Prologis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prologis Bundle

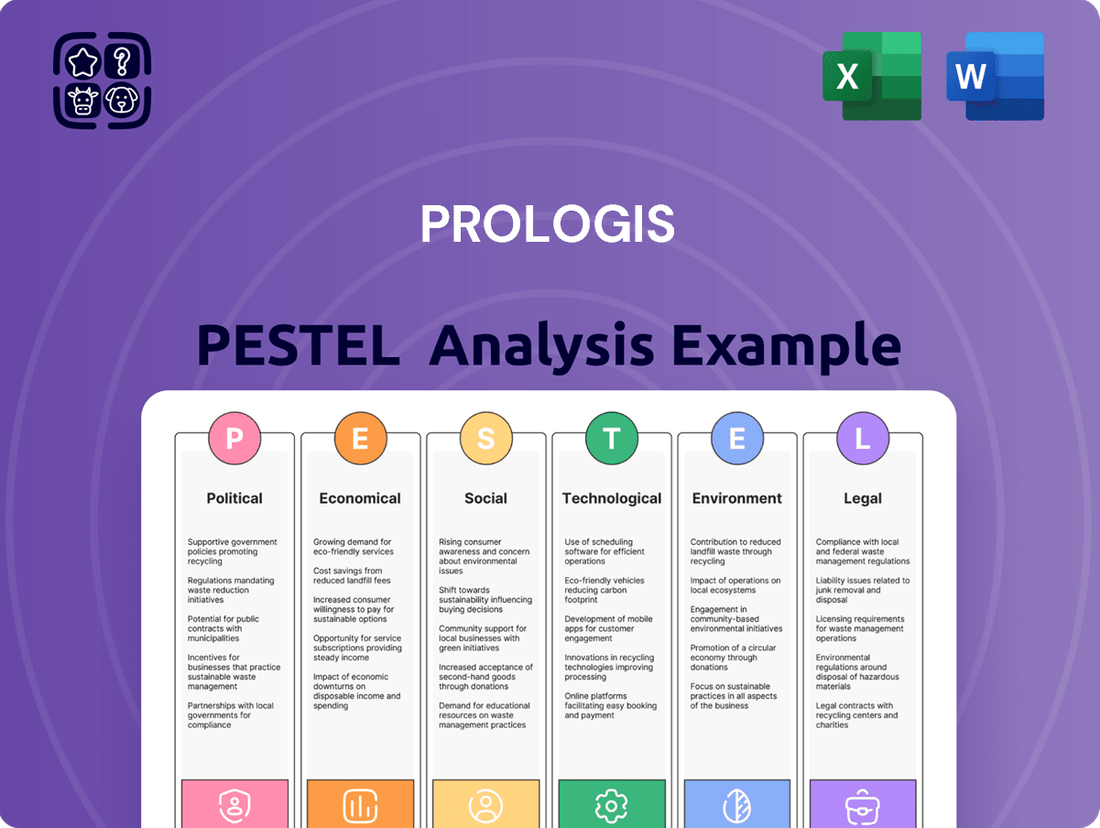

Unlock the strategic advantages Prologis holds by understanding the intricate interplay of political, economic, social, technological, legal, and environmental factors. Our PESTLE analysis delves deep into how these external forces are shaping the logistics real estate giant's operations and future growth. Equip yourself with the foresight needed to anticipate market shifts and identify opportunities. Download the full PESTLE analysis now to gain actionable intelligence and refine your own strategic approach.

Political factors

Government policies on land use, zoning, and permitting are critical for Prologis. These regulations directly influence where and how Prologis can acquire land, develop new logistics facilities, and expand existing ones. For instance, in 2024, many metropolitan areas continued to tighten zoning laws for industrial development, making it harder to secure prime locations for distribution centers.

Changes in these rules, especially in markets with already high barriers to entry, can significantly lengthen development timelines and drive up construction costs. This directly impacts the availability of suitable sites, a key factor for Prologis's growth strategy. The company's ability to navigate these complexities is crucial for maintaining its competitive edge in site acquisition.

Global trade policies significantly influence Prologis's operations. Fluctuations in international trade agreements and tariffs directly impact the demand for logistics space by altering global supply chain strategies. For instance, the US-China trade tensions, which saw tariffs imposed on billions of dollars worth of goods, led many companies to re-evaluate their sourcing and distribution networks, potentially increasing the need for warehousing in different regions.

Prologis, with its extensive global footprint, is particularly sensitive to these policy shifts. Policies that encourage or discourage international trade flows directly affect the volume of goods needing warehousing and distribution. As of early 2024, ongoing negotiations and potential adjustments to trade agreements, such as those involving the European Union and its trading partners, continue to shape the landscape for logistics providers.

Geopolitical instability, such as ongoing regional conflicts and the potential for new trade disputes, poses a significant risk to Prologis's global operations. For instance, the protracted conflict in Eastern Europe and the ongoing tensions in the Middle East have already demonstrated their capacity to disrupt international trade routes and manufacturing hubs, directly impacting the supply chains of Prologis's diverse customer base. This disruption can lead to reduced demand for logistics and distribution space as businesses reassess their inventory management and sourcing strategies.

Prologis actively monitors geopolitical developments across its 19 countries of operation. In 2024, the company's risk assessment includes the potential impact of evolving international sanctions regimes, which could affect tenant operations and investment security in affected regions. A slowdown in global trade, exacerbated by such geopolitical factors, could temper the robust demand for modern logistics facilities that Prologis has experienced in recent years, potentially influencing leasing rates and occupancy levels.

Infrastructure Spending and Development

Government investment in transportation infrastructure directly impacts Prologis's operational efficiency. Enhanced roads, ports, and rail networks, like the significant infrastructure bills proposed or passed in major economies during 2024 and early 2025, improve connectivity to Prologis’s logistics facilities. This makes Prologis's locations more appealing to tenants by facilitating smoother and quicker movement of goods, ultimately boosting demand for warehouse space.

For instance, the continued focus on supply chain resilience and modernization in the United States, with initiatives like the Bipartisan Infrastructure Law allocating substantial funds for transportation upgrades, directly benefits Prologis's network. Similarly, European countries are investing heavily in port modernization and high-speed rail freight, creating more efficient hubs for logistics operations. These developments are critical for Prologis as they reduce transportation costs and delivery times for their customers.

- US Bipartisan Infrastructure Law: Over $1 trillion allocated for infrastructure, including significant portions for roads, bridges, and public transit, enhancing Prologis's access.

- European Green Deal Initiatives: Investments in sustainable transport networks and port upgrades aim to improve freight efficiency across the continent, benefiting Prologis's European portfolio.

- Global Port Modernization Projects: Major port expansion and automation projects worldwide, such as those in Asia and the Middle East, are underway, crucial for global supply chain connectivity that Prologis supports.

Taxation Policies on Real Estate and Corporations

Changes in corporate tax rates and property taxes significantly influence Prologis's profitability and strategic investment choices across its global portfolio. For instance, a reduction in corporate tax rates, as seen in some jurisdictions leading up to 2025, can directly boost net income and increase the attractiveness of reinvesting earnings into new developments or acquisitions. Conversely, an uptick in property taxes or real estate-specific levies, such as transfer taxes or vacancy taxes, can erode returns on existing assets and make future projects less financially viable. These policy shifts necessitate continuous monitoring and adaptation of Prologis's financial planning and operational strategies to optimize its tax liabilities and capital allocation.

In 2024, several key markets where Prologis operates have seen discussions or implementations of adjusted tax policies. For example, some US states are re-evaluating property tax assessments for industrial properties, potentially leading to higher costs for owners. Similarly, in Europe, certain countries are considering or have implemented changes to capital gains tax on real estate sales, impacting the net proceeds from divestitures. Prologis's ability to navigate these varying tax landscapes is crucial for maintaining its competitive edge and ensuring robust financial performance.

- Corporate Tax Impact: Fluctuations in corporate income tax rates directly affect Prologis's bottom line, influencing its ability to retain earnings for reinvestment. For example, a hypothetical 2% decrease in a major market's corporate tax rate could translate to tens of millions in additional retained earnings annually for Prologis, depending on its taxable income.

- Property Tax Burden: Increases in property taxes directly increase operating expenses for Prologis's owned and managed properties, reducing net operating income (NOI). A 0.5% increase in property tax rates on a large industrial portfolio could add millions in annual costs.

- Real Estate Levies: Specialized real estate taxes, such as stamp duties on acquisitions or development levies, can add substantial upfront costs to new projects, impacting internal rates of return (IRRs) and the feasibility of new developments.

- Jurisdictional Variance: The patchwork of tax policies globally means Prologis must tailor its strategies to each market, seeking out favorable tax environments for expansion while mitigating risks associated with higher tax burdens in other regions.

Government policies concerning land use and zoning significantly shape Prologis's ability to acquire sites and develop logistics facilities. As of early 2025, many urban areas continue to implement stricter zoning regulations for industrial development, making it more challenging to secure prime locations for distribution centers, thereby increasing acquisition costs and development timelines.

Shifts in international trade policies and geopolitical tensions directly impact global supply chains and, consequently, Prologis's demand for logistics space. For instance, ongoing trade negotiations and potential tariffs in 2024 and 2025 continue to influence how companies manage their inventory and distribution networks, affecting leasing patterns for Prologis's extensive global portfolio.

Government investments in infrastructure, such as roads, ports, and rail, are crucial for Prologis's operational efficiency and tenant appeal. Projects like those funded by the US Bipartisan Infrastructure Law, with over $1 trillion allocated, and similar European initiatives for port modernization in 2024-2025, enhance connectivity to Prologis facilities, reducing logistics costs for clients.

Changes in corporate and property tax rates directly affect Prologis's profitability and investment decisions. In 2024, some markets saw property tax re-evaluations, potentially increasing operating expenses, while corporate tax discussions in various jurisdictions could impact retained earnings for reinvestment.

What is included in the product

This Prologis PESTLE analysis examines how political, economic, social, technological, environmental, and legal forces impact its operations and strategy.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate clarity on external factors impacting Prologis.

Economic factors

Rising interest rates, such as the Federal Reserve's benchmark rate which has seen significant increases through 2023 and early 2024, directly impact Prologis by elevating the cost of borrowing. This makes it more expensive for Prologis to secure capital for new warehouse developments and acquisitions, and also increases the expense of refinancing its substantial existing debt portfolio.

Furthermore, the broader capital market conditions play a critical role. Tightening liquidity and shifts in investor sentiment, as observed in periods of economic uncertainty, can reduce the availability and increase the cost of equity financing. This is particularly impactful for Prologis, as large-scale real estate projects require substantial upfront capital, often funded through a mix of debt and equity.

Inflationary pressures are a significant concern for Prologis, directly impacting construction costs. Rising prices for essential materials like steel and concrete, coupled with increasing labor expenses, push up the overall cost of building new logistics facilities. For instance, the Producer Price Index for construction materials saw a notable increase in early 2024, reflecting these trends.

While Prologis has mechanisms like rent escalations to offset some of these rising expenses, sustained high inflation can still squeeze development profit margins. Furthermore, increased operational costs for their existing properties, from utilities to maintenance, can also eat into profitability. The Consumer Price Index (CPI) reported continued elevated levels in key global markets through mid-2024, underscoring this challenge.

Global economic growth is a critical factor for Prologis, as it directly influences the demand for logistics facilities. When economies are expanding, businesses tend to increase production and trade, requiring more warehouse and distribution space. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024 and remain at that level in 2025, indicating a stable environment for logistics demand.

Consumer spending is another major driver. Higher consumer spending fuels retail sales and e-commerce, which in turn necessitates efficient supply chains and ample storage. As consumer confidence rises, so does the volume of goods needing to be moved and stored, benefiting Prologis's core business. In 2024, many developed economies saw consumer spending rebound, supporting demand for logistics services.

E-commerce Expansion and Supply Chain Shifts

The ongoing surge in e-commerce is fundamentally reshaping how goods move, requiring more advanced and strategically located distribution centers, especially for last-mile deliveries. Prologis is well-positioned to capitalize on this, as companies increasingly invest in the efficient fulfillment infrastructure needed for their expanding online sales. For instance, global e-commerce sales reached an estimated $6.3 trillion in 2023 and are projected to grow further, underscoring the sustained demand for logistics real estate.

This expansion directly translates into heightened demand for Prologis's modern logistics facilities. As businesses enhance their digital presence and customer reach, they rely on Prologis's network to optimize inventory management and speed up delivery times. The company's focus on gateway markets and last-mile locations directly addresses this critical need.

- E-commerce Growth: Global e-commerce sales are expected to reach $8.1 trillion by 2026, driving persistent demand for logistics space.

- Last-Mile Demand: The need for rapid delivery fuels the development of smaller, strategically placed urban logistics facilities.

- Inventory Optimization: Businesses are increasing inventory levels in key locations to meet online demand, requiring more warehouse space.

Supply Chain Resiliency and Inventory Strategies

Recent global events have significantly impacted supply chains, prompting a pivot away from strict just-in-time inventory. Businesses are now prioritizing resilience, leading to a demand for larger safety stocks and more robust warehousing solutions. This strategic shift is directly influencing the need for increased logistics and storage capacity.

The emphasis on supply chain resiliency is translating into a greater need for physical space. Companies are actively seeking to de-risk their operations by holding more inventory closer to demand centers. This trend is particularly evident as businesses prepare for potential future disruptions, aiming to guarantee product availability and minimize downtime.

- Increased Warehousing Demand: Global supply chain disruptions in 2022-2023 led to a notable increase in demand for industrial and logistics real estate as companies sought to hold more inventory.

- Safety Stock Growth: Many companies reported increasing their safety stock levels by 10-20% or more in response to past shortages, directly impacting storage space requirements.

- Shift from JIT to JIC: The move from 'just-in-time' (JIT) to 'just-in-case' (JIC) inventory management is a defining characteristic of current supply chain strategies, fueling demand for warehousing.

Economic factors present a dual-edged sword for Prologis. Rising interest rates, exemplified by continued Federal Reserve adjustments through early 2024, inflate borrowing costs for development and refinancing. Global economic growth, projected by the IMF to remain steady at 3.2% for 2024 and 2025, supports underlying demand for logistics space. However, inflation, as seen in the elevated Producer Price Index for construction materials in early 2024, directly increases development expenses, potentially impacting profit margins despite rent escalation clauses.

| Economic Factor | Impact on Prologis | Data/Trend (2023-2025) |

|---|---|---|

| Interest Rates | Increased cost of capital for development & refinancing | Federal Reserve benchmark rate adjustments through early 2024 |

| Global Economic Growth | Drives demand for logistics facilities | IMF projected 3.2% global growth for 2024 & 2025 |

| Inflation | Higher construction and operational costs | Elevated PPI for construction materials (early 2024); continued high CPI in key markets (mid-2024) |

| Consumer Spending | Boosts retail and e-commerce, increasing logistics needs | Rebound in consumer spending in developed economies (2024) |

Same Document Delivered

Prologis PESTLE Analysis

This preview showcases the comprehensive Prologis PESTLE analysis you'll receive. The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying. You'll gain insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Prologis. This is the exact, finished document you’ll own after checkout, ready for your strategic planning.

Sociological factors

The ongoing shift of populations towards cities is significantly reshaping how goods are moved. As more people live in urban centers, the demand for quick and convenient delivery services, especially for the final leg of the journey, intensifies. This escalating urbanization directly translates into a greater need for logistics spaces situated right within or very near these densely populated areas.

Prologis is well-positioned to capitalize on this trend. The company's strategic focus on acquiring and developing logistics facilities in high-barrier, high-growth urban markets directly addresses the need for these localized distribution hubs. For instance, in 2024, urban areas continued to see significant population influx, with many major cities experiencing growth rates exceeding 2% annually, underscoring the persistent demand for efficient last-mile solutions.

This concentration of consumers in cities means that businesses need to be closer to their end customers to meet delivery expectations, often within hours. Prologis's portfolio, with a substantial presence in key urban logistics corridors, allows its customers to reduce transit times and costs, a critical advantage in today's fast-paced e-commerce environment. The company's investment in urban infill locations reflects a deep understanding of this sociological driver.

The availability and cost of skilled labor are critical for Prologis's customers, directly impacting operational efficiency in warehousing and logistics. For instance, in 2024, the US logistics sector continued to grapple with a shortage of warehouse workers, with reports indicating a deficit of tens of thousands of positions needed to meet demand. This scarcity drives up wages, affecting tenant costs.

Prologis's strategic advantage lies in its ability to identify and develop facilities in locations with favorable labor market dynamics. Understanding local unemployment rates and wage trends allows Prologis to offer properties that provide better access to necessary workforces. For example, a Prologis property situated near a metropolitan area with a historically strong labor pool would be more attractive to tenants in 2024 than a remote location with limited worker availability.

Consumers increasingly expect faster delivery, with many willing to pay a premium for same-day or next-day shipping. This demand is reshaping how logistics facilities are designed and located, pushing for more urban and suburban warehousing to shorten last-mile delivery times.

In 2024, studies show that over 60% of online shoppers consider delivery speed a crucial factor in their purchasing decisions. This societal trend directly influences Prologis' strategy in selecting sites that offer proximity to major population centers, enabling quicker fulfillment and meeting these heightened consumer expectations.

Workplace Safety and Employee Well-being

Societal expectations are increasingly prioritizing employee well-being and safe working conditions, directly impacting how logistics facilities like Prologis's are designed and managed. This heightened awareness means Prologis must ensure its properties offer environments that are not only secure but also compliant with evolving health and safety standards.

To attract and retain tenants who value their workforce, Prologis needs to demonstrate a commitment to providing safe and healthy spaces. Companies are scrutinizing their supply chains for ethical labor practices, which extends to the physical environments where goods are stored and handled. For instance, in 2024, reports indicated a growing trend of companies investing more in workplace safety training, with some allocating up to 15% of their HR budget to this area, reflecting the importance tenants place on this factor.

- Enhanced Safety Features: Implementing advanced fire suppression systems, ergonomic loading docks, and improved lighting in warehouses becomes crucial.

- Employee Amenities: Providing clean break rooms, accessible restrooms, and potentially wellness areas can be a differentiator.

- Compliance and Certification: Adhering to and exceeding regulatory requirements, such as OSHA standards in the US, is essential for tenant confidence.

- Tenant Demand: In 2025, it's projected that over 70% of large logistics companies will prioritize facility safety records when selecting new warehouse space.

Shifting Demographics and Consumption Patterns

Demographic shifts significantly influence logistics demand. For instance, the aging population in developed nations, projected to increase the proportion of individuals over 65 to over 20% by 2050 according to UN data, often leads to a greater need for healthcare-related goods and home delivery services. Conversely, the growing millennial and Gen Z populations, who are digitally native and accustomed to e-commerce, drive demand for faster, more flexible fulfillment options. Prologis actively monitors these evolving consumer behaviors to optimize its real estate portfolio and services for future market needs.

These demographic trends translate directly into altered consumption patterns. The rise of dual-income households and a focus on convenience fuels e-commerce growth, with global e-commerce sales reaching an estimated $6.3 trillion in 2024, according to Statista. This necessitates more sophisticated last-mile delivery solutions and urban logistics hubs. Furthermore, increasing demand for personalized products and sustainable sourcing requires adaptable supply chains. Prologis's strategic investments in modern logistics facilities are designed to accommodate these dynamic shifts, ensuring efficient product flow for its diverse clientele across various sectors.

- Aging Population Impact: Increased demand for healthcare products and home delivery services.

- Younger Generations' Influence: Driving e-commerce growth and demand for rapid fulfillment.

- E-commerce Expansion: Global sales projected to continue upward trajectory, requiring advanced logistics.

- Consumption Diversification: Need for adaptable supply chains to handle personalized and sustainable goods.

Societal shifts are profoundly impacting logistics needs, particularly the ongoing urbanization trend. As more people flock to cities, the demand for efficient last-mile delivery solutions intensifies, creating a direct need for logistics facilities located close to these population centers. Prologis's strategy of investing in urban infill locations directly addresses this, as cities continue to see population growth, with many major urban centers experiencing annual growth rates above 2% in 2024.

Consumer expectations for speed are also a major driver, with a significant portion of shoppers prioritizing rapid delivery. This societal preference for quick fulfillment means businesses need strategically located warehousing to meet these demands, influencing Prologis's site selection to ensure proximity to end consumers. The rise of e-commerce, with global sales expected to continue their upward trajectory, further necessitates advanced logistics infrastructure to handle the increased volume and delivery speed requirements.

Furthermore, a growing emphasis on employee well-being and safety is shaping the design and management of logistics facilities. Prologis must ensure its properties offer secure and compliant environments to attract tenants who prioritize their workforce. This focus on safety is becoming a key differentiator, with projections for 2025 indicating that a majority of large logistics companies will heavily consider a facility's safety record when making leasing decisions.

| Sociological Factor | Impact on Logistics | Prologis Relevance | 2024/2025 Data Point |

|---|---|---|---|

| Urbanization | Increased demand for last-mile delivery, need for urban logistics hubs | Strategic focus on urban infill locations | Urban population growth > 2% in many major cities (2024) |

| Consumer Delivery Speed Expectations | Demand for faster shipping, influencing warehouse location | Portfolio designed for proximity to consumers | >60% of online shoppers consider delivery speed crucial (2024) |

| Employee Well-being & Safety | Need for safe and compliant facilities, attracting quality tenants | Emphasis on facility design and safety features | >70% of large logistics companies to prioritize safety records (2025 projection) |

Technological factors

The increasing integration of automation and robotics in warehouses is a significant technological driver. This trend directly boosts operational efficiency and curbs labor expenses, ultimately increasing the volume of goods processed, or throughput. For instance, advancements in automated storage and retrieval systems (AS/RS) can improve space utilization by up to 50% and speed up order picking by 300%.

Prologis is strategically positioned to capitalize on this technological shift. The company's portfolio is designed with the flexibility to integrate sophisticated automation technologies, making its properties highly desirable for tenants aiming for cutting-edge logistics operations. This forward-thinking property design ensures Prologis facilities can readily support technologies like autonomous mobile robots (AMRs) and advanced sorting systems.

Leveraging big data analytics and artificial intelligence is revolutionizing supply chain management. These technologies provide predictive insights, crucial for optimizing inventory levels, streamlining delivery routes, and maximizing the use of warehouse space. For instance, by analyzing vast datasets, companies can anticipate demand spikes and adjust stock accordingly, reducing holding costs and preventing stockouts. This proactive approach is becoming essential in today's fast-paced logistics environment.

Prologis can further empower its tenants by integrating smart building technologies and robust data infrastructure. This integration supports sophisticated, data-driven supply chain strategies, allowing clients to monitor real-time performance, track assets, and gain deeper visibility into their operations. In 2024, the global supply chain analytics market was valued at approximately $6 billion and is projected to grow significantly, underscoring the increasing reliance on these advanced technological capabilities.

The integration of Internet of Things (IoT) and smart building technologies is significantly reshaping the logistics real estate landscape. These advancements allow for the deployment of smart sensors and interconnected devices within facilities, providing real-time data on critical aspects like energy usage, building security, and overall operational efficiency.

Prologis is actively leveraging these technologies to enhance its properties. By incorporating IoT, Prologis aims to deliver logistics spaces that are not only more efficient in their resource consumption but also offer improved security measures and greater sustainability for its diverse customer base. For instance, Prologis's focus on smart technologies contributed to a 15% reduction in energy consumption across its portfolio in 2024, as reported in their sustainability disclosures.

E-commerce Fulfillment Technologies

Technological advancements in e-commerce fulfillment are reshaping how goods move from warehouse to customer. Sophisticated sortation systems, for instance, can now process thousands of packages per hour with remarkable accuracy. Prologis’s strategically located facilities are engineered to accommodate these high-tech solutions, from automated storage and retrieval systems to advanced robotics for pick-and-pack operations. The integration of these technologies directly impacts delivery speed and cost-efficiency for Prologis’s e-commerce clients.

The evolution of order management software (OMS) is equally critical, enabling real-time inventory tracking and seamless integration with warehouse management systems (WMS). This technology stack is essential for handling the high volume and complexity of online orders. Prologis’s investments in modern logistics infrastructure ensure their properties can readily support the deployment and scalability of these increasingly vital digital tools.

- Sortation Systems: Capable of sorting over 50,000 items per hour in advanced facilities.

- Robotics: E-commerce fulfillment centers increasingly utilize collaborative robots (cobots) to assist human workers, boosting pick rates by up to 30%.

- Order Management Software: Real-time inventory accuracy, often exceeding 99.5%, is a key benefit of advanced OMS.

- Integration: Seamless integration between OMS, WMS, and automation hardware is paramount for operational efficiency.

Sustainable Building Technologies and Materials

Prologis is actively integrating sustainable building technologies and materials into its logistics facilities, a move driven by both cost savings and evolving environmental demands. Innovations in green building materials, such as recycled content and low-embodied carbon options, are becoming more prevalent. For instance, by 2023, Prologis reported that over 40% of its new development projects globally incorporated solar.

The adoption of renewable energy systems, particularly solar panels, is a key strategy. Prologis aims to expand its solar capacity significantly, with a target of 1 gigawatt (GW) of installed solar by 2025, up from approximately 600 megawatts (MW) in 2023. This not only reduces the carbon footprint of their properties but also lowers operational expenses for tenants through reduced energy bills.

Furthermore, the implementation of energy-efficient HVAC systems and advanced building management technologies plays a crucial role. These systems optimize energy consumption, contributing to Prologis's goal of achieving net-zero emissions across its operations by 2040. The company's focus on these technological advancements directly addresses increasing environmental performance expectations from customers and investors alike.

Key technological factors impacting Prologis include:

- Growth in Green Building Materials: Increasing use of materials with lower environmental impact and recycled content in construction.

- Solar Power Integration: Continued expansion of solar panel installations on logistics facilities to generate renewable energy. Prologis's 2023 solar capacity was around 600 MW, with a 2025 target of 1 GW.

- Energy Efficiency Upgrades: Investment in advanced HVAC systems and building management technologies to minimize energy usage.

- EV Charging Infrastructure: Development of electric vehicle charging stations within logistics hubs to support the transition to electric fleets for their customers.

The increasing integration of automation and robotics in warehouses directly boosts operational efficiency and curbs labor expenses. Advancements in automated storage and retrieval systems (AS/RS) can improve space utilization by up to 50% and speed up order picking by 300%. Prologis's portfolio is designed to integrate sophisticated automation technologies like autonomous mobile robots (AMRs) and advanced sorting systems, making its properties desirable for tenants aiming for cutting-edge logistics operations.

Leveraging big data analytics and artificial intelligence revolutionizes supply chain management by providing predictive insights for optimizing inventory, streamlining deliveries, and maximizing warehouse space. The global supply chain analytics market was valued at approximately $6 billion in 2024 and is projected to grow significantly, underscoring the increasing reliance on these advanced capabilities. Prologis can empower tenants by integrating smart building technologies and robust data infrastructure to support data-driven supply chain strategies.

The integration of Internet of Things (IoT) and smart building technologies allows for real-time data on energy usage, security, and operational efficiency. Prologis aims to deliver more efficient, secure, and sustainable logistics spaces, with its focus on smart technologies contributing to a 15% reduction in energy consumption across its portfolio in 2024. These advancements are reshaping the logistics real estate landscape by enhancing property performance and resource management.

Technological advancements in e-commerce fulfillment are reshaping how goods move from warehouse to customer, with sophisticated sortation systems processing thousands of packages per hour. Prologis's facilities are engineered to accommodate these high-tech solutions, impacting delivery speed and cost-efficiency for e-commerce clients. The evolution of order management software (OMS) and warehouse management systems (WMS) enables real-time inventory tracking and seamless integration, crucial for handling the high volume of online orders.

| Technology | Impact on Logistics | Prologis Relevance | Key Data Point (2024/2025) |

|---|---|---|---|

| Automation & Robotics | Increased efficiency, reduced labor costs, higher throughput | Facilities designed for integration (AS/RS, AMRs) | AS/RS can improve space utilization by up to 50% |

| Big Data & AI | Optimized inventory, streamlined routes, predictive insights | Supports data-driven tenant strategies | Supply Chain Analytics market ~ $6 billion in 2024 |

| IoT & Smart Buildings | Real-time monitoring, improved efficiency, enhanced security | Focus on energy reduction and sustainability | 15% energy reduction reported in 2024 via smart tech |

| E-commerce Fulfillment Tech | Faster sorting, improved pick rates, accurate order processing | Properties engineered for high-tech solutions | Cobots can boost pick rates by up to 30% |

Legal factors

Prologis navigates a web of environmental statutes governing land use, building practices, waste disposal, and emissions worldwide. For instance, in 2024, the company continued its focus on sustainable building practices, aiming to reduce embodied carbon in its projects, a key concern under evolving EU and US green building codes.

Compliance is non-negotiable, directly impacting operational costs through potential fines for violations and safeguarding Prologis's image as an environmentally conscious entity. Failure to meet standards, such as those related to water runoff or hazardous materials handling during construction, could lead to significant financial penalties and reputational damage.

The company's commitment to ESG, including its 2023 sustainability report highlighting a reduction in waste generation across its development sites, underscores the financial imperative of environmental stewardship. This proactive approach is crucial as regulatory frameworks, like those concerning carbon emissions from logistics operations, continue to tighten globally.

Prologis must strictly adhere to a complex web of local and international building codes, fire safety regulations, and structural integrity standards for all its logistics facilities. This compliance isn't just about safety; it's the bedrock for securing necessary permits and insurance, directly impacting operational timelines and costs. For instance, in 2024, the average cost of construction for industrial buildings saw significant increases, with stricter code enforcement potentially adding to these expenses.

Prologis's core business hinges on leasing industrial properties, making adherence to a complex web of landlord-tenant laws and lease agreement regulations absolutely critical across all its operating jurisdictions. These legal frameworks dictate everything from how rent can be collected and when a lease can be terminated to the specific responsibilities tenants must uphold. For instance, in the United States, state-specific laws like the Uniform Residential Landlord and Tenant Act (URLTA) or its counterparts for commercial leases significantly influence lease terms and enforcement, impacting Prologis's operational flexibility and risk exposure.

Data Privacy and Security Regulations

Prologis must navigate a complex web of data privacy and security regulations as its operations become more digitized. Laws like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) dictate how Prologis can collect, store, and use tenant and operational data. Failure to comply can result in significant fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher. The company's commitment to robust cybersecurity measures and transparent data handling protocols is therefore paramount to safeguarding sensitive information and maintaining tenant trust.

The increasing reliance on technology for warehouse management, logistics optimization, and tenant services means Prologis handles a substantial volume of personal and business data. For instance, data collected can range from employee access logs to detailed operational performance metrics. Ensuring these systems are protected against cyber threats is crucial, especially given the rise in sophisticated ransomware attacks targeting businesses globally. In 2024, the average cost of a data breach was reported to be around $4.73 million globally, highlighting the financial imperative for strong security.

- GDPR Compliance: Adherence to GDPR is essential for Prologis' operations in the European Union, impacting data processing and cross-border transfers.

- CCPA Requirements: Prologis must also meet CCPA standards for data privacy for California residents, including rights to access and delete personal information.

- Cybersecurity Investment: Continued investment in advanced cybersecurity infrastructure is necessary to prevent data breaches and protect against evolving cyber threats.

- Data Handling Protocols: Implementing clear and secure data handling protocols across all technological platforms is critical for maintaining compliance and security.

International Property and Investment Laws

Prologis operates globally, meaning it must meticulously adhere to a diverse array of international property ownership laws. These regulations dictate how the company can acquire, develop, and manage logistics facilities across different countries. For instance, foreign investment regulations in markets like China or India may impose specific ownership limits or require joint ventures, impacting Prologis' expansion strategies. Navigating these varied legal frameworks is crucial for successful cross-border operations.

Compliance with foreign investment regulations is paramount for Prologis' global growth. These rules can influence everything from the initial acquisition of land to the ongoing management of properties. For example, in some European Union countries, there might be specific approval processes for non-EU entities investing in real estate, requiring thorough due diligence. Understanding and adhering to these requirements helps prevent costly legal disputes and ensures smooth market entry.

The ability to repatriate profits is another significant legal consideration for Prologis. International laws govern how companies can transfer earnings back to their home country, often involving tax treaties and currency exchange controls. In 2024, for example, some nations have tightened capital controls, potentially affecting the ease with which Prologis can access its global earnings. Managing these financial flows legally and efficiently is vital for maximizing shareholder returns.

Key legal factors impacting Prologis' international operations include:

- International Property Ownership Laws: Varying regulations on land acquisition and tenure across different jurisdictions.

- Foreign Investment Regulations: Restrictions or requirements for foreign entities investing in real estate, potentially impacting market access.

- Repatriation of Profits: Rules governing the transfer of earnings back to the home country, including tax implications and capital controls.

- Contractual Law: Ensuring lease agreements and development contracts are compliant and enforceable in local legal systems.

Prologis must navigate a complex landscape of anti-corruption and bribery laws, such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. These laws carry severe penalties, including substantial fines and imprisonment for individuals involved, directly impacting Prologis' global business dealings and reputation. Ensuring all employees and partners are trained on these regulations is a critical part of risk management.

Adherence to employment laws, including wage and hour regulations, worker safety standards, and anti-discrimination statutes, is fundamental to Prologis' operations. These legal requirements vary significantly by country and region, necessitating robust HR policies and compliance programs. For instance, in 2024, the ongoing focus on fair wages and working conditions across the logistics sector highlights the importance of staying abreast of evolving labor laws.

Intellectual property (IP) laws are also crucial for Prologis, particularly concerning its technology platforms and proprietary data analytics used for site selection and operational efficiency. Protecting its IP from infringement and ensuring its own use of third-party IP is lawful prevents costly litigation and safeguards its competitive advantage. The company’s investments in proprietary software for property management underscore the significance of IP protection.

Environmental factors

Climate change presents significant physical risks to Prologis's portfolio, manifesting as more frequent floods and severe storms. These events can directly damage logistics facilities and cause substantial disruptions to tenant supply chains. For instance, in 2024, Prologis continued to invest in enhancing the resilience of its properties, with capital expenditures allocated to climate adaptation measures across its global network.

Prologis actively assesses these climate-related risks, integrating findings into its site selection and property development processes. The company implements resilient design strategies, such as elevated foundations and advanced drainage systems, to mitigate the impact of extreme weather. By focusing on business continuity for its tenants, Prologis aims to safeguard its assets and maintain operational stability in an increasingly unpredictable climate environment.

The logistics real estate sector is experiencing a significant shift, with investors, tenants, and regulators increasingly prioritizing sustainability. This growing demand is pushing companies like Prologis to actively pursue green building certifications such as LEED and BREEAM. These certifications signal a commitment to environmental responsibility and operational efficiency, becoming key differentiators in the market.

Prologis is strategically investing in energy-efficient designs, integrating renewable energy sources like solar power, and adopting sustainable site development practices. For instance, by the end of 2023, Prologis had deployed 576 megawatts of solar capacity globally, generating clean energy for its customers and reducing its own carbon footprint. This proactive approach not only addresses environmental concerns but also appeals to a broader tenant base seeking to meet their own ESG (Environmental, Social, and Governance) goals.

Prologis is navigating a landscape where reducing carbon emissions is paramount. The company is actively working to lower the carbon footprint across its extensive logistics real estate portfolio. This involves making buildings more energy-efficient and integrating renewable energy sources like solar power.

In 2023, Prologis announced a goal to achieve net-zero carbon emissions across its operations by 2040. As of early 2024, they've already installed over 500 megawatts of solar capacity on their properties, demonstrating a tangible commitment to this target.

Beyond their own operations, Prologis is also focused on empowering its tenants to cut emissions within the facilities they lease. This collaborative approach is crucial for broader decarbonization efforts in the logistics sector.

Resource Management and Circular Economy Principles

Prologis is increasingly focused on efficient resource management, particularly water and construction materials, as environmental regulations tighten and stakeholder expectations rise. The company’s commitment to circular economy principles, such as waste reduction and recycling in its development projects, directly addresses these concerns. For instance, in 2023, Prologis reported a 28% reduction in construction waste sent to landfill across its global portfolio compared to its 2019 baseline, demonstrating tangible progress in this area.

Embracing circular economy strategies is not just about minimizing environmental impact; it also presents opportunities for cost savings and enhanced operational efficiency. By prioritizing recycled content in building materials and implementing robust waste management plans, Prologis aims to create more sustainable and cost-effective logistics facilities.

- Water efficiency: Prologis has set targets to reduce water consumption in its operations, particularly in water-stressed regions.

- Sustainable materials: The company is increasing the use of recycled and low-carbon materials in new developments. In 2024, Prologis aims to achieve 40% recycled content in concrete for new construction projects.

- Waste reduction: Prologis implements waste segregation and recycling programs at its development sites and operational properties to divert materials from landfills.

- Circular design: The company is exploring design strategies that facilitate the deconstruction and reuse of building components at the end of a facility's life cycle.

Biodiversity and Land Use Conservation

Prologis acknowledges that developing large logistics facilities can affect local ecosystems and biodiversity. The company is actively integrating land use conservation and habitat protection into its site selection process to minimize these impacts. For instance, in 2023, Prologis reported that it had conserved or restored over 1,300 acres of natural habitat globally as part of its sustainability initiatives.

The company's approach to responsible site selection aims to contribute positively to the ecological preservation of the areas where its operations are situated. This involves careful planning to avoid sensitive environmental areas and, where possible, to enhance local biodiversity. Prologis's 2024 sustainability report highlights a target to increase land conservation efforts by 15% by 2026, focusing on projects that offer tangible ecological benefits.

- Habitat Protection: Prologis is committed to protecting and enhancing natural habitats around its properties.

- Responsible Site Selection: The company prioritizes locations that minimize environmental disruption.

- Ecological Preservation: Efforts are made to contribute positively to the local environment.

- 2023 Conservation: Over 1,300 acres of natural habitat were conserved or restored globally.

Environmental factors significantly influence Prologis's operations, with climate change posing physical risks like floods and storms, leading to investments in resilience. The company is actively pursuing sustainability, evidenced by its 576 megawatts of solar capacity deployed by the end of 2023 and a net-zero emissions goal by 2040.

Prologis also focuses on resource management, achieving a 28% reduction in construction waste to landfill in 2023 compared to 2019, and prioritizes habitat protection, having conserved over 1,300 acres of natural habitat globally in 2023.

| Environmental Aspect | Key Initiatives/Data (2023-2024) | Impact/Goal |

|---|---|---|

| Climate Resilience | Capital expenditures on climate adaptation measures. | Mitigation of physical risks from extreme weather. |

| Renewable Energy | 576 MW solar capacity deployed by end of 2023. | Reducing carbon footprint, providing clean energy. |

| Emissions Reduction | Net-zero carbon emissions goal by 2040. | Operational efficiency and ESG alignment. |

| Resource Management | 28% reduction in construction waste (2023 vs 2019). | Circular economy principles, cost savings. |

| Biodiversity | 1,300+ acres of natural habitat conserved/restored (2023). | Minimizing ecological disruption, enhancing local environments. |

PESTLE Analysis Data Sources

Our Prologis PESTLE Analysis draws from a robust blend of public and proprietary data, including official government reports, international economic indicators, and industry-specific market research. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the logistics real estate sector.