NW Natural Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NW Natural Bundle

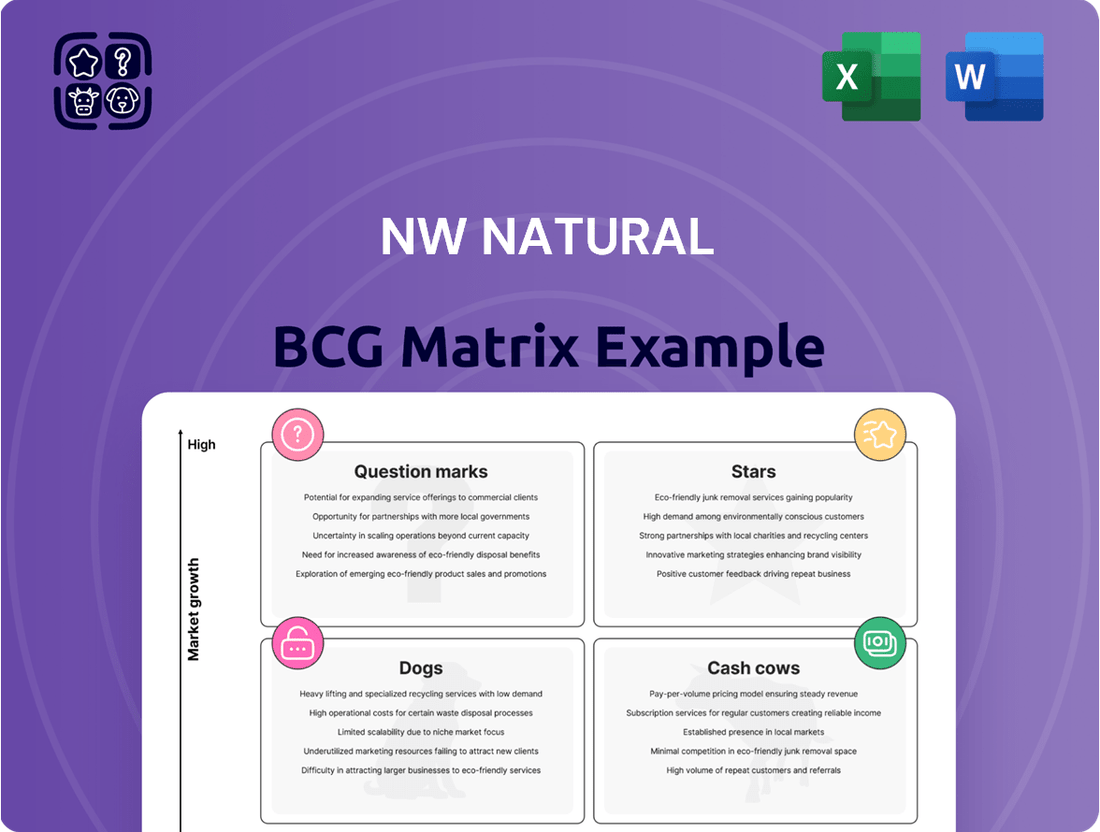

Curious about NW Natural's product portfolio? This preview highlights how their offerings might fit into the BCG Matrix – identifying potential Stars, Cash Cows, Dogs, or Question Marks. Understanding this structure is crucial for any investor or strategist looking to optimize resource allocation and drive growth within the energy sector.

Don't settle for a glimpse; unlock the full strategic potential by purchasing the complete NW Natural BCG Matrix. You'll gain detailed quadrant placements, crucial market share and growth rate data, and actionable insights tailored to NW Natural's specific market position.

This comprehensive report is your roadmap to making informed decisions about NW Natural's products. Discover which areas are generating significant cash flow, which require further investment, and which may need to be divested for maximum efficiency.

Equip yourself with the knowledge to navigate NW Natural's business landscape with confidence. Purchase the full BCG Matrix today and gain a clear, data-driven perspective on their current strategic standing.

Stars

NW Natural is making significant strides in the burgeoning renewable natural gas (RNG) market, a sector experiencing rapid growth driven by decarbonization efforts. This strategic focus positions them as a key player, anticipating substantial future opportunities within this environmentally conscious industry.

The company has already commenced operations at two RNG facilities through its NW Natural Renewables subsidiary. This tangible progress means they are not just planning but actively generating cash flows from these ventures, demonstrating a real commitment to their RNG strategy.

NW Natural is strategically investing in decarbonization, focusing on high-growth areas like clean hydrogen and carbon capture. A key initiative involves a project with Modern Hydrogen at their Central Portland facility, successfully producing clean hydrogen while capturing solid carbon. This venture highlights the company's commitment to innovative environmental solutions that have significant future potential.

NW Natural is strategically positioning itself for the future by exploring the delivery of lower-carbon fuels like renewable natural gas (RNG) and hydrogen through its existing pipeline infrastructure. This innovative approach allows the company to adapt to the energy transition while leveraging its established assets, suggesting a potential growth area. In 2023, NW Natural reported investments in RNG projects, signaling a tangible commitment to this evolving market.

Expansion into High-Growth Gas Utility Markets

NW Natural's expansion into high-growth gas utility markets, exemplified by the SiEnergy acquisition and the Hughes Gas Resources agreement, marks a significant strategic pivot. These moves target rapidly expanding regulated gas utility sectors beyond their established Pacific Northwest base. SiEnergy's robust customer growth trajectory in Texas is particularly noteworthy, indicating NW Natural's potential for substantial market share expansion in these dynamic new territories.

This strategic geographic diversification is crucial for continued growth.

- SiEnergy's strong customer growth in Texas positions NW Natural for increased market penetration.

- The acquisition of Hughes Gas Resources further solidifies NW Natural's presence in growing regulated gas markets.

- These moves aim to capitalize on demographic and economic expansion in regions outside their traditional service area.

- NW Natural reported that its regulated segment, which includes these new acquisitions, is expected to represent a larger portion of its overall business moving forward.

Advancing Carbon Neutrality Goals

NW Natural is actively pursuing ambitious carbon neutrality goals, demonstrating a strong commitment to environmental stewardship. The company has set a voluntary target to achieve 30% carbon savings by 2035 and aims for a fully carbon-neutral system by 2050. This includes addressing both their own operational emissions and those generated by their customers.

To support these aggressive targets, NW Natural is making significant investments in various decarbonization technologies. These investments are crucial for their long-term strategy and position them as a forward-thinking utility.

- Investment Focus: Key areas include Renewable Natural Gas (RNG), hydrogen development, and expanded energy efficiency programs.

- 2035 Goal: Aims for a 30% reduction in carbon emissions.

- 2050 Goal: Targets a completely carbon-neutral system, covering operational and customer-related emissions.

- Market Position: These initiatives solidify NW Natural's role as a leader in environmental progress within the utility industry.

NW Natural's ventures into renewable natural gas (RNG) and hydrogen development can be viewed as potential Stars within the BCG Matrix framework. These sectors are characterized by high growth potential, driven by the global push for decarbonization and cleaner energy solutions. The company's active investments and operational commencement at RNG facilities, such as those through NW Natural Renewables, indicate a strong market position and a commitment to capturing future opportunities in these emerging energy markets.

What is included in the product

NW Natural's BCG Matrix analyzes its business units by market share and growth to guide strategic decisions.

It identifies which segments to invest in, maintain, or divest for optimal resource allocation.

NW Natural's BCG Matrix offers a clear, one-page overview of business unit performance, relieving the pain of complex strategic analysis.

Cash Cows

NW Natural's extensive natural gas distribution network, serving over 800,000 meters across Oregon and Southwest Washington, firmly places it in the Cash Cows quadrant of the BCG Matrix. This core business is a mature market where the company enjoys a dominant market share, ensuring consistent and predictable revenue streams. In 2023, NW Natural reported total operating revenue of $898.6 million, with its Gas Distribution segment being the primary contributor.

NW Natural benefits from a substantial and devoted customer base spanning residential, commercial, and industrial sectors. This enduring loyalty ensures a steady and predictable demand for natural gas services. For instance, in 2023, NW Natural served approximately 767,000 natural gas customers, a number that has shown consistent, albeit modest, year-over-year growth.

This stable customer footprint translates into highly reliable revenue streams, characteristic of a mature, low-growth market. High customer satisfaction ratings further bolster this stability, suggesting that the company effectively meets the needs of its existing clientele without significant churn. Such a foundation makes it a quintessential cash cow.

NW Natural's regulated utility revenue stream functions as a classic cash cow within the BCG matrix. Its predictable earnings are underpinned by rate structures approved by state regulatory bodies, providing a stable and reliable income source.

Recent rate adjustments in Oregon, implemented in November 2024, are set to enhance NW Natural's utility margins. This regulatory approval directly boosts the cash-generating capacity of its foundational natural gas distribution business.

These rate increases are a testament to the company's ability to secure revenue even in a regulated environment, reinforcing its position as a mature business with low growth but high profitability.

High Market Share in Established Territories

NW Natural holds a dominant market share, essentially a monopoly, in the natural gas distribution sector across its established territories in Oregon and Southwest Washington. This secure position in a mature and essential utility market translates into predictable and steady cash flows. The company’s infrastructure is already in place, requiring minimal additional investment for growth within these core areas, allowing for efficient cash generation. For instance, in 2023, NW Natural reported that approximately 75% of its operating revenue came from its regulated gas distribution utilities, highlighting the stability of these operations. This consistent performance makes these segments true cash cows.

- Monopoly in Oregon and Southwest Washington

- Mature and essential service market

- Consistent cash generation

- Low promotional investment required

Consistent Cash Flow from Core Operations

NW Natural’s natural gas distribution segment acts as a robust cash cow. This core utility business reliably churns out substantial operating cash flow, a vital source for funding necessary capital expenditures, servicing its debt obligations, and distributing dividends to shareholders. For example, in 2024, the company reported over $200 million in operating cash flow, predominantly stemming from this stable utility operation.

The consistency of this cash flow is a defining characteristic. It provides the financial bedrock upon which NW Natural can build and maintain its infrastructure, ensuring reliable service for its customers. This predictable income stream is particularly valuable in the current economic climate, offering stability and a dependable return.

- Consistent Operating Cash Flow: The natural gas distribution segment is the primary generator of NW Natural’s operating cash flow.

- Funding Capital Expenditures: This cash flow is essential for investing in infrastructure upgrades and maintenance.

- Debt Service and Dividends: It supports the company’s financial health by covering debt payments and shareholder returns.

- 2024 Performance: NW Natural generated over $200 million in operating cash flow in 2024, highlighting the segment's strength.

NW Natural's gas distribution segment is the company's primary cash cow, benefiting from a dominant market share in a mature, essential service. This translates into predictable, consistent revenue streams, with 2023 operating revenue for this segment contributing significantly to the company's total $898.6 million. The stable customer base, exceeding 767,000 in 2023, ensures ongoing demand, allowing the company to generate substantial cash flow, reported at over $200 million in 2024.

| Metric | Value (2023/2024) | Significance |

|---|---|---|

| Total Operating Revenue | $898.6 million (2023) | Highlights overall business scale. |

| Gas Distribution Revenue Contribution | Approx. 75% of operating revenue (2023) | Confirms segment's dominance. |

| Customer Count (Gas Distribution) | ~767,000 (2023) | Indicates stable demand base. |

| Operating Cash Flow | Over $200 million (2024) | Demonstrates strong cash generation. |

Preview = Final Product

NW Natural BCG Matrix

The NW Natural BCG Matrix preview you are viewing is the identical, complete document you will receive immediately after your purchase. This means no watermarks, no demo sections, and absolutely no hidden surprises—just a fully formatted, professionally analyzed report ready for immediate strategic application. You can be confident that the insights and structure you see now are precisely what you'll be working with to inform your business decisions and competitive planning.

Dogs

NW Natural, while actively modernizing, likely faces challenges with specific, aging segments of its extensive pipeline infrastructure. These older sections, particularly in areas with minimal growth, can demand significant capital for upkeep, often exceeding the revenue they produce. This situation classifies them as 'dogs' within the BCG matrix framework. For instance, in 2023, NW Natural reported capital expenditures of $425.6 million, a substantial portion of which is directed towards system modernization and integrity. However, localized pockets of older, less efficient assets may still represent a disproportionate maintenance burden, consuming resources without contributing to overall growth.

NW Natural's portfolio likely includes minor, non-strategic ancillary services that haven't achieved significant market penetration. These could represent small ventures or investments that consistently operate at break-even or incur minimal losses, consuming valuable capital without driving substantial growth or profit for the company.

These 'dog' segments, while not causing major financial strain, are characterized by their low contribution to NW Natural's overall performance. For instance, if a particular niche service generated only $1 million in revenue in 2024 with a net profit of $50,000, it would exemplify this category, tying up resources that could be better allocated to core or high-potential areas.

Within NW Natural's broader portfolio, there are likely to be underperforming small-scale assets, potentially representing minor operational units or niche service offerings that are not meeting desired performance benchmarks and exhibit limited prospects for significant future growth. These are the classic 'cash traps' in a BCG matrix, consuming resources without generating substantial returns. For instance, a small, localized gas distribution network in an area with declining population might fall into this category.

These assets, while perhaps not individually material to NW Natural's overall financial health, collectively represent an inefficient allocation of capital. Their underperformance suggests they are not contributing effectively to the company's cash flow or strategic objectives. Consider a scenario where a particular legacy infrastructure upgrade project in a very small community is experiencing cost overruns and is unlikely to generate sufficient future revenue to justify the initial investment.

The challenge with these underperforming small-scale assets lies in their potential to drain resources that could be better deployed elsewhere. They might require ongoing maintenance and regulatory compliance without a corresponding revenue stream to support these activities. For example, a very small, specialized pipeline segment serving a single industrial client that is phasing out operations would be a prime candidate for this classification.

In 2024, utilities nationwide are facing increased pressure to optimize their asset portfolios. NW Natural, like its peers, must continually evaluate whether to divest, restructure, or invest in such minor units. The focus is on maximizing shareholder value by ensuring all assets contribute positively to the company's bottom line and strategic direction, rather than allowing them to become persistent drains on resources.

Highly Localized Declining Service Areas

Within NW Natural's service territories, certain highly localized areas exhibit characteristics of 'dogs' in the BCG Matrix. While the utility generally operates in regions with positive demographic and economic trends, pockets within these areas can face population stagnation or even decline, impacting customer growth and revenue. These micro-markets, often due to specific local economic downturns or demographic shifts, present challenges for expansion and can lead to flat or shrinking revenue streams.

These localized 'dogs' are characterized by their limited growth potential and the possibility of a diminishing market share within their specific geographic confines. For instance, a small industrial park experiencing closure or a rural community losing younger residents can create these stagnant micro-markets.

- Localized Population Decline: Specific neighborhoods or small towns within NW Natural's broader service area might experience out-migration, leading to fewer residential connections.

- Industrial Attrition: The closure of a significant local employer or a decline in industrial activity can reduce commercial and industrial customer demand for natural gas services.

- Low Investment in Infrastructure: In these stagnant areas, NW Natural might see reduced opportunities for new infrastructure development or upgrades, further limiting growth prospects.

- Stagnant Revenue: The combination of these factors results in flat or declining revenue generation from these specific, localized service areas.

Obsolete Internal Systems or Processes

Obsolete internal systems or processes represent a significant drag on NW Natural's resources, much like a product in the 'dog' quadrant of the BCG matrix. These are operational elements that are no longer efficient or effective, demanding continuous capital for upkeep without contributing to market share growth or competitive advantage. Such systems can include outdated IT infrastructure, inefficient manual workflows, or legacy operational technologies that hinder productivity and increase operating costs.

These internal inefficiencies directly impact the company's cash flow. For instance, a utility company like NW Natural might struggle with an antiquated customer billing system that requires substantial IT support and manual intervention, diverting funds that could be invested in modernizing infrastructure or improving customer service. In 2024, maintaining such systems can become a significant expense. If a system requires over 50% of its original implementation cost annually for maintenance, it's a strong indicator of obsolescence.

- High Maintenance Costs: Systems that consume a disproportionate amount of operating budget for upkeep, such as legacy software requiring specialized, expensive support.

- Lack of Scalability: Inability of current processes to adapt to increasing demand or new business requirements, leading to bottlenecks and manual workarounds.

- Reduced Productivity: Outdated tools and workflows that slow down employees and create inefficiencies, impacting service delivery and operational speed.

- Security Vulnerabilities: Older systems often lack modern security features, posing risks that require ongoing, costly patching and monitoring.

NW Natural's 'dogs' likely encompass niche, low-growth service areas or specific legacy infrastructure segments that require substantial upkeep without generating proportional returns. These might include small, geographically isolated distribution networks or ancillary services with minimal market penetration. In 2023, NW Natural invested $425.6 million in capital expenditures, with a portion allocated to maintaining and modernizing existing assets, some of which may fall into this 'dog' category due to their limited growth prospects and high maintenance needs.

Question Marks

NW Natural Water, a key subsidiary, is strategically positioned as a Question Mark within NW Natural's broader BCG Matrix. The company is actively pursuing growth in the water and wastewater services sector, evidenced by its expansion across states like Oregon, Arizona, and Texas. This segment operates within a burgeoning market driven by the critical need for water infrastructure upgrades.

Despite the market's growth potential, NW Natural Water currently holds a relatively small market share compared to the company's established natural gas utility business. This positioning necessitates significant capital investment to fuel its expansion ambitions and capture a larger piece of the market. For instance, as of early 2024, NW Natural has allocated substantial funds towards its water segment's capital expenditure plans, aiming to bolster its infrastructure and service capabilities.

NW Natural's early-stage Renewable Natural Gas (RNG) projects are classified as question marks within the BCG matrix. While the RNG sector is experiencing rapid growth, NW Natural is still in the process of building its portfolio, holding a relatively small market share currently. These projects demand substantial initial capital outlays, reflecting their high investment requirement.

NW Natural is seriously looking into hydrogen as a cleaner energy option, aiming to blend it into their existing natural gas infrastructure. They conducted a successful test in 2023, blending 20% hydrogen into their system at their Sherwood facility. This move positions hydrogen as a potential high-growth area for the company's long-term decarbonization strategy.

While the potential for hydrogen is significant, it's still in its early stages of market adoption and commercial feasibility. NW Natural recognizes the need for ongoing research and development to fully understand and scale up hydrogen integration. The company is investing in these efforts to pave the way for a more sustainable energy future.

New Geographical Market Entry via Acquisitions

NW Natural's strategic expansion into new geographical markets through acquisitions, exemplified by the SiEnergy purchase and the pending Hughes Gas Resources deal, positions it within high-growth regulated gas utility sectors. These moves are designed to capture new customer bases in markets NW Natural has not previously operated in.

The company's 2023 financial reports indicate a significant capital deployment towards these growth initiatives, aiming to establish a stronger presence in these emerging territories. The success of these entries hinges on effective integration and sustained market share growth, requiring continued strategic focus and investment.

- Acquisition of SiEnergy: Entered new regulated gas utility markets.

- Agreement to purchase Hughes Gas Resources: Further expands into Texas, a high-growth area.

- Strategic Importance: These acquisitions represent NW Natural's "Question Marks" in the BCG Matrix, requiring careful management and investment to achieve market leadership.

- Financial Commitment: Significant capital allocation is dedicated to integrating and growing these new market segments.

Innovative Decarbonization Technologies and Pilots

Beyond traditional renewable natural gas (RNG) and hydrogen blending, NW Natural is actively exploring cutting-edge decarbonization technologies. These include methane pyrolysis, which converts natural gas into hydrogen and solid carbon, and carbon capture projects aimed at mitigating emissions from existing infrastructure. These initiatives represent NW Natural's commitment to a diversified decarbonization strategy.

These advanced technologies are currently in nascent stages of development and pilot testing. While they hold significant long-term growth potential, their current market share is minimal. For instance, methane pyrolysis is a relatively new field, with early-stage projects in the US often focusing on proving technical feasibility rather than commercial scale. Similarly, carbon capture projects, while gaining traction, still face significant cost and infrastructure challenges, with many in the pilot or demonstration phase. NW Natural's investment here is crucial for understanding their future viability and scalability.

- Methane Pyrolysis: Converts natural gas into hydrogen and solid carbon, offering a pathway to carbon-free hydrogen production and valuable carbon byproducts.

- Carbon Capture Projects: Focus on capturing CO2 emissions from industrial processes or power generation, with ongoing pilots exploring various capture technologies and utilization methods.

- Early-Stage Investment: Significant research and development (R&D) funding and pilot program investments are necessary to overcome technical hurdles and assess economic feasibility for these emerging solutions.

- Low Market Share, High Potential: While these technologies currently represent a tiny fraction of the energy market, successful scaling could dramatically impact decarbonization efforts.

NW Natural Water's expansion efforts, while promising, require substantial investment to gain meaningful market share. The company's focus on high-growth areas underscores its ambition but also highlights the capital-intensive nature of these "question mark" ventures.

The company's early-stage RNG projects are also categorized as question marks. These ventures demand significant capital to build scale and market presence in a rapidly evolving sector.

NW Natural's exploration into hydrogen and advanced decarbonization technologies like methane pyrolysis and carbon capture represent future growth avenues. These are currently low-market-share initiatives, necessitating considerable investment for development and commercialization.

The strategic acquisitions of SiEnergy and the pending Hughes Gas Resources deal position NW Natural in new, high-growth regulated gas utility markets. These are classic question marks, requiring dedicated capital and strategic execution to achieve desired market positions.

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial disclosures, market research reports, and industry growth projections to offer strategic clarity.