OPC Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OPC Energy Bundle

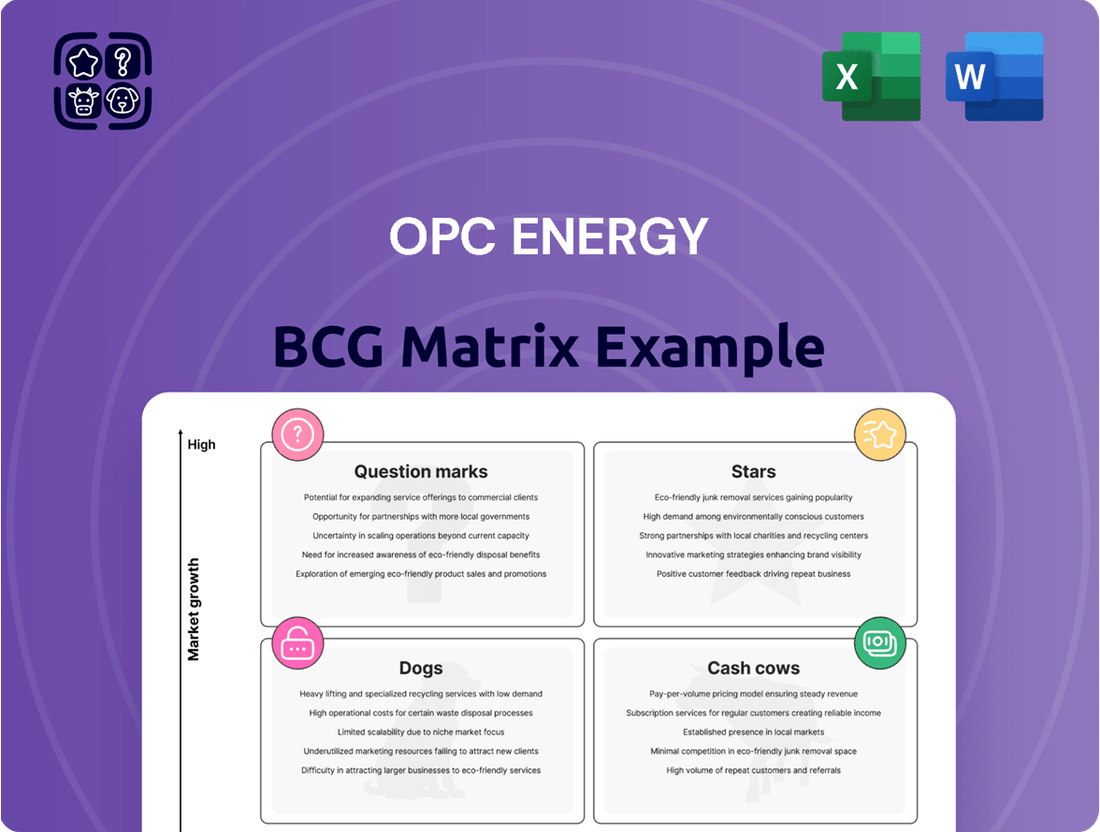

Unlock the strategic potential of OPC Energy with a comprehensive BCG Matrix analysis. This preview offers a glimpse into how their diverse portfolio is positioned, highlighting areas of rapid growth and established stability. Understanding these dynamics is crucial for any investor or stakeholder looking to capitalize on OPC Energy's market presence.

This initial overview merely scratches the surface of OPC Energy's strategic landscape. For a complete and actionable understanding of their Stars, Cash Cows, Dogs, and Question Marks, purchase the full BCG Matrix report. It’s your essential guide to informed decision-making.

Stars

OPC Energy is significantly bolstering its renewable energy presence in the United States, a strategic move reflecting the sector's robust expansion. This commitment is validated by a substantial $300 million investment from an American fund in August 2024, a clear signal of confidence in OPC's growth trajectory within the U.S. renewable energy market.

The company's leadership anticipates sustained growth, largely fueled by the increasing demand for electricity. This surge is primarily driven by energy-intensive sectors like data centers and other industrial operations, which require reliable and increasingly green power sources.

The Rogue's Wind Project, an 114 MW wind power plant in Pennsylvania, began construction in August 2024. This project, fully owned by OPC's subsidiary CPV, is a significant addition to the booming US wind energy sector.

OPC Energy's investment in Rogue's Wind highlights its strategy to capture growth in renewable energy markets. This project is poised to solidify OPC's presence and competitive advantage in a key high-growth area.

The 179 MW Backbone Solar Project in Maryland, expected to begin operations in 2025, represents a significant move for OPC Energy into the utility-scale solar generation market. This project is positioned in a high-growth sector, aiming to expand OPC's market presence.

A key indicator of its potential is the binding agreement secured in October 2024 with a tax partner, bringing in approximately $116 million in investment. This substantial financial backing underscores the project's viability and OPC's strategic commitment.

Ramat Beka Solar with Storage (Israel)

OPC Energy is strategically developing the Ramat Beka Solar with Storage project in Israel. This ambitious undertaking features a significant renewable energy capacity of approximately 505 MW for electricity generation, complemented by a substantial 2,760 MWh of energy storage. The project represents a significant move into Israel's dynamic renewable energy sector.

The commitment to Ramat Beka was underscored by an initial payment made in September 2024 for land rights. This investment highlights the forward-looking nature of the project and OPC Energy's dedication to securing a strong market position.

- Project Capacity: 505 MW solar, 2,760 MWh storage.

- Land Rights Secured: September 2024.

- Strategic Focus: Capturing share in Israel's growing renewable energy market.

Strategic Investment in CPV Renewables

Strategic investment in CPV Renewables positions OPC Energy's renewable energy segment as a strong contender within the BCG matrix. This strategic move, finalized in August 2024 with binding agreements totaling $300 million for a 33.3% stake, underscores significant investor confidence. The pre-money valuation of $600 million reflects the high growth potential OPC sees in its US renewable energy operations.

This influx of capital is specifically earmarked to accelerate CPV Renewables' expansion and enhance its market penetration in the rapidly growing clean energy sector. The investment is a clear indicator of the company's forward-looking strategy to capitalize on the global shift towards sustainable energy sources.

- Investment Amount: $300 million secured in August 2024.

- Stake Acquired: 33.3% ordinary rights stake in CPV Renewables.

- Valuation: Based on a pre-money valuation of $600 million.

- Strategic Objective: Fuels rapid expansion and market penetration in the US renewable energy sector.

OPC Energy's renewable energy projects, such as the Rogue's Wind Project and the Backbone Solar Project, are prime examples of its Stars within the BCG matrix. These ventures are in high-growth markets with strong competitive positions, generating significant revenue and requiring substantial investment to maintain their growth trajectory.

The substantial $300 million investment from an American fund in August 2024, alongside the $116 million from a tax partner for the Backbone Solar Project in October 2024, highlights the high growth and cash flow characteristics of these Star assets.

These projects represent OPC Energy's strategic focus on capitalizing on the expanding renewable energy demand, particularly from energy-intensive sectors. Their significant capacity and ongoing development indicate a strong market presence and future revenue potential, justifying continued investment.

The company's commitment to these high-potential renewable assets solidifies their classification as Stars, demanding ongoing strategic resource allocation to sustain and expand their market leadership.

| Project | Capacity | Investment Secured (Approx.) | Status/Expected Operation |

|---|---|---|---|

| Rogue's Wind Project | 114 MW (Wind) | Included in $300M US fund investment | Construction started August 2024 |

| Backbone Solar Project | 179 MW (Solar) | $116 million (Tax Partner) | Expected to begin operations 2025 |

What is included in the product

The OPC Energy BCG Matrix visually categorizes business units by market share and growth, guiding strategic decisions for investment, divestment, or maintenance.

Clear, actionable insights from the OPC Energy BCG Matrix to identify and address underperforming business units.

Cash Cows

OPC Energy's established Israeli natural gas-fired power plants, including Rotem (466 MW), Hadera (144 MW), Zomer (396 MW), and Gat (75 MW), are its core Cash Cows. Rotem, operational since 2013, demonstrates the longevity of these assets, supplying electricity to over 20 private customers under long-term contracts.

These mature facilities are dependable generators of substantial and stable cash flow, reflecting a significant market share within Israel's conventional power generation sector. Their consistent performance underpins OPC Energy's financial stability and provides capital for investment in other business areas.

OPC Energy's Long-Term Power Purchase Agreements (PPAs) are a significant strength, acting as solid cash cows within its business portfolio. These agreements provide a predictable and stable revenue stream, insulating the company from market volatility. For example, the Rotem Power Plant benefits from PPAs with private customers, ensuring consistent demand for its energy output.

These long-term contracts, often spanning many years, are crucial for maintaining a high market share in the mature energy sector. They guarantee consistent cash generation, a hallmark of businesses with strong, established positions in essential industries. This stability allows OPC Energy to reliably fund its other ventures and strategic initiatives.

The refinanced Israeli power assets, specifically the Zomet and Gat power plants, represent OPC Energy's cash cows. In August 2024, OPC Holdings Israel secured refinancing for NIS 1.65 billion, primarily to pay down earlier project financing for these facilities. This successful refinancing underscores their robust cash-generating capabilities, allowing for optimized debt management and improved financial efficiency.

Intel Israel Power Plant MOU

OPC Energy's agreement with Intel Israel, signed in March 2024, positions this venture as a strong Cash Cow within its BCG Matrix. This non-binding MOU outlines the construction and operation of a 450-650 MW power plant, a substantial commitment with a 20-year duration.

This long-term contract with a major, expanding client like Intel guarantees a highly predictable and significant revenue stream for OPC Energy. It directly addresses a critical need for Intel's facilities, ensuring consistent demand and operational stability for the power plant.

- Projected Capacity: 450-650 MW

- Contract Duration: 20 years

- Announced: March 2024

- Customer: Intel Israel

Leading Private Electricity Manufacturer in Israel

OPC Energy's position as Israel's pioneering private electricity producer firmly places its operational power plants in the Cash Cows quadrant of the BCG matrix. This leadership status guarantees a substantial and consistent market share within a vital national infrastructure sector. The company's proven ability to maintain electricity supply, even during periods of national stress, highlights its dependable and strong cash flow generation. For instance, in 2023, OPC Energy reported significant revenue streams from its operational assets, contributing substantially to its overall financial performance, with a notable portion derived from its Israeli generation capacity.

- Market Dominance: First and leading private electricity manufacturer in Israel.

- Stable Market Share: High and consistent share due to essential service provision.

- Robust Cash Generation: Reliable income streams from operational power plants.

- Resilience: Ability to maintain supply during challenging times, ensuring continued revenue.

OPC Energy's established Israeli natural gas-fired power plants, including Rotem (466 MW), Hadera (144 MW), Zomer (396 MW), and Gat (75 MW), are its core Cash Cows. These mature facilities are dependable generators of substantial and stable cash flow, reflecting a significant market share within Israel's conventional power generation sector. Their consistent performance underpins OPC Energy's financial stability and provides capital for investment in other business areas.

The company's Long-Term Power Purchase Agreements (PPAs), such as those with private customers for the Rotem Power Plant, further solidify these assets as Cash Cows. These agreements provide a predictable and stable revenue stream, insulating OPC Energy from market volatility and guaranteeing consistent cash generation.

The refinanced Israeli power assets, specifically the Zomet and Gat power plants, with a NIS 1.65 billion refinancing in August 2024, highlight their robust cash-generating capabilities. This refinancing allows for optimized debt management and improved financial efficiency, further cementing their status as reliable cash cows.

OPC Energy's agreement with Intel Israel, signed in March 2024 for a 450-650 MW power plant with a 20-year duration, positions this venture as a strong Cash Cow. This long-term contract guarantees a highly predictable and significant revenue stream for OPC Energy.

| Asset | Capacity (MW) | Operational Since | Key Feature | BCG Quadrant |

|---|---|---|---|---|

| Rotem | 466 | 2013 | Long-term PPAs with private customers | Cash Cow |

| Hadera | 144 | Established | Core generation asset | Cash Cow |

| Zomer | 396 | Refinanced (Aug 2024) | Strong cash generation | Cash Cow |

| Gat | 75 | Refinanced (Aug 2024) | Strong cash generation | Cash Cow |

| Intel Israel Project | 450-650 (Projected) | Agreement Mar 2024 | 20-year contract with major client | Cash Cow |

What You See Is What You Get

OPC Energy BCG Matrix

The OPC Energy BCG Matrix preview you're viewing is precisely the same comprehensive document you'll receive after purchasing. This means you'll get the fully formatted, analysis-ready report, complete with all strategic insights and market data, without any watermarks or demo content. What you see is exactly what you'll download, enabling immediate application in your business planning and decision-making processes.

Dogs

Older, less efficient conventional assets within OPC Energy's portfolio, if any, would likely fall into the Dogs category of the BCG matrix. These might include aging fossil fuel power plants that are becoming increasingly expensive to maintain and operate, especially with stricter environmental compliance requirements. For instance, if OPC Energy has older coal or oil-fired plants, these could be facing declining market demand due to the global shift towards renewables and increasing carbon taxes. Their profitability might be marginal, potentially draining resources that could be better invested in newer, more efficient technologies.

Niche, non-scalable legacy projects within OPC Energy's portfolio likely represent older, smaller-scale operations with limited growth potential. These ventures, by their nature, may not be able to expand significantly or compete effectively in evolving energy markets. For instance, if OPC Energy has a few small, aging hydroelectric plants that are no longer cost-efficient to upgrade or expand, these would fall into this category.

These projects often tie up capital and management attention without contributing substantially to overall revenue or profit. Consider a scenario where OPC Energy operates a series of legacy diesel generators in remote areas that are becoming increasingly uneconomical to maintain compared to newer, more efficient technologies. Such assets might have a book value but generate minimal operating profit, perhaps even incurring losses.

The strategic imperative for these "dogs" is often divestiture or a planned phase-out. In 2024, the global energy sector saw continued investment shifts towards renewables and more efficient fossil fuel technologies. If OPC Energy's legacy projects don't align with these trends, they could represent a drag on financial performance, potentially hindering investment in more promising growth areas.

Within OPC Energy's US market expansion, smaller conventional power assets in intensely competitive regions that haven't secured substantial market share could be classified as Dogs. These assets might experience falling availability prices or face escalating competition from more modern, efficient facilities, hindering their ability to deliver satisfactory returns.

For instance, in 2024, the US power generation market saw continued pressure on older, less efficient plants due to the rapid integration of renewables and advancements in natural gas turbine technology. Assets with high operating costs and limited flexibility would likely be most vulnerable.

A strategic reassessment becomes crucial for these underperforming assets to prevent them from negatively impacting OPC's overall financial health. This could involve exploring divestiture, operational efficiency improvements, or repurposing if feasible.

Assets with Declining Demand or Regulatory Hurdles

Assets experiencing a persistent drop in demand or facing substantial regulatory challenges that render them unprofitable fall into this category. These are typically power plants operating in markets that are either stagnant or shrinking, with minimal potential for expansion. For example, coal-fired power plants in regions with aggressive decarbonization mandates, such as Germany which plans to phase out coal power by 2038, could be seen as facing declining demand and significant regulatory hurdles. Continued capital allocation to such facilities without a viable transition plan would be a misallocation of resources.

These assets are characterized by their placement in low-growth or declining markets and their limited capacity to increase their market share. Consider older, less efficient natural gas peaker plants that are increasingly being displaced by renewable energy sources and battery storage. In 2024, many such plants face uncertainty due to evolving grid needs and the push for cleaner energy alternatives, potentially leading to reduced operating hours and profitability.

- Declining Demand: Assets like aging fossil fuel plants face reduced electricity demand as renewables gain market share.

- Regulatory Hurdles: Stricter environmental regulations, such as carbon pricing or emissions caps, increase operating costs and can limit viability.

- Low Market Growth: Operating in markets with little to no expansion in electricity consumption limits revenue potential.

- Limited Market Share Gain: In mature or shrinking markets, capturing additional market share is challenging, further pressuring profitability.

Divested or Phased-Out Smaller Projects

While OPC Energy’s specific divested or phased-out projects aren't detailed in publicly available BCG Matrix analyses, companies of its scale often strategically exit smaller, underperforming ventures. These would fall into the Dogs quadrant, characterized by low market share and low growth potential. For instance, if OPC had invested in a small-scale renewable energy project in a region with declining demand or facing intense competition, it might have been a candidate for divestment.

The rationale behind phasing out or divesting such projects is to reallocate capital and management focus to more promising areas, preventing cash drain. Think of it like pruning a garden; you remove the weaker plants to allow the stronger ones to thrive. In 2024, energy companies are increasingly scrutinizing their portfolios for efficiency and profitability, making the identification and management of Dog assets a continuous process.

Consider the broader energy sector trends in 2024: a significant push towards digitalization and advanced grid technologies. Smaller, legacy projects that do not align with these forward-looking strategies, or require disproportionate investment to remain competitive, would logically be considered for divestment. Such a move allows OPC to concentrate resources on high-growth areas, potentially those identified as Stars or Cash Cows in their BCG Matrix.

- Potential Divestment Criteria: Projects with declining revenue streams, high operational costs, or those requiring substantial future investment with uncertain returns.

- Strategic Rationale: Freeing up capital for investment in higher-growth, more profitable segments of the energy market.

- Market Context (2024): Increased focus on energy transition technologies and digital infrastructure may render older, smaller-scale projects less viable.

- Financial Impact: Divestment can improve overall portfolio profitability and reduce exposure to low-return assets.

Older, less efficient conventional assets within OPC Energy's portfolio, particularly those with declining demand or facing significant regulatory hurdles, would be classified as Dogs. These might include aging fossil fuel power plants in markets with aggressive decarbonization mandates or legacy natural gas peaker plants increasingly displaced by renewables. In 2024, the global energy sector's shift towards cleaner technologies intensified pressure on such assets, making divestment or phase-out a strategic consideration to prevent capital drain.

These underperforming assets often tie up capital and management attention without contributing substantially to revenue or profit. For instance, smaller conventional power assets in intensely competitive US regions that haven't secured substantial market share in 2024 face falling availability prices and competition from modern facilities. Strategic reassessment is crucial to prevent these "dogs" from negatively impacting OPC's overall financial health.

The primary strategic imperative for these Dog assets is divestiture or a planned phase-out. Companies like OPC Energy often strategically exit smaller, underperforming ventures to reallocate capital to more promising areas. In 2024, the increased focus on energy transition technologies and digital infrastructure may render older, smaller-scale projects less viable, highlighting the need for continuous identification and management of Dog assets.

Assets in this category are typically characterized by low market share and low growth potential, often operating in stagnant or shrinking markets. For example, coal-fired power plants in regions with aggressive decarbonization mandates, like Germany's planned 2038 phase-out, face declining demand and significant regulatory challenges. Continued capital allocation to such facilities without a viable transition plan represents a misallocation of resources.

Question Marks

OPC Energy's early-stage renewable projects in the US, especially those targeting nascent or intensely competitive sub-markets, are classic examples of Question Marks in the BCG matrix. These ventures are positioned in high-growth renewable sectors, such as advanced solar or emerging offshore wind technologies, but they are still finding their footing. For instance, while the US solar market saw over 37 GW of new capacity installed in 2023, many niche technologies or regional deployments are still in their infancy.

These projects demand significant capital infusion and meticulous strategic planning to navigate uncertainties and build market presence. The goal is to determine if they possess the potential to transition into Stars, becoming market leaders. For example, a new geothermal energy project in a region previously dominated by fossil fuels would fall into this category, requiring substantial R&D and market development efforts.

The success hinges on OPC's ability to foster innovation and secure crucial partnerships, much like how early-stage battery storage projects are now pivotal in grid modernization efforts. By 2025, the global battery storage market is projected to reach hundreds of gigawatts, highlighting the potential for early movers in this space.

OPC Energy's involvement in the Block Energy CCS project in Georgia, focusing on geological studies for CO2 storage, positions it within the high-growth, emerging environmental technology sector. As a new entrant, OPC's market share in CCS is likely minimal at this stage.

Successful pilot CO2 injection, anticipated by mid-2025, will be a key determinant for OPC's future trajectory in this market. The significant investment required for such projects aligns with the characteristics of a Question Mark in the BCG Matrix, where potential is high but market share is low.

New geographic market entries at a small scale for OPC Energy, often initiated as pilot projects, represent their question marks. These are ventures into potentially high-growth regions where OPC is just beginning to establish a presence, holding a low market share currently. For instance, if OPC initiated a small-scale renewable energy project in Southeast Asia in early 2024, this would fit the question mark category.

These nascent operations require significant strategic evaluation and likely substantial investment to transition from low market share to a leading position. Consider a hypothetical situation where OPC Energy in 2024 began a limited solar farm development in a rapidly industrializing African nation. The initial investment might be modest, but the potential for future growth is considerable, provided the company can navigate local regulations and secure further funding to expand its operations.

Emerging Technologies in Energy Transition

OPC Energy's dedication to the energy transition extends to exploring nascent technologies that could reshape the energy landscape. Think beyond just solar and wind; this includes areas like advanced battery storage or sophisticated smart grid systems. These sectors often start with a small market share but hold immense promise for future growth, fitting the profile of question marks in a BCG matrix.

These exploratory ventures necessitate careful strategic evaluation. OPC Energy must decide whether to invest heavily to nurture these emerging technologies into market leaders or to divest if the potential doesn't materialize as anticipated. This strategic balancing act is crucial for long-term success.

- Advanced Energy Storage: The global energy storage market, including batteries, was projected to reach over $100 billion by 2025, with significant growth anticipated through 2030.

- Smart Grid Technologies: Investments in smart grid infrastructure are expected to exceed $600 billion globally by 2029, driven by the need for grid modernization and efficiency.

- Emerging Renewables: Technologies like green hydrogen and advanced geothermal are also gaining traction, offering new pathways for decarbonization.

- Market Potential: While current market penetration for many of these technologies is low, their potential to disrupt traditional energy systems is substantial.

Newly Acquired Smaller Power Plants

The acquisition of OPC Energy's 75 MW power plant in Kiryat Gat, Israel, could be classified as a Question Mark within the BCG matrix. This classification stems from its potential operation within a dynamic and competitive energy market where OPC's initial market share might be relatively small.

This 75 MW asset, acquired in recent years, likely faces the challenge of needing significant investment and strategic effort to solidify its market position. If the growth prospects of the specific energy segment it operates in are high, but its current market share is low, it fits the Question Mark profile, requiring careful consideration for future development.

- Asset: 75 MW power plant in Kiryat Gat, Israel.

- Potential BCG Classification: Question Mark.

- Reasoning: High market growth potential combined with a low initial market share for OPC Energy.

- Strategic Imperative: Requires investment and strategic integration to increase market share or profitability.

OPC Energy’s ventures into new, high-growth energy technologies or geographic markets, characterized by low initial market share, are prime examples of Question Marks. These initiatives, like early-stage green hydrogen projects or pilot deployments in emerging economies, require substantial investment to build market presence and overcome inherent uncertainties.

The strategic challenge lies in identifying which of these Question Marks have the potential to evolve into Stars, thereby securing future market leadership. For instance, a new battery storage facility in a region rapidly adopting renewable energy presents such an opportunity, demanding significant capital and strategic focus.

By 2025, the global green hydrogen market is expected to see substantial investment, highlighting the potential for early entrants that successfully navigate technological and market hurdles. Similarly, smart grid technologies, with global investments projected to exceed $600 billion by 2029, represent another area where OPC’s nascent projects could become significant players.

The success of these Question Marks hinges on OPC Energy’s ability to foster innovation, secure crucial partnerships, and make decisive capital allocation choices to either develop them into market leaders or divest if their potential proves limited.

BCG Matrix Data Sources

Our OPC Energy BCG Matrix is informed by a blend of financial disclosures, industry growth forecasts, and market trend analyses to provide strategic direction.