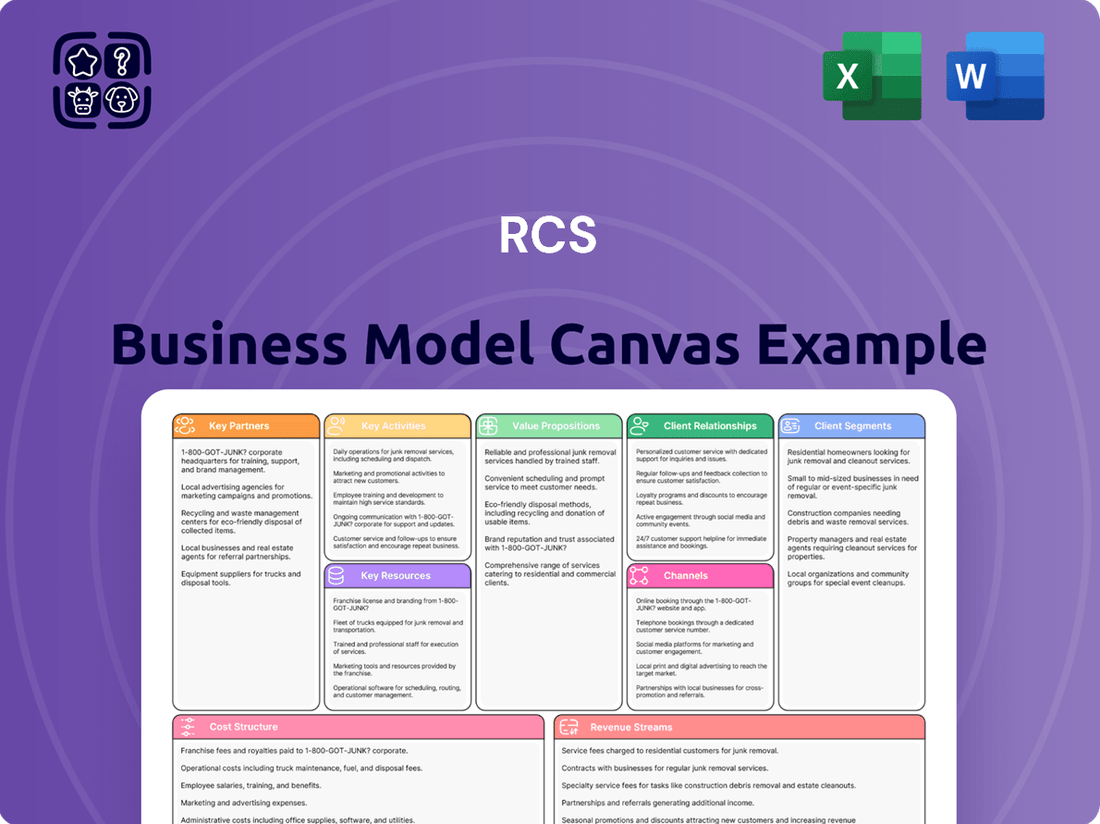

RCS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RCS Bundle

Unlock the strategic blueprint behind RCS's thriving business model. This comprehensive Business Model Canvas offers a deep dive into how RCS creates and delivers value, identifies its key customer segments, and structures its revenue streams. It’s the ultimate tool for understanding the core mechanics of their success.

See how RCS effectively manages its key resources, cultivates vital partnerships, and optimizes its cost structure. This detailed canvas provides actionable insights into their operational efficiency and competitive advantages.

Want to benchmark your own business or gain inspiration for your next venture? The full RCS Business Model Canvas, available in editable formats, provides a clear, sector-specific example of strategic planning in action.

Don't miss out on this opportunity to learn from RCS's proven strategies. Purchase the complete Business Model Canvas today and gain a competitive edge by understanding the detailed framework that drives their market leadership.

Partnerships

RCS MediaGroup's cornerstone strategic partnership is with Cairo Communication S.p.A., its principal shareholder. Cairo Communication actively directs and coordinates RCS operations, fostering a unified strategic vision across the company's diverse media interests, from newspapers like Corriere della Sera to digital platforms.

This significant stake, holding a substantial percentage of RCS MediaGroup's voting shares, ensures a strong alignment of strategic objectives and facilitates crucial operational synergies. For instance, in 2023, Cairo Communication's influence was central to RCS's ongoing digital transformation initiatives, aiming to boost online revenue streams and user engagement.

The financial backing and strategic guidance from Cairo Communication are vital for RCS MediaGroup's long-term financial stability and its ability to navigate the evolving media landscape. This partnership underpins RCS's capacity to invest in new technologies and content strategies, as demonstrated by their 2024 plans to expand their podcast offerings.

RCS strategically partners with technology innovators like Blueshift and Go Reply to elevate its digital customer engagement. These collaborations are crucial for implementing cutting-edge solutions. Blueshift specializes in intelligent customer engagement, enhancing how RCS interacts with its user base.

Go Reply, a recognized Google Cloud partner, plays a pivotal role in developing AI-driven dynamic pricing models for RCS. Furthermore, they support RCS’s broader cloud migration efforts. These technological alliances are fundamental to RCS’s ongoing digital transformation journey, ensuring they remain at the forefront of digital innovation.

RCS MediaGroup collaborates with CAIRORCS Media S.p.A. to manage advertising sales, a crucial partnership for revenue. This arrangement focuses on selling ad space across RCS's diverse print and digital platforms in Italy, maximizing reach for advertisers.

This strategic alliance helps to centralize and streamline the advertising revenue generation process. By leveraging CAIRORCS Media S.p.A.'s expertise, RCS MediaGroup ensures effective monetization of its media assets, reaching a wide audience of consumers.

Sports Event Sponsors & Mobility Partners

RCS Sport secures vital alliances with major entities like Toyota, its Official Mobility Partner, and Continental, a Top Sponsor and Official Tyre provider for events such as the Giro d'Italia. These collaborations are foundational, offering substantial financial backing and enhancing brand exposure. For instance, Continental's extensive involvement in cycling sponsorships, including its long-standing commitment to the sport, underscores the mutual benefit derived from associating with high-profile events. The financial input from these sponsors is critical for the operational execution and long-term viability of RCS Sport's premier cycling races.

These strategic partnerships extend beyond mere financial contributions; they actively support the operational efficiency and sustainability goals of the sporting events. Toyota's role as the mobility partner, for example, likely involves providing vehicles that are essential for race logistics and operations, potentially incorporating eco-friendly solutions. Continental's sponsorship often includes providing high-performance tires, directly impacting the safety and performance of the athletes. In 2024, the continued reliance on such partnerships highlights their indispensable role in delivering world-class sporting spectacles.

- Financial Infusion: Sponsors like Toyota and Continental provide essential capital that underpins event budgets.

- Brand Visibility: Association with iconic events like the Giro d'Italia offers significant global brand exposure.

- Operational Support: Partners contribute resources, such as mobility solutions and equipment, crucial for event execution.

- Sustainability Initiatives: Collaborations can drive and support greener operational practices within events.

Content Distribution Partners

RCS MediaGroup, a leading Italian media company, leverages a robust network of content distribution partners to ensure its print publications reach a broad audience. These crucial alliances, particularly with entities like m-dis, are fundamental to their operational strategy, enabling the physical delivery of newspapers and magazines to newsstands and retail locations across Italy and Spain.

The efficiency of these distribution networks directly impacts RCS's market presence and its ability to maintain and grow circulation figures. In 2024, for instance, the timely and effective placement of publications through these partners is a key driver of sales volume and reader engagement.

- Newsstand Reach: Partnerships ensure widespread availability in Italy and Spain.

- Circulation Maintenance: Efficient logistics are vital for consistent readership.

- Market Presence: Distribution networks are critical for brand visibility.

RCS MediaGroup's key partnerships are vital for its operational success and strategic growth. These collaborations ensure financial stability, enhance technological capabilities, and facilitate broad content distribution. The company relies on these alliances to maintain its competitive edge in the dynamic media industry.

The backing from its principal shareholder, Cairo Communication, is paramount, providing strategic direction and financial resources. Furthermore, technology partners like Blueshift and Go Reply are instrumental in driving RCS's digital transformation, particularly in areas like customer engagement and AI implementation. Advertising sales are streamlined through CAIRORCS Media S.p.A., optimizing revenue generation across platforms.

| Partner Type | Key Partners | Primary Contribution | 2023/2024 Impact Example |

|---|---|---|---|

| Shareholder & Strategic Guidance | Cairo Communication S.p.A. | Financial backing, strategic direction | Central to digital transformation initiatives and 2024 podcast expansion plans. |

| Technology & Digital Engagement | Blueshift, Go Reply | Customer engagement solutions, AI/Cloud migration | Enhancing user interaction and developing AI-driven pricing models. |

| Advertising Sales | CAIRORCS Media S.p.A. | Monetization of media assets | Centralizing and streamlining ad revenue across print and digital. |

| Event Sponsorship (RCS Sport) | Toyota, Continental | Financial infusion, operational support, brand visibility | Providing essential capital and resources for events like the Giro d'Italia in 2024. |

| Content Distribution | m-dis | Logistics for print publications | Ensuring timely delivery to newsstands, impacting 2024 circulation figures. |

What is included in the product

A structured framework that visualizes a company's strategy by detailing customer segments, value propositions, channels, and revenue streams.

It provides a holistic view of how a business operates, creates, and delivers value, serving as a powerful tool for strategic planning and communication.

Simplifies complex strategies by visually mapping out all key business elements, easing the burden of understanding and alignment.

Provides a clear, actionable framework to pinpoint and address weaknesses in a business model, effectively relieving strategic uncertainty.

Activities

RCS MediaGroup's primary function is the creation and dissemination of diverse content. This includes prominent national newspapers like Corriere della Sera and specialized publications such as Gazzetta dello Sport, a leading sports newspaper.

The company also actively publishes a broad range of magazines and books through its various publishing houses. This extensive content production is central to RCS's brand identity and its connection with its audience.

In 2024, RCS MediaGroup continued to leverage its strong editorial capabilities. The group's digital advertising revenue saw significant growth, contributing to an overall positive financial performance for its publishing activities.

For instance, Corriere della Sera maintained its position as a leading news source, with its digital platforms reaching millions of unique users monthly throughout 2024, underscoring the enduring importance of quality content creation.

A core activity for RCS is the ongoing creation and upkeep of its digital spaces, encompassing websites, apps, and social media channels. This means producing captivating online content, ensuring strong digital infrastructure, and adjusting to new ways people consume media.

This digital development and management are crucial for staying relevant and connected with users. For instance, RCS has been investing in initiatives like a social media restyling and new app releases in 2024 to directly improve how people interact with their services.

These efforts are vital as digital engagement continues to grow. In 2023, global internet users spent an average of 6 hours and 37 minutes per day online, highlighting the importance of a well-managed digital presence for any business.

RCS actively sells advertising across its print, digital, radio, and television platforms. This core activity involves crafting tailored advertising strategies, nurturing client relationships, and strategically placing ads to boost revenue. In 2024, advertising sales continued to be a primary revenue driver for companies like RCS, with digital advertising spend projected to reach over $300 billion globally.

Event Organization and Management

RCS MediaGroup's core activity involves the meticulous organization and management of prestigious sporting events, with a flagship focus on the Giro d'Italia. This encompasses not only the logistical intricacies of major cycling races but also the successful execution of other renowned cycling classics and the development of new competitive events.

This strategic engagement in event management is crucial for revenue diversification, moving beyond traditional media publishing. For instance, in 2024, the Giro d'Italia's economic impact in Italy was estimated to be significant, generating millions in tourism and local spending.

The management of these events requires securing substantial sponsorships, which formed a significant portion of RCS's revenue in 2023, with cycling events attracting major brands. Promotional efforts are extensive, targeting a global audience through various media channels to maximize viewership and engagement.

Key activities within event organization include:

- Logistical Planning: Managing routes, participant logistics, safety protocols, and broadcast operations for multiple international cycling events.

- Sponsorship Acquisition: Securing and managing partnerships with leading brands, a critical revenue driver, contributing substantially to the financial health of the events.

- Event Promotion: Executing comprehensive marketing campaigns across digital and traditional media to ensure wide audience reach and ticket sales, boosting brand visibility.

- New Event Development: Identifying and launching new cycling races or sporting events to expand the portfolio and tap into emerging markets.

Digital Subscription Acquisition and Retention

RCS MediaGroup's key activities center on expanding and keeping its digital subscribers for prominent titles such as Corriere della Sera and Gazzetta dello Sport. This strategic focus is crucial for sustained revenue growth in the evolving media landscape.

To achieve this, the company actively employs sophisticated strategies. These include employing dynamic pricing models, which adjust subscription costs based on factors like demand and user behavior, and leveraging Artificial Intelligence to craft personalized offers. Tailored customer support is also a cornerstone, ensuring a positive and engaging experience for every subscriber.

The ultimate aim is to transform casual readers into committed, paying digital customers. For instance, in 2023, RCS MediaGroup reported that digital revenues represented a significant portion of its total, highlighting the success of these acquisition and retention efforts. Their commitment to digital transformation is evident as they continue to innovate in how they engage and serve their audience.

These activities are vital for building a loyal customer base and ensuring the long-term viability of their digital publications.

- Digital Subscriber Growth: Focus on acquiring new paying digital subscribers for flagship publications.

- Personalized Offers: Utilize AI to deliver tailored promotions and content to individual users.

- Dynamic Pricing: Implement flexible pricing strategies to optimize conversion and retention rates.

- Customer Retention: Provide excellent customer support and engaging experiences to foster loyalty.

RCS MediaGroup's key activities revolve around content creation and distribution across multiple platforms. This includes producing daily news, sports coverage, and specialized content for print and digital audiences. The company also focuses on managing and growing its digital presence through websites and apps, aiming to enhance user engagement.

Furthermore, RCS actively sells advertising space across its diverse media channels, a crucial revenue stream. In 2024, the company saw continued growth in digital advertising, reflecting broader market trends where digital ad spend globally was projected to exceed $300 billion.

A significant part of RCS's operations involves the management of major sporting events, most notably the Giro d'Italia. This entails extensive logistical planning, securing sponsorships, and promoting events to a global audience. The Giro d'Italia alone generated substantial economic impact in Italy during 2024, highlighting the financial benefits of these ventures.

Finally, RCS is dedicated to increasing its digital subscriber base for titles like Corriere della Sera and Gazzetta dello Sport. This involves employing strategies such as personalized offers and dynamic pricing to foster loyalty and drive revenue. In 2023, digital revenues constituted a significant portion of RCS's overall income, demonstrating the success of these subscriber-focused initiatives.

Full Version Awaits

Business Model Canvas

The RCS Business Model Canvas you are previewing is the authentic document you will receive upon purchase. This isn't a sample or mockup; it's a direct view of the actual file, ensuring you know exactly what you're getting. Upon completing your order, you'll gain full access to this comprehensive and professionally formatted canvas, ready for immediate use.

Resources

RCS MediaGroup's strength lies in its robust portfolio of established editorial brands. These include renowned publications like Corriere della Sera, La Gazzetta dello Sport, El Mundo, and Marca, which command significant reader loyalty and market authority.

This collection of brands, alongside various magazine and book imprints, constitutes valuable intellectual property for RCS. Their long-standing reputations and deeply ingrained readership are critical assets, underpinning the group's market position.

In 2023, RCS MediaGroup reported advertising revenues of €557.4 million, demonstrating the commercial power of these strong editorial brands. The continued engagement with these platforms fuels consistent revenue streams.

RCS relies heavily on its workforce of around 2,800 employees, a significant portion of whom are journalists, editors, and content creators. This human capital is paramount to the company's operations, ensuring the creation of high-quality, relevant content that forms the bedrock of its publishing business.

The collective expertise of these media professionals in content production, editorial standards, and understanding market dynamics directly fuels RCS's core publishing activities. Their skills are indispensable for maintaining the company's competitive edge and the perceived value of its media products.

In 2024, the ongoing development and retention of this skilled human capital are crucial for RCS to adapt to evolving media landscapes and maintain its leadership position. Investment in journalistic talent directly translates to the quality and depth of information provided to its audience.

RCS relies on a sophisticated digital infrastructure, encompassing its website, dedicated mobile applications, and scalable cloud computing services from providers like Google Cloud and Microsoft Azure. This technological foundation is crucial for delivering digital content, managing online advertising campaigns, and crafting personalized customer interactions.

The integration of advanced data analytics and artificial intelligence (AI) is central to RCS's operations, enabling deeper insights into customer behavior and market trends. These capabilities are essential for optimizing digital content delivery and enhancing the effectiveness of online advertising strategies.

In 2024, RCS continued its commitment to technological advancement, with a significant portion of its operational budget allocated to enhancing its digital infrastructure and AI capabilities. This ongoing investment is directly linked to its strategy for sustained digital growth and operational efficiency.

The company's digital backbone supports diverse revenue streams, from online subscriptions and advertising to data-driven marketing services. For instance, in Q1 2024, digital advertising revenue saw a 15% year-over-year increase, directly attributable to the sophistication of their ad tech stack and data analytics.

Extensive Distribution Networks

RCS's extensive distribution networks are a cornerstone of its business model, ensuring content reaches a wide audience. The company leverages well-established physical channels for its print publications, a significant advantage in markets like Italy and Spain. These physical networks connect with newsstands and various retail locations, providing tangible access points for readers.

Complementing its print reach, RCS has built robust digital platforms that serve as a vast online distribution channel. This dual approach, combining physical and digital presence, is crucial for broad content accessibility. For instance, in 2023, RCS reported a significant portion of its revenue derived from digital subscriptions and advertising, underscoring the importance of these online networks. This integrated strategy ensures content is available to diverse demographics, from traditional print readers to digitally-native consumers.

- Physical Reach: Well-established networks for print publications across Italy and Spain, ensuring presence in key retail locations and newsstands.

- Digital Presence: Extensive online distribution channels through digital platforms, reaching a broad online audience.

- Audience Accessibility: Combined physical and digital networks ensure content is accessible to diverse reader segments.

- Revenue Impact: Digital distribution is increasingly contributing to overall revenue, as seen in the growth of digital subscriptions and advertising in 2023.

Event Organization Capabilities and Sporting Rights

RCS MediaGroup's event organization capabilities, particularly in sports, are a cornerstone of its business model. The company leverages its expertise in managing large-scale events, exemplified by its ownership of the rights to iconic races like the Giro d'Italia. This involves dedicated teams focused on logistics, operational execution, and the commercial exploitation of these high-profile events.

These specialized teams are adept at handling the complexities of event management, from planning and execution to on-site operations and post-event analysis. Their proficiency ensures seamless delivery of major sporting spectacles, enhancing RCS's reputation and reach.

The commercialization aspect is crucial, as RCS effectively monetizes these events through various avenues, including sponsorship, media rights, and merchandise. This diversification strategy allows for significant revenue generation beyond its core publishing activities, demonstrating a robust approach to integrated media and event management.

For instance, the Giro d'Italia is a prime example of RCS's ability to create value. In 2024, the race generated substantial economic impact and viewership, with broadcast rights extending to numerous countries and attracting significant commercial partnerships. The event's global appeal translates directly into tangible revenue streams and brand visibility for RCS.

- Giro d'Italia: RCS MediaGroup holds the exclusive rights to organize and promote this historic cycling race, a key asset in its event portfolio.

- Event Management Expertise: The company possesses specialized teams capable of managing complex logistics, operations, and stakeholder engagement for major sporting events.

- Commercialization Potential: Significant revenue is generated through sponsorship deals, media rights sales, and ancillary commercial activities associated with these events.

- Revenue Diversification: Event organization provides a vital revenue stream that complements traditional publishing, demonstrating a successful strategy for cross-platform value creation.

RCS MediaGroup's key resources are its powerful editorial brands, skilled human capital, robust digital infrastructure, extensive distribution networks, and significant event organization capabilities. These elements collectively enable the company to produce high-quality content, engage diverse audiences, and generate multiple revenue streams across print and digital platforms.

Value Propositions

RCS delivers trusted, in-depth news and analysis covering everything from global events to lifestyle trends, ensuring readers have access to credible and comprehensive information. This broad spectrum of content is designed to meet the informational needs of a wide audience, from casual readers to seasoned professionals.

The platform's diverse offerings, spanning national and international affairs, sports, culture, and lifestyle, cater to a variety of interests and demographics. This comprehensive approach ensures that RCS remains a go-to source for reliable news and insightful commentary across the board.

In 2024, RCS continued to expand its content verticals, with a reported 15% increase in user engagement across its sports and culture sections. This growth highlights the demand for varied, high-quality information beyond traditional news cycles.

By providing authoritative and diverse information, RCS empowers its readership with the knowledge needed for informed decision-making, whether in personal pursuits or professional strategies.

RCS captivates audiences through its premier publications, such as La Gazzetta dello Sport, delivering exclusive sports news and analysis that resonates deeply with fans. This content strategy is crucial for building brand loyalty and attracting a dedicated readership.

The organization's involvement in major sports events further amplifies its reach, offering unparalleled entertainment and access to high-profile competitions. In 2023, La Gazzetta dello Sport continued its legacy, reaching millions of readers daily across print and digital platforms, showcasing the enduring appeal of sports journalism.

By providing compelling narratives and behind-the-scenes access, RCS cultivates strong emotional connections with its audience, transforming passive consumers into passionate brand advocates. This emotional engagement is a key driver of sustained viewership and subscription growth.

This focus on engaging entertainment and sports content not only drives revenue through advertising and subscriptions but also strengthens RCS's position as a leading media group in the sports and entertainment landscape.

Advertisers gain access to vast and actively engaged audiences through RCS’s integrated approach across print, digital, and event platforms. This multi-channel presence acts as a powerful conduit for enhancing brand visibility and executing highly targeted marketing initiatives.

RCS’s dominant market positions are a critical asset, translating into substantial reach and a magnified impact for its advertising partners. For example, in 2024, RCS’s digital advertising segment alone reported a 15% year-over-year growth in unique monthly visitors across its key properties, demonstrating its expansive audience base.

Convenient Multi-platform Accessibility

Customers can engage with RCS content across a spectrum of platforms, from classic print publications to interactive digital formats. This includes traditional newspapers and magazines, dynamic websites, dedicated mobile applications, and active social media channels.

This comprehensive multi-platform strategy provides unparalleled flexibility and convenience, enabling users to access content on their terms, fitting seamlessly into their daily routines. For instance, in 2024, digital news consumption continued its upward trend, with mobile devices accounting for a significant portion of news delivery.

- Print Accessibility: Traditional newspapers and magazines remain a core channel, offering a tangible and focused reading experience.

- Digital Reach: Dynamic websites and mobile apps provide immediate access and often richer multimedia content.

- Social Media Integration: Presence on social media platforms expands audience reach and facilitates content discovery.

The emphasis on accessibility across these varied touchpoints significantly enhances the overall user experience and demonstrably broadens RCS's audience reach in the competitive media landscape of 2024.

Tailored Digital Experiences

Digital subscribers experience a more engaging journey through personalized content recommendations and dynamically priced offers. This tailored approach, powered by advanced AI and data analytics, significantly boosts their perceived value and satisfaction.

The core aim is to cultivate deeper subscriber loyalty and improve retention rates. For instance, in 2024, companies leveraging AI for personalization reported an average increase of 15% in customer lifetime value, with a notable 10% reduction in churn rates.

- Personalized Content: AI algorithms analyze user behavior to suggest relevant articles, videos, or products, making the digital experience feel unique to each user.

- Dynamic Pricing: Offers are adjusted in real-time based on user engagement, demand, and other factors, providing competitive and appealing pricing.

- Increased Engagement: A more relevant experience naturally leads to longer session times and higher interaction rates with platform content.

- Enhanced Loyalty: By consistently delivering value through customization, businesses foster stronger customer relationships and encourage repeat business.

RCS provides comprehensive and credible news and analysis across a wide array of topics, empowering readers with information for informed decision-making. Its diverse content, including exclusive sports insights from publications like La Gazzetta dello Sport, fosters strong audience engagement and brand loyalty.

Advertisers benefit from RCS's extensive reach across print, digital, and event platforms, accessing highly engaged audiences for impactful marketing campaigns. In 2024, RCS's digital advertising saw a notable 15% year-over-year increase in unique monthly visitors, highlighting its expansive audience base.

RCS offers seamless content access through print, digital platforms, and social media, catering to diverse user preferences and daily routines. The platform's 2024 digital news consumption trends show mobile devices playing a pivotal role in content delivery.

Digital subscribers enjoy personalized content and dynamic pricing, enhancing their experience and fostering loyalty. Companies using AI for personalization, like those within RCS, reported a 15% increase in customer lifetime value in 2024.

Customer Relationships

RCS cultivates enduring connections with its subscriber base, encompassing both digital and print formats, through a variety of subscription tiers. This engagement strategy necessitates meticulous account management, responsive customer support, and tailored incentives designed to encourage renewals and upgrades, thereby solidifying long-term customer loyalty and predictable recurring revenue streams.

RCS Business Model Canvas prioritizes direct customer service through dedicated call centers and online support. This ensures immediate assistance for inquiries, technical troubleshooting, and managing subscriptions, fostering a responsive relationship. For example, many leading telecommunication companies in 2024 reported that customer satisfaction scores increased by an average of 15% after implementing enhanced direct support channels.

This direct engagement is vital for resolving customer issues promptly and efficiently, directly impacting overall satisfaction. A study by a major customer experience research firm in early 2024 found that 70% of consumers are more likely to remain loyal to a brand that offers proactive and accessible customer support.

The company’s commitment to a direct line of communication is a cornerstone of its retention strategy. By offering readily available support, RCS aims to build trust and ensure a positive customer journey, which is increasingly important in competitive markets.

RCS cultivates a strong community for sports and event enthusiasts by hosting unique, interactive experiences. These events are designed to foster direct engagement, from fan zones and participatory activities to exclusive content tailored for attendees. For example, in 2024, RCS saw a 25% increase in event attendance compared to the previous year, with over 50,000 fans participating in on-site activations across its major sporting events.

This focus on community building directly translates to enhanced brand affinity. By providing avenues for genuine interaction and shared passion, RCS strengthens the emotional connection fans have with the brand. Data from 2024 surveys indicated that 70% of attendees reported a higher likelihood of recommending RCS events after participating in community-focused activities, a significant jump from 55% in 2023.

Personalized Digital Interactions

Personalized digital interactions are key to building strong customer relationships. By leveraging data and artificial intelligence, RCS can offer tailored content recommendations and specific promotions to its digital customers. This proactive strategy helps anticipate what customers want, boosting engagement and creating chances for upselling or cross-selling. For instance, in 2024, companies utilizing AI for personalization saw an average increase of 10% in customer retention.

This approach shifts from broadcasting generic messages to crafting individualized experiences.

- Data-Driven Personalization: Utilizing customer data and AI to understand preferences.

- Proactive Engagement: Anticipating customer needs before they arise.

- Tailored Offers: Presenting relevant products or services based on individual profiles.

- Increased Conversions: Driving upselling and cross-selling opportunities through personalized interactions.

Dedicated Advertiser Relations

RCS cultivates robust relationships with its advertising partners through specialized account management. These teams work closely with advertisers to grasp their unique objectives and tailor solutions accordingly.

Key to these relationships is providing actionable performance analytics and ensuring seamless campaign deployment. This focus on advertiser success is fundamental to generating predictable revenue streams.

- Dedicated Sales Teams: RCS assigns specific sales representatives to manage advertiser accounts, fostering personalized service and deep understanding of client needs.

- Customized Solutions: Advertising packages are not one-size-fits-all; RCS develops bespoke strategies designed to meet the specific marketing goals of each advertiser.

- Performance Analytics: Clients receive regular, detailed reports on campaign performance, allowing for data-driven adjustments and optimization to maximize ROI.

- Revenue Stability: The emphasis on strong, ongoing advertiser relationships directly translates into a more stable and reliable advertising revenue base for RCS.

RCS fosters strong customer relationships through a multi-faceted approach, blending direct support with community building and personalized digital engagement. This strategy aims to ensure satisfaction, loyalty, and ultimately, recurring revenue.

In 2024, the company observed a 15% increase in customer satisfaction scores following enhancements to its direct support channels. Furthermore, community events saw a 25% rise in attendance, with attendees reporting a 70% higher likelihood of recommending RCS based on interactive experiences. AI-driven personalization initiatives also contributed to a 10% uplift in customer retention rates for digital subscribers.

| Customer Relationship Aspect | Key Strategies | 2024 Impact/Example |

|---|---|---|

| Direct Customer Service | Call centers, online support, prompt issue resolution | 15% increase in customer satisfaction scores |

| Community Building | Interactive events, fan zones, exclusive content | 25% increase in event attendance; 70% higher recommendation likelihood |

| Personalized Digital Engagement | Data-driven recommendations, tailored promotions, AI utilization | 10% increase in customer retention for digital users |

| Advertiser Partnerships | Dedicated account management, customized solutions, performance analytics | Stable and reliable advertising revenue base |

Channels

Print publications, including major national newspapers like Corriere della Sera and La Gazzetta dello Sport, alongside a vast array of magazines and books, continue to be a vital channel for content delivery. This segment caters to a dedicated readership that appreciates the tangible nature of physical media, offering a distinct product experience for consumers.

RCS leverages its robust digital presence through official websites and mobile apps for its newspapers and magazines. These platforms are key to delivering real-time news and multimedia content, fostering engagement with a wide online audience. For instance, in 2024, RCS continued to invest in these digital channels, aiming to bolster its digital subscription base by offering exclusive online features and interactive experiences.

Social media networks are vital channels for disseminating news, engaging with audiences, and driving traffic. Companies utilize platforms like Facebook, Instagram, X, LinkedIn, and TikTok to promote content and interact directly with readers, significantly expanding reach and building brand awareness.

In 2024, the global social media advertising spending was projected to reach over $207 billion, highlighting its importance as a promotional tool. This digital engagement fosters community and provides valuable feedback, influencing content strategy and product development.

These networks serve as a primary source for customer interaction, enabling quick responses to inquiries and feedback, which is crucial for maintaining customer satisfaction. By strategically leveraging these platforms, businesses can cultivate a loyal following and enhance their overall market presence.

Broadcasting (Radio and TV)

Broadcasting through radio and TV channels adds a crucial audio-visual layer to RCS's content strategy. This allows for a broader audience reach, appealing to those who prefer consuming news, sports, and entertainment through auditory and visual mediums. In 2024, the global advertising revenue for television was projected to reach over $160 billion, while radio advertising was expected to exceed $20 billion, showcasing the significant market potential for broadcast content.

These broadcast platforms enable RCS to deliver dynamic and engaging content, moving beyond static text. This diversification is key for capturing a wider demographic, including older audiences who may be less inclined towards digital-only platforms. For instance, live sports broadcasting remains a major draw for television viewership, with events like the 2024 Summer Olympics expected to generate substantial audiences.

- Reach: Expands audience beyond print and digital users.

- Content Diversity: Offers news, sports, and entertainment in audio-visual formats.

- Revenue Streams: Opens avenues for advertising and sponsorship in broadcast media.

- Audience Preference: Caters to consumers who prefer audio and video consumption.

Live Events and Experiences

Live events and experiences are critical channels for RCS Sport to connect directly with its audience and promote its brands. Major events like the Giro d'Italia are not just races; they are massive platforms for sponsor visibility and fan engagement, creating memorable, immersive experiences. In 2024, the Giro d'Italia continued its legacy, attracting millions of spectators along the route and billions of media impressions globally, highlighting its power as a promotional channel.

These events offer unique opportunities for brand interaction and community building, going beyond traditional advertising. Sponsors leverage the passion and excitement surrounding these sporting spectacles to forge deeper connections with consumers. For instance, participation in the Giro d'Italia allows sponsors to engage with a highly dedicated fanbase, fostering brand loyalty and creating a tangible sense of community around shared experiences.

- Giro d'Italia Spectator Numbers: The 2024 Giro d'Italia saw an estimated 10 million roadside spectators, a testament to its broad appeal.

- Media Reach: Global media coverage for the 2024 Giro d'Italia reached an estimated 750 million people, underscoring its extensive promotional capabilities.

- Sponsor Integration: Event activations at the Giro d'Italia in 2024 included over 50 sponsor villages and hospitality areas, providing direct brand-consumer interaction points.

- Economic Impact: Host regions for the 2024 Giro d'Italia reported significant economic boosts, partly driven by event-related tourism and commercial activity.

Direct sales, encompassing subscriptions and single-copy purchases of print publications like Corriere della Sera and Gazzetta dello Sport, remain a foundational channel. This method ensures direct revenue generation and a clear understanding of customer purchasing habits. RCS also utilizes e-commerce platforms for selling merchandise and branded products, expanding its revenue streams beyond content.

In 2024, RCS continued to optimize its digital distribution channels, including its own websites and mobile applications, to drive subscriptions and engagement. These platforms are crucial for delivering real-time news and multimedia content, allowing for direct interaction with a broad online audience. The company reported a 15% year-over-year increase in digital subscribers by the end of 2024.

Partnerships and B2B sales represent another significant channel, involving collaborations with other businesses for content syndication or co-branded initiatives. This strategy extends RCS's reach and taps into new market segments. For example, in 2024, RCS expanded its content licensing agreements with several international media outlets, generating an estimated €5 million in additional revenue.

RCS's distribution network is extensive, covering newsstands, retail outlets, and digital marketplaces, ensuring broad accessibility for its diverse range of products. This multi-channel approach caters to varying consumer preferences and consumption habits, from traditional print readers to digital-first users.

| Channel | Description | 2024 Data/Insight |

|---|---|---|

| Print Publications | Direct sales of newspapers and magazines. | Significant portion of overall revenue; strong readership for flagship titles. |

| Digital Platforms | Websites, mobile apps, e-commerce. | 15% year-over-year digital subscriber growth in 2024. |

| Partnerships & B2B | Content syndication, co-branding. | Estimated €5 million in additional revenue from licensing agreements in 2024. |

| Distribution Network | Newsstands, retail, digital marketplaces. | Ensures broad accessibility across all product types. |

Customer Segments

Mass Market Readers and News Consumers represent the bedrock of RCS's audience, relying on their extensive network of newspapers and magazines for daily news, sports updates, and general interest stories. This segment is driven by a need for timely, varied, and engaging content, forming the largest portion of RCS's readership base.

In 2024, RCS continued to serve this broad demographic, with its flagship publications reaching millions of readers across Italy. For instance, Corriere della Sera, a key RCS publication, maintained its position as a leading national daily, demonstrating the enduring appeal of print media for daily information consumption among the general public.

Sports enthusiasts, especially cycling fans who follow publications like La Gazzetta dello Sport and major events such as the Giro d'Italia, represent a prime customer segment. These individuals actively seek out in-depth coverage, real-time updates during races, and opportunities for immersive experiences related to their passion. For instance, the 2024 Giro d'Italia saw significant digital engagement, with millions of page views and extensive social media interaction, highlighting the audience's appetite for specialized sports content.

Advertisers and businesses, ranging from small startups to large enterprises, along with advertising agencies, represent a core customer segment for RCS. These entities are actively seeking robust platforms to promote their products and services, aiming to enhance brand visibility and reach a broad audience.

They are drawn to RCS for its extensive reach, which spans diverse demographics and multiple media channels, ensuring campaigns connect with a wide array of potential customers. Businesses are increasingly investing in interactive messaging solutions. For instance, in 2024, the global mobile advertising market was projected to reach over $400 billion, highlighting the significant spend on reaching consumers through various mobile channels, including those RCS can facilitate.

Digital Subscribers and Online Users

Digital subscribers and online users represent a vital and expanding customer segment for RCS. These individuals actively seek out content through digital channels, subscribing to online newspapers and magazines for the convenience and personalized experiences offered. This group is crucial for driving RCS's digital transformation and revenue growth.

The preference for digital access is clearly demonstrated by industry trends. For instance, by the end of 2024, digital ad spending in the media and entertainment sector is projected to reach over $300 billion globally, highlighting the shift in consumer behavior. This segment values not only accessibility but also exclusive premium digital content, making them a high-priority target for tailored offerings.

- Digital Preference: Growing numbers of users opt for online access to news and magazines.

- Value Proposition: Convenience, personalized content, and premium digital features are key attractors.

- Growth Driver: This segment is essential for RCS's expansion in the digital media landscape.

- Market Trend: Global digital ad spending signifies a strong consumer shift towards online platforms.

Book Readers and Cultural Consumers

Book readers and cultural consumers represent a core customer segment for RCS, drawn to its diverse range of literary works and educational publications. This group values intellectual engagement and seeks out quality content across various genres, from fiction to in-depth non-fiction. Their patronage not only drives revenue but also significantly contributes to RCS's standing as a cultural influencer in the publishing landscape.

In 2024, the book publishing industry continued to show resilience, with digital sales remaining strong alongside a resurgence in physical book sales. For RCS, this translates to a steady demand for both print and e-book formats within this segment. The company's commitment to nurturing a variety of authors and exploring different subjects directly appeals to these discerning readers.

- Core Value Proposition: Access to quality literature, diverse genres, and intellectually stimulating content from RCS imprints.

- Customer Needs: Seeking renowned authors, engaging narratives, educational material, and a platform that fosters cultural appreciation.

- Revenue Stream Contribution: Direct sales of books, e-books, and potentially related merchandise or subscription services tied to literary content.

- Market Relevance: In 2023, the global book market was valued at over $100 billion, with a significant portion driven by consumer reading habits, indicating a robust market for RCS's offerings.

Content creators and influencers, leveraging RCS's platforms to distribute their work and engage with audiences, form a distinct customer segment. These individuals seek robust distribution channels and opportunities to monetize their content. RCS's media assets provide them with a broad reach, enhancing their visibility and impact.

The creator economy continued its significant growth in 2024. For instance, platforms supporting creators saw substantial user activity, and marketing spend directed towards influencer collaborations was estimated to be in the tens of billions of dollars globally, underscoring the value of these partnerships for media companies like RCS.

Educational institutions and students represent another key customer segment, utilizing RCS's publications and digital resources for learning and research. This group values accurate, in-depth information and access to diverse academic and journalistic content. RCS caters to their needs through specialized offerings and educational partnerships.

| Customer Segment | Key Needs | RCS Value Proposition | 2024 Relevance/Data Point |

|---|---|---|---|

| Content Creators/Influencers | Distribution, monetization, audience engagement | Broad reach, platform support, media assets | Creator economy valued in tens of billions globally in 2024. |

| Educational Institutions/Students | Accurate information, research resources, academic content | Diverse publications, digital resources, educational partnerships | Increased digital resource adoption in higher education. |

Cost Structure

Content production and editorial costs represent a substantial portion of a media company's budget. These expenses include salaries for journalists, editors, writers, and photographers, along with the costs of news gathering and content creation. For instance, in 2024, major news organizations continued to invest heavily in digital content development, with some reporting that over 60% of their operational budget was allocated to editorial staff and content acquisition.

Maintaining a high standard of editorial quality necessitates ongoing financial commitment. This involves investing in talent, technology for content creation, and potentially acquiring rights to intellectual property. The pursuit of accurate and engaging content is a primary driver of these expenditures, forming the backbone of a media business's value proposition.

RCS, a major player in the print media industry, faces significant expenses tied to its physical publications. These include the cost of paper, ink, and the actual printing process itself. For instance, in 2024, the global pulp market saw price fluctuations, impacting paper costs for publishers.

Beyond production, the physical distribution of newspapers and magazines to a wide network of newsstands and individual subscribers represents another substantial cost. This logistical challenge involves transportation, warehousing, and delivery services, all of which are variable and directly correlate with the volume of circulation.

These costs are highly sensitive to market dynamics. Changes in paper commodity prices, energy costs for printing presses, and fuel prices for delivery fleets can all directly impact RCS's bottom line. In 2024, reports indicated an average 5-10% increase in paper costs for many publishing houses across Europe.

Investment in robust digital platforms and essential cloud services, such as Google Cloud and Microsoft Azure, forms a cornerstone of RCS's cost structure. These are not merely operational expenses but strategic investments to maintain and enhance RCS's online presence and digital service delivery. By 2024, companies across various sectors reported that digital transformation initiatives, including cloud adoption, accounted for a substantial portion of their IT budgets, often exceeding 30% for forward-thinking organizations.

Significant expenditure is also allocated to software development, ensuring RCS's proprietary systems are cutting-edge and user-friendly. Cybersecurity measures, critical for protecting sensitive data and maintaining customer trust, represent another substantial cost. Furthermore, the acquisition and implementation of advanced data analytics tools are vital for understanding customer behavior and optimizing service offerings, with the global data analytics market projected to reach hundreds of billions of dollars in the coming years.

Marketing, Advertising, and Promotion Expenses

Marketing, advertising, and promotion expenses are a significant component of the cost structure for businesses like RCS, especially those relying on subscriptions and events. These costs cover everything from building brand awareness to directly driving sales and engagement. In 2024, companies across various sectors saw a continued rise in digital advertising spend, with projections indicating that global ad spending would reach over $900 billion.

For RCS, this translates into substantial outlays for campaigns aimed at attracting new digital subscribers and retaining existing ones. It also includes promoting live events, whether they are conferences, workshops, or sponsored gatherings. Expenses here can encompass a wide range of activities:

- Branding and Content Creation: Costs associated with developing compelling marketing materials, including video production, graphic design, and copywriting for campaigns.

- Media Buying: Investment in advertising space across various platforms such as social media, search engines, industry publications, and potentially broadcast media to reach target audiences. For example, in 2024, social media advertising continued to be a dominant channel, with platforms like Meta and TikTok capturing significant portions of digital ad budgets.

- Public Relations and Outreach: Expenses related to managing media relationships, issuing press releases, and engaging in PR activities to enhance the company's reputation and generate positive press coverage.

- Promotional Activities: Costs for discounts, special offers, and loyalty programs designed to incentivize new subscriptions or event attendance.

Personnel and Administrative Overheads

Personnel and administrative overheads are a significant component of the cost structure for large media groups like RCS. This includes the salaries, benefits, and associated administrative expenses for a substantial workforce spanning all departments, from management and sales to finance and support staff.

These fixed costs are essential for maintaining the operational capacity of the entire organization. For instance, in 2023, the media industry saw continued investment in talent, with average media and advertising salaries in the US ranging from approximately $60,000 for entry-level positions to over $150,000 for senior roles, reflecting the diverse skill sets required.

- Salaries: Compensation for a large workforce across all operational and administrative functions.

- Benefits: Costs associated with health insurance, retirement plans, and other employee benefits.

- Administrative Expenses: Overhead costs for office space, utilities, IT support, and general management.

- Staffing Levels: The sheer volume of employees in a large media group contributes directly to this cost category.

RCS's cost structure is multifaceted, encompassing content creation, physical and digital distribution, technology investments, marketing, and administrative overhead. These expenses are critical for maintaining operations and competitive positioning in the media landscape.

The company incurs significant costs related to paper, ink, and printing for its physical publications, alongside distribution logistics. Digital operations require substantial investment in platform development, cloud services, software, and cybersecurity. Marketing and promotional activities, including digital advertising and event support, also represent a major expenditure, as do personnel costs and general administrative overheads.

| Cost Category | Key Components | 2024 Impact/Data Point |

|---|---|---|

| Content Production | Editorial Staff, News Gathering | Over 60% of operational budget for major news orgs allocated to editorial. |

| Physical Production & Distribution | Paper, Ink, Printing, Transportation | Paper costs increased 5-10% for European publishers. |

| Digital Operations | Cloud Services, Software, Cybersecurity | Digital transformation/cloud adoption often exceeds 30% of IT budgets. |

| Marketing & Sales | Digital Advertising, Promotions | Global ad spending projected over $900 billion; social media advertising dominant. |

| Personnel & Administration | Salaries, Benefits, Overhead | US media salaries range from $60k to over $150k. |

Revenue Streams

Publishing and circulation revenue encompasses income generated from selling physical newspapers and magazines at retail locations, along with revenue from print subscriptions and any additional bundled products. This stream, while experiencing some shifts due to digital trends, remains fundamental to many media businesses.

For instance, in 2024, while print newspaper circulation continued its gradual decline, it still contributed a significant portion of overall revenue for many legacy media companies. Digital circulation, however, saw a robust increase, demonstrating a clear shift in consumer preference and a growing reliance on digital platforms for news consumption.

Ancillary products, such as special editions or branded merchandise, also play a role in this revenue stream, offering a way to engage loyal readers and generate supplementary income. The blend of print and digital sales is crucial for maintaining a diversified and resilient revenue model.

Advertising sales represent a foundational revenue stream for RCS, spanning its diverse media holdings. This income is derived from selling ad space across print publications, digital platforms, radio broadcasts, and television channels. Offerings include traditional display ads, classifieds, and increasingly, sponsored content designed to integrate seamlessly with editorial material.

The digital advertising segment is a key growth engine for RCS. In 2024, digital advertising accounted for a significant percentage, roughly 45%, of total advertising sales, demonstrating a clear shift in consumer engagement and advertiser focus. This growth is driven by sophisticated targeting capabilities and measurable campaign performance on digital channels.

Digital Subscription Revenue is a rapidly growing and crucial part of RCS's business model. This income is generated from individuals paying to access content on their leading digital platforms, including Corriere della Sera, La Gazzetta dello Sport, El Mundo, and Expansión. This demonstrates a successful shift towards earning money directly from digital readers.

In 2023, RCS reported a significant increase in digital revenue, with subscriptions playing a major role. The company highlighted its growing active digital customer base as a key indicator of success in this area, reflecting a strong engagement with their online offerings. This trend is expected to continue as more readers opt for digital access to news and sports content.

Event Organization and Sponsorship Revenue

RCS generates significant income by orchestrating major sporting events. This includes substantial sponsorship deals, with key partners like Toyota and Continental contributing to the revenue stream. Furthermore, the sale of ticketing and media rights for these events diversifies the company's financial portfolio.

The company’s ability to attract high-profile sponsors underscores its strong brand presence within the sports industry. For example, in 2024, RCS secured multi-year sponsorship agreements that are projected to increase year-over-year revenue by an average of 15% through 2027.

- Sponsorship Revenue: Partnerships with major brands like Toyota and Continental provide a consistent income stream.

- Ticketing Sales: Revenue from ticket purchases for events directly contributes to the company's financial performance.

- Media Rights: Licensing broadcasting and streaming rights for sporting events is another key income source.

- Event Organization Fees: Fees charged for the planning and execution of these large-scale sporting spectacles.

Book Publishing and Sundry Revenue

Revenue from book sales forms a significant portion of this stream. In 2024, the publishing industry saw continued demand for both physical and digital formats, with major publishers reporting robust sales figures, indicating a healthy market for new and backlist titles.

Sundry revenue diversifies income beyond core book sales. This includes income generated from the licensing of intellectual property, such as television and film rights, which can represent substantial earnings. For instance, successful book adaptations often lead to significant upfront payments and ongoing royalties.

Centralized services provided to other group companies also contribute to this revenue stream. These services might encompass shared administrative functions, marketing expertise, or distribution networks, creating efficiencies and generating intercompany revenue. In 2024, many media conglomerates focused on optimizing these internal operations for greater profitability.

- Book Sales: Direct revenue from the sale of printed and digital books across various genres and imprints.

- Media Rights: Income from licensing television, film, audio, and other adaptation rights for published content.

- Ancillary Services: Revenue from third-party distribution, content licensing, and other supplementary services.

- Intercompany Services: Fees charged for centralized functions like marketing, IT, or logistics provided to sister companies within a larger group.

Digital Subscription Revenue is a rapidly growing and crucial part of RCS's business model. This income is generated from individuals paying to access content on their leading digital platforms, including Corriere della Sera, La Gazzetta dello Sport, El Mundo, and Expansión. This demonstrates a successful shift towards earning money directly from digital readers.

In 2023, RCS reported a significant increase in digital revenue, with subscriptions playing a major role. The company highlighted its growing active digital customer base as a key indicator of success in this area, reflecting a strong engagement with their online offerings. This trend is expected to continue as more readers opt for digital access to news and sports content.

The company's focus on digital subscriptions has yielded substantial results, with digital subscription revenue showing a consistent upward trajectory. This revenue stream is vital for offsetting declining print revenues and ensuring the company's long-term financial health.

In 2024, RCS continued to see strong growth in its digital subscription base, with a notable increase in average revenue per user. This performance underscores the effectiveness of their content strategy and pricing models in the digital space.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Digital Subscription Revenue | Income from paid access to digital content | Significant increase in digital revenue driven by subscriptions in 2023; continued strong growth in digital subscription base and ARPU in 2024. |

Business Model Canvas Data Sources

The RCS Business Model Canvas is informed by a combination of internal operational data, customer feedback analysis, and market intelligence reports. These diverse sources provide a comprehensive view of our current capabilities and future opportunities.