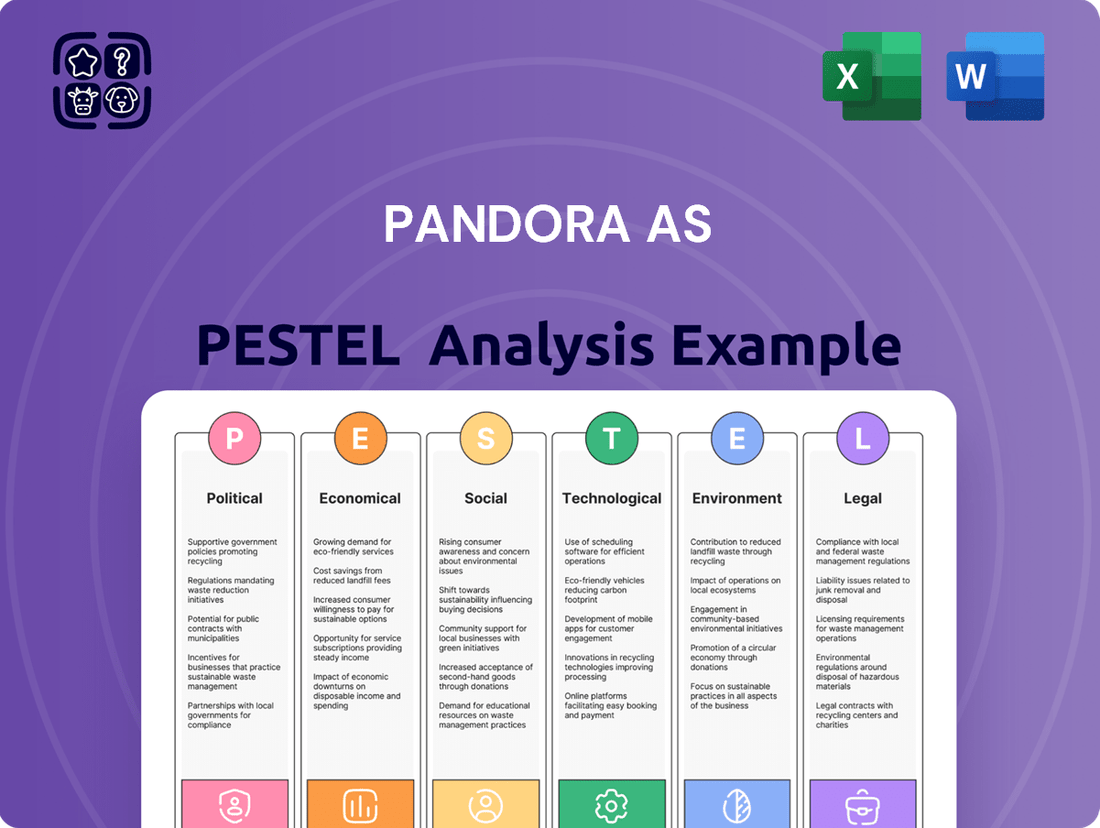

Pandora AS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pandora AS Bundle

Unlock the strategic roadmap for Pandora AS with our comprehensive PESTLE analysis. Delve into the political, economic, social, technological, legal, and environmental factors that are actively shaping the company's operational landscape and future growth trajectory. Gain actionable intelligence to anticipate market shifts and identify potential opportunities or threats. Download the full PESTLE analysis now and equip yourself with the critical insights needed to navigate the complexities of the global market and make informed business decisions.

Political factors

Pandora AS, being a global jewelry retailer, faces significant influence from government regulations and trade policies across its operating markets. For instance, in 2024, ongoing geopolitical tensions and shifts in trade alliances, such as potential changes to existing free trade agreements impacting key manufacturing hubs in Asia, could alter import costs. The company must remain vigilant regarding evolving trade barriers, tariffs, and sanctions imposed by various nations, as these can directly affect the landed cost of its precious metals and gemstones, as well as the final price of its finished products to consumers.

Changes in import duties or value-added tax (VAT) rates in major markets like the European Union or the United States can also directly impact Pandora's revenue and profit margins. For example, a hypothetical increase in tariffs on gold or silver could necessitate price adjustments, potentially affecting consumer demand. Staying ahead of these policy shifts is vital for Pandora to maintain competitive pricing and ensure continued market access for its diverse product lines.

Political stability in Pandora's key markets like the United States and Europe is crucial. For instance, the U.S. economy, representing a significant portion of global retail sales, experienced a GDP growth of approximately 2.5% in 2024, with consumer spending remaining a key driver, though potential policy shifts around trade or economic regulations could impact Pandora's market access and profitability.

Pandora's manufacturing hubs, especially in Thailand and Vietnam, are critical. Thailand, a major production base for Pandora, has seen periods of political transition. While the country maintained a relatively stable political environment in early 2024 following its 2023 general election, any resurgence of social unrest or significant policy changes affecting labor or export regulations could disrupt Pandora's efficient supply chain, which is vital for its direct-to-consumer model.

Pandora AS must diligently navigate a complex web of consumer protection laws across its global markets. These regulations, covering everything from product safety and material disclosure to advertising accuracy and fair pricing, are crucial for maintaining brand integrity. For instance, in the EU, the General Product Safety Regulation (2001/95/EC) mandates that products placed on the market must not endanger the safety of consumers. Failure to comply can result in substantial fines; for example, in 2023, several major retailers faced significant penalties for non-compliant product safety standards, with some fines reaching hundreds of thousands of euros. This underscores the financial and reputational risks associated with lax adherence, particularly for a brand like Pandora, which emphasizes the quality and authenticity of its precious metals and gemstones.

Taxation Policies on Retail and Luxury Goods

Pandora AS, like many global retailers, navigates a complex web of taxation policies across its key markets. For instance, variations in sales tax rates, such as the VAT in Europe or GST in other regions, directly affect the final price consumers pay for Pandora's jewelry. In 2024, the average VAT rate across the European Union, a significant market for Pandora, hovers around 21%, impacting disposable income available for discretionary purchases like jewelry.

Furthermore, the imposition or modification of luxury taxes in certain countries can directly influence Pandora's profitability and sales volume. If a market introduces or raises a luxury tax on jewelry items above a certain price threshold, it could make those products less appealing to consumers, potentially dampening demand. For example, some Asian markets have specific luxury goods taxes that can add a substantial percentage to the retail price.

Corporate tax rates also play a crucial role in Pandora's overall financial performance. Changes in corporate tax legislation in countries where Pandora has significant operations, such as Denmark or major sales regions, can impact its net earnings. As of 2024, corporate tax rates can vary considerably, with some European nations maintaining rates in the low to mid-20% range, while others might be higher or lower, necessitating careful financial planning.

- Sales Tax Impact: VAT rates across the EU, averaging around 21% in 2024, directly affect consumer affordability of Pandora products.

- Luxury Tax Considerations: Potential luxury taxes in specific markets could reduce demand for higher-priced jewelry items.

- Corporate Tax Landscape: Fluctuations in corporate tax rates in key operational countries, like Denmark, influence Pandora's net profitability.

- Strategic Tax Planning: Pandora must continually adapt its financial strategies to comply with and mitigate the effects of diverse and evolving tax structures globally.

Ethical Sourcing and Human Rights Regulations

Pandora AS operates within a landscape of increasing scrutiny on ethical sourcing and human rights, particularly within the jewelry sector. This focus presents both compliance challenges and opportunities for brand differentiation. For instance, the UK Modern Slavery Act 2015, and similar legislation globally, mandates transparency in supply chains. Pandora's proactive stance, including its commitment to 100% recycled gold and silver and a robust Responsible Sourcing Policy, directly addresses these regulatory demands. This commitment is not just about compliance; it's about building trust and enhancing brand reputation with increasingly conscious consumers. In 2023, Pandora reported that 98% of its suppliers by value had undergone social and ethical audits, demonstrating a tangible effort towards responsible practices.

Political stability and government policies in key markets significantly influence Pandora's operations. For example, the US economy, a major market, saw GDP growth of around 2.5% in 2024, with consumer spending a key driver, though potential policy shifts could impact market access. Pandora's manufacturing hubs, particularly Thailand, which held a stable political environment in early 2024, could be disrupted by unforeseen policy changes affecting exports or labor.

What is included in the product

This PESTLE analysis dissects the external macro-environmental forces impacting Pandora AS across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering a comprehensive view of the business landscape.

Offers a clear, actionable breakdown of external factors affecting Pandora, enabling strategic adjustments to mitigate risks and capitalize on opportunities.

Economic factors

Pandora's success is closely tied to how well the global economy is doing and how much people feel comfortable spending on non-essentials like jewelry. When times are tough or uncertain, consumers tend to hold back on buying luxury or even accessible luxury items, impacting demand for Pandora's products.

Despite a generally cautious consumer sentiment across the globe, Pandora demonstrated remarkable resilience. In 2024, the company achieved a notable organic growth rate, showcasing its ability to navigate economic headwinds and maintain consumer interest in its offerings.

Inflationary pressures directly impact Pandora's operational costs. For instance, rising prices for key metals like silver and gold can significantly increase the cost of goods sold, potentially squeezing gross margins. This is a critical consideration given that silver prices have seen notable volatility.

Pandora has demonstrated resilience by strengthening its gross margin, however, ongoing fluctuations in raw material prices, particularly silver, necessitate continuous and astute management. This dynamic requires proactive strategies to offset potential cost increases and maintain profitability.

To counteract these rising expenses, Pandora has strategically implemented price increases across its product lines. This approach aims to transfer some of the increased raw material costs to consumers, thereby protecting the company's profitability in a challenging economic environment.

Pandora AS, as a global business, sees its financial results directly influenced by shifts in exchange rates. When local currencies in important markets strengthen, or currencies in regions where Pandora manufactures weaken, it can alter the reported revenue and the cost of producing its goods.

For instance, a stronger Danish Krone (Pandora's reporting currency) against currencies like the US Dollar or Euro could make Pandora's products appear more expensive to international buyers, potentially impacting sales volumes. Conversely, a weaker Krone could boost reported revenues when converted back.

These foreign exchange movements can also affect Pandora's profitability targets, specifically its Earnings Before Interest and Taxes (EBIT) margin. In 2024, currency headwinds were a notable factor for many global retailers, and Pandora likely experienced similar pressures. Effective financial hedging strategies and continuous monitoring are essential to mitigate these risks and maintain financial stability.

Interest Rates and Consumer Credit Availability

Changes in interest rates significantly impact consumer behavior, especially concerning credit-financed purchases like jewelry. When interest rates climb, the cost of borrowing increases, potentially dampening consumer demand for discretionary items.

For Pandora, this means higher borrowing costs could lead consumers to postpone or reduce spending on new jewelry, particularly items financed through credit. This effect is more pronounced in economies where consumer credit is a common method for acquiring such goods. For example, in early 2024, the US Federal Reserve maintained interest rates at a higher level, influencing consumer confidence and spending patterns on non-essential goods.

- Rising interest rates can decrease disposable income for consumers using credit.

- Higher borrowing costs may lead to reduced demand for Pandora's products.

- Consumer credit availability is a key factor influencing sales, especially for larger purchases.

- Pandora's sales could be indirectly impacted by tighter credit conditions or increased borrowing costs in key markets.

Market Competition and Promotional Environment

Pandora AS operates in a highly competitive jewelry market, facing pressure from both established luxury houses and emerging non-luxury brands increasingly targeting the affordable luxury segment. This intensified competition, particularly in markets like the US and Europe, requires constant innovation and strategic differentiation to maintain market share.

The promotional environment is particularly aggressive, especially during peak shopping periods like the Christmas holidays and Black Friday. In 2023, for example, many retailers across the apparel and accessories sectors, including jewelry, saw increased promotional activity to drive sales, which can indeed put a strain on profit margins if not managed effectively. Pandora's strategy aims to counter this by focusing on brand elevation and strengthening its direct-to-consumer e-commerce capabilities, which allows for greater control over customer experience and pricing.

- Intense Competition: Luxury brands like Tiffany & Co. and Cartier, alongside accessible brands such as Mejuri and Ana Luisa, vie for consumer attention in the affordable luxury space.

- Promotional Pressures: Holiday sales events in late 2023 and early 2024 saw significant discounts across the retail sector, impacting profitability for brands reliant on volume.

- E-commerce Growth: Pandora's investment in its online platform is crucial, as global online jewelry sales are projected to continue their upward trajectory, reaching an estimated $30 billion by 2027.

- Brand Elevation Strategy: Pandora's focus on higher-quality materials and more sophisticated designs aims to position it more favorably against both ultra-luxury and fast-fashion jewelry competitors.

Economic factors significantly shape Pandora's performance, with global economic health directly influencing consumer discretionary spending on jewelry. Despite economic uncertainties in 2024, Pandora demonstrated resilience, achieving positive organic growth. However, inflationary pressures, particularly on raw materials like silver, necessitate careful cost management, as seen in Pandora's strategic price adjustments to maintain margins.

Exchange rate fluctuations also play a critical role, impacting Pandora's reported revenues and profitability, especially with a stronger Danish Krone in 2024 potentially affecting international sales. Furthermore, rising interest rates in markets like the US in early 2024 can dampen consumer demand for credit-financed purchases, a key segment for accessible luxury goods.

Preview the Actual Deliverable

Pandora AS PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Pandora covers all critical political, economic, social, technological, legal, and environmental factors impacting the brand. You’ll gain insights into market dynamics and strategic considerations for Pandora.

Sociological factors

Consumer tastes in jewelry are in constant flux, with a growing demand for personalization, unique designs, and items carrying personal significance. Pandora’s customizable charm bracelets and emphasis on self-expression directly tap into this evolving preference, allowing customers to curate pieces that reflect their individuality. This aligns with a broader market shift where consumers seek jewelry that tells a story.

Pandora's strategic pivot, often referred to as its 'Phoenix strategy,' is designed to reposition the brand as a comprehensive jewelry house, moving beyond its core charm-based identity. This strategy acknowledges the need to adapt to wider fashion trends and consumer aspirations, aiming to capture a larger share of the premium jewelry market. By doing so, Pandora seeks to broaden its appeal and resonate with a more diverse customer base that values sophisticated and versatile designs.

In 2023, Pandora reported a revenue increase of 5% in local currency to DKK 28.1 billion (approximately $4.1 billion USD), demonstrating its ability to navigate changing consumer preferences. The company has been actively investing in marketing and product innovation to support this brand transformation, particularly focusing on enhancing its digital presence and in-store experiences. This proactive approach to evolving tastes is crucial for maintaining market relevance and driving future growth.

Consumers are increasingly scrutinizing the ethical and environmental footprint of their purchases, driving a significant shift in market expectations. This heightened awareness translates into a growing demand for products crafted from responsibly sourced materials and manufactured through sustainable processes. For instance, by early 2024, a significant majority of consumers across major markets indicated a preference for brands demonstrating strong sustainability credentials.

Pandora's strategic pivot to address this trend is evident in its pioneering use of 100% recycled silver and gold across its product lines, a commitment solidified by 2023. Furthermore, their embrace of lab-grown diamonds, which by 2024 represented a growing segment of the diamond market, directly caters to this conscious consumer base. These initiatives not only align with evolving societal values but also serve to bolster Pandora's brand reputation and market appeal, particularly among younger demographics.

Pandora's marketing and product development strategies are significantly influenced by demographic shifts, particularly the growing purchasing power of Gen Z and Millennials. These younger generations, born between 1981 and 2012, are increasingly prioritizing self-expression and personalization in their fashion choices, making them a key target market for Pandora's customizable jewelry. For instance, by the end of 2023, Millennials and Gen Z represented a substantial portion of global consumer spending, with their influence projected to grow considerably in the coming years.

Pandora actively targets a broad customer base, resonating with fashion-conscious younger consumers who view jewelry as a means of personal expression. The company's strategy often includes collaborations and collections designed to appeal to these trends, such as limited-edition pieces or influencer partnerships that capture the attention of this demographic. This focus on expressive jewelry aligns with the desire of many younger consumers to showcase their individuality.

Expanding into new demographics and emerging markets presents significant growth opportunities for Pandora. As global economic development continues, new consumer segments with increasing disposable income will emerge, offering fertile ground for brand penetration. For example, Pandora has been strategically expanding its presence in Asia-Pacific markets, recognizing the significant potential for growth among a rising middle class eager for accessible luxury and personal adornment.

Influence of Social Media and Digital Culture

Social media profoundly shapes how consumers view jewelry, directly impacting buying habits. Pandora, recognizing this, actively uses platforms to build its brand. For instance, their 'BE LOVE' campaign, heavily promoted across social channels, aimed to foster emotional connections with customers, driving engagement and brand loyalty.

Influencer marketing and user-generated content are critical components of Pandora's digital strategy. By partnering with influencers, Pandora reaches new audiences and builds trust. User-generated content, like customers sharing their styled Pandora bracelets, provides authentic social proof and encourages further purchases. In 2023, influencer marketing spend globally was estimated to be around $21 billion, highlighting its significance.

Pandora's digital marketing efforts are geared towards creating a strong online presence and direct customer interaction. This includes engaging content, responsive customer service, and targeted advertising. The brand's focus on digital channels allows them to gather valuable consumer insights, which inform product development and marketing campaigns. As of early 2024, Pandora's Instagram account boasts over 7 million followers, demonstrating their substantial reach.

- Brand Perception: Social media is a primary driver of consumer perceptions in the jewelry sector.

- Engagement Strategies: Influencer collaborations and user-generated content are key for building authentic brand connections.

- Digital Reach: Pandora utilizes platforms like Instagram to connect with millions of followers, fostering brand awareness.

- Campaign Impact: Campaigns like 'BE LOVE' are designed to resonate emotionally and drive purchasing decisions.

Cultural Significance of Jewelry and Gifting Traditions

Jewelry is more than just adornment; it's a powerful symbol interwoven with cultural heritage and cherished gifting rituals across the globe. These traditions often dictate when, why, and what kind of jewelry is exchanged, reflecting deeply held values and social customs. Pandora's brand ethos, centered on enabling individuals to express their personal stories and affections through customizable pieces, aligns perfectly with these enduring practices.

In 2024, the global jewelry market, valued at approximately USD 289.1 billion, continues to see strong demand driven by these cultural underpinnings. Pandora, in particular, has capitalized on this by offering charms and collections that commemorate life events, from anniversaries to milestones, which are prime occasions for gift-giving in many cultures. For instance, the gifting of jewelry for occasions like Diwali in India or Lunar New Year in Asia remains a significant driver of sales, highlighting the need for culturally sensitive marketing and product design.

Pandora’s success in diverse markets, including its strong presence in regions like Europe and Asia-Pacific, demonstrates an effective adaptation to varying cultural nuances surrounding jewelry and gifting. By offering products that can be personalized to reflect specific cultural symbols or traditions, Pandora fosters a deeper connection with consumers. This strategy is crucial as the company aims for continued global market penetration and brand loyalty.

- Global Jewelry Market Value (2024): Estimated at USD 289.1 billion, indicating substantial consumer spending.

- Cultural Gifting Occasions: Key events like Diwali and Lunar New Year significantly influence jewelry sales patterns.

- Pandora's Brand Alignment: Focus on personalized expression and commemorating life events resonates with gifting traditions.

- Regional Performance: Strong presence in Europe and Asia-Pacific showcases successful adaptation to diverse cultural contexts.

Societal shifts toward ethical consumption and sustainability are profoundly influencing consumer choices in the jewelry market. By early 2024, a significant majority of consumers across major markets expressed a preference for brands demonstrating robust sustainability credentials. Pandora has responded by committing to using 100% recycled silver and gold across its product lines by 2023 and incorporating lab-grown diamonds, which represented a growing segment of the diamond market in 2024.

Demographic changes, particularly the increasing purchasing power of Millennials and Gen Z, are key drivers for Pandora. These generations, born between 1981 and 2012, prioritize self-expression and personalization, making them a core target audience. By the end of 2023, these cohorts constituted a substantial portion of global consumer spending, with their influence projected to grow significantly.

Social media's pervasive influence is reshaping consumer perceptions and purchasing habits in the jewelry sector. Pandora leverages platforms like Instagram, which had over 7 million followers by early 2024, to foster brand awareness and emotional connections. Influencer marketing, with global spend estimated around $21 billion in 2023, and user-generated content are crucial for building trust and authentic brand engagement.

Jewelry holds deep cultural significance, interwoven with heritage and gifting rituals that shape consumer behavior globally. The global jewelry market was valued at approximately USD 289.1 billion in 2024. Pandora's strategy of offering customizable pieces that commemorate life events aligns with these traditions, particularly in key gifting seasons like Diwali and Lunar New Year, which significantly drive sales.

Technological factors

The ongoing expansion of e-commerce platforms directly shapes Pandora's approach to reaching customers. The company's strategic focus includes a significant investment in its digital presence, culminating in a newly launched, more engaging e-commerce platform that went live worldwide in 2025.

This digital push is yielding tangible results. In 2024, online sales experienced robust growth, becoming a crucial contributor to Pandora's overall revenue streams, underscoring the importance of a strong digital sales channel.

Technological leaps in digital marketing, particularly in data analytics and artificial intelligence (AI), are transforming how Pandora connects with its customers. These advancements allow Pandora to craft highly personalized shopping experiences, from curated product recommendations to tailored promotions. This data-driven approach is crucial for identifying and engaging potential new customers.

Pandora is actively leveraging AI-powered platforms to unlock substantial value by refining its customer outreach. This includes creating highly specific advertising content and gaining real-time insights into consumer behavior, which directly fuels engagement and drives business growth. For instance, by the end of 2024, Pandora's investment in digital capabilities is expected to yield a significant uplift in online conversion rates.

Technological advancements in materials and manufacturing are reshaping the jewelry industry, and Pandora is at the forefront. Innovations like lab-grown diamonds offer a sustainable and often more affordable alternative to mined diamonds, directly impacting product development and cost structures. Pandora’s strategic embrace of these materials, notably through its use of lab-grown diamonds produced with 100% renewable energy, aligns with growing consumer demand for ethically sourced and environmentally conscious products.

This technological shift isn't just about materials; it extends to how products are made. 3D printing, for instance, can revolutionize jewelry design and production, allowing for greater customization and potentially reducing lead times and waste. Pandora's investment in advanced manufacturing techniques, coupled with its commitment to sustainable materials, positions it to capitalize on these trends, appealing to a demographic that prioritizes both style and substance.

Supply Chain Digitalization and Automation

Pandora is actively digitizing and automating its supply chain, a move expected to boost efficiency and cut expenses. This includes everything from how they make their jewelry to managing stock and getting it to stores. For example, their investment in a new ERP system, powered by SAP S/4HANA, is designed to create a more unified and streamlined operation across their entire business. This digital overhaul is key to improving how they handle everything from sourcing raw materials to delivering finished products to customers, aiming for greater visibility and control throughout the process.

The company's commitment to digital transformation is evident in its strategic investments. By centralizing data and processes through systems like SAP S/4HANA, Pandora can achieve significant operational improvements. This initiative is crucial for enhancing agility and responsiveness in a dynamic global market. Pandora's focus on these technological advancements supports their goal of a more integrated and data-driven supply chain, ultimately contributing to better inventory management and faster delivery times.

- Digital Transformation Investment: Pandora's implementation of SAP S/4HANA as its core ERP system signifies a substantial investment in modernizing its business processes.

- Efficiency Gains: Automating supply chain functions is projected to yield improvements in operational efficiency, potentially leading to cost reductions.

- Enhanced Transparency: Digitalization efforts aim to provide greater visibility across the entire value chain, from production to final sale.

- Streamlined Operations: The new ERP system is intended to standardize and simplify business operations, fostering a more cohesive approach to supply chain management.

Data Analytics and Business Intelligence

Pandora AS heavily relies on data analytics and business intelligence to navigate the competitive music streaming landscape. The capability to gather, dissect, and understand vast datasets is paramount for making sound strategic choices. In 2024, companies like Pandora are increasingly leveraging advanced analytics to refine their offerings and understand user behavior. For instance, insights from user listening habits directly influence content curation and promotional strategies, aiming to boost engagement and retention.

Pandora employs data insights, alongside rule-based systems and machine learning, to sharpen its content and channel strategies. This data-driven approach helps optimize operational efficiency and predict emerging market trends. By analyzing user data, Pandora can tailor recommendations, which is vital for personalization in a saturated market. For example, understanding which genres or artists are gaining traction allows for proactive content acquisition and marketing campaigns.

A strong data infrastructure underpins Pandora's ability to scale its personalization efforts and artificial intelligence (AI) initiatives. As of 2024, investments in cloud-based data platforms are critical for handling the sheer volume and velocity of data generated by millions of users. This infrastructure enables the sophisticated algorithms that power personalized radio stations and discover new music, directly impacting user satisfaction and subscription renewals. The company’s ability to process real-time data streams is key to its adaptive business model.

Key technological factors impacting Pandora AS include:

- Data-Driven Decision Making: Utilizing analytics to inform content, marketing, and operational strategies.

- Machine Learning & AI: Employing algorithms for personalized user experiences and trend forecasting.

- Robust Data Infrastructure: Investing in scalable platforms to support personalization and AI growth.

- Real-time Data Processing: Enabling adaptive strategies based on immediate user engagement and market shifts.

Pandora AS is actively integrating advanced analytics and artificial intelligence (AI) to enhance its customer engagement and operational efficiency. These technologies are fundamental to personalizing user experiences, from curated music selections to targeted advertising campaigns. By leveraging AI, Pandora aims to gain deeper insights into consumer behavior, thereby optimizing its content and marketing strategies for greater impact.

The company's strategic investment in digital transformation, including a new e-commerce platform launched globally in 2025, highlights its commitment to leveraging technology for growth. This digital push is supported by robust data infrastructure, enabling real-time data processing essential for adapting to market shifts and improving user satisfaction.

Technological advancements in materials, such as lab-grown diamonds produced with renewable energy, are also influencing Pandora's product development and cost structures. Furthermore, the automation and digitization of its supply chain, underpinned by systems like SAP S/4HANA, are designed to boost efficiency and transparency across its operations.

Pandora's reliance on machine learning and data analytics is crucial for navigating the competitive music streaming market. In 2024, the company is focusing on using user listening habits to refine content curation and promotional strategies, aiming to increase engagement and retention.

Legal factors

Pandora AS heavily relies on intellectual property rights and trademark protection to safeguard its distinctive jewelry designs, branding, and innovative customizable charm concepts. The company actively pursues legal avenues to combat counterfeiting and unauthorized reproduction, which is crucial for preserving its brand integrity and market position. In 2023, Pandora reported that its anti-counterfeiting efforts led to the removal of a significant volume of infringing products online, demonstrating the ongoing legal battle to protect its assets. This legal framework is fundamental to maintaining Pandora's competitive edge in the global jewelry market.

Pandora AS must meticulously comply with labor laws across its global operations, a significant challenge given its manufacturing base in Thailand. Ensuring fair wages, safe working conditions, and upholding human rights are paramount to its reputation and legal standing. In 2023, Pandora reported that 99% of its suppliers were compliant with its Supplier Code of Conduct, a testament to its efforts in this area.

The company's commitment to ethical employment extends to its supply chain through its robust Supplier Code of Conduct. This framework, coupled with continuous training for suppliers, reinforces standards for fair labor practices. Pandora's 2024 sustainability report highlighted a 15% increase in supplier audits focused on labor conditions, aiming to further mitigate risks and promote responsible employment.

Pandora AS, with its substantial online presence and customer data collection, must navigate a complex web of data privacy regulations. Key among these are the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, both of which impose strict rules on how personal data is collected, processed, and stored. Failure to comply can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher.

Maintaining consumer trust is paramount, and robust data protection is central to this. Pandora has implemented measures to uphold data privacy rights, including providing customers with access to their data and the ability to request its deletion. Furthermore, the company is obligated to report data security incidents promptly, a critical step in mitigating reputational damage and demonstrating accountability to both consumers and regulatory bodies.

Advertising and Marketing Regulations

Pandora's global advertising and marketing efforts are heavily influenced by a complex web of legal frameworks. The company must navigate varying regulations concerning product claims, particularly regarding the materials used in its jewelry, such as the authenticity of precious metals and gemstones. Consumer protection laws in key markets like the European Union and the United States mandate truthful advertising and prohibit misleading statements about product origin or ethical sourcing practices. Failure to comply can result in significant fines and reputational damage. For instance, the EU's Unfair Commercial Practices Directive sets strict rules against deceptive advertising, which Pandora must meticulously follow across all its promotional activities.

Key legal considerations for Pandora’s marketing include:

- Truth in Advertising: Ensuring all claims about product quality, materials, and benefits are substantiated and not misleading.

- Consumer Protection Laws: Adhering to regulations designed to safeguard consumers from unfair or deceptive commercial practices.

- Intellectual Property Rights: Respecting trademark and copyright laws in all marketing materials to avoid infringement issues.

- Data Privacy: Complying with global data protection regulations, such as GDPR, for any customer data collected during marketing campaigns.

International Trade Laws and Anti-Money Laundering (AML) Compliance

Pandora AS, operating in more than 100 countries, faces a complex web of international trade laws. These regulations govern everything from importing raw materials, like precious metals and gemstones, to exporting finished jewelry. For instance, in 2023, the global trade in precious metals alone was valued in the hundreds of billions of dollars, highlighting the scale of cross-border activity Pandora engages in.

Crucially, Pandora must adhere to Anti-Money Laundering (AML) regulations, particularly given the high value of its products which can attract illicit financial flows. Compliance is not just a legal obligation but a cornerstone for maintaining trust and ensuring seamless global operations. Pandora's commitment to AML is demonstrated through its robust internal policies designed to prevent the company from becoming a conduit for illegal activities.

- Global Trade Complexity: Pandora navigates over 100 national trade regimes impacting import/export of jewelry components and finished goods.

- AML Focus: High-value goods necessitate strict adherence to Anti-Money Laundering regulations to deter financial crime.

- Compliance Strategy: Pandora implements internal policies to actively prevent its operations from being exploited for money laundering purposes.

- Industry Context: The global precious metals trade, exceeding hundreds of billions in 2023, underscores the financial significance and regulatory scrutiny of Pandora's sector.

Pandora AS must navigate complex intellectual property laws to protect its unique designs and brand, actively combating counterfeiting. The company also faces stringent labor laws globally, particularly in its manufacturing hubs, striving for supplier compliance with its ethical standards. Furthermore, data privacy regulations like GDPR and CCPA significantly impact Pandora's online operations and customer data handling.

Environmental factors

The environmental impact of sourcing precious metals and stones is a major consideration for jewelry companies like Pandora. Concerns range from habitat destruction to water pollution associated with mining operations.

Pandora has made a significant commitment to sustainability by achieving its goal of using 100% recycled silver and gold in all its jewelry. This initiative, implemented by the end of 2020, dramatically reduces the environmental footprint associated with raw material extraction.

Using recycled metals means Pandora avoids the substantial carbon emissions and resource depletion that come with mining new materials. For instance, recycled silver production can result in up to a 90% lower carbon footprint compared to virgin silver, and recycled gold can offer an even greater reduction.

This focus on recycled materials is a cornerstone of Pandora's broader sustainability strategy, aiming to minimize its environmental impact across its entire value chain and appeal to increasingly eco-conscious consumers.

Pandora AS is actively working to shrink its environmental impact by focusing on its carbon footprint and greenhouse gas emissions. The company has set ambitious goals to cut these emissions in half by 2030 and reach complete net-zero status by 2040. This commitment spans their entire operational network, from sourcing materials to final production.

Key to achieving these targets is Pandora's strategic shift towards using recycled metals, which significantly lowers the carbon intensity associated with raw material extraction. Furthermore, powering its crafting facilities with 100% renewable energy sources is another major step, directly reducing the emissions generated from energy consumption.

Pandora AS is increasingly focusing on waste reduction within its manufacturing operations and actively promoting a circular economy model. This approach is vital for environmental sustainability, aiming to minimize the impact of its production processes. The company's commitment is evident in its use of recycled metals, a key component of a circular economy where materials are reused without degradation in quality.

By incorporating recycled precious metals, Pandora supports a system where resources are kept in use for as long as possible. This aligns with a broader trend in the jewelry industry to move away from linear "take-make-dispose" models. Pandora's exploration into more eco-friendly production processes further underscores its dedication to minimizing its environmental footprint.

Sustainable Packaging and Product Lifecycle

The environmental footprint of packaging and the entire product journey is increasingly critical for consumers and regulators. Pandora has proactively addressed this by re-engineering its packaging, significantly reducing plastic and material usage. This not only simplifies recycling but also contributes to lower greenhouse gas emissions. By 2023, Pandora reported that 96% of its packaging was made from recycled and/or certified sustainable materials, a testament to their commitment.

This strategic shift directly responds to growing consumer preference for sustainable goods. Pandora's efforts in this area are crucial for maintaining brand reputation and market share in an environmentally conscious market. Their focus on circularity is evident in their packaging initiatives, aiming to minimize waste and maximize resource efficiency throughout the product lifecycle.

Key environmental initiatives by Pandora include:

- Reduced Plastic Content: Significant decrease in virgin plastic use in packaging.

- Recycled and Certified Materials: Aiming for 100% recycled and/or certified sustainable packaging materials.

- Greenhouse Gas Emission Reduction: Efforts to lower emissions associated with packaging production and disposal.

- Easier Recyclability: Designing packaging for straightforward recycling processes.

Water and Energy Consumption in Operations

Pandora AS is actively managing its environmental footprint, particularly concerning water and energy consumption across its crafting facilities and retail network. This focus is a key part of their ongoing sustainability efforts. In 2023, Pandora reported that 100% of the electricity used at its crafting facilities was sourced from renewable energy. This commitment is a significant step towards reducing greenhouse gas emissions associated with its manufacturing processes.

The company is also dedicated to expanding the use of renewable energy in its broader operations. This includes retail stores and other administrative sites. Pandora aims to increase its reliance on renewable energy sources to further its climate commitments, aligning with global efforts to combat climate change. For instance, their ongoing strategy involves transitioning to renewable electricity in their retail portfolio, targeting a substantial increase in renewable energy usage by 2025.

Pandora's approach to water management also plays a role in its environmental strategy. While specific water consumption figures for 2023 are being consolidated, the company's broader sustainability goals include responsible water usage in its production processes. This involves implementing measures to reduce water intensity and ensure responsible discharge practices.

Key initiatives and achievements related to energy and water consumption include:

- 100% renewable electricity at crafting facilities in 2023.

- Ongoing efforts to increase renewable energy adoption in retail operations.

- Focus on reducing water intensity in manufacturing processes.

- Commitment to meeting science-based targets for emissions reduction.

Pandora AS demonstrates a strong commitment to environmental sustainability, primarily through its ambitious goals for carbon emission reduction and its widespread adoption of renewable energy. By 2023, 100% of electricity used in their crafting facilities was sourced from renewable sources, a significant stride towards their net-zero target by 2040. This proactive approach extends to their packaging, with 96% composed of recycled and/or certified sustainable materials by 2023, minimizing plastic and enhancing recyclability.

The company's strategy heavily relies on recycled precious metals, a move that drastically cuts down the environmental impact of raw material sourcing. For instance, recycled silver production can reduce carbon footprints by up to 90% compared to virgin silver, a crucial factor in their overall sustainability efforts. Pandora is also focused on water management and reducing waste in its production, aiming to embed circular economy principles throughout its operations.

| Environmental Metric | 2023 Status/Target | Impact |

|---|---|---|

| Renewable Electricity (Crafting Facilities) | 100% | Reduced GHG emissions from manufacturing |

| Recycled/Certified Sustainable Packaging | 96% | Minimized plastic use, improved recyclability |

| Recycled Silver/Gold Usage | 100% in all jewelry | Reduced carbon footprint from material extraction |

| GHG Emission Reduction Target | Halve by 2030, Net-zero by 2040 | Aligns with global climate action |

PESTLE Analysis Data Sources

Our Pandora AS PESTLE Analysis is meticulously constructed using data from reputable industry reports, market research firms, and financial news outlets. We incorporate information on technological advancements, regulatory changes, and economic forecasts to provide a comprehensive view of the external environment.