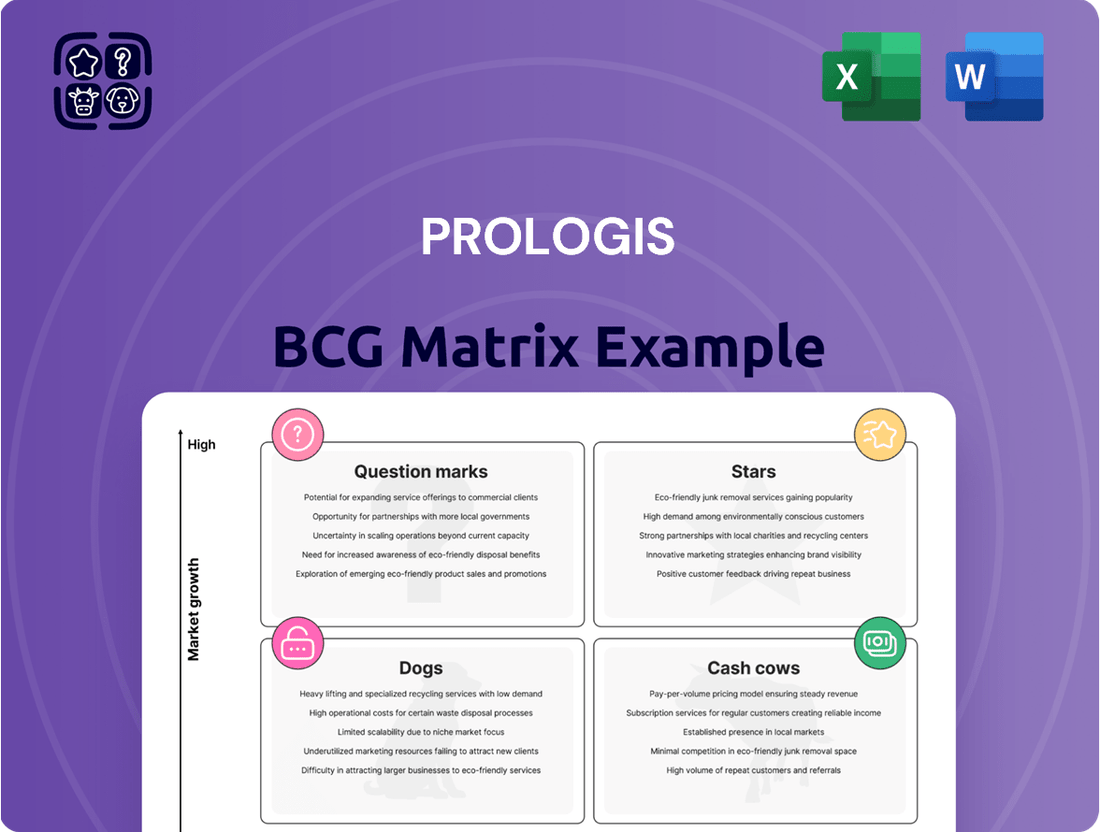

Prologis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prologis Bundle

Curious about Prologis's strategic positioning? Our BCG Matrix preview offers a glimpse into how their portfolio might stack up. See which of their offerings could be driving growth and which might require a closer look.

This initial overview highlights the potential to identify market leaders and resource drains within Prologis's operations. Understanding these dynamics is crucial for any investor or competitor seeking to navigate the logistics real estate landscape.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Prologis' dominant e-commerce fulfillment centers are stars in their portfolio, thriving in prime urban locations essential for fast delivery. These logistics hubs benefit from consistent demand driven by the ongoing growth of online shopping. In 2024, Prologis reported continued strength in these markets, with high occupancy rates and sustained rental growth, reflecting their critical role in the modern supply chain.

Prologis strategically targets high-growth regions, particularly the U.S. Southeast and Texas, alongside key markets in Latin America like Brazil and select European hubs. These areas are characterized by robust economic expansion, increasing populations, and dynamic shifts in supply chain demands, all fueling a strong need for contemporary logistics facilities.

This focus allows Prologis to capture significant market share as these regions experience heightened activity. For instance, the U.S. Southeast's logistics real estate market has seen consistent rental growth, with average rents increasing by over 7% year-over-year in many submarkets as of early 2024. This upward trend underscores the demand Prologis is well-positioned to meet.

Prologis's established presence and deep understanding of these specific markets translate into a distinct competitive edge. Their ability to identify and secure prime locations before competitors is crucial, especially as demand for modern warehousing continues to outpace supply in these booming economic zones.

Prologis is significantly expanding its portfolio of advanced, sustainable logistics facilities, integrating automation and AI to meet tenant demand. These modern, energy-efficient buildings offer reduced operational costs for customers and satisfy increasing ESG requirements, leading to longer leases and higher rental income.

In 2024, Prologis's focus on sustainability is demonstrated by its commitment to achieving net-zero emissions by 2040. The company is actively scaling clean energy solutions across its properties, enhancing their attractiveness and long-term value.

Data Center Co-location and Power Expansion

Prologis is making significant moves to expand its power capacity for data centers within its extensive logistics parks. This strategic expansion leverages their existing robust infrastructure and vast land holdings to tap into the booming data center sector, which is projected for substantial growth through 2024 and beyond.

This initiative offers Prologis the potential for substantially higher yields compared to its traditional, albeit strong, warehouse operations. By integrating data center facilities, Prologis aims to capture new and lucrative revenue streams, particularly from major tech companies and other businesses with significant power demands.

- Data Center Market Growth: The global data center colocation market was valued at approximately $60 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 12% through 2029, indicating strong demand for power-intensive facilities.

- Prologis's Strategic Advantage: Prologis's existing land portfolio and infrastructure provide a unique platform for efficient power deployment, reducing development costs and time-to-market for new data center capacity.

- Yield Enhancement: Data center colocation services typically command higher rental rates and offer greater potential for ancillary service revenues than standard industrial warehouse space, boosting overall property yields.

- Capturing Tech Demand: Major cloud providers and tech enterprises are actively seeking hyperscale data center solutions, presenting Prologis with an opportunity to secure long-term leases with creditworthy tenants.

Strong Build-to-Suit Development Pipeline

Prologis's strong build-to-suit development pipeline is a key differentiator, allowing them to create highly customized logistics facilities for specific client needs. This strategic approach ensures high occupancy rates and provides tailored solutions that truly meet tenant requirements. For instance, in 2024, Prologis continued to emphasize build-to-suit projects, particularly for large e-commerce and retail clients seeking specialized distribution centers. This focus on pre-leased developments helps them navigate market uncertainties while securing stable revenue streams.

This strategy allows Prologis to capture growth opportunities even when speculative development might be slowing down. By concentrating on build-to-suit projects in areas with strong demand, they effectively mitigate market risks. Their ability to deliver these specialized facilities reinforces their market leadership and strengthens relationships with key customers who rely on these tailored solutions.

- Customized Facilities: Development of build-to-suit projects meets specific tenant operational requirements.

- High Occupancy: Pre-leased or build-to-suit nature of these developments ensures immediate occupancy.

- Market Risk Mitigation: Focus on demand-driven projects reduces exposure to speculative development downturns.

- Customer Retention: Tailored solutions foster strong, long-term relationships with strategic clients.

Prologis's prime logistics facilities, particularly those serving e-commerce, are definite stars. These properties are in high-demand urban locations crucial for rapid delivery, benefiting from the sustained growth of online retail. In 2024, Prologis highlighted the robust performance of these assets, citing high occupancy rates and consistent rental increases, affirming their indispensable role in today's supply chains.

What is included in the product

The Prologis BCG Matrix analyzes its portfolio, highlighting which logistics assets to invest in, hold, or divest based on market growth and share.

Clear, actionable insights from the Prologis BCG Matrix data, directly addressing the challenge of prioritizing strategic investments.

Cash Cows

Prologis's established global portfolio, spanning approximately 1.3 billion square feet in mature logistics hubs across 20 countries, represents its core Cash Cow.

These prime assets, concentrated in stable U.S. and European markets, are the bedrock of its significant rental income and consistent cash flow generation.

With occupancy rates holding strong at around 94.9% as of Q1 2025, these properties demonstrate exceptional stability and reliable income streams.

The mature nature of these markets and the high demand for Prologis's well-located industrial real estate solidify their position as dependable cash generators.

Prologis's long-term leases with blue-chip tenants are a core strength, acting as a significant cash cow. Their customer base is nicely spread across various sectors like manufacturing, retail, and logistics, meaning they aren't overly dependent on any one industry. This diversification, coupled with leases that often span many years, creates a very stable and predictable revenue stream.

This stability is further bolstered by strong customer relationships. In 2024, Prologis continued to see high customer retention rates, a testament to their service and the essential nature of their logistics facilities. A high Net Promoter Score, often exceeding 50, indicates that their clients are very satisfied, leading to consistent renewal of leases and ongoing cash flow generation.

For instance, as of early 2024, Prologis reported that over 90% of their revenue came from existing customers, with a significant portion of their lease agreements extending beyond five years. This points to a predictable and consistent inflow of cash, making these operations a true cash cow for the company.

Prologis consistently demonstrates robust pricing power through significant cash rent changes during lease renewals and new lease agreements, particularly in its established markets. For instance, through the first quarter of 2024, Prologis reported a 35.7% mark-to-market on new and renewal leases in the US, highlighting sustained demand and its ability to command higher rental rates.

Even with some market adjustments, Prologis's in-place rents remain notably below current market levels across numerous locations. This gap presents a substantial mark-to-market opportunity, ensuring a continuous upward trend in rent growth. The company's strategic advantage lies in its capacity to leverage these existing assets to achieve higher rental income, solidifying their position as cash cows.

Strategic Capital Business and Fund Management

Prologis's strategic capital business, which includes co-investment ventures and funds, is a significant driver of its fee and promote revenue. This segment, holding a substantial portion of its assets under management, generates stable management fees from its institutional investor base. These funds capitalize on Prologis's deep expertise and extensive portfolio, delivering a consistent and low-risk revenue stream.

As of the first quarter of 2024, Prologis reported that its strategic capital segment managed approximately $67 billion in assets. This robust AUM translates into predictable management fees. For context, in 2023, Prologis's total fee revenue, which this segment heavily influences, reached $1.2 billion, showcasing its importance to the company's overall financial health.

- Significant AUM: Managed approximately $67 billion in assets as of Q1 2024, providing a substantial base for fee generation.

- Fee Revenue Driver: Contributes significantly to Prologis's fee and promote revenue streams.

- Stable Income: Generates consistent management fees from institutional investors due to its low-risk nature.

- Leveraging Expertise: Utilizes Prologis's industry knowledge and portfolio to attract capital and deliver returns.

Efficient Property Management and Operations

Prologis's operational excellence, honed over years of industry leadership, translates directly into strong cash flow from its established properties. This deep experience, coupled with an integrated platform, allows for superior property management and cost control, a hallmark of a cash cow. For instance, in 2023, Prologis reported a Funds From Operations (FFO) of $5.51 billion, demonstrating the robust profitability of its mature asset base.

The company's commitment to advanced analytics and technology is key to maximizing the efficiency of its vast portfolio. By optimizing space utilization and streamlining operational expenses, Prologis ensures that its existing, high-performing assets generate substantial cash. This focus on efficiency directly contributes to higher profit margins and consistent cash generation.

- Leveraging Technology: Prologis utilizes data analytics to enhance occupancy rates and reduce operating expenses across its global logistics facilities.

- Cost Optimization: The company's integrated platform enables economies of scale in property management, leading to lower per-square-foot operating costs.

- Profitability Driver: These operational efficiencies directly translate into maximized profit margins and reliable cash flow from their established portfolio.

Prologis's established global portfolio, spanning approximately 1.3 billion square feet in mature logistics hubs across 20 countries, represents its core Cash Cow.

These prime assets, concentrated in stable U.S. and European markets, are the bedrock of its significant rental income and consistent cash flow generation.

With occupancy rates holding strong at around 94.9% as of Q1 2025, these properties demonstrate exceptional stability and reliable income streams.

The mature nature of these markets and the high demand for Prologis's well-located industrial real estate solidify their position as dependable cash generators.

| Metric | Value | Period |

| Occupancy Rate | 94.9% | Q1 2025 |

| Mark-to-Market (US) | 35.7% | Q1 2024 |

| Funds From Operations (FFO) | $5.51 billion | 2023 |

| Assets Under Management (Strategic Capital) | $67 billion | Q1 2024 |

| Fee Revenue | $1.2 billion | 2023 |

Preview = Final Product

Prologis BCG Matrix

The Prologis BCG Matrix you are previewing is the identical, fully rendered document you will receive upon completing your purchase, offering an immediate, unadulterated strategic tool.

This comprehensive analysis, showcasing Prologis's portfolio across the BCG Matrix quadrants, is exactly what you'll download, ensuring no surprises and immediate utility for your business planning.

What you see here is the definitive Prologis BCG Matrix, ready for immediate application; the purchased version will be precisely the same, devoid of any watermarks or demo content.

This preview accurately represents the final Prologis BCG Matrix report you will obtain, providing a clear, actionable framework for understanding their market positions without any hidden alterations.

Dogs

Properties situated in industrial zones facing persistent economic downturns or significant shifts away from conventional logistics operations often fall into the dog category within a portfolio. These assets typically contend with reduced occupancy levels and subdued rental income expansion. For instance, industrial properties in regions heavily reliant on manufacturing that has largely relocated might see occupancy rates dip below 80%.

Maintaining these underperforming assets can demand a substantial portion of resources, yielding meager financial returns in comparison. This often translates to higher-than-average capital expenditure per occupied square foot for upkeep and necessary upgrades, eating into any potential profits. In 2024, some older industrial assets in Rust Belt cities saw operating expenses increase by over 15% year-over-year due to deferred maintenance.

Consequently, these properties represent prime candidates for strategic divestiture to optimize the overall portfolio's performance and resource allocation. Selling these dogs can free up capital that can be reinvested in more promising growth areas or modern, high-demand logistics facilities. For example, Prologis has actively divested older, less efficient assets in tertiary markets to focus on gateway cities with strong demand fundamentals.

Certain submarkets, particularly those experiencing a significant increase in new industrial property development alongside weaker demand, can lead to higher vacancy rates and downward pressure on rental income. While Prologis, a major player in industrial real estate, typically steers clear of oversupply situations, some of its smaller, less strategically positioned assets in these challenged areas might not perform as expected.

These specific holdings could struggle to generate enough cash flow to cover their ongoing expenses, effectively becoming what are known as cash traps. For instance, in early 2024, some secondary markets saw vacancy rates climb to over 5%, a noticeable increase from previous years, impacting rental growth potential for properties in those locations.

Prologis strategically divests assets that no longer fit its core mission of prime logistics real estate in high-growth, high-barrier markets. This proactive approach ensures capital is reinvested in opportunities that offer superior returns and strategic alignment. For instance, Prologis has previously exited markets or sold portfolios that didn't meet evolving investment criteria or where a reduced presence was deemed more beneficial.

A notable example of this strategic pruning was the disposition of a 5 million square foot portfolio in Minneapolis-St. Paul. This move exemplifies Prologis' commitment to optimizing its real estate holdings, shedding properties that may not offer the same long-term growth potential as its core investments. Such sales are crucial for maintaining a lean, high-performing portfolio.

Assets Requiring Extensive, Uneconomical Turnaround Investments

Properties demanding substantial capital for modernization to align with current logistics needs, especially when situated in areas with dim long-term growth potential, can be categorized as dogs within the Prologis BCG Matrix. The expense associated with revitalizing these assets frequently exceeds their projected future earnings, making their sale a more sensible strategy.

Such holdings immobilize capital that could be more effectively allocated to ventures with higher return potential. For instance, older industrial warehouses in declining manufacturing hubs might require millions in upgrades for automation and climate control, yet their location may limit rental growth to single-digit percentages annually, yielding a poor return on investment compared to newer, strategically located facilities.

- High Renovation Costs: Properties needing significant investment for upgrades like enhanced clear heights, modern dock doors, or advanced fire suppression systems.

- Limited Growth Prospects: Assets located in regions experiencing economic contraction or population decline, impacting future rental demand and appreciation.

- Uneconomical Turnaround: The cost-benefit analysis of bringing these properties up to modern standards shows a low or negative return on investment.

- Capital Recapture: Divesting these assets frees up capital for investment in high-growth potential properties or new development projects.

Small, Isolated Properties with Limited Network Synergy

Small, isolated properties within Prologis's portfolio might struggle to achieve optimal efficiency. These individual or small clusters of assets, lacking the scale and strategic connections of larger, integrated logistics parks, can be more challenging and costly to manage and market effectively. For instance, in 2024, Prologis reported a global portfolio of over 1 billion square feet, emphasizing the network effect of its larger hubs. Isolated properties may not fully leverage the operational synergies or established customer relationships that benefit from Prologis's extensive network.

Furthermore, these isolated assets often possess a limited market share within their specific micro-markets. This reduced competitive standing can hinder their ability to attract and retain high-value customers, potentially impacting rental income and occupancy rates. While Prologis focuses on strategic locations, smaller, standalone properties might not command the same pricing power or demand as those situated within a dense cluster of logistics facilities.

- Limited Network Synergy: Isolated assets do not benefit from the same scale and connectivity as larger Prologis hubs.

- Operational Inefficiencies: Management and marketing of standalone properties can be less efficient compared to integrated parks.

- Lower Market Share: These properties may hold a smaller share in their respective micro-markets, reducing competitive advantage.

- Reduced Customer Access: They might not tap into the same broad customer relationships that Prologis cultivates across its larger network.

Properties that are underperforming due to obsolescence or location in declining economic zones are classified as dogs. These assets often require significant capital for upgrades that may not yield proportional returns, such as older warehouses in former manufacturing hubs. For example, a 2024 report highlighted that industrial properties in tertiary markets with limited access to major transportation networks saw rental growth of less than 2%, significantly trailing prime markets.

These assets can become cash traps, consuming resources without generating sufficient income, and are candidates for divestment to reallocate capital. Prologis's strategy involves shedding less productive assets to focus on core markets, exemplified by past portfolio sales in secondary locations to reinvest in growth areas. This pruning ensures capital is directed toward opportunities with higher return potential.

The financial reality of these dog assets is their low return on investment, often due to high renovation costs versus limited rental upside. Properties needing substantial modernization, like enhanced clear heights or advanced fire suppression, in areas with poor long-term growth prospects, fall into this category. Divesting them allows for capital recapture and reinvestment in more promising logistics facilities.

| Asset Characteristic | Prologis BCG Matrix Classification | Example Scenario | 2024 Market Insight |

|---|---|---|---|

| Location in declining industrial region | Dog | Warehouse in a city with a closed major factory | Vacancy rates in some secondary industrial markets rose to 5% in early 2024. |

| Requires extensive modernization for current logistics needs | Dog | Older facility with low clear heights needing climate control | Capital expenditures for modernization can exceed 30% of asset value for older stock. |

| Low rental growth prospects | Dog | Property in a tertiary market with limited infrastructure | Rental growth in prime markets averaged 7-9% in 2024, while tertiary markets saw sub-3% growth. |

| High operating expenses relative to income | Dog | Asset with deferred maintenance and high utility costs | Operating expenses for older industrial assets increased by over 15% YoY in 2024 in some regions. |

Question Marks

Prologis is strategically investing in early-stage developments in emerging logistics hubs. These are areas identified for significant future growth where their current market presence is minimal but the potential upside is substantial.

These forward-thinking projects, often speculative in nature, require considerable upfront capital. The goal is to secure a first-mover advantage in these nascent, high-potential markets, anticipating their future expansion.

The success of these ventures relies heavily on the targeted markets developing as projected and Prologis successfully capturing a meaningful share of that growth. For instance, in 2024, Prologis announced significant land acquisition and development plans in Southeast Asia, a region expected to see robust e-commerce growth, with investment projected to exceed $500 million.

Prologis is strategically investing in niche logistics sectors such as cold storage and multi-story urban facilities. These specialized areas are experiencing significant growth due to evolving consumer demands and supply chain complexities. For instance, the global cold chain market was valued at approximately $170 billion in 2023 and is projected to reach over $300 billion by 2028, showcasing the immense potential.

While these specialized segments offer high-growth prospects, Prologis's market share within them might still be relatively nascent compared to traditional industrial logistics. Establishing a strong foothold requires substantial capital expenditure for developing the necessary infrastructure and technology. This investment is crucial for scaling operations and achieving market leadership in these emerging specialized areas.

Prologis' expansion into new geographic markets, particularly those with limited existing operations, places them in a classic question mark scenario within the BCG matrix. These ventures demand substantial upfront investment to acquire land, develop facilities, and build brand recognition. For instance, while Prologis has a strong presence in North America and Europe, entering emerging markets in Southeast Asia or Africa would represent a significant strategic bet.

The success of these new market entries hinges on Prologis' ability to navigate complex local landscapes, including varying regulatory frameworks, land acquisition challenges, and the competitive intensity from established local players. A key factor will be their capacity to adapt their proven business model to the unique demands of each new territory. For example, understanding specific tax incentives or zoning laws in a new country is crucial for cost-effective development.

In 2024, Prologis continued its strategic global expansion, focusing on markets with strong secular tailwinds in e-commerce and supply chain modernization. While specific new market entries are often not detailed until they are well underway, the company's consistent capital allocation towards global growth initiatives signals a commitment to these question mark opportunities. Their ability to secure prime logistics locations and attract anchor tenants will be critical indicators of future success.

Prologis Ventures' Early-Stage Technology Investments

Prologis Ventures actively seeks out early- and growth-stage companies that are pushing the boundaries in logistics innovation. Their focus spans critical areas like artificial intelligence, automation technologies, and advancements in sustainable building solutions. These ventures are designed to secure Prologis's future competitive edge.

While these early-stage investments represent a high-risk, high-reward proposition, they are fundamental to Prologis's long-term strategy. The potential for substantial returns or significant enhancements to Prologis's existing operations is considerable, though not yet fully realized.

- Focus Areas: AI, automation, sustainable building technologies.

- Investment Stage: Early- and growth-stage companies.

- Strategic Importance: Crucial for future competitive advantage.

- Risk Profile: High-risk, high-reward.

Strategic Initiatives to Support EV Fleets and Battery Storage

Prologis is actively investing in expanding its electric vehicle (EV) charging infrastructure and battery storage capabilities across its logistics facilities. This strategic move directly addresses the growing demand from customers seeking to decarbonize their transportation operations. For instance, in 2024, Prologis announced plans to install charging stations at numerous sites globally, aiming to support the electrification of last-mile delivery fleets.

While these initiatives align with a high-growth market trend, the financial viability and broad market acceptance are still in formative stages. The significant capital outlay for these advanced infrastructure solutions means that their full return on investment and widespread adoption are projected over the coming years. Nevertheless, Prologis's commitment positions them to capture future value as EV penetration accelerates.

- Capacity Expansion: Prologis is increasing its EV charging points, anticipating a surge in demand from logistics companies transitioning to electric fleets.

- Battery Storage Integration: The company is incorporating battery storage systems to manage energy demand efficiently and provide reliable power for charging operations.

- Customer Demand Driven: Investments are directly responsive to requests from Prologis customers looking to meet their sustainability targets and operational needs.

- Developing Profitability: While currently an investment-heavy area, the long-term profitability is expected as EV adoption scales and energy management solutions mature.

Question marks represent Prologis's investments in new geographic markets and specialized logistics sectors. These are areas with high growth potential but also significant uncertainty regarding market penetration and profitability. For example, Prologis's expansion into Southeast Asia in 2024, a region with burgeoning e-commerce, fits this category. The success of these ventures hinges on Prologis's ability to adapt its model and capture market share amid evolving local conditions.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitive landscape analysis, to provide strategic insights.