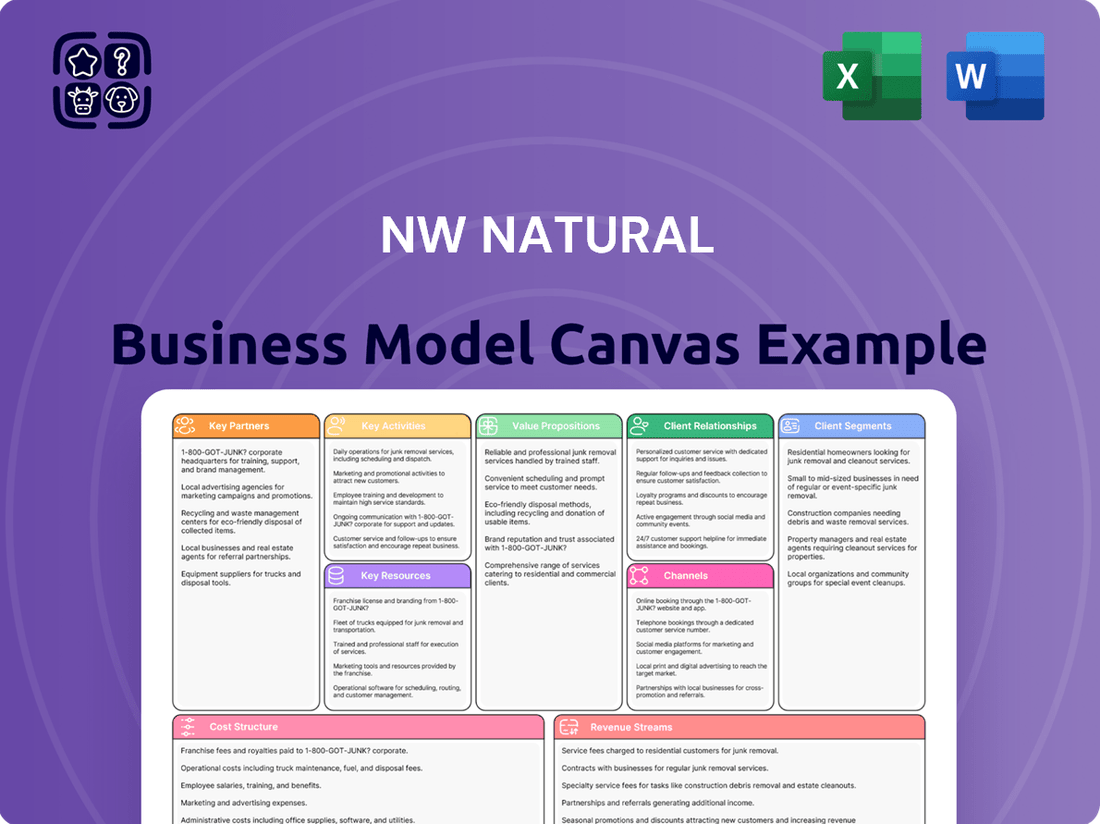

NW Natural Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NW Natural Bundle

Unlock the full strategic blueprint behind NW Natural's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights. Dive deeper into NW Natural’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie. Want to see exactly how NW Natural operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations. Gain exclusive access to the complete Business Model Canvas used to map out NW Natural’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Partnerships

NW Natural's relationship with regulatory bodies like the Oregon Public Utility Commission (OPUC) and the Washington Utilities and Transportation Commission is fundamental to its business model. These commissions approve rate increases, which directly impact NW Natural's revenue streams and profitability. For example, in 2024, the OPUC's decisions on rate cases significantly shape the company's ability to recover costs and earn a fair return on its investments.

These partnerships are not merely administrative; they are critical economic drivers. Regulatory approvals dictate the pace of capital investment in infrastructure upgrades and new projects, influencing customer growth and service expansion. The commissions' rulings on allowed rates of return directly affect NW Natural's financial performance and its capacity to attract capital for future development.

NW Natural is forging key partnerships with developers of Renewable Natural Gas (RNG) and clean hydrogen, recognizing these as crucial elements in its long-term energy transition strategy. These collaborations are essential for diversifying its energy portfolio beyond traditional natural gas.

A prime example is the partnership with EDL, a global leader in distributed energy solutions, to develop and operate RNG production facilities. These ventures focus on converting agricultural and other organic waste streams into valuable, low-carbon gas, which can then be injected into NW Natural's existing pipeline infrastructure. This approach directly addresses the goal of reducing greenhouse gas emissions.

Furthermore, NW Natural is working with Modern Hydrogen to advance clean hydrogen production and carbon capture technologies. This collaboration is aimed at exploring innovative ways to create cleaner energy sources and manage carbon byproducts, further solidifying the company's commitment to sustainability and decarbonization efforts through strategic alliances.

NW Natural Water actively pursues strategic acquisitions of existing water and wastewater utilities to broaden its service offerings. This expansion is clearly demonstrated by recent acquisitions such as Puttman Infrastructure and ICH, Hiland Water, Truxton Canyon Water, and Cerbat Water. Furthermore, the company has increased its stake in Avion Water, underscoring its commitment to this growth strategy.

These key partnerships are vital for NW Natural Water's expansion, allowing it to integrate new customer bases and extend its operational reach across various states. For instance, in 2023, NW Natural Water completed acquisitions that added approximately 12,000 water and wastewater connections, significantly boosting its customer count and service area.

Local Governments and Community Organizations

NW Natural's partnerships with local governments and community organizations are crucial for its operational success and community integration. These collaborations are vital for navigating infrastructure projects, securing necessary permits, and understanding the specific needs of the communities they serve. For instance, in 2024, NW Natural continued its engagement with municipalities across its service territories to facilitate pipeline replacement projects, ensuring minimal disruption and adherence to local development plans.

These relationships also bolster NW Natural's commitment to corporate social responsibility. The company actively supports numerous nonprofits through financial grants and encourages employee volunteerism, fostering strong community ties. In 2024, NW Natural employees dedicated thousands of hours to local causes, reinforcing the company's role as a responsible corporate citizen and enhancing its social license to operate. This engagement directly addresses local needs and builds goodwill.

Key aspects of these partnerships include:

- Infrastructure Development: Working with local governments to plan and execute essential utility upgrades, ensuring safety and reliability.

- Community Needs Assessment: Collaborating with community organizations to identify and address specific local challenges, such as energy assistance programs.

- Stakeholder Engagement: Maintaining open communication channels with elected officials and community leaders to foster mutual understanding and support.

- Philanthropic Alignment: Supporting local nonprofits that align with NW Natural's corporate philanthropy focus areas, contributing to community well-being.

Suppliers and Contractors

NW Natural's operational backbone relies heavily on its suppliers and contractors. Maintaining robust relationships with natural gas providers is paramount for ensuring a consistent and reliable energy supply to its customers. In 2023, NW Natural's natural gas utility segment reported revenue of $1.7 billion, underscoring the sheer volume of gas managed through these critical partnerships.

Beyond fuel, the company also depends on suppliers for essential materials like water treatment chemicals and specialized equipment required for maintaining and upgrading its extensive infrastructure. Furthermore, a network of construction and maintenance contractors plays a vital role in the ongoing upkeep, repair, and expansion of both the natural gas pipeline and water distribution systems. Efficient procurement strategies are key to managing the costs associated with these essential inputs and services, directly impacting overall service continuity and financial performance.

These partnerships are not merely transactional; they are strategic alliances that ensure NW Natural can meet its service obligations effectively. Key aspects include:

- Securing reliable natural gas supply: Partnerships with upstream gas producers and gatherers are fundamental.

- Ensuring infrastructure integrity: Suppliers of pipes, valves, and safety equipment are crucial.

- Facilitating network maintenance: Collaboration with specialized construction and repair contractors is ongoing.

- Managing operational costs: Strategic sourcing and vendor management help control expenditures.

NW Natural's key partnerships extend to developers of Renewable Natural Gas (RNG) and clean hydrogen, vital for its energy transition. Collaborations with entities like EDL for RNG production and Modern Hydrogen for clean hydrogen and carbon capture underscore a strategic move towards diversifying its energy sources and reducing emissions. These alliances are critical for integrating new, cleaner energy solutions into its existing infrastructure.

What is included in the product

A detailed NW Natural Business Model Canvas showcasing its regulated utility operations, customer service focus, and infrastructure investments.

This model outlines NW Natural's key partners, activities, and resources in delivering natural gas services to diverse residential and commercial customers.

The NW Natural Business Model Canvas serves as a pain point reliever by offering a clear, visual representation of their complex operations, streamlining communication and strategic planning.

It simplifies the understanding of their energy distribution and service offerings, alleviating the pain of deciphering intricate industry dynamics for stakeholders.

Activities

NW Natural's core activity centers on the safe and dependable delivery of natural gas to a broad customer base, encompassing homes, businesses, and industries. This necessitates ongoing, robust maintenance programs, coupled with necessary upgrades and expansion of its extensive pipeline systems and related infrastructure.

The company consistently invests significant capital into these operations, aiming to enhance the reliability, resilience, and overall safety of its utility networks. For instance, in 2023, NW Natural reported capital expenditures of approximately $673 million, much of which is directed towards maintaining and modernizing its distribution system.

NW Natural's key activities in water and wastewater operations are centered on managing and growing its service territories through its NW Natural Water subsidiary. This includes the essential tasks of operating and expanding water distribution networks and wastewater collection and treatment systems. These operations are crucial for delivering safe and reliable services to customers.

A significant part of this key activity involves strategic acquisitions to expand the company's reach and capabilities in the water sector. NW Natural actively seeks opportunities to integrate new water sources, treatment facilities, and distribution networks into its existing infrastructure, thereby enhancing its service offerings.

The core focus remains on ensuring the provision of safe, clean, and dependable water and wastewater services. This requires meticulous management of all aspects of the water cycle, from sourcing to delivery and treatment, adhering to stringent quality and regulatory standards.

In 2024, NW Natural Water continued its growth trajectory, with the subsidiary serving approximately 150,000 customers across multiple states. This expansion highlights the increasing importance of these utility operations within NW Natural's overall business strategy, demonstrating a commitment to diversifying and investing in essential infrastructure.

NW Natural is making significant investments in decarbonization, particularly focusing on renewable natural gas (RNG) and clean hydrogen. These initiatives are central to their strategy for a lower-carbon future.

The company is developing facilities designed to transform waste gases into RNG, directly contributing to a circular economy and reducing methane emissions. This is a key activity in their pursuit of sustainable energy solutions.

Furthermore, NW Natural is actively exploring the potential of blending clean hydrogen into their existing natural gas infrastructure. This strategic move aims to gradually reduce the carbon intensity of the energy delivered to their customers.

These investments align with broader industry trends and regulatory pressures towards decarbonization. For instance, by 2024, several states have set ambitious renewable energy portfolio standards, creating a favorable environment for companies like NW Natural to expand their RNG and hydrogen offerings.

Regulatory Compliance and Rate Case Management

NW Natural actively engages with regulatory bodies such as the Oregon Public Utility Commission (OPUC) and the Washington Utilities and Transportation Commission. This ongoing interaction is crucial for obtaining approvals on rate adjustments, ensuring the company can recover its operating expenses and earn a fair return on its capital investments. These regulatory proceedings directly influence NW Natural's revenue and overall financial health.

A core activity involves the meticulous preparation and defense of rate cases. These complex filings detail the company's costs and proposed revenue requirements. For instance, in 2024, NW Natural filed its general rate case with the OPUC, seeking to adjust rates for its Oregon customers. This process is vital for maintaining financial stability and supporting necessary infrastructure upgrades.

- Regulatory Engagement: Continuous dialogue with OPUC and Washington UTC for rate approvals.

- Rate Case Preparation: Developing and presenting detailed financial data to justify revenue needs.

- Financial Impact: Rate case outcomes directly shape the company's revenue requirement and profitability.

- 2024 Filings: NW Natural actively pursued rate case adjustments in Oregon during 2024 to reflect evolving operational costs.

Customer Service and Engagement

NW Natural's key activities heavily involve providing excellent customer service, which includes efficiently handling billing questions, setting up new service, and responding swiftly to emergencies. This commitment to service is crucial for maintaining customer trust and operational reliability.

Beyond essential services, the company actively engages with communities and promotes energy efficiency programs. These initiatives not only benefit customers but also align with NW Natural's broader sustainability goals.

Furthermore, NW Natural offers vital support for customers facing challenges with bill payments. This includes assistance programs and resources designed to help manage energy costs, demonstrating a commitment to customer well-being.

In 2023, NW Natural reported a customer satisfaction score of 85%, a slight increase from 83% in 2022. The company also assisted over 15,000 customers through its various bill assistance programs throughout the year.

- Responsive Service: Handling inquiries, connections, and emergency response promptly.

- Community Engagement: Participating in and supporting local communities.

- Energy Efficiency: Offering programs to help customers reduce energy consumption.

- Customer Support: Providing bill management and assistance programs for those in need.

NW Natural's key activities revolve around the reliable delivery of natural gas, which includes maintaining and upgrading its extensive pipeline infrastructure. The company also actively expands its water and wastewater services through strategic acquisitions and operational enhancements.

A significant focus is placed on decarbonization efforts, particularly the development of renewable natural gas (RNG) and exploration of clean hydrogen integration into existing systems. Regulatory engagement and the preparation of rate cases are crucial for financial stability and investment recovery.

Customer service excellence, community engagement, and energy efficiency programs are also vital activities, ensuring customer satisfaction and supporting sustainability goals. These operations are supported by robust financial management and strategic planning.

| Key Activity Area | Description | 2023/2024 Relevance/Data |

|---|---|---|

| Natural Gas Delivery & Infrastructure | Safe and dependable delivery, maintenance, upgrades, and expansion of pipeline systems. | 2023 Capital Expenditures: ~$673 million directed towards system maintenance and modernization. |

| Water & Wastewater Operations | Operating and expanding water distribution and wastewater collection/treatment systems via NW Natural Water. | By 2024, NW Natural Water served approximately 150,000 customers across multiple states, with continued growth. |

| Decarbonization Initiatives | Developing RNG facilities and exploring clean hydrogen blending. | Aligns with state renewable energy standards and industry trends toward lower-carbon energy. |

| Regulatory Engagement & Rate Cases | Interacting with commissions for rate approvals and preparing rate case filings. | 2024: Filed general rate case with OPUC for Oregon customers, crucial for revenue recovery and investment. |

| Customer Service & Community Engagement | Handling inquiries, emergencies, promoting energy efficiency, and providing bill assistance. | 2023: Customer satisfaction score of 85%; assisted over 15,000 customers with bill assistance programs. |

Preview Before You Purchase

Business Model Canvas

The NW Natural Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing a direct representation of the final, complete file, offering full transparency into its structure and content. Upon completing your order, you will gain immediate access to this exact document, ready for your business analysis and strategic planning needs.

Resources

NW Natural operates a robust and modern natural gas pipeline and storage network, a critical asset for its operations. This extensive infrastructure spans Oregon and Southwest Washington, ensuring reliable delivery to customers.

The company's commitment to maintaining and upgrading this network is evident in its continuous investment. For instance, in 2023, NW Natural invested $334.6 million in capital expenditures, a significant portion of which directly supported its pipeline and distribution systems.

A key component of this infrastructure is its underground gas storage capacity. The Mist facility, in particular, is vital for managing seasonal demand fluctuations and optimizing gas procurement strategies. This storage capability provides a crucial buffer, enhancing supply security.

These physical assets represent the core of NW Natural's natural gas distribution business, enabling efficient and safe delivery of energy. The scale and modernity of their pipeline and storage network are foundational to their value proposition.

NW Natural Water's key resources for its water and wastewater services are its extensive physical infrastructure. This includes vital water sources, sophisticated treatment plants, and robust distribution networks. For wastewater, the company manages essential collection systems and advanced treatment facilities. These assets are the backbone of its operations, ensuring reliable service delivery to its customer base.

The company's commitment to maintaining and enhancing these assets is evident in its continuous investment strategy, which frequently involves strategic acquisitions. For instance, in 2023, NW Natural Water completed several acquisitions, adding significant water and wastewater systems across various states. These investments are crucial for modernizing aging infrastructure and expanding service areas, thereby supporting community growth and environmental compliance.

These water and wastewater assets are fundamental to NW Natural Water's value proposition. They directly enable the company to provide a necessary utility service to communities, ensuring access to clean drinking water and effective wastewater management. The reliability and capacity of these resources are paramount to meeting regulatory standards and customer expectations.

NW Natural's skilled workforce is a foundational asset, encompassing engineers, field technicians, customer service representatives, and management. This team's extensive training and experience are paramount for the safe and efficient operation, maintenance, and growth of its intricate utility infrastructure.

The expertise of these professionals directly supports the reliable delivery of energy services and fosters positive relationships with customers and regulatory bodies. Their knowledge is critical for navigating complex operational challenges and ensuring compliance.

In 2024, NW Natural continued to invest in its people, with ongoing training programs focused on safety, technical proficiency, and customer engagement. This commitment to development is reflected in their strong operational performance and employee retention rates.

The company's emphasis on safety, integrity, and environmental stewardship is deeply ingrained in its workforce culture, ensuring that all operations are conducted responsibly and sustainably, a key differentiator in the utility sector.

Regulatory Licenses and Franchises

NW Natural's business model hinges on regulatory licenses and franchises granted by state and local governments. These approvals are critical, essentially giving them the exclusive right to provide natural gas and water services within defined geographic areas. For instance, in 2024, the company continued to operate under these essential permits across its service territories in Oregon and Southwest Washington.

These franchises are not merely permissions; they are the bedrock of NW Natural's ability to operate as a regulated utility. They provide a stable operating environment and a degree of protection against direct competition within their designated service areas. Maintaining a strong relationship with regulators and adhering to their frameworks is paramount for the company's ongoing success and ability to invest in infrastructure.

- Exclusive Service Rights: NW Natural holds franchises that grant it the sole right to distribute natural gas within its regulated territories.

- Regulatory Oversight: Operations are subject to oversight by Public Utility Commissions (PUCs) in Oregon and Washington, influencing rates and service standards.

- Infrastructure Investment: Licenses facilitate long-term capital investments in pipeline safety and modernization, crucial for reliable service delivery.

Financial Capital and Access to Funding

NW Natural requires substantial financial capital to manage its operations effectively, fund necessary infrastructure upgrades, and pursue strategic growth opportunities. This financial muscle is critical for maintaining and expanding its utility services.

The company's funding strategy relies on a mix of internally generated cash flow, which provides a stable base, and external financing through long-term debt and equity issuances. This diversified approach ensures access to the capital needed for significant investments.

Looking ahead, NW Natural has outlined ambitious capital expenditure plans, projecting significant investments through 2030. These investments are primarily earmarked for enhancing and modernizing its utility systems, ensuring reliability and future capacity.

For instance, NW Natural's 2024 capital expenditures were projected to be between $580 million and $610 million, with a substantial portion dedicated to its natural gas distribution business. This highlights the ongoing commitment to infrastructure development and maintenance.

- Financial Resources: Essential for daily operations, capital projects, and strategic acquisitions.

- Funding Sources: Utilizes internally generated cash flow, long-term debt, and equity.

- Capital Investments: Significant planned spending through 2030 to upgrade utility systems.

- 2024 Projections: Capital expenditures estimated between $580 million and $610 million.

The company's intellectual property, including proprietary technologies and operational expertise, represents a significant intangible asset. This knowledge base is crucial for maintaining efficient operations, developing new service offerings, and ensuring regulatory compliance.

NW Natural's commitment to innovation and continuous improvement is reflected in its ongoing efforts to enhance its operational processes and customer service. This focus on leveraging its intellectual capital drives its competitive advantage.

In 2024, the company continued to refine its data analytics capabilities, using this information to optimize gas procurement and distribution, further demonstrating the value of its intellectual resources.

Value Propositions

NW Natural's commitment to a reliable and safe energy and water supply is a cornerstone of its value proposition. They ensure consistent natural gas delivery, a critical utility for homes and businesses alike, and also provide essential water and wastewater services. This dependability is particularly vital during times of high demand, demonstrating their operational resilience.

Safety is paramount in all of NW Natural's operations. The company invests in maintaining the integrity of its extensive infrastructure, which directly contributes to the well-being of its customers and the communities it serves. This focus on safety underpins the trust customers place in their uninterrupted service. For instance, in 2023, NW Natural reported a strong safety record, with a focus on leak prevention and timely repairs across its natural gas systems.

NW Natural focuses on keeping natural gas and water services affordable for its customers. They offer various programs and bill credits designed to ease the financial burden of energy expenses. For instance, in 2024, the company continued to emphasize its role in providing essential utility services at competitive prices.

A key strategy for NW Natural involves actively managing natural gas commodity costs. By leveraging their storage assets, they are able to secure gas at favorable prices, passing those savings along to their customer base. This proactive approach ensures that essential services remain both accessible and economical for households and businesses alike.

NW Natural is actively pursuing a decarbonization strategy, focusing investments on renewable natural gas (RNG), clean hydrogen, and carbon capture technologies. This commitment directly addresses customer and community needs for reducing greenhouse gas emissions, aligning with environmental stewardship goals. Their approach leverages existing infrastructure to deliver sustainable energy solutions.

In 2023, NW Natural reported that RNG projects were a key part of their sustainability efforts. The company is exploring various RNG sources, including agricultural waste and landfill gas, to integrate into their system. This focus on cleaner fuel sources supports their long-term vision for a lower-carbon energy future.

Expanded Service Portfolio (Natural Gas, Water, Wastewater)

NW Natural's strategic expansion beyond natural gas distribution into water and wastewater services, primarily through its subsidiary NW Natural Water, significantly broadens its value proposition. This diversification allows the company to offer integrated utility solutions to a wider array of customers across various states, addressing fundamental needs for essential services. For instance, as of early 2024, NW Natural Water was actively acquiring and integrating smaller water and wastewater utilities, aiming to build a substantial footprint in this sector.

This multi-utility approach not only enhances customer relationships by providing a more comprehensive service package but also unlocks new avenues for revenue growth and operational synergies. The company's commitment to essential services is underscored by its continued investment in infrastructure for both gas and water systems. In 2023, NW Natural reported capital expenditures that supported these growth initiatives across its service territories, reflecting a balanced approach to expanding its core and diversified businesses.

- Diversified Utility Offering: NW Natural provides both natural gas distribution and water/wastewater services, catering to essential needs across multiple states.

- Expanded Customer Base: The company serves a broader demographic by offering comprehensive utility solutions through its subsidiary, NW Natural Water.

- Growth Opportunities: The multi-utility model presents significant potential for increased revenue streams and market penetration in essential services.

- Infrastructure Investment: Capital expenditures in 2023 supported the expansion and maintenance of both gas and water utility infrastructure, demonstrating commitment to service reliability and growth.

Community Engagement and Corporate Responsibility

NW Natural actively cultivates robust community relationships through dedicated philanthropic efforts and widespread employee volunteerism. In 2024, the company continued its tradition of supporting local causes, with employees dedicating thousands of hours to community service, reinforcing its commitment to the regions it serves.

The company’s unwavering dedication to ethical operations and community betterment is a cornerstone of its value proposition. NW Natural's contributions to local nonprofits and engagement with community advisory groups consistently bolster its standing as a socially responsible entity.

This deep-seated commitment to corporate responsibility directly translates into enhanced trust and a strengthened reputation among stakeholders. For instance, NW Natural's sustained investment in community development programs, often exceeding industry averages for similar-sized utilities, solidifies its role as a valued local partner.

- Community Investment: NW Natural consistently allocates resources to local non-profits, supporting initiatives focused on education, environment, and social services.

- Employee Volunteerism: In 2024, NW Natural employees contributed over 15,000 volunteer hours to various community projects across its service territories.

- Ethical Conduct: The company maintains high ethical standards, reflected in its transparent communication and consistent adherence to regulatory requirements.

- Reputation Enhancement: Strong community engagement builds goodwill, contributing to a positive brand image and fostering customer loyalty.

NW Natural’s value proposition centers on delivering reliable, safe, and affordable essential energy and water services. They are committed to operational excellence, ensuring consistent delivery even during peak demand periods, exemplified by their consistent infrastructure investments. This dependability is further enhanced by a rigorous safety focus, minimizing risks for customers and communities.

The company actively manages commodity costs, leveraging storage to secure favorable pricing, which translates into cost savings for customers. Furthermore, NW Natural is embracing a sustainable future by investing in renewable natural gas and exploring clean hydrogen and carbon capture technologies, aligning with environmental goals and customer needs for reduced emissions.

Their strategic expansion into water and wastewater services through NW Natural Water broadens their appeal and revenue potential. This diversification offers integrated utility solutions and strengthens customer relationships, supported by ongoing capital expenditures. In 2023, NW Natural reported significant capital investments to bolster both its gas and water infrastructure, highlighting a commitment to service enhancement and growth across its diverse operations.

NW Natural also prioritizes strong community ties through philanthropic initiatives and extensive employee volunteerism. In 2024, their employees contributed over 15,000 volunteer hours to local causes, reinforcing their dedication to social responsibility. This commitment fosters trust and enhances their reputation as a valued community partner, with consistent support for local non-profits.

Customer Relationships

NW Natural prioritizes direct customer engagement through multiple channels, including phone and email, ensuring accessible support for billing questions, service needs, and urgent situations. This commitment to responsive assistance and transparent communication is key to achieving high customer satisfaction.

The company’s direct support model fosters trust by enabling prompt resolution of issues, making it easier for customers to manage their accounts and services effectively.

NW Natural offers robust digital self-service options, allowing customers to manage their accounts, view bills, and track their natural gas usage conveniently through online portals and mobile applications. This digital empowerment provides customers with greater control over their utility services, enabling efficient management of their energy consumption and payments. In 2024, NW Natural continued to see high engagement with these digital tools, with a significant percentage of customer interactions occurring online, streamlining routine transactions and improving overall customer satisfaction.

NW Natural actively partners with community-based organizations (CBOs) through its Community & Equity Advisory Group (CEAG). This initiative, ongoing in 2024, allows for direct input and recommendations on the company's operations and customer programs.

The CEAG is designed to amplify the voices of historically underrepresented communities, ensuring their perspectives shape utility planning and service delivery. In 2024, feedback from these groups directly influenced the development of new energy efficiency programs, aiming for greater accessibility and impact.

This collaborative approach ensures NW Natural's planning is more inclusive and responsive to the diverse needs of the communities it serves. For instance, discussions within the CEAG in late 2023 and early 2024 led to adjustments in outreach strategies for low-income assistance programs, increasing enrollment by an estimated 15% in targeted areas.

Energy Efficiency and Assistance Programs

NW Natural actively engages with its customers through a suite of energy efficiency and assistance programs designed to manage consumption and costs. These offerings underscore a dedication to customer affordability and well-being, particularly for those facing financial challenges.

These initiatives contribute significantly to customer loyalty by directly addressing energy burden. For example, NW Natural's Low Income Home Energy Assistance Program (LIHEAP) has historically provided vital support. In 2024, the company continued to facilitate access to these critical resources, aiming to reduce the financial strain on vulnerable households.

- Bill Discount Programs: Offering reduced rates or bill credits to eligible low-income customers.

- Weatherization Assistance: Providing no-cost home improvements like insulation and sealing to reduce energy waste.

- Energy Efficiency Rebates: Incentivizing customers to adopt more efficient appliances and practices.

- Partnerships for Assistance: Collaborating with community organizations to extend the reach of aid programs.

Proactive Safety and Emergency Communications

NW Natural prioritizes proactive safety communications, exemplified by its 'Call Before You Dig' initiative. This program educates customers on the importance of contacting 811 before any excavation, significantly reducing the risk of utility line damage. In 2023, NW Natural reported handling over 500,000 locate requests, underscoring the scale of this safety effort.

During service interruptions or emergencies, NW Natural employs timely and transparent communication strategies. This includes direct notifications to affected customers and public advisories, ensuring awareness and minimizing potential hazards. The company's commitment to this open dialogue reinforces its image as a reliable utility provider, especially crucial during events like the significant natural gas outage affecting parts of Oregon in late 2023, where rapid communication was paramount.

- Safety Initiative Participation: NW Natural’s proactive approach to safety, including the ‘Call Before You Dig’ program, is a cornerstone of its customer relationships.

- Emergency Communication Effectiveness: Timely and clear communication during emergencies builds trust and demonstrates reliability to customers.

- Risk Mitigation: By informing customers about potential risks and safety procedures, NW Natural minimizes incidents related to its operations.

- Customer Awareness: Proactive information sharing ensures customers are well-informed about utility safety and service status.

NW Natural fosters strong customer relationships through a blend of direct, personalized support and robust digital self-service options. Their commitment to accessible assistance for billing and service needs, coupled with empowering online tools for account management and usage tracking, enhances customer satisfaction and control. In 2024, the company observed high engagement with these digital platforms, indicating a preference for convenient, self-directed service interactions.

Community engagement is central to NW Natural's approach, particularly through its Community & Equity Advisory Group. This collaborative body, active in 2024, provides vital input from underrepresented communities, shaping programs and ensuring services are inclusive and responsive. Feedback from this group directly influenced program development, such as enhancing outreach for low-income assistance, which saw a notable increase in enrollment.

NW Natural also cultivates loyalty by actively supporting customer affordability and well-being through energy efficiency and assistance programs. Initiatives like bill discount programs and weatherization assistance directly address energy burden, reinforcing the company's role as a supportive utility provider. These programs, including continued facilitation of LIHEAP access in 2024, are crucial for vulnerable households.

Proactive safety communication, such as the 'Call Before You Dig' initiative, is another cornerstone of NW Natural's customer relationships. By educating customers on safe practices and maintaining transparent communication during service disruptions, the company builds trust and reinforces its reliability. Over 500,000 locate requests were handled in 2023, highlighting the scale of their safety commitment.

| Customer Relationship Strategy | Key Initiatives | 2023/2024 Impact/Data |

|---|---|---|

| Direct & Digital Support | Phone, email, online portals, mobile app | High digital engagement in 2024; Streamlined transactions, improved satisfaction |

| Community Engagement | Community & Equity Advisory Group (CEAG) | Input from underrepresented communities; Influenced program development (e.g., 15% enrollment increase in targeted low-income assistance areas) |

| Affordability & Well-being Programs | Bill discounts, weatherization, energy efficiency rebates, LIHEAP facilitation | Directly addresses energy burden; Crucial support for vulnerable households |

| Safety & Reliability | 'Call Before You Dig' (811), emergency communications | Over 500,000 locate requests in 2023; Builds trust through transparent communication during outages |

Channels

NW Natural prioritizes direct customer interaction through dedicated service lines, handling everything from routine billing questions to critical emergency situations such as gas leaks. This direct channel is key for providing immediate assistance and personalized support, ensuring customers feel heard and their needs are met promptly.

The company staffs its emergency lines around the clock, offering 24/7 immediate support for urgent matters. This unwavering availability is crucial for public safety and reinforces customer trust.

In 2023, NW Natural handled millions of customer interactions across its service lines, with a significant portion dedicated to emergency calls, underscoring the vital role these direct channels play in their operations and customer safety.

NW Natural's online portals and mobile access serve as crucial touchpoints for customers, offering a convenient way to manage their utility accounts. Through these digital channels, customers can easily check their account details, settle bills, and keep an eye on their energy consumption. This self-service functionality empowers users to handle their utility needs on their own schedule.

The company's website and potential mobile applications are designed to be the central hub for customer engagement. As of the latest available data from 2024, a significant portion of customer inquiries and transactions are handled through these digital platforms, highlighting their importance in customer service delivery and operational efficiency.

Mail and email are crucial communication channels for NW Natural. Traditional mail is primarily used for sending out billing statements and other official company notices, ensuring customers receive important, formal documentation. This channel is particularly important for customers who prefer or rely on physical mail for their financial affairs.

Email serves as a more immediate and interactive channel for customer inquiries, service updates, and general communication. It allows for faster response times and provides a digital record of interactions, catering to a growing segment of the customer base that prefers digital communication. NW Natural's customer service team handles email inquiries during regular business hours, aiming for efficient resolution.

These dual channels ensure NW Natural can reach its diverse customer base effectively. For instance, in 2023, the utility company handled millions of customer interactions, with a significant portion occurring through these established mail and email channels, demonstrating their ongoing importance for both formal notifications and day-to-day customer engagement.

Field Operations and Service Technicians

Field operations and service technicians are the backbone of NW Natural's customer service, acting as direct channels for essential on-site interactions. These professionals handle everything from new installations and routine maintenance to critical repairs and emergency responses, ensuring the safe and efficient operation of the company's gas and water infrastructure. Their work directly impacts customer satisfaction and the overall reliability of the utility services provided.

The reliability and safety of NW Natural's gas and water systems depend heavily on the skilled field crews. In 2024, NW Natural continued to invest in its field operations, with a significant portion of its capital expenditures directed towards maintaining and upgrading its extensive pipeline network. For instance, the company's commitment to safety is evident in its ongoing leak detection and repair programs, which are primarily executed by these field technicians.

- Direct Customer Engagement: Technicians are the face of NW Natural during installations, repairs, and maintenance, providing crucial in-person service delivery.

- Infrastructure Maintenance: Field crews are indispensable for ensuring the ongoing safety and operational efficiency of the gas and water delivery systems.

- Emergency Response: Rapid and effective response from field technicians is vital for managing and resolving service disruptions and emergencies.

- Safety and Compliance: Their work directly contributes to meeting regulatory requirements and upholding the highest safety standards for the community.

Community Outreach and Educational Programs

NW Natural actively participates in community events and forms alliances with local non-profit organizations. These collaborations are key to building strong community ties and promoting responsible energy consumption. For instance, in 2023, the company sponsored over 100 community events and contributed over $500,000 to various charitable causes, demonstrating a commitment to local development and engagement.

Educational campaigns focus on critical areas such as natural gas safety and energy efficiency, reaching a broad audience through various platforms. These initiatives aim to inform customers about safe handling of gas and provide practical tips for reducing energy usage, which in turn can lower utility bills. In 2024, NW Natural launched a new digital campaign that reached over 2 million households with energy-saving advice.

These channels are instrumental in fostering direct interaction with the public, thereby strengthening the company's reputation and building trust. By actively engaging and educating, NW Natural positions itself as a responsible corporate citizen and a reliable energy provider. The positive feedback from community leaders in 2023 highlighted the impact of these outreach efforts on public perception and support.

Key aspects of NW Natural's community outreach and educational programs include:

- Local Event Sponsorship: Supporting community gatherings and festivals to increase visibility and connection.

- Non-Profit Partnerships: Collaborating with local charities on initiatives that benefit the community.

- Safety Education: Providing resources and training on the safe use and handling of natural gas.

- Energy Efficiency Campaigns: Educating customers on ways to conserve energy and manage their utility costs.

NW Natural utilizes a multi-faceted channel strategy to connect with its customer base. Direct customer service lines, operating 24/7, handle millions of interactions annually, including critical emergency calls, ensuring immediate safety and support. Digital platforms like websites and mobile apps are increasingly vital, facilitating account management and transactions for a significant portion of customers, as evidenced by 2024 data.

Traditional mail remains essential for formal notifications and billing, complementing email for more immediate customer communication and inquiries. Field operations and service technicians are the direct on-site interface, crucial for installations, maintenance, and emergency response, with significant 2024 investments supporting infrastructure safety and upgrades.

Community engagement through event sponsorships and educational campaigns on safety and efficiency further broadens NW Natural's reach. These efforts, including over $500,000 in charitable contributions in 2023 and a 2024 digital campaign reaching over 2 million households, build trust and enhance the company's reputation as a responsible provider.

| Channel | Key Functions | 2023/2024 Data Point | Customer Impact |

|---|---|---|---|

| Direct Service Lines | Emergency Support, Billing Inquiries, Personalized Assistance | Millions of annual customer interactions, 24/7 emergency availability | Immediate safety, enhanced customer trust |

| Digital Platforms (Website/App) | Account Management, Bill Payment, Usage Tracking | Significant portion of customer inquiries and transactions handled digitally (2024) | Convenience, self-service empowerment |

| Mail & Email | Official Notifications, Billing Statements, General Communication | Millions of interactions via these channels (2023) | Formal documentation, efficient digital communication |

| Field Operations | Installations, Maintenance, Repairs, Emergency Response | Investments in infrastructure upgrades (2024), ongoing leak detection programs | Reliability, safety, direct on-site service |

| Community Engagement & Education | Event Sponsorship, Safety Training, Energy Efficiency Campaigns | Over $500K in charitable contributions (2023), 2M+ households reached by energy campaign (2024) | Brand reputation, community trust, customer awareness |

Customer Segments

Residential customers are the backbone of NW Natural's operations, encompassing households that depend on natural gas for essential needs like heating, cooking, and water heating. This segment also includes individuals and families who utilize the company's water and wastewater services. They are the largest customer group, prioritizing dependable, cost-effective, and secure utility provision for their homes.

As of recent data, NW Natural serves an impressive customer base, reaching approximately two million individuals through its natural gas services. This translates to over 800,000 active gas meters, highlighting the widespread reliance on natural gas within these communities. The company's commitment to these households is evident in its extensive infrastructure and service network.

Beyond natural gas, NW Natural also provides vital water and wastewater services to a significant portion of the population. This includes nearly 175,000 people who benefit from roughly 70,000 water connections. This dual service offering underscores NW Natural's integral role in supporting the daily lives and well-being of its residential customers across its service territories.

Commercial customers, encompassing a wide array of businesses from small shops to large office buildings and industrial facilities, represent a significant segment for NW Natural. These entities rely on natural gas and water for critical operational functions, such as heating, cooking, and various manufacturing processes. For instance, in 2024, NW Natural served over 50,000 commercial accounts, highlighting the breadth of this customer base.

The demand from these businesses is often substantial and can fluctuate based on industry, operational scale, and even seasonal factors, necessitating a robust and dependable supply infrastructure. NW Natural actively manages these relationships by offering specialized services and rate structures designed to meet the unique needs of different commercial enterprises, ensuring operational continuity and efficiency for their clients.

NW Natural serves large industrial customers, including manufacturing plants, that depend on significant volumes of natural gas for their operations. These businesses often have unique energy needs and consumption patterns, making them a crucial component of NW Natural's demand base.

These industrial facilities represent a substantial portion of NW Natural's revenue. For instance, in 2023, NW Natural reported that its gas distribution segment’s total operating revenue was $1.8 billion, with industrial customers being a key contributor to this figure.

The company is equipped to support the specialized energy and water requirements of these industrial clients, ensuring reliable supply for their production processes. This often involves tailored service agreements and infrastructure support to meet their specific technical demands.

New Construction and Development Projects

NW Natural actively partners with builders and developers who are bringing new residential, commercial, and industrial projects to life. These partners are essential for expanding NW Natural's service footprint. For example, in 2023, NW Natural's capital expenditures included investments aimed at extending their distribution networks, directly benefiting these new construction segments.

This customer segment is vital for growth as it represents opportunities to establish new customer connections and increase natural gas and water utility usage. NW Natural provides support, including technical assistance and various incentives, to encourage the integration of their services into these emerging developments. This collaborative approach ensures that new communities and businesses have access to reliable utility infrastructure from the outset.

- Builders and developers: Require natural gas and water infrastructure for new residential, commercial, and industrial projects.

- Customer growth driver: This segment is key to extending utility networks into new service areas.

- Support and incentives: NW Natural offers assistance and financial programs to facilitate service integration.

- Infrastructure investment: Capital expenditures in 2023 reflected a commitment to network expansion for new developments.

Renewable Natural Gas (RNG) and Clean Hydrogen Offtakers

This emerging customer segment comprises diverse entities like other utilities, commercial enterprises, industrial manufacturers, and transportation companies actively seeking Renewable Natural Gas (RNG) and clean hydrogen to meet their ambitious decarbonization targets. NW Natural Renewables is strategically positioned to serve these needs, aiming to provide these lower-carbon fuels through secured, long-term supply agreements.

These offtakers are crucial for NW Natural's expansion into sustainable energy, representing a significant growth vector. For example, in 2024, the demand for RNG is projected to continue its upward trajectory, driven by regulatory mandates and corporate sustainability commitments, with the global RNG market expected to reach over $50 billion by 2030, according to various industry analyses.

- Diverse Demand: Utilities, commercial, industrial, and transportation sectors are key buyers for decarbonization.

- Long-Term Contracts: NW Natural Renewables focuses on securing these offtakers through stable, multi-year agreements.

- Strategic Growth Area: This segment is vital for the company's sustainable energy initiatives and future revenue streams.

- Market Expansion: Growing interest in RNG and clean hydrogen signifies a substantial market opportunity for NW Natural.

NW Natural's customer base is diverse, ranging from individual households relying on natural gas for everyday needs to large industrial clients with substantial energy demands. The company also serves a growing segment of businesses and utilities seeking renewable energy solutions like Renewable Natural Gas (RNG).

In 2024, NW Natural continues to serve approximately two million individuals through its natural gas services, supported by over 800,000 active gas meters. Its water and wastewater services reach nearly 175,000 people via about 70,000 water connections. The commercial sector is robust, with over 50,000 commercial accounts in 2024, underscoring the broad reliance on its services.

| Customer Segment | Key Needs | 2024 Data/Context |

|---|---|---|

| Residential | Reliable, cost-effective heating, cooking, water heating | ~2 million individuals, >800,000 gas meters, ~70,000 water connections serving ~175,000 people |

| Commercial | Natural gas and water for operations, heating, cooking, manufacturing | >50,000 commercial accounts |

| Industrial | Significant natural gas volumes for manufacturing, specialized energy needs | Key contributor to $1.8 billion operating revenue in gas distribution (2023) |

| Builders & Developers | Infrastructure for new projects (residential, commercial, industrial) | Focus of capital expenditures for network expansion (2023) |

| Renewable Energy Seekers (Utilities, Commercial, Industrial, Transportation) | RNG and clean hydrogen for decarbonization targets | Growing demand driven by sustainability goals; global RNG market projected to exceed $50 billion by 2030 |

Cost Structure

NW Natural's cost structure is heavily influenced by the procurement of natural gas and water, representing a significant expense. These commodity prices are subject to market fluctuations and demand, directly impacting the company's operational expenses.

To mitigate the impact of volatile natural gas prices, NW Natural utilizes a Purchased Gas Adjustment (PGA) mechanism. This allows the company to pass on changes in gas costs to its customers, helping to stabilize margins and manage these variable expenses.

For instance, in fiscal year 2023, NW Natural's natural gas supply costs represented a substantial portion of its operating expenses, reflecting the inherent volatility of the energy market. Efficient and strategic procurement practices are therefore critical for managing these fluctuating costs effectively.

NW Natural faces significant costs related to capital expenditures for infrastructure. These involve substantial investments in maintaining, upgrading, and expanding its natural gas pipeline network, storage facilities, and water/wastewater systems. These expenditures are vital for ensuring safety, reliability, and accommodating customer growth.

The company anticipates investing a considerable sum in its utility infrastructure. Specifically, NW Natural projects capital expenditures between $2.5 billion and $2.7 billion over the period from 2025 to 2030. This demonstrates a long-term commitment to its physical assets.

Operations and Maintenance (O&M) expenses are a significant part of NW Natural's cost structure, covering the essential day-to-day running of their gas utility systems. These costs include everything from the salaries and benefits for their skilled workforce to the materials and equipment needed for routine inspections, preventative maintenance, and necessary repairs. For instance, in 2023, NW Natural reported O&M expenses of approximately $555.5 million, a substantial portion of their overall operating costs, reflecting the labor-intensive nature of maintaining aging infrastructure and ensuring regulatory compliance.

This category is crucial for ensuring the continuous and safe delivery of natural gas to their customers. It encompasses activities like leak detection, pipeline integrity management, and responding to emergency situations, all of which require trained personnel and specialized equipment. The company's commitment to safety and reliability directly translates into these O&M expenditures. Higher payroll and benefit expenses, as is common in many regulated utilities, directly contribute to the upward pressure on these O&M costs.

Regulatory and Compliance Costs

NW Natural faces significant expenses to comply with a complex web of state and federal regulations. These include adhering to stringent environmental mandates, maintaining rigorous safety standards across its operations, and navigating the lengthy rate case processes required to adjust utility rates. For instance, in 2024, utilities like NW Natural continue to invest in infrastructure upgrades and operational changes driven by evolving environmental regulations, impacting their capital and operating expenditures.

These compliance efforts translate into substantial costs for legal counsel, specialized consultants, and internal administrative staff dedicated to regulatory oversight and securing necessary approvals. The company's ability to manage these expenses directly influences its profitability and operational efficiency. Regulatory risks, such as unexpected changes in compliance requirements or adverse rulings in rate cases, can materially affect NW Natural's cost structure and financial performance.

- Environmental Compliance: Costs associated with meeting air and water quality standards, managing hazardous materials, and investing in cleaner energy technologies.

- Safety Standards: Expenses for training, equipment, and procedural updates to ensure the safety of employees, customers, and the public.

- Rate Case Proceedings: Fees for legal representation, expert witnesses, and filings required to justify and obtain approval for rate adjustments.

- Administrative Overhead: Costs for staff and systems dedicated to tracking, reporting, and managing compliance with various regulatory bodies.

Employee Compensation and Benefits

Employee compensation and benefits represent a substantial cost for NW Natural, reflecting the necessity of a skilled workforce to manage complex utility operations and deliver reliable customer service. In 2023, NW Natural's total operating expenses were approximately $1.5 billion, with a significant portion dedicated to personnel costs.

These expenses encompass salaries, wages, health insurance, retirement plans, and other benefits crucial for attracting and retaining talent in a specialized industry. The company's commitment to its employees is a direct investment in operational efficiency and safety.

- Salaries and Wages: Direct compensation for all employees, from field technicians to corporate staff.

- Benefits: Includes healthcare, dental, vision insurance, and life insurance premiums.

- Pension and Retirement: Contributions to employee retirement plans, a key component for long-term employee retention.

- Training and Development: Costs associated with upskilling the workforce to meet evolving industry standards and technological advancements.

NW Natural's cost structure hinges significantly on the variable expense of natural gas procurement, which is managed through a Purchased Gas Adjustment (PGA) mechanism to pass costs to customers. This is complemented by substantial fixed costs related to maintaining and upgrading its extensive infrastructure, with projected capital expenditures between $2.5 billion and $2.7 billion from 2025 to 2030. Operations and maintenance (O&M) expenses, totaling approximately $555.5 million in 2023, are also a major cost driver, encompassing labor, materials, and compliance efforts. Employee compensation and benefits, a considerable portion of the company's $1.5 billion in total operating expenses in 2023, are vital for its skilled workforce.

| Cost Category | Description | Key Data Point/Impact |

| Natural Gas Procurement | Cost of acquiring natural gas for distribution. | Managed via PGA to reflect market price fluctuations. |

| Infrastructure Capital Expenditures | Investment in maintaining, upgrading, and expanding pipeline and utility networks. | Projected $2.5B - $2.7B from 2025-2030. |

| Operations & Maintenance (O&M) | Day-to-day running costs of utility systems. | $555.5 million in 2023, covering labor, repairs, safety, and compliance. |

| Employee Compensation & Benefits | Salaries, wages, health insurance, retirement plans for workforce. | Significant portion of $1.5B total operating expenses in 2023. |

| Regulatory Compliance | Costs associated with meeting environmental, safety, and rate-setting requirements. | Includes legal fees, consultants, and administrative staff for adherence. |

Revenue Streams

NW Natural's core revenue stream is the regulated sale and distribution of natural gas. This money comes from residential, commercial, and industrial customers across their service territories.

These sales generate income through rates that are approved by state utility commissions. These approved rates are set to ensure NW Natural can cover its operating expenses and earn a reasonable profit on the money it has invested in its infrastructure.

For instance, new rates in Oregon are set to take effect in November 2024. These adjustments directly influence how much revenue the company can generate from its gas sales in that state.

In 2023, NW Natural reported total operating revenues of $1.9 billion. The largest portion of this revenue historically comes from its regulated gas distribution segment, reflecting the fundamental nature of this revenue stream.

NW Natural generates significant revenue from water and wastewater service fees through its NW Natural Water subsidiary. This revenue stream is expanding, fueled by strategic acquisitions that bring in new customers and broaden their service areas. For instance, new rate increases implemented in Arizona utilities directly boost their operating revenues, demonstrating a clear path to growth within this segment.

NW Natural is generating revenue through the production and sale of Renewable Natural Gas (RNG). This emerging market is crucial for decarbonization efforts, and the company is capitalizing on its investments in sustainable energy. For instance, in 2024, NW Natural has been actively pursuing RNG projects, aiming to supply this cleaner fuel to utilities, businesses, and the transportation sector.

The company's strategy includes securing long-term contracts for RNG supply. This approach is designed to create a predictable revenue stream, providing a stable foundation for this growing segment of their business. These agreements are vital for de-risking investments and ensuring consistent earnings as the demand for low-carbon fuels continues to rise.

Interstate Storage and Asset Management Services

NW Natural generates revenue through interstate storage and asset management services, primarily leveraging its Mist facility. These services capitalize on existing infrastructure and operational expertise to create additional income streams.

The company optimizes pipeline capacity and utilizes its storage assets to serve third-party customers. This segment allows NW Natural to monetize its extensive natural gas infrastructure beyond its core utility operations.

- Interstate Storage Revenue: Fees earned from third-party access to natural gas storage capacity, particularly at the Mist facility.

- Asset Management Fees: Income generated from managing natural gas assets and pipelines on behalf of other entities.

- Pipeline Optimization: Revenue derived from the efficient utilization and scheduling of pipeline transportation capacity.

- 2023 Performance: In 2023, NW Natural reported approximately $14 million in revenue from its Gas Storage segment, reflecting the value of these services.

Connection and Service Fees

NW Natural generates revenue through connection and service fees, charging customers for new gas and water utility hookups and service activations. These fees play a role in the company's revenue growth as it expands its customer base. For instance, in 2023, NW Natural reported adding approximately 10,000 new customer connections across its service territories, directly contributing to this revenue stream.

This particular revenue stream is bolstered by several factors. Organic customer growth within existing service areas is a primary driver, alongside expansion into new residential and commercial developments. The company's strategic focus on infrastructure upgrades also supports the ability to service more connections efficiently, thereby increasing revenue from these fees.

Key aspects of this revenue stream include:

- New Customer Connection Fees: Charges levied when a new property is connected to the gas or water network.

- Service Turn-On Fees: Fees associated with activating utility services for existing or new customers.

- Other Specific Utility Service Fees: Revenue from specialized services like meter testing or reconnection after disconnection.

NW Natural's revenue streams are diverse, encompassing regulated gas distribution, water and wastewater services, renewable natural gas production, and interstate storage and asset management. These segments are supported by customer connection fees and strategic growth initiatives.

| Revenue Stream | Description | 2023 Data/Key Facts |

|---|---|---|

| Regulated Gas Distribution | Sale and distribution of natural gas to residential, commercial, and industrial customers. | Largest revenue contributor; rates approved by state commissions (e.g., new Oregon rates in Nov 2024). Total operating revenues $1.9 billion in 2023. |

| Water & Wastewater Services | Fees from water and wastewater services through NW Natural Water subsidiary. | Expanding through acquisitions; rate increases in Arizona utilities drive revenue. |

| Renewable Natural Gas (RNG) | Production and sale of RNG for decarbonization efforts. | Actively pursuing RNG projects in 2024 for utilities, businesses, and transportation; securing long-term supply contracts. |

| Interstate Storage & Asset Management | Services leveraging Mist facility and pipeline capacity for third parties. | Fees for storage access and asset management; pipeline optimization. Gas Storage segment revenue was approx. $14 million in 2023. |

| Connection & Service Fees | Charges for new utility hookups and service activations. | Bolstered by organic customer growth and infrastructure upgrades; approx. 10,000 new customer connections added in 2023. |

Business Model Canvas Data Sources

The NW Natural Business Model Canvas is constructed using a blend of internal financial data, regulatory filings, and extensive market research. This comprehensive data approach ensures each component accurately reflects the company's operational realities and market positioning.