Quilter Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Quilter Bundle

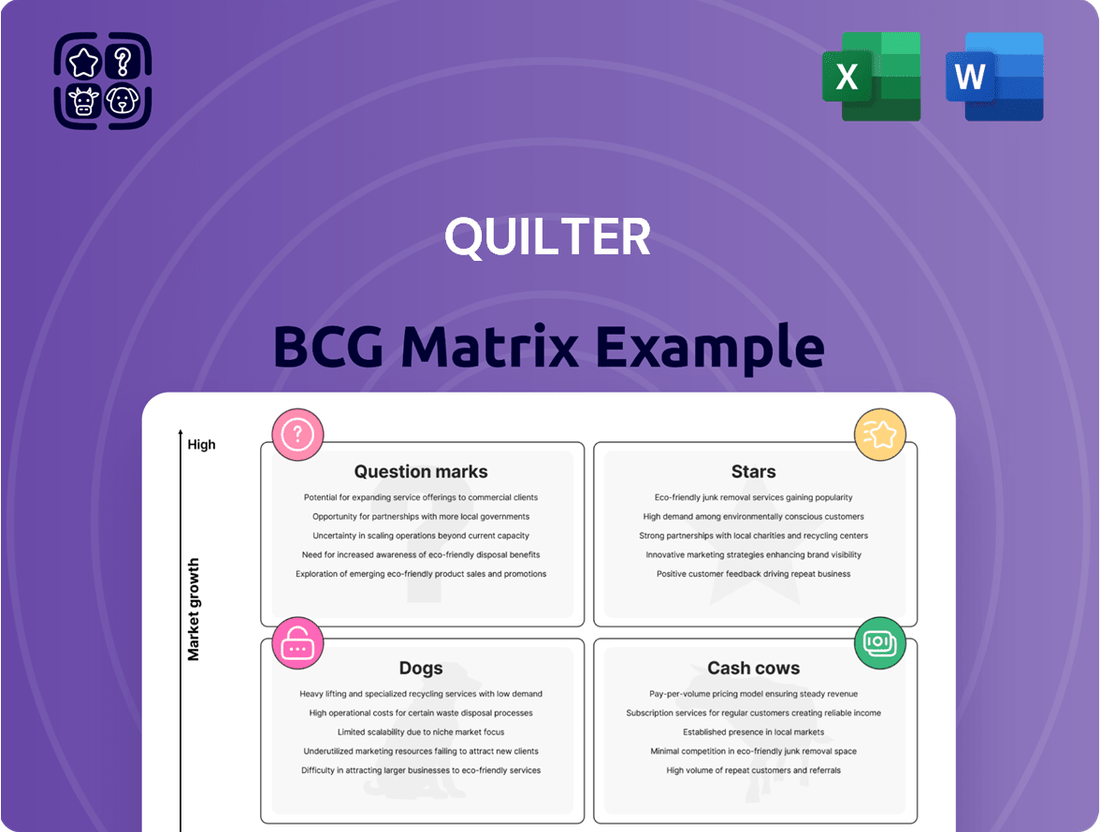

Uncover the strategic heart of this company's product portfolio with a glimpse into its BCG Matrix. See how its offerings are positioned as Stars, Cash Cows, Dogs, or Question Marks, and understand the growth potential and market share of each. This preview offers a foundational understanding, but to truly unlock actionable strategies and make informed investment decisions, you need the complete picture. Purchase the full BCG Matrix report for detailed quadrant analysis, data-driven recommendations, and a clear roadmap to optimize your business's future success.

Stars

Quilter's Investment Platform, a key player within the IFA channel, demonstrated robust expansion in 2024. Gross inflows surged by an impressive 68% to reach £8.8 billion, complemented by net inflows totaling £3.0 billion.

This performance firmly positions Quilter as the UK's preeminent and most rapidly expanding retail advised platform provider when compared to its larger competitors. Such a standing highlights its substantial market share within a thriving segment of the wealth management industry.

The sustained strong inflow momentum, notably observed in the fourth quarter of 2024 and extending into the first quarter of 2025, signals persistent high demand and widespread market acceptance for Quilter's offerings.

WealthSelect Managed Portfolio Service (MPS), a key offering from Quilter, stands out as a strong contender within the Investment Management sector, aligning with the stars quadrant of a BCG Matrix due to its high growth and high market share. By the close of 2024, WealthSelect had achieved an impressive £18 billion in assets under management (AuM). This substantial growth reflects the increasing adoption of outsourced investment solutions like Direct-to-consumer (DTC) and MPS by both investors and financial advisors.

The significant AuM for WealthSelect underscores its dominant position in a rapidly expanding market segment. This expansion is fueled by a broader industry trend where more investors are opting for managed portfolio services, recognizing the benefits of professional management and diversification. Quilter's platform assets are increasingly being allocated to these outsourced models, highlighting WealthSelect's success in capturing a substantial portion of this growing demand.

Quilter's High Net Worth segment, anchored by Quilter Cheviot's discretionary fund management, has shown impressive new business flows and profit growth. This segment is a cornerstone for the company, leveraging integrated advice and investment management to maintain a strong market standing.

The segment's resilience is highlighted by its ability to achieve substantial net inflows, even while navigating asset adjustments in anticipation of tax reforms. This demonstrates a solid and expanding footprint within the affluent and high-net-worth demographics.

For the fiscal year 2024, Quilter Cheviot reported significant contributions to the group's overall performance, with net inflows reaching £2.5 billion. This performance underscores the segment's vital role in driving Quilter's revenue and market share in the wealth management sector.

Digital Transformation Initiatives

Quilter's digital transformation is a core pillar of its strategy, with significant investment in technology to bolster its direct-to-consumer (D2C) offerings. This initiative is designed to streamline operations and improve the client experience, anticipating a market shift towards digital engagement. By prioritizing these upgrades, Quilter aims to solidify its competitive position and drive future growth.

A key move in this digital push was the acquisition of NuWealth in September 2024. This acquisition is specifically intended to accelerate Quilter's digital capabilities and enhance its overall value proposition to clients and advisers. The integration of NuWealth’s technology is expected to modernize processes and reduce complexity within Quilter’s operations.

The strategic focus on digital and D2C capabilities positions Quilter to capitalize on high-growth opportunities. As the financial services market increasingly favors digital solutions and improved client journeys, these investments are crucial for capturing market share. This forward-looking approach demonstrates a commitment to adapting to evolving consumer preferences and technological advancements.

- Digital Transformation Acceleration: Quilter's acquisition of NuWealth in September 2024 is a significant step to speed up its digital capabilities.

- Enhanced Proposition: The strategic investment aims to improve Quilter's offerings, particularly in online direct-to-consumer (D2C) channels.

- Market Positioning: This focus on technology and D2C is designed to position Quilter for high growth in an increasingly digital financial services landscape.

- Modernization and Efficiency: The initiative prioritizes modernizing processes and removing complexity to improve client experience and operational efficiency.

Strategic Expansion through Quilter Partners

Strategic Expansion through Quilter Partners represents a key growth initiative for Quilter, aiming to leverage external relationships to boost distribution. The onboarding of nine firms since the program's 2023 inception demonstrates a tangible commitment to this strategy.

This initiative is designed to foster deeper connections with established financial advisers and capture a greater share of new business. In an expanding market, this approach positions Quilter for significant growth by tapping into the expertise and client bases of its partner firms.

- Quilter Partners onboards nine firms since 2023 launch.

- Initiative targets deeper adviser relationships and increased market share.

- Program signifies a high-growth strategy within an expanding market.

- Collaboration extends Quilter's reach and accelerates asset gathering through external networks.

WealthSelect Managed Portfolio Service (MPS) is a prime example of a star within Quilter's BCG Matrix. Its substantial £18 billion in assets under management by the end of 2024 signifies high market share. This, coupled with the increasing investor preference for outsourced investment solutions, points to a high-growth market segment where WealthSelect is a leading product.

Quilter's overall platform also exhibits star-like qualities, with gross inflows reaching £8.8 billion in 2024, a 68% increase. This strong performance, particularly the sustained momentum into early 2025, indicates rapid growth and a dominant position within the UK retail advised platform market.

The company's strategic focus on digital transformation and the acquisition of NuWealth in September 2024 further solidify its star status. These moves are designed to capture high-growth opportunities in an increasingly digital financial services landscape, enhancing Quilter's competitive edge.

Quilter Cheviot, representing the High Net Worth segment, also demonstrates characteristics of a star. With net inflows of £2.5 billion in 2024 and consistent profit growth, it shows both strong market share and operates within a segment experiencing significant demand.

| Segment | BCG Classification | Key Metrics (2024) | Growth Indicator | Market Share Indicator |

| WealthSelect MPS | Star | £18bn AuM | Growing demand for outsourced solutions | Dominant position in a key segment |

| Quilter Platform | Star | £8.8bn gross inflows (+68%) | Rapidly expanding retail advised market | Preeminent UK provider |

| Quilter Cheviot (HNW) | Star | £2.5bn net inflows | Strong demand from affluent demographics | Solid and expanding footprint |

| Digital/D2C Initiatives | Star (Emerging) | NuWealth acquisition (Sep 2024) | Shift towards digital financial services | Strategic positioning for future market share |

What is included in the product

Strategic overview of Quilter's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

Eliminate strategic paralysis by clearly visualizing your portfolio's performance.

Cash Cows

Quilter Financial Planning, a cornerstone of the Affluent segment, represents a significant and steady revenue generator for Quilter. Its established financial advice services operate in a mature market, ensuring consistent cash flow.

This stability comes with a lower investment requirement for growth compared to emerging business lines. The strategy centers on nurturing existing client relationships and capitalizing on the extensive adviser network already in place.

In 2024, Quilter's financial planning segment continued to be a primary driver of recurring revenue. The company reported approximately £1.6 billion in assets under management within its financial planning services by the end of the first half of 2024, highlighting the scale of its established operations.

The Quilter Investment Platform, particularly its internal Quilter channel, stands as a robust cash cow for the company. This segment consistently generates substantial gross and net inflows, playing a vital role in the growth of Quilter's Assets under Management and Administration (AuMA).

This channel benefits from a dedicated base of restricted advisers and a mature operational infrastructure. This established foundation ensures a reliable stream of recurring fee income, a hallmark of a cash cow, contributing significantly to Quilter's overall profitability and cash generation capabilities.

While its growth rate may not match that of the Independent Financial Adviser (IFA) channel, the Quilter channel's significant market share within the Quilter adviser network guarantees sustained and predictable earnings. For example, in 2024, the platform saw continued strong inflows, reinforcing its position as a stable revenue generator.

Quilter Investors' Cirilium brand of multi-asset investment solutions serves as a cornerstone of their business, attracting and retaining significant client assets. These established fund-of-funds offerings are a consistent source of management fee income, reflecting their enduring appeal and broad client adoption. As of the first quarter of 2024, Quilter Investors reported that their multi-asset solutions, including those under the Cirilium banner, continued to be a primary driver of revenue, even as they navigated evolving market dynamics and client preferences.

Traditional Discretionary Fund Management (DFM)

Quilter Cheviot's traditional discretionary fund management (DFM) services are a cornerstone of their business, acting as a classic Cash Cow within the BCG framework. These offerings are geared towards established clients with substantial assets, providing a steady stream of recurring fee income. The emphasis here is on client retention and efficient management rather than aggressive expansion, reflecting the maturity of this segment.

In 2024, Quilter Cheviot continued to leverage its strong reputation in traditional DFM. The firm managed significant assets within this segment, contributing robustly to overall revenue. This stability allows for consistent profitability, funding investment in other areas of the business.

Key characteristics of this Cash Cow include:

- Mature Market Position: Deeply entrenched client relationships and a well-established service offering.

- Stable Fee Income: Generates predictable revenue through ongoing management fees on substantial assets under management.

- Focus on Retention: Strategies prioritize client satisfaction and loyalty to maintain existing asset levels.

- Lower Growth Investment: Requires less capital outlay for growth compared to Stars or Question Marks, maximizing cash generation.

Operating Margin and Cost Discipline

Quilter's operating margin saw a significant boost, reaching 29% in 2024. This upward trend highlights the company's adeptness at managing its existing, profitable business lines effectively. A steadfast commitment to cost discipline is central to this performance, ensuring that operational expenses are kept in check. This efficiency is the bedrock of strong cash generation, providing the necessary resources for future investments and shareholder returns.

The company's strategic simplification program has been a key driver of enhanced profitability. By the close of 2024, this initiative successfully delivered £35 million in savings. These cost reductions directly bolster the cash-generating capabilities of Quilter's core activities, creating a more robust financial foundation.

- Operating Margin: Reached 29% in 2024.

- Cost Discipline: Continual focus on efficiency in core operations.

- Simplification Program: Achieved £35 million in savings by end-2024.

- Cash Generation: Strong performance from existing business lines.

Cash Cows within Quilter's portfolio, such as its Financial Planning services and the Quilter Investment Platform's internal channel, are characterized by their mature market positions and consistent revenue generation. These segments benefit from established client bases and operational efficiencies, leading to stable fee income and strong cash flow.

In 2024, Quilter's operating margin reached an impressive 29%, a testament to the effective management of these profitable core businesses. This strong performance is further supported by the company's strategic simplification program, which yielded £35 million in savings by the end of the year, directly enhancing cash generation from existing operations.

The Quilter Investors' Cirilium brand and Quilter Cheviot's discretionary fund management services also exemplify Cash Cow characteristics, providing predictable recurring income through management fees on substantial assets. These segments require lower growth investment, thus maximizing their cash-generating potential.

| Segment | BCG Category | 2024 Data/Insight | Key Characteristic |

|---|---|---|---|

| Quilter Financial Planning | Cash Cow | £1.6 billion AuM (H1 2024) | Mature market, steady revenue |

| Quilter Investment Platform (Internal Channel) | Cash Cow | Strong gross and net inflows | Reliable recurring fee income |

| Quilter Investors (Cirilium) | Cash Cow | Primary revenue driver (Q1 2024) | Consistent management fee income |

| Quilter Cheviot (DFM) | Cash Cow | Significant assets managed | Steady, recurring fee income |

What You’re Viewing Is Included

Quilter BCG Matrix

The Quilter BCG Matrix you're previewing is the complete, unaltered document you'll receive immediately after purchase. This means you get the fully formatted analysis, ready for strategic application, without any watermarks or demo elements. It's designed for immediate use in your business planning and decision-making processes.

Dogs

Certain Quilter Investors funds, including the Global Unconstrained Equity and Precious Metals Equity, were flagged in 2024 due to persistent underperformance over a five-year span. These legacy funds, despite some management changes, often hold a small market share and struggle to attract new capital, limiting their growth potential.

The continued underperformance of these funds means capital remains deployed without generating robust returns, highlighting their position as potential candidates for restructuring or divestment if performance improvements are not consistently achieved.

The review of historical advice practices within Quilter's network, which resulted in a £76 million provision for client remediation, highlights significant issues with outdated advisory service models. These legacy approaches may struggle to meet current regulatory demands, leading to increased operational expenses and a potential for client dissatisfaction or departures. This situation indicates that these older models are likely in the "Question Marks" category of the BCG matrix, requiring substantial investment to modernize and align with contemporary financial advice standards, with the success of such a turnaround remaining uncertain.

Quilter's financial reporting clearly separates 'core' and 'non-core' assets, with the latter experiencing net outflows. This distinction highlights a strategic shift, as these non-core segments, likely legacy products or businesses no longer central to the company's vision, are being managed for a gradual decline.

These non-core areas typically exhibit characteristics of low growth potential and diminishing market share. For instance, in the first half of 2024, Quilter reported that net outflows from non-core assets were £0.7 billion. This figure underscores the resource allocation challenge, as these segments consume capital without offering significant contributions to the company's future expansion.

Advisory-based Investment Management

Advisory-based investment management on Quilter's platform has seen a notable contraction, now representing only 15.8% of total platform assets. This marks a significant drop from its position in 2020, with outsourced investment solutions experiencing a corresponding growth. This shift suggests a diminishing market share for traditional advisory-managed portfolios as clients increasingly favor model portfolio services.

The continued decline in advisory-based assets poses a potential risk of these services becoming a niche offering. As client preferences evolve towards more automated and outsourced investment solutions, the profitability of this segment may be further impacted.

- Declining Market Share: Advisory-managed assets represent 15.8% of Quilter's platform assets, down from prior years.

- Growth in Outsourced Investments: This contrasts with the increasing popularity of outsourced and model portfolio services.

- Profitability Concerns: A continued trend could reduce the profitability of traditional advisory services.

- Client Preference Shift: The data indicates a move towards automated and outsourced investment solutions.

Segments with High Outflow Pressure

Even with robust overall net inflows, some business segments might face significant outflow pressure. This can happen when specific products or services experience more customer departures than new acquisitions, even if they attract some new business. For instance, in the asset management industry, a particular fund category might see substantial redemptions due to underperformance or a shift in investor sentiment towards alternative asset classes.

These segments, despite their gross inflows, become net negative contributors. This situation signals a shrinking market share within a competitive landscape. For example, if a company's traditional annuity products are seeing significant outflows as clients move to newer, more flexible investment vehicles, that segment could be classified as having high outflow pressure.

- High Outflow Pressure Segments: Areas experiencing more customer departures than new acquisitions.

- Net Negative Contribution: Outflows exceeding gross inflows, leading to a decline in the segment's value.

- Competitive Dynamics: Shifting client preferences and new market entrants can exacerbate outflows.

- Market Share Decline: These segments often indicate a weakening position in a challenging environment.

Dogs in the BCG matrix represent business units or products with low market share and low growth. For Quilter, these are likely legacy products or services that are no longer strategically important and are being managed for a gradual decline, as evidenced by net outflows from non-core assets. These segments consume resources without offering significant future expansion potential, indicating a shrinking market position within a competitive landscape.

The advisory-based investment management segment on Quilter's platform, now at 15.8% of total assets, down from previous years, exemplifies a Dog. This decline, coupled with client preference shifts towards outsourced solutions, suggests a diminishing market share and potential profitability concerns for these traditional advisory services.

The continued underperformance of certain legacy funds, like the Global Unconstrained Equity and Precious Metals Equity, also points to their Dog status. These funds struggle with low market share and limited growth potential, despite management changes, leading to capital being deployed without robust returns.

| Quilter Segment | Market Share (Growth) | Market Growth | BCG Classification | Recent Data Point (H1 2024) |

|---|---|---|---|---|

| Advisory-based Investment Management | Low (Declining) | Low | Dog | Represents 15.8% of platform assets |

| Legacy Funds (e.g., Global Unconstrained Equity) | Low | Low | Dog | Persistent underperformance over five years |

| Non-Core Assets | Low (Declining) | Low | Dog | £0.7 billion net outflows |

Question Marks

Quilter’s acquisition of NuWealth in September 2024 signals a strategic pivot to bolster its direct-to-consumer (D2C) digital wealth capabilities. This move targets a high-growth segment where Quilter's existing market penetration may be relatively nascent.

The D2C digital wealth market, projected to see substantial growth through 2025, demands significant investment to build scalable platforms and user experiences that can effectively compete. Quilter's investment here reflects an anticipation of considerable returns if they can capture meaningful market share.

By integrating NuWealth's digital infrastructure, Quilter aims to enhance its offering in this crucial area, potentially moving it towards a 'Star' quadrant in the BCG matrix if rapid D2C client acquisition and revenue growth are realized.

Quilter might be testing the waters with new services targeting specific client groups that are currently overlooked or represent growing wealth pools. For instance, they could be developing tailored investment solutions for digital nomads or focusing on sustainable investing options for younger, environmentally conscious investors. These are typically high-growth areas where Quilter's current market share is still developing.

The key to success for these niche initiatives hinges on precisely understanding what these specific client segments need and then developing products that perfectly meet those demands. Effective marketing campaigns that resonate with these groups are also crucial. For example, if Quilter were to target the burgeoning fintech entrepreneur market, their outreach would need to highlight specialized services that cater to the unique financial complexities of this industry.

By 2024, the global wealth management market for high-net-worth individuals was estimated to be over $30 trillion, with significant growth projected in emerging markets and among younger generations of wealth holders. Quilter's strategic expansion into niche segments would aim to capture a slice of this expanding pie by offering specialized advisory and investment products that traditional broad-market approaches might miss.

Quilter is actively investing in new technology and platform enhancements to offer more features and a broader product selection. This aligns with the booming market for sophisticated digital tools in wealth management, a sector experiencing high growth. For example, in 2024, the wealth management technology market was valued at over $10 billion globally, with digital solutions driving much of that growth.

While these investments are vital for maintaining a competitive edge, their immediate impact on market share might be modest as clients gradually adopt the new capabilities. These development and implementation efforts require substantial cash outlays upfront, meaning they are likely to be cash consumers in the short term before generating significant returns.

International Expansion Beyond Core Markets (e.g., South Africa Growth)

Expanding beyond its core UK market, Quilter's strategic moves into or deeper within South Africa, or other international regions, could be classified as Question Marks. These markets often present attractive growth prospects, but Quilter might currently hold a smaller market share or encounter distinct operational hurdles compared to its established UK presence.

For instance, while Quilter has a significant presence in South Africa, further deepening its penetration or introducing new services there could be considered a Question Mark. This strategic direction necessitates a thorough understanding of local market dynamics and regulatory frameworks, which can differ significantly from the UK. Success hinges on effectively navigating these new environments.

- High Growth Potential: Emerging markets, including parts of Africa, often exhibit higher GDP growth rates than mature economies, offering substantial opportunities for wealth management firms like Quilter.

- Market Share Uncertainty: While Quilter has a presence in South Africa, its market share in specific segments or potential new territories might be relatively low, indicating a need for investment and strategic effort to gain traction.

- Regulatory and Competitive Landscape: International expansion requires adaptation to diverse regulatory requirements and competition from established local players, posing potential challenges.

- Strategic Investment Required: Moving these operations from Question Mark to Star status typically involves significant investment in marketing, talent, and product development to capture market share.

Relaunch of Financial Adviser Academy

Quilter's relaunch of its Financial Adviser Academy signals a strategic commitment to expanding and enhancing its network of financial professionals. This investment is pivotal for securing future revenue streams, as a robust adviser base directly influences asset inflows. In 2024, the company continued to focus on adviser development as a core growth driver, recognizing that a skilled workforce is essential for navigating evolving market complexities.

The academy targets a high-growth segment within financial services by addressing the increasing demand for qualified financial planners. While the immediate impact on market share may be gradual, as new advisers establish their client bases, the long-term benefits are substantial. For instance, Quilter reported that advisers completing their development programs often exhibit higher client retention rates and greater average assets under advice within their first three years.

This initiative requires consistent investment to nurture a pipeline of effective advisers capable of generating future business. Quilter's approach aligns with industry trends where firms are prioritizing talent development to maintain a competitive edge. In the UK, the demand for financial advice is projected to grow, with an estimated £1.3 trillion in wealth expected to transfer between generations in the next decade, underscoring the need for a well-equipped advisory force.

- Strategic Investment: The Financial Adviser Academy relaunch demonstrates Quilter's commitment to its adviser network, vital for future asset inflows.

- Addressing Skill Gaps: The program focuses on developing skilled financial planners, a segment experiencing significant demand.

- Long-Term Growth Focus: While immediate market share impact may be limited, the academy builds a foundation for sustained business growth.

- Industry Relevance: Quilter's initiative addresses the critical need for talent in a growing financial advice market, particularly in light of intergenerational wealth transfer.

Quilter's expansion into new international markets, such as deeper penetration in South Africa or entry into other regions, can be viewed as Question Marks in the BCG matrix. These ventures offer considerable growth potential, mirroring the high GDP growth rates seen in many emerging economies, but they also carry significant market share uncertainty for Quilter.

Navigating these markets requires substantial strategic investment to overcome regulatory hurdles and competition from established local entities. Success in these Question Mark areas hinges on Quilter's ability to effectively adapt its offerings and marketing to diverse local dynamics, aiming to transition these ventures into Stars with sustained effort and capital allocation.

For instance, while Quilter has a presence in South Africa, further market deepening presents a classic Question Mark scenario. The company must understand and adapt to distinct local regulatory frameworks and competitive landscapes, which differ from its primary UK market. This necessitates tailored investment in marketing and local expertise to gain meaningful traction.

In 2024, emerging market wealth management was a key focus for growth, with many regions showing double-digit percentage increases in investable assets, presenting a clear opportunity for Quilter's international initiatives.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial disclosures, industry growth forecasts, and competitor analysis to provide a clear strategic overview.