Quilter Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Quilter Bundle

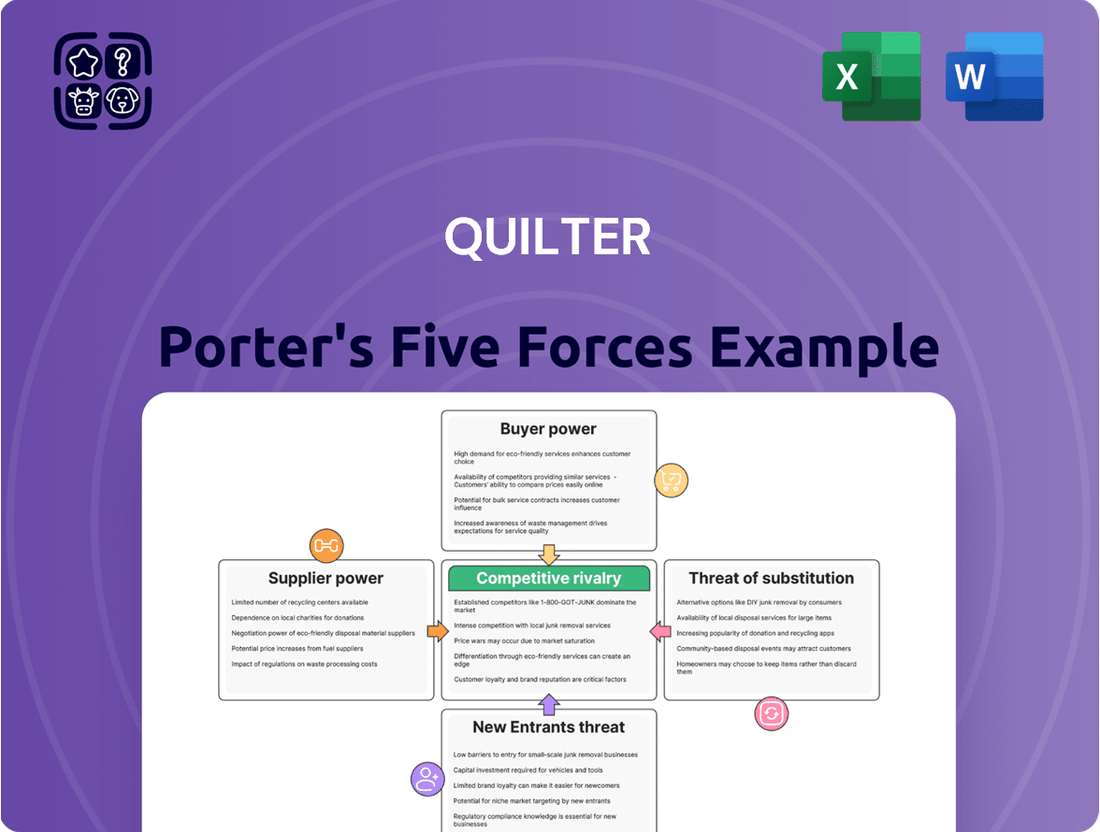

Understanding the competitive landscape is crucial for any business, and Quilter is no exception. Porter's Five Forces Analysis provides a powerful framework to dissect the industry's inherent profitability and identify key strategic levers.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Quilter’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Quilter's reliance on technology and software providers for its investment platforms, data analytics, and operational systems means these suppliers can wield significant bargaining power. This is particularly true for specialized wealth management software, which is crucial for efficient operations and client service, potentially giving suppliers leverage.

The switching costs for core technology platforms are substantial for companies like Quilter. These costs can encompass data migration, staff re-training, and the risk of service disruption, all of which can make it difficult and expensive to change providers, thereby increasing supplier power.

The market for specialized financial technology is often characterized by a limited number of providers, especially for integrated wealth management solutions. This concentration can lead to higher prices and less favorable terms for Quilter, as there are fewer viable alternatives for critical software and services.

The bargaining power of external fund managers and product providers is a key consideration for Quilter. While Quilter Investors offers its own range of multi-asset solutions, the company also relies on a diverse selection of external fund managers to provide a broad product offering to its clients. The strength of these suppliers is directly linked to the appeal and distinctiveness of their investment products.

For instance, if a particular external fund manager offers a unique investment strategy or has a strong track record in a niche market, they might command greater influence. This leverage allows them to potentially negotiate more favorable terms for distribution. However, Quilter's significant scale as a distributor acts as a counterweight, providing a degree of negotiating power due to the volume of assets it can bring to these external managers.

In 2024, the asset management industry continued to see consolidation and a focus on specialized active management. Funds demonstrating consistent outperformance or offering access to previously hard-to-reach asset classes are likely to be in higher demand, thereby increasing the bargaining power of their providers. Conversely, generic or underperforming funds would have diminished leverage.

The bargaining power of suppliers, specifically human capital in the form of financial advisers, is a significant consideration for Quilter. Highly skilled and experienced financial planners are essential to Quilter's network, and the demand for their expertise can be substantial. This demand, coupled with a potential scarcity of top-tier talent, grants these advisers considerable leverage in negotiating terms with Quilter, impacting everything from recruitment to compensation.

In 2024, the financial advisory market continues to see strong demand for qualified professionals, driven by an aging population and increasing complexity in financial planning. Initiatives like Quilter Partners and its Financial Adviser Academy are crucial for Quilter to mitigate this supplier power by fostering loyalty and developing in-house talent, thereby reducing reliance on external recruitment and the associated bargaining leverage of individual firms or advisers.

Data and Information Providers

Access to reliable market data, research, and financial information is critical for effective investment management and providing sound financial advice. Data providers, especially those offering specialized services like real-time market feeds or in-depth financial analytics, often possess moderate bargaining power. This stems from the essential nature of their offerings and the specialized expertise required to deliver them, making it difficult for firms like Quilter to easily substitute these services. In 2024, the reliance on such data remains high, as firms need accurate and timely information to inform investment decisions and ensure regulatory compliance.

Consider the following points regarding data and information providers:

- Necessity of Data: Financial institutions depend heavily on data providers for market insights, company financials, and economic indicators.

- Specialized Services: Providers offering unique datasets or advanced analytical tools have leverage due to the difficulty in replicating their offerings.

- Regulatory Compliance: Accurate data is crucial for meeting stringent regulatory reporting requirements, increasing the importance of reliable providers.

- Market Data Costs: For instance, Bloomberg terminals, a widely used data service, incur significant annual subscription fees, illustrating the cost associated with essential data access.

Regulatory Compliance and Legal Services

Legal and compliance service providers wield considerable influence in the financial sector due to stringent regulations in markets like the UK and South Africa. Quilter, like other firms, must navigate complex and changing rules, such as the UK's Consumer Duty, which requires continuous legal and compliance input. This dependence on specialized knowledge means fewer firms can offer these essential services, thereby enhancing their bargaining power.

For instance, the Financial Conduct Authority (FCA) in the UK continuously updates its rulebook, impacting how financial products are marketed and sold. In 2024, the FCA continued its focus on fair value and consumer protection, necessitating ongoing adjustments to business practices. This regulatory environment directly translates into increased demand for expert legal and compliance advice, giving these service providers leverage.

- Regulatory Burden: Financial services firms face a growing volume of regulations, increasing their reliance on specialized legal and compliance expertise.

- Limited Supplier Pool: The niche nature of regulatory compliance services restricts the number of qualified providers, concentrating bargaining power among them.

- Cost of Non-Compliance: The penalties for failing to meet regulatory standards, including significant fines and reputational damage, compel firms to invest in robust legal and compliance support, making them less price-sensitive.

- Evolving Landscape: Continuous changes in financial regulations, exemplified by initiatives like the Consumer Duty, require constant adaptation and ongoing engagement with legal and compliance advisors.

Suppliers of specialized technology and exclusive fund products can exert significant influence over Quilter due to high switching costs and limited alternatives. In 2024, the demand for niche, high-performing funds and sophisticated wealth management software remained strong, allowing providers of these services to negotiate more favorable terms. Furthermore, the scarcity of highly skilled financial advisers in 2024 also amplified the bargaining power of these crucial human capital suppliers.

| Supplier Type | Key Factor Influencing Power | Impact on Quilter | 2024 Trend/Data Point |

|---|---|---|---|

| Technology Providers | High switching costs, specialized software | Increased cost of platform upgrades, potential for unfavorable contract terms | Continued investment in digital transformation by financial firms |

| External Fund Managers | Product uniqueness, performance track record | Negotiating leverage on distribution fees, reliance on popular managers | Growth in assets under management for active and thematic funds |

| Financial Advisers (Human Capital) | Demand for expertise, potential scarcity of talent | Higher recruitment and retention costs, potential for increased service fees | Ongoing shortage of qualified financial planners in many markets |

| Data & Research Providers | Essential nature of data, specialized analytics | Subscription costs, dependence on reliable data for decision-making | Increased reliance on AI-driven analytics and real-time market data feeds |

| Legal & Compliance Services | Complex regulatory environment, limited expertise pool | Increased costs for regulatory adherence, need for specialized advisory | Heightened regulatory scrutiny on consumer protection and fair value in 2024 |

What is included in the product

This analysis dissects the competitive forces impacting Quilter, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on profitability.

Instantly identify and quantify competitive threats with a visual, actionable framework for strategic clarity.

Customers Bargaining Power

For certain customer groups, especially those opting for straightforward platform services or simpler investment products, the expense and effort involved in switching to a different provider can be minimal. This ease of transition empowers these customers.

The rise of accessible digital platforms and automated investment advisors has significantly lowered these barriers, making it simpler for customers to move their assets. This trend directly impacts traditional wealth managers like Quilter, compelling them to remain competitive on price and service quality.

For instance, the UK's direct-to-consumer investment platform market has seen substantial growth. In 2024, assets under administration on major UK platforms reached record highs, indicating a competitive landscape where customer retention is paramount. Many of these platforms offer low-cost index funds and ETFs, further reducing the perceived value of staying with a higher-cost provider.

Customers, particularly those with significant assets, are showing heightened price sensitivity and are meticulously examining the fees associated with wealth management. This trend is amplified by the increased transparency offered by digital platforms and the growing availability of more affordable options such as passive investment funds and robo-advisors. For instance, a 2024 survey indicated that over 70% of investors consider fees a primary factor when selecting a wealth manager.

The rise of digital tools and lower-cost investment alternatives places considerable pressure on traditional wealth management firms to justify their fee structures. Robo-advisors, for example, typically charge annual management fees between 0.25% and 0.50%, a stark contrast to the 1% or more often seen in traditional advisory services. This forces Quilter to carefully weigh the value and quality of its services against the competitive pricing landscape to effectively attract and retain its client base.

The proliferation of direct-to-consumer investing platforms and robo-advisors significantly amplifies customer bargaining power by offering readily available, cost-effective alternatives to traditional financial advisory services. For example, by mid-2024, the assets under management for robo-advisors in the US alone were projected to surpass $3 trillion, a testament to their growing appeal and accessibility.

These digital solutions, often featuring lower fees and enhanced online convenience, are particularly attractive to younger, digitally native investors, thereby reducing their dependence on established wealth management firms. This shift empowers clients to seek out providers that offer superior value, compelling traditional advisors to adapt their service models and pricing strategies to remain competitive.

Client Sophistication and Demand for Personalization

Clients who are more financially savvy, particularly high-net-worth individuals, increasingly expect tailored investment strategies and personalized advice. Their sophisticated understanding of financial markets translates into greater leverage, as they actively seek out firms capable of delivering unique solutions and superior returns. This demand for customization means that financial services providers must excel in offering bespoke products and advanced digital platforms to retain this discerning clientele.

The growing demand for personalization significantly amplifies customer bargaining power, especially among those with substantial assets. For instance, a significant portion of wealth management clients expect customized financial plans, with reports indicating that over 70% of affluent investors seek personalized recommendations. This trend forces firms to invest in technology and expertise to meet these exacting standards, as clients are more likely to switch providers if their specific needs are not met.

- Client Sophistication Drives Demand for Personalization: High-net-worth and sophisticated investors require bespoke investment solutions and personalized advice.

- Increased Bargaining Power: Deep market understanding allows these clients to negotiate better terms and seek out superior service offerings.

- Quilter's Competitive Edge: The firm's ability to cater to these specific, often complex, needs is vital for retaining its most valuable customer segments.

- Data Support: Surveys consistently show a high percentage of affluent investors prioritizing personalized financial advice and customized investment strategies.

Regulatory Protection (e.g., Consumer Duty)

Regulatory initiatives, such as the UK’s Consumer Duty implemented in 2023, significantly bolster the bargaining power of customers. This framework mandates that financial services firms deliver fair value and ensure good outcomes for their clients, effectively shifting the onus onto firms like Quilter to prove their worth.

By requiring firms to act in their customers’ best interests, regulatory protections empower individuals. This increased leverage means customers can more readily demand transparency, clear communication, and superior service quality, making it harder for firms to compete solely on price or inertia.

Quilter, like other players in the financial services sector, must now proactively demonstrate clear and compelling value propositions. This includes not only the products and services offered but also the overall customer experience and adherence to the spirit of these enhanced consumer protections.

The impact of such regulations is tangible. For instance, the Financial Conduct Authority (FCA) has emphasized that firms must be able to evidence how they are meeting the Consumer Duty’s requirements, leading to increased scrutiny and a greater need for customer-centric strategies.

- Consumer Duty Emphasis: Focus on fair value and positive customer outcomes.

- Increased Customer Leverage: Demand for transparency, clear communication, and quality service.

- FCA Scrutiny: Firms must evidence adherence to new consumer protection standards.

- Strategic Response: Quilter needs to highlight its value proposition to meet heightened expectations.

The bargaining power of customers significantly influences the profitability of wealth management firms like Quilter. Factors such as low switching costs, increased transparency, and the availability of cheaper alternatives, like robo-advisors, empower clients to demand better pricing and services. For instance, the UK's direct-to-consumer investment platform market saw substantial growth in 2024, with many platforms offering low-cost index funds, making it easier for customers to move assets and increasing their leverage.

Sophisticated investors, particularly those with high net worth, exert even greater influence by demanding personalized strategies and superior returns. Their market knowledge allows them to negotiate terms and seek out firms that can deliver unique, high-value solutions. This trend is supported by data showing that over 70% of affluent investors prioritize personalized financial advice, compelling firms to invest in advanced technology and expertise to meet these expectations.

Regulatory changes, such as the UK's Consumer Duty implemented in 2023, further amplify customer bargaining power by mandating fair value and positive customer outcomes. This regulatory environment forces firms like Quilter to proactively demonstrate their worth through transparency, clear communication, and superior service quality, as evidenced by the Financial Conduct Authority's emphasis on firms needing to prove their adherence to these standards.

| Factor | Impact on Bargaining Power | Example/Data Point (2024) |

|---|---|---|

| Switching Costs | Low for basic services, empowering customers. | Growth in UK direct-to-consumer platforms with low-cost funds. |

| Availability of Alternatives | High due to robo-advisors and digital platforms. | Robo-advisor fees typically 0.25%-0.50% vs. traditional 1%+. |

| Client Sophistication | High for HNW individuals seeking personalization. | Over 70% of affluent investors prioritize personalized advice. |

| Regulatory Environment | Increased leverage through consumer protection mandates. | UK Consumer Duty requires firms to prove fair value. |

Full Version Awaits

Quilter Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Quilter Porter's Five Forces Analysis you see here thoroughly examines the competitive landscape of the quilting industry, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products, and the intensity of rivalry among existing firms. You'll gain actionable insights into the strategic positioning of quilting businesses. This comprehensive analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The UK and South African wealth management sectors are characterized by a high degree of fragmentation. This includes a wide array of participants, from major banking institutions and insurance companies to numerous independent financial advisers (IFAs) and niche firms. This diversity of players creates a complex competitive landscape.

Despite the fragmentation, a clear trend of consolidation is evident. This is particularly noticeable with IFA consolidators actively acquiring smaller practices, which directly impacts the competitive intensity for both client relationships and experienced advisory professionals. For instance, in 2023, the UK saw a significant number of IFA firm acquisitions, continuing a trend that has been building for several years.

This ongoing consolidation means Quilter must remain agile, constantly reassessing its competitive positioning. The drive to acquire smaller firms suggests a strategic move to gain market share and scale, making it crucial for Quilter to differentiate its offerings and value proposition to retain and attract both clients and talent in this evolving market.

Quilter operates in a landscape crowded with substantial, long-standing competitors. Key rivals like St. James's Place, Schroders, Rathbones Group, Hargreaves Lansdown, M&G, and abrdn command considerable market presence and customer loyalty.

These established players benefit from significant brand equity and deep-rooted client relationships, often built over decades. For instance, as of early 2024, many of these firms report assets under management in the tens or hundreds of billions of pounds, highlighting their scale.

Their substantial financial resources allow for aggressive marketing campaigns and continuous investment in product innovation and technology. This creates a high barrier to entry and necessitates that Quilter continually refines its value proposition to stand out.

To thrive, Quilter must focus on clear differentiation, perhaps through specialized advice, innovative digital platforms, or a unique approach to wealth management, to capture market share from these formidable incumbents.

The financial advice industry is seeing fiercer competition due to the rise of digital-first platforms and hybrid models. These new entrants, including robo-advisors, significantly lower the cost and complexity of accessing financial guidance, drawing in clients who prefer digital interactions. This shift forces established players to adapt rapidly.

In 2024, the demand for digital financial services continues its upward trajectory. For instance, the global robo-advisor market was valued at approximately $2.5 billion in 2023 and is projected to grow significantly, indicating a strong client preference for tech-enabled solutions. Quilter itself is actively enhancing its digital offerings, aiming to blend the efficiency of technology with the personalized touch of human advisors to stay competitive.

Focus on Net Inflows and Asset Retention

The competition for both attracting new assets through net inflows and keeping existing assets under management (AuMA) is intense. Financial firms are constantly striving to differentiate themselves by excelling in investment performance, offering competitive fees, providing superior client service, and developing a comprehensive range of products and services. This multi-faceted approach is crucial for drawing in new clientele while simultaneously mitigating client attrition.

Quilter's performance in 2024 highlights its effectiveness in this challenging environment, demonstrating a capacity to secure substantial net inflows. This achievement suggests the firm is successfully navigating the competitive pressures by offering a compelling value proposition to its clients. However, maintaining this momentum requires continuous strategic focus and execution to ensure sustained growth and asset retention.

- Fierce Competition: Firms compete vigorously on investment returns, fee structures, client support, and the diversity of their offerings.

- Attracting and Retaining Assets: The primary goal is to increase assets under management (AuMA) by securing net inflows and minimizing client outflows.

- Quilter's 2024 Success: Quilter reported strong net inflows in 2024, indicating successful client acquisition and asset retention strategies.

- Sustained Effort Needed: Continuous innovation and client-centric approaches are vital for long-term success in this dynamic market.

Regulatory Changes Driving Competition

Regulatory changes are significantly reshaping the competitive landscape. For instance, the UK's Consumer Duty, implemented in July 2023, mandates that financial firms act to deliver good outcomes for retail customers. This evolving regulatory environment acts as a powerful force, either leveling the playing field or creating distinct advantages for those firms adept at adapting.

Successfully navigating and complying with these new rules, alongside demonstrating fair value to clients, is becoming a critical differentiator. It directly impacts client trust and, consequently, a firm's market share. In 2024, the Financial Conduct Authority (FCA) reported that over 85% of firms stated they had made significant changes to their business models to comply with the Consumer Duty.

Firms that can efficiently manage these regulatory shifts and proactively integrate them into their strategic operations are positioning themselves to gain a substantial competitive edge. This involves not just meeting the letter of the law but truly embedding customer-centric principles.

- Consumer Duty Implementation: Firms in the UK financial services sector faced significant compliance burdens and opportunities with the July 2023 Consumer Duty implementation.

- Fair Value Demonstration: Proving fair value to customers is now a key competitive battleground, directly influencing client retention and acquisition.

- Market Share Impact: Adaptability to regulatory changes is demonstrably linked to a firm's ability to capture or maintain market share.

- Client Trust as a Differentiator: Regulatory adherence and fair treatment foster client trust, a crucial element in a competitive market.

The competitive rivalry within Quilter's operating sectors is intense, driven by a fragmented market and significant consolidation. Major players like St. James's Place and Hargreaves Lansdown leverage strong brand equity and substantial financial resources, creating high barriers to entry. The rise of digital-first platforms and robo-advisors also intensifies competition by offering lower-cost, tech-enabled solutions, forcing established firms like Quilter to innovate their digital offerings and client engagement models. In 2024, Quilter reported strong net inflows, indicating successful strategies for attracting and retaining assets amidst this dynamic rivalry.

| Competitor | Estimated AuMA (Early 2024) | Key Differentiator Focus |

|---|---|---|

| St. James's Place | £170 billion+ | Personalized face-to-face advice, strong brand loyalty |

| Hargreaves Lansdown | £130 billion+ | Digital investment platform, low-cost execution |

| Schroders | £700 billion+ (Group) | Global asset management expertise, institutional focus |

| Rathbones Group | £60 billion+ | Discretionary wealth management, bespoke client solutions |

SSubstitutes Threaten

The rise of direct-to-consumer (DIY) investment platforms presents a substantial threat of substitutes for advised financial services. Platforms like InvestEngine, eToro, and Trading 212 empower individuals to self-manage their portfolios, bypassing traditional advisory relationships. This trend is particularly strong among younger, tech-savvy investors and those seeking lower costs.

In 2024, the growth in DIY investing continues unabated. For instance, the number of retail investor accounts on platforms like Hargreaves Lansdown and AJ Bell has seen significant increases year-on-year, reflecting a broader shift towards self-directed investing. These platforms often boast considerably lower fees compared to traditional advised models, making them an attractive alternative for cost-sensitive or more experienced investors.

The appeal of DIY platforms lies not only in their cost-effectiveness but also in the perceived control and accessibility they offer. Users can access a wide range of investment products, research tools, and often educational resources directly through intuitive online interfaces. This direct access can be a powerful substitute for the personalized advice and relationship management offered by firms like Quilter.

Robo-advisors are a significant threat of substitutes for traditional wealth management services. These automated platforms leverage algorithms to manage investments, offering a cost-effective alternative. For instance, by early 2024, many robo-advisors were charging annual fees around 0.25%, a stark contrast to the typical 1% charged by human advisors.

This lower fee structure makes wealth management accessible to a wider range of investors, particularly those with smaller account balances who might not meet the minimums for traditional advisors. The convenience and ease of use, often through intuitive mobile apps, further enhance their appeal as a substitute.

While they may not offer the nuanced, personalized advice of a human advisor, robo-advisors excel at serving investors with straightforward financial goals and a preference for passive investing strategies. Their ability to provide diversified portfolios at a fraction of the cost directly challenges the value proposition of conventional advisory models.

Clients are increasingly exploring investment avenues beyond conventional stocks, bonds, and mutual funds. Alternative investment vehicles like direct real estate, private equity, and even cryptocurrencies are gaining traction. For instance, the global alternative investments market was valued at approximately $13.9 trillion in 2023 and is projected to reach $23.9 trillion by 2028, showcasing significant growth.

These alternatives, while often presenting distinct risk and return profiles, can effectively substitute traditional wealth management offerings. This is particularly true for more experienced investors actively seeking enhanced diversification or the potential for superior returns not readily available in mainstream markets.

Savings Accounts and Fixed-Rate Bonds

For individuals who are particularly cautious with their money or prioritize keeping their principal safe, traditional savings accounts and fixed-rate bonds are a significant substitute for wealth management services. This is especially true when interest rates are on the rise, making these options more attractive. They offer a predictable return and easy access to funds, although they generally don't offer the same growth potential as more actively managed investments.

These conservative financial products directly compete with wealth management by providing a baseline level of security and income. For example, in early 2024, the Federal Reserve kept its benchmark interest rate in the 5.25%-5.50% range, making savings accounts and short-term bonds competitive for risk-averse investors. As of mid-2024, many high-yield savings accounts were offering APYs above 4.5%, while U.S. Treasury bills were yielding around 5% for short maturities. This presents a clear alternative for those who might otherwise seek professional advice for modest investment growth.

- Capital Preservation: Savings accounts and fixed-rate bonds are designed to protect the initial investment, appealing to risk-averse individuals.

- Guaranteed Returns: These instruments offer predictable interest payments, unlike market-linked investments which can fluctuate.

- Liquidity: Funds in savings accounts are readily accessible, and bonds can often be sold before maturity, though with potential price changes.

- Interest Rate Sensitivity: The attractiveness of these substitutes increases significantly when prevailing interest rates are high, as seen in the 2023-2024 period.

Self-Directed Financial Planning Tools and Information

The rise of readily accessible, often free, online financial planning tools and educational content significantly increases the threat of substitutes for traditional wealth management. These digital platforms empower individuals to manage their own investments, track spending, and even create basic financial plans without professional assistance. For instance, platforms like Mint, Personal Capital, and various robo-advisors offer sophisticated budgeting and investment management capabilities, often at a fraction of the cost of human advisors.

This trend is particularly impactful for individuals with simpler financial needs or those who are more tech-savvy and comfortable conducting their own research. By 2024, a substantial portion of the investing public, especially younger demographics, are increasingly turning to these digital solutions. For example, a significant percentage of millennials and Gen Z now utilize robo-advisors for their investment needs, demonstrating a clear shift in preference and a reduced reliance on traditional advisory services.

The availability of vast amounts of financial information through reputable websites, financial news outlets, and online courses further strengthens this substitute threat. Individuals can educate themselves on investment strategies, market trends, and tax implications, diminishing the perceived necessity of paying for expert guidance. This accessibility democratizes financial knowledge, allowing individuals to take a more hands-on approach to their financial well-being.

While these tools may not fully replicate the personalized, holistic advice offered by experienced financial professionals, they effectively address certain needs, thereby siphoning off a segment of the market. This competitive pressure forces traditional wealth managers to differentiate their offerings by emphasizing value-added services such as complex financial planning, estate planning, and behavioral coaching. The threat is amplified by the low switching costs associated with digital tools, allowing individuals to easily experiment with and adopt alternative solutions.

The threat of substitutes for traditional financial advice is significant, driven by the proliferation of DIY investment platforms and robo-advisors. These digital solutions offer lower costs and greater accessibility, particularly for younger, tech-savvy investors. As of 2024, platforms like Hargreaves Lansdown and AJ Bell reported substantial growth in retail investor accounts, indicating a clear shift towards self-directed investing.

Robo-advisors, for instance, typically charge around 0.25% annually, a fraction of the 1% often seen with human advisors, making wealth management accessible to a broader audience. Beyond digital platforms, alternative investments like direct real estate and private equity are also gaining traction, with the global alternative investments market projected to reach $23.9 trillion by 2028. Even conservative options like high-yield savings accounts, offering APYs above 4.5% in mid-2024, serve as substitutes for those prioritizing capital preservation and predictable income.

| Substitute Type | Key Features | Cost Example (Annual) | Target Investor | 2024 Trend Indicator |

|---|---|---|---|---|

| DIY Investment Platforms | Self-directed portfolio management, wide product access | Low (e.g., trading fees or minimal platform fees) | Cost-conscious, tech-savvy, experienced investors | Continued user growth reported by major platforms |

| Robo-Advisors | Automated portfolio management, algorithmic advice | ~0.25% | Beginner to intermediate investors, those seeking low-cost diversification | Increasing adoption for basic financial goals |

| Alternative Investments | Diversification, potential for higher returns (e.g., real estate, private equity) | Varies widely (management fees, performance fees) | Sophisticated investors seeking enhanced diversification | Market growth projected to $23.9 trillion by 2028 |

| Savings Accounts/Bonds | Capital preservation, predictable income, high liquidity | N/A (interest earned) | Risk-averse investors, those prioritizing safety | Attractive yields (e.g., >4.5% APY on high-yield savings in mid-2024) |

Entrants Threaten

The financial services sector, especially wealth management in the UK and South Africa, faces substantial regulatory scrutiny. Firms must navigate complex licensing procedures, meet stringent capital adequacy rules, and adhere to extensive compliance frameworks. For instance, in the UK, the Financial Conduct Authority (FCA) oversees a robust regulatory regime, and establishing a new advisory firm can involve significant upfront costs for legal, compliance, and operational setup, potentially running into tens of thousands of pounds.

These demanding regulatory requirements effectively deter many potential entrants. The sheer cost and complexity associated with obtaining the necessary authorizations and maintaining ongoing compliance make it a formidable challenge for new businesses to establish a foothold. This acts as a powerful barrier, protecting existing, established players from a surge of new competition.

The significant capital required to establish a reputable wealth management firm acts as a strong deterrent for new entrants. Setting up robust technology, implementing effective marketing campaigns, and acquiring initial clients can easily demand millions of dollars. For instance, in 2024, many emerging fintech platforms focused on wealth management reported initial funding rounds in the tens of millions, underscoring these high upfront costs.

Beyond financial investment, building a trusted brand in wealth management is a long and arduous process. Clients entrust advisors with their financial futures, making brand recognition and a solid reputation paramount. New firms must overcome the ingrained loyalty many clients have to established players, a feat that requires sustained effort and significant marketing spend over many years, a challenge that few new entrants can easily surmount.

Existing players like Quilter leverage significant economies of scale, which reduce per-unit costs in areas like platform operations, investment management, and essential back-office functions. This cost advantage makes it difficult for new entrants to compete on price from the outset.

Furthermore, Quilter benefits from deeply entrenched distribution networks, comprising both its employed financial advisers and a broad base of relationships with independent financial advisers (IFAs). This established reach allows for efficient client acquisition and service delivery, a hurdle new entrants must overcome.

The capital required to build comparable operational scale and establish a widespread distribution network represents a substantial barrier. For instance, replicating Quilter's platform infrastructure and adviser network would likely necessitate hundreds of millions in upfront investment, a daunting prospect for most newcomers.

In 2024, the wealth management sector continued to see consolidation, underscoring the importance of scale. Companies with larger assets under management (AUM) often report lower operating cost ratios, a trend that new, smaller entrants find challenging to match without significant initial funding.

Client Switching Costs and Loyalty

While certain aspects of client switching in financial advisory might seem straightforward, the reality is often more complex due to established relationships and the perceived difficulty of transferring intricate investment portfolios. This inertia, coupled with a natural loyalty to familiar advisors, creates a significant hurdle for new entrants. They must present an exceptionally attractive proposition to overcome this inherent client stickiness and secure their first customers.

The financial advisory sector in 2024 continues to see clients valuing the personal touch and trust built over time. This loyalty, while not always quantifiable in hard numbers, represents a substantial soft barrier to entry. For instance, a recent survey indicated that over 60% of retail investors cite their existing advisor relationship as a primary reason for not switching, even when presented with potentially lower fees elsewhere.

- Client Retention: Loyalty and established trust are key deterrents for clients considering a move to new financial advisory firms.

- Portfolio Complexity: The perceived administrative burden of transferring diversified and complex investment portfolios discourages switching.

- Value Proposition: New entrants must offer demonstrably superior value, whether through fees, services, or investment performance, to overcome these switching costs.

- Market Dynamics: In 2024, the emphasis on personalized advice and long-term relationships means that new firms face a considerable challenge in displacing incumbents.

Talent Acquisition and Retention

The wealth management industry is highly dependent on skilled individuals, particularly financial advisers and investment professionals. New companies entering this space often struggle to lure top talent away from established firms, which typically offer more robust compensation and appealing work environments. This competition for talent is a significant barrier.

In 2024, the demand for experienced financial advisors remained high, with industry reports indicating a persistent shortage of qualified professionals. For instance, some recruitment firms specializing in financial services noted that it could take upwards of six months to fill senior advisory roles, often necessitating signing bonuses and enhanced benefits packages to attract candidates. This limited supply of seasoned experts directly impacts the scalability and competitive positioning of any new entrant aiming to establish a significant market presence.

- Talent Shortage: Finding and keeping experienced financial advisors is a major hurdle for new wealth management firms.

- Competitive Compensation: Entrants must offer attractive salaries and benefits to compete with established players for talent.

- Limited Skilled Pool: The scarcity of qualified professionals can directly hinder the growth and expansion plans of new businesses in the sector.

The threat of new entrants in wealth management is significantly mitigated by high regulatory hurdles and substantial capital requirements, making it difficult for newcomers to gain traction. Established firms benefit from strong brand loyalty and complex client relationships, which act as significant deterrents to switching. Furthermore, the industry’s reliance on skilled professionals and the associated competition for talent create additional barriers for emerging businesses.

| Barrier Type | Description | Impact on New Entrants (2024) | Example/Data Point |

|---|---|---|---|

| Regulatory & Compliance Costs | Navigating licensing, capital adequacy, and ongoing compliance frameworks. | High deterrent due to upfront and recurring expenses. | UK FCA authorization costs can reach tens of thousands of pounds. |

| Capital Investment | Funding technology, marketing, and initial client acquisition. | Requires significant upfront capital, often in the millions. | Fintech wealth management startups in 2024 raised tens of millions in seed funding. |

| Brand Reputation & Trust | Building client confidence and overcoming loyalty to incumbents. | Long and costly process, requiring sustained marketing efforts. | Over 60% of retail investors cite existing advisor relationships as a reason not to switch. |

| Economies of Scale | Lower per-unit costs for established firms in operations and management. | New entrants struggle to compete on price without matching scale. | Larger AUM firms generally report lower operating cost ratios in 2024. |

| Distribution Networks | Access to existing adviser bases and client relationships. | Difficult for new entrants to replicate established reach. | Replicating Quilter's adviser network would require hundreds of millions in investment. |

| Client Switching Costs | Inertia, complexity of portfolio transfer, and established personal relationships. | Clients are often reluctant to move unless a significantly better offer is presented. | Perceived administrative burden of transferring complex portfolios discourages switching. |

| Talent Acquisition | Attracting and retaining experienced financial advisors and investment professionals. | High demand and competition for skilled personnel. | Filling senior advisory roles in 2024 could take over six months, requiring enhanced packages. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of comprehensive data, including company annual reports, investor presentations, and industry-specific market research reports to provide a robust understanding of competitive dynamics.