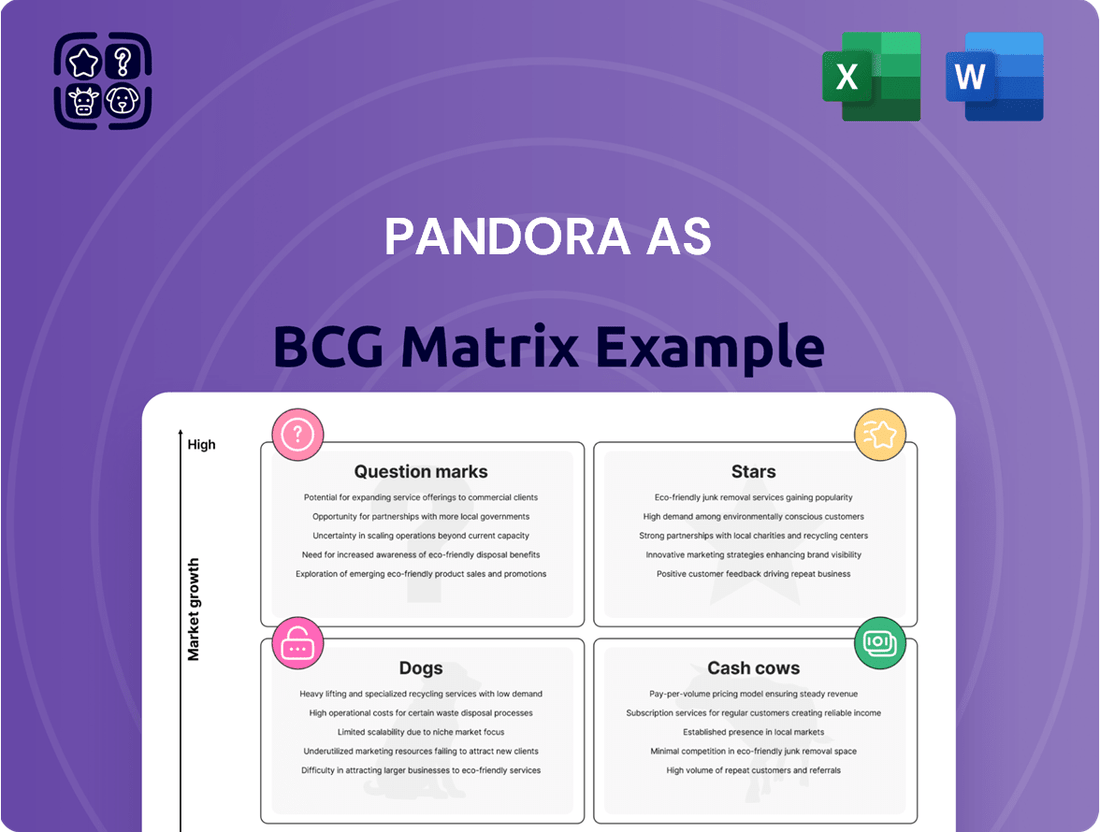

Pandora AS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pandora AS Bundle

This initial look at Pandora's AS BCG Matrix highlights key areas of their product portfolio. You've seen a glimpse of where their offerings might fall as Stars, Cash Cows, Dogs, or Question Marks, offering a foundational understanding of their market position.

But to truly unlock strategic advantage, you need the complete picture. The full BCG Matrix provides a detailed quadrant-by-quadrant breakdown, revealing precise market share and growth rate data for each Pandora product.

Imagine having a clear roadmap for resource allocation and investment decisions, all derived from robust analysis. This comprehensive report offers exactly that, empowering you to optimize Pandora's portfolio for maximum profitability and future growth.

Don't settle for a partial view. Purchase the full BCG Matrix today to gain actionable insights and a strategic edge in navigating the competitive landscape.

Stars

Pandora's lab-grown diamonds are a star in its BCG matrix, showing impressive growth. In 2024, this collection achieved a remarkable 43% like-for-like growth, a trend that continued into Q1 2025 with another 43% LFL increase. This segment is central to Pandora's strategy to expand its market reach with accessible luxury.

The strong performance of lab-grown diamonds, contributing to a 22% overall growth for Pandora in 2024, highlights their significant market potential. This burgeoning segment not only drives revenue but also enhances the brand's overall image and customer consideration across its diverse jewelry offerings.

The 'Fuel with More' segment, representing Pandora's newer, contemporary jewelry lines, is a critical component of its growth strategy. This segment saw impressive like-for-like (LFL) growth of 22% in 2024, demonstrating strong market reception.

Further reinforcing this positive trend, the 'Fuel with More' offerings achieved a 12% LFL growth in the first quarter of 2025. This sustained momentum underscores Pandora's successful expansion beyond its traditional charm bracelet dominance.

This expansion is key to Pandora's ambition to evolve into a comprehensive jewelry brand, attracting a wider customer base. The strong performance of these newer collections indicates their potential to become future market leaders.

The U.S. market is a significant growth engine for Pandora AS, representing 31% of its total revenue in 2024. This strong performance, with a 14% organic sales increase and 11% like-for-like growth in Q1 2025, is particularly notable given the broader U.S. jewelry market's general stagnation.

Pandora's strategic network expansion in the U.S. is a key driver of this success. In 2024 alone, the company added 37 new concept stores and acquired 36 stores from its partners, directly contributing to its market penetration efforts.

The company views the U.S. as a prime opportunity for further expansion, recognizing its relatively low market share in the single digits. This presents substantial room for growth and increased brand presence.

Global Online Platform Rollout

Pandora’s new e-commerce platform, which proved successful in Q4 2024 trials, is scheduled for a worldwide launch throughout 2025. This digital push is vital for increasing brand appeal and improving customer interaction, with online sales already contributing to an 18% like-for-like growth in Q1 2025.

This rapidly expanding sales channel capitalizes on digital engagement and tailored shopping experiences to drive higher conversion rates.

- Global Rollout: The e-commerce platform, tested in Q4 2024, will be launched globally in 2025.

- Growth Driver: Online sales achieved 18% like-for-like growth in Q1 2025.

- Strategic Importance: The platform aims to enhance brand desirability and customer experience.

- Channel Performance: Digital engagement and personalization are key to boosting online conversions.

Sustainability-Focused Collections (Recycled Metals)

Pandora's strategic shift to 100% recycled silver and gold for all new jewelry, achieved in mid-2024, ahead of its initial 2025 goal, places it at the forefront of sustainable luxury. This move is projected to significantly cut its carbon emissions, a critical factor for attracting the growing segment of eco-conscious buyers. The company's proactive stance on sustainability not only bolsters its brand image but also aligns perfectly with escalating global environmental expectations.

This commitment to recycled metals is a key differentiator for Pandora, particularly within the jewelry market. By mid-2024, the company reported that 91% of its raw materials were from recycled sources, with a clear trajectory to reach 100% for new products. This aligns with their aim to reduce absolute carbon emissions across their value chain by 42% by 2030, a target that this initiative directly supports.

- Pioneering Sustainability: Pandora's early adoption of 100% recycled precious metals for new items solidifies its leadership in responsible luxury.

- Environmental Impact: This transition is instrumental in reducing the company's carbon footprint, addressing a key concern for modern consumers.

- Market Appeal: The focus on recycled materials resonates strongly with environmentally aware shoppers, tapping into a rapidly expanding market segment.

- Brand Enhancement: Pandora's dedication to sustainability strengthens its brand reputation and reinforces its alignment with global environmental initiatives.

Pandora's lab-grown diamonds are a clear star in its BCG matrix, demonstrating exceptional growth potential. This segment is crucial for Pandora's strategy to broaden its market reach with accessible luxury. The strong performance of lab-grown diamonds, contributing significantly to Pandora's overall growth, highlights their substantial market opportunity and brand image enhancement.

| Segment | Growth (2024) | Q1 2025 Growth | Strategic Role |

|---|---|---|---|

| Lab-grown diamonds | 43% LFL | 43% LFL | Market expansion, accessible luxury |

| 'Fuel with More' collections | 22% LFL | 12% LFL | Brand evolution, wider customer base |

What is included in the product

The Pandora AS BCG Matrix analyzes its jewelry portfolio, identifying Stars for growth and Cash Cows for funding.

It strategically guides investment in Stars and Question Marks, while managing Dogs and Cash Cows.

Visualize your portfolio's health with the Pandora AS BCG Matrix, a clear pain point reliever for strategic decision-making.

Cash Cows

Pandora's classic charm bracelets are undeniably its cash cow. In 2024, this iconic segment was responsible for a staggering 74% of all Pandora's sales, underscoring its enduring importance as a revenue engine. While its like-for-like growth stood at a more modest 2% in the same year, this reflects a mature market where Pandora already commands a substantial market share.

The consistent profitability of these bracelets stems from deep-seated brand loyalty and a predictable stream of repeat purchases from customers. This established customer base and the recurring nature of charm additions allow Pandora to reliably generate strong cash flow from this core product line, providing a stable financial foundation for the company.

Pandora's core jewelry collections, encompassing rings, necklaces, and earrings, represent a significant Cash Cow for the company. These established offerings achieved a stable 2% like-for-like (LFL) growth in both Q1 2025 and 2024, underscoring their consistent performance.

With a high market share in the accessible luxury jewelry segment, these core products benefit from Pandora's strong brand equity and a dedicated customer following. This established position allows for efficient operations, as they require less aggressive marketing spend compared to newer product lines.

Established European markets, including the United Kingdom, Italy, and Australia, represent significant revenue contributors for Pandora AS due to their high market share. These regions function as dependable cash cows, consistently generating profits that bolster the company's financial health.

Despite minor contractions or flat growth in certain European markets during Q4 2024 and Q1 2025, the continent as a whole demonstrated resilience. Europe achieved a 4% like-for-like (LFL) growth in Q1 2025, underscoring its position as a mature yet stable revenue stream for Pandora.

Physical Concept Stores

Pandora's physical concept stores are firmly positioned as cash cows within the BCG matrix, reflecting their strong market share and consistent revenue generation.

The company's commitment to expanding its physical footprint is evident, with 137 new concept stores opened in 2024, contributing to an expansive network of nearly 7,000 points of sale worldwide. This extensive reach solidifies their dominant presence in the physical retail landscape.

Despite the rapid growth of online channels, these brick-and-mortar locations continue to be vital for customer engagement and sales, as demonstrated by a 3% like-for-like (LFL) growth in Q1 2025. The tangible customer experience offered by concept stores, combined with Pandora's established brand recognition, ensures their ongoing success and profitability.

- Market Dominance: Nearly 7,000 global points of sale, including 137 new concept stores in 2024, indicate significant market share.

- Consistent Revenue: Physical stores achieved 3% LFL growth in Q1 2025, showcasing their role as reliable revenue generators.

- Customer Engagement: Concept stores provide a tangible brand experience, crucial for customer loyalty and sales.

Gifting Solutions Segment

Pandora's Gifting Solutions segment is a clear Cash Cow. Over 60% of Pandora's sales are driven by gifting, a market that's inherently less sensitive to price fluctuations and enjoys consistent demand throughout the year. This consistent demand translates directly into stable and predictable revenue streams for the company.

The recurring nature of gift-giving occasions, from birthdays and anniversaries to holidays, ensures that this segment continues to perform reliably. Pandora's strong brand recognition and emotional connection with consumers in the gifting space allow it to maintain healthy profit margins.

- Gifting Drives Sales: Over 60% of Pandora's revenue originates from the gifting market.

- Price Insensitivity: This segment demonstrates lower price sensitivity, supporting stable demand.

- Recurring Revenue: Gift-giving occasions provide a consistent and predictable income source.

- High Profitability: Pandora's brand strength in gifting enables sustained high profit margins.

Pandora's Charm Bracelets remain its most significant Cash Cow. In 2024, this segment accounted for 74% of total sales, with a 2% like-for-like growth, indicating market maturity. The consistent profitability is driven by strong brand loyalty and repeat purchases, providing a stable financial base.

| Product Segment | 2024 Sales Contribution | 2024 LFL Growth | Key Driver |

| Charm Bracelets | 74% | 2% | Brand Loyalty, Repeat Purchases |

| Core Jewelry Collections | N/A (Significant Contributor) | 2% (2024 & Q1 2025) | Brand Equity, Dedicated Following |

| Physical Concept Stores | N/A (Vital Revenue Stream) | 3% (Q1 2025) | Extensive Footprint, Tangible Experience |

Preview = Final Product

Pandora AS BCG Matrix

The BCG Matrix analysis you see here is the exact, fully completed report you will receive upon purchase. It's designed to provide immediate strategic insights into Pandora's product portfolio, with no watermarks or demo content. You're previewing the final, professionally formatted document ready for your immediate use in business planning and decision-making.

Dogs

Underperforming niche collections within Pandora AS's portfolio represent products that aren't resonating with current consumer demand or the brand's strategic shift towards becoming a comprehensive jewelry house. These items likely possess a low market share and face minimal growth prospects.

These collections, often older or catering to very specific tastes, can tie up valuable inventory and marketing capital without delivering substantial returns. For instance, if a specific gemstone collection launched in 2022 with a 0.5% market share and saw only a 1% year-over-year sales increase by mid-2024, it would be a prime candidate for this category.

The strategy for these underperformers typically involves a careful evaluation for potential divestiture or a gradual phasing out. This move is crucial for streamlining Pandora's product offerings and enhancing overall operational efficiency, allowing resources to be redirected to more promising areas.

Outdated Design Archives represent Pandora's potential 'Dogs' in the BCG Matrix. These are collections that no longer capture the imagination of their target audience, leading to sluggish sales and minimal contribution to overall revenue. For instance, if a particular jewelry style, like chunky charm bracelets from the early 2010s, saw a significant sales decline by 2024, it would likely fall into this category.

Continuing to invest in the production and marketing of these underperforming items would be financially unwise. In 2024, Pandora has actively worked to streamline its product offerings, focusing on contemporary designs that align with current fashion trends. Products languishing in the Outdated Design Archives can tie up capital in inventory and potentially tarnish the brand's image as a purveyor of modern, desirable jewelry.

Pandora AS has experienced a significant downturn in markets like China, a region exhibiting less penetration and facing considerable challenges. From 2019 to 2024, revenue in this area plummeted by almost 80%, signaling a severe contraction.

Currently, China accounts for a mere 1% of Pandora's overall revenue. This performance is attributed to a combination of negative consumer sentiment and escalating competitive pressures from local and international brands.

The company's presence in such markets, if continued without a clear strategy for regaining market share, positions them as a potential 'Dog' in the BCG Matrix. This classification suggests a need for strategic re-evaluation, potentially including restructuring operations or exploring licensing agreements to mitigate further losses.

Inefficient Wholesale Partnerships

Inefficient wholesale partnerships within Pandora AS's distribution network may represent a challenge. These are third-party distributors that consistently show low sales volumes and limited potential for significant growth. This is particularly notable when contrasted with the performance of Pandora's own concept stores and its burgeoning online sales channels.

Such underperforming wholesale relationships might not be generating enough revenue or providing the desired brand visibility to warrant the ongoing investment of resources. For instance, if a specific wholesale partner accounted for less than 0.5% of Pandora's total revenue in 2024 and showed a year-over-year sales decline of 3%, it could be a candidate for review. Re-evaluating these partnerships is crucial for optimizing resource allocation towards more lucrative avenues.

- Low Sales Volume: Partnerships contributing minimally to overall revenue, potentially less than 1% in the 2024 fiscal year.

- Limited Growth Prospects: Channels showing stagnant or negative sales growth over the past two reporting periods.

- Resource Drain: Partnerships requiring significant management time or marketing support without commensurate returns.

- Strategic Misalignment: Distributors not effectively reflecting Pandora's brand image or reaching target customer segments.

Products Using Previously Mined Materials

Products utilizing previously mined materials represent a potential 'Dog' in Pandora AS's BCG Matrix, particularly concerning their sustainability initiatives. While Pandora announced a full transition to recycled gold and silver for new jewelry production starting mid-2024, any lingering inventory or ongoing production of items made from non-recycled, previously mined materials could pose a challenge. This situation could undermine their newly solidified sustainable image and alienate environmentally aware consumers, a segment that is demonstrably growing.

For instance, if a significant portion of their product line still relies on virgin materials, it directly conflicts with their stated commitment to 100% recycled precious metals by 2025. Failure to rapidly phase out these older stock items could lead to a decline in market share within the eco-conscious consumer demographic, which is increasingly important for jewelry brands. This could result in lower sales volume and profitability for these specific product categories.

- Sustainability Conflict: Products not using recycled materials directly contradict Pandora's mid-2024 transition to 100% recycled gold and silver.

- Market Appeal Erosion: Continued use of previously mined materials risks alienating environmentally conscious consumers, a growing market segment.

- Brand Image Risk: Holding inventory of non-recycled items could create a perception of greenwashing if not managed and phased out quickly.

- Potential for Write-downs: Unsold inventory made from non-recycled materials may face future write-downs if market demand shifts entirely to sustainable options.

Pandora AS's 'Dogs' category within the BCG Matrix encompasses products or market segments with low market share and minimal growth potential. These are items that consume resources without generating significant returns, requiring strategic divestment or phasing out. For example, outdated design archives or inefficient wholesale partnerships fall into this classification.

These underperformers, such as specific jewelry styles that have fallen out of fashion or distribution channels with consistently low sales, can tie up valuable inventory and marketing capital. By 2024, Pandora's focus has been on streamlining its offerings, making it essential to identify and address these low-performing assets to improve overall efficiency.

The strategy for these 'Dogs' involves a critical assessment for potential divestiture or a gradual discontinuation. This proactive approach allows Pandora to reallocate resources towards more promising and profitable areas of its business, enhancing its competitive position.

Pandora's performance in China, accounting for only 1% of revenue in 2024 after an 80% drop since 2019, exemplifies a 'Dog' market. Similarly, any wholesale partnerships contributing less than 0.5% of total revenue with declining sales in 2024 would also be classified here.

Question Marks

Pandora's strategic focus on new geographic market entries, such as further expansion in Germany and venturing into new developing markets, positions these regions as potential Stars or Question Marks within its BCG Matrix. These markets offer high growth potential, but Pandora's current market share is often low, demanding substantial investment.

For instance, Germany demonstrated remarkable like-for-like (LFL) growth of 45% in 2024, underscoring its high-growth trajectory. However, compared to more mature markets, Pandora's penetration in Germany might still be developing, necessitating continued investment to solidify its brand and capture a larger share of this expanding market.

Pandora's strategic focus on advanced digital transformation, particularly with AI-powered website enhancements and a new personalized loyalty program, positions these initiatives squarely within the "Question Marks" category of the BCG matrix. These efforts, slated for a global rollout in 2025, aim to significantly boost customer engagement and attract new demographics by offering tailored experiences. For instance, the company reported in its 2024 annual report that digital sales represented 22% of total revenue, a figure they aim to expand significantly through these new digital tools.

The potential for high growth is evident, as these initiatives are designed to create a more sticky and valuable customer journey. By leveraging AI for personalized recommendations and a tiered loyalty program that rewards deeper engagement, Pandora seeks to capture a larger share of the growing personalized retail market. The company anticipates these digital investments to drive a 5-7% increase in customer lifetime value within the first two years post-launch, according to internal projections shared in early 2025.

However, the current market impact of these advanced digital initiatives is still nascent, necessitating substantial and ongoing investment to realize their full potential. While the strategic intent is clear, the actual market share gains and revenue impact are yet to be fully demonstrated on a global scale. Pandora has allocated approximately $150 million in capital expenditure for digital transformation projects through 2026, underscoring the commitment and the inherent uncertainty associated with these "Question Mark" ventures.

Pandora's strategic use of brand collaborations, such as those with Disney, Marvel, HBO's Game of Thrones, and Netflix, aims to significantly broaden its customer base and attract new demographics. These partnerships often create substantial initial excitement and drive strong sales, but their sustained impact on long-term market share remains a key consideration for their BCG matrix positioning.

The success of these limited-edition collections, while potent for generating immediate revenue and brand visibility, hinges on Pandora's ability to consistently innovate and maintain relevance with consumers. Without ongoing fresh offerings and a clear strategy to convert temporary buzz into lasting customer loyalty, their position in the market can be volatile.

New Jewelry Categories Beyond Charms (e.g., high-end fashion jewelry, non-traditional materials)

Pandora is strategically expanding beyond its iconic charms into new jewelry categories like high-end fashion jewelry and pieces crafted from non-traditional materials. This move targets segments of the broader jewelry market exhibiting robust growth. For instance, the global fine jewelry market alone was valued at approximately $230 billion in 2023 and is projected to grow significantly.

These new ventures represent potential stars in Pandora's BCG matrix, given their high market growth potential. However, Pandora's current market share in these more specialized, higher-end niches remains relatively modest. This indicates an opportunity for significant market penetration and brand building.

To capitalize on this, Pandora needs to make strategic investments in design innovation, marketing, and potentially new manufacturing capabilities. This will be crucial to establish a stronger foothold and convert the market's potential into tangible market share.

- High Growth Potential: New fashion jewelry and non-traditional material categories tap into expanding segments of the global jewelry market.

- Low Current Market Share: Pandora's presence in these specific high-end or niche material categories is still developing, offering room for growth.

- Strategic Investment Required: Significant investment in design, marketing, and possibly R&D for new materials is essential to capture market share.

- Brand Diversification: Successfully entering these categories transforms Pandora from a charm specialist into a comprehensive jewelry brand.

Enhanced In-Store Experiences and Service Offerings

Pandora is actively enhancing its in-store experiences to foster customer engagement. This includes offering personalized services like engraving, aiming to make each purchase unique.

The company is also piloting new store concepts designed for a more interactive shopping environment, featuring additional selling stations to streamline the customer journey. These initiatives are crucial for driving sales within their physical retail footprint.

While these updated store concepts are showing promising early results, their impact on Pandora's overall market share is still developing. Therefore, these strategic investments in physical retail experiences are classified as Question Marks, necessitating continued financial support and strategic evaluation.

- Personalized Services: Engraving options are being introduced to add a bespoke element to purchases.

- Store Concept Evolution: New layouts are being tested with more selling stations to improve customer flow and efficiency.

- Customer Journey Focus: The goal is to create a more engaging and seamless experience that encourages repeat business.

- Market Share Impact: The direct contribution of these enhanced experiences to overall market share is still being measured and requires ongoing assessment.

Pandora's investment in new digital initiatives, like AI-powered personalization and a loyalty program, are positioned as Question Marks. These are high-potential growth areas, as seen by digital sales already making up 22% of total revenue in 2024, but they require significant ongoing investment to prove their market share impact. The company projects these could boost customer lifetime value by 5-7% within two years, with $150 million earmarked for digital transformation through 2026.

The expansion into new jewelry categories, such as high-end fashion jewelry and pieces using non-traditional materials, also falls into the Question Mark quadrant. While these segments represent a substantial global market, valued at approximately $230 billion for fine jewelry in 2023, Pandora's current market share in these specific niches is relatively low. Capturing this growth requires substantial investment in design, marketing, and potentially new material R&D.

Pandora's efforts to enhance in-store experiences, including personalized services like engraving and new interactive store concepts, are also classified as Question Marks. These initiatives aim to improve customer engagement and streamline the shopping journey, potentially driving sales within their physical retail footprint. However, their overall impact on market share is still being evaluated, necessitating continued financial support and strategic assessment.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer acquisition costs, and competitive landscape analysis, to accurately position each business unit.