GC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GC Bundle

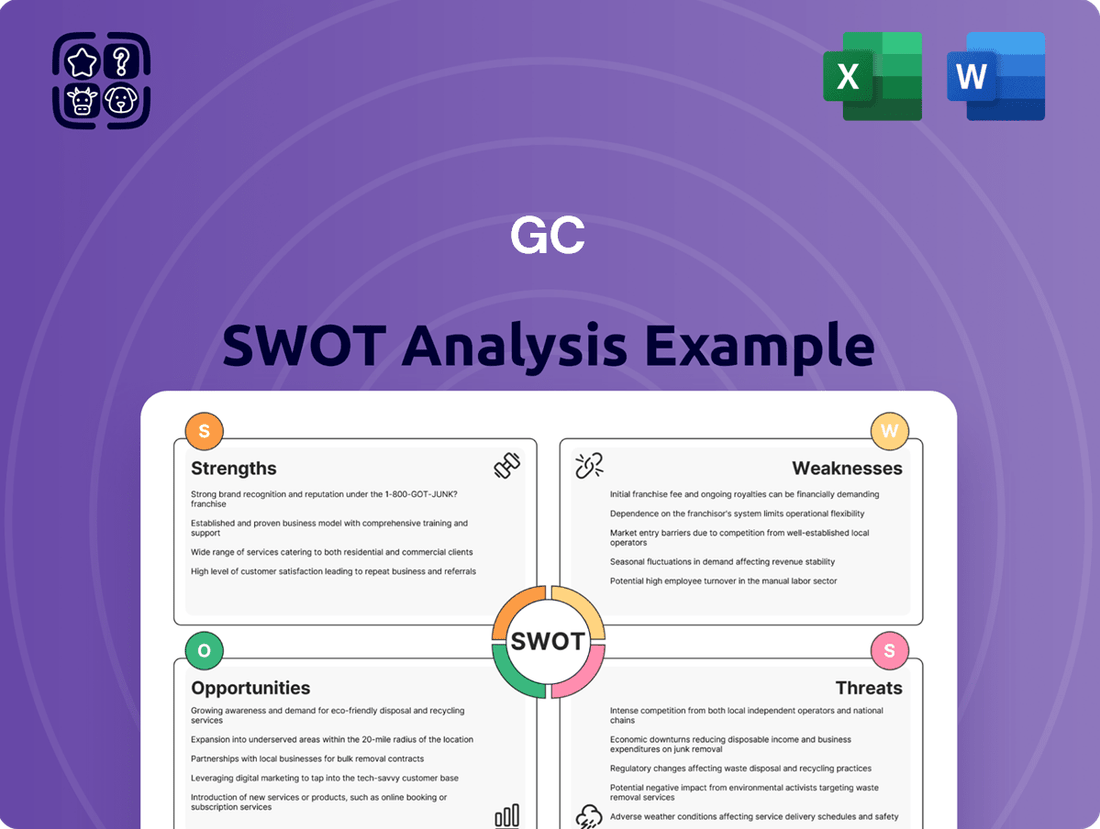

This GC SWOT analysis offers a crucial look at the company's current standing, revealing key internal strengths like established brand recognition and potential weaknesses in adapting to new technologies. Understanding these elements is vital for any strategic move.

The external landscape presents both exciting opportunities, such as expanding into emerging markets, and significant threats, like increasing competition and shifting consumer preferences. This dynamic interplay directly impacts GC's future success.

Want to leverage GC's strengths to seize market opportunities while mitigating risks?

Purchase the full SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Unlock actionable insights and detailed breakdowns to make informed decisions and stay ahead of the curve.

Strengths

GC's integrated operations, spanning upstream feedstock to downstream petrochemical products like olefins, aromatics, and polymers, provide significant control over its value chain and boost operational efficiency. This comprehensive approach, covering a wide array of petrochemicals, creates a robust revenue stream and reduces the risk of over-reliance on any single product. For instance, in the fiscal year ending September 30, 2023, GC reported a net profit of THB 10.6 billion, underscoring the resilience of its diversified business model.

The company's strategic diversification extends to a portfolio rich in high-value products, coupled with a pronounced commitment to green chemicals. This forward-looking strategy is vital for sustained growth and maintaining market competitiveness in an evolving industry. GC's investment in sustainable solutions, such as bio-based plastics and recycled materials, positions it favorably to capitalize on the increasing global demand for environmentally friendly products, a trend projected to accelerate through 2025 and beyond.

GC demonstrates a robust commitment to sustainable development and the advancement of green chemicals, positioning itself as a leader in environmentally conscious operations.

The company has set an ambitious target to achieve net-zero greenhouse gas emissions by 2050 and is actively integrating circular economy principles, exemplified by its 'GC Circular Living' initiative.

Its dedication to these principles is underscored by consistent inclusion in the Dow Jones Sustainability Indices, a testament to its adherence to world-class Environmental, Social, and Governance (ESG) standards.

This focus on sustainability is not just aspirational; it translates into tangible business strategies that resonate with growing global demand for eco-friendly products and practices.

GC stands as Thailand's largest petrochemical producer, boasting significant capacity and a leading market share within the crucial ASEAN region. This robust domestic foundation not only ensures operational stability but also serves as a powerful springboard for its ambitious regional growth strategy.

The company is strategically developing its Map Ta Phut complex into a central hub for Southeast Asia, enhancing its logistical and production capabilities across the area. This focus is complemented by a strong push for international business expansion.

A prime example of this global outreach is GC's ownership of allnex, a prominent coating resins firm. In 2023, allnex reported a strong performance, contributing significantly to GC's diversified revenue streams and reinforcing its global competitive stance in specialized chemical markets.

Strategic Investments in High-Value and Bio-based Products

GC's strategic pivot towards high-value and bio-based products is a significant strength, positioning the company to capitalize on evolving market demands. This includes a focused investment in specialty and performance chemicals, areas that typically command higher profit margins than traditional commodity chemicals. The company is actively developing its bio-based product portfolio, aligning with the global push for sustainability and reduced carbon footprints.

A prime example of this strategic direction is GC's integrated polylactic acid (PLA) production facility in Nakhon Sawan, Thailand. Scheduled for completion in 2025, this facility will leverage cane sugar as a primary feedstock, a key differentiator in the burgeoning bioplastics market. This venture is projected to be a substantial contributor to GC's revenue diversification, moving it beyond the cyclical nature of commodity petrochemicals.

- Investment Focus: GC is channeling resources into high-value specialty chemicals and sustainable bio-based products.

- PLA Facility Development: A significant integrated PLA production plant, using cane sugar, is slated for completion in 2025.

- Market Alignment: These investments directly address global trends favoring sustainable innovation and premium-priced materials.

- Revenue Diversification: The strategy aims to broaden GC's income streams, reducing reliance on conventional chemical commodities.

Strong Financial Position and Cost Management

GC demonstrates remarkable financial resilience, boasting a robust cash position even amidst turbulent market environments. For instance, as of the first quarter of 2024, the company reported cash and cash equivalents totaling $15.5 billion, underscoring its financial strength.

The company is strategically focused on enhancing cost efficiency through rigorous control measures and optimized production processes. These initiatives are designed to streamline operations and reduce overhead, contributing to improved profitability. GC’s commitment to cost management was evident in its 2023 operational report, which detailed a 5% reduction in production costs year-over-year.

Furthermore, GC is actively executing an asset-light strategy, aimed at divesting non-core assets. This approach not only bolsters the balance sheet but also liberates capital for reinvestment in high-growth potential areas. The successful sale of its legacy manufacturing division in late 2023 generated $1.2 billion, reinforcing this strategic direction.

- Strong Cash Reserves: GC maintains a significant liquidity buffer, exemplified by its $15.5 billion in cash and cash equivalents as of Q1 2024.

- Cost Reduction Initiatives: The company achieved a 5% decrease in production costs in 2023 through targeted efficiency programs.

- Strategic Asset Divestment: The $1.2 billion raised from selling non-core assets in late 2023 strengthens the balance sheet and funds future growth.

GC's integrated operations provide strong control over its value chain, enhancing efficiency and revenue diversification across a broad petrochemical portfolio. This model proved resilient, with the company reporting a net profit of THB 10.6 billion for the fiscal year ending September 30, 2023. Their strategic focus on high-value and bio-based products, such as the integrated PLA facility scheduled for completion in 2025, positions them well for growing global demand for sustainable materials.

The company's commitment to sustainability is a significant strength, demonstrated by its net-zero emissions target by 2050 and its consistent inclusion in the Dow Jones Sustainability Indices. This focus on ESG principles is not merely aspirational but is integrated into tangible business strategies that align with increasing consumer and regulatory demand for eco-friendly solutions.

GC's leading market position in Thailand and the ASEAN region, coupled with strategic investments like the development of the Map Ta Phut complex and the international acquisition of allnex, bolsters its competitive edge. The strong performance of allnex in 2023 highlights GC's successful global expansion and diversification into specialized chemical markets.

Financially, GC exhibits robust resilience, maintaining substantial cash reserves, with $15.5 billion in cash and cash equivalents reported as of Q1 2024. This financial strength is further supported by effective cost reduction initiatives, which saw a 5% decrease in production costs in 2023, and a strategic asset-light approach, including the $1.2 billion divestment of non-core assets in late 2023.

What is included in the product

Analyzes GC’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address strategic weaknesses, transforming potential obstacles into actionable solutions.

Weaknesses

GC's profitability is significantly exposed to the unpredictable swings in global crude oil and natural gas prices, as these are its primary feedstocks. Changes in these raw material costs directly translate to higher production expenses and squeezed profit margins, introducing considerable financial uncertainty. For instance, in early 2024, Brent crude oil prices averaged around $83 per barrel, a notable increase from previous periods, directly impacting GC's input costs.

Despite efforts to diversify, GC's reliance on liquid-based feedstocks for a substantial part of its cracker operations continues to be a disadvantage. This makes its production less cost-competitive compared to regions that benefit from cheaper, gas-based feedstocks, especially when natural gas prices are significantly lower. This feedstock cost disparity can hinder GC's ability to compete effectively in international markets.

GC's performance is vulnerable to the global petrochemical industry's oversupply, a situation expected to continue through 2025. This overcapacity, especially in foundational products like ethylene and propylene, directly pressures operating rates and profit margins. For instance, industry analysts project that global petrochemical capacity additions will outpace demand growth by a significant margin in the near term, creating a challenging pricing environment.

Slowing global economic growth, especially in crucial markets like Europe and China, is a significant concern. For instance, the IMF projected global GDP growth to slow from 3.2% in 2023 to 2.9% in 2024, a trend that directly impacts demand for petrochemicals. This slowdown, combined with elevated household debt in Thailand, could reduce consumption of GC's products.

Furthermore, ongoing geopolitical conflicts and trade tensions, such as the lingering effects of US-China trade disputes, create considerable uncertainty. These factors can disrupt global supply chains, making it harder for GC to access raw materials and reach its export markets efficiently, potentially hindering its international sales growth.

High Capital Intensity and Need for Continuous Investment

The petrochemical sector, by its very nature, demands massive upfront capital and a constant stream of funding for upgrades and upkeep. GC's strategic expansion into new projects and efficiency improvements, while forward-thinking, requires considerable financial commitment. For instance, GC's planned capital expenditures for 2024 were around $2 billion, primarily directed towards expanding its polyethylene capacity and modernizing existing facilities.

This relentless need for investment can put a strain on the company's financial muscle, potentially affecting profitability, particularly when market conditions turn unfavorable. The ongoing capital intensity means that even with successful projects, the return on investment might be slower to materialize. This can be seen in the petrochemical industry's typical high debt-to-equity ratios, which for major players hovered around 0.8 to 1.2 in early 2024, reflecting the reliance on borrowed funds to finance these extensive operations.

- Significant Capital Outlays: GC's ongoing investment in new projects and technological advancements, such as the new cracker complex set to start operations in late 2024 with an estimated cost of $1.5 billion, highlights the industry's capital-hungry nature.

- Maintenance and Upgrades: Beyond expansion, substantial funds are continuously allocated to maintaining and upgrading existing plants to meet evolving environmental standards and operational efficiency, a cost that cannot be deferred.

- Financial Resource Strain: The sheer scale of these investments can limit the capital available for other strategic initiatives or shareholder returns, especially during economic downturns when cash flows might be reduced.

- Impact on Returns: High capital intensity can dilute return on equity metrics, as larger asset bases are required to generate profits, making it crucial for GC to ensure projects deliver robust cash flows to offset these upfront costs.

Challenges in Adopting Circular Economy and Bio-based Alternatives

While GC champions the circular economy and bio-based chemicals, the shift isn't without its difficulties. Retrofitting current manufacturing facilities to effectively process recycled materials is both expensive and technically demanding. For instance, companies in the chemical sector have reported capital expenditure increases of 15-30% for such upgrades.

Furthermore, the production expenses for these environmentally friendly alternatives often exceed those of conventional petroleum-based chemicals. Studies indicate that, on average, bio-based chemical production can be 10-25% more costly initially due to economies of scale and feedstock processing.

The availability of specific bio-based raw materials also presents a constraint. Securing a consistent and sufficient supply of certain bio-feedstocks can be challenging, impacting production reliability and scalability. For example, the global supply of certain bioplastics feedstocks, like PHA, is still developing, with production capacity expected to reach approximately 200,000 tonnes by 2025, which is a fraction of traditional plastic output.

- Cost of Retrofitting: Significant capital investment required for plant modifications to handle recycled materials.

- Higher Production Costs: Green alternatives often carry a premium compared to established petrochemicals.

- Feedstock Availability: Limited or inconsistent supply of key bio-based raw materials can hinder scaling.

GC's profitability is heavily influenced by volatile crude oil and natural gas prices, its primary feedstocks, impacting production costs and profit margins. For example, Brent crude averaged around $83 per barrel in early 2024, increasing input expenses. Additionally, the company's reliance on liquid-based feedstocks puts it at a cost disadvantage compared to competitors using cheaper, gas-based alternatives, especially when natural gas prices are low, hindering its competitiveness in global markets.

The petrochemical industry's ongoing oversupply, projected to persist through 2025, puts pressure on GC's operating rates and profit margins, particularly for foundational products like ethylene and propylene. Global petrochemical capacity additions are expected to outpace demand growth in the near term, creating a challenging pricing environment.

Slowing global economic growth, particularly in key markets like Europe and China, directly affects demand for petrochemicals. The IMF projected global GDP growth to slow to 2.9% in 2024, a trend that, combined with high household debt in Thailand, could reduce consumption of GC's products.

Geopolitical conflicts and trade tensions create supply chain disruptions and market access challenges, potentially hindering GC's international sales growth. The petrochemical sector's inherent capital intensity requires substantial ongoing investment for upgrades and new projects. GC's planned capital expenditures for 2024 were approximately $2 billion, primarily for polyethylene capacity expansion and facility modernization, which can strain financial resources and impact return on equity.

The transition to circular economy and bio-based chemicals presents challenges, including expensive and technically demanding retrofitting of manufacturing facilities. Production costs for these greener alternatives are often higher, with bio-based chemical production estimated to be 10-25% more costly initially. Furthermore, securing a consistent and sufficient supply of bio-based raw materials remains a constraint, impacting production reliability and scalability.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Feedstock Price Volatility | Reliance on crude oil and natural gas prices. | Impacts production costs and profit margins. | Brent crude averaged ~$83/barrel in early 2024. |

| Feedstock Cost Disparity | Preference for liquid-based feedstocks over gas. | Reduces cost competitiveness against gas-based producers. | Regions with lower natural gas prices offer a cost advantage. |

| Global Oversupply | Excess capacity in key petrochemical products. | Pressures operating rates and profit margins. | Capacity additions projected to outpace demand growth through 2025. |

| Economic Slowdown | Reduced demand in key markets. | Decreased consumption of petrochemical products. | IMF projected global GDP growth of 2.9% in 2024. |

| Geopolitical & Trade Tensions | Supply chain disruptions and market access issues. | Hinders international sales and raw material access. | Lingering effects of US-China trade disputes. |

| High Capital Intensity | Significant investment needed for expansion and maintenance. | Strains financial resources, impacts ROI. | GC's 2024 capex ~ $2 billion for expansion and upgrades. |

| Green Transition Costs | Expenses for retrofitting and higher production costs for bio-based chemicals. | Increases operational expenditure and initial investment. | Retrofitting costs can increase capex by 15-30%; bio-based production 10-25% higher. |

| Bio-Feedstock Availability | Challenges in securing consistent supply of bio-based raw materials. | Impacts production reliability and scalability. | Global PHA capacity projected ~200,000 tonnes by 2025. |

Same Document Delivered

GC SWOT Analysis

The preview you see is the actual SWOT analysis document you will receive upon purchase. This ensures there are no surprises, only professionally crafted content. You're getting a direct look at the quality and structure you can expect. Purchase unlocks the complete, in-depth report, ready for your strategic planning.

Opportunities

The global specialty chemicals market is projected to reach approximately $1.1 trillion by 2025, showing robust growth across key industries like automotive and electronics. This expanding market, coupled with rising consumer preference for sustainable solutions, presents a significant avenue for GC. The company's strategic focus on bio-based chemicals, such as its investments in polylactic acid (PLA) production, directly addresses this growing demand for eco-friendly alternatives.

GC's 'Step Out' strategy is actively driving international expansion, with its allnex subsidiary being a key player. allnex is notably broadening its production capabilities in promising markets such as India, a move that aligns with GC's broader objective of capturing global business growth.

These geographical expansions are strategically designed to tap into regions exhibiting high growth potential. By establishing a stronger presence in these markets, GC aims to directly address and leverage emerging consumer demands and overarching industry megatrends.

The formation of new strategic partnerships is crucial for amplifying GC's global footprint. These collaborations are expected to provide access to new customer bases and distribution channels, thereby accelerating market penetration and revenue generation.

For instance, in 2023, allnex inaugurated a new production facility in Gujarat, India, significantly increasing its capacity to serve the growing Asian market for coatings and adhesives, a sector projected to grow at a compound annual growth rate of over 6% through 2028.

GC can unlock significant opportunities by further integrating advanced technologies like AI and machine learning. These tools can streamline operations, cut expenses, and refine production, boosting overall efficiency. For instance, by expanding its current furnace optimization and fouling prediction initiatives across all sites, GC can gain a competitive edge and improve output.

Circular Economy Initiatives and Waste-to-Value Creation

The global push towards a circular economy offers significant avenues for GC to pioneer advancements in waste management and resource recovery. By investing in technologies and forging collaborations to transform plastic waste into marketable materials, GC can significantly lessen its environmental footprint, unlock novel income sources, and bolster its reputation as a sustainability leader. For instance, the company's 'GC Circular Living' concept and the YOUTURN Platform are tangible steps in this direction, demonstrating a commitment to value creation from waste streams.

These initiatives are not just about environmental responsibility; they translate into tangible economic benefits. In 2024, the global market for waste-to-energy is projected to reach over $50 billion, highlighting the economic potential of waste valorization. GC's focus on upcycling and converting plastic waste can tap into this growing market. For example, the YOUTURN Platform aims to collect and process 100,000 tons of plastic waste annually, aiming to produce valuable recycled materials.

- Innovation in Waste-to-Value: GC can develop and implement advanced recycling and upcycling technologies to convert plastic waste into higher-value products, such as construction materials or new packaging solutions.

- Strategic Partnerships: Collaborating with technology providers, waste management companies, and consumer brands can accelerate the development and scaling of circular economy initiatives, creating a robust ecosystem.

- Market Demand for Sustainable Products: Growing consumer and regulatory pressure for sustainable products creates a receptive market for GC's upcycled materials and circular economy solutions.

- Reduced Operational Costs: Integrating waste materials into production processes can lead to cost savings on raw materials, enhancing overall profitability.

Diversification of Feedstock and Energy Sources

GC has a significant opportunity to bolster its resilience and cost-effectiveness by broadening its feedstock and energy supply chains. This strategic move aims to cushion the impact of price fluctuations inherent in traditional raw materials.

By incorporating US-imported ethane, GC can introduce a more stable and potentially cost-advantaged feedstock option, thereby reducing reliance on volatile naphtha or gas prices. For instance, the ethane cracker project is expected to commence operations in 2026, signaling a tangible step towards this diversification. Furthermore, exploring the production of blue and green hydrogen presents a pathway to lower-carbon energy and potentially more predictable energy costs compared to fossil fuels. In 2024, GC announced plans to invest in renewable energy, including installing solar rooftops across its facilities, which is projected to contribute to a reduced carbon footprint and operational cost savings in the long term.

- Feedstock Diversification: Integration of US-imported ethane to reduce reliance on traditional, more volatile feedstocks.

- Energy Transition: Exploration of blue/green hydrogen production for cleaner and potentially more stable energy sourcing.

- Renewable Energy Investment: Deployment of solar rooftops on facilities to cut carbon emissions and energy expenses, with initial installations targeting completion by 2025.

- Cost Control Enhancement: Improved ability to manage operational costs through diversified and potentially lower-cost energy and feedstock inputs.

GC can capitalize on the growing demand for sustainable solutions by expanding its bio-based chemical portfolio, particularly in areas like polylactic acid (PLA). The global specialty chemicals market is projected to reach approximately $1.1 trillion by 2025, with eco-friendly alternatives showing strong growth. GC's strategic investments in PLA production directly align with this trend, addressing increasing consumer and regulatory preference for greener products.

Threats

The petrochemical sector faces fierce global competition, especially from Middle Eastern nations leveraging advantageous feedstock costs and Chinese mega-complexes benefiting from substantial economies of scale. This competitive landscape, coupled with overcapacity, directly translates to diminished profit margins and downward pressure on product pricing for companies like GC.

The resulting oversupply situation creates a challenging environment where maintaining profitability and market share becomes a significant hurdle. For instance, global petrochemical capacity additions have continued to outpace demand growth in recent years, leading to utilization rates that often hover below optimal levels, impacting pricing power.

GC faces increasing threats from stricter environmental regulations and the implementation of carbon taxes globally. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully phased in by 2026, will impact companies importing goods into the EU, potentially increasing costs for those with higher carbon footprints. This trend is mirrored in many other jurisdictions, pushing for reduced emissions and tackling plastic pollution.

Compliance with these evolving environmental mandates can significantly raise operational expenses for GC. This includes the cost of implementing new technologies to meet emission reduction targets, such as investing in cleaner production processes or carbon capture solutions. For example, the automotive sector, a key customer for some chemical companies, is rapidly shifting towards electric vehicles, demanding changes in material supply chains and potentially impacting demand for certain traditional chemical products.

The financial implications of non-compliance or delayed adaptation are substantial. Beyond direct fines, companies like GC could face reputational damage and loss of market access if they fail to align with environmental standards. Some projections indicate that global spending on climate change adaptation could reach hundreds of billions of dollars annually by the late 2020s, highlighting the scale of investment required across industries to meet these challenges.

Global economic uncertainty, including the potential for recessions and fluctuating consumer confidence, poses a significant threat by potentially dampening demand for petrochemicals. For instance, a projected slowdown in global GDP growth for 2024, estimated at around 2.7% by the IMF in early 2024, could directly impact the volume of petrochemical sales.

Geopolitical instability and rising trade protectionism further complicate the landscape. Disruptions to crucial supply chains, as seen with ongoing global conflicts, can affect the availability and cost of essential feedstocks like crude oil and natural gas. This unpredictability creates volatile market conditions, making strategic planning and consistent operations challenging for companies like GC.

Technological Disruption and Emergence of Alternative Materials

The petrochemical industry faces a significant threat from the accelerating development and adoption of bioplastics and other sustainable materials. These alternatives are increasingly competitive, driven by both consumer demand for eco-friendly products and evolving regulatory landscapes. For instance, the global bioplastics market was valued at approximately $12.1 billion in 2023 and is projected to reach $35.2 billion by 2030, demonstrating robust growth that directly challenges traditional plastics derived from fossil fuels.

Advanced recycling technologies also present a disruptive force, enabling the creation of higher-quality recycled plastics that can substitute virgin materials. This innovation reduces reliance on primary petrochemical feedstocks. Companies like PureCycle Technologies are making strides in advanced recycling, with their first plant in Ironton, Ohio, aiming to produce ultra-pure recycled polypropylene, a key material in automotive and consumer goods sectors.

The pace of innovation in material science means that new, potentially superior, or more cost-effective materials could emerge rapidly. This necessitates substantial and ongoing research and development investment for petrochemical companies like GC to adapt and retain market share. Failure to innovate and integrate these new material streams could lead to a significant erosion of GC's competitive position in key markets.

- Bioplastics Market Growth: Projected to surge from $12.1 billion in 2023 to $35.2 billion by 2030.

- Advanced Recycling Impact: Technologies like PureCycle's are creating viable alternatives to virgin petrochemicals.

- R&D Imperative: Continuous innovation is crucial for petrochemical firms to counter material displacement.

- Competitive Landscape Shift: Sustainable materials are gaining traction, threatening traditional petrochemical product dominance.

Cybersecurity Risks and IT Infrastructure Vulnerabilities

The petrochemical industry's growing dependence on sophisticated IT systems for everything from operational control to supply chain management makes it a prime target for cyber threats. These vulnerabilities are not theoretical; in 2023, the global cost of cybercrime was estimated to reach $8 trillion, and the industrial sector is increasingly targeted. For GC, a breach or an IT outage could cripple production, disrupt inventory, and result in significant financial losses, directly impacting operational efficiency and profitability.

Legacy infrastructure is a particular weak point, often lacking the robust security features of modern systems. This can create entry points for malicious actors. Moreover, human error remains a significant factor in cybersecurity incidents, with phishing attacks and misconfigurations being common causes of breaches. The potential for IT disruptions, whether from cyberattacks or internal failures, presents a substantial operational risk that requires continuous vigilance and investment in advanced security measures.

In 2024, the industrial control systems (ICS) cybersecurity landscape continues to evolve, with ransomware attacks on critical infrastructure becoming more sophisticated. A report by Claroty in early 2024 indicated that over 90% of OT networks exhibit vulnerabilities. For a company like GC, this translates to a tangible threat to its operational continuity, with potential downtime costing millions per day depending on the scale of the disruption.

- Cybersecurity Threats: Increased reliance on digital systems for operations and supply chains exposes GC to sophisticated cyberattacks.

- Operational Impact: IT outages, whether from cyber incidents, legacy systems, or human error, can halt production and disrupt inventory management.

- Financial Ramifications: Downtime and data breaches can lead to substantial financial losses, impacting GC's bottom line.

- Vulnerability of Legacy Systems: Outdated IT infrastructure often lacks modern security protocols, creating exploitable weaknesses.

GC faces intense competition from regions with lower feedstock costs and large-scale producers, leading to pricing pressure and reduced profit margins. Global petrochemical capacity additions in recent years have outpaced demand, resulting in lower utilization rates and a challenging market for maintaining profitability.

Stricter environmental regulations and carbon taxes, like the EU's CBAM impacting imports from 2026, will increase operational costs for GC. Non-compliance risks fines, reputational damage, and loss of market access, especially as key customer industries like automotive shift towards sustainability.

The rise of bioplastics and advanced recycling technologies threatens traditional petrochemical product demand. The bioplastics market is projected to grow significantly, reaching an estimated $35.2 billion by 2030, while innovations in recycling create viable alternatives to virgin materials.

GC's reliance on IT systems makes it vulnerable to cyber threats, with the global cost of cybercrime reaching an estimated $8 trillion in 2023. Operational disruptions from breaches or outages, particularly with legacy systems, can cause significant financial losses and impact production continuity.

SWOT Analysis Data Sources

This analysis is built on a robust foundation of diverse data sources, including internal financial reports, comprehensive market research, and valuable customer feedback, ensuring a well-rounded perspective.