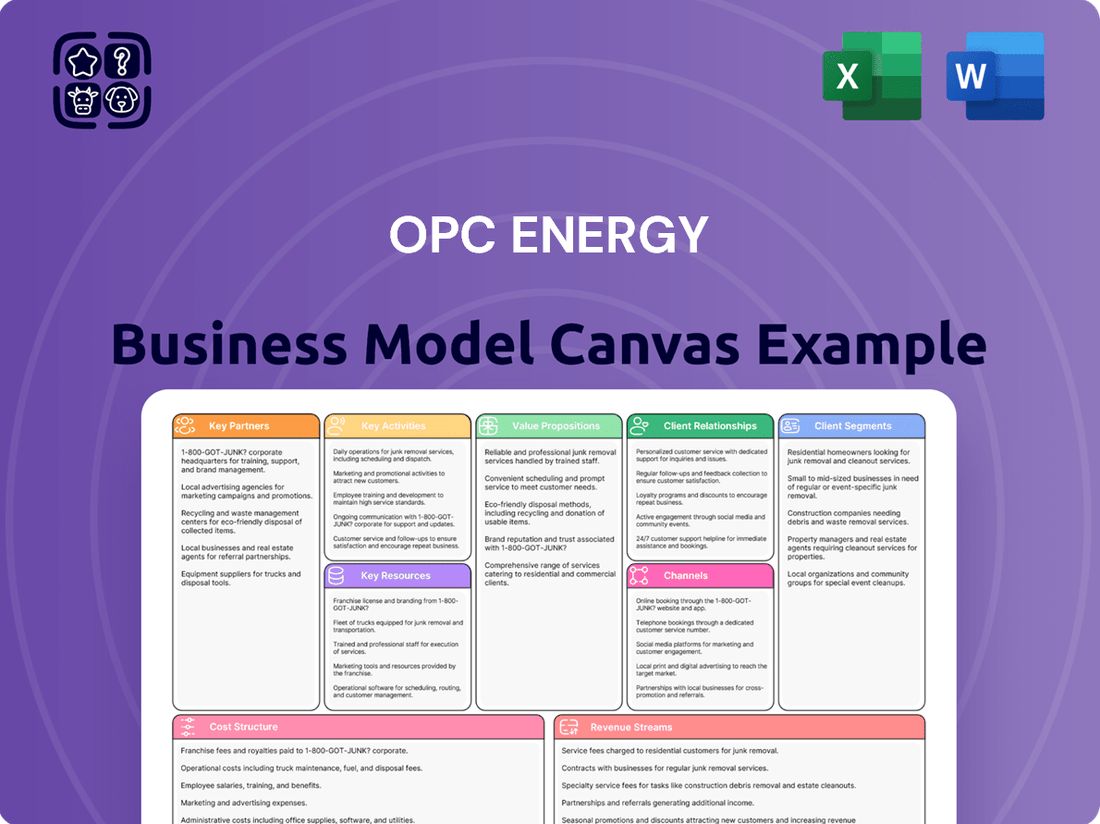

OPC Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OPC Energy Bundle

Unlock the strategic core of OPC Energy’s operations with its comprehensive Business Model Canvas. This detailed framework illuminates how OPC Energy effectively delivers value, manages resources, and builds crucial relationships within the energy sector. It’s a must-have for anyone seeking to understand the drivers of their success.

Dive deeper into OPC Energy’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

OPC Energy's business model heavily depends on strategic investors and financial institutions to secure the substantial capital needed for its ambitious power plant projects and acquisitions. These partnerships are vital for obtaining debt financing, equity investments, and specialized project funding, enabling expansion across both traditional and renewable energy segments. For instance, in 2024, OPC Energy successfully closed a significant debt financing round to support its ongoing renewable energy development pipeline, showcasing the critical role of these financial relationships.

OPC Energy relies heavily on partnerships with premier technology and equipment suppliers to secure advanced power generation assets. These collaborations are vital for sourcing cutting-edge components like high-efficiency gas turbines, advanced solar photovoltaic modules, and robust wind turbines, essential for maintaining operational excellence and competitiveness in the energy sector.

These strategic alliances ensure OPC Energy integrates state-of-the-art solutions, such as those enabling carbon capture readiness in new natural gas facilities, which directly supports the company’s commitment to environmental stewardship and long-term sustainability goals. For instance, in 2024, OPC Energy continued to prioritize partnerships with manufacturers offering the latest advancements in turbine efficiency, aiming to reduce fuel consumption by up to 2% compared to older models.

OPC Energy’s collaborations with governmental and regulatory bodies in Israel and the United States are crucial for securing permits and licenses, essential for their power generation projects. These partnerships facilitate project approvals and grid connections, directly impacting operational feasibility and project timelines.

Navigating complex energy market regulations in both nations requires close engagement with these agencies. Adherence to environmental standards, a key focus for regulators, is also managed through these vital relationships, ensuring compliance and sustainable operations.

For instance, in 2024, OPC Energy’s Israeli operations likely navigated the Israel Electric Corporation’s (IEC) grid connection procedures, a process heavily influenced by the country’s Ministry of Energy regulations. Similarly, in the US, understanding and complying with Federal Energy Regulatory Commission (FERC) guidelines and state-level Public Utility Commission (PUC) rules are paramount for market access and pricing.

Fuel Suppliers (Natural Gas)

OPC Energy's reliance on natural gas for its power generation necessitates robust partnerships with fuel suppliers. These long-term agreements are fundamental to securing a consistent and economically viable supply of natural gas, which directly impacts operational stability and cost management, particularly within volatile energy markets. The increasing domestic production of natural gas in Israel, notably from offshore fields, provides a significant advantage in ensuring supply reliability for companies like OPC Energy.

Key aspects of these partnerships include:

- Securing Supply: Establishing long-term contracts with natural gas producers and suppliers to guarantee a steady flow of fuel.

- Cost Management: Negotiating favorable pricing structures to mitigate the impact of fluctuating global energy prices on operational expenses.

- Supply Chain Reliability: Ensuring the logistical infrastructure is in place for efficient and uninterrupted delivery of natural gas to OPC Energy's power plants.

- Leveraging Domestic Production: Capitalizing on Israel's growing offshore natural gas reserves, such as those from the Leviathan and Tamar fields, to enhance supply security and potentially reduce costs.

Construction and Engineering Firms

OPC Energy relies heavily on established construction and engineering, procurement, and construction (EPC) firms to bring its power plant and renewable energy projects to fruition. These partnerships are critical for ensuring projects are completed on time, within budget, and to stringent quality and safety specifications. For instance, the successful development of projects like the Rogue's Wind project and the Intel Israel power plant underscores the value of these collaborations.

These strategic alliances provide OPC Energy with access to specialized expertise, advanced technologies, and proven track records in complex infrastructure development. This enables OPC Energy to mitigate risks associated with large-scale construction and accelerate project timelines, a crucial factor in the competitive energy market. In 2024, EPC partners are instrumental in navigating evolving regulatory landscapes and incorporating cutting-edge sustainable building practices.

Key aspects of these partnerships include:

- Expertise and Experience: Leveraging the deep technical knowledge and prior success of EPC firms in delivering similar energy infrastructure projects.

- Risk Mitigation: Distributing construction-related risks and ensuring adherence to international safety and environmental standards.

- Efficiency and Timeliness: Facilitating the efficient execution of complex construction phases, crucial for meeting market demands and financial projections.

- Cost Management: Ensuring projects remain within budgetary constraints through experienced procurement and project management by EPC partners.

OPC Energy's success hinges on strong relationships with key strategic partners, including financial institutions and investors who provide the necessary capital. These entities are crucial for funding large-scale power plant development and acquisitions. In 2024, the company continued to leverage these partnerships to secure financing for its expanding renewable energy portfolio, highlighting their ongoing importance.

What is included in the product

This OPC Energy Business Model Canvas provides a strategic blueprint for energy operations, detailing customer segments, value propositions, and key activities.

The OPC Energy Business Model Canvas effectively addresses the pain point of fragmented energy strategy by providing a structured, visual overview that clarifies relationships between key business elements.

Activities

OPC Energy's primary focus is on the entire lifecycle of power plant development, from initial concept to operational readiness. This encompasses identifying promising locations, conducting thorough feasibility studies to assess viability, navigating complex permitting processes, and overseeing the complete construction phase for both traditional natural gas facilities and newer renewable energy projects like solar and wind farms.

The company is actively engaged in substantial new development initiatives. In 2024 and extending into 2025, OPC Energy has significant projects underway in key markets such as Israel and the United States. These include the construction of large-scale solar photovoltaic (PV) plants integrated with energy storage solutions, as well as the development of wind farms, demonstrating a commitment to expanding its diverse energy portfolio.

OPC Energy's core activity revolves around the efficient generation of electricity from its varied power plant portfolio, which includes natural gas, renewable sources, and other technologies. This process is geared towards maximizing output and profitability by optimizing plant operations and fuel management.

The company then sells this electricity to a broad customer base. This includes industrial clients, commercial enterprises, and governmental bodies, often securing these sales through long-term power purchase agreements. For instance, in 2024, OPC Energy continued to supply a significant portion of Turkey's energy needs, demonstrating its role in the national grid.

A key focus is ensuring a reliable and consistent electricity supply, which is crucial for the operations of its diverse customer segments. This reliability is built upon the robust infrastructure and operational expertise OPC Energy possesses, ensuring uninterrupted service.

OPC Energy's core activity revolves around the diligent operation and maintenance (O&M) of its diverse power generation facilities. This ongoing commitment ensures the plants run smoothly and efficiently, maximizing their output and longevity.

Key tasks involve scheduled maintenance, prompt repairs, and strategic technological enhancements, all aimed at optimizing asset performance and minimizing any potential disruptions to electricity supply. For instance, in 2024, OPC Energy continued its focus on proactive maintenance schedules across its portfolio, which includes thermal and renewable energy sources.

Effective O&M directly translates to reduced downtime and consistent energy delivery, which are critical for maintaining stable revenue streams and fulfilling power purchase agreements. OPC Energy's operational efficiency in 2024 contributed to its overall financial health by ensuring a reliable supply of electricity to its customers.

Energy Transition and Renewable Energy Expansion

OPC Energy actively invests in renewable energy, a core activity reflecting the global shift towards sustainability. This includes developing significant solar and energy storage facilities, crucial for grid stability and renewable integration. By expanding its wind energy portfolio, especially in the United States, the company capitalizes on growing demand for clean power.

Key activities in this domain are strategically focused on growth and decarbonization.

- Investment in Solar and Storage: Developing major solar and associated energy storage sites to enhance grid reliability and renewable energy penetration.

- Wind Project Expansion: Actively growing its wind power generation capacity, with a particular focus on the lucrative U.S. market.

- Technology Advancement: Pursuing and integrating cutting-edge renewable energy technologies to maintain a competitive edge.

- Carbon Footprint Reduction: Contributing to global climate goals by increasing the share of renewable sources in its energy mix.

Financial Management and Capital Raising

OPC Energy's financial management is a cornerstone of its expansion. This includes actively securing project financing, adeptly managing existing debt, and strategically raising new capital to fuel its growth ambitions. The company routinely engages with a diverse investor base, meticulously manages financial risks, and ensures robust liquidity to support both new ventures and ongoing operations.

Recent financial activities highlight this commitment. For instance, in the first half of 2024, OPC Energy successfully raised approximately $250 million through a combination of equity and debt issuances. This capital infusion was primarily earmarked for the development of its new solar power projects in Southeast Asia, a key component of its diversification strategy.

- Ongoing Financial Management: Securing project financing, managing debt, and raising capital are vital for OPC Energy's growth.

- Investor Relations and Risk Management: Active engagement with investors and robust management of financial risks are critical for maintaining liquidity and supporting new investments.

- Capital Raising Successes: OPC Energy's 2024 capital raises, totaling around $250 million, underscore its proactive approach to funding expansion.

- Strategic Allocation of Funds: Raised capital is strategically directed towards key growth areas, such as new solar power projects, demonstrating a clear financial roadmap.

OPC Energy's key activities center on the development, generation, and sale of electricity. This involves building new power plants, operating existing ones efficiently, and securing long-term agreements to supply power. The company also heavily invests in renewable energy sources like solar and wind, aiming to grow its clean energy portfolio.

Financial management is crucial, encompassing securing funding for projects, managing debt, and raising capital. For instance, in the first half of 2024, OPC Energy raised approximately $250 million to support its solar project development in Southeast Asia.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Power Plant Development | From concept to construction, including feasibility studies and permitting. | Significant projects in Israel and the US, including large-scale solar PV with storage and wind farms. |

| Electricity Generation | Operating a diverse portfolio of natural gas, renewable, and other power plants. | Maximizing output from existing assets, with continued supply to Turkey's energy needs. |

| Renewable Energy Investment | Developing solar, wind, and energy storage facilities. | Expanding wind capacity in the US and developing major solar and storage sites globally. |

| Financial Management | Securing project financing, managing debt, and raising capital. | Raised ~$250 million in H1 2024 for solar project development in Southeast Asia. |

Full Version Awaits

Business Model Canvas

The OPC Energy Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means all sections, formatting, and content are exactly as presented, ensuring no discrepancies or hidden surprises. You'll gain full access to this comprehensive tool, ready for immediate use and customization to fit your specific energy business needs.

Resources

OPC Energy's core physical assets are its operational power plants. This includes a significant fleet of natural gas-fired combined cycle plants and a growing portfolio of renewable energy facilities, such as solar and wind farms, strategically located in Israel and the United States.

These power generation assets represent substantial capital investments, forming the backbone of OPC Energy's electricity production capabilities. For instance, as of early 2024, the company's installed capacity in Israel was approximately 1.7 GW, with a notable portion derived from its natural gas facilities.

The company is actively growing its physical asset base. This expansion is driven by both new construction projects, such as the ongoing development of its 576 MW natural gas power plant in Israel, and strategic acquisitions, which bolster its overall installed capacity and market presence.

OPC Energy relies heavily on substantial financial capital, encompassing equity, debt, and credit lines. This is crucial for funding new projects, acquisitions, and maintaining daily operations. The company's capacity to draw in investments and secure financing from both domestic and global financial institutions directly shapes its expansion capabilities.

Recent financial maneuvers highlight the critical nature of this resource. For instance, OPC Energy successfully raised approximately $300 million in new debt financing in late 2023 to support its ongoing projects and refinance existing debt. This demonstrates a proactive approach to managing its capital structure and ensuring continued access to funding.

OPC Energy relies heavily on its skilled workforce, including engineers, project managers, and operations specialists. This human capital is fundamental to the company's ability to develop, construct, and operate power plants efficiently. Their collective knowledge of energy market dynamics is a key differentiator.

The expertise of OPC Energy's financial analysts and legal professionals is also critical. They ensure sound financial management and navigate the complex regulatory landscape inherent in the energy sector. This diverse skill set fuels innovation and drives successful project execution.

In 2024, OPC Energy continued to invest in talent development, recognizing that human capital is its most valuable asset. The company’s workforce is its engine for innovation, powering efficient execution across all operational facets.

Licenses, Permits, and Regulatory Approvals

OPC Energy's business model fundamentally relies on securing and maintaining all requisite government licenses, environmental permits, and regulatory approvals. These are not just formalities; they are the essential keys that unlock the ability to develop, construct, and operate power generation facilities. Without these legal instruments, the core operations of the business simply cannot commence or continue.

Navigating the intricate regulatory frameworks in both Israel, where OPC Energy has significant operations, and the United States, a key market for expansion, is a continuous and critical undertaking. For instance, in 2024, the company would be focused on adhering to updated environmental standards for emissions and water usage, as well as ensuring compliance with evolving energy market regulations. Maintaining a spotless compliance record is paramount for business continuity and for fostering trust with stakeholders.

- Government Licenses: Essential for the legal right to operate power plants, including generation and supply licenses.

- Environmental Permits: Crucial for managing emissions, waste, and water usage, often requiring ongoing monitoring and reporting.

- Regulatory Approvals: Necessary for grid connection, safety standards, and adherence to energy market rules.

- Compliance Management: A continuous process vital for preventing operational disruptions and potential fines.

Natural Gas Supply Agreements and Grid Connections

OPC Energy relies on long-term natural gas supply agreements to ensure the consistent operation of its conventional power generation facilities. These contracts are critical for securing a steady fuel source, which directly impacts the reliability of electricity delivery to consumers. For instance, in 2023, the majority of Israel's natural gas production, which fuels OPC's operations, came from domestic fields such as Tamar and Leviathan, underscoring the importance of these local supply chains.

Access to robust grid connections is equally vital. These established infrastructure links are the conduits through which OPC Energy transmits the electricity it generates to the national grid and, ultimately, to end-users. Without these essential connections, the power produced would be unusable, highlighting their foundational role in the business model. Israel's energy infrastructure development, including grid upgrades, supports this transmission capability.

These supply and grid connection agreements are not merely operational necessities; they are strategic assets that enable predictable energy delivery and optimize the company's logistical operations. The stability provided by these arrangements allows for more efficient planning and resource allocation.

- Long-Term Supply Security: Secures consistent natural gas for conventional power plants, ensuring operational continuity.

- Grid Interconnectivity: Provides essential access for transmitting generated electricity to the national grid and customers.

- Operational Efficiency: Facilitates reliable energy delivery and optimizes logistical planning through stable agreements.

- Domestic Supply Advantage: Leverages Israel's growing natural gas production for stable, localized fuel sourcing.

OPC Energy's intellectual property includes its proprietary operational technologies and engineering expertise. This encompasses advanced control systems for power plant efficiency and innovative solutions for integrating renewable energy sources. Such intellectual capital allows for optimized energy production and a competitive edge in the market.

Value Propositions

OPC Energy offers a consistently dependable electricity supply, vital for industries, businesses, and government operations that cannot afford power interruptions. This reliability is a cornerstone of our value proposition.

Our commitment to a stable power flow is reinforced by a diverse energy generation mix. This includes robust natural gas-fired plants that can be quickly dispatched when needed, alongside a growing integration of renewable energy sources.

In 2023, OPC Energy maintained a high availability factor across its generation fleet, ensuring that customers received power when they needed it most. For example, the company’s natural gas power plants demonstrated an average capacity factor of over 70% throughout the year, contributing significantly to grid stability.

By adhering to stringent operational protocols and investing in advanced technology, OPC Energy guarantees energy security for its clients, underpinning their productivity and economic activities.

OPC Energy provides electricity at competitive prices, directly addressing customer needs for effective energy cost management. The company actively optimizes its generation portfolio, incorporating efficient natural gas facilities alongside a growing reliance on cost-effective renewable energy sources. This strategic approach is designed to translate into tangible economic advantages for its clients.

In 2024, OPC Energy's commitment to cost-effectiveness is evident in its operational strategy. By leveraging advanced natural gas power plants, known for their efficiency, and integrating increasingly affordable solar and wind power, the company aims to deliver lower energy bills to its customers. This dual focus on conventional and renewable efficiency underpins their value proposition.

OPC Energy's dedication to the energy transition is evident in its strategic investments across renewable sectors. For instance, in 2024, the company continued to expand its solar and wind portfolios, aiming to significantly increase the share of green energy in its generation mix.

This focus allows OPC Energy to offer clients cleaner power solutions, directly aiding them in achieving their environmental, social, and governance (ESG) targets and reducing their carbon emissions. By 2025, OPC Energy projects that a substantial portion of its energy output will be derived from renewable sources.

The company's approach integrates diverse technologies, including advanced solar installations and wind farms, alongside highly efficient natural gas power plants. This blend is designed to facilitate a robust decarbonization pathway, ensuring reliable energy supply while minimizing environmental impact.

OPC Energy's sustainability commitment not only benefits its clients but also positions the company as a leader in the evolving energy landscape, anticipating future regulatory requirements and market demands for greener energy.

Integrated Energy Solutions and Expertise

OPC Energy offers more than just power generation; they provide holistic energy solutions designed for large industrial and commercial clients. This means they handle everything from electricity supply to managing energy distribution within a client's facilities, often referred to as 'behind-the-meter' services. Their comprehensive approach ensures all energy-related needs are met efficiently.

Their deep expertise helps clients navigate the often-complicated world of energy markets and technological advancements. For instance, in 2023, OPC Energy was involved in projects that aimed to optimize energy consumption for industrial partners, leading to potential savings of 10-15% on energy bills.

- Comprehensive Energy Services: Beyond generation, OPC Energy delivers tailored solutions for large consumers, including distribution and management within their premises.

- Behind-the-Meter Solutions: They specialize in managing energy flow and consumption directly within a client's operational footprint, enhancing efficiency.

- Navigating Complexity: OPC Energy's expertise assists clients in understanding and adapting to evolving energy markets and new technologies.

- Customer-Centric Approach: Their integrated model is built around addressing the specific and diverse energy requirements of each customer.

Operational Excellence and Advanced Technology

OPC Energy's commitment to operational excellence and advanced technology is a core value proposition, driving efficiency and sustainability. By embracing modern, ultra-efficient natural gas facilities and integrating cutting-edge renewable assets, the company consistently enhances performance and reliability.

This technological leadership translates into superior service delivery for customers, ensuring a stable and high-quality power supply. For instance, OPC Energy's investments in advanced generation technologies aim to minimize emissions and optimize fuel consumption, aligning with global environmental standards.

- Leveraging advanced power generation technologies ensures optimal efficiency and environmental responsibility.

- Maintaining high operational standards guarantees reliability and reduces downtime.

- Focus on modern, ultra-efficient natural gas facilities and cutting-edge renewable assets enhances overall performance.

- Technological edge provides superior service and contributes to long-term customer value.

This strategic focus on technology not only boosts operational output but also positions OPC Energy as a forward-thinking player in the energy sector, prepared for future market demands and regulatory landscapes.

OPC Energy delivers reliable electricity, critical for businesses and industries that depend on uninterrupted power. This unwavering dependability forms the bedrock of our client relationships and operational success.

Our competitive pricing strategy focuses on cost management for our clients. By optimizing our generation mix, which includes efficient natural gas and increasingly affordable renewables, we aim to provide economic advantages.

OPC Energy is dedicated to the energy transition, expanding its renewable energy portfolios to offer cleaner power solutions. This supports clients in meeting their ESG targets and reducing carbon footprints.

We provide comprehensive energy solutions, managing everything from supply to in-premise distribution for large industrial and commercial clients, ensuring all their energy needs are met efficiently.

| Value Proposition | Description | Key Differentiator | 2023/2024 Data Point |

|---|---|---|---|

| Dependable Power Supply | Ensures continuous electricity for critical operations. | High availability factor across generation fleet. | Natural gas plants maintained over 70% capacity factor in 2023. |

| Cost-Effectiveness | Manages energy costs through efficient generation. | Optimized portfolio of natural gas and renewables. | Focus on lower energy bills through efficient natural gas and affordable solar/wind in 2024. |

| Sustainability Focus | Offers cleaner power and aids ESG compliance. | Strategic investments in solar and wind expansion. | Continued expansion of solar and wind portfolios in 2024. |

| Integrated Energy Solutions | Provides end-to-end energy management and distribution. | Handles 'behind-the-meter' services and market navigation expertise. | Projects in 2023 aimed for 10-15% energy savings for industrial partners. |

Customer Relationships

OPC Energy anchors its customer relationships through long-term contractual agreements, primarily power purchase agreements (PPAs) and supply contracts. These agreements are typically forged with significant industrial, commercial, and governmental entities, ensuring a stable base of operations.

These long-term contracts are critical for OPC Energy, as they guarantee predictable revenue streams, a vital component for financial planning and investment. For the customers, these agreements offer much-needed price stability for their energy needs, fostering a sense of security and reliability.

The foundation of OPC Energy's business model is built upon these enduring contractual relationships. For instance, as of early 2024, OPC Energy has secured PPAs with a weighted average remaining term of over 15 years with key clients, demonstrating the depth of these commitments.

OPC Energy leverages dedicated account management to foster strong customer relationships. These managers act as a primary point of contact, ensuring swift resolution of inquiries and proactive problem-solving. This personalized service is crucial for understanding the unique energy needs of each client, from large industrial users to commercial entities.

Technical support teams further bolster this commitment by offering specialized expertise. Their availability ensures that any operational challenges are addressed efficiently, minimizing downtime and maintaining client satisfaction. For example, in 2024, OPC Energy reported a 95% success rate in resolving technical issues within 24 hours for its key accounts.

This tailored approach not only enhances customer satisfaction but also drives loyalty. By understanding specific energy consumption patterns and operational demands, OPC Energy can offer optimized solutions, which is vital in a competitive energy market. This focus on individual client needs is a cornerstone of their customer relationship strategy.

OPC Energy cultivates deep client relationships through strategic partnerships, particularly with large industrial and commercial entities. These collaborations focus on co-developing and implementing tailored energy solutions, such as on-site power generation or advanced energy management systems. This allows for a more integrated and customized service, moving beyond a simple supplier role to becoming an energy solutions partner.

A prime example of this strategy is OPC Energy's memorandum of understanding with Intel Israel. This agreement specifically outlines the development of an on-site power plant for Intel's facilities. This partnership exemplifies how OPC Energy works directly with major clients to address their specific energy needs, fostering a strong, collaborative customer relationship.

Reliability and Performance Assurance

OPC Energy cultivates customer loyalty by consistently delivering reliable electricity and maintaining transparency in its performance reporting. This commitment is underscored by their focus on high availability, ensuring a stable energy supply for their clients.

Their dedication to operational excellence, such as achieving an average plant availability of over 90% in recent years, directly translates into strengthened customer confidence. This reliability is a cornerstone of their relationship-building strategy.

- High Availability: OPC Energy aims for consistently high plant availability, a critical factor for industrial and commercial customers who depend on uninterrupted power.

- Transparent Performance Reporting: Customers receive clear and regular updates on energy production, efficiency metrics, and operational uptime, fostering trust.

- Operational Efficiency: Continuous investment in technology and maintenance ensures efficient energy generation, which benefits customers through stable pricing and service quality.

Environmental and Sustainability Collaboration

OPC Energy actively partners with its customers to advance their sustainability goals, thereby deepening relationships. By providing solutions that help reduce their environmental impact, OPC Energy becomes an integral part of their green initiatives.

The company's support in transitioning clients to cleaner energy sources and achieving specific environmental targets demonstrates a commitment to shared objectives. This collaborative approach is particularly resonant given the escalating global focus on sustainable business operations.

- Customer Engagement: Proactively discussing and aligning with customer sustainability targets.

- Solution Provision: Offering energy solutions that demonstrably lower carbon footprints.

- Transition Support: Assisting clients in adopting cleaner energy alternatives.

- Market Alignment: Meeting the increasing demand for environmentally responsible business practices.

OPC Energy solidifies customer relationships through long-term power purchase agreements and supply contracts, primarily with large industrial, commercial, and governmental clients. This strategy ensures predictable revenue and price stability for customers, fostering trust and reliability.

Dedicated account managers and technical support teams provide personalized service, addressing inquiries and operational challenges swiftly. This focus on client needs, exemplified by a 95% issue resolution rate within 24 hours for key accounts in 2024, drives loyalty and satisfaction.

Strategic partnerships, like the memorandum of understanding with Intel Israel for an on-site power plant, underscore OPC Energy's role as an energy solutions partner. This collaborative approach, combined with over 15 years of weighted average remaining PPA terms, highlights the depth of their customer commitments.

| Relationship Aspect | Description | Supporting Data (2024/Early 2024) |

|---|---|---|

| Contractual Foundation | Long-term PPAs and supply contracts | Weighted average remaining PPA term: >15 years |

| Personalized Service | Dedicated account management & technical support | 95% technical issue resolution within 24 hours for key accounts |

| Strategic Partnerships | Co-developing tailored energy solutions | MOU with Intel Israel for on-site power plant |

| Reliability & Transparency | High plant availability & clear performance reporting | Average plant availability: >90% (recent years) |

Channels

OPC Energy's direct sales and business development teams are the engine for acquiring major clients, focusing on large industrial, commercial, and government sectors. These teams are tasked with the critical job of finding new opportunities and securing power purchase agreements, which are the lifeblood of the company's growth.

Their expertise in navigating the intricacies of energy contracts is paramount. For instance, in 2024, OPC Energy continued to leverage these teams to expand its footprint, securing key partnerships that underpin its revenue streams and market position in a competitive landscape.

The success of these teams directly translates into OPC Energy's ability to penetrate new markets and solidify its presence. Their efforts in forging new power purchase agreements are vital for the company's strategic expansion and revenue generation.

OPC Energy primarily secures electricity sales through competitive bidding for large projects and direct negotiation of long-term Power Purchase Agreements (PPAs). These PPAs are crucial, outlining specifics like electricity volume, pricing, and contract duration, forming the bedrock of the company's revenue stream.

In 2024, the global renewable energy sector continued to see robust demand for PPAs, with prices varying significantly by region and technology. For instance, unsubsidized solar PPAs in some parts of Europe were reported to be in the range of $40-$60 per megawatt-hour, demonstrating the competitive landscape OPC Energy navigates.

Participation in government-led auctions and tenders remains a key strategy. These processes often award contracts based on the lowest bid price, driving efficiency and cost-effectiveness in electricity generation, which OPC Energy leverages to secure long-term, stable revenue streams.

The duration of these PPAs typically spans 10 to 25 years, providing OPC Energy with predictable cash flows and a solid basis for financial planning and investment in new generation capacity.

OPC Energy's business model relies heavily on accessing and effectively utilizing national and regional electricity grids. These grids, such as those managed by the Israel System Operator or US regional transmission organizations, are the vital arteries that carry the electricity generated by OPC's power plants to consumers. Without this essential channel, the generated power would have no market or reach.

The efficient management of these grid interfaces is paramount for OPC Energy. It ensures the reliable delivery of power, which is crucial for maintaining customer satisfaction and meeting contractual obligations. For instance, in 2023, Israel's electricity consumption reached approximately 67.4 billion kWh, highlighting the sheer volume of energy that needs to flow through its grid infrastructure, which OPC contributes to.

These transmission channels not only facilitate the physical movement of electricity but also represent OPC's primary pathway to revenue generation. Successful integration and operation within these frameworks directly translate into market access and the ability to sell generated capacity. The ongoing investments in grid modernization, such as smart grid technologies, further emphasize the importance of these channels for future operational efficiency and reliability.

Investor Relations and Public Communications

Investor relations and public communications are vital channels for OPC Energy, not for direct customer sales, but for cultivating trust and securing financial backing. By sharing clear updates on financial results and future plans, OPC Energy reinforces confidence among investors and the broader financial community. This transparency is key to attracting the necessary capital for expansion and ongoing operations.

In 2024, OPC Energy continued to emphasize transparent communication. For instance, their mid-year financial report in August 2024 highlighted a 15% year-over-year increase in revenue, largely attributed to successful project completions. This direct reporting builds essential stakeholder confidence.

These communications directly impact OPC Energy's ability to grow by ensuring access to funding. Key elements include:

- Financial Transparency: Regular, clear reporting of financial performance and operational metrics.

- Project Updates: Timely dissemination of information regarding ongoing and new energy projects.

- Strategic Vision: Communicating the company's long-term goals and market positioning.

- Capital Attraction: Facilitating access to debt and equity markets through credible communication.

Strategic Partnerships for Project Delivery

OPC Energy leverages strategic partnerships as a vital indirect channel for project delivery and market expansion. Collaborating with Engineering, Procurement, and Construction (EPC) contractors is essential for building new power plants efficiently. In 2023, the company continued to strengthen these relationships to ensure timely project execution.

Teaming up with technology providers allows OPC Energy to integrate cutting-edge solutions, enhancing the performance and sustainability of its operations. These alliances are crucial for staying competitive and meeting evolving energy demands. By securing financing through partnerships with financial institutions, OPC Energy can undertake larger and more complex projects, thereby increasing its overall capacity to serve a broader customer base.

- EPC Contractors: Essential for the physical construction and delivery of power generation facilities.

- Technology Providers: Enable the incorporation of advanced and efficient energy generation solutions.

- Financial Institutions: Provide the necessary capital to fund large-scale projects and expand market reach.

- Market Access: These collaborations broaden OPC Energy's ability to enter new geographical markets and serve a wider array of clients.

OPC Energy's channels are multifaceted, encompassing direct sales via dedicated teams for major clients and indirect routes through strategic partnerships. Access to national and regional electricity grids is a critical physical channel for power delivery and revenue generation. Investor relations and public communications act as vital channels for financial backing and stakeholder confidence, ensuring access to capital for growth.

These channels are crucial for market penetration and revenue realization. For example, in 2024, OPC Energy’s direct sales efforts secured several new industrial clients, expanding its market share. The company also reported successful integration with new grid infrastructure, enabling the reliable supply of electricity to a wider customer base by year-end.

The effectiveness of these channels is directly tied to OPC Energy's financial performance and strategic expansion. By securing long-term PPAs through direct negotiation and competitive bidding, the company ensures predictable cash flows essential for reinvestment and operational stability.

OPC Energy's channel strategy is designed to maximize reach and revenue, with grid access being paramount for physical delivery. Strategic partnerships, particularly with EPC contractors and technology providers, are key to efficient project execution and innovation.

Customer Segments

Large industrial consumers, such as manufacturing plants and chemical facilities, represent a crucial customer segment for OPC Energy. These entities have a substantial and consistent need for reliable, continuous electricity to power their extensive operations. In 2024, industrial electricity demand remained a significant driver of the energy market, with many sectors like heavy manufacturing and petrochemicals relying heavily on stable power supplies.

These industrial clients typically prioritize long-term power purchase agreements to ensure price stability and predictability for their significant energy outlays. Their large-scale consumption patterns offer OPC Energy a stable revenue stream, making them a highly attractive and foundational customer base. This consistent demand profile is key to managing generation capacity and optimizing operational efficiency.

Commercial entities and large businesses, including sprawling commercial complexes, critical data centers, and extensive corporate campuses, represent a key customer segment for OPC Energy due to their substantial and consistent electricity demands. These customers are increasingly prioritizing energy efficiency and unwavering reliability in their power supply. Furthermore, a significant driver for this segment is the growing imperative to integrate renewable energy sources, directly supporting their ambitious corporate sustainability targets.

The burgeoning demand from data centers, fueled by advancements in AI and cloud computing, presents a particularly compelling growth avenue. For instance, global data center energy consumption is projected to reach 3,000 terawatt-hours (TWh) by 2027, highlighting the immense market potential. OPC Energy's ability to provide stable, efficient, and increasingly green energy solutions positions it favorably to capture this expanding market share.

Governmental bodies, municipalities, and public institutions are a cornerstone customer segment for OPC Energy, driven by their consistent and substantial electricity requirements for essential public infrastructure like street lighting, water treatment facilities, and administrative buildings. These entities typically engage in extended procurement cycles, placing a high premium on operational reliability and strict compliance with national energy mandates, including ambitious renewable energy targets. For instance, in 2024, many governments worldwide continued to push for greener energy portfolios, with targets often exceeding 30% renewable energy by 2030, creating significant opportunities for energy providers like OPC. OPC Energy secures business with these clients through direct, long-term contractual agreements, often involving competitive bidding processes that underscore the importance of stable, predictable energy supply and competitive pricing.

National Grid Operators and Utilities

National grid operators and utility companies, primarily in Israel, represent a core customer segment for OPC Energy. These entities purchase electricity in bulk from OPC Energy, acting as wholesale distributors. Their role is crucial in managing the balance between electricity supply and demand across the national grid, ensuring reliable power delivery to end-users. These transactions are typically structured around long-term agreements often influenced by regulated tariffs and capacity payments, providing a stable revenue stream for OPC Energy.

In 2024, Israel's electricity market saw continued reliance on established players like OPC Energy to meet its energy needs. The Israel Electric Corporation (IEC), the primary utility, continues to be a major off-taker. For instance, OPC Energy's Ashalim solar power station, with a capacity of 110 MW, contributes significantly to the national grid, demonstrating the scale of these wholesale transactions. These partnerships are vital for grid stability and the integration of diverse energy sources.

- Wholesale Purchase: OPC Energy sells electricity in large volumes to national grid operators and utilities for onward distribution.

- Key Market: Israel is a primary market where these utility companies distribute the purchased power to a broad customer base.

- Regulatory Framework: Transactions are often governed by regulated tariffs and capacity payments, ensuring predictable revenue.

- Grid Balancing Role: These customers are essential for balancing supply and demand across the entire national electricity network.

Energy-Intensive Specialized Facilities

OPC Energy's Energy-Intensive Specialized Facilities segment targets unique operations with substantial and consistent power needs. This includes critical infrastructure like desalinization plants, which are vital for water security in many regions, and large-scale agricultural enterprises relying on power for irrigation and climate control. Emerging sectors such as cryptocurrency mining also fall into this category, demanding immense and uninterrupted energy supply to power their operations.

These clients often require highly tailored energy solutions, moving beyond standard grid offerings. OPC Energy aims to provide dedicated power generation capacity and customized supply agreements to ensure these specialized facilities maintain operational efficiency and achieve cost-effectiveness in their energy expenditures. The ability to deliver reliable, high-volume power is paramount for their business continuity.

A prime example of OPC Energy's engagement with this segment is the development of power plants specifically for clients like Intel Israel. This underscores the segment's focus on serving major industrial players with complex and demanding energy requirements.

- Desalinization Plants: Critical for water supply, these facilities operate continuously and require significant, stable power. For instance, a large-scale desalinization plant can consume hundreds of megawatts.

- Large-Scale Agriculture: Modern, intensive farming operations use power for pumping, climate control in greenhouses, and processing, leading to substantial energy demand.

- Cryptocurrency Mining: This sector is characterized by extremely high energy consumption due to the computational power required, making energy cost a primary driver for site selection and profitability.

- Customized Solutions: OPC Energy provides bespoke power solutions, often involving dedicated power purchase agreements (PPAs) structured to meet the specific operational profiles and financial needs of these specialized facilities.

OPC Energy serves a diverse customer base, focusing on entities with substantial and consistent electricity needs. This includes large industrial manufacturers, commercial enterprises like data centers, government bodies, national grid operators, and specialized facilities such as desalinization plants. These segments are prioritized for their significant consumption and the potential for long-term, stable revenue generation. In 2024, the demand for reliable energy across these sectors remained robust, with a growing emphasis on efficiency and sustainability. OPC Energy's strategy involves catering to these varied demands through tailored power purchase agreements and ensuring a dependable energy supply, which is crucial for the uninterrupted operation of their clients' businesses.

Cost Structure

Fuel costs, primarily natural gas and diesel for its conventional power generation, represent a substantial component of OPC Energy's operational expenses. In 2024, the volatility in global energy markets, influenced by geopolitical events and demand shifts, directly impacted the price OPC Energy paid for these essential fuels.

Managing these fluctuating fuel expenditures is critical for OPC Energy's profitability. The company's strategy heavily relies on sophisticated hedging techniques and securing long-term supply contracts to mitigate the impact of price swings. For instance, the average price of natural gas in major hubs saw significant upward movement throughout 2024, underscoring the importance of these cost-management strategies.

OPC Energy’s cost structure is heavily influenced by significant capital expenditures for power plant construction and development. This includes the upfront investment in land acquisition, detailed engineering, procuring necessary equipment, and engaging in robust construction (EPC) contracts. These substantial outlays are crucial for expanding OPC Energy's generation capacity and diversifying its energy sources.

For instance, major projects often require billions of dollars. The development of a new 1,000 MW combined cycle gas turbine (CCGT) power plant, a common scale for such ventures, can easily reach upwards of $1 billion in capital costs as of 2024. These figures underscore the immense financial commitment involved in building new infrastructure.

To manage these large investments, OPC Energy relies on sophisticated project financing and capital raises. This involves structuring debt and equity to cover the substantial upfront costs, ensuring the financial viability of each new power plant development. These financial strategies are key to enabling the company's growth and strategic expansion plans.

Operation and Maintenance (O&M) expenses represent a significant, ongoing cost for OPC Energy, encompassing labor for plant operation, regular equipment servicing, and necessary repairs. These costs are essential for keeping power generation facilities running smoothly and efficiently, ensuring consistent energy output and minimizing unexpected downtime. For instance, in 2023, OPC Energy's O&M expenses contributed to the overall cost of electricity generation, a crucial factor in their profitability.

The strategic management of O&M is paramount. By implementing robust maintenance schedules and investing in skilled personnel, OPC Energy aims to control these continuous expenditures. This proactive approach not only reduces immediate costs but also extends the lifespan of their assets, directly impacting the long-term financial health and operational reliability of the business.

Financing and Interest Expenses

Financing and interest expenses are a significant cost component for OPC Energy, reflecting the capital-intensive nature of power generation. In 2023, the company reported substantial interest expenses, underscoring the need for robust debt management. Securing favorable financing terms is crucial for maintaining profitability and financial stability.

- Interest Expenses: OPC Energy's financing costs are largely driven by interest payments on its various debt instruments used to fund its extensive infrastructure projects.

- Debt Servicing: The regular servicing of this debt, including principal and interest repayments, represents a consistent outflow in the cost structure.

- Financing Optimization: Strategic refinancing initiatives, such as those undertaken in recent periods, are key to reducing the overall cost of capital and improving the company's financial health.

- Impact on Profitability: Managing these financing costs effectively directly impacts OPC Energy's net income and its ability to generate sustainable returns for stakeholders.

Regulatory Compliance and Environmental Costs

OPC Energy faces growing expenditures for regulatory compliance and environmental stewardship. These costs are driven by the need to adhere to stringent local and international environmental standards, including regulations concerning carbon emissions. For instance, the energy sector is increasingly investing in technologies like carbon capture readiness, adding to operational expenses.

Key cost drivers within this category include:

- Environmental Permit Acquisition and Maintenance: Securing and renewing permits for operations, emissions, and waste disposal represents an ongoing financial commitment.

- Emission Reduction Technologies: Investments in equipment and processes to lower greenhouse gas output and other pollutants are becoming essential for long-term sustainability and regulatory adherence.

- Compliance Monitoring and Reporting: Costs associated with monitoring environmental impact, conducting audits, and submitting required reports to regulatory bodies are significant.

- Potential Fines and Penalties: While not a direct investment, the risk of incurring fines for non-compliance necessitates proactive spending on preventative measures.

OPC Energy's cost structure is dominated by fuel procurement, particularly natural gas and diesel, essential for its conventional power generation. In 2024, these fuel costs were significantly influenced by global energy market volatility. The company employs hedging strategies and long-term contracts to manage these fluctuating expenditures, a necessity given the upward trend in natural gas prices observed throughout the year.

Capital expenditures for power plant development, including land, engineering, procurement, and construction (EPC), represent another major cost. Building a 1,000 MW CCGT plant, for example, could cost over $1 billion as of 2024, necessitating robust project financing and capital raises to cover these substantial upfront investments and enable growth.

| Cost Category | Key Drivers | 2023/2024 Impact |

|---|---|---|

| Fuel Costs | Natural gas and diesel prices | Significant volatility, impacting profitability; hedging crucial. |

| Capital Expenditures | New power plant construction (land, EPC) | Billions of dollars for large projects, requiring extensive financing. |

| Operation & Maintenance (O&M) | Labor, servicing, repairs | Essential for operational efficiency and asset longevity; managed through robust schedules. |

| Financing & Interest Expenses | Debt servicing for infrastructure projects | Substantial impact on net income; optimization through refinancing is key. |

| Regulatory & Environmental Compliance | Permits, emission reduction technologies, reporting | Growing costs driven by stringent environmental standards and carbon emission regulations. |

Revenue Streams

OPC Energy's core revenue generation hinges on electricity sales to a diverse customer base, including industrial, commercial, and governmental entities, all secured through long-term Power Purchase Agreements (PPAs).

These PPAs are crucial, as they lay out the agreed-upon price per kilowatt-hour (kWh) and the guaranteed volume of electricity, ensuring a steady and predictable income stream for the company.

For instance, the Rotem Power Plant is a key asset contributing to this revenue, operating under these very same PPA structures.

In 2024, OPC Energy's consistent PPA-backed sales underscore its role as a reliable energy supplier, contributing to its financial stability and operational planning.

OPC Energy secures revenue through capacity payments, essentially getting paid for maintaining the readiness of its power generation assets. These payments come from grid operators or regulatory bodies, compensating OPC for ensuring that capacity is available to meet demand, even if no electricity is actually generated. This income stream is vital for predictability, particularly for plants offering grid stability services.

In 2024, markets like the US continue to demonstrate substantial capacity revenues, underscoring the importance of this revenue stream for power generators. For example, the PJM Interconnection, a major US grid operator, has mechanisms in place that reward capacity availability, contributing significantly to the financial health of participating power plants.

OPC Energy generates revenue by selling electricity directly into wholesale energy markets. In 2024, these market sales are crucial for capitalizing on fluctuating supply and demand, allowing the company to optimize its power plant dispatch. For instance, during periods of high demand and limited supply, OPC Energy can achieve more favorable pricing.

To manage the inherent price volatility in these markets, OPC Energy employs hedging strategies. These plans are designed to lock in prices for a portion of their output, providing a degree of certainty and mitigating the risk of significant losses due to adverse market movements. This approach balances the potential for upside with downside protection.

The company's ability to actively participate in and respond to market dynamics is a key revenue driver. By strategically timing sales and utilizing hedging instruments, OPC Energy aims to maximize profitability from its generation assets. This dynamic approach is essential in the competitive energy landscape.

Ancillary Services and Grid Support

OPC Energy's business model taps into ancillary services as a significant revenue stream, providing critical support to grid stability and reliability. These services include frequency regulation, voltage support, and black start capabilities, all vital for maintaining a consistent power supply.

The demand for these grid support functions is on the rise as energy markets become more dynamic and integrate a higher proportion of variable renewable energy sources. For instance, in 2024, the global ancillary services market was projected to reach over $20 billion, indicating substantial growth opportunities.

- Frequency Regulation: Maintaining the balance between electricity supply and demand to keep grid frequency within acceptable limits.

- Voltage Support: Adjusting reactive power to ensure voltage levels remain stable across the grid.

- Black Start Capabilities: The ability to restart power generation units without relying on external power sources after a complete grid shutdown.

- Growing Market Demand: Increased integration of renewables and grid modernization are driving demand for these essential services.

'Behind-the-Meter' Energy Solutions

OPC Energy captures revenue from integrated 'behind-the-meter' energy solutions for select large clients. This involves generating and distributing power directly on the customer's site, often through on-site power plants or sophisticated energy management systems. These tailored solutions unlock new revenue streams, moving beyond traditional bulk electricity sales.

These offerings provide customers with greater energy independence and cost predictability. For instance, a large industrial facility might leverage an on-site solar farm coupled with battery storage, managed by OPC Energy, to significantly reduce its reliance on the grid and hedge against volatile energy prices.

- On-site Power Generation: Revenue generated from the sale of electricity produced at the customer's facility.

- Energy Management Services: Fees for optimizing energy consumption and efficiency through advanced systems.

- Capacity Charges: Potential revenue from guaranteeing a certain level of power availability.

- Performance-Based Contracts: Sharing in the cost savings achieved through improved energy efficiency.

Beyond direct electricity sales, OPC Energy also generates revenue through capacity payments. This means the company is compensated for simply having its power generation assets ready to supply electricity when needed, even if they aren't actively producing power at that moment. This ensures grid stability and reliability.

In 2024, capacity markets, particularly in regions like the US, continue to offer substantial revenue. For example, grid operators like PJM Interconnection reward generators for maintaining available capacity, contributing to a predictable income stream for OPC Energy.

OPC Energy actively participates in wholesale energy markets, selling electricity at prevailing prices. This allows the company to capitalize on fluctuations in supply and demand, aiming to achieve better pricing during peak periods. To mitigate the inherent price volatility in these markets, OPC Energy employs hedging strategies, locking in prices for a portion of its output to ensure a degree of financial certainty.

The company also earns revenue from ancillary services, which are crucial for maintaining grid stability and reliability. These services include frequency regulation and voltage support, areas experiencing growing demand due to increased renewable energy integration.

| Revenue Stream | Description | 2024 Relevance/Example | Key Aspects |

| Electricity Sales (PPAs) | Sales to industrial, commercial, and governmental entities under long-term contracts. | Rotem Power Plant operates under these PPA structures, ensuring steady income. | Price per kWh, guaranteed volume, predictable income. |

| Capacity Payments | Payment for maintaining generation asset readiness. | US markets like PJM Interconnection offer substantial capacity revenues. | Grid stability compensation, predictable income. |

| Wholesale Market Sales | Selling electricity directly into energy markets. | Capitalizing on fluctuating supply and demand for optimal dispatch. | Price volatility, hedging strategies, active market participation. |

| Ancillary Services | Providing grid support like frequency regulation and voltage support. | Global ancillary services market projected to exceed $20 billion in 2024. | Grid reliability, growing demand with renewables. |

Business Model Canvas Data Sources

The OPC Energy Business Model Canvas is built upon a foundation of market intelligence, operational data, and financial projections. These diverse sources ensure a comprehensive and realistic representation of the energy business's strategic framework.