NW Natural Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NW Natural Bundle

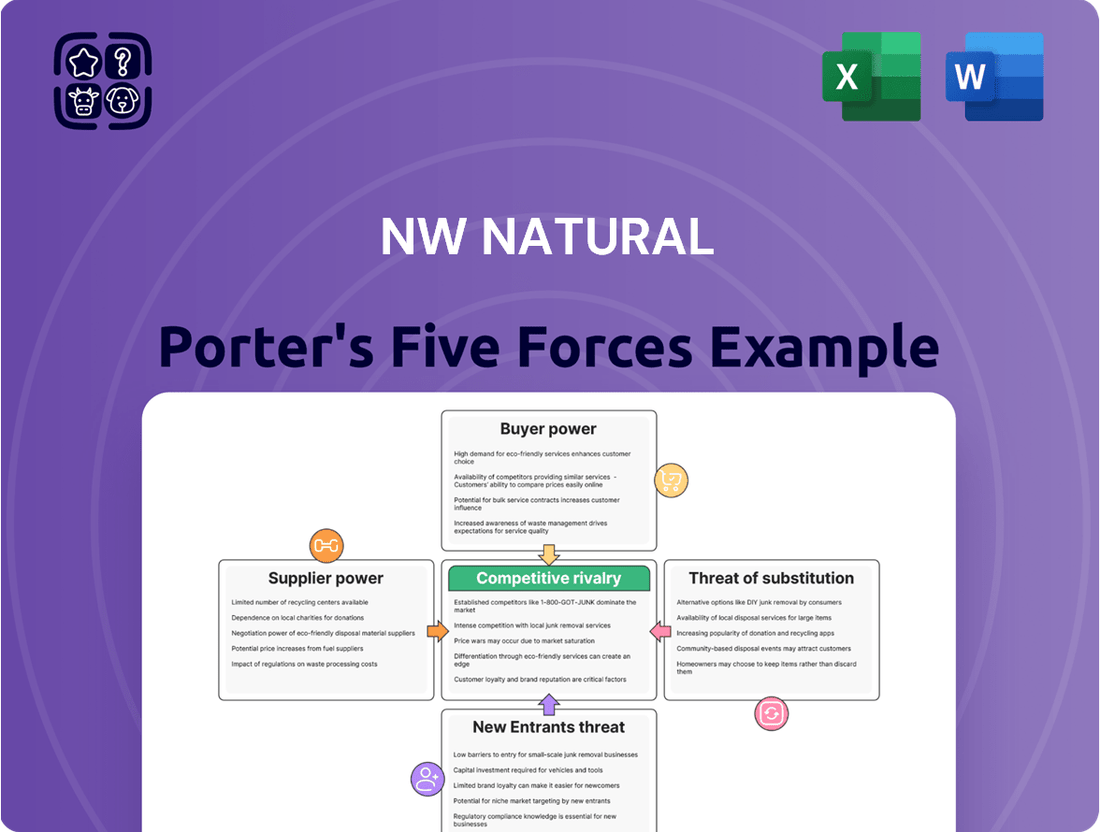

Understanding NW Natural's competitive landscape through Porter's Five Forces reveals critical insights into industry structure and profitability. We've examined the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the natural gas utility sector. This analysis highlights how these forces collectively shape NW Natural's strategic options and market performance.

The complete report reveals the real forces shaping NW Natural’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

NW Natural's dependence on a concentrated network of natural gas suppliers, including major interstate pipeline operators and key production basins, grants these entities considerable leverage. This concentration means fewer alternatives for NW Natural, potentially leading to higher wholesale natural gas costs and impacting supply reliability.

In 2024, the U.S. natural gas market continues to be shaped by a relatively small number of large-scale producers and pipeline companies. For instance, the Permian Basin and the Haynesville Shale remain dominant supply regions, with a few key midstream companies controlling significant transportation infrastructure, directly influencing the cost and accessibility of gas for utilities like NW Natural.

As NW Natural delves deeper into the renewable natural gas (RNG) sector, the landscape of RNG suppliers is experiencing a surge in competition. This heightened rivalry among suppliers can directly impact NW Natural's ability to secure favorable terms.

While NW Natural is actively seeking RNG purchase agreements, the broader market demand from other utilities and various industrial sectors is also on the rise. This increasing demand, fueled by decarbonization goals, can empower RNG suppliers, potentially leading to higher prices and more stringent contract conditions for NW Natural.

For instance, the U.S. Environmental Protection Agency's Renewable Fuel Standard (RFS) program and similar state-level initiatives are driving significant investment and demand for RNG across the nation. This creates a scenario where multiple large energy consumers are vying for limited RNG supplies, thereby strengthening the bargaining position of RNG producers.

Suppliers of essential infrastructure, such as specialized pipe manufacturers and advanced meter technology providers, exert a degree of bargaining power over NW Natural. This power stems from the highly specific nature of these components and the stringent regulatory standards they must meet, which inherently restricts NW Natural's ability to easily switch suppliers. For example, in 2023, capital expenditures for NW Natural's utility operations were approximately $370 million, a significant portion of which would be allocated to acquiring such infrastructure components.

Regulatory Oversight on Gas Costs

While suppliers of natural gas can hold significant power, NW Natural's ability to absorb or pass on these costs is frequently managed by regulatory bodies. Mechanisms like the Purchased Gas Adjustment (PGA) allow NW Natural to adjust customer rates based on the prevailing cost of natural gas, but this process requires state Public Utility Commission approval. This regulatory oversight can mitigate the direct impact of supplier price hikes on NW Natural's margins, as seen in past PGA filings where adjustments were made to reflect market conditions while ensuring customer affordability. For instance, in 2024, regulatory reviews of NW Natural's gas supply contracts and associated costs would have been a key factor in determining rate adjustments.

- Regulatory Approval: NW Natural must seek approval from state Public Utility Commissions for changes in natural gas costs passed to customers via the PGA.

- Mitigation of Volatility: This oversight helps temper the impact of extreme supplier price fluctuations on the utility and its customers.

- 2024 Context: Regulatory filings and decisions throughout 2024 would have directly influenced NW Natural's ability to manage supplier price pressures.

Long-Term Supply Contracts

NW Natural proactively manages supplier power by entering into long-term agreements for its natural gas supply and storage needs. These contracts are crucial for securing stable pricing and guaranteeing delivery, thereby insulating the company from the unpredictable swings of the short-term energy market. For instance, in 2024, NW Natural continued to rely on these multi-year contracts to hedge against volatile commodity prices, a strategy that has historically provided significant cost predictability.

These long-term contracts offer several distinct advantages:

- Price Stability: They lock in prices for extended periods, reducing exposure to sudden market upticks.

- Supply Assurance: Guaranteeing a consistent flow of natural gas is vital for a utility company's operational reliability.

- Reduced Volatility Impact: By minimizing the effect of short-term price fluctuations, NW Natural strengthens its financial planning and customer rate stability.

- Enhanced Negotiation Position: The commitment inherent in long-term deals can often lead to more favorable terms with suppliers.

NW Natural faces significant bargaining power from its natural gas suppliers due to market concentration, particularly from major interstate pipeline operators. This leverage allows suppliers to influence wholesale gas costs and supply reliability. For example, in 2024, the continued dominance of regions like the Permian Basin by a few midstream companies directly impacts the cost and accessibility of gas for utilities. This situation is further amplified by increasing demand for renewable natural gas (RNG) from various sectors, empowering RNG producers and potentially leading to higher prices for NW Natural. Despite these pressures, regulatory oversight through mechanisms like Purchased Gas Adjustments (PGA) helps mitigate the direct impact of supplier price hikes on the utility's margins, as seen in 2024 regulatory reviews. Furthermore, NW Natural employs long-term supply agreements to secure stable pricing and ensure delivery, a strategy that has historically provided cost predictability.

| Supplier Type | Bargaining Power Factors | Impact on NW Natural | Mitigation Strategies | 2024 Relevance |

|---|---|---|---|---|

| Natural Gas Producers/Pipelines | Market concentration, limited alternatives | Higher wholesale costs, supply reliability concerns | Long-term contracts, regulatory oversight (PGA) | Continued reliance on major supply regions and pipeline infrastructure |

| Renewable Natural Gas (RNG) Suppliers | Growing demand, limited supply, government incentives (RFS) | Potential for higher prices, stringent contract terms | Diversifying RNG sources, securing purchase agreements | Increased competition for RNG due to decarbonization goals |

| Infrastructure Component Suppliers | Specialized nature of products, stringent regulatory standards | Limited supplier options, potential cost increases | Long-term supplier relationships, bulk purchasing | Capital expenditures in 2023 were around $370 million for utility operations |

What is included in the product

This analysis of NW Natural's competitive environment reveals the intensity of rivalry, buyer and supplier power, threats from new entrants and substitutes, all within the context of the regulated utility sector.

Instantly identify and address critical competitive pressures with a visually intuitive five forces framework, streamlining strategic planning for NW Natural.

Customers Bargaining Power

As a regulated public utility, NW Natural's rates are subject to approval by state commissions, such as the Oregon Public Utility Commission (OPUC) and the Washington Utilities and Transportation Commission (WUTC). This regulatory oversight significantly curtails customers' direct bargaining power over the price of natural gas. For instance, in 2024, NW Natural's rate cases involve detailed filings and public hearings, where customer input is considered, but the final decision rests with the commission, not individual consumers.

The nature of natural gas as an essential service further diminishes customer bargaining power. Households and businesses rely on natural gas for heating, cooking, and industrial processes, creating a inelastic demand. This means that even with price increases, customers have a limited ability to reduce their consumption or switch to alternatives, especially in the short term. In 2023, residential customers accounted for a significant portion of NW Natural's revenue, highlighting their dependency on the service.

NW Natural’s customer base spans residential, commercial, and industrial sectors, each exhibiting distinct price sensitivities. Residential customers, often locked into specific service areas due to infrastructure, generally possess lower bargaining power. Conversely, larger industrial clients, while still operating within regulated utility structures, might explore alternative energy sources or demand more favorable contract terms.

Customers wield bargaining power through energy efficiency programs, often bolstered by utility incentives. This allows them to reduce their natural gas consumption, thereby managing their energy bills. For instance, NW Natural offers various rebates and programs designed to help customers improve insulation or upgrade to more efficient appliances, directly impacting their usage and, by extension, their financial outlay.

Bill Discount Programs and Consumer Advocacy

For NW Natural, the bargaining power of customers is amplified by bill discount programs and consumer advocacy, particularly for low-income households. These initiatives, often supported by regulatory bodies, push for affordable pricing and continued access to essential utility services. This collective action translates into significant customer leverage.

Consumer advocacy groups can effectively lobby for lower rates or specific service protections, directly impacting NW Natural's revenue streams and operational flexibility. For instance, in 2024, many states saw increased scrutiny on utility rate hikes, with advocacy groups playing a pivotal role in public comment periods and legislative discussions. This pressure can force utilities to absorb costs or find efficiencies to maintain affordability.

- Impact of Discount Programs: Bill discount programs, like the Low Income Home Energy Assistance Program (LIHEAP) in the US, directly reduce the amount customers pay, shifting some of the cost burden or necessitating utility adjustments.

- Consumer Advocacy Influence: Groups like Public Citizen or state-specific consumer counsel offices actively participate in regulatory proceedings, presenting data and arguments to influence pricing decisions.

- Regulatory Mediation: Regulatory bodies act as intermediaries, often incorporating consumer concerns into their rate-setting decisions, thereby channeling customer bargaining power.

- Collective Action: The unified voice of many low-income households, amplified by advocacy, creates a formidable collective bargaining force that utilities must address.

Acquisition-Driven Customer Growth

NW Natural's acquisition of SiEnergy in late 2023, for instance, added approximately 20,000 customers, primarily in Texas. This strategic move significantly broadened its operational footprint and customer demographics. While this expansion bolsters overall customer numbers, it introduces a greater diversity of needs and service expectations that NW Natural must effectively address to maintain strong customer relationships.

Managing this enlarged and more geographically dispersed customer base presents a challenge in maintaining consistent service quality and responsiveness. The company must invest in systems and processes to cater to varying customer preferences across different regions. This increased customer volume necessitates a more sophisticated approach to customer engagement and support.

- Acquisition Impact: SiEnergy acquisition added ~20,000 customers.

- Geographic Expansion: Entry into new markets, notably Texas.

- Customer Diversity: Managing varied customer needs and expectations.

- Operational Challenge: Maintaining service quality across a larger base.

The bargaining power of NW Natural's customers is generally low due to the essential nature of natural gas and regulatory oversight. While customers can influence rates through advocacy and energy efficiency, their ability to negotiate prices directly is limited.

Customers exert influence through energy efficiency programs and collective action, particularly low-income households. Advocacy groups actively participate in regulatory proceedings, aiming to secure favorable pricing, as seen in 2024’s increased scrutiny on utility rate hikes.

NW Natural's 2023 acquisition of SiEnergy, adding about 20,000 customers, diversifies its base but also presents challenges in managing varied needs across expanded geographic regions.

| Customer Segment | Bargaining Power Influence | Key Factors |

|---|---|---|

| Residential | Low | Essential service, regulatory pricing, limited switching options |

| Commercial | Moderate | Potential for energy efficiency, some contract flexibility |

| Industrial | Moderate to High | Higher consumption, potential to explore alternatives, contract negotiation |

Full Version Awaits

NW Natural Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive NW Natural Porter's Five Forces Analysis meticulously dissects the competitive landscape, offering deep insights into industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potency of substitute products. You're previewing the final version—precisely the same document that will be available to you instantly after buying, providing actionable intelligence for strategic decision-making.

Rivalry Among Competitors

NW Natural enjoys a protected position in its core Oregon and Southwest Washington markets, where it functions as a regulated utility. This means direct competition from other natural gas distributors is virtually nonexistent in these areas. This limited rivalry is a significant advantage, allowing NW Natural to focus on operational efficiency and customer service rather than aggressive market share battles within its established footprint. For instance, in 2023, NW Natural served approximately 778,000 customers across these key regions.

NW Natural's venture into water and wastewater services via NW Natural Water significantly shifts its competitive landscape. Unlike its more consolidated natural gas operations, the water utility sector can exhibit greater fragmentation, potentially intensifying rivalry.

This fragmentation, coupled with opportunities for growth through acquisitions, means NW Natural Water faces a more dynamic competitive environment. For instance, in 2023, the U.S. water utility sector saw numerous transactions as companies consolidated to achieve economies of scale and operational efficiencies.

This increased M&A activity signals a heightened level of competition, as established players and new entrants vie for market share and strategic acquisitions. Companies like American Water Works and Aqua America are key players, often competing for the same acquisition targets.

While NW Natural doesn't face much direct competition for its existing natural gas customers, it does encounter indirect rivalry from electric utilities and other energy suppliers. This competition becomes particularly relevant when new buildings are constructed or when existing ones consider switching energy sources for heating, cooking, and other essential functions. Customers are increasingly weighing the pros and cons of electricity, propane, and even renewable energy options against natural gas.

Decarbonization Goals and Policy Influence

The push towards decarbonization creates intense competition among various energy providers and technologies, all vying for favorable policies and market share. NW Natural's strategic investment in renewable natural gas (RNG) directly addresses this trend, positioning them to capitalize on the growing demand for cleaner energy solutions.

This competitive dynamic isn't just about traditional gas utilities; it includes electricity providers, hydrogen producers, and other alternative energy sources. For instance, in 2024, many utilities are reporting increased capital expenditures on infrastructure upgrades to support or transition to lower-carbon fuels, reflecting this competitive pressure.

- Policy Uncertainty: Shifting government regulations and incentives related to climate goals create an unpredictable competitive environment.

- Technology Race: Companies are investing heavily in R&D for cleaner energy technologies, fostering a competitive race for innovation.

- Market Share Battle: Different energy sources are competing to win over consumers and industrial clients seeking to reduce their carbon footprint.

- Infrastructure Adaptation: The need to adapt existing infrastructure for new energy sources adds another layer of competitive investment and strategic planning.

Customer Growth and System Investment

NW Natural's strategy hinges on robust organic customer growth, a critical factor influencing competitive rivalry. The company actively invests in its utility infrastructure to support this expansion and ensure system reliability. For example, in 2023, NW Natural reported adding approximately 11,000 new customer connections, a testament to its growth initiatives.

These substantial capital investments, totaling over $600 million in 2023 for system modernization and expansion, are designed to enhance resilience and meet the demands of a growing customer base. Such investments can create a barrier to entry for potential competitors who would also need to undertake similar capital outlays to serve new customers effectively.

- Customer Acquisition: NW Natural prioritizes organic customer growth, evident in their consistent addition of new service connections.

- System Investment: Significant capital expenditure is directed towards upgrading and expanding utility systems to support growth and ensure reliability.

- Reliability Focus: Investments aim to improve system resiliency, a key differentiator in the utility sector.

- Competitive Advantage: Strong organic growth and system investment contribute to NW Natural's market position by making it more costly for rivals to replicate their service capabilities.

While NW Natural faces minimal direct competition in its core natural gas markets due to its regulated status, the broader energy landscape presents indirect rivalry. Electric utilities and alternative energy sources like propane and renewable options compete for new constructions and customer switching. This is amplified by the push for decarbonization, creating a competitive race for market share and favorable policies among various energy providers and technologies. In 2024, many utilities are increasing capital spending on infrastructure upgrades to support lower-carbon fuels, reflecting this intensifying competition.

| Metric | 2023 Data | 2024 Outlook |

| New Customer Connections (NW Natural) | ~11,000 | Projected growth |

| Capital Investments (NW Natural) | Over $600 million | Continued investment |

| U.S. Water Utility M&A Activity | Significant transactions | Continued consolidation expected |

SSubstitutes Threaten

The most significant threat of substitution for NW Natural stems from the increasing adoption of electric heat pumps for space and water heating. This trend is directly fueled by government incentives and evolving building codes in key markets like Oregon and Washington, which actively promote electric alternatives to natural gas.

For instance, as of 2024, many states are offering substantial tax credits and rebates for heat pump installations, making them more financially attractive to consumers. This growing preference for electric heating solutions directly erodes the market share previously held by natural gas, impacting NW Natural's customer base and revenue potential.

The increasing accessibility and falling prices of renewable energy sources, especially solar and wind power for electricity, present a significant long-term threat of substitution for traditional energy providers like NW Natural. As consumers and governments push for cleaner energy, these alternatives become more attractive.

In 2024, the levelized cost of electricity from utility-scale solar photovoltaics (PV) is projected to be around $25-30 per megawatt-hour, with onshore wind at approximately $25-35 per megawatt-hour, making them increasingly competitive with natural gas generation.

This trend is further amplified by supportive government policies and advancements in battery storage technology, which address the intermittency challenges of renewables, thereby enhancing their reliability as substitutes for consistent energy supply.

Improvements in energy efficiency for homes and businesses are a significant threat of substitution for NW Natural. By reducing overall natural gas demand through better insulation, more efficient appliances, and smart home technologies, consumers can lower their reliance on natural gas. For instance, the U.S. Department of Energy reported that advancements in building codes and appliance standards have led to substantial energy savings, directly impacting the need for traditional energy sources.

Policy and Regulatory Push for Decarbonization

The increasing policy and regulatory push for decarbonization presents a significant threat of substitutes for natural gas. State and federal mandates, such as Oregon's Climate Protection Program, actively encourage a transition away from fossil fuels. This includes promoting cleaner alternatives and establishing stringent emissions reduction targets, directly impacting the demand for natural gas.

These governmental actions are designed to accelerate the adoption of renewable energy sources and electrification across various sectors. For instance, incentives for electric heat pumps and stricter building codes that limit natural gas hookups are becoming more common. By 2023, the U.S. saw a substantial increase in renewable energy capacity additions, signaling a growing market for these substitutes.

- Renewable Energy Growth: Continued expansion of solar and wind power provides viable alternatives for electricity generation, which can then be used for heating and other applications traditionally served by natural gas.

- Electrification Initiatives: Government programs and private sector investments are driving the adoption of electric vehicles and electric heating systems, directly substituting for gasoline and natural gas.

- Emissions Standards: Stricter emissions regulations on industrial processes and buildings make natural gas less attractive compared to zero-emission alternatives.

- Carbon Pricing Mechanisms: The implementation of carbon taxes or cap-and-trade systems increases the cost of using fossil fuels like natural gas, making substitutes more economically competitive.

Hydrogen and Other Emerging Fuels

While still in early stages, hydrogen and other emerging fuels pose a potential long-term threat to NW Natural's core business. The possibility of blending hydrogen into existing natural gas infrastructure or its direct use as a replacement fuel could significantly alter the energy landscape. For instance, the U.S. Department of Energy's Hydrogen Shot initiative aims to reduce the cost of clean hydrogen by 80% to $1 per kilogram in a decade, signaling a strong governmental push towards this alternative.

The viability of these substitutes will depend on technological advancements, regulatory support, and cost competitiveness. If hydrogen becomes a cost-effective and widely adopted alternative, it could reduce demand for traditional natural gas. However, this also presents an opportunity for NW Natural to potentially adapt its infrastructure and services to accommodate these new energy sources, turning a threat into a strategic advantage.

Key considerations for NW Natural include:

- Technological Maturity: The feasibility of widespread hydrogen blending or direct hydrogen use in residential and commercial applications is still being tested and scaled.

- Infrastructure Investment: Significant investment would be required to adapt or build new infrastructure capable of handling hydrogen, which behaves differently than natural gas.

- Regulatory Landscape: Evolving government policies and incentives for clean fuels like hydrogen will heavily influence the pace of adoption and NW Natural's strategic response.

- Cost Competitiveness: The price of producing and delivering hydrogen needs to become competitive with natural gas for it to be a significant substitute.

The threat of substitutes for NW Natural is intensifying due to the growing popularity of electric heat pumps, driven by government incentives and evolving building codes in states like Oregon and Washington. By 2024, substantial tax credits and rebates are making heat pump installations more financially appealing, directly chipping away at natural gas demand.

Renewable energy sources, particularly solar and wind, are also becoming more competitive. In 2024, the levelized cost of electricity from utility-scale solar is around $25-30 per megawatt-hour, and onshore wind is approximately $25-35 per megawatt-hour, making them increasingly attractive alternatives to natural gas generation.

Furthermore, advancements in energy efficiency, coupled with government mandates pushing for decarbonization, significantly reduce the need for natural gas. Initiatives like Oregon's Climate Protection Program actively promote cleaner alternatives and restrict natural gas usage in new constructions, as evidenced by the substantial increase in renewable energy capacity additions seen in the U.S. by 2023.

| Substitute Category | Key Drivers | Impact on NW Natural | 2024 Data/Trends |

|---|---|---|---|

| Electric Heat Pumps | Government incentives (tax credits, rebates), building codes, environmental concerns | Reduced demand for natural gas for space and water heating | Increased adoption rates, falling installation costs |

| Renewable Electricity (Solar, Wind) | Falling generation costs, grid modernization, energy storage advancements | Potential displacement of natural gas in power generation and direct electrification for heating | Levelized cost of solar ~$25-30/MWh, wind ~$25-35/MWh |

| Energy Efficiency Measures | Appliance standards, building codes, smart home technology, consumer awareness | Lower overall energy consumption, reducing the need for any energy source, including natural gas | DOE reports substantial savings from code improvements |

| Hydrogen and Other Emerging Fuels | Decarbonization goals, R&D investment, infrastructure development | Long-term potential to displace natural gas, but requires significant infrastructure adaptation | DOE's Hydrogen Shot aims for $1/kg by 2030 |

Entrants Threaten

The natural gas distribution sector demands substantial upfront capital, creating a significant hurdle for newcomers. Building and maintaining miles of pipelines, essential storage facilities, and other complex infrastructure requires billions of dollars. For instance, in 2023, NW Natural reported capital expenditures of $368.8 million, primarily for system modernization and expansion, illustrating the ongoing investment needed. This massive financial commitment effectively deters many potential entrants, safeguarding existing companies like NW Natural.

As a regulated utility, NW Natural operates within a framework that presents substantial barriers to new entrants. The process of obtaining state and local franchises is a significant hurdle, often requiring extensive negotiation and demonstration of public need and financial viability. For instance, in 2024, the regulatory landscape continues to demand rigorous compliance with environmental standards and intricate approval processes for rate adjustments and operational changes, effectively deterring potential competitors.

These extensive regulatory hurdles, encompassing environmental permits and approvals for rates and operations, create a formidable deterrent. The sheer complexity and time-consuming nature of navigating these requirements mean that any new entity looking to enter the natural gas distribution market would face considerable upfront investment and uncertainty. This prolonged approval cycle is a key factor in limiting new competition in the sector.

NW Natural enjoys a substantial advantage due to its deeply entrenched customer base and the significant economies of scale it has achieved. This makes it exceedingly challenging for any new entrant to replicate its cost structure or service delivery without incurring substantial upfront investment and likely initial operating losses. For instance, in 2024, NW Natural continued to serve hundreds of thousands of customers across its primary Oregon and Southwest Washington service areas, a scale that allows for efficient infrastructure utilization and lower per-unit operating costs.

Access to Natural Gas Supply and Transportation

Securing consistent access to natural gas is a significant hurdle for potential new entrants in the utility sector. This often necessitates substantial upfront investment in long-term supply contracts and securing rights for transportation through existing interstate pipelines. For instance, in 2024, the average cost for a new industrial natural gas connection could range from tens of thousands to millions of dollars, depending on the infrastructure required.

The capital-intensive nature of building or accessing the necessary transportation infrastructure effectively acts as a deterrent. Companies like NW Natural have already established relationships and agreements for pipeline capacity, which new entrants would struggle to replicate without considerable financial resources and regulatory approvals. This reliance on established infrastructure creates a high barrier to entry, as obtaining permits and rights-of-way can be a protracted and costly process.

Furthermore, the need for robust financial backing to secure these essential resources is paramount. Potential new entrants must demonstrate significant financial stability and the ability to commit to long-term agreements, often involving substantial financial guarantees. This requirement inherently limits the pool of viable competitors who can realistically challenge established players in the natural gas utility market.

- High Capital Investment: New entrants face substantial costs for securing natural gas supply and pipeline access.

- Long-Term Contracts: Access often requires locking into lengthy supply agreements, demanding significant financial commitment.

- Infrastructure Dependence: Reliance on existing interstate pipelines, controlled by established entities, limits independent operation.

- Regulatory Hurdles: Obtaining permits and rights-of-way for new infrastructure or access is complex and time-consuming.

Public Utility Status and Essential Service Provision

The public utility status of NW Natural significantly dampens the threat of new entrants. This status comes with an obligation to serve all customers within its franchised territory, a commitment that is difficult for new companies to replicate. Furthermore, natural gas provision is considered an essential service, which typically fosters a natural monopoly structure in established service areas.

This inherent structure makes it highly improbable for new direct competitors to emerge and gain a foothold where NW Natural already operates. The substantial capital investment required for infrastructure, coupled with stringent regulatory oversight designed to protect consumers and ensure reliable service, creates formidable barriers to entry. For instance, in 2023, NW Natural reported capital expenditures of approximately $467 million, highlighting the significant investment needed to maintain and expand its network, a cost that new entrants would also need to bear.

The regulatory environment further solidifies this barrier. Utility commissions approve rates and service standards, which new entrants would need to navigate and meet, adding layers of complexity and cost. These factors combined mean that the threat of new companies directly competing with NW Natural for its existing customer base is very low.

- Public Utility Obligation: NW Natural has a legal duty to serve all customers in its designated service areas, a responsibility that new entrants would also face.

- Essential Service Nature: Natural gas is a vital commodity, often leading regulators to favor a single, regulated provider to ensure reliability and affordability.

- High Capital Investment: Building and maintaining natural gas infrastructure requires massive upfront and ongoing capital, creating a significant financial hurdle for potential competitors. In 2023, NW Natural invested heavily in its system, demonstrating the scale of these requirements.

- Regulatory Barriers: Approvals from utility commissions for rates, service, and expansion are necessary, adding time, cost, and complexity for any new market participant.

The threat of new entrants for NW Natural is considerably low due to the industry's inherent capital intensity and regulatory framework. Building and maintaining the vast pipeline networks and associated infrastructure demands billions in upfront investment, a significant deterrent for any potential competitor. For instance, NW Natural's 2023 capital expenditures reached $368.8 million, underscoring the ongoing financial commitment required.

Furthermore, the public utility status and the complex regulatory environment create substantial barriers. Obtaining franchises and navigating stringent approval processes for rates and operations are time-consuming and costly. In 2024, the necessity of securing long-term supply contracts and access to transportation infrastructure, often controlled by established entities, adds another layer of difficulty for newcomers.

The established customer base and economies of scale enjoyed by NW Natural, serving hundreds of thousands of customers in 2024, make it challenging for new entrants to compete on cost or service delivery. This combination of high capital requirements, regulatory hurdles, and established market advantages effectively shields NW Natural from significant new competitive threats.

| Barrier Type | Description | Impact on New Entrants | Example Data (NW Natural) |

|---|---|---|---|

| Capital Intensity | Massive upfront investment required for infrastructure (pipelines, storage). | High deterrent due to immense financial requirements. | 2023 Capital Expenditures: $368.8 million |

| Regulatory Hurdles | Complex approval processes for franchises, rates, and operations. | Significant time, cost, and uncertainty for new entrants. | Ongoing compliance with environmental standards and rate adjustment approvals (2024). |

| Economies of Scale | Established operational efficiency and customer base. | Difficult for new entrants to match cost structure or service delivery. | Serving hundreds of thousands of customers across Oregon and SW Washington (2024). |

| Supply & Infrastructure Access | Need for long-term supply contracts and pipeline capacity. | Requires substantial financial commitment and reliance on existing infrastructure. | Average industrial connection costs can range from tens of thousands to millions (2024). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for NW Natural leverages data from annual reports, regulatory filings with the SEC, and industry-specific publications to provide a comprehensive view of the utility's competitive landscape.