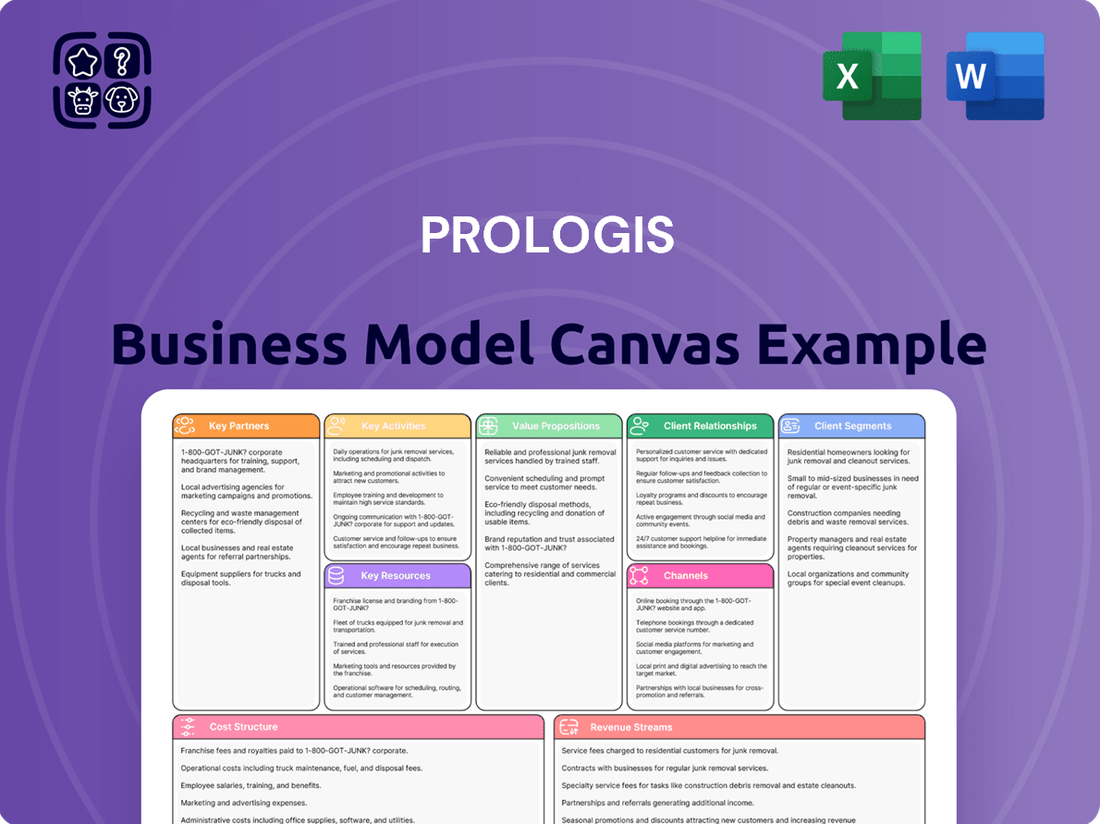

Prologis Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prologis Bundle

Unlock the strategic core of Prologis with our comprehensive Business Model Canvas. Discover how this logistics real estate giant builds its value proposition, identifies key customer segments, and leverages crucial partnerships to dominate its market.

This detailed canvas breaks down Prologis's revenue streams, cost structure, and essential resources, offering a clear roadmap to their operational success and market leadership.

Want to understand the engine driving Prologis's growth and profitability? This full Business Model Canvas provides an in-depth, actionable blueprint.

Ideal for investors, strategists, and business students, this document offers a tangible example of a highly successful, scalable business model in the logistics sector.

Gain the insights you need to benchmark your own strategies or identify new opportunities by downloading the complete Prologis Business Model Canvas today.

Partnerships

Prologis actively collaborates with strategic capital investors, primarily institutional entities, through co-investment ventures. These crucial partnerships accounted for roughly 47% of Prologis's total assets under management by the end of 2024.

These relationships, which encompass a variety of structures like open-ended funds, private joint ventures, and publicly traded funds, are vital for securing the substantial capital needed for both acquiring new properties and developing new logistics facilities.

Through these alliances, Prologis can effectively expand its extensive global portfolio and consistently deliver strong, risk-adjusted returns that are benchmarks within the industry.

Prologis’s ability to deliver its ambitious development pipeline hinges on strong alliances with major real estate developers and construction firms. These collaborations are vital for constructing state-of-the-art logistics facilities, including custom build-to-suit projects tailored to specific client needs, ensuring efficiency and speed in project execution.

These partnerships are fundamental to maintaining the high quality and expanding the sheer scale of Prologis's global portfolio. For instance, in 2023, Prologis reported a development pipeline of approximately $4.5 billion, underscoring the significant reliance on these construction and development partners to bring these projects to fruition and meet market demand for modern logistics space.

Prologis actively partners with leading technology providers to integrate cutting-edge solutions like smart warehouse management systems and IoT devices. These collaborations are crucial for enhancing operational efficiency and providing customers with sophisticated tools for supply chain optimization. For instance, Prologis’ investments in digital infrastructure, which includes cloud computing and advanced logistics analytics, are often facilitated by these tech partnerships.

Sustainability and Energy Partners

Prologis's sustainability initiatives are significantly bolstered by strategic alliances with organizations like the U.S. Green Building Council and the LEED Certification Program. These collaborations are fundamental to their drive for greener logistics facilities.

Working with energy solution providers is crucial for expanding Prologis's solar and storage capabilities. They also partner to implement advanced energy-efficient lighting systems across their portfolio, directly supporting their climate objectives.

These partnerships are instrumental in Prologis’s pursuit of net-zero-ready buildings. By early 2024, Prologis had already deployed 500 megawatts of solar capacity globally, demonstrating the tangible impact of these collaborations.

- LEED Certification Program: Enhances building design and operational efficiency.

- Green Building Council: Provides frameworks and standards for sustainable construction.

- Energy Solution Providers: Facilitate the adoption of solar, storage, and efficient lighting.

- Climate Goal Alignment: Partnerships directly support Prologis's ambitious environmental targets.

Logistics and Supply Chain Service Providers

Prologis strategically partners with a range of logistics and supply chain service providers, including major transportation companies and third-party logistics (3PL) providers. These collaborations are crucial for expanding Prologis's service offerings beyond traditional real estate. For example, in 2024, Prologis continued to build out its network of electric vehicle charging stations for heavy-duty trucks, often in conjunction with transportation partners.

These alliances enable Prologis to provide integrated solutions that address the evolving needs of its customers. By teaming up with specialized firms, Prologis can offer services like on-demand labor platforms and advanced logistics technology, creating a more comprehensive ecosystem for its tenants. This approach enhances the value proposition of Prologis's properties by turning them into operational hubs rather than just warehousing spaces.

- Transportation Network Integration: Prologis collaborates with trucking and freight companies to streamline last-mile delivery and intermodal connectivity.

- 3PL Service Expansion: Partnerships with 3PLs allow Prologis to offer value-added services such as inventory management, kitting, and order fulfillment directly within Prologis facilities.

- Technology and Innovation Hubs: Collaborations with technology providers are fostering the development of smart logistics solutions, including AI-driven warehouse management and autonomous vehicle integration, with pilot programs active in 2024.

- Workforce Solutions: Alliances with labor providers aim to address critical staffing needs within the logistics sector, offering access to flexible and skilled workers for Prologis customers.

Prologis’s strategic capital partners, primarily institutional investors, are fundamental, representing approximately 47% of assets under management by year-end 2024. These alliances facilitate significant capital infusion for property acquisition and development, enabling global portfolio expansion and competitive returns.

Collaborations with major real estate developers and construction firms are vital for delivering Prologis’s $4.5 billion development pipeline in 2023, ensuring the construction of modern, high-quality logistics facilities.

Partnerships with technology providers enhance operational efficiency through smart warehouse systems and IoT integration, with investments in digital infrastructure ongoing in 2024.

Sustainability efforts are amplified through alliances with organizations like the U.S. Green Building Council, supporting Prologis’s goal of net-zero-ready buildings, evidenced by 500 megawatts of solar capacity deployed globally by early 2024.

Expanding service offerings beyond real estate, Prologis partners with transportation and 3PL providers to offer integrated solutions, including EV charging infrastructure for trucks, a key focus in 2024.

What is included in the product

A strategic blueprint detailing Prologis's real estate solutions, focusing on logistics facilities, customer relationships, and key partnerships.

This model outlines Prologis's approach to providing modern logistics facilities and services, driven by a deep understanding of customer needs and market trends.

Provides a structured framework to pinpoint and address inefficiencies in Prologis' logistics operations, streamlining complex supply chains.

Activities

Prologis's core operations revolve around the strategic acquisition of land and existing industrial properties in key, growth-oriented global markets. This approach ensures they are positioned in areas with strong demand and limited supply. For instance, by the end of 2023, Prologis's portfolio spanned approximately 1.3 billion square feet, a testament to their ongoing acquisition efforts.

Furthermore, Prologis is deeply involved in development, constructing both speculative and build-to-suit facilities. These build-to-suit projects are crucial for meeting specific customer requirements, solidifying tenant relationships and capturing value. In 2024, the company continued to emphasize development, with a significant portion of their capital expenditure allocated to new projects designed to enhance their portfolio's quality and relevance.

Prologis's property management and leasing activities are central to its business, focusing on efficiently managing its extensive global portfolio of logistics facilities. This involves actively marketing available spaces, screening potential tenants, and negotiating lease terms to maintain high occupancy rates and secure favorable rental income. Their operational excellence ensures tenants have reliable and well-maintained facilities.

In 2024, Prologis continued to demonstrate strength in leasing. For instance, in the first quarter of 2024, they reported a leasing ratio of 97.2% across their portfolio, highlighting their ability to keep their properties occupied. This sustained high occupancy is a testament to their effective property management and strong tenant relationships.

The company also prioritizes ongoing property maintenance and tenant support, which is crucial for retaining customers and ensuring the long-term value of their assets. This includes everything from routine upkeep to addressing specific tenant needs, fostering a positive and productive environment for businesses operating within their logistics parks.

Prologis excels in strategic capital management by fostering co-investment ventures with a broad base of institutional investors. This collaborative approach allows Prologis to leverage external capital for growth and expansion, extending its reach and capabilities in the industrial real estate market.

The company provides comprehensive fund management, asset management, and property management services for these co-invested ventures. This integrated service model ensures efficient operations and optimal performance of the underlying assets, creating value for both Prologis and its partners.

In 2024, Prologis's strategic capital platform continued to be a significant driver of its financial performance. The fee and promote revenues generated from these ventures contributed substantially to the company's overall profitability, underscoring the success of its capital-light growth strategy.

These co-investment structures allow Prologis to deploy capital effectively, participate in larger transactions, and maintain a strong balance sheet while accessing a diverse pool of capital. This strategic focus on capital management is central to Prologis's business model.

Innovation and Technology Integration

Prologis actively invests in and integrates cutting-edge technologies to boost warehouse operations and supply chain robustness. This includes leveraging artificial intelligence, automation, and advanced digital tools to streamline logistics and improve efficiency.

The company is at the forefront of developing smart building technologies, incorporating features that optimize energy consumption and operational performance. This commitment extends to providing sustainable energy solutions, such as solar power installations and electric vehicle charging infrastructure, to its customers.

- Smart Building Technologies: Prologis is implementing IoT sensors and data analytics to optimize building performance and energy usage across its portfolio.

- AI and Automation: The company is exploring and deploying AI-driven solutions for inventory management, predictive maintenance, and automated material handling within its facilities.

- Energy Solutions: Prologis aims to expand its renewable energy offerings, with a goal to have solar power installed on 100% of its eligible rooftops by 2025, contributing to a greener supply chain.

- Data Analytics: Prologis provides customers with advanced data analytics platforms, offering insights into inventory levels, operational efficiency, and environmental impact to enhance decision-making.

Sustainability and ESG Initiatives

Prologis actively engages in sustainability and ESG initiatives, a core component of its operations. A significant activity is their commitment to environmental, social, and governance (ESG) practices, aiming for net-zero greenhouse gas emissions by 2040. This ambitious goal drives their strategic decisions and operational focus.

These initiatives encompass several key areas. Prologis pursues sustainable building certifications for its properties, ensuring environmental responsibility in construction and operations. They are also focused on expanding their renewable energy capacity, integrating solar power and other clean energy solutions across their portfolio.

Furthermore, Prologis emphasizes community engagement programs. These efforts aim to foster positive relationships with the communities in which they operate, addressing social impacts and contributing to local well-being. The company's commitment is reflected in its progress towards its 2040 net-zero target.

- Net-Zero Emissions Goal: Targeting net-zero greenhouse gas emissions by 2040.

- Sustainable Building: Securing certifications like LEED for its logistics facilities.

- Renewable Energy: Expanding solar power generation on its rooftops, aiming for 1 gigawatt of solar capacity by 2025.

- Community Investment: Implementing programs focused on social impact and local economic development.

Prologis's key activities focus on developing and managing a global portfolio of logistics real estate. They acquire land and existing properties in strategic, high-growth markets, then develop and lease these spaces to customers. Property management and tenant support are crucial for maintaining high occupancy and long-term asset value.

Their business model also involves significant capital management through co-investment ventures with institutional investors, generating fee and promote revenues. Technology integration for operational efficiency and sustainability initiatives, like renewable energy solutions, are also vital activities.

| Key Activity | Description | 2024 Highlight/Data |

|---|---|---|

| Property Acquisition & Development | Acquiring land and existing logistics facilities, then developing new speculative and build-to-suit properties. | Continued emphasis on development projects to enhance portfolio quality. |

| Leasing & Property Management | Marketing spaces, screening tenants, negotiating leases, and managing properties to ensure high occupancy and tenant satisfaction. | Reported a 97.2% leasing ratio in Q1 2024. |

| Capital Management & Co-investments | Leveraging institutional capital through co-investment ventures, providing fund, asset, and property management services. | Fee and promote revenues from these ventures contributed substantially to profitability. |

| Technology & Sustainability Integration | Implementing smart building technologies, AI, automation, and renewable energy solutions to improve efficiency and environmental performance. | Aiming for 1 gigawatt of solar capacity by 2025 and net-zero emissions by 2040. |

Full Version Awaits

Business Model Canvas

The Prologis Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means the structure, content, and formatting are exactly as you see them now, ensuring no discrepancies. You're not viewing a sample; this is a direct representation of the final, ready-to-use deliverable. Once your purchase is complete, you will gain full access to this entire Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Prologis's extensive global logistics real estate portfolio is its core asset, spanning roughly 1.3 billion square feet. This massive footprint is strategically concentrated in 20 countries, focusing on high-barrier and high-growth markets. In 2024, Prologis continued to leverage this portfolio, which is central to its ability to facilitate global supply chains.

The sheer scale of Prologis's real estate holdings, approximately 1.3 billion square feet as of recent reporting, underscores its dominant position. These facilities are not just warehouses; they are critical hubs for distribution, situated in prime locations that offer significant advantages to customers. This strategic placement is key to Prologis's value proposition in the competitive logistics landscape.

Operating across 20 countries, Prologis's portfolio is a testament to its global reach and operational expertise. The company's focus on high-barrier markets means these properties are often in areas with limited new development opportunities, enhancing their long-term value and tenant demand. This global diversification and strategic market selection are crucial for sustained growth and resilience.

Prologis maintains a powerful financial foundation, evidenced by its strong balance sheet and consistently high credit ratings. This financial muscle grants them significant leverage in securing capital, both through established debt markets and key strategic partnerships. For instance, as of the first quarter of 2024, Prologis reported total assets exceeding $100 billion, showcasing their substantial scale.

This robust financial standing is crucial for Prologis’ business model, allowing them to pursue major acquisitions, undertake large-scale development projects, and invest heavily in innovation. Their access to diverse funding sources, including a substantial revolving credit facility, ensures they can capitalize on market opportunities and weather economic fluctuations. In 2023, Prologis deployed approximately $5 billion in capital for development and acquisitions, underscoring their capacity to execute significant strategic moves.

Prologis's most valuable asset is its highly skilled workforce, a diverse team of professionals with deep expertise in real estate development, property management, finance, and sustainability. This collective knowledge is fundamental to their success in navigating complex global markets and delivering value to customers.

The company fosters a culture that prioritizes innovation, customer focus, and operational excellence. This environment empowers their employees, driving continuous improvement and ensuring that Prologis remains at the forefront of the logistics real estate industry.

As of the first quarter of 2024, Prologis employed approximately 5,000 individuals globally, a testament to their substantial operational footprint. This engaged team is crucial in executing Prologis's strategy and maintaining its leadership position.

Advanced Technology and Data Platforms

Prologis heavily relies on its proprietary data platforms and digital tools, including significant investments in Artificial Intelligence (AI) and the Internet of Things (IoT). This technological backbone is crucial for enhancing decision-making processes, optimizing the performance of its vast property portfolio, and delivering cutting-edge solutions to its clientele.

This advanced technological infrastructure directly contributes to Prologis's operational efficiency and strengthens its competitive edge in the logistics real estate market. The company actively uses data analytics to understand market trends and customer needs, enabling more strategic property development and management.

- Proprietary Data Platforms: Prologis utilizes sophisticated data analytics to identify optimal locations and understand supply chain dynamics.

- AI and IoT Integration: Investments in AI and IoT enable smart building technology, improving energy efficiency and operational insights for customers.

- Digital Tools for Customers: The company offers digital solutions that streamline logistics operations, enhancing customer experience and efficiency.

- Data-Driven Decision Making: Prologis leverages real-time data to make informed decisions regarding acquisitions, development, and asset management.

Established Customer Relationships and Brand Reputation

Prologis leverages its deeply entrenched, long-standing relationships with a vast and diverse customer base, encompassing global manufacturers, leading retailers, and third-party logistics providers (3PLs). This extensive network forms a cornerstone of their business, ensuring consistent demand for their logistics facilities.

The company's robust brand reputation as a premier, innovative leader in logistics real estate is a critical asset. This strong market perception not only attracts new tenants but also significantly contributes to tenant retention, reinforcing their market position.

- Customer Loyalty: Prologis reported a customer retention rate of 81.5% in 2023, underscoring the strength of these established relationships.

- Brand Value: The Prologis brand is recognized globally for reliability and operational excellence in the logistics sector.

- Diversified Tenant Base: Their portfolio includes tenants from e-commerce, retail, consumer electronics, and automotive sectors, mitigating risk.

Prologis's key resources are its vast global logistics real estate portfolio, spanning approximately 1.3 billion square feet across 20 countries, and its strong financial foundation, with total assets exceeding $100 billion as of Q1 2024. Complementing these are its skilled workforce of around 5,000 employees and advanced proprietary data platforms leveraging AI and IoT. Finally, its deeply entrenched customer relationships and strong brand reputation are critical intangible assets, evidenced by an 81.5% customer retention rate in 2023.

Value Propositions

Prologis offers strategically positioned, contemporary logistics facilities in key global trade locations. This prime placement allows clients to achieve superior supply chain efficiency and accelerate product delivery times.

These modern spaces are purpose-built to handle intricate warehousing operations, distribution networks, and the demands of e-commerce fulfillment. For instance, in 2024, Prologis continued to expand its portfolio, emphasizing locations that offer significant connectivity advantages for its customer base.

The company's commitment to high-quality infrastructure ensures that businesses can optimize their operations, reducing transit times and associated costs. This focus on efficiency is a core element of their value proposition.

Prologis provides essential infrastructure and services that bolster supply chain resilience, helping customers navigate disruptions and shifting trade landscapes. Their strategically located facilities and logistics solutions support the move towards 'just-in-case' inventory management, a trend that gained significant traction in 2024 as businesses sought to mitigate risks.

By offering advanced warehousing and distribution capabilities, Prologis empowers businesses to adapt to changing inventory needs and optimize their logistics networks. This focus on efficiency is critical, especially as global trade patterns continue to evolve, impacting delivery times and costs for many industries.

The company's ability to provide flexible and scalable solutions directly addresses the growing demand for supply chain agility. For instance, Prologis reported significant leasing activity in 2024, underscoring the market's need for adaptable real estate that can support dynamic inventory strategies.

Prologis offers sustainable logistics solutions that go beyond traditional warehousing. They provide rooftop solar installations, enabling customers to generate their own clean energy. In 2024, Prologis continued to expand its solar portfolio, aiming to increase renewable energy generation across its global properties, which directly translates to lower energy costs for tenants.

The company also focuses on energy-efficient building designs, incorporating features like LED lighting and advanced insulation. This commitment helps clients significantly reduce their carbon footprint and meet increasingly stringent environmental, social, and governance (ESG) targets. For instance, Prologis’s customers can often see a reduction in their utility bills by as much as 20% through these efficiency measures.

Furthermore, Prologis is actively investing in electric vehicle (EV) charging infrastructure within its logistics parks. This proactive approach supports the growing adoption of electric fleets for last-mile delivery and other transportation needs, aligning with broader sustainability trends observed throughout 2024 in the logistics sector.

Integrated Logistics and Technology Services (Prologis Essentials)

Prologis Essentials offers more than just warehouse space; it provides a comprehensive suite of integrated services designed to boost customer efficiency. These services encompass smart warehouse management, cutting-edge automation technologies, and tailored workforce solutions, all aimed at enhancing operational performance.

By leveraging these value-added services, Prologis empowers its clients to optimize their supply chains, significantly increase productivity, and readily adapt to the ever-evolving landscape of technological advancements. This integrated approach helps customers navigate complex logistical challenges and stay competitive.

- Smart Warehouse Management: Prologis Essentials provides digital tools for real-time inventory tracking, space utilization monitoring, and operational visibility.

- Automation Solutions: Clients can access and implement advanced automation technologies, such as robotics and automated storage and retrieval systems (AS/RS), to streamline warehouse processes.

- Workforce Solutions: Prologis offers services to help clients find, train, and manage their warehouse labor force, addressing critical staffing needs.

- Data-Driven Insights: The platform generates actionable data to inform decision-making, leading to improved efficiency and cost savings for customers.

Scalability and Flexibility

Prologis provides adaptable space solutions, allowing businesses to adjust their footprint seamlessly. This flexibility is crucial for companies navigating fluctuating demand, as demonstrated by Prologis’s ability to offer tailored solutions across its extensive global portfolio. For instance, in 2024, Prologis reported significant leasing activity driven by customers seeking precisely these kinds of adaptable arrangements.

Their worldwide network is a key asset, enabling clients to expand or contract operations efficiently. This global reach supports diverse business needs, from startups requiring minimal initial space to large enterprises managing complex supply chains. In 2024, Prologis’s strategic development of new logistics facilities in key growth markets further underscored this commitment to scalability.

- Global Network: Prologis operates in 19 countries, offering a broad geographic reach for businesses.

- Flexible Lease Terms: Options cater to various business cycles, allowing for short-term or long-term needs.

- Diverse Portfolio: Space solutions range from small units to large distribution centers, accommodating all sizes of operations.

- Adaptable Design: Facilities can be modified to meet specific operational requirements, enhancing flexibility.

Prologis offers prime logistics locations, enabling clients to optimize supply chains and speed up delivery. Their modern, purpose-built facilities are designed for complex warehousing and e-commerce fulfillment, with expansion in 2024 focusing on high-connectivity sites. This ensures businesses can reduce transit times and operational costs.

Customer Relationships

Prologis prioritizes a superior customer experience through specialized teams. These dedicated Customer Experience and Customer Led Solutions groups actively engage with clients to grasp their unique requirements, ensuring satisfaction and building lasting partnerships.

This proactive approach is crucial for Prologis's success. By offering tailored solutions and robust operational support, they foster loyalty and drive repeat business. For instance, in 2024, Prologis reported high customer retention rates, underscoring the effectiveness of these dedicated teams in meeting and exceeding client expectations in the logistics real estate sector.

Prologis prioritizes long-term lease agreements, with build-to-suit developments often securing terms averaging 16 years. This commitment to extended partnerships fosters stability and predictability for both Prologis and its customers. The company boasts an impressive customer retention rate exceeding 80%, underscoring the success of this relationship-focused approach.

Prologis actively fosters strong customer relationships through proactive engagement, hosting approximately 20 customer advisory board meetings annually and conducting regular customer satisfaction surveys. This direct dialogue allows them to gather invaluable feedback, anticipating evolving supply chain needs and ensuring their logistics solutions remain highly relevant.

In 2024, Prologis continued to invest in digital platforms and direct interactions, facilitating a continuous feedback loop. This approach is critical for refining their offerings, as evidenced by their development of specific solutions in response to customer input on areas like energy efficiency and last-mile delivery challenges.

Sustainability Collaboration and Support

Prologis actively partners with its customers to advance their sustainability objectives, offering features like green building certifications, on-site renewable energy solutions, and specialized decarbonization guidance. This collaborative approach, focusing on Environmental, Social, and Governance (ESG) principles, not only deepens customer loyalty but also directly assists them in meeting their environmental targets. For instance, Prologis's solar programs have seen significant expansion, with over 500 MW of solar capacity installed across its portfolio by early 2024, directly benefiting tenant sustainability metrics.

This shared focus on ESG fosters stronger, more resilient customer relationships. Prologis's commitment to providing these sustainable solutions demonstrates a clear value proposition beyond traditional real estate services, enhancing customer retention and attracting environmentally conscious businesses. By integrating sustainability into the core of their offerings, Prologis positions itself as a strategic partner, essential for businesses navigating the increasing demands for environmental responsibility.

Key aspects of this collaboration include:

- Green Building Features: Providing access to buildings designed with energy-efficient materials and systems, contributing to reduced operational carbon footprints.

- Renewable Energy Options: Facilitating the adoption of on-site solar power generation and access to renewable energy procurement, directly lowering customers' Scope 2 emissions.

- Decarbonization Expertise: Offering guidance and support on strategies for reducing carbon emissions throughout the supply chain and building operations.

- ESG Goal Alignment: Working with customers to align Prologis's real estate solutions with their specific ESG targets and reporting requirements.

Strategic Advisory and Market Insights

Prologis acts as a strategic advisor, offering clients access to extensive market insights and data analytics. This advisory role helps customers navigate complex supply chain decisions and optimize their real estate footprints. For instance, Prologis's 2024 market reports highlighted a significant surge in demand for cold storage facilities, directly influencing customer location strategies.

By leveraging their proprietary data platforms and deep industry knowledge, Prologis empowers clients to make more informed choices. This strategic partnership goes beyond just leasing space, positioning Prologis as a critical partner in their customers' long-term success. Their insights have been instrumental in helping businesses adapt to evolving e-commerce trends, a key driver in logistics real estate throughout 2024.

- Market Intelligence: Providing clients with up-to-date data on market trends, rental rates, and vacancy levels.

- Strategic Guidance: Offering advice on supply chain optimization and real estate portfolio management.

- Data-Driven Decisions: Enabling customers to make informed choices backed by Prologis's research.

- Trusted Partnership: Building relationships where Prologis is seen as a vital advisor, not just a landlord.

Prologis cultivates deep customer relationships by acting as a strategic partner, offering market intelligence and data analytics to optimize supply chains. This advisory role, supported by proprietary data platforms, helps clients navigate evolving logistics needs, such as the 2024 surge in demand for cold storage. Their commitment to understanding and anticipating customer requirements fosters loyalty and drives repeat business, evidenced by consistently high retention rates.

| Customer Relationship Aspect | Prologis Approach | 2024 Impact/Data |

|---|---|---|

| Proactive Engagement | Dedicated Customer Experience teams, customer advisory boards | High customer retention (>80%) |

| Tailored Solutions | Build-to-suit developments, addressing specific client needs | Average lease terms of 16 years for build-to-suit |

| Sustainability Partnership | ESG guidance, green building features, renewable energy solutions | Over 500 MW solar capacity installed by early 2024 |

| Strategic Advisory | Market insights, data analytics, supply chain optimization advice | Reports highlighting demand for cold storage |

Channels

Prologis utilizes its dedicated global and local sales and leasing teams as a crucial direct channel. These teams actively connect with customers, managing everything from property tours to complex lease negotiations and bespoke development discussions.

This direct engagement is fundamental to Prologis' strategy for attracting new tenants and nurturing relationships with existing ones. In 2023, Prologis reported leasing approximately 287 million square feet, underscoring the effectiveness of these customer-facing teams.

Their responsibilities extend to understanding specific client needs, facilitating custom development projects, and ensuring a seamless leasing experience. This hands-on approach allows Prologis to tailor solutions and solidify its market position.

By maintaining these direct sales and leasing capabilities, Prologis ensures a deep understanding of market dynamics and customer requirements, directly impacting their strong occupancy rates, which consistently hover around 95%.

Prologis actively collaborates with commercial real estate brokers and advisors, leveraging their extensive networks to connect with potential tenants. These partnerships are crucial for marketing Prologis' vast portfolio of logistics facilities and identifying businesses actively seeking industrial space across key global markets.

In 2024, the industrial real estate sector continued to see strong demand, with Prologis reporting significant leasing activity facilitated through these broker relationships. For instance, in the first half of 2024, Prologis secured new and expanded leases totaling approximately 93.4 million square feet globally, a testament to the effectiveness of its broker channel.

These advisors provide invaluable market intelligence, helping Prologis understand tenant needs and tailor offerings. Their expertise ensures Prologis’ properties are visible to the right businesses, driving occupancy and revenue for the company’s strategically located logistics assets.

Prologis leverages its corporate website, a key digital platform, to provide comprehensive information about its extensive global logistics real estate portfolio. This includes detailed property listings and virtual tours, making it easier for potential customers to explore available spaces.

Furthermore, Prologis actively publishes online research reports and market insights, positioning itself as a thought leader in the industrial real estate sector. This content strategy aims to attract and engage a diverse audience, from individual investors to large corporations seeking warehousing solutions.

In 2024, Prologis continued to invest in enhancing its digital platforms, recognizing their critical role in customer acquisition and communication. Their online presence is designed not just to showcase properties but also to foster relationships and provide valuable data for decision-making.

The company's digital channels are instrumental in driving leads and facilitating transactions, making them a crucial component of their customer relationship management and sales funnel.

Industry Events and Conferences

Prologis actively participates in key industry events and conferences, a vital component of its business model. Their flagship event, GROUNDBREAKERS™, serves as a platform for networking with influential figures, demonstrating cutting-edge solutions, and reaching a wide array of potential clients and collaborators.

These gatherings are crucial for staying abreast of market trends and fostering valuable relationships. For instance, in 2023, Prologis’s continued investment in thought leadership through events like these reinforced their position as an industry innovator.

The company leverages these forums to:

- Connect with industry leaders and stakeholders.

- Showcase new technologies and service offerings.

- Generate leads and strengthen customer relationships.

- Gather market intelligence and identify emerging opportunities.

Strategic Capital Partnerships

Strategic Capital Partnerships serve as a vital channel for Prologis to engage institutional investors, offering them direct co-investment opportunities within its extensive logistics real estate portfolio. This approach is fundamental to Prologis's capital raising strategy, enabling significant growth in its managed assets.

These partnerships are instrumental in scaling Prologis's global platform by leveraging external capital. For instance, in 2024, Prologis continued to attract substantial investment from sovereign wealth funds and pension plans seeking exposure to the resilient logistics sector.

- Attracts institutional investors

- Facilitates co-investment in logistics real estate

- Drives capital raising for portfolio expansion

- Enhances scale and global reach through partnerships

Prologis leverages its direct sales and leasing teams as a primary channel, fostering strong customer relationships. These teams are adept at managing property tours, lease negotiations, and bespoke development discussions, directly contributing to their robust leasing volumes. In the first half of 2024, Prologis reported leasing approximately 93.4 million square feet globally, highlighting the effectiveness of this direct engagement strategy.

Customer Segments

Global manufacturers and industrial companies represent a core customer segment, requiring extensive logistics and supply chain infrastructure. These businesses, ranging from automotive giants to consumer goods producers, rely on Prologis for strategically positioned facilities to house production, store raw materials, and manage the flow of finished products. For instance, in 2024, major automotive manufacturers continued to invest heavily in supply chain resilience, increasing demand for large, modern distribution centers near key transportation hubs.

This segment prioritizes long-term leasing agreements and often seeks build-to-suit solutions tailored to their specific operational needs. They value proximity to ports, major roadways, and other critical infrastructure to optimize their global distribution networks. As of mid-2024, the industrial real estate market saw continued strong demand from these players, with vacancy rates in prime logistics markets remaining exceptionally low.

Omni-channel retailers and e-commerce giants represent a crucial customer base, demanding sophisticated logistics solutions to manage their burgeoning online sales. These businesses need highly efficient distribution centers and fulfillment hubs to navigate complex supply chains and ensure rapid delivery. For instance, in 2024, e-commerce sales in the US alone are projected to reach over $1.3 trillion, highlighting the immense need for optimized warehousing.

Speed, scalability, and strategic location near major consumer markets are paramount for these companies. They rely on Prologis's network to reduce last-mile delivery times, a critical factor in customer satisfaction and competitive advantage. The ability to scale operations up or down quickly in response to seasonal demand or market shifts is also a key consideration, directly impacting their bottom line.

Third-Party Logistics (3PL) providers are a crucial customer segment for Prologis. These companies manage the complex logistics operations for numerous other businesses, meaning they need warehouse and distribution facilities that are incredibly flexible and adaptable. They serve a wide array of clients with varying demands, from e-commerce fulfillment to traditional manufacturing.

Prologis offers the essential physical infrastructure that allows 3PLs to effectively deliver their services. This includes strategically located, modern warehouse space equipped for efficient inbound and outbound movement of goods. By partnering with Prologis, 3PLs can expand their service offerings to encompass warehousing, transportation management, and order fulfillment, all powered by Prologis's real estate solutions.

In 2024, the global 3PL market was valued at approximately $1.3 trillion, and it's projected to continue its robust growth. This growth is driven by companies increasingly outsourcing their supply chain functions to specialists like 3PLs to improve efficiency and reduce costs. Prologis's ability to provide scalable and well-located facilities directly supports this market expansion, enabling 3PLs to meet the surging demand for their services.

Transportation and Freight Companies

Transportation and freight companies, encompassing trucking, rail, air, and sea operations, represent a crucial customer segment for Prologis. These businesses require strategically positioned logistics facilities. They specifically seek locations that facilitate efficient cross-docking, transshipment, and short-term storage, all vital for optimizing complex transportation networks. Proximity to major transport arteries, such as highways, rail yards, and ports, is a paramount consideration for these clients to minimize transit times and costs.

These companies are driven by the need to streamline their supply chains and reduce lead times. For instance, a trucking company might utilize Prologis facilities for rapid unloading and reloading of goods, enabling faster delivery to final destinations. Similarly, a shipping line could use a Prologis warehouse near a port for consolidating or deconsolidating cargo, improving the efficiency of container movements. The demand for such facilities is directly tied to global trade volumes and the efficiency of intermodal transportation systems.

- Strategic Location: Key requirement for proximity to major highways, ports, and airports to facilitate seamless intermodal transfers.

- Cross-Docking & Transshipment: Demand for facilities designed for quick transfer of goods between different modes of transport or distribution channels.

- Short-Term Storage: Need for flexible warehousing solutions to manage inventory fluctuations and optimize shipment consolidation.

- Efficiency & Cost Reduction: Focus on facilities that reduce transit times, minimize handling costs, and improve overall supply chain velocity.

Data Center Operators (Emerging)

Prologis is actively catering to emerging data center operators, a rapidly expanding niche within their customer base. This involves repurposing existing warehouse space and significantly increasing power infrastructure to accommodate the intense demands of data storage and processing. The 2024 market shows a clear acceleration in this trend.

This segment is characterized by specialized needs, particularly concerning robust power supply and high-speed connectivity, which Prologis is uniquely positioned to provide. Their strategy focuses on adapting logistics facilities to become hubs for digital infrastructure.

- High Growth Potential: The global data center market is projected to grow substantially, with demand for colocation and hyperscale facilities driving expansion.

- Specialized Requirements: Data center operators require significant power density, advanced cooling systems, and direct fiber optic connectivity, areas where Prologis is investing heavily.

- Strategic Conversions: Prologis is converting approximately 10 million square feet of its portfolio into data center space, demonstrating a tangible commitment to this sector.

- Power Capacity Expansion: The company is focused on securing and expanding power capacity, a critical bottleneck for data center development, with significant investments planned through 2025.

Prologis serves a diverse range of customers, from global manufacturers and e-commerce giants to 3PL providers and even emerging data center operators. Each segment has unique needs regarding location, facility specifications, and service requirements.

The core value proposition for many of these clients is Prologis's extensive network of strategically located, modern logistics facilities. These properties are crucial for optimizing supply chains, reducing operational costs, and ensuring timely delivery of goods in an increasingly competitive market. As of 2024, the demand for prime logistics space remained exceptionally high, underscoring the critical role Prologis plays.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Global Manufacturers | Large, modern facilities near transport hubs; build-to-suit options | Continued strong demand, low vacancy rates in prime markets |

| E-commerce Retailers | Efficient fulfillment centers, speed, scalability, proximity to consumers | US e-commerce sales projected over $1.3 trillion |

| 3PL Providers | Flexible, adaptable, well-located warehouse space | Global 3PL market valued at ~$1.3 trillion, robust growth |

| Data Center Operators | High power density, connectivity, strategic location | Repurposing 10 million sq ft of Prologis portfolio |

Cost Structure

Prologis’s cost structure is heavily influenced by property acquisition and development. This includes the substantial capital required to buy land and existing industrial facilities, alongside the expenses for constructing new logistics properties. These are significant upfront investments critical to expanding their global portfolio.

In 2023, Prologis reported capital expenditures of $5.2 billion, primarily directed towards development and acquisitions. This figure underscores the immense scale of their investment in physical assets, which forms the backbone of their business model. These expenditures are essential for maintaining and growing their competitive edge in the logistics real estate market.

Prologis incurs significant ongoing costs for property taxes, insurance, and utilities across its extensive global logistics portfolio. These are essential to maintain the operational integrity and tenant appeal of their facilities. For instance, in 2024, property operating and maintenance expenses represented a substantial portion of their overall cost structure, reflecting the scale and quality of their real estate holdings.

Prologis's capital-intensive model means significant financing and interest expenses, a crucial cost. In 2023, the company reported $1.6 billion in interest expense, reflecting the substantial debt needed for its extensive real estate portfolio. Managing the timing of debt repayments and the fluctuating interest rates is paramount to controlling these costs and maintaining profitability.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Prologis are essential for maintaining its global operations. These costs encompass corporate overhead like executive salaries, marketing initiatives, legal services, and other administrative functions that underpin the management of a vast real estate portfolio. While a smaller component of their overall cost structure compared to property-related expenses, G&A is crucial for strategic direction and operational efficiency.

For instance, Prologis reported G&A expenses of $790.4 million in 2023, representing a modest increase from the previous year. This figure reflects the investment in talent and infrastructure needed to support their extensive network of logistics facilities and customer relationships across key markets.

- Salaries and benefits for corporate staff

- Marketing and business development costs

- Legal and compliance expenditures

- Technology and IT support for global operations

Technology and Innovation Investment Costs

Prologis dedicates substantial resources to its technology and innovation endeavors, recognizing their critical role in maintaining a competitive edge and delivering enhanced customer value. These investments are multifaceted, encompassing the development and refinement of proprietary technology platforms, rigorous research and development aimed at creating more sustainable logistics solutions, and strategic capital injections into promising proptech firms.

These expenditures are not merely operational costs but strategic drivers of future growth and efficiency. For instance, Prologis' commitment to innovation is evident in its ongoing development of its global logistics platform, which aims to provide seamless and data-driven solutions for its customers. This includes investments in areas like AI and automation to optimize warehouse operations and supply chain visibility.

In 2024, Prologis continued its focus on R&D for sustainable solutions, including advancements in building materials, energy efficiency technologies for its facilities, and solutions for the growing e-commerce sector. Their strategic investments in proptech companies are also a key component, allowing them to tap into emerging technologies and business models within the real estate and logistics industries.

- Technology Platforms: Ongoing investment in proprietary software and data analytics to enhance operational efficiency and customer experience.

- Research & Development: Funding for sustainable building technologies, energy management systems, and innovative logistics solutions.

- Proptech Investments: Strategic capital allocation to startups and companies developing cutting-edge technologies relevant to the logistics real estate sector.

Prologis's cost structure is dominated by property-related expenses. These include significant capital expenditures for land acquisition and development, as well as ongoing operational costs like property taxes, insurance, and maintenance. In 2023, Prologis's capital expenditures reached $5.2 billion, highlighting the scale of investment in its physical assets.

Financing costs are also a major component, with $1.6 billion in interest expense reported in 2023, reflecting the substantial debt used to fund its vast real estate holdings. General and Administrative (G&A) expenses, while smaller, are essential for managing its global operations, amounting to $790.4 million in 2023.

| Cost Category | 2023 (USD Billions) | Notes |

| Capital Expenditures | 5.2 | Primarily development and acquisitions |

| Interest Expense | 1.6 | Reflects debt financing for portfolio |

| G&A Expenses | 0.79 | Corporate overhead and operational support |

Revenue Streams

Prologis primarily generates revenue through rental income from its extensive portfolio of logistics and distribution properties. This income is derived from leases with a broad range of customers across various industries.

The total rental income for Prologis in 2024 reached an impressive $7.515 billion. This figure encompasses not only the base rent charged to tenants but also includes reimbursements for operating expenses and property taxes, contributing to a stable and predictable revenue base.

Prologis earns revenue through its strategic capital segment by managing co-investment funds alongside institutional partners. This involves earning fees for asset management, property management, and performance-based promote fees.

In the first quarter of 2025, Prologis reported $141 million in revenue from these strategic capital activities. This highlights the significant contribution of these fee-based services to their overall financial performance.

Prologis generates significant revenue through the development of industrial properties and their subsequent sale once they are stabilized, meaning they have achieved a certain level of occupancy and rental income. These real estate transactions contribute directly to the company's net earnings, reflecting the value created during the development cycle.

In 2024, Prologis continued to capitalize on its development pipeline, realizing gains from the sale of various logistics facilities. For instance, the company reported substantial gains from its development activities, which are a key component of its overall profitability. These sales, often involving build-to-suit or turnkey projects, underscore the demand for modern logistics infrastructure.

The sale of stabilized properties is a crucial revenue stream, allowing Prologis to recycle capital and reinvest in new development opportunities. This strategy is particularly effective in dynamic markets where demand for logistics space remains robust, enabling the company to capture value created through expertise in site selection, construction, and leasing.

Prologis Essentials and Value-Added Services

Prologis is expanding its revenue through Prologis Essentials, a platform offering a suite of value-added services designed to support logistics operations. This initiative taps into customer needs beyond just warehousing space, creating new income streams.

The Prologis Essentials platform encompasses several key areas. These include providing energy solutions, such as solar installations and electric vehicle charging infrastructure, which not only benefit customers but also contribute to Prologis's sustainability goals. Additionally, the platform offers warehouse operations services, aiming to streamline efficiency for its clients, and workforce solutions, addressing the critical labor needs within the logistics sector.

These diversified services are projected to significantly boost Prologis's overall revenue. For instance, by the end of 2023, Prologis reported that its Essentials platform had already achieved an annual revenue run rate of $500 million, demonstrating substantial early traction and market acceptance.

- Energy Solutions: Offering solar power generation and EV charging infrastructure to customers.

- Warehouse Operations: Providing services to optimize efficiency within Prologis facilities.

- Workforce Solutions: Addressing labor needs for logistics operations.

- Financial Impact: The Essentials platform reached a $500 million annual revenue run rate by the end of 2023.

Data Center and Energy Solutions Revenue (Emerging)

Prologis is diversifying its revenue streams by venturing into data center development and energy solutions. This emerging segment is becoming a significant contributor, driven by the demand for power capacity and specialized services for data centers. As of 2024, Prologis is actively developing and leasing space for these high-demand facilities, capitalizing on the digital economy's growth.

A key aspect of this revenue growth comes from selling energy generated by Prologis' substantial solar installations. These solar farms, integrated into their logistics real estate portfolio, provide clean energy to tenants and the grid, creating a dual revenue stream from real estate and energy generation. This strategic move aligns with the increasing focus on sustainability and reliable power for critical infrastructure.

- Power Capacity Sales: Revenue generated by providing dedicated power capacity to data center tenants.

- Energy Services: Income from managing and delivering energy-related services for data center operations.

- Solar Energy Generation: Revenue from selling excess solar energy produced at Prologis facilities.

- Renewable Energy Credits: Potential revenue from trading renewable energy certificates tied to solar production.

Prologis’s revenue is primarily anchored in rental income from its vast logistics property portfolio, which amounted to $7.515 billion in 2024. Beyond base rent, this includes expense reimbursements, solidifying a consistent income base.

Strategic capital activities, such as managing co-investment funds, generate fee-based revenue. In Q1 2025, these activities contributed $141 million, showcasing a growing income stream from asset and property management services.

Development and sale of stabilized industrial properties also form a key revenue component, allowing capital recycling and capturing value from construction and leasing expertise.

The Prologis Essentials platform, offering energy, warehouse, and workforce solutions, is a rapidly expanding revenue source, having achieved a $500 million annual revenue run rate by the end of 2023.

| Revenue Stream | Description | 2024 Data | Q1 2025 Data | 2023 Data (Essentials) |

|---|---|---|---|---|

| Rental Income | Lease income from logistics properties | $7.515 billion | N/A | N/A |

| Strategic Capital | Fees from managing co-investment funds | N/A | $141 million | N/A |

| Development & Sales | Gains from selling stabilized properties | Substantial gains reported | N/A | N/A |

| Prologis Essentials | Value-added services (energy, operations, workforce) | N/A | N/A | $500 million (annual run rate) |

Business Model Canvas Data Sources

The Prologis Business Model Canvas is informed by a robust combination of proprietary operational data, market intelligence reports, and financial disclosures. This integrated approach ensures that each component, from customer relationships to cost structures, is validated by real-world performance and industry insights.