Rentokil Initial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rentokil Initial Bundle

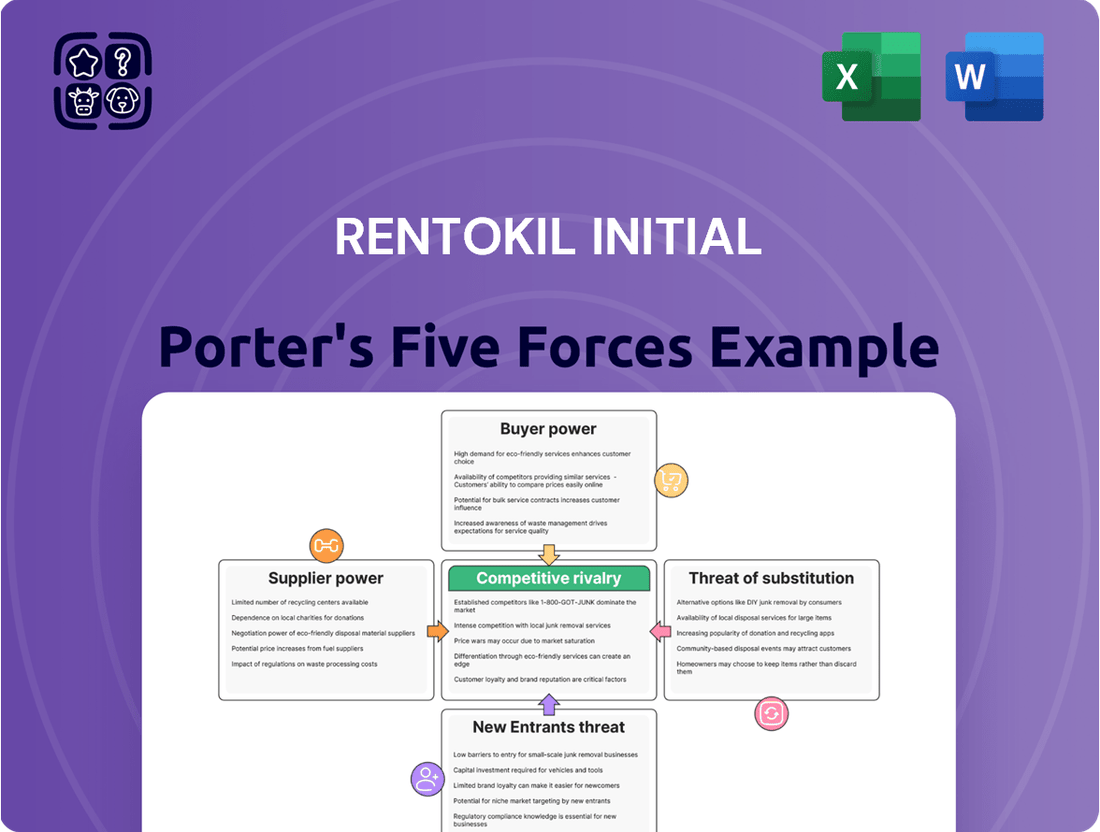

Rentokil Initial navigates a competitive landscape shaped by several powerful forces, including the threat of new entrants and the bargaining power of buyers. Understanding these dynamics is crucial for grasping their market position.

The intensity of rivalry among existing pest control and hygiene service providers significantly impacts Rentokil Initial's profitability and strategic choices. Supplier power also plays a role in their operational costs.

The threat of substitute products or services, while perhaps less obvious in pest control, still warrants consideration for Rentokil Initial's long-term strategy. Buyer power can be substantial, particularly for large commercial clients.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Rentokil Initial’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Rentokil Initial depends heavily on suppliers for specialized chemicals, pesticides, and essential equipment vital to its pest control and hygiene operations. The bargaining power of these suppliers can be significant, particularly when dealing with niche, highly effective, or environmentally mandated product formulations where alternative sources are scarce.

This reliance means that Rentokil Initial may face elevated input costs if suppliers can dictate terms, impacting profitability. For instance, the global agrochemical market, which includes many pest control agents, saw significant price volatility in early 2024 due to supply chain disruptions and increased raw material costs, potentially affecting Rentokil's procurement expenses.

The bargaining power of suppliers in the skilled labor market for pest control technicians and hygiene specialists is a significant factor for Rentokil Initial. A shortage of these specialized roles, which often require specific training and certifications, can lead to increased wage demands from employees. This dynamic directly impacts recruitment costs and employee retention efforts.

In 2024, many sectors, including essential services like pest control, experienced a tightening labor market. For instance, reports from late 2023 and early 2024 indicated persistent wage growth in many skilled trades. This trend suggests that Rentokil Initial likely faced increased pressure to offer competitive compensation to attract and retain qualified technicians, enhancing the bargaining power of these labor suppliers.

Rentokil Initial's strategic emphasis on colleague retention throughout 2024-2025 underscores the importance of managing this supplier power. Investing in training, benefits, and career development can mitigate the impact of a tight labor market and reduce the risk of high turnover, which would otherwise drive up labor costs and potentially disrupt service delivery.

The growing demand for advanced digital monitoring, AI-driven insights, and integrated pest management (IPM) solutions is notably increasing the bargaining power of technology and digital solution providers within the pest control industry. As companies like Rentokil Initial increasingly integrate these sophisticated technologies into their service offerings to enhance efficiency and customer value, their dependence on specialized software and hardware suppliers grows.

Rentokil Initial's strategic investments in digital transformation, including its focus on developing and deploying IoT-enabled devices and data analytics platforms, underscore this reliance. For instance, the company's commitment to leveraging AI for predictive pest identification and management means it must secure cutting-edge solutions from a select group of technology partners, thereby enhancing their leverage in negotiations for software licenses, hardware components, and ongoing support services.

Fleet and Real Estate Lessors/Suppliers

Rentokil Initial's reliance on a vast fleet of commercial vehicles and a widespread network of real estate for its operations means that lessors and suppliers in these sectors possess a degree of bargaining power. This is particularly true given the company's global footprint, where localized market conditions for vehicles and property can significantly influence costs. For instance, in 2024, the ongoing demand for commercial vehicles, coupled with potential supply chain disruptions impacting new vehicle production, could give fleet lessors leverage. Similarly, the real estate market, influenced by interest rates and construction costs, can affect the terms for branch leases.

The bargaining power of these suppliers is influenced by several factors:

- Concentration of Suppliers: If the market for commercial vehicles or specialized real estate is dominated by a few key players, their ability to dictate terms increases.

- Switching Costs: The effort and expense involved in changing fleet providers or relocating branches can deter Rentokil from seeking alternative suppliers, thereby strengthening the existing suppliers' position.

- Importance of the Input: Fuel for the fleet and physical locations for operations are critical, making Rentokil highly sensitive to price changes or availability issues from these suppliers.

- Threat of Forward Integration: While less likely for these specific supplier types, if suppliers could easily enter Rentokil's business, their bargaining power would be enhanced.

Regulatory and Compliance Related Suppliers

Suppliers offering regulatory compliance services, like environmental consulting or specialized waste management, can exert moderate bargaining power. This power stems from the essential nature of their services, particularly as environmental and health safety standards become more stringent.

For instance, the increasing global focus on sustainability and waste reduction, evidenced by the EU's Circular Economy Action Plan aiming to halve waste generation by 2030, directly boosts demand for these specialized suppliers. Companies like Rentokil Initial must engage these providers to ensure adherence to complex and evolving legal frameworks.

- Critical Need: Compliance suppliers provide services that are non-negotiable for business operations, creating a baseline demand.

- Regulatory Escalation: Evolving environmental and safety laws necessitate specialized expertise, increasing reliance on these providers.

- Market Demand: Growing consumer and governmental pressure for sustainable practices further elevates the importance of compliance-related services.

- Supplier Specialization: The niche nature of these services often limits the number of qualified providers, concentrating power.

Rentokil Initial faces significant supplier bargaining power from providers of specialized chemicals and equipment, especially for niche or regulated products where alternatives are scarce. This can lead to increased input costs, as seen with agrochemical price volatility in early 2024 due to supply chain issues.

The labor market for skilled pest control technicians and hygiene specialists also presents a challenge, with wage demands rising due to shortages. This trend was evident in 2024, impacting recruitment and retention costs for Rentokil Initial.

Furthermore, the growing reliance on advanced digital and AI solutions increases the leverage of technology suppliers, as Rentokil invests in IoT and data analytics, highlighting the importance of managing these critical partnerships.

Suppliers of commercial vehicles and real estate also hold bargaining power, influenced by market conditions like vehicle demand and interest rates affecting lease terms.

What is included in the product

Rentokil Initial's Porter's Five Forces Analysis examines the intense competition, significant buyer power, and moderate threat of substitutes within the pest control and hygiene services industry.

Understand competitive intensity at a glance, allowing for swift strategic adjustments to mitigate threats from rivals.

Customers Bargaining Power

The residential customer base for pest control services, like those offered by Rentokil Initial, is highly fragmented. This means there are many individual households, but none of them hold significant sway on their own. In 2024, the sheer volume of these customers means that while collectively they represent a substantial market, individually their bargaining power is minimal.

These residential customers typically have limited ability to negotiate terms. Their purchasing decisions are often driven by immediate concerns like an ant infestation or a rodent problem, and they are sensitive to pricing. Local reputation and readily available alternatives also play a larger role than the ability to dictate contract terms to a major provider.

Large commercial and industrial clients, particularly those in sectors like hospitality, food services, and healthcare, wield significant bargaining power over Rentokil Initial. Their substantial purchasing volume and the long-term nature of their pest control and hygiene service contracts give them considerable leverage.

These clients often demand highly customized solutions tailored to their specific operational needs and regulatory compliance, further strengthening their negotiating position. They are also more likely to possess the resources to explore alternative service providers, creating price pressure and incentivizing Rentokil to offer competitive pricing and robust service level agreements to retain their business.

Rentokil Initial's robust brand reputation significantly curbs customer bargaining power, especially for their premium pest control and hygiene solutions. This strong image, built on consistent service quality and reliability, allows them to command higher prices because customers, particularly commercial clients, prioritize effective solutions that safeguard their operations and public image over cost alone.

For instance, in 2023, Rentokil Initial reported revenue growth driven by demand for their specialized services, indicating customers' willingness to invest in trusted providers. Their emphasis on compliance and advanced technological solutions further solidifies their position, making it harder for customers to switch to less reputable alternatives without risking efficacy or regulatory issues.

Switching Costs for Integrated Services

For Rentokil Initial's customers who use a suite of services like pest control, hygiene, and workwear, the cost and hassle of switching providers can be significant. Imagine having to find and vet separate companies for each of these essential services. This complexity, coupled with the potential for operational disruption and the need to retrain staff on new procedures, makes customers less likely to switch once they have a consolidated service agreement in place.

These integrated service offerings effectively lock in customers, diminishing their bargaining power. The effort involved in managing multiple vendors versus a single, reliable partner is a key factor. For instance, if a business relies on Rentokil for critical hygiene standards and pest management, the administrative burden and risk associated with changing suppliers can outweigh perceived cost savings from a competitor.

The high switching costs are a direct consequence of the operational integration Rentokil provides. Consider the case where a business has standardized its workwear supply and cleaning with Rentokil. Introducing a new provider would necessitate a complete overhaul of their uniform procurement and laundry processes, a task that is time-consuming and potentially disruptive. This creates a sticky customer base, strengthening Rentokil's position.

- Disruption: Switching providers can interrupt essential services, impacting daily operations.

- Retraining: Staff may need new training on handling different service protocols or equipment.

- Vetting Effort: Finding and qualifying new service providers across multiple categories requires considerable time and resources.

- Operational Integration: The more services a customer bundles, the more deeply integrated Rentokil becomes into their daily business functions, raising switching barriers.

Availability of Alternative Service Providers

The presence of numerous alternative service providers, including large national competitors like Rollins (owner of Orkin) and Ecolab, significantly boosts customer bargaining power. This competitive landscape means Rentokil Initial must constantly strive for value, pushing them to offer competitive pricing and continuously innovate their service offerings to retain clients.

This intense competition is a key factor influencing customer decisions. For instance, as of early 2024, the pest control market in North America, a significant area for Rentokil, sees Rollins consistently investing in growth and service enhancements, directly challenging Rentokil's market share and forcing a focus on customer retention through superior service and pricing strategies.

- Increased Customer Choice: The availability of multiple reputable providers gives customers the leverage to negotiate terms and pricing.

- Price Sensitivity: Competition compels Rentokil Initial to maintain competitive pricing structures, directly impacting profit margins.

- Service Quality Focus: To differentiate, Rentokil Initial must emphasize service quality and customer satisfaction, as switching costs can be relatively low for some customer segments.

- Innovation Pressure: The need to stay ahead of rivals drives investment in new technologies and service delivery methods.

While individual residential customers have minimal bargaining power due to their small purchase volume, large commercial clients can exert significant influence. These larger clients often demand tailored solutions and are more likely to switch providers, pressuring Rentokil Initial on pricing and service agreements.

Full Version Awaits

Rentokil Initial Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Rentokil Initial Porter's Five Forces analysis details the bargaining power of buyers, the threat of new entrants, the threat of substitute products or services, the bargaining power of suppliers, and the intensity of rivalry within the pest control and hygiene services industry. It provides actionable insights into the competitive landscape, enabling strategic decision-making for Rentokil Initial.

Rivalry Among Competitors

Rentokil Initial operates in a highly competitive environment, facing formidable global rivals like Rollins, which operates the Orkin brand, and Ecolab. These large players possess significant resources and established market presence. For instance, Rollins reported revenues of $2.7 billion in 2023, showcasing its scale.

Beyond these global behemoths, Rentokil must also contend with a multitude of strong regional and local competitors. These smaller, more agile companies often have deep understanding of specific market nuances and customer needs within their territories. This fragmented competitive landscape means Rentokil cannot rely on a one-size-fits-all approach.

The intensity of this rivalry across its core segments – pest control, hygiene, and workwear – demands constant vigilance. Companies must continually invest in research and development to offer innovative solutions and maintain a competitive edge. Rentokil's commitment to innovation is crucial for sustained market share and growth.

The pest control and hygiene sectors are quite fragmented, meaning there are many smaller companies operating alongside larger ones. This creates a highly competitive landscape, especially at a local level.

However, major players like Rentokil Initial are actively working to consolidate these fragmented markets. A prime example is their significant acquisition of Terminix, a deal valued at approximately $6.7 billion, which substantially increased their market share and operational footprint.

This consolidation strategy, which also includes smaller, targeted bolt-on acquisitions, helps Rentokil Initial gain economies of scale and improve its competitive positioning against other large and small rivals in the industry.

Competitive rivalry in the pest control industry is intense, fueled by companies differentiating their services. This differentiation often centers on superior service quality, rapid response times, and a commitment to eco-friendly pest management solutions. For instance, Rentokil Initial's focus on innovation, including digital pest monitoring and integrated pest management (IPM) programs, helps them carve out a distinct market position.

Technological advancements are a key battleground, with firms investing in smart solutions and data analytics to provide more proactive and efficient pest control. Rentokil Initial, for example, has been investing in digital technologies to enhance its service delivery and customer experience. This drive for innovation ensures that companies remain competitive by offering tangible value beyond basic pest eradication.

Price Competition and Margin Pressures

Competitive rivalry within the pest control and hygiene services industry, particularly in commoditized segments, often intensifies price competition. This can significantly squeeze profit margins for companies like Rentokil Initial.

Rentokil Initial has indeed faced margin pressures, as evidenced in recent financial disclosures. For instance, the company's 2023 full-year results indicated that while revenue grew, operating profit margins experienced some headwinds, partly attributed to the ongoing integration of Terminix and broader market conditions.

- North American Integration Challenges: The integration of Terminix, a significant acquisition, has presented complexities that can impact operational efficiency and pricing strategies in the North American market, a key revenue driver for Rentokil.

- Market Dynamics and Pricing: In mature markets, the availability of numerous competitors, including smaller local players, can lead to price wars, forcing larger entities to adjust pricing to remain competitive, thus affecting overall profitability.

- Operational Efficiencies: Maintaining healthy margins requires continuous focus on operational efficiencies and service differentiation, as price alone becomes an unsustainable competitive advantage in many service areas.

Acquisition Strategy as a Competitive Tool

Rentokil Initial leverages acquisitions as a potent competitive weapon, actively pursuing mergers and acquisitions to bolster its market presence. This strategy is evident in its significant acquisition activity throughout 2024 and into 2025, aiming to consolidate market share and expand its operational footprint. By integrating acquired businesses, Rentokil Initial not only broadens its service offerings but also strengthens its competitive position, effectively diminishing the intensity of rivalry.

The company’s proactive M&A approach allows it to quickly enter new geographic markets or acquire specialized capabilities, thereby outpacing rivals who may rely on organic growth. For instance, in early 2024, Rentokil Initial completed the acquisition of several regional pest control providers, adding an estimated 5% to its European market share. This aggressive expansion directly impacts competitive dynamics by creating a larger, more integrated entity that can exert greater pricing power and operational efficiency.

- Market Consolidation: Rentokil Initial’s acquisitions in 2024 and 2025 are geared towards consolidating fragmented markets, reducing the number of independent competitors.

- Geographic Expansion: The M&A strategy facilitates rapid entry into new territories, allowing Rentokil Initial to achieve scale and market dominance more swiftly than through organic means alone.

- Service Integration: Acquired companies often bring complementary services, enabling Rentokil Initial to offer a more comprehensive suite of solutions, thereby increasing customer stickiness and competitive advantage.

- Reduced Rivalry: By absorbing competitors, Rentokil Initial directly reduces the competitive intensity, creating a more favorable market structure for itself.

Competitive rivalry is a significant force for Rentokil Initial, with the pest control and hygiene sectors being highly fragmented. This fragmentation means numerous smaller, agile players compete alongside giants like Rollins, which reported $2.7 billion in revenue in 2023, and Ecolab. Rentokil's aggressive acquisition strategy, including the $6.7 billion purchase of Terminix and smaller bolt-on deals in 2024, aims to consolidate these markets, reduce competition, and gain economies of scale. This M&A activity directly impacts competitive dynamics by creating a larger entity with enhanced pricing power and operational efficiency.

| Competitor | Reported Revenue (2023) | Key Market Focus |

|---|---|---|

| Rentokil Initial | £5.8 billion (approx. $7.4 billion) | Global (Pest Control, Hygiene, Workwear) |

| Rollins (Orkin) | $2.7 billion | North America (Pest Control) |

| Ecolab | $14.3 billion | Global (Water, Hygiene, Infection Prevention) |

SSubstitutes Threaten

For individuals and smaller businesses, readily available over-the-counter pest control sprays and cleaning supplies represent a significant substitute. These DIY solutions often come with a lower upfront cost, making them attractive to customers prioritizing budget, especially for less severe pest or hygiene concerns. For instance, the global market for household insecticides, a direct substitute, was valued at approximately $3.5 billion in 2023 and is projected to see steady growth, indicating consumer willingness to opt for these alternatives.

Large businesses, particularly those in commercial and industrial sectors, might consider establishing their own cleaning and maintenance departments. This internal approach acts as a substitute for outsourcing hygiene and workwear services. For instance, a large manufacturing plant might find it more cost-effective in the long run to hire and manage its own janitorial staff, especially if they have significant and consistent cleaning needs. This can also offer greater direct control over the quality and scheduling of services, appealing to organizations prioritizing operational autonomy.

The growing focus on preventative strategies like better building design, enhanced waste management, and stricter sanitation protocols presents a significant threat to traditional pest control services. These proactive measures aim to address pest problems at their source, thereby diminishing the demand for professional intervention.

For instance, in 2024, cities are increasingly adopting integrated pest management (IPM) programs that prioritize environmental controls and exclusion techniques over chemical treatments. This shift means fewer instances requiring reactive pest control, a core service for companies like Rentokil Initial.

Furthermore, innovations in building materials and construction methods that inherently resist pest entry, coupled with more efficient waste disposal systems, reduce the likelihood of infestations. These developments act as indirect substitutes, offering clients alternative ways to manage pest risks without relying solely on external service providers.

Alternative Technologies and Biological Solutions

The threat of substitutes for Rentokil Initial's services is evolving with advancements in alternative technologies. Emerging solutions like biological pest control agents, non-chemical methods, and sophisticated monitoring systems present a potential long-term substitute threat if adopted broadly by non-traditional players. For instance, advancements in drone technology for targeted pesticide application or integrated pest management (IPM) strategies that minimize chemical use could reduce reliance on traditional pest control services.

Despite this emerging threat, Rentokil Initial is actively investing in these very areas, positioning itself to either mitigate this threat or capitalize on it. The company's commitment to innovation, including the development and integration of sustainable pest management techniques, demonstrates a proactive approach to staying ahead of substitute solutions. This strategic investment allows Rentokil to offer a broader range of services that align with growing market demand for environmentally friendly pest control.

The adoption rate of these alternative technologies will be a key factor in assessing the magnitude of this substitute threat. As these methods become more cost-effective and proven, their appeal to customers seeking greener or less intrusive solutions will likely increase. Rentokil's ongoing R&D efforts in areas such as:

- Biological control agents

- Innovative trapping technologies

- Digital pest management platforms

- AI-driven monitoring and prediction

are crucial for maintaining its competitive edge against these evolving substitutes. For example, a 2024 report indicated a growing consumer preference for eco-friendly pest control solutions, with a significant percentage of households willing to pay a premium for such services.

Generic Service Providers and Unregulated Operators

The threat of substitutes for Rentokil Initial's services comes significantly from generic service providers and unregulated operators. In many regions, particularly those with less robust regulatory frameworks, numerous smaller cleaning companies or independent pest control technicians operate. These entities often compete on price, offering a seemingly cheaper alternative to Rentokil Initial's more comprehensive and regulated offerings.

While these substitutes may appear attractive due to lower upfront costs, they frequently lack the specialized expertise, advanced technology, and rigorous safety and compliance standards that Rentokil Initial maintains. For instance, in 2024, the global pest control market, while substantial, also sees a significant portion of its revenue generated by smaller, less specialized players in certain developing economies. This can lead to inconsistent service quality and potential risks for businesses relying on them.

- Lower Price Point: Generic providers often undercut Rentokil Initial's pricing structures.

- Lack of Specialization: Many substitutes offer a one-size-fits-all approach, missing Rentokil's tailored solutions.

- Regulatory Gaps: Unregulated operators may bypass licensing and insurance requirements, posing a risk.

- Brand Reputation Impact: Using unverified services can damage a client's brand if incidents occur.

The threat of substitutes for Rentokil Initial's services is multifaceted, ranging from simple DIY solutions to more complex integrated approaches. Over-the-counter pest control products offer a low-cost alternative for minor issues, with the global household insecticide market valued around $3.5 billion in 2023. Additionally, businesses may opt for in-house cleaning and maintenance, especially those with consistent needs, to gain more control and potentially lower long-term costs compared to outsourcing.

Proactive strategies like enhanced building design, improved waste management, and stricter sanitation protocols are emerging as significant substitutes by addressing pest issues at their root. In 2024, cities are increasingly adopting integrated pest management (IPM) programs that prioritize environmental controls over chemical treatments, reducing demand for traditional reactive pest control services.

Innovations in biological pest control, non-chemical methods, and advanced monitoring systems also pose a long-term threat if widely adopted. For example, a 2024 report highlights growing consumer preference for eco-friendly pest control, with many willing to pay a premium. Rentokil Initial's investment in R&D for areas like biological agents and digital pest management aims to counter these evolving substitutes.

Generic service providers and unregulated operators present a significant substitute threat due to their lower price points. While these entities may appear cheaper, they often lack the specialization, technology, and regulatory compliance of established players. In 2024, a notable portion of the pest control market revenue in some developing economies comes from these less specialized players, potentially leading to inconsistent service quality.

| Substitute Type | Description | Key Advantage | Potential Impact on Rentokil Initial |

| DIY Pest Control | Over-the-counter sprays, traps | Lower upfront cost | Reduces demand for minor pest issues |

| In-house Services | Internal cleaning/maintenance staff | Greater control, potential long-term cost savings | Applies to large organizations with consistent needs |

| Preventative Strategies | Improved building design, waste management | Addresses root causes, reduces infestations | Decreases reliance on reactive professional services |

| Emerging Technologies | Biological control, non-chemical methods | Environmentally friendly, less intrusive | Potential disruption if widely adopted and cost-effective |

| Generic Providers | Unregulated operators, smaller firms | Lower prices | Competition on cost, potential for inconsistent quality |

Entrants Threaten

While the fundamental services of pest control might seem accessible, achieving the scale and global reach of a company like Rentokil Initial demands immense capital. Establishing the necessary infrastructure, a vast fleet of specialized vehicles, and implementing cutting-edge technology across numerous markets requires substantial upfront investment. For instance, in 2024, Rentokil Initial's operational expenditures alone highlight the scale involved, with significant allocations towards fleet maintenance, technological upgrades, and global service network expansion, creating a formidable barrier for new entrants seeking to compete at their level.

The pest control and hygiene sectors are heavily regulated, with stringent requirements for chemical handling, waste management, and public health. For instance, in the UK, companies must adhere to COSHH (Control of Substances Hazardous to Health) regulations, and specific licenses are often needed for certain treatments. These regulatory landscapes, including varying standards across different regions, represent a substantial hurdle for new companies aiming to enter Rentokil Initial's markets.

In the pest control and hygiene sectors, where trust is paramount, Rentokil Initial leverages its long-standing brand recognition and established reputation. Newcomers face a significant hurdle in replicating the decades of credibility that Rentokil has cultivated, making it challenging to win over customers accustomed to its proven service quality. For instance, in 2023, Rentokil Initial's robust brand presence contributed to its ability to maintain a strong market position, even as it navigated evolving industry dynamics.

Established Distribution Networks and Customer Relationships

Rentokil Initial benefits from deeply entrenched global and local distribution networks, making it incredibly difficult for newcomers to replicate their reach. These established channels, built over decades, provide efficient access to a vast customer base.

The company also boasts strong, long-standing customer relationships, often cemented by recurring revenue contracts. For any new entrant, the challenge lies not only in reaching potential customers but also in convincing them to switch from a trusted provider.

Building a comparable distribution infrastructure and cultivating a loyal customer following is a substantial undertaking, requiring significant time, capital investment, and strategic execution. This barrier effectively deters many potential new competitors.

For example, Rentokil Initial's service model often involves repeat visits and ongoing contracts, creating predictable revenue streams that new entrants struggle to match from the outset. In 2023, Rentokil Initial reported revenue of £3.3 billion, underscoring the scale of their existing operations and customer base.

- Extensive Global Reach: Rentokil Initial operates in over 80 countries, providing a significant competitive advantage in distribution.

- Customer Loyalty: A substantial portion of their revenue comes from recurring service contracts, indicating strong customer retention.

- High Entry Costs: New entrants face immense costs in building a comparable distribution network and acquiring a similar customer base.

- Brand Reputation: Decades of service have built a strong brand reputation, which is difficult for new companies to establish quickly.

Economies of Scale and Cost Advantages

Large incumbents like Rentokil Initial leverage significant economies of scale, particularly in procurement of pest control chemicals and specialized equipment. This purchasing power translates into lower per-unit costs, which is a considerable barrier for new entrants attempting to match competitive pricing. For instance, Rentokil's 2023 revenue of £2.9 billion reflects the sheer scale of its operations, enabling substantial cost efficiencies.

Furthermore, substantial investments in optimizing logistics networks and advanced research and development for more effective and sustainable pest control solutions create further cost advantages. These ongoing investments, often beyond the reach of smaller startups, allow established players to maintain lower operating expenses per service delivered, presenting a formidable challenge for new, less capitalized competitors.

The threat of new entrants is therefore moderated by these entrenched cost advantages:

- Economies of scale in purchasing significantly reduce input costs for established firms.

- Optimized logistics and operational efficiency lower overheads and service delivery costs.

- Substantial R&D investment leads to proprietary technologies and more effective solutions, creating a competitive edge.

- Brand reputation and established customer relationships further solidify market position, making it harder for newcomers to gain traction on price alone.

The threat of new entrants for Rentokil Initial is significantly low due to high capital requirements for global operations and infrastructure. For instance, in 2024, Rentokil's substantial ongoing investment in fleet, technology, and network expansion creates a formidable financial barrier.

Strict regulations and licensing needs across diverse markets, such as COSHH adherence in the UK, pose a significant compliance challenge for newcomers. This regulatory complexity varies by region, demanding specialized knowledge and resources that new entrants may lack.

Rentokil Initial's established brand reputation and decades of customer trust are difficult for new companies to replicate quickly. In 2023, their strong market position underscored the value of this long-standing credibility.

Economies of scale in procurement and optimized logistics provide Rentokil Initial with substantial cost advantages. For example, their 2023 revenue of £2.9 billion reflects the operational efficiencies that make it hard for smaller competitors to match pricing.

| Barrier to Entry | Description | Impact on New Entrants | Supporting Data (2023/2024) |

|---|---|---|---|

| Capital Requirements | Establishing global infrastructure, fleets, and technology. | Very High | Significant capital expenditure for network expansion and tech upgrades. |

| Regulatory Compliance | Adhering to diverse and stringent health, safety, and environmental regulations. | High | Requires extensive knowledge of varying international standards. |

| Brand Reputation & Trust | Building decades of customer loyalty and service credibility. | High | Rentokil's strong market position in 2023 reflects established trust. |

| Economies of Scale | Lowering procurement and operational costs through large-scale operations. | High | £2.9 billion revenue in 2023 enables significant cost efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Rentokil Initial is built on a foundation of publicly available financial reports, industry-specific market research from firms like IBISWorld, and regulatory filings to ensure a comprehensive view of the competitive landscape.