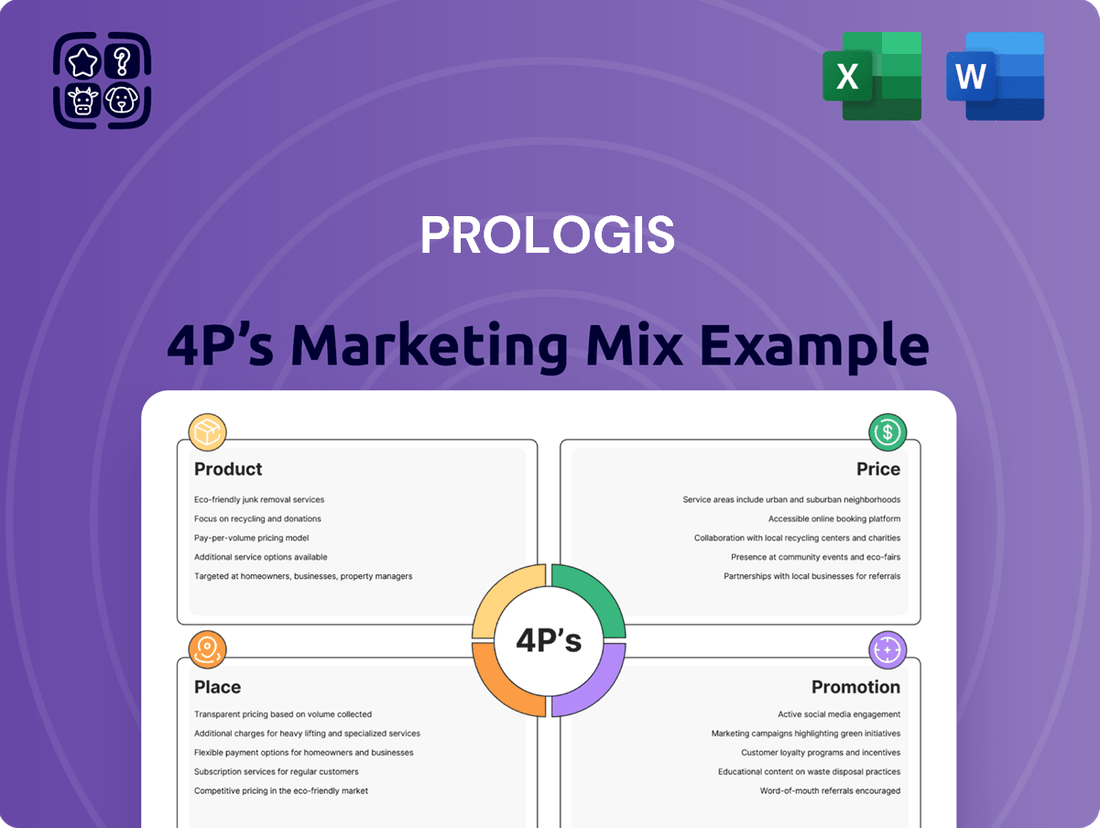

Prologis Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prologis Bundle

Discover Prologis's strategic approach to its core offerings, pricing models, vast distribution network, and impactful promotional activities. This analysis reveals how these elements synergize to solidify their leadership in the logistics real estate sector.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Prologis's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Explore how Prologis's product strategy, pricing decisions, distribution methods, and promotional tactics work together to drive success in the dynamic logistics market. Get the full analysis in an editable, presentation-ready format.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning related to Prologis.

Gain instant access to a comprehensive 4Ps analysis of Prologis. Professionally written, editable, and formatted for both business and academic use, offering a clear roadmap to their market dominance.

Product

Prologis's Logistics Real Estate Portfolio is a cornerstone of its marketing mix, showcasing a global network of over 1.2 billion square feet of modern logistics facilities as of late 2024. This extensive collection features high-quality warehouses and distribution centers strategically positioned in key markets worldwide, ensuring efficient supply chain operations for a diverse clientele.

The portfolio is meticulously designed to meet the evolving needs of manufacturers, retailers, and third-party logistics providers, offering adaptable spaces crucial for the seamless movement and storage of goods. This focus on prime locations and state-of-the-art infrastructure directly supports their customers' ability to optimize inventory management and accelerate delivery times in an increasingly competitive global marketplace.

Prologis Essentials transforms their real estate offerings into comprehensive logistics solutions. Beyond just space, they provide integrated services focused on operations, energy, and workforce development, directly impacting the Product aspect of their marketing mix. This platform aims to boost efficiency and sustainability for their customers.

The Essentials suite includes tangible products like racking systems and forklifts, alongside advanced solutions such as smart warehouse management software. These offerings are designed to directly enhance the functionality and value of Prologis properties, making them more attractive and efficient for tenants. This expands the definition of their product beyond traditional warehousing.

Sustainability is a key component, with Prologis Essentials offering solar power installations and EV charging infrastructure. This demonstrates a forward-thinking approach to their product, aligning with growing market demand for environmentally conscious logistics operations. This also adds a significant value-add for businesses looking to reduce their carbon footprint.

By providing these integrated services, Prologis is essentially selling a complete logistics ecosystem, not just industrial real estate. This strategic move in their Product strategy allows them to capture more value and differentiate themselves in the market. For example, their solar solutions can significantly reduce energy costs for tenants, a direct benefit tied to the property's functionality.

Prologis excels in developing logistics facilities, including build-to-suit projects customized for clients. They strategically acquire land and construct modern, sustainable buildings designed for efficiency and future supply chain needs, responding to market evolution.

In 2023, Prologis reported $1.1 billion in development starts, highlighting their commitment to expanding their portfolio with facilities that meet specific customer demands. This includes incorporating advanced features like solar-ready roofs and energy-efficient lighting systems.

Their development services focus on creating state-of-the-art infrastructure, ensuring clients have access to cutting-edge logistics solutions. This proactive approach anticipates future market trends and provides a competitive edge for businesses relying on efficient supply chains.

Sustainability and Green Building Features

Prologis's product strategy heavily emphasizes sustainability and green building features, directly addressing the growing demand for environmentally responsible logistics solutions. New developments frequently achieve high certifications, such as BREEAM Excellent, demonstrating a commitment to best practices in sustainable construction.

These green features are not just aspirational; they are integrated into the physical product. This includes substantial investments in rooftop solar arrays, designed to generate clean energy on-site, and the widespread implementation of energy-efficient LED lighting systems. Furthermore, Prologis facilities are increasingly equipped with electric vehicle (EV) charging solutions, anticipating the shift towards electrified fleets.

This focus on sustainability offers tangible benefits to Prologis's customers. By occupying Prologis facilities, companies can more effectively pursue their own carbon reduction targets. For example, Prologis reported that its renewable energy projects contributed to avoiding approximately 200,000 metric tons of CO2 emissions in 2023, a significant figure that directly aids customer sustainability reporting and goals.

- BREEAM Excellent Certification: Many new Prologis facilities meet this rigorous environmental standard.

- Rooftop Solar Arrays: Integrated to generate renewable energy, reducing reliance on fossil fuels.

- Energy-Efficient Lighting: LED technology is standard, lowering energy consumption.

- EV Charging Solutions: Provided to support the transition to electric logistics vehicles.

Data Center Capabilities

Prologis is strategically converting some of its existing warehouse spaces into data centers to meet the escalating demand for digital infrastructure. This move capitalizes on their established real estate footprint and existing power capabilities, demonstrating significant adaptability in their product offering.

This expansion into data center services signifies a crucial diversification beyond traditional logistics real estate. It underscores Prologis' commitment to developing intelligent infrastructure that bridges the physical and digital realms, a key component of their evolving service model.

The company's focus on data centers is a direct response to the rapid growth in cloud computing and digital services. For instance, global data center traffic was projected to reach 200 zettabytes annually by 2025, highlighting the immense market opportunity. Prologis' existing power infrastructure is a significant asset in this energy-intensive sector, with many facilities boasting robust electrical capacity.

This strategic pivot allows Prologis to leverage its core competencies in real estate development and management while entering a high-growth market. Their data center capabilities are designed to offer secure, scalable, and efficient solutions, integrating seamlessly with their broader logistics network.

- Leveraging Existing Infrastructure: Prologis utilizes its established warehouse network and power capacity for data center conversion.

- Meeting Surging Demand: The move addresses the significant and growing need for digital infrastructure and data storage.

- Strategic Diversification: This expands Prologis' product portfolio beyond traditional logistics, entering the intelligent infrastructure space.

- Connecting Digital and Physical Worlds: The data centers are positioned to facilitate the integration of digital services within the physical supply chain.

Prologis's product offering extends beyond mere physical space to encompass integrated logistics solutions and a commitment to sustainability. They provide essential services like racking and management software, alongside tangible assets such as solar power and EV charging infrastructure. This holistic approach transforms properties into efficient, eco-conscious operational hubs, directly enhancing tenant productivity and environmental goals.

The company's development expertise ensures clients receive state-of-the-art facilities, including customized build-to-suit projects. Prologis’s 2023 development starts totaled $1.1 billion, underscoring their investment in modern, sustainable buildings designed for future supply chain demands, often featuring solar-ready roofs and advanced lighting.

Their product innovation includes converting warehouses into data centers, capitalizing on existing infrastructure to meet the booming demand for digital services. This strategic diversification leverages Prologis's real estate strength in the high-growth intelligent infrastructure market.

| Product Offering | Key Features | Customer Benefit | 2023 Data/Projections |

|---|---|---|---|

| Logistics Facilities | 1.2 billion sq ft global portfolio, modern warehouses, strategic locations | Optimized inventory, accelerated delivery | N/A (Portfolio size) |

| Prologis Essentials | Racking, forklifts, warehouse management software, solar power, EV charging | Enhanced efficiency, reduced energy costs, sustainability goals | Solar projects avoided ~200,000 metric tons CO2 in 2023 |

| Development Services | Build-to-suit, land acquisition, sustainable construction | State-of-the-art, efficient, future-ready infrastructure | $1.1 billion in development starts |

| Data Centers | Conversion of existing warehouse space, leveraging power infrastructure | Scalable, secure digital infrastructure solutions | Projected global data center traffic to reach 200 zettabytes annually by 2025 |

What is included in the product

This analysis offers a comprehensive breakdown of Prologis's marketing mix, examining their product (logistics real estate solutions), price (market-driven lease rates and service fees), place (global network of distribution facilities), and promotion (thought leadership and direct client engagement) strategies.

Prologis's 4Ps analysis provides a clear roadmap to address customer pain points by optimizing product, price, place, and promotion strategies for logistics real estate.

Place

Prologis leverages its significant global network, spanning 20 countries and encompassing roughly 1.3 billion square feet of logistics space as of early 2024. This extensive reach, covering North America, Latin America, Europe, and Asia, is a cornerstone of their market strategy.

Their operational focus is deliberately concentrated in high-barrier, high-growth markets. These are typically areas where acquiring land is challenging and where significant economic activity necessitates robust logistics infrastructure.

This strategic placement in 2024 ensures Prologis properties are situated in vital hubs for global trade and distribution. The scarcity of land in these key locations further enhances the value and demand for their logistics facilities.

A cornerstone of Prologis's 'place' strategy is its meticulously chosen property locations. A significant portion of their portfolio, often exceeding 90%, is strategically positioned within a few miles of major highway intersections or critical transportation arteries. This prime positioning ensures unparalleled convenience for their diverse customer base.

This proximity to vital infrastructure, including extensive rail networks and key seaports, is not coincidental; it's a deliberate business decision. It directly translates to optimized inbound and outbound logistics for Prologis's clients, a critical factor in today's fast-paced global supply chains.

For instance, Prologis's presence in key logistics markets across the US and Europe means their facilities are often mere minutes from major interstates. In 2024, Prologis reported that a substantial majority of its properties were within a 5-mile radius of a major highway, facilitating quicker transit times and reducing transportation costs for their tenants.

Prologis primarily distributes its logistics real estate through direct leasing to a broad customer base, including major e-commerce players, manufacturers, and logistics providers.

They manage this distribution using a mix of wholly-owned properties and co-investment ventures, ensuring their facilities are readily available to a wide range of businesses.

This direct approach fosters strong customer relationships and enables the creation of customized solutions for diverse operational needs.

As of early 2024, Prologis reported a strong occupancy rate, exceeding 97% across its global portfolio, underscoring the effectiveness of its customer-centric distribution strategy in meeting demand.

Focused Regional and Metropolitan Presence

Prologis emphasizes a targeted presence in crucial metropolitan hubs, concentrating its efforts where logistics demand is most intense. This strategic focus allows the company to effectively serve major economic centers and their complex supply chains.

Key markets demonstrating this concentration include Southern California, a powerhouse for e-commerce and trade, and the New York/New Jersey corridor, a critical gateway for East Coast distribution. Internationally, Germany and Japan represent vital logistics clusters where Prologis maintains a significant footprint.

This deliberate market concentration enables Prologis to cater to the unique requirements of large-scale operations and address specific regional supply chain dynamics. For instance, in the 2024 fiscal year, Prologis reported occupancy rates in the high 90s across its major markets, underscoring the strong demand for its strategically located facilities.

- Southern California: A prime example of a high-demand logistics cluster, consistently showing strong leasing activity.

- New York/New Jersey: Essential for East Coast distribution, benefiting from dense population and significant import volumes.

- Germany: A central European hub for manufacturing and distribution, driving demand for modern logistics facilities.

- Japan: A critical market for efficient supply chain management in Asia, with Prologis holding key assets in major metropolitan areas.

Adaptive Portfolio Management and Expansion

Prologis actively shapes its real estate portfolio by acquiring new properties and developing modern logistics facilities. This dynamic approach ensures their footprint aligns with evolving customer requirements and emerging market trends. For instance, in 2024, Prologis continued its strategic expansion, notably increasing its presence in key European markets like Germany to meet heightened demand for high-quality logistics space.

The company’s expansion strategy isn't just about growth; it’s about optimization. Prologis carefully analyzes market conditions, leading to both consolidation in prime locations and the divestment of less strategic assets. This focus on portfolio efficiency underpins their ability to serve customers effectively. Their expansion into India, a rapidly growing market for e-commerce and logistics, further illustrates this commitment to capitalizing on global opportunities.

- Strategic Acquisitions: Prologis targets properties in high-growth markets, enhancing its network density.

- New Development: The company invests in building state-of-the-art logistics facilities to meet specific customer needs.

- Portfolio Optimization: Prologis regularly reviews its holdings, selling underperforming assets to reinvest in prime locations.

- Geographic Expansion: Recent initiatives in Germany and India highlight Prologis's focus on expanding into critical global logistics hubs.

Prologis's 'Place' strategy is deeply rooted in its global network, strategically positioning logistics facilities within 20 countries. By early 2024, this network spanned approximately 1.3 billion square feet, emphasizing presence in high-barrier, high-growth markets where land scarcity amplifies asset value. Their focus on proximity to major transportation infrastructure, often within five miles of key highway intersections, ensures optimal connectivity for tenants.

| Metric | Value (Early 2024) | Significance |

| Global Network Size | ~1.3 billion sq ft | Extensive reach across 20 countries |

| Proximity to Highways | >90% of properties | Facilitates efficient transportation |

| Occupancy Rate | >97% | High demand for strategically located assets |

| Key Market Focus | Southern California, NY/NJ, Germany, Japan | Concentration in high-demand logistics hubs |

Same Document Delivered

Prologis 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Prologis 4P's Marketing Mix Analysis offers a comprehensive look at their strategy. You'll gain insights into their Product, Price, Place, and Promotion tactics. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with the complete picture of Prologis' market approach.

Promotion

Prologis actively cultivates its digital presence through its robust corporate website, a central hub for all information. This platform effectively disseminates details on property listings, in-depth research reports, and crucial investor relations data. It also highlights their innovative 'Essentials' platform, demonstrating a commitment to digital engagement.

The company's digital-first strategy ensures wide-reaching communication with both potential and existing clients and investors. In 2023, Prologis reported a significant portion of their customer interactions and lead generation originating from online channels, underscoring the effectiveness of their digital marketing efforts.

Prologis actively cultivates its image as a vanguard in logistics real estate through the consistent dissemination of in-depth research. Their publications, like the anticipated 2024-2025 Global Supply Chain Outlook, showcase a deep understanding of industry dynamics, from e-commerce growth to sustainability initiatives.

These reports serve a dual purpose: they inform Prologis's clientele and stakeholders about emerging trends and potential challenges, while simultaneously solidifying Prologis's reputation as a knowledgeable and authoritative voice in the market. This commitment to sharing expertise, as evidenced by their regular research output, is a cornerstone of their marketing strategy.

Prologis actively engages its investor base through quarterly earnings announcements, investor conferences, and comprehensive annual reports. These communications underscore robust financial performance, such as their reported 2024 net income and projected growth for 2025, alongside strategic capital allocation and expansion plans in key logistics markets. This consistent and transparent dialogue is crucial for maintaining investor trust and facilitating access to capital.

Customer-Centric Engagement and Solutions

Prologis places a strong emphasis on its customers, building dedicated teams to enhance their experience, develop tailored solutions, and lead site development projects. This customer-centric approach is a core component of their marketing strategy.

The company actively engages with clients through various customer-focused events, fostering direct communication and understanding of evolving needs. This proactive engagement is reflected in their high Net Promoter Score (NPS), which stood at 73 in their recent disclosures, underscoring significant customer loyalty and satisfaction.

By prioritizing direct interaction and feedback, Prologis ensures they are responsive to client requirements, which cultivates robust, long-term relationships and drives repeat business within their logistics real estate portfolio.

- Customer Experience Teams: Dedicated personnel focused on client satisfaction.

- Solution Development: Tailoring offerings to meet specific customer needs.

- Customer Events: Regular forums for engagement and feedback.

- High NPS: Indicating strong customer loyalty and positive sentiment.

Public Relations and Industry Recognition

Prologis leverages public relations to showcase its accomplishments, commitment to sustainability, and position as a market leader. This strategic approach has resulted in numerous industry accolades and high-profile rankings. For instance, its consistent inclusion in lists like Fortune's Most Admired Companies and Barron's 100 Most Sustainable Companies not only bolsters its brand image but also significantly increases its visibility among key stakeholders.

The company's proactive media engagement, through press releases and strategic media coverage, is instrumental in amplifying its narrative. In 2024, Prologis reported a strong ESG (Environmental, Social, and Governance) performance, with initiatives focused on reducing carbon emissions across its portfolio, a key area highlighted in its PR efforts. This focus on sustainability is increasingly important for investors and customers alike, driving positive perception and market differentiation.

Prologis's industry recognition is more than just an honor; it's a tangible marketing asset. Being recognized for operational excellence and sustainable practices directly supports its value proposition. For example, in 2024, Prologis was again named to the Dow Jones Sustainability Index North America, underscoring its leadership in responsible business practices. This recognition translates into enhanced brand equity and a stronger competitive advantage in the logistics real estate sector.

- Industry Awards: Prologis frequently receives awards for its development projects, operational efficiency, and ESG performance.

- Sustainability Recognition: Consistent inclusion in global sustainability rankings like the Dow Jones Sustainability Index and Barron's 100 Most Sustainable Companies.

- Media Amplification: Strategic use of press releases and media relations to communicate achievements and sustainability progress.

- Brand Reputation: Enhanced brand image and market perception driven by positive industry recognition and media coverage.

Prologis strategically utilizes content marketing, particularly through its extensive research publications, to establish thought leadership. Their 2024-2025 Global Supply Chain Outlook, for instance, provides critical insights into market trends, influencing client and investor perceptions. This approach positions Prologis as an indispensable resource in the logistics real estate sector.

The company's digital presence is a key promotional tool, with its website serving as a comprehensive information hub. This platform effectively communicates their commitment to innovation, exemplified by their 'Essentials' platform, and drives lead generation through online channels, as evidenced by a significant portion of customer interactions originating digitally in 2023.

Prologis actively engages its investor audience through transparent communication of financial performance and strategic initiatives, such as their 2024 net income and 2025 growth projections. This consistent dialogue, coupled with a strong customer-centric approach that yielded a Net Promoter Score of 73, reinforces brand loyalty and market confidence.

Price

Prologis generates its primary revenue from leasing logistics properties, employing a strategic market-based rental income approach. This means their rental prices are not fixed but adjust based on what the market will bear, considering factors like demand and economic health.

The company aims to secure rental rates that reflect the high quality and prime locations of its vast portfolio. For instance, as of Q1 2024, Prologis reported a 30.6% increase in average rent on new and renewal leases in the U.S., demonstrating their ability to capture rising market values.

This dynamic pricing strategy allows Prologis to maximize profitability while remaining competitive. In Q1 2024, their net effective rents grew by 25.1% year-over-year globally, showcasing the effectiveness of their market-based approach in a robust leasing environment.

Prologis utilizes a value-driven pricing model, moving beyond simple per-square-foot rates. This approach factors in crucial elements like a property's prime location, the quality of its amenities, and the prevailing market demand in specific submarkets. For instance, a facility in a densely populated logistics hub with excellent transportation links will command a premium price reflective of its strategic importance to a tenant's supply chain operations.

This strategy ensures that pricing aligns with the tangible benefits and competitive advantages a Prologis facility provides. Properties boasting advanced sustainable features, such as solar energy integration or energy-efficient lighting, and those equipped with robust power infrastructure to support modern operational needs, are demonstrably priced higher to capture this added value. This reflects an understanding that operational efficiency and sustainability are increasingly critical components of a customer's overall business strategy.

Prologis' Clear Lease® program, available in markets like the Netherlands and France, offers a refreshingly straightforward approach to industrial property leasing. This innovative structure moves beyond traditional triple-net leases by bundling base rent with a fixed charge that accounts for operating expenses, management fees, and capital repairs. This predictability is a significant advantage, as evidenced by tenant feedback highlighting the elimination of surprise year-end reconciliations, a common pain point in the industry.

This commitment to transparency fosters greater trust between Prologis and its customers, simplifying their financial planning and budgeting processes. By providing cost certainty, Clear Lease® allows tenants to more accurately forecast their occupancy costs, a crucial element for businesses operating on tight margins. This customer-centric approach is a key differentiator in the competitive logistics real estate market.

Lease Mark-to-Market and Rent Growth

Prologis strategically leverages its lease portfolio through mark-to-market adjustments, resetting existing rents to current market levels upon lease renewals. This process allows the company to capture the difference between contractual rents and prevailing higher market rates, directly boosting net operating income.

Despite some moderation in rent growth in 2024, Prologis anticipates a sustained upward trend in the long term. This outlook is underpinned by a persistent imbalance between demand and supply, coupled with elevated construction expenses that constrain new development.

- Mark-to-Market Advantage: Prologis actively renews leases at current market rates, increasing rental income.

- Rent Growth Outlook: Long-term rent growth is expected due to limited new supply and high building costs.

- Incremental NOI Capture: The mark-to-market strategy directly enhances net operating income.

- Market Dynamics: Recent market adjustments are being navigated, with a focus on underlying supply/demand fundamentals.

Factors Influencing Pricing and Concessions

Prologis' pricing strategies are dynamic, constantly adapting to a complex interplay of internal and external forces. Beyond the intrinsic value of its logistics facilities, pricing is heavily influenced by competitive landscapes. For instance, in markets where Prologis faces significant competition, pricing adjustments might be necessary to remain attractive to potential tenants. This is particularly true in areas with ample supply, where concessions such as a few months of free rent can become a standard tool to secure new leases.

Regional market dynamics, specifically the balance between supply and demand for industrial and logistics space, are critical. In late 2024 and into 2025, many high-barrier markets, characterized by limited new construction and robust demand, are expected to continue demonstrating pricing resilience. Conversely, markets experiencing a surge in new supply might see a softening in rental rates or an increase in landlord concessions. Prologis closely monitors these supply/demand metrics to set optimal rental terms.

The broader economic climate also plays a significant role. Inflationary pressures, interest rate environments, and overall GDP growth directly impact tenant demand and their ability to absorb rental increases. For example, a strong economy typically fuels higher demand for logistics services, allowing Prologis to maintain or increase rental prices. Conversely, economic slowdowns can lead to increased concessions to maintain occupancy levels.

The prevailing 'flight-to-quality' trend is a key pricing differentiator. Tenants increasingly seek modern, well-located, and sustainable facilities, often referred to as Class A properties. Prologis' Class A assets, which often incorporate advanced technology and energy-efficient features, command premium rental rates compared to older or less desirable properties. This trend suggests that investments in property upgrades and development of new, high-quality facilities directly translate into higher pricing power.

- Competitive Pricing: In markets with multiple providers, Prologis may adjust rates to stay competitive.

- Supply/Demand Balance: High-demand, low-supply markets (e.g., certain coastal regions) support higher pricing, while oversupplied markets may see concessions.

- Economic Conditions: Inflation, interest rates, and GDP growth impact tenant affordability and demand, influencing pricing flexibility.

- Flight-to-Quality: Premium pricing is achievable for modern, well-located, and sustainable Class A facilities.

Prologis’ pricing strategy is deeply rooted in market realities, ensuring rents align with the value provided. This is evident in their Q1 2024 results, where U.S. average rents on new and renewal leases saw a significant 30.6% increase, reflecting strong market demand and Prologis’ ability to capture it.

The company’s value-driven approach considers factors beyond simple square footage, including prime locations and amenity quality. For example, a facility in a key logistics hub with superior transportation access commands a premium, a strategy reinforced by a 25.1% global net effective rent growth in Q1 2024.

Looking ahead, Prologis anticipates continued long-term rent growth, driven by persistent supply-demand imbalances and elevated construction costs, making their dynamic pricing model particularly effective in the 2024-2025 period.

| Metric | Q1 2024 Value | Significance |

|---|---|---|

| U.S. Rent Growth (New/Renewal Leases) | 30.6% | Demonstrates ability to capture rising market values. |

| Global Net Effective Rent Growth | 25.1% (YoY) | Highlights success of market-based pricing. |

| Long-Term Rent Outlook | Positive | Supported by supply constraints and construction costs. |

4P's Marketing Mix Analysis Data Sources

Our Prologis 4P's Marketing Mix Analysis leverages a comprehensive blend of data, including Prologis' official investor relations materials, annual reports, and press releases. We also incorporate industry-specific market research and data from leading real estate analytics firms to ensure accuracy and relevance.