Rentokil Initial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rentokil Initial Bundle

Curious about Rentokil Initial's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse business units perform in terms of market share and growth potential. Understand which segments are their Stars, generating significant revenue and growth, and which are Cash Cows, providing stable income.

By examining their placement within the BCG framework, you can begin to discern their current market strengths and potential weaknesses. This overview is just the tip of the iceberg, offering a high-level perspective on a complex portfolio.

To truly grasp Rentokil Initial's strategic direction and make informed decisions, dive deeper into the full BCG Matrix. Purchase the complete report for a detailed quadrant-by-quadrant breakdown, including actionable insights and recommendations for optimizing their product and service portfolio.

Stars

Rentokil Initial's international pest control operations, excluding North America, have demonstrated impressive organic revenue growth. In 2024, this segment saw a healthy 4.7% increase, followed by a strong 3.3% rise in the first quarter of 2025. This consistent upward trend highlights the business's solid market position in key expanding regions.

The company's success in Europe, Asia, and Sub-Saharan Africa is particularly noteworthy, reflecting a significant market share within these dynamic territories. Rentokil Initial's strategic diversification and deep-rooted presence across these growing markets are instrumental in driving overall business expansion.

Digital Pest Management Solutions represent a significant growth area for Rentokil Initial. The market is expanding rapidly, with projections indicating it will reach $2.5 billion by 2025, fueled by a compound annual growth rate of 12% from 2025 to 2033. This expansion is largely attributed to the increasing integration of the Internet of Things (IoT) and other smart technologies within pest control services.

Rentokil has strategically invested more than £50 million in developing its digital capabilities. This includes the implementation of sophisticated smart monitoring systems and a robust pipeline of 75 innovation projects. These investments underscore Rentokil's commitment to establishing its advanced technology offerings as a segment with both high growth potential and a strong market share.

The advantages of these digital solutions extend beyond mere efficiency gains. By reducing the reliance on traditional pesticides, they appeal strongly to environmentally conscious consumers and businesses alike. This focus on sustainability, combined with improved service delivery, positions Rentokil's digital pest management as a key "star" performer within its portfolio.

Rentokil Initial's strategic bolt-on acquisition program is a key driver for its growth, particularly in expanding its presence in fragmented markets. In 2024 alone, the company successfully integrated 36 businesses, adding approximately £140 million in revenue. This demonstrates a clear commitment to inorganic expansion.

The first quarter of 2025 saw further acceleration with the completion of six strategic deals. These acquisitions are not random; they are targeted at bolstering Rentokil's position in high-growth and emerging geographies. This focused approach allows for rapid market share gains and strengthens its global footprint.

Successfully integrating these bolt-on acquisitions is crucial. When executed effectively, they contribute substantially to the company's overall growth trajectory and enhance its competitive advantage. This M&A strategy is designed to consolidate markets and drive operational efficiencies.

Global Commercial Pest Control Leadership

Rentokil Initial stands as the undisputed leader in global commercial pest control, operating in roughly 90 countries. This vast reach allows them to command a substantial share of a market that's experiencing consistent growth. The industry is expected to see a compound annual growth rate of 5-6% between 2023 and 2028. Key drivers for this expansion include increasing urbanization and the impacts of climate change, both of which create more favorable conditions for pest proliferation.

Their core pest control services are firmly established as a Star within the BCG matrix. This classification is supported by their dominant market position coupled with the ongoing expansion of the pest control sector itself. This strategic advantage allows Rentokil to leverage its scale and expertise effectively across various international markets, reinforcing its leadership.

- Market Dominance: Rentokil Initial is the largest global player in commercial pest control.

- Market Growth: The global pest control market is projected to grow at a 5-6% CAGR from 2023-2028.

- Growth Drivers: Urbanization and climate change are key factors fueling market expansion.

- Strategic Position: Their established leadership in a growing market designates core pest control as a Star.

Hygiene & Wellbeing in High-Growth Regions

Rentokil Initial's Hygiene & Wellbeing division, especially its operations beyond the UK, has shown impressive organic growth, highlighting the strength of its international business. This segment benefits from a significant surge in global awareness regarding hygiene standards, a trend amplified by recent health events which directly boosts demand for their essential services.

The high profit margins within this sector, coupled with robust underlying market demand, position it as a key performer. Rentokil Initial commands a leading market share in numerous geographical areas, solidifying its status as a Star in the BCG matrix. For instance, in 2024, the company reported substantial revenue contributions from its international hygiene services, reflecting this strong market penetration and demand.

- Strong Organic Growth: The international Hygiene & Wellbeing segment consistently delivered robust organic growth throughout 2024.

- Market Leadership: Rentokil Initial holds a dominant market share in many high-growth regions for hygiene services.

- Favorable Market Trends: Increased global focus on hygiene, spurred by public health concerns, continues to drive demand.

- High Profitability: The segment boasts high profit margins, contributing significantly to the company's overall financial performance.

Rentokil Initial’s Digital Pest Management Solutions are a clear Star. This segment saw significant investment, with over £50 million channeled into digital capabilities, including 75 innovation projects. The market itself is expanding rapidly, projected to reach $2.5 billion by 2025, growing at a 12% CAGR from 2025 to 2033, driven by IoT integration.

The core pest control operations also firmly sit within the Star category. As the global leader in commercial pest control, operating in approximately 90 countries, Rentokil benefits from a market projected to grow at a 5-6% CAGR between 2023 and 2028. Urbanization and climate change are key drivers fueling this expansion.

Furthermore, the Hygiene & Wellbeing division, particularly its international operations, demonstrates Star characteristics. Benefiting from increased global hygiene awareness and commanding leading market shares in many regions, this segment showed strong organic growth in 2024 and boasts high profit margins, making it a significant contributor to Rentokil's success.

| Segment | BCG Classification | Key Growth Drivers | Market Share / Position | Investment/Focus |

|---|---|---|---|---|

| Core Pest Control | Star | Urbanization, Climate Change, Industry Growth (5-6% CAGR 2023-2028) | Global Leader (90+ countries) | Leveraging scale and expertise |

| Digital Pest Management | Star | IoT Integration, Smart Technologies, Growing Market ($2.5B by 2025, 12% CAGR 2025-2033) | Emerging Leader, High Potential | £50M+ investment, 75 innovation projects |

| Hygiene & Wellbeing (International) | Star | Global Hygiene Awareness, Public Health Concerns | Leading market share in high-growth regions | Focus on international expansion and profitability |

What is included in the product

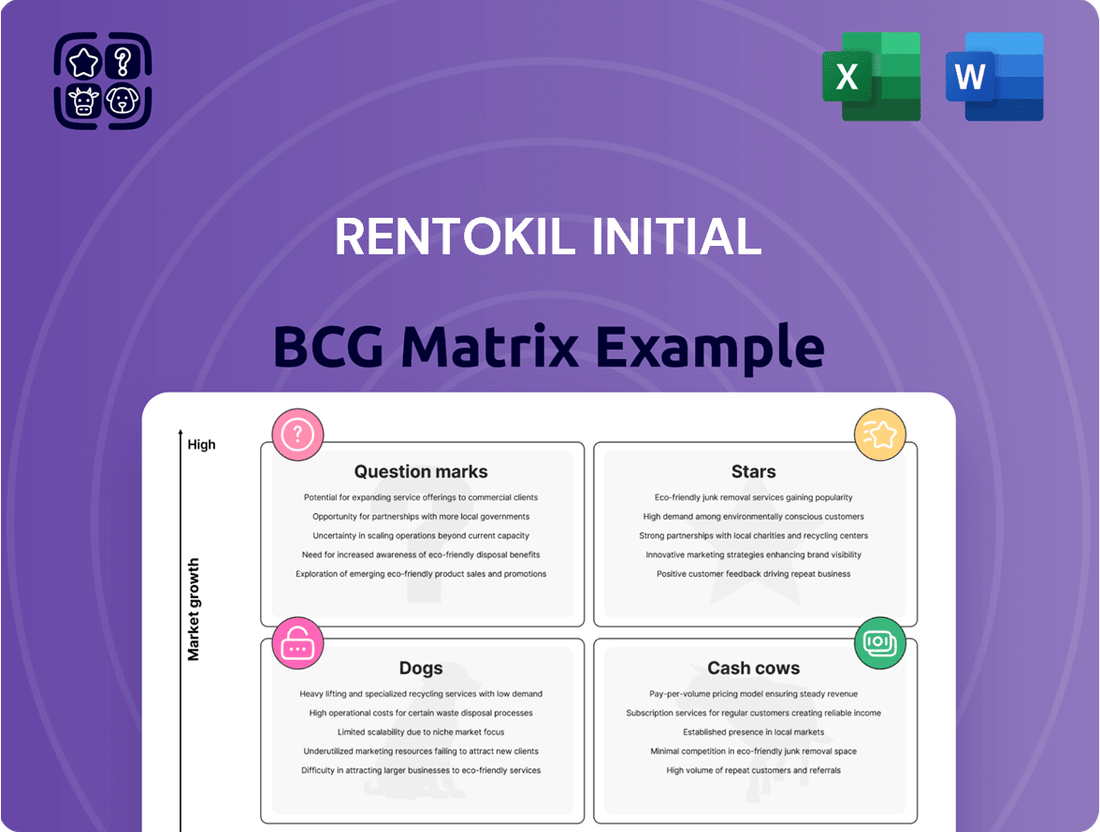

The Rentokil Initial BCG Matrix categorizes its diverse services into Stars, Cash Cows, Question Marks, and Dogs, guiding investment and divestment decisions.

The Rentokil Initial BCG Matrix offers a clear, one-page overview, instantly relieving the pain of strategic uncertainty by placing each business unit in a quadrant.

Cash Cows

Rentokil Initial's established pest control services outside of North America, particularly in Europe and Asia, are prime examples of Cash Cows within the BCG Matrix. These mature markets benefit from Rentokil's deep penetration and long-standing customer relationships, leading to consistent and significant cash generation.

These operations, while experiencing moderate growth, boast high market share, which translates into strong recurring revenue streams and robust profit margins. For instance, in 2024, Rentokil Initial reported continued strong performance in its European and Asia Pacific divisions, underscoring the stability of these established pest control businesses.

The need for significant investment in marketing or expansion is minimal, as these services are well-known and trusted. This allows Rentokil Initial to redirect the substantial cash flow generated by these businesses to support other strategic initiatives, such as investing in its Stars or funding acquisitions.

Rentokil Initial's core hygiene services, particularly washroom solutions in developed markets, function as a robust cash cow. These essential business services boast high customer retention, ensuring a steady stream of predictable revenue. The company's strong market position in these mature segments allows for consistent profit generation with limited need for significant capital reinvestment, effectively milking these established operations.

Rentokil Initial's workwear services in France are a prime example of a Cash Cow within the company's portfolio. This segment has demonstrated robust financial performance, achieving organic revenue growth of 4.4% in the first quarter of 2025 and a significant 7.1% in 2024.

Operating within a mature yet stable French market, Rentokil enjoys a dominant position with a high market share in its workwear services. This strong market presence translates into predictable and consistent revenue streams.

The low capital expenditure typically associated with mature service businesses like workwear allows this segment to generate substantial free cash flow. These reliable cash inflows are vital for funding other areas of Rentokil's business, such as Stars or Question Marks.

Recurring Revenue Model

Rentokil Initial's business model thrives on long-term service agreements, which create predictable, recurring revenue across its diverse operations. This consistent income, particularly from its pest control and hygiene divisions, forms a strong financial bedrock.

This stability in cash flow is a defining characteristic of a cash cow. It provides the financial muscle needed to invest in and support other business units within the company.

- Recurring Revenue Streams: Rentokil Initial's pest control and hygiene services, often secured through multi-year contracts, generate consistent income.

- Financial Stability: This predictable revenue provides a stable financial foundation, allowing for strategic investments and operational continuity.

- Funding Growth: The cash generated from these established services can be reinvested into higher-growth or emerging business areas.

- Example: In 2023, Rentokil Initial reported revenue of £3.2 billion, with a significant portion derived from its core service contracts.

Customer Retention in Mature Segments

Rentokil Initial's mature segments, particularly pest control and hygiene services in established international markets, operate as significant cash cows. These divisions benefit from exceptionally high customer retention rates, a testament to the company's service quality and brand trust.

This consistent customer loyalty dramatically reduces the need for expensive new customer acquisition efforts, directly translating into enhanced profit margins. For instance, in 2024, Rentokil Initial continued to emphasize its strong recurring revenue model, built on long-term contracts within these stable markets. The company's established presence in regions like Europe and North America underpins this consistent cash generation.

- High customer retention in mature segments like pest control and hygiene fuels consistent cash flow.

- Reduced customer acquisition costs in these established markets lead to improved profit margins.

- A stable, loyal customer base ensures a predictable revenue stream, minimizing the need for aggressive marketing spend.

- Rentokil Initial's strong performance in 2024 was largely supported by the reliable earnings from these mature, high-retention business lines.

Rentokil Initial's established pest control and hygiene services in mature markets, such as Europe and North America, are prime examples of Cash Cows. These operations benefit from high market share and strong customer loyalty, generating consistent and substantial cash flow with minimal need for reinvestment. For example, Rentokil Initial's 2024 results highlighted the stability of these core services, which provide reliable earnings to fund growth initiatives elsewhere. The workwear services in France also fit this profile, achieving 4.4% organic revenue growth in Q1 2025 and 7.1% in 2024, demonstrating their cash-generating capability.

| Business Segment | Market Position | Growth Rate (2024) | Cash Generation Potential |

|---|---|---|---|

| Pest Control (Europe/Asia) | High Market Share | Moderate | High |

| Hygiene Services (Washroom Solutions) | High Market Share | Moderate | High |

| Workwear Services (France) | Dominant Market Position | 7.1% | High |

Preview = Final Product

Rentokil Initial BCG Matrix

The Rentokil Initial BCG Matrix preview you are examining is the identical, fully formatted report you will receive upon purchase. This means no hidden watermarks or placeholder content, just a professional-grade strategic tool ready for immediate implementation. You can be confident that the analysis and presentation will be exactly as you see it now, empowering your decision-making processes without any surprises.

Dogs

Underperforming legacy workwear contracts outside of France often fall into the 'Dogs' category of the BCG Matrix. These are typically smaller, older agreements in less developed markets where Rentokil Initial has a low market share and faces limited growth opportunities. Think of highly specialized, localized services that are essentially commodities, and where the company doesn't hold a strong competitive edge.

These types of contracts, while perhaps historically significant, often operate at a break-even point or generate very low returns. For instance, some legacy contracts in Eastern European markets might struggle to achieve profitability due to intense local competition and price sensitivity, despite Rentokil Initial's global brand. In 2024, these might represent a very small percentage of the company's overall workwear revenue, perhaps less than 2%, yet consume disproportionate management attention.

The challenge with these 'Dogs' is that they tie up valuable resources, including capital and management time, that could be better allocated to higher-growth or more profitable segments. This could involve fleet maintenance, local sales team efforts, or administrative overhead that doesn't yield substantial returns. Divesting or consolidating these smaller, less strategic contracts allows for a more focused approach on core, high-potential markets.

Highly localized, non-scalable niche services at Rentokil Initial might be classified as Dogs. These are services that don't easily fit into the company's wider strategy or digital growth plans, often requiring significant management effort for minimal return.

Consider a hypothetical specialized pest control service for a very specific, small agricultural region. While it might serve a local need, its limited geographic reach and lack of broader application prevent significant growth.

Such services often operate in micro-markets with little to no growth potential, meaning they have a low market share and are unlikely to improve. In 2023, Rentokil Initial's revenue was approximately £3.5 billion, and while specific divisional data for such niche services isn't publicly detailed, any segment not contributing to the overall growth strategy would be a candidate for this classification.

These operations can drain resources that could be better allocated to more promising areas, like their commercial pest control or hygiene services, which are more scalable and aligned with market trends.

Legacy service delivery models at Rentokil Initial, if not upgraded with current technology or optimized routing, would fall into this category. For example, a reliance on paper-based scheduling and manual customer service interactions, rather than integrated digital platforms, can significantly increase operational costs. This inefficiency can directly impact profitability per service call, potentially reducing Rentokil's competitive edge.

Non-Core, Low-Margin Ancillary Services

Non-core, low-margin ancillary services within Rentokil Initial's BCG Matrix are those offerings that aren't central to their main business areas like pest control, hygiene, or workwear. These services often struggle with thin profit margins and limited market share, hindering their ability to generate substantial revenue or growth.

These ancillary services might include offerings that were previously part of bundled deals or acquired through mergers but never really took off. They often lack the strategic importance or growth prospects needed to justify significant investment.

- Low Profitability: These services typically operate with net profit margins below 5%, significantly lower than Rentokil's core services which have seen operating margins in the mid-to-high teens in recent years.

- Limited Market Penetration: Market share for these ancillary offerings often remains in the single digits, failing to achieve the critical mass needed for competitive advantage.

- Lack of Strategic Fit: They do not align with the company's primary value proposition, making it difficult to integrate them effectively into marketing and sales strategies.

Divested or Phased-Out Business Units

Divested or phased-out business units within Rentokil Initial's portfolio, like the Paragon distribution business which ceased operations in April 2024, are classified as Dogs in the BCG Matrix. These are typically operations with limited growth prospects and a small market share. The company’s strategic decision to exit these segments, as seen with Paragon, allows for the redirection of capital and management focus towards more promising areas.

These exits align with a strategy to streamline operations and enhance overall profitability by shedding underperforming assets.

- Paragon Distribution Business: Closed in April 2024, indicating a strategic withdrawal from this segment.

- Low Growth & Low Market Share: Characteristic of Dog business units, these operations offer minimal returns.

- Resource Reallocation: Exiting these units frees up capital and management bandwidth for investment in Stars or Question Marks.

- Strategic Divestment: A common tactic to improve the overall health and potential of the company's business portfolio.

Rentokil Initial's 'Dogs' are typically legacy contracts, niche services, or divested units with low market share and limited growth. These segments, like the Paragon distribution business exited in April 2024, often operate at break-even or generate minimal profits, consuming resources that could be better invested elsewhere. For instance, specialized, non-scalable services in micro-markets with little potential for improvement exemplify this category, often having profit margins below 5% compared to core services in the mid-to-high teens.

| Business Unit Example | BCG Category | Key Characteristics | Strategic Implication |

|---|---|---|---|

| Legacy Workwear Contracts (Outside France) | Dog | Low market share, limited growth, low profitability | Resource drain, potential divestment |

| Specialized Niche Agricultural Pest Control | Dog | Micro-market focus, no scalability, minimal growth | Opportunity cost, consider phasing out |

| Paragon Distribution Business | Dog | Divested (April 2024), low returns | Capital and management reallocation |

Question Marks

The North American pest control segment, especially after integrating Terminix, is currently a Question Mark for Rentokil Initial. This region is the largest pest control market globally and contributes a significant 60% to Rentokil's overall revenue.

Despite its market size, this business faced challenges with subdued inbound lead flow and contract sales, leading to a modest organic revenue growth of just 0.7% in the first quarter of 2025.

Rentokil's strategic focus on revitalizing this segment through new brand initiatives and expanding with satellite branches is crucial for its future classification.

The success of these integration and growth strategies will dictate whether this substantial business can transition into a Star performer within the BCG Matrix.

Rentokil Initial's investment in new digital and IoT pest control innovations positions them in a rapidly expanding sector. The company's commitment is evident through its pipeline of around 75 science and innovation projects, with a significant portion focused on these advanced solutions. The opening of their North American Innovation Centre in 2024 further underscores this strategic focus.

These digital and IoT-enabled offerings are entering a market characterized by high growth potential. However, their current market penetration is still in its nascent stages, meaning Rentokil Initial has a significant opportunity to capture a larger share. This presents a classic scenario for a potential 'Star' in the BCG matrix, requiring substantial investment to fuel growth and market adoption.

The considerable investment needed to scale these innovations and achieve widespread adoption is a key factor. This capital expenditure is crucial for transforming these developing technologies into market leaders. By successfully navigating this phase, Rentokil Initial aims to solidify its position and leverage the high-growth characteristics of the digital pest control market to its advantage.

Rentokil Initial's strategy for emerging markets, such as those in Asia and South America, centers on aggressive bolt-on acquisitions. These regions present significant growth opportunities, driven by urbanization and a burgeoning demand for professional pest control and hygiene services. For example, in 2024, Rentokil completed several acquisitions in Southeast Asia, bolstering its presence in countries with rapidly growing middle classes.

While these markets are poised for expansion, Rentokil Initial's market share remains relatively low. This necessitates significant investment in local infrastructure, brand awareness campaigns, and tailoring services to specific regional needs. The company allocated an estimated $150 million in 2024 towards these expansion efforts, aiming to establish a stronger foothold and capitalize on the untapped potential.

Advanced Air Quality and Environmental Monitoring Services

Rentokil Initial's advanced air quality and environmental monitoring services, including green walls, are positioned as potential Stars or Question Marks in their BCG Matrix. These offerings cater to a burgeoning market driven by increased awareness of indoor environmental health, a trend amplified in the post-pandemic era. For instance, the global indoor air quality monitoring market was valued at approximately $4.5 billion in 2023 and is projected to grow significantly, with some estimates suggesting a CAGR of over 8% through 2030.

While these services represent a strategic diversification beyond core hygiene, their current contribution to Rentokil's overall revenue is likely modest, placing them in the Question Mark quadrant. This suggests a high-growth potential market where Rentokil's current market share might be relatively small, requiring substantial investment in marketing and operational expansion to gain a stronger foothold.

- Market Growth: The global market for indoor air quality solutions is experiencing robust growth, driven by health concerns and regulatory changes.

- Rentokil's Position: These services are new or emerging within Rentokil's portfolio, indicating a potentially low current market share.

- Investment Needs: Significant investment in R&D, sales, and marketing will be crucial to capitalize on the market opportunity.

- Strategic Importance: These services align with broader trends towards sustainable and healthy building environments, offering long-term strategic value.

Pilot Programs for Sales and Branch Optimization

Rentokil Initial is actively exploring new avenues for growth and efficiency through pilot programs. A notable example is their door-to-door sales initiative, designed to enhance lead generation by directly engaging potential customers.

Furthermore, the company is rolling out 36 new satellite branches across North America. This expansion is a strategic move to bolster their operational presence and service delivery in a key growth market.

These initiatives are positioned within the context of optimizing sales and branch operations, particularly in the North American region, which represents a high-growth potential area for the company.

- Pilot Programs: Door-to-door sales and 36 new North American satellite branches.

- Objective: Improve lead generation and operational efficiency.

- Market Context: Targeting high-growth potential in North America.

- BCG Matrix Classification: These initiatives represent investments in potential future Stars, as their ability to significantly impact market share and profitability is still being tested.

The North American pest control segment, especially after integrating Terminix, is currently a Question Mark for Rentokil Initial. Despite its market size, this business faced challenges with subdued inbound lead flow and contract sales, leading to a modest organic revenue growth of just 0.7% in the first quarter of 2025. Rentokil's strategic focus on revitalizing this segment through new brand initiatives and expanding with satellite branches is crucial for its future classification.

Rentokil Initial's investment in new digital and IoT pest control innovations positions them in a rapidly expanding sector. The opening of their North American Innovation Centre in 2024 further underscores this strategic focus. These digital and IoT-enabled offerings are entering a market characterized by high growth potential, but their current market penetration is still in its nascent stages, meaning Rentokil Initial has a significant opportunity to capture a larger share. This presents a classic scenario for a potential Star in the BCG matrix, requiring substantial investment to fuel growth and market adoption.

Rentokil Initial's advanced air quality and environmental monitoring services, including green walls, are positioned as potential Stars or Question Marks. These offerings cater to a burgeoning market driven by increased awareness of indoor environmental health, a trend amplified in the post-pandemic era. For instance, the global indoor air quality monitoring market was valued at approximately $4.5 billion in 2023 and is projected to grow significantly. While these services represent a strategic diversification, their current contribution to Rentokil's overall revenue is likely modest, placing them in the Question Mark quadrant.

| Segment/Initiative | Market Growth | Rentokil's Share | Investment Required | BCG Classification |

| North America Pest Control | High | Significant (post-Terminix) | Moderate (revitalization efforts) | Question Mark |

| Digital/IoT Pest Control | Very High | Low (nascent) | High | Question Mark (potential Star) |

| Air Quality/Environmental Monitoring | High | Low (emerging) | High | Question Mark |

| Emerging Markets (Asia/South America) | High | Low | Moderate to High (acquisitions) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages a comprehensive blend of internal financial performance data, external market share analysis, and industry growth rate research to inform strategic positioning.