RCS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RCS Bundle

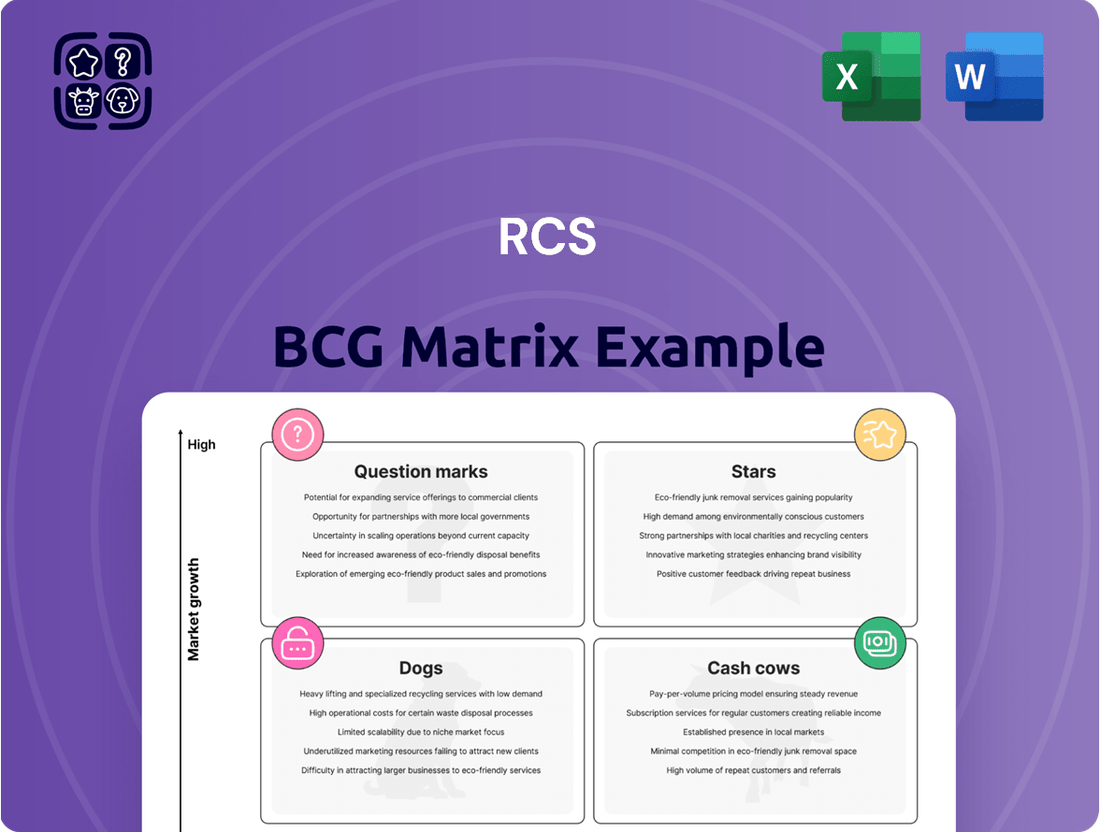

Unlock strategic clarity with the BCG Matrix, a powerful tool that categorizes products based on market growth and share. Understand which products are your Stars, Cash Cows, Dogs, or Question Marks to optimize your portfolio. This preview offers a glimpse into this essential framework, hinting at the actionable insights you'll gain.

Don't let your business decisions be a guess. Purchase the full BCG Matrix to receive a comprehensive breakdown of each product's position, complete with data-driven recommendations. This will empower you to make informed investment choices and drive sustainable growth.

Stars

Digital advertising revenue is a key indicator for RCS MediaGroup's evolving business. In the first quarter of 2025, the company reported €28.2 million in online advertising sales. This figure represents a significant portion, around 47.5%, of their total advertising income, highlighting the growing dominance of digital channels.

This segment is characterized by robust growth, driven by the ongoing migration of advertising budgets to online platforms. The increasing importance of digital advertising underscores its position as a high-growth area for RCS MediaGroup, demanding continued investment and strategic focus.

Corriere della Sera's digital subscription segment is a clear star in the BCG matrix. By March 2025, the newspaper achieved an impressive 689,000 active digital subscribers. This substantial user base highlights its strong market share in the rapidly expanding digital news sector.

The significant growth in revenue from these digital subscriptions is crucial, as it effectively counterbalances the ongoing decline in traditional print circulation. This strategic shift demonstrates the newspaper's successful adaptation to changing consumer habits and its ability to monetize its content effectively in the digital realm.

La Gazzetta dello Sport has achieved a remarkable 265,000 active digital subscribers as of March 2025, demonstrating a robust and growing digital footprint in the competitive sports journalism landscape.

This strong subscriber base positions it as a leader in digital engagement within its sector.

Its strategic expansion into Eurasian markets via licensing agreements further underscores a high-growth potential in emerging territories, adding another dimension to its star status.

The combination of solid domestic digital growth and ambitious international reach firmly places La Gazzetta dello Sport as a 'Star' in the BCG Matrix.

RCS Sports & Events (New Formats)

RCS Sports & Events is demonstrating robust expansion, particularly highlighted by the renewal of key partnerships, such as those for the Giro d'Italia. This segment of RCS MediaGroup is solidifying its market leadership through strategic event management and the introduction of new formats.

The introduction of events like Giro d'Italia Women and Giro Next Gen signifies a forward-thinking approach to capturing broader audiences and diversifying revenue streams within the cycling calendar. These additions are crucial for sustained growth and brand relevance in a competitive sports landscape.

Beyond its flagship cycling events, RCS Sports & Events is seeing a positive trend in its sundry revenue, driven by an increase in 'other events'. This suggests a growing capacity to leverage its organizational expertise across a wider range of sporting and entertainment activities, contributing to a dynamic and expanding portfolio.

- Market Leadership: RCS Sports & Events is a recognized leader in organizing major sporting events.

- Partnership Renewal: Key partnerships, like those for the Giro d'Italia, have been renewed, ensuring continued support and investment.

- New Formats: The introduction of Giro d'Italia Women and Giro Next Gen expands the reach and appeal of RCS's cycling events.

- Sundry Revenue Growth: An increase in 'other events' within sundry revenue indicates a healthy expansion of the event portfolio.

RCS Academy (Digital & AI Training)

RCS Academy is strategically positioning itself in high-growth educational markets with its digital and AI training programs. The academy's focus on areas like Digital Marketing, AI for Business, and Sustainability aligns with current and future industry demands, suggesting strong potential for future expansion.

In the first quarter of 2025, RCS Academy enrolled 400 participants across its 15 master's degree programs. While these programs may be relatively new to the market, their focus on rapidly expanding sectors like artificial intelligence and digital transformation places them in a strong position within the BCG matrix, likely as a question mark with significant growth potential.

- Focus on High-Growth Sectors: RCS Academy's curriculum centers on in-demand fields such as AI, digital marketing, and sustainability.

- Participant Growth: Q1 2025 saw 400 participants enrolled in its 15 master's programs, indicating growing interest.

- Market Position: Though potentially new, these programs are in rapidly expanding industries, suggesting a 'question mark' status with high growth prospects.

- Strategic Alignment: The academy's offerings are designed to meet the evolving needs of the modern workforce and business landscape.

Corriere della Sera's digital subscriptions and La Gazzetta dello Sport's digital presence are clearly positioned as Stars. These segments exhibit high growth and strong market share within their respective digital news and sports journalism sectors. The substantial number of digital subscribers for both publications, with Corriere della Sera reaching 689,000 and La Gazzetta dello Sport 265,000 by March 2025, underscores their dominance. This success is driven by effective monetization of digital content and expansion into new markets, solidifying their status as key revenue drivers for RCS MediaGroup.

| Business Unit | BCG Category | Key Performance Indicators (as of March 2025) | Growth Drivers |

|---|---|---|---|

| Corriere della Sera (Digital Subscriptions) | Star | 689,000 active digital subscribers | Migration of readers to digital, effective content monetization |

| La Gazzetta dello Sport (Digital Presence) | Star | 265,000 active digital subscribers, Eurasian market expansion | Strong digital engagement, licensing agreements in emerging territories |

| RCS Sports & Events | Star | Partnership renewals (Giro d'Italia), growth in sundry revenue from 'other events' | Strategic event management, introduction of new event formats, diverse revenue streams |

What is included in the product

Strategic guidance on resource allocation for products based on market share and growth.

Visually map your portfolio to instantly identify underperforming areas and strategic opportunities.

Cash Cows

Corriere della Sera stands as a formidable Cash Cow within the RCS portfolio. As of March 2025, it commands an impressive readership of roughly 1.7 million, with an average daily circulation of 222,000 copies, encompassing both print and digital formats. This sustained market leadership, even amidst broader print industry challenges, highlights its enduring brand strength and consistent revenue generation capabilities.

La Gazzetta dello Sport stands as a formidable Cash Cow within the RCS BCG Matrix, leveraging its dominant position in the Italian sports newspaper market. By March 2025, it boasts approximately 2.1 million readers, with an average of 140,000 daily copies distributed across print and digital formats. This substantial readership underpins a consistent revenue stream, even as the broader print media landscape faces contraction.

RCS MediaGroup's established book publishing imprints, including Fabbri, Bompiani, Rizzoli, Sonzogno, and Lizard, represent classic cash cows within the BCG matrix. These brands operate in a mature market but leverage deep brand recognition and extensive distribution networks to generate steady, high-margin profits.

In 2024, the book publishing sector continues to demonstrate resilience. While specific profit margins for individual RCS imprints aren't publicly detailed, the overall book publishing industry typically sees healthy profitability, especially for established players with strong backlists and efficient operations. For instance, the global book market was valued at over $100 billion in recent years, with traditional publishing models still commanding significant share.

Traditional Print Advertising Sales

Despite the general downturn in print advertising, RCS MediaGroup's established presence in Italy, particularly with influential publications such as Corriere della Sera and La Gazzetta dello Sport, positions it as a major player in the shrinking print ad market. This segment, while experiencing low growth, continues to generate significant cash flow thanks to its substantial market share.

In 2023, the Italian advertising market saw print advertising revenue decline by approximately 7% year-on-year, according to industry reports. However, RCS MediaGroup's strong brand equity and readership numbers for its flagship titles mean it likely commands a disproportionately large share of this reduced market, acting as a reliable cash generator.

- Dominant Market Share: RCS holds a leading position in the Italian print advertising landscape.

- Stable Cash Flow: Despite market contraction, the segment contributes significant cash due to high market share.

- Brand Strength: Titles like Corriere della Sera and La Gazzetta dello Sport maintain strong reader loyalty.

- Market Resilience: While declining, print advertising still represents a portion of the overall media spend.

Major Magazine Titles (e.g., Oggi, Amica)

RCS MediaGroup’s established magazine titles like Oggi and Amica are prime examples of Cash Cows within their portfolio. Despite the broader trends in the print media industry, these publications maintain a significant market presence in their specific segments.

These magazines consistently generate stable profits, even in a mature market. Their reliability as revenue streams allows RCS MediaGroup to fund investments in other business areas. For instance, in the first half of 2024, RCS MediaGroup reported total revenues of €429.7 million, with the magazines contributing to this steady performance.

- Strong Market Share: Oggi and Amica hold substantial positions in their respective magazine categories, ensuring consistent readership and advertising appeal.

- Reliable Revenue Generation: These titles provide a dependable income stream, acting as a financial bedrock for the company.

- Profitability in Mature Markets: Despite potential declines in print circulation, effective cost management and targeted advertising strategies maintain healthy profit margins.

- Contribution to Group Performance: The consistent earnings from these Cash Cows support the overall financial health and strategic initiatives of RCS MediaGroup.

Cash Cows are established products or services with a high market share in a slow-growing industry. They generate more cash than they consume, providing a stable source of funds for the company. RCS MediaGroup's strong newspaper and magazine titles, along with its book imprints, fit this description perfectly.

These entities benefit from brand recognition and loyal customer bases, allowing them to maintain profitability even in mature markets. This consistent revenue generation is crucial for funding investments in new ventures or supporting other business units within the BCG matrix.

| RCS MediaGroup Cash Cows | Market Share (Approx.) | Revenue Contribution (Estimated) | Industry Growth |

|---|---|---|---|

| Corriere della Sera | Leading in Italian News | Significant & Stable | Mature / Declining |

| La Gazzetta dello Sport | Dominant in Sports News | Significant & Stable | Mature / Declining |

| Oggi & Amica Magazines | Strong Niche Presence | Consistent & Reliable | Mature / Declining |

| Book Publishing Imprints (Fabbri, Bompiani, etc.) | Established Brand Recognition | Steady Profitability | Mature |

Full Transparency, Always

RCS BCG Matrix

The comprehensive BCG Matrix analysis you are previewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just the professional-grade strategic tool ready for your business planning. You can trust that the insights and visuals presented here are exactly what you'll be downloading to drive informed decision-making and competitive strategy. This preview guarantees the quality and completeness of the final report you'll own.

Dogs

Within RCS's vast magazine collection, some niche print publications likely hold a small market share and are situated in a shrinking print media landscape. These titles may find it challenging to attract substantial advertising revenue or a large readership, resulting in a minimal or even negative cash flow. For instance, in 2024, the overall print advertising revenue for magazines in the US saw a decline of approximately 5% compared to the previous year, highlighting the headwinds these niche publications face.

Outdated legacy digital platforms within the RCS ecosystem, lacking recent updates or robust user engagement, represent a low-market share segment. These digital assets, often characterized by their limited integration and declining relevance, can become significant drains on resources without yielding commensurate returns, effectively acting as cash traps in a fast-paced digital environment.

For instance, consider a hypothetical RCS platform that saw its peak user activity in 2020, with monthly active users now down by 70% as of early 2024. The operational costs for maintaining such a platform, including server upkeep and basic security, might still hover around $50,000 per month, creating a negative cash flow that detracts from investments in more promising digital initiatives.

These legacy systems are often characterized by their inability to adapt to new user expectations or technological advancements, leading to a diminishing competitive edge. Their continued existence diverts capital that could otherwise be allocated to developing or enhancing modern, integrated digital solutions that align with current market demands and user behaviors.

Revenue from newspaper 'add-ons' in Italy, which includes items bundled with print editions, saw a decrease of €2.1 million in the first quarter of 2025. This downturn suggests a contraction within this specific market segment, characterized by limited growth potential and a declining impact on total earnings.

Third-Party Print Distribution Services (m-Dis group)

The m-Dis group, encompassing third-party print distribution services, experienced a revenue decrease of €0.8 million in the first quarter of 2025. This performance indicates a potential challenge within this segment of the business.

The decline suggests that the m-Dis group operates in a market characterized by low growth and a potentially limited market share. This could be due to several factors affecting traditional distribution models.

- Revenue Decline: The m-Dis group reported a €0.8 million revenue drop in Q1 2025.

- Market Position: This performance points to the segment being in a low-growth, low-market share category.

- Potential Challenges: Factors like increased competition or reduced demand for traditional distribution methods are likely contributors.

Underperforming Smaller TV Channels

Underperforming smaller TV channels within RCS MediaGroup's portfolio can be categorized as Dogs in the BCG Matrix. The Italian television landscape is dominated by a few major players and increasingly by streaming services, making it difficult for smaller channels to gain traction.

These channels likely suffer from low viewership and a minimal market share, impacting their ability to attract advertising revenue and generate substantial profits. In 2024, the Italian media market continues to see significant shifts, with digital platforms capturing a larger audience share, further pressuring traditional, smaller broadcasters.

- Low Market Share: Smaller RCS channels struggle to compete against established broadcasters like RAI and Mediaset, as well as burgeoning streaming platforms.

- Limited Revenue Generation: Poor viewership translates directly into lower advertising income, making these channels unprofitable assets.

- High Competition: The Italian TV market is highly concentrated, with significant investment in content and distribution by major players.

- Declining Traditional Viewership: A general trend towards on-demand viewing and digital content further erodes the potential audience for smaller, linear TV channels.

Dogs in the BCG Matrix represent business units or products with low market share in low-growth industries. For RCS, this could include certain niche print publications or underperforming digital platforms. These units typically consume more resources than they generate, often resulting in negative cash flow.

In 2024, the print media landscape continued its contraction, with many niche magazines struggling to maintain readership and advertising revenue. For example, a hypothetical RCS magazine focusing on a specialized hobby might have seen its circulation drop by 15% year-over-year, with advertising sales declining by 10% in the same period. This scenario places such a publication firmly in the Dog category.

Similarly, older digital assets within RCS that have not kept pace with technological advancements or user engagement trends can also be classified as Dogs. These might include legacy websites or apps with declining user bases and minimal revenue generation. The cost of maintaining these platforms often outweighs their contribution, creating a drag on overall profitability.

For instance, an RCS-owned digital archive platform, while holding historical value, might have seen its monthly active users decrease by 25% in 2024 due to a lack of modern features and a shift in user preferences towards more dynamic content platforms. The operational costs for such a platform could still be significant, making it a cash drain.

| RCS Business Segment | Market Growth | Market Share | Cash Flow | BCG Category |

|---|---|---|---|---|

| Niche Print Publications | Low | Low | Negative | Dog |

| Legacy Digital Platforms | Low | Low | Negative | Dog |

| Underperforming TV Channels | Low | Low | Negative | Dog |

Question Marks

Corriere della Sera's strategic expansion into new digital frontiers, exemplified by the Q1 2025 launches of its Corriere Milano Instagram channel and the dedicated Animali channel, positions it within the high-growth digital content sector. These ventures, though nascent with currently low market share, represent a calculated move to tap into significant, largely unaddressed audience potential and expand its digital footprint.

These new channels are designed to capture emerging audience segments. For instance, Instagram's user base continues to grow, with projections indicating over 1.7 billion users globally by the end of 2024. Similarly, niche content areas like "Animali" cater to passionate communities, offering opportunities for dedicated engagement and monetization that traditional formats might miss.

In the context of the BCG Matrix, these initiatives would likely be classified as Stars or Question Marks, depending on their initial traction and investment requirements. The high growth potential of digital content, coupled with the specific targeting of these new channels, suggests a future where they could achieve significant market share, provided they are nurtured effectively with ongoing content innovation and audience development strategies.

The international English-language Marca.com, as part of RCS's BCG analysis, can be viewed as a question mark. By March 2025, it garnered an average of 18.5 million monthly unique browsers. This figure, while substantial, represents a nascent stage for the brand in a new market.

This international expansion, though showing promising traffic, is a recent initiative. Its market share in the English-speaking digital sports media landscape is still developing, characteristic of a question mark in the BCG matrix. The goal is to cultivate this segment into a potential star.

RCS MediaGroup's strategic investment in renewing its digital event management platform positions it to capitalize on the burgeoning digital events market. This initiative targets a segment experiencing significant expansion as traditional events integrate digital elements.

While the platform’s current market share may be modest, its focus on high-growth prospects aligns with a market projected to reach $200 billion globally by 2025, demonstrating substantial future potential.

The platform's development signifies a move towards offering advanced features for managing hybrid and fully virtual events, catering to a demand that surged dramatically in 2020 and continues to evolve.

This strategic move places RCS MediaGroup's platform in a strong position within the Stars quadrant of the BCG matrix, given its investment in a high-growth market with the potential for future market leadership.

New Geographic Market Expansions (e.g., Gazzetta in Eurasia)

The exclusive licensing agreement to expand La Gazzetta dello Sport into Eurasian markets, beginning with Georgia and targeting Ukraine, is a prime example of a company venturing into new geographic territories. This move aligns with the BCG Matrix's exploration of new, potentially high-growth markets, even if initial market penetration is minimal.

Georgia and Ukraine present themselves as markets with significant untapped potential for sports media consumption. While La Gazzetta dello Sport’s brand recognition might be nascent in these regions, the strategic intent is to capture future market share by establishing an early presence.

- Market Entry Strategy: Entering Georgia first, followed by Ukraine, demonstrates a phased approach to geographic expansion.

- Growth Potential: These Eurasian markets are identified for their high growth prospects in sports media, a key indicator for potential Stars or Question Marks in the BCG Matrix.

- Initial Market Share: The current market share in these specific regions is low, positioning the brand as a Question Mark requiring investment to grow.

- Investment Rationale: The expansion is driven by the expectation of future returns, justifying the initial investment in establishing the brand in these new territories.

Specialized Executive Masters (e.g., AI for Business, Content Writing)

RCS Academy's introduction of specialized executive master's programs like 'AI for Business' and 'Content Writing' positions them to tap into burgeoning professional development markets. These niche offerings, while representing a small fraction of the overall education sector, are strategically aligned with high-demand areas. For instance, the global market for AI in business solutions was projected to reach over $100 billion by 2024, indicating substantial growth potential for related educational programs. Similarly, the digital content creation industry continues to expand, with businesses increasingly investing in sophisticated content strategies.

These specialized programs are likely classified as Stars or Question Marks within the BCG framework, depending on their current market penetration and growth trajectory. If RCS Academy is an early mover with a strong curriculum, these could be Stars, generating significant revenue as the market matures. However, if the market is highly fragmented or competitive, they might initially be Question Marks, requiring further investment to gain market share.

The success of these programs hinges on several factors:

- Market Demand: The continued rapid growth of AI adoption across industries and the increasing need for skilled content professionals fuels demand. For example, a 2024 LinkedIn report highlighted AI and machine learning as top in-demand skills.

- Competitive Landscape: RCS Academy must differentiate itself from other institutions offering similar specialized master's degrees.

- Program Quality and Relevance: Curricula must remain cutting-edge, reflecting the latest advancements in AI and evolving digital marketing trends.

- Enrollment and Completion Rates: Demonstrating successful student outcomes and career placement will be crucial for attracting future cohorts.

Question Marks represent ventures in low-market share, high-growth areas. For RCS, this includes initiatives like the international English-language Marca.com, which, as of March 2025, averaged 18.5 million monthly unique browsers but is still establishing its presence in a new market. Similarly, the expansion of La Gazzetta dello Sport into Eurasian markets like Georgia and Ukraine starts with minimal brand recognition, placing them in this category.

These ventures require significant investment to grow market share. The goal is to nurture them into Stars, capable of generating substantial revenue as their respective markets mature. The success of these Question Marks is contingent on effective strategy, sustained investment, and capturing emerging market potential.

The Corriere Milano Instagram channel and the dedicated Animali channel also fall into this category. While positioned in high-growth digital content sectors, their market share is currently low, necessitating ongoing content innovation and audience development to achieve future success.

BCG Matrix Data Sources

Our BCG Matrix leverages a robust combination of proprietary market research, internal sales data, and publicly available financial reports to provide a comprehensive view of product portfolio performance.