital services; uses remote monitoring and online reporting. |

| Global Reach & Local Expertise | Provides consistent, high-quality service across diverse markets with local adaptation. | Operates in over 90 countries (2024); tailored solutions to specific regional needs and regulations. |

| Health, Safety, and Environmental Assurance | Integrates sustainable practices and responsible product use, aligning with ESG goals. | Targeting net-zero emissions by 2040; achieved 12% reduction in GHG intensity by 2023 (vs. 2019 baseline). |

Customer Relationships

Rentokil Initial cultivates strong customer bonds through its network of dedicated local service teams. These teams, comprising on-the-ground technicians, are the face of the company, providing regular, personalized visits to client sites.

This direct, consistent interaction is crucial for building trust and ensuring high service quality. By offering tailored solutions based on specific site needs, Rentokil Initial demonstrates a commitment to customer satisfaction that goes beyond a one-off service.

In 2024, Rentokil Initial continued to emphasize this localized approach, with over 40,000 colleagues globally, many of whom are client-facing service technicians. This vast workforce allows for deep penetration into local markets, fostering familiarity and reliability.

The consistent presence of familiar faces for pest control and hygiene services creates a sense of security and partnership, differentiating Rentokil Initial from competitors who might rely more heavily on remote support.

Rentokil Initial prioritizes keeping its customers happy through superior service and a better overall experience. This focus on customer relationships aims to boost retention, as seen in positive trends in regions like North America where specific initiatives have led to higher retention rates.

Rentokil Initial leverages digital platforms like myRentokil to foster strong customer relationships. These platforms offer clients a convenient way to track service history, view detailed reports, and manage their accounts entirely online, enhancing transparency.

This digital engagement ensures clients have immediate access to crucial information, improving satisfaction and trust. For instance, in 2024, myRentokil facilitated millions of customer interactions, streamlining reporting and communication processes across its diverse service offerings.

The ability for customers to self-serve and access information 24/7 significantly boosts convenience. This digital channel allows for proactive communication and efficient issue resolution, further solidifying the client-provider partnership.

Key Account Management

Rentokil Initial leverages Key Account Management (KAM) to foster deep, strategic relationships with its largest commercial and multinational clients. This approach focuses on delivering highly customized pest control, hygiene, and workwear solutions, recognizing the unique and often complex operational demands of these organizations.

Through KAM, Rentokil Initial ensures centralized coordination and a single point of contact for clients operating across multiple locations. This streamlined communication is vital for managing diverse service requirements and maintaining consistent quality standards globally. In 2024, this focus on tailored solutions for large enterprises is a significant driver of recurring revenue and client retention.

- Dedicated Relationship Managers: Assigning specialized account managers who understand the client's industry and specific needs.

- Customized Service Plans: Developing bespoke pest control, hygiene, and other service strategies tailored to each key account's operational environment.

- Strategic Partnership: Collaborating with clients to proactively address evolving challenges and integrate services for maximum efficiency and compliance.

- Global Account Coordination: Providing consistent service delivery and reporting across all of a multinational client's locations.

Feedback and Improvement Loops

Rentokil Initial prioritizes customer feedback, employing surveys and dedicated programs to gather insights. This proactive approach allows the company to continuously refine its service quality and effectively address any client concerns that arise.

This commitment to customer input directly fuels ongoing service enhancements. By actively listening and responding to feedback, Rentokil Initial ensures its offerings remain aligned with customer expectations and evolving market needs.

- Customer Satisfaction: In 2024, Rentokil Initial reported strong customer retention rates, a testament to its feedback-driven improvement processes.

- Service Innovation: Feedback loops have led to the introduction of new digital service platforms, enhancing customer experience and operational efficiency.

- Addressing Concerns: The company's structured complaint resolution mechanism, informed by customer input, aims for swift and satisfactory outcomes.

Rentokil Initial builds robust customer relationships through a combination of localized service delivery, digital engagement, and strategic account management. Their extensive network of over 40,000 global colleagues, many of whom are client-facing, ensures consistent, personalized interactions. Digital platforms like myRentokil enhance transparency and convenience, allowing customers to manage services and access reports online. This multifaceted approach, focused on trust and tailored solutions, drives customer retention and satisfaction.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Local Service Teams | On-the-ground technicians providing regular, personalized site visits. | Fosters trust and familiarity, crucial for high retention rates. |

| Digital Platforms (myRentokil) | Online portal for service tracking, reporting, and account management. | Facilitated millions of customer interactions in 2024, improving efficiency. |

| Key Account Management (KAM) | Dedicated management for large commercial and multinational clients. | Drives recurring revenue and retention through highly customized solutions. |

| Customer Feedback Integration | Utilizing surveys and programs to gather and act on client input. | Led to service innovations and strong customer retention in 2024. |

Channels

Rentokil Initial's direct sales force is a cornerstone of its customer acquisition strategy, with a dedicated team actively engaging both commercial and residential clients. This force is instrumental in generating leads, securing new business contracts, and nurturing ongoing relationships with existing customers. Their efforts encompass crucial field sales activities and strategic business development initiatives, ensuring a proactive approach to market penetration.

In 2024, Rentokil Initial continued to invest in its sales infrastructure, recognizing the direct impact of this channel on revenue growth. The company's field sales teams are equipped with modern tools and training to effectively communicate the value proposition of its pest control and hygiene services. This direct engagement allows for tailored solutions and a deeper understanding of client needs, which is critical in a competitive landscape.

Rentokil Initial leverages online and digital platforms extensively. Their company websites serve as primary hubs for information and service inquiries. Digital marketing campaigns and targeted online lead generation are vital for connecting with potential customers, particularly in the residential and small business markets.

The company actively invests in improving its search engine optimization (SEO) and creating valuable online content to attract and engage customers. In 2024, Rentokil Initial continued to refine its digital presence, aiming to enhance user experience and streamline the customer journey from initial contact to service delivery.

Rentokil Initial's extensive network of local service branches are the backbone of its operational strategy. These physical locations act as crucial hubs, facilitating the efficient dispatch of their 16,000+ strong technician workforce. They also provide essential space for storing vital equipment and offering localized, on-the-ground customer support, which is key to their service-oriented business model.

The company is actively growing its reach by expanding its satellite branch network. This strategic move allows Rentokil Initial to penetrate new geographic areas more effectively and respond faster to local market needs. For instance, in 2024, the company continued its investment in infrastructure to support this expansion, aiming to reduce response times and enhance service density across its operating regions.

Call Centers and Customer Service

Centralized and regional call centers act as Rentokil Initial's primary touchpoint for customers, handling everything from initial inquiries and service scheduling to critical support and urgent requests.

These channels are absolutely essential for building and maintaining responsive customer relationships, ensuring timely assistance and problem resolution.

In 2023, Rentokil Initial reported that its customer service operations, heavily reliant on these call centers, handled millions of customer interactions globally.

- Customer Interaction Volume: Millions of calls and digital inquiries processed annually across global call centers.

- Service Scheduling: Efficiently manage appointments for pest control, hygiene services, and workwear.

- Emergency Support: Provide immediate assistance for urgent pest or hygiene-related issues.

- Customer Retention: Directly impact customer loyalty through effective communication and problem-solving.

Referral Programs and Word-of-Mouth

Referral programs and word-of-mouth are crucial for Rentokil Initial's growth. Positive experiences with their technicians, who are often the primary point of customer contact, frequently translate into recommendations. This organic channel is a cost-effective way to acquire new business.

Rentokil Initial actively cultivates these channels through initiatives designed to incentivize existing clients. For example, their 'Trusted Advisor' program is structured to encourage clients to introduce new leads, recognizing the value of their existing customer base as advocates.

- Customer Satisfaction Drives Referrals: High satisfaction rates, often stemming from positive technician interactions, are a primary driver of organic growth for Rentokil Initial.

- 'Trusted Advisor' Program: This initiative specifically aims to leverage existing clients for lead generation, formalizing the word-of-mouth process.

- Organic Growth Channel: Referrals represent a significant and cost-efficient method for Rentokil Initial to expand its customer base.

Rentokil Initial utilizes a multi-channel approach to reach its diverse customer base. Its direct sales force actively engages commercial and residential clients, focusing on lead generation and contract acquisition. Online and digital platforms, including optimized websites and targeted marketing, are crucial for attracting customers, particularly in the smaller business and residential segments.

The company's extensive network of local service branches serves as operational hubs, enabling efficient dispatch of its technician workforce and providing localized customer support. Furthermore, centralized and regional call centers handle millions of customer interactions annually, managing inquiries, scheduling, and emergency support, which directly impacts customer retention.

Referral programs and word-of-mouth marketing, often driven by positive technician experiences, are vital for organic growth. In 2024, Rentokil Initial continued to enhance its digital presence and expand its satellite branch network to improve market penetration and response times.

| Channel | Description | Key Activities | 2024 Focus/Data Point |

|---|---|---|---|

| Direct Sales Force | Dedicated team for commercial and residential client engagement. | Lead generation, contract acquisition, relationship nurturing. | Investment in sales tools and training for revenue growth. |

| Online/Digital Platforms | Company websites, digital marketing, SEO. | Information hub, lead generation, customer acquisition. | Refining user experience and streamlining customer journey. |

| Local Service Branches | Physical locations for operations and support. | Technician dispatch, equipment storage, localized customer support. | Expansion of satellite branches for increased geographic reach. |

| Call Centers | Centralized and regional customer contact points. | Inquiries, scheduling, emergency support, customer retention. | Handled millions of customer interactions globally in 2023. |

| Referrals/Word-of-Mouth | Organic growth driven by customer satisfaction. | Lead generation through existing client recommendations. | Cultivating through initiatives like the 'Trusted Advisor' program. |

Customer Segments

Commercial businesses, often referred to as B2B clients, represent a massive customer base for Rentokil Initial. This segment is incredibly diverse, encompassing industries like hospitality, food processing, healthcare, retail, and general office environments. Each of these sectors has unique needs for pest control, hygiene solutions, and workwear services.

These businesses rely on Rentokil Initial to uphold critical health, safety, and regulatory compliance standards. For instance, in the food processing industry, stringent pest prevention is paramount to avoid contamination and comply with food safety regulations. In healthcare, sterile environments are non-negotiable, making advanced hygiene and disinfection services essential.

The sheer scale of the B2B market is significant. For example, the global pest control market was valued at approximately $22.5 billion in 2023 and is projected to grow steadily. Rentokil Initial's ability to offer tailored solutions for each industry within this broad segment—from rodent control in restaurants to specialized disinfection in hospitals—is a key driver of its business.

Homeowners and tenants are a core customer segment, actively seeking reliable solutions for common household pests like rodents, insects, and termites. For instance, in 2024, the residential pest control market in the UK saw continued demand, with surveys indicating over 60% of households experiencing some form of pest issue annually.

This group often prioritizes convenience and accessibility, readily engaging with businesses through direct contact, phone calls, and increasingly, online platforms and mobile applications for booking services and managing accounts.

Hygiene is also a significant concern for this segment, especially post-pandemic, with a growing interest in professional cleaning and disinfection services for homes and apartments to ensure a healthy living environment.

The decision-making process for residential customers is often driven by immediate needs, perceived value, and trust in service providers, making clear communication and demonstrable results crucial for retention.

Public institutions, including government offices, schools, and hospitals, represent a significant customer segment for Rentokil Initial. These entities have a critical need for reliable pest control and hygiene services to maintain public health, safety, and regulatory compliance. For instance, in 2024, governments globally continue to allocate substantial budgets towards public health infrastructure, which inherently includes sanitation and pest management in facilities like hospitals and educational institutions.

These public sector clients typically engage Rentokil Initial through long-term contracts, providing a stable revenue stream. The emphasis on public well-being means these services are often considered essential, leading to consistent demand regardless of economic fluctuations. The scale of operations in schools and municipal buildings, for example, necessitates comprehensive and ongoing service plans.

The procurement processes for government and public sector entities often involve rigorous tendering and compliance checks. Rentokil Initial's ability to meet stringent service level agreements, demonstrate a strong track record, and offer environmentally responsible solutions is key to securing these valuable contracts. The company's global presence and standardized service offerings also appeal to multinational public sector organizations.

Industrial Clients

Industrial clients, encompassing manufacturing plants, warehouses, and logistics centers, represent a critical customer segment for Rentokil Initial. These businesses operate at a significant scale, often dealing with large volumes of goods and materials, which inherently creates unique and demanding pest management and hygiene challenges. Their operations are heavily scrutinized by regulatory bodies, making compliance with stringent health and safety standards paramount.

The specific needs of industrial clients stem from the nature of their operations. For instance, food processing plants require highly specialized pest control to prevent contamination, while pharmaceutical manufacturers need to maintain sterile environments to protect product integrity. Warehouses, especially those storing raw materials or finished goods, are susceptible to infestations that can lead to product spoilage and significant financial losses. Logistics centers, with their constant movement of goods, face the risk of pests being introduced and spread across supply chains.

Rentokil Initial's solutions for this segment are tailored to address these complexities. They offer integrated pest management programs designed to minimize disruption while ensuring effective control. This includes advanced monitoring systems, targeted treatments, and comprehensive sanitation services. The company’s understanding of industry-specific regulations, such as those from the FDA or HACCP, allows them to provide compliant and effective solutions.

- Manufacturing Plants: Focus on preventing contamination of products and maintaining operational continuity. In 2024, the global manufacturing sector faced increasing pressure to adhere to stringent food safety regulations, with pest control being a key component.

- Warehouses and Distribution Centers: Require protection against pests that can damage stored goods, leading to write-offs and reputational damage. For example, rodent infestations can cause millions in losses through damaged inventory and contamination.

- Logistics Operations: Need to ensure that pests are not transported between locations, safeguarding supply chains. The global logistics industry's growth in 2024 highlighted the importance of biosecurity measures.

- Regulatory Compliance: Industrial clients must meet strict health, safety, and environmental standards. Failure to comply can result in significant fines and operational shutdowns, emphasizing the critical role of expert pest and hygiene services.

Businesses with Multi-Site Operations

Large corporations with multi-site operations are a cornerstone customer segment for Rentokil Initial. These businesses, often spanning multiple branches, retail locations, or manufacturing plants, require a unified approach to pest control, hygiene, and workwear services. Rentokil Initial's strength lies in its capacity to deliver consistent service quality and standardized protocols across diverse geographical locations, ensuring brand protection and operational efficiency for its clients.

These clients typically engage Rentokil Initial through key account management structures. This allows for centralized oversight and reporting, simplifying the management of essential services across a wide network. For example, a global retail chain can rely on Rentokil Initial to maintain hygiene standards in all its stores, from London to Sydney, with a single point of contact for service coordination and performance review.

The benefits are tangible. Businesses can achieve cost savings through bulk agreements and streamlined service delivery. Furthermore, by entrusting these critical functions to a single, reliable provider, they reduce the administrative burden associated with managing multiple local contracts. This focus allows them to concentrate on their core business activities.

In 2024, Rentokil Initial continued to solidify its position with these large enterprises. The company reported significant contract wins with major corporations, underscoring the demand for its integrated, multi-site service capabilities. These partnerships often involve comprehensive solutions tailored to the specific needs of each business, from advanced digital reporting to specialized pest management for sensitive environments.

- Key Account Management: Centralized service delivery and reporting for geographically dispersed operations.

- Service Standardization: Consistent application of pest control and hygiene protocols across all sites.

- Cost Efficiency: Potential for savings through consolidated contracts and optimized service routes.

- Risk Mitigation: Ensuring compliance and brand protection through reliable, professional services.

Rentokil Initial serves a broad customer base, including commercial businesses across various sectors like hospitality and food processing, who require adherence to strict health and safety standards. The company also caters to homeowners and tenants seeking convenient solutions for common pest issues and hygiene concerns. Public institutions such as schools and hospitals rely on Rentokil Initial for essential pest control and sanitation services to maintain public well-being.

Furthermore, industrial clients, including manufacturing plants and warehouses, depend on Rentokil Initial for specialized pest management to prevent product contamination and ensure operational continuity. Large corporations with multi-site operations benefit from Rentokil Initial's ability to deliver consistent service quality and standardized protocols across numerous locations, simplifying management and ensuring brand protection.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Commercial Businesses (B2B) | Health, safety, regulatory compliance, pest prevention, hygiene | Global pest control market projected to reach over $26 billion by 2024. |

| Residential Customers (B2C) | Pest removal, home hygiene, convenience | Over 60% of UK households experience pest issues annually. |

| Public Institutions | Public health, safety, compliance, long-term contracts | Continued global government investment in public health infrastructure. |

| Industrial Clients | Product integrity, contamination prevention, supply chain security | Stringent regulations in food processing and pharmaceutical sectors drive demand. |

| Large Corporations (Multi-site) | Service consistency, cost efficiency, risk mitigation | Significant contract wins reported by Rentokil Initial in 2024 with major corporations. |

Cost Structure

Employee salaries and benefits represent a significant cost for Rentokil Initial, reflecting its substantial global workforce. This category includes wages, health insurance, retirement contributions, and other benefits for its many employees, especially those on the front lines like pest control technicians and sales representatives.

In 2024, Rentokil Initial's employee-related expenses are a primary driver of its operational costs. The company's commitment to attracting and retaining skilled personnel, particularly its extensive network of service technicians, necessitates competitive compensation packages and ongoing investment in training and development to maintain service quality and expand its reach.

Rentokil Initial's operational and fleet costs are substantial, driven by the need to maintain a vast network of service vehicles and equipment. These expenses are critical for delivering their pest control and hygiene services efficiently across numerous locations.

Fuel for the extensive vehicle fleet is a major ongoing expenditure, directly impacting profitability given fluctuating energy prices. In 2024, companies in the logistics and service sectors are closely monitoring fuel efficiency and exploring alternative energy sources to mitigate these costs.

Beyond vehicles, the upkeep of specialized pest control and hygiene equipment, along with the infrastructure of their branch network, represents significant operational investment. This includes maintenance, calibration, and replacement of tools essential for service delivery.

These operational and fleet expenditures are a core component of Rentokil Initial's cost structure, requiring careful management and strategic planning to ensure cost-effectiveness and service quality.

Rentokil Initial dedicates substantial resources to marketing and sales. In 2024, the company continued to invest heavily in brand awareness initiatives and lead generation activities to attract new customers across its diverse service offerings. This includes significant spending on digital marketing platforms and traditional advertising to maintain a strong market presence and reach a broad customer base.

The company's sales infrastructure also receives considerable investment. This encompasses building and maintaining a robust sales force, providing them with advanced training and tools, and developing efficient sales processes. These investments are crucial for converting leads into paying customers and driving revenue growth. For example, in 2023, Rentokil Initial reported that marketing and selling expenses were £1.1 billion, reflecting the scale of these investments.

Acquisition and Integration Costs

Acquisition and integration costs represent a significant component of Rentokil Initial's expense structure, particularly following major strategic moves like the Terminix acquisition. These costs encompass the entire process, from identifying potential targets and conducting due diligence to the complex undertaking of integrating acquired businesses. This includes harmonizing IT systems, aligning operational processes, and managing the cultural integration of workforces. The Terminix deal alone incurred substantial one-time integration expenses that impacted the company's financial performance in the short term.

For context, Rentokil Initial reported that the Terminix acquisition, completed in 2022, involved integration costs estimated to be around $150 million. These costs are crucial for realizing the projected synergies and operational efficiencies that justify such large-scale acquisitions. The company actively manages these expenditures to ensure they remain within budget and contribute positively to the long-term value creation from these strategic expansions.

- Due Diligence and Legal Fees: Expenses incurred during the evaluation of potential acquisition targets, including legal reviews and financial assessments.

- System Harmonization: Costs associated with integrating IT infrastructure, software, and data management systems of acquired companies with Rentokil Initial's existing platforms.

- Operational Adjustments: Expenditures related to aligning business processes, supply chains, and operational standards post-acquisition to achieve synergy targets.

- Severance and Restructuring: Costs associated with workforce consolidation, redundancies, and restructuring necessary for efficiency gains after an acquisition.

Research and Development Expenses

Rentokil Initial invests heavily in research and development to stay ahead in pest control and hygiene. This commitment fuels the creation of new, innovative solutions and technological advancements. In 2023, Rentokil Initial reported £134.7 million in R&D expenses, reflecting this dedication to innovation.

These R&D costs are crucial for developing next-generation pest management techniques and advanced hygiene products. The company focuses on sustainability and efficacy, ensuring their offerings meet evolving customer needs and regulatory standards.

- Investment in Innovation: Continuous spending on research to create novel pest control and hygiene solutions.

- Product Development: Resources allocated to designing, testing, and refining new products and services.

- Technological Advancements: Funding for incorporating new technologies, such as AI and digital monitoring, into their offerings.

- 2023 R&D Spend: £134.7 million allocated to R&D activities, underscoring the strategic importance of innovation.

Rentokil Initial's cost structure is heavily influenced by its extensive global operations and workforce. Key cost drivers include employee salaries and benefits, operational and fleet expenses, marketing and sales investments, acquisition and integration costs, and research and development. These elements are crucial for maintaining service quality, expanding market reach, and driving innovation.

| Cost Category | 2023 Financials (approx.) | 2024 Focus |

|---|---|---|

| Employee Salaries & Benefits | Largest cost component, reflecting global workforce | Attracting and retaining skilled service technicians, training |

| Operational & Fleet Costs | Significant expenditure on vehicles and equipment | Fuel efficiency, fleet maintenance, specialized equipment upkeep |

| Marketing & Sales | £1.1 billion (2023) | Digital marketing, lead generation, sales force development |

| Acquisition & Integration | Significant due to Terminix acquisition (est. $150M integration costs) | System harmonization, operational adjustments, workforce consolidation |

| Research & Development | £134.7 million (2023) | New pest control/hygiene solutions, technological advancements |

Revenue Streams

Rentokil Initial's core revenue is generated through pest control services. This includes ongoing contracts for prevention and monitoring, as well as individual treatments for pest issues. These services cater to a broad client base, encompassing both businesses and homeowners.

In the year 2024, pest control was a dominant force in the company's financial performance. Specifically, this segment contributed a significant 78.9% to Rentokil Initial's net sales, underscoring its critical role in the business model.

Hygiene and Wellbeing Service Fees represent a core revenue stream for Rentokil Initial, primarily generated through recurring contracts with businesses. These agreements cover essential services such as washroom maintenance, air purification systems, and safe clinical waste disposal. This segment is a significant contributor to the company's overall financial performance.

In 2024, Rentokil Initial reported strong performance in its Hygiene division, with the segment consistently demonstrating robust growth. The demand for enhanced hygiene solutions, particularly in post-pandemic environments, has fueled contract renewals and new business acquisitions, solidifying this as a vital revenue generator.

Rentokil Initial generates income through the rental, cleaning, and ongoing maintenance of workwear and textile items for businesses. This service ensures clients have consistently clean and presentable uniforms, contributing a steady revenue stream. While not their largest segment, it underpins their comprehensive service offering, providing a reliable income source.

Product Sales

Rentokil Initial generates revenue through the direct sale of specialized pest control products, including insecticides, rodenticides, and traps, alongside essential hygiene consumables like soaps, sanitizers, and air fresheners. This product-centric approach extends to the sale of related equipment, such as sprayers, traps, and dispensing units, catering to a broad client base. In 2024, Rentokil’s strategic focus on integrated pest management solutions and enhanced hygiene services likely bolstered product sales as clients sought comprehensive offerings. The company's commitment to innovation in product development further supports this revenue stream.

Key aspects of Rentokil Initial's Product Sales revenue stream include:

- Specialized Product Offerings: Sale of proprietary insecticides, rodenticides, and other pest control agents.

- Hygiene Consumables: Revenue from disinfectants, sanitizers, soaps, and air care products.

- Equipment Sales: Income derived from selling application devices, traps, and dispensing systems.

- Ancillary Services: Potential for upselling or bundling products with service contracts.

Acquisition-Driven Revenue Growth

Rentokil Initial's revenue growth is significantly bolstered by acquisitions. This inorganic growth strategy immediately boosts the company's top line by incorporating the revenue streams of acquired businesses. This approach allows for rapid expansion and market share gains.

For instance, in 2023, Rentokil Initial completed several notable acquisitions, including Terminix Global Holdings, a major pest control company. This transaction alone added substantial revenue and expanded Rentokil's presence in North America.

- Acquisition-Driven Growth: A substantial portion of Rentokil Initial's revenue expansion stems from integrating newly acquired companies.

- Immediate Top-Line Impact: Acquisitions contribute directly to increased revenue upon completion and integration.

- Market Expansion: This strategy facilitates rapid entry into new geographical markets and service segments.

- 2023 Terminix Acquisition: The significant purchase of Terminix Global Holdings in 2023 exemplifies this acquisition-driven revenue growth, bolstering North American operations.

Rentokil Initial also generates revenue from its workwear and hygiene services segments. These involve the rental, cleaning, and maintenance of uniforms and textile items for businesses, ensuring a consistent income. Additionally, the sale of pest control products and hygiene consumables, such as insecticides, rodenticides, soaps, and sanitizers, forms another important revenue stream.

The company's strategic acquisitions play a crucial role in revenue expansion. By integrating newly acquired businesses, Rentokil Initial experiences an immediate boost to its top line. The significant acquisition of Terminix Global Holdings in 2023 is a prime example, substantially increasing revenue and market share, particularly in North America.

| Revenue Stream | Description | 2024 Significance |

|---|---|---|

| Pest Control Services | Ongoing contracts for prevention, monitoring, and treatments. | Dominant segment, contributing 78.9% to net sales. |

| Hygiene and Wellbeing | Recurring contracts for washroom maintenance, air purification, clinical waste disposal. | Consistent growth fueled by demand for hygiene solutions. |

| Workwear and Textile Services | Rental, cleaning, and maintenance of business uniforms. | Provides a reliable and steady income source. |

| Product Sales | Specialized pest control products and hygiene consumables. | Bolstered by integrated solutions and product innovation. |

| Acquisitions | Revenue growth from integrating acquired companies. | Significant top-line impact, facilitating market expansion. |

Business Model Canvas Data Sources

The Rentokil Initial Business Model Canvas is constructed using a blend of internal financial data, extensive market research on pest control and hygiene services, and insights derived from operational performance metrics. This comprehensive data approach ensures each component of the canvas is grounded in verifiable information.