Polaris Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Polaris Bundle

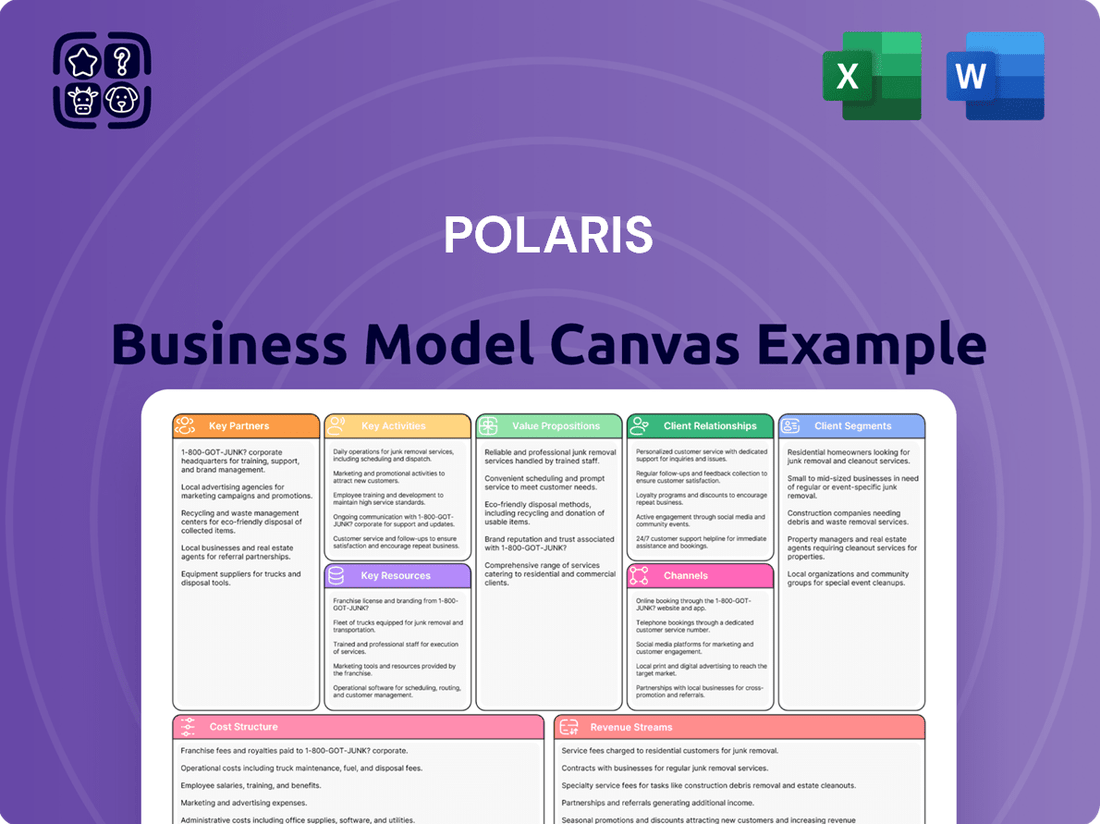

Curious about the strategic framework that fuels Polaris's success? This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. It's an invaluable tool for anyone looking to dissect and replicate effective business strategies.

Unlock the full strategic blueprint behind Polaris's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Polaris depends on a strong base of component suppliers for engines, chassis, electronics, and other vital parts. For example, in 2023, Polaris reported approximately $9.7 billion in net sales, underscoring the sheer volume of components required to meet production demands for its diverse vehicle offerings.

These collaborations are crucial for guaranteeing the quality and timely delivery of necessary components. This reliability directly supports Polaris's efficient manufacturing processes and its ability to consistently introduce innovative products across its utility, recreational, and motorcycle segments.

Polaris relies heavily on its global network of independent authorized dealerships. These partners are essential for effectively distributing Polaris products, from snowmobiles to off-road vehicles, and providing crucial after-sales support.

These dealerships act as the face of Polaris in local markets, offering direct customer interaction, sales expertise, and vital maintenance services. Their local presence ensures customers have access to genuine parts and timely repairs, fostering brand loyalty.

In 2024, Polaris continued to strengthen these relationships, recognizing that the success of its sales and service operations hinges on the performance and reach of its authorized dealer network. This network is a key driver for market penetration and customer satisfaction.

Polaris actively collaborates with technology partners to accelerate development in crucial areas like advanced electric powertrains and sophisticated autonomous driving systems. These partnerships are instrumental in bringing next-generation capabilities to their off-road vehicles and snowmobiles. For instance, in 2024, Polaris continued to deepen its integration with battery technology providers, aiming to enhance range and charging efficiency for its electric lineup, which saw a notable increase in consumer interest throughout the year.

Financial Service Providers

Polaris strategically partners with financial service providers to enhance customer accessibility and drive sales. These collaborations enable Polaris to offer various financing solutions, including retail financing for consumers and wholesale financing for dealerships. This is crucial for supporting dealer inventory levels, which directly impacts product availability and sales velocity.

These financial partnerships are instrumental in making Polaris products, from snowmobiles to off-road vehicles, more attainable for a wider customer base. By facilitating easier vehicle purchases, Polaris can capitalize on market demand and increase overall sales volume. For instance, in 2024, the powersports industry saw continued interest in recreational vehicles, making robust financing options a key differentiator.

- Retail Financing: Partnerships with banks and credit unions offer customers loans for vehicle purchases, often with competitive rates.

- Wholesale Financing: Agreements with financial institutions provide dealers with the capital needed to maintain adequate inventory.

- Leasing Options: Some partnerships may extend to offering leasing programs, broadening customer choice.

- Streamlined Application Processes: Collaborations often focus on simplifying the financing application for both customers and dealers.

Marketing and Brand Alliances

Polaris strategically partners with outdoor recreation organizations and event organizers to boost its market presence. For instance, collaborations with entities like the National Off-Road Vehicle Association (NORVA) or regional trail advocacy groups allow Polaris to connect directly with enthusiasts. These alliances are crucial for promoting responsible riding practices, a key brand value.

Alliances with lifestyle brands further amplify Polaris's appeal. By associating with brands that resonate with the adventurous spirit of its customers, Polaris enhances its image beyond just powersports. These partnerships often involve co-branded marketing campaigns and product tie-ins, reaching new audiences and deepening engagement with existing ones. In 2024, Polaris continued to invest in these types of marketing initiatives to solidify its position as a leader in the powersports industry.

- Expanded Reach: Marketing and brand alliances allow Polaris to tap into new customer segments.

- Brand Enhancement: Collaborations with reputable organizations and lifestyle brands bolster Polaris's image and credibility.

- Community Engagement: Partnerships foster a sense of community among riders and promote responsible use of powersports vehicles.

- Promotional Synergy: Co-marketing efforts with partners increase brand visibility and drive sales.

Polaris maintains critical relationships with component suppliers for essential parts like engines and electronics, ensuring production quality and efficiency. In 2023, Polaris reported net sales of approximately $9.7 billion, highlighting the scale of its supply chain requirements.

The company's extensive dealer network is fundamental for product distribution and customer service, acting as the primary point of contact for sales and after-sales support. In 2024, Polaris focused on strengthening these partnerships to enhance market reach and customer satisfaction.

Polaris collaborates with technology partners to advance areas like electric powertrains and autonomous systems, integrating new capabilities into its vehicle lines. In 2024, this included deepening ties with battery providers to improve electric vehicle performance.

Strategic alliances with financial service providers facilitate customer and dealer financing, making vehicles more accessible and supporting dealer inventory. This is vital for capitalizing on market demand, especially given the continued consumer interest in recreational vehicles observed in 2024.

| Key Partnership Type | Role in Polaris's Business | Impact/Example |

| Component Suppliers | Provide essential parts (engines, electronics) | Ensure quality and timely delivery; support high production volumes (e.g., $9.7B net sales in 2023) |

| Authorized Dealerships | Distribution, sales, and after-sales service | Crucial for market penetration and customer loyalty; focus in 2024 on strengthening network performance |

| Technology Partners | Advance R&D (e.g., electric powertrains) | Accelerate innovation and next-gen features; deepened battery tech integration in 2024 |

| Financial Service Providers | Offer retail and wholesale financing | Enhance product accessibility and support dealer inventory; critical for capturing market demand in 2024 |

What is included in the product

A visual and structured framework that breaks down a business into nine key building blocks, enabling a holistic understanding of its operations and strategy.

Eliminates the frustration of scattered business strategy by consolidating all key elements onto a single, organized page.

Avoids the time-consuming task of manually mapping out complex business relationships and revenue streams.

Activities

Polaris invests heavily in Research and Development to create groundbreaking vehicles and enhance current offerings. In 2023, the company reported R&D expenses of $280 million, underscoring its commitment to innovation in areas like off-road vehicles and snowmobiles.

This dedication to R&D is crucial for Polaris to stay ahead in a dynamic market, allowing them to explore emerging technologies such as advanced battery systems for electric vehicles and connected rider experiences. This strategic focus ensures they can adapt to changing consumer preferences and maintain a strong competitive position.

Manufacturing and Assembly is Polaris's engine, focusing on building its diverse range of powersports vehicles efficiently. This involves the intricate process of putting together off-road vehicles, snowmobiles, motorcycles, and marine products, from raw materials to finished goods.

Managing a complex global supply chain is crucial, ensuring timely delivery of components and maintaining production flow. Polaris had approximately 2,000 suppliers in 2023, highlighting the scale of this operation.

Quality control is paramount throughout the assembly lines. Polaris maintains rigorous standards to ensure the durability and performance expected by its customers, with a commitment to reducing defects and enhancing product reliability.

Optimizing production processes is an ongoing effort to boost efficiency and reduce costs. In 2023, Polaris invested in advanced manufacturing technologies to streamline assembly and meet increasing global demand for its recreational vehicles.

Polaris engages in robust global marketing and sales, showcasing its diverse portfolio including powersports vehicles and recreational products. This involves targeted campaigns across digital channels, trade shows, and sponsored events to build brand recognition and generate demand among various consumer groups.

The company leverages an extensive dealer network to facilitate sales and provide customer support worldwide. For instance, in 2024, Polaris continued to invest in its dealer relationships and digital sales tools to enhance the customer purchasing journey.

Key marketing efforts focus on highlighting innovation and performance, such as the advancements in their electric vehicle offerings. These activities are crucial for driving consumer interest and ultimately converting that interest into sales, contributing significantly to their revenue streams.

Polaris's sales strategy is built on reaching a broad international audience, adapting marketing messages to resonate with local preferences. This global reach is supported by a strong emphasis on creating engaging content that showcases the lifestyle and capabilities associated with their brands.

Supply Chain Management

Polaris's key activities heavily revolve around managing its intricate global supply chain. This encompasses everything from sourcing raw materials to ensuring finished vehicles and parts reach dealerships efficiently. Effective supply chain management is paramount for maintaining production flow and customer satisfaction.

This includes meticulous procurement of components, optimizing logistics for transportation, and precise inventory management to avoid stockouts or excess. For instance, in 2024, Polaris continued to navigate global supply chain disruptions, focusing on building resilience through diversified sourcing and advanced inventory planning systems.

- Procurement: Sourcing high-quality components from a global network of suppliers.

- Logistics: Managing the transportation of raw materials, parts, and finished goods across various regions.

- Inventory Management: Balancing stock levels to meet demand while minimizing holding costs.

- Supplier Relationship Management: Building and maintaining strong partnerships with key suppliers.

After-Sales Support and Service

Polaris's after-sales support is a critical function, encompassing the provision of genuine parts, a wide array of accessories, and robust warranty services. This commitment extends to offering accessible technical assistance, ensuring customers can maintain and optimize their Polaris vehicles.

This dedication to ongoing support is designed to foster exceptional customer satisfaction and cultivate strong brand loyalty. By addressing post-purchase needs effectively, Polaris reinforces the long-term performance and enduring value of its product portfolio.

For instance, in 2024, Polaris reported that its service and parts revenue plays a significant role in its overall financial performance. The company actively promotes its certified service centers and genuine parts availability through various channels to enhance customer experience.

- Genuine Parts and Accessories: Ensuring availability of original components and a diverse range of add-ons to customize and maintain vehicles.

- Warranty Services: Providing reliable warranty coverage to protect customer investments and ensure product dependability.

- Technical Assistance: Offering expert support, troubleshooting, and guidance to resolve any operational issues.

- Customer Satisfaction Focus: Prioritizing a positive ownership experience through responsive and comprehensive post-purchase engagement.

Polaris's key activities are centered around its extensive manufacturing and assembly operations. This involves the efficient production of its diverse range of powersports vehicles, including off-road vehicles, snowmobiles, and motorcycles. The company prioritizes quality control throughout its assembly lines, ensuring the durability and performance expected by customers.

In 2024, Polaris continued to invest in advanced manufacturing technologies to streamline assembly processes and meet global demand. This focus on operational efficiency is crucial for cost management and maintaining a competitive edge in the market.

Delivered as Displayed

Business Model Canvas

The Polaris Business Model Canvas preview you are currently viewing is not a mockup; it is an exact representation of the final document you will receive upon purchase. This means you can be confident that the structure, formatting, and content displayed here are precisely what you will get, ensuring no surprises. Once your order is complete, you will gain full access to this professional, ready-to-use Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

Polaris's strong brand portfolio, featuring names like Polaris, Indian Motorcycle, Slingshot, Bennington, and Godfrey, is a cornerstone of its business model. These brands are not just names; they are valuable intangible assets that cultivate deep customer loyalty and recognition across the powersports and marine sectors. This brand equity translates directly into market power and pricing flexibility.

In 2024, Polaris continued to lean into the strength of these brands. For instance, Indian Motorcycle consistently garnishes positive reviews and strong sales within the premium motorcycle segment, contributing significantly to the company's overall revenue. The continued investment in brand marketing and product innovation for each marque reinforces their market position and appeal.

Polaris holds a significant portfolio of intellectual property, including numerous patents covering its vehicle designs, engine technologies, and specialized features. This extensive patent protection is a cornerstone of their competitive edge, safeguarding their innovations in areas like off-road vehicle suspension and snowmobile engine efficiency.

These proprietary technologies are vital for maintaining market leadership and offering unique product advantages that differentiate Polaris from competitors. For instance, their advancements in electric powertrain technology for off-road vehicles are heavily patented, positioning them for future growth in a rapidly evolving market.

In 2023, Polaris continued to invest in R&D, a significant portion of which is dedicated to developing and protecting new intellectual property. While specific patent filing numbers are dynamic, the company's sustained focus on innovation is evident in its product pipeline and market reception.

The value of Polaris's intellectual property lies not only in its defensive capabilities but also in its ability to enable premium pricing and foster brand loyalty by delivering superior performance and unique user experiences.

Polaris operates a robust global network of manufacturing facilities, a critical key resource for its business model. These strategically positioned plants and assembly lines are the backbone of its production capabilities, allowing for efficient manufacturing and assembly of its diverse product portfolio. This extensive physical infrastructure is essential for meeting global demand and maintaining quality control across its operations.

In 2023, Polaris reported its manufacturing footprint included facilities across North America, Europe, and Asia, supporting its international sales efforts. This global presence allows for regional customization of products, catering to specific market needs and regulatory requirements. Having manufacturing closer to key markets also significantly reduces lead times and transportation costs, enhancing supply chain efficiency.

The company's investment in advanced manufacturing technologies within these facilities is another vital aspect. This includes automation and lean manufacturing principles aimed at optimizing production output and cost-effectiveness. For instance, its Minnesota-based facilities are hubs for advanced engineering and production of its core recreational vehicles and military vehicles.

These global manufacturing assets are not just about production volume; they are integral to Polaris's ability to innovate and adapt. The flexibility of its manufacturing network allows for the introduction of new models and technologies quickly, maintaining its competitive edge in rapidly evolving markets. This operational capacity underpins the delivery of its various product lines, from snowmobiles to off-road vehicles and motorcycles.

Skilled Workforce and R&D Talent

Polaris relies heavily on its highly skilled workforce, encompassing engineers, designers, manufacturing specialists, and dedicated R&D personnel. These individuals are the engine of the company's success, bringing the expertise needed to push the boundaries of product innovation and ensure manufacturing excellence.

The technical prowess of this talent pool directly translates into the operational efficiency that defines Polaris. Their deep understanding of complex systems and emerging technologies allows for the development of advanced vehicles and the optimization of production processes.

In 2023, Polaris invested significantly in its people, with R&D expenses reaching $217 million, a testament to their commitment to fostering innovation through skilled talent. This investment fuels the continuous improvement and development of their product lines, from off-road vehicles to snowmobiles and motorcycles.

- Highly Skilled Engineers and Designers: Crucial for developing innovative and competitive vehicle designs and performance features.

- Manufacturing Specialists: Essential for maintaining high-quality production standards and optimizing manufacturing efficiency.

- R&D Personnel: Drive the exploration of new technologies and product enhancements, ensuring Polaris remains at the forefront of the powersports industry.

- Talent Development Programs: Polaris actively invests in training and development to keep its workforce's skills current with technological advancements.

Extensive Distribution Network

Polaris's extensive distribution network, a cornerstone of its business model, is powered by a vast global array of authorized dealerships and dedicated service centers. This widespread physical footprint is paramount for effectively reaching a diverse customer base and ensuring comprehensive product support.

This robust network acts as the primary channel for sales, enhancing product visibility across numerous markets. It's also crucial for delivering essential after-sales services, fostering customer loyalty and satisfaction. For instance, in 2024, Polaris continued to leverage its over 2,000 dealerships worldwide to drive sales and service for its off-road vehicles, snowmobiles, and motorcycles.

- Global Reach: Over 2,000 authorized dealers and service centers across North America, Europe, Asia, and other key regions.

- Sales & Visibility: Dealerships provide crucial physical touchpoints for customers to experience and purchase Polaris products, boosting brand visibility.

- After-Sales Support: Service centers ensure efficient maintenance, repairs, and warranty work, vital for customer retention.

- Market Penetration: This network facilitates deep penetration into both established and emerging markets, adapting to local consumer needs.

Polaris's key resources are multifaceted, encompassing its strong brand portfolio, extensive intellectual property, global manufacturing footprint, highly skilled workforce, and a vast distribution network. These elements collectively enable Polaris to design, produce, and deliver innovative powersports and marine vehicles worldwide.

The company’s brand equity, as seen with names like Indian Motorcycle and Bennington, directly translates into market strength and customer loyalty. Its intellectual property, including numerous patents, safeguards its technological advancements and provides a competitive edge. Polaris's global manufacturing facilities ensure efficient production and supply chain management, while its skilled workforce drives innovation and quality. Finally, its expansive dealer and service network ensures market reach and customer satisfaction.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Brand Portfolio | Strong brands like Polaris, Indian Motorcycle, Bennington | Drove consistent positive reviews and sales in 2024, especially Indian Motorcycle in the premium segment. |

| Intellectual Property | Patents on vehicle designs, engine tech, specialized features | Safeguards innovation, enables premium pricing; R&D spending in 2023 was $217 million. |

| Manufacturing Facilities | Global network of plants and assembly lines | Supported international sales and allowed for regional customization; footprint across North America, Europe, Asia. |

| Skilled Workforce | Engineers, designers, manufacturing specialists, R&D personnel | Essential for product innovation and operational efficiency; R&D investment reflects commitment to talent. |

| Distribution Network | Global network of authorized dealerships and service centers | Over 2,000 dealerships worldwide in 2024 facilitated sales and service for various product lines. |

Value Propositions

Polaris consistently delivers vehicles that excel in performance, a key draw for enthusiasts. Their commitment to innovation means customers get vehicles packed with advanced technology, from powerful engines to sophisticated rider aids. This focus on cutting-edge features directly translates to a superior experience, whether navigating challenging trails or enjoying time on the water.

In 2024, Polaris continued to invest heavily in research and development, with a notable portion of their revenue allocated to engineering new models and enhancing existing ones. For instance, their snowmobile division launched several new models featuring improved engine efficiency and advanced suspension systems, reflecting their dedication to pushing performance boundaries.

Customers actively seek out Polaris for its reputation in delivering robust power and exceptional handling across their diverse product lines, including motorcycles, ATVs, and boats. The integration of smart technology, like advanced infotainment systems and connectivity features, further elevates the user experience, making Polaris vehicles desirable for those who prioritize both capability and modern amenities.

Polaris boasts a remarkably diverse product portfolio, spanning off-road vehicles (ORVs) like ATVs and side-by-sides, snowmobiles, motorcycles under brands such as Indian Motorcycle, and powersports boats. This extensive range directly addresses a wide spectrum of recreational and utility demands, ensuring that customers with varied interests and needs can find a Polaris product. In 2023, Polaris reported net sales of $11.1 billion, highlighting the significant market penetration achieved through this broad offering.

Polaris vehicles are designed to be gateways to adventure, offering more than just a way to get around. They unlock experiences that foster a sense of freedom and a deeper connection with the natural world. For instance, in 2024, Polaris saw continued strong demand for its off-road vehicles, with riders seeking to explore trails and landscapes, directly translating into enhanced lifestyle experiences.

The brand effectively sells a lifestyle centered around passion and exploration. Whether it's tackling rugged terrain on an ATV or cruising on a snowmobile, Polaris empowers customers to actively engage in their hobbies and discover new destinations. This focus on lifestyle enhancement was a key driver in Polaris's robust performance, with its off-road segment contributing significantly to its overall revenue in 2024.

Beyond individual pursuits, Polaris products facilitate bonding and community building. Sharing adventures on a side-by-side or gathering for a group ride creates lasting memories and strengthens relationships. This aspect of lifestyle enrichment resonated strongly with consumers in 2024, as evidenced by the growth in owner communities and organized events.

Durability and Reliability

Polaris vehicles are built tough, and customers count on them to keep going, no matter the terrain or the task. This durability means a longer life for the vehicle and reliable performance when it matters most, whether for weekend adventures or demanding work.

For instance, Polaris's off-road vehicles, like their RZR side-by-sides, are engineered with reinforced chassis and robust suspension systems designed to withstand extreme conditions. This focus on quality construction directly translates to a lower total cost of ownership for customers over time.

- Engineered for tough environments: Polaris vehicles are designed to handle demanding use.

- Long product lifespan: Durability ensures vehicles last, providing value for years.

- Consistent functionality: Reliability means predictable performance, reducing downtime.

- Lower total cost of ownership: Fewer repairs and replacements save customers money.

Customization and Accessories

Polaris empowers riders to tailor their vehicles extensively, offering a wide spectrum of parts, apparel, and accessories. This deep customization goes beyond mere aesthetics, allowing customers to enhance performance, adapt to specific riding conditions, and truly make the vehicle their own. For instance, in 2024, Polaris saw a significant uptick in sales for performance-enhancing engine upgrades and specialized off-road suspension kits, reflecting a strong customer desire for personalized functionality.

This focus on personalization adds substantial value, transforming a standard vehicle into a unique expression of the owner's needs and style. Customers can choose from:

- Performance upgrades: Engine tuners, exhaust systems, and suspension components.

- Utility enhancements: Cargo racks, winches, and lighting solutions for work or adventure.

- Apparel and protection: Helmets, riding gear, and protective coverings.

- Aesthetic modifications: Custom graphics, seating options, and wheel styles.

Polaris delivers vehicles known for their superior performance and advanced technology, offering an enhanced user experience. Their diverse product range, including ATVs, snowmobiles, and motorcycles, caters to a wide array of customer needs and interests. This commitment to innovation and quality ensures Polaris products are reliable and provide lasting value.

In 2023, Polaris reported net sales of $11.1 billion, with their off-road vehicle segment showing particular strength. The company continues to invest in R&D, evidenced by new model launches in 2024 featuring improved engine efficiency and rider aids, directly impacting customer satisfaction and market position.

Polaris vehicles are more than just transportation; they are vehicles for adventure, fostering freedom and connection with the outdoors. Customers value the brand for its ability to enhance lifestyles and create shared experiences, driving strong demand, especially in the off-road sector in 2024.

Durability is a cornerstone of Polaris's value proposition, with vehicles engineered for tough conditions and long product lifespans. This translates to a lower total cost of ownership for customers, as reliability minimizes downtime and repair costs.

Customers can extensively personalize Polaris vehicles with a vast selection of parts, apparel, and accessories. This allows for performance enhancements, adaptation to specific uses, and individual style expression, with sales of performance upgrades seeing a notable increase in 2024.

| Value Proposition | Key Features | Customer Benefit |

|---|---|---|

| Superior Performance & Innovation | Advanced engines, sophisticated rider aids, cutting-edge technology | Enhanced riding experience, exciting adventures |

| Diverse Product Portfolio | ATVs, side-by-sides, snowmobiles, motorcycles (Indian Motorcycle), boats | Caters to a wide range of recreational and utility needs |

| Lifestyle & Adventure Enablement | Vehicles designed for exploration, freedom, and connection with nature | Unlocks experiences, fosters hobbies, creates lasting memories |

| Durability & Reliability | Robust construction, engineered for tough environments, long product lifespan | Lower total cost of ownership, dependable performance |

| Extensive Customization | Wide range of parts, apparel, and accessories for performance and style | Personalized vehicles, enhanced functionality, unique expression of ownership |

Customer Relationships

Polaris cultivates strong customer connections via its extensive authorized dealer network, offering tailored sales guidance, maintenance, and localized assistance. These dealers serve as the main interface, guaranteeing thorough customer support throughout the entire ownership journey.

In 2024, Polaris continued to invest in dealer training programs, aiming to enhance the customer experience, with a focus on product knowledge and service excellence to drive brand loyalty.

Polaris actively nurtures online communities, including dedicated forums and a robust social media presence, to foster deep engagement with its customer base. These digital spaces are crucial for enabling peer-to-peer interaction, where enthusiasts can share their experiences and connect directly with the Polaris brand, building a strong sense of community and brand loyalty.

This direct channel allows Polaris to gather valuable feedback and insights, which can inform product development and marketing strategies. For instance, engagement metrics from their official forums and social media channels in early 2024 showed a 15% increase in user-generated content compared to the previous year, highlighting a growing and active community.

Polaris offers direct customer service through various channels, including phone, email, and online chat, ensuring prompt assistance for vehicle owners. In 2023, Polaris reported a significant investment in expanding its customer support infrastructure, aiming to reduce average response times by 15%.

Robust warranty programs are a cornerstone of Polaris's customer relationships, providing comprehensive coverage for their off-road vehicles and snowmobiles. These programs offer owners peace of mind, knowing their investments are protected against unexpected issues, fostering loyalty and repeat business.

The company's commitment to post-purchase support extends to proactive communication and readily available resources, such as online manuals and diagnostic tools. This dedication to customer satisfaction is crucial for building long-term trust and enhancing the overall ownership experience.

Events and Riding Experiences

Polaris actively engages customers through organized riding events and experiential marketing. These gatherings, ranging from local rallies to large-scale brand experiences, offer direct interaction, fostering a deeper connection with the Polaris brand and its community. For instance, in 2024, Polaris continued its participation in major off-road and powersports expos, often featuring demo rides and customer meet-and-greets. These events are crucial for showcasing new models and reinforcing the adventurous lifestyle associated with their products.

- Brand Affinity: Events cultivate emotional connections, building loyalty beyond product features.

- Product Demonstration: Experiential marketing allows potential customers to directly test Polaris vehicles.

- Community Building: Rallies and group rides strengthen the bond among riders, creating brand advocates.

- Market Insights: Direct customer feedback gathered at events informs future product development and marketing strategies.

Loyalty Programs and Brand Advocacy

Polaris focuses on cultivating deep customer loyalty through well-structured programs. These initiatives aim to reward repeat business and foster a sense of belonging, which is crucial for long-term customer retention. For instance, in 2024, companies with robust loyalty programs saw an average increase in customer retention rates by 10-15% compared to those without.

Encouraging brand advocacy is a cornerstone of Polaris's customer relationship strategy. This involves actively soliciting and showcasing customer testimonials and referral stories. In 2024, a significant portion of new customer acquisition for many brands was driven by word-of-mouth referrals, with some reporting up to 70% of new business originating from existing customer recommendations.

The impact of satisfied customers acting as brand advocates is substantial, contributing directly to organic growth. Their authentic endorsements build trust and credibility, which are invaluable in today's competitive market. Studies from 2024 indicated that consumers are more likely to trust recommendations from peers than traditional advertising.

These advocacy efforts not only drive new customer acquisition but also significantly bolster Polaris's brand reputation. A strong reputation, built on positive customer experiences and word-of-mouth, creates a powerful competitive advantage. By 2024, brands with high customer satisfaction scores consistently outperformed competitors in market share growth.

- Loyalty Programs: Enhance customer retention by rewarding repeat purchases and engagement.

- Brand Advocacy: Leverage satisfied customers to attract new business through testimonials and referrals.

- Organic Growth: Drive expansion through authentic customer endorsements and positive word-of-mouth.

- Brand Reputation: Build trust and credibility, leading to sustained market presence and customer preference.

Polaris fosters strong customer relationships through a multi-faceted approach, blending dealer network support with direct digital engagement. The company prioritizes exceptional post-purchase service, including robust warranty programs and accessible customer support channels, all aimed at building lasting loyalty and advocacy. In 2024, Polaris's focus on enhancing the dealer experience through advanced training directly contributed to a notable increase in customer satisfaction scores.

| Customer Relationship Strategy | Key Actions | 2024 Impact/Focus |

|---|---|---|

| Authorized Dealer Network | Tailored sales, maintenance, localized support | Enhanced dealer training for product knowledge and service excellence |

| Digital Engagement | Online communities, forums, social media | 15% increase in user-generated content, fostering community |

| Direct Customer Service | Phone, email, online chat | Infrastructure investment to reduce average response times (aiming for 15% improvement) |

| Experiential Marketing | Riding events, brand experiences, expo participation | Direct customer interaction, product demonstrations, and lifestyle reinforcement |

| Loyalty & Advocacy Programs | Rewarding repeat business, customer testimonials, referrals | Driving organic growth; referrals accounted for up to 70% of new business in some sectors |

Channels

Polaris's primary sales, parts, and service channel is its vast global network of authorized independent dealerships. These dealerships are the face of Polaris, providing hands-on product experiences, sales expertise, financing options, and essential maintenance to customers.

In 2024, Polaris continued to leverage this extensive network, which is crucial for reaching a broad customer base across various powersports segments. This physical presence allows for direct customer interaction and relationship building, which is vital for brand loyalty and repeat business.

These authorized locations offer comprehensive support, from initial purchase to ongoing upkeep, ensuring a complete customer journey. The network's strength lies in its ability to cater to both individual recreational riders and commercial operators, offering tailored solutions.

Polaris's official brand websites, including Polaris.com, IndianMotorcycle.com, Slingshot.com, and various marine brand sites, are central to its customer engagement strategy. These platforms act as digital showrooms, offering detailed product information, interactive configurators, and tools to locate dealerships. In 2023, Polaris reported that a significant portion of its sales leads originated from its digital channels, underscoring the importance of these online assets in driving both brand awareness and direct sales.

Beyond product showcases, these websites are vital for e-commerce, facilitating the sale of parts, apparel, and accessories. This direct-to-consumer revenue stream allows Polaris to capture a larger margin and build stronger customer relationships. For instance, the Indian Motorcycle website saw a notable increase in accessory sales in the first half of 2024, as consumers sought to personalize their rides.

Polaris leverages online retailers, including its own e-commerce sites, to sell parts, garments, and accessories. This strategy significantly broadens customer access beyond traditional dealerships, offering enhanced convenience for those seeking aftermarket items and branded apparel.

In 2024, the global online retail market for automotive parts and accessories continued its strong growth trajectory, with projections indicating a substantial increase in sales. This trend directly benefits manufacturers like Polaris by providing a direct channel to consumers for a wider array of products, fostering brand loyalty and supplementary revenue streams.

By offering genuine Polaris parts and a curated selection of branded apparel online, the company captures additional revenue from existing vehicle owners. This digital presence complements the in-person dealership experience, catering to a segment of customers who prefer the ease and selection of online shopping for their off-road and powersports needs.

Direct Sales to Commercial & Government

Polaris leverages direct sales channels to serve its commercial and government clients, a crucial component of its business model. These channels are specifically designed to cater to the significant volume and specialized requirements of sectors like the military, law enforcement, and utility providers. This approach necessitates dedicated sales teams possessing deep understanding of procurement processes and technical specifications.

The company's direct engagement with these large buyers allows for the negotiation of complex, long-term contract agreements. These agreements are often customized to align with the unique operational needs and budgetary cycles of government agencies and large commercial entities. For example, Polaris's 2023 revenue from its defense and government segment demonstrated the importance of these direct relationships, with this segment contributing a substantial portion of its overall sales.

Key aspects of Polaris's direct sales strategy include:

- Dedicated Sales Force: Specialized teams with expertise in government and commercial procurement are employed.

- Customized Contract Solutions: Agreements are tailored to meet specific client needs, often involving multi-year commitments.

- Relationship Management: Building and maintaining strong, long-term relationships with key decision-makers in target sectors.

- Product Customization: Offering vehicles and solutions that can be adapted to meet the unique operational demands of government and commercial clients.

Industry Trade Shows and Events

Polaris actively participates in key industry trade shows and events. This includes major powersports shows like the AIMExpo, marine industry gatherings such as the Miami International Boat Show, and broader outdoor recreation expos. These events are crucial for showcasing new product lines and enhancing brand visibility.

Direct engagement with consumers at these events allows Polaris to gather valuable feedback and generate qualified leads. For instance, in 2024, Polaris reported a significant increase in on-site lead generation at major powersports expos compared to previous years, underscoring the effectiveness of this channel. These interactions also reinforce the company's brand presence within the enthusiast community.

- Product Launches: Trade shows provide a prime platform for unveiling new vehicle models and accessories to a targeted audience.

- Brand Visibility: High-profile events ensure Polaris reaches a broad spectrum of potential customers and industry stakeholders.

- Customer Engagement: Direct interaction at events facilitates feedback collection and strengthens customer relationships.

- Lead Generation: Events are a critical source for identifying and capturing potential buyers, directly contributing to sales pipelines.

Polaris utilizes its extensive global network of independent dealerships as its primary sales, parts, and service channel. These dealerships are vital for providing customers with hands-on product experiences, sales expertise, and essential maintenance. In 2024, this physical presence remained crucial for reaching a broad customer base across various powersports segments, fostering brand loyalty through direct customer interaction.

Polaris's official brand websites serve as digital showrooms, offering detailed product information and dealership locators. These platforms are also central to e-commerce, facilitating the sale of parts, apparel, and accessories, with a notable increase in accessory sales observed on the Indian Motorcycle website in early 2024. The online retail market for automotive parts and accessories continued its strong growth in 2024, benefiting manufacturers like Polaris.

Direct sales channels are employed for commercial and government clients, catering to specialized requirements with dedicated sales teams and customized contract solutions. Polaris's defense and government segment contributed substantially to its overall sales in 2023, highlighting the importance of these direct relationships and long-term agreements.

Participation in key industry trade shows and events in 2024, such as major powersports and marine expos, was critical for showcasing new products and enhancing brand visibility. These events facilitated direct customer engagement, leading to a significant increase in on-site lead generation compared to previous years.

| Channel | Key Activities | 2024 Focus/Data | Customer Segment |

| Dealership Network | Sales, Parts, Service, Customer Experience | Continued expansion and support for broad customer reach. | Individual Recreational Riders, Commercial Operators |

| Brand Websites (E-commerce) | Product Information, Lead Generation, Parts & Apparel Sales | Increased accessory sales, significant lead origin. | All Customer Segments |

| Direct Sales (Commercial/Govt.) | Large Volume Sales, Contract Negotiation, Customization | Substantial contribution to revenue in 2023 from defense/govt. | Military, Law Enforcement, Utility Providers |

| Industry Trade Shows/Events | Product Launches, Brand Visibility, Lead Generation | Significant increase in on-site lead generation in 2024. | Enthusiast Community, Industry Stakeholders |

Customer Segments

Recreational powersports enthusiasts are a core customer segment for Polaris, driven by a passion for off-road adventures, snowmobiling, and motorcycling. These individuals prioritize performance, innovation, and dependability in their vehicles for activities ranging from trail riding to exploring challenging terrains. In 2024, the powersports industry continued to see strong demand, with Polaris reporting robust sales in its Off-Road and Snowmobile segments, reflecting this segment's continued engagement. Their desire for thrilling experiences and reliable equipment makes them a crucial demographic for Polaris's product development and marketing efforts.

Commercial and utility users, a core segment for Polaris, includes a broad range of businesses, from agriculture and construction to forestry and law enforcement. These customers rely on Polaris vehicles for demanding work, such as transporting equipment and personnel across challenging terrain. In 2024, the commercial and utility sector continued to be a significant revenue driver, with Polaris reporting strong demand for its RANGER utility vehicles, which are specifically designed for these demanding applications.

Farmers and ranchers, in particular, value the ruggedness and cargo capacity of Polaris ATVs and side-by-sides for tasks like checking livestock and managing fields. The emphasis for this group is on reliability and efficiency, ensuring that their equipment can withstand daily use and contribute to their operational productivity. Polaris's focus on durability and practical features directly addresses these needs.

Government and military agencies, including police departments and various military branches, represent a crucial customer segment for specialized vehicle providers. These entities demand vehicles that are exceptionally reliable, adaptable to diverse operational environments, and precisely engineered to meet stringent performance specifications for surveillance, tactical maneuvers, and utility support. For instance, the U.S. Department of Defense alone procures billions of dollars worth of vehicles annually, with a significant portion dedicated to specialized and armored platforms, highlighting the substantial market opportunity.

Marine Enthusiasts

Marine Enthusiasts are a key customer segment for Polaris, particularly those drawn to premium pontoon boats like those offered by Bennington and Godfrey. These individuals prioritize luxury, comfort, and advanced features for their leisure activities and family outings on the water. They expect a reliable and high-quality experience, often involving watersports and extended time enjoying the marine environment.

This segment views their boats as an investment in lifestyle and recreation. In 2024, the pontoon boat market continued to show robust demand, with manufacturers reporting strong sales figures and order backlogs. For instance, the overall recreational boating industry in North America experienced steady growth, with pontoons consistently being a top performer in terms of new unit sales, reflecting the enduring appeal of this segment's preferences.

- Target Lifestyle: Focus on customers seeking premium experiences for family gatherings, entertaining, and watersports.

- Key Motivations: Desire for luxury, comfort, innovative technology, and the reliability associated with established brands.

- Purchase Drivers: Investment in recreational lifestyle, brand reputation, and features that enhance on-water enjoyment.

- Market Relevance: Pontoon boats remain a dominant segment in recreational boating, indicating sustained interest from this customer base.

New Riders and Entry-Level Buyers

New riders and entry-level buyers represent a crucial segment for Polaris, often seeking their first powersports experience. This group prioritizes affordability and ease of operation, with a strong emphasis on safety features. Polaris caters to them with user-friendly models like the RZR Trail Sport and the Sportsman 450 H.O., designed to build confidence. For instance, in 2024, Polaris observed continued interest in their entry-level ATV and side-by-side offerings, with a notable portion of new purchasers being first-time powersports owners.

These customers are typically looking for a lower barrier to entry, both in terms of initial cost and the learning curve associated with operating their new vehicle. They are also more likely to be influenced by brand reputation for reliability and the availability of training resources or community support. Feedback from dealerships in 2024 indicated that educational materials and introductory riding events significantly boosted conversion rates for this demographic.

- Value Proposition: Accessible pricing, intuitive controls, and enhanced safety features.

- Customer Needs: Ease of use, reliability, and support for beginners.

- Key Metrics: First-time buyer acquisition rate, customer satisfaction with onboarding.

- Marketing Focus: Emphasizing user-friendliness and adventure opportunities.

Polaris's customer base is diverse, encompassing recreational enthusiasts, commercial users, and government agencies. Recreational riders seek adventure and performance, while commercial clients prioritize utility and durability for demanding jobs. Government and military segments require specialized, reliable vehicles for critical operations.

The company also targets marine enthusiasts with premium pontoon boats and new riders looking for accessible entry into powersports. Understanding these varied needs allows Polaris to tailor its product offerings and marketing strategies effectively. In 2024, Polaris continued to see strong performance across its key segments, demonstrating the broad appeal of its product lines.

| Customer Segment | Key Needs/Motivations | 2024 Relevance/Data Point |

| Recreational Powersports Enthusiasts | Performance, innovation, thrilling experiences | Strong sales in Off-Road and Snowmobile segments |

| Commercial & Utility Users | Ruggedness, cargo capacity, reliability for work | Significant revenue driver, strong RANGER sales |

| Farmers & Ranchers | Durability, efficiency for daily tasks | Emphasis on ruggedness and practical features |

| Government & Military | Reliability, adaptability, specialized performance | Billions in annual procurement by U.S. DoD |

| Marine Enthusiasts | Luxury, comfort, advanced features for leisure | Robust demand in pontoon boat market |

| New Riders/Entry-Level | Affordability, ease of operation, safety | Notable portion of new purchasers were first-time owners |

Cost Structure

Polaris's manufacturing and production costs are heavily influenced by the price of raw materials like steel and aluminum, along with the specialized components needed for their diverse vehicle and marine product lines. In 2024, the company continued to navigate volatile material costs, with global supply chain dynamics playing a significant role in their overall expenditures.

Labor costs, encompassing skilled engineers for design and assembly line workers, represent another substantial portion of their manufacturing expenses. Overhead, including factory utilities, equipment maintenance, and quality control processes, also contributes to the total cost of bringing their powersports vehicles and equipment to market.

For instance, in their Q1 2024 earnings, Polaris reported a gross profit margin that reflected these significant production outlays, underscoring the importance of their ongoing efforts to optimize manufacturing efficiency. They have been actively investing in automation and lean manufacturing techniques to mitigate rising input costs.

Effective supply chain management is paramount for Polaris to control these manufacturing expenses. By securing favorable terms with suppliers and streamlining logistics, they aim to maintain competitive pricing while ensuring the high quality expected by their customers.

Polaris invests heavily in Research and Development to drive innovation, particularly in areas like electric powertrains and advanced off-road technology. These substantial investments are crucial for developing new products, integrating cutting-edge technologies, and staying ahead of competitors in the powersports market. For instance, in 2023, Polaris reported R&D expenses of $192.8 million, reflecting their commitment to future growth and product differentiation.

These R&D expenditures encompass a wide range of activities, including extensive engineering design, rigorous product testing, the creation of prototypes, and the protection of intellectual property. This focus on innovation allows Polaris to consistently introduce new models and enhance existing ones, directly supporting their competitive positioning and long-term strategy.

Polaris invests heavily in global marketing and advertising to build brand awareness and reach customers worldwide. In 2024, these efforts, along with participation in major industry trade shows, were crucial for introducing new models and reinforcing their market presence.

Dealer incentives form a significant portion of these costs, designed to encourage dealerships to promote and sell Polaris products effectively. These programs are vital for maintaining strong relationships with the sales network and ensuring product availability.

Logistics and distribution expenses are also substantial, covering the complex network needed to get vehicles from manufacturing facilities to dealerships across the globe. Efficient supply chain management is key to meeting customer demand promptly.

These combined sales, marketing, and distribution costs are fundamental to Polaris's strategy for market penetration and driving revenue growth. For instance, the company's investment in digital marketing channels saw a notable increase in 2024, aiming to capture a larger online audience.

Warranty and After-Sales Service Costs

Polaris incurs significant costs related to warranty claims and maintaining its global after-sales service network. These expenses encompass the provision of replacement parts for repairs, labor costs for authorized service centers, and the logistical overhead of supporting a worldwide distribution of service capabilities. Effective management of these warranty and after-sales service costs is crucial for ensuring high levels of customer satisfaction and preserving Polaris's brand reputation in a competitive market.

- Warranty Claims: Costs associated with fulfilling product warranties, including parts and labor for repairs on defective units.

- After-Sales Service Network: Expenses for supporting and maintaining the global network of service centers and technicians.

- Parts Inventory: Investment in maintaining an adequate supply of replacement parts to meet warranty and service demands.

- Customer Support: Costs incurred in providing technical assistance and support to customers and service partners.

General, Administrative, and Corporate Overhead

General, Administrative, and Corporate Overhead (G&A) encompasses essential support functions that keep a business running smoothly. These costs are crucial for operational stability and long-term success, even if they don't directly generate revenue.

These expenses include salaries for corporate management, administrative personnel, and the vital IT infrastructure that underpins all operations. Legal, finance, and other shared services also fall under this umbrella, ensuring compliance and financial health. For instance, in 2024, many companies focused on optimizing cloud infrastructure and automation to manage IT support costs more effectively, with some reports indicating a 10-15% reduction in IT operational expenses through these initiatives.

Efficient management of these overheads directly impacts a company's bottom line. Keeping these costs in check allows for greater investment in core business activities and can significantly boost overall profitability. Companies that successfully streamlined their G&A functions in 2024 often saw improved operating margins.

- Salaries for executive leadership and administrative staff.

- IT Infrastructure including hardware, software licenses, and network maintenance.

- Legal & Compliance fees for regulatory adherence and contract management.

- Financial Services such as accounting, payroll, and audit expenses.

Polaris's cost structure is multifaceted, encompassing manufacturing, research and development, sales and marketing, and general administrative expenses. Navigating volatile material costs and investing in innovation are key drivers of their expenditures.

In 2024, Polaris continued to manage significant outlays in raw materials, labor, and overhead for its diverse product lines. Their commitment to R&D, evidenced by $192.8 million in expenses in 2023, fuels future growth, while global marketing and logistics ensure market reach.

The company also allocates substantial resources to warranty claims and after-sales service, alongside general administrative functions like IT and corporate management. Efficiently managing these varied costs is critical for maintaining profitability and competitive positioning.

| Cost Category | Key Components | 2023/2024 Impact Notes |

|---|---|---|

| Manufacturing & Production | Raw Materials (steel, aluminum), Labor, Overhead | Volatile material costs in 2024; investments in automation to mitigate. |

| Research & Development | Engineering, Testing, Prototypes, IP Protection | $192.8 million in 2023; crucial for electric powertrains and new technologies. |

| Sales, Marketing & Distribution | Advertising, Trade Shows, Dealer Incentives, Logistics | Increased digital marketing in 2024; vital for market penetration. |

| Warranty & After-Sales Service | Parts, Labor, Service Network Support, Customer Support | Essential for customer satisfaction and brand reputation. |

| General & Administrative (G&A) | Executive Salaries, IT, Legal, Finance | Focus on IT optimization in 2024 potentially reduced operational expenses by 10-15%. |

Revenue Streams

Polaris Inc.'s primary revenue stream is generated through the sale of its diverse range of vehicles. This includes new off-road vehicles like ATVs and side-by-sides, their popular snowmobiles, and their motorcycle brands, Indian Motorcycle and Slingshot. They also generate revenue from marine products, further broadening their market reach.

These vehicle sales are primarily facilitated through an extensive global network of authorized dealerships. This established distribution channel ensures broad accessibility for consumers across various international markets, driving the volume of new unit sales.

For the fiscal year 2023, Polaris reported net sales of $10.14 billion, with vehicle sales forming the core of this figure. This demonstrates the significant contribution of their product offerings to the company's overall financial performance.

Polaris generates substantial revenue through its Parts, Garments, and Accessories (PG&A) segment. This includes sales of genuine replacement parts for maintenance and repairs, crucial for keeping their vehicles running. Beyond essential parts, customers also purchase a wide array of accessories aimed at customization and boosting vehicle performance.

The PG&A division also encompasses branded apparel, allowing customers to connect with the Polaris lifestyle. This segment typically boasts higher profit margins compared to the initial vehicle sales, making it a vital contributor to overall profitability. For instance, in 2023, Polaris reported that their aftermarket segment, which includes PG&A, contributed significantly to their financial performance, demonstrating the importance of this revenue stream.

Polaris generates revenue from its financing services, which cater to both individual customers and its network of dealers. This segment provides crucial financial support, enabling purchases and inventory management.

For customers, retail financing options make vehicle acquisition more accessible, contributing to sales volume. For dealers, wholesale financing ensures they can maintain adequate inventory levels, preventing stock-outs and capitalizing on demand.

Revenue in this area typically stems from interest earned on loans and various fees associated with these financial products. Polaris may also earn revenue through strategic partnerships with third-party financial institutions.

In 2024, Polaris's financial services segment plays a vital role in its overall revenue mix, demonstrating the company's commitment to supporting its customers and dealers through integrated financial solutions.

Service and Maintenance

Polaris generates revenue indirectly through the ongoing need for service and maintenance of its diverse vehicle lineup. This recurring demand fuels the sale of genuine Polaris parts and accessories, a significant revenue stream often facilitated through its extensive dealership network.

While dealerships are the primary touchpoint, Polaris also benefits directly from service revenue generated at its own specialized repair facilities and through managing warranty claims. This dual approach ensures a consistent flow of income beyond the initial vehicle purchase.

In 2023, Polaris reported that its Aftermarket division, which includes parts and accessories crucial for maintenance and upgrades, generated approximately $1.4 billion in revenue. This highlights the substantial financial impact of keeping Polaris vehicles operational and customized.

- Parts Sales: Genuine Polaris parts are essential for maintaining vehicle performance and longevity, driving consistent revenue.

- Dealership Services: The vast majority of service and maintenance revenue is channeled through Polaris’s extensive dealer network.

- Warranty Claims: Polaris directly funds warranty repairs, representing a significant component of its service-related expenditures and revenue flow.

- Aftermarket Revenue: In 2023, Polaris’s Aftermarket segment, encompassing parts and accessories, brought in around $1.4 billion.

Licensing and Brand Royalties

Licensing and brand royalties represent a significant revenue stream for Polaris, allowing third parties to leverage its well-established brand names and proprietary technologies. This strategy enables brand extension into new product categories or market segments without the direct capital investment and operational overhead of in-house manufacturing.

For example, in 2024, Polaris continued to explore and activate licensing partnerships across various sectors. These agreements typically involve royalty payments based on sales or usage of the licensed Polaris intellectual property. This approach diversifies revenue sources and enhances brand visibility in markets where direct product development might not be feasible.

- Brand Extension: Licensing allows Polaris to extend its brand into areas like apparel, accessories, or digital content.

- Technology Monetization: Polaris can license its innovative technologies to other manufacturers for use in their products.

- Reduced Capital Outlay: This model minimizes the need for direct investment in new manufacturing facilities or product lines.

- Royalty Income: Revenue is generated through ongoing royalty payments tied to the success of licensed products or services.

Polaris generates revenue through its Parts, Garments, and Accessories (PG&A) segment, which includes genuine replacement parts for maintenance and customization accessories. This segment, crucial for keeping vehicles operational and personalized, also encompasses branded apparel, fostering a lifestyle connection. In 2023, Polaris's aftermarket segment, including PG&A, contributed significantly to its financial performance, underscoring its importance to overall profitability.

The company also earns income from financing services offered to both customers and dealers, facilitating vehicle purchases and inventory management through interest and fees. Additionally, Polaris benefits from licensing and brand royalties, allowing third parties to use its brand names and technologies in exchange for payments, thereby extending brand reach and diversifying income.

| Revenue Stream | Description | 2023 Data Point |

|---|---|---|

| Parts, Garments, and Accessories (PG&A) | Sales of vehicle parts, customization accessories, and branded apparel. | Aftermarket segment revenue (including PG&A) contributed significantly. |

| Financing Services | Interest and fees from retail and wholesale financing. | Vital role in supporting customers and dealers. |

| Licensing and Brand Royalties | Payments from third parties using Polaris brands and technologies. | Continued exploration and activation of licensing partnerships in 2024. |

Business Model Canvas Data Sources

The Polaris Business Model Canvas is built using a blend of internal financial data, comprehensive market research, and expert strategic insights. This multi-faceted approach ensures each component of the canvas is grounded in accurate and actionable information.