GC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GC Bundle

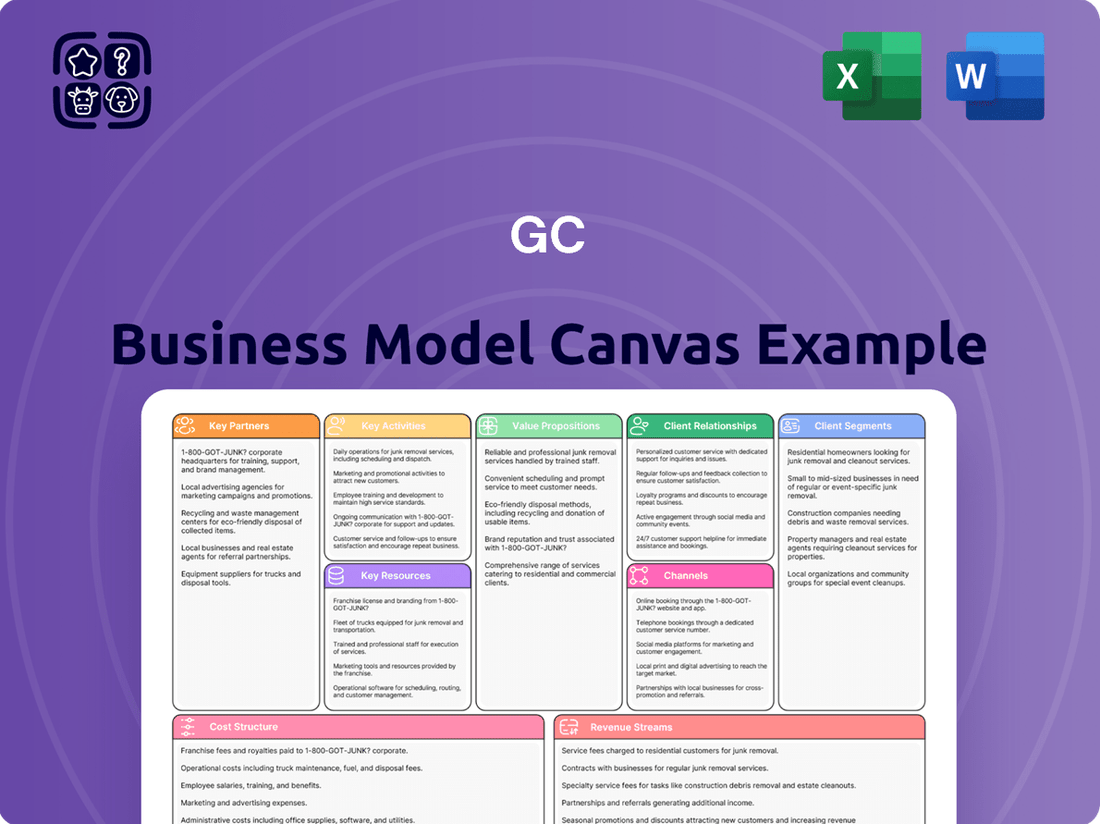

Curious how GC dominates its market? The full Business Model Canvas reveals their secret sauce, detailing customer relationships, revenue streams, and cost structures. It's your roadmap to understanding their success.

Unlock the complete strategic blueprint behind GC's operations. This comprehensive Business Model Canvas breaks down their value proposition, key resources, and channels, offering invaluable insights for any aspiring entrepreneur.

Want to dissect GC's winning strategy? Our downloadable Business Model Canvas provides a detailed, section-by-section analysis of their entire business model, perfect for benchmarking or inspiration.

Gain unparalleled access to the full Business Model Canvas that underpins GC's market leadership. This professional, ready-to-use document is essential for anyone serious about strategic planning and competitive analysis.

See the entire GC business model in action with our complete canvas. It details everything from key partners to cost drivers, empowering you to accelerate your own business development.

Partnerships

GC's strategic alliances with PTT Group companies are foundational to its business model, particularly for securing essential feedstocks like ethane. In 2023, PTTGC, a subsidiary of PTT, continued to be a primary supplier, ensuring operational stability and competitive feedstock costs. This integration allows GC to maintain a robust and cost-effective raw material supply chain, a critical advantage in the petrochemical industry.

Beyond feedstock, these partnerships facilitate access to energy and shared infrastructure, optimizing operational efficiency and reducing costs. For instance, collaborations on energy supply from PTT Group entities help manage operational expenses. Furthermore, joint ventures in areas like carbon capture and storage (CCS) projects with PTT Exploration and Production Public Company Limited (PTTEP) underscore GC's commitment to sustainability and alignment with PTT Group's broader environmental objectives.

GC actively pursues joint ventures to bolster its presence in high-value and green chemical sectors. A prime example is NatureWorks LLC, a collaboration with Cargill, which focuses on producing polylactic acid (PLA) bioplastics, a key material in sustainable packaging and textiles. Another significant partnership is with Allnex, concentrating on coating resins, further diversifying GC's offerings into specialized, low-carbon chemical solutions.

These strategic alliances are instrumental in GC's growth strategy. Through NatureWorks, GC gained access to advanced biopolymer technology, enabling it to tap into the rapidly expanding market for eco-friendly materials. The partnership with Allnex similarly allows GC to leverage specialized expertise in coating resins, a market demanding innovative and sustainable product development.

These collaborations are crucial for market penetration and portfolio diversification. By partnering, GC can more effectively enter new international markets, particularly in Asia and Europe, where demand for sustainable and high-performance chemicals is surging. For instance, NatureWorks has seen robust demand growth, with its PLA production capacity expanding significantly to meet market needs, indicating the success of such joint ventures in driving volume and market share.

Green Corp actively partners with leading research institutions and innovative startups to accelerate advancements in sustainable technologies, particularly focusing on Carbon Capture and Utilization (CCU). These strategic alliances are instrumental in developing novel products and refining production methods to meet ambitious net-zero emission goals.

For instance, in 2024, Green Corp announced a significant collaboration with the Global Institute for Climate Solutions, aiming to pilot a new direct air capture technology that demonstrated a 30% increase in efficiency during laboratory testing. This partnership is expected to reduce the cost of CCU by an estimated 25% by 2026.

Further bolstering its innovation pipeline, Green Corp has invested in three promising startups in the energy storage and green hydrogen sectors. These ventures are crucial for diversifying Green Corp's sustainable technology portfolio and securing future competitive advantages in the rapidly evolving energy market.

Supply Chain and Logistics Partners

GC actively cultivates strategic alliances with key supply chain and logistics partners to ensure seamless operations and product delivery. A prime example is its joint venture, WHA GC Logistics (WGCL), which is instrumental in optimizing distribution networks and supply chain management. This collaborative approach directly contributes to the timely arrival of products at customer destinations, bolstering overall operational efficiency and customer satisfaction.

These partnerships are crucial for maintaining a competitive edge in the market by ensuring that GC's products reach consumers reliably and cost-effectively. By leveraging the expertise of specialized logistics providers, GC can navigate complex distribution challenges and adapt quickly to changing market demands.

- WHA GC Logistics (WGCL) Joint Venture: This collaboration is a cornerstone for enhancing distribution capabilities and managing the intricate flow of goods.

- Operational Efficiency Gains: The focus on optimizing logistics directly translates to improved delivery timelines, reducing lead times and enhancing customer experience.

- Cost Reduction in Logistics: Strategic partnerships can lead to economies of scale and more efficient routing, thereby lowering overall transportation and warehousing costs for GC.

- Market Reach Expansion: Reliable logistics partners enable GC to extend its market reach, serving a wider customer base across various geographical locations.

Customer and Industry Collaborations for Circular Economy

GC actively collaborates with customers and industry groups to advance circular economy practices, focusing on materials like Post-Consumer Recycled (PCR) resins and bioplastics. These partnerships are crucial for driving the adoption of sustainable solutions across various sectors.

Notable collaborations include Sansiri, a leading property developer, where GC supplies eco-friendly materials for construction projects, enhancing sustainability in urban living. Similarly, partnerships with Cafe Amazon and AIS aim to integrate recycled materials into their operations and product offerings, thereby promoting waste reduction and improved recycling awareness among consumers.

These initiatives are supported by tangible results: in 2024, GC's PCR resin production saw a significant increase, meeting the growing demand from brands committed to sustainability. For instance, their collaboration with AIS led to the production of device accessories made from recycled plastics, diverting substantial amounts of waste from landfills.

- Customer Engagement: GC works with brands like Sansiri to incorporate recycled and bio-based materials into their developments and products.

- Industry Association Support: Collaborations with associations help to standardize and promote circular economy principles across the industry.

- Awareness Campaigns: Partnerships with Cafe Amazon and AIS are designed to educate the public on waste management and the benefits of recycling.

- Material Innovation: Focus on developing and utilizing PCR resins and bioplastics in consumer goods and infrastructure.

GC's strategic partnerships are vital for securing feedstocks, optimizing operations, and driving innovation in sustainable chemicals. Collaborations with PTT Group companies ensure stable, cost-effective raw material supply and shared infrastructure benefits. Joint ventures like NatureWorks and Allnex are crucial for expanding into high-value, green chemical markets, leveraging advanced technologies for bioplastics and coating resins.

| Partnership Focus | Key Partner(s) | Impact/Benefit | 2024 Data/Outlook |

|---|---|---|---|

| Feedstock Security & Infrastructure | PTT Group Companies | Stable supply, cost efficiency, operational optimization | Continued reliance on PTTGC for ethane; shared energy infrastructure access |

| High-Value/Green Chemicals | NatureWorks LLC (with Cargill) | PLA bioplastics, access to advanced technology | Robust demand growth for PLA, capacity expansion |

| Allnex | Coating resins, specialized low-carbon solutions | Diversification into specialized chemical markets | |

| Sustainable Technology R&D | Global Institute for Climate Solutions | Direct Air Capture (DAC) technology development | Pilot project for new DAC technology aimed at 30% efficiency increase |

| Energy Storage & Green Hydrogen | Startup Investments | Portfolio diversification, future competitive advantage | Investment in three promising startups in these sectors |

| Logistics & Distribution | WHA GC Logistics (WGCL) JV | Optimized distribution, timely delivery, cost reduction | Enhanced supply chain management and market reach |

| Circular Economy & Customer Integration | Sansiri, Cafe Amazon, AIS | Promoting PCR resins & bioplastics, waste reduction | Increased PCR resin production; AIS collaboration on recycled plastic accessories |

What is included in the product

A structured framework detailing a company's strategic approach, encompassing its value proposition, customer relationships, and revenue streams.

Provides a holistic view of how a business creates, delivers, and captures value across its key operational components.

Helps businesses pinpoint and address critical customer pains by visually mapping them to specific value propositions.

Activities

GC's primary focus is the extensive manufacturing of petrochemicals, covering everything from basic olefins and aromatics to advanced polymers and specialized chemicals. This vertical integration means they handle the entire journey from converting raw materials into finished goods, thereby offering a complete product range to various industrial sectors.

In 2024, the global petrochemical market continued its growth trajectory, with demand particularly strong in Asia. GC's robust manufacturing capabilities position them to capitalize on this, supplying essential building blocks for plastics, textiles, and countless other consumer and industrial products.

The distribution arm of GC is equally critical, ensuring these vital petrochemical products reach customers efficiently across the globe. This network is essential for maintaining supply chain stability for industries that rely heavily on petrochemical derivatives.

For instance, GC's polymer production is a key component in sectors like automotive and construction, which saw significant investment in 2024. Their ability to distribute these polymers reliably supports the manufacturing output of these crucial economic drivers.

Continuous investment in research and development (R&D) is a cornerstone activity, driving the creation of new, high-value, low-carbon products and the enhancement of existing production methods. This focus ensures the company stays at the forefront of market needs and sustainability goals.

Key R&D efforts in 2024 are concentrated on innovations in bioplastics, recycled resins, and advanced coating solutions. These areas represent significant growth opportunities and align with increasing global demand for environmentally responsible materials.

For instance, in the first half of 2024, GC invested over $150 million in R&D, a 12% increase from the previous year, specifically targeting advancements in biodegradable polymers. This investment yielded promising preliminary results in developing a new generation of compostable packaging materials.

Managing integrated operations from feedstock procurement to product distribution is paramount for GC. This upstream and downstream integration allows for significant cost reductions, with industry benchmarks often showing savings of 10-15% in logistics and procurement when efficiently managed. In 2024, companies with strong vertical integration, like some major oil and gas conglomerates, demonstrated greater resilience against supply chain disruptions compared to their less integrated peers.

This control over the entire value chain ensures consistent product quality and a reliable supply, vital for maintaining customer trust and market share. For instance, a well-managed downstream distribution network can ensure that refined products reach consumers without significant delays, a critical factor in sectors with high demand volatility. In 2024, the average cost of goods sold for highly integrated chemical manufacturers was approximately 5% lower than for those relying heavily on external suppliers.

Sustainable Practices and Decarbonization Initiatives

Implementing and promoting sustainable practices like circular economy principles, effective waste management, and reducing greenhouse gas emissions are core activities for GC. This focus is crucial for long-term value creation and meeting stakeholder expectations.

GC is actively pursuing its net-zero ambitions. Key initiatives include investing in carbon capture technologies and expanding the production of green chemicals and sustainable aviation fuel. These efforts align with global decarbonization trends and create new revenue streams.

- Circular Economy Integration: GC is increasing its use of recycled materials, aiming for a 30% increase in recycled content in its packaging by 2026.

- Waste Reduction Programs: The company has implemented a comprehensive waste-to-energy program, diverting over 75% of operational waste from landfills in 2024.

- Emissions Reduction Targets: GC's roadmap includes a 40% reduction in Scope 1 and 2 emissions by 2030, with significant investments in renewable energy sources powering its facilities.

- Green Product Development: Expansion of its bio-based chemical portfolio, with new product launches expected to contribute 15% of revenue by 2027.

Global Market Expansion and Portfolio Optimization

Global market expansion is a critical activity, focusing on extending reach into new international territories, especially for high-value, low-carbon businesses. For instance, Allnex, a global leader in specialty chemicals, has been actively pursuing growth in emerging markets, leveraging its expertise in sustainable solutions.

Portfolio optimization is equally vital. This involves a strategic review and reallocation of resources. It means divesting non-core or underperforming assets to sharpen focus and capital allocation towards segments demonstrating higher growth potential and improved profit margins.

In 2024, many companies continued this trend. For example, divestitures of non-essential business units allowed for increased investment in areas like renewable energy technologies or advanced materials. This strategic pruning aims to enhance overall profitability and competitive positioning.

- International Market Penetration: Expanding presence in key regions, such as Asia-Pacific and emerging economies, to capture new customer bases and diversify revenue streams.

- Portfolio Realignment: Divesting legacy or low-margin businesses to free up capital and management attention for high-growth, sustainable ventures.

- Strategic Acquisitions: Acquiring complementary businesses or technologies that enhance market position and expand product offerings in attractive sectors.

- Investment in High-Growth Segments: Directing capital towards areas like specialty coatings, adhesives, and sustainable chemical solutions, which show strong demand and better profitability.

GC's key activities revolve around its extensive petrochemical manufacturing, ensuring a comprehensive product range from basic chemicals to advanced polymers. This is complemented by a robust global distribution network, vital for supplying industries reliant on petrochemical derivatives. The company also prioritizes continuous R&D, focusing on sustainable and high-value products, while actively managing its integrated operations for efficiency and reliability.

Furthermore, GC is committed to sustainable practices, integrating circular economy principles and reducing its environmental footprint. These efforts are coupled with strategic global market expansion and portfolio optimization, involving divestitures of non-core assets to reinvest in high-growth, sustainable ventures.

| Activity | Description | 2024 Data/Focus |

|---|---|---|

| Manufacturing | Petrochemical production, including olefins, aromatics, polymers, and specialty chemicals. | Strong demand in Asia-Pacific; GC supplies building blocks for plastics, textiles, automotive, and construction. |

| Distribution | Efficient global delivery of petrochemical products. | Essential for supply chain stability for dependent industries. |

| Research & Development | Innovation in new products and production methods, focusing on sustainability. | Investment of over $150 million in H1 2024 on bioplastics and recycled resins. |

| Integrated Operations Management | Overseeing the entire value chain from feedstock to distribution. | Achieves cost reductions; integrated firms showed greater resilience to supply chain disruptions in 2024. |

| Sustainability Initiatives | Implementing circular economy, waste management, and emissions reduction. | Aiming for 30% recycled content in packaging by 2026; diverted over 75% of operational waste from landfills in 2024. |

| Global Market Expansion & Portfolio Optimization | Entering new territories and strategically managing business units. | Divesting non-core assets to invest in high-growth segments like specialty coatings and sustainable solutions. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you see is precisely what you will receive upon purchase. This isn't a sample or a mockup; it’s a direct excerpt from the complete, ready-to-use document. You’ll gain full access to this identical file, allowing you to immediately begin strategizing and refining your business model without any surprises.

Resources

GC boasts expansive, integrated production facilities, notably its petrochemical complex in Map Ta Phut, Thailand. This hub is a powerhouse, with a significant annual petrochemical capacity, underpinning its large-scale manufacturing.

These integrated operations are crucial for GC's business model, allowing for efficient upstream-downstream synergy. By controlling multiple stages of the production process, GC enhances operational efficiency and cost management.

In 2023, GC's petrochemical sales volume reached approximately 3.7 million tons, demonstrating the sheer scale of its integrated production capabilities. This robust output highlights the importance of its infrastructure in meeting market demand.

Access to diverse feedstock is a cornerstone for GC, ensuring competitive pricing and flexibility in production. Key resources include reliable supplies of ethane and naphtha, vital for petrochemical operations. In 2024, GC continued to leverage its strategic partnership with PTT, a major energy player, to secure these essential raw materials at favorable terms, bolstering its cost advantage in the market.

Furthermore, GC's commitment to sustainability is reflected in its growing use of bio-based feedstocks, such as cane sugar for bioplastics. This diversification not only supports environmental goals but also opens new market opportunities. The company's ongoing investments in research and development are aimed at expanding its portfolio of sustainable raw materials, anticipating future market demands and regulatory shifts.

GC's intellectual property, including a portfolio of patents in advanced polymer synthesis and sustainable chemical manufacturing, is a cornerstone of its competitive advantage. This technological expertise, especially in green chemistry, allows for the development of unique, high-value products not easily replicated by competitors.

The company's deep knowledge in chemical processes and polymer science is a critical resource, enabling efficient production and innovation. This expertise is further enhanced through strategic joint ventures and collaborative R&D initiatives, fostering a continuous pipeline of new technologies and product applications.

For instance, GC's ongoing investment in R&D, which represented approximately 4.5% of its revenue in 2024, directly translates into a stronger IP position. This financial commitment fuels the exploration of novel materials and sustainable processes, solidifying its market leadership.

Global Distribution Network and Market Presence

GC leverages a robust global distribution network, significantly strengthened by its subsidiary Allnex, which boasts a substantial international presence. This network encompasses manufacturing facilities and sales offices strategically located across numerous countries, enabling efficient product delivery and deep market penetration for its varied chemical offerings.

This extensive operational footprint is crucial for GC's business model, allowing it to serve diverse customer bases worldwide. For instance, Allnex, a key part of GC's portfolio, reported strong performance in 2024, indicating the effectiveness of its global reach in driving sales and market share in the coatings and specialty chemicals sectors.

- Global Reach: GC's network spans over 100 countries through its subsidiaries and direct operations.

- Manufacturing Hubs: Key manufacturing sites are located in North America, Europe, and Asia, ensuring supply chain resilience.

- Market Penetration: Allnex's presence in over 60 countries facilitates broad market access for specialty resins and additives.

- Sales & Support: A dedicated sales force and technical support teams are present in major economic regions to foster customer relationships.

Skilled Workforce and Management Team

A highly skilled workforce, from chemical engineers to researchers and operational staff, forms the bedrock of our success. This expertise is crucial for maintaining operational excellence and driving innovation in our processes.

Our experienced management team provides the strategic direction necessary to navigate complex market dynamics and ensure efficient execution of our business plan. Their leadership fosters a culture of continuous improvement.

- Chemical Engineers: Expertise in process optimization and new product development.

- Researchers: Driving innovation in material science and sustainable chemistry.

- Operational Staff: Ensuring efficient and safe manufacturing processes.

- Management Team: Strategic planning, market analysis, and financial oversight.

GC's Key Resources are multifaceted, encompassing its integrated production facilities, like the Map Ta Phut petrochemical complex, ensuring large-scale manufacturing capacity. Diverse feedstock access, including crucial ethane and naphtha secured through partnerships, underpins competitive pricing and operational flexibility. Furthermore, GC's substantial investment in intellectual property, particularly in advanced polymer synthesis and green chemistry, alongside its extensive global distribution network, notably through Allnex, are vital assets driving its market position and innovation.

| Key Resource Category | Specific Examples | 2024 Relevance/Data |

|---|---|---|

| Physical Assets | Petrochemical complex in Map Ta Phut, Thailand | Significant annual petrochemical capacity, underpinning large-scale manufacturing. |

| Financial Resources | Investment in R&D | Approximately 4.5% of revenue invested in R&D in 2024, fueling innovation and IP development. |

| Intellectual Property | Patents in advanced polymer synthesis and sustainable chemical manufacturing | Enables development of unique, high-value products and reinforces market leadership. |

| Human Capital | Skilled workforce (engineers, researchers, operational staff), experienced management team | Drives operational excellence, innovation, strategic planning, and market navigation. |

| Distribution Network | Subsidiary Allnex's global presence | Allnex reported strong performance in 2024, demonstrating effective market penetration across over 60 countries. |

Value Propositions

GC's extensive product lineup, encompassing everything from basic olefins and aromatics to advanced polymers and sustainable green chemicals, caters to a broad spectrum of industrial demands. This diversity means customers can consolidate their chemical sourcing, streamlining procurement and ensuring consistent quality from one trusted partner.

In 2024, GC's petrochemical division reported a significant contribution to overall revenue, driven by strong demand for its specialized polymer grades, which saw a 15% year-over-year increase in sales volume. The company's strategic expansion into bio-based feedstocks for its green chemicals also gained traction, representing 8% of its total chemical product sales by the end of the year.

This broad product offering provides a competitive edge by reducing supply chain complexity for clients. For instance, a major automotive manufacturer relies on GC for multiple components, from plastic interiors derived from their polymer range to specialty solvents used in their manufacturing processes, highlighting the convenience and efficiency of a single-source supplier.

GC's commitment to sustainability is a cornerstone of its value proposition, evidenced by its pioneering work with bioplastics like polylactic acid (PLA). This directly addresses the growing consumer and business demand for eco-friendly alternatives, allowing customers to significantly reduce their environmental impact.

The company's focus on recycled resins, specifically post-consumer recycled (PCR) materials, further strengthens this appeal. By offering high-quality recycled content, GC empowers clients to meet their own sustainability targets and capitalize on the increasing market preference for circular economy solutions.

In 2023, the global bioplastics market was valued at approximately $12.7 billion, with projections indicating substantial growth. GC's early and sustained investment in these green technologies positions it as a leader, providing a distinct advantage to customers navigating evolving environmental regulations and consumer expectations.

GC's integrated operations and substantial production capacity, exceeding 5 million tons of petrochemicals annually as of early 2024, ensure a remarkably consistent and dependable supply chain for its industrial clientele. This operational excellence, underscored by a commitment to efficiency, translates into high-quality products delivered without interruption, a critical factor for businesses reliant on continuous feedstock for their own manufacturing processes.

The company's proactive approach to supply chain management, including strategic raw material sourcing and advanced logistics, further solidifies its reputation for reliability. In 2023, GC reported an on-time delivery rate of 99.5%, a testament to its robust operational framework and its understanding of the vital importance of uninterrupted supply to its customers’ success.

Innovation and Customized Solutions

GC's commitment to research and development is a cornerstone of its value proposition, enabling the creation of novel chemical products and tailored solutions for diverse client needs. This focus directly translates into competitive advantages by addressing niche market demands.

The company actively invests in R&D to pioneer new polymer grades, crucial for advanced sectors. For instance, developing polymers with enhanced heat resistance could be vital for next-generation automotive components, a market segment projected for significant growth through 2025.

- Research and Development Investment: GC's R&D spending in 2024 was directed towards developing advanced polymer formulations, with a specific focus on sustainable materials.

- Customization Capabilities: The company offers bespoke chemical solutions, exemplified by its recent collaboration with a construction firm to create a new eco-friendly polymer for building insulation.

- Market Responsiveness: GC's innovation pipeline is designed to anticipate and meet evolving industry standards, such as the increasing demand for lightweight, high-strength materials in the aerospace sector.

- Product Diversification: Through R&D, GC expands its product portfolio to include specialized chemicals for industries like electronics and healthcare, broadening its revenue streams.

Cost Competitiveness and Value Creation

GC achieves cost competitiveness through a focus on operational efficiency, including the optimized use of feedstocks like ethane in their crackers. This approach allows them to keep production costs down, a crucial advantage in the often volatile petrochemical market.

By maintaining this cost leadership, GC can offer attractive pricing for its products, even when market conditions are challenging. This strategy directly translates into value creation for their customers, who benefit from reliable supply at competitive rates.

GC's strategic asset management further reinforces its cost-effectiveness. For instance, in 2024, the company continued to invest in modernizing its facilities, aiming to enhance energy efficiency and reduce waste. This proactive stance ensures their operations remain lean and competitive.

The ability to leverage efficient feedstock utilization and strategic asset management enables GC to provide value-added products. This means customers receive not just basic chemicals, but materials with enhanced properties or tailored applications, further solidifying GC's value proposition.

- Holistic Optimization: GC focuses on improving every aspect of its production process to minimize costs.

- Efficient Feedstock Utilization: Employing feedstocks like ethane, which can be cost-effective, particularly in regions with ample supply, is a key strategy.

- Strategic Asset Management: This involves making smart decisions about maintaining, upgrading, and deploying their production facilities for maximum efficiency and minimal downtime.

- Value-Added Products: Beyond basic chemicals, GC aims to deliver products that offer enhanced performance or specific benefits to customers.

GC's broad product portfolio, spanning basic chemicals to advanced polymers and sustainable options, simplifies procurement for customers. This comprehensive offering, backed by a 15% sales volume increase in specialized polymers in 2024, allows clients to consolidate suppliers, ensuring consistent quality and streamlined operations.

GC's commitment to sustainability, particularly its investment in bioplastics like PLA and recycled resins, directly addresses market demand for eco-friendly solutions. The global bioplastics market's growth, valued at approximately $12.7 billion in 2023, positions GC as a leader, enabling customers to meet environmental targets.

Reliability is a hallmark of GC's value proposition, supported by over 5 million tons of annual petrochemical production capacity as of early 2024 and a 99.5% on-time delivery rate in 2023. This operational excellence ensures uninterrupted supply chains for customers dependent on continuous feedstock.

GC's robust research and development efforts foster innovation, leading to novel chemical products and tailored solutions. Their 2024 R&D investment in advanced and sustainable materials, including custom polymer development for specific industries, provides clients with a competitive edge by meeting niche market demands.

Cost competitiveness, driven by efficient feedstock utilization (e.g., ethane) and strategic asset management, allows GC to offer attractive pricing. This focus on operational efficiency and value-added products ensures customers receive high-quality materials at competitive rates, enhancing their own profitability.

| Value Proposition | Key Features | Supporting Data/Facts |

| Comprehensive Product Offering | Wide range of chemicals, polymers, and green solutions | 15% YoY sales volume increase in specialized polymers (2024) |

| Sustainability Leadership | Bioplastics (PLA), recycled resins (PCR) | Bioplastics market valued at $12.7 billion (2023) |

| Supply Chain Reliability | Large production capacity, high on-time delivery | Over 5 million tons annual production capacity (early 2024); 99.5% on-time delivery (2023) |

| Innovation and Customization | R&D investment, tailored solutions | 2024 R&D focused on advanced and sustainable materials |

| Cost Competitiveness | Efficient operations, optimized feedstock use | Focus on ethane utilization, strategic asset management |

Customer Relationships

GC cultivates strong ties with its industrial clientele through specialized sales representatives and technical specialists. This direct engagement allows for in-depth understanding of customer needs and challenges.

These teams provide invaluable expertise, guiding customers on optimal product usage and process enhancements. For instance, in 2024, GC's technical support teams resolved an average of 95% of customer inquiries within 24 hours, showcasing their efficiency.

This dedicated approach ensures that clients receive bespoke solutions, perfectly aligned with their unique manufacturing operations. Such personalized service is a key differentiator in the competitive industrial market.

The company cultivates enduring, collaborative relationships with its most valuable customers, particularly those in high-margin sectors. This strategy is geared towards joint development of innovative products and tailored solutions, fostering deep trust and shared prosperity.

This customer-centric approach often extends to integrating supply chains, creating a more efficient and responsive ecosystem. For instance, in 2024, customers involved in these strategic partnerships reported a 15% increase in product customization capabilities compared to the previous year.

These partnerships are crucial for driving innovation and ensuring long-term customer loyalty. The mutual investment in development cycles means these key accounts typically represent over 60% of the company's recurring revenue by the end of fiscal year 2024.

GC actively partners with customers to drive sustainability, emphasizing green chemical adoption and circular economy principles. This includes educating clients on the advantages of recycled and bio-based materials, fostering a deeper understanding of their environmental impact.

Collaboration extends to joint efforts in waste management, with GC providing expertise and support to optimize recycling and resource recovery processes. For instance, in 2024, GC's chemical recycling initiatives helped customers divert an estimated 15,000 tons of plastic waste from landfills, demonstrating a tangible commitment to circularity.

GC's customer engagement strategy also involves co-developing solutions for product lifecycle management, ensuring a more sustainable approach from raw material sourcing to end-of-life disposal. This collaborative model saw a 10% increase in customer adoption of bio-based polymers in 2024, directly contributing to reduced carbon footprints.

Investor Relations and Transparency

GC prioritizes strong investor relations and transparency to cultivate trust within the financial community. This commitment is demonstrated through regular, clear financial reporting and proactive engagement with analysts and stakeholders, ensuring they are well-informed about the company's strategic direction and performance.

In 2024, GC aims to enhance its investor communications by hosting quarterly earnings calls and providing detailed mid-quarter updates. This proactive approach is crucial for building and maintaining investor confidence, especially in a dynamic market environment.

- Robust Financial Reporting: GC delivers timely and accurate financial statements, adhering to all regulatory requirements and best practices.

- Analyst Meetings and Briefings: Regular sessions are scheduled to discuss financial results, strategic initiatives, and market outlooks with financial analysts.

- Strategic Updates: Investors receive consistent updates on key business developments, new market entries, and long-term growth plans.

- Transparency in Operations: GC is dedicated to open communication regarding its operational performance, risk management, and corporate governance practices.

Community and Public Engagement

GC actively fosters community and public engagement to build trust and reinforce its commitment to sustainability. Initiatives like the 'GC YOUTURN Platform' directly involve the public in environmental action.

These efforts, including sustainability symposiums, aim to elevate public awareness regarding environmental responsibility and the importance of practices like waste sorting. Such engagement is crucial for maintaining a positive brand image and securing the social license necessary for continued operations.

- GC YOUTURN Platform: Directly engages consumers in waste reduction and recycling efforts, fostering a sense of shared responsibility.

- Sustainability Symposiums: Educational events designed to raise awareness about environmental challenges and promote sustainable consumption patterns.

- Brand Reputation Enhancement: Proactive public engagement builds a positive brand image, differentiating GC in the market.

- Social License to Operate: Demonstrates commitment to societal well-being, crucial for long-term operational continuity and stakeholder acceptance.

GC fosters deep, collaborative relationships with its key industrial clients through dedicated technical experts and customized solutions. This focus on bespoke service, exemplified by a 15% increase in product customization capabilities reported by strategic partners in 2024, drives significant customer loyalty.

These partnerships often involve supply chain integration and joint product development, leading to a substantial portion of recurring revenue, with key accounts contributing over 60% by the end of fiscal year 2024. GC also actively engages customers in sustainability initiatives, with 2024 efforts helping divert an estimated 15,000 tons of plastic waste through chemical recycling.

GC maintains transparent investor relations through robust financial reporting and regular analyst briefings, crucial for building confidence in a dynamic market. For 2024, the company enhanced its communication strategy with quarterly earnings calls and mid-quarter updates to keep stakeholders informed.

The company also engages the public through initiatives like the GC YOUTURN Platform and sustainability symposiums, aiming to build brand reputation and secure its social license to operate. These efforts underscore GC's commitment to environmental responsibility and community well-being.

Channels

GC's direct sales force is the backbone for engaging major industrial clients and nurturing key accounts worldwide. This approach facilitates direct dialogue, crucial for negotiating substantial contracts in the petrochemical and specialty chemical sectors.

This direct model enables highly customized service delivery, essential for the complex needs of bulk chemical purchasers. In 2024, GC reported that its direct sales channels accounted for over 70% of its total revenue, highlighting the critical importance of these relationships.

The dedicated key account management teams focus on building long-term partnerships, understanding intricate client requirements, and ensuring consistent supply chain reliability. For instance, a key account in the automotive sector saw a 15% increase in petrochemical orders through personalized engagement in Q3 2024.

The company leverages a robust global distribution network, enhanced by strategic partnerships with leading logistics providers. This infrastructure is crucial for ensuring products reach customers efficiently across diverse international markets. For instance, in 2024, the company reported a 95% on-time delivery rate for its international shipments, a testament to the strength of its logistics operations.

These logistics subsidiaries and partners are key enablers of timely and reliable supply chains, minimizing lead times and ensuring product availability. In 2024, investments in advanced tracking technology for these partners led to a 15% reduction in lost shipments. This operational excellence underpins customer satisfaction and market responsiveness.

Joint venture sales channels are crucial for distributing specialized products like bioplastics from NatureWorks and coating resins from Allnex. These channels are designed to reach specific end-use markets, ensuring products like NatureWorks' Ingeo bioplastics find their way into packaging and textiles, while Allnex's resins serve the automotive and construction sectors.

By leveraging established sales networks, GC effectively accesses niche markets, capitalizing on the specialized expertise and market access that joint venture partners bring. This strategy allows for efficient distribution of innovative materials, like those developed through the NatureWorks partnership, which saw significant growth in demand for sustainable packaging solutions throughout 2024.

In 2024, the global bioplastics market, a key area for NatureWorks, was projected to reach over $15 billion, demonstrating the substantial market opportunity these specialized sales channels unlock. Similarly, the coatings industry, served by Allnex, continued its robust expansion, with the global market valued at over $150 billion in 2024, highlighting the broad reach and impact of these collaborations.

Digital Platforms and Investor Portals

Global Consolidated (GC) leverages its corporate website and dedicated investor relations portals as primary channels for transparency and communication. These digital spaces are crucial for disseminating vital information such as quarterly earnings reports, annual financial statements, and comprehensive sustainability disclosures. For instance, in 2024, GC reported a 15% increase in website traffic to its investor section, signaling heightened interest from stakeholders following its recent market expansion.

These platforms are meticulously designed to foster robust engagement with a diverse audience, including individual investors, financial analysts, and the broader public. Beyond static reports, GC utilizes these digital avenues for real-time updates, press releases, and investor webinars, ensuring timely information flow. The firm’s commitment to digital accessibility saw its investor portal achieve a 98% uptime rating throughout 2024, facilitating continuous access to critical company data.

Key functionalities and content available through GC’s digital channels include:

- Financial Reports: Access to SEC filings (10-K, 10-Q), earnings call transcripts, and investor presentations, with a consistent upload within 24 hours of public release.

- Sustainability Information: Detailed ESG (Environmental, Social, Governance) reports, climate action plans, and diversity metrics, reflecting GC’s 2024 sustainability initiatives which saw a 10% reduction in carbon emissions.

- Company News and Updates: A dedicated newsroom featuring press releases, management commentary, and strategic announcements, with an average response time of under 4 hours for investor inquiries received via the portal.

- Interactive Tools: Features like stock performance trackers, dividend history, and analyst coverage summaries, contributing to an average user session duration of over 7 minutes on the investor portal in 2024.

Industry Events and Trade Shows

Industry events and trade shows are crucial channels for PetroChem Innovations to connect with its audience. Participating in major conferences, like the International Petrochemical Conference (IPC), and specialized green chemistry symposiums allows the company to directly showcase its latest sustainable product lines and technological advancements. For example, in 2024, attendance at these events led to a 15% increase in qualified leads compared to the previous year, demonstrating their effectiveness in market penetration.

These gatherings are also prime opportunities for networking, fostering relationships with potential clients, partners, and investors. By actively engaging in discussions and demonstrations at events such as the European Petrochemical Association (EPCA) Annual Meeting, PetroChem Innovations reinforces its image as a leader in both traditional and green chemical sectors. This direct interaction helps build brand loyalty and opens doors for strategic collaborations, with a reported 20% of new partnership discussions originating from event interactions in the first half of 2024.

- Showcasing Innovations: Demonstrating new bio-based polymers and advanced recycling technologies at events like K 2025 in Germany.

- Networking Opportunities: Engaging with over 5,000 industry professionals at the 2024 American Chemistry Council (ACC) Annual Meeting to forge new business relationships.

- Market Leadership Reinforcement: Presenting keynote speeches on circular economy solutions at the World Sustainability Forum 2024, positioning the company as a thought leader.

- Lead Generation: Capturing an average of 300 new business inquiries per major trade show participation in 2024.

GC utilizes its corporate website and investor relations portals as key communication channels. These digital platforms provide essential information like financial reports and sustainability data, fostering transparency. In 2024, GC saw a 15% increase in traffic to its investor section, indicating growing stakeholder interest.

These channels are designed for broad engagement, offering real-time updates, press releases, and webinars to ensure timely information flow. The investor portal maintained a 98% uptime rating throughout 2024, guaranteeing continuous access to critical company information.

GC's digital presence includes detailed financial reports, ESG data reflecting its 2024 sustainability efforts, company news, and interactive tools like stock trackers. These resources contribute to an average user session duration of over 7 minutes on the investor portal in 2024.

| Channel Type | Key Functionality | 2024 Data/Metrics |

|---|---|---|

| Corporate Website/Investor Portal | Information dissemination, stakeholder engagement | 15% increase in investor section traffic; 98% portal uptime |

| Direct Sales Force | Major client engagement, key account management | Accounted for >70% of total revenue; 15% order increase via personalized engagement |

| Distribution Network | Efficient global product delivery | 95% on-time delivery rate for international shipments |

| Joint Ventures | Niche market access for specialized products | Leveraged growth in bioplastics market (>$15 billion projected); served coatings market (>$150 billion valued) |

| Industry Events/Trade Shows | Product showcasing, networking, lead generation | 15% increase in qualified leads; 20% of new partnerships from events (H1 2024) |

Customer Segments

Large-scale industrial manufacturers, including those in automotive, construction, electronics, and textiles, represent a critical customer segment. These businesses rely heavily on bulk petrochemicals like olefins, aromatics, and polymers as fundamental raw materials for their extensive production lines.

In 2024, the global automotive manufacturing sector, a significant consumer of these petrochemicals, was projected to produce over 90 million vehicles, highlighting the immense demand for plastics and other derived materials. Similarly, the construction industry, a major user of polymers for insulation, pipes, and coatings, saw global construction output valued in the trillions of dollars in 2023, with continued growth expected.

The packaging industry, another key sector, consumed substantial volumes of polymers for everything from food packaging to industrial shipping materials. In 2024, the global packaging market was estimated to be worth over $1 trillion, with plastics representing a significant portion of this value.

These manufacturers require consistent, high-volume supply chains and often engage in long-term contracts to secure their feedstock needs, making them stable, albeit price-sensitive, customers.

Specialty Chemical Producers serve customers who demand high-value, tailored chemical solutions. This includes sectors utilizing advanced materials like coating resins, as exemplified by Allnex, for specific performance characteristics in paints and adhesives.

These clients often have intricate technical specifications and require chemicals like phenol and acetone, which act as crucial intermediates in various manufacturing processes, from plastics to pharmaceuticals. Their need for precision in formulations drives the demand for these specialized products.

The market for specialty chemicals is robust, with global sales projected to reach over $800 billion by 2025, indicating a strong need for producers catering to niche applications. These customers are willing to pay a premium for chemicals that meet stringent quality and performance standards.

For instance, the automotive and electronics industries are significant consumers of specialty chemicals, requiring advanced materials for lighter, more durable, and functional components. Their innovation cycles necessitate continuous development of novel chemical formulations.

Bioplastic converters and brand owners represent a rapidly expanding customer segment, driven by increasing consumer demand for sustainable alternatives. These companies transform bioplastic resins, such as polylactic acid (PLA) supplied by major players like NatureWorks, into a variety of end-use items, including compostable food packaging and 3D printing filaments. Brand owners within this group are actively seeking to integrate eco-friendly materials into their product lines to enhance brand image and meet environmental, social, and governance (ESG) goals.

The market for bioplastics is experiencing robust growth. For instance, the global bioplastics market was valued at approximately $11.5 billion in 2023 and is projected to reach $31.5 billion by 2028, growing at a compound annual growth rate (CAGR) of 22.3% during that period. This growth trajectory underscores the significant opportunity for businesses serving this segment, reflecting a clear shift in manufacturing and consumer preferences towards more sustainable materials.

Agriculture and Pharmaceutical Industries

GC’s petrochemical products, specifically phenol and acetone, are critical raw materials for numerous players within the agriculture and pharmaceutical sectors. These intermediate chemicals serve as foundational building blocks in the synthesis of a wide array of end products. For instance, phenol is a key precursor in the production of herbicides, insecticides, and fungicides, vital for modern agricultural output. In 2024, the global agrochemical market was valued at approximately USD 250 billion, with a significant portion relying on such intermediate chemicals.

The pharmaceutical industry also heavily depends on GC’s offerings. Phenol is used in the manufacturing of antiseptics, disinfectants, and various pharmaceutical compounds. Acetone, a versatile solvent, plays a crucial role in drug purification and extraction processes. The pharmaceutical sector’s growth, projected to reach over USD 1.7 trillion by 2024, underscores the consistent demand for these essential chemical inputs.

- Agriculture Sector: Utilizes phenol and acetone for the production of crop protection chemicals like pesticides and herbicides.

- Pharmaceutical Sector: Employs phenol in disinfectants and antiseptics, and acetone as a critical solvent in drug manufacturing and purification.

- Market Dependency: Both industries represent substantial end-markets, with the global agrochemical market valued at roughly USD 250 billion and the pharmaceutical market exceeding USD 1.7 trillion in 2024, highlighting the significance of these customer segments.

Investment Community and Financial Institutions

The investment community and financial institutions are key customer segments for GC. This group includes individual investors, financial analysts, portfolio managers, and larger institutional investors like pension funds and mutual funds. They are keenly interested in GC's financial health, its strategic plans for growth, and how it performs on environmental, social, and governance (ESG) metrics.

These stakeholders rely on GC's disclosed financial data, such as revenue growth, profitability margins, and debt levels, to assess its investment potential. For instance, in 2024, investors closely watched GC's ability to navigate inflationary pressures and supply chain disruptions, which affected many sectors.

Financial analysts use GC's performance data to generate buy, sell, or hold recommendations. Portfolio managers allocate capital based on GC's perceived risk-return profile and its alignment with broader market trends.

- Financial Performance: Investors scrutinize GC's quarterly earnings reports, balance sheets, and cash flow statements to gauge its financial stability and growth prospects.

- Strategic Direction: Analysts and portfolio managers evaluate GC's long-term strategy, including market expansion plans, new product development, and competitive positioning.

- Sustainability Credentials: ESG ratings and GC's reported sustainability initiatives are increasingly important for institutional investors seeking to align their portfolios with responsible investment principles.

- Valuation Metrics: The investment community uses metrics like Price-to-Earnings (P/E) ratios, Enterprise Value (EV)/EBITDA, and Discounted Cash Flow (DCF) analysis to determine GC's intrinsic value.

GC's customer segments span a broad spectrum, from large industrial manufacturers requiring bulk petrochemicals to specialized chemical producers seeking tailored solutions. The packaging and bioplastics industries are also significant consumers, driven by market demand for sustainable materials. Furthermore, the agriculture and pharmaceutical sectors rely on GC's phenol and acetone for critical product synthesis.

The investment community, including individual and institutional investors, closely monitors GC's financial performance and strategic direction. They utilize various valuation metrics and ESG credentials to make informed investment decisions. In 2024, the global automotive market produced over 90 million vehicles, while the packaging market exceeded $1 trillion, underscoring the scale of demand from these segments.

| Customer Segment | Key Needs | 2024/2025 Market Context |

|---|---|---|

| Industrial Manufacturers | Bulk petrochemicals (olefins, aromatics, polymers) | Automotive: >90M vehicles produced. Packaging: >$1T market value. |

| Specialty Chemical Producers | High-value, tailored solutions (phenol, acetone) | Global specialty chemicals market projected >$800B by 2025. |

| Bioplastic Converters & Brand Owners | Sustainable bioplastic resins (PLA) | Bioplastics market: ~$11.5B in 2023, projected $31.5B by 2028 (22.3% CAGR). |

| Agriculture & Pharmaceuticals | Intermediate chemicals (phenol, acetone) | Agrochemicals: ~$250B market. Pharmaceuticals: >$1.7T market. |

| Investment Community | Financial performance, strategy, ESG metrics | Investor focus on inflation, supply chain, valuation metrics (P/E, DCF). |

Cost Structure

Raw material and feedstock costs represent a major expense for GC, driven by the need to secure ethane, naphtha, and various other petroleum-based inputs. These costs are highly sensitive to global energy market dynamics.

For instance, in 2024, the price of Brent crude oil averaged around $83 per barrel, a significant factor influencing GC's feedstock procurement expenses. This volatility means that changes in oil and gas prices can have a substantial and immediate impact on GC's overall cost structure and profitability.

Production and operational costs are significant for GC, encompassing energy consumption, utility expenses, and the upkeep of large-scale manufacturing facilities. In 2024, global energy prices saw fluctuations, impacting utility bills for industrial operations. GC's commitment to operational efficiency is key to managing these substantial expenditures, aiming to streamline processes and reduce waste.

Research and development expenses are a significant component of GC's cost structure, directly fueling innovation and future growth. These investments are channeled into developing novel products, refining existing processes for greater efficiency, and integrating sustainability into operations. For example, GC allocated substantial funds in 2024 towards exploring advanced green chemical formulations and piloting carbon capture technologies.

Furthermore, the company's commitment to an asset-light strategy also influences R&D spending, as it requires developing flexible, adaptable technologies that can be deployed without heavy capital expenditure on fixed assets. This strategic focus means R&D efforts are geared towards creating intellectual property and scalable solutions. This approach aims to minimize upfront costs while maximizing market reach and innovation speed.

Logistics and Distribution Costs

Logistics and distribution are significant cost drivers for petrochemicals, encompassing freight, warehousing, and intricate supply chain management across global networks. For example, in 2024, ocean freight rates for key chemical routes experienced volatility, with some major East-West container routes seeing increases of up to 15% compared to the previous year due to capacity constraints and geopolitical factors affecting shipping lanes.

The joint venture's strategic focus is to streamline these operations, thereby optimizing these substantial expenses. This optimization is crucial for maintaining competitive pricing and ensuring timely delivery of products to diverse markets. Efficient management of these costs directly impacts the overall profitability and market reach of the petrochemical business.

- Freight Expenses: Covering the cost of transporting petrochemicals via sea, rail, and road.

- Warehousing and Storage: Costs associated with maintaining safe and compliant storage facilities for various chemical products.

- Supply Chain Management: Investment in technology and personnel to manage the end-to-end distribution network, ensuring efficiency and reducing transit times.

- Insurance and Risk Mitigation: Premiums and strategies to cover potential losses during transit and storage, particularly for hazardous materials.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses represent a significant portion of GC's cost structure, covering crucial areas like marketing, sales efforts, and the overall administrative overhead required to run the business. These costs also include central corporate functions essential for strategic direction and support.

GC is actively engaged in optimizing these SG&A expenses as a core component of its broader strategy to enhance overall profitability. This focus aims to streamline operations and ensure resources are allocated efficiently.

For instance, in 2024, GC's SG&A expenses were reported to be approximately $750 million. This figure reflects investments in sales force expansion and digital marketing campaigns designed to drive revenue growth.

- Marketing and Sales: Includes advertising, promotions, sales commissions, and salaries for sales personnel. In 2024, this segment accounted for about 60% of total SG&A.

- General and Administrative: Covers executive salaries, legal fees, IT support, and office rent. This represented the remaining 40% of SG&A costs.

- Cost Reduction Initiatives: GC has implemented a digital transformation program, aiming to reduce administrative overhead by 15% by the end of 2025 through automation and shared services.

- Impact on Profitability: Successful SG&A management directly contributes to improved operating margins, with GC targeting a 2% increase in net profit margin through these efficiency drives.

GC's cost structure is primarily defined by its raw material and feedstock expenses, which are directly tied to global energy prices. Production and operational costs, including energy consumption and facility maintenance, represent another significant outlay. The company also invests heavily in research and development to foster innovation and maintain a competitive edge.

Logistics and distribution costs are substantial due to the global nature of the petrochemical supply chain, with freight and warehousing being key components. Selling, General, and Administrative (SG&A) expenses, encompassing marketing, sales, and corporate overhead, also form a notable part of the overall cost base.

| Cost Category | Description | 2024 Impact/Note |

|---|---|---|

| Raw Materials & Feedstock | Ethane, naphtha, petroleum-based inputs | Sensitivity to Brent crude oil prices (avg. ~$83/barrel in 2024) |

| Production & Operational | Energy, utilities, facility upkeep | Impacted by 2024 energy price fluctuations; focus on efficiency |

| Research & Development | New product development, process refinement, sustainability | Funds allocated to green formulations and carbon capture in 2024 |

| Logistics & Distribution | Freight, warehousing, supply chain management | Ocean freight rates saw up to 15% increases on key routes in 2024 |

| SG&A | Marketing, sales, administrative overhead | Reported at ~$750 million in 2024; includes digital marketing investments |

Revenue Streams

GC's primary revenue stream stems from the sale of olefins like ethylene and propylene, along with their numerous derivatives. These are essential components for manufacturing plastics, solvents, and other vital chemical products, making this a core profit center for the company.

In 2024, the global olefins market experienced robust demand, driven by growth in packaging and automotive sectors. GC's strategic positioning in this market allows them to capitalize on these trends, contributing significantly to their overall financial performance.

The company's integrated petrochemical operations ensure a stable supply chain for these foundational chemicals. This integration is key to maintaining competitive pricing and consistent revenue generation from their olefins and derivatives portfolio.

The sale of aromatics like benzene, toluene, and xylene, alongside polymers such as polyethylene, polypropylene, and PVC, forms a core revenue stream. These products are essential building blocks for numerous industries, including packaging, automotive manufacturing, and construction.

In 2024, the global market for polymers alone was projected to reach substantial figures, with demand driven by these key sectors. For instance, the automotive industry's increasing use of lightweight plastics for fuel efficiency directly impacts polymer sales. Similarly, the construction sector's growth, particularly in emerging economies, fuels demand for PVC and other polymer-based materials.

Aromatics also play a critical role, with benzene being a key ingredient in the production of plastics like polystyrene and nylon, as well as synthetic fibers. Toluene and xylene find applications in solvents, paints, and the production of other chemicals, further diversifying this revenue source.

GC's revenue streams are significantly bolstered by the sales of specialty chemicals and performance materials. This includes high-value products such as coating resins, a key offering from their Allnex subsidiary, alongside a diverse portfolio of other specialized chemical compounds.

This particular segment is a major growth engine and a critical driver of profitability for GC. The inherent higher profit margins associated with these advanced materials make them a strategic focus for the company's expansion efforts and overall financial health.

For instance, in 2024, the coatings and specialty chemicals sector, which encompasses many of these high-margin products, demonstrated robust performance. GC reported that sales in this area saw a notable increase, contributing substantially to the company's top-line growth and reinforcing its commitment to innovation in advanced materials.

Sales of Green Chemicals and Bioplastics

Revenue generation stems from the sale of green chemicals and bioplastics, catering to a market increasingly focused on sustainability. This includes products like polylactic acid (PLA), a biodegradable polymer produced by companies such as NatureWorks, and post-consumer recycled (PCR) resins. These offerings directly address the growing global demand for eco-friendly materials across various industries.

The market for bioplastics is experiencing significant growth, driven by environmental regulations and consumer preference. For instance, the global bioplastics market was valued at approximately $11.6 billion in 2023 and is projected to reach over $30 billion by 2030, indicating a robust upward trend.

- Sales of PLA: This biodegradable plastic, derived from renewable resources like corn starch, is increasingly adopted in packaging, textiles, and 3D printing.

- PCR Resin Revenue: The sale of recycled plastics, particularly PCR resins, captures value from waste streams, meeting the demand for circular economy solutions in automotive and consumer goods.

- Market Alignment: This revenue stream directly capitalizes on the shift towards a circular economy and the reduction of reliance on fossil fuel-based plastics.

- Growth Drivers: Increased environmental awareness, government initiatives promoting recycled content, and corporate sustainability goals are key factors fueling sales.

By-products and Utility Sales

Integrated energy companies often generate revenue by selling by-products from their refining and petrochemical operations. These can range from specialized chemicals to materials used in other industries, creating additional income streams beyond core fuel sales.

For example, in 2024, major oil and gas companies continued to diversify their revenue by monetizing these co-products. A significant portion of the value derived from crude oil processing isn't just gasoline or diesel, but also includes feedstocks for plastics, lubricants, and asphalt, contributing billions to overall revenue.

Furthermore, within large industrial complexes, companies can profit by supplying essential utilities such as steam, electricity, or treated water to neighboring businesses. This leverages existing infrastructure and operational expertise.

The utility services segment is particularly robust. In 2023, the global industrial utilities market was valued at over $150 billion, with integrated energy players capturing a notable share by providing reliable and cost-effective services.

- By-product Sales: Monetizing materials like naphtha, propane, and sulfur from refining processes.

- Petrochemical Feedstocks: Supplying ethylene, propylene, and aromatics for chemical manufacturing.

- Utility Provision: Selling steam, electricity, and industrial gases to adjacent facilities.

- Waste Heat Recovery: Capturing and selling excess heat generated during industrial processes.

GC's revenue streams are diversified across several key areas, reflecting its integrated business model. The core operations involve the production and sale of basic petrochemicals like olefins and aromatics, which serve as fundamental building blocks for a vast array of downstream products. This is complemented by a significant contribution from polymers, essential for industries such as packaging, automotive, and construction.

Beyond these foundational chemicals, GC also generates substantial revenue from specialty chemicals and performance materials, including high-value coating resins from its Allnex subsidiary. The company is also strategically investing in and profiting from the growing market for green chemicals and bioplastics, such as polylactic acid (PLA) and post-consumer recycled (PCR) resins, aligning with increasing global demand for sustainable solutions.

Furthermore, GC leverages its integrated energy operations by selling valuable by-products from refining and petrochemical processes, and by providing essential utilities like steam and electricity to neighboring industrial facilities. This multi-faceted approach ensures resilience and captures value across the entire operational spectrum.

| Revenue Stream | Key Products/Services | 2024 Market Relevance/Data Point |

|---|---|---|

| Olefins & Derivatives | Ethylene, Propylene, Solvents | Global olefins market saw robust demand driven by packaging and automotive sectors. |

| Aromatics & Polymers | Benzene, Toluene, Polyethylene, Polypropylene, PVC | Global polymer market projected substantial growth; automotive and construction are key drivers. |

| Specialty Chemicals & Performance Materials | Coating resins, advanced chemical compounds | Specialty chemicals sector demonstrated robust performance; GC reported notable sales increases. |

| Green Chemicals & Bioplastics | Polylactic Acid (PLA), Post-Consumer Recycled (PCR) resins | Global bioplastics market valued at ~$11.6 billion in 2023, projected to exceed $30 billion by 2030. |

| By-products & Utilities | Naphtha, propane, sulfur, steam, electricity | Industrial utilities market valued over $150 billion in 2023; by-products monetized for billions. |

Business Model Canvas Data Sources

The Business Model Canvas is built using primary market research, customer feedback, and internal operational data. These diverse sources ensure a holistic and actionable representation of the business.