NW Natural Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NW Natural Bundle

NW Natural's marketing strategy is a masterclass in balancing essential services with customer engagement. Their product focuses on reliable natural gas delivery, a foundational need for homes and businesses. Understanding their pricing and distribution is key to appreciating their market penetration and operational efficiency.

Delve deeper into how NW Natural crafts its promotional campaigns to build trust and inform consumers about energy efficiency and safety. This analysis goes beyond surface-level observations, providing a comprehensive look at their strategic choices.

Unlock the full potential of this brand analysis by accessing our complete 4Ps Marketing Mix report. Gain actionable insights into NW Natural's product, price, place, and promotion strategies, perfect for business professionals, students, and consultants. Save hours of research and get a ready-to-use, editable document.

Product

NW Natural's core offering is the dependable delivery of natural gas, serving a wide array of customers from homes to large industrial facilities. This fundamental service powers essential needs like heating and cooking.

In 2023, NW Natural reported approximately 792,000 total utility customers, underscoring the broad reach of its core natural gas distribution service. This extensive customer base highlights the essential nature of the company's product for daily life and economic activity.

The company's commitment to safety and reliability is paramount. They invest significantly in maintaining and upgrading their pipeline infrastructure to ensure uninterrupted service and build customer confidence. This focus on operational integrity is key to their enduring success in the utility sector.

NW Natural is actively expanding its utility services beyond natural gas through its NW Natural Water subsidiary. This strategic move diversifies the company's revenue streams and taps into the growing demand for essential water and wastewater solutions. The company has made significant strides in this sector, evidenced by recent acquisitions across Oregon, Arizona, Idaho, and California, which significantly broadened its customer base and operational reach in the 2024 fiscal year.

This expansion into water and wastewater services is a key component of NW Natural's long-term growth strategy. By acquiring and integrating water utilities, the company is not only enhancing its overall utility portfolio but also creating new avenues for sustainable investment and capital deployment. This diversification strategy aims to provide more stable and predictable earnings, complementing its core natural gas business.

NW Natural is making significant strides in renewable natural gas (RNG) and decarbonization, aiming to be a key player in the energy transition. They are actively developing projects, like converting landfill waste into RNG, demonstrating a commitment to providing lower-carbon fuel alternatives for their customer base.

The company has set voluntary targets for integrating RNG into its existing pipeline infrastructure. For instance, in 2023, NW Natural announced plans to acquire RNG from a facility expected to produce approximately 1.5 million therms annually, showcasing tangible progress towards these environmental goals.

Beyond RNG, NW Natural is also exploring innovative solutions such as clean hydrogen production coupled with carbon capture technology. This forward-thinking approach underscores their dedication to offering a diverse portfolio of decarbonization options that align with evolving environmental standards and customer demands.

Enhanced Reliability and Modern Infrastructure

NW Natural’s commitment to enhanced reliability and modern infrastructure is a cornerstone of its product offering. The company consistently invests in upgrading its gas and water utility systems, ensuring dependable service for its customers. This focus on resiliency is crucial for delivering essential services effectively, especially in the face of evolving environmental and operational challenges.

Significant capital investments are channeled into infrastructure modernization, a key driver of NW Natural's value proposition. These expenditures are strategically allocated to maintain and improve the safety and efficiency of its networks. For instance, NW Natural projects substantial capital expenditures, with approximately $800 million planned for 2024 and a similar range anticipated for 2025, primarily targeting system modernization and replacements.

The benefits of this ongoing investment are tangible for NW Natural's growing customer base. Modernized infrastructure reduces service interruptions and enhances the overall quality of essential utilities. This proactive approach ensures that the company can reliably meet demand and maintain operational integrity.

Key aspects of NW Natural's infrastructure investment strategy include:

- System Modernization: Replacing aging pipes and upgrading distribution networks to improve safety and reduce leaks.

- Resiliency Investments: Enhancing infrastructure to withstand extreme weather events and other potential disruptions.

- Technology Integration: Implementing advanced technologies for leak detection, system monitoring, and operational efficiency.

- Safety Enhancements: Prioritizing safety through regular inspections, maintenance, and upgrades of critical components.

Customer-Focused Energy Solutions and Programs

NW Natural goes beyond simply providing gas service by offering customer-focused energy solutions. These initiatives aim to boost customer value and encourage smarter energy usage. For instance, in 2023, their energy efficiency programs helped residential customers save an estimated $5.5 million on their utility bills by reducing natural gas consumption by 1.2 million therms.

The company actively promotes smart energy options and provides crucial support through bill discount programs for income-qualified customers. This commitment underscores their dedication to both energy affordability and responsible consumption, fostering customer loyalty and supporting broader environmental objectives.

Key customer-focused offerings include:

- Energy Efficiency Programs: Providing rebates and incentives for upgrades like insulation and high-efficiency appliances.

- Smart Energy Options: Facilitating customer understanding and control over their energy use.

- Bill Discount Programs: Offering financial assistance to low-income households, ensuring essential energy access.

- Customer Education: Resources and tools to help customers manage their energy usage and costs effectively.

NW Natural’s product is multifaceted, encompassing the reliable delivery of natural gas, which is essential for heating and cooking, serving nearly 792,000 customers in 2023. This core offering is bolstered by a strategic expansion into water and wastewater services through its NW Natural Water subsidiary, which broadened its reach through acquisitions in 2024 across several western states.

The company is also actively pursuing decarbonization through renewable natural gas (RNG) initiatives, aiming to integrate lower-carbon alternatives into its system, evidenced by plans to acquire RNG production in 2023. Furthermore, NW Natural is investing heavily in infrastructure modernization, with approximately $800 million allocated for 2024 and a similar amount projected for 2025 to ensure safety, reliability, and efficiency across its natural gas and water utilities.

Customer value is enhanced through energy efficiency programs, which in 2023 helped residential customers save an estimated $5.5 million, and financial assistance programs for low-income households. These efforts demonstrate a commitment to affordability, responsible energy use, and expanding essential utility services.

What is included in the product

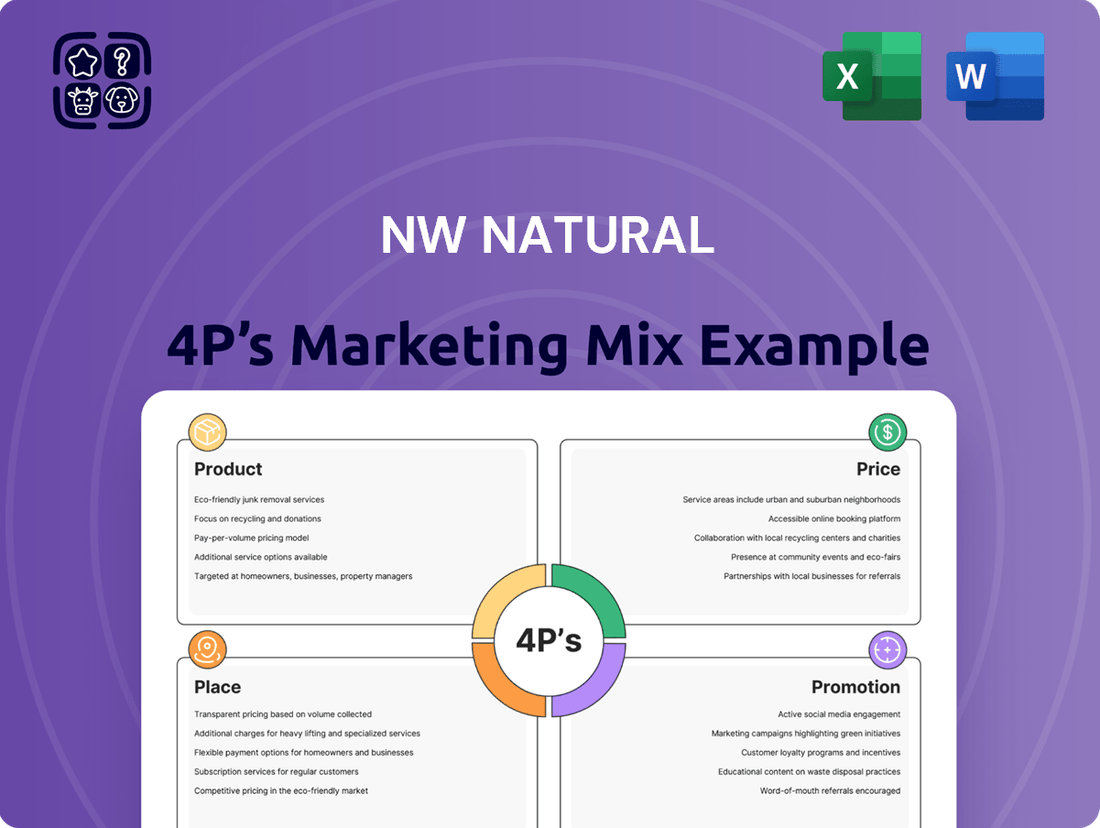

This analysis offers a comprehensive examination of NW Natural's marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It serves as a valuable resource for understanding NW Natural's market positioning and is easily adaptable for reports, presentations, or competitive benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of information overload for busy executives.

Streamlines understanding of NW Natural's marketing approach, easing the burden of deciphering intricate plans for cross-functional teams.

Place

NW Natural's regulated service territory is its foundation, primarily encompassing Oregon and Southwest Washington. This well-defined geographic area dictates its operational scope and market access.

The company's extensive distribution network reaches roughly two million individuals, supported by over 800,000 meters. This deep penetration into communities underscores its established presence and the essential nature of its natural gas services.

As of the first quarter of 2024, NW Natural continued to serve these core regions, with capital expenditures focused on system modernization and safety initiatives within this established territory.

NW Natural is actively growing its water utility operations through its subsidiary, NW Natural Water. This expansion involves strategic acquisitions aimed at increasing its water and wastewater service footprint. For instance, in 2023, NW Natural Water completed acquisitions totaling approximately $150 million, adding around 16,000 customer connections.

These moves extend the company's reach into new states such as Arizona, Idaho, and California. This diversification broadens its service area considerably beyond its core natural gas business. The company's strategy focuses on acquiring well-managed, smaller water systems in attractive growth markets.

By the end of 2024, NW Natural Water aimed to have over 100,000 customer connections. This growth is a key element of NW Natural's broader strategy to diversify revenue streams and capitalize on the consolidated water utility sector. The company sees significant opportunities in acquiring and integrating these essential services.

Direct distribution via advanced pipeline infrastructure is the cornerstone of NW Natural's product delivery. This extensive network, comprising thousands of miles of modern pipelines, ensures natural gas reaches customer homes and businesses safely and reliably. In 2024, NW Natural continued its investment in modernizing this infrastructure, with capital expenditures focused on safety and reliability projects, including replacing aging pipes.

Underground Gas Storage Facilities

NW Natural's underground gas storage facilities, like those strategically located in Oregon, are a cornerstone of their product strategy, directly impacting availability and cost. These assets enable the company to smooth out the inherent volatility in natural gas supply and demand. By purchasing gas during off-peak periods when prices are typically lower, NW Natural can then inject and store this gas for later withdrawal during periods of high demand, such as cold winter months. This proactive management of inventory is crucial for ensuring a consistent and reliable supply to their customers.

The financial implications of these storage operations are significant. For instance, in their 2023 financial reporting, NW Natural highlighted how their storage capabilities contribute to managing commodity costs. The company’s ability to strategically store gas allows them to hedge against price spikes and pass on more stable, predictable energy costs to their customer base. This operational efficiency directly supports the product's value proposition, making it more competitive and dependable.

- Storage Capacity: NW Natural operates substantial underground storage capacity, with key facilities contributing to their overall system reliability and flexibility.

- Operational Efficiency: The ability to store gas during low-demand periods and inject it during high-demand periods optimizes procurement costs and ensures supply availability.

- Customer Benefit: This strategy helps stabilize natural gas prices for customers, providing a more predictable energy expense.

- Reliability Enhancement: Underground storage is a critical component in meeting peak demand and mitigating supply disruptions, thereby bolstering service reliability.

Localized Customer Service and Operational Hubs

NW Natural's marketing mix emphasizes localized customer service and operational hubs, complementing its widespread distribution. These local centers are crucial for direct customer engagement, enabling prompt responses to inquiries and issues. For instance, in 2024, NW Natural continued to invest in its customer service infrastructure, aiming to improve response times for its over 770,000 customers across Oregon and Southwest Washington. This local presence also underpins efficient maintenance and emergency response for their extensive gas distribution network, ensuring community safety and service reliability.

These hubs allow for a more intimate understanding of regional needs and challenges. They serve as vital points for community outreach and education on natural gas safety and efficiency programs. By maintaining these localized operations, NW Natural strengthens its connection with the communities it serves, fostering trust and brand loyalty. This strategy ensures that despite the utility's scale, service remains personal and responsive to individual customer requirements.

- Local Presence: Facilitates direct customer interaction and support within specific service areas.

- Emergency Response: Enhances rapid deployment of resources for gas leaks or service disruptions.

- Network Maintenance: Enables efficient upkeep and repairs of the distribution infrastructure.

- Community Engagement: Supports local outreach and educational initiatives, strengthening relationships.

NW Natural's place is defined by its core regulated natural gas service territories in Oregon and Southwest Washington, serving approximately two million individuals through over 800,000 meters as of early 2024. Concurrently, its expanding water utility subsidiary, NW Natural Water, is strategically acquiring smaller systems in Arizona, Idaho, and California, aiming for over 100,000 customer connections by the end of 2024 after adding around 16,000 in 2023 through acquisitions totaling $150 million.

| Service Area | Customer Count (Approx.) | Key Infrastructure |

|---|---|---|

| Oregon & SW Washington (Gas) | 800,000+ meters | Thousands of miles of pipeline, underground storage facilities |

| Arizona, Idaho, California (Water) | 16,000+ (added in 2023) | Acquired water and wastewater systems |

What You See Is What You Get

NW Natural 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive NW Natural 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version you'll download, detailing Product, Price, Place, and Promotion strategies. We don't believe in mockups; this is the real, high-quality analysis you’ll receive upon purchase.

Promotion

NW Natural's promotion as a public utility centers on safety and reliability, fundamental to its brand and public trust. Communications frequently highlight safety tips, emergency readiness, and the secure management of its natural gas and water infrastructure. This persistent focus underscores the company's dedication to being a dependable and responsible service provider.

In 2024, NW Natural reported investing $181 million in infrastructure improvements, a significant portion dedicated to enhancing safety and reliability across its service territories. For instance, the company completed 19 miles of pipeline replacement in Oregon alone during the first half of 2024, directly contributing to system integrity and reducing potential safety risks.

NW Natural is making significant strides in sustainability, actively promoting its investments in renewable natural gas (RNG). This strategic focus on decarbonization aligns the company with environmental stewardship and a lower-carbon future, a key element in their marketing mix.

The company is publicizing projects like clean hydrogen production coupled with carbon capture technology. These initiatives, along with efforts to integrate RNG into their energy mix, appeal directly to environmentally conscious stakeholders. In 2023, NW Natural reported a 10% increase in their RNG portfolio, demonstrating tangible progress.

These forward-thinking strategies are crucial for attracting investors and customers who prioritize environmental responsibility. By highlighting these efforts, NW Natural is not just meeting regulatory demands but also building a brand identity centered on a sustainable energy future.

NW Natural's investor relations is a key promotional pillar, focusing on clear communication of financial health and strategic direction. This includes detailed earnings calls, investor presentations, and comprehensive annual reports, all designed to foster investor confidence.

The company actively promotes its stable earnings, strategic acquisitions, and long-term growth objectives to attract and retain a diverse investor base. For instance, in the first quarter of 2024, NW Natural reported diluted earnings per share of $1.05, demonstrating consistent operational performance.

This transparent reporting aims to showcase the company's commitment to shareholder value, evidenced by its consistent dividend payouts and strategic investments in infrastructure and renewable natural gas initiatives.

NW Natural's forward-looking statements, often shared during these investor events, highlight planned capital expenditures of approximately $500 million for 2024, underscoring its focus on future growth and operational improvements.

Community Engagement and Corporate Social Responsibility

NW Natural actively invests in its communities through diverse outreach and corporate social responsibility (CSR) programs, reinforcing its image as a committed partner. These initiatives, ranging from educational scholarships to local event sponsorships, underscore a dedication to the well-being of the regions it serves. For instance, in 2023, NW Natural contributed over $2.1 million to community organizations and supported more than 300 events. This commitment fosters significant goodwill and strengthens its reputation as an ethically minded corporation.

The company's CSR strategy focuses on key areas that align with its operations and community needs. This includes environmental stewardship, safety education, and economic development support. These targeted efforts not only benefit the communities but also enhance NW Natural's brand perception and stakeholder relationships. Their 2024 sustainability report highlighted a 15% increase in volunteer hours by employees compared to the previous year, demonstrating a tangible commitment beyond financial contributions.

- Community Investment: NW Natural allocated $2.1 million to community organizations in 2023.

- Employee Engagement: A 15% year-over-year increase in employee volunteer hours was noted in 2024.

- Program Focus: Initiatives center on education, environmental stewardship, and economic development.

- Reputation Enhancement: CSR activities bolster NW Natural's standing as an ethical and supportive partner.

Digital Presence and Customer Education Programs

NW Natural actively leverages its digital presence, including its comprehensive website and timely press releases, to educate its customer base. These platforms serve as vital conduits for information on critical topics such as energy efficiency best practices, available bill assistance programs, and details on newly introduced service offerings. This digital approach directly fosters customer engagement, delivering essential resources and elevating the overall customer experience.

For instance, in 2024, NW Natural's website likely saw significant traffic driven by customers seeking information on energy-saving tips ahead of seasonal demand shifts. Press releases frequently highlight partnerships or initiatives aimed at improving customer access to financial aid, a crucial service for many households. The company's commitment to digital communication is underscored by its efforts to make complex information, like rate changes or new infrastructure projects, easily digestible online.

- Website as a Hub: NW Natural's website serves as a central repository for customer information, offering detailed guides on energy conservation and program eligibility.

- Press Releases for Timely Updates: Through press releases, the company disseminates important news regarding service enhancements, safety information, and community outreach.

- Digital Engagement Metrics: While specific 2024/2025 engagement metrics are proprietary, similar utility companies often report substantial increases in website visits and inquiries following targeted digital campaigns promoting assistance programs.

- Customer Education Focus: The digital platforms are specifically designed to empower customers with knowledge, enabling them to manage their energy usage and costs more effectively.

NW Natural's promotional efforts in 2024 and early 2025 heavily emphasize safety, reliability, and customer education through digital channels. The company highlights infrastructure investments, such as the $181 million allocated in 2024 for system improvements, with specific projects like 19 miles of pipeline replacement in Oregon demonstrating tangible safety enhancements. This focus on dependable service delivery remains a core promotional message, reinforced by accessible information on their website and through press releases regarding energy efficiency and assistance programs.

Price

NW Natural's pricing, a crucial element of their 4Ps marketing mix, is heavily influenced by regulated rate structures. In both Oregon and Washington, state utility commissions meticulously set these rates. The primary goal is to ensure NW Natural can cover its operational costs and achieve a reasonable, regulated return on the capital it invests in its infrastructure.

To manage these rates effectively, NW Natural actively participates in regular regulatory filings and rate cases. These processes allow the company to propose adjustments to its pricing. Such adjustments are driven by a variety of factors, including changes in operating expenses, significant investments in infrastructure upgrades, and evolving market conditions, reflecting the dynamic nature of utility operations.

For instance, in their 2024 rate case in Oregon, NW Natural sought to recover over $110 million in infrastructure investments, demonstrating the direct link between capital expenditure and customer rates. This highlights the ongoing need for the company to justify its pricing through detailed filings that showcase the necessity of these investments for system reliability and safety.

NW Natural's pricing strategies are directly tied to the necessity of recouping substantial investments in modernizing and expanding its natural gas infrastructure. These capital expenditures are crucial for maintaining reliability and safety. For example, the company’s 2024 capital expenditure forecast was $565 million, with $385 million earmarked for system modernization and $180 million for growth projects.

New rates, implemented in Oregon on November 1, 2024, aim to balance the recovery of these significant capital outlays with operational and maintenance costs, as well as rising inflation. These adjustments are vital for sustaining the utility's financial stability and ensuring continued service. The Oregon Public Utility Commission (OPUC) approved an increase of $53.5 million in annual revenue for NW Natural, reflecting these investment needs.

NW Natural employs a differentiated pricing strategy across its residential, commercial, and industrial customer segments. This approach acknowledges the diverse consumption habits and service needs inherent in each group, aiming to align prices with value and service costs. For instance, residential customers might see tiered rates based on usage, while industrial clients could have contract-based pricing reflecting significant volume and specialized delivery. In 2024, regulatory filings indicated that average residential rates were approximately $1.15 per therm, compared to commercial rates averaging $0.90 per therm and industrial rates around $0.75 per therm, showcasing this segmentation.

Renewable Natural Gas (RNG) Cost Integration

NW Natural's integration of Renewable Natural Gas (RNG) into its supply portfolio brings new cost dynamics. These costs can influence customer rates, but regulatory frameworks exist to permit the recovery of these added expenses. The company is focused on harmonizing the environmental advantages of RNG with its cost-effectiveness for consumers.

The financial implications of RNG adoption are significant. For instance, while RNG offers a cleaner alternative, its procurement costs can be higher than conventional natural gas. NW Natural's filings, such as those with the Oregon Public Utility Commission (OPUC), detail these cost components and the proposed rate adjustments to accommodate them. These filings aim to ensure a transparent process for cost recovery.

- RNG Procurement Costs: The price of RNG can fluctuate based on feedstock availability, processing technologies, and market demand.

- Incremental Cost Recovery: Regulatory bodies review and approve mechanisms that allow utilities to recover the higher costs associated with purchasing RNG.

- Customer Rate Impact: These recovered costs are typically passed on to customers through volumetric charges or specific RNG program rates.

- Balancing Act: NW Natural aims to balance the customer's desire for cleaner energy with the need to maintain affordable and reliable service.

Customer Assistance and Affordability Programs

NW Natural actively supports customer affordability through several key initiatives. In Oregon and Washington, the company offers income-qualified bill discount programs designed to ease the financial burden on low-income households. These programs are crucial for ensuring access to essential energy services, especially during periods of high demand.

Beyond bill discounts, NW Natural also provides debt forgiveness initiatives. These programs can offer significant relief to customers struggling with past-due balances, preventing service disconnection and promoting financial stability. This dual approach of immediate discounts and long-term debt solutions underscores NW Natural's commitment to its customer base.

For example, NW Natural's Oregon Energy Assistance Program (OEAP) works in conjunction with state and federal funding to assist eligible customers. In 2023, the company helped facilitate over $12 million in energy assistance for its Oregon customers. These efforts are vital for maintaining service reliability for all customers by reducing the risk of widespread non-payment.

- Income-Qualified Bill Discounts: Programs like the Oregon Energy Assistance Program (OEAP) provide direct bill relief to eligible low-income customers.

- Debt Forgiveness Initiatives: NW Natural offers programs to help customers resolve past-due balances, preventing service interruptions.

- Financial Relief: These affordability programs aim to ensure vulnerable households can maintain essential utility access.

- Social Responsibility: The company's commitment to these programs reflects a balance between business operations and community support.

NW Natural's pricing strategy is deeply intertwined with regulatory approvals and the company's substantial capital investments in infrastructure modernization. The approved average residential rates in Oregon for 2024 were approximately $1.15 per therm, a figure that reflects these recovery needs. These rates are designed to cover operational costs, a regulated return on investment, and the increasing expenses associated with integrating cleaner energy sources like Renewable Natural Gas (RNG).

| Customer Segment | Average Rate (per therm) - 2024 (Oregon) | Key Pricing Drivers |

|---|---|---|

| Residential | ~$1.15 | Infrastructure investment recovery, operational costs, RNG integration |

| Commercial | ~$0.90 | Usage volume, service complexity, infrastructure costs |

| Industrial | ~$0.75 | Large volume contracts, specialized delivery, infrastructure costs |

4P's Marketing Mix Analysis Data Sources

Our NW Natural 4P’s Marketing Mix Analysis leverages a comprehensive blend of data sources. This includes official company reports like annual filings and investor presentations, alongside detailed insights from industry analyses, competitor benchmarking, and publicly available information on their service offerings and pricing structures.