NW Natural PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NW Natural Bundle

Uncover the critical external factors impacting NW Natural's strategic trajectory. Our comprehensive PESTLE analysis delves into the political, economic, social, technological, legal, and environmental forces that are shaping the energy landscape. Gain a competitive edge by understanding these dynamics. Download the full PESTLE analysis now for actionable insights to inform your business decisions and investment strategies.

Political factors

State and federal governments in Oregon and Washington are pushing for decarbonization, a major shift for NW Natural's natural gas business. Oregon, for instance, aims for a 90% greenhouse gas reduction by 2050, with initiatives like the Climate Protection Program already in effect.

These governmental mandates directly influence NW Natural's operational strategies, requiring increased investment in renewable natural gas and other cleaner energy solutions to meet emission reduction targets.

For 2024 and looking ahead to 2025, utilities like NW Natural are navigating these evolving regulatory landscapes, which will shape their capital expenditure plans and the long-term viability of their traditional natural gas infrastructure.

NW Natural's financial health is significantly shaped by regulatory rate cases overseen by state Public Utility Commissions (PUCs). These bodies hold the authority to approve the rates the company can charge its customers, directly impacting revenue and profitability. The company consistently files general rate cases to ensure it can recover operational expenses and fund crucial infrastructure upgrades.

Recent regulatory activity highlights this dependency. In Oregon, new rates approved by the PUC became effective in November 2024. Furthermore, NW Natural has proposed another rate increase for November 2025, which is currently under regulatory review. The outcomes of these cases are pivotal for the company's ability to invest in system reliability and advance its decarbonization initiatives.

Legislation like Oregon's Senate Bill 98, which champions voluntary goals for integrating renewable natural gas (RNG) into the pipeline system, targeting up to 30% RNG by 2050, offers a significant political tailwind for NW Natural. This legislative backing directly encourages the company's strategic investments in RNG infrastructure and procurement initiatives.

Furthermore, this supportive legal framework enables utilities like NW Natural to recoup the additional expenses associated with developing and maintaining RNG infrastructure. This cost recovery mechanism acts as a crucial financial incentive, making the transition towards a higher RNG portfolio more economically viable and attractive for the company.

Hydrogen Blending Regulations and Public Scrutiny

Political discussions surrounding hydrogen blending in natural gas systems are intensifying, with Oregon considering legislation that would require utilities to notify customers about potential safety and health risks associated with these blends. This move is a direct response to public concern, signaling a strong demand for transparency and safety guarantees as new energy technologies are introduced. For NW Natural, these proposed regulations could introduce significant compliance burdens and potentially impact the economic viability of their hydrogen projects.

The political landscape is actively shaping the future of hydrogen integration. For instance, in early 2024, Oregon lawmakers were reviewing proposals that could mandate extensive customer disclosures regarding hydrogen blending. This legislative activity reflects a broader trend of increased public scrutiny and a desire for robust safety frameworks, especially concerning modifications to existing energy infrastructure.

- Mandatory Customer Notification: Proposed Oregon bills could force utilities like NW Natural to inform customers about the specific risks and benefits of hydrogen blending, increasing communication overhead.

- Public Scrutiny Driving Policy: Past public opposition to hydrogen blending plans has directly influenced current legislative efforts, emphasizing the need for strong public engagement and safety assurances.

- Compliance Costs and Feasibility: New regulations, such as enhanced safety testing and disclosure requirements, are likely to increase operational expenses and could affect the financial attractiveness of hydrogen initiatives for NW Natural.

- Evolving Regulatory Environment: The political climate indicates a shift towards stricter oversight of emerging energy technologies, requiring companies to adapt their strategies to meet new compliance standards.

Infrastructure Development and Permitting

Governmental support for energy infrastructure is a key factor for NW Natural. For instance, in 2024, Oregon's legislature continued to grapple with balancing renewable energy goals with the need for reliable natural gas delivery systems, impacting potential pipeline expansions. The recognition of resilient energy systems, particularly for winter peak demand, is a stated priority by the Northwest Power and Conservation Council, influencing investment decisions.

However, the permitting process for new infrastructure projects, such as the proposed Jordan Cove LNG project (though not directly NW Natural, it highlights regional challenges), has faced significant delays due to environmental reviews, costing billions and extending timelines by years. These regulatory hurdles can add substantial costs and uncertainty to essential network upgrades for companies like NW Natural.

- Government Support: Ongoing legislative discussions in Washington and Oregon in 2024 and 2025 will shape the regulatory environment for natural gas infrastructure.

- Resilience Priority: Regional energy planning bodies emphasize the need for robust systems to meet peak demand, a factor supporting infrastructure maintenance and upgrades.

- Permitting Delays: Lengthy environmental reviews and permitting processes, as seen in similar regional projects, can significantly increase project costs and timelines for NW Natural's development plans.

Governmental push for decarbonization, exemplified by Oregon's 2050 greenhouse gas reduction targets, directly impacts NW Natural's strategy, requiring significant investment in renewable natural gas (RNG). Regulatory bodies like the Oregon Public Utility Commission (PUC) are critical, approving rates that affect NW Natural's revenue and ability to invest in infrastructure upgrades and cleaner energy solutions, with new rates approved in late 2024 and another proposed for late 2025.

Legislation like Oregon's SB 98, aiming for up to 30% RNG integration by 2050, provides a political tailwind, making RNG investments more economically viable by allowing cost recovery. However, proposed rules for hydrogen blending, such as mandatory customer notifications in Oregon, could increase compliance costs and impact project feasibility.

The political climate also influences infrastructure development; while there's recognition of the need for system resilience, permitting delays for new projects can add substantial costs and uncertainty. For example, in 2024, ongoing legislative discussions in both Oregon and Washington are shaping the regulatory environment for natural gas infrastructure.

What is included in the product

This NW Natural PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations.

It provides actionable insights for strategic decision-making by highlighting both emerging threats and potential opportunities within NW Natural's operating landscape.

Provides a structured framework to identify and mitigate external threats, easing concerns about market volatility and regulatory changes.

Economic factors

Wholesale natural gas prices are a critical economic factor for NW Natural, directly impacting its operational costs. The company utilizes mechanisms like the Purchased Gas Adjustment (PGA) to pass these costs directly to customers, meaning NW Natural doesn't profit from gas price fluctuations. Despite claims of lower average customer bills compared to two decades ago, significant volatility in global and regional gas markets in 2024 and 2025 can still affect customer affordability and the company's financial predictability.

NW Natural is channeling substantial funds into capital expenditures to bolster its utility infrastructure. In 2024, the company allocated $394.4 million towards its gas and water utility systems, aiming to enhance growth, reliability, and overall resilience.

Looking ahead to 2025, NW Natural anticipates capital expenditures to be between $450 million and $500 million. These investments will cover its existing gas and water operations, as well as integrate the recently acquired Texas gas utility, SiEnergy.

The company's capacity to fund these extensive capital programs through a mix of internal cash flow, strategic debt financing, or equity issuance is a key determinant of its ability to maintain and expand service offerings. Successfully managing these financial levers is crucial for sustaining operational integrity and pursuing strategic growth initiatives.

NW Natural's financial stability is significantly strengthened by its steady customer expansion. In 2024, the company saw an addition of almost 10,000 new gas and water utility connections, marking a 1.1% overall growth rate. This organic increase is crucial for bolstering revenue streams and supporting the company's earnings per share (EPS) objectives.

Beyond organic growth, strategic acquisitions play a vital role in NW Natural's customer base expansion. The company's recent moves, such as acquiring Puttman/ICH and SiEnergy, directly contribute to increasing its total customer connections. These acquisitions not only boost revenue but also align with and support NW Natural's long-term financial growth targets, particularly in expanding its EPS.

Inflation and Operational Costs

Rising inflation significantly impacts NW Natural's operational costs, affecting everything from equipment purchases to labor expenses. For instance, the Producer Price Index (PPI) for industrial commodities, a key indicator of input costs, saw notable increases throughout 2024. This necessitates careful financial management as the company navigates higher expenditures.

NW Natural's strategy involves seeking recovery of these increased costs through regulatory rate cases. However, there's often a lag between incurring higher expenses and receiving approval for rate adjustments. This regulatory lag can temporarily squeeze profit margins, creating a challenge in balancing necessary service investments with customer affordability.

The company aims to maintain service quality and reliability, which requires ongoing investment in infrastructure and maintenance. Continued inflationary pressures can translate into higher bills for customers, potentially leading to increased scrutiny from regulators and consumer advocates regarding the affordability of energy services.

- Increased Material Costs: Inflation drives up the price of essential materials like pipes, valves, and meters, directly impacting capital expenditure budgets.

- Labor Wage Pressures: A tight labor market, exacerbated by inflation, often leads to demands for higher wages, increasing payroll expenses.

- Fuel and Transportation Costs: Higher energy prices and increased transportation logistics costs add to the expense of delivering natural gas and maintaining the distribution network.

- Regulatory Lag: The time it takes for rate cases to be approved means NW Natural may absorb higher costs for a period before being able to pass them on, affecting near-term profitability.

Renewable Energy Investment Economics

NW Natural's strategic shift towards renewable natural gas (RNG) and hydrogen blending necessitates substantial initial capital expenditures, alongside potentially elevated operational expenses when contrasted with conventional natural gas infrastructure. For instance, the development of RNG facilities can range from tens to hundreds of millions of dollars depending on scale and technology.

The economic feasibility of these cleaner energy initiatives hinges critically on supportive regulatory frameworks. These mechanisms must enable cost recovery for the investments made in decarbonization technologies, ensuring a predictable return for NW Natural. Without such provisions, the financial viability of these projects becomes significantly more uncertain.

Furthermore, the evolving marketplace for renewable fuels and their associated environmental attributes, like Renewable Identification Numbers (RINs) or California Low Carbon Fuel Standard (LCFS) credits, plays a pivotal role. The price volatility and demand for these credits directly influence the overall profitability of RNG projects. For example, LCFS credit prices have fluctuated, impacting project economics throughout 2023 and into 2024.

- Capital Outlay: Significant upfront investment is required for RNG production and hydrogen blending infrastructure.

- Operational Costs: Renewable solutions may incur higher ongoing operational expenses than traditional natural gas.

- Regulatory Support: Favorable regulations are essential for cost recovery and project economic viability.

- Market Dynamics: The fluctuating market for renewable fuels and environmental credits directly impacts profitability.

NW Natural's financial health is closely tied to the broader economic climate, with wholesale natural gas prices being a primary driver. While the company passes these costs to customers via Purchased Gas Adjustments, significant price volatility in 2024 and 2025 can still impact customer affordability and NW Natural's own financial predictability.

Inflation continues to be a significant economic factor, raising operational costs for NW Natural, from materials to labor. Despite seeking cost recovery through regulatory rate cases, the inherent lag in these approvals can temporarily compress profit margins, making it crucial for the company to manage expenditures carefully.

The company's substantial capital expenditure plans, projecting $450 million to $500 million for 2025, are designed to enhance infrastructure and integrate acquisitions like SiEnergy. Funding these investments through a combination of internal cash flow, debt, or equity will be key to maintaining operational capacity and pursuing growth.

| Economic Factor | Impact on NW Natural | Data/Notes (2024-2025) |

|---|---|---|

| Wholesale Natural Gas Prices | Directly impacts operational costs; no profit from price fluctuations. | Volatility in 2024-2025 affects customer affordability and company predictability. |

| Inflation | Increases material, labor, and transportation costs. | Producer Price Index (PPI) for industrial commodities showed notable increases in 2024. |

| Capital Expenditures | Investments in infrastructure and acquisitions. | 2024: $394.4 million. 2025 projection: $450-$500 million. |

| Customer Growth | Drives revenue and supports EPS objectives. | Added nearly 10,000 connections in 2024 (1.1% growth). |

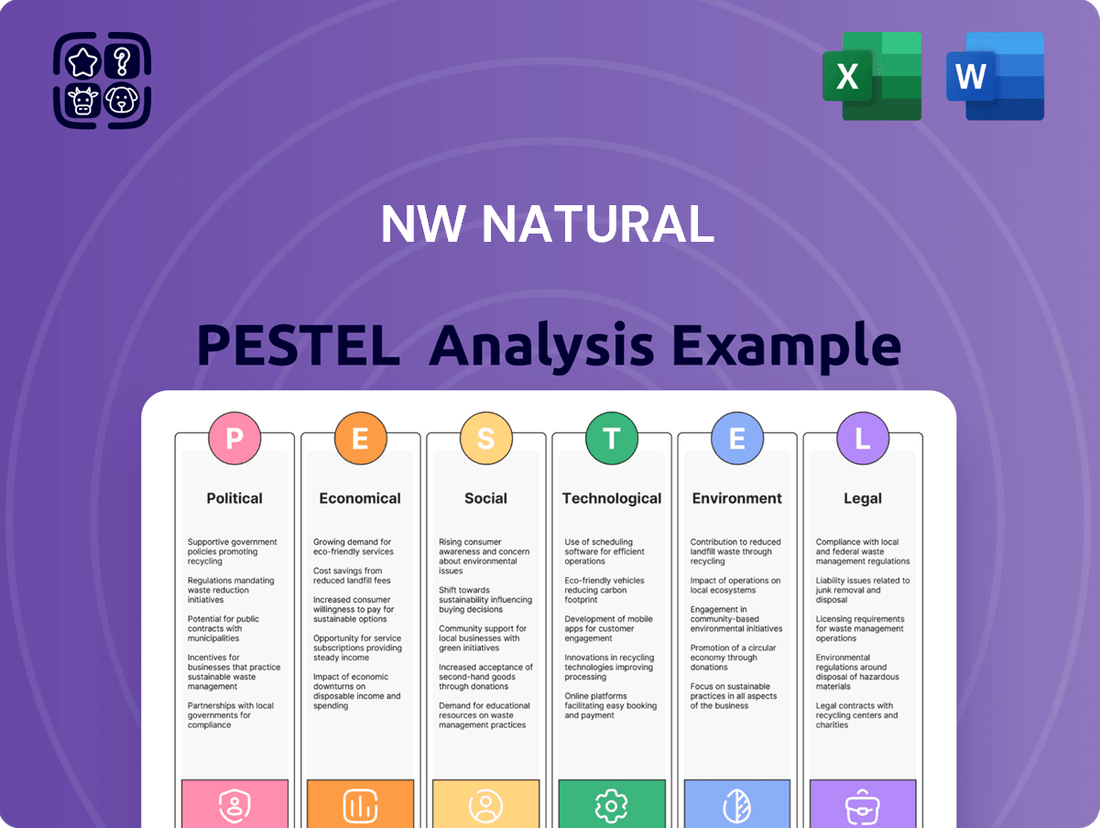

Preview the Actual Deliverable

NW Natural PESTLE Analysis

The preview shown here is the exact NW Natural PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting NW Natural.

The content and structure shown in the preview is the same NW Natural PESTLE Analysis document you’ll download after payment.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering actionable insights for strategic planning.

Sociological factors

Public sentiment towards natural gas is increasingly complex, with environmental concerns at the forefront. Many advocacy groups are actively promoting a shift towards electric appliances, directly questioning the long-term viability and environmental advantages of natural gas, including renewable natural gas (RNG). This evolving public discourse is a significant factor that regulators and utilities like NW Natural must navigate.

This changing perception directly impacts regulatory landscapes and consumer choices, potentially dampening demand for natural gas services. For NW Natural, effectively communicating its decarbonization strategies and the role of RNG in reducing emissions is crucial to maintaining customer trust and market position. For instance, as of early 2024, public opinion polls in key NW Natural service territories show a growing, albeit divided, interest in renewable energy sources, with a notable segment expressing reservations about continued reliance on fossil fuels, even in a transitional capacity.

Customers and communities are increasingly vocal about their desire for cleaner energy options and want utilities to be more open about their environmental footprint. This rising demand for sustainability is a significant sociological factor influencing the energy sector.

NW Natural is actively addressing these societal expectations by investing in renewable natural gas (RNG) and researching hydrogen as a future fuel source. For instance, in 2023, the company completed its first RNG project, injecting RNG into its distribution system, and continues to explore partnerships to expand its RNG portfolio. This proactive approach helps the company align with climate goals and meet public demand for a lower-carbon future.

The pressure from consumers and communities to reduce greenhouse gas emissions is substantial, making a clear and forward-thinking sustainability strategy essential for NW Natural's long-term success and social license to operate.

Rising energy costs are a major worry for many families, especially those on tighter budgets. Inflation and necessary upgrades to energy infrastructure are pushing prices up. For example, in early 2024, the U.S. experienced a significant increase in energy prices compared to the previous year, impacting household budgets across the board.

NW Natural, like other utility providers, is actively working to make energy more affordable. They offer programs like bill discounts and assistance for customers who are behind on payments, aiming to help those most in need. These initiatives are crucial for maintaining customer stability and ensuring essential services remain accessible.

Consumer advocacy groups are vocal about preventing unfair price increases and ensuring everyone has access to affordable energy. They often highlight the disproportionate impact of high energy costs on low-income households and push for regulatory measures that protect consumers from excessive rate hikes.

Community Engagement and Transparency

NW Natural's relationship with its communities is a significant factor, particularly as it navigates new energy frontiers. Past initiatives, such as proposed hydrogen blending projects, encountered public resistance stemming from concerns about insufficient transparency. This highlights the critical need for open communication and active community involvement.

Building and maintaining public trust is paramount for NW Natural's social license to operate. By actively engaging community-based organizations in the development of customer assistance programs, the company demonstrates a commitment to shared responsibility and local needs. This collaborative approach fosters goodwill and can mitigate potential opposition to future projects.

NW Natural's ongoing efforts to communicate its climate initiatives are also crucial. As of early 2024, the company has been outlining its strategy for reducing greenhouse gas emissions, a key area of public interest. For instance, in its 2023 ESG report, NW Natural detailed progress on its emissions reduction targets, aiming for a 30% reduction in Scope 1 and Scope 2 emissions by 2030 compared to a 2019 baseline.

- Community Trust: Past public opposition to hydrogen blending projects underscores the importance of transparent communication and community input.

- Partnerships: Collaborating with community-based organizations on assistance programs strengthens social ties and demonstrates corporate responsibility.

- Climate Communication: Proactive updates on climate initiatives, such as emissions reduction targets, are vital for maintaining public support and social license.

- Data-Driven Engagement: NW Natural aims to leverage data to better understand and respond to community concerns, fostering more effective dialogue.

Demographic Shifts and Urbanization

NW Natural's service territories in Oregon and Southwest Washington are experiencing significant population growth, directly fueling increased demand for utility services. For instance, Oregon's population grew by approximately 1.5% between 2022 and 2023, reaching over 4.2 million residents, while Southwest Washington also shows steady population increases. This consistent customer growth is a critical driver for NW Natural's ongoing business expansion and infrastructure development.

Urbanization trends are also playing a crucial role, concentrating demand in specific areas. As more people move into urban and suburban centers, the density of service requirements rises, directly influencing NW Natural's strategic decisions regarding its distribution network investments. This means planning for more robust and efficient delivery systems to serve these growing population clusters.

- Population Growth: Oregon's population growth rate averaged 1.2% annually from 2020-2023, indicating sustained demand for NW Natural services.

- Urban Concentration: Metropolitan areas like Portland and Vancouver, WA, are central to NW Natural's service area expansion planning due to high population density.

- Infrastructure Needs: Increased urbanization necessitates upgrades and expansions to the natural gas distribution network to meet rising demand efficiently.

- New Connections: Population increases directly translate to a higher volume of new customer connections, a key metric for NW Natural's revenue growth.

Public sentiment is increasingly focused on environmental impact, with a growing preference for electric alternatives over natural gas. This shift, amplified by advocacy groups, necessitates that NW Natural proactively communicate its decarbonization efforts, including its investments in renewable natural gas (RNG). As of early 2024, public opinion surveys in NW Natural's service areas reveal a divided public on continued reliance on fossil fuels, highlighting the need for transparent communication on sustainability initiatives.

Consumer demand for cleaner energy options and greater utility transparency regarding environmental footprints is a significant sociological driver. NW Natural's commitment to RNG, evidenced by its first RNG project completion in 2023, directly addresses these expectations. The company's 2023 ESG report detailed progress towards a 30% reduction in Scope 1 and 2 emissions by 2030 from a 2019 baseline, aligning with public interest in climate action.

Affordability remains a key concern for households, particularly with rising energy costs influenced by inflation and infrastructure upgrades. NW Natural's customer assistance programs and bill discount initiatives are vital for maintaining service accessibility. Consumer advocacy groups actively monitor pricing, emphasizing the impact on low-income families and advocating for regulatory protections against excessive rate increases.

Community trust is paramount, especially following past public resistance to projects like hydrogen blending due to perceived transparency issues. NW Natural's collaborative approach, including partnerships with community organizations for assistance programs, builds goodwill and supports its social license to operate. Effective communication of climate initiatives, as demonstrated by the company's emissions reduction targets, is crucial for sustained public support.

Technological factors

NW Natural is making significant strides in renewable natural gas (RNG) production, a key technological factor for its future. By developing RNG from organic waste, the company is aligning with decarbonization goals.

In 2024, NW Natural achieved substantial completion on two RNG facilities. This infrastructure is crucial for integrating this cleaner fuel source into their existing natural gas pipeline network, a process that demonstrates tangible progress in their sustainability efforts.

The company is actively pursuing a 20-year supply agreement for RNG, underscoring a long-term commitment to this technology. This strategic move positions NW Natural to meet evolving environmental regulations and customer demand for lower-carbon energy solutions.

NW Natural is actively investigating hydrogen blending in its existing natural gas infrastructure. The company has conducted pilot projects, achieving successful blending of up to 20% hydrogen at its largest facility. This move positions NW Natural to potentially leverage hydrogen as a cleaner energy source within its distribution network.

Further demonstrating its commitment to advanced decarbonization, NW Natural is also involved in methane pyrolysis projects. This innovative technology breaks down methane into hydrogen and solid carbon, offering a pathway to produce hydrogen with a reduced carbon footprint. These initiatives highlight NW Natural's forward-looking approach to energy transition technologies.

NW Natural is actively exploring carbon capture and storage (CCS) technologies beyond its focus on renewable natural gas and hydrogen. A significant development is a pilot project, slated to begin in 2024, that will transform natural gas and air into solid, sequestered carbon. This captured carbon has potential applications in building materials, such as asphalt, showcasing a novel pathway for emissions mitigation.

Advanced Gas Distribution Infrastructure

Technological factors significantly influence NW Natural's operations, particularly through advancements in its gas distribution infrastructure. The company actively invests in upgrading its natural gas delivery systems to boost reliability and resilience. This includes ongoing pipeline retrofitting projects and enhancements to underground storage and liquefied natural gas (LNG) facilities.

These technological upgrades are crucial for ensuring the safe and efficient transportation of natural gas to customers. Furthermore, these improvements are designed to accommodate the integration of renewable fuels, aligning with evolving energy landscapes. For instance, NW Natural's capital expenditures for system modernization were approximately $268 million in 2023, with a significant portion dedicated to pipeline replacement and infrastructure improvements. The company also reported that roughly 73% of its main replacements in 2023 were completed using advanced technologies like direct bury or boring methods, which are more efficient and less disruptive.

- Ongoing Pipeline Modernization: NW Natural is committed to replacing older, leak-prone pipelines with modern materials, enhancing safety and reducing emissions.

- Investment in Storage and LNG: Upgrades to underground storage and LNG facilities are key to ensuring a consistent and reliable supply of natural gas, especially during peak demand periods.

- Integration of Renewable Fuels: Technological advancements in infrastructure are paving the way for the safe and efficient delivery of renewable natural gas (RNG) and other alternative fuels.

- Efficiency Gains: Investments in advanced distribution technologies are expected to yield operational efficiencies and reduce the environmental impact of natural gas delivery.

Energy Efficiency and Smart Technologies

Technological advancements are significantly shaping NW Natural's operational landscape, particularly through energy efficiency and smart technologies. The company's commitment to these areas is evident in its 2024-2025 Biennial Energy Efficiency Plan, which details strategies for both residential and industrial sectors.

These initiatives are designed to empower customers by providing tools and programs that help them better manage their energy usage. For instance, NW Natural's programs aim to reduce overall energy consumption, which directly benefits system efficiency and can lead to cost savings for customers. This focus on smart energy solutions is crucial for adapting to evolving energy demands and regulations.

- Residential Energy Efficiency: Programs encourage behavioral changes and adoption of energy-saving practices in homes.

- Industrial Energy Efficiency: Initiatives target businesses to optimize their energy consumption through technological upgrades and process improvements.

- Smart Meter Deployment: Investments in smart grid technologies enable more accurate monitoring and management of energy flow.

- Data Analytics: Leveraging data from smart technologies allows for better forecasting and operational planning.

NW Natural is actively integrating renewable natural gas (RNG) and exploring hydrogen blending, showcasing a strong technological pivot towards decarbonization. The company's 2024 progress includes completing two RNG facilities, with a 20-year supply agreement actively pursued for this cleaner fuel source.

Beyond RNG, NW Natural is piloting methane pyrolysis for hydrogen production and investigating carbon capture and storage (CCS) technologies, including a 2024 pilot to convert natural gas and air into solid carbon for potential use in building materials.

Significant investment in pipeline modernization, with approximately $268 million in capital expenditures for system upgrades in 2023, enhances safety and efficiency, with 73% of main replacements in 2023 using advanced methods.

The company's 2024-2025 Biennial Energy Efficiency Plan emphasizes smart technologies and customer empowerment to manage energy usage, with initiatives targeting both residential and industrial sectors for reduced consumption and improved system efficiency.

Legal factors

NW Natural navigates a dense regulatory landscape, facing federal and state mandates concerning emissions, waste, and water quality. For instance, compliance with the Oregon Climate Protection Program, effective in 2024 with a 2050 net-zero goal, necessitates careful management of greenhouse gas emissions, potentially impacting operational strategies and investment in cleaner technologies.

Public Utility Commissions (PUCs) in Oregon and Washington hold significant legal sway over NW Natural, dictating everything from its rates and how it recovers costs to the standards of service it must provide. For instance, recent rate case decisions in Oregon, which took effect in November 2024, and the ongoing reviews for 2025, directly showcase this legal oversight on NW Natural's earnings and its ability to recoup investments. These regulatory bodies also carefully examine any new spending the company proposes and its target profit margins, ensuring they align with public interest.

Oregon's Senate Bill 98 (SB 98) is a significant legal driver for NW Natural, specifically enabling the utility to invest in renewable natural gas (RNG). This bill provides a clear legal framework for procuring RNG and developing the necessary infrastructure. It's a crucial piece of legislation that supports the company's transition towards cleaner energy sources.

SB 98 allows NW Natural to recover costs associated with RNG investments, up to a cap of 5% of its revenue requirement. This cost recovery mechanism is a direct financial incentive, making the pursuit of RNG projects more viable and attractive. It essentially legalizes and financially supports the integration of RNG into NW Natural's operations, aligning with Oregon's broader decarbonization objectives.

Customer Protection and Service Obligations

As a public utility, NW Natural operates under strict legal mandates to ensure safe, reliable, and affordable natural gas service to its customers. This commitment involves adhering to rigorous service quality standards and complying with all consumer protection laws designed to safeguard individuals. For instance, in 2023, NW Natural's regulatory filings detailed its ongoing compliance with state-specific service reliability metrics, aiming to minimize outages and ensure consistent delivery.

Furthermore, the company is legally obligated to participate in and administer assistance programs for low-income customers, helping to mitigate energy affordability challenges. These programs are often subject to specific regulatory oversight and funding requirements. Recent legal actions, such as settlements addressing proposed rate adjustments, highlight the scrutiny NW Natural faces regarding pricing and the necessity of demonstrating that any rate changes are justified and in the public interest. In 2024, discussions around energy affordability and the role of utilities in providing relief continue to be a focal point for regulators.

Key legal factors impacting NW Natural include:

- Regulatory Compliance: Adherence to service quality, safety, and environmental regulations set by state public utility commissions and federal agencies like the Department of Transportation.

- Consumer Protection Laws: Meeting requirements related to fair billing practices, dispute resolution, and access to information for all customers.

- Rate Case Proceedings: Navigating the legal and regulatory processes for approving rate changes, which often involve extensive public input and legal challenges.

- Low-Income Assistance Programs: Legal mandates to implement and manage programs like the Low Income Home Energy Assistance Program (LIHEAP), often requiring specific reporting and fund management.

Infrastructure Siting and Permitting Laws

NW Natural's operations are heavily influenced by infrastructure siting and permitting laws, which govern the development and upkeep of its natural gas and water systems. These regulations often necessitate lengthy public review processes, directly affecting project timelines and overall expenses. For instance, the process for obtaining permits for new pipeline construction or upgrades can take anywhere from several months to over a year, depending on the jurisdiction and environmental impact assessments required.

Compliance with these legal frameworks is paramount for NW Natural to effectively expand and maintain its critical utility infrastructure. Failure to adhere to siting, zoning, and environmental permitting requirements can lead to significant delays, fines, or even project cancellations. In 2024, the company likely allocated a substantial portion of its capital expenditure towards ensuring regulatory compliance and navigating these complex legal landscapes for its ongoing infrastructure modernization programs.

- Siting Regulations: Laws dictating where utilities can build and operate, often involving local zoning ordinances.

- Environmental Permitting: Requirements for assessing and mitigating the environmental impact of infrastructure projects, such as those under the National Environmental Policy Act (NEPA).

- Public Review Processes: Mandated opportunities for public comment and input on proposed infrastructure developments, adding time to project lifecycles.

- Compliance Costs: Direct expenses associated with meeting legal and regulatory standards, including studies, legal fees, and mitigation efforts.

NW Natural operates under strict legal frameworks, particularly concerning its utility services and environmental impact. The Oregon Climate Protection Program, in effect since 2024, mandates a net-zero goal by 2050, requiring NW Natural to manage greenhouse gas emissions closely and potentially invest in cleaner technologies. Oregon's Senate Bill 98 is a key legal enabler, allowing NW Natural to invest in and recover costs for renewable natural gas (RNG) projects, up to 5% of its revenue requirement, directly supporting its decarbonization efforts.

Public Utility Commissions (PUCs) in Oregon and Washington exert substantial legal authority over NW Natural, dictating rates, cost recovery, and service standards. For instance, Oregon's PUC rate case decisions, with new rates effective November 2024, directly impact the company's earnings and investment recovery. Furthermore, NW Natural is legally bound to ensure safe, reliable, and affordable service, adhering to consumer protection laws and administering low-income assistance programs, with ongoing regulatory scrutiny on pricing and affordability measures throughout 2024.

Infrastructure development for NW Natural is governed by siting and permitting laws, requiring compliance with zoning ordinances and environmental impact assessments, often involving lengthy public review processes. These legal requirements can significantly influence project timelines and costs, with new pipeline construction permits potentially taking over a year. In 2024, a significant portion of NW Natural's capital expenditure was likely dedicated to ensuring regulatory compliance for its infrastructure modernization programs.

| Legal Factor | Impact on NW Natural | Example/Data Point (2024/2025 Focus) |

|---|---|---|

| Regulatory Compliance (Environmental) | Mandates emissions management and investment in cleaner technologies. | Compliance with Oregon Climate Protection Program (effective 2024) for net-zero goals. |

| Public Utility Commission (PUC) Oversight | Dictates rates, cost recovery, and service standards. | Oregon PUC rate case decisions effective November 2024 impacting earnings. |

| Renewable Natural Gas (RNG) Legislation | Enables investment and cost recovery for RNG projects. | Oregon's SB 98 allows RNG cost recovery up to 5% of revenue requirement. |

| Infrastructure Siting & Permitting | Governs development, impacts timelines and costs. | Permit acquisition for new pipelines can exceed one year; significant 2024 capex for compliance. |

Environmental factors

NW Natural faces significant pressure to curb its greenhouse gas emissions, mirroring ambitious state mandates like Oregon's objective for a 90% reduction by 2050. This regulatory landscape directly impacts the company's operational strategies and future investments.

To meet these environmental challenges, NW Natural is actively exploring and investing in solutions such as renewable natural gas (RNG) and hydrogen blending, with a stated goal of achieving carbon neutrality by 2050. These initiatives represent a forward-looking approach to decarbonization.

Despite these stated aims, the actual progress in emissions reduction and the long-term viability of technologies like widespread hydrogen blending remain under active review and subject to evolving scientific and economic assessments. For instance, the cost and scalability of RNG production, a key component of their strategy, is a critical factor.

NW Natural is actively pursuing renewable natural gas (RNG) development, a significant environmental initiative. This involves sourcing RNG from various waste streams, including landfills, agricultural byproducts, and wastewater treatment facilities.

The primary goal of this strategy is to lower the carbon intensity of the natural gas supplied to its customers. By utilizing these waste-derived resources, NW Natural can offer a cleaner energy alternative.

This approach leverages NW Natural's existing infrastructure for efficient and lower-carbon energy distribution. It's a practical way to integrate renewable sources into their current delivery systems.

For instance, in 2023, NW Natural announced a multi-year agreement to purchase RNG, representing a tangible step in their commitment to decarbonization. This aligns with broader industry trends and regulatory pressures to reduce greenhouse gas emissions.

NW Natural's direct involvement in water and wastewater services through its NW Natural Water subsidiary places it squarely within the realm of environmental factors. This means the company shoulders significant responsibilities concerning water quality, conservation efforts, and the sustainable treatment of wastewater, all critical for ecological health and regulatory compliance.

Recent strategic acquisitions, particularly in the recycled water sector, underscore NW Natural's expanding commitment to environmental stewardship. This move signals a proactive approach to sustainability that extends beyond its traditional natural gas operations, embracing innovative solutions for water resource management.

For example, NW Natural Water acquired Water Utility Company, Inc. in June 2024, adding approximately 15,000 retail water and wastewater customer connections. This expansion into new territories, like Texas, highlights the company's growth trajectory in water services and its increasing role in managing vital water resources.

Methane Emissions and Leakage Control

While natural gas is often viewed as a more environmentally friendly option compared to coal, the issue of methane leakage from existing infrastructure presents a significant environmental challenge. Methane is a potent greenhouse gas, with a warming potential many times greater than carbon dioxide over a 20-year period. Controlling these emissions is crucial for mitigating climate change impacts.

NW Natural is actively addressing methane emissions through its continuous investments in modernizing its extensive pipeline system. These upgrades not only enhance system reliability and safety but also play a direct role in minimizing methane leakage. By replacing older, more prone-to-leaking components with state-of-the-art materials and technologies, the company is working to reduce its environmental footprint.

Specific initiatives include advanced leak detection technologies and proactive maintenance programs. For instance, in 2024, NW Natural reported progress on its multi-year pipeline modernization program, which targets the replacement of older cast iron and bare steel mains. These efforts are directly linked to reducing fugitive methane emissions.

- Methane Potency: Methane traps 80 times more heat than carbon dioxide over a 20-year period.

- Infrastructure Modernization: NW Natural's ongoing pipeline replacement projects are key to reducing leaks.

- Investment in Technology: The company utilizes advanced leak detection equipment to identify and repair emission sources promptly.

- Regulatory Focus: Increasing regulatory scrutiny on methane emissions is driving further investment in control technologies and practices.

Climate Change Adaptation and Resiliency

Climate change presents significant risks to infrastructure, particularly through an increase in extreme weather events that can compromise service reliability. NW Natural is actively addressing these risks by investing in system resilience, which includes crucial seismic upgrades and the development of robust infrastructure designed to withstand environmental challenges and ensure continuous, safe service delivery.

The company's strategic approach to energy security and resilience in the face of a changing climate involves maintaining two distinct energy systems: one above ground and one below ground. This dual-system strategy provides a buffer against disruptions.

- Infrastructure Resilience: NW Natural's commitment to system resilience is demonstrated through ongoing investments, such as the $105 million allocated in 2023 for capital improvements, which includes seismic retrofitting and pipeline modernization efforts.

- Dual Energy Systems: The maintenance of both above and below-ground energy delivery systems is a key component of their strategy to ensure energy security and operational continuity during adverse weather conditions.

- Adaptation Investments: The company reported spending $38 million in 2023 specifically on projects related to system modernization and resilience, which directly addresses climate-related risks.

NW Natural is actively pursuing renewable natural gas (RNG) development, a significant environmental initiative. This involves sourcing RNG from various waste streams, including landfills, agricultural byproducts, and wastewater treatment facilities, with a goal to lower the carbon intensity of the natural gas supplied to customers.

The company's water and wastewater services subsidiary, NW Natural Water, places it directly within environmental stewardship responsibilities concerning water quality, conservation, and sustainable wastewater treatment. This is further evidenced by acquisitions in the recycled water sector, expanding its sustainability focus beyond natural gas operations.

Addressing methane leakage from its extensive pipeline system is a critical environmental focus for NW Natural, with ongoing investments in modernization and advanced leak detection technologies aimed at minimizing greenhouse gas emissions.

NW Natural is also investing in system resilience to combat climate change risks, including extreme weather events. This involves seismic upgrades and maintaining dual above and below-ground energy systems to ensure service reliability.

| Environmental Factor | NW Natural's Response/Initiative | Key Data/Facts |

| Greenhouse Gas Emissions Reduction | Investing in Renewable Natural Gas (RNG) and hydrogen blending; Carbon neutrality goal by 2050. | Oregon mandate for 90% reduction by 2050. Agreement to purchase RNG announced in 2023. |

| Water Resource Management | Operating NW Natural Water subsidiary focused on water quality, conservation, and wastewater treatment. | Acquired Water Utility Company, Inc. in June 2024, adding 15,000 customer connections in Texas. |

| Methane Leakage Control | Pipeline modernization program to replace older infrastructure and advanced leak detection technologies. | Ongoing program targeting cast iron and bare steel mains replacement. Methane traps 80 times more heat than CO2 over 20 years. |

| Climate Change Resilience | Investing in infrastructure resilience, seismic upgrades, and dual energy systems. | $105 million allocated in 2023 for capital improvements including seismic retrofitting. $38 million spent in 2023 on modernization and resilience projects. |

PESTLE Analysis Data Sources

Our NW Natural PESTLE Analysis is informed by a robust blend of official government data, industry-specific market research, and reputable economic and environmental reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the natural gas utility sector.