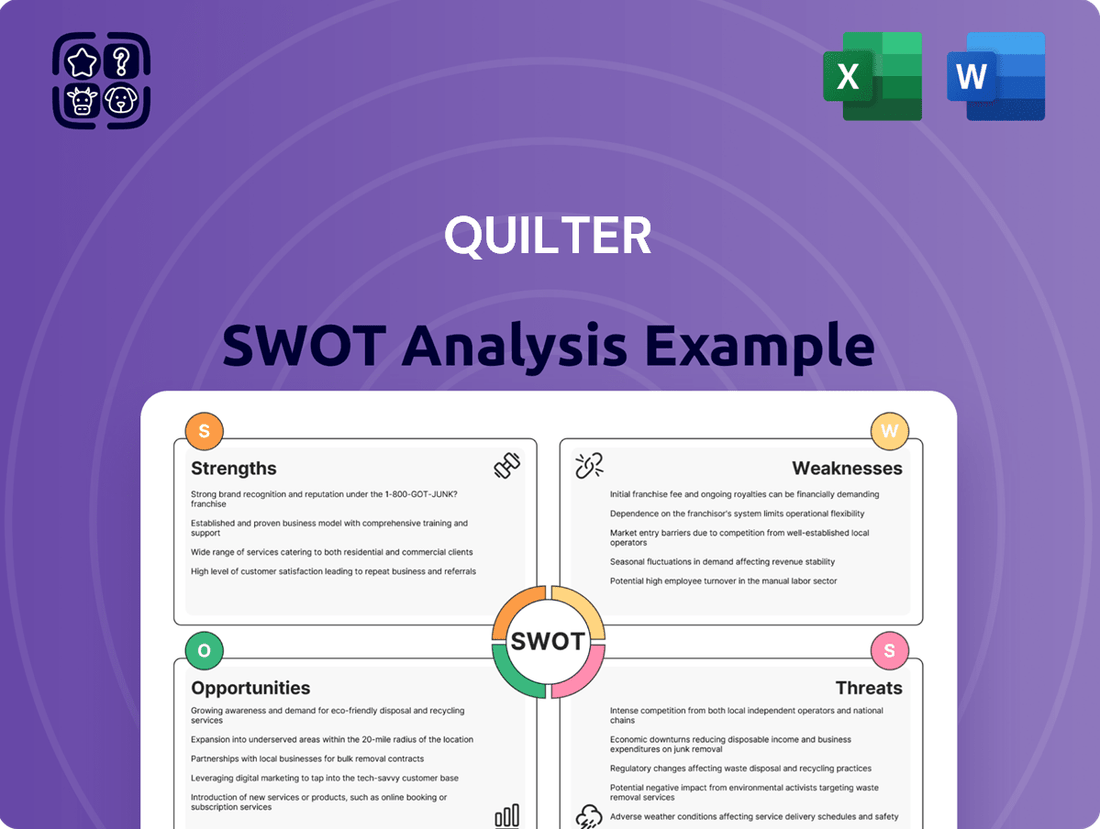

Quilter SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Quilter Bundle

Quilter's strengths lie in its established brand and diversified service offerings, catering to a broad client base. However, it faces challenges from increasing regulatory scrutiny and intense competition within the financial advisory sector.

Opportunities exist in leveraging technology for enhanced customer experience and expanding into underserved markets. Conversely, threats include economic downturns and potential shifts in investment preferences, impacting revenue streams.

Want the full story behind Quilter's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Quilter benefits from a well-established presence in its primary markets, the UK and South Africa, which is a significant strength. This long-standing operation has cultivated a strong brand reputation and fostered considerable client trust, both vital elements in the competitive wealth management sector.

The company's deep market penetration in these regions translates into a stable client base and a robust referral network. For instance, as of the first quarter of 2024, Quilter reported £125.5 billion in Assets Under Management and Advice (AUMA), demonstrating the scale of its established operations and client relationships.

Quilter boasts a comprehensive service offering, encompassing financial planning, investment management, and retirement planning. This all-encompassing approach allows them to address a wide array of client needs across their entire financial journey, fostering strong client relationships and creating avenues for cross-selling. For instance, in 2024, Quilter’s platform facilitated over £100 billion in assets under management, demonstrating the scale of their integrated services.

Quilter's integrated platform is a significant strength, effectively combining digital investment tools with personalized, advisor-led financial guidance. This hybrid approach, which saw its platform assets under management reach £118.1 billion as of December 31, 2023, appeals to a broad client base, from those preferring self-service to individuals seeking in-depth advice. The synergy between technology and human expertise streamlines operations and elevates the client journey.

Strong Client Relationships

Quilter's commitment to providing personalized financial advice and fostering long-term financial planning is a cornerstone of its strength, leading to exceptionally strong client relationships. This advisor-led approach is crucial in wealth management, where trust and a consistent point of contact are highly valued, allowing for the development of deep client rapport.

These enduring connections directly translate into impressive client retention, a key indicator of a healthy and stable business model. For instance, in the first half of 2024, Quilter reported a net client cash flow of £3.1 billion, underscoring the loyalty and continued engagement of its client base.

The stability provided by these strong relationships contributes to predictable and recurring revenue streams, a significant advantage in the financial services sector. This predictability allows for more confident strategic planning and investment in future growth initiatives.

- Personalized Advice: Quilter's focus on tailored financial guidance fosters deep client trust.

- Advisor-Led Model: The consistent presence of advisors builds rapport and continuity.

- High Retention: Strong relationships lead to greater client loyalty and reduced churn.

- Predictable Revenue: Client stability ensures a reliable income flow for the company.

Experienced Management and Advisor Network

Quilter benefits significantly from its seasoned management team and an extensive network of financial advisors. This deep pool of expertise is crucial for delivering top-tier advice and service, a necessity in the highly regulated financial sector. For instance, as of Q1 2024, Quilter reported a 91% client satisfaction rate among those using their financial advice services, highlighting the impact of this experienced network.

The company’s leadership is well-versed in navigating the complexities of the financial markets and regulatory landscapes. This seasoned approach is a key strength, enabling Quilter to adapt to evolving economic conditions and client needs. The firm's ability to attract and retain top talent in both management and advisory roles directly contributes to its competitive edge.

- Experienced Leadership: Quilter’s management team brings years of industry experience, fostering strategic decision-making.

- Extensive Advisor Network: A wide reach of qualified financial advisors ensures comprehensive client coverage and service.

- High Client Satisfaction: In Q1 2024, 91% of clients utilizing advice services reported high satisfaction, underscoring the network's effectiveness.

- Industry Navigation: The team's expertise aids in successfully managing regulatory changes and market volatility.

Quilter's integrated platform, which combined digital tools with personalized advice, saw its platform assets under management reach £118.1 billion by the end of 2023. This hybrid model appeals to a broad client base, streamlining operations and enhancing the client experience through the synergy of technology and human expertise.

The company's commitment to personalized financial planning fosters exceptionally strong client relationships, a critical factor in wealth management where trust and continuity are paramount. This advisor-led approach cultivates deep client rapport.

These strong client connections directly translate into high retention rates, a key indicator of business stability. For instance, Quilter reported a net client cash flow of £3.1 billion in the first half of 2024, demonstrating significant client loyalty and engagement.

This client stability contributes to predictable, recurring revenue streams, providing a significant advantage in the financial services sector and enabling confident strategic planning and investment.

| Metric | Value | Period |

|---|---|---|

| Platform Assets Under Management | £118.1 billion | End of 2023 |

| Net Client Cash Flow | £3.1 billion | H1 2024 |

| Client Satisfaction (Advice Services) | 91% | Q1 2024 |

What is included in the product

Delivers a strategic overview of Quilter’s internal strengths and weaknesses, alongside external market opportunities and threats.

Offers a clear, structured framework to identify and address strategic weaknesses, turning potential problems into actionable solutions.

Weaknesses

Quilter's significant operational concentration in the United Kingdom and South Africa presents a distinct weakness. This geographic focus means the company is particularly susceptible to economic fluctuations and regulatory shifts within these specific markets. For instance, a slowdown in the UK economy, which represents a substantial portion of Quilter's revenue base, could have a more pronounced negative effect than if its operations were more spread out.

This reliance on a limited number of geographies also potentially hinders its growth trajectory when compared to competitors with a more global footprint. While diversification can introduce complexity, it also opens up broader customer bases and reduces the impact of localized economic downturns.

In 2023, Quilter reported that its UK operations accounted for the vast majority of its assets under management and administration, highlighting this concentration. Adverse regulatory changes in either the UK or South Africa, such as new capital requirements or changes to financial advice regulations, could therefore disproportionately affect Quilter's financial health and strategic flexibility.

The wealth management sector is grappling with significant fee pressure. Intense competition, coupled with stricter regulations and the growing popularity of cost-effective passive investing, is forcing firms to re-evaluate their pricing. This trend directly impacts profitability, and for Quilter, it means a constant challenge to justify its fee structure against lower-cost alternatives.

Margin compression is a tangible consequence of this fee pressure. In 2023, the average management fee in the UK wealth management sector saw a slight decline, with many firms adjusting their models to remain competitive. Quilter, like its peers, must balance the need to offer attractive fees with the imperative to maintain high-quality service and deliver value, a delicate balancing act.

Quilter's brand recognition, while solid in its established markets, may not carry the same global weight as some of the larger, more established financial services giants. This could present a hurdle in attracting new clientele beyond its core demographic or when venturing into unfamiliar international territories.

Directly competing with the brand awareness of these global players necessitates substantial and sustained marketing expenditures. For instance, while Quilter's assets under management were reported at £96.2 billion as of December 31, 2023, a key challenge remains translating this scale into widespread international brand recall comparable to firms with decades of global marketing campaigns.

Technology Investment Needs

Quilter faces a significant weakness in its ongoing need for substantial technology investments to remain competitive. The financial technology sector evolves at a breakneck pace, demanding continuous upgrades to digital platforms, robust cybersecurity measures, and sophisticated data analytics capabilities. This constant need for investment can strain financial resources.

To meet client expectations for seamless digital interaction and efficient operations, Quilter must consistently enhance its technological infrastructure. For instance, in 2023, the wealth management industry saw significant spending on digital transformation initiatives, with many firms allocating over 10% of their revenue to technology upgrades. Failing to keep pace with these industry trends could indeed lead to a considerable competitive disadvantage.

- High ongoing expenditure required for technology modernization.

- Risk of obsolescence if investments lag behind industry advancements.

- Potential impact on profitability due to significant technology outlays.

- Challenges in attracting and retaining clients if digital offerings are subpar.

Regulatory Compliance Burden

Quilter operates within a heavily regulated wealth management landscape, presenting a significant weakness in the form of a substantial regulatory compliance burden. Adhering to ever-changing rules, like the UK's Consumer Duty, requires considerable financial investment and operational strain. For example, in 2023, financial services firms globally spent an estimated $1.3 trillion on compliance, a figure that continues to climb. This ongoing need to adapt to new mandates, such as those concerning data protection and client suitability, diverts resources that could otherwise be used for growth initiatives.

The complexity of these regulations demands constant vigilance and investment in technology and personnel. Failure to comply can lead to severe consequences, including substantial financial penalties and lasting damage to Quilter's reputation. For instance, a major fintech firm faced a £17 million fine in early 2024 for compliance failures related to customer onboarding and anti-money laundering checks. This underscores the critical importance and the inherent risks associated with navigating this intricate regulatory environment.

Key aspects of the regulatory compliance burden include:

- Significant ongoing costs: Resources must be allocated to understand, implement, and monitor new and existing regulations.

- Operational complexity: Evolving compliance requirements necessitate changes to processes, systems, and staff training.

- Risk of penalties: Non-compliance can result in hefty fines and sanctions from regulatory bodies.

- Reputational damage: Breaches of regulation can erode client trust and harm the brand's image.

Quilter's reliance on a concentrated geographic base, primarily the UK and South Africa, exposes it to significant risks from localized economic downturns or adverse regulatory changes. This limited diversification, as evidenced by the substantial portion of its assets under management being UK-based in 2023, hinders its ability to mitigate country-specific impacts compared to more globally diversified competitors.

The wealth management industry faces intense fee pressure, leading to margin compression for firms like Quilter. In 2023, average management fees in the UK wealth sector saw a slight decrease, forcing companies to balance competitive pricing with service quality. Quilter must continually justify its fee structure against lower-cost alternatives, impacting its profitability.

While established in its core markets, Quilter's brand recognition may not match that of larger global financial institutions, potentially limiting its appeal in new territories. For instance, despite £96.2 billion in assets under management as of December 31, 2023, translating this scale into broad international brand recall remains a challenge against competitors with extensive global marketing histories.

The constant need for substantial technology investments to remain competitive presents a significant weakness. The wealth management sector saw considerable spending on digital transformation in 2023, with many firms investing over 10% of revenue in upgrades. Lagging in technological advancements, such as cybersecurity and data analytics, could lead to a considerable competitive disadvantage for Quilter.

Quilter faces a substantial regulatory compliance burden. The industry's evolving rules, such as the UK's Consumer Duty, demand significant financial and operational resources. Global financial services firms spent approximately $1.3 trillion on compliance in 2023, highlighting the cost and complexity Quilter must navigate, with potential penalties for non-compliance, such as a £17 million fine levied on a fintech firm in early 2024 for AML failures.

What You See Is What You Get

Quilter SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a thorough examination of Quilter's Strengths, Weaknesses, Opportunities, and Threats. You can trust that the preview accurately represents the quality and content you will receive. Unlock the complete, actionable insights by completing your purchase.

Opportunities

Quilter has a significant opportunity to expand its digital offerings, providing clients with more flexible and accessible ways to manage their finances. This includes developing advanced online platforms and hybrid advice models that cater to a wider demographic, particularly younger, tech-savvy investors.

By embracing these digital advancements, Quilter can attract new client segments and solidify its position in an increasingly competitive market. For instance, the UK wealth management sector saw a 15% increase in digital adoption for client onboarding in 2023, highlighting a clear trend towards online engagement.

Furthermore, investing in technology can streamline operations, leading to greater efficiency and reduced costs in service delivery. This enhanced operational efficiency can directly translate into improved profitability and a stronger competitive edge in the financial services landscape.

Quilter has a significant opportunity to expand its reach by targeting younger wealth accumulators and tech-savvy investors. As of late 2024, the wealth management sector is increasingly seeing a demand for digital-first solutions and personalized investment strategies from these demographics. By developing user-friendly platforms and offering tailored ESG and sustainable investment options, Quilter can tap into these growing markets and cultivate long-term client relationships.

Furthermore, the ongoing generational wealth transfer presents a compelling avenue for growth. With trillions of dollars expected to change hands in the coming years, Quilter can position itself as a trusted advisor for both the departing and inheriting generations. Adapting its services to cater to the diverse needs and preferences of these evolving client profiles will be crucial for capturing a larger share of this significant market opportunity.

Quilter can capitalize on the ongoing consolidation in wealth management by strategically acquiring smaller advisory firms or innovative technology providers. This approach allows for faster market penetration and access to new client bases. For instance, the wealth management sector saw significant M&A activity in 2023, with deal volumes remaining robust, indicating a fertile ground for such strategic moves.

Forming partnerships with complementary businesses, such as fintech startups offering specialized digital solutions or employee benefits providers, presents another avenue for growth. These collaborations can broaden Quilter's service portfolio and extend its reach into new market segments. For example, a partnership with a fintech firm could enhance Quilter's digital client onboarding process, improving efficiency and client experience.

Such alliances are crucial for gaining access to new markets and acquiring advanced capabilities that might be difficult or time-consuming to develop internally. By leveraging external expertise and client networks, Quilter can accelerate its growth trajectory and strengthen its competitive position in a rapidly evolving financial landscape.

Growth in Retirement Savings Market

The retirement savings market presents a significant opportunity for Quilter, fueled by favorable demographic shifts. An aging global population and increasing life expectancies mean more individuals require robust retirement planning and wealth preservation services. By 2050, the number of people aged 65 and over is projected to reach 1.6 billion, nearly double the 2019 figure, according to the UN. This trend directly benefits companies like Quilter with established expertise in retirement solutions.

Furthermore, the ongoing transition from traditional defined benefit pension schemes to defined contribution plans across many developed economies creates a growing need for personalized retirement advice and investment management. This shift places greater responsibility on individuals to manage their own retirement funds, opening doors for expert guidance and product offerings. For instance, in the UK, auto-enrolment in workplace pensions has significantly increased the pool of individuals actively saving for retirement, with total contributions reaching £115.1 billion in the year to March 2023, up from £107.5 billion the previous year.

- Demographic Tailwinds: An aging global population and increasing longevity are increasing demand for retirement planning and wealth management services.

- Defined Contribution Shift: The move away from defined benefit pensions places more onus on individuals, boosting the need for expert advice and management.

- Market Size: The UK pension market alone is substantial, with significant annual contributions indicating a large addressable market for retirement solutions.

- Quilter's Position: Quilter's established expertise in retirement solutions is well-aligned to capitalize on these growth trends.

Product Innovation

Quilter's product innovation is a significant opportunity, particularly in developing personalized portfolios and specialized ESG funds. For instance, by the end of 2023, ESG assets under management in the UK had reached £59 billion, demonstrating a strong client appetite for responsible investing. This trend is projected to continue growing, with a notable portion of younger investors prioritizing sustainability in their investment choices.

By focusing on these evolving client demands, Quilter can attract new assets and differentiate itself. Innovative solutions can also include access to alternative investments, a segment experiencing growing interest. The company's ability to continuously adapt its product offerings is crucial for maintaining a competitive edge in a dynamic market.

- Personalized Portfolios: Catering to individual client risk appetites and financial goals.

- ESG Funds: Meeting the increasing demand for sustainable and ethical investment options.

- Alternative Investments: Offering access to a broader range of asset classes beyond traditional equities and bonds.

- Digital Integration: Enhancing client experience through seamless digital platforms for product access and management.

Quilter can leverage demographic shifts, particularly the increasing demand for retirement planning driven by an aging population and longer life expectancies. The UN projects the 65+ population to reach 1.6 billion by 2050, presenting a substantial market for Quilter's expertise. Additionally, the ongoing move from defined benefit to defined contribution pension schemes places greater responsibility on individuals for their retirement savings, creating a strong need for personalized advice and investment management, as evidenced by the UK's £115.1 billion in workplace pension contributions for the year ending March 2023.

The firm also has a significant opportunity in product innovation, especially in personalized portfolios and ESG-focused funds, with UK ESG assets under management reaching £59 billion by the end of 2023. This aligns with growing investor preferences for sustainable options. Expanding into alternative investments can further diversify offerings and attract clients seeking broader asset class exposure.

Furthermore, Quilter can capitalize on market consolidation through strategic acquisitions of smaller firms or fintech providers, accelerating market penetration and client base expansion. Partnerships with complementary businesses, such as fintech startups, can enhance service delivery and client experience, as seen in the trend of digital onboarding improvements in wealth management.

Targeting younger wealth accumulators through digital-first solutions and personalized strategies, including ESG options, is another key opportunity. The generational wealth transfer also presents a substantial market, requiring Quilter to adapt its services to cater to the evolving needs of different client segments.

| Opportunity Area | Key Trend | Data Point/Example |

| Demographics & Retirement | Aging population, shift to defined contribution pensions | Global 65+ population to reach 1.6 billion by 2050 (UN); UK pension contributions £115.1bn (year to March 2023) |

| Product Innovation | Demand for personalized portfolios, ESG, alternative investments | UK ESG AUM £59bn (end of 2023) |

| Market Expansion | Wealth transfer, digital adoption, M&A activity | 15% increase in digital client onboarding (UK wealth management, 2023) |

Threats

The wealth management sector Quilter operates in is incredibly crowded. Established players like major banks, alongside a growing number of independent financial advisors and nimble fintech firms, are all competing for the same clients. Global asset managers also add to this pressure, intensifying the fight for market share.

This fierce competition directly impacts Quilter by creating downward pressure on fees, which can squeeze profit margins. Furthermore, acquiring new clients and keeping existing ones requires significant investment in marketing and client services, driving up operational costs. For instance, industry reports from late 2024 indicate that client acquisition costs in wealth management have risen by an average of 15% year-on-year.

The emergence of new companies with innovative, often digital-first, business models presents a significant threat. These disruptors can offer more streamlined services or lower costs, potentially luring clients away from traditional providers like Quilter. Keeping pace with technological advancements and evolving client expectations is crucial to remain competitive.

Quilter's financial performance is intrinsically linked to the broader economic climate, with its revenue directly influenced by the value of its assets under management (AUM). Economic volatility and market downturns pose a significant threat, as a decline in asset values directly translates to lower management fees, impacting overall profitability. For instance, during periods of market stress, such as the anticipated slowdowns in 2024 and potential global recessions in 2025, Quilter's AUM could contract considerably.

This susceptibility is amplified by the fact that prolonged market declines can erode client confidence, potentially leading to reduced new asset inflows. Economic uncertainty often makes investors more risk-averse, causing them to pull back from investment markets or shift to lower-fee products, further squeezing Quilter's revenue streams.

The financial services sector is inherently dynamic, with regulations constantly shifting. For Quilter, this means a persistent need to adapt, which can translate into substantial costs and operational overhauls. For instance, the Financial Conduct Authority (FCA) in the UK, where Quilter is a major player, frequently updates its rulebook, impacting everything from product disclosure to advice standards.

New rules, especially those focusing on enhanced consumer protection, greater transparency in fees, and robust data security, necessitate continuous investment in compliance technology and personnel. This isn't a one-off expense but an ongoing commitment. In 2024, the industry saw increased scrutiny on digital assets and ESG reporting, areas where Quilter must ensure its systems and practices remain compliant.

Quilter's ability to swiftly integrate these regulatory changes is critical. Delays or non-compliance can lead to significant financial penalties and, perhaps more damagingly, erode customer trust and brand reputation. For example, a failure to meet stringent data protection standards like GDPR could result in substantial fines and a loss of client confidence, impacting future business growth.

Cybersecurity Risks and Data Breaches

Quilter, as a custodian of sensitive client information, confronts an ever-present and growing threat from cyberattacks and data breaches. The financial sector, in general, saw a 20% increase in reported cyber incidents in 2023 compared to the previous year, highlighting the intensifying landscape.

A successful breach could result in substantial financial penalties, potentially impacting profitability, alongside severe damage to Quilter's reputation and a critical loss of client confidence. For instance, a major financial services firm in 2024 faced over $50 million in costs following a significant data leak.

While continuous investment in advanced cybersecurity defenses is essential, the nature of these threats is constantly evolving, necessitating ongoing adaptation and vigilance. The average cost of a data breach in the financial services sector reached $5.90 million in 2023.

- Escalating Threat Landscape: Financial institutions like Quilter are prime targets for increasingly sophisticated cyber threats.

- Financial and Reputational Impact: Breaches can lead to direct financial losses and severe damage to client trust and brand image.

- Evolving Defense Needs: Continuous investment in cutting-edge cybersecurity is crucial to counter dynamic threat patterns.

- Industry Averages: The financial sector faces significant financial repercussions from data breaches, underscoring the urgency of robust security measures.

Talent Attrition and Advisor Shortage

The wealth management sector faces a significant challenge with talent attrition and a notable advisor shortage. Demand for skilled financial advisors remains robust, making it difficult to attract and keep the best people. For instance, in the UK, the Financial Conduct Authority (FCA) reported that the number of financial advisers providing investment advice fell by 4% between 2022 and 2023, highlighting a shrinking talent pool.

Competitors actively recruit experienced advisors, which can result in client losses and escalate recruitment expenses for firms like Quilter. This poaching trend directly impacts service continuity and client relationships.

Furthermore, a scarcity of qualified advisors can directly constrain Quilter's ability to expand its services and take on new clients. This limitation could hinder strategic growth initiatives and impact overall service delivery capacity.

Key implications of this threat include:

- Increased recruitment costs due to competitive hiring market.

- Risk of client loss when advisors depart.

- Reduced capacity for new business and service expansion.

- Potential impact on service quality if advisor workload increases due to shortages.

Intense competition from established players and agile fintech firms exerts downward pressure on Quilter's fees and necessitates significant investment in client acquisition, driving up operational costs. Disruptive business models and evolving client expectations further challenge market position, while economic downturns directly impact assets under management, reducing fee income and client confidence.

SWOT Analysis Data Sources

This Quilter SWOT analysis is built upon robust data, encompassing Quilter's official financial statements, comprehensive market research reports, and insights from industry analysts and experts. This multi-faceted approach ensures a well-rounded and accurate assessment of the company's strategic position.