RCS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RCS Bundle

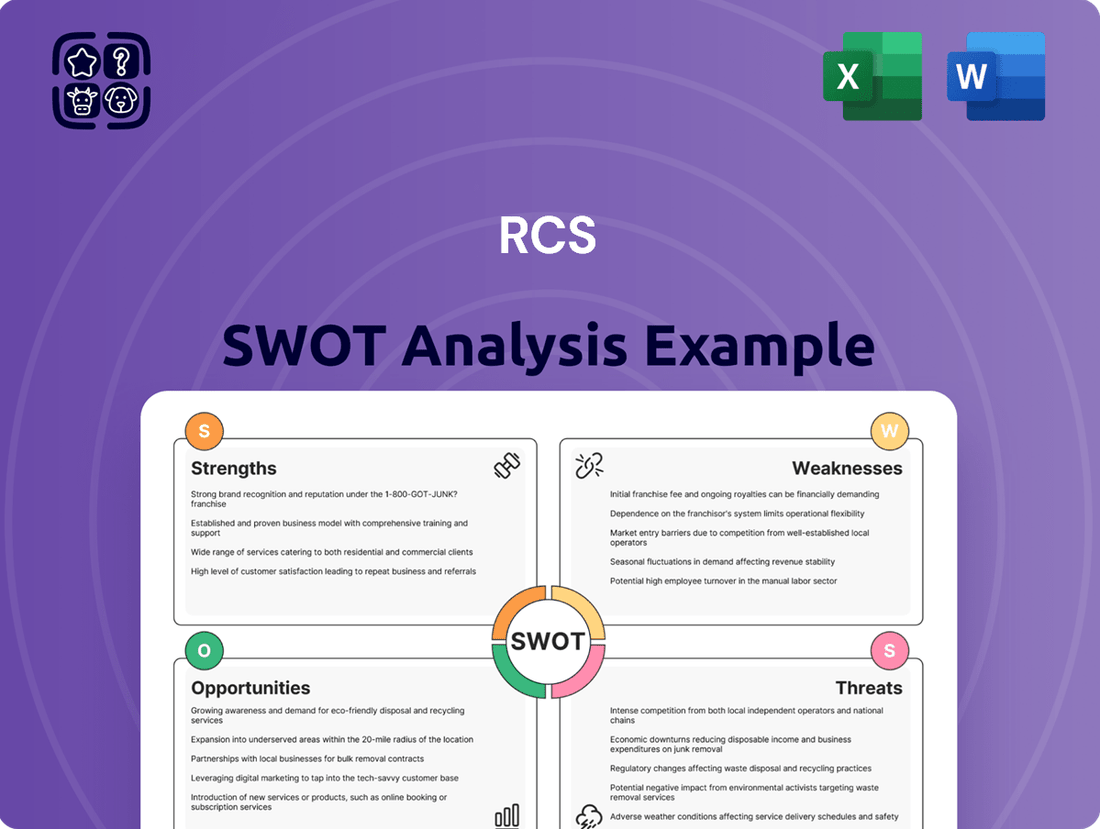

This glimpse into RCS's SWOT analysis reveals key strengths and potential challenges. You've seen the highlights of their market position and internal capabilities. To truly understand how to leverage these insights for your own strategic advantage, a deeper dive is essential.

Want the full story behind RCS's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

RCS MediaGroup boasts a commanding presence in Italy, firmly established as the country's foremost multimedia publishing entity. Its iconic titles, Corriere della Sera and La Gazzetta dello Sport, consistently capture significant readership and digital interaction, underscoring the company's substantial market share.

This leadership is reflected in robust circulation figures and digital audience numbers. For instance, in 2024, Corriere della Sera continued to be a dominant force, with its print circulation remaining a key indicator of its enduring appeal, complemented by millions of monthly unique visitors to its digital platforms.

La Gazzetta dello Sport also maintains its status as Italy's leading sports newspaper, consistently reporting high print and digital engagement. This dual strength in broadsheet and specialized publishing provides a solid base for advertising revenue and brand recognition across diverse consumer segments.

RCS MediaGroup has excelled in its digital transformation, establishing itself as Italy's leading online publisher. By late 2024, the company boasted over 1.1 million active digital subscriptions, a testament to its successful digital-first approach.

This robust digital expansion is further evidenced by consistent growth in digital revenues, demonstrating RCS's adeptness at monetizing its online content offerings. The focus on enhancing digital editions and dedicated apps for its key publications has been instrumental in this achievement, aligning with changing consumer preferences.

RCS MediaGroup benefits significantly from its diversified content and revenue streams. The company's operations span national and sports newspapers, magazines, book publishing, digital media, advertising sales, and event organization. This broad portfolio, which includes high-profile events like the Giro d'Italia, safeguards against over-reliance on any single income source, fostering resilience and multiple monetization opportunities.

Positive Financial Performance and Outlook

RCS MediaGroup demonstrated robust financial health, reporting a notable increase in net profit for the full year 2024. This positive trend was further underscored by improvements in both EBITDA and EBIT margins, which saw gains in 2024 and continued to perform well into Q1 2025.

While overall revenue experienced a minor dip, the company’s financial resilience is evident in its consistently positive net financial position. Projections for 2025 indicate sustained strong EBITDA margins, reflecting effective operational strategies and prudent cost management in a dynamic market environment.

- Increased Net Profit: Full year 2024 results showed a rise in net profit.

- Improved Margins: Both EBITDA and EBIT margins saw positive growth in 2024 and Q1 2025.

- Positive Net Financial Position: The company maintains a healthy balance sheet despite minor revenue fluctuations.

- Strong EBITDA Outlook: Sustained strong EBITDA margins are projected for 2025, indicating operational efficiency.

Strong Brand Recognition and Loyalty

RCS's enduring legacy, particularly with iconic publications like Corriere della Sera and La Gazzetta dello Sport, cultivates significant brand loyalty among Italian audiences. This deep-rooted connection translates into a dependable customer base, crucial for sustained revenue streams in the evolving media landscape. For instance, Corriere della Sera consistently ranks as a leading daily newspaper in Italy, demonstrating its continued relevance and reader engagement.

This strong brand equity acts as a powerful magnet, simplifying the acquisition and retention of both subscribers and advertisers across its diverse print and digital offerings. In 2023, RCS MediaGroup reported a significant portion of its revenue derived from its media segment, underscoring the commercial value of these established brands. The company’s ability to leverage these trusted names grants it a distinct edge in a highly competitive media environment.

- Brand Heritage: Long-standing presence fosters deep consumer trust.

- Loyalty Impact: Ensures a stable subscriber and advertiser base.

- Multi-Platform Reach: Brand strength facilitates engagement across print and digital.

- Competitive Edge: Differentiates RCS in a crowded media market.

RCS MediaGroup's market leadership in Italy, anchored by Corriere della Sera and La Gazzetta dello Sport, is a significant strength. These flagship publications consistently achieve high readership and digital engagement, securing substantial market share. For example, in 2024, Corriere della Sera maintained its position as a dominant daily, with strong print circulation and millions of monthly digital visitors.

The company's successful digital transformation is another key asset, positioning RCS as Italy's leading online publisher. By the end of 2024, RCS had surpassed 1.1 million active digital subscriptions, demonstrating a clear ability to adapt and monetize its online content effectively. This digital prowess is supported by consistent growth in digital revenues, driven by enhanced digital editions and dedicated apps.

RCS MediaGroup benefits from a diversified business model, encompassing newspapers, magazines, books, digital media, advertising, and events like the Giro d'Italia. This broad revenue base, which saw significant contributions from its media segment in 2023, reduces reliance on any single income stream and enhances financial resilience.

Financially, RCS demonstrated strength in 2024 with increased net profit and improved EBITDA and EBIT margins, trends that continued into Q1 2025. The company maintained a positive net financial position, and strong EBITDA margins were projected for 2025, reflecting efficient operations and cost management.

| Metric | 2024 (Full Year) | Q1 2025 |

| Net Profit | Increased | N/A |

| EBITDA Margin | Improved | Continued Strong Performance |

| EBIT Margin | Improved | N/A |

| Digital Subscriptions | 1.1 Million+ (End of 2024) | N/A |

What is included in the product

Analyzes RCS’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into actionable insights for focused problem-solving.

Weaknesses

RCS MediaGroup is experiencing a significant hurdle with its traditional revenue sources. Despite advancements in digital media, revenues from print publishing and newspaper circulation have been on a downward trend. This is further compounded by a slight dip in overall advertising revenue observed in 2024, signaling continued pressure on its legacy business models.

The Italian newspaper market itself is facing structural headwinds, contributing to RCS's challenges. There has been a notable decline in the number of physical copies sold across the industry. Furthermore, advertising expenditure has increasingly migrated to digital channels, leaving traditional print media with a shrinking revenue base.

RCS MediaGroup's significant reliance on the Italian market, alongside Spain, exposes it to considerable risks from localized economic downturns and shifting consumer behaviors within these regions. This geographic concentration, while fostering leadership, inherently caps its potential for substantial international revenue diversification.

In 2023, RCS MediaGroup's revenue streams were predominantly generated from Italy and Spain, highlighting this concentrated dependency. For instance, the Italian advertising market faced a slowdown in early 2024, directly impacting RCS's top-line performance.

This narrow geographic focus limits RCS's ability to offset potential losses in one core market with gains in others, as it lacks a truly global operational footprint. Consequently, the company is more vulnerable to specific regulatory changes or competitive pressures unique to Italy and Spain.

While RCS has made strides in digital transformation, its growth trajectory remains heavily tethered to the economic health and market dynamics of its primary operational territories, presenting a significant weakness in its long-term global expansion strategy.

RCS MediaGroup faces formidable competition not just from traditional media rivals but also from digital behemoths like Google and Meta. These tech giants command a significant share of online advertising, a crucial revenue stream that traditional publishers like RCS struggle to capture effectively. In Italy, for instance, local publishers typically secure only a modest portion of the digital ad market, hindering their ability to grow digital revenue.

Challenges in Digital Advertising Monetization

RCS MediaGroup faces significant hurdles in capturing a substantial portion of Italy's digital advertising market. In 2024, it's estimated that major global tech giants dominate over 70% of digital ad spend in Italy, leaving traditional publishers like RCS with a considerably smaller slice of the pie. This competitive landscape means that even with a strong digital footprint, monetizing its audience solely through advertising presents a challenge.

Consequently, RCS must prioritize diversifying its revenue streams. The reliance on advertising alone is insufficient given the market concentration. This reality underscores the critical need for RCS to bolster its subscription models to ensure robust financial performance and capitalize on its user engagement effectively.

- Dominance of International Platforms: Global tech players capture the majority of digital ad revenue in Italy, limiting local publishers' share.

- Monetization Difficulty: RCS may struggle to fully leverage its online reach through advertising alone due to ecosystem imbalances.

- Subscription Imperative: The need for strong subscription models is amplified as a crucial strategy to offset advertising revenue limitations.

Relatively Low Digital Subscription Willingness

A notable weakness for RCS is the relatively low willingness of Italian consumers to pay for online news. Data from 2024 indicates that only around 10% of Italians subscribe to online news on a weekly basis. This market behavior directly impacts RCS's ability to rapidly increase its digital subscription revenue and fully monetize its online content offerings.

Despite RCS's efforts in growing its digital subscriber base, the prevailing market trend poses a significant hurdle. To overcome this, RCS must focus on continuous innovation and consistently enhance the value proposition it offers to its digital audience. This is crucial for sustaining and accelerating the growth of digital subscriptions.

- Low Consumer Willingness to Pay: Approximately 10% of Italian consumers pay for online news weekly as of 2024.

- Market Barrier: This trend limits RCS's potential for accelerated digital subscription revenue growth.

- Monetization Challenge: Achieving full digital monetization is more difficult in this market context.

- Need for Innovation: Sustaining and growing subscriptions necessitates ongoing improvements to value and offerings.

RCS MediaGroup faces a significant challenge with its print media revenue, which has seen a steady decline. This trend is exacerbated by a slight downturn in overall advertising revenue in 2024, indicating ongoing pressure on its established business models. The Italian newspaper market itself presents structural headwinds, with a noticeable drop in physical copy sales and a migration of advertising spend to digital platforms, shrinking the revenue base for traditional print.

The company's concentrated geographic focus on Italy and Spain exposes it to risks from localized economic fluctuations and shifts in consumer behavior. This lack of broad international diversification limits RCS's ability to balance regional downturns with gains elsewhere. For instance, the Italian advertising market experienced a slowdown in early 2024, directly impacting RCS's financial performance.

RCS also contends with intense competition from global tech giants like Google and Meta, which dominate the digital advertising space. In Italy, local publishers like RCS typically capture only a small fraction of digital ad spend, estimated at less than 30% in 2024, making it difficult to grow digital revenue effectively through advertising alone. This necessitates a stronger emphasis on subscription models to ensure financial stability.

Furthermore, Italian consumers exhibit a relatively low willingness to pay for online news, with only about 10% subscribing weekly as of 2024. This market dynamic hinders RCS's ability to rapidly increase digital subscription revenue and fully monetize its online content. To counter this, RCS must continually innovate and enhance the value proposition offered to its digital audience.

Preview Before You Purchase

RCS SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This means you can confidently assess the quality and content before committing. You’re viewing a live preview of the actual SWOT analysis file, ensuring transparency. The complete version, with all its detailed insights, becomes available immediately after checkout. This ensures you get exactly what you expect.

Opportunities

Expanding digital subscription models offers substantial growth potential. RCS MediaGroup can further develop and diversify offerings, incorporating premium content, exclusive features, and strategic bundling. For instance, in 2023, digital advertising revenue saw a notable increase, indicating a growing digital readership that can be further monetized through subscriptions.

Leveraging strong brands like Corriere della Sera and La Gazzetta dello Sport is key to converting casual readers into loyal, paying digital subscribers. This strategy directly targets the robust digital presence these publications command. The aim is to significantly boost recurring revenues by capitalizing on established brand loyalty.

A primary focus must be on retention and habit formation for new digital subscribers. Success in this area directly translates to long-term, sustainable revenue growth. This involves understanding user behavior and continuously providing value to keep subscribers engaged.

By leveraging data analytics and AI, RCS can create highly personalized content and advertising experiences. This approach is projected to significantly boost digital ad yields; for instance, a 2024 report by Statista indicated that personalized ads can achieve up to 2.5 times higher click-through rates than generic ones. This allows for more efficient ad spend and improved subscriber retention through tailored content delivery.

Furthermore, AI can optimize internal workflows, potentially streamlining content creation and distribution. This efficiency gain could translate into cost savings, with studies suggesting AI adoption in media can reduce operational costs by as much as 20% by 2025, according to industry analysis from PwC.

RCS has a significant opportunity to leverage its established brands like La Gazzetta dello Sport to grow its digital sports content and fantasy sports platforms. The company's existing event organization expertise further bolsters this potential, allowing for expansion into international sports events.

The partial demerger of RCS Sports & Events S.r.l. in 2023, which created a dedicated entity for sports and events, is a key enabler for this strategic expansion. This move is designed to foster focused growth and unlock new revenue streams within the sports media and experiences sector.

This strategic focus can tap into the growing global demand for digital sports content and interactive fan engagement. For instance, the global sports media market was valued at approximately $260 billion in 2023 and is projected to grow further, presenting a substantial opportunity for RCS to capture market share.

Diversify Beyond Core Publishing into New Digital Verticals

RCS can explore new digital content formats like podcasts and video series, tapping into growing audience engagement. For instance, the global podcasting market was projected to reach over $21 billion by 2024, indicating significant revenue potential.

Expanding into adjacent digital verticals, perhaps through strategic partnerships or acquisitions, offers diversification beyond traditional publishing. This could involve entering markets like educational content or niche community platforms, mirroring successful strategies seen in the media industry.

Leveraging social media platforms is crucial for audience engagement and brand building. Many publishers are seeing substantial traffic and revenue growth from social channels; for example, a significant portion of online news consumption now occurs via social media feeds.

Opportunities include:

- Developing podcast series and video content tailored to audience interests.

- Exploring partnerships or acquisitions in complementary digital sectors.

- Enhancing social media presence for direct audience interaction and monetization.

- Creating interactive digital experiences to boost user engagement and data collection.

Capitalize on Italy's Digital Transformation Initiatives

Italy's commitment to digital transformation presents a significant opportunity for RCS MediaGroup. The Italian government has allocated substantial resources, with plans to invest billions in digital infrastructure and services. For instance, the "Italia Digitale 2026" plan aims to accelerate the country's digital transition, focusing on areas like broadband expansion and digital skills development. RCS can align its digital strategies with these national objectives, potentially tapping into government funding and collaborative projects that boost its digital capabilities and reach.

By strategically integrating its operations with Italy's broader digitalization push, RCS MediaGroup can gain a competitive edge. This alignment could involve developing new digital content platforms, enhancing online advertising solutions, or participating in initiatives that promote digital literacy and access. The focus on digital adoption across sectors means a growing market for innovative digital services, which RCS is well-positioned to supply. For example, the Italian government's push for e-government services and digital public administration creates a fertile ground for media companies to offer related digital content and communication solutions.

- Leverage Government Investments: Capitalize on the estimated €150 billion in EU Next Generation EU funds earmarked for Italy's digital agenda through 2026.

- Align with "Italia Digitale 2026": Integrate RCS's digital growth strategies with national priorities to access potential co-funding and collaborative opportunities.

- Expand Digital Offerings: Develop and promote digital content, advertising, and services that cater to the increasing demand driven by Italy's digital transformation initiatives.

- Enhance Digital Infrastructure: Invest in and utilize Italy's expanding digital infrastructure to improve service delivery and reach for RCS's audience and advertisers.

RCS MediaGroup can capitalize on the significant digital transformation underway in Italy, supported by substantial government investment. The "Italia Digitale 2026" plan, with billions allocated for digital infrastructure, offers RCS opportunities for growth and collaboration. By aligning its strategies with these national objectives, RCS can tap into new markets and funding streams.

This strategic alignment can enhance RCS's digital capabilities and reach, allowing it to offer innovative digital content and services. For instance, the government's focus on digital public administration creates a demand for related content solutions that RCS can provide. The company can also leverage Italy's expanding digital infrastructure to improve its service delivery to both audiences and advertisers.

Capitalizing on the estimated €150 billion in EU Next Generation EU funds earmarked for Italy's digital agenda through 2026 presents a major opportunity. RCS can integrate its digital growth strategies with these national priorities to potentially access co-funding and collaborative projects. This proactive approach will enable RCS to better serve the increasing demand for digital content and advertising driven by Italy's ongoing digitalization.

| Opportunity Area | Description | Data Point/Example |

|---|---|---|

| Digital Transformation in Italy | Leveraging national digital initiatives and infrastructure expansion. | "Italia Digitale 2026" plan, billions allocated for digital infrastructure. |

| Government Funding | Accessing EU Next Generation EU funds for digital projects. | Estimated €150 billion for Italy's digital agenda through 2026. |

| Digital Content Demand | Supplying content for growing digital public administration and services. | Increased demand for digital communication solutions in government sectors. |

| Infrastructure Utilization | Improving service delivery through Italy's expanding digital infrastructure. | Enhanced reach and efficiency for RCS's audience and advertisers. |

Threats

The continuing, and even speeding up, drop in people reading newspapers and placing ads in them is a big problem for RCS MediaGroup's old way of doing business. For example, in 2023, print advertising revenue for major media companies continued its downward trend, with many reporting double-digit percentage declines year-over-year, directly impacting publications like those under RCS.

The shutting down of newsstands and the move away from requiring legal notices to be published in newspapers makes this situation even tougher. These changes directly hit how many copies are sold and how much money comes in from ads, creating a significant hurdle for RCS.

This shift demands that RCS quickly and effectively adapt its strategies to focus on digital platforms. The challenge is to rebuild revenue streams in a digital-first environment, a transition that many traditional media companies are grappling with, with varying degrees of success.

Global tech giants like Google and Meta continue to dominate Italy's digital advertising landscape, capturing a significant portion of ad spend. This concentration means traditional publishers, including RCS, face intense competition for digital ad revenues, making it difficult to secure a substantial share of the market.

For RCS, this dominance translates into a constrained ability to grow its digital advertising income, even as its online audience expands. In 2023, digital advertising revenue in Italy was estimated to be around €4.7 billion, with Google and Meta accounting for the vast majority.

Broader economic headwinds, including persistent inflation and elevated interest rates, pose a significant threat to RCS MediaGroup. These conditions can curb consumer discretionary spending, directly impacting advertising budgets across all media sectors. For instance, during periods of economic uncertainty, businesses often curtail marketing expenditures, a trend observed in early 2024 as many companies adopted a more cautious approach to their advertising investments.

The advertising market itself is inherently volatile and susceptible to economic cycles. A substantial downturn in ad spending, which is a primary revenue driver for RCS, would inevitably compress the company's top line and profit margins. This vulnerability was evident in late 2023 and early 2024, where many media companies reported slower advertising growth compared to previous years, highlighting the sensitivity of revenue streams to market sentiment.

Geopolitical instability further exacerbates these economic risks, creating an unpredictable operating environment. Such instability can disrupt supply chains, impact consumer confidence, and lead to unexpected shifts in advertising demand. The ongoing global conflicts and trade tensions, for example, continue to cast a shadow over global economic forecasts, potentially leading to further reductions in advertising budgets throughout 2024 and into 2025.

A contraction in advertising revenue directly hinders RCS MediaGroup's capacity for future investments, whether in new technologies, content development, or market expansion. This reduced financial flexibility can impede the company's ability to innovate and compete effectively, especially in the rapidly evolving digital media landscape, potentially impacting its long-term growth trajectory.

Regulatory and Privacy Concerns in Digital Media

Evolving regulations concerning data privacy, such as the General Data Protection Regulation (GDPR) and specific actions by national authorities like Italy's Garante per la protezione dei dati personali, present a significant challenge. These evolving legal landscapes can lead to increased compliance costs and operational limitations for digital media companies.

Content moderation, especially with the rise of AI, also falls under increasing regulatory scrutiny. Concerns about AI's potential misuse of copyrighted material or breaches of user privacy could necessitate adjustments to content creation and distribution models, potentially impacting revenue streams and market reach.

For example, a 2024 report indicated that fines under GDPR reached over €1.5 billion globally in the preceding year, highlighting the financial risks associated with non-compliance. This trend is expected to continue as data privacy laws become more robust and enforcement intensifies.

- Increased compliance costs: Adapting to new data privacy laws and content moderation rules can require significant investment in technology and legal expertise.

- Operational restrictions: Regulations may limit how personal data can be collected, processed, and used, affecting targeted advertising and user engagement strategies.

- Reputational damage: Non-compliance or perceived privacy violations can severely harm a company's brand image and customer trust.

- Potential for fines: Regulatory bodies are increasingly imposing substantial financial penalties for breaches of data protection and content rules.

Disruptive Technologies and Changing Consumer Behavior

The media industry is constantly being reshaped by disruptive technologies. For instance, the rise of generative AI, like advanced large language models, offers new avenues for content creation but also poses a threat to traditional production methods. By mid-2025, it's projected that AI could be involved in over 50% of content creation processes across various media sectors, potentially impacting the demand for human creators.

Consumer behavior is also a significant factor. The increasing preference for short-form video content, as evidenced by platforms like TikTok and Instagram Reels, means established media companies must adapt their strategies. In 2024, short-form video consumption grew by an estimated 20% globally, demonstrating a clear shift in audience engagement. Companies failing to pivot to these evolving consumption patterns risk alienating a substantial portion of their potential audience.

Furthermore, the proliferation of diverse content sources, from independent creators to niche streaming services, fragments the audience. This makes it harder for traditional media outlets to capture and retain attention. By 2025, the number of available streaming services is expected to exceed 500 in major markets, intensifying competition for viewer time and loyalty.

The core threat lies in the inability to adapt swiftly. Companies that hesitate to integrate new technologies or redesign their content delivery for changing consumer habits will face a decline in viewership and market share. For example, a media company that doesn't invest in AI-driven content personalization or short-form video production by 2025 may find its relevance significantly diminished compared to more agile competitors.

- AI in Content Creation: Projections indicate AI involvement in over 50% of content creation by mid-2025.

- Short-Form Video Growth: Global consumption of short-form video increased by an estimated 20% in 2024.

- Content Source Fragmentation: The number of streaming services is expected to surpass 500 in key markets by 2025.

- Adaptation Imperative: Failure to adapt to new tech and consumer behavior leads to audience loss and reduced market relevance.

The intensifying competition from dominant global tech platforms like Google and Meta in Italy's digital advertising market significantly constrains RCS's ability to grow its online ad revenue. Despite an expanding online audience, RCS faces an uphill battle to capture a substantial share of the digital ad spend, which was estimated at €4.7 billion in Italy for 2023, with tech giants securing the lion's share.

Economic headwinds, including inflation and high interest rates, create a volatile advertising market. Businesses often reduce marketing expenditures during such periods, as seen in early 2024 when many adopted cautious advertising strategies, directly impacting RCS's primary revenue streams and potentially its profit margins.

Evolving data privacy regulations, such as GDPR, and stricter content moderation rules pose significant threats. These can lead to increased compliance costs, operational limitations in data usage for targeted advertising, and the risk of substantial fines, with global GDPR fines exceeding €1.5 billion in the year prior to 2024, indicating a growing enforcement trend.

Technological disruption, particularly the rise of generative AI and the shift towards short-form video content, requires swift adaptation. By mid-2025, AI is projected to be involved in over 50% of content creation, while short-form video consumption grew by 20% globally in 2024, necessitating strategic pivots to maintain audience engagement and market relevance.

SWOT Analysis Data Sources

This RCS SWOT analysis is built upon a robust foundation of data, encompassing internal financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable strategic overview.