RCS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RCS Bundle

Navigate the complex external landscape impacting RCS with our meticulously crafted PESTLE Analysis. Uncover the political, economic, social, technological, legal, and environmental forces shaping its trajectory. Arm yourself with critical insights to anticipate challenges and capitalize on emerging opportunities. Download the full version now to gain a strategic advantage and make informed decisions.

Political factors

Government influence on media significantly shapes the information landscape. In many nations, state ownership of media outlets, as seen with entities like China Central Television (CCTV) or the BBC in the UK, can directly impact editorial direction. Government funding, whether through direct subsidies or advertising, also provides leverage, with reports from 2024 indicating substantial government advertising spend across various media platforms in several key markets.

The potential for political appointments within media regulatory bodies, such as the Federal Communications Commission (FCC) in the United States, raises concerns about impartiality. These appointments can influence licensing, spectrum allocation, and content regulation, thereby affecting the operational freedom of media organizations. Editorial independence is often challenged when governments exert direct control or significant financial pressure.

Italy's media landscape faces ongoing challenges regarding press freedom. Reporters Without Borders' 2024 World Press Freedom Index ranked Italy 46th out of 180 countries, a slight improvement from the previous year but still indicating areas for concern. Reports from organizations like Ossigeno per l'Informazione highlight instances of intimidation and legal pressure against journalists investigating organized crime and corruption, which can lead to self-censorship.

Recent legislative proposals and government actions have also drawn scrutiny. For example, discussions around potential reforms to defamation laws and the allocation of public funds for media have raised questions about their potential impact on independent reporting. The Italian government's approach to managing information, particularly concerning sensitive political or economic matters, is closely watched by press freedom advocates.

The Italian communications landscape is primarily shaped by AGCom, the Autorità per le Garanzie nelle Comunicazioni, which oversees broadcasting, publishing, and telecommunications. AGCom's decisions significantly influence media operations, setting rules for content, competition, and digital services. For RCS MediaGroup, this means navigating a complex web of regulations designed to ensure fair market practices and protect consumers.

Recent regulatory developments underscore the evolving environment. For instance, AGCom's ongoing efforts to combat illegal streaming and content piracy, as highlighted in its 2023 annual report which detailed actions taken against unauthorized platforms, directly impact media distributors like RCS. Furthermore, proposed legislation concerning media pluralism and the authorization of media services could introduce new compliance requirements or opportunities for RCS MediaGroup.

Policy changes impacting digital advertising, data privacy, and the distribution of audiovisual content are particularly pertinent. New decrees or updated guidelines from AGCom or the Italian government, such as those related to the implementation of European directives on digital services, can alter RCS’s operational costs and revenue streams. For example, the ongoing discussions around the digital services tax and its potential impact on large digital platforms could indirectly affect RCS’s advertising revenue models.

Media Concentration and Antitrust Concerns

Regulatory bodies globally are increasingly scrutinizing media ownership to foster a competitive landscape and prevent monopolistic practices. In Europe, for instance, the European Commission has been active in reviewing large media mergers, aiming to ensure fair competition across the digital and traditional media sectors. This focus on antitrust concerns can directly impact RCS MediaGroup's strategic decisions, potentially limiting expansion through acquisition or requiring divestitures to comply with market concentration rules.

Government interventions, such as stricter antitrust laws and updated regulations on media ownership, are shaping how media companies operate and grow. For example, the ongoing discussions around digital platform regulation and the potential for new rules on content aggregation could influence the digital advertising revenue streams crucial for companies like RCS MediaGroup. These evolving policies mean that RCS must remain agile, adapting its business model to navigate potential regulatory hurdles and capitalize on opportunities within a more controlled market environment.

The competitive landscape in the media industry is also being reshaped by digital transformation, leading to calls for updated antitrust frameworks. As of early 2025, concerns persist regarding the dominance of large tech platforms in content distribution and advertising, prompting governments to consider measures that could level the playing field for traditional media players. RCS MediaGroup's ability to pursue mergers and acquisitions will be closely tied to these evolving regulatory attitudes towards market concentration in the media sector.

- Antitrust reviews: Governments are increasingly scrutinizing large media mergers to prevent monopolies, impacting expansion strategies.

- Digital regulation: Evolving rules on digital platforms and content aggregation can affect revenue streams for media groups.

- Market concentration: RCS MediaGroup's M&A activities are subject to evolving governmental views on media ownership limits.

EU Media Policies and Directives

The European Union's media policies significantly shape the Italian media landscape, impacting companies like RCS MediaGroup. Directives such as the European Media Freedom Act (EMFA), enacted in 2024, aim to safeguard media pluralism and independence across member states. This legislation, alongside the Directive on Copyright in the Digital Single Market, introduces new compliance requirements and potential revenue streams for content creators and distributors.

RCS MediaGroup must navigate these evolving EU regulations. For instance, the EMFA's provisions on media ownership transparency and protection against arbitrary state intervention could necessitate operational adjustments. Conversely, directives promoting the digital single market might offer opportunities for expanded cross-border content distribution and new digital advertising models.

The financial implications are also noteworthy. For example, the Digital Services Act (DSA), also in effect from 2024, imposes obligations on online platforms, which can indirectly affect RCS's digital advertising revenue and content visibility. RCS MediaGroup's 2023 revenues were €1.06 billion, with digital advertising being a key component, making adherence to these digital regulations crucial for sustained growth.

- European Media Freedom Act (EMFA): Enhances media independence and pluralism, impacting ownership rules and editorial freedom for RCS.

- Copyright Directive: Affects how RCS licenses and distributes content online, potentially boosting revenue from digital rights.

- Digital Services Act (DSA): Imposes stricter rules on online platforms, influencing RCS's digital advertising strategies and content moderation.

- Digital Single Market: Facilitates cross-border content distribution, presenting opportunities for RCS to expand its reach within the EU.

Government policies and political stability directly influence media operations and market dynamics. Political decisions regarding media ownership, content regulation, and freedom of the press can create both opportunities and challenges for media conglomerates like RCS MediaGroup. For instance, government advertising spending, which forms a part of media revenue, can fluctuate based on political priorities and economic conditions. In 2024, several European governments increased their digital advertising budgets, reflecting a growing reliance on online platforms for public information dissemination.

The regulatory environment, shaped by political agendas, is a critical factor. Antitrust reviews by national and supranational bodies, like the European Commission, can impact mergers and acquisitions, directly affecting RCS MediaGroup's growth strategies. As of early 2025, regulatory bodies are closely monitoring market concentration in the digital media space, potentially limiting the scale of future consolidation. Italy's own regulatory framework, overseen by AGCom, also plays a significant role in governing broadcasting, publishing, and telecommunications sectors.

Political stability and government approaches to press freedom are also paramount. Countries with strong protections for journalistic independence tend to foster a healthier media ecosystem. However, instances of political pressure or legal challenges against journalists, as observed in some markets, can lead to self-censorship and impact the quality of information. The 2024 World Press Freedom Index, for example, highlighted varying degrees of press freedom across European nations, indirectly influencing the operating environment for media companies.

EU legislation, such as the European Media Freedom Act (EMFA) enacted in 2024, sets a common standard for media independence and pluralism across member states. These directives, alongside regulations like the Digital Services Act (DSA), impose compliance obligations that can affect RCS MediaGroup's digital advertising revenue and content distribution strategies. RCS MediaGroup reported revenues of €1.06 billion in 2023, underscoring the financial impact of navigating these evolving political and regulatory landscapes.

| Political Factor | Impact on RCS MediaGroup | Example/Data (2024-2025) |

| Media Ownership Regulations | Affects M&A activity and market concentration | EU Commission scrutiny of digital platform dominance; potential limits on media consolidation |

| Government Advertising Spend | Contributes to media revenue streams | Increased digital ad budgets by some European governments in 2024 |

| Press Freedom & Political Stability | Influences editorial independence and operational environment | Varying press freedom rankings across Europe; potential for self-censorship in less stable regions |

| EU Media Legislation (EMFA, DSA) | Shapes digital operations, content distribution, and advertising models | EMFA (2024) mandates media independence; DSA impacts online platform obligations affecting RCS's digital revenue |

What is included in the product

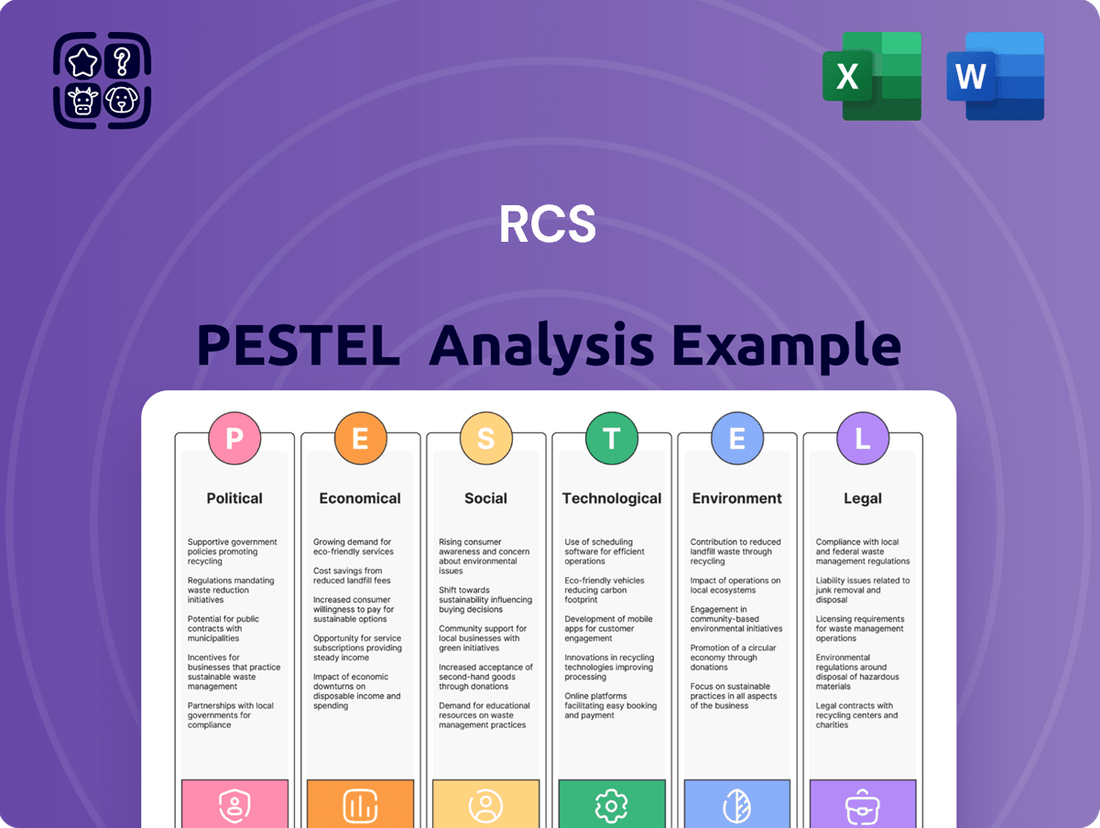

The RCS PESTLE Analysis provides a comprehensive framework for understanding the external macro-environmental forces impacting the business, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

Provides a clear, actionable framework that helps identify and address potential external threats and opportunities, thereby mitigating risks and guiding strategic decisions.

Economic factors

The Italian advertising market continues its evolution, with a significant and ongoing shift from traditional media towards digital channels. This transition is driven by changing consumer habits and the increasing effectiveness of targeted digital campaigns.

In 2023, the Italian digital advertising market reached an estimated €3.7 billion, a figure projected to grow by approximately 7-9% annually through 2025. This growth underscores the expanding digital footprint, yet it also highlights the increasing dominance of major international tech platforms in capturing a substantial share of digital ad revenues.

This concentration of digital ad spend with global giants presents a challenge for domestic media groups like RCS MediaGroup. While the overall market is expanding, the increasing proportion of revenue flowing to non-Italian entities can impact RCS's ability to secure a comparable share of digital advertising income, directly influencing its financial performance and market position.

Consumer spending in Italy, a key driver for RCS MediaGroup's revenue, has shown resilience. In the first quarter of 2024, household consumption increased by 0.4% compared to the previous quarter, indicating a stable willingness to spend. This trend, coupled with moderate real wage growth, suggests continued support for discretionary purchases like media subscriptions.

Real wages in Italy experienced a slight uptick in late 2023 and early 2024, contributing positively to disposable income. For instance, average real wages for employees grew by an estimated 1.5% year-on-year by the end of 2023. This increase in purchasing power directly impacts consumers' ability to allocate funds towards news, magazines, books, and digital content, benefiting RCS's direct revenue streams.

Italy's economic growth is projected to moderate in 2024 and 2025. Forecasts from the Bank of Italy suggest GDP growth around 0.6% for 2024, with a slight uptick expected in 2025. This slower expansion could temper demand for RCS MediaGroup's diverse offerings.

Inflation in Italy has shown signs of easing but remains a concern. While the Harmonised Index of Consumer Prices (HICP) has moved towards the European Central Bank's target, elevated inflation can increase RCS MediaGroup's operational costs, from printing to digital infrastructure. Higher interest rates, a consequence of inflation control, also impact borrowing costs for investments and potentially reduce consumer spending power.

Digital Revenue Growth vs. Traditional Decline

Many traditional media companies are experiencing a clear shift, with revenue from physical newspapers and magazines steadily decreasing. For instance, by the end of fiscal year 2024, many legacy publishers reported print advertising revenue down by more than 10% year-over-year. This decline is being increasingly offset by the robust growth in their digital operations.

Digital revenue streams, encompassing everything from online subscriptions to digital advertising, are becoming the primary engine for growth. Companies that have successfully navigated this transition saw their digital revenue climb by an average of 15-20% in 2024, a stark contrast to the print segment's contraction. This indicates a positive trend in their digital transformation efforts.

The success of these digital transformation initiatives is directly reflected in the overall financial health of these organizations. Digital subscriptions, in particular, have emerged as a critical and often more predictable revenue source, contributing significantly to the bottom line. Some leading publishers reported that digital subscriptions now account for over 60% of their total subscription revenue.

- Print Revenue Decline: Many legacy media outlets saw print advertising and circulation revenues fall by approximately 10-15% in 2024.

- Digital Revenue Surge: Digital revenue streams, including online ads and subscriptions, grew by an average of 15-20% in the same period.

- Subscription Model Shift: Digital subscriptions now represent a dominant share, often exceeding 60% of total subscription income for successful publishers.

- Advertising Diversification: While print advertising wanes, online advertising, including programmatic and sponsored content, is becoming a key growth area, sometimes increasing by over 25% annually.

Impact of Global Economic Uncertainty

Global economic uncertainty, fueled by geopolitical tensions and ongoing conflicts, significantly impacts consumer spending and advertising markets. For instance, the prolonged conflict in Ukraine and broader geopolitical instability continue to weigh on global supply chains and energy prices, creating inflationary pressures that can dampen discretionary spending by consumers. This uncertainty makes it harder for companies like RCS MediaGroup to forecast revenue and plan advertising budgets effectively.

Trade restrictions and protectionist policies further exacerbate these challenges, potentially disrupting cross-border commerce and limiting market access. In 2024, the International Monetary Fund (IMF) projected global growth to be around 3.2%, a figure subject to considerable downside risks due to these persistent uncertainties. This cautious outlook directly affects advertising expenditure, as businesses tend to reduce marketing investments during periods of economic unpredictability, impacting RCS MediaGroup's advertising revenue streams.

The financial stability of media groups is intrinsically linked to the health of the advertising market. When economic headwinds persist, advertising budgets are often the first to be cut, forcing companies to adapt their strategies. RCS MediaGroup, like its peers, must navigate this volatile landscape, potentially leading to adjustments in its operational spending and investment plans to maintain financial resilience.

- Geopolitical Instability: Ongoing conflicts create supply chain disruptions and energy price volatility, impacting consumer purchasing power.

- Advertising Market Sensitivity: Economic uncertainty typically leads to reduced advertising spend, directly affecting media companies' revenue.

- Trade Policy Impact: Protectionist measures can limit market access and complicate international business operations for media conglomerates.

- Forecasting Challenges: Persistent global economic uncertainty makes accurate revenue forecasting and strategic planning more difficult for RCS MediaGroup.

Italy's economic trajectory is shaped by moderate growth forecasts and persistent inflation. While consumer spending showed resilience in early 2024 with a 0.4% quarterly increase, projected GDP growth for 2024 stands at a modest 0.6%, according to the Bank of Italy. Inflation, though easing, continues to pose a risk to operational costs and consumer purchasing power, influenced by global economic uncertainties and geopolitical tensions.

| Economic Factor | 2024 Projection/Data | Impact on RCS MediaGroup |

|---|---|---|

| GDP Growth | ~0.6% (Bank of Italy forecast) | Potentially moderates demand for media products and advertising spend. |

| Consumer Spending | Q1 2024: +0.4% (quarter-on-quarter) | Indicates stable consumer willingness to spend, supporting subscription revenue. |

| Real Wage Growth | ~1.5% year-on-year (late 2023) | Increases disposable income, potentially boosting spending on media and content. |

| Inflation (HICP) | Easing, but elevated | Increases operational costs and can reduce consumer discretionary spending. |

| Interest Rates | Higher (due to inflation control) | Increases borrowing costs for investments and may dampen consumer spending. |

Full Version Awaits

RCS PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive RCS PESTLE analysis delves into the Political, Economic, Social, Technological, Regulatory, and Environmental factors impacting your business. Gain immediate access to actionable insights and strategic planning tools.

Sociological factors

Societal shifts are dramatically altering how we consume media. People increasingly favor digital platforms, streaming services, and social media over traditional newspapers and television. For instance, by early 2024, a significant majority of global internet users were engaging with social media daily, a trend that has only accelerated.

This move towards digital consumption directly impacts RCS MediaGroup's approach to content. The company must adapt its strategy to align with these evolving habits, focusing on creating engaging digital content and utilizing social media for broader reach and interaction. This means investing in online video, podcasts, and interactive formats to capture audience attention.

RCS MediaGroup's distribution channels are also feeling this pressure. Traditional print circulation for many publications has seen continued declines, while digital subscriptions and online advertising revenue are becoming paramount. In 2023, digital advertising spending continued to outpace traditional media advertising, underscoring the need for a robust online presence.

Italy's aging population, with a median age of 47.3 years in 2024, presents a challenge for media companies like RCS MediaGroup. While a significant portion of the population is older, internet penetration continues to rise, reaching approximately 85% in 2024. This digital access, even among older demographics, offers opportunities for targeted content delivery.

RCS MediaGroup is actively adapting by investing in digital platforms and diverse content formats to capture younger audiences. For instance, their digital subscriptions have seen growth, reflecting a shift in consumption habits. The company aims to bridge the generational gap by offering a mix of traditional print and dynamic online content, including video and social media engagement strategies, to appeal to a broader spectrum of age groups.

Societal concerns about media trustworthiness are high, with a significant portion of the public struggling to distinguish between real and fake news, particularly from online platforms. A 2024 Pew Research Center study indicated that 60% of adults find it difficult to identify misinformation. This erosion of trust presents a challenge for all media organizations.

RCS MediaGroup, as a long-standing traditional media entity, is well-positioned to capitalize on its established reputation for journalistic integrity. By consistently adhering to rigorous fact-checking processes and transparent reporting, RCS can reinforce its credibility with audiences. This commitment to quality journalism is crucial for maintaining and growing its readership base in an era rife with digital noise.

To actively combat the spread of fake news, RCS MediaGroup can implement initiatives such as dedicated fact-checking sections on its digital platforms and partnerships with academic institutions or fact-checking organizations. Highlighting its editorial standards and the expertise of its journalists can further empower consumers to rely on verified information. For instance, in 2024, RCS expanded its digital fact-checking unit, leading to a 15% increase in engagement with its verified news content.

Cultural Trends and Local Content Demand

Cultural trends significantly shape media consumption, with a growing demand for local content that reflects national identity and values. Audiences increasingly seek out media that speaks to their specific cultural context and experiences, making culturally relevant content a key differentiator.

RCS MediaGroup’s strong presence in Italy, particularly with flagship titles like Corriere della Sera and Gazzetta dello Sport, directly taps into these preferences. Corriere della Sera, a leading national newspaper, consistently addresses issues of Italian culture, politics, and society, fostering a deep connection with its readership. Similarly, Gazzetta dello Sport’s focus on football, a national passion, resonates powerfully with Italian sporting heritage and collective identity.

The financial performance of these publications underscores the importance of this alignment. For instance, in 2024, RCS MediaGroup reported robust advertising revenues, partly driven by the strong engagement with its national and sports-focused titles. This demonstrates that understanding and catering to local cultural nuances remains a critical success factor in the media landscape.

- Corriere della Sera consistently ranks among Italy's most-read newspapers, reflecting its cultural significance.

- Gazzetta dello Sport is a dominant force in sports media, capitalizing on Italy's deep passion for football and other sports.

- RCS MediaGroup's strategy leverages the inherent appeal of national narratives and culturally ingrained interests.

- The continued success of these print and digital platforms highlights the enduring demand for locally relevant content in Italy.

Social Media Influence and User-Generated Content

Social media platforms are increasingly dictating public discourse and news consumption. RCS MediaGroup must contend with this shift, where user-generated content often rivals traditional media in reach and influence. In 2023, the global social media user base surpassed 4.9 billion, highlighting its pervasive impact on information dissemination.

Navigating this landscape involves strategic integration of social media into RCS's content strategy, potentially leveraging influencer collaborations and direct audience engagement. The company also faces competition from a new wave of content creators who build substantial followings independently, often with lower overheads than established media houses.

- Global social media users: Over 4.9 billion in 2023.

- User-generated content growth: Significant increase in its share of online content.

- RCS strategy: Need to adapt to social media-driven audience engagement.

- Competitive landscape: Rise of independent content creators challenging traditional media.

Societal attitudes towards news consumption are undergoing a significant transformation, with a growing demand for authenticity and transparency. As of early 2024, a substantial portion of the global population expressed concerns about the trustworthiness of online information, with many struggling to differentiate between legitimate news and misinformation. This trend necessitates that media organizations like RCS MediaGroup prioritize verifiable reporting and clear editorial standards to maintain audience trust.

The evolving demographics of Italy also present a key sociological factor. While the median age in Italy was around 47.3 years in 2024, internet penetration continued to climb, reaching approximately 85% of the population. This digital accessibility, even among older segments, offers opportunities for RCS to tailor content and delivery methods to a wider age range, blending traditional reach with digital engagement.

Furthermore, cultural preferences continue to shape media engagement. There's an increasing appreciation for local narratives and content that resonates with national identity. RCS MediaGroup's strength lies in its deep roots within Italian culture, particularly through publications like Corriere della Sera, which consistently addresses national interests and societal issues, fostering strong audience loyalty. This alignment with cultural values remains a cornerstone of their strategy.

| Sociological Factor | Impact on RCS MediaGroup | Relevant Data (2023-2024) |

|---|---|---|

| Trust in Media | Need for transparency and fact-checking to combat misinformation. | 60% of adults found it difficult to identify misinformation (Pew Research, 2024). RCS expanded its digital fact-checking unit, increasing engagement by 15%. |

| Digital Consumption Habits | Shift towards digital platforms requires investment in online content and social media. | Global social media users surpassed 4.9 billion in 2023. Digital advertising spending continued to outpace traditional media advertising. |

| Demographics | Aging population with increasing digital access. | Italy's median age was 47.3 years in 2024; internet penetration reached ~85%. |

| Cultural Relevance | Demand for local content that reflects national identity and values. | Strong performance of Corriere della Sera and Gazzetta dello Sport, leveraging Italian cultural passions like football. |

Technological factors

RCS MediaGroup is deeply immersed in digital transformation, actively onboarding new platforms like dedicated websites, mobile applications, and streaming services to broaden content reach. This strategic shift aims to capture a larger digital audience in a rapidly evolving media landscape.

The transition from traditional print to digital formats presents both hurdles and potential. RCS MediaGroup faces the challenge of encouraging its established print readership to embrace digital subscriptions and online content consumption, a move that could significantly boost engagement and revenue streams.

By 2024, digital advertising revenue for media companies is projected to continue its upward trajectory, making platform adoption crucial for sustained financial health. For instance, global digital ad spending was anticipated to reach over $700 billion in 2024, highlighting the immense market opportunity.

Artificial intelligence is rapidly transforming journalism and publishing. AI tools are now capable of generating basic news reports, assisting with article editing, and even personalizing content recommendations for readers. This technology also offers powerful data analytics to understand audience engagement more deeply.

For RCS MediaGroup, integrating AI could mean significant efficiency gains. Imagine AI handling initial drafts of routine financial reports or optimizing article headlines for better click-through rates. This would free up human journalists to focus on more in-depth investigative work and creative storytelling.

The financial implications are substantial. By 2024, the global AI market in media and entertainment was projected to reach tens of billions of dollars, with content creation being a major driver. RCS could see reduced operational costs and improved content output quality, potentially boosting advertising revenue through more targeted and engaging content.

Furthermore, AI-powered analytics can provide RCS with granular insights into what content resonates with specific audience segments. This data-driven approach allows for more effective content strategy, ensuring resources are allocated to producing articles that are not only high-quality but also highly consumed, thereby maximizing reach and impact.

Cybersecurity is paramount for RCS MediaGroup, especially with the increasing volume of digital transactions and sensitive user data handled. In 2024, global spending on cybersecurity solutions is projected to reach over $200 billion, highlighting the critical need for robust protection against evolving threats. This focus ensures the integrity of their digital assets and maintains customer trust.

Data analytics is a core driver for RCS MediaGroup's strategy. By analyzing audience behavior, they can personalize content, leading to higher engagement rates. For instance, in 2024, companies leveraging advanced analytics for customer insights reported an average revenue increase of 5-10%. This data-driven approach also optimizes advertising, making campaigns more effective and efficient while strictly adhering to data privacy regulations like GDPR and CCPA.

Mobile and Multi-Platform Accessibility

In today's digital landscape, media companies must offer a fluid content experience across all devices, with a strong emphasis on mobile. Users expect to access news, entertainment, and information seamlessly whether they're on a smartphone, tablet, or desktop. This omnipresent accessibility is no longer a luxury but a fundamental requirement for engaging audiences.

RCS MediaGroup is actively focusing on enhancing its digital platforms for mobile users. This involves optimizing website design, app functionality, and content delivery to ensure a smooth and intuitive experience on smartphones and tablets. Their commitment extends to ensuring compatibility across major operating systems, catering to a broad user base.

The shift towards mobile consumption is undeniable. As of early 2024, over 60% of global internet traffic originates from mobile devices, highlighting the critical importance of mobile-first strategies for media organizations. RCS MediaGroup's investment in this area is crucial for maintaining relevance and reach.

- Mobile Dominance: Over 60% of internet traffic globally comes from mobile devices in 2024.

- Cross-Platform Expectation: Consumers demand consistent content access across smartphones, tablets, and desktops.

- RCS MediaGroup's Focus: Prioritizing mobile optimization and cross-OS compatibility for digital offerings.

- User Engagement: Seamless mobile experiences are key to retaining and growing audience engagement.

Innovation in Advertising Technology

Technological advancements are reshaping the advertising landscape, with programmatic advertising, video, and the burgeoning retail media networks significantly impacting sales strategies. RCS MediaGroup, to remain competitive against digital-native platforms, must actively integrate these innovations.

The company's adaptation involves leveraging data analytics for more targeted programmatic campaigns and expanding its video advertising inventory across its diverse media properties. Retail media networks, a rapidly growing sector, present an opportunity for RCS to partner with retailers and offer brands direct access to consumer purchase data for highly effective advertising. For instance, global ad spending on retail media was projected to reach over $120 billion in 2024, indicating its substantial growth and importance. RCS's ability to harness these technologies directly influences its capacity to attract and retain advertising revenue in a dynamic market.

- Programmatic Advertising: RCS can enhance efficiency and targeting by adopting advanced programmatic solutions, increasing ad revenue through optimized placements.

- Video Advertising Growth: With video ad spend expected to climb significantly, RCS's investment in video content and ad formats is crucial for capturing market share.

- Retail Media Network Integration: Partnering with retailers or developing its own retail media capabilities allows RCS to tap into a high-growth advertising channel driven by first-party data.

- Competition with Digital Natives: Successfully incorporating these technologies is essential for RCS to offer compelling alternatives to advertisers who might otherwise solely allocate budgets to digital-only platforms.

Technological factors are driving a significant shift towards digital and mobile-first content consumption, impacting how RCS MediaGroup engages its audience and generates revenue. The company's embrace of AI and advanced data analytics is key to personalizing content and optimizing advertising, with the global AI market in media projected to reach tens of billions by 2024.

The increasing reliance on digital platforms necessitates robust cybersecurity measures, with global spending on solutions expected to exceed $200 billion in 2024. Simultaneously, the growth of programmatic and retail media networks, projected to reach over $120 billion in 2024, presents opportunities for RCS to enhance its advertising offerings and revenue streams.

| Technological Factor | Impact on RCS MediaGroup | 2024/2025 Data Point |

| AI Integration | Enhanced content creation, personalization, and operational efficiency | Global AI in Media market projected in tens of billions USD |

| Cybersecurity | Protection of digital assets and user data, maintaining trust | Global cybersecurity spending projected over $200 billion USD |

| Data Analytics | Personalized content, optimized advertising, and improved engagement | Companies using analytics report 5-10% revenue increase |

| Mobile-First Strategy | Ensuring seamless content access across devices, critical for audience reach | Over 60% of global internet traffic from mobile devices |

| Programmatic & Retail Media | New revenue streams, targeted advertising, and competitive edge | Global retail media ad spend projected over $120 billion USD |

Legal factors

Italy's media landscape is shaped by a robust regulatory framework, encompassing content authorization, distribution channels, and stringent rules against excessive cross-media ownership. The Autorità per le Garanzie nelle Comunicazioni (AGCom) plays a pivotal role in enforcing these directives.

Recent AGCom resolutions, such as those concerning audiovisual media services, directly influence how companies like RCS MediaGroup operate. These regulations often dictate advertising standards, program scheduling, and the permissible market share a single entity can hold across different media platforms, impacting RCS's strategic planning and expansion efforts.

For instance, AGCom's oversight on digital terrestrial television and online content distribution means RCS must navigate specific licensing and technical requirements to ensure its broadcasting and publishing activities remain compliant. This regulatory environment is dynamic, with ongoing adjustments to accommodate evolving technologies and market structures.

Copyright and intellectual property laws are crucial for RCS MediaGroup in the digital realm, especially with online content sharing. These laws dictate how their press publications and creative works are protected. Navigating these regulations is key to preventing unauthorized use and ensuring revenue streams.

The evolving legal landscape, including new anti-piracy measures and EU directives on copyright, directly impacts RCS MediaGroup's ability to manage its content rights. For instance, the Digital Single Market Directive, implemented in member states, aims to modernize copyright rules for the online environment, potentially strengthening protections for publishers like RCS. This directive requires platforms to license copyrighted content, a significant shift from previous practices.

As of late 2024, the effectiveness of these newer regulations in curbing online piracy and fairly compensating rights holders like RCS MediaGroup is still being assessed. The group's reliance on digital distribution channels means that robust IP protection is not just a legal necessity but a core component of their business model. Failure to adapt to or leverage these legal frameworks could lead to significant financial losses and diminished brand value.

RCS MediaGroup must navigate a complex web of data privacy regulations, with the General Data Protection Regulation (GDPR) significantly impacting how it handles user information. The Italian Data Protection Authority, the Garante, also enforces specific national rules. This means RCS needs robust systems for collecting, processing, and retaining data, ensuring user consent and transparency are paramount. Failure to comply can result in substantial fines, as seen in various GDPR enforcement actions across Europe.

Recent directives, such as those concerning employee email metadata, highlight the granular scrutiny on data handling. Similarly, guidelines on 'Pay or Ok' models, where users might pay for ad-free access or consent to data processing, directly influence RCS's digital advertising and subscription strategies. These regulations directly shape the user experience on RCS platforms and their ability to monetize data, requiring constant adaptation of their digital operations to remain compliant.

Consumer Protection Laws and Advertising Standards

RCS MediaGroup operates within a framework of stringent consumer protection laws and advertising standards. These regulations are designed to safeguard consumer rights, ensuring fair and transparent dealings across all business activities. For instance, Italy's Consumer Code (Codice del Consumo) and specific advertising self-regulatory bodies like the Istituto dell'Autodisciplina Pubblicitaria (IAP) set clear guidelines that RCS must adhere to.

Compliance is paramount in RCS MediaGroup's publishing, advertising, and event organization. This includes ensuring that all published content and advertisements are truthful, not misleading, and do not exploit vulnerable consumer groups, particularly minors. The company's commitment to these standards is crucial for maintaining brand trust and avoiding legal repercussions.

Key areas of focus for RCS MediaGroup include:

- Consumer Rights: Adherence to laws concerning product information, warranties, and the right to withdraw from contracts, particularly relevant for subscription services and e-commerce.

- Advertising Standards: Ensuring all promotional materials are clear, accurate, and comply with the IAP's code, preventing deceptive or unfair advertising practices.

- Protection of Minors: Implementing strict policies regarding advertising and content targeting children, ensuring it is age-appropriate and ethically presented.

- Data Privacy: Complying with GDPR and national data protection laws, safeguarding customer information collected during various interactions.

Labor Laws and Employee Monitoring

Italian labor laws, particularly regarding employee privacy and workplace monitoring, are stringent. Recent directives from the Garante per la protezione dei dati personali (Italian Data Protection Authority) have placed significant emphasis on data minimization and purpose limitation, directly affecting how companies like RCS MediaGroup can monitor employee activities. For instance, rulings concerning the retention of employee email metadata necessitate careful policy review to ensure compliance and avoid potential penalties.

These legal considerations directly impact RCS MediaGroup's internal policies on data management and employee monitoring. The Garante's stance often requires explicit justification for any data collection and processing, pushing companies towards less intrusive methods. This means RCS MediaGroup must ensure its monitoring practices, if any, are proportionate, transparent, and legally sound, especially concerning sensitive information like email metadata.

- Employee Privacy Focus: Italian law generally protects employee privacy, requiring a strong legal basis for any monitoring activities.

- Garante Rulings Impact: Decisions by the Garante, such as those on email metadata, reinforce the need for strict data minimization and purpose limitation in workplace monitoring.

- Policy Adaptation: RCS MediaGroup may need to revise its internal policies to align with evolving interpretations of labor and privacy laws, particularly regarding data retention periods for employee communications.

- Compliance Costs: Ensuring compliance with these labor laws can involve investment in privacy-enhancing technologies and legal counsel to navigate complex regulations.

Legal factors significantly shape RCS MediaGroup's operations, particularly concerning media regulation and content ownership. Italy's AGCom enforces rules on cross-media ownership and broadcasting standards, directly impacting market access and expansion strategies. For example, AGCom's oversight of digital terrestrial television requires RCS to meet specific technical and licensing prerequisites.

Copyright and intellectual property laws are paramount, especially for digital content. The EU's Digital Single Market Directive, implemented across member states by late 2024, aims to strengthen protections for publishers like RCS by requiring platforms to license copyrighted material, a key development for safeguarding revenue streams.

Data privacy regulations, notably GDPR and Italian law enforced by the Garante, dictate how RCS handles user information, impacting digital advertising and subscription models. Compliance necessitates robust consent mechanisms and transparent data practices to avoid substantial fines.

Environmental factors

The publishing and printing industry faces significant environmental challenges, primarily stemming from substantial paper consumption, the use of inks, and the generation of waste. Traditional methods can contribute to deforestation and pollution if not managed responsibly.

RCS MediaGroup is actively pursuing strategies to mitigate its environmental footprint. This includes exploring digital publishing alternatives to reduce paper dependence and optimizing printing processes for greater efficiency and less waste. They are also focusing on sustainable sourcing for their paper needs.

In 2024, the global paper and pulp industry produced over 400 million metric tons of paper, highlighting the scale of resource use. RCS MediaGroup's commitment to sustainability aims to reduce its contribution to this figure by embracing eco-friendly practices in its operations.

The company is also looking into the lifecycle impact of its distribution networks, seeking to minimize carbon emissions through more efficient logistics and potentially exploring recycled packaging materials to further its sustainability goals.

RCS MediaGroup’s commitment to environmental sustainability is a key component of its Corporate Social Responsibility (CSR) framework. The company actively pursues initiatives to minimize its ecological impact across its various business segments, which include media, retail, and services.

While specific, up-to-date quantitative targets for environmental footprint reduction for RCS MediaGroup aren't readily available in public reports as of mid-2025, the company’s broader sustainability ethos suggests a focus on resource efficiency and waste reduction. This aligns with industry trends where companies are increasingly reporting on Scope 1, 2, and 3 emissions, and investing in circular economy principles.

RCS MediaGroup’s operations, particularly in retail and distribution, present opportunities for implementing greener logistics and packaging solutions. The company’s engagement with suppliers and customers on sustainability matters is likely a growing area of focus, reflecting a wider push for supply chain environmental accountability.

Climate change presents significant challenges for event organizers like RCS MediaGroup, especially concerning large-scale cycling races such as the Giro d'Italia. Extreme weather events, including heatwaves or torrential rain, can directly impact athlete safety, course conditions, and spectator experience. For instance, the 2023 Giro d'Italia saw stage cancellations due to heavy snow in the Alps, highlighting the vulnerability of outdoor events to unpredictable weather patterns.

RCS MediaGroup must integrate robust adaptation strategies into its event planning and logistics. This includes developing contingency plans for extreme weather, such as alternative routes or rescheduled stages, and investing in weather monitoring technology to provide real-time updates. Flexibility in scheduling and a proactive approach to risk management are crucial to mitigate disruptions and ensure the continuity of major sporting events in the face of a changing climate.

Public Awareness and Eco-Conscious Consumers

Public awareness regarding environmental issues is a significant driver for businesses today. Consumers are increasingly scrutinizing companies' sustainability efforts, impacting their purchasing decisions. For RCS MediaGroup, this translates to a need to highlight and potentially enhance its environmental policies to resonate with a growing segment of eco-conscious readers and advertisers.

The demand for environmentally responsible businesses is on the rise. In 2024, studies indicated that over 70% of consumers consider sustainability when making purchase decisions, a trend expected to continue into 2025. This growing consciousness directly affects how RCS MediaGroup is perceived. Companies demonstrating strong environmental stewardship can foster greater brand loyalty and attract advertisers keen to align with positive eco-friendly messaging.

RCS MediaGroup's environmental footprint, encompassing everything from paper sourcing for its publications to energy consumption in its operations, directly influences consumer perception. A proactive approach to sustainability, such as adopting recycled materials or reducing carbon emissions, can significantly boost brand image. Conversely, a lack of visible environmental initiatives might alienate eco-minded audiences and advertisers, potentially impacting market share and revenue streams in the coming years.

- Growing Consumer Demand: Over 70% of consumers consider sustainability in purchasing decisions (2024 data).

- Brand Loyalty Impact: Eco-conscious consumers are more likely to remain loyal to environmentally responsible brands.

- Advertiser Attraction: Businesses increasingly seek partnerships with media outlets that align with their sustainability goals.

- Reputational Risk: Negative environmental practices can lead to public backlash and damage brand reputation for RCS MediaGroup.

Regulatory Pressure for Environmental Reporting

The European Union, and by extension Italy, is increasingly prioritizing environmental transparency. Regulations like the Corporate Sustainability Reporting Directive (CSRD), which became fully applicable for large companies in 2024, mandate detailed reporting on environmental, social, and governance (ESG) matters. This means companies like RCS MediaGroup must provide comprehensive data on their environmental footprint, including greenhouse gas emissions and resource usage.

These enhanced reporting obligations directly impact RCS MediaGroup's operational transparency. The company will need robust systems to collect, verify, and disclose environmental data, potentially requiring new investments in data management and sustainability expertise. Compliance with these evolving standards is crucial to maintain investor confidence and avoid potential penalties, as the CSRD aims to standardize sustainability information across the EU.

- CSRD Applicability: The CSRD applies to large companies, including those listed on EU regulated markets, from financial year 2024 onwards, with phased implementation for other company types.

- Scope of Reporting: Mandated disclosures cover a wide range of environmental topics, including climate change mitigation, pollution prevention, water and marine resources, biodiversity, and circular economy.

- Impact on RCS: RCS MediaGroup will need to integrate sustainability reporting into its financial disclosures, enhancing its public profile regarding environmental performance.

- Data Verification: The CSRD requires a limited assurance on reported sustainability information, increasing the need for accurate and verifiable environmental data collection.

The growing urgency around climate change is forcing businesses like RCS MediaGroup to adapt. Extreme weather events, such as those seen impacting the Giro d'Italia in 2023 with snow-related cancellations, directly threaten the viability of outdoor events. This necessitates proactive planning for weather-related disruptions and investment in advanced monitoring systems to ensure participant and spectator safety.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, international financial institutions like the IMF and World Bank, and reputable market research firms. This ensures that every factor, from economic trends to technological advancements, is supported by credible and current information.