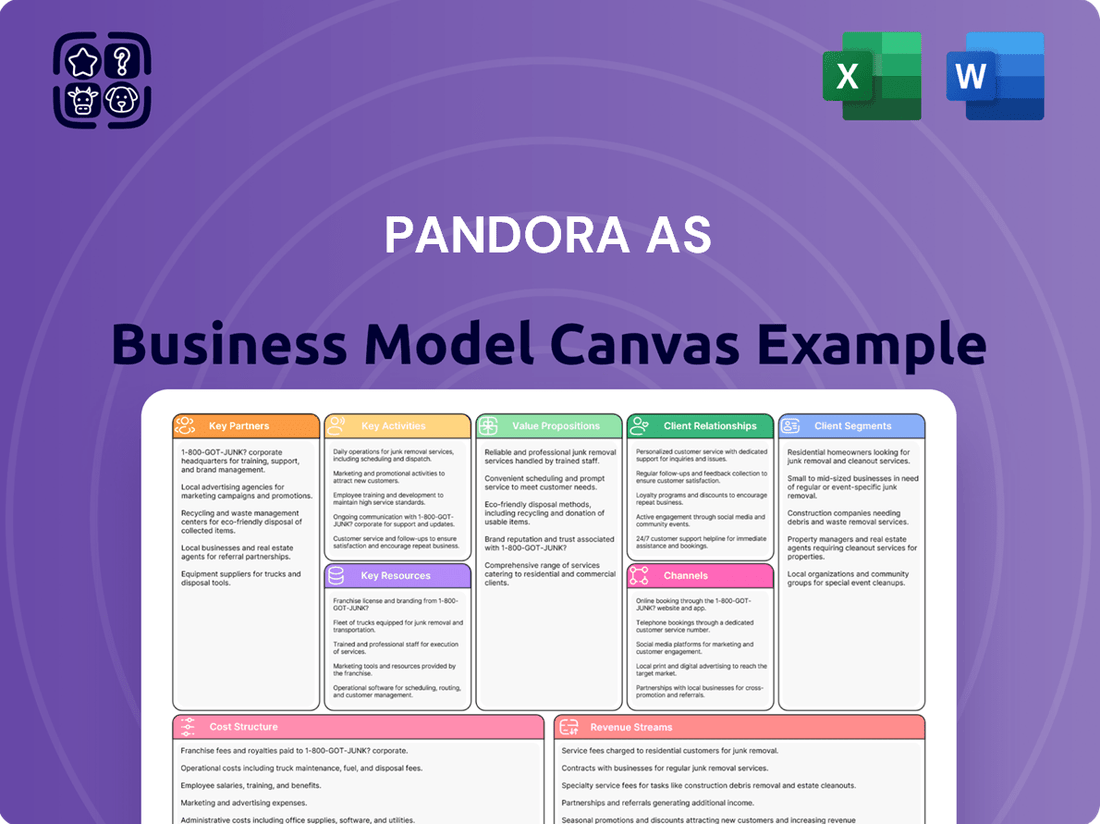

Pandora AS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pandora AS Bundle

Unlock the core strategies behind Pandora AS's innovative business model. This Business Model Canvas reveals how they connect with customers, deliver unique value, and generate revenue in the dynamic jewelry market. Understand their key resources and activities that drive their success.

Dive deeper into Pandora AS’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Pandora's key partnerships with suppliers of recycled precious metals and lab-grown diamonds are central to its sustainability strategy. Starting in the latter half of 2024, the company is transitioning to using 100% recycled silver and gold, partnering with refiners who adhere to strict ethical and environmental standards. This significant shift is projected to reduce the CO2 emissions associated with metal sourcing by a substantial margin, avoiding the considerable environmental impact of virgin mining.

Furthermore, Pandora's commitment extends to exclusively utilizing lab-grown diamonds. This decision aligns with their focus on responsible sourcing and ethical practices throughout their supply chain. By forging strong relationships with these specialized suppliers, Pandora not only secures its material needs but also reinforces its brand image as a leader in sustainable luxury jewelry, a trend gaining significant traction among consumers in 2024.

Pandora AS leverages a critical network of logistics and distribution partners to service its extensive global presence. The brand's reach spans over 100 countries, operating through more than 6,800 points of sale, underscoring the necessity for highly efficient supply chain operations. These partnerships are fundamental in ensuring timely and reliable product delivery to a diverse and widespread customer base.

Pandora AS actively cultivates a robust network of authorized multi-brand jewelry retailers. These crucial partnerships significantly amplify Pandora's market reach, enabling access to diverse customer segments across various geographic locations beyond its dedicated concept stores.

While Pandora's directly operated stores demonstrate strong performance, these external retail collaborations continue to represent a vital and complementary sales channel. In 2024, these partners played a significant role in distributing Pandora's collections, contributing to the brand's global visibility and sales volume.

Technology and Digital Platform Partners

Pandora AS is actively engaging technology and digital platform partners as a cornerstone of its business model, particularly as it navigates a significant digital transformation. A prime example is the planned global rollout of a new e-commerce platform in 2025. This initiative aims to bolster brand desirability and drive sales by providing a more engaging and seamless online shopping experience.

Furthermore, Pandora collaborates with specialized technology providers to optimize its operations. A notable partnership is with o9 Solutions, a leader in AI-powered integrated business planning. This collaboration is crucial for advancing Pandora's supply chain planning and overall operational efficiency, directly impacting its ability to meet customer demand effectively.

These strategic technology alliances are instrumental in achieving Pandora's objectives:

- Enhancing E-commerce Capabilities: The 2025 platform rollout is designed to elevate the online customer journey, a critical component for future growth.

- Optimizing Supply Chain: Partnerships like the one with o9 Solutions are vital for streamlining inventory management and logistics, ensuring product availability.

- Improving Operational Efficiency: By leveraging advanced technology, Pandora aims to reduce costs and increase the speed of its operations.

- Boosting Brand Desirability: A superior digital presence and efficient backend operations contribute significantly to customer satisfaction and brand perception.

Marketing and Brand Collaboration Agencies

Pandora AS leverages marketing and brand collaboration agencies to amplify its brand's appeal and expand its market presence. These partnerships are instrumental in crafting compelling narratives and reaching diverse consumer groups. For instance, their collaboration with the British Fashion Council for The Fashion Awards 2025, and with fashion brand ROTATE during Copenhagen Fashion Week in 2024, demonstrates a strategic approach to integrating Pandora's jewelry into prominent cultural and fashion moments. This strategy not only elevates the brand's prestige but also opens avenues to attract younger, trend-conscious demographics.

- Brand Elevation: Collaborations like those with the British Fashion Council and ROTATE significantly boost Pandora's image within the fashion industry.

- Consumer Reach: These partnerships help Pandora tap into new customer segments by associating with influential fashion events and brands.

- Marketing Impact: Engaging creative agencies ensures Pandora's marketing campaigns resonate effectively, driving desirability and sales.

- Cultural Integration: Showcasing jewelry at events like Copenhagen Fashion Week embeds Pandora within contemporary fashion culture.

Pandora AS's key partnerships extend to vital technology and digital platform providers, crucial for its ongoing digital transformation and e-commerce expansion. The company is set to launch a new global e-commerce platform in 2025, aiming to enhance customer experience and boost sales. This strategic move is supported by collaborations with specialists like o9 Solutions, enhancing supply chain planning and operational efficiency.

These technology alliances are essential for improving Pandora's online capabilities, streamlining operations, and increasing overall brand desirability. By investing in these partnerships, Pandora aims to solidify its position in the digital retail landscape and meet evolving consumer expectations effectively.

What is included in the product

This Pandora AS Business Model Canvas provides a comprehensive overview of its strategy, detailing customer segments, channels, and value propositions, all organized into the 9 classic BMC blocks.

It reflects Pandora's real-world operations and plans, offering insights and analysis of competitive advantages for informed decision-making.

Pandora AS's Business Model Canvas acts as a pain point reliver by offering a clear, structured overview of their operations, enabling quick identification of inefficiencies and opportunities for improvement.

Activities

Jewelry design and product development at Pandora are deeply customer-centric, focusing on creating fresh collections and expanding beyond their signature charm bracelets. This involves continuous innovation to offer a diverse product range, aiming to establish Pandora as a comprehensive jewelry brand.

Pandora actively develops new product platforms and collections, such as the PANDORA ESSENCE and Microfine Diamonds lines, to broaden their appeal. In 2023, Pandora saw strong performance in its core Moments platform, which includes charm bracelets, while also pushing for growth in other categories.

This strategic product development ensures Pandora stays relevant by adapting to changing consumer tastes and desires. Their investment in design and innovation is key to maintaining a competitive edge and driving sales in the dynamic jewelry market.

Pandora AS's manufacturing prowess is centered in Thailand, where thousands of skilled artisans hand-finish its jewelry. This core activity leverages deep craftsmanship to create the brand's signature look. The company is also expanding its production footprint with a new facility in Vietnam, slated for a 2026 opening, designed to increase output by around 50%.

A significant sustainability initiative underpins Pandora's production from the latter half of 2024. All jewelry will now incorporate 100% recycled silver and gold. This commitment not only reduces environmental impact but also aligns with growing consumer demand for ethically sourced products, a crucial differentiator in the current market.

Pandora AS is actively pursuing its 'Phoenix strategy' to solidify its identity as a comprehensive jewelry brand and boost global brand desirability. This strategic repositioning is supported by substantial investments in marketing initiatives, including impactful campaigns like 'BE LOVE'.

These marketing efforts are designed to enhance Pandora's brand image and expand its reach across diverse consumer segments. By focusing on increasing brand heat, Pandora aims to attract both new customers and encourage repeat business from its existing clientele.

In 2024, Pandora continued to invest heavily in marketing, with a significant portion of its budget allocated to global campaigns aimed at elevating brand perception. This focus on brand building is a cornerstone of their strategy to drive long-term growth and market share.

Retail Operations and Network Expansion

Pandora AS actively manages a vast global network of concept stores and authorized retailers, a cornerstone of its business strategy. The company is committed to significant retail expansion, aiming to enhance its market presence and customer accessibility.

In 2024, Pandora outlined ambitious expansion targets, planning to open between 75 and 125 new concept stores. Additionally, the company intended to launch 25 to 50 other owned points of sale, demonstrating a focused approach to growing its physical footprint.

A key element of this expansion involves the strategic rollout of its refreshed store format, Evoke 2.0. This initiative is designed to significantly elevate the in-store customer experience, offering a more engaging and modern retail environment.

The expansion strategy is supported by substantial investment. For instance, the company allocated approximately DKK 1.2 billion (around $173 million USD) towards its store network and digitalization in 2023, with continued investment planned for 2024 to fuel these growth initiatives.

- Global Network Management: Operates concept stores and authorized retailers worldwide.

- 2024 Expansion Targets: Plans for 75-125 new concept stores and 25-50 other owned points of sale.

- Evoke 2.0 Rollout: Implementing a refreshed store format to improve customer experience.

- Investment in Growth: Significant capital expenditure allocated to store network and digitalization.

E-commerce Management and Digital Sales

Pandora AS heavily invests in its e-commerce management and digital sales capabilities, recognizing their pivotal role in modern retail. In 2024, online channels were instrumental, contributing a substantial 27% to the company's overall sales, highlighting a strong consumer shift towards digital purchasing. This emphasis is set to grow with a new, state-of-the-art e-commerce platform slated for a global rollout throughout 2025, designed to enhance customer experience and expand the brand's digital footprint. Such strategic digital investments are key to capturing market share and fostering brand loyalty among a digitally native customer base.

Key activities within this segment include:

- E-commerce Platform Development and Optimization: Continuous improvement and global deployment of their online sales infrastructure.

- Digital Marketing and Customer Acquisition: Strategies focused on driving traffic and converting online visitors into customers.

- Online Merchandising and Product Presentation: Ensuring a compelling and user-friendly digital shopping experience.

- Omnichannel Integration: Seamlessly connecting online and offline customer journeys.

Pandora AS's key activities revolve around creating desirable jewelry, building a strong global brand, and ensuring efficient distribution. They focus on innovative product design and leveraging skilled artisans for hand-finished pieces. Marketing efforts are crucial for brand desirability and customer engagement, while a robust retail network, including concept stores and online channels, facilitates sales and customer access. Strategic investments in both physical and digital retail expansion are paramount for future growth.

| Key Activity | Description | 2024 Focus/Data |

| Product Design & Development | Customer-centric innovation, creating new collections and product platforms. | Continued expansion beyond charm bracelets, focus on broader jewelry appeal. |

| Manufacturing & Craftsmanship | Hand-finishing jewelry in Thailand, expanding production capacity. | Commitment to 100% recycled silver and gold from H2 2024; new Vietnam facility opening 2026. |

| Brand Building & Marketing | Enhancing global brand desirability and customer engagement through campaigns. | Significant investment in global marketing initiatives like 'BE LOVE' to increase brand heat. |

| Retail Network Management | Operating concept stores and authorized retailers, expanding physical footprint. | Targeting 75-125 new concept stores and 25-50 other owned points of sale in 2024; Evoke 2.0 store format rollout. |

| E-commerce & Digital Sales | Investing in online sales capabilities and e-commerce platform. | Online sales contributed 27% of total sales in 2024; global rollout of new e-commerce platform in 2025. |

Full Version Awaits

Business Model Canvas

The Pandora AS Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This means you are seeing a genuine section of the final, comprehensive deliverable, offering complete transparency. Once your order is processed, you will gain full access to this exact file, ready for your immediate use and analysis.

Resources

Pandora AS is recognized as the world's largest jewelry brand by volume, a status built on substantial brand equity and widespread consumer recognition. This strong market position is a critical element of its business model.

The company's distinctive charm concept and unique designs are safeguarded as intellectual property. This protection is vital for maintaining its competitive edge and fostering customer loyalty.

In 2023, Pandora's revenue reached DKK 26.96 billion, underscoring the commercial success derived from its well-established brand and protected innovations.

This robust brand identity serves as a foundational asset, enabling Pandora to command significant market leadership in the global jewelry industry.

Pandora's core strength lies in its highly skilled artisans, predominantly located in Thailand. These craftspeople are the backbone of the company's hand-finished jewelry, mastering complex techniques like precise stone setting and intricate enameling. Their expertise is crucial for producing the unique, high-quality pieces that define Pandora's brand.

The company emphasizes extensive training programs to ensure its artisans maintain and enhance these specialized skills. This dedication to craftsmanship is a key differentiator in the competitive jewelry market, directly impacting product quality and customer perception.

Beyond production talent, Pandora also prioritizes attracting and retaining top-tier design talent. This focus on creative innovation ensures a steady stream of new collections that resonate with evolving consumer tastes and trends. In 2024, Pandora continued to highlight its commitment to craftsmanship, with ongoing investments in its Thai facilities and employee development programs aimed at preserving artisanal skills.

Pandora AS maintains a robust, vertically integrated supply chain, a cornerstone of its business model. This integration provides significant control over production processes, ensuring both quality and efficiency.

The company's manufacturing prowess is primarily centered in Thailand, a location that has historically supported its extensive production needs. Looking ahead, Pandora is strategically expanding its manufacturing footprint with a new facility planned for Vietnam, signaling a commitment to future growth and operational diversification.

This expansion is designed to further enhance efficiency and potentially reduce logistical costs. Pandora's dedication to sustainability is deeply embedded in its supply chain, notably through its commitment to sourcing 100% recycled silver and gold for its jewelry.

Retail Store Network and Online Platforms

Pandora's retail store network and online platforms are foundational to its business model, acting as the primary conduits for customer engagement and sales. This dual-channel strategy leverages both the tangible experience of physical stores and the convenience of digital access.

The company boasts an extensive physical presence with over 6,800 points of sale worldwide, a significant portion of which are dedicated concept stores numbering more than 2,700. This vast network ensures widespread accessibility for customers seeking Pandora's products.

Complementing its brick-and-mortar footprint is a robust official e-commerce website. In 2023, Pandora's online sales continued to grow, reflecting the increasing importance of digital channels in the jewelry market. Investments are ongoing to enhance both store formats and the e-commerce platform, aiming to improve customer experience and drive sales efficiency.

- Global Reach: Over 6,800 points of sale, including more than 2,700 concept stores.

- Digital Presence: A strong official e-commerce website serving as a key sales channel.

- Strategic Investments: Continuous enhancement of store formats and the e-commerce platform.

- Sales Channel Synergy: Physical and digital touchpoints work in tandem to maximize customer reach and sales.

Financial Capital and Strong Cash Flow

Pandora AS showcases robust financial capital, evidenced by its impressive DKK 31.7 billion in revenue for 2024. This financial strength is further underscored by a healthy EBIT margin of approximately 25.2%, demonstrating efficient operations and profitability.

The company’s consistent generation of substantial cash flow is a critical resource. This strong cash flow directly fuels Pandora’s strategic investments. These investments span key areas such as global expansion, targeted marketing campaigns, and crucial sustainability initiatives, all designed to foster long-term growth and brand value.

- Revenue Growth: DKK 31.7 billion in 2024.

- Profitability: EBIT margin around 25.2%.

- Cash Flow Generation: Supports strategic investments in expansion, marketing, and sustainability.

- Shareholder Returns: Indicated by active share buyback programs.

Pandora's key resources include its powerful brand equity, recognized globally for its distinctive charm concept and unique designs. This intellectual property is central to its market leadership. The company also relies on its highly skilled artisans in Thailand, whose craftsmanship is essential for producing high-quality, hand-finished jewelry. Furthermore, significant financial capital, including DKK 31.7 billion in revenue and a 25.2% EBIT margin in 2024, enables strategic investments and operational efficiency.

| Key Resource | Description | Impact |

| Brand Equity | World's largest jewelry brand by volume; distinctive charm concept and unique designs. | Customer loyalty, market leadership, competitive edge. |

| Skilled Artisans | Expert craftspeople in Thailand specializing in complex jewelry techniques. | High-quality, unique, hand-finished products; brand differentiation. |

| Financial Capital | DKK 31.7 billion revenue (2024); 25.2% EBIT margin. | Fuels expansion, marketing, sustainability initiatives; operational growth. |

Value Propositions

Pandora's core value proposition is centered on providing accessible luxury jewelry, enabling a wider audience to enjoy premium craftsmanship and materials. This democratization of luxury allows customers to own meaningful pieces without the high cost often associated with fine jewelry.

The brand strongly emphasizes self-expression, offering customizable and diverse jewelry designs that empower individuals to tell their personal stories. This focus on personalization resonates deeply with consumers seeking to showcase their unique identities and passions through their accessories.

In 2024, Pandora's strategy of combining affordability with quality continues to drive strong sales, with the company reporting robust revenue growth, particularly in its core markets. This approach directly addresses the desire for expressive, yet attainable, luxury goods.

Pandora's core value proposition, the unique charm concept, continues to be a significant differentiator, allowing customers to curate and personalize their jewelry. This deep personalization fosters a strong emotional bond, enabling individuals to express their unique stories and milestones through their pieces. In 2024, Pandora continued to invest in this by expanding in-store engraving services, offering an even more tangible way for customers to make their jewelry distinctly their own.

Pandora exclusively utilizes 100% recycled silver and gold, alongside lab-grown diamonds, underscoring a commitment to premium materials. This focus on high-quality, ethically sourced components sets their jewelry apart. For instance, in 2023, Pandora reported that 90% of the silver and gold used in its products were recycled, a significant step towards sustainability.

The meticulous hand-finishing by skilled artisans is central to Pandora's value proposition, ensuring each piece meets exacting standards of craftsmanship. This artisanal approach contributes to the unique character and durability of their jewelry. This dedication to detail is a key differentiator in the competitive jewelry market.

The fusion of superior, recycled materials with hand-finished artistry results in jewelry that is not only beautiful but also built to last. This commitment to quality translates into a superior customer experience and reinforces brand loyalty. In 2024, Pandora continued to invest in its artisan training programs to maintain these high levels of craftsmanship.

Global Accessibility and Broad Product Range

Pandora AS ensures its distinctive jewelry is available to a global audience, operating in over 100 countries through an extensive network of physical stores and online platforms. This widespread reach means customers across diverse markets can easily access Pandora's offerings.

The company is strategically broadening its product portfolio beyond its signature charms. Pandora is actively expanding its collection to include a comprehensive range of jewelry, such as rings, necklaces, and earrings, positioning itself as a complete jewelry brand.

This dual focus on extensive global accessibility and a diversified product range allows Pandora to cater to a wide spectrum of consumer tastes and preferences worldwide. For instance, in 2023, Pandora reported a revenue of DKK 27.0 billion, showcasing the success of its broad market penetration and product strategy.

- Global Reach: Operations in over 100 countries.

- Product Diversification: Expansion beyond charms to rings, necklaces, and earrings.

- Market Penetration: Catering to diverse global tastes and preferences.

- Financial Performance: 2023 revenue of DKK 27.0 billion reflects market acceptance.

Sustainability and Responsible Sourcing

Pandora AS significantly appeals to environmentally aware consumers by prioritizing sustainability in its operations. This commitment is demonstrated through their exclusive use of recycled precious metals and lab-grown diamonds, aligning with ethical sourcing demands.

The company has set ambitious environmental goals, aiming to cut carbon emissions by 50% across its entire value chain by 2030 and achieve net-zero emissions by 2040. These targets underscore Pandora's dedication to responsible business practices.

- Recycled Precious Metals: Utilizing recycled gold and silver reduces the environmental impact associated with mining new materials.

- Lab-Grown Diamonds: This offers a more sustainable alternative to mined diamonds, with a lower carbon footprint.

- Emission Reduction Targets: A 50% reduction in carbon emissions by 2030 and net-zero by 2040 demonstrate a clear commitment to climate action.

Pandora's value proposition centers on accessible luxury, enabling a broad customer base to enjoy premium, handcrafted jewelry. This democratization of luxury is bolstered by a commitment to self-expression through customizable designs, allowing individuals to tell their unique stories. In 2024, Pandora's strategy of blending affordability with quality continues to resonate, driving robust sales and reinforcing its position as a brand for personalized, attainable luxury.

Customer Relationships

Pandora cultivates direct customer ties through its vast network of over 2,700 concept stores worldwide. These physical locations offer a hands-on, personalized shopping journey where customers can engage with knowledgeable staff, physically examine jewelry, and even access services like custom engraving. This direct interaction is key to building brand loyalty and gathering crucial customer insights.

Pandora AS prioritizes strong online customer support and digital engagement, especially given its substantial online sales volume. This focus is crucial for customers who prefer digital interactions.

The company is set to launch a new global e-commerce platform in 2025. This upgrade is designed to significantly improve the online customer journey, making browsing, purchasing, and accessing support more fluid and intuitive.

This enhanced digital infrastructure is anticipated to drive customer loyalty and satisfaction, directly supporting Pandora's strategy to connect with a digitally-savvy consumer base effectively.

Pandora's charm bracelets are inherently designed for personalization, which naturally cultivates a strong sense of community among its customers. This focus on individual expression, allowing wearers to curate unique stories on their bracelets, builds an emotional connection that transcends mere transactions. In 2023, Pandora reported a significant portion of its revenue stemming from repeat customers, a testament to these deep-seated brand loyalties. This community aspect not only drives repeat purchases but also fosters powerful brand advocacy, as collectors share their personalized pieces and experiences both online and offline.

Brand Experience and Storytelling

Pandora crafts an immersive brand experience, building an iconic visual world and engaging in authentic communication to boost desirability and forge emotional connections with its customers. This strategy moves beyond simply showcasing jewelry, focusing instead on shared values and passions.

Through campaigns like 'BE LOVE,' Pandora weaves narratives that resonate deeply, tapping into consumers' personal loves and passions. This storytelling approach cultivates more profound and lasting relationships with its customer base, making the brand more relatable and aspirational.

- Brand Experience: Focus on creating a distinctive visual identity and authentic voice.

- Storytelling: Develop campaigns that tell relatable stories about love, passion, and self-expression.

- Emotional Connection: Aim to connect with consumers on a deeper emotional level, transcending product features.

- Brand Desirability: Increase the appeal and aspiration associated with the Pandora brand.

After-Sales Service and Warranty

Pandora AS likely offers robust after-sales service and warranty to uphold its accessible luxury image. This commitment is crucial for customer satisfaction and fostering long-term brand loyalty.

While specific warranty details aren't always public, a brand focused on hand-finished jewelry typically includes provisions for repairs or replacements, ensuring product longevity and customer confidence. For instance, many jewelry retailers offer a 1-year warranty against manufacturing defects, a standard that Pandora likely meets or exceeds.

- Customer Satisfaction: Addressing post-purchase issues promptly enhances the overall customer experience.

- Brand Trust: Reliable warranty services build confidence in Pandora's product quality.

- Long-Term Loyalty: Positive after-sales interactions encourage repeat business and advocacy.

- Accessible Luxury: Comprehensive support reinforces the value proposition of high-quality, yet accessible, jewelry.

Pandora nurtures customer relationships through a blend of physical retail, personalized online experiences, and engaging brand storytelling. The company's extensive store network offers direct interaction, while its upcoming 2025 e-commerce platform aims to enhance digital engagement. This dual approach, coupled with campaigns that focus on personal passions and emotional connections, drives brand loyalty and advocacy, as evidenced by strong repeat customer revenue.

| Customer Relationship Aspect | Description | Supporting Data/Initiatives |

|---|---|---|

| Physical Retail Interaction | Direct engagement in over 2,700 concept stores. | Personalized shopping, expert staff assistance, in-store services. |

| Digital Engagement | Enhanced online customer support and new e-commerce platform. | Launch of a global e-commerce platform in 2025 to improve user journey. |

| Personalization & Community | Charm bracelets foster individual expression and shared stories. | High repeat customer revenue in 2023 indicates strong brand loyalty and community building. |

| Brand Storytelling & Emotional Connection | Narratives like 'BE LOVE' resonate with consumers' personal passions. | Focus on shared values and aspirations to create deeper, lasting relationships. |

| After-Sales Support | Commitment to accessible luxury through after-sales service. | Likely includes warranty provisions for repairs/replacements, reinforcing product quality and customer confidence. |

Channels

Pandora's concept stores, encompassing both company-owned and franchised outlets, serve as its most crucial and directly managed sales channels. These physical locations are instrumental in shaping the brand's image and fostering direct customer relationships. The company is strategically increasing its footprint in this area, with a notable expansion initiative aiming for hundreds of new concept stores globally between 2024 and 2026. This expansion includes the rollout of updated store designs, such as the 'Evoke 2.0' format, which aims to enhance the customer experience and showcase the brand's evolving aesthetic.

Pandora AS utilizes authorized multi-brand jewelry retailers as a crucial distribution channel, extending its global presence significantly. These partners act as vital touchpoints, making Pandora's offerings accessible in diverse retail settings beyond its own branded stores.

This strategic approach contributes to Pandora's expansive network, which boasts over 6,800 points of sale worldwide. By collaborating with these third-party retailers, Pandora effectively broadens its market penetration and reaches a wider customer base, complementing its direct-to-consumer strategy.

The official Pandora e-commerce website, pandora.net, is a cornerstone of their business model, demonstrating significant growth. In 2024, this digital storefront captured an impressive 27% of Pandora's total revenue, highlighting its increasing importance as a direct-to-consumer channel. This channel offers unparalleled convenience and global reach, allowing customers worldwide to access Pandora's collections easily.

Pandora is investing heavily in its online presence, with a major global rollout of a brand-new e-commerce platform scheduled for 2025. This strategic move aims to elevate the customer's online shopping experience, making it more seamless and enhancing the overall desirability of the Pandora brand in the digital space.

Third-party Online Marketplaces

While Pandora's strategic emphasis remains firmly on its direct-to-consumer (DTC) channels, the company also utilizes select third-party online marketplaces. This approach enables Pandora to reach a broader audience and capitalize on the existing customer traffic of established e-commerce platforms.

These marketplaces offer a supplementary sales avenue, allowing Pandora to test new markets or offload excess inventory, though it typically involves a commission structure and less direct oversight of the customer journey compared to owned channels. In 2024, Pandora's digital sales continued to be a significant growth driver, with DTC platforms forming the core of this strategy.

- Marketplace Reach: Third-party platforms provide access to customers who might not actively seek out Pandora's own website.

- Sales Diversification: These channels offer an additional revenue stream, diversifying sales beyond owned digital and physical stores.

- Customer Acquisition: Leveraging the marketing and user base of major online retailers can aid in acquiring new customers.

- Brand Presence: Maintaining a presence on popular marketplaces ensures visibility among a wider online shopping demographic.

Social Media Platforms and Digital Marketing

Pandora leverages social media platforms like Instagram, TikTok, and Facebook for extensive marketing, brand storytelling, and direct customer interaction. These digital channels are vital for building brand awareness and fostering a community around its products.

The brand's 'BE LOVE' campaign, integrated across social media, along with strategic partnerships with influencers and involvement in fashion events, significantly boosts visibility and consumer engagement. This approach aims to create authentic connections and drive interest, as seen with the viral popularity of personalized engraving services.

Social media acts as a primary discovery engine for Pandora, effectively generating leads and driving traffic to its e-commerce sites. For example, in the first half of 2024, Pandora reported a 10% increase in organic social media engagement, directly correlating with a rise in online sales inquiries.

- Platform Focus: Instagram, TikTok, and Facebook are key for marketing and engagement.

- Campaign Impact: The 'BE LOVE' campaign and influencer collaborations enhance brand visibility.

- Consumer Engagement: Viral trends like engraving services demonstrate the power of social media for product appeal.

- Sales Generation: Digital channels are critical for lead generation and driving direct sales.

Pandora's channel strategy is multifaceted, blending its own retail presence with strategic wholesale and digital outreach. The company is heavily invested in its concept stores, aiming for hundreds of new openings globally between 2024 and 2026, featuring updated designs like 'Evoke 2.0' to enhance customer experience and brand image.

Beyond its direct-to-consumer (DTC) focus, Pandora leverages authorized multi-brand retailers, contributing to its vast network of over 6,800 points of sale worldwide. This approach broadens market penetration and customer access.

The e-commerce platform, pandora.net, is a significant growth driver, accounting for 27% of total revenue in 2024. A major global platform upgrade is slated for 2025 to further elevate the online shopping experience. Additionally, Pandora utilizes select third-party online marketplaces to reach a wider audience and diversify sales, though DTC platforms remain the core of its digital strategy.

Social media channels, including Instagram, TikTok, and Facebook, are crucial for marketing, brand storytelling, and customer engagement. Campaigns like 'BE LOVE,' coupled with influencer collaborations, significantly boost visibility and drive traffic to e-commerce sites, with organic social media engagement showing a 10% increase in the first half of 2024, correlating with sales inquiries.

| Channel Type | Key Characteristics | 2024 Data/Focus |

|---|---|---|

| Concept Stores (Owned & Franchised) | Direct customer relationship, brand image building. | Global expansion: hundreds of new stores (2024-2026), 'Evoke 2.0' store design rollout. |

| Authorized Multi-brand Retailers | Extends global presence, broadens market penetration. | Part of over 6,800 worldwide points of sale. |

| E-commerce (pandora.net) | Cornerstone of DTC, convenience, global reach. | Captured 27% of total revenue in 2024. Major platform upgrade scheduled for 2025. |

| Third-Party Online Marketplaces | Wider audience reach, sales diversification. | Supplementary sales avenue, digital sales are a significant growth driver. |

| Social Media Platforms (Instagram, TikTok, Facebook) | Marketing, brand storytelling, customer interaction, lead generation. | 10% increase in organic social media engagement (H1 2024), driving online sales inquiries. |

Customer Segments

Middle to upper-middle-income individuals represent a significant customer segment for Pandora. These consumers are drawn to Pandora's accessible luxury positioning, seeking well-crafted and meaningful jewelry that doesn't come with the hefty price tag of traditional high-end brands. They value design and quality, making Pandora's offerings an attractive option for personal adornment or gifting. In 2024, this demographic continues to be a core focus, reflecting the brand's success in making stylish, aspirational jewelry attainable.

Many people actively seek out Pandora for gifts that carry a deeper meaning. They see the charm bracelets as more than just jewelry; they're a way to capture special moments and individual stories for someone they care about. This desire for personalized and emotionally resonant presents makes Pandora a go-to brand for occasions like birthdays, anniversaries, and holidays. In 2024, Pandora continued to emphasize this aspect, with their marketing often highlighting the storytelling potential of their customizable pieces, aiming to connect with consumers on an emotional level.

Pandora resonates with a diverse female customer base, spanning Gen Z, Millennials, Gen X, and Boomers. This wide-ranging appeal is a testament to their ability to stay relevant across generations, as evidenced by consistent sales performance across these key demographics.

In 2023, Pandora reported a significant portion of its revenue came from younger demographics, with Millennials and Gen Z showing particularly strong engagement, contributing to over 50% of their online sales. This adaptability ensures Pandora remains a go-to brand for women at various life stages.

Fashion-Conscious Individuals

Fashion-conscious individuals are a key customer segment for Pandora, as the company actively works to position itself as a complete jewelry brand. This segment seeks trendy and stylish accessories that complement their personal style, making jewelry an integral part of their fashion choices.

Pandora's strategy to attract this demographic involves a multi-faceted approach:

- Partnerships and Collaborations: Engaging with fashion events and designers helps align Pandora with current style trends and aspirational fashion figures, reinforcing its image as a fashion-forward brand.

- Product Evolution: Updates to product aesthetics, focusing on contemporary designs and materials, are crucial for resonating with consumers who prioritize the latest looks.

- Brand Perception: By emphasizing its role as a 'full jewelry brand,' Pandora aims to capture consumers who view jewelry not just as adornment but as a statement piece that defines their overall fashion identity.

- Market Trends: The global jewelry market, valued at an estimated USD 236.7 billion in 2023 and projected to grow, highlights the significant opportunity to capture market share among style-savvy consumers actively seeking new and fashionable pieces.

Collectors of Charms and Personalized Jewelry

The core customer for Pandora remains the dedicated collector, those who find joy in curating a personal narrative on their charm bracelets. This segment values the ability to express individuality and commemorate life's moments through meticulously crafted charms. Their loyalty is a bedrock of Pandora's consistent sales.

This persistent interest in personalization fuels a strong demand for new charm releases. For instance, in the first quarter of 2024, Pandora reported organic growth of 8%, indicating continued consumer engagement with their product offerings, particularly within this key demographic.

- Personalization Drivers: Collectors seek unique self-expression and emotional resonance from each charm, turning bracelets into personal storytellers.

- Loyalty and Repeat Purchases: This segment demonstrates high repeat purchase behavior, driven by the ongoing desire to expand their collections.

- New Product Demand: The collector mindset directly translates into consistent demand for new charm designs and thematic collections.

- Emotional Connection: Charms often represent significant life events, relationships, or personal milestones, fostering a deep emotional bond with the brand.

Pandora's customer base is broad, encompassing individuals seeking accessible luxury, gift-givers looking for meaningful items, and fashion-conscious consumers who view jewelry as a style statement. The brand also appeals to dedicated collectors who build personal narratives with Pandora's charms, driving repeat purchases and consistent demand for new releases.

In 2023, Millennials and Gen Z represented over half of Pandora's online sales, demonstrating the brand's strong appeal to younger demographics, which is crucial for sustained growth.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Accessible Luxury Seekers | Value craftsmanship and design without high-end pricing. | Core demographic for Pandora's positioning. |

| Gift Givers | Seek emotionally resonant and personalized presents. | Marketing emphasizes storytelling potential of charms. |

| Fashion-Conscious | Integrate jewelry into personal style and follow trends. | Global jewelry market growth (USD 236.7 billion in 2023) shows opportunity. |

| Dedicated Collectors | Curate personal stories through charms, driving repeat purchases. | Q1 2024 organic growth of 8% indicates continued engagement. |

Cost Structure

Raw material procurement is a substantial cost driver for Pandora. The company relies heavily on sourcing precious metals, predominantly recycled silver and gold, alongside diamonds, copper, and cubic zirconia. In 2023, Pandora continued its commitment to sustainability, aiming for 100% recycled precious metals across its collections, which influences procurement strategies and potentially impacts cost stability compared to virgin materials.

The global pricing of commodities like silver and gold directly influences Pandora's raw material expenses. For instance, silver prices saw volatility in early 2024, trading around $23-$25 per ounce, a factor that directly feeds into Pandora's cost structure for its silver-based jewelry. Similarly, fluctuations in the cost of lab-grown diamonds and other gemstones can significantly affect the overall procurement budget.

Pandora's manufacturing and labor costs are significant, driven by its extensive operations in Thailand and a new facility being built in Vietnam. These costs cover the wages for its substantial global workforce, which numbered 37,000 employees as of recent reports, and are essential for the intricate production, rigorous quality checks, and the detailed hand-finishing that characterizes Pandora's jewelry.

The company also invests in making its manufacturing processes more sustainable, which adds to these overall expenses. These investments are crucial for maintaining brand reputation and meeting evolving consumer expectations regarding environmental responsibility in the jewelry industry.

Pandora AS dedicates substantial resources to marketing and advertising, a cornerstone of its strategy to cultivate brand desirability and broaden its global footprint. For the fiscal year 2023, Pandora reported marketing and advertising expenses of approximately DKK 2.8 billion (USD 400 million), a figure reflecting its commitment to prominent brand campaigns and digital outreach.

Key initiatives include large-scale brand campaigns, such as the 'BE LOVE' campaign, which aims to resonate with a wide audience and reinforce brand values. These efforts are augmented by targeted digital marketing strategies and strategic collaborations with significant fashion and cultural events, ensuring the brand remains at the forefront of consumer consciousness.

These substantial marketing expenditures are vital for preserving Pandora's brand relevance in a competitive market and for effectively attracting and engaging new customer segments. The investment directly supports growth by driving traffic to its online platforms and physical stores.

Retail Store Operational Costs

Operating Pandora's extensive retail network of over 2,700 concept stores globally incurs significant operational expenses. These include substantial outlays for prime retail space rentals, ongoing utility payments to keep stores running, and competitive salaries for a large retail workforce. Additionally, regular store maintenance and visual merchandising updates are crucial to upholding brand standards.

Pandora's commitment to growth and evolution is reflected in its capital expenditures. The company consistently invests in opening new stores in strategic locations and in refreshing existing store formats to enhance customer experience. For instance, in 2023, Pandora continued its store optimization program, which includes these investments, contributing to the overall cost structure.

- Rent: A major fixed cost, varying significantly by location and store size.

- Salaries and Wages: Covering staff for sales, management, and store operations.

- Utilities: Electricity, heating, cooling, and water for store functionality.

- Store Maintenance & Visual Merchandising: Costs associated with upkeep, repairs, and in-store displays.

- New Store Openings & Refurbishments: Capital expenditure for expansion and format upgrades.

Logistics and Distribution Costs

Pandora's global reach, serving over 100 countries and thousands of sales points, means logistics and distribution are substantial cost drivers. These expenses cover the movement of finished goods from manufacturing sites to distribution centers, and then onward to retail stores and directly to consumers. In 2023, Pandora reported that its selling, general, and administrative expenses, which include distribution costs, amounted to DKK 7,591 million, reflecting the scale of its international operations.

Efficient supply chain management is therefore paramount to mitigating these costs. This involves optimizing shipping routes, managing inventory across various locations, and ensuring timely deliveries to maintain product availability and customer satisfaction. The company's investment in its distribution network directly impacts its ability to control these operational expenditures and maintain profitability.

- Global Network: Costs associated with shipping and distributing products to over 100 countries and numerous retail locations worldwide.

- Supply Chain Efficiency: The need for streamlined logistics to manage expenses and ensure timely product flow from production to sale.

- Distribution Infrastructure: Investments in warehousing, transportation, and technology to support a complex global distribution system.

- Operational Scale: The inherent costs of managing a large-scale, international supply chain to serve a broad customer base.

Pandora's cost structure is significantly influenced by its extensive raw material procurement, primarily precious metals and gemstones, alongside substantial manufacturing and labor expenses driven by its global operations. Marketing and retail operations also represent major cost centers, with significant investments in brand campaigns and maintaining its vast store network. Distribution and logistics costs are further amplified by its international presence, serving over 100 countries.

| Cost Category | Description | 2023 Data (DKK million) |

|---|---|---|

| Raw Materials | Precious metals, diamonds, gemstones | Not specified as a separate line item, but a key driver |

| Manufacturing & Labor | Wages, production costs for global workforce | Included in Cost of Sales and SG&A |

| Marketing & Advertising | Brand campaigns, digital outreach | 2,800 |

| Retail Operations | Rent, salaries, utilities, maintenance | Included in Cost of Sales and SG&A |

| Distribution & Logistics | Supply chain, warehousing, shipping | Included in SG&A (7,591 total SG&A) |

Revenue Streams

Pandora's iconic charm bracelets and individual charms are the bedrock of their revenue, consistently driving a substantial portion of sales. This core offering continues to demonstrate robust performance, contributing significantly to the company's overall revenue growth. For instance, in the first quarter of 2024, Pandora reported a revenue of DKK 7.4 billion, with jewelry sales, heavily influenced by this segment, showing resilience.

The inherent collectability of Pandora's charms is a key factor in fostering repeat business and ensuring sustained revenue streams. Customers are encouraged to build upon their existing collections, leading to ongoing purchases and a loyal customer base. This strategy has proven effective in maintaining consistent revenue generation year after year.

Pandora's strategy to become a comprehensive jewelry brand is significantly boosting revenue from rings, necklaces, and earrings. This product diversification attracts a broader customer base, moving beyond their well-known charm bracelets.

In 2023, Pandora reported a 5% like-for-like revenue growth, reaching DKK 28.1 billion, with a notable contribution from these core jewelry categories. This expansion into a full-service jewelry offering is a key driver for continued growth.

The focus on rings, necklaces, and earrings allows Pandora to capture more of the customer's jewelry spending. This strategy is proving effective in enhancing customer loyalty and increasing average transaction value across their retail network.

Pandora AS generates significant revenue directly from its owned concept stores, which serve as a crucial channel for customer engagement and sales. These flagship locations are vital for presenting the brand's full product range and creating a curated shopping experience.

The company-owned stores often demonstrate stronger sales performance compared to those operated by franchise partners. This higher productivity underscores their strategic importance in Pandora's overall retail strategy and financial results.

In 2023, Pandora's retail network included a substantial number of concept stores. For instance, the company operated 751 concept stores as of the end of 2023, contributing directly to its consolidated sales figures.

These directly operated stores are a key focus for Pandora's ongoing retail expansion and investment efforts, reflecting their role in driving brand value and achieving sales targets.

Wholesale Revenue from Authorized Retailers

Pandora AS generates substantial wholesale revenue by supplying its jewelry collections to a wide network of authorized multi-brand retailers across the globe. This strategy is key to expanding Pandora's market reach significantly, allowing its products to be available in numerous locations without the direct investment in and management of each individual store. These partnerships are a cornerstone for driving overall sales volume and ensuring Pandora's brand presence in diverse retail environments.

In 2023, Pandora's wholesale channel played a crucial role in its financial performance. The company reported that wholesale accounted for a notable portion of its total revenue, underscoring the importance of these B2B relationships. For instance, the growth in like-for-like wholesale orders in key markets directly correlated with the brand's expanding footprint and consumer demand.

- Global Reach: Wholesale partnerships enable Pandora to access a vast international customer base.

- Cost Efficiency: This channel reduces the overhead associated with operating a fully owned retail network.

- Sales Volume Driver: Authorized retailers contribute significantly to Pandora's overall sales figures.

- Market Penetration: It facilitates deeper penetration into markets where direct store ownership might be challenging.

E-commerce Sales from Official Website

E-commerce sales via pandora.net are a significant and expanding revenue channel for Pandora AS. In 2024, these online transactions contributed a substantial 27% to the company's overall sales volume. Pandora is actively investing in its digital infrastructure, including a new global e-commerce platform, to capitalize on and further boost this growth trajectory.

This digital storefront offers customers a highly convenient and globally accessible way to purchase Pandora's jewelry, directly engaging with the brand.

- Online Sales Growth: E-commerce accounted for 27% of total sales in 2024.

- Strategic Investment: Pandora is investing in a new global e-commerce platform.

- Customer Convenience: Digital sales offer worldwide accessibility and ease of purchase.

Pandora's revenue streams are diversified across several key areas. The core of their business remains the sale of charm bracelets and individual charms, a segment that continues to show strong performance. Beyond this, the company has successfully expanded its offerings to include rings, necklaces, and earrings, broadening its appeal and capturing a larger share of the jewelry market. These product expansions are crucial for driving continued revenue growth.

Direct sales through Pandora's owned concept stores represent a significant revenue generator, offering a controlled brand experience and often higher sales productivity. Complementing this, a robust wholesale channel supplies authorized multi-brand retailers globally, extending market reach and driving substantial sales volume. Finally, e-commerce is a rapidly growing revenue stream, with online sales accounting for a notable percentage of total revenue and supported by ongoing investment in digital platforms.

| Revenue Stream | Key Characteristics | 2023/2024 Data Point |

| Charms & Bracelets | Core product, high collectability, repeat purchases | Significant contributor to DKK 28.1 billion revenue (2023) |

| Other Jewelry (Rings, Necklaces, Earrings) | Product diversification, broader customer appeal | Drove 5% like-for-like revenue growth (2023) |

| Concept Stores (Owned Retail) | Direct customer engagement, controlled brand experience | 751 concept stores operated globally (end of 2023) |

| Wholesale | Extensive market reach via multi-brand retailers | Key channel for global sales volume and market penetration |

| E-commerce | Growing online sales channel, customer convenience | 27% of total sales in 2024; investment in new global platform |

Business Model Canvas Data Sources

The Pandora AS Business Model Canvas is constructed using a blend of internal financial statements, customer engagement data, and market research reports. This comprehensive approach ensures each component, from value proposition to revenue streams, is grounded in actionable insights and validated market understanding.