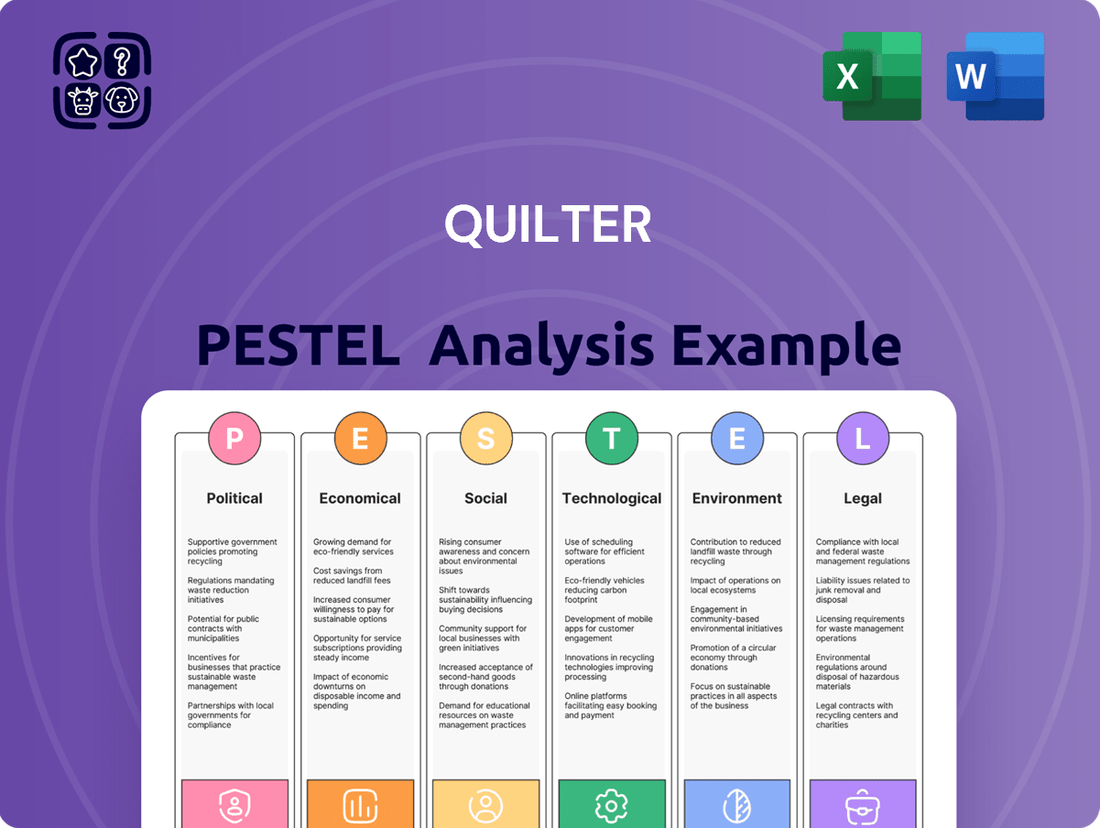

Quilter PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Quilter Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Quilter. Discover how political, economic, social, technological, environmental, and legal forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Quilter's business is closely tied to the political climate in its key markets, the UK and South Africa. Instability or unexpected policy shifts can significantly alter the operating environment for financial services firms.

Changes in government, whether through elections or internal reshuffling, can lead to altered regulations concerning pensions, investments, and taxation, directly affecting Quilter's product offerings and client strategies. For instance, the UK government's approach to pension auto-enrolment and lifetime ISAs has a material impact on the savings market where Quilter operates.

Investor sentiment is also heavily influenced by political factors. For example, in 2024, ongoing discussions around potential changes to capital gains tax in the UK could influence investment flows and product demand, impacting Quilter's asset management and platform businesses.

The South African political landscape, with its own set of economic and social policy considerations, also presents challenges and opportunities. Policy decisions related to economic growth, foreign investment, and financial inclusion directly shape the market conditions for Quilter's operations there.

Alterations to tax laws, such as shifts in capital gains tax, inheritance tax, or income tax rates, directly influence client investment choices and financial planning. Quilter needs to consistently update its guidance and services to assist clients in navigating these changing tax environments.

For example, in late 2024, Quilter observed clients repositioning assets, with many accelerating disposals in anticipation of potential capital gains tax adjustments. This dynamic highlights the critical need for financial firms to remain agile in response to fiscal policy changes.

The political landscape significantly influences the financial services sector, setting the tempo for regulatory changes. Governments worldwide are increasingly focused on consumer protection and market integrity, leading to new compliance requirements. For instance, the UK's Financial Conduct Authority (FCA) has been actively pursuing reforms, with its 2024/2025 regulatory initiatives grid highlighting key areas like the Consumer Duty, which aims to improve outcomes for retail customers. This focus on consumer well-being can create both challenges and opportunities for firms like Quilter.

New regulations can impose substantial operational costs as firms adapt to stricter rules. However, these changes can also level the playing field and foster greater trust in the financial system, potentially attracting more clients. The FCA's ongoing work on the Advice Guidance Boundary Review, for example, seeks to clarify the distinction between providing advice and guidance, impacting how firms interact with consumers seeking financial support. Such policy shifts are critical for understanding the evolving market dynamics for wealth management businesses.

Brexit Implications for UK Operations

Despite Brexit being finalized, its long-term effects on UK operations, particularly for financial services firms like Quilter, are still unfolding. The ongoing renegotiation and evolution of trade deals with the EU, coupled with the complexities of regulatory divergence, continue to shape the landscape. For Quilter, staying abreast of these changes is crucial for maintaining compliance and effectively serving a diverse client base with both UK and international interests.

The UK's economy, heavily reliant on its services sector, faces potential headwinds if broader European economic growth falters. For example, in Q1 2024, UK services output growth slowed to 0.2%, indicating the sensitivity to external economic conditions. A constrained EU economy could translate to reduced demand for UK financial services, impacting Quilter's export performance.

- Trade Deal Evolution: Ongoing adjustments to UK-EU trade agreements could impact market access and operational costs for financial services.

- Regulatory Divergence: The UK's ability to set its own regulations may create opportunities but also compliance challenges for firms operating across both jurisdictions.

- Economic Interdependence: The performance of the UK economy remains closely linked to that of the EU, affecting demand for financial services.

- Sectoral Impact: The services-oriented nature of the UK economy makes it particularly susceptible to shifts in international trade and economic sentiment.

Geopolitical Events Impacting Investor Confidence

Global and regional geopolitical tensions have a profound effect on investor confidence and market stability. These events can cause significant shifts in how investors allocate their assets and influence the demand for wealth management services. For Quilter, operating in markets like the UK and South Africa, staying abreast of these developments is crucial for advising clients through periods of uncertainty that can lead to market volatility and increased client caution.

For instance, the potential return of former President Donald Trump to the US presidency has already begun to reshape global priorities. Europe, for example, is increasingly shifting its focus from climate objectives towards bolstering economic growth, enhancing competitiveness, and strengthening its defence capabilities. This strategic pivot has implications for the global promotion of Environmental, Social, and Governance (ESG) initiatives, potentially altering investment flows and corporate strategies.

- Geopolitical Uncertainty: Events such as ongoing conflicts and potential shifts in major global leadership create a climate of unpredictability for investors.

- Market Volatility: Heightened geopolitical tensions often correlate with increased fluctuations in stock markets and currency exchange rates, impacting portfolio values.

- Shifting Investment Priorities: As seen with Europe's re-evaluation of its focus areas, geopolitical landscapes can redirect investment towards sectors like defence and energy security, while potentially affecting areas like climate-focused investments.

- Client Advisory Needs: Financial institutions like Quilter face an increased demand for guidance on navigating these complex geopolitical risks and adjusting investment strategies accordingly.

Political stability directly influences investor confidence and the regulatory landscape for financial services. Quilter's operations in the UK and South Africa are subject to government policies on taxation, pensions, and investment, which can significantly impact client behaviour and product demand. For instance, the UK's approach to pension reform, such as auto-enrolment, has shaped the savings market, while potential changes to capital gains tax in late 2024 prompted clients to adjust their portfolios.

What is included in the product

This Quilter PESTLE Analysis comprehensively examines the impact of external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—on the company's strategic landscape.

The Quilter PESTLE Analysis provides a clear, summarized version of complex external factors, simplifying discussions and reducing the cognitive load for teams during strategic planning.

Economic factors

Interest rate fluctuations and inflation are pivotal economic factors impacting Quilter. Changes in interest rates directly influence the cost of borrowing for individuals and businesses, affecting the returns on cash savings and the overall attractiveness of different investment vehicles. For Quilter, this means interest rate hikes can increase borrowing costs for the company and potentially reduce client investment appetite, while rate cuts can boost investment returns and client engagement.

Inflation also plays a crucial role. High inflation erodes the purchasing power of money, impacting client investment goals and potentially leading to demands for higher returns. Conversely, controlled inflation can create a more stable economic environment conducive to long-term investment planning. Understanding these dynamics is key for Quilter's strategic financial planning.

The Bank of England's monetary policy significantly shapes these trends. As of mid-2024, there were indications and market expectations of potential interest rate cuts throughout 2025. Such reductions would typically lead to lower returns on cash savings, potentially encouraging a shift towards higher-risk, higher-return investment products, which could benefit Quilter's asset management and financial planning services.

The economic health of both the UK and South Africa directly impacts Quilter's business. Strong economic growth typically boosts client wealth and their ability to invest, potentially leading to higher inflows and demand for Quilter's services. Conversely, economic downturns or recessions can shrink asset values and reduce new business opportunities.

For South Africa, economic prospects appear to be improving. The International Monetary Fund (IMF) projected South Africa's real GDP growth to be 1.1% in 2024 and anticipated an acceleration to 1.4% in 2025. Similarly, the World Bank forecast a GDP growth of 1.3% for 2024 and 1.4% for 2025, indicating a positive trend for the region.

While specific UK growth figures for 2024 and 2025 are subject to ongoing updates, the Bank of England's Monetary Policy Committee has been navigating inflationary pressures, with the Consumer Price Index (CPI) showing a decline from its peak. For instance, CPI stood at 3.2% in February 2024, down from 4.0% in December 2023, suggesting a potential easing of economic headwinds.

Market volatility, exemplified by fluctuations in major indices, can significantly impact investor sentiment. For instance, periods of heightened uncertainty in 2024, driven by geopolitical events and persistent inflation, saw a dip in consumer confidence, potentially affecting investment inflows into firms like Quilter. This necessitates strong client communication to manage expectations and maintain trust.

Quilter must navigate this by offering resilient investment strategies that aim for stable, albeit potentially modest, returns even when markets are turbulent. This approach helps retain assets and client loyalty, crucial for long-term growth. The firm’s ability to demonstrate capital preservation during downturns is key to its appeal.

Despite current headwinds like elevated interest rates and a cost-of-living crisis impacting disposable income in the UK, the long-term outlook for the retail wealth management sector remains positive. Projections indicate continued growth in assets under management, suggesting that strategic positioning can capitalize on future market recoveries and demographic trends, such as an aging population requiring wealth management services.

Currency Exchange Rates

Fluctuations in currency exchange rates, especially between the British Pound (GBP) and the South African Rand (ZAR), directly influence the value of Quilter's assets under management and administration (AuMA). This volatility also affects how Quilter's financial results are reported, given its significant presence in both the UK and South Africa.

For instance, a weaker Sterling can positively impact Quilter's reported earnings. This was indeed observed in Quilter's Q4 2024 trading statement, which highlighted a positive contribution from Sterling weakness.

- GBP/ZAR Volatility: Significant swings in the GBP/ZAR exchange rate can alter the Rand-denominated value of Quilter's South African assets when translated into Pounds for reporting.

- Q4 2024 Impact: Quilter explicitly mentioned that Sterling weakness provided a beneficial uplift to its performance in the final quarter of 2024.

- Asset Valuation: Changes in exchange rates can lead to unrealized gains or losses on foreign currency-denominated assets held by Quilter, impacting its balance sheet.

- Revenue Translation: Income generated in South Africa and repatriated to the UK will translate differently based on the prevailing GBP/ZAR rate, affecting overall profitability.

Disposable Income Levels and Savings Rates

Disposable income and savings rates are critical for wealth management firms like Quilter. When individuals have more money left after essential expenses, they are more likely to invest, directly boosting Quilter's potential client base and asset inflows. For instance, in South Africa, a notable factor influencing these trends is the economic environment.

Economic conditions that foster consumer confidence and encourage higher savings rates create a more fertile ground for Quilter's expansion. Recent data from South Africa indicates that while inflation has presented challenges, there are also shifts in consumer behavior. The South African Reserve Bank's interest rate decisions play a significant role; lower rates, as seen in recent periods, can make borrowing more affordable, potentially impacting both consumer spending and saving decisions.

- South Africa's household savings rate has seen fluctuations, with analysts observing a trend influenced by economic uncertainty and inflation, though specific aggregate figures for 2024/2025 are still emerging and subject to revision.

- Disposable income levels are directly tied to employment figures and wage growth, which in turn affect the capacity for individuals to engage with financial planning and investment services.

- Lower interest rates, a recent characteristic of the South African economic landscape, can incentivize borrowing for consumption or investment, potentially altering traditional savings patterns.

- Consumer confidence indices, when positive, often correlate with increased willingness to allocate funds towards savings and investments, benefiting wealth management sector growth.

Economic stability and growth are paramount for Quilter's operational success. Key indicators like GDP growth, inflation rates, and interest rate policies directly influence client investment capacity and market sentiment across its operating regions, the UK and South Africa.

The Bank of England's monetary policy adjustments, including potential interest rate cuts anticipated in 2025, could stimulate investment activity. Similarly, South Africa's projected GDP growth, with the IMF forecasting 1.4% for 2025, suggests improving economic conditions that may bolster asset inflows.

Currency fluctuations, particularly the GBP/ZAR exchange rate, significantly impact Quilter's reported earnings and asset valuations. Sterling weakness, noted in Q4 2024, provided a beneficial uplift, highlighting the sensitivity of financial results to foreign exchange movements.

| Economic Indicator | UK (Forecast/Trend) | South Africa (Forecast/Trend) | Impact on Quilter |

|---|---|---|---|

| GDP Growth | Subject to updates; generally navigating post-inflationary environment. | IMF: 1.1% (2024), 1.4% (2025); World Bank: 1.3% (2024), 1.4% (2025) | Positive growth in SA supports asset inflows; UK growth impacts client wealth. |

| Inflation (CPI) | Declining; 3.2% (Feb 2024) vs 4.0% (Dec 2023) | Navigating inflationary pressures, influencing savings and investment decisions. | Lower inflation can improve consumer confidence and investment capacity. |

| Interest Rates | Potential cuts anticipated in 2025. | Recent periods of lower rates, influencing borrowing and savings. | Rate cuts may encourage investment in higher-return products; higher rates increase borrowing costs. |

| GBP/ZAR Exchange Rate | Sterling weakness noted as beneficial in Q4 2024. | Significant volatility impacts asset translation and reported earnings. | Favorable Sterling movements can boost reported profits and asset values. |

Preview Before You Purchase

Quilter PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Quilter PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain critical insights into the external forces shaping Quilter's strategic landscape. This detailed analysis provides a robust framework for understanding opportunities and threats.

Sociological factors

The UK's aging population, with the Office for National Statistics projecting over 20% of the population to be 65 and over by 2030, creates a significant demand for retirement planning and wealth management services. This demographic trend, coupled with an estimated £5.5 trillion in intergenerational wealth transfer expected over the next 30 years, presents a substantial opportunity for Quilter to expand its client base and service offerings.

However, catering to younger inheritors who are often digitally native and have different financial priorities requires a strategic approach. Quilter must adapt its digital platforms and investment products to resonate with these evolving expectations, ensuring accessibility and engagement for a new generation of wealth holders.

Clients today are demanding more than just financial advice; they want a personalized, digital-first experience. This means everything from easy online onboarding to managing their investments through user-friendly apps, all available in real-time. For instance, a 2024 survey indicated that over 70% of investors under 40 prefer digital communication channels for their financial interactions.

Furthermore, Environmental, Social, and Governance (ESG) factors are no longer a niche concern but a mainstream expectation. Investors, particularly younger generations, are actively seeking to align their portfolios with their values, pushing firms like Quilter to integrate ESG screening and reporting more robustly. Indeed, assets under management in ESG-focused funds globally are projected to exceed $40 trillion by 2025, highlighting this significant shift.

Transparency and control are also paramount. Clients want to understand where their money is invested and have the ability to make adjustments easily, often through self-service digital platforms. This desire for control is reflected in the growing popularity of robo-advisors and hybrid models that offer both digital convenience and human oversight.

The general level of financial literacy significantly shapes how many people seek financial advice and what kind of products they feel comfortable using. If people understand financial concepts better, they're more likely to engage with complex services, potentially growing Quilter's client base.

In South Africa, a notable advice gap exists, meaning a substantial portion of the population isn't receiving the financial guidance they need. This presents a substantial opportunity for companies like Quilter to step in and serve this underserved market.

In 2023, the FinScope Consumer Survey indicated that approximately 59% of South African adults were considered financially vulnerable, highlighting the widespread need for improved financial education and access to advice.

Wealth Distribution and Inequality

Growing wealth disparity can significantly shape how wealth management firms operate, potentially shifting their focus towards ultra-wealthy clients or necessitating the creation of more inclusive, affordable services for the broader affluent population. Quilter's diversified client base, serving individuals, families, and businesses, indicates a strategic approach that caters to various wealth segments. This is reflected in their financial performance, with both High Net Worth and Affluent segments demonstrating robust profit growth in 2024.

The increasing concentration of wealth can create a bifurcated market. Firms may specialize in catering to the very top tier, offering bespoke, high-touch services, or conversely, develop scaled-down, digitally-enabled solutions to attract and retain a larger number of affluent clients who may have less complex needs but still require sophisticated financial planning. Quilter's reported profit growth in their High Net Worth and Affluent segments for 2024 underscores their success in navigating these evolving market dynamics.

- Focus on High-Net-Worth Individuals: As wealth concentrates, firms may allocate more resources to serving the needs of ultra-wealthy clients, offering highly personalized investment strategies, estate planning, and philanthropic advisory services.

- Development of Accessible Services: To tap into the growing affluent market, firms might introduce tiered service models or digital platforms that provide access to expert advice and investment tools at a lower cost, broadening their client base.

- Quilter's Segmental Performance: Quilter's 2024 results, showing good profit progress in both High Net Worth and Affluent segments, suggest an effective strategy in serving different wealth levels within the current economic landscape.

- Impact on Financial Planning: Wealth inequality influences the types of financial products and advice that are in demand, potentially increasing demand for tax-efficient investment vehicles and intergenerational wealth transfer strategies.

Trust in Financial Institutions

Public trust in financial institutions significantly impacts Quilter's ability to attract and keep clients. Historical events, such as the 2008 financial crisis or more recent scandals, can erode this confidence, making potential clients hesitant and existing ones more prone to seeking alternatives. A strong reputation for integrity is paramount for Quilter's sustained growth and client loyalty.

The Financial Conduct Authority (FCA) has explicitly prioritized building and maintaining trust in the financial sector as a key objective in its five-year strategy. This regulatory focus underscores the importance of client-centricity and ethical conduct for all financial firms, including Quilter. For instance, the FCA's recent consumer duty, implemented in 2023, places a significant emphasis on firms acting in good faith to deliver good outcomes for retail customers, directly addressing the need for enhanced trust.

- FCA Consumer Duty: Mandates firms to act in good faith and deliver good outcomes, fostering greater client trust.

- Reputation Management: Quilter's commitment to transparency and ethical practices is vital for overcoming past trust deficits in the industry.

- Client Retention: High levels of trust directly correlate with improved client retention rates, a key performance indicator for financial services firms.

- Market Confidence: Societal trust in financial institutions underpins overall market stability and economic confidence, benefiting Quilter through a more receptive client base.

Societal attitudes towards financial planning and investment are evolving, with a growing demand for personalized, digital-first experiences. For instance, a 2024 survey revealed that over 70% of investors under 40 prefer digital communication for financial interactions. Furthermore, Environmental, Social, and Governance (ESG) considerations are increasingly important, with global ESG-focused fund assets projected to surpass $40 trillion by 2025, indicating a strong societal shift towards value-aligned investing.

Technological factors

The financial advice sector is undergoing a significant digital shift, with platforms increasingly offering automated investment solutions and online advisory services. Quilter needs to bolster its digital infrastructure, including user-friendly online portals and mobile apps. This investment is crucial for delivering a smooth client journey, from initial onboarding to ongoing portfolio oversight, ensuring competitiveness in a rapidly evolving market.

As financial services rapidly embrace digital platforms, the likelihood of encountering sophisticated cyber threats and data breaches escalates dramatically. Quilter, like all firms in this sector, must place paramount importance on implementing advanced cybersecurity protocols and rigorously complying with evolving data protection regulations. This is crucial not only for protecting sensitive client information but also for preserving the essential trust placed in them by their customers. For instance, in South Africa, where Quilter operates, regulators have jointly issued standards focusing on cybersecurity and cyber resilience for financial institutions, underscoring the critical nature of these measures.

Artificial intelligence and automation are fundamentally reshaping wealth management. By 2025, the global AI in fintech market is projected to reach $25.6 billion, highlighting its significant growth and impact. These technologies empower financial advisors to be more efficient, offering hyper-personalized client interactions and sophisticated portfolio optimization.

Quilter can capitalize on AI to gain deeper client insights, streamline routine servicing tasks, and proactively address client needs. This strategic integration allows for enhanced risk mitigation through advanced data analysis, ensuring that while technology drives efficiency, the crucial human element of trust and personalized advice remains central to the client relationship.

Fintech Competition and Innovation

The wealth management industry is experiencing significant disruption from financial technology (FinTech) firms, creating intense competition and driving innovation. These agile companies are introducing novel approaches to client acquisition, portfolio construction, and service delivery, forcing established players like Quilter to adapt rapidly. By mid-2024, FinTech funding in wealth management continued to show robust activity, with over $2 billion invested globally in Q1 2024 alone, highlighting the sector's dynamism.

Quilter must actively monitor and, where appropriate, integrate emerging FinTech solutions to maintain its competitive edge and offer advanced client services. This includes adopting new digital platforms, leveraging AI for personalized financial advice, and streamlining operational processes. For instance, the adoption of robo-advisory services, a key FinTech innovation, is projected to manage over $5 trillion in assets by 2027, indicating a significant shift in client preferences.

- Increased Competition: FinTech startups are challenging traditional wealth managers with lower fees and user-friendly digital interfaces.

- Innovation in Service Delivery: New technologies are enabling more personalized investment strategies and improved client communication.

- Client Acquisition: Digital-first FinTechs are attracting younger demographics and those seeking streamlined online experiences.

- Operational Efficiency: Automation and AI are being deployed to reduce costs and enhance the speed of financial advice and transaction processing.

Blockchain and Distributed Ledger Technology Adoption

Blockchain and distributed ledger technology (DLT), while still in early stages for widespread use in wealth management, present significant potential for improving how transactions are handled, records are kept, and data is secured. Quilter should closely observe how these technologies evolve and where they might be applied to create more transparent and cost-effective operations in the future.

The adoption of these technologies could streamline processes like trade settlement and client onboarding, potentially reducing operational risks and improving data integrity. For instance, a 2024 report indicated that financial institutions exploring DLT anticipated cost savings of up to 30% in areas like compliance and reconciliation.

Decentralised finance (DeFi) is an emerging area, particularly in markets like South Africa, where it's seeing growing interest. However, it's crucial to note that DeFi currently operates in a largely unregulated environment, which presents both opportunities and risks for firms like Quilter looking to engage with these innovations.

The potential benefits of blockchain in finance include:

- Enhanced Security: Cryptographic principles make DLT inherently secure against tampering.

- Increased Efficiency: Automation through smart contracts can speed up processes like clearing and settlement.

- Improved Transparency: Shared ledgers offer a clear audit trail for transactions.

- Reduced Costs: Eliminating intermediaries can lower transaction fees and operational overhead.

Technological advancements are rapidly transforming wealth management, pushing for greater digitalization and automation. Quilter must embrace these changes, investing in robust digital platforms and AI-driven solutions to enhance client experience and operational efficiency. The global market for AI in fintech is expected to reach $25.6 billion by 2025, a clear indicator of this trend.

Legal factors

Quilter's UK operations are intrinsically linked to the Financial Services and Markets Act (FSMA), the cornerstone of financial regulation in the United Kingdom. This legislation dictates the rules under which Quilter must operate to maintain its authorization and conduct business.

Adherence to FSMA and associated regulations is not a static requirement but demands constant vigilance. Quilter must continuously track legislative changes and interpret new regulatory guidance from bodies like the Financial Conduct Authority (FCA) to ensure ongoing compliance.

The FCA's regulatory initiatives grid, a key document for the sector, highlights the FCA's current priorities. For example, in 2024, the FCA has emphasized consumer protection and market integrity, areas directly impacting Quilter's business model and operational focus.

As of early 2025, the FCA continues to focus on areas such as the Consumer Duty, aiming to ensure firms deliver good outcomes for retail customers. Quilter's strategic planning will therefore heavily incorporate responses to these ongoing regulatory developments, influencing product design and customer engagement strategies.

The Financial Conduct Authority's (FCA) Consumer Duty, implemented in 2023, significantly elevates expectations for firms like Quilter to ensure retail customers achieve good outcomes. This means Quilter must prioritize fair value, transparent communication, and robust customer support across its operations. Failure to embed this duty effectively can lead to regulatory scrutiny and potential penalties.

Quilter has proactively addressed potential issues arising from regulatory reviews, including setting aside a provision for ongoing advice refunds. This provision, likely reflecting the FCA's focus on ensuring fair treatment and value for consumers, demonstrates a commitment to rectifying past practices if identified as non-compliant with evolving consumer protection standards.

Quilter's operations are significantly shaped by data privacy regulations. Compliance with the UK's General Data Protection Regulation (GDPR) and South Africa's Protection of Personal Information Act (POPIA) is paramount, as the company manages substantial amounts of sensitive client financial data. Failure to adhere to these stringent laws can result in severe financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is greater.

These regulations dictate how Quilter must collect, store, process, and protect personal information, impacting everything from marketing practices to internal data management systems. The increased regulatory burden necessitates robust data security measures and transparent client communication regarding data usage, which can influence operational costs and client trust. For example, the enforcement actions under GDPR have already led to significant fines for various companies across different sectors, underscoring the financial risks involved.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

Quilter operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations across its key markets, the UK and South Africa. These rules are designed to combat financial crime and require comprehensive client verification and ongoing transaction monitoring. Failure to comply can result in significant penalties and reputational damage.

In the UK, Quilter must adhere to frameworks like the Proceeds of Crime Act 2002 and the Money Laundering Regulations 2017. This includes robust due diligence during client onboarding, identifying beneficial owners, and reporting suspicious activity to the National Crime Agency (NCA). For instance, the NCA reported a 20% increase in Suspicious Activity Reports (SARs) in the financial year ending March 2023, highlighting the active enforcement environment.

South Africa's Financial Intelligence Centre Act (FICA) mandates similar AML/CFT (Combating the Financing of Terrorism) obligations. South African regulators are actively coordinating to enhance compliance, with the FIC Act undergoing amendments to strengthen its provisions. Recent reports indicate a growing emphasis on technological solutions for KYC verification and transaction monitoring to improve efficiency and effectiveness in identifying illicit financial flows.

- UK Compliance: Adherence to the Proceeds of Crime Act 2002 and Money Laundering Regulations 2017.

- South African Framework: Compliance with the Financial Intelligence Centre Act (FICA).

- Regulatory Focus: Increased coordination among South African regulators to bolster AML/CFT compliance.

- Industry Trend: Growing adoption of technology for enhanced KYC and transaction monitoring.

Cross-border Financial Regulations (UK-South Africa)

Quilter’s dual presence in the UK and South Africa necessitates careful navigation of cross-border financial regulations. Divergent rules regarding investment product suitability, client onboarding processes, and cross-border data transfer can impact operational efficiency and compliance. For instance, changes in UK’s Financial Conduct Authority (FCA) rules, such as those related to consumer duty, may require adjustments for Quilter’s South African operations to maintain consistent client treatment standards.

South African independent financial advisors are currently navigating a landscape marked by significant volatility and uncertainty, a situation often benchmarked against the evolving regulatory environment for their UK counterparts. This includes adapting to new prudential requirements and consumer protection measures introduced by bodies like the Financial Sector Conduct Authority (FSCA) in South Africa, mirroring trends seen with the FCA in the UK. The ongoing implementation of Treating Customers Fairly (TCF) principles across both regions underscores the regulatory emphasis on client outcomes.

Key regulatory considerations for Quilter include:

- Cross-border Data Protection: Adherence to both GDPR (UK) and Protection of Personal Information Act (POPIA) (South Africa) for client data handling.

- Investment Product Harmonization: Ensuring investment offerings meet the regulatory standards and disclosure requirements of both jurisdictions, especially concerning ESG mandates.

- Regulatory Reporting: Managing differing reporting frameworks and timelines for financial authorities in the UK and South Africa.

- Client Protection Frameworks: Aligning client safeguarding measures, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, across both operating environments.

Quilter's operations are heavily influenced by the regulatory landscape in both the UK and South Africa, necessitating strict adherence to frameworks like the Financial Services and Markets Act (FSMA) and the Financial Sector Conduct Authority (FSCA) regulations. The FCA's Consumer Duty, implemented in 2023, continues to shape expectations for customer outcomes, with ongoing focus in 2024 and into 2025 on fair value and transparent communication.

Data privacy laws, including the UK's GDPR and South Africa's POPIA, impose significant obligations on Quilter regarding the handling of sensitive client data, with potential fines reaching substantial percentages of global revenue. Furthermore, robust Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, such as the Proceeds of Crime Act 2002 in the UK and the FICA in South Africa, require diligent client verification and transaction monitoring, with regulators actively enhancing compliance measures.

Environmental factors

Client demand for investment solutions that consider environmental, social, and governance (ESG) factors continues to surge, making it a critical environmental consideration for Quilter. By 2025, Europe is leading this trend, with a significant portion of assets under management in the region being ESG-aligned. This necessitates Quilter developing a robust suite of sustainable investment options and clearly articulating how ESG principles are woven into their financial advice and portfolio management strategies to meet evolving client expectations.

Climate change presents a dual-edged sword for investment portfolios, with risks like stranded fossil fuel assets and physical damage from extreme weather events threatening returns. For instance, the Intergovernmental Panel on Climate Change (IPCC) has highlighted that global temperatures are likely to rise by 2.5°C to 4.0°C by 2100 under current policies, underscoring the urgency of adaptation.

Conversely, significant opportunities arise in sectors like renewable energy, with the global renewable energy market projected to reach $1.977 trillion by 2030, growing at a CAGR of 8.4%. Quilter must proactively integrate these climate-related factors into its investment strategies, advising clients on how to navigate both the perils and the potential financial gains in this evolving landscape.

Quilter faces growing demands for transparency in sustainability reporting, driven by both regulators and clients. By 2025, expect more stringent requirements for disclosing environmental impact and the ESG credentials of investment offerings. This pressure is amplified by an increased focus on combating greenwashing, necessitating robust, evidence-based claims regarding sustainability practices.

Reputational Risks Related to Environmental Impact

Failing to genuinely address environmental concerns or engaging in 'greenwashing' can severely damage a wealth management company's reputation. Clients increasingly scrutinize firms' environmental commitments, and a lack of authenticity can lead to lost trust and business. For Quilter, demonstrating transparency in its environmental initiatives is crucial for maintaining client loyalty and attracting new investors who prioritize sustainability.

Quilter needs to adopt purpose-driven strategies in its climate activities and investment choices. This means going beyond mere compliance and actively showcasing leadership in Environmental, Social, and Governance (ESG) principles. For instance, by 2024, global sustainable investment assets were projected to exceed $50 trillion, highlighting a significant market demand for genuinely responsible financial practices.

Maintaining client trust hinges on the credibility of Quilter's environmental claims. A recent survey indicated that over 70% of investors consider ESG factors when making investment decisions. Therefore, robust and verifiable environmental commitments are not just about risk mitigation but also about unlocking new growth opportunities.

To mitigate reputational risks, Quilter should focus on:

- Transparent reporting of environmental impact metrics.

- Authentic integration of ESG into investment strategies.

- Proactive engagement with stakeholders on climate-related issues.

- Avoiding misleading or exaggerated environmental claims.

Investor Demand for Green Investments

Investor demand for environmentally friendly investments, often termed 'green' investments, is a significant environmental factor. This trend is reshaping financial markets as a growing number of individuals and institutions prioritize sustainability in their portfolios. For instance, the global sustainable investment market reached an estimated $35.3 trillion in early 2024, reflecting substantial investor commitment.

Quilter can strategically leverage this burgeoning demand by broadening its product suite to include specialized funds focused on renewable energy, sustainable infrastructure projects, and other ventures actively contributing to environmental conservation. The market for green bonds and sustainable fixed-income instruments is also experiencing considerable growth and deepening liquidity.

- Increased investor preference for ESG (Environmental, Social, Governance) compliant assets.

- Significant growth in assets under management in sustainable funds, exceeding trillions globally.

- Expanding market for green bonds, with issuance volumes reaching new highs annually.

- Opportunities for Quilter to develop and promote green investment products.

The escalating demand for sustainable investments presents a substantial opportunity and challenge for Quilter, as clients increasingly prioritize environmental, social, and governance (ESG) factors. By 2025, Europe alone is expected to see a significant portion of assets under management aligned with ESG principles, underscoring the need for Quilter to offer robust sustainable investment solutions and transparently integrate ESG into its financial advice to meet evolving client expectations.

The growing investor preference for environmentally conscious assets is reshaping the financial landscape, with global sustainable investment assets projected to exceed $50 trillion by 2024. This trend highlights a clear market demand for responsible financial practices, offering Quilter opportunities to expand its product offerings in areas like renewable energy and sustainable infrastructure.

Quilter must navigate the financial implications of climate change, which poses risks such as stranded assets and physical damage, while also capitalizing on opportunities in green sectors. The global renewable energy market, for instance, is anticipated to reach $1.977 trillion by 2030, growing at a compound annual growth rate of 8.4%, presenting a significant avenue for growth.

Transparency in environmental reporting is becoming paramount, with increasing regulatory and client pressure to disclose ESG credentials and combat greenwashing. Failure to provide authentic and verifiable environmental commitments can lead to reputational damage and loss of client trust, making robust, evidence-based claims crucial for maintaining credibility and market position.

| Environmental Factor | Impact on Quilter | Data Point (2024/2025 Focus) |

|---|---|---|

| Client Demand for ESG | Drives product development and advisory services | Global sustainable investment assets projected to exceed $50 trillion by 2024 |

| Climate Change Risks & Opportunities | Requires portfolio adaptation and strategic investment | Renewable energy market to reach $1.977 trillion by 2030 (8.4% CAGR) |

| Sustainability Reporting & Transparency | Necessitates robust disclosure and anti-greenwashing measures | Increasing regulatory scrutiny on ESG reporting and greenwashing claims |

| Investor Preference for Green Investments | Opens avenues for specialized product creation | Significant growth in green bond issuance and sustainable fixed-income markets |

PESTLE Analysis Data Sources

Our Quilter PESTLE Analysis is meticulously constructed using a blend of public and proprietary data sources. This ensures that each assessment is grounded in real-world business conditions and relevant to the specific market and industry context.