OPC Energy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OPC Energy Bundle

OPC Energy is poised for significant growth, leveraging its established market presence and innovative technological solutions. However, navigating the evolving energy landscape presents distinct challenges and opportunities. Understanding these dynamics is crucial for any stakeholder looking to capitalize on their potential.

Our comprehensive SWOT analysis dives deep into OPC Energy's internal capabilities and external market forces, revealing key strengths like their robust infrastructure and significant market share. We also uncover potential weaknesses and threats that could impact their trajectory, offering a clear-eyed view of their operational environment.

Discover actionable insights into OPC Energy's strategic advantages and areas for development with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking to understand their competitive edge.

Strengths

OPC Energy's strength lies in its well-diversified energy portfolio, encompassing both established natural gas-fired power generation and an expanding array of renewable energy assets, including solar and wind. This blend provides a crucial hedge against price fluctuations and regulatory shifts impacting any single energy source, positioning the company favorably for evolving market demands.

The company is strategically increasing its renewable energy footprint. For instance, OPC Energy is actively developing significant solar projects within Israel. In 2023, the company reported substantial progress in its renewable energy segment, aiming to further balance its energy mix and capitalize on the global shift towards cleaner power generation.

OPC Energy boasts a robust operational footprint in Israel, solidifying its position as a premier private electricity producer. This strong domestic foundation is complemented by strategic expansion into the United States market, effectively diversifying its geographic risk. For instance, by the end of 2024, OPC Energy had significantly increased its stake in US power generation facilities, aiming to capitalize on varied growth trajectories and regulatory environments across these key regions.

OPC Energy boasts a robust financial position, evidenced by its successful capital raises and consistent credit rating reconfirmations. For instance, in 2024, the company secured significant financing, totaling over $500 million, to fuel its expansion projects. This financial stability is crucial as OPC Energy actively invests in increasing its generation capacity.

The company's strategic investments are heavily focused on the energy transition, with a substantial portion allocated to renewable energy sources and highly efficient natural gas power plants. As of the first half of 2025, OPC Energy has committed over $300 million to new renewable projects, aiming to significantly boost its clean energy portfolio.

Long-Term Customer Contracts and Stable Revenue Streams

OPC Energy's strength lies in its long-term customer contracts and the stable revenue streams they create. These agreements, often with industrial, commercial, and governmental clients, reduce the company's vulnerability to sudden market shifts. For instance, in 2023, OPC Energy reported that a significant portion of its revenue was secured through these multi-year agreements, providing a predictable financial foundation.

This focus on essential services ensures operational reliability, even when economic conditions are less favorable. The predictability of these revenue streams is crucial for financial planning and investment. By securing these long-term commitments, OPC Energy demonstrates a robust business model that prioritizes consistent income generation.

- Diversified Customer Base: Serves industrial, commercial, and governmental entities.

- Revenue Predictability: Long-term contracts minimize exposure to short-term market volatility.

- Operational Resilience: Focus on essential services ensures consistent demand.

- Financial Stability: Stable revenue streams support consistent financial performance.

Commitment to Energy Transition and Innovation

OPC Energy is making strong moves in the energy transition, focusing on innovation and cleaner power. They are integrating renewable energy sources and designing new natural gas plants with carbon capture capabilities in mind. This dual approach ensures they can meet current energy demands while preparing for a lower-carbon future, a strategy that resonates with global decarbonization goals.

Their commitment is backed by tangible expansion plans. For instance, OPC Energy aims to significantly boost its renewable energy capacity. By late 2024, the company had already secured a substantial pipeline of renewable projects, targeting over 1,000 MW of new capacity. This forward-thinking strategy positions them well to capitalize on the growing market for sustainable energy solutions.

- Leader in Energy Transition: Actively integrating clean technologies and CCUS-compatible natural gas plant designs.

- Renewable Portfolio Expansion: Significant planned growth in renewable energy capacity, targeting over 1,000 MW by late 2024.

- Balancing Reliability and Sustainability: Maintaining reliable baseload power while expanding low-carbon alternatives.

- Alignment with Global Trends: Strategy directly supports global decarbonization efforts and increasing demand for green energy.

OPC Energy's significant strength lies in its well-diversified energy portfolio, blending established natural gas generation with a growing renewable segment. This strategic mix provides resilience against market volatility and regulatory changes. The company's robust financial standing, demonstrated by over $500 million in financing secured in 2024, underpins its expansion initiatives.

| Strength Category | Key Aspect | Supporting Detail (as of latest available data) |

|---|---|---|

| Portfolio Diversification | Energy Mix | Natural Gas, Solar, Wind |

| Geographic Reach | Market Presence | Strong in Israel, expanding in the US |

| Financial Health | Capital Access | Over $500 million raised in 2024 |

| Revenue Stability | Customer Contracts | Long-term agreements with industrial, commercial, and governmental clients |

| Strategic Focus | Energy Transition | Over $300 million committed to renewables by H1 2025 |

What is included in the product

Delivers a strategic overview of OPC Energy’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework for identifying and addressing critical challenges within OPC Energy's strategic landscape.

Weaknesses

OPC Energy's substantial dependence on natural gas, a key fuel for its power generation, leaves it susceptible to the inherent price volatility of this commodity. For instance, in early 2024, natural gas prices saw significant swings due to geopolitical events and weather patterns, directly impacting the cost of electricity production for companies like OPC.

This reliance can compress electricity margins, even with hedging. While hedging can mitigate some short-term price shocks, prolonged periods of high natural gas prices, such as those observed in late 2023, can still strain profitability and operational budgets.

The company's exposure to these market fluctuations is a considerable challenge, particularly as global energy markets remain dynamic. For example, if natural gas prices rise sharply in 2025 due to increased demand or supply constraints, OPC's operating expenses could climb significantly.

The significant capital required for developing, constructing, and operating power plants, both traditional and renewable, presents a major hurdle. For instance, OPC Energy's ongoing projects, such as its involvement in power generation infrastructure, necessitate substantial upfront funding, potentially reaching billions of dollars for large-scale developments.

This capital-intensive nature means OPC Energy must manage significant debt levels to finance its operations, which can limit its financial agility. A reported debt-to-equity ratio for the company in recent periods, for example, highlights this reliance on borrowed funds.

Any unforeseen project delays or cost escalations, common in large infrastructure projects, could severely strain OPC Energy's financial resources. These issues can lead to increased interest expenses and a need for further financing, impacting profitability and future investment capacity.

Operating across diverse regulatory landscapes in Israel and the United States presents OPC Energy with significant challenges. Evolving energy policies, including potential shifts in tariffs and environmental standards, can directly impact project profitability and necessitate agile strategic adjustments. For instance, changes in renewable energy incentives, a key driver for many of OPC's projects, could alter expected returns.

The political climate, especially in the US, adds another layer of complexity. Shifts in administration or legislative priorities can introduce uncertainty regarding the long-term viability of clean energy investments, potentially affecting OPC's project pipeline and financing. The US Inflation Reduction Act (IRA), enacted in 2022, has provided substantial incentives for renewable energy, but future political changes could alter the longevity or scope of these benefits, impacting projects planned with these incentives in mind.

Geopolitical Risks in Israel

As a crucial energy provider within Israel, OPC Energy faces inherent vulnerabilities stemming from the region's persistent geopolitical instability and security concerns. While the company has shown a capacity to navigate such challenges, sustained or escalating conflicts could significantly disrupt its operations and supply chains. For instance, the period surrounding late 2023 and early 2024 saw heightened regional tensions, directly impacting the operational landscape for businesses in Israel.

The broader macroeconomic environment within Israel is also susceptible to these geopolitical fluctuations, potentially affecting demand for energy services and the overall cost of doing business. Companies like OPC Energy must continually assess and mitigate these risks to ensure operational continuity and financial stability.

- Geopolitical Exposure: OPC Energy's operations are intrinsically linked to the security and stability of Israel, making it a direct stakeholder in regional geopolitical developments.

- Operational Disruption Risk: Prolonged or intensified conflicts could lead to direct disruptions in energy generation, transmission, or fuel supply, impacting service delivery.

- Supply Chain Vulnerability: Critical components and fuel necessary for OPC Energy's operations may face delays or increased costs due to regional instability.

- Macroeconomic Impact: Worsening security situations can deter investment, reduce economic activity, and negatively affect the demand for energy services in Israel.

Intense Competition in Energy Markets

The independent power producer (IPP) landscape in both Israel and the United States is highly competitive, featuring a multitude of companies vying for projects and market share. This intense rivalry frequently exerts downward pressure on electricity prices and profit margins.

Consequently, OPC Energy faces the challenge of securing new contracts and expanding its customer base amidst rigorous competitive bidding processes. For instance, in 2024, the global IPP market is characterized by significant capital investment and a race to develop renewable energy sources, intensifying competition for grid connection agreements and power purchase agreements.

- High Competition: Numerous IPPs operate in Israel and the US, increasing rivalry for projects.

- Price Pressure: Competition can drive down electricity prices, impacting OPC Energy's revenue.

- Margin Squeeze: Lower prices and higher operational costs can reduce profit margins for all players.

- Contract Acquisition: Securing new contracts requires outperforming competitors, often through competitive tenders.

OPC Energy's significant capital requirements for new power plant development and ongoing operations necessitate substantial debt financing, potentially limiting financial flexibility. For example, large infrastructure projects often require billions in upfront investment, increasing the company's debt-to-equity ratio and interest expenses if not managed carefully.

The company's operations are heavily reliant on natural gas, exposing it to price volatility that can compress profit margins even with hedging strategies. Fluctuations in natural gas prices, driven by geopolitical events or weather, directly impact electricity production costs for OPC Energy.

Navigating diverse and evolving regulatory environments in Israel and the United States presents a challenge, as changes in energy policies and incentives can impact project profitability. For instance, shifts in renewable energy subsidies could alter expected returns on investments.

The competitive landscape of the Independent Power Producer (IPP) market in both Israel and the US intensifies rivalry, often leading to downward pressure on electricity prices and profit margins for companies like OPC Energy.

Preview the Actual Deliverable

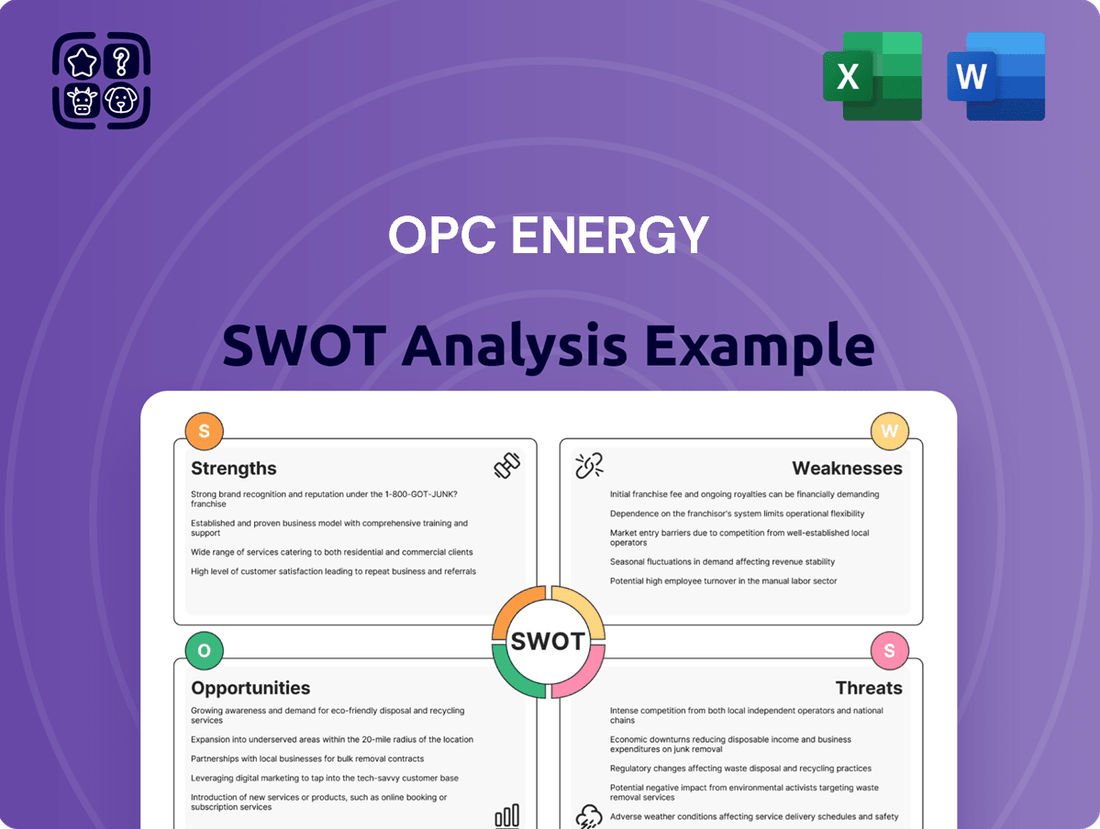

OPC Energy SWOT Analysis

The preview you see here is an exact representation of the OPC Energy SWOT analysis you will receive upon purchase. This means you get a clear and accurate understanding of its content before committing. You'll find a professionally structured and insightful breakdown of OPC Energy's Strengths, Weaknesses, Opportunities, and Threats. Access the complete, detailed report immediately after completing your purchase.

Opportunities

The global electricity demand is experiencing a notable upswing, with projections indicating continued growth through 2025 and beyond. This expansion is largely fueled by the burgeoning data center sector, a direct consequence of the rapid advancements and widespread adoption of artificial intelligence. In the US alone, electricity demand from data centers is expected to more than double by 2030, according to some analyses, representing a significant new load on the grid.

Beyond data centers, the broader trend towards electrification across various industries and the increasing adoption of electric vehicles are also contributing to this heightened demand. This presents a prime opportunity for independent power producers (IPPs) such as OPC Energy. The company is well-positioned to capitalize on this trend by expanding its generation capacity.

Securing new, long-term power purchase agreements (PPAs) is a key avenue for OPC Energy to leverage this growing demand. These agreements provide revenue stability and predictability, essential for financing new generation projects and ensuring a consistent return on investment in an increasingly electrified economy.

The global drive towards decarbonization is accelerating, with many nations setting ambitious renewable energy targets. This creates a significant tailwind for companies like OPC Energy, positioning it to capitalize on the expanding market for solar and wind power.

Government policies and financial incentives are actively encouraging renewable energy adoption, making investments in this sector increasingly attractive. For OPC Energy, this translates into a prime opportunity to bolster its existing renewable energy assets and explore new project developments, directly supporting its strategic focus on the energy transition.

In 2024, global investment in clean energy is projected to reach approximately $2 trillion, a substantial increase reflecting this ongoing transition. OPC Energy is well-placed to capture a portion of this growth by expanding its solar and wind energy capacity.

Innovations in battery technology, like solid-state batteries, are making energy storage more efficient and cost-effective, creating significant opportunities. For instance, the global energy storage market was valued at approximately $200 billion in 2023 and is projected to reach over $600 billion by 2030, according to various market reports. This growth trajectory directly benefits companies like OPC Energy that can leverage these advancements to improve grid stability and integrate renewables.

Advancements in smart grid infrastructure, including AI-driven grid management systems and distributed energy resource management, offer a chance to optimize energy distribution and reduce losses. By 2024, investments in smart grid technology globally were expected to exceed $100 billion, highlighting a strong market demand for modern grid solutions. OPC Energy can capitalize on this by enhancing its grid modernization efforts, leading to greater operational efficiency and new service offerings.

Integrating more intermittent renewable sources, such as solar and wind, becomes more feasible with robust energy storage and modernized grids. By 2025, renewable energy sources are expected to account for a larger share of the global energy mix, necessitating advanced grid capabilities. OPC Energy can gain a competitive edge and unlock new revenue streams by investing in and deploying these enabling technologies, thereby facilitating a cleaner energy future.

Strategic Acquisitions and Partnerships

OPC Energy can capitalize on the evolving energy landscape by pursuing strategic acquisitions of established power generation facilities. This approach offers a more immediate path to expanding its operational footprint and generating revenue compared to greenfield development. For instance, acquiring a well-positioned renewable energy project in a rapidly growing market could significantly bolster its portfolio.

Forming strategic partnerships presents another avenue for growth. Collaborating with technology providers, especially in areas like advanced battery storage or smart grid solutions, can enhance OPC Energy's existing offerings and create new revenue streams. Similarly, partnerships with established players in emerging markets can accelerate market entry and reduce initial investment risks.

By leveraging these opportunities, OPC Energy can achieve several key benefits:

- Accelerated Market Entry: Acquiring existing assets bypasses lengthy development and permitting processes.

- Geographical Expansion: Partnerships and acquisitions can quickly establish a presence in new, high-demand regions.

- Synergistic Expertise: Collaborations allow for the integration of complementary skills and technologies, improving operational efficiency and innovation.

- Portfolio Diversification: Strategic moves can broaden OPC Energy's energy mix, mitigating risks associated with reliance on a single fuel source or technology.

Government Incentives and Supportive Policies for Clean Energy

Governments in key markets, including Israel and the United States, are actively promoting clean energy adoption through a variety of incentives. These include significant tax credits, direct grants, and streamlined regulatory processes designed to accelerate the development of renewable energy projects. For instance, the US Inflation Reduction Act of 2022 offers substantial investment tax credits and production tax credits for solar and wind power, with potential for direct pay options.

OPC Energy is well-positioned to leverage these favorable government policies. The availability of such incentives can significantly de-risk new project investments and improve the overall financial returns for its renewable energy initiatives. This support structure is crucial for expanding capacity and enhancing the profitability of its sustainable energy portfolio.

- US Inflation Reduction Act: Provides substantial tax credits for renewable energy, boosting project economics.

- Israeli Government Support: Policies in Israel also encourage renewable energy development, creating a favorable operating environment.

- Funding Opportunities: Incentives can be used to secure capital for new solar and wind projects.

- Enhanced Profitability: Supportive frameworks increase the financial viability of OPC Energy's sustainable operations.

The escalating global demand for electricity, driven by AI-powered data centers and increased electrification, presents a substantial growth avenue for OPC Energy. The company can capitalize on this by expanding its generation capacity and securing long-term power purchase agreements, ensuring stable revenue streams.

The accelerating global push towards decarbonization, supported by ambitious renewable energy targets and government incentives like the US Inflation Reduction Act, creates a favorable environment for OPC Energy to invest in and expand its solar and wind power portfolios. Innovations in battery technology and smart grid infrastructure further enhance the feasibility of integrating intermittent renewables, offering opportunities for operational efficiency and new service offerings.

Strategic acquisitions of existing power generation facilities and partnerships with technology providers can accelerate OPC Energy's market entry, geographical expansion, and portfolio diversification. For example, the global clean energy investment was projected to hit around $2 trillion in 2024, indicating a robust market for expansion.

OPC Energy is strategically positioned to benefit from the increasing demand for electricity, particularly from data centers which are expected to significantly drive up consumption. The company can also leverage advancements in energy storage, with the global market projected to grow substantially by 2030, to enhance grid stability and renewable integration.

Threats

While OPC Energy utilizes natural gas, a cleaner fuel source, the inherent volatility in global fuel prices, including natural gas and oil, presents a substantial threat. Even with hedging, significant price spikes can directly increase operational expenses, impacting the profitability of its conventional power generation facilities. For instance, if natural gas prices surge unexpectedly in 2024 or 2025, OPC's margins could shrink considerably.

Heightened environmental regulations, including the potential implementation of carbon pricing and stricter emissions standards, pose a significant threat to OPC Energy. These measures could directly increase operational expenses for their natural gas-fired power plants. For instance, many European nations are actively discussing or implementing carbon taxes, with some anticipating rates to climb considerably by 2025, potentially adding substantial costs to emissions-heavy operations.

Adapting to these evolving environmental mandates may necessitate considerable capital outlay for OPC Energy to invest in advanced emissions reduction technologies. Failure to proactively adapt to these stricter rules, such as investing in carbon capture or upgrading to more efficient, lower-emission turbines, could lead to financial penalties or diminish the company's overall competitive standing in the energy market.

The independent power producer (IPP) and renewable energy sectors are seeing a surge of interest, with many new players entering the market. This influx of competition is expected to put downward pressure on electricity prices, making it more challenging for companies like OPC Energy to secure new projects with favorable returns, especially in markets that are becoming increasingly saturated.

In 2024, the global renewable energy capacity is projected to grow significantly, with the International Energy Agency (IEA) forecasting an additional 50% of renewable capacity compared to the previous five years. This rapid expansion, while positive for energy transition, intensifies competition for project development and offtake agreements, potentially impacting OPC Energy's expansion plans.

Market saturation is a growing concern in established renewable energy markets, where the number of available, high-yield projects is diminishing. For OPC Energy, this means that new market entries or expansion in existing regions will likely require more competitive bidding and potentially lower profit margins on new developments.

Cybersecurity Risks to Critical Infrastructure

As a key player in the energy sector, OPC Energy is particularly vulnerable to sophisticated cyber threats targeting critical infrastructure. These attacks can cripple operations, leading to widespread power outages and significant economic impact. For instance, the U.S. Department of Energy reported in 2023 that ransomware attacks on energy companies are increasing, with some incidents causing days of disruption.

The potential for data breaches also poses a serious risk, compromising sensitive operational data, customer information, and intellectual property. Such breaches could result in substantial financial penalties and severe damage to OPC Energy's reputation. In 2024, the average cost of a data breach in the energy sector was estimated to be around $4.7 million, according to IBM's Cost of a Data Breach Report.

The physical consequences of cyberattacks are also a major concern. Malicious actors could manipulate control systems, leading to equipment damage or safety hazards. The Colonial Pipeline incident in 2021, where a ransomware attack led to a shutdown of a major fuel pipeline, highlights the real-world implications of such threats, underscoring the need for robust cybersecurity defenses for OPC Energy.

- Increased Sophistication of Cyber Threats: Advanced persistent threats (APTs) and nation-state sponsored attacks pose a continuous and evolving danger to energy infrastructure.

- Ransomware Attacks: These attacks can lock down critical systems, demanding hefty payments for their release and causing prolonged operational downtime.

- Supply Chain Vulnerabilities: Third-party vendors and software suppliers can introduce security weaknesses into OPC Energy's systems, creating indirect attack vectors.

- Impact of Disruptions: Beyond financial losses, operational disruptions can lead to widespread service interruptions, affecting national security and public well-being.

Project Development and Execution Risks

Developing large power plants like those OPC Energy undertakes is incredibly complex. Risks like construction delays and budget blowouts are common. For instance, similar large-scale energy infrastructure projects globally have seen average cost overruns of 15-30% in recent years. Obtaining the necessary permits and securing land rights can also be a lengthy and unpredictable process, significantly impacting project timelines and delaying the start of revenue generation, which directly affects profitability.

These execution risks can have a substantial financial impact. Delays in project completion mean postponed income streams. OPC Energy's ability to manage these challenges is crucial, as a delay in a major project could mean millions in lost revenue and increased financing costs. For example, a single year delay on a $1 billion power plant could easily add $50-$100 million in extra costs and lost opportunity revenue.

- Construction Delays: Unforeseen site conditions or labor shortages can push back completion dates.

- Cost Overruns: Fluctuations in material prices and unexpected engineering challenges often lead to increased project expenses.

- Permitting and Land Rights: Navigating regulatory hurdles and acquiring land can be time-consuming and complex.

- Revenue Generation Impact: Any delay directly postpones the start of income, impacting financial projections and investor returns.

The increasing global demand for renewable energy sources, coupled with aggressive government incentives for their development, intensifies competition for OPC Energy. This trend, particularly evident in 2024 with significant capacity additions worldwide, challenges OPC's market share and project acquisition opportunities.

Market saturation in mature renewable energy sectors means fewer high-return projects are available, forcing OPC to consider less profitable ventures or enter more competitive new markets. This dynamic directly impacts the company's ability to secure favorable terms for new developments and maintain its growth trajectory.

The ongoing evolution of environmental regulations, including potential carbon pricing mechanisms, presents a significant threat. Stricter emissions standards could increase operational costs for OPC's natural gas facilities, potentially impacting profitability if adaptation investments lag. By 2025, many European nations anticipate higher carbon tax rates, directly affecting companies with emissions-heavy operations.

SWOT Analysis Data Sources

The OPC Energy SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations. This multi-faceted approach ensures a thorough and accurate assessment of the company's strategic position.