Pandora AS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pandora AS Bundle

Pandora’s unique brand recognition and innovative jewelry design are significant strengths, but the company faces intense competition and evolving consumer trends. Understanding these dynamics is crucial for navigating the market. Our comprehensive SWOT analysis delves deeper into Pandora's opportunities, such as expanding into new markets and leveraging digital platforms, alongside potential threats like supply chain disruptions and changing fashion preferences. Want the full story behind Pandora's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Pandora benefits from exceptional global brand recognition, a significant asset in the competitive jewelry market. This strong brand awareness is directly supported by an extensive retail network that spans over 100 countries, encompassing concept stores, authorized retailers, and a rapidly expanding online platform. This broad reach is a key driver of its financial success, evidenced by a 13% organic growth and a record DKK 31.7 billion in revenue for 2024.

Pandora's strength lies in its accessible luxury positioning, making stylish, hand-finished jewelry available to a wide audience. This strategy is further bolstered by significant product diversification beyond its iconic charm bracelets.

The company's 'Phoenix strategy' has successfully transformed Pandora into a comprehensive jewelry brand, now offering a diverse range of rings, necklaces, earrings, and even lab-grown diamonds. This expansion broadens its market reach considerably.

The 'Fuel with more' initiative, encompassing new collections and lab-grown diamonds, demonstrated impressive growth, with a 22% increase in 2024. This highlights Pandora's ability to attract new customer segments and enhance overall brand appeal.

Pandora AS consistently showcases impressive financial performance, evidenced by a strong gross margin hovering around 80%. This healthy margin translates into significant profitability, with an EBIT margin reaching 25.2% in 2024, contributing to a substantial 17% year-over-year EPS growth.

The company's strategic initiatives are clearly resonating with the market, as demonstrated by achieving six consecutive quarters of double-digit organic growth through the fourth quarter of 2024. This sustained growth trajectory underscores effective operational execution and strong brand momentum.

Further bolstering its financial strength, Pandora maintains robust cash conversion capabilities. Coupled with a low leverage ratio, this financial stability provides ample capacity for continued strategic investments aimed at driving future growth and innovation.

Commitment to Sustainability and Ethical Sourcing

Pandora's dedication to sustainability and ethical sourcing is a significant strength. The company's commitment to using 100% recycled silver and gold for all new jewelry, achieved ahead of its 2025 target in mid-2024, is a major differentiator. This move is expected to cut annual CO2 emissions by an impressive 58,000 tons. Furthermore, the use of 100% renewable energy in its crafting facilities and the ambitious goal to halve value chain CO2 emissions by 2030 strongly resonate with increasingly environmentally conscious consumers, bolstering brand reputation.

This focus on sustainability translates into tangible benefits:

- Environmental Impact Reduction: Transitioning to 100% recycled precious metals by mid-2024 is projected to slash CO2 emissions by 58,000 tons annually.

- Renewable Energy Adoption: Pandora powers its crafting facilities with 100% renewable energy, aligning operations with environmental goals.

- Ambitious Emission Targets: The company aims to reduce CO2 emissions across its entire value chain by 50% by 2030.

- Enhanced Brand Reputation: Ethical sourcing and sustainability initiatives appeal to a growing segment of consumers seeking responsible brands, improving market perception.

Robust E-commerce and Digital Transformation

Pandora AS boasts a robust and expanding e-commerce and digital transformation initiative, a key strength underpinning its future growth. The company saw its online sales surge by 20% in Q4 2024, now representing a significant 27% of the total business revenue. This digital momentum is being further amplified through the global rollout of a new e-commerce platform throughout 2025, a core component of its Phoenix strategy aimed at boosting brand appeal and customer engagement. This strategic digital investment is vital for connecting with today's digitally-savvy consumers and driving increased sales conversions.

The company's commitment to digital transformation is evident in its strategic initiatives:

- Significant Online Revenue Growth: Online sales increased by 20% in Q4 2024, contributing 27% to overall revenue.

- Global E-commerce Platform Upgrade: A new, enhanced e-commerce platform is being deployed worldwide during 2025.

- Data-Driven Personalization: Leveraging customer data for tailored marketing efforts to improve engagement and drive conversions.

- Phoenix Strategy Alignment: The digital advancements are integral to the broader Phoenix strategy focused on brand desirability and customer experience.

Pandora AS possesses exceptional global brand recognition, a crucial advantage in the competitive jewelry sector. This is complemented by a vast retail footprint across over 100 countries and a rapidly advancing online presence, which together drove 13% organic growth and DKK 31.7 billion in revenue in 2024.

The company's accessible luxury positioning and product diversification, moving beyond charm bracelets to include rings, necklaces, earrings, and lab-grown diamonds, significantly broaden its market appeal. The 'Fuel with more' initiative, featuring new collections and lab-grown diamonds, saw a 22% increase in 2024, attracting new customer segments.

Pandora demonstrates strong financial health with a gross margin around 80% and an EBIT margin of 25.2% in 2024, leading to a 17% year-over-year EPS growth. Six consecutive quarters of double-digit organic growth through Q4 2024 highlight effective execution and brand momentum. Robust cash conversion and low leverage provide capacity for strategic investments.

A key strength is Pandora's commitment to sustainability, including the use of 100% recycled precious metals by mid-2024, projected to cut CO2 emissions by 58,000 tons annually. The company also utilizes 100% renewable energy in its crafting facilities and aims to halve value chain CO2 emissions by 2030, enhancing brand reputation among environmentally conscious consumers.

| Strength | Description | 2024 Data/Impact |

| Brand Recognition | Global brand awareness and extensive retail network | 13% organic growth, DKK 31.7 billion revenue |

| Market Positioning | Accessible luxury, product diversification | 22% growth for 'Fuel with more' initiative |

| Financial Performance | High margins, strong profitability, consistent growth | 80% gross margin, 25.2% EBIT margin, 17% EPS growth |

| Sustainability | Ethical sourcing, recycled materials, renewable energy | 100% recycled metals by mid-2024, 58,000 tons CO2 reduction |

| Digital Presence | Expanding e-commerce and digital transformation | 20% online sales growth in Q4, 27% of total revenue |

What is included in the product

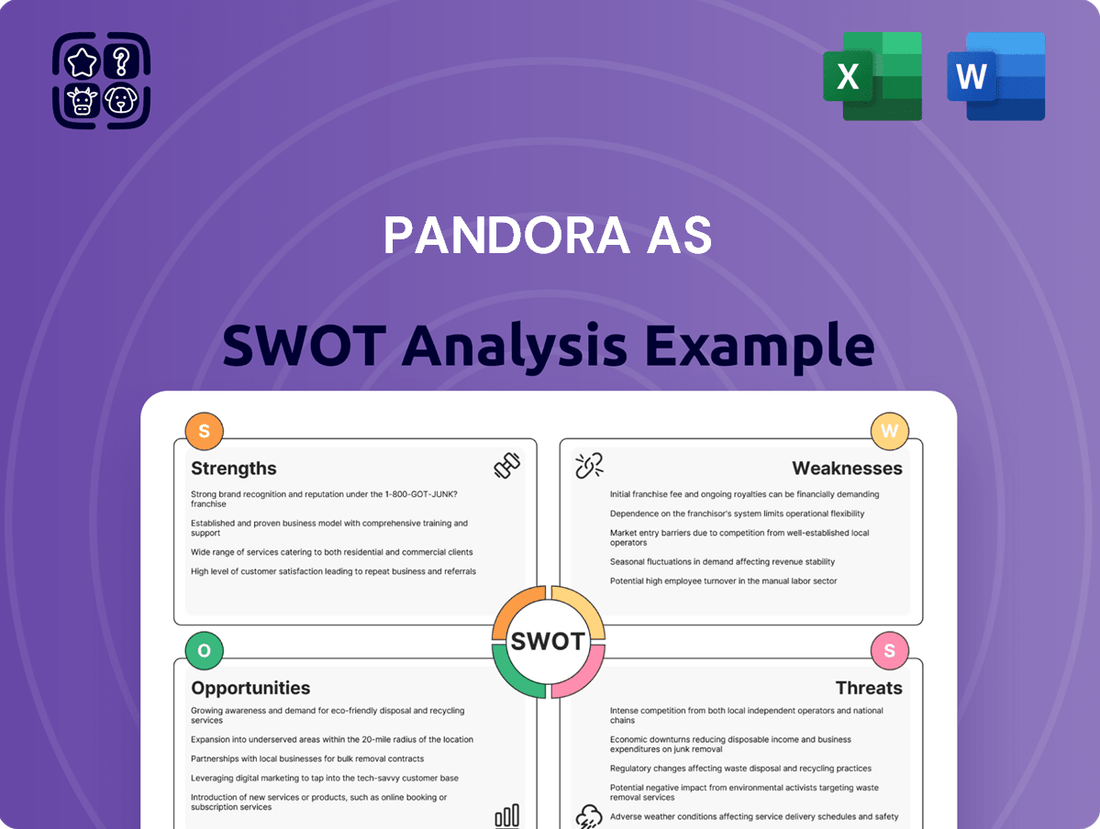

Analyzes Pandora AS’s competitive position through key internal and external factors, highlighting its brand strength and digital transformation opportunities alongside potential market saturation and evolving consumer preferences.

The Pandora AS SWOT analysis offers a clear, visual representation of strategic factors, alleviating the pain of complex data by presenting it in an easily digestible format for quick understanding and decision-making.

Weaknesses

Pandora's continued strong reliance on its charm and bracelet category presents a notable weakness. In 2024, this core segment still represented a substantial 74% of the company's total revenue.

While other product lines, such as the 'Fuel with more' initiative, show promising growth, a significant dependency on a single product type inherently carries risk. Should consumer tastes evolve and move away from charm bracelets, Pandora could face considerable challenges.

This situation underscores the critical need for ongoing, robust innovation within the charm and bracelet offerings themselves. Maintaining the category's desirability and relevance is paramount to mitigating the potential downsides of this concentrated revenue stream.

Pandora AS experienced a slowdown in some important European markets. For instance, like-for-like growth was flat at 0% in Q4 2024 for certain countries. Additionally, the four European markets reported individually saw a slight contraction of 2% in Q1 2025.

Pandora's focus on accessible luxury and wide availability, while boosting sales volume, risks diminishing the perceived exclusivity of its jewelry. This strategy might make it harder to attract customers looking for truly high-end or unique pieces, potentially hindering upward market movement, even with new offerings like lab-grown diamonds.

In 2023, Pandora's revenue reached DKK 26.7 billion, showcasing strong volume but also highlighting the challenge of maintaining an exclusive image. The brand's broad market appeal, a key strength, can conversely be a weakness if it prevents Pandora from commanding premium pricing associated with traditional luxury houses.

While Pandora's expansion into new product categories and markets is positive, it could strain brand identity if not managed carefully. Maintaining a consistent brand message across diverse offerings is crucial to avoid confusing consumers or diluting the core appeal that made Pandora popular in the first place.

Vulnerability to Macroeconomic Headwinds and Discretionary Spending

Pandora AS, as a purveyor of discretionary goods, faces inherent risks tied to broader economic shifts. During periods of economic contraction, elevated inflation, or a general decline in consumer confidence, demand for non-essential items like jewelry can falter significantly. This sensitivity was highlighted in early 2025, when management noted ongoing macroeconomic uncertainties, which, coupled with currency fluctuations, necessitated a slight recalibration of their 2025 EBIT margin guidance.

The competitive landscape also presents challenges. A persistently promotional external environment can exert downward pressure on pricing, potentially impacting Pandora's profitability. This means that even with strong underlying performance, as seen through 2024 and into Q1 2025, the company must navigate external market dynamics that could squeeze margins.

- Economic Sensitivity: Pandora's sales are vulnerable to economic downturns, inflation, and reduced consumer spending, as its products are considered discretionary purchases.

- Macroeconomic Uncertainty: Management acknowledged macroeconomic uncertainties in early 2025, impacting business outlook.

- Currency Fluctuations: Foreign exchange rate movements have already led to a minor adjustment in the 2025 EBIT margin guidance.

- Pricing Pressures: A highly promotional market environment suggests ongoing challenges in maintaining optimal pricing strategies.

Intense Competitive Landscape

Pandora operates in a fiercely competitive global jewelry market. This includes established luxury houses, agile online-only retailers, and fast-fashion brands all vying for consumer attention. Maintaining relevance requires constant innovation in design and a keen eye on pricing strategies.

The company faces significant pressure to differentiate its product lines. Many competitors are also emphasizing personalization and ethical sourcing, mirroring Pandora's own strategic pillars. This makes it harder to stand out and capture market share.

- Market Saturation: The jewelry sector is crowded, with numerous brands at various price points.

- Price Sensitivity: Consumers often compare prices, especially for accessible luxury items.

- Evolving Consumer Tastes: Rapid shifts in fashion trends necessitate continuous product development.

- Digital Disruption: Online retailers can often offer lower overheads, intensifying price competition.

Pandora's significant revenue concentration in its charm and bracelet category, which accounted for 74% of total revenue in 2024, represents a key vulnerability. While growth initiatives exist, this reliance on a single product type poses a substantial risk if consumer preferences shift away from this core offering.

The brand's strategy of accessible luxury and broad availability, while driving sales volume, risks undermining its perceived exclusivity. This could limit its appeal to customers seeking higher-end, unique jewelry pieces, even as it expands into areas like lab-grown diamonds.

Pandora's performance in certain European markets showed signs of strain, with flat like-for-like growth in Q4 2024 and a 2% contraction in four key markets during Q1 2025. This indicates regional challenges that could impact overall sales momentum.

The company's vulnerability to economic fluctuations, as highlighted by management's early 2025 acknowledgment of macroeconomic uncertainties, means discretionary spending on jewelry can decline during economic slowdowns or high inflation periods. This led to a slight adjustment in the 2025 EBIT margin guidance.

Preview the Actual Deliverable

Pandora AS SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Pandora AS SWOT analysis, providing a clear snapshot of its strategic position. Upon purchase, you'll gain access to the complete, in-depth report, ready for your immediate use.

Opportunities

Pandora can build on the success of initiatives like its 'Fuel with More' program and the introduction of lab-grown diamonds to explore broader product diversification. This presents a chance to move beyond its core charm bracelets and introduce a wider array of designs and materials.

Expanding into new accessory categories or lifestyle products that resonate with Pandora's established brand identity could attract a wider customer base. Such expansion aims to meet evolving consumer preferences and potentially boost the average value of each customer transaction.

For instance, Pandora's revenue from lab-grown diamonds has seen significant growth, contributing to a stronger overall financial performance. In 2023, Pandora reported group revenue of DKK 23.5 billion, with new product introductions playing a key role in this expansion.

Pandora AS is keenly focused on expanding its reach in markets where its brand presence is currently less established. While the United States remains a core market, significant untapped potential exists in regions like Germany, France, and China. This strategic push aims to diversify revenue streams and capture new customer bases.

The company is actively investing in its physical and digital infrastructure in these underpenetrated territories. This includes the rollout of new concept stores and the strategic placement of shop-in-shops within existing retail environments. These initiatives are designed to enhance brand visibility and accessibility, driving sales growth.

In 2023, Pandora reported that its European markets, excluding the UK, saw organic growth of 4%. The company has identified Germany and France as key growth areas for further expansion in 2024 and beyond. This focus on geographic diversification is a critical element of Pandora's long-term growth strategy.

Pandora's upcoming global e-commerce platform launch in 2025 is a prime opportunity to elevate its online presence. This digital transformation aims to create a more engaging customer journey, which can translate into improved sales conversion rates. By focusing on a seamless user experience, Pandora can capture a larger share of the growing online jewelry market.

Leveraging advanced data analytics and AI will be crucial for unlocking the full potential of this new platform. Pandora can use these tools to deliver highly personalized product recommendations and tailor marketing efforts to individual customer preferences. This data-driven approach can foster deeper customer loyalty and increase the lifetime value of online shoppers.

For instance, in the first half of 2024, Pandora's online sales saw a notable increase, indicating a strong consumer shift towards digital channels. By enhancing personalization, Pandora can further capitalize on this trend, potentially seeing a significant uplift in its digital revenue streams. This strategic investment in technology directly addresses the evolving consumer behavior in the retail landscape.

Strengthening Sustainability Leadership and Circular Economy Focus

Pandora's early adoption of 100% recycled silver and gold, achieved by the end of 2022, positions it strongly to meet increasing consumer desire for sustainable jewelry. This commitment is a significant opportunity to capture market share among environmentally aware buyers.

Further investment in circular economy models, such as product repair and resale programs, can enhance brand loyalty and create new revenue streams. Transparently showcasing these initiatives will reinforce Pandora's image as a responsible industry leader.

The company's sustainability efforts are already resonating with consumers; in 2023, Pandora reported that over 75% of its customers considered sustainability important when making a purchase. This trend is expected to grow, with projections indicating a continued rise in demand for eco-friendly products across the luxury and fashion sectors through 2025.

- Capitalize on growing consumer demand for sustainable and ethically produced jewelry.

- Enhance brand image and attract environmentally conscious consumers through transparent supply chains.

- Expand circular economy initiatives to create new revenue streams and foster customer loyalty.

- Solidify leadership in responsible business practices within the jewelry industry.

Strategic Collaborations and Brand Partnerships

Pandora has a history of leveraging successful collaborations, such as its popular collections with Disney, Marvel, and Game of Thrones. These partnerships have demonstrably broadened its customer base and introduced the brand to new demographics.

Future strategic alliances with influential figures, renowned designers, or brands that complement Pandora's aesthetic can significantly boost consumer engagement. Such ventures often result in highly sought-after, limited-edition products, thereby enhancing brand prestige and driving sales.

For instance, in Q3 2023, Pandora reported a 10% like-for-like growth, partly attributed to strong performance from its licensed products, which include many of these franchise collaborations. The company aims to continue this trend, recognizing the substantial uplift these partnerships provide.

Opportunities exist to explore collaborations with emerging cultural trends and digital influencers to maintain relevance with younger consumers. These partnerships can create buzz and drive traffic both online and in-store.

- Proven Success: Past collaborations with Disney, Marvel, and Game of Thrones have expanded reach.

- Brand Elevation: Partnerships with cultural icons and designers can increase desirability and create buzz.

- Sales Driver: Limited-edition collections from collaborations have historically boosted revenue.

- Audience Expansion: Strategic alliances offer pathways to engage new and diverse consumer segments.

Pandora can expand its product line beyond core offerings, such as incorporating more lab-grown diamonds and diverse materials, building on the success of programs like 'Fuel with More.' This strategy aims to capture evolving consumer tastes and increase the average transaction value.

Geographic expansion into markets like Germany, France, and China presents a significant opportunity for Pandora to diversify revenue and tap into new customer bases, as indicated by the 4% organic growth in European markets (excluding the UK) in 2023.

Launching an enhanced global e-commerce platform in 2025, supported by AI and data analytics for personalization, will allow Pandora to better capitalize on the growing online jewelry market and foster customer loyalty.

Pandora's commitment to sustainability, using 100% recycled precious metals since 2022, positions it well to attract environmentally conscious consumers, with over 75% of customers in 2023 considering sustainability important in their purchasing decisions.

Leveraging successful collaborations with franchises like Disney and Marvel, which contributed to a 10% like-for-like growth in Q3 2023, can be continued by partnering with influential figures and designers to boost engagement and brand prestige.

| Opportunity Area | Key Initiatives | Supporting Data (2023/2024 Projections) |

|---|---|---|

| Product Diversification | Expand into new accessory categories, incorporate more lab-grown diamonds and diverse materials. | Lab-grown diamond revenue shows significant growth; 2023 group revenue DKK 23.5 billion. |

| Market Expansion | Focus on underpenetrated markets like Germany, France, and China; invest in physical and digital infrastructure. | 4% organic growth in European markets (excl. UK) in 2023; Germany and France identified as key growth areas for 2024. |

| Digital Transformation | Launch global e-commerce platform in 2025; leverage AI and data analytics for personalization. | Notable increase in online sales in H1 2024; aim to improve conversion rates and digital revenue. |

| Sustainability Leadership | Capitalize on demand for sustainable jewelry; expand circular economy models. | Over 75% of customers consider sustainability important (2023); 100% recycled silver and gold used since end of 2022. |

| Strategic Collaborations | Partner with cultural icons, designers, and influencers; create limited-edition collections. | Licensed products, including collaborations, contributed to 10% like-for-like growth in Q3 2023. |

Threats

The jewelry market’s sensitivity to fleeting fashion trends presents a significant threat to Pandora. Rapid shifts in consumer tastes can quickly diminish demand for specific styles, including their iconic charm bracelets, potentially impacting sales volume.

Pandora faces the challenge of constant design innovation to stay relevant; failure to adapt could render their signature products less appealing or even obsolete in the eyes of consumers. For instance, in 2023, while Pandora reported strong performance, the ongoing need to refresh collections to align with evolving aesthetics remains a critical operational imperative.

The accessible luxury jewelry market is seeing a surge of new competitors, particularly online direct-to-consumer (DTC) brands and established companies expanding into this space. This influx intensifies rivalry, potentially squeezing profit margins and increasing customer acquisition costs for brands like Pandora.

Intense competition often leads to pricing wars, forcing companies to either lower prices or invest more heavily in marketing to stand out. For Pandora, this could mean a squeeze on its traditionally strong margins.

Market saturation poses a significant challenge, making it harder to gain new customers and retain existing ones. In mature markets, growth often comes at the expense of rivals, requiring sophisticated strategies to capture and hold market share.

Pandora's market share in the global jewelry market, estimated at around 5-6% in recent years, faces pressure from these new and existing competitors. The accessibility of online platforms further lowers barriers to entry for new players.

Global economic headwinds, including persistent inflation and the looming threat of recession, present a substantial challenge for Pandora. As consumers face tighter budgets, spending on non-essential items like jewelry is likely to decrease, directly impacting sales volumes.

While Pandora has demonstrated a degree of resilience, a prolonged period of economic hardship could significantly curb consumer spending. For instance, in late 2023 and early 2024, many regions experienced a slowdown in consumer confidence, directly correlating with reduced discretionary spending on durable and luxury goods.

This economic slowdown could compress Pandora's profit margins as the company may need to offer more promotions to drive sales. The impact is amplified as discretionary spending, crucial for brands like Pandora, is typically the first area consumers cut back on when managing household finances during uncertain economic times.

Raw Material Price Volatility and Supply Chain Disruptions

Even with a move towards recycled materials, Pandora AS still faces threats from the fluctuating prices of precious metals like gold and silver. These price swings directly impact the company’s cost of goods sold and can squeeze profit margins. For instance, in early 2024, gold prices reached record highs, and while silver prices are more volatile, significant increases can still affect Pandora’s financial performance.

Beyond material costs, global supply chain disruptions pose another significant challenge. Geopolitical tensions, shifts in trade policies, or unexpected events such as natural disasters can interrupt manufacturing and distribution networks. This can lead to increased operational expenses due to higher shipping costs or material sourcing challenges, and potentially cause delays in getting products to market, impacting sales and customer satisfaction.

- Precious Metal Price Volatility: Continued fluctuations in gold and silver prices, even with recycled sourcing, can impact Pandora’s cost base.

- Supply Chain Vulnerabilities: Geopolitical instability and trade policy changes create risks for manufacturing and distribution efficiency.

- Increased Logistics Costs: Disruptions often translate to higher shipping expenses, affecting overall profitability.

Trade Tariffs and Geopolitical Risks

The imposition of new trade tariffs, especially from major markets like the United States, presents a significant threat to Pandora AS. Such tariffs could directly impact the cost of raw materials and finished goods, thereby squeezing profit margins and potentially leading to higher prices for consumers, which might affect demand. Pandora has acknowledged these risks, with its 2025 guidance and 2026 targets being sensitive to potential U.S. tariff scenarios. The company is actively engaged in scenario planning to mitigate the financial fallout from these trade policies.

Beyond direct tariffs, broader geopolitical instability poses a considerable operational risk. Disruptions in key manufacturing hubs or important sales regions due to political unrest, trade wars, or other international conflicts could interrupt supply chains, delay shipments, and negatively affect sales performance. This global interconnectedness means that even localized geopolitical events can have ripple effects across Pandora's international business operations.

- Tariff Impact: Potential U.S. tariffs could directly affect Pandora's profitability and pricing strategies.

- Guidance Sensitivity: Pandora's financial outlook for 2025 and 2026 is explicitly stated to be vulnerable to U.S. tariff developments.

- Geopolitical Disruption: Instability in manufacturing or sales territories threatens supply chain continuity and market access.

- Scenario Planning: The company is proactively developing strategies to navigate various trade and geopolitical risk scenarios.

The intensifying competition from online DTC brands and established players entering the accessible luxury market poses a threat to Pandora's market share and profit margins. Furthermore, global economic uncertainties, including inflation and potential recessions, could dampen consumer spending on non-essential items like jewelry, impacting Pandora's sales volumes and necessitating promotional activities that could compress margins.

SWOT Analysis Data Sources

This Pandora AS SWOT analysis is built upon a foundation of verified financial reports, comprehensive market research, and expert industry analysis to provide a data-driven and accurate strategic overview.