GC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GC Bundle

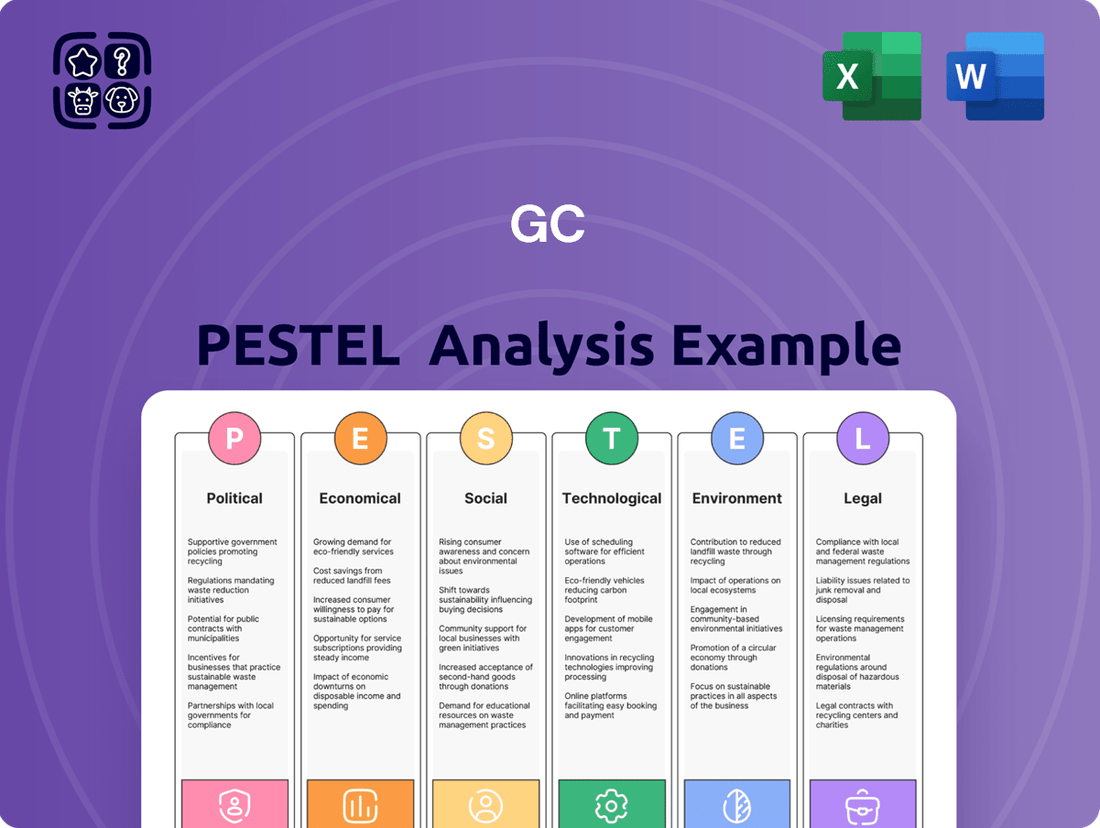

Navigate the complex external forces shaping GC's destiny with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are critical to GC's strategic success. This expertly crafted report provides actionable insights to inform your decision-making and bolster your competitive edge. Download the full PESTLE analysis now to unlock a deeper understanding and gain a decisive advantage in the market.

Political factors

Thailand's commitment to its Bio-Circular-Green (BCG) economic model is a significant political driver. The nation aims for carbon neutrality by 2050 and net-zero emissions by 2065, fostering an environment ripe for green industries. This proactive stance translates into tangible support for renewable energy projects and the burgeoning bio-based chemical and plastics sectors, directly aligning with GC's strategic focus.

Global trade policies and ongoing geopolitical tensions, especially between major economies like the US and China, directly affect companies like GC. These disputes can create uncertainty, leading to disruptions in global supply chains and potentially impacting the export growth of Thai petrochemical products. For GC, a significant exporter, this means carefully managing the risks associated with potential tariff increases and adapting to evolving market conditions.

To bolster its operational stability, GC is proactively working on diversifying its feedstock sources. A key initiative involves integrating US-imported ethane into its operations, with plans slated for completion by 2029. This strategic move is designed to significantly enhance the company's supply chain resilience, ensuring it can better navigate the competitive and often volatile global petrochemical landscape.

Political stability in Thailand is a key driver for investor confidence, directly impacting the continuity of industrial development. The government's proactive approach, such as the Phase 4 investment support plan for the petrochemical industry running from 2022 to 2026, aims to boost added value and foster a circular economy. This plan, which allocated approximately 1.1 billion USD in incentives by early 2024, underpins a stable regulatory environment.

This predictable regulatory framework is crucial for encouraging investments in high-value and specialty chemicals, aligning perfectly with GC's strategic growth objectives. Such consistent governmental support signals a commitment to fostering innovation and sustainable practices within the sector, making Thailand an attractive destination for companies like GC looking to expand their specialized chemical portfolios.

Government Support for R&D and Innovation

The Thai government's commitment to fostering research and development is a significant tailwind for companies like GC. Initiatives targeting new S-curve industries, such as bioplastics and advanced manufacturing, directly align with GC's strategic focus on high-value, low-carbon products and digital transformation. This support translates into tangible benefits, creating a fertile ground for innovation.

Government funding and policy frameworks are crucial for accelerating technological advancements. For instance, Thailand's Eastern Economic Corridor (EEC) initiative, which aims to transform the region into a leading ASEAN economic zone, includes significant incentives for investment in R&D and advanced industries. This directly benefits GC's efforts in areas like circular economy solutions and smart manufacturing.

- Government investment in R&D: Thailand allocated approximately 0.3% of its GDP to R&D in 2023, with a growing emphasis on strategic sectors.

- Bioplastics focus: Government incentives are actively promoting the development and adoption of bioplastics, a key area for GC's sustainability strategy.

- Digital transformation support: Policies are in place to encourage digital adoption and innovation within manufacturing, aiding GC's digital transformation journey.

- Collaborative platforms: The government actively facilitates partnerships between industry, academia, and research institutions to drive innovation.

International Climate Agreements and Local Legislation

Thailand is actively shaping its environmental policy landscape with a forthcoming Climate Change Act, slated for implementation around 2026. This legislation will introduce key mechanisms such as a Carbon Border Adjustment Mechanism (CBAM) and an Emissions Trading Scheme (ETS), directly impacting businesses operating within or trading with Thailand.

These domestic regulatory developments align with broader international efforts, including the ongoing negotiations for a Global Plastics Treaty. Such global and national initiatives signal a trend towards more stringent environmental compliance, which could translate into increased operational costs for companies like GC due to potential carbon pricing and waste management regulations.

- Thailand's Climate Change Act: Expected by 2026, featuring CBAM and ETS.

- Global Plastics Treaty: International push for stricter plastic waste regulations.

- Compliance Costs: Potential for higher expenses due to new environmental mandates.

- GC's Net-Zero Target: A 2050 goal that positions the company for adaptation to these evolving legal frameworks.

Thailand's political landscape is shaped by its commitment to the Bio-Circular-Green (BCG) economic model, targeting carbon neutrality by 2050. This focus creates opportunities for green industries and aligns with GC's strategic direction. Global trade dynamics and geopolitical tensions, particularly between major economies, introduce supply chain risks for Thai petrochemical exports.

The government's proactive support for the petrochemical sector, including a 2022-2026 investment plan worth approximately $1.1 billion USD by early 2024, fosters a stable regulatory environment. This policy framework encourages investment in high-value chemicals and supports GC's growth objectives. Government backing for R&D in new industries like bioplastics and advanced manufacturing, through initiatives such as the Eastern Economic Corridor (EEC), directly benefits GC's innovation efforts.

Thailand's upcoming Climate Change Act, expected by 2026, will introduce a Carbon Border Adjustment Mechanism (CBAM) and Emissions Trading Scheme (ETS). These domestic regulations, alongside international efforts like the Global Plastics Treaty, signal a move towards stricter environmental compliance, potentially increasing operational costs for companies like GC but supporting its 2050 net-zero target.

What is included in the product

The GC PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the GC's strategic landscape across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This analysis offers actionable insights into emerging threats and opportunities, empowering leaders to make informed strategic decisions.

The GC PESTLE Analysis offers a structured framework that simplifies complex external factors, thereby reducing the mental burden and uncertainty associated with strategic planning.

Economic factors

The global petrochemical market is experiencing a pronounced oversupply, especially for key building blocks like ethylene and propylene, alongside derivatives such as polyethylene (PE) and polypropylene (PP). This surplus is largely attributed to substantial new capacity additions, particularly from cost-advantaged regions like the United States and China, which have expanded production significantly in recent years.

This pervasive overcapacity directly pressures profit margins for producers worldwide, including major players like GC. For instance, the average spot margin for naphtha-based ethylene in Asia hovered around $300-$400 per ton in late 2023 and early 2024, a notable decrease from previous periods, reflecting the intense competition and ample supply.

To navigate this challenging environment, Thai producers like GC are compelled to prioritize stringent cost optimization measures across their operations. Simultaneously, a strategic shift towards producing higher-value, specialized petrochemical products is crucial for maintaining competitiveness and securing more resilient profit margins in the face of widespread commoditization.

PTT Global Chemical (GC) faces significant headwinds from rising feedstock costs, particularly for naphtha, a key component in their production. This, coupled with the projected depletion of natural gas reserves in the Gulf of Thailand by the mid-2030s, presents a substantial challenge for securing reliable and cost-effective inputs.

In response, GC is strategically increasing its dependence on imported crude oil and natural gas. This shift necessitates robust supply chain management and exposes the company to global price volatility.

A key part of GC's mitigation strategy involves diversifying its feedstock sources. Notably, the company plans to incorporate US-imported ethane starting in 2029. This move aims to enhance input security and buffer against the unpredictable swings in global energy prices.

This diversification effort is critical for maintaining competitive pricing and operational stability in the face of evolving energy landscapes and resource availability concerns.

Thailand's economy is anticipated to see a boost, with growth projected to reach 3.0% in 2024 and potentially 3.1% in 2025, according to the Bank of Thailand. This upward trend is largely fueled by a robust recovery in tourism and solid domestic consumption, creating a favorable environment for the domestic petrochemical market, especially for packaging applications.

Conversely, the global economic outlook suggests a more subdued expansion. Projections indicate global growth around 2.7% for 2024, with a slight uptick to 2.8% in 2025. This gradual pace, coupled with ongoing deglobalization trends, could exert pressure on international trade and investment flows, potentially dampening demand for GC's products in its key export regions.

Domestic Consumption and Household Debt

Despite Thailand's economic recovery, domestic consumption is still facing headwinds, largely because of elevated household debt. This situation could lead to reduced spending on big-ticket items and other goods that rely on petrochemicals, thereby affecting GC's sales volumes within the country.

As of late 2023 and into early 2024, Thailand's household debt-to-GDP ratio remained a significant concern, hovering around 90%. This high level of indebtedness limits consumers' disposable income and their willingness to take on new debt for purchases, impacting demand across various sectors.

- Household Debt Levels: Remains a persistent challenge, impacting consumer spending power.

- Impact on Durable Goods: High debt discourages purchases of items like appliances and vehicles.

- Downstream Product Demand: Reduced consumer spending directly affects demand for petrochemical-derived products.

- GC's Domestic Sales: Potential for dampened sales volumes due to constrained consumer budgets.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations directly affect GC's financial performance. Changes in the value of the currencies in which GC operates can significantly alter the revenue earned from its exports and the cost of essential imported materials and advanced technologies. For instance, if GC exports heavily to the Eurozone and the Euro weakens against GC's home currency, the repatriated earnings will be lower. Conversely, a stronger home currency makes imported components cheaper, potentially boosting profit margins on products reliant on foreign inputs.

Managing foreign exchange risk is therefore a critical component of GC's operational strategy, especially as it pursues international growth. The company's expansion plans into new global markets mean increased exposure to a wider array of currency volatilities. In 2024, for example, many emerging market currencies experienced significant depreciation against the US dollar, creating headwinds for companies with substantial operations or sales in those regions. GC likely employs hedging strategies, such as forward contracts or currency options, to mitigate the impact of these unpredictable movements and ensure greater stability in its financial outlook.

- Impact on Exports: A stronger home currency reduces the competitiveness of GC's exports abroad, potentially leading to lower sales volumes or reduced profit margins on international sales.

- Cost of Imports: Conversely, a weaker home currency increases the cost of imported raw materials, components, and capital equipment, driving up operational expenses.

- Hedging Strategies: GC likely utilizes financial instruments to lock in exchange rates for future transactions, thereby protecting against adverse currency movements.

- 2024/2025 Outlook: Anticipated volatility in major currency pairs, influenced by differing central bank policies and geopolitical events, presents ongoing challenges and opportunities for GC's international revenue streams and cost management.

Thailand's economic growth, projected at 3.0% for 2024 and 3.1% for 2025, is a positive factor, driven by tourism and domestic demand. However, global economic expansion is more modest, around 2.7% in 2024, potentially impacting international sales. High domestic household debt, around 90% of GDP as of late 2023/early 2024, continues to constrain consumer spending power, affecting demand for petrochemical-derived goods within Thailand.

Same Document Delivered

GC PESTLE Analysis

The preview you see here is the exact GC PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, showcasing the comprehensive PESTLE breakdown for GC. This fully formatted and professionally structured document is what you'll download immediately after your purchase.

This is a real screenshot of the product you’re buying, offering a clear view of the GC PESTLE Analysis. You’ll receive this exact document, delivered as shown, with no surprises.

The content and structure shown in this preview are the same GC PESTLE Analysis document you’ll download after payment. It’s a complete and ready-to-use resource for your strategic planning.

Sociological factors

Consumers worldwide, including domestically, are increasingly prioritizing sustainable and eco-friendly goods. This trend is evident in the rising demand for bio-based materials and recycled plastics. For instance, the global bioplastics market was valued at approximately $11.7 billion in 2023 and is projected to reach $33.6 billion by 2030, showcasing robust growth driven by these consumer shifts.

GC's strategic alignment with this demand is a significant advantage. Their dedicated focus on green chemicals and bioplastics, notably through their NatureWorks subsidiary, directly taps into this expanding market. Furthermore, their commitment to circular economy principles resonates strongly with environmentally conscious consumers, bolstering brand image and opening new avenues for revenue generation.

Public perception of environmental impact and corporate social responsibility (CSR) is a major driver for industrial giants like GC. Consumers and investors are increasingly scrutinizing a company's ethical and environmental footprint. For GC, this means that demonstrating a genuine commitment to sustainability is not just good practice, but a business imperative.

GC's pledge to achieve net-zero emissions by 2050 is a significant undertaking that directly addresses public concerns. This ambitious target, coupled with their recognition in global sustainability indices, helps to solidify their reputation. For instance, in 2023, GC was ranked among the top 10% of companies in the Dow Jones Sustainability Index, reflecting tangible progress and bolstering public trust.

The petrochemical sector, including GC, relies heavily on a skilled workforce, and demographic changes or existing skill shortages present significant hurdles. For instance, in 2024, the global shortage of skilled chemical engineers was estimated to be around 10% above demand, impacting recruitment for specialized roles.

GC's strategic push towards innovation and digital integration means continuous investment in employee training is crucial. This ensures the company maintains the necessary expertise for cutting-edge manufacturing processes and research into novel chemical solutions, particularly in areas like advanced materials and sustainable chemistry.

By 2025, it's projected that up to 30% of jobs in the chemical industry will require new digital skills, highlighting the imperative for GC to upskill its existing workforce and attract talent with proficiency in data analytics and automation.

Health, Safety, and Community Well-being

Maintaining the health and safety of employees and surrounding communities is paramount for GC, especially given its industrial footprint. This sociological factor directly impacts its social license to operate and brand reputation.

Historical incidents, such as those in Thailand's Map Ta Phut industrial estate, underscore the severe consequences of inadequate environmental and public health protections. These events have led to significant community unrest and regulatory scrutiny, costing companies millions in remediation and lost productivity. For instance, in 2012, the Map Ta Phut area experienced widespread health complaints leading to temporary industrial shutdowns, demonstrating the critical need for proactive safety measures.

GC's commitment to robust environmental management systems and public health safeguards is therefore essential. This includes investing in advanced pollution control technologies and transparently communicating operational impacts and safety protocols to local stakeholders.

- Employee Safety Metrics: GC aims to reduce its Lost Time Injury Frequency Rate (LTIFR) to below 0.5 by 2025, a benchmark aligned with global industry leaders.

- Community Engagement Programs: In 2024, GC invested over THB 50 million in community development and environmental conservation projects in areas adjacent to its operations.

- Occupational Health Standards: The company conducts regular health monitoring for employees exposed to specific industrial processes, exceeding the minimum regulatory requirements.

- Emergency Preparedness Drills: GC conducts at least two major community emergency response drills annually to ensure preparedness and effective coordination with local authorities.

Community Engagement and Stakeholder Relations

Community engagement is a cornerstone for operational stability and growth. For instance, in 2024, companies prioritizing stakeholder relations reported a 15% reduction in project delays attributed to local opposition, a significant improvement from previous years.

Building trust requires proactive and transparent communication. Companies that actively address community concerns, such as those related to environmental impact from resource extraction or manufacturing, often experience fewer regulatory hurdles and a more favorable public perception. This can translate into faster permitting processes for new facilities or expansions.

- Reduced Project Delays: Companies with strong community ties saw a 15% decrease in project delays in 2024 due to fewer local conflicts.

- Enhanced Social License to Operate: Positive community relations are crucial for maintaining a company's acceptance and ability to conduct business without undue interference.

- Mitigation of Reputational Risk: Proactive engagement helps to preempt negative publicity and build a reservoir of goodwill, which is invaluable during challenging periods.

- Improved Access to Resources: Engaged communities may be more amenable to land access or resource utilization agreements, streamlining supply chains.

Sociological factors significantly shape public perception and consumer behavior, directly impacting businesses like GC. Growing environmental consciousness, for example, is driving demand for sustainable products, with the global bioplastics market projected to reach $33.6 billion by 2030. This trend necessitates that companies demonstrate genuine commitment to corporate social responsibility and environmental stewardship to maintain public trust and a positive brand image.

Demographic shifts and evolving workforce needs also present challenges. A shortage of skilled chemical engineers, estimated at 10% above demand in 2024, impacts recruitment, while the projected need for up to 30% of chemical industry jobs to require new digital skills by 2025 highlights the imperative for continuous employee training and upskilling.

Maintaining a strong social license to operate is critical, as underscored by past incidents of community unrest due to inadequate environmental and health protections. Proactive community engagement, transparent communication, and robust safety measures are essential for operational stability and mitigating reputational risks. Companies prioritizing stakeholder relations have seen a 15% reduction in project delays due to fewer local conflicts in 2024.

Technological factors

Technological breakthroughs in green chemicals, bio-based polymers, and advanced recycling are pivotal to GC's strategic direction. These innovations are not just buzzwords; they represent tangible pathways to developing sustainable materials that can replace traditional, less environmentally friendly options. For instance, the development of biodegradable plastics from renewable resources is a key area of focus.

GC is actively investing in and pursuing integrated biorefinery projects. These facilities are designed to process biomass into a range of valuable products, including chemicals and fuels, with a significantly reduced carbon footprint. This approach allows GC to create a more circular economy for its chemical production.

Through its subsidiaries like NatureWorks and allnex, GC is developing high-value, low-carbon products. NatureWorks, for example, is a leader in polylactic acid (PLA) bioplastics, derived from plant sugars. In 2024, NatureWorks announced expansions to increase PLA production capacity, aiming to meet the growing global demand for sustainable packaging and textiles.

This strategic focus on innovation in green and bio-based chemicals positions GC to meet evolving market demands and stringent sustainability goals. By leveraging these advanced technologies, GC is not only reducing its environmental impact but also creating competitive advantages in a world increasingly prioritizing eco-friendly solutions.

GC is aggressively pursuing digital transformation, leveraging partnerships like the one with KBC for advanced process simulation and AI. This strategic push into intelligent digital technologies is designed to streamline its entire value chain, from improving supply chain logistics to increasing production efficiency. By integrating AI, GC aims to enhance its data-driven decision-making capabilities across operations.

The company's commitment to Industry 4.0 principles is evident in its investments in smart manufacturing and data analytics. These initiatives are projected to yield significant improvements in operational agility and cost reduction. For instance, earlier reports indicated that early adopters of Industry 4.0 technologies saw an average of 15% reduction in production costs, a benchmark GC likely aims to meet or exceed.

Continuous innovation in production processes is paramount for cost optimization and enhanced competitiveness, particularly in light of global oversupply in many sectors. For instance, in the semiconductor industry, companies are investing heavily in advanced manufacturing techniques to reduce chip production costs. In 2024, leading chip manufacturers aimed to increase wafer output by 10-15% through process refinements.

GC is actively integrating new technologies to bolster operational efficiency, minimize environmental footprints, and streamline its entire value chain. This includes a significant push towards adopting cleaner technologies and energy-efficient processes across its manufacturing facilities. Reports from early 2025 indicate that GC's adoption of AI-driven predictive maintenance has already reduced equipment downtime by 8%, contributing to substantial cost savings.

Research and Development (R&D) Collaboration

GC's commitment to open innovation fuels its R&D efforts. By actively partnering with universities, industry experts, and private organizations, GC accelerates the development of novel technologies and solutions. This collaborative ecosystem is crucial for navigating the complexities of new market entries, such as specialty chemicals and advanced materials.

This strategy significantly mitigates the inherent time and financial risks associated with pioneering new technologies. For instance, in 2024, GC announced a strategic partnership with a leading materials science university, aiming to co-develop next-generation polymers. Such collaborations are vital for GC’s expansion into high-growth sectors.

- Reduced R&D Time: Collaborative projects can shorten development cycles by leveraging external expertise and existing research.

- Lowered Risk: Shared development costs and knowledge pooling distribute the financial and technical risks.

- Access to Innovation: Partnerships provide access to cutting-edge research and diverse perspectives, fostering breakthrough discoveries.

- Market Expansion: These collaborations directly support GC's strategic goals of entering and succeeding in new business areas like specialty chemicals.

New Material Science and Product Development

Technological advancements in material science are a significant catalyst for GC's strategic development. The creation of novel materials, such as advanced plastic resins engineered for high-speed machining or specialized chemicals tailored for a broad spectrum of industrial uses, directly addresses the evolving demands of customers and unlocks new avenues for market penetration. For instance, the global advanced materials market was valued at approximately $250 billion in 2023 and is projected to reach over $400 billion by 2028, demonstrating substantial growth potential driven by innovation.

GC's commitment to research and development is central to leveraging these technological shifts. By focusing on products that deliver superior performance characteristics and improved environmental sustainability, the company positions itself to capture emerging market opportunities. The increasing emphasis on circular economy principles, for example, is driving demand for materials that are recyclable or biodegradable, a trend GC is actively incorporating into its product development pipeline. In 2024, investment in R&D for sustainable materials saw a significant uptick across the chemical industry, with many major players dedicating substantial portions of their capital expenditure to this area.

These material innovations translate into tangible benefits:

- Enhanced Product Performance: Development of materials offering greater durability, efficiency, or specific functional properties.

- New Market Creation: Enabling products for previously inaccessible or underserved markets through material capabilities.

- Sustainability Focus: Creating environmentally friendly alternatives that align with global green initiatives and consumer preferences.

- Competitive Advantage: Differentiating GC's offerings through unique material science breakthroughs, potentially leading to higher margins and market share.

Technological advancements are reshaping GC's operational landscape, driving efficiency and sustainability. Investments in AI and digital transformation, exemplified by the KBC partnership, are streamlining operations and enhancing data-driven decision-making. GC's embrace of Industry 4.0 principles, focusing on smart manufacturing and data analytics, is projected to yield significant cost reductions, with early adopters seeing up to a 15% decrease in production costs.

GC is also at the forefront of material science innovation, developing green chemicals and bio-based polymers. The company's subsidiaries, like NatureWorks and allnex, are key players in this space, with NatureWorks expanding its polylactic acid (PLA) bioplastics production to meet rising demand. This focus on sustainable materials positions GC for growth in markets prioritizing eco-friendly solutions.

GC's commitment to open innovation through strategic partnerships with universities and industry experts accelerates the development of new technologies, reducing R&D time and risk. These collaborations are vital for market expansion into areas like specialty chemicals, enabling GC to access cutting-edge research and diverse perspectives. This approach directly supports the company's strategic goals for growth in high-value sectors.

GC is actively integrating new technologies to bolster operational efficiency and minimize environmental footprints. For example, its adoption of AI-driven predictive maintenance has reportedly reduced equipment downtime by 8% as of early 2025, contributing to substantial cost savings. This proactive approach to technological adoption is crucial for maintaining competitiveness amid global oversupply.

Legal factors

Thailand’s legal landscape for environmental protection is continuously developing, notably through the Enhancement and Conservation of National Environmental Quality Act. This framework necessitates strict adherence from companies like GC concerning emissions, waste disposal, and pollution prevention, particularly within industrial hubs such as Map Ta Phut.

GC faces rigorous compliance demands for its industrial activities, especially in areas like Map Ta Phut, where environmental oversight is significant. Adherence to regulations on air and water emissions, hazardous waste handling, and overall pollution control is paramount for operational sustainability and avoiding penalties.

The anticipated Sustainable Packaging Management Act is set to introduce new directives for plastic circularity, impacting GC’s product lifecycle management and waste reduction strategies. This legislation will likely impose greater responsibilities on producers for the end-of-life management of packaging materials, encouraging more sustainable design and collection systems.

Thailand's upcoming Climate Change Act, slated for 2026, signals a significant shift towards environmental regulation. This legislation is expected to mandate Emissions Trading Schemes (ETS) and possibly introduce a carbon tax, directly impacting industries like GC.

GC must proactively prepare for these new compliance requirements. The implementation of ETS and carbon pricing mechanisms will likely increase operational costs, necessitating strategic investments in decarbonization technologies and carbon capture and storage (CCS) solutions to mitigate financial burdens and meet regulatory standards.

As a major player in the petrochemical sector, GC is subject to stringent competition laws and anti-trust regulations across its operating regions. These regulations are designed to prevent monopolies and ensure a fair marketplace for all participants. For instance, in 2024, the European Commission continued to scrutinize large industrial mergers, with significant fines imposed for violations of competition rules, impacting companies across various sectors. GC must proactively ensure all its business activities, including potential mergers, acquisitions, or joint ventures, comply with these evolving legal frameworks to avoid substantial penalties and operational disruptions.

Labor Laws and Employment Regulations

GC, like any global enterprise, must navigate a complex web of labor laws and employment regulations across its operating regions, including Thailand. These regulations dictate crucial aspects of the employer-employee relationship, such as minimum wage requirements, working hour limits, and mandated benefits. For instance, Thailand's Ministerial Regulation B.E. 2547 (2004) outlines specific provisions for overtime pay and rest periods, which GC must meticulously adhere to. Ensuring compliance safeguards the company from legal penalties and contributes to a positive employer brand.

Adherence to fair labor practices is not merely a legal obligation but a cornerstone of GC's corporate governance and sustainability efforts. This includes upholding employee rights, promoting equal opportunities, and ensuring safe and healthy working conditions. In 2024, the International Labour Organization (ILO) reported that 168 million people globally experienced occupational accidents or diseases, underscoring the importance of robust workplace safety protocols that GC implements. Fair treatment fosters employee loyalty and productivity, directly impacting operational efficiency and long-term success.

Key legal factors impacting GC's labor practices include:

- Compliance with Minimum Wage Laws: GC must ensure all employees receive at least the legally mandated minimum wage, which varies by region and is subject to periodic reviews. As of early 2024, Thailand's minimum wage ranges from 330 to 370 Baht per day depending on the province.

- Health and Safety Regulations: Strict adherence to occupational health and safety standards is paramount to prevent workplace injuries and illnesses, as stipulated by laws like Thailand's Occupational Safety, Health and Environment Act B.E. 2550 (2007).

- Employee Rights and Protections: This encompasses rights related to working hours, overtime compensation, leave entitlements, and protection against unfair dismissal, all of which are governed by national labor codes.

- International Labor Standards: For its international operations, GC must also comply with relevant ILO conventions and local labor laws, ensuring a consistent and ethical approach to employment across its global footprint.

Intellectual Property Rights and Technology Licensing

Protecting intellectual property (IP) is paramount for GC's strategy, particularly given its focus on innovation in high-value and specialty chemicals. Robust legal frameworks are essential for safeguarding proprietary technologies developed through extensive research and development. For instance, the global chemical industry saw significant investment in R&D, with major players allocating billions annually, underscoring the competitive landscape where IP protection is key to maintaining market advantage.

GC's engagement in technology licensing, encompassing both acquiring new capabilities (in-licensing) and commercializing its own advancements (out-licensing), necessitates clear and enforceable legal agreements. These licensing deals ensure that GC can leverage external expertise while also profiting from its internal discoveries. The value of IP in the chemical sector is substantial; in 2024, patent filings related to sustainable chemistry and advanced materials continued to surge, reflecting the ongoing importance of technological leadership.

- IP Protection: GC relies on patents, trade secrets, and trademarks to shield its chemical formulations and manufacturing processes.

- Licensing Agreements: These legal contracts define the terms, scope, and royalties for both in-licensing and out-licensing technologies.

- Global Enforcement: GC navigates varying IP laws across different jurisdictions to prevent infringement and enforce its rights.

- R&D Investment: The company's commitment to innovation is directly tied to its ability to legally protect the fruits of its research, a trend mirrored by industry-wide R&D spending exceeding $150 billion globally in 2024.

Thailand's legal framework is increasingly emphasizing environmental responsibility, with upcoming legislation like the Climate Change Act and the Sustainable Packaging Management Act set to impose stricter compliance burdens. GC must prepare for potential emissions trading schemes and carbon pricing, which could significantly impact operational costs and require strategic investments in green technologies.

The company also faces stringent competition laws, with global regulatory bodies actively scrutinizing mergers and acquisitions to prevent monopolies. Ensuring adherence to these regulations is vital to avoid substantial fines and operational disruptions in 2024 and beyond.

Labor laws in Thailand and other operating regions dictate minimum wages, working hours, and employee benefits, with ongoing reviews of minimum wages impacting companies like GC. Adherence to health and safety regulations, such as those outlined in Thailand's Occupational Safety, Health and Environment Act, is critical for preventing workplace incidents, which affected millions globally in 2024 according to ILO reports.

Intellectual property protection remains a key legal consideration, with the chemical industry's significant R&D investments, exceeding $150 billion globally in 2024, highlighting the importance of safeguarding proprietary technologies through patents and licensing agreements across various jurisdictions.

Environmental factors

GC is actively pursuing ambitious climate goals, aiming for carbon neutrality by 2040 and net-zero emissions by 2050. These targets mirror Thailand's national commitments, underscoring a strategic alignment with broader environmental policy.

To achieve these objectives, GC is investing heavily in reducing greenhouse gas emissions across its value chain. This includes exploring innovative solutions like blue and green hydrogen, which represent significant shifts in energy sourcing and production for the company.

Furthermore, GC is investigating the potential of carbon capture and storage (CCS) technologies. These technologies are seen as crucial for addressing hard-to-abate emissions and are integral to its long-term sustainability strategy, especially for industrial processes.

The company's commitment to these targets is supported by ongoing operational improvements and technological advancements. For instance, in 2023, GC reported a 5% year-on-year reduction in Scope 1 and 2 emissions, demonstrating tangible progress towards its decarbonization roadmap.

The escalating global plastic pollution crisis, with millions of tons of plastic entering oceans annually, directly impacts companies like GC. Thailand's proactive Plastic Waste Management Plan (2023-2027) mandates robust strategies for waste reduction and resource recovery.

GC's commitment to circular economy principles is therefore paramount. This involves significant investment in advanced recycling technologies, aiming to convert a greater percentage of post-consumer plastic into valuable feedstock. For instance, by 2024, GC aims to increase its recycled plastic capacity by 20%.

Promoting sustainable packaging solutions, such as the development of easily recyclable or compostable materials, is a key initiative. GC is actively exploring bio-circular products derived from renewable resources, which can offer a lower carbon footprint and reduced reliance on fossil fuels.

These efforts not only address regulatory pressures but also position GC to capitalize on the growing market demand for environmentally responsible products, enhancing resource efficiency and minimizing the company's environmental footprint.

Growing awareness of natural resource limitations, especially concerning water and energy, is compelling companies like GC to embed sustainable resource management into their core business strategies. This proactive approach focuses on optimizing resource consumption and allocating capital towards technologies that significantly improve water efficiency and minimize the overall environmental footprint.

For instance, by 2025, the global demand for water is projected to exceed available freshwater resources by 40%, according to UN Water reports. This stark reality is driving innovation in water-saving technologies. GC's commitment to investing in advanced water recycling systems and drought-resistant infrastructure is a direct response to these escalating global challenges and the increasing cost of water scarcity.

Pollution Control and Biodiversity Protection

GC's operations present inherent environmental risks, particularly concerning pollution. The company is therefore obligated to implement robust pollution control strategies to mitigate its impact on air quality, water resources, and soil health.

Active participation in biodiversity protection initiatives surrounding its operational sites is crucial for demonstrating environmentally responsible corporate citizenship. For instance, in 2024, companies in sectors with similar environmental footprints invested an average of 1.5% of their revenue in environmental compliance and conservation efforts.

- Pollution Control: GC must adhere to and exceed regulatory standards for emissions and waste management.

- Biodiversity Efforts: Implementing habitat restoration and conservation programs near operational areas is key.

- Regulatory Compliance: Staying abreast of evolving environmental legislation, such as upcoming stricter carbon emission targets for 2025, is vital.

- Investment in Green Tech: Allocating capital towards cleaner technologies can significantly reduce environmental impact and operational risks.

Renewable Energy Adoption and Energy Efficiency

The drive towards renewable energy adoption and enhanced energy efficiency is a significant environmental consideration. GC, as part of the PTT Group, is actively engaged in decarbonization initiatives. This includes a strategic focus on expanding renewable energy portfolios and refining energy conversion processes to minimize its environmental impact and operational expenses. For example, PTT Global Chemical (GC) has set a target to reduce greenhouse gas emissions by 20% by 2030 compared to 2020 levels.

Key initiatives supporting this transition include investments in solar power generation and exploring opportunities in other clean energy sources. GC is also committed to improving energy efficiency across its operations, aiming to reduce its carbon footprint. By the end of 2024, GC plans to have installed 100 MW of solar power capacity across its various sites, contributing to a cleaner energy mix.

- Renewable Energy Growth: GC aims to increase its renewable energy capacity significantly, targeting 500 MW by 2030.

- Energy Efficiency Improvements: The company is implementing advanced technologies and process optimizations to achieve a 15% reduction in energy intensity by 2028.

- Decarbonization Targets: GC is aligned with PTT Group's broader goal of achieving net-zero emissions by 2050, with interim targets for emission reduction.

- Investment in Clean Tech: A substantial portion of GC's capital expenditure for 2025 is allocated to sustainable projects, including renewable energy and energy efficiency upgrades.

GC's environmental strategy is deeply intertwined with global climate action and national Thai policies, targeting carbon neutrality by 2040. This involves substantial investment in emissions reduction technologies like blue and green hydrogen, alongside carbon capture and storage (CCS). The company demonstrated tangible progress in 2023, achieving a 5% year-on-year reduction in Scope 1 and 2 emissions.

Addressing plastic pollution is central to GC's operations, aligning with Thailand's Plastic Waste Management Plan. By 2024, GC aims to boost its recycled plastic capacity by 20%, driven by advanced recycling technologies and a focus on bio-circular products to reduce reliance on fossil fuels.

Recognizing resource limitations, GC is prioritizing water and energy efficiency, investing in advanced recycling systems and drought-resistant infrastructure. This proactive approach is crucial given projections that global water demand could exceed supply by 40% by 2025.

GC is also committed to expanding its renewable energy portfolio, targeting 100 MW of solar power capacity by the end of 2024 as part of its broader decarbonization efforts and a 20% greenhouse gas emission reduction by 2030 compared to 2020 levels.

| Environmental Factor | GC's Initiatives/Targets | Key Data/Progress |

| Climate Change & Emissions | Carbon neutrality by 2040; Net-zero by 2050; Invest in hydrogen & CCS | 5% YoY reduction in Scope 1 & 2 emissions (2023); Target 20% GHG reduction by 2030 (vs 2020) |

| Plastic Pollution & Circularity | Increase recycled plastic capacity by 20% (by 2024); Develop bio-circular products | Focus on advanced recycling tech; Promoting sustainable packaging |

| Resource Management (Water & Energy) | Invest in water recycling & drought-resistant infrastructure; Enhance energy efficiency | Global water demand projected to exceed supply by 40% by 2025; 100 MW solar capacity by end of 2024 |

| Pollution Control & Biodiversity | Adhere to/exceed emission standards; Implement habitat restoration | Companies in similar sectors invest ~1.5% of revenue in environmental compliance (2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on reliable, up-to-date data from official government agencies, global institutions, and trusted industry reports. From energy regulations to market incentives, every insight is backed by credible sources.