Polaris Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Polaris Bundle

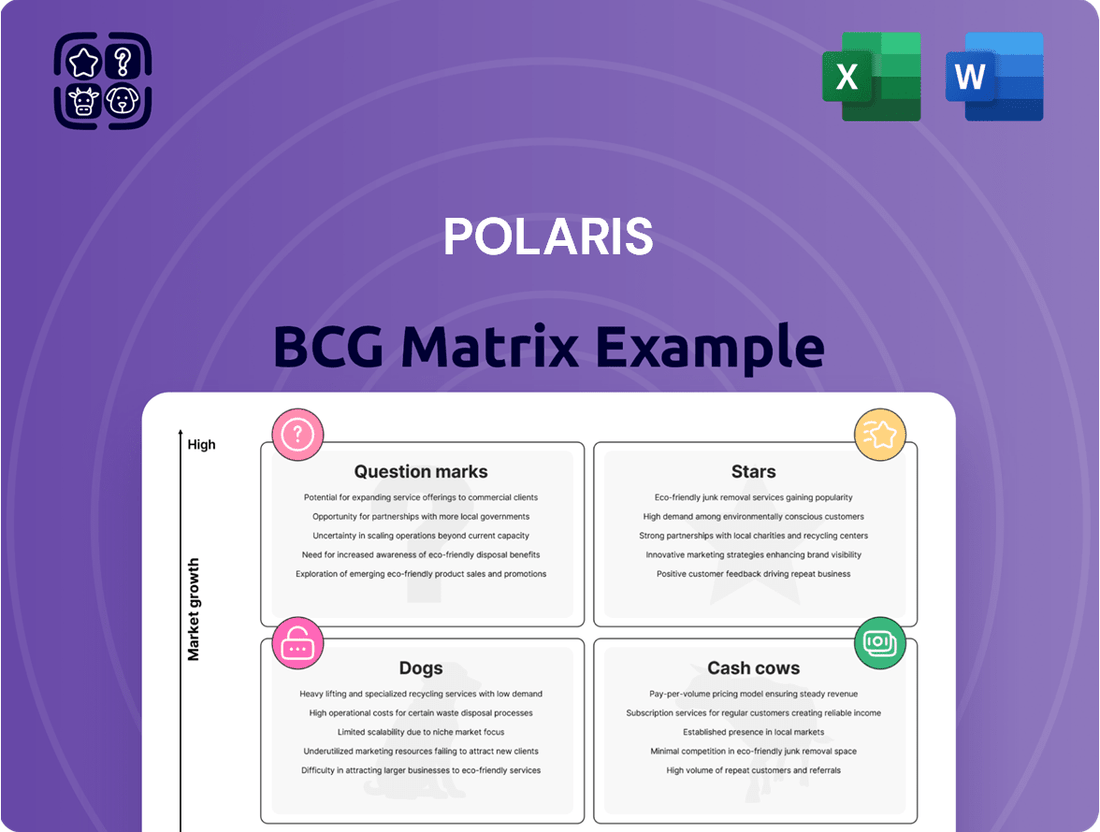

The Polaris BCG Matrix offers a powerful framework to dissect a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. Understanding these classifications is crucial for effective resource allocation and strategic planning. This preview hints at the potential, but the full BCG Matrix unlocks a comprehensive view of your company's competitive landscape and the critical insights needed to optimize your business.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Indian Motorcycle is a shining star within Polaris's portfolio, experiencing a remarkable comeback in the high-end cruiser and touring motorcycle markets. Its growing market share in this expanding niche highlights its strength as a key growth driver for Polaris.

With a rich brand history and a dedicated following, Indian Motorcycle is well-positioned for continued success. For instance, in 2023, Polaris reported a notable increase in revenue for its Motorcycles segment, with Indian contributing significantly to this growth.

Sustained investment in developing innovative new models and expanding its global reach will be vital. This strategic approach aims to solidify Indian Motorcycle's position and transition it into a future cash cow for Polaris Industries.

Polaris's marine division, spearheaded by the Bennington and Godfrey pontoon brands, is a clear Star in the BCG matrix. This segment benefits from a robustly growing premium pontoon market, a niche known for its luxury and strong recreational appeal.

In 2023, Polaris's Marine segment saw significant growth, contributing to the company's overall performance. The demand for pontoon boats, particularly in the higher-end segment where Bennington and Godfrey operate, has remained exceptionally strong.

These brands are actively capturing market share, underscoring their strategic importance to Polaris's expansion plans. Continued investment in product innovation and broadening distribution networks are key to maintaining this upward trajectory and solidifying their Star status.

The Polaris RANGER XP Kinetic is a prime example of a 'Star' in Polaris's product portfolio, signifying a strong position in a high-growth market. This electric UTV is Polaris's bold move to lead the burgeoning electric off-road vehicle sector, a segment experiencing significant consumer and commercial adoption. Polaris is investing heavily in the technology and production of the RANGER XP Kinetic to maintain its leading edge in this emerging market.

Polaris RZR (Performance Side-by-Sides)

The Polaris RZR line continues to dominate the high-performance recreational side-by-side market, a segment known for its rapid innovation and passionate customer base. Polaris consistently fuels demand and sales through frequent updates and performance improvements across its RZR models.

In 2024, the side-by-side market saw robust growth, with Polaris holding a significant portion of this expanding recreational vehicle sector. The RZR's appeal is further amplified by its consistent presence in motorsports and active lifestyle marketing campaigns.

- Market Dominance: RZR holds a leading market share in the performance recreational side-by-side segment.

- Innovation Driver: Continuous model refreshes and performance enhancements keep the RZR lineup competitive.

- Sales Momentum: Strong consumer enthusiasm and marketing efforts contribute to sustained sales growth.

- Strategic Focus: Ongoing research and development are crucial for maintaining its 'Star' status in a dynamic market.

Polaris General (Crossover Side-by-Sides)

The Polaris General, a key player in the crossover side-by-side market, has demonstrated robust performance. This segment, characterized by its blend of work and play capabilities, has been a significant growth driver for Polaris. In 2024, the demand for versatile off-road vehicles continued to climb, with the General series well-positioned to capture a substantial portion of this expanding market.

This strategic positioning allows Polaris to cater to a broad customer base, from those needing a capable workhorse to enthusiasts seeking recreational adventures. The crossover segment’s inherent versatility translates into sustained sales momentum.

Polaris's continued investment in product innovation and targeted marketing for the General line is expected to solidify its market leadership. This focus on its dual-purpose appeal is crucial for maintaining its growth trajectory and expanding its reach within this dynamic segment.

- Market Position: The Polaris General is a strong contender in the high-growth crossover UTV segment.

- Growth Drivers: The demand for versatile vehicles that can handle both work and recreation fuels the General's market expansion.

- Strategic Focus: Polaris emphasizes the General's dual-purpose appeal through marketing and product development.

- Future Outlook: Continued innovation and strategic marketing are key to securing the General's ongoing success and market share growth.

Stars represent products with high market share in a high-growth industry. They require significant investment to maintain their growth and market position, but also generate substantial profits. For Polaris, Indian Motorcycle, its marine division (Bennington, Godfrey), the RZR line, and the Polaris General are all prime examples of Stars.

| Product Line | Market Position | Growth Rate | Polaris's Strategy | 2023/2024 Data Insight |

| Indian Motorcycle | High (Premium Cruiser/Touring) | High (Expanding Niche) | Innovation, Global Expansion | Significant revenue contribution to Motorcycles segment. |

| Marine (Bennington, Godfrey) | High (Premium Pontoon) | High (Growing Market) | Product Innovation, Distribution | Strong growth in Marine segment, high demand for premium pontoons. |

| Polaris RZR | Dominant (Performance SxS) | High (Innovation-Driven) | Model Refreshes, Marketing | Held significant share in robustly growing 2024 SxS market. |

| Polaris General | Strong (Crossover SxS) | High (Versatility Demand) | Dual-Purpose Focus, Marketing | Well-positioned for continued growth in versatile off-road vehicle demand. |

What is included in the product

Strategic guidance on investing in Stars, maintaining Cash Cows, developing Question Marks, and divesting Dogs.

Quickly identify underperforming "Dogs" and resource-draining "Question Marks" to reallocate capital and focus efforts.

Cash Cows

Polaris's snowmobile division is a classic cash cow, dominating a mature but steady market. This segment consistently throws off substantial cash with minimal need for major new investment, mainly just routine updates. In 2023, Polaris reported that its Snowmobile segment generated approximately $1.4 billion in revenue, a testament to its strong market position.

The division benefits from deep-rooted brand loyalty and a well-established dealer network, making it a dependable source of capital. This reliable cash generation allows Polaris to fund growth initiatives in other business areas. For instance, the company has been investing heavily in its powersports business, which includes motorcycles and off-road vehicles.

The traditional, non-electric Polaris RANGER utility side-by-side models are true cash cows for Polaris. These workhorse vehicles have a dominant market share in the utility segment, a testament to their enduring appeal and reliability.

Their established presence and proven durability mean they consistently generate substantial cash flow with minimal need for heavy marketing spend. In 2023, Polaris reported that their Off-Road segment, which includes RANGER, saw a net sales increase of 10%, indicating continued strong demand for these foundational revenue generators.

Polaris's Parts, Garments, and Accessories (PG&A) segment is a classic cash cow, consistently delivering strong profits. This business thrives by serving the vast number of existing Polaris vehicle owners, who need replacement parts, maintenance items, and upgrades. In 2023, Polaris reported that its PG&A segment generated approximately $1.1 billion in revenue, showcasing its significant contribution to the company's overall financial health.

The beauty of the PG&A segment lies in its low incremental investment needs. Unlike new vehicle sales, which require substantial marketing and R&D, PG&A demand is largely organic, stemming from the ongoing use and personalization of Polaris vehicles. This means that a significant portion of the revenue generated flows directly to the bottom line, boosting profitability and providing a stable, predictable income stream for Polaris.

This segment's high-margin nature, coupled with its reliance on an established customer base, makes it a vital component of Polaris's business strategy. It effectively subsidizes investments in other areas of the company, such as new product development and market expansion, ensuring Polaris remains competitive and innovative across its entire product portfolio.

Polaris Commercial & Government Vehicles

Polaris's Commercial & Government Vehicles division functions as a robust cash cow within its BCG matrix. This segment benefits from a stable, predictable demand, often secured through lengthy contracts with government entities and commercial clients who require specialized vehicles for specific operational needs. The consistent revenue stream and healthy profit margins generated by this unit are vital for funding other areas of Polaris's business.

While the growth prospects in this niche market may not be as explosive as in other sectors, Polaris's established strong market position ensures reliable cash flow. For instance, in fiscal year 2023, Polaris reported a total revenue of $10.05 billion, with its Off-Road and Snowmobile segments, which often include commercial applications, showing resilience. The company's ability to secure and fulfill these long-term contracts underscores the dependable nature of this cash cow.

- Stable Demand: Driven by essential operational requirements and long-term contracts, ensuring consistent sales.

- Predictable Revenue: The nature of government and commercial contracts provides a reliable income stream.

- Strong Profit Margins: Specialized vehicles often command higher margins due to their unique features and applications.

- Contribution to Cash Reserves: This segment reliably generates surplus cash that can be reinvested or used to support other business units.

Polaris Sportsman ATVs

The Polaris Sportsman ATV lineup represents a classic cash cow for Polaris, thriving in a mature yet stable recreational and utility market. These vehicles have cemented their position, consistently delivering robust cash flow without requiring significant investment to grow their already substantial market share.

Their enduring reputation and broad adoption across various user segments underscore their role as a dependable revenue generator. For instance, in 2023, Polaris reported that its Off-Road segment, which heavily features ATVs like the Sportsman, saw a net sales increase, demonstrating the continued strength of these established products.

Key aspects of the Sportsman's cash cow status include:

- Established Market Presence: The Sportsman line benefits from decades of brand loyalty and a strong foothold in a predictable market segment.

- Consistent Cash Generation: These models require minimal reinvestment for growth, allowing them to contribute significantly to Polaris's overall profitability.

- Brand Recognition: The Sportsman name is synonymous with quality and reliability in the ATV space, reducing marketing costs and driving consistent sales.

- Mature Market Stability: While not a high-growth area, the recreational and utility ATV market offers steady demand, ensuring predictable revenue streams.

Cash cows in the Polaris BCG matrix represent established products or divisions that generate more cash than they consume. These are typically in mature markets with strong market share, requiring minimal investment for maintenance. Polaris leverages the consistent profits from these segments to fund growth in other areas.

Polaris's Snowmobile and Parts, Garments, and Accessories (PG&A) segments are prime examples of cash cows. In 2023, the Snowmobile segment generated approximately $1.4 billion in revenue, while PG&A brought in about $1.1 billion. These figures highlight their significant and reliable cash-generating capabilities.

The Sportsman ATV lineup and traditional RANGER utility side-by-sides also function as cash cows within Polaris's Off-Road segment. These products benefit from strong brand loyalty and proven reliability, ensuring steady sales and cash flow. The Off-Road segment itself saw a 10% net sales increase in 2023, reflecting continued demand for these core offerings.

The Commercial & Government Vehicles division also acts as a cash cow, providing stable revenue through long-term contracts. While not high-growth, its predictable demand and strong margins contribute substantially to Polaris's financial stability.

| Polaris Business Segment | BCG Classification | 2023 Revenue (Approx.) | Key Characteristics |

| Snowmobiles | Cash Cow | $1.4 Billion | Mature market, dominant share, low investment needs |

| Parts, Garments, & Accessories (PG&A) | Cash Cow | $1.1 Billion | Serves existing customer base, high margins, organic demand |

| Off-Road (e.g., Sportsman ATVs, RANGER UTVs) | Cash Cow | Segment saw 10% net sales increase | Established presence, brand loyalty, reliable demand |

| Commercial & Government Vehicles | Cash Cow | Contributes to overall $10.05 Billion total revenue | Stable demand, long-term contracts, predictable cash flow |

Delivered as Shown

Polaris BCG Matrix

The BCG Matrix document you are previewing is the identical, fully functional report you will receive upon completing your purchase. This comprehensive analysis tool, designed to illuminate your product portfolio's strategic positioning, will be delivered without any watermarks or demo content, ready for immediate application in your business planning.

Dogs

The Polaris Slingshot, a distinctive three-wheeled vehicle, has faced challenges in gaining widespread market traction since its introduction. Its unique appeal hasn't translated into substantial sales figures, positioning it as a product with a low market share within its specialized niche.

In 2024, the Slingshot continued to operate in a segment that, while unique, remains relatively small. Despite ongoing marketing efforts, its sales volumes have not consistently met internal projections, preventing it from becoming a significant profit driver for Polaris. The company has invested in its development and production, but the return on these investments has been modest, leading to its classification as a potential cash consumer.

Given its performance, the Slingshot's position within Polaris's product portfolio warrants careful strategic consideration. It often operates at the breakeven point or requires capital infusion without generating substantial profits, making it a prime candidate for a strategic review concerning its future investment or potential divestment.

Older, phased-out vehicle platforms often fall into the Dogs category of the BCG matrix. These are products with a low market share in a market that isn't growing much, if at all. Think of models that have been discontinued or are nearing the end of their lifecycle, with little to no future sales potential.

These platforms tie up valuable capital in unsold inventory and the resources needed to support them, like warehousing and maintenance. For instance, a manufacturer might have a significant amount of legacy sedan inventory from a model that has been replaced by an SUV. In 2024, many automakers are still working through residual stocks of older internal combustion engine (ICE) vehicles as they pivot to electric, highlighting this challenge.

The lack of growth prospects means these assets are unlikely to generate new revenue or significant profits. Instead, they become a drain on financial resources that could be better allocated to more promising products or research and development. For example, if a particular model's sales have been steadily declining for years, its contribution to overall profitability is likely negative.

The recommended strategy for these Dog products is typically divestiture or liquidation. This involves selling off the remaining stock, often at a discount, to free up capital. For example, dealerships might offer substantial rebates on these older models to clear inventory before new model years arrive, aiming to recover as much of the initial investment as possible.

Underperforming Niche Accessories are those specialized products that simply aren't resonating with customers. Think of very specific tools for a niche hobby or custom parts for older vehicles. These items typically see very low sales figures and hold a tiny slice of the market, meaning they don't bring in much money.

For instance, in 2024, a hypothetical company specializing in vintage camera accessories might find that a particular line of custom leather straps for a discontinued film camera model has sold fewer than 50 units nationwide. This low demand translates to minimal revenue, often not even covering the cost of manufacturing and marketing.

Because of their poor performance, these accessories often lead to businesses having to write off unsold inventory, directly impacting profitability. The financial drain is significant, as resources are tied up in products that aren't generating returns.

Given their status as Dogs in the BCG matrix, it's generally not advisable to pour more money into promoting or developing these niche accessories. The focus should be on divesting or phasing them out to reallocate resources to more promising product lines.

Select International Market Segments with Low Penetration

In specific international markets where Polaris has struggled to establish a strong presence, certain product lines might show both low market share and minimal growth.

These areas or product categories within them could be considered Dogs within the BCG matrix framework. This is particularly true if the substantial investment needed to develop these markets exceeds the potential future profits. For instance, in 2024, Polaris's snowmobile division in a particular South American market might only command a 1% market share with negligible growth projections, making further investment unviable.

The strategic response typically involves either a controlled withdrawal from these segments or maintaining only a minimal level of investment to preserve existing, albeit small, customer bases. This approach frees up capital and resources for more promising opportunities.

- Low Market Share: Polaris could be facing less than 5% market share in several emerging European markets for its off-road vehicle segment in 2024.

- Stagnant Growth: In these same markets, the annual growth rate for off-road vehicles might be hovering around 1-2%, significantly below the company's overall growth targets.

- High Market Development Costs: Establishing distribution networks, marketing campaigns, and localizing products in these regions could require an estimated $50 million in upfront investment for Polaris.

- Unattractive Profit Potential: The projected return on investment (ROI) for these underperforming international segments, based on 2024 forecasts, might be as low as 3%, making them unattractive compared to other strategic options.

Entry-Level, Low-Margin Snowmobile Models

Entry-level, low-margin snowmobile models are categorized as Dogs within the Polaris BCG Matrix. These models, often older generations, face declining market share and generate minimal profits. For instance, while Polaris offers a range of snowmobiles, their entry-level options might represent a small fraction of overall revenue.

These units typically have very low profit margins, meaning each sale contributes little to Polaris's financial health. They may still find buyers, but their contribution to the company's bottom line is negligible, often serving more as inventory clearance items than growth drivers. Resources allocated to these models could be better invested in developing or promoting higher-margin, more innovative snowmobile lines.

- Low Profitability: Entry-level models often operate on razor-thin margins.

- Diminishing Market Share: Older or basic models struggle to compete with newer, feature-rich snowmobiles.

- Resource Drain: Continued investment in low-performing products can hinder innovation in more promising areas.

- Inventory Management: These models are sometimes kept to manage existing stock rather than for strategic market growth.

Dogs in the BCG matrix represent products with low market share in slow-growing industries. These are typically items that are not performing well and are unlikely to improve. For Polaris, this could include older vehicle platforms that have been discontinued or are nearing the end of their lifecycle.

These products often tie up capital in inventory and support resources without generating significant profits. In 2024, many manufacturers are still dealing with legacy stock as markets shift, highlighting this challenge. The lack of growth prospects means these assets can become a drain on financial resources.

The strategic recommendation for Dogs is usually divestiture or liquidation to free up capital for more promising ventures. For example, offering discounts on older models helps clear inventory and recover investment costs.

Polaris's Slingshot, despite its unique design, fits the Dog category due to its low market share and the niche nature of its segment. While Polaris invested in its development, sales in 2024 did not translate into substantial profits, positioning it as a product requiring careful strategic review, potentially leading to divestment.

Question Marks

Polaris is actively investigating electric motorcycle concepts, aiming to tap into the burgeoning electric two-wheeler market, a sector projected for significant expansion. While Polaris currently possesses a modest presence in this high-growth area, these emerging electric concepts represent potential game-changers.

These nascent electric motorcycle ideas fall into the "Question Marks" category of the BCG Matrix. They are characterized by their presence in rapidly growing markets but with a currently low market share. For instance, the global electric motorcycle market was valued at approximately USD 15.5 billion in 2023 and is anticipated to grow substantially, with some projections indicating a CAGR of over 10% through 2030.

Developing these concepts demands considerable investment in research and development, alongside rigorous market testing. The outcome is uncertain, but the potential rewards are substantial if these electric models achieve widespread consumer acceptance. This is a classic speculative venture where the upside is significant, but the risk of failure is also present.

Polaris's strategic move into electric motorcycle concepts reflects a forward-looking approach, acknowledging the shift in consumer preferences towards sustainable transportation. The success of these ventures hinges on innovation, effective marketing, and the ability to capture a meaningful share of this evolving market.

Polaris is actively investing in autonomous and semi-autonomous technologies for its off-road vehicles. This represents a strategic move into a high-growth sector with substantial long-term promise, though current practical applications remain limited, resulting in a very low market share for these advanced systems.

These cutting-edge technologies demand considerable research and development capital. The commercialization timelines and the rate of market acceptance are still uncertain, making these investments somewhat speculative in nature, yet they hold the potential to fundamentally reshape Polaris's future product offerings.

Polaris is venturing into specialized urban mobility, a segment distinct from its core powersports. This area, encompassing everything from compact electric scooters to innovative last-mile delivery vehicles, is experiencing rapid expansion, projected to reach hundreds of billions globally by 2030. Think about the growing need for efficient, eco-friendly transport in densely populated cities.

These new urban mobility solutions are positioned as potential Stars within Polaris's BCG matrix. The market is characterized by high growth potential, fueled by evolving consumer preferences and regulatory support for sustainable transportation. For instance, the global micro-mobility market alone was valued at over $40 billion in 2023 and is expected to grow at a compound annual growth rate of over 15% through 2030.

However, Polaris currently holds a low market share in this burgeoning sector, making these initiatives question marks. The significant investment required for research, development, manufacturing, and marketing these highly experimental products poses a considerable challenge. Success hinges on Polaris’s ability to innovate and effectively capture market share against established players and emerging startups.

Next-Generation Connected Vehicle Services

Polaris is strategically positioning its next-generation connected vehicle services and digital platforms as a high-growth opportunity, aiming to tap into the expanding market for value-added services and recurring revenue streams across its entire product lineup. This initiative represents a significant investment in a sector with substantial future potential.

While the connected vehicle services market is experiencing robust growth, with global revenues projected to reach over $230 billion by 2025, Polaris's penetration in this digital segment is still in its early stages. The company is therefore undertaking substantial investment to develop the necessary technology infrastructure and drive widespread customer adoption of these new offerings.

- Market Potential: The global connected car market is expected to grow significantly, with estimates suggesting it could reach over $230 billion by 2025, indicating a fertile ground for Polaris's new services.

- Investment Needs: Developing advanced digital platforms and connected services requires considerable capital expenditure for technology build-out, cybersecurity, and data management.

- Customer Adoption: Achieving meaningful market share necessitates overcoming potential barriers to customer adoption, such as data privacy concerns and the perceived value proposition of these digital services.

- Recurring Revenue: The focus on connected services aims to establish a new, predictable stream of recurring revenue for Polaris, diversifying its traditional product sales model.

Expansion into New, Untapped Geographic Markets for Specific Products

Polaris might be looking at expanding into new, untapped geographic markets for specific products, aiming for areas where it currently has little to no presence but sees significant potential. This strategy aligns with the question marks in the BCG matrix, indicating a need for careful evaluation. For instance, a company specializing in electric vehicle charging infrastructure could identify emerging markets in Southeast Asia or Africa with rapidly growing EV adoption rates but limited existing charging networks.

- High Investment, High Reward: Entering these markets demands substantial upfront capital for establishing distribution channels, tailoring marketing campaigns to local cultures, and adapting products to meet regional regulations and consumer preferences. For example, a company might need to invest millions in building out a new sales force and supply chain in a region like India, where the EV market is projected to grow significantly but is still in its nascent stages.

- Market Potential Assessment: The success hinges on accurately assessing the market potential, which includes understanding consumer demand, competitive landscape, and economic stability. A recent report from Statista projected the global electric vehicle market to reach over $800 billion by 2027, with emerging markets playing a crucial role in this growth.

- Risk Mitigation: The inherent risk is high due to the unknowns of market reception and the potential for unforeseen challenges. Companies often employ pilot programs or phased rollouts to test the waters before committing to a full-scale launch, thereby mitigating some of the financial exposure.

- Strategic Importance: Despite the risks, these ventures are strategically important for long-term growth and diversification, preventing over-reliance on established markets. By 2024, many automotive manufacturers are setting ambitious targets for EV sales in regions previously considered secondary, underscoring the shift towards global market expansion.

Question Marks represent business ventures in high-growth markets where Polaris currently holds a low market share. These initiatives, such as the nascent electric motorcycle concepts, require significant investment for research and development. The outcome is inherently uncertain, presenting a high-risk, high-reward scenario crucial for future market positioning.

These ventures are characterized by their potential to capture substantial future market share if successful, mirroring the early stages of many disruptive technologies. The global electric two-wheeler market alone, valued at roughly USD 15.5 billion in 2023, illustrates the immense growth potential that Polaris is targeting with these question marks.

The strategic imperative for Polaris is to nurture these question marks, transforming them into Stars or Cash Cows through sustained investment and innovation. Failure to do so could mean missing out on lucrative future markets, making the careful management of these high-potential, high-risk ventures critical for long-term success.

| Polaris Initiative | Market Growth Rate | Polaris Market Share | Strategic Implication |

| Electric Motorcycle Concepts | High | Low | High investment needed, uncertain outcome, potential for future market leadership. |

| Autonomous Off-Road Tech | High | Very Low | Long-term potential, significant R&D capital, uncertain commercialization timeline. |

| Specialized Urban Mobility | High | Low | Requires significant investment in R&D, manufacturing, and marketing; potential to capture market share. |

| Connected Vehicle Services | High | Early Stage | Focus on recurring revenue, requires substantial tech investment, dependent on customer adoption. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.