GC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GC Bundle

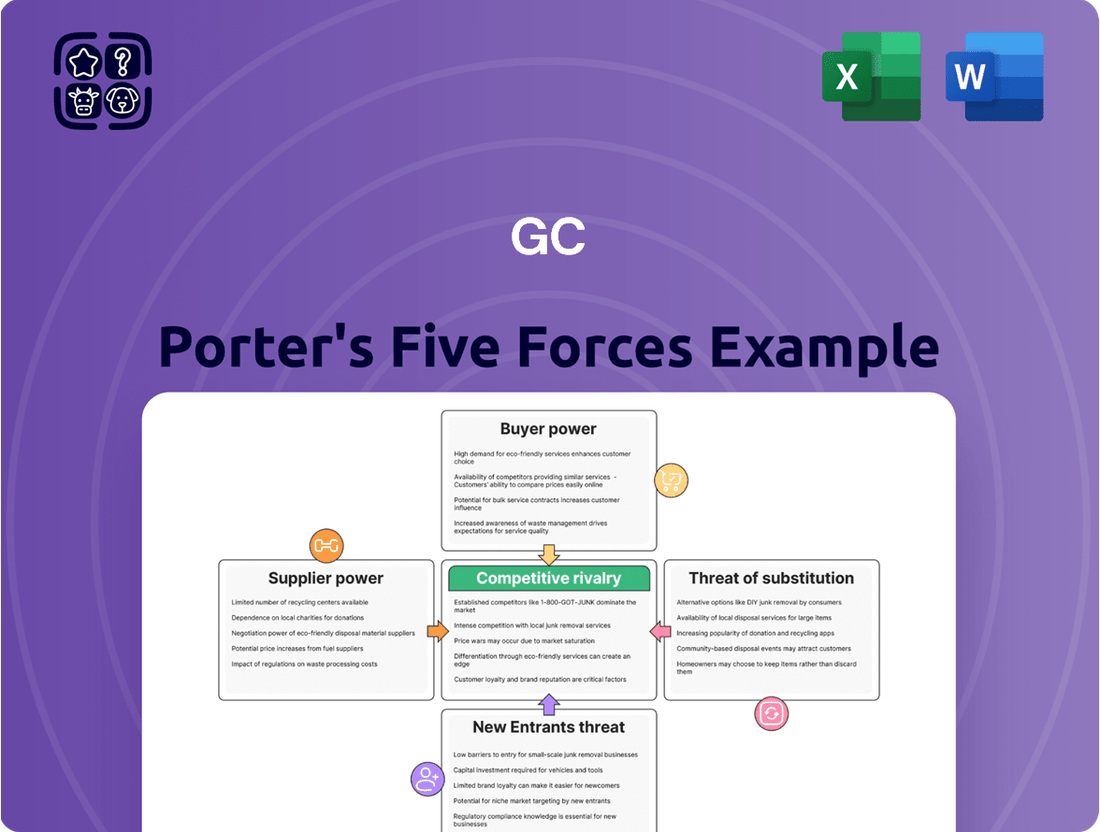

GC Porter's Five Forces Analysis provides a crucial lens into the competitive landscape, revealing the power dynamics at play. Understanding the intensity of rivalry, the sway of buyers and suppliers, and the ever-present threats of new entrants and substitutes is paramount. This framework helps dissect the underlying forces that shape profitability and strategic positioning within GC's industry.

The complete report reveals the real forces shaping GC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

GC's significant reliance on upstream raw materials such as naphtha, natural gas, and various crude oil derivatives directly impacts its bargaining power with suppliers. The global pricing and consistent availability of these essential commodities are critical determinants of GC's manufacturing expenses and overall profitability.

The inherent volatility in crude oil prices has a direct and pronounced effect on feedstock costs for GC. Many of these feedstocks are benchmarked against oil prices, meaning fluctuations in the oil market can rapidly translate into higher or lower input costs for the company.

For instance, in early 2024, crude oil prices experienced considerable swings, with Brent crude trading in a range that significantly influenced the cost of naphtha, a key petrochemical feedstock. This price sensitivity underscores how dependent GC is on the supply conditions and pricing strategies of its raw material providers.

GC's strategic initiative in feedstock diversification, notably importing ethane from the U.S., directly combats the bargaining power of traditional suppliers. By reducing its dependence on a singular source, GC strengthens its negotiating position and can secure more favorable pricing and terms.

This diversification not only enhances cost efficiency but also bolsters supply chain resilience. In 2024, the global petrochemical industry continued to grapple with supply chain disruptions, making diversification a critical strategy for maintaining operational stability and cost control.

The ability to source raw materials from multiple origins, such as the U.S. for ethane, diminishes the leverage individual suppliers hold over GC. This strategic flexibility allows GC to pivot to alternative sources if one supplier attempts to exert undue pressure on pricing or availability.

As a key subsidiary of PTT Public Company Limited, GC enjoys significant benefits from vertical integration, especially with natural gas feedstocks sourced from PTT's own gas separation plants.

This internal supply chain significantly mitigates the bargaining power of external suppliers of these crucial raw materials, ensuring a more stable and potentially cost-controlled input for GC's operations.

For instance, PTT's extensive natural gas infrastructure in Thailand, a core asset of the PTT Group, provides GC with a reliable foundation for its petrochemical production.

While specific financial data on the exact cost savings from this internal sourcing isn't publicly detailed, the strategic advantage of reduced reliance on open market feedstock prices is substantial.

Specialized Equipment and Technology Providers

Specialized equipment and technology providers wield considerable influence in the petrochemical sector. The industry relies on highly complex machinery and cutting-edge technology, meaning few suppliers can meet these stringent demands. For instance, advanced catalytic converters or specialized distillation columns are often proprietary and require extensive integration, leading to high switching costs for petrochemical companies like GC.

These suppliers' proprietary intellectual property and the technical expertise required to operate and maintain their equipment further solidify their bargaining power. The global market for such specialized petrochemical equipment is dominated by a limited number of key players, such as Technip Energies or KBR, which can dictate terms due to the unique nature of their offerings.

- High Switching Costs: Replacing specialized petrochemical equipment can involve significant capital expenditure, retraining of personnel, and potential production downtime, making it difficult for buyers to change suppliers.

- Proprietary Technology: Suppliers offering unique and patented technologies or processes in areas like advanced cracking or polymerization have a distinct advantage.

- Limited Supplier Base: The niche nature of petrochemical manufacturing equipment means there are often only a handful of global suppliers capable of providing the necessary technology, such as manufacturers of high-pressure reactors or advanced separation units.

- Supplier Dependence: Petrochemical firms depend on these suppliers for ongoing maintenance, upgrades, and spare parts, creating a continuous relationship and leverage for the supplier.

Logistics and Infrastructure Suppliers

Logistics and infrastructure suppliers, including shipping, transportation, and port facilities, wield significant bargaining power. GC's reliance on these services for its widespread operations means any disruption or cost escalation from them directly affects GC's supply chain efficiency and distribution reach. For example, the global shipping industry experienced substantial rate increases in 2024, with the Freightos Baltic Index for Asia-North Europe routes averaging around $3,500 per TEU for much of the year, a significant jump from pre-pandemic levels.

This dependence grants these suppliers leverage. If GC faces limited alternative logistics providers or port access, these suppliers can dictate terms, potentially increasing prices or reducing service levels. Given that GC's global presence necessitates complex and continuous movement of goods, the reliability and cost of these services are paramount to its operational success.

- High Reliance: GC's extensive global operations are critically dependent on efficient logistics and infrastructure.

- Cost Impact: Increased rates from shipping and transportation providers, as seen with the 2024 average TEU costs on key routes, directly impact GC's operational expenses.

- Supply Chain Vulnerability: Disruptions from infrastructure suppliers, such as port congestion or limited storage capacity, can hinder GC's distribution capabilities.

- Supplier Leverage: Limited availability of alternative logistics solutions strengthens the bargaining power of existing infrastructure and logistics providers.

The bargaining power of suppliers for GC is significantly shaped by the concentration of providers for essential raw materials like naphtha and natural gas. When the supply base for critical feedstocks is limited, or when these suppliers control unique resources or technologies, their ability to influence pricing and terms increases substantially.

GC's strategic efforts, such as diversifying feedstock sources by importing ethane from the U.S., directly counter this supplier leverage by creating alternative supply options. This diversification not only enhances cost control but also builds greater resilience against market fluctuations and supplier-imposed pressures.

Furthermore, GC benefits from vertical integration, particularly through its parent company PTT, which provides internal access to natural gas. This internal sourcing significantly reduces reliance on external suppliers for certain key inputs, thereby mitigating their bargaining power.

The petrochemical industry's reliance on specialized equipment and technology from a concentrated group of providers also grants these suppliers considerable sway. Suppliers of advanced machinery, often protected by proprietary intellectual property, can command higher prices and dictate terms due to the high switching costs and technical expertise required.

What is included in the product

This analysis dissects the competitive landscape for GC by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Quickly identify and mitigate competitive threats with a visual representation of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

GC Porter's diverse downstream industries, encompassing sectors like plastics, automotive, packaging, textiles, and construction, significantly shape its customer bargaining power. This broad market reach means GC is not overly reliant on any single industry for its revenue.

For instance, in 2024, the automotive sector, a key consumer of plastics and other materials, experienced a projected 3.5% growth in global vehicle production, while the packaging industry saw an estimated 4.2% expansion. This diversification means that if demand softens in automotive, growth in packaging or construction could mitigate the impact, thereby limiting the leverage of any one customer group.

The sheer variety of applications for GC's products across these different end markets means that customers often have limited alternatives if GC's pricing or terms become unfavorable. A plastic manufacturer might find it difficult to switch suppliers for a specialized polymer, especially if GC holds a significant market share or has proprietary technology.

Furthermore, the scale of GC's operations across these multiple industries can also give it an advantage. By serving a vast number of customers, it can achieve economies of scale that smaller competitors cannot match, further reducing the bargaining power of individual buyers who may not represent a substantial portion of GC's overall sales volume.

For commodity petrochemicals such as polyethylene and polypropylene, GC Porter faces significant customer bargaining power. This is because these products are largely standardized, meaning customers can easily switch to another supplier with minimal disruption or cost. In 2024, the global polyethylene market alone was valued at over $100 billion, highlighting the sheer volume and interchangeability of such commodities.

However, GC Porter's strategic shift towards specialty chemicals is actively working to mitigate this customer power. By developing products with unique formulations and performance characteristics, the company increases switching costs for its clients. For instance, a custom-engineered polymer for a specific automotive application might require extensive re-tooling or R&D for a customer to switch suppliers, thereby strengthening GC's position.

Customers in the petrochemical sector often exhibit significant price sensitivity, particularly for widely produced, undifferentiated products. This sensitivity is amplified by the competitive pressures these customers face in their own respective industries, pushing them to seek the lowest possible input costs.

The prevailing global oversupply in key petrochemical segments, such as olefins and aromatics, directly bolsters customer bargaining power. This excess capacity means buyers have more options and can readily switch suppliers if better pricing or terms are offered, leading to increased leverage in negotiations.

For instance, in 2024, the ethylene market experienced periods of substantial overcapacity in certain regions, with operating rates dipping below 80% in some instances. This dynamic allowed downstream consumers of ethylene to negotiate more favorable contract prices, directly impacting petrochemical producers' margins.

Global Competition and Import Options

GC's industrial customers, particularly major buyers, benefit from a global marketplace for petrochemicals. This access to international suppliers means they aren't solely reliant on GC.

The presence of imports, especially from cost-competitive regions like the Middle East and China, significantly broadens customer choices. For instance, in 2024, the global petrochemical market saw increased trade volumes, with countries like Saudi Arabia and China being major exporters, putting downward pressure on prices for buyers.

This expanded range of options directly translates into heightened bargaining power for GC's customers. They can leverage competitive offers from other suppliers to negotiate better terms with GC, potentially influencing pricing and contract conditions.

- Global Petrochemical Trade: In 2023, global petrochemical trade reached trillions of dollars, with significant contributions from regions known for lower production costs.

- Import Penetration: Certain petrochemical product categories saw import penetration rates exceeding 30% in key developed markets during 2023, illustrating substantial customer alternatives.

- Price Sensitivity: Industrial buyers are often highly price-sensitive, making them more inclined to switch suppliers if offered more favorable pricing, a trend evident throughout 2024.

- Supplier Diversification: Companies actively seek to diversify their supplier base to mitigate risks and secure competitive pricing, a strategy that empowers them in negotiations.

Demand for Sustainable Products

Customers are increasingly prioritizing environmentally friendly and sustainable products, a trend that significantly impacts the bargaining power of buyers in the chemical industry. This heightened awareness, fueled by both personal values and evolving regulations, means companies that can offer green chemical alternatives or demonstrate strong environmental stewardship gain a competitive edge. For instance, a significant portion of consumers globally now report actively seeking out sustainable brands, with surveys from 2023 and early 2024 indicating this preference translates into a willingness to pay more for eco-conscious options.

GC's strategic focus on green chemicals and responsible manufacturing practices positions it favorably to meet this growing demand. By emphasizing its commitment to sustainability, GC can differentiate itself from competitors who may lag in environmental performance. This can translate into stronger customer loyalty and the ability to command better pricing, thereby reducing the overall bargaining power of customers who might otherwise switch to lower-cost, less sustainable alternatives.

- Growing Demand: Customer surveys consistently show an increasing preference for sustainable products, with many willing to pay a premium.

- Regulatory Influence: Environmental regulations worldwide are tightening, pushing both producers and consumers towards greener options.

- GC's Advantage: GC's investment in green chemistry and sustainable practices acts as a key differentiator in the market.

- Premium Pricing Potential: The focus on sustainability can allow GC to negotiate better terms and potentially achieve higher margins with environmentally conscious buyers.

Customers wield significant bargaining power when GC Porter deals in standardized petrochemicals like polyethylene and polypropylene, as these are easily sourced from multiple suppliers. The sheer scale of the global polyethylene market, exceeding $100 billion in 2024, underscores this interchangeability. This power is amplified by price-sensitive industrial buyers facing their own competitive pressures, driving them to seek the lowest input costs.

Conversely, GC's move into specialty chemicals, developing unique formulations, actively diminishes customer leverage by increasing switching costs. For example, a custom polymer for automotive applications might require substantial re-tooling for a customer to change suppliers, strengthening GC's negotiating position.

Global oversupply in segments like olefins, with ethylene operating rates dipping below 80% in some regions during 2024, further empowers buyers. This excess capacity allows customers to negotiate better prices, impacting producer margins.

The availability of imports, particularly from cost-competitive regions such as the Middle East and China, broadens customer choices and intensifies bargaining power. Increased global petrochemical trade in 2023, with significant contributions from major exporters, has put downward pressure on prices for buyers.

| Factor | Impact on GC Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Product Standardization (e.g., Polyethylene) | High power due to easy switching | Global polyethylene market valued over $100 billion. |

| Specialty Chemicals Development | Low power due to high switching costs | GC's strategy to increase customer stickiness. |

| Global Oversupply (e.g., Ethylene) | High power, enabling price negotiation | Ethylene operating rates below 80% in some regions. |

| Import Availability (e.g., from Middle East/China) | High power due to wider supplier options | Increased global petrochemical trade volumes. |

Same Document Delivered

GC Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You are viewing a comprehensive GC Porter's Five Forces Analysis that delves into the competitive landscape of the industry. This detailed report outlines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Once you complete your purchase, you’ll get instant access to this exact file, ready to inform your strategic decisions.

Rivalry Among Competitors

GC Corporation faces a fiercely competitive landscape in the petrochemical sector, grappling with aggressive rivals both within Southeast Asia and on the global stage. This intense rivalry is exacerbated by significant industry overcapacity, particularly in key product lines like olefins and aromatics.

The prevalent overcapacity directly translates into heightened pricing pressures and squeezed profit margins for all market participants. For instance, by the end of 2023, the global petrochemical industry capacity for ethylene, a key olefin, was estimated to be around 190 million metric tons, with significant new capacity additions planned, intensifying the competitive dynamic.

GC Porter's competitive rivalry hinges on its strategy to move beyond commoditized basic petrochemicals. While the broader petrochemical market sees intense price competition for undifferentiated products, GC is actively pursuing differentiation through its emphasis on value-added chemicals and specialty product lines. This approach aims to carve out higher-margin segments and reduce direct exposure to the volatile pricing of basic commodities.

The success of GC's differentiation strategy is crucial as the global petrochemical market, particularly for basic building blocks like ethylene and propylene, remains inherently cyclical and prone to oversupply. For instance, in early 2024, the average price of ethylene experienced fluctuations, impacting margins for producers focused solely on this commodity. GC's investment in green innovations and specialty chemicals, such as advanced polymers and sustainable additives, provides a buffer against these commodity price swings.

By focusing on these higher-value segments, GC seeks to command better pricing power and foster customer loyalty based on performance and innovation rather than solely on cost. This allows the company to navigate the intense rivalry in the commodity space more effectively. For example, the demand for high-performance plastics in the automotive sector, a key area for GC’s specialty products, remained robust through 2024, showcasing the potential for differentiation.

The petrochemical industry, known for its capital-intensive nature, presents substantial fixed costs. Companies are thus strongly motivated to achieve high capacity utilization to effectively spread these significant expenses across their production. This drives a competitive environment where maintaining sales volumes becomes paramount.

When the market experiences oversupply, this pressure can lead to aggressive pricing strategies, often referred to as price wars. For instance, in 2024, certain petrochemical segments saw increased competition as global supply outpaced demand, leading to downward pressure on prices as producers sought to keep their plants running efficiently.

Strategic Alliances and Acquisitions

Competitive rivalry extends beyond direct product competition to encompass strategic alliances, joint ventures, and acquisitions. These moves are designed to broaden market access, diversify offerings, and secure critical resources. For instance, GC's strategic investments in biopolymers through its stake in NatureWorks and its acquisition of coating resins producer allnex are clear indicators of this competitive strategy, aiming to bolster its market position and product breadth.

These strategic maneuvers are vital for companies like GC to stay ahead. By forming alliances or acquiring complementary businesses, companies can gain access to new technologies, customer bases, and supply chains. This not only strengthens their competitive stance but also allows for more efficient resource allocation and risk sharing.

- Market Expansion: Alliances and acquisitions allow companies to enter new geographic markets or customer segments more rapidly than organic growth.

- Portfolio Diversification: These strategies enable companies to offer a wider range of products and services, reducing reliance on any single market.

- Resource Securing: Acquiring or partnering with suppliers can guarantee access to essential raw materials or components, a critical advantage in many industries.

- Synergy Creation: Merging operations or collaborating can lead to cost savings and operational efficiencies, enhancing overall profitability.

Sustainability and Decarbonization Efforts

Competitive rivalry within the industry is increasingly defined by sustainability and decarbonization efforts. Companies are now vying not only on traditional metrics like price and product quality but also on their environmental impact and dedication to circular economy principles. This shift means a firm's commitment to reducing its carbon footprint is becoming a significant competitive differentiator.

GC, for instance, is actively channeling resources into green technologies and has set ambitious targets for achieving net-zero emissions. This strategic focus on sustainability is not just about corporate responsibility; it's a direct response to evolving market demands and regulatory pressures. As of 2024, investments in renewable energy and sustainable supply chains are becoming critical for maintaining market share and attracting environmentally conscious investors.

- Environmental, Social, and Governance (ESG) factors are now central to competitive strategy, influencing customer loyalty and investor confidence.

- Decarbonization targets are driving innovation in product development and operational efficiency across many sectors.

- Circular economy principles are reshaping business models, focusing on resource efficiency and waste reduction.

- GC's commitment to net-zero emissions represents a significant investment in future-proofing its operations and market position.

GC Corporation faces intense competition driven by overcapacity in basic petrochemicals, forcing a strategic shift towards value-added and specialty products. This rivalry is intensified by high fixed costs, compelling producers to maintain high capacity utilization, often leading to aggressive pricing. GC's response includes strategic alliances and acquisitions, like its investment in NatureWorks and acquisition of allnex, to broaden its market reach and product portfolio.

The competitive landscape is increasingly shaped by sustainability initiatives, with companies like GC investing heavily in green technologies and net-zero targets. This focus on ESG factors is crucial for customer loyalty and investor confidence, as demonstrated by the growing demand for sustainable materials. For instance, the global specialty chemicals market, where GC is expanding, was projected to grow at a compound annual growth rate of over 5% through 2024.

| Competitive Factor | GC's Strategy | Market Context (2024) |

|---|---|---|

| Price Competition (Basic Petrochemicals) | Focus on Value-Added/Specialty Products | High overcapacity, leading to margin pressure. |

| Capacity Utilization | Maintain high operational efficiency | Crucial for covering high fixed costs; drives volume focus. |

| Strategic Moves | Alliances (NatureWorks), Acquisitions (allnex) | Enhances market access, diversifies offerings. |

| Sustainability | Investment in green tech, Net-Zero targets | Increasingly a key differentiator; ESG factors influence investors. |

SSubstitutes Threaten

The increasing global focus on sustainability and environmental protection significantly elevates the threat posed by bio-based alternatives and bioplastics. These materials, like polylactic acid (PLA), offer viable substitutes for traditional plastics derived from petroleum, driven by consumer demand and regulatory pressures. For instance, the global bioplastics market was valued at approximately $12.5 billion in 2023 and is projected to reach over $30 billion by 2030, indicating substantial growth and a growing competitive landscape.

GC Porter is proactively countering this threat by investing in and developing its own bio-based solutions. A prime example is its dedicated PLA biopolymer production plant, which aims to capture a share of this expanding market. This strategic move not only addresses the substitution threat but also positions GC Porter as a leader in sustainable materials, aligning with market trends and future consumer preferences.

The increasing adoption of circular economy models and sophisticated recycling processes for plastics presents a significant substitution threat. This trend directly impacts the demand for new, virgin petrochemicals, which are core to GC Porter's operations. For instance, by 2024, the global plastic recycling market was projected to reach over $50 billion, indicating a substantial shift away from virgin materials.

GC Porter's strategic focus on integrating circular economy principles and enhancing resource efficiency is a proactive response to this evolving landscape. By investing in advanced recycling technologies and developing products with recycled content, GC aims to mitigate the substitution threat. This approach not only addresses environmental concerns but also opens new avenues for revenue and market positioning, demonstrating a commitment to sustainable growth.

Traditional materials such as paper, glass, metals, and wood frequently offer viable alternatives to petrochemical-based products across numerous applications. For example, paper packaging is increasingly replacing plastic packaging, particularly for single-use items, influenced by evolving consumer attitudes and new regulations. This trend is notable as the global market for sustainable packaging materials is projected to reach over $400 billion by 2027, indicating a significant shift away from traditional plastics.

Cost-Performance Trade-offs

The attractiveness of substitutes for petrochemical products is heavily influenced by their cost-performance trade-offs. For instance, while bio-based plastics might offer a lower carbon footprint, their production costs can be significantly higher than traditional petroleum-based plastics. In 2024, the global market for bioplastics was estimated to reach over $15 billion, yet adoption in many high-volume industrial sectors remained constrained by these cost differentials and, in some cases, performance limitations like heat resistance or durability.

While substitutes can offer advantages such as reduced environmental impact or unique functionalities, these benefits often come at a premium. For example, advanced composite materials, which can replace some metal components derived from petrochemical feedstocks, may provide superior strength-to-weight ratios but at a substantially higher price point. This cost premium can be a significant barrier to entry, particularly in price-sensitive markets like automotive manufacturing or consumer goods, limiting their ability to fully displace established petrochemical products.

- Higher Costs: Many eco-friendly alternatives, such as biodegradable polymers, can be 20-50% more expensive to produce than their conventional counterparts.

- Performance Gaps: Certain substitutes may not yet match the performance characteristics of petrochemical products in terms of strength, flexibility, or longevity required for specific industrial applications.

- Scale Limitations: The production capacity for many emerging substitutes is still developing, which can lead to supply chain issues and higher unit costs compared to the mature, large-scale production of petrochemicals.

- Market Acceptance: Consumer and industrial acceptance of substitutes can be slow, especially if there are perceived risks associated with new materials or a lack of established performance data.

Technological Advancements in Substitutes

Technological advancements are a significant driver of the threat of substitutes. For instance, breakthroughs in biodegradable plastics, which saw a global market value of approximately USD 50 billion in 2023, could offer viable alternatives to traditional materials used by GC. These innovations not only improve environmental profiles but also have the potential to match or even surpass the performance of existing products at a lower cost point.

GC must actively track these emerging technologies. For example, the development of advanced composite materials, projected to grow substantially in the coming years, could offer superior strength-to-weight ratios, potentially displacing established solutions. Staying ahead of such trends is crucial for GC to maintain its market position and adapt its offerings proactively.

The increasing efficiency and decreasing costs of renewable energy sources, such as solar and wind power, represent another area where substitutes can emerge. By 2024, the cost of solar photovoltaic (PV) electricity has fallen by over 90% since 2010, making it increasingly competitive with traditional energy generation methods. This trend could impact industries that rely heavily on conventional energy inputs, potentially creating new competitive pressures for GC if its operations are energy-intensive.

- Monitoring Innovation: Continuous surveillance of technological progress in substitute materials and production methods is essential.

- Adaptability: GC needs to be agile in modifying its product lines and manufacturing processes to incorporate or counter innovations.

- Cost-Performance Analysis: Evaluating how new technologies affect the cost and performance of substitutes relative to GC's own offerings is critical.

- Strategic Investment: Consider investing in or partnering with companies developing disruptive technologies that could either benefit or threaten GC's business.

The rise of sustainable and bio-based alternatives directly challenges petrochemical products. For instance, the global bioplastics market, valued around $15 billion in 2024, showcases this shift. GC's investment in a PLA biopolymer plant is a direct response to capture this growing market and mitigate the threat of these substitutes.

Circular economy principles and advanced recycling also pose a substitution threat by reducing demand for virgin materials. With the global plastic recycling market projected to exceed $50 billion by 2024, GC's focus on recycled content and efficiency is crucial for adaptation.

Traditional materials like paper and glass continue to offer alternatives, especially in packaging, driven by consumer and regulatory shifts. The sustainable packaging market's projected growth to over $400 billion by 2027 highlights this ongoing substitution pressure.

However, substitutes often face challenges like higher costs, performance gaps, and scale limitations. For example, bioplastics can be 20-50% more expensive, and their performance may not always match petrochemicals in demanding applications, impacting market acceptance.

| Substitute Type | Market Growth Projection (Approx.) | Key Challenge for Adoption |

|---|---|---|

| Bio-based Plastics | $30 billion by 2030 | Higher production costs |

| Recycled Plastics | > $50 billion (2024 market value) | Maintaining virgin material performance |

| Sustainable Packaging (General) | > $400 billion by 2027 | Cost-effectiveness and material properties |

Entrants Threaten

The petrochemical industry demands colossal upfront investments, often running into billions of dollars for state-of-the-art manufacturing plants and the necessary supporting infrastructure. For instance, constructing a new ethylene cracker, a foundational petrochemical facility, can easily cost upwards of $5 billion as of 2024. This immense capital requirement acts as a formidable barrier, making it exceedingly difficult for new players to even consider entering the market.

These substantial financial hurdles effectively deter most potential entrants. The sheer scale of investment needed to build competitive petrochemical facilities, coupled with the long lead times for construction and regulatory approvals, creates a significant risk profile. Consequently, only well-established companies with deep pockets and access to significant capital can realistically contemplate entering this sector.

Established players in the industry, such as GC, often command significant economies of scale. This means they can produce goods or services at a lower cost per unit due to their large production volumes, bulk purchasing power, and efficient distribution networks. For instance, in 2024, major automotive manufacturers achieved production costs per vehicle that were substantially lower than what a new entrant could manage due to their established supply chains and high-volume assembly lines.

New companies entering the market would find it incredibly difficult to replicate these cost advantages. To achieve similar per-unit cost efficiencies, a new entrant would need to invest heavily upfront to build comparable production capacity and establish robust procurement and distribution systems. This high barrier to entry, stemming from the need to overcome existing economies of scale, can deter potential competitors and protect the market share of incumbents.

Newcomers face significant challenges in securing reliable and cost-effective access to crucial feedstocks like naphtha and ethane. These raw materials are the lifeblood of many industries, and their availability can be a major determinant of success.

Furthermore, proprietary production technologies represent another substantial barrier. Established companies often possess years of invested research and development, leading to advanced, efficient processes that are difficult and expensive for new entrants to replicate.

For instance, in the petrochemical sector, long-term supply agreements for feedstocks provide existing players with a distinct cost advantage. In 2024, the volatility in crude oil prices, a primary driver for naphtha, directly impacted feedstock costs, making it even harder for new players to compete on price.

The established technological know-how of incumbent firms, often protected by patents or trade secrets, creates a formidable entry barrier. This technological gap can translate into higher operating costs and lower product quality for new entrants, limiting their ability to gain market share.

Stringent Regulatory and Environmental Hurdles

The petrochemical industry faces substantial barriers to entry due to stringent regulatory and environmental hurdles. Compliance with complex safety standards and permitting processes requires significant upfront investment and can lead to lengthy approval timelines, especially as decarbonization efforts intensify.

These regulations, which are becoming increasingly rigorous, add considerable cost and complexity for any new player looking to establish a foothold. For instance, in 2024, the cost of obtaining environmental permits and ensuring compliance with emissions standards could easily run into tens or even hundreds of millions of dollars for a new petrochemical facility.

- Capital Intensity: New entrants require massive capital outlays for state-of-the-art, compliant facilities.

- Regulatory Compliance Costs: Expenses associated with meeting environmental, health, and safety regulations are substantial.

- Permitting Delays: Obtaining necessary permits can take years, delaying market entry and increasing project risk.

- Decarbonization Pressures: The growing demand for sustainable practices and reduced carbon footprints adds another layer of complexity and cost for newcomers.

Brand Loyalty and Distribution Networks

The petrochemical industry, while featuring some commoditized products, is heavily influenced by established players' brand loyalty and entrenched distribution networks. Companies like Dow Chemical and BASF have cultivated long-standing relationships with customers, built on a reputation for consistent quality and dependable supply. For instance, in 2024, major petrochemical producers continued to leverage their extensive global logistics infrastructure, which is a significant barrier for newcomers.

New entrants face the daunting task of replicating these deeply ingrained customer connections and the complex logistical capabilities that ensure timely delivery across diverse markets. Building comparable trust and market access requires substantial investment in time and resources, often spanning many years. This makes the threat of new entrants in the petrochemical sector moderate, as significant capital and strategic planning are essential to overcome these established advantages.

- Brand Loyalty: Established petrochemical firms benefit from decades of building trust and consistent product delivery, making it difficult for new players to attract and retain customers.

- Distribution Networks: Extensive global supply chains and logistics capabilities are critical in the petrochemical industry, representing a substantial barrier to entry.

- Reputation for Reliability: A proven track record of product quality and dependable supply is a key differentiator that new entrants must meticulously build.

- Resource Investment: Overcoming existing brand loyalty and distribution advantages necessitates considerable financial outlay and a long-term strategic commitment.

The threat of new entrants in the petrochemical industry is generally low to moderate, primarily due to extremely high capital requirements and significant economies of scale enjoyed by established players. For instance, building a new world-scale ethylene cracker in 2024 could cost upwards of $5 billion. This immense upfront investment creates a substantial barrier, as new firms must match or exceed the production volumes and efficiency of incumbents to be competitive.

Furthermore, securing access to feedstocks and proprietary technology presents considerable challenges for newcomers. Established companies often have long-term supply contracts and advanced, patented processes that are difficult and costly to replicate. For example, in 2024, feedstock price volatility, driven by crude oil markets, highlighted the advantage of existing players with secured, cost-effective supply chains.

Stringent regulatory and environmental compliance adds another layer of complexity and cost. Obtaining permits and adhering to evolving standards, such as those related to decarbonization, can require hundreds of millions of dollars in 2024. Combined with established brand loyalty and entrenched distribution networks, these factors make it very difficult for new companies to enter and gain traction in the petrochemical market.

| Barrier Type | Description | Estimated Cost Impact (2024) |

|---|---|---|

| Capital Intensity | Building new, large-scale petrochemical facilities. | >$5 billion for an ethylene cracker. |

| Economies of Scale | Matching the cost efficiencies of established high-volume producers. | Requires matching incumbent production capacity. |

| Feedstock Access | Securing reliable and cost-effective raw materials. | Millions to billions in long-term contracts. |

| Technology & R&D | Replicating proprietary and patented production processes. | Significant R&D investment or licensing fees. |

| Regulatory Compliance | Meeting environmental, safety, and permitting standards. | Tens to hundreds of millions for new facilities. |

| Brand & Distribution | Building customer relationships and logistics networks. | Years of investment and strategic partnerships. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of publicly available information, including company annual reports, industry-specific trade publications, and reputable market research databases.

We leverage data from government economic reports, financial news outlets, and business intelligence platforms to comprehensively assess industry structure and competitive dynamics.