GC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GC Bundle

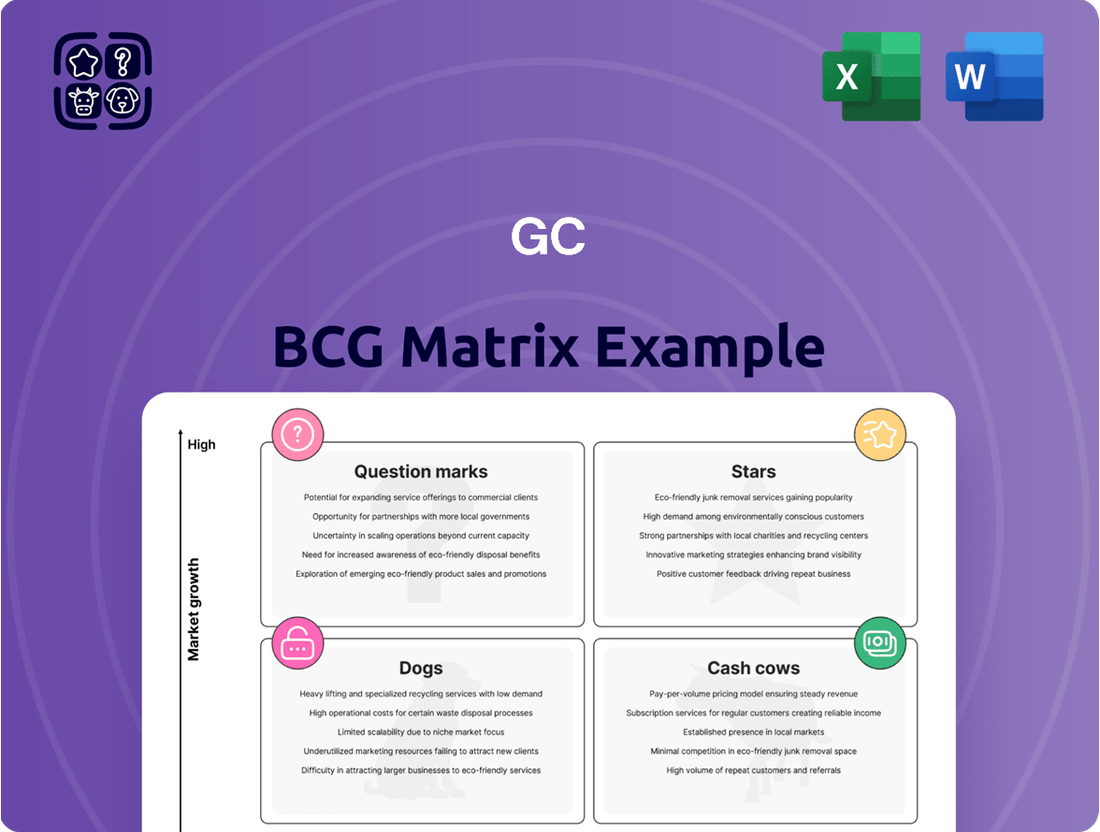

The BCG Matrix is a powerful tool for analyzing a company's product portfolio, categorizing each product into Stars, Cash Cows, Dogs, or Question Marks based on market growth and relative market share.

Understanding where your products fit within these quadrants is crucial for making informed strategic decisions about investment, divestment, and resource allocation.

This preview offers a glimpse into the foundational concepts of the BCG Matrix, but the real strategic advantage lies in a comprehensive, in-depth analysis.

Unlock the full potential of strategic portfolio management by purchasing the complete BCG Matrix.

Gain actionable insights and a clear roadmap to optimize your product mix for sustained growth and profitability.

Invest in clarity and empower your business with the full BCG Matrix today.

Stars

GC is strategically investing in high-value bio-chemicals like Bio-Propylene, Bio-Butadiene (Bio-BD), and Bio-Purified Terephthalic Acid (Bio-PTA). These are produced from renewable sources, such as used cooking oil, aligning with the increasing global demand for eco-friendly materials.

The market for sustainable materials in sectors like packaging and automotive rubber is experiencing significant growth, with projections indicating continued expansion. GC's focus on these bio-based products positions them to capitalize on this trend, offering alternatives to traditional petrochemicals.

GC's commitment extends to developing an integrated Polylactic Acid (PLA) production facility, a biodegradable polymer. This move solidifies GC's leadership in the high-potential bio-polymer segment, reflecting a forward-thinking approach to sustainable chemical manufacturing.

Allnex, a key player in coating resins and specialty coating resins, is positioned as a star within GC's portfolio. The company is actively pursuing market share growth and enhanced competitiveness, evident in its strategic capacity expansions.

Significant investments are being made in high-growth regions, with capacity expansion in China slated for 2024. Furthermore, an anticipated Q3 2026 expansion in India underscores a commitment to emerging markets.

The development of a Southeast Asia Hub in Rayong, Thailand, specifically targeting waterborne coatings and specialty coating resins, highlights a focus on high-value, performance-driven segments.

This strategic direction, concentrating on specialty chemicals with a global footprint, strongly indicates a substantial market share within a growing and specialized industry segment.

GC's venture into Sustainable Aviation Fuel (SAF) marks Thailand's first production, currently operating at 6 million liters annually in its initial phase.

The global aviation sector's aggressive decarbonization targets are fueling exponential growth in the SAF market, giving GC a crucial head start with its established production capacity.

This product category is a prime example of a high-growth opportunity where GC has strategically secured an early market presence.

As of 2024, the global SAF market is projected to reach approximately $15 billion, with a compound annual growth rate (CAGR) of over 40% expected in the coming years, underscoring the immense potential for GC's SAF business.

High-Value Performance Chemicals (HVP)

GC is actively reorienting its business towards High-Value Performance Chemicals (HVP). This strategic pivot is driven by a desire for enhanced profitability and a commitment to aligning with significant global megatrends. HVP encompasses specialty chemicals that offer distinct advantages over basic commodity chemicals, positioning them as crucial growth engines for GC.

The company's objective is to significantly boost the proportion of HVP within its overall product mix. This ambition underscores a deliberate move into markets characterized by robust growth potential and higher profit margins. For instance, GC's investment in advanced materials and sustainable solutions reflects this HVP focus.

- Strategic Shift: GC is prioritizing High-Value Performance Chemicals (HVP) for greater profitability.

- Product Focus: Specialty chemicals beyond commodities are central to GC's future growth strategy.

- Portfolio Expansion: The company aims to increase the HVP share in its product portfolio.

- Market Alignment: This strategy aligns GC with key global megatrends and high-growth sectors.

Map Ta Phut Specialty Hub Initiative

GC is actively developing the Map Ta Phut Specialty Hub, a strategic move to position Thailand as a premier center for specialty chemicals in Southeast Asia. This initiative involves close collaboration with governmental bodies to draw in top-tier international partners.

The goal is to bolster Thailand's economic standing and meet the escalating demand for sophisticated industrial products across the region. GC's focus on specialty chemicals targets a lucrative segment characterized by substantial growth, both geographically and in terms of product innovation.

- Regional Specialty Market Growth: The global specialty chemicals market is projected to reach over $850 billion by 2027, with Southeast Asia showing particularly strong growth, estimated at a compound annual growth rate (CAGR) of 6.5% in the coming years.

- Foreign Direct Investment (FDI) Focus: In 2023, Thailand's Board of Investment (BOI) reported a significant increase in FDI applications, with a notable portion directed towards advanced manufacturing and chemical industries, signaling government support for initiatives like the Map Ta Phut Hub.

- GC's Strategic Alignment: GC aims to capture a substantial share of this expanding market by offering advanced, high-value chemical solutions, leveraging Map Ta Phut's existing infrastructure and its own R&D capabilities.

Stars in the BCG matrix represent business units with high market share in high-growth markets. GC's bio-chemicals, like Bio-Propylene and Bio-Butadiene, are stars due to the rapidly expanding demand for sustainable materials. Similarly, Allnex, with its strategic capacity expansions in high-growth regions like China and India, is positioned as a star. GC's Sustainable Aviation Fuel (SAF) venture is another prime example of a star, capitalizing on the aggressive decarbonization targets of the aviation sector and the projected exponential growth of the SAF market.

| Business Unit | Market Growth | Market Share | Strategic Position |

| Bio-chemicals (Bio-Propylene, Bio-BD) | High | Growing | Leading in eco-friendly alternatives |

| Allnex (Coating Resins) | High | Strong | Expanding capacity in emerging markets |

| Sustainable Aviation Fuel (SAF) | Very High (40%+ CAGR projected) | Early Market Presence | First mover in Thailand, meeting global demand |

What is included in the product

Strategic framework for analyzing a company's product portfolio based on market share and growth rate.

Guides decisions on investment, divestment, or harvesting for different business units.

Visualizes portfolio strengths and weaknesses, easing strategic allocation decisions.

Cash Cows

Olefins, specifically ethylene and propylene, represent GC's cash cows, forming the backbone of its sales revenue. These essential petrochemical building blocks are fundamental to numerous downstream industries.

Despite a volatile petrochemical market, GC is bolstering its position. A projected 20% increase in ethane feedstock supply by 2025, with ethane accounting for 38% of the feedstock mix, is set to significantly enhance competitiveness and profitability in this mature segment.

These products typically command a high market share, a testament to their critical role in the chemical value chain. Their consistent demand allows GC to generate substantial and reliable cash flow, reinforcing their status as cash cows.

Aromatics, specifically paraxylene and benzene, are GC's bedrock, significantly driving sales revenue. This segment has demonstrated enhanced performance, underscoring its importance to the company's financial health.

While some aromatics, such as paraxylene, are expected to see reduced product spreads in 2024, GC's aromatics business continues to operate at high utilization rates. This is supported by a consistent recovery in market demand, showcasing the resilience of this mature segment.

GC's strong market position within the aromatics sector ensures consistent contributions to the company's EBITDA. For instance, in 2023, the aromatics segment was a key contributor, with paraxylene prices averaging around $1,000 per metric ton, demonstrating its substantial revenue-generating capacity.

Polyethylene (PE) and polypropylene (PP) represent GC's established cash cows within its Polymers and Chemicals segment. As key derivatives of olefins, these polymers are foundational to GC's product portfolio, consistently generating substantial revenue. Despite the inherent cyclicality of commodity polymer markets, GC's integrated manufacturing processes and significant operational scale allow it to maintain a dominant market share, ensuring steady cash flow generation.

These high-volume, lower-margin products provide the stable financial bedrock needed to fund GC's more ambitious growth initiatives. Even with ongoing market pressures from new capacity additions and moderating demand growth, PE and PP continue to deliver reliable financial performance. For instance, GC's Polymers business unit, heavily reliant on these products, has historically demonstrated resilience, contributing positively to the company's overall financial health.

Refinery Business

GC's refinery business functions as a classic Cash Cow within the BCG Matrix. It has consistently demonstrated resilient gross refining margins, significantly contributing to the company's overall EBITDA. For instance, in 2024, the segment's EBITDA contribution remained robust, underscoring its stable cash-generating capabilities despite anticipated market pressures in 2025.

The integrated nature of this business within GC's broader operations is key to its Cash Cow status. This integration ensures consistent production cycles and a reliable revenue stream. Its established position signifies a high market share in its operational domain, characteristic of mature businesses that generate more cash than they consume.

- Resilient Margins: Historically strong gross refining margins, a hallmark of a Cash Cow.

- EBITDA Contribution: A significant and stable contributor to GC's overall earnings before interest, taxes, depreciation, and amortization.

- Market Position: High market share in its segment, indicating a mature and dominant player.

- Future Outlook: While facing potential margin pressure in 2025, it remains a vital, stable cash generator for the company.

Phenol and Acetone

Phenol and acetone, key products within GC's Intermediates unit, are considered cash cows due to their stable market position and consistent contribution to cash flow. Despite facing headwinds like increased Chinese capacity and broader economic pressures, GC maintains a significant presence in this mature market.

The phenol and acetone market is characterized by steady demand across various industrial applications, contributing a reliable baseline of earnings for GC. While market dynamics can cause short-term fluctuations in profitability, the established market share of these products underpins their cash cow status.

In 2024, the global phenol market experienced mixed performance. While new capacity additions, particularly in Asia, put pressure on pricing, demand from downstream sectors like polycarbonates and phenolic resins remained robust in many regions. Acetone, a co-product of phenol production, also saw its market influenced by these supply-demand dynamics.

- Market Maturity: Phenol and acetone operate in a well-established, mature market, signifying consistent, albeit not rapid, growth potential.

- Contribution to Cash Flow: These products are vital for GC's baseline cash generation, providing stability even during market volatility.

- Competitive Landscape: GC's position as a key producer helps it navigate challenges posed by new market entrants and economic downturns.

- Downstream Demand: Continued demand from industries such as construction, automotive, and electronics supports the ongoing relevance of phenol and acetone.

Olefins, specifically ethylene and propylene, remain GC's core cash cows, underpinning significant sales revenue. These fundamental petrochemicals are crucial for numerous downstream industries, ensuring consistent demand.

GC is enhancing its competitive edge in this mature segment. An anticipated 20% rise in ethane feedstock supply by 2025, with ethane comprising 38% of the feedstock mix, is poised to boost profitability.

Full Transparency, Always

GC BCG Matrix

The BCG Matrix document you are currently previewing is precisely the same comprehensive file you will receive immediately after completing your purchase. This means you get the fully editable and professionally formatted strategic planning tool without any watermarks or placeholder content. It's designed to provide immediate actionable insights for your business analysis and strategic decision-making.

Dogs

PTT Asahi Chemical, a joint venture where GC holds a stake, has been a notable example of an underperforming asset. GC has flagged anticipated net operating losses and impairment expenses stemming from this investment.

This situation highlights how joint ventures or older assets, particularly those in intensely competitive or saturated markets, often struggle with low market share and limited future growth potential.

GC's strategic shift towards an 'asset-light' approach, coupled with plans to divest non-core holdings, strongly indicates that such underperforming entities are prime candidates for either significant restructuring or complete divestment to streamline operations.

Certain commodity petrochemicals, especially those experiencing oversupply from new plants in China and the Middle East, are seeing reduced profit margins and fierce competition. For instance, the global ethylene market, a key petrochemical building block, faced significant price pressure in early 2024 due to these capacity expansions. Many producers of these basic chemicals struggle to remain profitable.

Within GC's portfolio, older or less efficient product lines in this commodity petrochemical segment would be classified as Dogs. These are areas where profitability is consistently low or negative, demanding capital investment without generating meaningful returns. Such segments often hover around the break-even point, acting as drains on resources.

Certain legacy polymer grades within GC's portfolio are likely positioned as Dogs in the BCG matrix. These products, characterized by low market share in mature or shrinking markets, face declining demand and significant price pressure from newer, more cost-effective alternatives. For instance, by the end of 2024, the global market for certain commodity plastics, like low-density polyethylene (LDPE) in some applications, has seen capacity additions outpace demand growth, leading to tighter margins for older grades.

Divested/Reorganized Entities (e.g., Vencorex)

Global Chemicals (GC) has strategically divested or reorganized underperforming entities, exemplified by Vencorex. This move aligns with the BCG matrix principles, where entities with low market share and low growth prospects, essentially 'Dogs', are prime candidates for divestiture to optimize the overall portfolio.

The company anticipates accounting gains from the deconsolidation of Vencorex and is actively negotiating asset sales. These actions are crucial for GC to eliminate potential cash traps and enhance the efficiency of its business units.

- Divestiture Rationale: Vencorex, likely a 'Dog' in GC's portfolio, exhibited low market share and limited growth potential, necessitating its removal to free up resources.

- Financial Impact: GC expects to realize accounting gains from Vencorex's deconsolidation, underscoring the financial benefit of shedding underperforming assets.

- Portfolio Optimization: These strategic divestitures aim to improve GC's overall portfolio efficiency by eliminating entities that drain capital without significant returns.

Non-Core Assets earmarked for Asset-Light Strategy

GC is strategically divesting non-core assets, aiming to unlock approximately 30 billion baht. This capital injection is earmarked for deleveraging the company's balance sheet. These assets are considered "Dogs" in the BCG matrix, meaning they have low market share and low growth potential, and are not central to GC's future strategic direction.

The divestment of these non-core holdings aligns with an asset-light strategy. This approach focuses on optimizing resource allocation and enhancing financial flexibility. By shedding these underperforming assets, GC can concentrate on its core, higher-growth business segments, thereby improving overall portfolio efficiency and profitability.

- Non-core assets are those with low market share and limited growth prospects.

- GC targets 30 billion baht from divestments for deleveraging.

- The strategy shifts towards an asset-light model.

- Divestments improve portfolio efficiency and financial flexibility.

Dogs in the BCG matrix represent business units or products with low market share in slow-growing or declining industries. These entities typically generate low profits or even losses, often requiring significant cash to maintain operations without promising future returns. GC's approach to these "Dogs" involves strategic divestment or restructuring to free up capital and focus on more promising areas of its portfolio. By identifying and addressing these underperforming assets, GC aims to improve its overall financial health and strategic focus.

GC's portfolio contains several examples that fit the "Dog" classification. Older commodity petrochemical lines, like certain legacy polymer grades facing intense competition and oversupply, are prime candidates. For instance, by late 2024, the global market for specific commodity plastics saw capacity increases outpacing demand, squeezing margins for older, less competitive grades. Similarly, underperforming joint ventures, such as PTT Asahi Chemical, have shown anticipated net operating losses and impairment expenses, signaling their status as Dogs that are candidates for divestment or significant overhaul.

The divestment of entities like Vencorex exemplifies GC's strategy for handling "Dogs." Vencorex, with its low market share and limited growth prospects, was divested, generating accounting gains for GC and improving portfolio efficiency. This aligns with GC's broader goal of unlocking approximately 30 billion baht through the sale of non-core assets, a move designed to deleverage the balance sheet and support an asset-light strategy.

| BCG Category | Market Share | Market Growth | GC Examples | Strategic Action |

|---|---|---|---|---|

| Dogs | Low | Low/Declining | Legacy polymer grades, underperforming joint ventures (e.g., PTT Asahi Chemical), certain commodity petrochemical lines | Divestment, restructuring, or exiting |

Question Marks

GC's strategic expansion into Bio-Naphtha, Bio-PE, and Bio-MEG positions these products squarely in the question mark quadrant of the BCG matrix. While these bio-based alternatives tap into a burgeoning demand for sustainable materials, their market penetration for GC is currently minimal, reflecting their nascent stage. For instance, the global bio-plastics market, which includes bio-PE, was valued at approximately USD 11.5 billion in 2023 and is projected to reach USD 30.7 billion by 2030, highlighting the significant growth potential but also the competitive landscape GC is entering.

These ventures necessitate substantial capital investment for research, development, and scaling production capabilities. The potential for high returns is evident, given the increasing consumer and regulatory pressure for eco-friendly products, but the inherent uncertainty in market adoption and technological maturation means they currently represent high-risk, high-reward opportunities for GC.

Advanced recycling technologies, such as chemical recycling, are positioned as question marks within the GC BCG Matrix. This reflects GC's dedication to circular economy principles, investing heavily in these nascent but high-growth market areas for sustainable materials.

While current market share for these advanced recycling solutions is low, the potential for significant future growth is substantial. For instance, the chemical recycling market is projected to reach $10.3 billion by 2027, growing at a CAGR of 15.6% according to some market analyses.

These initiatives demand considerable research and development investment and significant capital outlay to reach commercial viability and widespread adoption. Companies are pouring billions into developing these technologies, with global investment in advanced recycling expected to exceed $5 billion by 2025.

Carbon Capture and Utilization (CCU) initiatives are currently positioned as Question Marks within the GC BCG Matrix. These ventures are characterized by their high growth potential, fueled by ambitious global decarbonization targets and increasing regulatory pressure. For instance, the global CCU market was valued at approximately USD 1.8 billion in 2023 and is projected to reach USD 8.2 billion by 2030, demonstrating substantial growth prospects.

However, the commercial viability and scalability of CCU products, such as converting captured CO2 into useful chemicals or building materials, remain in their nascent stages. While GC is actively collaborating with research institutions to develop a detailed CCU roadmap, the market share and profitability of these emerging technologies are still uncertain. These projects require significant capital investment with an unpredictable return on investment, aligning them with the characteristics of a Question Mark.

New Strategic Partnerships for High Value/Specialty Chemicals

GC is strategically positioning its High Value/Specialty Chemicals segment as Question Marks within the BCG matrix. This involves actively seeking new partnerships, particularly in the burgeoning Southeast Asian market, to fuel investment and growth. These ventures are characterized by their focus on high-growth market segments but will start with a minimal market share.

The success of these new specialty chemical initiatives hinges on substantial capital infusion and aggressive market penetration strategies. Given their nascent stage and the competitive landscape, they represent significant potential but also carry considerable risk. For instance, the specialty chemicals market in Southeast Asia is projected to grow at a CAGR of 7.5% through 2027, reaching an estimated $35 billion, according to recent industry analyses.

- Question Mark Positioning: High Value/Specialty Chemicals ventures in Southeast Asia are being treated as Question Marks due to their low initial market share in high-growth segments.

- Investment Dependency: Significant capital investment is crucial for market penetration and realizing the high growth potential of these new partnerships.

- Market Opportunity: Southeast Asia's specialty chemicals market is a key target, with projections indicating robust growth, offering a fertile ground for these new ventures.

- Strategic Focus: GC's strategy emphasizes developing partnerships to attract the necessary investment to transform these Question Marks into Stars.

Hydrogen Economy Initiatives (e.g., Low-Carbon Hydrogen Production)

GC is actively pursuing the hydrogen economy, notably through collaborations with partners like Bangkok Industrial Gas Co., Ltd. (BIG). These efforts are geared towards developing innovative solutions and encouraging the adoption of low-carbon hydrogen. The global hydrogen market, particularly for green and blue hydrogen, is projected for substantial growth as a key carbon-free fuel. For instance, the International Energy Agency (IEA) reported in 2024 that global hydrogen production capacity could reach 235 million tonnes per annum by 2030 under current policy settings, with a significant portion dedicated to low-carbon hydrogen.

Despite the promising outlook, GC's current market share in this emerging sector is understandably low, reflecting its nascent stage. The company's strategic focus on this area positions it for future gains, but it requires significant capital outlay.

- Market Potential: The global hydrogen market is anticipated to reach $400 billion by 2030, with low-carbon hydrogen accounting for a substantial portion of this growth.

- Investment Needs: Scaling up low-carbon hydrogen production facilities and infrastructure demands considerable investment, potentially in the billions of dollars for large-scale projects.

- Competitive Landscape: While GC is entering a growing market, it will face competition from established energy players and specialized hydrogen technology firms.

- Strategic Focus: GC's partnerships and innovation drive are critical for building a competitive position in this evolving energy landscape.

GC's foray into advanced recycling technologies, such as chemical recycling, positions these initiatives as Question Marks on the BCG matrix. These ventures are characterized by substantial investment requirements and a need for significant capital outlay to achieve commercial viability and widespread market adoption. The global chemical recycling market is projected to experience significant growth, with some analyses suggesting it could reach $10.3 billion by 2027, underscoring the high-growth potential alongside inherent market uncertainties for GC.

| Initiative | BCG Quadrant | Market Growth Potential | Current Market Share | Investment Needs | Risk Profile |

|---|---|---|---|---|---|

| Advanced Recycling (Chemical) | Question Mark | High (e.g., projected CAGR of 15.6% for chemical recycling market) | Low | Substantial | High |

BCG Matrix Data Sources

Our BCG Matrix leverages diverse data streams, including internal sales figures, market share reports, and industry growth projections, to accurately position each business unit.