Prologis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prologis Bundle

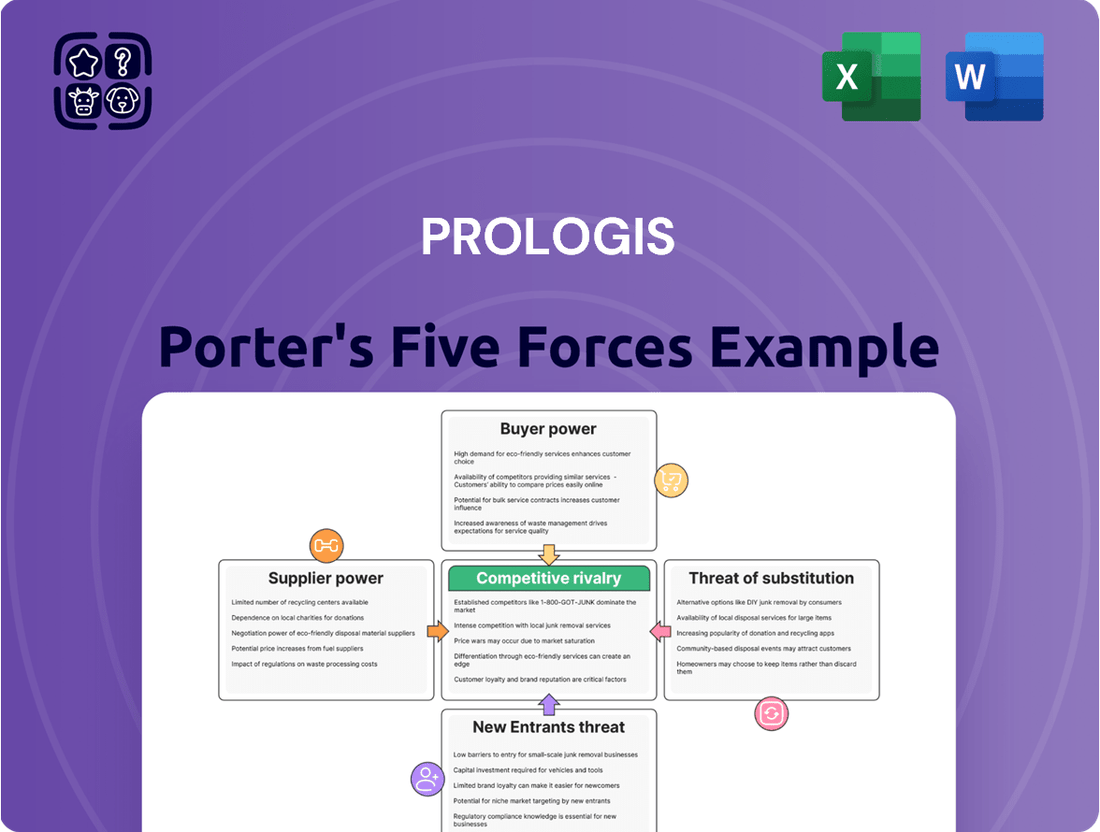

Prologis, a leader in logistics real estate, faces significant competitive pressures that shape its market. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Prologis’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Prologis faces a significant challenge due to the scarcity of prime land in high-barrier, high-growth logistics markets. This limited supply grants considerable bargaining power to landowners, allowing them to dictate higher prices and more advantageous lease terms. For instance, in 2024, the average cost of industrial land in key logistics hubs saw an increase of 8-12% year-over-year, directly escalating Prologis's development expenses and potentially hindering its expansion plans.

The critical nature of location for supply chain efficiency further strengthens the hand of those who control these sought-after parcels. Proximity to major transportation networks and consumer centers is paramount, and with fewer available sites, landowners can leverage this demand to secure premium pricing. This dynamic directly impacts Prologis's ability to acquire land at competitive rates, influencing its overall profitability and strategic growth trajectory.

The construction of Prologis's extensive, state-of-the-art logistics centers hinges on specialized construction firms and a highly skilled workforce. While Prologis's considerable size may grant it some leverage in negotiations, the intense demand for these niche construction services, particularly when labor markets are constrained, can drive up expenses. For instance, in 2024, construction labor shortages in key markets pushed up wages and material costs for large-scale projects.

Furthermore, the increasing integration of advanced automation and the growing emphasis on sustainable building techniques narrow the field of qualified contractors. These specialized requirements mean Prologis cannot simply switch to any builder; they must engage firms with specific expertise, thereby enhancing the bargaining power of these select suppliers.

Suppliers of essential building materials such as steel, concrete, and advanced roofing systems hold significant leverage due to their ability to adjust prices. These fluctuations are often tied to global commodity market volatility, unforeseen supply chain interruptions, and the increasing impact of environmental compliance mandates.

Prologis, a prominent player in real estate development, faces direct exposure to these material cost swings, which can significantly affect their project budget allocations and overall profitability. For instance, steel prices saw considerable upward pressure in early 2024, impacting construction costs globally.

To counter this supplier power, Prologis actively employs strategies like robust, long-term procurement contracts. This approach helps to lock in prices and ensure a more predictable cost structure, thereby reducing the immediate impact of market volatility.

Furthermore, diversifying their supplier base and exploring alternative, sustainable materials are key tactics in mitigating the bargaining power of individual suppliers, ensuring greater resilience in their supply chain management.

Technology and Automation Providers

As Prologis and other logistics giants increasingly adopt advanced automation, robotics, and smart building technologies within their facilities, the companies providing these specialized solutions are experiencing a surge in their bargaining power. This is because the adoption of such sophisticated systems often requires unique expertise and a proven track record, limiting the pool of viable suppliers. For instance, the global market for warehouse automation is projected to reach over $30 billion by 2026, indicating significant investment and a growing reliance on a select group of technology providers.

This concentration of specialized knowledge means that few vendors can offer the comprehensive integration and support necessary for these complex systems. Consequently, Prologis may face higher upfront implementation costs and a prolonged dependence on these specific suppliers for crucial maintenance, software updates, and future upgrades. The proprietary nature of many of these technologies further solidifies the suppliers' leverage, as switching providers can be technically challenging and prohibitively expensive.

- Limited Vendor Pool: The specialized nature of advanced logistics automation means fewer companies possess the required expertise, concentrating power among a select few.

- Proprietary Technologies: Many automation solutions are proprietary, creating lock-in effects and increasing dependence on the original provider.

- High Implementation Costs: The complexity of integrating new technologies can lead to substantial upfront investments, enhancing supplier bargaining power.

- Ongoing Support Needs: Essential maintenance, upgrades, and software support create continued reliance on technology providers, solidifying their bargaining position.

Utility and Infrastructure Providers

Utility and infrastructure providers, such as electricity, water, and gas companies, frequently operate as regional monopolies. For Prologis, this means limited options when it comes to connecting its logistics facilities to essential services. This lack of alternatives grants these suppliers significant leverage in negotiating pricing and service agreements.

The bargaining power of these utility and infrastructure providers can directly impact Prologis's operational expenses. For instance, in 2024, the average industrial electricity rate in the United States was approximately $0.11 per kilowatt-hour, a figure that can fluctuate based on regional supply and demand, as well as the terms negotiated with utility monopolies. These costs are a crucial factor in Prologis's site selection and development decisions, as reliable and cost-effective utility access is paramount for warehouse operations.

- Monopolistic Tendencies: Utility companies often hold exclusive rights in specific geographic areas, reducing competition and increasing their bargaining power.

- Essential Services: Access to electricity, water, and gas is non-negotiable for modern logistics facilities, making Prologis dependent on these providers.

- Cost Impact: Higher utility rates directly translate to increased operating costs for Prologis's properties.

- Site Selection Influence: The availability and cost of utility services are key determinants in choosing new development locations.

The bargaining power of suppliers for Prologis is amplified by the scarcity of prime land in desirable logistics markets, where landowners can command higher prices and terms. This is further compounded by the specialized nature of construction firms and material providers, especially for advanced logistics facilities. Additionally, companies supplying proprietary automation and essential utilities often operate with limited competition, giving them significant leverage.

In 2024, Prologis faced rising costs due to these supplier dynamics, with industrial land prices increasing 8-12% in key hubs and steel prices experiencing upward pressure. This highlights the direct impact on development expenses and profitability.

| Supplier Type | Key Leverage Factor | 2024 Impact Example |

|---|---|---|

| Landowners | Scarcity of prime locations | 8-12% increase in industrial land costs |

| Construction Firms | Specialized expertise, labor shortages | Increased wages and material costs for large projects |

| Material Suppliers | Commodity price volatility | Upward pressure on steel prices |

| Automation Providers | Proprietary technology, limited vendors | Higher upfront implementation costs |

| Utility Providers | Regional monopolies | Average industrial electricity rate ~$0.11/kWh |

What is included in the product

Analyzes the bargaining power of Prologis' customers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the logistics real estate sector.

Instantly identify and address competitive pressures with a dynamic visualization of Prologis' Porter's Five Forces, making strategic adjustments easier.

Customers Bargaining Power

For Prologis's customers, relocating a large-scale logistics operation involves substantial costs. These include moving inventory, reconfiguring supply chains, installing new equipment, and potential business disruption.

These high switching costs significantly reduce the bargaining power of existing tenants. This makes them less likely to move even if marginal price differences exist, creating a sticky customer base for Prologis.

In 2024, the demand for modern logistics facilities remained robust, with Prologis reporting strong leasing activity. This sustained demand further solidifies the advantage of high switching costs for Prologis's tenant base.

Prologis's customer base is remarkably diverse, spanning industries like manufacturing, retail, and e-commerce. This wide reach, from global giants to smaller businesses, means no single client wields outsized influence. For instance, in 2024, Prologis reported a global portfolio of over 1 billion square feet, serving tens of thousands of customers, underscoring this fragmentation.

The sheer number of customers across various sectors dilutes the bargaining power of any individual or small group. A customer leaving or renegotiating terms, while impactful for that specific lease, doesn't pose a systemic risk to Prologis's revenue streams. This broad customer appeal, with demand coming from numerous industries, effectively shields Prologis from concentrated customer pressure.

Prologis's strategic emphasis on prime, high-barrier markets significantly shapes the bargaining power of its customers. These locations are critical logistics hubs, offering proximity to major consumer bases and extensive transportation infrastructure. For instance, Prologis's portfolio in key gateway markets like Southern California, a vital node for US trade, means customers are heavily reliant on these sites for efficient operations.

The scarcity of comparable, strategically advantageous locations limits customers' leverage. When a Prologis property offers unparalleled access to ports, major highways, and a skilled workforce, the customer's ability to negotiate lower rents or more favorable lease terms diminishes. This is particularly true in 2024, where demand for industrial space in these prime areas remains robust, driven by e-commerce growth and supply chain resilience efforts.

Long-Term Lease Agreements

Prologis's long-term lease agreements, typically spanning five to ten years, significantly curb customer bargaining power. These extended contracts lock in tenants, creating predictable revenue for Prologis and limiting opportunities for customers to renegotiate terms frequently. While market shifts can impact renewals, the duration of these leases inherently reduces a customer's leverage in the short term.

- Lease Duration: Prologis's standard leases are 5-10 years, providing significant revenue stability.

- Reduced Renegotiation: Long terms limit how often customers can press for better terms.

- Market Influence: While market conditions play a role at renewal, the lease length dampens immediate bargaining strength.

Value-Added Services and Global Network

Prologis differentiates itself by offering more than just industrial real estate. Their value-added services, including advanced property management and sustainability consulting, create stickiness. This means customers are less likely to switch providers based solely on price when they receive a comprehensive, integrated solution. For instance, Prologis's focus on ESG (Environmental, Social, and Governance) initiatives, such as solar installations and energy efficiency programs, adds tangible value that competitors without such capabilities struggle to match, thereby reducing customer bargaining power.

The company’s extensive global network is another key factor. With operations in 19 countries, Prologis provides consistent service and access to critical logistics hubs worldwide. This broad reach is particularly valuable for multinational corporations that require standardized solutions across different regions. In 2024, Prologis continued to expand its portfolio, reinforcing its position as a global leader and making it difficult for customers to find comparable alternatives that offer the same level of geographic coverage and operational reliability.

- Global Network Advantage: Prologis operates in key markets across the Americas, Europe, and Asia, offering customers consistent service and access to vital logistics infrastructure.

- Integrated Service Offering: Beyond space, Prologis provides property management, sustainability solutions, and technology integration, increasing switching costs for clients.

- Reduced Price Sensitivity: The comprehensive value proposition makes customers less sensitive to price alone, as they are buying a bundled solution rather than just real estate.

- Enhanced Customer Loyalty: By delivering superior services and global reach, Prologis fosters stronger customer relationships, diminishing individual customer leverage.

The bargaining power of Prologis's customers is notably low, primarily due to high switching costs associated with relocating large logistics operations. These costs, encompassing inventory movement, supply chain reconfiguration, and potential business disruptions, make tenants hesitant to move, even for minor price differences. Furthermore, Prologis's diverse customer base, spanning numerous industries and tens of thousands of clients globally, means no single entity holds significant sway. For instance, in 2024, Prologis’s extensive portfolio of over 1 billion square feet across 19 countries highlights this broad customer reach, effectively diluting individual customer leverage.

| Factor | Impact on Customer Bargaining Power | Prologis's Position (2024 Data) |

|---|---|---|

| Switching Costs | High | Significant costs for tenants to relocate logistics operations. |

| Customer Base Diversity | Low | Tens of thousands of customers across diverse industries, preventing concentrated influence. |

| Lease Duration | Low | Standard 5-10 year leases lock in tenants and revenue. |

| Strategic Location Scarcity | Low | Prime, high-barrier locations limit customer alternatives. |

| Value-Added Services | Low | Property management, sustainability, and technology integration increase stickiness. |

What You See Is What You Get

Prologis Porter's Five Forces Analysis

This preview showcases the complete Prologis Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the logistics real estate sector. You're looking at the actual document, meaning the same professionally written and formatted analysis you'll receive instantly upon purchase. This comprehensive breakdown covers the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. You'll gain immediate access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

Prologis contends with formidable rivals like Rexford Industrial and international entities such as Goodman Group, all possessing substantial industrial real estate portfolios and development expertise. This intense competition is evident in the race for prime land acquisitions and development projects, particularly in crucial logistics corridors where demand is high.

The acquisition of Duke Realty by Prologis in 2023, a deal valued at approximately $26 billion, underscores the consolidation trend and the immense capital deployed by major players. This merger itself reshapes the competitive landscape, concentrating market share and intensifying rivalry with remaining large industrial REITs.

These well-capitalized competitors, much like Prologis, benefit from strong balance sheets and established relationships, enabling them to pursue aggressive growth strategies. This includes securing favorable financing for new developments and offering competitive lease terms to attract and retain major industrial tenants, directly impacting Prologis' market position.

The concentration of assets and capabilities among a few large industrial REITs means that competition for market share, talent, and capital is perpetually fierce. This dynamic forces all players, including Prologis, to maintain operational efficiency and strategic foresight to remain leaders in the sector.

Prologis faces significant competition from a multitude of smaller, localized players beyond the major global industrial REITs. These regional and local developers often possess deep understanding of specific submarkets and may have access to advantageous land positions, allowing them to offer tailored solutions or more aggressive pricing in their immediate areas. While their individual scale is limited compared to Prologis, their collective impact across various geographies creates a complex competitive landscape.

The industrial real estate sector demands massive capital for land, construction, and upkeep, creating a landscape where deep pockets and varied financing are key. Prologis, with its robust financial standing, is well-positioned to navigate these substantial investment requirements.

Companies like Prologis face intense competition, particularly in securing prime development locations. The lengthy timelines and significant upfront expenditures inherent in industrial real estate projects mean that success hinges on efficient project execution and strategic site acquisition.

As of the first quarter of 2024, Prologis reported total assets of approximately $100.5 billion, underscoring the capital-intensive nature of its operations and its capacity to undertake large-scale developments.

Differentiation Through Technology and Sustainability

Competitive rivalry in the logistics real estate sector is intensifying, with differentiation increasingly centered on technology and sustainability rather than solely on location and price. Prologis and its competitors are channeling significant capital into advanced solutions. This includes smart building technologies for enhanced operational efficiency, automation readiness to support evolving logistics needs, and sustainable design features like rooftop solar installations and improved energy efficiency.

These investments are not merely about keeping pace; they are about securing a competitive advantage. Companies that successfully implement and offer more technologically sophisticated, efficient, and environmentally conscious facilities are better positioned to attract and retain tenants. For instance, Prologis reported in its 2023 earnings that its solar initiatives generated $120 million in earnings and cash flow. This focus on innovation pushes rivals to accelerate their own development efforts, lest they face erosion of market share.

- Technological Integration: Investment in smart sensors, IoT, and data analytics for optimized building management and tenant services.

- Sustainability Focus: Implementation of solar power, EV charging infrastructure, and green building materials to meet ESG demands.

- Automation Readiness: Designing facilities to accommodate advanced robotics and automated material handling systems.

- Tenant Value Proposition: Offering spaces that reduce operating costs and improve supply chain efficiency for customers.

Mergers, Acquisitions, and Market Consolidation

The industrial real estate sector is experiencing significant consolidation, with major players like Prologis actively engaging in mergers and acquisitions. A prime example is Prologis's acquisition of Duke Realty in 2023 for $26 billion, a deal that dramatically reshaped the market by combining two of the largest industrial REITs in the United States. This trend reduces the number of dominant competitors but often intensifies rivalry among the remaining large entities, as they vie for market share and operational efficiencies.

These consolidation activities lead to substantial economies of scale and increased market power for the surviving firms. For instance, the Prologis-Duke Realty merger created a combined entity with a portfolio spanning over 1 billion square feet across 19 countries. This scale provides enhanced bargaining power with suppliers and customers, as well as greater capacity for capital deployment, making it increasingly challenging for smaller, regional players to compete effectively on price and service.

- Market Consolidation Impact: Acquisitions like Prologis's $26 billion purchase of Duke Realty in 2023 consolidate the industrial real estate sector.

- Intensified Rivalry: While reducing the number of major players, consolidation often heightens competition among the remaining large entities.

- Economies of Scale: Dominant firms gain significant economies of scale and market power, impacting competitive dynamics.

- Barriers for Smaller Players: Increased market power of larger entities creates higher barriers to entry and competition for smaller firms.

Competitive rivalry within the industrial real estate sector is fierce, characterized by significant capital deployment and strategic maneuvering among major players. Prologis, with approximately $100.5 billion in total assets as of Q1 2024, faces intense competition from well-capitalized rivals like Rexford Industrial and Goodman Group, who also boast extensive portfolios and development capabilities. This competition is particularly acute in the pursuit of prime logistics locations, driving up acquisition costs and development opportunities.

The landscape is also shaped by ongoing consolidation, exemplified by Prologis's $26 billion acquisition of Duke Realty in 2023. This merger created a combined entity exceeding 1 billion square feet globally, amplifying economies of scale and market power for the largest players. This concentration intensifies the rivalry among the remaining giants, forcing a continuous focus on innovation in technology and sustainability, such as Prologis's reported $120 million earnings from solar initiatives in 2023, to maintain a competitive edge.

| Competitor | Key Characteristics | Notable Activity (2023-2024) |

| Rexford Industrial | Focus on U.S. infill industrial properties, strong tenant relationships. | Continued strategic acquisitions and development in key U.S. markets. |

| Goodman Group | Global presence, integrated property services, focus on logistics and industrial sectors. | Expansion into new markets and development of large-scale logistics facilities. |

| Duke Realty (Acquired by Prologis) | Significant U.S. industrial portfolio, focus on development and leasing. | Acquisition by Prologis in 2023 for $26 billion, reshaping market concentration. |

SSubstitutes Threaten

A significant substitute threat for Prologis is customers undertaking self-ownership of logistics facilities. This involves large companies, especially those with substantial capital and long-term operational requirements, choosing to build or buy their own distribution centers instead of leasing. For instance, major e-commerce players or large automotive manufacturers might find it strategic to own their logistics assets to have complete control over customization and operational flow.

This self-ownership strategy allows for tailored facility design to meet specific operational needs and potentially offers long-term cost advantages by avoiding lease escalations. However, the substantial upfront capital investment and the need for specialized expertise in real estate development, construction, and ongoing facility management act as significant deterrents, thereby mitigating this threat for Prologis.

The burgeoning e-commerce sector and the escalating consumer expectation for rapid last-mile delivery are fueling the proliferation of micro-fulfillment centers within urban landscapes. These compact facilities, strategically positioned closer to end customers, can diminish reliance on vast, centrally located distribution hubs by decentralizing inventory.

While micro-fulfillment centers are not direct replacements for large-scale warehouses, their ability to hold and dispatch goods from closer proximity can lessen the demand for extensive stock in traditional, remote logistics parks. This shift could impact the necessity for exceptionally large, far-flung logistics facilities as a portion of the demand is absorbed by these agile, urban operations.

For instance, in 2024, reports indicated a significant investment in urban logistics infrastructure, with companies exploring smaller footprint solutions to optimize delivery times. The cost savings associated with reduced transportation miles and faster order fulfillment are key drivers for this trend, potentially altering the competitive dynamics for established, large-scale warehouse providers.

Technological advancements in storage and automation present a significant threat of substitutes for Prologis. Innovations like vertical storage solutions and advanced robotics can reduce the physical footprint needed for warehousing. For example, companies adopting these technologies might require less square footage, potentially slowing demand for new logistics facilities.

Highly efficient automation systems can also streamline operations, meaning businesses may need fewer or smaller warehouses to achieve the same throughput. This could directly impact Prologis's growth in developing new, larger facilities. In 2024, the automation market for warehouses saw substantial investment, with companies like Amazon continuing to expand their use of robotics, demonstrating the growing viability of these solutions.

While these technologies might reduce the need for extensive physical space, they often necessitate modern, purpose-built facilities. This is where Prologis can still leverage its expertise by providing the advanced infrastructure required to house and integrate these cutting-edge automation and storage systems, turning a potential threat into an opportunity.

Improvements in Transportation and Supply Chain Optimization

Improvements in transportation and supply chain optimization present a significant threat of substitutes for traditional logistics real estate. For instance, advancements in air cargo and high-speed rail can drastically cut delivery times, diminishing the reliance on strategically located warehouses for proximity to end consumers. In 2024, the global logistics market saw continued investment in technologies aimed at reducing transit times and improving efficiency.

Sophisticated supply chain management software, leveraging AI and predictive analytics, enables companies to maintain leaner inventories and implement just-in-time delivery models. This reduces the overall need for extensive storage space, a core offering of logistics companies like Prologis. By mid-2024, many large retailers reported significant reductions in inventory holding periods due to these technological integrations.

- Faster Shipping Methods: Innovations like drone delivery and hyperloop technology, while still developing, represent future substitutes for traditional warehousing by enabling direct, rapid delivery.

- Optimized Freight Logistics: Enhanced route planning and load consolidation reduce the need for intermediate storage points, making supply chains more direct.

- Predictive Analytics in Inventory Management: Companies can forecast demand more accurately, minimizing the buffer stock held in warehouses.

- Reduced Demand for Storage Space: These efficiencies collectively lower the demand for new or expanded logistics facilities, impacting rental income and asset values.

Shifting Global Supply Chain Strategies

Geopolitical shifts and evolving trade policies are prompting businesses to rethink where they manufacture and distribute goods. This can significantly impact the demand for logistics real estate.

Companies are increasingly exploring strategies like nearshoring, reshoring, or building more diversified supply chains to mitigate risks. For example, many companies have been reassessing their reliance on single-country sourcing following disruptions. This trend could lessen the demand for massive, centralized distribution centers in favor of smaller, more strategically located facilities closer to end markets.

- Supply Chain Diversification: In 2024, over 60% of companies surveyed by McKinsey were actively diversifying their supply chains beyond single-country dependence.

- Nearshoring Trends: Mexico, for instance, saw a significant increase in foreign direct investment in manufacturing in 2023, partly driven by nearshoring initiatives.

- Reshoring Initiatives: The US Department of Commerce reported a notable rise in manufacturing reshoring announcements in 2023 compared to previous years.

- Impact on Logistics: This geographic reallocation of production can reduce the need for extensive long-haul transportation and large import/export hubs, altering the traditional logistics real estate landscape.

The threat of substitutes for Prologis primarily stems from alternative methods of managing logistics and inventory that reduce the need for traditional, large-scale warehouse space. These substitutes range from companies owning their facilities to technological advancements and supply chain optimization strategies.

For instance, the rise of micro-fulfillment centers in urban areas, supported by significant 2024 investments in localized logistics, can decrease reliance on Prologis's larger, more remote facilities by decentralizing inventory. Furthermore, advancements in automation, with substantial warehouse automation market investments in 2024, allow companies to achieve higher throughput with less physical space, directly impacting demand for new facilities.

Additionally, improved transportation and supply chain software, which enabled many large retailers to reduce inventory holding periods by mid-2024, lessen the overall need for extensive storage. Geopolitical shifts and diversification trends, where over 60% of companies were actively diversifying supply chains in 2024, also contribute by potentially reducing demand for massive, centralized hubs.

| Threat of Substitute | Description | Impact on Prologis | 2024 Data/Example |

| Self-Ownership of Facilities | Large companies build or buy their own logistics centers. | Reduces leasing demand but requires significant capital, limiting its widespread adoption. | Major e-commerce players and automotive manufacturers often consider this for customization. |

| Micro-Fulfillment Centers | Smaller, urban facilities for faster last-mile delivery. | Diminishes reliance on large, central distribution hubs by decentralizing inventory. | Significant investment in urban logistics infrastructure in 2024 to optimize delivery times. |

| Technological Advancements (Automation/Vertical Storage) | Robotics and vertical systems reduce physical footprint needs. | Less square footage required, potentially slowing demand for new, large facilities. | Amazon continues to expand robotics use, demonstrating growing viability of these solutions. |

| Supply Chain Optimization & Faster Shipping | AI-driven inventory management, air cargo, high-speed rail. | Leaner inventories and just-in-time models reduce overall storage space needs. | Many retailers reported reduced inventory holding periods by mid-2024 due to tech integration. |

| Geopolitical Shifts & Supply Chain Diversification | Nearshoring, reshoring, and diversified sourcing. | Can reduce demand for massive, centralized distribution centers in favor of smaller, strategic locations. | Over 60% of companies surveyed in 2024 were diversifying supply chains; Mexico saw increased FDI in manufacturing in 2023 due to nearshoring. |

Entrants Threaten

The logistics real estate sector, where Prologis operates, demands substantial upfront investment. Acquiring prime land, constructing modern distribution centers, and managing extensive portfolios requires billions of dollars. For instance, Prologis’s total assets were valued at approximately $105 billion as of the end of 2023, highlighting the sheer scale of capital involved.

New companies looking to compete at this level must therefore secure massive amounts of financing. This high capital intensity acts as a significant deterrent, effectively limiting potential new entrants to only well-funded institutional investors or established real estate conglomerates with access to deep pockets. The barrier to entry is undeniably steep.

The scarcity of prime land and the specialized expertise needed for logistics development act as significant barriers to new entrants. Prologis competes in markets where suitable, logistics-zoned land is both limited and costly, making it difficult for newcomers to acquire prime development sites with crucial transportation access.

For instance, in many major industrial hubs, land prices have continued to climb. In the US, industrial land values in key markets saw substantial increases throughout 2023 and into early 2024, driven by sustained demand. Acquiring such sites requires substantial capital outlay and established relationships, posing a hurdle for new players.

Beyond land acquisition, developing modern logistics facilities demands intricate knowledge of construction, zoning regulations, and permitting processes. This requires a proven track record and significant investment in specialized teams and knowledge, which new entrants typically lack, thus reinforcing Prologis's position.

Prologis benefits immensely from its deeply entrenched tenant relationships, often spanning years and involving major global companies. This loyalty is hard for newcomers to replicate. For instance, Prologis reported in its 2023 annual report that its top 25 customers, representing approximately 40% of its rental revenue, have an average tenure of over 10 years.

The company's strong brand reputation for reliability and its comprehensive suite of services, from property management to data analytics, position it as a trusted partner. New entrants would face a significant hurdle in establishing this same level of trust and demonstrating comparable value propositions to sophisticated logistics operators.

Disrupting these established ties is challenging because businesses often prioritize stability and proven performance for their critical supply chain infrastructure. Switching providers can introduce operational risks and disruptions that most companies are unwilling to undertake lightly, especially when dealing with essential warehousing and distribution facilities.

Economies of Scale and Network Effects

Prologis leverages substantial economies of scale across its global operations, impacting everything from property management and technology investment to securing favorable financing terms. This scale allows for greater cost efficiencies that are difficult for new players to replicate quickly.

The company's extensive network is a significant barrier. Customers benefit from the ability to expand or shift operations seamlessly within Prologis's existing footprint, a flexibility that emerging competitors cannot easily match. For instance, Prologis reported having approximately 1.2 billion square feet of space in its portfolio as of late 2023, a scale new entrants would struggle to build rapidly.

New entrants face considerable challenges in overcoming these established economies of scale and network effects. Without a comparable global presence and the associated cost advantages, it is difficult for them to compete effectively on price or offer the same level of integrated service and flexibility that Prologis provides to its tenants.

- Economies of Scale: Prologis's large portfolio allows for cost savings in property management, financing, and technology adoption.

- Network Effects: A vast global network offers customers flexibility for expansion and relocation, a key competitive advantage.

- Barriers for New Entrants: New companies would struggle to match Prologis's scale and network, making it hard to compete on cost or service offerings.

Regulatory and Environmental Hurdles

Developing logistics real estate for companies like Prologis is a process fraught with regulatory complexities. Navigating intricate zoning laws, stringent environmental regulations, and the maze of permitting processes at local, regional, and national levels presents a significant barrier. These hurdles are not merely bureaucratic; they are time-consuming, expensive, and demand specialized legal and environmental expertise, which can be a steep learning curve for newcomers.

For potential new entrants, these regulatory challenges translate into increased risk and substantial upfront costs. The learning curve involved in understanding and complying with diverse regulations can lead to significant delays or even outright rejection of projects. For instance, in 2024, the average time to obtain construction permits in major industrial hubs often exceeded six months, with environmental impact assessments adding further weeks or months to the timeline. This lengthy and uncertain process effectively raises the cost of entry, making it harder for less established players to compete with incumbents like Prologis, who have established processes and expertise in managing these challenges.

- Zoning Laws: Local zoning ordinances dictate land use, building height, and operational restrictions, often requiring extensive public hearings and approvals.

- Environmental Regulations: Compliance with statutes like the Clean Air Act and the National Environmental Policy Act (NEPA) mandates assessments for potential impacts on air quality, water, and endangered species.

- Permitting Processes: Obtaining building permits, occupancy certificates, and specific operational licenses can involve multiple agencies and lengthy review periods, often extending well into 2024 and beyond.

- Expertise Requirement: Successfully navigating these regulations necessitates in-house or contracted legal and environmental consultants, adding significant overhead for new entrants.

The threat of new entrants into the logistics real estate sector is considerably low, primarily due to the immense capital requirements and the scarcity of prime development locations. Prologis’s substantial asset base, valued at around $105 billion at the close of 2023, underscores the enormous financial commitment needed to compete. This high capital intensity acts as a significant barrier, effectively filtering out all but the most well-capitalized institutional investors and established players.

Furthermore, the specialized expertise and established relationships required to navigate complex zoning, permitting, and environmental regulations present another formidable hurdle. Newcomers would find it exceptionally difficult to replicate the operational efficiencies and tenant loyalty, exemplified by Prologis's top customers averaging over a decade of tenancy, that Prologis has cultivated over years of operation. These factors combine to create a robust defense against new competition.

Porter's Five Forces Analysis Data Sources

Our Prologis Porter's Five Forces analysis is built on a foundation of diverse data, including Prologis' annual reports, investor presentations, and filings with the SEC. We also integrate industry-specific research from leading real estate analytics firms and macroeconomic data to provide a comprehensive view of the competitive landscape.