OPC Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OPC Energy Bundle

OPC Energy operates within a dynamic energy sector, facing significant pressures that shape its competitive landscape. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic planning. For instance, the capital-intensive nature of the energy industry can deter new players, yet evolving technologies constantly introduce potential disruptors.

The full report reveals the real forces shaping OPC Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

OPC Energy's reliance on natural gas for conventional power generation, especially in Israel, means the bargaining power of its suppliers is a critical factor. Key domestic fields like Karish and Leviathan are supplied by a limited number of major players, including Energean and Chevron.

This concentration allows these suppliers, such as Energean which operates the Karish field, to wield significant influence over pricing and contract terms. Long-term gas sale agreements, often valued in the billions of dollars, underscore the substantial leverage these concentrated suppliers possess in negotiating with OPC Energy.

The power generation sector leans heavily on specialized equipment like turbines and advanced control systems. Suppliers of these essential components, including giants like Siemens Energy and General Electric, wield considerable influence. This is largely due to the substantial financial and operational hurdles involved in switching providers, coupled with the unique, often proprietary, nature of their technology offerings.

Developing and operating power plants requires substantial capital, making reliable access to financing a critical factor for companies like OPC Energy. Suppliers of capital, such as banks and investment funds, hold significant bargaining power because their funding is essential for project viability.

These financial institutions can influence project terms and interest rates, directly impacting profitability and operational flexibility. For instance, the American fund’s investment of $300 million in OPC’s renewable energy projects in 2023 underscores the leverage these capital providers possess in shaping project development and financial structures.

Skilled Labor and Expertise

The operation and maintenance of complex power plants, whether conventional or renewable, absolutely require a workforce with specialized skills. This includes everything from engineers and technicians to project managers. A shortage of this kind of expertise can directly lead to higher wage demands, giving these professionals more leverage when negotiating with companies like OPC Energy.

This bargaining power is amplified by the fact that the power sector is increasingly reliant on advanced technologies. For instance, in 2024, the demand for specialized renewable energy technicians, particularly in solar and wind installation and maintenance, saw significant growth. This scarcity means companies must compete more intensely for talent, potentially driving up labor costs.

- Skilled workforce essential: Power plant operations necessitate engineers, technicians, and project managers.

- Limited supply drives costs: A scarcity of specialized labor increases wage expenses.

- Technological reliance: Advanced technologies in the power sector further elevate the demand for skilled professionals.

- Competitive talent market: Companies face increased competition for specialized talent, impacting labor costs.

Land Availability and Permitting

For new power plant developments, especially renewables like solar farms, securing suitable land and obtaining permits are crucial hurdles. Limited land availability, particularly in densely populated areas such as Israel, coupled with intricate regulatory processes, can significantly inflate costs and extend project timelines. This dynamic grants landowners and regulatory bodies increased bargaining power, impacting the overall cost structure for companies like OPC Energy.

In 2024, the scarcity of prime land for large-scale renewable projects in Israel remains a significant challenge. The permitting process, often involving multiple government agencies and environmental impact assessments, can add years to development schedules. This extended timeline and the inherent uncertainty of approvals empower local authorities and landowners, allowing them to negotiate more favorable terms for land leases or sales, ultimately enhancing their bargaining power.

- Land Scarcity: Limited suitable land for new power plant development in Israel, particularly for large renewable projects, increases landowner leverage.

- Regulatory Complexity: Israel's intricate permitting processes for energy infrastructure can add significant time and cost, strengthening the hand of regulatory bodies.

- Increased Project Costs: The combined effect of land scarcity and complex regulations translates to higher upfront development costs for companies like OPC Energy.

- Negotiating Power: Landowners and regulatory agencies gain greater bargaining power, influencing lease agreements, land prices, and project approval conditions.

OPC Energy's reliance on a concentrated supply of natural gas, primarily from domestic fields, grants significant leverage to suppliers like Energean and Chevron. These key players dictate terms in long-term agreements, often valued in the billions, directly impacting OPC's operational costs and profitability.

Suppliers of specialized power generation equipment, such as Siemens Energy and General Electric, also hold considerable sway. The high switching costs and proprietary nature of their technology mean OPC Energy faces limited alternatives, strengthening supplier bargaining power.

Capital providers, including banks and investment funds, possess substantial influence. Their financing is crucial for project development, enabling them to negotiate favorable terms and interest rates, as seen with a $300 million investment in OPC's renewable projects in 2023.

The scarcity of skilled labor in the power sector, particularly for advanced renewable technologies, amplifies the bargaining power of the workforce. In 2024, this demand for specialized technicians drove up wage expectations, impacting labor costs for companies like OPC Energy.

Limited land availability and complex permitting processes in Israel, especially for renewable projects, empower landowners and regulatory bodies. This dynamic increases development costs and project timelines for OPC Energy, enhancing the bargaining power of these entities.

| Supplier Type | Key Players | Impact on OPC Energy | Key Factors | 2024 Context |

|---|---|---|---|---|

| Natural Gas | Energean, Chevron | Pricing and contract terms | Concentrated supply, long-term agreements | Continued reliance on domestic fields |

| Specialized Equipment | Siemens Energy, GE | Cost of essential components | High switching costs, proprietary technology | Ongoing demand for advanced turbines |

| Capital Providers | Banks, Investment Funds | Project financing terms, interest rates | Essential for project viability | $300M renewable investment in 2023 |

| Skilled Workforce | Engineers, Technicians | Labor costs | Scarcity of specialized skills | High demand for renewable technicians |

| Land & Permits | Landowners, Regulatory Bodies | Development costs, project timelines | Land scarcity, complex regulations | Permitting delays for renewable projects |

What is included in the product

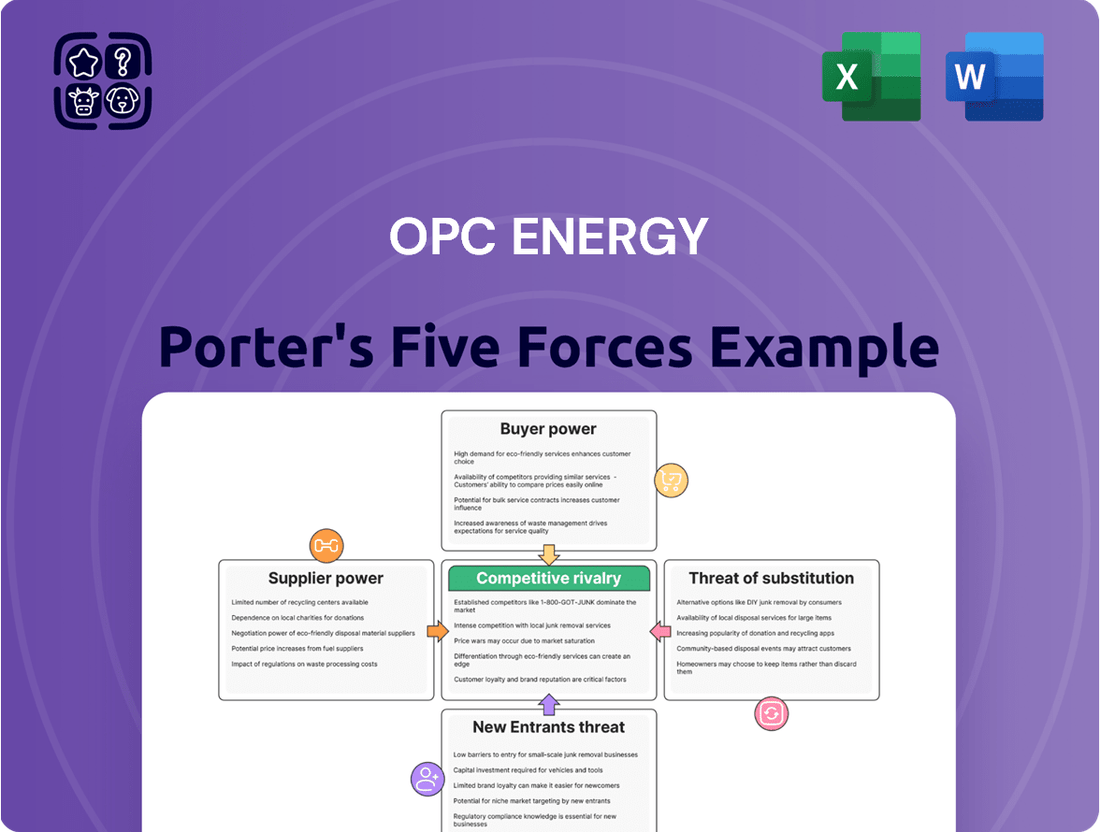

Analyzes the competitive intensity within the energy sector, focusing on OPC Energy's specific market position by examining supplier power, buyer bargaining, new entrant threats, substitute products, and existing rivalries.

Instantly identify and mitigate competitive threats with a clear, visual breakdown of Porter's Five Forces for OPC Energy.

Streamline strategic planning by pinpointing key areas of pressure and opportunity within the energy sector.

Customers Bargaining Power

OPC Energy benefits from a broad customer spectrum, encompassing industrial, commercial, and governmental sectors. This diversity helps mitigate the risk associated with over-reliance on any single customer segment. As of 2024, the growing demand for electricity, especially in the United States driven by expansions in data centers and reshoring manufacturing, suggests a tightening market. This increased demand can empower suppliers like OPC Energy by making customers more reliant on securing power, thus potentially diminishing their bargaining leverage.

For many end-users, electricity is essentially a commodity. This means that switching between different electricity providers, where such options exist, often incurs minimal costs. This low barrier to entry for consumers empowers them to be more price-sensitive, directly impacting how they negotiate rates with Independent Power Producers (IPPs) like OPC Energy.

In deregulated electricity markets, this ease of switching significantly amplifies the bargaining power of customers. They can readily compare offers and move to providers with more favorable pricing. For instance, in regions with active retail electricity markets, customer churn rates can provide an indicator of this power, with some markets seeing annual churn rates exceeding 10% among residential customers as of 2024.

Regulatory oversight significantly impacts customer bargaining power in the energy sector. In many jurisdictions, government agencies set or cap electricity prices to ensure affordability for consumers. For instance, in some European markets where OPC Energy operates as an Independent Power Producer (IPP), price caps implemented in 2024 to mitigate high energy costs directly limited the company's ability to pass on all costs to customers, thereby enhancing customer bargaining power.

These regulatory frameworks, even in competitive markets, can restrict OPC Energy's pricing flexibility. While OPC aims to compete on price and efficiency, the presence of regulated tariffs can create a ceiling on what customers are willing or able to pay. This can reduce the overall profitability of projects if OPC cannot adjust prices to reflect market conditions or operational costs, effectively strengthening the customer's position by ensuring a baseline level of affordability.

Potential for Self-Generation and Distributed Energy Resources

Large industrial and commercial customers can significantly influence OPC Energy's pricing and service terms by exploring self-generation options. For instance, the increasing affordability of rooftop solar installations means a large factory could offset a portion of its electricity demand. This ability to generate their own power, or access it through distributed energy resources (DERs), creates a credible threat of switching away from OPC Energy, thereby strengthening the customers' bargaining position.

The potential for customers to invest in their own energy solutions directly impacts OPC Energy's market power. As of 2024, the cost of solar photovoltaic (PV) systems has continued to decline, making onsite generation a more attractive proposition for businesses looking to control energy expenses. This trend is supported by government incentives and technological advancements in battery storage, further empowering customers with viable alternatives to traditional grid supply.

- Reduced Reliance: Customers generating their own power decrease their dependence on OPC Energy, giving them leverage in negotiations.

- Cost Control: Self-generation offers a predictable energy cost, contrasting with potentially volatile grid prices.

- Technological Advancements: Innovations in solar efficiency and battery storage make DERs increasingly competitive with grid electricity.

- Market Trends: Corporate power purchase agreements (PPAs) for renewable energy are growing, demonstrating customer willingness to invest in alternative supply.

Long-Term Power Purchase Agreements (PPAs)

OPC Energy’s long-term Power Purchase Agreements (PPAs) significantly shape customer bargaining power. While these agreements offer revenue predictability, they also fix prices, limiting immediate negotiation flexibility for customers. However, the initial terms of these substantial contracts are heavily influenced by the considerable leverage held by large-volume electricity buyers.

- Long-Term PPA Influence: OPC Energy’s PPAs, often spanning decades, provide a stable revenue stream but also lock in pricing for customers.

- Initial Negotiation Leverage: Large industrial or commercial customers possess significant bargaining power during the initial negotiation phase of these long-term contracts.

- Price Sensitivity: For customers with substantial energy consumption, securing favorable, predictable pricing through PPAs is a critical negotiation point.

- Reduced Immediate Power: Once a PPA is executed, the customer’s immediate bargaining power regarding price is substantially reduced for the duration of the agreement.

The bargaining power of customers for OPC Energy is influenced by the commodity nature of electricity and the ease of switching providers in deregulated markets. As of 2024, customer churn rates in some markets exceeding 10% highlight this leverage, with price sensitivity being a key factor in negotiations.

Regulatory price caps, such as those seen in some European markets in 2024, directly limit OPC Energy's ability to adjust prices, thereby strengthening customer positions. Furthermore, the increasing viability of self-generation options, driven by falling solar PV costs and battery storage advancements, presents a credible threat for large customers to switch, enhancing their bargaining power.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024) |

| Commodity Nature of Electricity | High; customers are price-sensitive. | Minimal switching costs for consumers in many markets. |

| Ease of Switching (Deregulated Markets) | High; customers can compare and move providers. | Annual churn rates exceeding 10% in some retail electricity markets. |

| Regulatory Price Caps | High; limits supplier pricing flexibility. | European markets implemented price caps to mitigate high energy costs. |

| Self-Generation Options (DERs) | Moderate to High; credible threat of switching. | Declining solar PV costs; increased investment in battery storage. |

Same Document Delivered

OPC Energy Porter's Five Forces Analysis

This preview showcases the complete OPC Energy Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape within the energy sector. What you see here is the exact, professionally formatted document you will receive immediately after purchase, ensuring full transparency and immediate usability. This detailed analysis will equip you with a thorough understanding of the industry's competitive intensity, supplier and buyer power, the threat of new entrants, and the availability of substitutes, all presented in the final version you are currently viewing.

Rivalry Among Competitors

The independent power producer (IPP) market, particularly in Israel and the United States, is characterized by intense rivalry among numerous participants. This fragmentation means companies like OPC Energy face many competitors, all striving to capture market share and secure profitable projects.

In Israel, this competitive landscape has intensified significantly. By early 2024, private producers, encompassing both traditional IPPs and renewable energy sources, now account for over 50% of the total grid-connected capacity. This shift means more players are competing for new project development opportunities and vying for existing electricity supply contracts.

Electricity's nature as a largely undifferentiated commodity means that companies, including OPC Energy, must compete fiercely on price and reliability. This commoditization drives intense rivalry, forcing players to constantly refine their cost structures and operational efficiency to stay ahead. For instance, in 2024, the volatility in global energy prices underscores the critical need for robust cost management strategies within the sector.

The power generation sector, including companies like OPC Energy, operates with substantial fixed costs. Building a power plant, for instance, can easily run into billions of dollars, creating significant capital investment. These high upfront expenses mean that once a plant is operational, companies have a strong incentive to keep it running to recoup their investment, even if market conditions are unfavorable.

These high fixed costs directly translate into high exit barriers. It's not as simple as shutting down a small business; decommissioning a power plant involves complex regulations and costs. This inability to easily exit the market forces companies to compete fiercely to maintain market share and generate revenue, intensifying rivalry among existing players as they all aim to cover their substantial operational and capital expenditures.

For example, in 2024, the global average cost to build a new utility-scale solar farm can range from $1 million to $2 million per megawatt, while a new natural gas power plant can cost upwards of $1,500 per kilowatt. These figures highlight the immense capital commitment, making it extremely difficult and costly for companies to leave the industry, thereby perpetuating intense competition.

Government Policies and Energy Transition Goals

Government policies significantly influence the energy sector, creating both challenges and opportunities for Independent Power Producers (IPPs) like OPC Energy. Initiatives aimed at transitioning away from fossil fuels and towards renewable energy sources are a prime example of this dynamic. For instance, Israel, where OPC Energy has a significant presence, has set ambitious targets, aiming for 30% of its electricity to come from renewable sources by 2030. This policy directive directly impacts competitive rivalry by fostering a surge in demand for renewable energy projects.

This policy-driven shift intensifies competition among IPPs vying for renewable energy tenders. Companies are compelled to innovate and optimize their offerings to secure these crucial contracts. Furthermore, the race for grid connection approvals becomes a critical bottleneck, adding another layer of competition as limited grid capacity means not all projects can be accommodated, impacting market entry and expansion for all players.

The competitive rivalry is further shaped by:

- Government subsidies and incentives for renewable energy projects, which attract new entrants and encourage existing players to expand their renewable portfolios.

- Regulatory frameworks governing grid access and energy market participation, which can favor certain technologies or project sizes, thereby influencing competitive dynamics.

- International climate agreements and national decarbonization targets, which set the long-term direction for energy policy and directly impact investment decisions and competitive strategies of IPPs.

- The pace of technological advancements in renewables and energy storage, often spurred by government research and development funding, which can quickly alter the competitive landscape by making certain solutions more viable and cost-effective.

Expansion and Acquisition Strategies

Competitors in the power sector are aggressively expanding their operations, both through developing new energy projects and by acquiring existing ones. This trend is particularly evident in the US power and utilities sector, where mergers and acquisitions (M&A) activity has been robust, with notable deals continuing into 2024 and projected to remain strong through 2025. This heightened M&A landscape means that rivals, including other independent power producers (IPPs), are consistently growing their capacity and market share, intensifying overall competition for OPC Energy.

The drive for expansion and consolidation among power sector players directly fuels competitive rivalry. For instance, in early 2024, reports indicated a significant uptick in M&A discussions within the US utilities space, signaling a strategic push for scale. This aggressive growth strategy by competitors means OPC Energy faces a market where rivals are not only building new capacity but also actively consolidating market positions, creating a more concentrated and competitive environment.

- Increased M&A Activity: The US power and utilities sector saw substantial M&A deals in late 2023 and throughout 2024, with projections for continued activity in 2025.

- Portfolio Expansion: Competitors are actively developing new power generation projects, adding to overall market supply and increasing competitive pressure.

- Market Consolidation: Strategic acquisitions by larger players aim to create economies of scale and broaden geographic reach, directly impacting market concentration.

- Intensified Rivalry: The combined effect of new developments and acquisitions by rivals heightens the competitive landscape for all participants, including OPC Energy.

Competitive rivalry is fierce in the independent power producer (IPP) market, with OPC Energy facing numerous competitors, especially in Israel and the US. The market fragmentation and the commoditized nature of electricity force companies to compete intensely on price and reliability, pushing for cost efficiency. High fixed costs and exit barriers inherent in power generation further compel existing players to maintain market share, intensifying competition.

| Market Trend | Impact on Rivalry | Example Data (2024/2025) |

|---|---|---|

| Market Fragmentation | Increased number of players vying for projects and contracts. | Over 50% of Israeli grid-connected capacity held by private producers (early 2024). |

| Commoditization of Electricity | Intense price and reliability competition. | Volatility in global energy prices underscores need for robust cost management. |

| High Fixed Costs & Exit Barriers | Incentive to operate at capacity, leading to sustained competition. | Global average cost to build utility-scale solar: $1M-$2M/MW; Natural gas plant: >$1,500/kW. |

| Renewable Energy Push | Growth in renewable projects attracts more competitors. | Israel's target of 30% renewable electricity by 2030 drives competition for renewable tenders. |

| Mergers & Acquisitions (M&A) | Consolidation and expansion by rivals heighten competitive pressure. | Robust M&A activity in US power and utilities sector continued through 2024, projected strong for 2025. |

SSubstitutes Threaten

The escalating adoption of distributed generation (DG) presents a considerable threat to traditional energy providers like OPC Energy. For instance, in 2024, residential solar installations continued their upward trajectory, driven by falling panel costs and favorable net metering policies in many regions, allowing consumers to generate their own power and reduce reliance on the grid.

Government incentives, including tax credits and rebates, further sweetened the deal for DG adoption throughout 2024, making it a more financially viable alternative for both homeowners and businesses. This trend directly impacts OPC Energy by potentially reducing overall electricity demand from these customer segments.

Technological advancements in battery storage in 2024 also amplified the threat, enabling consumers to store excess solar energy for later use, further decreasing their dependence on utility-provided electricity, especially during peak demand hours.

Improvements in energy efficiency and the growing adoption of demand-side management strategies present a significant threat of substitutes for traditional power generation companies like OPC Energy. As consumers and industries become more adept at reducing their energy usage, the need for new or increased electricity supply diminishes.

For instance, by 2024, many nations have seen substantial gains in building insulation and smart grid technologies, which directly curb electricity demand. This trend means that energy saved through efficiency measures effectively acts as a substitute for the energy OPC Energy might otherwise sell.

Consider the impact of smart thermostats and energy-efficient appliances; these technologies empower consumers to manage and reduce their consumption, thereby lessening their reliance on grid-supplied power. This reduction in overall demand translates to a direct competitive pressure on power producers.

The International Energy Agency reported in 2024 that energy efficiency measures continue to be a crucial tool in meeting climate goals, further highlighting its role as a substitute for new energy infrastructure development. This means less investment might be directed towards new power plants if existing capacity can be managed more effectively through demand reduction.

The rapid advancement and widespread adoption of battery energy storage systems present a significant threat of substitution for traditional grid electricity providers like OPC Energy. These systems, particularly large-scale installations, empower consumers to store energy, thereby reducing their reliance on the grid, especially during peak demand periods. By 2024, global battery energy storage deployment is projected to reach over 100 GW, a substantial increase from previous years, indicating a growing capacity for consumers to self-supply.

This growing capability for energy self-sufficiency, driven by falling battery costs and improved performance, directly challenges the revenue streams of conventional power generation and distribution. As consumers integrate intermittent renewable sources with storage, they can further decouple from grid services, diminishing the value proposition of constant grid power. The International Energy Agency reported a record 40 GW of energy storage capacity added globally in 2023 alone, underscoring the accelerating shift towards decentralized energy solutions.

Alternative Fuel Sources for Self-Generation

While OPC Energy focuses on natural gas and renewable energy sources, customers with critical power requirements may turn to alternative backup fuel sources for self-generation. Diesel generators, for instance, offer an independent power supply, allowing users to bypass grid providers during outages or to meet specific operational demands.

This threat is particularly relevant for businesses that cannot afford any downtime. For example, data centers or hospitals often maintain on-site backup generation capabilities. In 2023, the global backup power market, which includes diesel generators, was valued at approximately $25 billion, indicating a substantial existing infrastructure and customer willingness to invest in alternative power solutions.

- Market Size: The global backup power market, a key area for substitute fuels, reached roughly $25 billion in 2023.

- Customer Adoption: Industries with critical uptime needs, such as data centers and healthcare, are primary adopters of self-generation alternatives like diesel.

- Operational Independence: These substitutes provide a crucial layer of energy security, ensuring continuous operation regardless of grid stability.

- Cost Considerations: While upfront costs for generators can be significant, the cost of lost revenue due to power outages can often justify the investment for these users.

Emergence of Microgrids and Off-Grid Solutions

The rise of microgrids and self-sufficient off-grid power systems presents a significant threat of substitution for traditional, centralized power utilities like OPC Energy. These localized solutions, often utilizing renewable energy sources, offer greater independence from the main grid, particularly appealing for industrial parks and remote areas seeking reliable and sometimes cheaper power. As of 2024, the global microgrid market is projected to reach substantial figures, indicating a growing adoption rate. For instance, the market size was estimated to be around $30 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 15% in the coming years.

This shift allows end-users to bypass conventional power purchase agreements and invest directly in their own generation and distribution infrastructure. This trend is fueled by advancements in battery storage technology and the decreasing cost of solar and wind power, making localized generation more economically viable. Consider the impact on large industrial consumers; they can potentially achieve greater cost predictability and energy security by investing in a microgrid, thereby reducing their reliance on utility-provided electricity.

- Growing Market: The global microgrid market size was approximately $30 billion in 2023 and is anticipated to expand significantly by 2030.

- Renewable Integration: Microgrids increasingly integrate solar PV and wind power, offering a cleaner alternative to traditional fossil fuel-based generation.

- Cost Savings: For industrial users, microgrids can lead to an estimated 10-20% reduction in energy costs by optimizing generation and consumption.

- Energy Independence: Off-grid solutions provide critical energy security for remote communities and industrial facilities, mitigating risks associated with grid instability.

The increasing adoption of distributed generation, powered by falling solar panel costs and supportive policies throughout 2024, allows consumers to generate their own electricity, directly reducing demand for utility-supplied power. This trend, coupled with advancements in battery storage, further enhances self-sufficiency, as seen by the record 40 GW of energy storage capacity added globally in 2023, enabling greater independence from grid providers.

Furthermore, improvements in energy efficiency and demand-side management, such as smart thermostats and better building insulation, effectively act as substitutes by curbing overall electricity consumption. The International Energy Agency highlighted energy efficiency as a key tool for climate goals in 2024, underscoring its role in reducing the need for new power infrastructure.

The backup power market, valued at approximately $25 billion in 2023, demonstrates customer willingness to invest in self-generation, particularly for critical industries like data centers and healthcare, to ensure operational continuity.

The microgrid market, projected to reach around $30 billion in 2023, offers localized, often renewable-powered, energy solutions that can bypass traditional grid providers, providing cost savings and enhanced energy security for industrial users.

| Substitute Technology | 2023 Market Value (Approx.) | Key Driver | Impact on Utilities |

|---|---|---|---|

| Distributed Generation (Solar) | N/A (Component of broader markets) | Falling panel costs, government incentives | Reduced grid demand |

| Battery Energy Storage Systems | $150 Billion+ (Global Energy Storage Market) | Cost reduction, performance improvement | Decreased reliance on grid power |

| Backup Power (e.g., Diesel Generators) | $25 Billion | Need for operational independence, uptime assurance | Bypass for critical users |

| Microgrids | $30 Billion | Renewable integration, cost predictability | Customer disintermediation |

Entrants Threaten

The power generation industry, including players like OPC Energy, demands immense capital outlays for plant development and construction, presenting a formidable barrier to newcomers. These projects frequently necessitate investments running into billions of dollars, making it exceptionally challenging for new entrants to achieve the scale needed to rival established independent power producers (IPPs).

New companies entering the energy sector, like OPC Energy, must navigate a labyrinth of complex regulations and permitting requirements. This includes securing numerous licenses, environmental impact assessments, and crucial grid interconnection approvals, especially in markets with established utility structures.

These bureaucratic processes are not only lengthy but also financially burdensome, frequently causing significant project delays and amplifying the inherent risks for any new player attempting to establish a foothold.

For instance, in 2024, the average time to obtain all necessary permits for new renewable energy projects in many developed nations often exceeded 18-24 months, with associated costs frequently running into millions of dollars, acting as a substantial barrier to entry.

Connecting new power generation facilities to the existing electricity grid is a significant hurdle for potential entrants. This process demands substantial investment in transmission infrastructure, and new projects often face lengthy interconnection queues, delaying their operational start. For instance, in the US, the Federal Energy Regulatory Commission (FERC) reported that as of December 2023, the interconnection queue had grown to over 18,000 projects totaling more than 2 terawatts of capacity, highlighting the extensive wait times and complexity involved.

Established energy companies benefit from existing, fully operational grid connections and often possess preferential access rights, which act as a substantial barrier to entry. These incumbents have already made the necessary capital expenditures and navigate the regulatory landscape with established relationships. The cost and time associated with securing new interconnection agreements can be prohibitive for smaller or newer companies looking to enter the market.

Established Player Dominance and Experience

Established independent power producers and traditional utilities boast significant operational experience and deeply entrenched customer relationships. This long history allows them to leverage economies of scale, making it difficult for newcomers to quickly capture market share. For example, in 2024, the top five utility companies in the United States accounted for over 60% of the nation's electricity generation capacity, highlighting their considerable dominance.

Their established infrastructure and proven track record provide a substantial barrier to entry. New entrants often struggle to match the capital resources and operational efficiencies that incumbents have cultivated over decades. This ingrained advantage translates into lower per-unit production costs for established players, a hurdle that new, smaller operations find challenging to overcome.

- Deep Operational Experience: Incumbents have decades of hands-on knowledge in power generation and distribution.

- Established Customer Base: Long-standing relationships with consumers and businesses create a stable revenue stream.

- Economies of Scale: Larger operational capacity leads to lower per-unit costs, enhancing price competitiveness.

- Capital Intensity: The high cost of building new power infrastructure favors companies with substantial financial backing.

Uncertainty in Policy and Market Dynamics

The energy sector, particularly for companies like OPC Energy, faces significant uncertainty due to rapidly changing government policies and global energy transition mandates. This dynamic environment makes it challenging for potential new entrants to accurately forecast long-term profitability and justify substantial investments. For instance, shifts in renewable energy subsidies or carbon pricing mechanisms can dramatically alter the viability of new projects.

Geopolitical influences further compound this uncertainty. Fluctuations in global energy prices, driven by international relations and supply disruptions, can create volatile market conditions. New companies entering the fray must contend with the risk that political instability or trade disputes could undermine their carefully laid business plans, especially when considering the lengthy payback periods typical in energy infrastructure.

- Policy Volatility: Government incentives for renewables, carbon taxes, and energy efficiency standards are subject to frequent revision, creating an unpredictable landscape for new energy ventures.

- Geopolitical Risks: International conflicts and trade tensions can impact fuel prices and supply chains, introducing significant operational and financial risks for new market participants.

- Energy Transition Pace: The speed at which countries adopt cleaner energy sources varies, making it difficult for new entrants to align their investment strategies with future market demand and regulatory frameworks.

- Investment Horizon: The long-term nature of energy projects means new entrants must commit capital years in advance, facing the challenge of projecting market conditions and policy environments over extended periods.

The threat of new entrants for companies like OPC Energy is generally moderate to low, primarily due to the immense capital requirements and complex regulatory landscape inherent in the power generation sector. High upfront investment, often in the billions, and the lengthy, costly process of obtaining permits and grid connections create substantial barriers. Furthermore, established players benefit from economies of scale and deep operational experience, making it difficult for newcomers to compete effectively on price and reliability.

| Barrier | Description | Impact on New Entrants |

| Capital Intensity | Power plant development requires billions in investment. | Very High Barrier |

| Regulatory Hurdles | Complex permits, licenses, and grid interconnection. | High Barrier |

| Economies of Scale | Established firms have lower per-unit costs. | Moderate to High Barrier |

| Operational Experience | Decades of expertise provide a competitive edge. | Moderate Barrier |

Porter's Five Forces Analysis Data Sources

Our OPC Energy Porter's Five Forces analysis leverages data from industry-specific trade journals, company annual reports, and energy market intelligence platforms. These sources provide insights into market concentration, technological advancements, and regulatory landscapes.