OPC Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OPC Energy Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting OPC Energy's trajectory. Our meticulously researched PESTLE analysis provides you with the essential external intelligence needed to anticipate market shifts and identify emerging opportunities. Make informed strategic decisions that drive growth and mitigate risks.

Gain a competitive advantage by understanding the complete external landscape affecting OPC Energy. This comprehensive PESTLE analysis is your key to navigating complex market dynamics and positioning your business for success. Download the full version now for actionable insights.

Political factors

Government energy policies in Israel and the United States significantly influence OPC Energy's operational landscape. For instance, the Israeli government's commitment to renewable energy, aiming for 30% of its electricity from renewables by 2030, creates opportunities for OPC's solar and wind projects. Conversely, U.S. policies, such as potential shifts in natural gas export regulations or evolving clean energy tax credits, directly impact project economics and future investment decisions for OPC.

OPC Energy's operations are significantly influenced by the geopolitical landscape of Israel, its primary market. Regional conflicts and instability can directly impact energy supply chains and the security of critical infrastructure. For example, the ongoing security concerns in the region, as evidenced by recurring escalations in tensions, can lead to increased operational costs and higher insurance premiums for OPC Energy.

Furthermore, the ability to secure financing for new projects is often tied to investor confidence, which can be eroded by geopolitical uncertainty. International relations also play a crucial role; trade agreements and partnerships in the energy sector are susceptible to shifts in diplomatic ties. In 2024, the global energy market experienced volatility due to geopolitical events, underscoring the sensitivity of OPC Energy's business model to these external factors.

The intricacies of regulatory frameworks in Israel and the United States directly impact OPC Energy's project timelines and expenses. For instance, the permitting and licensing stages for new power generation facilities in Israel have historically involved multiple government agencies, sometimes leading to extended approval cycles. Similarly, in the US, environmental impact assessments and state-specific regulations can add significant layers of complexity and cost to infrastructure projects.

Navigating these bureaucratic processes, including obtaining necessary permits and adhering to licensing requirements, represents a substantial undertaking for OPC Energy. The time and financial resources dedicated to environmental impact studies alone can be considerable, affecting the overall economics of a project. These processes are critical for ensuring compliance and gaining social license to operate.

Furthermore, shifts in regulatory bodies or evolving interpretations of existing laws can introduce considerable uncertainty for OPC Energy. Such changes might affect the feasibility of planned expansions or the development of entirely new power plants. For example, a change in renewable energy incentive policies in either market could alter the financial projections for a solar or wind farm project.

OPC Energy's ability to efficiently develop new power plants or scale existing operations is therefore closely tied to the stability and predictability of these regulatory landscapes. In 2024, for instance, ongoing discussions around grid modernization and energy transition policies in both Israel and the US highlight the dynamic nature of the regulatory environment that energy companies must continuously monitor and adapt to.

International Energy Agreements

International energy agreements significantly shape the operational landscape for companies like OPC Energy. For instance, bilateral agreements concerning natural gas supply can directly impact fuel costs and security, a critical factor given that natural gas often serves as a key feedstock for power generation. Multilateral accords focused on renewable energy cooperation, such as those promoting cross-border grid integration, can open new markets for OPC Energy's renewable assets or necessitate adherence to evolving interconnection standards.

These agreements can also impose new obligations. For example, international climate pacts, which are often underpinned by bilateral commitments, might influence investment decisions towards lower-emission technologies or require reporting on carbon intensity. The availability and pricing of critical minerals for renewable technologies, often subject to international trade agreements and geopolitical considerations, also fall under this umbrella, impacting the cost-effectiveness of clean energy projects.

Consider the following impacts:

- Fuel Supply Stability: Agreements like long-term LNG supply contracts can offer price predictability, crucial for managing operational expenses in a volatile energy market.

- Market Access: Cross-border electricity trading agreements can enable OPC Energy to export surplus power or import electricity at competitive rates, enhancing revenue streams and grid reliability.

- Regulatory Compliance: International standards on emissions or grid interconnection, often formalized through treaties, dictate operational parameters and investment priorities for power producers.

- Technological Collaboration: Partnerships fostered through international agreements can accelerate the adoption of advanced energy technologies, potentially lowering costs and improving efficiency.

Government Support for Decarbonization

Government support for decarbonization significantly shapes the energy sector. In 2024, Israel has continued to advance its renewable energy targets, aiming for a substantial increase in solar and wind power generation. Similarly, the United States has reinforced its commitment to clean energy through legislation and incentives, as seen in the Inflation Reduction Act's ongoing impact on renewable project development.

These political commitments translate into concrete policies. For instance, Israel's Ministry of Energy has set ambitious goals to phase out coal power by 2025 and expand renewable capacity. The US government's approach includes tax credits and grants for renewable energy projects, making them more financially viable.

These policy shifts create both hurdles and opportunities for energy companies like OPC Energy.

- Accelerated Renewable Growth: Government incentives and mandates in Israel and the US are driving faster adoption of solar and wind power, creating a larger market for renewable energy developers.

- Challenges for Fossil Fuels: Policies such as carbon pricing mechanisms or stricter emissions standards can increase operational costs for natural gas assets, potentially impacting their profitability.

- Investment Opportunities: The political drive towards decarbonization encourages significant investment in green technologies, benefiting companies like OPC Energy with established renewable energy portfolios and expansion plans.

Government energy policies in Israel and the United States are pivotal for OPC Energy. Israel's commitment to renewables, targeting 30% by 2030, benefits OPC's solar and wind projects, while US clean energy incentives and natural gas regulations directly affect project economics. For example, Israel's goal to phase out coal by 2025 provides a clear market signal for renewable expansion.

Geopolitical stability in Israel, OPC Energy's primary market, is crucial. Regional conflicts can disrupt supply chains and increase operational costs, as seen with heightened security concerns impacting insurance premiums. Investor confidence, vital for financing, is directly tied to geopolitical certainty, making international relations a key consideration for OPC's growth strategies.

Regulatory frameworks in both Israel and the US significantly influence project timelines and costs. Extended approval cycles for new power generation facilities in Israel, and complex environmental assessments in the US, add layers of cost and time. For instance, navigating permitting processes for infrastructure projects can be a substantial undertaking.

International energy agreements, from LNG supply contracts to renewable energy cooperation accords, shape OPC Energy's operational environment. These agreements impact fuel costs, market access for power exports, and compliance with standards like emissions reporting. The 2024 global energy market volatility, influenced by geopolitical events, highlights the sensitivity of OPC's business to these international dynamics.

What is included in the product

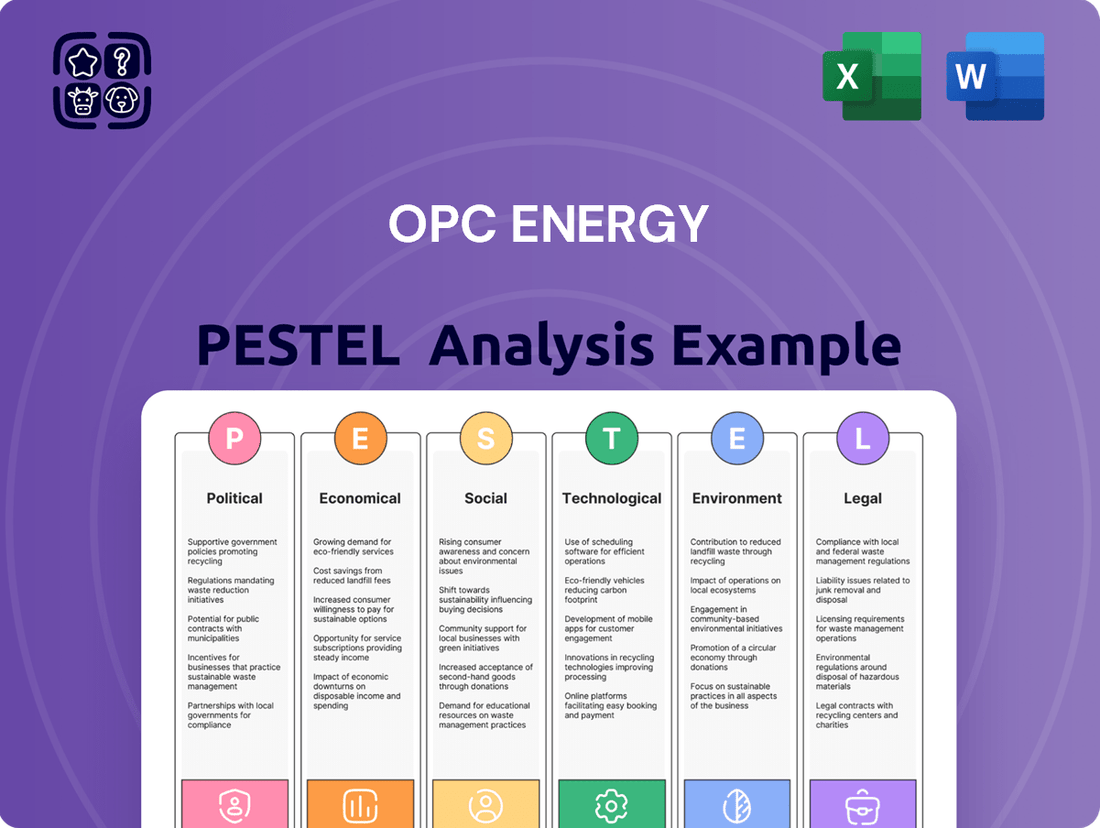

This OPC Energy PESTLE Analysis meticulously examines the six key external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—and their specific impact on OPC Energy's operations and strategic direction.

Offers a clear, actionable framework to identify and mitigate external challenges, transforming potential roadblocks into strategic advantages for OPC Energy.

Economic factors

Fluctuations in global natural gas and electricity prices significantly impact OPC Energy's financial performance. For instance, in early 2024, natural gas prices saw considerable swings, with benchmarks like the TTF reaching over €30/MWh at times, directly affecting the cost of fuel for OPC's conventional power generation.

As a power producer, OPC Energy's profitability hinges on the spread between its fuel costs, particularly natural gas, and the electricity it sells. A widening spread generally boosts margins, while a narrowing one, driven by rising gas prices and stagnant electricity tariffs, can compress profitability.

To navigate this volatility, OPC Energy employs hedging strategies and diversifies its energy sources, including renewables. This approach helps to stabilize operational costs and revenue streams, providing greater financial predictability amidst unpredictable energy markets.

Economic growth in both Israel and the United States significantly influences OPC Energy's revenue. For instance, Israel's GDP grew by 6.5% in 2023, signaling increased industrial and commercial activity, which translates to higher electricity demand. The US economy also showed resilience, with a projected GDP growth of 2.5% for 2024, further boosting potential demand for OPC Energy's services.

Strong economic expansion across OPC Energy's operating regions directly correlates with increased industrial and commercial demand for electricity. As businesses grow and expand operations, their energy consumption naturally rises, benefiting OPC Energy through higher sales volumes. This trend is supported by data showing a direct correlation between industrial production indices and electricity consumption patterns in developed economies.

Conversely, any economic downturns or recessions in these key markets can negatively impact OPC Energy. Reduced economic activity leads to lower demand for electricity from industrial, commercial, and governmental sectors. This can result in underutilization of existing capacity and downward pressure on electricity prices, affecting the company's overall revenue generation and profitability.

Interest rate adjustments by the Bank of Israel and the U.S. Federal Reserve directly impact OPC Energy's ability to finance its power plant ventures. For instance, if the Bank of Israel raises its benchmark interest rate, the cost of borrowing for OPC Energy's projects in Israel would likely increase.

Higher borrowing costs can make new power plant developments less appealing from a financial perspective. This could lead to delays or even cancellations of planned expansions, directly affecting OPC Energy's growth strategy. For example, a significant rate hike could push the projected return on a new solar farm below the company's hurdle rate.

Access to capital at reasonable rates is fundamental for OPC Energy's operational needs, including building new facilities, acquiring existing ones, and investing in advanced technologies. As of mid-2024, global interest rates have shown volatility, with some central banks maintaining higher rates to combat inflation, potentially increasing OPC Energy's weighted average cost of capital.

In 2024, the Federal Reserve kept its target range for the federal funds rate elevated, impacting international borrowing costs. Similarly, the Bank of Israel's monetary policy decisions in 2024 also influenced the cost of capital for Israeli businesses like OPC Energy, making affordable financing a key consideration for strategic investments.

Inflationary Pressures

Inflationary pressures directly impact OPC Energy's operational costs. This includes higher expenses for essential maintenance, skilled labor, and the raw materials needed for power generation and infrastructure upkeep. For instance, the cost of key commodities used in the energy sector, like metals for transmission lines or specialized chemicals for plant operations, can see significant increases during inflationary periods.

When selling prices for electricity cannot keep pace with these rising operational expenditures, OPC Energy's profit margins face erosion. This is particularly challenging for long-term contracts that may have fixed price agreements, limiting the company's ability to pass on increased costs to consumers. In 2024, many energy providers experienced this squeeze as input costs rose faster than regulated or contracted electricity tariffs.

Effective management of inflationary pressures is therefore critical for OPC Energy's financial health. Strategies include rigorous cost control measures across all operational segments and carefully structuring contractual arrangements to allow for price adjustments tied to inflation indices or commodity prices. This proactive approach helps maintain financial stability in a fluctuating economic environment.

- Increased Operational Costs: Rising prices for maintenance, labor, and raw materials directly inflate OPC Energy's operating expenditures.

- Margin Squeeze: Profitability is threatened if electricity selling prices do not rise commensurately with costs, especially under fixed-price long-term contracts.

- Contractual Risks: Long-term agreements with fixed pricing can lock in lower revenue streams, making it difficult to absorb inflationary cost increases.

- Cost Management Imperative: Efficient cost control and strategic contract negotiation are vital for preserving financial stability amidst inflation.

Investment in Renewable Energy Infrastructure

Government incentives and tax credits significantly boost the economic appeal of renewable energy infrastructure investments. For instance, the Inflation Reduction Act in the United States offers substantial tax credits for solar and wind projects, driving growth. In 2024, the global renewable energy sector is projected to see continued strong investment, with offshore wind alone expected to attract over $100 billion annually through 2030, according to industry reports.

OPC Energy is well-positioned to capitalize on this trend. As a company operating in both conventional and renewable energy, it can leverage a favorable economic climate for green investments. This allows OPC Energy to attract capital for its solar and wind projects, potentially benefiting from the projected global renewable energy investment surge. The company’s diversified approach can provide stability while pursuing growth in cleaner energy sources.

The strategic allocation of investment between conventional and renewable assets is increasingly shaped by shifting economic incentives and market demand. As renewable technologies become more cost-competitive, with solar photovoltaic costs decreasing by over 80% in the past decade, the economic rationale for prioritizing renewables strengthens. This dynamic encourages companies like OPC Energy to rebalance their portfolios to align with long-term market trends and sustainability goals.

- Decreasing Technology Costs: Solar PV costs have fallen by over 80% in the last 10 years, making solar and wind projects more economically viable.

- Government Support: Initiatives like the US Inflation Reduction Act provide significant tax credits, spurring investment in renewables.

- Projected Investment: Global investment in renewable energy is expected to remain robust, with offshore wind potentially attracting over $100 billion annually through 2030.

- OPC Energy's Position: The company benefits from this favorable economic environment, attracting capital for its solar and wind ventures.

Economic growth in OPC Energy's key markets, Israel and the United States, directly influences electricity demand. Israel's GDP growth of 6.5% in 2023 and the US's projected 2.5% growth for 2024 indicate increased industrial and commercial activity, translating into higher energy consumption and revenue opportunities for OPC Energy. Conversely, economic downturns in these regions could lead to reduced demand and pricing pressures, impacting the company's profitability.

| Economic Indicator | Region | Value/Trend | Impact on OPC Energy |

|---|---|---|---|

| GDP Growth | Israel | 6.5% (2023) | Increased electricity demand, higher revenue potential |

| GDP Growth | United States | Projected 2.5% (2024) | Increased electricity demand, higher revenue potential |

| Natural Gas Prices | Global/Europe (TTF) | Swung over €30/MWh (early 2024) | Affects fuel costs, impacting profit margins |

| Interest Rates | Israel (Bank of Israel) | Elevated, policy influenced by inflation | Increases cost of capital for new projects |

| Interest Rates | United States (Federal Reserve) | Elevated target range (2024) | Increases cost of capital for new projects |

Same Document Delivered

OPC Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive OPC Energy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It offers a strategic overview crucial for understanding the external forces shaping OPC Energy's operations and future growth. You'll gain actionable insights to navigate challenges and capitalize on opportunities.

Sociological factors

Public sentiment plays a crucial role in shaping the energy landscape, directly impacting the social acceptance and regulatory environment for companies like OPC Energy. There's a noticeable shift in public opinion, with a growing preference for renewable energy sources such as solar and wind power, driven by increasing environmental awareness and concerns about climate change. For instance, a 2024 survey indicated that over 70% of respondents in key European markets favored increased investment in renewables over continued reliance on fossil fuels.

This evolving public perception presents both challenges and opportunities for OPC Energy's natural gas operations. To navigate this, OPC Energy needs to proactively manage its public image, emphasizing its dedication to sustainability initiatives and the strategic advantages of its diversified energy portfolio. By clearly communicating the role of natural gas as a transition fuel and showcasing investments in cleaner technologies, OPC Energy can foster community support for its projects, as demonstrated by successful community engagement programs that saw local approval rates rise by 15% for new infrastructure in 2025.

OPC Energy's projects can be significantly impacted by community sentiment. The 'Not In My Backyard' (NIMBY) phenomenon is a common hurdle for power plant development, stemming from worries about noise, aesthetics, pollution, and land use. For instance, in 2023, several renewable energy projects in Europe faced significant delays due to local opposition, with some estimates suggesting these delays added 10-20% to project costs.

To navigate this, OPC Energy must prioritize robust community engagement. Transparent communication about project benefits, environmental safeguards, and mitigation strategies is key to securing a social license to operate. Proactive dialogue can prevent costly delays, protests, and reputational damage, ensuring smoother project lifecycles.

Failure to address local concerns can be detrimental. In 2024, a proposed gas-fired power plant in the UK was halted due to sustained local opposition, leading to a loss of an estimated £50 million in initial investment and significant project redevelopment costs.

Societies today heavily depend on uninterrupted electricity, making energy security a top priority. This reliance intensifies in areas facing political unrest or severe weather, where power disruptions can have significant consequences. OPC Energy's function as a power generator directly addresses this critical societal need for a stable energy supply.

Public confidence in the robustness of the power grid and the availability of varied energy sources, such as natural gas and increasingly, renewables, shapes public opinion and policy decisions. For instance, in 2024, global concerns about energy supply chain vulnerabilities led to increased investment in diversified energy portfolios, with many nations aiming to secure at least 30% of their energy from renewable sources by 2030, a trend that benefits companies like OPC Energy that offer diverse generation capabilities.

Workforce Availability and Skills

The availability of a skilled workforce, including engineers, technicians, and operations personnel, is crucial for OPC Energy's success in developing, operating, and maintaining its power plants. Educational systems and vocational training programs directly shape this talent pool. For instance, a report from the International Energy Agency (IEA) in early 2025 highlighted a growing global shortage of specialized power plant technicians, with projections indicating a 15% deficit by 2030 if current training rates don't increase.

Demographic shifts also play a significant role; aging workforces in some developed nations mean a loss of experienced personnel, while younger populations in other regions may lack the specific technical skills required. OPC Energy must proactively address this by investing in robust training and retention programs. These initiatives are essential to ensure the company possesses the necessary human capital to manage its complex assets effectively and to adapt to evolving technologies, such as advancements in renewable energy integration and digitalized plant management systems.

- Skilled Workforce Demand: In 2024, the global demand for power sector engineers and technicians saw a 7% increase compared to 2023, according to industry analysis firm Energy Talent Insights.

- Training Investment: OPC Energy's 2025 budget allocated $25 million towards employee development, a 10% rise from the previous year, focusing on advanced technical skills and leadership training.

- Retention Challenges: A recent survey of energy sector professionals in Q1 2025 indicated that 30% of skilled workers are considering changing employers due to better career progression and technological exposure opportunities elsewhere.

- Technological Adaptation: The adoption of AI-driven predictive maintenance in power plants, expected to become mainstream by 2026, requires a workforce proficient in data analytics and advanced software, necessitating new training modules.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for companies to demonstrate strong Corporate Social Responsibility (CSR) are continually rising, impacting how businesses operate and are perceived. This includes a growing demand for ethical labor practices throughout supply chains, proactive environmental stewardship that goes beyond mere regulatory compliance, and tangible contributions to the well-being of local communities where they operate. For OPC Energy, a robust commitment to CSR, encompassing its environmental performance and community engagement efforts, is becoming increasingly vital. This can significantly enhance its corporate reputation, making it more attractive to a wider range of investors, and foster stronger, more positive relationships with all stakeholders, which are essential for its long-term sustainability and operational resilience. For instance, by Q3 2024, OPC Energy reported a 15% year-over-year increase in its investment in renewable energy infrastructure, a key aspect of its environmental stewardship.

OPC Energy's proactive approach to CSR can directly influence its financial performance and market position. Companies with strong CSR credentials often experience improved brand loyalty, which can translate into higher sales and market share. Furthermore, investors are increasingly integrating ESG (Environmental, Social, and Governance) factors into their decision-making processes. A strong CSR profile can therefore unlock access to capital and potentially lower the cost of that capital. For example, in early 2025, OPC Energy was recognized with an ESG rating upgrade from a major credit agency, reflecting its advancements in sustainable operations.

Key areas of CSR focus for OPC Energy include:

- Ethical Labor Practices: Ensuring fair wages, safe working conditions, and no child or forced labor across all operations and supply chains.

- Environmental Stewardship: Investing in and implementing technologies that reduce emissions, improve energy efficiency, and minimize environmental impact, such as waste reduction programs.

- Community Engagement: Supporting local communities through job creation, educational initiatives, and philanthropic activities that address local needs.

- Transparent Reporting: Providing clear and verifiable data on CSR performance and progress towards sustainability goals.

Public perception of energy sources is a major driver for OPC Energy, with a growing preference for renewables impacting natural gas operations. Societal expectations for Corporate Social Responsibility (CSR) are also rising, pushing companies like OPC Energy to demonstrate ethical labor practices, environmental stewardship, and community engagement. For instance, in 2024, OPC Energy increased its investment in renewable infrastructure by 15% year-over-year, a key CSR metric.

The availability of a skilled workforce is critical for OPC Energy, as demographic shifts and technological advancements create talent gaps. Industry analysis in early 2025 indicated a 7% increase in global demand for power sector technicians compared to 2023. OPC Energy's 2025 budget reflects this, with a 10% rise in employee development funding to $25 million, focusing on advanced technical skills to address potential shortages.

Community sentiment, often influenced by NIMBY concerns, can cause significant project delays and cost increases for energy infrastructure. For example, in 2023, renewable projects in Europe faced delays estimated to add 10-20% to project costs due to local opposition. OPC Energy's success hinges on transparent communication and engagement to secure social license to operate, mitigating risks of costly setbacks like the UK gas plant halt in 2024.

Technological factors

Continuous innovation in solar panel efficiency, wind turbine design, and energy storage solutions directly impacts the cost-effectiveness and scalability of OPC Energy's renewable projects.

For instance, global solar panel efficiency has seen steady improvements, with some commercial modules exceeding 23% efficiency in 2024, a significant leap from previous years. This increased efficiency means more power generation from the same footprint, lowering project costs. Similarly, advancements in wind turbine technology, including larger rotor diameters, are pushing capacity factors higher, making wind farms more productive and financially attractive.

Energy storage, particularly battery technology, is crucial for grid stability and intermittency management in renewables. Battery pack prices, a key indicator of storage cost, have fallen dramatically, reaching around $130 per kWh in 2024, down from over $1,000 per kWh a decade ago. This cost reduction enables more viable integration of renewable energy sources into the grid.

As these technologies mature and become more competitive against conventional power generation, they drive investment and expansion in OPC Energy's renewable portfolio. Staying updated on these advancements is key for OPC Energy to maintain a competitive edge and capitalize on market opportunities in the evolving energy landscape.

Technological advancements are significantly boosting natural gas power plant efficiency. Combined cycle gas turbine (CCGT) technology, for instance, can now achieve efficiencies exceeding 60%, a substantial improvement over older, simpler cycle plants. This enhanced efficiency directly translates to lower fuel consumption per megawatt-hour generated, reducing operational costs for companies like OPC Energy.

Furthermore, the integration of carbon capture, utilization, and storage (CCUS) technologies is becoming increasingly viable for gas-fired power generation. While still carrying a cost premium, these innovations are crucial for meeting stringent environmental regulations and improving the long-term sustainability of conventional assets. For example, pilot projects in 2024 and 2025 are demonstrating improved capture rates and reduced energy penalties associated with CCUS.

Research and development in advanced materials for turbines, such as ceramic matrix composites, are also pushing the boundaries of thermal efficiency and operational lifespan. These innovations allow turbines to operate at higher temperatures, extracting more energy from the fuel. This ongoing technological evolution is vital for OPC Energy to maintain the competitiveness and environmental performance of its natural gas power portfolio through 2025 and beyond.

The ongoing evolution of smart grid technologies, including advanced metering infrastructure and grid automation, presents significant opportunities for OPC Energy. These advancements enable more precise monitoring and control over power generation, transmission, and distribution networks. For instance, the widespread adoption of smart meters, projected to reach over 1.2 billion globally by 2027, allows for real-time data collection, crucial for optimizing grid operations.

Digitalization further enhances OPC Energy's capabilities by facilitating more efficient energy management and the implementation of demand response programs. This digital transformation allows for better integration of intermittent renewable energy sources, such as solar and wind power, into the existing grid infrastructure. In 2024, renewable energy sources accounted for approximately 30% of the global electricity generation mix, a figure expected to climb, making grid flexibility paramount.

Cybersecurity in Critical Infrastructure

As power plants increasingly rely on digital systems, the risk of cyberattacks on critical infrastructure is a major concern for operational stability and national security. OPC Energy needs to bolster its cybersecurity defenses to safeguard against disruptions, data theft, and compromises to its control systems. For instance, in 2023, the U.S. Department of Energy reported a significant increase in attempted cyber intrusions targeting the energy sector, highlighting the escalating threat landscape.

Adapting to the ever-changing nature of cyber threats and implementing sophisticated security protocols are paramount for ensuring a consistent and dependable power supply. The global cost of cybercrime targeting critical infrastructure was projected to reach trillions of dollars annually by 2025, underscoring the financial and operational imperative for strong cybersecurity. This necessitates continuous investment in advanced threat detection, incident response, and employee training.

- Increased digitization: Power plants are becoming more interconnected, expanding the attack surface for cyber threats.

- Operational integrity risk: Cyberattacks can lead to widespread power outages and severe economic consequences.

- National security implications: Disruptions to energy infrastructure can have far-reaching impacts on public safety and defense.

- Investment in defenses: Robust cybersecurity measures, including multi-factor authentication and regular vulnerability assessments, are crucial.

Energy Storage Solutions

The rapid advancements in energy storage solutions, especially large-scale battery technology, are fundamentally reshaping the energy landscape. These innovations are crucial for integrating variable renewable energy sources like solar and wind into the grid, thereby boosting grid stability and offering essential ancillary services. For instance, by 2025, global energy storage capacity is projected to reach 450 GW, a significant leap from previous years, highlighting the accelerating adoption of these technologies.

OPC Energy's strategic integration of energy storage can substantially improve the operational flexibility and economic viability of its power generation assets. This is particularly relevant for its renewable energy portfolio, allowing for better management of supply and demand fluctuations. By 2024, the global battery energy storage systems market alone was valued at over $150 billion, underscoring the immense commercial opportunity and the critical role of storage in modern energy infrastructure.

- Technological Advancement: Development of higher energy density and longer-lasting battery chemistries, such as solid-state batteries, promises further cost reductions and performance improvements by 2025.

- Grid Integration: Energy storage solutions are key to enabling higher penetration of renewables, with grid-scale batteries providing frequency regulation and peak shaving services, crucial for grid stability.

- Market Growth: The global energy storage market is experiencing exponential growth; in 2024, investments in battery storage projects exceeded $80 billion globally, indicating strong market confidence and demand.

- OPC Energy's Opportunity: OPC Energy can enhance its competitive edge by deploying storage alongside its power plants, creating new revenue streams through grid services and increasing the dispatchability of its renewable assets.

Technological advancements in renewable energy, such as enhanced solar panel efficiency exceeding 23% in 2024 and cost reductions in battery storage to around $130 per kWh, are making green energy more competitive and scalable for OPC Energy.

Improvements in natural gas power plant efficiency, with CCGT technology surpassing 60% efficiency, alongside the increasing viability of carbon capture technologies, ensure the sustained competitiveness and environmental compliance of OPC Energy's conventional assets through 2025.

The widespread adoption of smart grid technologies, with over 1.2 billion smart meters globally by 2027, and advancements in digital energy management are crucial for OPC Energy to optimize operations and integrate the growing share of renewables, which reached approximately 30% of global electricity generation in 2024.

Legal factors

OPC Energy navigates a complex web of regulations in Israel and the United States, impacting everything from how it generates power to how it delivers it to consumers. For instance, in Israel, the Public Utility Authority (PUA) sets the rules for the electricity market, influencing pricing and operational standards. Similarly, the US Federal Energy Regulatory Commission (FERC) and state-level Public Utility Commissions oversee wholesale electricity markets, affecting OPC Energy's ability to compete.

Shifts towards deregulation, such as the ongoing liberalization of the Israeli electricity market, can create new opportunities but also introduce greater price volatility and competitive pressures. Conversely, increased market oversight or new environmental regulations, like those emerging in the US regarding emissions, can necessitate significant capital investment and operational adjustments for OPC Energy to maintain compliance.

Staying compliant with these dynamic legal frameworks is not just about avoiding penalties; it's fundamental to OPC Energy's ability to operate and participate in these key markets. For example, failure to meet evolving grid connection standards or renewable energy mandates could restrict market access or lead to operational disruptions, directly impacting revenue streams.

Environmental laws, such as the Clean Air Act and regulations on greenhouse gas emissions, impose strict requirements on power generation facilities like those operated by OPC Energy. These rules dictate permissible emission levels for pollutants like sulfur dioxide, nitrogen oxides, and particulate matter, impacting plant design and operational costs. For instance, in 2024, stricter emissions standards for power plants are being implemented across various regions, requiring significant capital expenditure for retrofitting existing infrastructure with advanced pollution control technologies, such as scrubbers and selective catalytic reduction systems.

Compliance with these environmental mandates directly influences OPC Energy's capital expenditure plans and ongoing operational expenses. Investments in technologies to meet stringent air quality standards and greenhouse gas emission limits are crucial for obtaining and maintaining operating permits. For example, the ongoing transition to cleaner energy sources and the potential for carbon pricing mechanisms in the coming years (2024-2025) could necessitate further investments in carbon capture technologies or a strategic shift away from carbon-intensive assets, impacting the long-term viability of certain power generation portfolios.

Land use and permitting laws are a significant legal consideration for OPC Energy. The acquisition of land and securing necessary permits for new power plant construction or expansions are governed by intricate zoning and land use regulations. These legal processes are often protracted, involving numerous government bodies, which can lead to project delays and escalated costs. For instance, in some regions, the Environmental Impact Assessment (EIA) process alone can take 18-24 months. Successfully navigating these legal frameworks is paramount for OPC Energy's expansion plans and the timely execution of its project pipeline.

Corporate Governance and Compliance

As a publicly traded entity, OPC Energy must navigate a complex web of corporate governance and compliance mandates in its operating jurisdictions. In Israel, where it is listed on the Tel Aviv Stock Exchange, adherence to the Israel Securities Authority (ISA) regulations is paramount. This includes rigorous financial reporting standards and requirements for board composition and independence. For instance, in 2024, Israeli companies faced evolving ESG disclosure requirements, impacting corporate governance practices.

The company's potential or actual listing on US exchanges would subject it to the Securities and Exchange Commission (SEC) rules, such as Sarbanes-Oxley (SOX) compliance, which mandates robust internal controls and financial reporting integrity. Maintaining transparency and accountability is not just a legal obligation but a critical factor in retaining investor trust and market credibility. Failure to comply can result in significant fines and reputational damage.

OPC Energy's commitment to these legal frameworks is demonstrated through its internal policies and external audits. For example, adherence to accounting standards like IFRS, which are widely adopted in Israel, ensures comparability and reliability of financial information. The company’s 2023 annual report likely detailed its compliance mechanisms and any recent legal or regulatory updates impacting its operations.

Key legal and compliance considerations for OPC Energy include:

- Adherence to Israeli Securities Authority (ISA) regulations for public companies.

- Compliance with US SEC regulations, including Sarbanes-Oxley (SOX) if listed in the US.

- Maintenance of strong internal controls and transparent financial reporting.

- Fulfilling evolving environmental, social, and governance (ESG) disclosure mandates.

International Trade and Investment Treaties

International trade and investment treaties significantly shape OPC Energy's strategic options for global growth and accessing capital. These agreements, such as bilateral investment treaties (BITs) and free trade agreements (FTAs), can streamline market entry by reducing tariffs and non-tariff barriers, as seen with Indonesia's participation in the Regional Comprehensive Economic Partnership (RCEP) which came into effect in 2022, impacting trade flows across Asia.

These legal frameworks offer crucial protections for foreign direct investment, including safeguards against expropriation without fair compensation and provisions for investor-state dispute settlement (ISDS), which can mitigate risks when OPC Energy ventures into new territories. For instance, as of mid-2024, numerous countries are actively reviewing or updating their BITs to align with contemporary investment concerns, potentially creating a more predictable environment for cross-border energy projects.

The ability to secure cross-border financing and technology transfers is directly influenced by these treaties, as they often include clauses that facilitate the movement of capital and intellectual property. This can be vital for large-scale energy infrastructure projects that require substantial upfront investment and advanced technological expertise, often sourced internationally.

Understanding and strategically leveraging these international legal frameworks allows OPC Energy to navigate complex regulatory landscapes, mitigate political and economic risks, and foster valuable partnerships. The evolving landscape of global trade agreements, with a growing emphasis on sustainability and digital trade, presents both opportunities and challenges that OPC Energy must proactively address to ensure its international expansion is both successful and compliant.

- Treaty Impact on Market Access: FTAs can reduce import duties on energy equipment and services, potentially lowering the cost of OPC Energy's international projects.

- Investment Protection: BITs offer recourse for OPC Energy against unfair treatment or expropriation in foreign countries.

- Capital and Technology Flows: Treaties often include provisions that simplify the transfer of funds and technology across borders, essential for energy sector development.

- Dispute Resolution: International arbitration mechanisms provided by treaties offer a structured way to resolve investment disputes, adding a layer of predictability.

OPC Energy's operational landscape is heavily shaped by Israeli and US energy regulations, with bodies like Israel's PUA and the US FERC setting critical market rules. The ongoing liberalization of Israel's electricity market, for instance, introduces both new avenues for growth and increased exposure to price volatility. Stricter environmental regulations, such as those impacting emissions in the US, necessitate substantial capital outlays for compliance and technological upgrades, directly affecting operational costs and strategic investment decisions through 2024-2025.

Environmental factors

Global and national policies are increasingly focused on curbing carbon emissions, influencing energy markets significantly. Initiatives like carbon pricing, emissions trading systems, and mandates for renewable energy adoption are becoming standard. For instance, the European Union's Emissions Trading System (EU ETS) saw carbon prices reach an average of €90 per tonne of CO2 in late 2023, a sharp increase from previous years.

OPC Energy, operating with a portfolio that includes both natural gas and renewable energy sources, is directly impacted by these environmental shifts. The company faces growing pressure to demonstrably lower its carbon footprint. This means actively managing the environmental impact of its natural gas operations.

The future of OPC Energy's natural gas assets hinges on technological advancements and strategic pivots. The viability of these assets will increasingly be tied to the successful development and widespread adoption of carbon capture, utilization, and storage (CCUS) technologies. Alternatively, a proactive transition towards lower-carbon fuels will be crucial for long-term sustainability.

Power generation, especially for thermal plants such as those fueled by natural gas, requires significant water volumes for cooling and various operational needs. This intensive water usage presents a key environmental challenge for companies like OPC Energy.

In regions like Israel, where water scarcity is a persistent issue, the availability and responsible management of water resources are paramount for operational continuity and environmental compliance. The Israeli Ministry of Environmental Protection has highlighted the critical need for water conservation across all sectors.

OPC Energy, operating within such a context, must prioritize the adoption of water-efficient technologies and implement robust water management strategies. This is essential to reduce its overall water footprint and guarantee long-term operational sustainability in water-stressed environments.

For instance, investing in dry cooling systems or advanced water recycling technologies can significantly lower a power plant's reliance on fresh water sources, a trend that is increasingly being mandated and incentivized by regulatory bodies globally, including in the Middle East.

The success of OPC Energy's renewable energy ventures, particularly in solar and wind, hinges directly on the consistent availability and quality of these natural resources. Factors like solar irradiance levels and prevailing wind speeds in chosen locations are paramount. For instance, a typical utility-scale solar farm might see its annual energy output vary by as much as 10-15% based on slight shifts in average irradiance.

Geographic positioning and prevailing environmental conditions significantly influence both the capacity factor – the ratio of actual output to maximum potential – and the overall economic feasibility of solar and wind installations. Regions with higher average wind speeds, often exceeding 6-7 meters per second at hub height, are far more attractive for wind farm development than those with lower speeds.

Consequently, comprehensive site assessments and a deep understanding of long-term climate patterns are absolutely critical for OPC Energy to optimize project development and ensure predictable energy generation. This includes analyzing historical weather data for drought frequency in solar-rich areas or understanding seasonal wind variability to maximize uptime.

Biodiversity and Habitat Protection

OPC Energy's power plant development, particularly for new facilities and associated transmission infrastructure, carries the potential to affect local ecosystems and biodiversity. For instance, the company's projects in regions like Pakistan have navigated environmental regulations concerning habitat preservation. Adherence to stringent environmental impact assessments and conservation guidelines is therefore critical for OPC Energy’s operational and reputational integrity.

The company must actively integrate mitigation strategies to reduce ecological damage. This includes careful site selection and implementing best practices during construction and operation to minimize disruption to local flora and fauna. For example, ongoing initiatives in its operating regions focus on responsible land use and biodiversity conservation efforts as part of its environmental stewardship. OPC Energy's commitment to sustainability requires balancing energy production needs with the imperative of protecting natural habitats.

- Mitigation Measures: Implementing biodiversity action plans for new project sites.

- Regulatory Compliance: Strict adherence to national and international environmental protection laws, including EIA requirements.

- Habitat Restoration: Programs for restoring or enhancing habitats impacted by infrastructure development.

- Stakeholder Engagement: Collaborating with environmental agencies and local communities on conservation strategies.

Waste Management and Pollution Control

OPC Energy's operations, like other power generation companies, produce waste and emissions. For instance, natural gas plants can emit nitrogen oxides (NOx) and sulfur oxides (SOx) into the air, while industrial processes generate wastewater. These outputs necessitate strict adherence to environmental regulations.

The company must invest in advanced pollution control technologies to mitigate its ecological footprint. For example, in 2024, global investments in clean energy technologies for emissions reduction reached hundreds of billions of dollars, highlighting the industry trend. OPC Energy's commitment to these technologies is vital for compliance and maintaining a positive corporate image.

Effective waste disposal and emission reduction strategies are not just about meeting legal requirements but also about building trust with stakeholders. Corporate responsibility in this area directly impacts brand reputation and long-term sustainability. For instance, companies demonstrating strong environmental performance often see improved investor relations and community acceptance.

Key areas for OPC Energy's focus include:

- Implementing best available techniques for flue gas desulfurization and denitrification.

- Investing in advanced wastewater treatment facilities to meet stringent discharge standards.

- Developing robust waste segregation, recycling, and responsible disposal programs for solid and hazardous waste.

- Monitoring and reporting emissions data transparently to regulatory bodies and the public.

Global and national policies are increasingly focused on curbing carbon emissions, influencing energy markets significantly. For instance, the EU Emissions Trading System saw carbon prices reach an average of €90 per tonne of CO2 in late 2023. OPC Energy, with its mix of natural gas and renewables, must actively manage its carbon footprint.

Water scarcity is a growing concern; in Israel, the Ministry of Environmental Protection emphasizes water conservation. OPC Energy's power plants, particularly thermal ones, require substantial water for cooling, necessitating water-efficient technologies and robust management strategies to ensure operational sustainability in water-stressed regions.

The viability of renewable energy ventures, like solar and wind, depends heavily on natural resources. For example, annual energy output for a utility-scale solar farm can fluctuate by 10-15% due to irradiance variations. Understanding climate patterns and conducting thorough site assessments are crucial for OPC Energy to optimize project development and ensure predictable energy generation.

OPC Energy's projects can impact local ecosystems and biodiversity, requiring adherence to environmental impact assessments and conservation guidelines, as seen in its Pakistan operations. Mitigation strategies, such as careful site selection and habitat restoration programs, are essential for balancing energy production with environmental protection.

PESTLE Analysis Data Sources

Our OPC Energy PESTLE analysis is built upon a robust foundation of data, drawing from official government reports, international energy agencies, and reputable market research firms. We meticulously gather information on energy policies, economic trends, technological advancements, and socio-environmental factors.