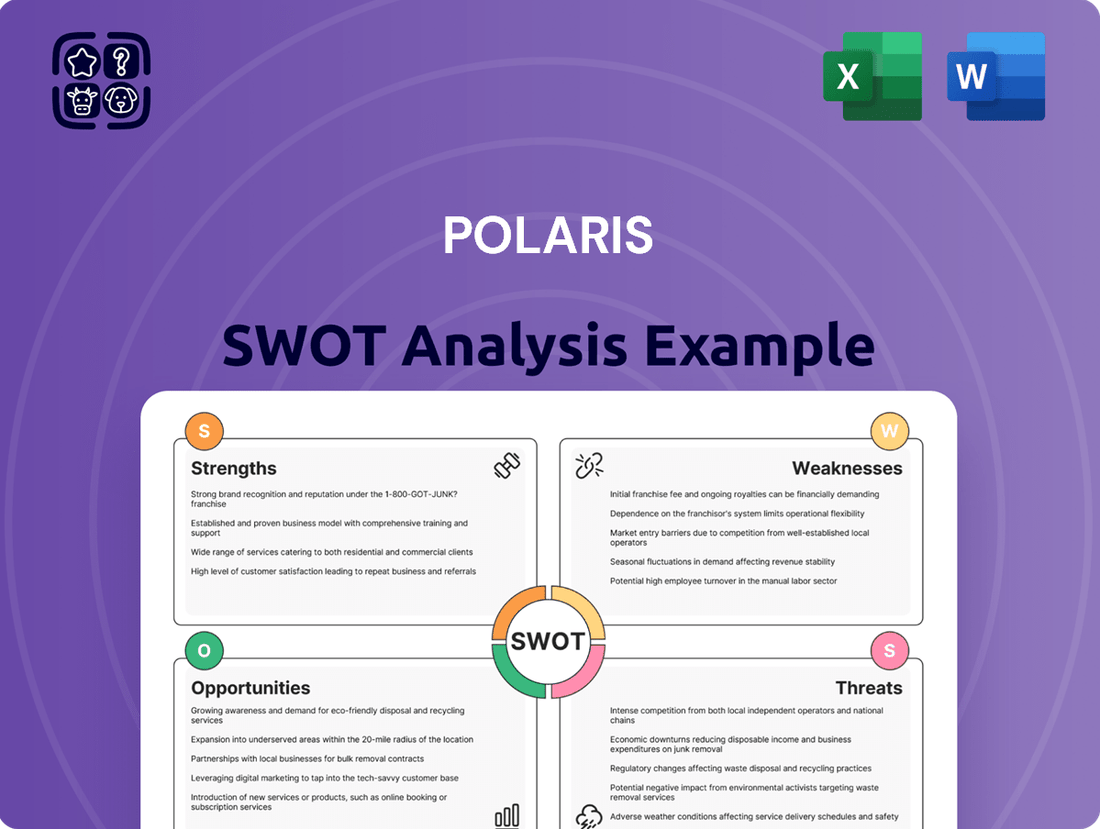

Polaris SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Polaris Bundle

Polaris, a leader in powersports, boasts strong brand loyalty and a diverse product portfolio, from snowmobiles to ATVs. However, the company faces intense competition and relies heavily on a few key markets, presenting potential vulnerabilities.

Discover the complete picture behind Polaris's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Polaris Inc. offers a robust and varied product lineup, encompassing off-road vehicles, snowmobiles, and motorcycles, notably through its Indian Motorcycle brand, alongside a significant presence in the marine sector with brands like Bennington. This broad product diversification serves to mitigate risk by lessening dependence on any single market segment, thereby appealing to a wide spectrum of consumers and bolstering overall market resilience.

The strength of Polaris's diverse portfolio is amplified by its powerful brand equity, with established names like Indian Motorcycle and Bennington Pontoon Boats commanding significant consumer loyalty and market recognition. For instance, in Q1 2024, Polaris reported net sales growth driven by strength in its Off-Road and Snowmobile segments, showcasing the continued demand for its diverse product offerings.

Polaris demonstrates a robust commitment to innovation, consistently channeling substantial resources into research and development. This dedication fuels the introduction of novel and enhanced product offerings, particularly in the rapidly expanding electric vehicle (EV) and smart connectivity sectors.

Their strategic investments in R&D are clearly paying off, positioning Polaris as a frontrunner in anticipating and shaping evolving market demands. This forward-thinking approach is crucial for maintaining a competitive edge in the dynamic powersports industry.

A prime example of this success is the RANGER XP Kinetic electric utility vehicle, which has garnered significant market traction and shows promising sales growth projections. This product's performance underscores Polaris's capability in developing and commercializing cutting-edge technologies.

Polaris boasts an impressive global footprint, serving recreational enthusiasts, businesses, and government bodies across the world. While North America remains its core market, international sales are steadily growing, indicating a broadening reach. This global presence is a significant strength, allowing for diversified revenue streams and reduced reliance on any single region.

The company's market leadership is undeniable, holding the top spot in the Off-Road Vehicle (ORV) segment with a commanding #1 market share. Furthermore, Polaris ranks second in the Snowmobile market. These strong positions highlight the company's ability to innovate and effectively compete in its key product categories.

This extensive global network, coupled with its dominant market share, translates into a robust distribution and support system. Polaris's established dealer network ensures that customers have access to sales, service, and parts, reinforcing brand loyalty and facilitating continued growth. As of early 2024, Polaris's ORV segment continues to show resilience, with market share figures remaining strong, and international expansion efforts showing promising early results in key European and Australian markets.

Operational Efficiency and Cost Management

Polaris has demonstrated a strong commitment to operational efficiency, implementing lean strategies that have yielded substantial cost savings and bolstered gross profit margins in key segments, even amidst a challenging economic landscape. These focused cost-reduction efforts are designed to enhance the company's resilience and competitive positioning, enabling it to navigate market fluctuations more effectively.

Key initiatives contributing to this strength include:

- Structural Cost Reductions: Polaris has actively pursued and achieved reductions in its operational overhead, directly impacting the bottom line.

- Dealer Inventory Management: A strategic focus on optimizing dealer inventory levels helps to streamline the supply chain, reduce carrying costs, and improve overall cash flow.

- Improved Gross Profit Margins: For example, in Q4 2023, Polaris reported a gross profit margin of 25.4%, an improvement from 23.8% in the prior year's comparable quarter, reflecting successful cost management and pricing strategies.

- Resilience in Downturns: By managing costs proactively, Polaris is better positioned to weather economic slowdowns and emerge with a stronger financial footing.

Commitment to Sustainability and ESG

Polaris exhibits a robust commitment to sustainability and Environmental, Social, and Governance (ESG) principles, as detailed in their 2024 Geared For Good Report. This dedication is not just aspirational; it translates into tangible achievements, such as a remarkable 90% waste diversion rate at one of their facilities, surpassing even their own 2035 targets. Furthermore, the company actively invests in crucial areas like safety education and vital trail stewardship programs, demonstrating a holistic approach to responsible operations.

This strong ESG focus is a significant competitive advantage for Polaris. It directly bolsters their brand reputation, resonating with an increasingly large segment of consumers and investors who prioritize environmentally and socially conscious companies. Moreover, this proactive stance on sustainability proactively aligns Polaris with evolving regulatory landscapes and market expectations, positioning them favorably for long-term growth and resilience.

- Waste Diversion: Achieved a 90% waste diversion rate at a key facility, ahead of 2035 goals.

- Community Investment: Significant investments in safety education and trail stewardship programs.

- Brand Enhancement: Strengthened brand image through demonstrable ESG commitments.

- Regulatory Alignment: Positioned to meet and exceed future environmental and social regulations.

Polaris's diversified product portfolio, including off-road vehicles, snowmobiles, and marine products, significantly reduces reliance on any single market, providing stability. This broad offering is supported by strong brand recognition, with names like Indian Motorcycle and Bennington enjoying substantial consumer loyalty. For instance, Polaris reported net sales growth in its Off-Road and Snowmobile segments in Q1 2024, highlighting the consistent demand across its diverse product lines.

The company's dedication to innovation is a key strength, with consistent investment in R&D fueling new product development, particularly in the growing electric vehicle and connected technology spaces. The success of models like the RANGER XP Kinetic electric utility vehicle demonstrates Polaris's ability to capitalize on emerging market trends.

Polaris holds a dominant position in the powersports industry, securing the #1 market share in the highly competitive Off-Road Vehicle (ORV) segment and ranking second in snowmobiles. This market leadership is underpinned by an extensive global distribution network, ensuring robust sales, service, and parts availability for its customers.

Furthermore, Polaris excels in operational efficiency, implementing strategies that have led to significant cost savings and improved gross profit margins. For example, their gross profit margin reached 25.4% in Q4 2023, an increase from the previous year, reflecting effective cost management. Their commitment to sustainability, highlighted by achieving a 90% waste diversion rate at a key facility, also enhances brand reputation and aligns with evolving consumer and regulatory expectations.

| Strength Area | Key Brands/Products | Market Position | Financial/Operational Data |

|---|---|---|---|

| Product Diversification | Indian Motorcycle, Bennington Pontoon Boats, RANGER XP Kinetic | #1 in ORV, #2 in Snowmobiles | Net sales growth in Off-Road and Snowmobile segments (Q1 2024) |

| Brand Equity | Indian Motorcycle, Bennington | High consumer loyalty and market recognition | N/A |

| Innovation & R&D | Electric Vehicle (EV) and Smart Connectivity | Frontrunner in emerging technologies | Development of RANGER XP Kinetic |

| Operational Efficiency | Lean strategies | Improved gross profit margins | 25.4% Gross Profit Margin (Q4 2023) |

| Sustainability (ESG) | Waste diversion, safety education, trail stewardship | Enhanced brand reputation | 90% waste diversion rate |

What is included in the product

Delivers a strategic overview of Polaris’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats to inform its competitive position and future success.

Offers a clear, actionable framework to identify and address strategic challenges efficiently.

Weaknesses

Polaris's reliance on discretionary consumer spending presents a significant weakness, as these purchases are highly sensitive to economic fluctuations. When interest rates are high or inflation erodes purchasing power, consumers tend to cut back on non-essential items like recreational vehicles.

This vulnerability was evident in Polaris's performance. The company reported a sales decline in the fourth quarter of 2024 and continued to see softness in the first quarter of 2025.

Looking ahead to 2025, projections indicate a continued downturn in the powersports industry, directly impacting Polaris's revenue streams due to this dependency on discretionary spending.

This makes Polaris particularly susceptible to economic downturns and periods of consumer uncertainty, highlighting a core weakness in its business model.

Polaris faces considerable risk from tariffs, especially given its reliance on imported parts for manufacturing in the United States, creating an unfair competitive environment. This exposure can directly impact the cost of goods sold and overall profitability.

Recent years have highlighted the fragility of global supply chains, with Polaris experiencing disruptions, component shortages, and escalating input costs. These issues have unfortunately hampered production timelines and squeezed profit margins, a trend observed across many automotive and recreational vehicle manufacturers in 2023 and continuing into early 2024.

The company is proactively addressing these vulnerabilities by strategically reducing its reliance on sourcing from China. Concurrently, Polaris is increasing shipments that qualify under the United States-Mexico-Canada Agreement (USMCA), aiming to build a more resilient and cost-effective supply chain for the North American market.

Polaris faces significant challenges due to seasonal demand, particularly with its snowmobile segment. This inherent seasonality creates predictable sales peaks and troughs, complicating production planning and inventory management. For instance, a lack of sufficient snowfall in crucial markets during recent winter seasons directly translated into lower snowmobile sales, exacerbating dealer inventory issues and impacting overall revenue predictability.

Decreased Profitability and Margin Pressures

Polaris has faced a notable dip in profitability, with recent quarters showing decreased net income and gross profit margins. This downturn is largely due to a combination of factors including softening sales volumes, an uptick in promotional efforts to drive demand, and a less favorable product mix contributing to lower overall profitability.

Looking ahead, the company anticipates continued pressure on its margins throughout 2025.

- Planned Production Reductions: These can lead to higher per-unit costs as fixed manufacturing expenses are spread over fewer units, impacting gross margins.

- Negative Absorption: This occurs when production levels fall below optimal capacity, meaning the overhead costs absorbed by each unit increase.

- Restoration of Profit-Sharing Programs: While beneficial for employee morale, the reinstatement of these programs directly increases operating expenses, further squeezing profit margins.

These headwinds suggest a challenging environment for margin improvement in the near term.

Intense Competition in Powersports Market

The powersports market is a crowded arena, with giants like Honda, Yamaha, and BRP constantly vying for consumer attention and loyalty. This fierce rivalry means Polaris faces significant pressure not only on pricing but also on continuously improving its product offerings.

This intense competition can hinder Polaris's capacity to pass on escalating costs directly to customers, potentially impacting its profit margins. For instance, in 2024, the industry saw continued price sensitivity among consumers, especially in the off-road vehicle segment where Polaris holds a strong position.

To stay ahead, Polaris must allocate substantial resources towards research and development, aiming for innovation that can secure or expand its market share. This necessity for ongoing investment in new technologies and features can place additional strain on the company's profitability.

- Aggressive Pricing Strategies: Competitors often engage in aggressive pricing to capture market share, forcing Polaris to match or risk losing sales.

- Product Innovation Race: A continuous need to introduce new features and technologies to counter competitor advancements.

- Market Share Defense: Maintaining market share requires significant investment in marketing and product development, even when profitability is challenged.

- Cost Pass-Through Limitations: The competitive landscape limits Polaris's ability to fully offset rising material and manufacturing costs through price increases.

Polaris's significant dependence on discretionary consumer spending makes it vulnerable to economic downturns and shifts in consumer confidence. This was evident with sales declines in late 2024 and continued softness into early 2025, with industry projections for 2025 indicating a further downturn impacting revenue.

The company's profitability has been squeezed by factors like softening sales, increased promotional activity, and unfavorable product mix, leading to decreased net income and gross profit margins. This margin pressure is expected to persist through 2025, compounded by planned production reductions and the restoration of profit-sharing programs.

Intense competition within the powersports market, with major players like Honda and Yamaha, limits Polaris's ability to pass on rising costs to consumers, impacting profit margins. This necessitates substantial R&D investment for innovation, further straining profitability.

Full Version Awaits

Polaris SWOT Analysis

The preview you see is the actual Polaris SWOT analysis document you will receive upon purchase. This ensures transparency and quality, so you know exactly what to expect. No surprises, just a professionally prepared and comprehensive report. Get the full, detailed analysis to inform your strategic decisions.

Opportunities

The burgeoning market for electric powersports vehicles presents a significant growth avenue. Projections indicate electric propulsion will capture a substantial market share in the coming years, driven by environmental consciousness and technological advancements.

Polaris is strategically positioned to leverage this shift, evidenced by its development of hybrid-electric UTVs and the successful introduction of models like the RANGER XP Kinetic. These initiatives directly address the growing consumer demand for sustainable recreational transportation.

This focus aligns with industry trends, as the global powersports market, including off-road vehicles, is anticipated to see continued expansion, with electric variants playing an increasingly crucial role in its future trajectory.

The global powersports market is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of around 5% to 6% through 2028, reaching an estimated value of over $25 billion. North America currently dominates this sector, but the Asia-Pacific region is anticipated to be the fastest-growing market, presenting a significant opportunity for expansion. This surge is fueled by a rising global interest in outdoor recreational activities and adventure tourism, directly benefiting companies like Polaris.

Polaris Inc. has a proven track record of successfully integrating acquisitions to expand its product portfolio and tap into new customer bases. This strategy remains a key opportunity for growth, allowing the company to quickly gain market share and technological advancements. For instance, the 2020 acquisition of G2 Trucking bolstered its logistics and delivery capabilities, a segment showing robust growth.

The recent strategic moves by Polaris Management, a private equity firm, to acquire businesses in adjacent markets highlight a potential playbook for Polaris Inc. These acquisitions often focus on synergy and operational efficiencies, suggesting that Polaris could explore similar partnerships or outright purchases to enhance its existing offerings or enter emerging segments like electric vehicle infrastructure.

By continuing to scout for and execute strategic acquisitions, Polaris can accelerate its innovation pipeline and diversify its revenue streams. This proactive approach is particularly relevant in 2024 and 2025, as the powersports and mobility sectors continue to evolve with new technologies and consumer demands.

Leveraging Aftermarket Parts, Garments, and Accessories (PG&A)

The aftermarket parts, garments, and accessories (PG&A) segment represents a significant opportunity for Polaris to cultivate a consistent revenue stream. This segment is not only resilient but also poised for expansion, offering a chance to bolster overall company profitability.

Polaris already boasts a strong PG&A offering that enhances the customer riding experience. By strategically growing this segment, the company can deepen customer loyalty and create a more integrated ecosystem that complements its core vehicle sales. This focus can lead to improved customer lifetime value and recurring revenue.

In 2023, Polaris reported that its Parts, Garments, and Accessories segment generated $1.3 billion in sales, demonstrating its substantial contribution to the company's financial performance. This indicates a strong existing market presence and a solid foundation for further development.

Key opportunities within PG&A include:

- Expanding digital platforms for PG&A sales to reach a wider customer base.

- Developing exclusive, co-branded apparel lines to enhance brand appeal.

- Introducing customizable accessory packages tailored to specific vehicle models and rider preferences.

- Leveraging data analytics to predict demand and optimize inventory for high-demand PG&A items.

Digitalization and Connectivity Features

Technological advancements are a significant opportunity for Polaris. Features like smart connectivity, including Bluetooth and advanced navigation systems, are increasingly important to consumers, especially younger demographics. Polaris can leverage these advancements to create a more engaging and informative riding experience. For instance, the integration of intuitive touchscreen displays and real-time vehicle diagnostics can attract tech-savvy riders seeking seamless integration with their digital lives.

Polaris is well-positioned to capitalize on the growing demand for connected vehicles. In 2024, the powersports industry saw a continued emphasis on digital integration. Companies are investing in software development to enhance user experience, offering features like over-the-air updates and advanced rider analytics. By further embedding these sophisticated digital tools into its product lines, Polaris can differentiate itself and appeal to a broader customer base.

- Enhanced Rider Experience: Smart connectivity features like GPS navigation and customizable display options improve usability and enjoyment.

- Attracting New Demographics: Tech-forward features appeal to younger, digitally native consumers entering the powersports market.

- Data-Driven Insights: Connectivity allows for the collection of valuable rider data, informing future product development and personalized services.

- Competitive Differentiation: Offering superior digital integration can set Polaris apart from competitors who lag in technological adoption.

The expansion into electric powersports vehicles presents a substantial growth opportunity, aligning with increasing consumer demand for sustainable options. Polaris's investment in electric models, such as the RANGER XP Kinetic, positions it to capture market share in this evolving segment.

Strategic acquisitions remain a key avenue for Polaris to broaden its product offerings and gain access to new technologies and markets. The company's history of successful integrations, coupled with the industry's ongoing consolidation and innovation, provides fertile ground for further expansion.

The aftermarket parts, garments, and accessories (PG&A) segment offers a consistent revenue stream and a chance to deepen customer loyalty. With $1.3 billion in sales in 2023, this segment is a robust platform for growth through enhanced digital sales and customized offerings.

Leveraging technological advancements, particularly in smart connectivity and digital integration, is crucial for attracting tech-savvy consumers. Enhancing the rider experience with features like GPS and real-time diagnostics can differentiate Polaris and appeal to younger demographics.

Threats

Persistent economic headwinds, characterized by high inflation and elevated interest rates, present a substantial threat to Polaris. These conditions are likely to reduce consumer spending, particularly on large discretionary items like recreational vehicles, which are core to Polaris's product line. This dampened demand is expected to continue impacting sales through the first half of 2025.

Polaris has already experienced sales declines attributable to these economic pressures. For instance, the company reported a net income of $276 million for the first quarter of 2024, a decrease from $307 million in the same period of the previous year, reflecting the impact of a challenging economic environment on its revenue streams.

Polaris, like others in the powersports sector, navigates a tightening regulatory environment. New emissions standards, such as the upcoming Euro 7 regulations affecting motorcycles and off-road vehicles, demand significant engineering adjustments and testing. For instance, manufacturers are investing heavily to meet stricter tailpipe emission limits and onboard diagnostic requirements, which can add 5-10% to component costs. This escalating compliance burden directly impacts research and development budgets and can slow down the introduction of new models, presenting a tangible threat to Polaris's market agility.

Ongoing global supply chain challenges continue to impact Polaris. Component shortages and shipping delays, exacerbated by geopolitical events in 2024, directly threaten production schedules. For instance, semiconductor availability remained a concern throughout 2024, affecting various industries including powersports.

Volatility in raw material costs, such as steel and aluminum, directly pressures Polaris's profit margins. These fluctuations, driven by global economic conditions and energy prices in 2024, necessitate careful inventory management and pricing strategies.

Polaris's reliance on a complex, international supply chain makes it inherently vulnerable to external disruptions. A single port closure or natural disaster can ripple through its operations, highlighting the need for robust contingency planning.

Aggressive Competition and Pricing Pressures

The powersports industry is intensely competitive, with both seasoned manufacturers and emerging players constantly vying for market share. This dynamic environment directly translates into significant pricing pressures for companies like Polaris. Competitors frequently launch innovative new models or engage in aggressive price reductions, forcing Polaris to consider similar strategies or bolster its promotional efforts to remain competitive. This can directly impact Polaris's ability to sustain or improve its profit margins.

For instance, in 2023, the powersports market saw continued robust demand, but also increased promotional activity from key rivals, particularly in the off-road vehicle segment. This trend is anticipated to persist into 2024 and 2025, as manufacturers aim to clear existing inventory and capture new customers. Polaris's response to these competitive actions will be critical in maintaining its financial performance.

- Intense Rivalry: Polaris faces strong competition from major players like BRP, Yamaha, and Honda, along with potential new entrants.

- Pricing Vulnerability: Aggressive competitor pricing can force Polaris to lower its own prices or increase marketing spend, impacting profitability.

- Product Innovation Race: Competitors' rapid introduction of new models necessitates continuous investment in R&D for Polaris to stay ahead.

- Market Share Defense: Maintaining market share in key segments requires strategic pricing and product offerings to counter competitive threats.

Changing Consumer Preferences and Market Shifts

Polaris faces a significant threat from evolving consumer preferences, particularly the accelerating transition towards electric vehicles (EVs). While Polaris is actively developing its electric off-road and snowmobile offerings, a rapid and widespread abandonment of internal combustion engine (ICE) powered recreational vehicles could challenge demand for its core product lines. For instance, the global EV market share for new passenger cars reached approximately 14% in 2023, a figure projected to climb significantly in the coming years, indicating a strong consumer appetite for electrification across various vehicle segments.

A sustained decline in interest in traditional powersports activities, such as off-roading or snowmobiling, could also impact Polaris. This shift might be driven by changing lifestyle choices, environmental concerns, or the emergence of new recreational trends. For example, the increasing popularity of outdoor adventure sports that don't require motorized vehicles could divert consumer spending and engagement away from Polaris's traditional markets.

- Consumer Preference Shift: A rapid move towards electric alternatives for ATVs, UTVs, and snowmobiles could diminish demand for Polaris's established gasoline-powered offerings.

- Market Disruption: Competitors with a strong early presence in the EV powersports market could gain significant market share if Polaris's transition is not swift enough.

- Recreational Trends: A broader societal shift away from traditional powersports activities towards other forms of recreation poses a risk to Polaris's core business.

- Regulatory Impact: Increasingly stringent emissions standards globally could further accelerate the shift away from ICE vehicles, impacting Polaris's legacy product lines.

Ongoing economic uncertainty remains a significant threat, with high inflation and interest rates likely to curb consumer spending on discretionary items like recreational vehicles through early 2025. Polaris's net income already saw a dip in Q1 2024 to $276 million from $307 million year-over-year, underscoring this vulnerability.

The company also faces increasing regulatory burdens, such as stricter emissions standards for off-road vehicles, which necessitate costly engineering changes and can delay product launches. Furthermore, persistent global supply chain disruptions, including semiconductor shortages experienced in 2024, continue to threaten production schedules and increase operational costs.

Intense competition within the powersports industry, marked by aggressive pricing and rapid new model introductions from rivals like BRP and Yamaha, puts pressure on Polaris's profit margins and requires continuous R&D investment to maintain market share.

A critical threat stems from evolving consumer preferences, particularly the accelerating shift towards electric vehicles (EVs). While Polaris is investing in electric offerings, a rapid market abandonment of internal combustion engine (ICE) vehicles could challenge its core product demand, as evidenced by the growing EV market share across vehicle segments, reaching approximately 14% for new passenger cars in 2023.

SWOT Analysis Data Sources

This Polaris SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry commentary to ensure accurate and actionable insights.