Rentokil Initial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rentokil Initial Bundle

Understand the intricate external forces shaping Rentokil Initial's trajectory with our comprehensive PESTLE analysis. Discover how political stability, economic fluctuations, and evolving social attitudes directly impact their pest control and hygiene services. This in-depth report goes beyond surface-level observations to provide actionable intelligence for your business strategy. Gain a competitive edge by leveraging these critical insights into the industry's future. Download the full PESTLE analysis now and make informed, strategic decisions.

Political factors

Government regulations significantly shape Rentokil Initial's core business. Stricter rules on pesticide types, concentrations, and application methods directly influence the chemicals the company can use and how services are delivered. For instance, evolving environmental protection laws in the European Union, such as those focusing on reducing neonicotinoid use, require Rentokil to develop and deploy alternative pest control strategies, impacting their product portfolio and R&D investments.

Adapting to these regulatory shifts is paramount. Changes driven by public health concerns or environmental impact assessments, like the potential for increased scrutiny on certain broad-spectrum insecticides, compel Rentokil to innovate and potentially phase out older product lines. This necessitates continuous investment in research and development for more targeted and environmentally friendly solutions to remain competitive and compliant across its diverse global markets.

Compliance is non-negotiable for maintaining operational licenses and avoiding substantial financial penalties. Rentokil Initial operates in numerous jurisdictions, each with its own set of chemical use regulations. Failure to adhere to these, perhaps by using an unregistered chemical or violating application protocols, could lead to significant fines, reputational damage, and even suspension of services in affected regions, impacting overall revenue streams.

Rentokil Initial’s global operations are significantly shaped by international trade policies and evolving geopolitical relationships. Favorable trade agreements, like the USMCA which replaced NAFTA, can streamline the movement of essential pest control products and equipment across borders, benefiting companies like Rentokil. Conversely, rising protectionism or trade disputes, such as those impacting global supply chains in 2023 and 2024, can increase costs and create logistical challenges for importing specialized chemicals and machinery, potentially impacting profit margins and operational efficiency.

Government emphasis on public health and sanitation directly fuels demand for Rentokil Initial's pest control and hygiene services. For instance, in 2024, many countries are strengthening regulations around food safety in commercial kitchens, a core market for Rentokil. This focus translates into a greater need for their integrated pest management and hygiene solutions.

Increased awareness of vector-borne diseases or new mandates for workplace hygiene can significantly broaden market opportunities. Following the COVID-19 pandemic, there's been a heightened focus on disinfection and air quality in public spaces, creating new service avenues for Rentokil. The company's hygiene division, which saw significant growth in 2023, is well-positioned to capitalize on these evolving standards.

Conversely, any relaxation of public health or sanitation standards could potentially dampen the perceived necessity for professional pest control and hygiene services. However, given the persistent nature of pest issues and the ongoing global focus on health security, a significant rollback of standards is unlikely to severely impact Rentokil's core business in the 2024-2025 period.

Political stability and governance

Rentokil Initial's global presence means it navigates a complex web of political landscapes. The company operates in over 70 countries, each with its unique governance structures and levels of political stability. For instance, in 2024, while many developed markets offer predictable regulatory frameworks, emerging economies may present greater volatility. Unstable political situations can directly impact Rentokil's ability to conduct business, potentially leading to unexpected tax changes or disruptions in service delivery, affecting its bottom line.

The quality of governance is a critical factor. Countries with strong rule of law and low corruption levels, such as those in Western Europe and North America, generally pose fewer operational risks. Conversely, regions experiencing political unrest or high levels of corruption, as observed in certain African or Asian nations, can introduce significant challenges. These challenges might include difficulties in enforcing contracts, increased security risks for employees and assets, and potential for supply chain interruptions, impacting Rentokil's operational efficiency and expansion plans.

Political stability directly influences Rentokil's strategic decisions regarding market entry and investment. For 2024, companies like Rentokil are likely to prioritize markets with proven political resilience. Factors such as the predictability of government policy, ease of doing business rankings, and the protection of foreign investment are key considerations. For example, a country like Singapore, consistently ranking high in governance and political stability, presents a more attractive environment for long-term investment compared to nations facing ongoing political transitions.

Rentokil's operational continuity can be significantly affected by political events.

- Geographic Diversification: Operating across 70+ countries mitigates risk from any single nation's political instability.

- Regulatory Compliance: Navigating diverse political systems requires robust compliance strategies to adapt to varying regulations.

- Investment Decisions: Political risk assessments are crucial for determining where to allocate capital for new facilities or acquisitions.

- Supply Chain Resilience: Political instability in a key supplier nation can disrupt the availability of essential materials or equipment.

Government contracts and procurement

Public sector entities, such as local councils, hospitals, and defense establishments, frequently outsource pest control and hygiene solutions via government contracts. Rentokil Initial's success in obtaining and retaining these agreements hinges on governmental procurement regulations, competitive bidding procedures, and the financial resources earmarked for public service provision. For instance, the UK government's commitment to public health and sanitation underpins significant opportunities in this sector, with local authorities awarding contracts for everything from rat control in urban areas to disinfection services in schools. These contracts offer a consistent and substantial source of income for service providers like Rentokil Initial.

These government contracts are crucial for Rentokil Initial's revenue stability. The company's ability to navigate complex tender processes and meet stringent service level agreements is paramount. In 2023, Rentokil Initial reported a significant portion of its revenue derived from its public sector contracts across its operating regions, demonstrating the importance of this segment. For example, securing a multi-year contract with a large metropolitan municipality can guarantee consistent business, insulating the company from some of the volatility experienced in the private sector.

- Government Procurement Policies: Changes in national or regional spending priorities can directly impact the availability and value of public sector contracts.

- Tender Processes: The competitiveness and transparency of bidding processes influence Rentokil Initial's success rate in winning new contracts.

- Budgetary Allocations: Government budgets for essential services like public health and sanitation directly affect the volume and scale of contracts available.

- Regulatory Compliance: Adherence to specific government standards for pest control and hygiene services is mandatory for contract award and retention.

Government regulations are a significant driver for Rentokil Initial, impacting everything from the chemicals it uses to the services it offers. For instance, evolving environmental laws in regions like the EU, focusing on reducing certain pesticide types, compel Rentokil to invest in R&D for more sustainable solutions, influencing its product development and operational strategies. This constant need for adaptation to new rules, driven by public health or environmental concerns, ensures continuous innovation and compliance across its global operations.

Political stability and government policies directly influence Rentokil's strategic decisions regarding market entry and investment. In 2024, the company likely prioritizes markets with stable governance and predictable policies. Factors such as ease of doing business rankings and protection of foreign investment are key, with countries like Singapore offering more attractive environments compared to those facing political transitions. This focus on political resilience is crucial for long-term capital allocation and operational continuity.

Rentokil Initial's success with government contracts, a key revenue stream, depends heavily on public sector procurement regulations and budgetary allocations. For example, government commitments to public health, as seen in the UK's approach to urban pest control and school disinfection, create substantial opportunities. The company's ability to navigate complex tender processes and meet stringent service level agreements is paramount, as demonstrated by its significant reliance on public sector contracts in 2023.

What is included in the product

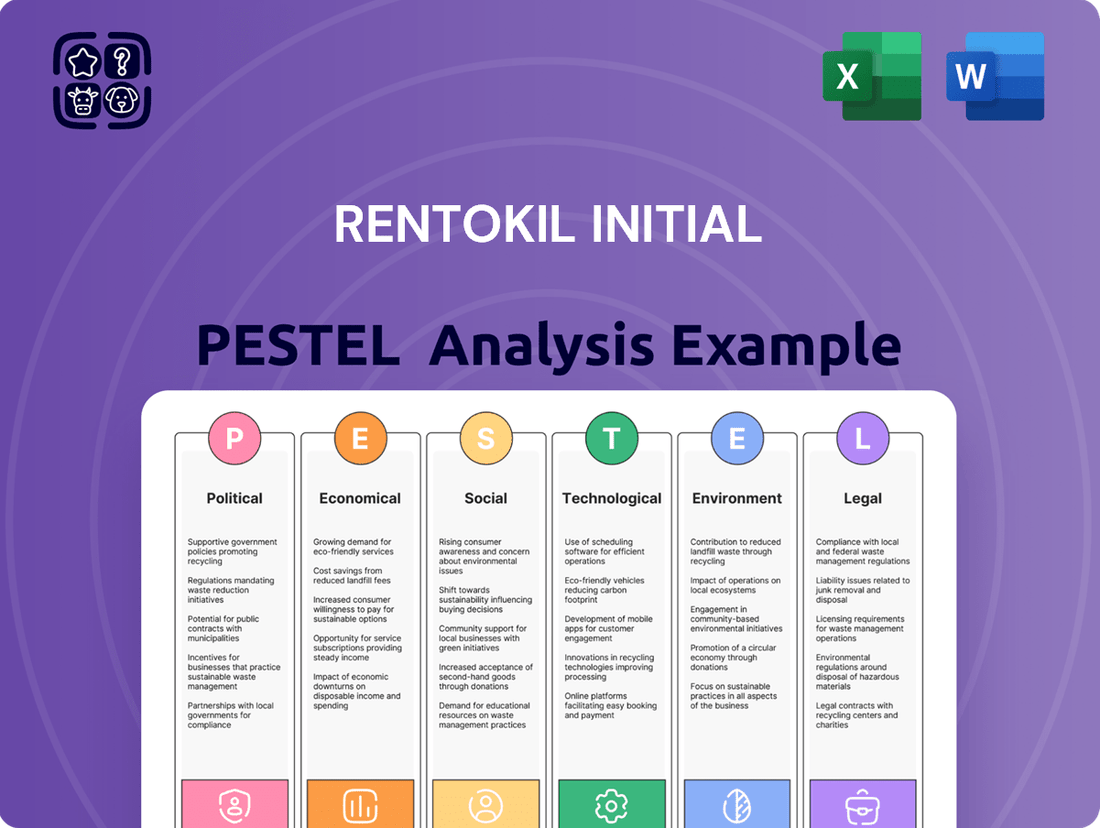

This Rentokil Initial PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategy.

Provides a clear, actionable summary of external factors impacting Rentokil Initial, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

Global economic growth directly impacts Rentokil Initial's performance, especially its commercial segment. A robust economy, marked by rising GDP and increased business investment, often translates to higher demand for essential services like pest control and hygiene. For instance, projected global GDP growth around 2.7% for 2024, according to the IMF, suggests a generally supportive environment for Rentokil's service uptake across various industries.

When economies expand, sectors like construction, hospitality, and food retail tend to flourish, boosting the need for Rentokil's offerings. In 2023, the global hospitality sector saw significant recovery, with many regions exceeding pre-pandemic occupancy rates, which directly benefits pest control and hygiene service providers.

Conversely, economic downturns can pressure businesses to reduce operating costs, potentially impacting discretionary spending on services perceived as non-essential. A slowdown in global industrial production or a contraction in consumer spending could lead to delayed contracts or reduced service levels for Rentokil, particularly in emerging markets where economic sensitivity is higher.

Rising inflation significantly impacts Rentokil Initial's operational expenses, affecting everything from employee wages and fuel for its extensive vehicle fleet to the cost of essential chemicals and pest control equipment. For instance, the UK's Consumer Price Index (CPI) remained elevated, hovering around 4% in early 2024, indicating sustained pressure on these input costs.

Effectively managing these escalating input costs while simultaneously preserving competitive pricing presents a considerable hurdle for the company. Rentokil Initial faces the delicate task of balancing the necessity of recovering these increased expenses through price adjustments with the imperative of retaining customer loyalty, especially within a highly competitive service landscape.

Interest rate fluctuations directly impact Rentokil Initial's cost of borrowing, a critical factor for funding expansion, acquisitions, and essential capital expenditures. For instance, if central banks like the Bank of England or the Federal Reserve continue to maintain higher interest rates through 2024 and into 2025, Rentokil Initial's debt financing for strategic moves becomes more expensive. This increased cost can squeeze profit margins and potentially temper the pace of growth initiatives.

Access to affordable capital is absolutely crucial for Rentokil Initial's strategy of inorganic growth, which involves acquiring other pest control and hygiene businesses. In 2024, with ongoing global economic uncertainty, the cost and availability of capital can shift rapidly. Companies that can secure favorable financing terms are better positioned to execute strategic acquisitions, thereby enhancing their market share and competitive advantage.

Exchange rate volatility

Exchange rate volatility presents a key economic challenge for Rentokil Initial, a global business operating across numerous countries. The company's financial performance is directly affected as revenues earned in foreign currencies are translated back into its reporting currency, typically GBP. For instance, a stronger GBP can diminish the reported value of earnings from markets like the US or Australia.

This currency risk is a constant factor. In 2024, major currency pairs like EUR/USD and GBP/USD experienced notable fluctuations, driven by differing monetary policies and geopolitical events. Such movements can significantly impact the profitability and balance sheet of multinational corporations like Rentokil. Managing this volatility often involves sophisticated hedging strategies, such as forward contracts or currency options, to lock in exchange rates for future transactions.

Rentokil Initial’s exposure to currency fluctuations necessitates careful financial management. The company's 2023 annual report, for example, would detail the impact of currency movements on its results. For instance, if a significant portion of revenue in 2024 came from the Eurozone and the Euro weakened against the Pound Sterling, Rentokil's reported revenue and profit would be negatively impacted, even if local currency revenues remained stable.

- Global Operations: Rentokil Initial operates in over 90 countries, exposing it to a wide array of currency exchange rates.

- Revenue Translation: Fluctuations in exchange rates directly affect the value of foreign earnings when converted to the reporting currency (GBP).

- Currency Risk Management: The company employs hedging instruments and operational strategies to mitigate the adverse effects of currency volatility.

- Impact on Profitability: A stronger GBP can reduce the reported profit from international operations, while a weaker GBP can boost it.

Consumer and business spending patterns

Consumer and business spending patterns are crucial for Rentokil Initial. The discretionary spending of residential clients, influenced by economic confidence and disposable income, directly impacts demand for home pest control services. For instance, in early 2024, continued inflation and interest rate concerns in key markets like the UK and US might lead some households to defer non-essential services.

Commercial client budget allocations are equally vital. Business profitability directly drives investment in Rentokil's hygiene and workwear services. As of mid-2024, many businesses are still navigating post-pandemic operational adjustments, which can affect their willingness to invest in these areas. However, increased focus on workplace safety and hygiene standards post-COVID-19 also presents an opportunity.

- Economic Confidence: Fluctuations in consumer and business sentiment directly correlate with spending on pest control and hygiene services.

- Disposable Income: Higher disposable income for households generally leads to increased demand for residential pest management.

- Business Profitability: The financial health of businesses dictates their capacity to invest in essential services like workwear and hygiene solutions.

- Employment Levels: Strong employment figures typically bolster consumer confidence and spending power, benefiting Rentokil's residential offerings.

Global economic growth is a significant driver for Rentokil Initial, with a projected 2.7% global GDP growth for 2024 by the IMF indicating a generally positive environment. Strong economies fuel demand in sectors like hospitality and food retail, which saw notable recovery in 2023, directly benefiting Rentokil's services.

Rising inflation, with the UK's CPI around 4% in early 2024, increases Rentokil's operational costs for wages, fuel, and chemicals. The company must balance passing these costs to customers with maintaining competitive pricing. Higher interest rates, potentially sustained through 2024-2025 by central banks, increase Rentokil's borrowing costs, impacting expansion and acquisition financing.

Currency volatility, particularly with significant fluctuations in EUR/USD and GBP/USD in 2024, affects Rentokil's global revenues. A stronger GBP, for instance, can reduce the reported value of earnings from markets like the US. Consumer and business spending patterns are also critical; household confidence impacts residential pest control, while business profitability influences investment in hygiene and workwear services.

Same Document Delivered

Rentokil Initial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Rentokil Initial PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape and potential challenges and opportunities Rentokil Initial faces. This is your complete guide to their external operating environment.

Sociological factors

Public concern over hygiene and diseases spread by pests like rodents and mosquitoes is a significant driver for Rentokil Initial. As people become more aware of the health risks, the demand for professional pest control and hygiene services naturally increases. This heightened awareness directly fuels the need for Rentokil's core business, making it a crucial factor in their market positioning.

Public health campaigns and actual disease outbreaks, such as those linked to mosquito-borne illnesses or rodent infestations, powerfully amplify this awareness. For example, the heightened focus on hygiene following the COVID-19 pandemic has broadly benefited the hygiene services sector. This trend means more individuals and businesses are actively seeking out preventative solutions, aligning perfectly with Rentokil's service portfolio.

In 2023, global spending on pest control services was estimated to be over $20 billion, with hygiene services adding substantially to that figure. This market growth is directly attributable to increased public and governmental focus on health and sanitation, particularly in urban environments where pest issues are more prevalent.

Growing urban populations and increased density in residential and commercial areas, a trend projected to see over 60% of the world’s population living in cities by 2030 according to the UN, often lead to higher incidences of pest problems. This urbanization creates new markets and increases the need for effective pest management solutions in these densely populated environments. For Rentokil Initial, this means expanding services in areas with higher customer density.

Furthermore, aging populations, which are expected to comprise a significant portion of developed economies in the coming years, may require more assistance with home maintenance services, including pest control. This demographic shift presents opportunities for tailored service offerings from Rentokil Initial.

Modern lifestyles, with their embrace of convenient food delivery services, a resurgence in outdoor dining, and increased international travel, are creating new and evolving pest challenges. These shifts in how people live and consume directly impact pest populations and their habitats. For instance, the surge in food delivery can lead to increased food waste in residential areas, a prime attractant for rodents and insects. In 2023, the global food delivery market was valued at an estimated $213.7 billion, highlighting the scale of this trend and its potential pest management implications.

Rentokil Initial must therefore continuously adapt its service offerings to effectively address pest issues stemming from these changing human behaviors and the associated waste management practices. This necessitates agile service development and a keen understanding of how evolving consumption patterns create new pest control needs. The company's ability to innovate and respond quickly to these societal shifts will be crucial for maintaining its market leadership and ensuring customer satisfaction.

Health and safety consciousness

Following the global health events of recent years, there's a significantly increased societal emphasis on health and safety across both residential and commercial spaces. This heightened awareness directly fuels demand for professional hygiene services and reliable pest control solutions, areas where Rentokil Initial operates. For instance, in 2024, many businesses are prioritizing enhanced sanitation protocols to ensure employee well-being and customer confidence, seeing these services as essential investments rather than discretionary spending.

This societal value translates into a stronger inclination for organizations to invest in services that demonstrably protect their workforce and clientele. Rentokil Initial’s integrated hygiene offerings, which include disinfection and air quality management, directly address these growing concerns. The company's 2023 annual report highlighted a substantial uplift in demand for these specific services, particularly from sectors like hospitality and corporate offices, underscoring the market’s response to this trend.

Furthermore, this elevated health and safety consciousness strongly aligns with and amplifies the concept of corporate social responsibility. Companies are increasingly judged not only on their financial performance but also on their commitment to creating safe and healthy environments. This societal expectation encourages businesses to partner with providers like Rentokil Initial, which can help them meet and exceed regulatory standards and public expectations related to health and safety.

- Increased Demand: Post-pandemic, demand for professional hygiene and pest control services has surged.

- Business Investment: Companies are allocating more resources to safety solutions for employees and customers.

- Corporate Responsibility: Societal values are pushing businesses to prioritize health and safety as a key aspect of their brand.

- Market Alignment: Rentokil Initial's service portfolio is well-positioned to capitalize on this growing societal priority.

Labor market trends and skilled workforce availability

Rentokil Initial's success hinges on a readily available pool of skilled technicians, especially for specialized pest control and hygiene services. As of early 2025, reports indicate a persistent shortage in vocational trades across many developed economies, directly impacting companies like Rentokil. For instance, a 2024 survey highlighted that over 60% of construction and trade businesses struggled with finding qualified labor, a trend likely to extend to related service industries.

Societal views on vocational careers, alongside educational system outputs, directly shape the talent pipeline. A growing emphasis on university degrees over apprenticeships can limit the number of individuals entering skilled trades. This societal perception, coupled with intense competition for talent from other service-based industries, necessitates proactive recruitment and retention strategies for Rentokil Initial.

- Skilled Labor Shortage: Reports in late 2024 and early 2025 continue to highlight a significant deficit in skilled trades, directly impacting the availability of qualified pest control and hygiene technicians.

- Societal Perceptions: Evolving societal views on vocational careers versus academic paths influence the attractiveness of the pest control industry for potential employees.

- Educational Pathways: The output of educational systems in providing relevant vocational training directly impacts the supply of new talent entering the workforce.

- Talent Competition: Rentokil Initial faces competition for skilled labor not only within the pest control sector but also from other service-oriented industries requiring similar technical proficiencies.

The increasing global focus on health and safety, amplified by recent pandemics, drives demand for Rentokil's core services. In 2024, businesses are prioritizing sanitation, viewing hygiene services as essential investments to protect staff and customers, a trend reflected in Rentokil's robust service uptake, particularly in hospitality and corporate sectors.

Societal expectations regarding corporate social responsibility now encompass creating safe and healthy environments, pushing companies to partner with providers like Rentokil to meet and exceed health and safety standards.

The growing urbanization trend, with over 60% of the global population expected to live in cities by 2030, creates denser living conditions that often exacerbate pest issues, thus expanding market opportunities for Rentokil's pest management solutions.

Shifting modern lifestyles, including increased food delivery and travel, create new pest challenges, such as heightened rodent activity due to food waste, directly impacting the need for Rentokil's adaptive pest control strategies.

| Sociological Factor | Impact on Rentokil Initial | Supporting Data (2023-2025) |

|---|---|---|

| Health & Safety Awareness | Increased demand for hygiene and pest control services. | Global pest control market exceeding $20 billion in 2023; heightened demand for disinfection services noted in 2023 annual reports. |

| Urbanization | Expansion of service needs in densely populated areas. | Projected 60%+ global urban population by 2030, increasing pest prevalence in cities. |

| Lifestyle Changes | Creation of new pest challenges (e.g., food delivery impact). | Global food delivery market valued at $213.7 billion in 2023; necessitates adaptive service offerings. |

| Skilled Labor Availability | Potential impact on service delivery due to technician shortages. | Reports in late 2024/early 2025 indicate vocational trade shortages affecting service industries. |

Technological factors

The integration of Internet of Things (IoT) devices and digital sensors is revolutionizing pest management. These technologies allow for continuous, remote monitoring of pest activity, providing real-time data that was previously unavailable. This shift enables companies like Rentokil Initial to move from reactive treatments to proactive, data-driven pest control strategies.

This advancement significantly enhances service efficiency by reducing the reliance on frequent physical inspections. With IoT sensors in place, Rentokil Initial can pinpoint pest issues as they arise, leading to more targeted and effective treatments. This not only optimizes resource allocation but also improves the overall client experience through more precise and timely interventions.

The increasing adoption of these digital solutions supports a more sustainable approach to pest control. By minimizing unnecessary pesticide application through precise targeting, Rentokil Initial can lessen its environmental footprint. For instance, in 2024, the global IoT in pest control market was valued at approximately $1.5 billion and is projected to grow substantially in the coming years, indicating strong industry adoption.

Environmental concerns are driving significant innovation in pest control. Rentokil Initial is seeing a rise in demand for eco-friendly solutions, with a focus on non-toxic or low-toxicity products. This includes advancements in biological controls, such as beneficial insects and microbial agents, which offer targeted pest management with minimal collateral impact. For instance, the market for biopesticides, a key component of biological controls, was valued at approximately $5.1 billion in 2023 and is projected to reach around $11.5 billion by 2030, showcasing a strong growth trend.

Smarter application technologies are also becoming paramount. Precision application tools, including drone-based spraying and sensor-driven bait stations, allow for more targeted delivery of treatments, significantly reducing the overall amount of product used. This not only minimizes environmental impact but also enhances cost-effectiveness. Rentokil Initial's investment in such technologies, like their use of AI-powered sensors to detect pest activity early, positions them to offer highly efficient and sustainable pest management services that align with evolving customer expectations and regulatory pressures.

Automation is significantly boosting efficiency in service delivery for companies like Rentokil Initial. Automated dispensing systems for hygiene products, for example, streamline maintenance and reduce waste. This technology directly contributes to operational cost savings.

Robotic solutions are emerging as potential game-changers, particularly for pest inspections and treatments in challenging or hazardous locations. This not only enhances the scope of services offered but also prioritizes technician safety, a critical factor in the industry. By 2024, the global robotics market is projected to reach over $200 billion, highlighting the rapid adoption of such technologies.

Furthermore, automation plays a key role in optimizing service routes, leading to reduced fuel consumption and labor hours. This technological integration allows for more efficient deployment of technicians, ultimately lowering operational expenses and improving customer service response times.

Data analytics for predictive pest management

Rentokil Initial leverages advanced data analytics for predictive pest management, a significant technological advancement. By analyzing vast datasets, the company can identify trends and anticipate potential pest outbreaks before they become widespread problems. This proactive approach allows for more targeted and efficient service delivery, ultimately enhancing customer satisfaction and operational efficiency. For instance, their digital platform integrates data from sensors and technician reports to forecast high-risk areas, optimizing deployment of resources. In 2024, Rentokil Initial reported a significant increase in the adoption of their digital service platforms, contributing to improved route planning and reduced response times.

The integration of big data and analytics is crucial for Rentokil Initial’s strategy. It enables them to not only predict infestations but also to tailor treatment plans based on specific environmental factors and pest behaviors. This optimization leads to more effective pest control and better resource management, minimizing waste and maximizing technician productivity. Furthermore, these data-driven insights are invaluable for refining existing services and developing innovative new solutions. As of early 2025, the company has invested heavily in AI-powered analytics to further refine these predictive models.

- Predictive Modeling: Utilization of AI and machine learning to forecast pest activity based on historical data, weather patterns, and environmental conditions.

- Optimized Scheduling: Data analytics inform the scheduling of preventative services, ensuring technicians are deployed to areas with the highest predicted need.

- Service Enhancement: Insights derived from data analytics are used to improve treatment efficacy and develop new service offerings.

- Resource Allocation: Efficient deployment of personnel and materials based on predictive insights, reducing operational costs.

Innovations in workwear materials and hygiene systems

Technological leaps in textile science are making workwear more robust, comfortable, and importantly, hygienic. For Rentokil Initial, this means materials that can better withstand demanding environments while offering enhanced protection. For instance, advancements in antimicrobial finishes are becoming standard, reducing odor and pathogen spread.

Innovations in hygiene systems are also a significant technological driver. This includes smarter hand sanitizing dispensers that track usage and refill needs, advanced air purification units filtering out airborne contaminants, and more effective, eco-friendly surface disinfection technologies. These advancements directly bolster the effectiveness and appeal of Rentokil Initial's service offerings.

These technological upgrades directly enhance the value proposition for Rentokil Initial's clients by providing demonstrably better protection and operational efficiency. For example, the global hygiene market, which Rentokil Initial operates within, saw significant growth in 2024, driven by increased awareness and demand for advanced cleaning and disinfection solutions. The market size for commercial hygiene services was estimated to be over $150 billion globally in 2023, with projections for continued expansion through 2025.

The impact of these innovations can be seen in:

- Enhanced Durability: New fabric blends offer longer lifespans for uniforms, reducing replacement costs for businesses.

- Improved Hygiene Standards: Antimicrobial treatments and advanced disinfection methods provide superior protection against germs.

- Sustainability Gains: Innovations often lead to reduced water and chemical usage in laundry processes for workwear.

- Smart Technology Integration: Connected hygiene devices offer data-driven insights into usage and maintenance needs.

Technological advancements are fundamentally reshaping pest control and hygiene services. Rentokil Initial is leveraging IoT sensors for real-time pest monitoring, transitioning from reactive to proactive strategies. This smart technology, with the IoT in pest control market valued around $1.5 billion in 2024, enhances service efficiency and sustainability by enabling precise treatments and minimizing pesticide use.

Automation and AI are further boosting operational efficiency. Automated hygiene systems and AI-driven predictive analytics for pest outbreaks improve resource allocation and service delivery. These innovations are critical as the global commercial hygiene services market was over $150 billion in 2023, with continued growth expected through 2025.

| Technology Area | Impact on Rentokil Initial | Market Relevance (2024/2025 Data) |

|---|---|---|

| IoT & Digital Sensors | Real-time pest monitoring, proactive treatments | IoT in Pest Control Market: ~$1.5 billion (2024 est.) |

| AI & Data Analytics | Predictive pest modeling, optimized scheduling | AI in Business Market: Significant growth, driving efficiency |

| Automation | Streamlined hygiene services, route optimization | Global Robotics Market: >$200 billion (2024 proj.) |

| Advanced Materials | Enhanced workwear durability and hygiene | Antimicrobial textile market expanding |

Legal factors

Rentokil Initial operates under a complex web of pesticide registration and usage laws that vary significantly across its global markets. These regulations, often overseen by bodies like the Environmental Protection Agency (EPA) in the US or the European Chemicals Agency (ECHA), dictate the approved active ingredients, application methods, and permissible concentration levels for pest control products. For instance, the EU's Biocidal Products Regulation (BPR) requires extensive data submission for product authorization, a process that can take years and significant investment.

Failure to comply with these stringent legal frameworks can result in severe repercussions for Rentokil Initial, including substantial fines, loss of operating licenses, and damage to its brand reputation. In 2023, the EPA reported over $10 million in penalties for pesticide misapplication and unregistered product sales, highlighting the financial risks. Therefore, robust internal compliance programs and continuous monitoring of evolving legislation are paramount to ensure the safe and legal application of pesticides across all its service territories, safeguarding both customer well-being and environmental integrity.

Rentokil Initial navigates a complex web of health and safety regulations, particularly concerning its use of chemicals and operations in diverse client environments. These laws, like the UK's Health and Safety at Work etc. Act 1974, are critical for protecting its workforce from potential chemical exposure and physical hazards. In 2023, Rentokil Initial reported a total recordable injury rate of 0.86 per 200,000 hours worked, demonstrating a focus on minimizing workplace incidents.

Client safety during pest control and hygiene services is also a major legal consideration. Regulations ensure that treatments are applied correctly and that any residual risks are communicated effectively, safeguarding public health. This commitment to safety is vital for maintaining client trust and avoiding costly litigation, as evidenced by the company's ongoing investment in training and safety protocols.

Rentokil Initial's increasing reliance on digital platforms for customer interaction means it manages substantial customer data. This necessitates stringent adherence to data privacy laws like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA). For instance, GDPR, enacted in 2018, imposes strict rules on how companies collect, process, and store personal data, with potential fines up to 4% of global annual turnover or €20 million, whichever is higher. Similarly, CCPA, effective from 2020, grants California consumers more control over their personal information.

Employment laws and labor relations

Rentokil Initial, as a major global employer with operations in over 90 countries, faces a complex web of employment laws. These regulations cover everything from minimum wage and working hour stipulations to collective bargaining rights and anti-discrimination statutes. For instance, in the United Kingdom, the National Living Wage, which applies to workers aged 21 and over, saw an increase to £11.44 per hour in April 2024. Companies like Rentokil must meticulously track and adhere to these varying legal requirements across their international workforce to ensure compliance and mitigate risks.

Managing labor relations effectively is paramount for Rentokil Initial's operational stability. The company must navigate diverse union landscapes and labor negotiation processes across its global footprint. In 2023, for example, industrial action and strike threats were reported in various sectors and countries, highlighting the ongoing importance of proactive engagement with employee representatives. Rentokil's ability to maintain positive industrial relations directly impacts its productivity and reputation.

Key legal considerations for Rentokil Initial include:

- Compliance with national and international labor standards, ensuring fair wages and working conditions across all operating regions.

- Navigating diverse unionization rights and collective bargaining agreements, a critical aspect of employee relations in many of its key markets.

- Adherence to anti-discrimination and equal opportunity legislation, promoting a diverse and inclusive workforce.

- Managing employee contracts and dismissal procedures according to the specific legal frameworks of each country.

Consumer protection laws and service quality standards

Consumer protection laws are a significant legal factor for Rentokil Initial, dictating how they interact with customers and ensuring fair business practices. These regulations cover aspects like transparent pricing, clear service contracts, and effective complaint resolution processes, all vital for maintaining customer trust and loyalty. For instance, in the UK, the Consumer Rights Act 2015 mandates that services must be carried out with reasonable care and skill, and that digital content supplied with services must be of satisfactory quality.

Adhering to these consumer protection statutes is not just about avoiding penalties; it directly impacts Rentokil Initial's service quality standards. High service quality fosters positive customer experiences, which in turn strengthens brand reputation and reduces the likelihood of costly legal challenges. Companies like Rentokil Initial must actively monitor and comply with evolving consumer protection legislation across all their operating regions to mitigate risks.

- Consumer Rights Act 2015 (UK): Mandates services are provided with reasonable care and skill, impacting pest control and hygiene services.

- Service Quality Standards: Directly linked to legal compliance; failure can result in fines and reputational damage.

- Customer Satisfaction: High service quality, compliant with consumer laws, is crucial for retaining clients in competitive markets.

- Regulatory Scrutiny: Rentokil Initial faces scrutiny from bodies like the Competition and Markets Authority (CMA) in the UK, ensuring fair trading.

Rentokil Initial must navigate a complex landscape of intellectual property laws to protect its innovations in pest control and hygiene technologies. This includes securing patents for new chemical formulations or application methods, as well as trademarks for its brand names and service offerings. Infringement of these IP rights, either by the company or against it, can lead to significant legal battles and financial penalties. For example, patent disputes can involve millions in damages, impacting profitability and market competitiveness.

Furthermore, the company's global operations mean it must comply with varying legal frameworks regarding contracts and commercial agreements. These range from service level agreements with clients to supplier contracts and franchise arrangements. Ensuring these agreements are legally sound and enforceable across different jurisdictions is critical for smooth business operations. In 2023, contract disputes in the business services sector continued to be a common source of litigation, underscoring the need for meticulous contract management.

Rentokil Initial faces significant legal obligations related to environmental protection, particularly concerning the disposal of chemical waste and the impact of its services on ecosystems. Regulations like the EU's Waste Framework Directive set strict guidelines for waste management and recycling. Non-compliance can result in substantial fines and reputational damage. The company's sustainability reports often detail initiatives to minimize its environmental footprint, directly addressing these legal imperatives.

Environmental factors

Consumers and businesses are increasingly aware of environmental issues, leading to a stronger demand for pest control methods that are kind to the planet. This means solutions that avoid harsh chemicals and focus on natural or integrated approaches are becoming more popular. For companies like Rentokil Initial, this trend presents a clear opportunity to innovate.

To capitalize on this shift, Rentokil Initial is investing in research and development for sustainable pest control. This includes exploring non-toxic options, biological controls, and integrated pest management (IPM) strategies. For instance, a growing segment of the market is seeking services that minimize chemical usage, reflecting a broader consumer preference for eco-friendly products and services.

By reducing reliance on traditional chemical treatments, Rentokil Initial can not only meet evolving customer expectations but also bolster its brand reputation as an environmentally responsible leader in the pest control industry. This strategic pivot aligns with a global movement towards sustainability, where companies demonstrating a commitment to greener practices often see enhanced customer loyalty and market differentiation.

Climate change is significantly altering how pests behave and where they can thrive. Shifting global weather patterns, including warmer temperatures and different rainfall amounts, directly impact pest breeding cycles and their ability to migrate into new areas. For instance, studies in 2024 indicate that certain insect species, previously confined to warmer climates, are now being reported in regions further north than ever before.

This means that areas that historically had fewer pest problems might now face new challenges, or existing infestations could become more severe. Rentokil Initial, as a global leader in pest control, needs to continuously update its strategies to effectively manage these evolving pest behaviors and ensure its services remain relevant and effective across diverse geographical locations.

Rentokil Initial navigates a complex web of waste management regulations governing the disposal of pest control chemicals, traps, and contaminated materials. These rules are critical for ensuring environmental protection and avoiding legal repercussions, as improper disposal can lead to significant fines and reputational damage. For instance, the European Union's Waste Framework Directive sets stringent standards for waste treatment and disposal, impacting Rentokil Initial's operations across member states.

Compliance with local and international hazardous waste disposal laws is paramount. This includes adhering to guidelines set by bodies like the Environmental Protection Agency (EPA) in the United States, which classifies many pest control substances as hazardous waste. In 2024, the global market for pest control services, a key area for Rentokil Initial, was valued at over $22 billion, underscoring the scale of operations and the associated waste management challenges.

The company must meticulously manage its waste streams, from leftover chemicals to used equipment and contaminated packaging. Responsible waste management is not only about regulatory adherence but also a core component of Rentokil Initial's commitment to sustainability. For example, their 2023 sustainability report highlighted efforts to reduce hazardous waste by 15% compared to 2020 levels, a testament to the focus on this environmental factor.

Biodiversity protection and non-target species impact

Environmental regulations and public awareness are increasingly prioritizing biodiversity protection and the impact of pest control on non-target species. Rentokil Initial must adopt highly selective methods to minimize harm to beneficial insects, wildlife, and overall ecosystems. This necessitates meticulous product selection and precise application techniques.

The company's commitment to sustainability is evident in its R&D efforts, focusing on developing integrated pest management (IPM) strategies that reduce reliance on broad-spectrum chemicals. In 2024, Rentokil reported a significant increase in the adoption of its digital pest control solutions, which offer more targeted interventions and data-driven insights, thereby reducing the potential for off-target impacts.

- Biodiversity Focus: Rentokil's strategy involves using targeted treatments and monitoring systems to minimize disruption to local flora and fauna.

- Product Stewardship: The company adheres to stringent guidelines for product selection and application, ensuring efficacy while safeguarding non-target organisms.

- IPM Integration: By promoting Integrated Pest Management, Rentokil encourages a holistic approach that combines biological, cultural, and chemical controls for sustainable pest management.

- Regulatory Compliance: Rentokil actively monitors and adapts to evolving environmental legislation globally, such as stricter regulations on neonicotinoids in Europe, impacting product availability and application protocols.

Corporate social responsibility (CSR) and environmental reporting

Stakeholders, from investors to customers and employees, are increasingly demanding that companies showcase robust environmental responsibility through corporate social responsibility (CSR) efforts and clear reporting. Rentokil Initial's dedication to lowering its carbon emissions, ensuring sustainable procurement, and maintaining responsible operational practices is crucial for its public image and for drawing in clients who prioritize environmental consciousness.

In 2023, Rentokil Initial reported a 16% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating progress towards its science-based targets. This commitment resonates with a growing segment of consumers and business partners who actively seek out environmentally sound service providers.

- Increased Demand for Sustainable Services: Many clients are now including environmental performance criteria in their supplier selection processes.

- Investor Scrutiny: Institutional investors, particularly those focused on ESG (Environmental, Social, and Governance) factors, are scrutinizing companies' environmental data and CSR strategies more closely than ever.

- Talent Attraction: A strong CSR profile helps attract and retain talent, as employees increasingly want to work for organizations that align with their values.

- Regulatory Landscape: Evolving environmental regulations globally necessitate proactive reporting and action on sustainability.

The increasing global focus on environmental sustainability is a significant driver for Rentokil Initial. This translates to a heightened demand for eco-friendly pest control solutions that minimize chemical use and protect biodiversity. For instance, in 2024, the market for green pest control solutions saw a notable uptick as consumers and businesses alike sought more responsible service providers.

Climate change is also reshaping pest behavior, leading to new or intensified pest challenges in various regions. Rentokil Initial must continually adapt its strategies to address these evolving patterns, ensuring effective pest management across different climates. The company's investment in research and development for sustainable and integrated pest management (IPM) strategies, including biological controls, directly addresses these environmental shifts.

Stringent waste management regulations for pest control chemicals and materials are critical. Rentokil Initial's commitment to responsible disposal, as evidenced by their 2023 report showing a 15% reduction in hazardous waste compared to 2020, is vital for compliance and maintaining a positive environmental footprint.

| Environmental Factor | Impact on Rentokil Initial | Key Data/Initiatives (2023-2024) |

|---|---|---|

| Demand for Sustainable Solutions | Increased demand for eco-friendly pest control methods. | Growing market segment seeking minimal chemical usage. |

| Climate Change & Pest Behavior | Altered pest distribution and activity patterns requiring strategy adaptation. | Reports of insect species migrating to previously unaffected northern regions. |

| Waste Management Regulations | Need for strict compliance in disposing of chemicals, traps, and contaminated materials. | Focus on reducing hazardous waste; 15% reduction reported by 2023 (vs. 2020). |

| Biodiversity Protection | Requirement for selective pest control methods to protect non-target species. | Increased adoption of digital pest control solutions for targeted interventions. |

| Corporate Social Responsibility (CSR) | Stakeholder demand for demonstrable environmental responsibility. | 16% reduction in Scope 1 & 2 GHG emissions reported by 2023 (vs. 2019 baseline). |

PESTLE Analysis Data Sources

Our Rentokil Initial PESTLE analysis is built on a comprehensive review of official government publications, reputable industry associations, and leading market research firms. We incorporate data on economic indicators, environmental regulations, technological advancements, and social trends to ensure a robust understanding of the external landscape.