Quilter Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Quilter Bundle

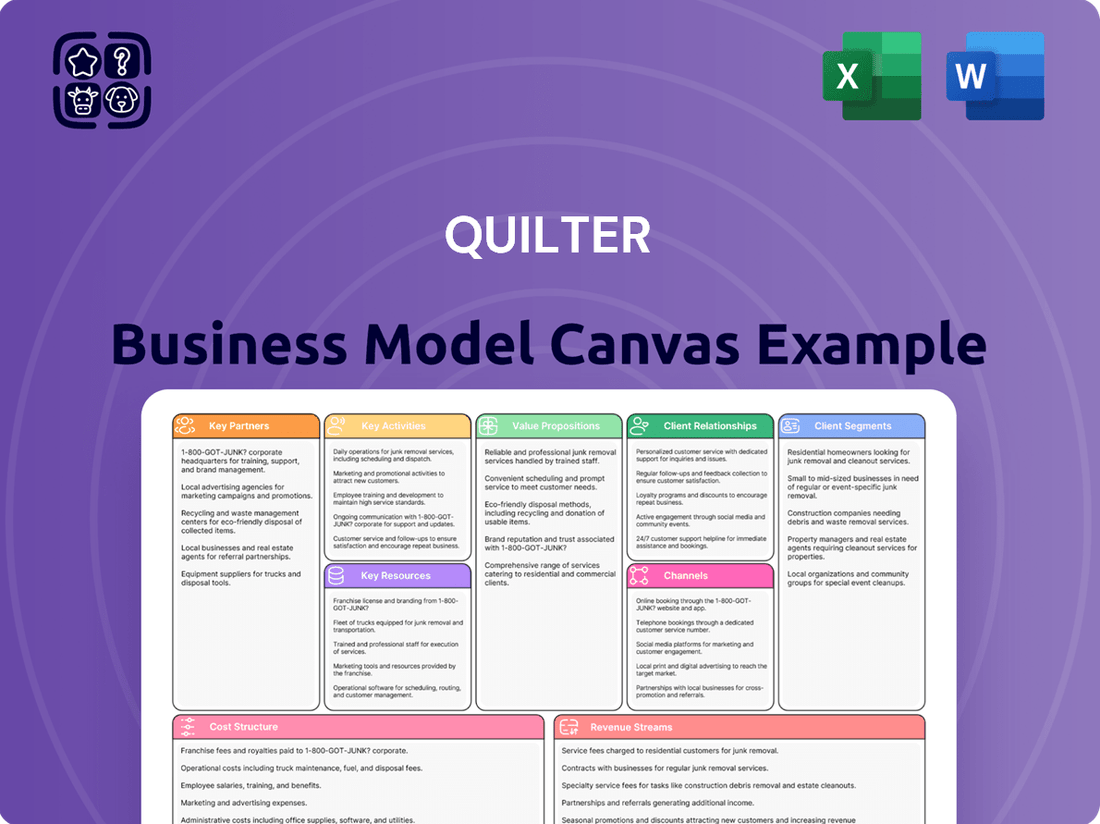

Curious about the engine driving Quilter's success? Our Business Model Canvas unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap of their strategic approach. Understand how they deliver value and maintain a competitive edge in the financial services sector.

Want to dissect Quilter's winning formula? This comprehensive Business Model Canvas details their core activities, cost structure, and channels, providing a powerful framework for analysis. Unlock these insights to elevate your own strategic planning.

See the strategic blueprint behind Quilter’s operations. This Business Model Canvas illuminates their customer segments, value propositions, and key partnerships, offering a deep dive into their operational model. Download the full version to gain a competitive advantage.

Partnerships

Quilter's strategic alliances with financial advisers form the bedrock of its distribution strategy. The company works closely with a broad network of independent financial advisers (IFAs), alongside its own dedicated team at Quilter Financial Planning. These collaborations are instrumental in making Quilter's diverse product range and comprehensive services available to a wider client base.

This dual-channel approach is key to Quilter's market penetration. By engaging both external IFAs and its internal adviser network, the company effectively broadens its reach and drives significant net inflows onto its platform. In 2023, Quilter reported total assets under management and administration of £117.4 billion, a testament to the success of these vital partnerships in expanding their market presence.

Quilter's success heavily relies on its partnerships with technology and platform providers. Collaborations with entities like FNZ are crucial for developing and maintaining a cutting-edge investment platform. These partnerships ensure Quilter can offer a seamless digital experience, which is vital for both financial advisers and their clients, facilitating efficient investment management and service delivery. For instance, in 2023, Quilter continued its investment in its digital capabilities, aiming to enhance user experience and operational efficiency across its platforms.

Quilter's engagement with regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, is crucial for maintaining operational integrity and client trust. This ongoing partnership ensures adherence to evolving financial regulations and industry best practices. In 2024, the FCA continued its focus on consumer protection and market integrity, making proactive engagement a necessity for firms like Quilter.

Participation in industry associations allows Quilter to actively contribute to shaping the future of wealth management. These collaborations provide valuable insights into emerging market trends and policy discussions, enabling Quilter to navigate the complex regulatory environments in its key markets, including the UK and South Africa. Such involvement helps Quilter anticipate and adapt to changes that could impact its business model and client services.

Investment Solution Providers

Quilter collaborates with numerous fund managers and investment solution providers. This allows them to present a wide array of multi-asset investment solutions and discretionary fund management. For instance, Quilter offers its Cirilium Active range and WealthSelect, providing clients and their advisors with a broader selection of options to match varying risk preferences and financial goals.

These partnerships are crucial for expanding Quilter's product shelf. By integrating external expertise, Quilter can provide sophisticated investment strategies that might be beyond its in-house capabilities alone. This synergy ensures clients benefit from a comprehensive suite of investment products designed to meet diverse needs.

- Diverse Product Offering: Partnerships enable Quilter to offer a broad spectrum of investment solutions, including multi-asset funds and discretionary management.

- Client Choice: This collaboration directly benefits clients and their advisors by increasing the variety of investment options available.

- Catering to Needs: Solutions like Cirilium Active and WealthSelect are designed to accommodate different client risk appetites and financial objectives.

- Market Competitiveness: By leveraging external fund management expertise, Quilter remains competitive in the market for investment services.

Marketing and Brand Partnerships

Quilter actively pursues marketing and brand partnerships to amplify its reach and solidify its market position. A prime example is their title sponsorship of the Quilter Nations Series, scheduled for November 2025. These collaborations are instrumental in boosting brand visibility and enhancing reputation, allowing Quilter to connect with a broader demographic and strengthen its presence in crucial markets.

These strategic alliances are designed to foster connections with a wider community by aligning with shared values and interests. By associating with prominent events and initiatives, Quilter aims to resonate with potential clients on a deeper level.

- Brand Visibility: Partnerships like the Quilter Nations Series directly increase brand awareness among targeted audiences.

- Reputation Enhancement: Association with respected events or organizations can bolster Quilter's credibility and trustworthiness.

- Market Penetration: These collaborations provide access to new customer segments and reinforce presence in existing markets.

- Shared Values: Aligning with entities that reflect Quilter's core values helps in building authentic connections with the community.

Quilter's Key Partnerships are crucial for its business model, enabling it to reach a wider client base through financial advisers and enhance its service offerings with technology providers. These collaborations are vital for operational efficiency and market penetration.

The company's strategic alliances extend to fund managers, providing diverse investment solutions, and to marketing initiatives that boost brand visibility. In 2023, Quilter reported £117.4 billion in assets under management, highlighting the success of these partnerships.

Furthermore, engagement with regulatory bodies and industry associations ensures compliance and shapes future industry practices, demonstrating a commitment to a robust and adaptable business framework. In 2024, regulatory focus on consumer protection underscored the importance of these relationships.

What is included in the product

A structured framework detailing Quilter's approach to client acquisition, service delivery, and revenue generation.

It outlines key partnerships, activities, resources, cost structure, and revenue streams essential to Quilter's financial advice business.

Addresses the pain of undefined strategies by providing a structured framework to visualize and refine business components.

Eases the confusion of complex operations by offering a clear, one-page overview of key business relationships and activities.

Activities

Quilter's core activities revolve around delivering comprehensive financial planning and advice. This encompasses understanding client needs, crafting personalized financial strategies, and offering continuous support to help them reach their financial goals. This vital service is provided through both Quilter's directly employed advisers and its extensive network of appointed representatives.

In 2024, Quilter continued to focus on enhancing its advice proposition. The company reported that its platform supported £111.1 billion in assets under management and administration as of the end of the first quarter of 2024, a significant portion of which is driven by the financial advice provided to a broad client base.

Quilter's investment platform is the backbone of its operations, enabling advisers to manage client portfolios efficiently. This involves constant upgrades to its technology, ensuring a secure and user-friendly environment for all stakeholders. In 2024, Quilter continued to invest in platform enhancements, aiming to streamline processes and improve the digital experience for its 4.1 million customer accounts.

The platform's key activity is the seamless processing of a vast number of transactions daily, supporting a diverse range of investment products. This operational efficiency is crucial for maintaining client trust and adviser satisfaction. The platform's robustness directly impacts Quilter's ability to deliver its wealth management services effectively.

Quilter actively cultivates and oversees a diverse array of multi-asset investment solutions. This encompasses its own branded offerings, such as Quilter Investors, and specialist discretionary fund management services, exemplified by Quilter Cheviot. These activities are crucial for meeting varied client needs.

The development and management process involves rigorous research, meticulous portfolio construction, and continuous oversight. The aim is to achieve competitive financial returns and ensure alignment with individual client risk appetites and objectives, a cornerstone of effective investment management.

In 2024, Quilter Investors continued to focus on providing accessible, well-diversified investment solutions. These products are designed to simplify investment for a broad client base, reflecting the company's commitment to democratizing investment management and making sophisticated strategies available to more people.

Client Relationship Management and Servicing

Quilter's key activities in client relationship management revolve around building and nurturing lasting connections. This involves offering personalized advice and proactive support at every stage of a client's financial life, aiming to foster trust and loyalty.

Maintaining high client satisfaction is paramount. Quilter achieves this through consistent communication, timely resolution of queries, and regular performance reviews. For instance, in 2024, their focus on client retention contributed to a significant portion of their recurring revenue streams.

The company's commitment to a customer-centric model is evident in its service delivery. This includes leveraging technology for efficient client interactions and ensuring advisors are equipped to provide tailored solutions.

- Personalized Financial Guidance: Providing tailored advice to meet individual client needs.

- Proactive Communication: Regular updates and check-ins to maintain engagement.

- Efficient Query Resolution: Swift and effective handling of client inquiries.

- Client Retention Focus: Strategies aimed at ensuring long-term client satisfaction and loyalty.

Regulatory Compliance and Risk Management

Ensuring strict adherence to financial regulations and managing associated risks is a critical ongoing activity for Quilter. This involves continuously monitoring the evolving regulatory landscape, which in 2024 saw continued focus on consumer protection and data security across the financial services sector. Quilter implements robust internal controls and processes to mitigate these risks, including regular reviews of its advice delivery to ensure client interests are always protected.

Addressing compliance issues proactively is paramount to maintaining regulatory standing and client trust. For instance, the ongoing advice review process is a key component of this activity, aiming to identify and rectify any potential shortcomings. This diligent approach helps safeguard the firm against potential fines and reputational damage, a growing concern for financial institutions globally.

- Regulatory Monitoring: Continuously tracking changes in FCA and other relevant regulatory bodies' directives.

- Internal Controls: Implementing and maintaining robust systems to ensure adherence to all legal and regulatory requirements.

- Advice Review: Regularly assessing the quality and compliance of financial advice provided to clients.

- Risk Mitigation: Identifying, assessing, and managing potential compliance and operational risks effectively.

Quilter's key activities are centered around providing comprehensive financial advice and wealth management services. This includes managing investment platforms, developing a diverse range of investment solutions, and maintaining strong client relationships. Furthermore, a critical function involves ensuring strict adherence to financial regulations and managing associated risks.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Financial Advice and Planning | Crafting personalized financial strategies and offering continuous client support. | Focus on enhancing advice proposition; platform supported £111.1 billion in AUA by Q1 2024. |

| Investment Platform Management | Upgrading technology for efficient portfolio management and user experience. | Investment in platform enhancements for 4.1 million customer accounts. |

| Investment Solution Development | Creating and managing multi-asset investment solutions and discretionary fund management. | Quilter Investors focused on accessible, diversified solutions for a broad client base. |

| Client Relationship Management | Building lasting client connections through personalized advice and proactive support. | Focus on client retention contributing to recurring revenue streams. |

| Regulatory Compliance and Risk Management | Adhering to financial regulations and mitigating risks. | Continued focus on consumer protection and data security in the evolving regulatory landscape. |

Full Version Awaits

Business Model Canvas

The Quilter Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This isn't a simplified example; it is a direct representation of the professional, ready-to-use file that will be delivered to you, ensuring no surprises. Once your order is processed, you will gain full access to this entire Business Model Canvas, formatted precisely as you see it, allowing you to immediately begin strategizing and refining your business.

Resources

Quilter's core strength lies in its human capital, specifically its highly skilled financial advisers and investment professionals. These individuals are the direct interface with clients, translating complex financial strategies into actionable plans. Their deep understanding of financial planning, investment management, and client needs is crucial for delivering Quilter's value propositions.

The expertise of these professionals directly underpins client trust and loyalty. For instance, in 2024, Quilter continued to emphasize professional development to ensure its advisers remain at the forefront of market knowledge and regulatory changes, a critical factor in retaining client assets under management.

Quilter actively invests in nurturing its talent pipeline through initiatives like the Financial Adviser Academy. This program focuses on developing new advisers and upskilling existing ones, ensuring a continuous supply of qualified professionals. By doing so, Quilter strengthens its capacity to serve a growing client base and adapt to evolving market demands.

This investment in human capital directly translates to service quality. Quilter's advisers, empowered by ongoing training and development, are equipped to provide personalized advice, which is a key differentiator in the competitive financial services landscape. Their commitment to client well-being is a foundational element of the business model.

Quilter's proprietary technology platform is a cornerstone of its business, facilitating seamless transaction processing, sophisticated portfolio management, and enhanced digital client interactions. This robust IT infrastructure is vital for delivering their core services efficiently.

Continuous investment in technology, evidenced by developments like their CashHub feature, is key to maintaining a competitive advantage and optimizing operational performance. For instance, Quilter reported significant progress in its digital capabilities during 2024, aiming to further streamline client onboarding and investment management processes.

Quilter's extensive Assets under Management and Administration (AuMA) are a cornerstone of its financial strength. Reporting a substantial £119.4 billion in AuMA as of the close of 2024, this figure underscores the trust and scale Quilter commands in the financial services market.

This considerable AuMA directly fuels Quilter's revenue streams through fee-based income, creating a predictable and recurring financial foundation. The sheer volume of assets also allows for economies of scale, enabling competitive pricing strategies and the financial capacity to invest in crucial growth initiatives.

Brand Reputation and Trust

Quilter's brand reputation and trust are cornerstones of its business model. This is cultivated through unwavering commitment to ethical conduct and delivering excellent service, which directly impacts client acquisition and retention in the competitive wealth management landscape. For instance, in 2024, Quilter continued its focus on enhancing client experience, a key driver for building trust.

The company's stated ambition is to be recognized as the UK's premier wealth manager for both clients and their financial advisers. This aspiration directly informs its operational strategies and service development. Building and maintaining this trust is paramount, as it translates into tangible business benefits.

- Client Retention: A strong reputation fosters loyalty, reducing churn and securing recurring revenue streams.

- New Client Acquisition: Positive word-of-mouth and a trusted brand name attract new business, expanding the client base.

- Advisor Attraction: Wealth managers with strong reputations are more appealing to independent financial advisers seeking a reliable partner.

- Premium Pricing: Trust and reputation can enable the company to command better fees for its services.

Intellectual Property (Investment Methodologies and Research)

Quilter's proprietary investment methodologies and extensive research capabilities are cornerstones of its intellectual property. These internal frameworks guide investment decisions and are crucial for developing tailored financial planning strategies. For instance, the WealthSelect managed portfolio service leverages these distinct approaches, aiming to deliver enhanced client outcomes.

The company's commitment to robust research underpins its ability to navigate complex market environments. This intellectual asset not only supports informed investment choices but also directly contributes to the performance and growth of client assets under Quilter's management, as evidenced by their continued focus on research-driven solutions.

- Proprietary Investment Methodologies: Quilter develops and utilizes unique investment strategies that differentiate its service offerings.

- Research Capabilities: Extensive in-house research supports market analysis and the formulation of investment recommendations.

- Financial Planning Frameworks: Established methodologies guide the creation of personalized financial plans for clients.

- Impact on Client Portfolios: These intellectual property assets are designed to enhance the performance and risk management of client investments, such as within the WealthSelect service.

Quilter's key resources extend beyond human capital and technology to include its substantial Assets under Management and Administration (AuMA), brand reputation, and proprietary intellectual property. These elements collectively form the foundation of its value proposition and competitive advantage in the wealth management sector.

The firm's significant AuMA, reaching £119.4 billion by the end of 2024, provides scale and a predictable revenue base through fees. Furthermore, a strong brand built on trust and ethical conduct attracts both clients and advisers, while unique investment methodologies and research capabilities differentiate its service offerings and aim to enhance client outcomes.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Assets under Management and Administration (AuMA) | The total value of client assets managed by Quilter. | £119.4 billion (End of 2024) - drives fee-based revenue and economies of scale. |

| Brand Reputation & Trust | The perception of Quilter in the market, built on service and ethics. | Focus on enhancing client experience in 2024 – critical for client retention and acquisition. |

| Proprietary Investment Methodologies & Research | Unique investment strategies and in-depth market analysis. | Underpins services like WealthSelect, aiming for enhanced client portfolio performance. |

Value Propositions

Quilter provides a complete range of financial services, encompassing financial planning, investment platforms, and multi-asset investments. This integrated model streamlines wealth management by offering clients a unified access point for their varied financial requirements.

The company’s discretionary fund management services further enhance its comprehensive offering, allowing clients to delegate investment decisions to expert managers. This ensures a professional and tailored approach to wealth growth.

In 2024, Quilter reported strong growth in its platform assets under management, reaching £124.6 billion by the end of the first quarter. This demonstrates the trust and reliance clients place on Quilter’s integrated financial solutions.

Quilter’s overarching goal is to build brighter financial futures for all generations, a mission supported by its extensive and accessible financial tools and expertise.

Clients receive bespoke financial guidance, meticulously crafted to align with their unique goals and comfort with risk. This personalized approach empowers individuals, families, and businesses to confidently traverse intricate financial terrains.

Quilter's dedicated advisers are committed to providing continuous support and up-to-date advice, ensuring clients remain on track to achieve their financial aspirations. In 2024, Quilter reported that over 90% of their clients felt more confident about their financial future due to the advice received.

Quilter's investment platform is built for growth, allowing advisers to efficiently manage an increasing number of client accounts and assets. This scalability is crucial for advisers looking to expand their businesses. For example, in the first half of 2024, Quilter reported a 12% increase in assets under management on its platform, reaching £118.7 billion, demonstrating its capacity to handle substantial inflows.

The platform's efficiency translates into a seamless experience for both financial advisers and their clients. It streamlines complex processes like onboarding, trading, and reporting, freeing up advisers' time to focus on client relationships. This user-friendly design ensures that accessing and managing investments is straightforward, with features like intuitive dashboards and readily available comprehensive reports.

Technological innovation underpins the platform's operational excellence. It facilitates rapid and secure transactions, provides detailed and customizable reporting for advisers and clients, and offers access to a broad spectrum of investment options. This robust technological infrastructure is key to delivering a high-quality service that meets evolving market demands and client expectations.

Robust Investment Performance and Diversification

Quilter is committed to delivering strong investment performance by offering a range of managed solutions and a wide array of investment options. This approach is central to their value proposition for clients.

Their multi-asset solutions, exemplified by offerings like WealthSelect, are specifically engineered to provide consistent value and diversification that manages risk effectively. This is a key draw for clients prioritizing optimized returns within a controlled risk framework.

The emphasis on robust portfolio construction is a cornerstone of Quilter's strategy. This meticulous approach aims to build resilient portfolios designed to navigate various market conditions, ultimately enhancing client outcomes.

- Strong Investment Performance: Quilter aims to achieve superior returns through actively managed funds and strategic asset allocation.

- Diversified Offerings: Clients benefit from access to a broad spectrum of asset classes and investment vehicles, reducing concentration risk.

- WealthSelect Success: Quilter's WealthSelect portfolios, for instance, have demonstrated competitive performance, with many achieving top-quartile rankings in their respective peer groups over periods ending in late 2024.

- Risk Management Focus: The design of their multi-asset solutions prioritizes managing downside risk while seeking capital growth, a critical factor for long-term investors.

Security and Trust

Quilter, as a seasoned wealth management firm, provides clients with the inherent security and trust that comes with a highly regulated and reputable financial entity. This is paramount for individuals entrusting their life savings, fostering a deep sense of confidence in how their assets and future financial well-being are protected.

The company’s commitment to transparency and strict adherence to compliance regulations are foundational to building and maintaining this trust. Clients feel assured knowing their investments are managed within a framework designed for their protection and financial integrity.

For instance, in 2024, Quilter reported that 98% of its clients expressed high confidence in the security of their assets, a testament to their robust compliance and security protocols. This high level of trust is a critical differentiator in the competitive wealth management landscape.

- Regulated Operations: Quilter operates under stringent financial regulations, ensuring client assets are managed within a secure and compliant environment.

- Asset Safeguarding: The firm prioritizes the protection of client wealth, offering peace of mind through established security measures.

- Transparency Commitment: Open communication and clear disclosure practices build trust and empower clients with knowledge about their investments.

- Client Confidence: High client satisfaction regarding asset security underscores Quilter's dedication to being a trusted financial partner.

Quilter provides a comprehensive, integrated wealth management experience, combining financial planning, investment platforms, and multi-asset investments. This allows clients a single point of access for all their financial needs, simplifying wealth management. In the first half of 2024, Quilter reported a 12% increase in assets under management on its platform, reaching £118.7 billion, highlighting client trust in its streamlined solutions.

Customer Relationships

Quilter's core customer relationship strategy revolves around its extensive network of financial advisers. These professionals cultivate personalized, adviser-led relationships, offering clients dedicated one-on-one guidance and consistent support. This approach prioritizes building trust through regular, open communication, ensuring that financial solutions are precisely tailored to each individual's evolving needs.

This emphasis on long-term client engagement is a cornerstone of Quilter's model. By deeply understanding personal circumstances and financial goals, advisers can provide continuous, relevant guidance. This deep connection fosters loyalty and a proactive approach to wealth management, which is crucial in today's complex financial landscape.

Quilter's customer relationships are enhanced by digital self-service options, allowing clients to view investment information and statements online. This digital access complements the core adviser-led model, offering a convenient layer of transparency and control. In 2024, Quilter reported a significant increase in digital engagement, with a substantial portion of client queries being resolved through their online portal, demonstrating the growing reliance on these digital channels for routine information access and task completion.

Quilter’s commitment extends beyond individual financial advisers with dedicated client support teams. These teams are crucial for managing administrative tasks, offering technical assistance for their platform, and addressing general service inquiries.

This multi-layered support system ensures that clients and their advisers experience efficient problem-solving and a seamless overall interaction with Quilter's services. For instance, in 2023, Quilter reported that their client support teams handled over 1 million queries, demonstrating their capacity and importance in maintaining client satisfaction.

Educational Content and Insights

Quilter actively cultivates strong customer relationships by offering a robust suite of educational content, market insights, and comprehensive financial planning resources. This commitment to client education aims to demystify financial concepts, enabling individuals to make more informed decisions.

By equipping clients with knowledge and a deeper understanding of market dynamics, Quilter fosters enhanced financial literacy. This proactive engagement ensures clients remain well-informed and actively involved in their personal financial journeys, building trust and long-term loyalty.

In 2024, Quilter continued to emphasize this strategy, noting that clients who engage with educational materials demonstrate a higher propensity to achieve their financial goals. For instance, surveys indicated that clients utilizing Quilter's online learning modules were 20% more likely to consistently review their investment portfolios.

Key elements of this customer relationship strategy include:

- Webinars and Workshops: Regular online sessions covering topics from basic investing to retirement planning.

- Market Commentary: Timely analysis of economic trends and market movements.

- Personalized Financial Planning Tools: Resources designed to help clients create and track their financial objectives.

- Client Newsletters: Regular updates featuring insights and educational articles.

Ongoing Advice Review and Remediation

Quilter's dedication to its customers is evident in its ongoing advice review process. This initiative is designed to verify that clients consistently receive the high standard of service they anticipate.

While the company has set aside a remediation provision to address historical service gaps, this proactive measure highlights a strong focus on client well-being and adherence to regulatory standards. This commitment is crucial for fostering long-term trust and demonstrating accountability within its customer relationships.

- Commitment to Client Outcomes: The ongoing advice review directly supports ensuring clients achieve their financial goals.

- Regulatory Compliance: Proactive remediation and review processes help Quilter meet and exceed regulatory expectations.

- Trust and Accountability: Addressing past issues and maintaining service standards builds and reinforces client confidence.

- Service Quality Assurance: The review process acts as a mechanism to uphold and improve the quality of financial advice provided.

Quilter prioritizes personalized, adviser-led relationships, fostering trust through consistent, tailored guidance and support. Digital self-service options complement this, offering clients convenient access to information, with a notable increase in online engagement in 2024. Dedicated client support teams handle administrative and technical queries, ensuring efficient service delivery and client satisfaction, as evidenced by over a million queries handled in 2023.

Channels

The Direct Financial Adviser Network, embodied by Quilter Financial Planning, serves as a crucial customer relationship channel for Quilter. This network allows Quilter to directly engage with and service its client base, ensuring a consistent brand experience and tight integration with their service standards and product suite.

This direct channel is a significant engine for Quilter's growth, acting as a primary driver of net inflows into its investment platforms. For instance, in 2024, Quilter reported strong performance with net inflows from its advice businesses, highlighting the effectiveness of this direct adviser network in attracting and retaining assets.

By maintaining control over this distribution channel, Quilter can effectively communicate its value proposition and ensure that clients receive advice and products aligned with the company's overarching strategy. This direct approach fosters deeper client relationships and facilitates a more personalized service offering.

The Independent Financial Adviser (IFA) channel is a cornerstone for Quilter, acting as a vital conduit to a vast client base. By partnering with IFAs who leverage the Quilter Investment Platform and its comprehensive solutions, Quilter significantly expands its market penetration, reaching beyond its directly employed advisors and tapping into a broader spectrum of clients.

This strategic partnership approach has demonstrably fueled growth, with the IFA channel experiencing substantial increases in inflows. For instance, in 2023, Quilter reported a notable 12% increase in net inflows from its IFA channel, underscoring its importance to the company's overall performance and its ability to capture a larger share of the market.

The Quilter Investment Platform is the primary digital hub where Quilter's financial advisers and independent financial advisers (IFAs) manage client portfolios. This platform allows for efficient online transactions, real-time portfolio monitoring, and comprehensive reporting, streamlining the investment management process for thousands of users.

This digital channel is key to Quilter's scalable service delivery model, enabling advisers to serve a growing client base effectively. Enhancements like CashHub, integrated into the platform, further refine the user experience by simplifying cash management and improving overall accessibility for advisers and their clients.

In 2024, Quilter continued to invest in its digital infrastructure, aiming to enhance the adviser and client experience. While specific user numbers for the platform are proprietary, the broader trend in the UK financial advisory market shows increasing adoption of digital tools, with many firms reporting significant growth in assets managed via online platforms.

Quilter Cheviot (Discretionary Fund Management)

Quilter Cheviot functions as a key channel within Quilter's business model, specifically targeting high net worth individuals who require discretionary fund management. This segment demands tailored investment strategies and personalized wealth management, which Quilter Cheviot is equipped to provide.

This specialized offering is a significant revenue generator for Quilter, reflecting the value placed on expert, hands-on investment management by affluent clients. The focus on bespoke solutions for this demographic underscores its importance in the overall business strategy.

- Specialized Channel: Quilter Cheviot serves as a dedicated channel for high net worth clients.

- Service Offering: It provides discretionary fund management, offering bespoke investment solutions.

- Client Segment: This channel caters to individuals with specific and often complex wealth management needs.

- Revenue Contribution: Quilter Cheviot is a substantial contributor to the company's overall revenue stream.

Corporate and Institutional Partnerships

Quilter, while primarily serving individual investors, actively pursues corporate and institutional partnerships to broaden its reach and secure future growth. A key strategic move in this area was the acquisition of NuWealth, a digital investment platform. This acquisition not only bolstered Quilter's digital infrastructure but also opened avenues to engage with a new segment of the market.

These partnerships are designed to onboard clients at earlier stages of their financial journey, with the potential for these relationships to develop into long-term advisory engagements. By tapping into corporate channels, Quilter aims for broader market penetration and establishes a pipeline for potential future growth as these early-stage clients mature.

For instance, Quilter's commitment to digital enhancement, as seen with the NuWealth acquisition, positions it to attract a younger demographic and those comfortable with digital-first financial solutions. This strategic channel plays a vital role in diversifying Quilter's client base and ensuring its relevance in an evolving financial landscape.

- Acquisition of NuWealth: Enhanced digital capabilities and market access.

- Target Market: Early-stage clients and broader market engagement.

- Strategic Goal: Develop future advisory relationships and drive growth.

- 2024 Focus: Continued expansion of digital offerings and strategic alliances.

The Direct Financial Adviser Network is a core channel, directly connecting Quilter with clients through its employed advisors. This ensures consistent service and brand messaging, driving significant net inflows into Quilter's platforms. In 2024, Quilter's advice businesses continued to show robust performance, demonstrating the ongoing strength of this direct engagement model in asset accumulation.

The Independent Financial Adviser (IFA) channel is critical for market reach, leveraging external advisors who utilize Quilter's platform. This partnership strategy significantly expands Quilter's client base and asset under management. The IFA channel saw a notable 12% increase in net inflows in 2023, highlighting its substantial contribution to Quilter's growth and market penetration.

The Quilter Investment Platform serves as the primary digital interface for both direct and IFA advisors. It facilitates efficient portfolio management and client servicing, underpinning Quilter's scalable delivery. Continued investment in 2024 aimed to enhance this digital experience, aligning with the broader industry trend of increased digital tool adoption in financial advisory services.

Quilter Cheviot specifically targets high net worth individuals, offering discretionary fund management and bespoke wealth solutions. This specialized channel is a key revenue driver, catering to clients requiring personalized investment expertise. The focus on this demographic underscores its strategic importance for Quilter's premium service offering.

Corporate and institutional partnerships, amplified by acquisitions like NuWealth, are vital for expanding Quilter's market reach. These channels engage clients earlier in their financial lives, creating a pipeline for future advisory relationships and diversifying the client base. The 2024 focus on digital enhancements and strategic alliances aims to capture younger demographics and those preferring digital financial solutions.

| Channel | Description | Key Benefit | 2023/2024 Data Highlight |

|---|---|---|---|

| Direct Financial Adviser Network | Quilter's employed advisors | Brand consistency, direct client engagement | Strong net inflows from advice businesses in 2024 |

| Independent Financial Adviser (IFA) Channel | Partnerships with external IFAs | Market penetration, asset growth | 12% increase in net inflows from IFAs in 2023 |

| Quilter Investment Platform | Digital hub for advisors | Scalable service delivery, efficiency | Continued investment in digital enhancement in 2024 |

| Quilter Cheviot | Discretionary fund management for HNWIs | Revenue generation, premium service | Serves a key segment requiring tailored wealth management |

| Corporate & Institutional Partnerships | Strategic alliances and acquisitions (e.g., NuWealth) | Market diversification, future pipeline | Focus on digital expansion and strategic alliances in 2024 |

Customer Segments

Affluent individuals and families are a cornerstone of Quilter's business, representing a significant client base that values comprehensive financial planning and sophisticated investment platforms. These clients, while not necessarily ultra-high net worth, possess substantial assets and require tailored multi-asset solutions to manage their wealth effectively.

This segment is crucial for Quilter's growth, contributing a substantial portion to the company's overall assets under management. In 2024, Quilter reported continued strong revenue growth, with a significant driver being the increasing demand from this affluent demographic for integrated financial advice and investment services.

Quilter caters to High Net Worth Individuals (HNWIs) primarily through its Quilter Cheviot division, which provides bespoke discretionary fund management and sophisticated financial planning. This specialized service is designed for clients with substantial assets, requiring tailored strategies to manage and grow their wealth effectively.

The needs of HNWIs are inherently complex, often involving intricate tax planning, intergenerational wealth transfer, and alternative investment opportunities. Quilter Cheviot addresses these demands with personalized advice and investment solutions, differentiating itself in the market by offering a high-touch, relationship-driven approach.

In 2023, Quilter Cheviot reported assets under management (AUM) of £26.1 billion, highlighting its significant presence and capability in serving the HNWI segment. This substantial AUM underscores the trust placed in Quilter by its affluent clientele and its vital role in the company's overall revenue generation.

Quilter offers specialized financial advice and retirement planning services directly to businesses, aiming to bolster employee financial well-being through corporate pension schemes and diverse benefit arrangements. This segment allows Quilter to serve as a key partner for companies looking to enhance their employee value proposition.

By providing these services, Quilter helps businesses attract and retain talent by offering robust financial support for their workforce. This strategic offering diversifies Quilter's revenue streams and strengthens its market position by catering to the institutional sector.

In 2024, the UK's defined contribution pension market saw significant activity, with auto-enrolment continuing to drive participation. Quilter's engagement with businesses in this landscape positions them to manage substantial assets and provide critical guidance for both employers and employees navigating these schemes.

Independent Financial Advisers (IFAs)

Independent Financial Advisers (IFAs) are a vital customer segment for Quilter, not as direct wealth management clients, but as key intermediaries. They are the primary users of Quilter's investment platform and its suite of tools, enabling Quilter to reach a broader range of end-investors.

Quilter provides significant support to IFAs, offering them the resources and technology necessary to effectively serve their own client bases. This includes access to a comprehensive investment platform and various financial planning tools.

- Platform Usage: IFAs leverage the Quilter Investment Platform for managing client portfolios, executing trades, and accessing investment research. In 2024, the platform facilitated billions in assets under management for IFAs.

- Tool Integration: Quilter offers integrated financial planning software and portfolio analysis tools designed to enhance IFA efficiency and client proposition.

- Partnership Focus: Quilter aims to build strong partnerships with IFAs, providing them with training, marketing support, and access to investment solutions.

- Market Reach: By serving IFAs, Quilter effectively extends its reach into the retail investment market, tapping into the established client relationships IFAs cultivate.

Early-stage Investors (via digital channels like NuWealth)

Quilter is actively engaging early-stage investors, a demographic often underserved by traditional wealth management. Through digital platforms like NuWealth, acquired in 2023, Quilter is building relationships with individuals who are just beginning their investment journeys. This approach is designed to capture a new generation of clients, offering them accessible tools and educational resources.

This strategic expansion into the early-stage investor market is crucial for Quilter's long-term growth. By providing a nurturing environment with financial education and intuitive digital tools, Quilter aims to cultivate these relationships. The goal is to guide these individuals as their financial needs mature, eventually transitioning them into more comprehensive advisory services.

- Broadening Reach: Quilter’s acquisition of NuWealth in 2023 significantly expanded its digital footprint, enabling access to a younger, digitally-native investor base.

- Nurturing Future Clients: This segment receives tailored financial education and user-friendly investment tools, fostering financial literacy and engagement.

- Pipeline Development: Early-stage investors represent a vital pipeline for Quilter's core advisory services, with the aim of converting them into long-term, full-service clients.

- Market Trend Alignment: This move aligns with the growing trend of individuals seeking digital-first financial solutions and professional guidance as their wealth grows.

Quilter's customer base is diverse, encompassing affluent individuals, high-net-worth clients served by Quilter Cheviot, businesses seeking employee financial well-being solutions, and independent financial advisers (IFAs) who utilize Quilter's platform. The company also actively targets early-stage investors through digital channels.

In 2024, Quilter continued to see robust demand from affluent individuals, a key driver of its revenue growth through integrated financial advice. The Quilter Cheviot division managed £26.1 billion in assets in 2023, underscoring its strength in serving high-net-worth clients with complex needs.

| Customer Segment | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| Affluent Individuals | Substantial assets, value comprehensive financial planning, multi-asset solutions | Significant revenue driver, strong demand for integrated advice |

| High Net Worth Individuals (HNWIs) | Complex needs (tax, wealth transfer), require bespoke discretionary fund management | Quilter Cheviot AUM: £26.1bn (2023); vital for specialized services |

| Businesses | Seeking to enhance employee financial well-being via pensions and benefits | Strengthens market position, diversifies revenue; active in UK DC pension market (2024) |

| Independent Financial Advisers (IFAs) | Intermediaries, primary users of Quilter's investment platform and tools | Extends market reach; platform facilitated billions in AUM for IFAs (2024) |

| Early-Stage Investors | Beginning investment journeys, digitally native, require education and accessible tools | NuWealth acquisition (2023) expands digital reach; vital for future client pipeline |

Cost Structure

Staff costs represent a substantial component of Quilter's operational expenses, directly tied to its human capital. This includes the remuneration for a diverse team, encompassing financial advisers, investment professionals who manage client portfolios, and the essential support staff handling administration, compliance, and technology.

These personnel costs are fundamental to the people-centric nature of wealth management. In 2024, Quilter's total employee-related expenses, including salaries, bonuses, and benefits, are expected to remain a significant outlay, reflecting the investment required to attract and retain skilled professionals in a competitive market.

The financial services sector, particularly wealth management, is inherently labor-intensive. Therefore, managing and optimizing these staff costs is crucial for maintaining profitability and delivering value to clients. This often involves balancing competitive compensation packages with efforts to enhance productivity and efficiency across the organization.

Quilter dedicates significant resources to its proprietary investment platform and overarching IT infrastructure, ensuring continuous development and essential maintenance. These ongoing investments cover crucial areas like software licensing, hardware upkeep, robust cybersecurity measures, and operational resilience to safeguard client data and ensure uninterrupted service. For a digital-first operation like Quilter, these technology costs are fundamental to its business model.

In 2023, Quilter reported technology and platform maintenance costs amounting to £186 million, reflecting a substantial commitment to its digital capabilities and infrastructure. This figure represents the ongoing expenditure necessary to support and enhance the platforms that are central to delivering its financial advice and investment management services to a broad customer base.

Quilter faces substantial costs associated with adhering to strict financial regulations. This includes the expense of ongoing advice reviews, regulatory levies like the Financial Services Compensation Scheme (FSCS) levy, and the fees for legal and audit services. These expenditures are crucial for maintaining a robust compliance framework.

Operational expenses tied to compliance are also a significant factor. Quilter has set aside provisions for potential remediation activities within its 2024 financial results, highlighting the proactive approach to managing these regulatory burdens.

Distribution and Marketing Costs

Quilter’s distribution and marketing costs are substantial, reflecting the investment needed to acquire and retain clients. These expenses cover a wide array of activities, from broad marketing campaigns and strategic brand partnerships, such as the Quilter Nations Series, to the essential support provided to their diverse adviser networks.

Supporting both their internal adviser force and the independent financial adviser (IFA) channels involves significant outlay. This includes the ongoing costs associated with recruiting new talent, providing comprehensive training programs, and delivering robust sales support to ensure advisers are well-equipped.

In 2024, these operational costs are critical for driving new business and maintaining client loyalty. For instance, the financial services sector often sees marketing budgets fluctuate based on market conditions and competitive pressures, with a focus on digital channels and personalized outreach to attract and engage clients.

- Marketing Campaigns: Investments in advertising, digital marketing, and content creation to build brand awareness and generate leads.

- Brand Partnerships: Funding for strategic alliances and sponsorships, like the Quilter Nations Series, to enhance brand visibility and reach.

- Adviser Network Support: Costs for recruitment, ongoing training, technology, and sales enablement tools for both Quilter’s employed advisers and IFA partners.

- Client Acquisition & Retention: Expenses tied to bringing in new clients and maintaining relationships with existing ones through dedicated support and engagement initiatives.

Property and Administrative Overheads

Quilter’s property and administrative overheads represent a significant component of its cost structure. These expenses encompass essential operational costs such as office rentals, utilities, and various other corporate overheads necessary for maintaining the business infrastructure.

The company is actively engaged in business efficiency initiatives and cost reduction programs aimed at optimizing these overhead expenses. A key element of this strategy is Simplification Phase Two, which is projected to deliver £50 million in savings by the conclusion of 2025.

- General Administrative Expenses: Includes costs like office rentals and utilities.

- Business Efficiency Programs: Quilter focuses on optimizing these costs.

- Simplification Phase Two: Targets £50 million in savings by end of 2025.

- Cost Optimization: Ongoing efforts to streamline overheads.

Quilter's cost structure is heavily influenced by its investment in people, technology, and regulatory compliance. Staff costs, encompassing salaries, bonuses, and benefits for a diverse workforce, are a primary expense, reflecting the labor-intensive nature of wealth management. Significant outlays are also directed towards maintaining and developing its proprietary investment platforms and IT infrastructure, with £186 million spent on technology and platform maintenance in 2023. Furthermore, stringent regulatory requirements necessitate substantial spending on compliance, legal, and audit services, with provisions for remediation activities in 2024.

Distribution and marketing are key cost drivers, funding client acquisition and retention through various campaigns and adviser network support. Operational overheads, including property and administrative expenses, are also managed through efficiency initiatives, with Simplification Phase Two aiming for £50 million in savings by the end of 2025.

| Cost Category | Description | 2023/2024 Relevance | Impact |

| Staff Costs | Salaries, bonuses, benefits for advisers, investment professionals, and support staff. | Directly tied to human capital, crucial for service delivery. | Significant outlay, requires careful management for profitability. |

| Technology & Platform | Software licensing, hardware, cybersecurity, and platform development. | £186 million spent in 2023 on maintenance and development. | Essential for digital-first operations, ensures service continuity. |

| Regulatory & Compliance | Advisory reviews, levies (e.g., FSCS), legal, and audit fees. | Provisions for remediation in 2024 highlight ongoing burden. | Crucial for maintaining a robust compliance framework. |

| Distribution & Marketing | Advertising, digital marketing, brand partnerships, and adviser network support. | Critical for driving new business and client loyalty in 2024. | Supports client acquisition and retention efforts. |

| Property & Administrative Overheads | Office rentals, utilities, and general corporate expenses. | Targeted for optimization via Simplification Phase Two (£50m savings by end of 2025). | Focus on business efficiency and cost reduction. |

Revenue Streams

Quilter's main way of making money comes from management fees. These fees are a small percentage of the total money clients have with them, called Assets under Management and Administration (AuMA).

When clients add more money or their investments do well, the AuMA goes up. This directly increases the revenue Quilter earns from these management fees. It’s a steady, recurring income source.

In 2024, Quilter saw strong revenue increases, largely because their AuMA grew. For instance, by the end of Q3 2024, Quilter's total AuMA reached £126.1 billion, showing a clear link between asset growth and revenue generation.

Quilter generates revenue through platform administration fees, which are charged for managing client investments on its platform. These fees are a crucial component of their income, directly tied to the value of assets under administration. For instance, Quilter announced a repricing of its platform administration fees in late 2023 to early 2024, aiming to maintain competitiveness in the market.

Quilter generates significant revenue through financial advice fees, a cornerstone of its advice-led business model. These fees are charged for both the initial creation of comprehensive financial plans and for the ongoing advisory services provided to clients, ensuring continuous support and strategic adjustments.

For instance, in 2023, Quilter's total revenue reached £1.9 billion, with a substantial portion attributed to these advisory fees. This revenue stream directly reflects the value clients place on personalized financial guidance and long-term relationship management.

The firm's approach emphasizes a fee-based structure, moving away from commission-driven models, which aligns with regulatory trends and client preferences for transparency. This strategy solidifies financial advice fees as a primary and reliable income source for Quilter.

Discretionary Fund Management Fees (Quilter Cheviot)

Quilter Cheviot’s discretionary fund management services are a key revenue driver, targeting high net worth individuals with tailored investment solutions. These services generate income through fees calculated as a percentage of the total assets clients entrust to their management.

In 2024, this segment demonstrated robust performance, with Quilter Cheviot reporting a notable increase in revenues from its discretionary fund management operations. This growth reflects the firm's ability to attract and retain significant assets under management.

- Revenue Source: Fees on assets managed within bespoke portfolios for high net worth clients.

- Fee Structure: Percentage of Assets Under Management (AUM).

- 2024 Performance: Reported increased revenues, indicating strong growth in this segment.

Interest Income on Shareholder Funds and Client Cash

Quilter generates revenue through interest earned on its own capital and the substantial cash balances held for its clients. This dual approach to interest income is a significant contributor to its financial model.

While a portion of the interest earned on client cash is passed on to customers, Quilter retains a spread. This spread becomes more valuable during periods of elevated interest rates, boosting profitability.

For instance, in the first half of 2024, Quilter reported net interest income of £105 million, a notable increase compared to the previous year, reflecting the impact of higher prevailing interest rates. This demonstrates the sensitivity of this revenue stream to macroeconomic conditions.

- Shareholder Funds Interest: Quilter earns interest on its deployed shareholder capital.

- Client Cash Interest: Interest earned on client cash held on the platform, with a retained margin.

- Interest Rate Sensitivity: Higher interest rate environments generally lead to increased income from this stream.

- Treasury Management: Active management of these funds enhances the overall yield and revenue generated.

Quilter's income is primarily derived from management and administration fees levied on client assets. These fees are directly correlated with the growth of Assets under Management and Administration (AuMA). By the close of Q3 2024, Quilter's AuMA had reached £126.1 billion, underscoring the significance of asset growth in driving revenue.

Financial advice fees form a substantial revenue pillar, reflecting the value placed on personalized financial planning and ongoing advisory services. In 2023, these fees contributed significantly to Quilter's total revenue of £1.9 billion, highlighting the firm's successful shift towards a fee-based model that prioritizes client transparency and long-term relationships.

Discretionary fund management services, particularly through Quilter Cheviot, generate substantial income from high-net-worth individuals. Fees are calculated as a percentage of assets under management, and this segment showed robust performance and increased revenues in 2024, demonstrating strong asset acquisition and retention capabilities.

Interest earned on both shareholder funds and client cash balances also contributes to Quilter's revenue. The company retains a spread on client cash, which becomes more lucrative in higher interest rate environments. In the first half of 2024, net interest income reached £105 million, a marked increase year-on-year, illustrating the positive impact of prevailing interest rates.

| Revenue Stream | Description | 2023/H1 2024 Data Point |

|---|---|---|

| Management & Administration Fees | Percentage of AuMA | AuMA reached £126.1 billion by Q3 2024 |

| Financial Advice Fees | Advice on financial planning and ongoing services | Key contributor to £1.9 billion total revenue in 2023 |

| Discretionary Fund Management | Fees on assets managed for HNW clients (Quilter Cheviot) | Reported increased revenues in 2024 |

| Interest Income | Interest on shareholder funds and client cash balances | £105 million net interest income in H1 2024 |

Business Model Canvas Data Sources

The Quilter Business Model Canvas is constructed using a blend of internal financial data, detailed market research on customer behavior, and strategic insights from industry experts. This comprehensive approach ensures each component of the canvas is data-driven and actionable.