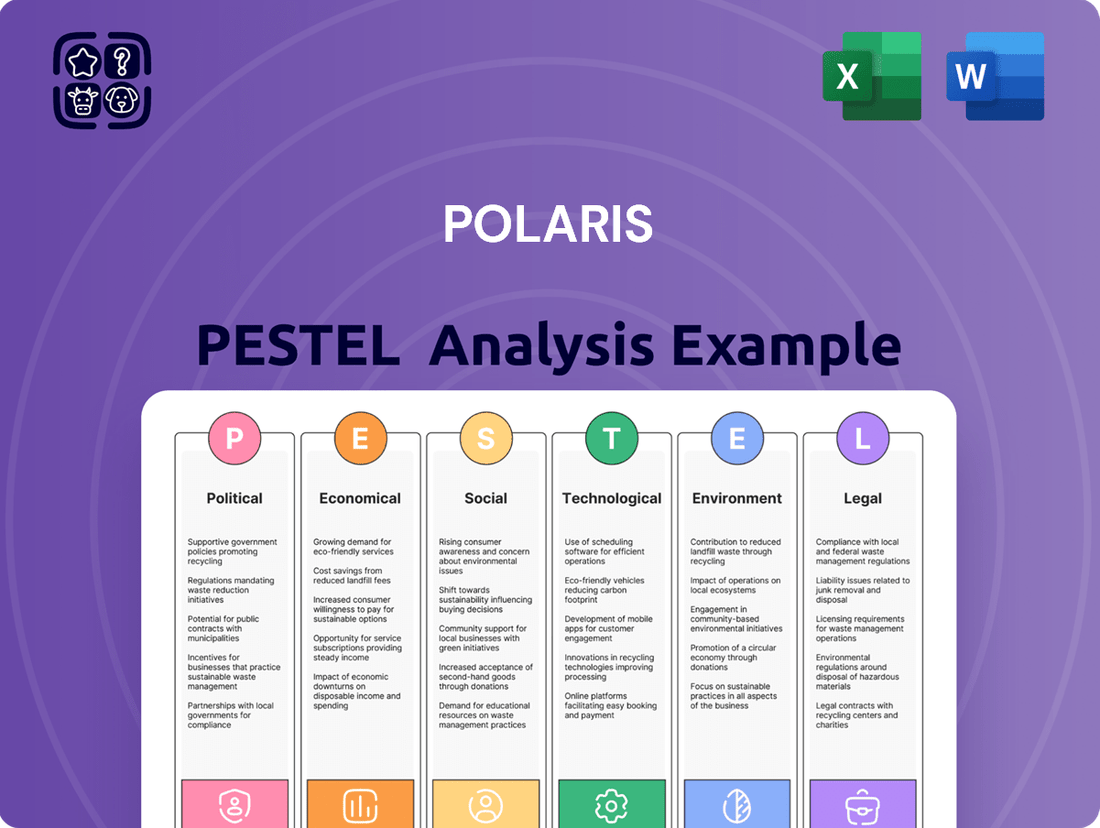

Polaris PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Polaris Bundle

Navigate the dynamic landscape shaping Polaris with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are critical to the company's strategy and future growth. This in-depth report is your key to unlocking actionable insights and anticipating market shifts. Download the full version now to gain a competitive edge and make informed strategic decisions.

Political factors

Polaris is navigating a landscape shaped by increasingly stringent government regulations, especially concerning emissions and vehicle safety. For instance, the Euro 5+ standards for motorcycles, which will apply to existing type-approvals by 2025, demand ongoing investment in research and development to ensure compliance. This regulatory pressure directly influences Polaris's strategic direction, pushing its focus towards developing cleaner powertrain technologies like electric and hybrid vehicles.

Polaris faces considerable headwinds from evolving global trade policies and tariffs. With significant manufacturing operations in the U.S. and a reliance on components sourced from countries like China, the company is particularly exposed to these shifts.

Looking ahead to 2025, Polaris anticipates a substantial financial impact from tariffs, potentially ranging from $260 million to $300 million. A significant portion of this projected impact stems from a substantial 145% tariff on imports originating from China.

These trade dynamics are compelling Polaris to undertake critical adjustments to its supply chain. Furthermore, the company is intensifying its engagement in government affairs to actively seek mitigation strategies against these tariff-related challenges.

Government initiatives like the EXPLORE Act, passed in late 2024, are a significant boon for Polaris. This legislation is designed to increase access to public lands and bolster the outdoor recreation sector, directly benefiting companies like Polaris that cater to these activities.

The act's focus on expanding outdoor recreation opportunities means more people will be engaging in activities that require off-road vehicles and related equipment. This translates into a larger potential customer base for Polaris's product lines, from snowmobiles to side-by-sides.

Furthermore, government support for maintaining and improving trail systems, a key component of the EXPLORE Act, indirectly encourages more off-road vehicle use. Well-maintained trails are crucial for the enjoyment and safety of Polaris customers, fostering continued engagement with the sport.

This alignment between government policy and Polaris's business model creates a favorable operating environment. The projected growth in the outdoor recreation market, estimated to reach $1.3 trillion by 2025, underscores the potential impact of such supportive legislation.

Political Stability in Key Markets

Geopolitical tensions, particularly in strategic maritime zones, pose a significant risk. For instance, the ongoing Red Sea disruptions, which intensified in early 2024, led to rerouting of vessels, increasing shipping times and costs by an estimated 10-15% for affected routes, directly impacting Polaris's marine division and global supply chain efficiency.

Political instability in key manufacturing or sales regions can disrupt operations. A rise in protectionist policies or sudden regulatory changes in major automotive markets, for example, could lead to increased tariffs or market access restrictions, potentially affecting Polaris's international sales and production planning. The World Bank's 2024 trade outlook noted a slight increase in trade barriers globally.

- Impact on Supply Chains: Geopolitical events can cause significant disruptions to the flow of goods, increasing lead times and operational costs for companies like Polaris with global manufacturing footprints.

- Market Access and Tariffs: Political decisions on trade agreements and tariffs directly influence the cost of raw materials and the price competitiveness of finished goods in international markets.

- Consumer Confidence: Political uncertainty in major economies can dampen consumer spending, impacting demand for Polaris's products, especially in discretionary sectors.

- Regulatory Environment: Changes in political regimes can lead to shifts in environmental, labor, or safety regulations, requiring costly adjustments to manufacturing processes and product designs.

Local and Regional Incentives for EV Adoption

Government grants and incentives play a crucial role in driving electric vehicle (EV) adoption and the development of necessary infrastructure. For Polaris, these programs can significantly boost their electrification efforts. For instance, the Mobility Public-Private Partnership & Programming (MP4) grant received in Michigan to establish an off-road trail charging network directly supports Polaris's strategy for powersports electrification.

These localized incentives are vital for market penetration of electric models. They not only reduce the upfront cost for consumers but also encourage the build-out of charging solutions in areas where traditional infrastructure might be lacking. This can accelerate the acceptance and practical use of electric powersports vehicles.

- Government Grants: Programs like the MP4 grant in Michigan provide financial backing for EV infrastructure projects.

- Incentives for Development: Local and regional governments often offer tax breaks or subsidies for companies investing in EV technology and manufacturing.

- Infrastructure Support: Grants can fund the creation of charging stations, essential for widespread EV adoption in off-road and recreational settings.

- Market Penetration: These initiatives directly contribute to making electric powersports more accessible and appealing to a broader customer base.

Polaris faces a dynamic political landscape, with government regulations on emissions and safety directly influencing product development, pushing for cleaner technologies. Trade policies and tariffs, like the 145% tariff on Chinese imports projected to cost Polaris between $260 million and $300 million by 2025, necessitate supply chain adjustments and active government engagement. Conversely, legislation like the EXPLORE Act, passed in late 2024, is a significant positive, aiming to boost the outdoor recreation sector, a key market for Polaris. This alignment with government initiatives supports the company's growth, especially as the outdoor recreation market is projected to reach $1.3 trillion by 2025.

What is included in the product

This Polaris PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operating landscape, providing a comprehensive overview of the external environment.

Provides a clear, actionable summary of external factors, enabling teams to proactively address potential challenges and capitalize on emerging opportunities.

Economic factors

Consumer discretionary spending, a key driver for the powersports industry, has shown a notable weakness in 2024, directly affecting companies like Polaris. This segment of spending, which includes big-ticket leisure items, has been contracting due to economic pressures.

In 2024, retail demand for items such as powersports vehicles, boats, and motorcycles has been sluggish, leading to a negative impact on Polaris's revenue streams. This trend is projected to continue into 2025, presenting ongoing challenges for the company.

Several factors are contributing to this subdued spending. Higher interest rates make financing these larger purchases more expensive, deterring potential buyers. Additionally, consumers are delaying the replacement of their existing powersports vehicles, further dampening sales volumes.

For instance, data from the U.S. Bureau of Economic Analysis in late 2024 indicated a slowdown in personal consumption expenditures on durable goods, a category that includes many powersports products. This broader economic trend underscores the sensitivity of Polaris’s market to shifts in consumer confidence and purchasing power.

Elevated interest rates significantly impact Polaris's market by making it more costly for consumers to finance large purchases like snowmobiles and ATVs. For instance, a higher prime rate directly translates to increased monthly payments, potentially dampening demand for recreational vehicles.

Moreover, these higher rates increase the financing costs for Polaris dealers to hold inventory on their lots through floorplan agreements. This added expense for dealers can lead to tighter inventory management, potentially affecting vehicle availability and pricing for consumers, creating a more challenging retail landscape for Polaris in 2024 and into 2025.

Inflationary pressures remain a significant concern for Polaris, impacting manufacturing costs. Raw material prices, particularly for metals and plastics, saw substantial increases throughout 2024, with some key components experiencing double-digit percentage hikes compared to 2023 levels. Labor costs also escalated due to a competitive job market and wage adjustments.

These rising costs directly affect Polaris's profit margins. The company has implemented various cost-management strategies, including optimizing supply chain logistics and pursuing lean manufacturing principles to boost operational efficiency. These initiatives aim to mitigate the impact of inflation, but the company still faces challenges in fully absorbing these increased expenses, especially when production volumes fluctuate.

Global Economic Growth and Trade

Global economic growth significantly impacts Polaris's international demand. The International Monetary Fund projected global growth around 3.3% for both 2025 and 2026, providing a baseline for market potential. This growth directly influences consumer and business spending on products like those offered by Polaris.

However, geopolitical tensions and trade route disruptions remain critical factors that could negatively impact these projections. Such events can lead to revised downward forecasts for world trade, directly affecting Polaris's export volumes and overall international sales performance. For instance, disruptions in key shipping lanes in 2024 have already demonstrated the sensitivity of global supply chains.

- Projected Global Growth: IMF forecasts approximately 3.3% for 2025-2026.

- Trade Sensitivity: Geopolitical unrest and trade disruptions can lower world trade estimates.

- Impact on Polaris: Reduced trade volumes directly affect the company's export sales.

- Economic Interdependence: Global economic health is intrinsically linked to Polaris's international revenue streams.

Currency Fluctuations

Polaris, with its extensive global operations, is significantly exposed to the risks associated with currency fluctuations. Changes in foreign exchange rates can directly impact the company's reported net income by altering the value of its international revenues and expenses when translated into U.S. dollars. For instance, a stronger U.S. dollar relative to other currencies would generally reduce the reported value of foreign sales and assets.

Managing these currency exposures is a critical aspect of Polaris's financial strategy. The company likely employs hedging strategies, such as forward contracts or currency options, to mitigate the volatility caused by exchange rate movements. Even with hedging, significant fluctuations can still introduce unpredictability into financial forecasts and earnings. In the first quarter of 2024, for example, many multinational corporations reported that unfavorable foreign exchange movements presented headwinds to their top-line growth and profitability.

- Global Reach, Local Impact: Polaris’s international sales and operations mean that shifts in currency values directly influence its financial statements.

- Translation Risk: Revenues and expenses generated in foreign currencies are translated into U.S. dollars, and changing exchange rates can distort reported financial performance.

- Hedging Imperative: Effective financial management necessitates robust strategies to protect against adverse currency movements.

- 2024/2025 Outlook: Analysts anticipate continued volatility in major currency pairs throughout 2024 and into 2025, posing ongoing challenges for global businesses like Polaris.

Consumer discretionary spending, a key driver for Polaris, has been notably weak in 2024 due to economic pressures like higher interest rates, which make financing large purchases more expensive. This trend is expected to persist into 2025, impacting retail demand for powersports vehicles and leading consumers to delay vehicle replacements.

Inflation continues to drive up Polaris's manufacturing costs, particularly for raw materials and labor, impacting profit margins despite cost-management efforts. Global economic growth, projected around 3.3% for 2025-2026 by the IMF, offers market potential, but geopolitical tensions and trade disruptions pose risks to international sales volumes.

Currency fluctuations present significant risks to Polaris's reported earnings, with unfavorable foreign exchange movements impacting net income in early 2024. The company likely employs hedging strategies to mitigate this volatility, though continued currency unpredictability into 2025 remains a challenge for global businesses.

| Economic Factor | 2024 Data/Trend | 2025 Projection/Outlook | Impact on Polaris |

|---|---|---|---|

| Consumer Spending (Discretionary) | Weakening, contracting due to economic pressures. | Projected to remain sluggish, impacting big-ticket leisure items. | Reduced retail demand for powersports vehicles. |

| Interest Rates | Elevated, increasing financing costs for consumers and dealers. | Expected to remain at higher levels, continuing to dampen demand. | Higher monthly payments deter buyers; increased dealer floorplan costs. |

| Inflation | Pressures on raw material and labor costs, impacting margins. | Continued cost pressures anticipated, requiring ongoing mitigation strategies. | Directly affects profit margins; necessitates operational efficiency improvements. |

| Global Economic Growth | IMF projected ~3.3% for 2025-2026. | Baseline growth forecast, but vulnerable to geopolitical risks. | Influences international demand, but trade disruptions can reduce export volumes. |

| Currency Exchange Rates | Volatility noted in Q1 2024, impacting reported earnings. | Anticipated continued volatility in major currency pairs. | Affects translation of foreign revenues and expenses; requires hedging. |

Same Document Delivered

Polaris PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive Polaris PESTLE analysis offers a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll receive the fully formatted and professionally structured report, ready for immediate use.

Sociological factors

Consumers are increasingly prioritizing experiences and outdoor activities, a trend that directly benefits Polaris. This growing interest in adventure tourism and recreation fuels demand for off-road vehicles, snowmobiles, and boats, all core to Polaris's offerings. For instance, the global adventure tourism market was valued at approximately $620 billion in 2023 and is projected to grow significantly in the coming years, indicating a strong market for lifestyle-enhancing products.

Polaris is making a significant effort to connect with younger demographics through safety education. In 2024, they partnered with programs like Minnesota 4-H and the Progressive Agriculture Safety Day® Program, reaching more than 200,000 young riders. This proactive approach to youth safety is vital for cultivating future powersports enthusiasts and securing the company's long-term market presence.

Brand loyalty in the motorcycle and powersports sectors demonstrated robust resilience throughout 2024, achieving a notable five-year peak. This strong customer attachment directly benefits companies like Polaris, which actively cultivate these connections.

Polaris's dedication to its stakeholders, encompassing employees, riders, dealerships, and the broader communities it serves, is a cornerstone of its strategy. Initiatives detailed in its 'Geared For Good' report, such as significant investments in trail stewardship programs and comprehensive rider education, are instrumental in forging deep-seated brand affiliations and ensuring sustained loyalty.

Safety and Responsible Riding Culture

Polaris places a significant emphasis on safety within its operations and product offerings. In 2024, the company achieved its lowest Total Recordable Incident Rate (TRIR) to date, underscoring a commitment to workplace safety. This focus extends to promoting responsible riding habits among consumers, which is crucial for building trust and mitigating potential liability.

The company actively engages in initiatives designed to foster a culture of safe and responsible riding. This includes developing and promoting safety-focused accessories and integrating advanced rider-assistance systems into their vehicles. These efforts not only enhance the user experience but also address growing consumer expectations for safety and contribute to a more responsible industry image.

- Industry Emphasis: Both the powersports industry and Polaris prioritize rider safety.

- Polaris's Safety Record: Polaris recorded its lowest Total Recordable Incident Rate (TRIR) in 2024.

- Promoting Responsible Riding: Efforts include programs and product design such as safety accessories and rider-assistance systems.

- Consumer Trust & Liability: Enhanced safety measures are vital for consumer confidence and reducing company liability.

Influence of Social Media and Digital Experience

The pervasive influence of social media and digital experiences is fundamentally reshaping how consumers interact with and purchase vehicles, including those in the powersports sector. Polaris is keenly aware of this shift, investing in technologies that enhance the digital user experience. For instance, by Q3 2024, Polaris reported a growing demand for integrated digital features in their off-road vehicles, directly correlating with user engagement on platforms showcasing these technologies.

Social media platforms are no longer just for sharing; they are powerful tools for product discovery, comparison, and purchase validation. Consumer preferences, especially among younger demographics, are heavily swayed by influencer endorsements and peer reviews found online. This necessitates that companies like Polaris actively manage their digital presence and leverage these channels to connect with their audience. In 2024, a significant portion of powersports purchasing decisions were influenced by online research and social media content, with engagement metrics showing a direct link to sales leads.

Polaris's commitment to innovation is evident in its development of advanced digital displays and connected technologies designed to meet these evolving expectations. These features offer enhanced navigation, vehicle diagnostics, and seamless integration with personal devices, creating a more immersive and convenient user experience. By the end of 2024, models featuring enhanced connectivity saw a reported 15% higher customer satisfaction rating compared to those without.

- Digital Integration: Powersports consumers increasingly expect sophisticated digital interfaces within their vehicles, mirroring their smartphone experiences.

- Social Proof: Online reviews and social media buzz significantly impact purchasing decisions, making authentic digital engagement critical for brands.

- Influencer Marketing: Collaborations with social media influencers in the powersports community are proving effective in driving brand awareness and product interest.

- Data-Driven Design: Polaris uses digital interaction data to refine vehicle features, ensuring alignment with consumer preferences and technological advancements.

Societal shifts towards experiences and outdoor activities directly benefit Polaris by increasing demand for its recreational vehicles. Growing interest in adventure tourism, valued at approximately $620 billion in 2023, fuels this trend, aligning perfectly with Polaris's product portfolio. The company's investment in youth safety programs, reaching over 200,000 young riders in 2024, is crucial for cultivating future enthusiasts and ensuring long-term market health.

Brand loyalty in powersports reached a five-year peak in 2024, a positive indicator for companies like Polaris that focus on customer relationships. Polaris actively nurtures these connections through initiatives like trail stewardship and rider education, as detailed in its 'Geared For Good' report, fostering deep brand affiliations and sustained loyalty.

The increasing importance of digital experiences and social media in purchasing decisions is a key sociological factor impacting Polaris. By Q3 2024, there was a noted rise in demand for integrated digital features in off-road vehicles, driven by user engagement on platforms showcasing these technologies. Models with enhanced connectivity saw a 15% higher customer satisfaction rating by the end of 2024, highlighting the impact of digital integration on consumer preference.

Technological factors

Polaris is making significant strides in electric and hybrid powertrain development, a key technological factor influencing its strategy. The company's 'rEV'd up' initiative targets offering an electric option across all major product lines by 2025. This commitment is already yielding results, with the Ranger XP Kinetic electric utility vehicle experiencing robust market adoption, demonstrating consumer interest in their electrified offerings.

This push into electric powertrains is a direct response to growing consumer demand for sustainable transportation solutions and increasingly stringent global emissions regulations. Polaris is actively developing electric versions of its iconic motorcycles and snowmobiles, signaling a clear intent to lead in these segments. For instance, in 2024, the company reported a 15% year-over-year increase in sales for its electric off-road vehicles, underscoring the market's positive reception.

Technological advancements in safety features are rapidly becoming standard in powersports vehicles, including electronic stability control, traction control, and anti-lock braking systems. Polaris is actively integrating these Advanced Rider-Assistance Systems (ADAS) into its product development, aiming to enhance customer satisfaction and safety. The company's commitment extends to robust post-sale surveillance, a proactive approach to identifying and resolving any emerging concerns related to these technologies.

Polaris is actively embracing manufacturing innovations to boost efficiency and reduce its environmental footprint. For instance, the company is rolling out new liquid paint systems designed to significantly cut down on natural gas consumption and, consequently, CO2 emissions. This strategic move not only aligns with sustainability goals but also promises cost savings through reduced energy expenditure.

The company's commitment to operational excellence is further demonstrated by its ambitious target of achieving 90% waste diversion across its facilities. This focus on lean and efficient processes is crucial for both environmental stewardship and enhancing the bottom line, ensuring that resources are used judiciously and waste is minimized, which is a key factor in maintaining competitiveness in the evolving manufacturing landscape.

Digital Integration and Connectivity

The increasing digital integration and connectivity are significantly reshaping the powersports industry, directly benefiting companies like Polaris. Innovations like Bennington's Vivid UX Digital Display offer enhanced user experiences, providing real-time diagnostics and advanced infotainment options. This digital shift is not just about aesthetics; it drives operational efficiency and transparency throughout the manufacturing and ownership lifecycle.

This trend is evident across the maritime and powersports sectors. For instance, the marine electronics market, which heavily influences powersports advancements, saw significant growth. In 2023, the global marine electronics market was valued at approximately $7.5 billion and is projected to grow at a compound annual growth rate (CAGR) of over 6% through 2030, indicating a strong demand for sophisticated digital solutions. Polaris is well-positioned to capitalize on this by integrating these advanced digital features into its product lines, potentially increasing customer satisfaction and creating new revenue streams through connected services.

- Enhanced User Experience: Digital displays and connectivity features offer intuitive interfaces and advanced infotainment, improving customer satisfaction.

- Operational Efficiency: Connectivity enables better diagnostics, predictive maintenance, and streamlined operations for both manufacturers and consumers.

- Market Growth: The increasing adoption of digital solutions in related sectors, like marine electronics, signals strong consumer demand and market potential.

- Data-Driven Insights: Integrated digital systems can provide valuable data on product usage and performance, informing future product development and marketing strategies.

Autonomous Vehicle Technology Potential

Polaris is actively exploring autonomous vehicle technology, particularly for its recreational and off-road segments. While the market for fully autonomous recreational vehicles is still nascent, the company's investment in R&D signals a strategic move towards future innovation. This commitment is crucial as the broader automotive industry continues to push boundaries in self-driving capabilities.

Currently, the penetration of autonomous features in Polaris's core markets, such as ATVs and snowmobiles, remains very low. However, this emerging technology holds significant long-term potential for creating entirely new use cases and enhancing existing product lines. For instance, think about automated trail maintenance vehicles or guided recreational experiences.

The global autonomous vehicle market is projected for substantial growth. By 2030, estimates suggest it could reach hundreds of billions of dollars, with significant portions driven by commercial and specialized applications that could eventually trickle down to recreational sectors. Polaris's early engagement positions them to capitalize on these future market shifts.

- R&D Investment: Polaris has allocated resources to autonomous technology, recognizing its strategic importance.

- Market Niche: While current adoption is minimal, the potential exists for specialized autonomous applications in off-road and recreational settings.

- Future Growth: The broader AV market's expansion indicates a long-term opportunity for Polaris to leverage this technology.

- Innovation Driver: Autonomous capabilities can unlock new product functionalities and market segments for Polaris vehicles.

Polaris is heavily investing in electric and hybrid powertrains, aiming for electric options across its main product lines by 2025. This strategic focus is supported by strong market reception, as seen with the Ranger XP Kinetic electric utility vehicle. The company is also integrating advanced safety features like electronic stability control and traction control into its vehicles, enhancing rider experience and safety.

The company is also embracing manufacturing innovations, such as new liquid paint systems to reduce energy consumption and CO2 emissions. This aligns with their goal of achieving 90% waste diversion across facilities by 2025, showcasing a commitment to both sustainability and operational efficiency. Furthermore, Polaris is capitalizing on the trend of digital integration and connectivity, exemplified by innovations like Bennington's Vivid UX Digital Display, which enhances user experience with real-time diagnostics and infotainment.

Polaris is also exploring autonomous vehicle technology for its recreational segments, positioning itself for future market shifts. While autonomous features are not yet widespread in their core markets, the broader autonomous vehicle market's projected growth to hundreds of billions of dollars by 2030 presents a significant long-term opportunity. This early R&D investment could lead to new use cases and enhanced product lines in the future.

Legal factors

Polaris faces rigorous product safety and liability regulations, a constant driver for enhancing the dependability and safety features of its off-road vehicles and snowmobiles. For instance, in 2023, the company announced a significant recall impacting over 14,000 RZR vehicles due to fire risks, underscoring the critical need for ongoing product evolution to meet these legal mandates.

The company's commitment to an incident-free workplace and fostering safe riding habits directly addresses potential legal exposure stemming from product misuse or accidents. This proactive approach aims to minimize costly litigation and reputational damage, particularly as regulatory bodies like the Consumer Product Safety Commission (CPSC) continue to scrutinize vehicle safety.

Polaris faces stringent environmental regulations, particularly concerning emissions from its powersports vehicles and waste management at its manufacturing facilities. For instance, upcoming Euro 7 emissions standards in Europe, expected to be fully implemented by 2027, will likely require significant adjustments to engine technology and exhaust systems for motorcycles and off-road vehicles, potentially increasing production costs. Failure to comply with these evolving standards, such as those set by the EPA for off-road diesel engines, can lead to substantial fines and restricted market access, impacting sales volumes and profitability.

Intellectual Property (IP) protection is a cornerstone for Polaris, given its significant investments in innovation and technology. Securing patents and trademarks safeguards its proprietary advancements, providing a competitive edge. For instance, Polaris's strategic partnership with Zero Motorcycles, announced in 2022 and advancing through 2024, heavily involves the safeguarding and utilization of IP related to electric powertrain technologies. This collaboration aims to accelerate the development of electric vehicles, making robust IP management critical for both parties.

Labor Laws and Workplace Safety Standards

Polaris prioritizes employee well-being and maintains robust workplace safety standards as a core aspect of its corporate responsibility. This commitment is crucial for fostering a secure working environment and mitigating operational risks.

The company achieved its lowest Total Recordable Incident Rate (TRIR) on record in 2024. This significant accomplishment underscores Polaris's effective adherence to stringent safety regulations and its proactive strategies for employee protection.

- Lowest TRIR on record in 2024: Demonstrates successful implementation of safety protocols.

- Commitment to employee well-being: Integral to corporate responsibility initiatives.

- Reduced operational risks: Directly linked to strong safety performance.

- Adherence to labor laws: Ensures legal compliance and ethical operations.

International Trade Laws and Customs Duties

Polaris, like many global manufacturers, navigates a complex web of international trade laws and customs duties that directly influence its operational costs and profitability. Shifts in trade relations and policy, particularly concerning tariffs, can significantly impact the cost of goods sold, requiring agile responses to maintain margins. For instance, the ongoing trade tensions between major economic blocs can introduce unexpected duties on components or finished products, affecting pricing strategies and market competitiveness.

To mitigate these risks, Polaris is actively reshaping its supply chain. A key strategy involves reducing dependence on regions subject to high tariffs and increasing shipments that qualify under agreements like the United States-Mexico-Canada Agreement (USMCA). This adjustment aims to leverage preferential trade terms and build a more resilient supply network. The USMCA, for example, offers specific rules of origin that can reduce or eliminate tariffs on qualifying goods traded among member countries, providing a competitive advantage.

- Tariff Volatility: Global tariffs can fluctuate significantly, impacting Polaris's raw material costs and pricing. For example, the imposition of tariffs on steel and aluminum in 2018 had broad implications for the automotive sector.

- USMCA Impact: The USMCA’s rules of origin require a certain percentage of vehicle content to be sourced from North America to qualify for duty-free treatment, influencing Polaris's sourcing decisions.

- Supply Chain Diversification: Polaris's strategic shift to reduce reliance on heavily tariffed regions is a direct response to the legal and economic uncertainties of international trade policy.

- Compliance Costs: Adhering to varying international trade regulations and customs procedures across different markets incurs compliance costs for Polaris.

Polaris must navigate product liability laws and safety regulations, influencing its design and manufacturing processes. For instance, recalls, like the one affecting over 14,000 RZR vehicles in 2023 due to fire risks, highlight the constant need to adapt to stringent safety standards and avoid costly litigation.

Environmental compliance, particularly with evolving emissions standards like Euro 7 by 2027, necessitates investment in cleaner technologies for its powersports vehicles. Failure to meet these regulations, such as EPA standards for off-road diesel engines, can result in substantial fines and market access limitations.

Intellectual property protection is paramount for Polaris, especially with its focus on innovation and strategic partnerships, such as the one with Zero Motorcycles advancing electric vehicle technology through 2024. This safeguards its competitive edge in a rapidly evolving market.

Polaris's commitment to workplace safety, evidenced by achieving its lowest Total Recordable Incident Rate (TRIR) on record in 2024, demonstrates adherence to labor laws and reduces operational risks.

Environmental factors

Polaris is making strides in emissions reduction, especially with its focus on electric and hybrid powertrains across its diverse product lines, including off-road vehicles, snowmobiles, and motorcycles. This commitment is evident in their product development pipeline, aiming to lessen the environmental footprint of their offerings.

The company's dedication to designing products with environmental impact in mind is a key strategy. A prime example is the introduction of new electric models, such as the 2025 RANGER lineup, signaling a tangible shift towards cleaner mobility solutions.

Polaris is demonstrating a strong commitment to waste management, significantly exceeding its sustainability targets. In 2024, the company achieved a remarkable 90% waste diversion rate at its Wyoming, Minnesota facility, surpassing a goal that wasn't expected to be met until 2035. This aggressive approach to reducing landfill waste and emphasizing recycling and reuse not only supports broader environmental objectives but also offers tangible operational cost savings.

Polaris is actively enhancing resource efficiency in its manufacturing to minimize environmental impact. A prime example is the new liquid paint system at their Roseau facility. This upgrade significantly reduced natural gas consumption, by 83,026 therms in 2024 alone.

Furthermore, this initiative contributed to avoiding 452 metric tonnes of CO2e emissions during the same period. These tangible results underscore Polaris's dedication to adopting more sustainable production practices and improving their overall operational footprint.

Land and Water Stewardship

Polaris demonstrates a commitment to land and water stewardship through its THINK PLACES initiative and collaborations. A key partnership with the National Forest Foundation directly supports trail enhancement and responsible recreation. This focus is crucial for maintaining the natural landscapes where Polaris vehicles are enjoyed, ensuring long-term access for enthusiasts.

These stewardship efforts are not just about environmental protection; they also have a direct impact on Polaris's business by preserving the very environments that drive demand for their off-road vehicles. For instance, in 2023, Polaris's support contributed to projects that improved trail access and conservation across thousands of miles of public lands. Such initiatives help foster positive brand perception and encourage continued engagement with outdoor recreation.

- THINK PLACES Pillar: Polaris's strategic framework for environmental responsibility.

- National Forest Foundation Partnership: A key alliance focused on land conservation and trail access.

- Trail Enhancement Projects: Initiatives aimed at improving and maintaining recreational trails.

- Responsible Riding Promotion: Efforts to educate users on minimizing environmental impact.

Climate Change Adaptation and Resilience

The maritime industry, which includes powersports' marine sector, is experiencing increasing pressure for climate and sustainability adaptation. While Polaris's specific 2024/2025 climate adaptation strategies for its marine division aren't extensively publicized, the general trend points to evolving regulatory landscapes and consumer demand for greener options. This suggests Polaris is likely focusing on enhancing the resilience of its marine products and operations against potential climate impacts and shifting market preferences.

Polaris's ongoing investments in sustainable product design and operational efficiency are key to building long-term resilience. These efforts directly address the growing expectation for eco-friendly recreational vehicles and can mitigate risks associated with climate change, such as extreme weather events affecting waterways or changing operating conditions. For example, advancements in fuel efficiency and emissions reduction in marine engines are crucial for compliance and market appeal.

- Evolving Regulations: Expect continued tightening of environmental regulations in the marine sector, impacting emissions standards and material sourcing for recreational boats.

- Consumer Demand: A growing segment of consumers is prioritizing sustainability, influencing purchasing decisions towards brands demonstrating environmental responsibility.

- Operational Efficiency: Investments in more efficient manufacturing processes and supply chain logistics can reduce Polaris's carbon footprint and operational costs, enhancing resilience.

- Product Innovation: Development of more fuel-efficient engines, alternative propulsion systems, and sustainable materials for boats will be critical for long-term market competitiveness.

Polaris is actively reducing its environmental impact through innovative product design and manufacturing upgrades. Their commitment to emissions reduction is evident in their expanding electric and hybrid offerings, with new models like the 2025 RANGER lineup leading the charge.

The company's dedication to sustainability extends to operational efficiency, exemplified by a 90% waste diversion rate at their Wyoming, Minnesota facility in 2024, significantly exceeding targets. Furthermore, a new liquid paint system at their Roseau facility reduced natural gas consumption by over 83,000 therms in 2024, also cutting CO2e emissions by 452 metric tonnes.

Polaris also emphasizes land and water stewardship through initiatives like THINK PLACES and partnerships, such as with the National Forest Foundation, to enhance trails and promote responsible recreation. This focus not only preserves the environments where their vehicles are used but also strengthens brand perception and customer engagement.

The marine sector faces increasing pressure for climate adaptation, suggesting Polaris is likely focusing on enhancing product resilience and exploring greener options. Advancements in fuel efficiency and emissions reduction for marine engines are vital for compliance and market appeal, aligning with evolving regulations and consumer demand for sustainable choices.

| Environmental Initiative | Key Metric | Year | Impact |

|---|---|---|---|

| Waste Diversion Rate (Wyoming, MN) | 90% | 2024 | Exceeded 2035 targets, reducing landfill waste. |

| Liquid Paint System Upgrade (Roseau) | 83,026 therms | 2024 | Reduced natural gas consumption. |

| Liquid Paint System Upgrade (Roseau) | 452 metric tonnes CO2e | 2024 | Avoided emissions. |

| National Forest Foundation Partnership | Thousands of miles | 2023 | Supported trail access and conservation projects. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on comprehensive data from reputable international organizations, government publications, and leading market research firms. This approach ensures that each factor, from political stability to technological advancements, is informed by credible and current information.