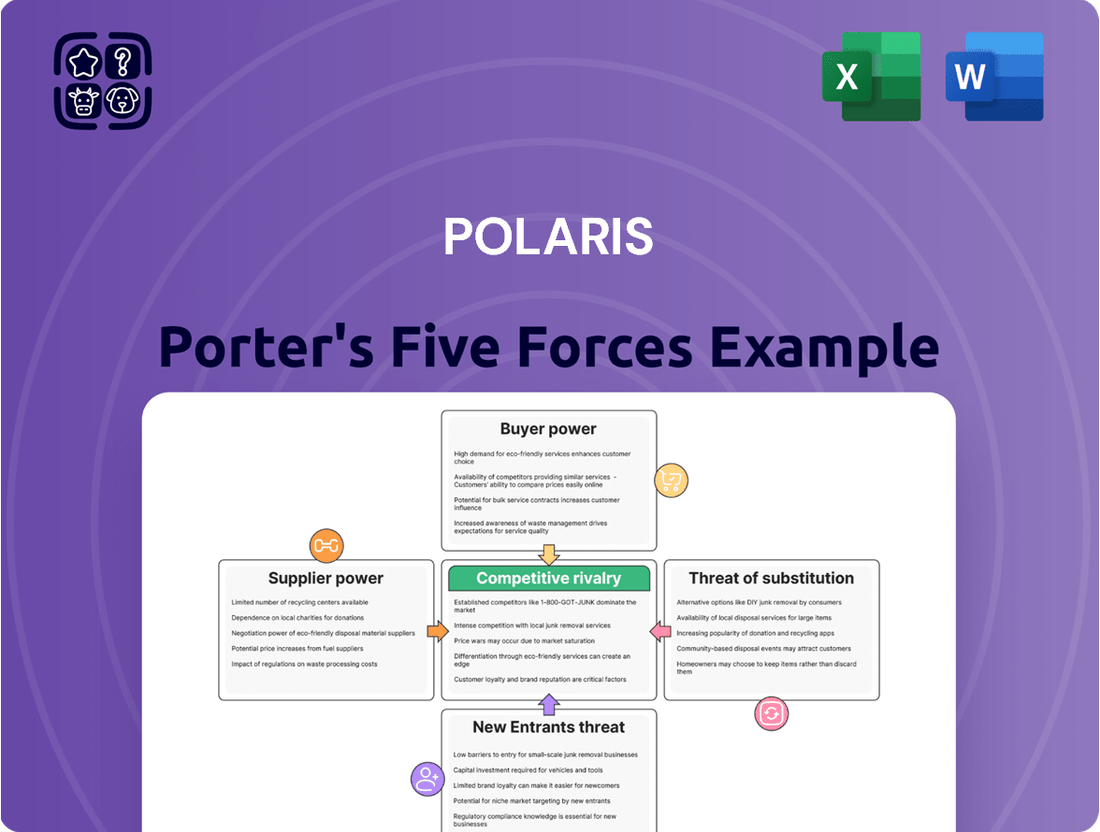

Polaris Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Polaris Bundle

Polaris faces intense competition, a key takeaway from our Porter's Five Forces analysis. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this landscape. The threat of new entrants and the availability of substitutes also significantly shape Polaris's market dynamics.

The complete report reveals the real forces shaping Polaris’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Polaris faces significant bargaining power from its suppliers due to a limited number of specialized component manufacturers. For crucial off-road vehicle parts like powertrains and chassis, Polaris relies on a small, concentrated group of global suppliers. In 2024, this number hovers around 7 to 8 key global manufacturers, meaning Polaris has few alternatives when sourcing these essential inputs.

This high degree of supplier concentration directly translates to increased leverage for these suppliers. When there are only a handful of companies capable of producing a vital component, they can often dictate terms, affecting pricing and availability for Polaris. This situation underscores the need for Polaris to carefully manage its supplier relationships and explore strategies to mitigate this dependency.

Polaris faces significant supplier power due to high switching costs associated with its integrated and specialized components. For instance, the intricate nature of engines and advanced electronics requires substantial investment in retooling, testing, and validation processes if Polaris were to change suppliers. This complexity translates into considerable financial outlay and time delays, making it difficult for Polaris to seek alternative sources.

The diverse product lines manufactured by Polaris, including ATVs, snowmobiles, motorcycles, and marine vehicles, further amplify these switching barriers. Integrating new parts into such a varied portfolio demands extensive engineering and compatibility testing for each segment. This deep integration means that a change in a critical supplier for one component can have ripple effects across multiple product lines, solidifying the bargaining power of existing, familiar suppliers who already meet these complex requirements.

Ongoing supply chain disruptions, particularly the persistent semiconductor shortages, continue to impact the automotive and powersports sectors through early 2025. This scarcity directly affects manufacturers like Polaris, limiting production capacity and increasing lead times for critical components.

The imposition of new tariffs, such as the 25% levy on imported powersports vehicles and components effective around April 2025, significantly escalates production costs. For companies heavily reliant on global sourcing, these tariffs can translate into hundreds of millions of dollars in additional expenses, directly impacting profitability and pricing strategies.

Importance of Polaris's Volume

Polaris, a dominant force in the powersports sector, wields considerable purchasing power. However, this leverage isn't absolute and fluctuates based on the criticality and uniqueness of the components it procures. For widely available, standardized parts, Polaris’s substantial order volumes grant it significant negotiation strength.

Conversely, when dealing with suppliers of highly specialized, technologically advanced, or patented components, the dynamic shifts. In these scenarios, the supplier’s unique contribution and the difficulty in finding alternatives mean their importance to Polaris's product innovation and manufacturing can outweigh Polaris's sheer volume. This can reduce Polaris's bargaining power.

- Supplier Specialization: For critical, proprietary components, suppliers hold more sway, potentially dictating terms.

- Component Interchangeability: For generic parts, Polaris's large order volumes enhance its bargaining power.

- Supply Chain Dependence: Polaris's reliance on specific suppliers for unique technologies can limit its negotiation leverage.

Raw Material Cost Volatility

Polaris, like many manufacturers, faces the challenge of fluctuating raw material costs. For instance, the price of key inputs like steel, aluminum, and plastics can experience significant swings. These increases directly impact Polaris's cost of goods sold.

For example, in early 2024, the global price of steel saw upward pressure due to increased demand from the automotive and construction sectors, alongside supply chain disruptions. This can force Polaris to either absorb these higher costs, squeezing profit margins, or pass them onto consumers through price adjustments.

- Steel prices: Global benchmark hot-rolled coil steel prices saw a notable increase in Q1 2024, reaching over $1000 per ton in some regions before stabilizing.

- Aluminum costs: Aluminum prices also experienced volatility in late 2023 and early 2024, influenced by energy costs and production levels in major producing nations.

- Plastic resin prices: Fluctuations in crude oil prices directly affect the cost of plastic resins, a critical component for many Polaris components, with spot prices showing variability throughout 2024.

Suppliers hold considerable power over Polaris due to the specialized nature of many components, limiting Polaris's ability to switch. This is particularly true for critical parts like engines and advanced electronics where high switching costs, including retooling and validation, make alternative sourcing difficult. The complexity of integrating new parts across Polaris’s diverse product lines further solidifies the position of existing, trusted suppliers.

Polaris's bargaining power is significantly reduced when dealing with suppliers of unique, technologically advanced, or patented components. In these instances, the supplier's critical contribution can outweigh Polaris's purchasing volume, allowing them to dictate terms. Conversely, for more standardized parts, Polaris’s substantial order volumes provide greater negotiation leverage.

External factors like persistent semiconductor shortages through early 2025 and potential new tariffs in 2025 amplify supplier power by increasing component scarcity and production costs. Fluctuating raw material prices, such as steel, aluminum, and plastic resins, also impact Polaris's cost of goods sold, giving suppliers more leverage in pricing negotiations.

| Factor | Impact on Polaris | 2024/2025 Context |

|---|---|---|

| Supplier Concentration | Limited alternatives increase supplier leverage for specialized parts. | Around 7-8 key global manufacturers for critical components. |

| Switching Costs | High for integrated and proprietary components, reducing Polaris's flexibility. | Significant investment in retooling, testing, and validation for new suppliers. |

| Component Uniqueness | Suppliers of unique technologies have greater power than Polaris's volume. | Polaris's reliance on specific technologies can reduce negotiation leverage. |

| Raw Material Volatility | Increases cost of goods sold, potentially squeezing margins or forcing price increases. | Steel prices exceeded $1000/ton in Q1 2024; aluminum and plastic resin prices volatile. |

| Supply Chain Disruptions | Scarcity of components like semiconductors limits production and increases lead times. | Semiconductor shortages continue to impact powersports sector through early 2025. |

What is included in the product

Analyzes the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants and substitutes, specifically for Polaris.

Effortlessly visualize competitive intensity with pre-built threat and opportunity charts, removing the pain of manual data plotting.

Customers Bargaining Power

Polaris Industries caters to a diverse and widely dispersed customer base across recreational, commercial, and governmental sectors globally. This broad market reach, characterized by millions of individual consumers and numerous businesses, prevents any single entity or small coalition from wielding substantial influence over Polaris's pricing or terms. For instance, in 2023, Polaris's off-road vehicle segment, a significant revenue driver, serves millions of individual enthusiasts, further diluting the power of any single buyer.

Customers in the powersports market often have it easy when deciding between different brands. They can readily switch from one manufacturer to another without much hassle or expense. This ease of transition significantly boosts their leverage.

The marketplace is filled with numerous companies offering comparable ATVs, side-by-sides, and motorcycles. This abundance of choice means consumers can effortlessly compare prices and the features of various vehicles. For instance, in 2024, the powersports industry saw continued strong sales, with brands actively competing on value propositions, making switching even more attractive for buyers.

Customers in the powersports sector, particularly when purchasing non-essential items like ATVs or snowmobiles, are quite sensitive to price. This means they pay close attention to the cost and are likely to shop around for the best deals. Polaris's financial reports from 2024 and early 2025 highlight this, showing a dip in net pricing. This reduction was directly linked to increased spending on promotions and discounts, clearly indicating that pricing strategies significantly impact customer purchasing decisions.

Increased Information Availability

Customers today have unprecedented access to information, significantly boosting their bargaining power. Online reviews, detailed product specifications, and price comparison websites allow buyers to thoroughly research options before making a purchase. This ease of access means customers can quickly identify the best value, forcing businesses to compete not only on product but also on price and service.

For instance, in the automotive sector, sites like Consumer Reports and Edmunds provide deep dives into vehicle performance, reliability, and pricing, empowering consumers. In 2024, studies indicated that over 80% of consumers conduct online research before buying a car, directly influencing dealer negotiations and manufacturer incentives. This transparency makes it harder for companies to maintain premium pricing based on information asymmetry.

- Enhanced Research Capabilities: Consumers can easily compare features, pricing, and customer satisfaction across numerous brands and models.

- Price Transparency: Online platforms and readily available data make it difficult for companies to charge significantly above market rates.

- Informed Decision-Making: Access to reviews and expert opinions allows customers to make more confident choices, reducing reliance on brand reputation alone.

- Increased Competitive Pressure: Businesses must offer compelling value propositions to attract and retain customers in an information-rich environment.

Dealer and Consumer Impact from Economic Factors

Economic headwinds, notably elevated interest rates and escalating vehicle prices, are significantly curbing consumer appetite for new powersports vehicles. This translates directly to weakened bargaining power for customers as demand softens. For instance, by early 2024, average new vehicle prices remained stubbornly high, putting a strain on discretionary spending. Dealers are consequently feeling the pinch, anticipating a slowdown in sales volumes as consumers postpone significant purchases or opt for more budget-friendly used options.

The impact on dealers is multifaceted. They face the challenge of higher inventory costs due to increased manufacturer pricing, coupled with the prospect of fewer units moving off the lot. This situation can lead to increased pressure on dealers to offer discounts or incentives, thereby reducing their profit margins and empowering customers to negotiate more aggressively. The overall economic climate, therefore, shifts the balance of power more firmly into the hands of the consumer.

- Rising Interest Rates: Higher borrowing costs make financing new vehicles less attractive, reducing the number of potential buyers.

- Increased Vehicle Costs: Persistent inflation in manufacturing and supply chains has driven up the base price of powersports vehicles.

- Reduced Consumer Demand: Economic uncertainty and affordability concerns lead consumers to delay or forgo purchases.

- Dealer Inventory Challenges: Higher vehicle prices and slower sales can lead to increased carrying costs for dealers, potentially forcing price reductions.

The bargaining power of customers for Polaris is generally low due to a fragmented customer base and the nature of powersports products as discretionary purchases. However, factors like price sensitivity and readily available information can increase their leverage. For example, in 2024, Polaris's increased promotional spending indicated customer responsiveness to discounts.

Customers in the powersports market can easily switch between brands, as there are many competitors offering similar products. This ease of switching enhances their negotiating position. The abundance of brands in 2024 meant consumers had ample opportunities to compare features and prices, making them less tied to any single manufacturer.

Price sensitivity is a key driver of customer bargaining power. Consumers in this segment are often looking for the best value, especially for non-essential items. Polaris's financial performance in early 2025 showed a direct correlation between pricing strategies, including discounts, and purchasing decisions, highlighting this sensitivity.

The extensive availability of product information online significantly empowers customers. They can readily compare specifications, read reviews, and check prices across different brands. This transparency, evident in 2024 consumer behavior where over 80% researched vehicles online before purchase, forces companies to compete more aggressively on value.

| Factor | Impact on Customer Bargaining Power | 2024/2025 Context |

|---|---|---|

| Customer Base Dispersion | Low | Polaris serves millions of individual consumers globally. |

| Switching Costs | Low | Powersports market offers many comparable brands. |

| Price Sensitivity | High | Promotional spending increased in 2024 due to customer price focus. |

| Information Availability | High | Over 80% of consumers researched vehicles online in 2024. |

Preview Before You Purchase

Polaris Porter's Five Forces Analysis

The document you see here is the exact, comprehensive Polaris Porter's Five Forces analysis you'll receive immediately after purchase, offering an in-depth examination of competitive forces within the powersports industry. This preview showcases the full scope of the analysis, detailing the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. You're looking at the actual document, ensuring no surprises or placeholders are present, and it's ready for your immediate use.

Rivalry Among Competitors

Polaris faces intense competition from global giants like BRP, Yamaha, and Honda, all vying for market share in the powersports sector. These formidable rivals offer a wide array of products, directly impacting Polaris's sales across its various divisions, including off-road vehicles, snowmobiles, and motorcycles.

The powersports industry is experiencing moderate growth, with the global market expected to expand at a compound annual growth rate of 5.68% between 2025 and 2034. This steady expansion, particularly in segments like utility-task vehicles (UTVs) and premium motorcycles, naturally fuels a competitive environment. Companies are actively seeking to capture a larger slice of this growing pie, leading to robust rivalry.

As more consumers embrace outdoor recreation and powersports, established players and new entrants alike are intensifying their efforts to gain market share. This heightened competition means businesses must continually innovate and differentiate their offerings to stand out. The pursuit of customers in these expanding categories drives aggressive pricing strategies and increased marketing spend across the sector.

Competitive rivalry in the powersports industry, particularly for companies like Polaris, is intensely driven by a commitment to product innovation and differentiation. This means companies are constantly pouring resources into research and development to bring new and improved offerings to market. For instance, Polaris has historically focused on introducing new technologies and performance enhancements across its product lines, from snowmobiles to off-road vehicles and motorcycles, aiming to capture market share through superior features and customer appeal.

Differentiation strategies are crucial for standing out in this competitive landscape. Polaris, for example, leverages its brand reputation and customer loyalty, built over years of delivering quality and performance. The introduction of new models and advanced technologies, such as electric vehicle platforms or enhanced rider-assist systems, are key tactics companies employ to gain a competitive edge and command premium pricing.

The focus on innovation isn't just about new models; it also involves enhancing existing product lines with cutting-edge features and improved performance metrics. This continuous cycle of product development ensures that companies remain relevant and attractive to consumers who are often seeking the latest advancements and the best possible riding experience. For example, advancements in engine technology, suspension systems, and digital integration are common areas of focus.

High Exit Barriers

The powersports manufacturing sector is characterized by substantial fixed costs, creating high exit barriers. Companies invest heavily in large-scale manufacturing plants, ongoing research and development for new models, and building comprehensive dealer networks. For instance, establishing a new engine production line can easily run into tens of millions of dollars.

These significant sunk costs make it economically challenging for firms to simply shut down operations and leave the market. Instead, they are often compelled to continue competing, even during periods of lower profitability, to try and recoup their investments. This dynamic directly contributes to sustained, often fierce, competitive rivalry within the industry.

- Significant Capital Investment: Powersports manufacturers must commit vast sums to physical plants and machinery, often exceeding hundreds of millions of dollars for major players.

- R&D Expenditures: Continuous innovation in engine technology, materials, and design necessitates substantial and ongoing investment in research and development.

- Dealer Network Investments: Building and maintaining a robust network of dealerships, including training and support, represents another considerable financial commitment that is difficult to abandon.

Market Share Dynamics and Promotional Activities

Competitive rivalry within the powersports industry intensified in 2024, leading to a noticeable dip in Polaris's overall sales. This downturn was partly fueled by aggressive promotional efforts from competitors vying for consumer discretionary spending.

Polaris experienced a decrease in sales during 2024 and into the first quarter of 2025. This trend was exacerbated by heightened promotional activity across the market as rivals engaged in price competition and marketing campaigns.

- Market Share Shifts: While Polaris saw a modest decline in its share of the Off-Road Vehicle (ORV) segment, it achieved gains in the motorcycle and marine sectors during Q1 2025.

- Intensified Competition: The overall market experienced increased promotional activity, directly impacting sales figures and indicating a fierce battle for market dominance.

- Segment Performance: Polaris's performance varied across its product lines, demonstrating the dynamic nature of market share battles within different segments of the powersports industry.

Competitive rivalry in the powersports sector is a significant force, compelling companies like Polaris to constantly innovate and differentiate. This intense competition is underscored by substantial capital investments required for manufacturing, research and development, and dealer networks, creating high exit barriers that keep firms engaged in the market.

In 2024, Polaris faced a more competitive landscape, marked by increased promotional activities from rivals. This led to a sales decrease for Polaris, particularly evident in its off-road vehicle segment, though it saw gains in motorcycles and marine sectors by Q1 2025.

| Competitor | Key Product Segments | 2024 Market Focus |

|---|---|---|

| BRP | Snowmobiles, ATVs, Sea-Doo Personal Watercraft | New model launches, technology integration |

| Yamaha | Motorcycles, ATVs, Snowmobiles, Marine | Performance enhancements, diverse product range |

| Honda | Motorcycles, ATVs, Marine | Reliability, fuel efficiency, established brand loyalty |

SSubstitutes Threaten

Consumers have many other ways to enjoy their leisure time besides powersports. Think about traditional camping, hitting hiking trails, going for a bike ride, or enjoying water activities that don't need a motor. These options can easily pull money away from what people might spend on ATVs or snowmobiles. For instance, the outdoor recreation market is vast, with hiking and camping alone seeing significant participation. In 2023, camping participation in the US reached an estimated 70 million adults, demonstrating a strong preference for less equipment-intensive activities.

For utility or commercial needs, traditional vehicles like vans, trucks, and even public transportation systems can act as substitutes for Polaris's off-road and on-road offerings. These alternatives frequently present lower operating expenses and cater to different functional requirements, potentially limiting Polaris's market share in certain segments.

In 2024, the commercial vehicle market, which includes vans and trucks, continued to see robust demand, with sales in the US reaching over 3.6 million units for light and medium-duty trucks and vans. This signifies a substantial competitive landscape where these conventional vehicles fulfill similar utility purposes for businesses and individuals who might otherwise consider a Polaris utility vehicle.

The rise of rental and sharing economy models for powersports vehicles poses a growing threat of substitutes. While still a nascent market, services offering temporary access to ATVs, snowmobiles, or jet skis cater to consumers who don't require full ownership. This can directly impact new vehicle sales, particularly for those with infrequent usage needs.

For instance, platforms facilitating peer-to-peer rentals are expanding, offering a more accessible alternative to purchasing. While specific 2024 data on powersports rentals is still emerging, the broader trend in the sharing economy, which saw significant growth in sectors like cars and accommodations, suggests similar potential here. This could pressure manufacturers and dealers to consider new sales or service models.

Cost-Performance Trade-off of Substitutes

Substitutes can lure customers away if they present a better cost-performance trade-off. For example, in the personal transportation sector, electric scooters and bicycles are increasingly seen as more economical alternatives to cars for short urban commutes, especially considering fuel costs and parking fees. By 2024, the global electric scooter market was projected to reach over $40 billion, highlighting a significant shift towards these more affordable options for certain travel needs.

Consider the recreational vehicle market; a well-maintained used camper van might offer a significantly lower entry cost compared to a new, high-end off-road vehicle, while still providing comparable functionality for outdoor enthusiasts on a budget. This cost advantage is a powerful driver for consumers prioritizing affordability without sacrificing core utility. In 2023, the used RV market saw a surge in demand, with sales increasing by approximately 15% year-over-year, demonstrating consumer appetite for value.

- Cost-Performance Advantage: Substitutes can offer a more compelling value proposition by providing similar benefits at a lower price point.

- Consumer Segmentation: Different consumer segments will be more or less sensitive to price, making certain substitutes more attractive to specific groups.

- Technological Advancements: Innovations in substitute product categories can rapidly improve their performance while keeping costs down, intensifying competitive pressure.

- Environmental and Social Factors: Growing consumer preference for sustainable or health-conscious alternatives can elevate the appeal of substitutes, even if their initial cost is comparable.

Technological Advancements in Other Sectors

Technological advancements in adjacent sectors can introduce novel substitutes for Polaris's core offerings. For instance, the burgeoning electric bicycle market, with models now boasting extended range and improved terrain capabilities, offers an alternative for recreational trail users. In 2024, the global e-bike market was valued at approximately $35 billion, with projections indicating significant growth, potentially diverting consumers from traditional ATV or snowmobile experiences.

Furthermore, increased accessibility to public lands for non-motorized activities, supported by government initiatives and community programs, presents another layer of substitution. As more park systems and recreational areas are designated or enhanced for hiking, biking, and other low-impact pursuits, these activities become more convenient and appealing alternatives to motorized recreational vehicles.

- E-bike Market Growth: The global e-bike market is projected to reach over $60 billion by 2027, indicating a substantial and growing alternative for outdoor recreation.

- Public Land Access: Initiatives to expand and improve trails for hiking and cycling can draw consumers away from motorized recreational pursuits.

- Technological Convergence: Advancements in battery technology and lightweight materials are making electric alternatives more viable and competitive across various outdoor activities.

The threat of substitutes for Polaris products is significant, as consumers have numerous alternative ways to spend their leisure time and fulfill utility needs. These substitutes can range from entirely different recreational activities to conventional vehicles and emerging sharing economy models. The key is that these alternatives often present a more favorable cost-performance trade-off or cater to specific consumer preferences, thereby diverting potential spending away from Polaris.

For example, the broader outdoor recreation market is vast. In 2023, an estimated 70 million adults in the US participated in camping, a popular low-equipment activity. Furthermore, the commercial vehicle market, with over 3.6 million light and medium-duty trucks and vans sold in the US in 2024, offers conventional alternatives for utility purposes. Even the growing electric scooter market, projected to exceed $40 billion globally by 2024, represents a cost-effective substitute for short-distance personal transportation, impacting potential customers who might otherwise consider a Polaris product for certain use cases.

Technological advancements are also introducing compelling substitutes. The global e-bike market, valued at approximately $35 billion in 2024, is a prime example, with improved range and capabilities drawing in recreational trail users. This, coupled with initiatives expanding access to public lands for non-motorized activities like hiking and cycling, intensifies the competitive pressure from substitutes that offer different value propositions.

Entrants Threaten

Entering the powersports manufacturing arena demands immense financial resources. Think about the costs for cutting-edge research and development to create innovative vehicles, setting up sophisticated production lines, and establishing widespread dealer and service networks. For instance, a new entrant might need to invest hundreds of millions, even billions, of dollars just to get a basic manufacturing operation off the ground and achieve economies of scale. This steep financial barrier significantly discourages new companies from attempting to compete with established players.

Established players like Polaris benefit from significant economies of scale in production, purchasing, and marketing. For instance, in 2024, Polaris's robust supply chain and high production volumes allowed them to negotiate favorable terms with suppliers, a distinct advantage over newcomers. This scale also translates to lower per-unit manufacturing costs.

New entrants would struggle to match these cost efficiencies, making it difficult to compete on price or profitability. Imagine a new powersports manufacturer trying to achieve the same purchasing power Polaris wields; it’s an uphill battle. This cost disadvantage is a substantial barrier, protecting Polaris's market share.

Polaris, like many established players in the powersports industry, benefits significantly from decades of cultivating strong brand loyalty. For instance, the 2024 market data shows that brands like Polaris, Yamaha, and BRP continue to dominate sales, with customer retention rates often exceeding 70% for repeat buyers. This deep-seated trust makes it incredibly difficult for newcomers to gain traction, as consumers often prefer the familiarity and proven performance associated with these household names.

Furthermore, Polaris and its main competitors have invested heavily in building and maintaining extensive dealer networks across the globe. These networks are not just sales channels; they are crucial for service, parts, and customer support, forming a vital part of the ownership experience. In 2023, Polaris reported having over 1,500 dealers in North America alone, a testament to the scale of infrastructure a new entrant would need to replicate. The sheer cost and time required to establish a comparable distribution and service infrastructure presents a formidable barrier, effectively deterring many potential new competitors.

Stringent Regulatory Hurdles

The powersports industry faces significant challenges from new entrants due to stringent regulatory hurdles. These complex and ever-changing rules govern everything from vehicle safety standards to emissions and environmental impact, requiring substantial upfront investment from any new player. For instance, in 2024, manufacturers must adhere to increasingly rigorous EPA emissions standards, demanding advanced engineering and costly testing protocols. This regulatory landscape acts as a powerful deterrent, making it difficult for smaller or less capitalized companies to enter the market and compete with established brands that have existing compliance infrastructure.

These regulatory demands translate into considerable financial commitments for new entrants. Companies must allocate significant capital towards research and development to ensure their products meet or exceed these standards. Furthermore, the ongoing need for testing and certification adds to the operational costs. For example, meeting the latest European Union's Stage V emission standards for off-road engines, which became fully applicable in 2020 and continues to influence global design, can add millions to development budgets. This financial barrier effectively limits the pool of potential new competitors.

- Safety Regulations: New entrants must navigate and comply with rigorous safety standards, such as those set by the Consumer Product Safety Commission (CPSC) in the US, which can necessitate expensive design modifications and testing.

- Emissions Standards: Adhering to evolving emissions regulations, like Euro 5 or EPA Tier 4 Final, requires substantial investment in cleaner engine technology and exhaust after-treatment systems, impacting R&D budgets significantly.

- Environmental Compliance: Growing environmental concerns mandate compliance with regulations related to noise pollution, material sourcing, and end-of-life vehicle disposal, adding layers of complexity and cost for new companies.

Access to Technology and Intellectual Property

Incumbent automotive manufacturers, like General Motors and Toyota, hold significant intellectual property, including thousands of active patents covering everything from engine efficiency to advanced driver-assistance systems. This IP creates a substantial barrier for new entrants. For example, developing a competitive electric vehicle platform requires overcoming complex battery technology, charging infrastructure integration, and autonomous driving software, all areas where established players have invested billions over decades.

- Proprietary Manufacturing Processes: Existing companies have honed efficient, large-scale manufacturing techniques, often protected by trade secrets and patents, making it difficult for newcomers to match production costs and quality.

- Patented Vehicle Technologies: Innovations in areas like powertrain efficiency, safety features, and connectivity are often patented, requiring significant R&D investment or licensing fees for new market entrants.

- Licensing Costs: Acquiring the rights to use critical existing technologies can be prohibitively expensive, diverting capital that could otherwise be used for product development or market entry.

- R&D Investment: The sheer scale of research and development already undertaken by incumbents means new entrants face a steep uphill battle to develop comparable or superior technologies from scratch.

The threat of new entrants in the powersports industry is generally low due to substantial barriers. High capital requirements for R&D, manufacturing, and distribution, coupled with strong brand loyalty and extensive dealer networks, make it difficult for newcomers to compete effectively. For instance, in 2024, the investment needed to establish a competitive powersports brand often runs into hundreds of millions of dollars, a significant deterrent.

Porter's Five Forces Analysis Data Sources

Our Polaris Porter's Five Forces analysis leverages a comprehensive suite of data, including financial statements from public companies, market research reports from leading firms, and industry-specific trade publications. This ensures a robust understanding of competitive dynamics, threat of new entrants, and bargaining power of both suppliers and buyers.