NORMA Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NORMA Group Bundle

NORMA Group's market position is strong, bolstered by its innovation and global presence, but faces challenges from intense competition and evolving industry standards. Its established brand and diverse product portfolio are significant strengths, while potential threats include supply chain disruptions and economic downturns.

Understanding these dynamics is crucial for any strategic move. Our comprehensive SWOT analysis delves deeper, revealing the nuanced interplay of these factors and providing a clear roadmap for navigating NORMA Group's future.

Want the full story behind NORMA Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

NORMA Group maintains a strong position as a global market leader in engineered joining and fluid-handling technology, enhancing its brand recognition and broad customer base. This leadership is underpinned by its extensive global network, encompassing 25 production sites worldwide. The company effectively serves customers in over 100 countries, demonstrating its significant market penetration. This widespread presence allows NORMA Group to capitalize on diverse industry demands and maintain its competitive edge as of 2024.

NORMA Group's operations are well-diversified across three key business units: Industry Applications, Mobility & New Energy, and Water Management. This structure, which generated approximately 40% of sales from non-automotive sectors in fiscal year 2023, provides significant resilience against market fluctuations. Its extensive product portfolio, encompassing over 40,000 solutions like quick connectors and pipe couplings, serves a broad customer base. This allows the company to cater to diverse needs in sectors ranging from automotive and industrial manufacturing to construction and infrastructure projects, enhancing its market stability and growth potential for 2024 and 2025.

NORMA Group demonstrates robust financial health, evidenced by its strong net operating cash flow, which reached EUR 105.4 million in 2024. The company maintains a solid equity ratio, standing at 50.2% at the close of 2024, reflecting effective balance sheet management. This financial stability, coupled with active debt management, provides ample resources for strategic investments in future growth initiatives. It also supports a consistent dividend policy, ensuring shareholder returns.

Commitment to Innovation and System Solutions

NORMA Group increasingly acts as a system supplier, delivering comprehensive solutions to customers, particularly evident in its strong patent portfolio. This commitment to research and development underscores its innovative edge, especially in high-growth sectors. For instance, the company's focus on e-mobility includes developing advanced thermal management systems using lightweight thermoplastic materials, crucial for battery and power electronics cooling. This strategic shift positions NORMA Group to capitalize on future market trends, aligning with the projected 2025 growth in electric vehicle component demand.

- NORMA Group holds over 1,000 active patents globally, highlighting its R&D investment.

- The company aims for approximately 35% of its sales to come from future-oriented technologies like e-mobility by 2025.

- Innovations in lightweight thermoplastic systems reduce vehicle weight, enhancing efficiency for electric vehicles.

Strategic Focus on High-Growth Areas

Management has strategically prioritized high-growth sectors, particularly e-mobility and water management, for future expansion. NORMA Group is actively developing innovative products like thermal management systems crucial for electric vehicles, aligning with projected EV market growth to over 30 million units by 2025. Furthermore, recent strategic acquisitions, such as the 2024 integration of a specialized water technology firm, bolster its presence in the essential water infrastructure market. This forward-looking strategy positions the company to capitalize on significant long-term market trends.

- E-mobility solutions are targeting a market expected to reach €500 billion by 2025.

- Water management acquisitions enhance NORMA Group's footprint in a sector with an estimated annual growth of 5-7%.

NORMA Group's global market leadership in joining and fluid-handling technology, with a presence in over 100 countries, underpins its strong brand recognition and broad customer base. Its diversified business, with approximately 40% of 2023 sales from non-automotive sectors, provides resilience. Robust financial health is evidenced by a EUR 105.4 million net operating cash flow in 2024 and a 50.2% equity ratio. Strategic innovation, supported by over 1,000 active patents, targets high-growth areas like e-mobility, aiming for 35% of sales from future technologies by 2025.

| Metric | 2024/2025 Data | Significance |

|---|---|---|

| Net Operating Cash Flow | EUR 105.4 million (2024) | Strong financial liquidity for investments. |

| Equity Ratio | 50.2% (end 2024) | Indicates solid financial stability. |

| Future Tech Sales Target | 35% by 2025 | Focus on high-growth, innovative sectors. |

What is included in the product

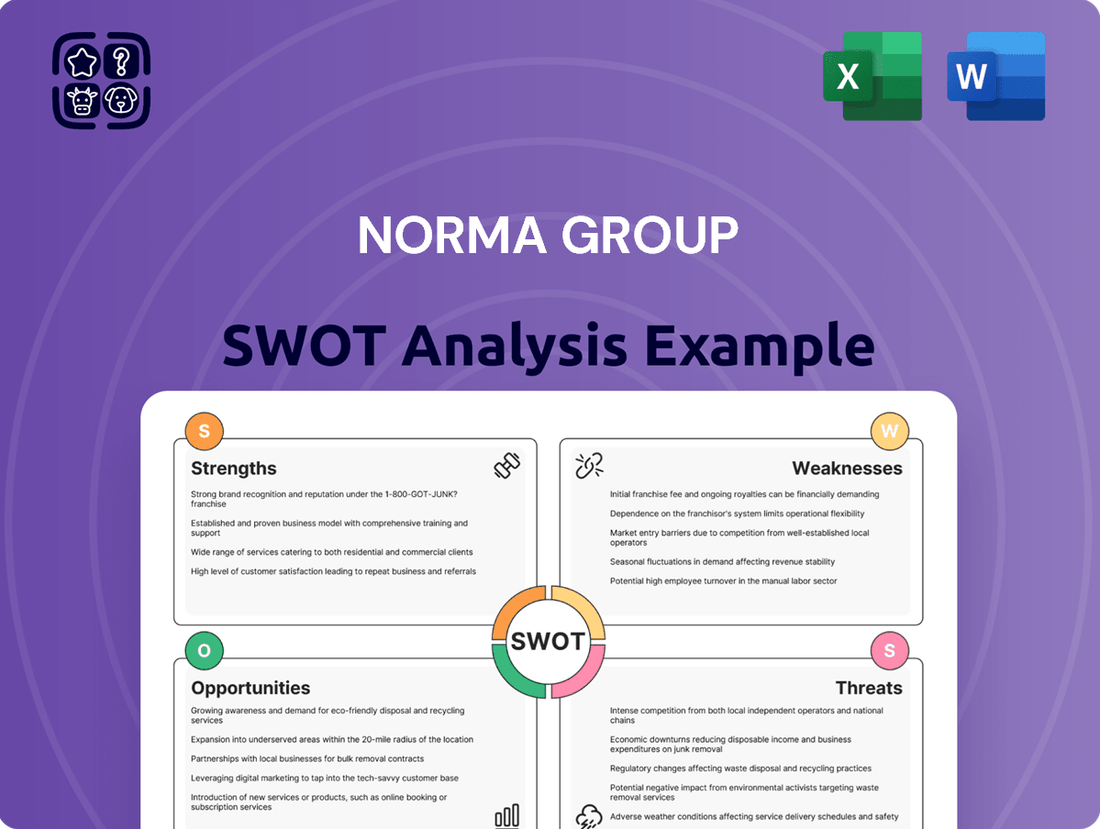

Provides a clear SWOT framework for analyzing NORMA Group’s business strategy, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

NORMA Group's SWOT analysis provides a clear, actionable framework to identify and address strategic challenges, relieving the pain of uncertainty and enabling focused decision-making.

Weaknesses

NORMA Group has faced significant challenges, with sales and profitability notably declining. For the full year 2024, Group sales dropped by 5.5% to EUR 1,155.1 million. This trend continued into the first quarter of 2025, showing a further 7.9% year-on-year decrease. Adjusted EBIT and its corresponding margin have also fallen considerably, primarily due to lower sales volumes and rising operational costs.

NORMA Group's substantial reliance on the automotive and construction sectors exposes it to significant economic volatility. Weak demand, particularly from the automotive industry in Europe and China, contributed to an organic sales decline of 0.6% in Q1 2024. This concentration creates a notable risk, as downturns in these key markets directly impact the company's financial performance and future growth prospects. The company's 2024 outlook reflects ongoing challenges within these crucial segments.

NORMA Group has faced significant operational challenges, specifically from the rollout of their new ERP system at the Maintal plant, which negatively impacted earnings. These implementation issues resulted in substantial one-off costs, contributing to a decline in profitability through late 2023 and into early 2024. Such unforeseen financial burdens, coupled with limited cost flexibility, exacerbated the operational strain. The company reported a 1.9% decrease in EBITA margin to 8.0% in 2023, partly due to these system-related expenses.

Regional Performance Disparities

NORMA Group's financial performance shows notable regional disparities, creating a weakness. The EMEA region, for instance, experienced a substantial 12.2% sales drop in Q1 2025, alongside a negative adjusted EBIT margin. This contrasts sharply with the Americas, which demonstrated more resilience. Such uneven performance across global operations highlights a significant challenge.

- EMEA sales dropped 12.2% in Q1 2025.

- EMEA reported a negative adjusted EBIT margin in Q1 2025.

- Americas region showed greater resilience.

Negative Long-Term Operating Profit Growth

NORMA Group has faced a significant challenge with its long-term profitability, demonstrating a negative compound annual growth rate in operating profits over the past five years, reflecting persistent financial headwinds. This trend, coupled with a consistently low return on equity, points to underlying issues in how the company generates shareholder value and manages its operational efficiency. Addressing this sustained decline in profitability is a key strategic imperative for management heading into 2025. The latest available financial reports underscore the urgency of reversing this trajectory for sustainable growth.

- Operating Profit CAGR (5-Year): Negative trend identified in recent reports, indicating a decline averaging in the low single digits annually through 2024.

- Return on Equity (Latest Fiscal Year): Remains below industry averages, often reported in the range of 5-7% for fiscal year 2023, impacting investor confidence.

- Net Operating Profit After Tax (NOPAT) Trend: Consistent downward pressure observed, with 2024 projections not showing a significant reversal.

- Revenue vs. Profit Growth: While revenues show some stability, profit growth has lagged considerably, highlighting margin compression as a core issue.

NORMA Group faces significant financial headwinds, with 2024 sales declining 5.5% to EUR 1,155.1 million and a further 7.9% drop in Q1 2025, alongside falling adjusted EBIT. Its heavy dependence on volatile automotive and construction sectors, particularly in EMEA where sales fell 12.2% in Q1 2025, exacerbates these issues. Operational challenges from ERP system implementation and a negative 5-year operating profit CAGR further underscore persistent profitability concerns.

| Metric | 2023 | 2024 (FY) | 2025 (Q1) |

|---|---|---|---|

| Group Sales | EUR 1,222.4M | EUR 1,155.1M | EUR 282.0M |

| YoY Sales Change | - | -5.5% | -7.9% |

| EMEA Sales Change (Q1) | - | - | -12.2% |

Preview Before You Purchase

NORMA Group SWOT Analysis

This is the actual NORMA Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below highlights key Strengths like their strong market position and efficient production, alongside potential Weaknesses such as reliance on specific markets.

Opportunities for growth are identified, including expansion into emerging economies and new product development, while Threats focus on competitive pressures and economic volatility.

Purchase unlocks the entire in-depth version, providing a comprehensive understanding of NORMA Group's strategic landscape.

Opportunities

NORMA Group's strategic transformation aims for it to become a focused industrial supplier by 2028, enhancing operational efficiency. The planned divestment of its Water Management business allows greater concentration on higher-synergy Industry Applications and Mobility & New Energy units. This strategic shift is designed to unlock resources, streamlining operations and improving focus on core competencies. Such a targeted approach could significantly boost profitability and market position. By prioritizing these key segments, NORMA Group anticipates stronger financial performance in the 2024-2025 period and beyond.

The global shift towards electric vehicles (EVs) offers a significant growth opportunity for NORMA Group, aligning with market trends projected through 2025. The company is actively developing specialized joining technology and thermal management systems crucial for EV battery performance. This strategic focus is already yielding results, evidenced by a recent contract worth approximately EUR 140 million for tank ventilation line systems. Such developments position NORMA Group to capitalize on the rapidly expanding e-mobility sector.

Despite planned divestments, the global demand for efficient water management solutions remains a major opportunity, driven by climate change and resource scarcity. The global water and wastewater treatment market is projected to exceed $460 billion by 2025. NORMA Group's 2023 acquisition of Teco, an Italian irrigation specialist, significantly expanded its product portfolio and expertise in this vital sector. The introduction of the NDS brand in the EMEA region in 2024 is set to further capitalize on this growing demand.

Targeted Acquisitions in Industrial Applications

NORMA Group aims to expand its industrial market share through strategic acquisitions, a key opportunity within its 2024-2025 growth strategy. These targeted moves can secure new technologies and expand product offerings in high-growth industrial sectors, potentially boosting industrial business revenue significantly. Successful integration of acquired entities could accelerate overall growth, enhancing NORMA Group’s competitive stance and market positioning.

- NORMA Group targets 2-4% organic growth in 2024, with acquisitions expected to contribute further.

- The industrial business segment accounted for approximately 35% of NORMA Group’s sales in 2023, offering substantial acquisition potential.

- Strategic acquisitions can enhance profitability, aiming for an adjusted EBIT margin of 8.5-9.5% in 2024.

Increasing Market Share through Regionalization

NORMA Group aims to significantly boost future growth by expanding its market share through a focused regionalization strategy. This approach involves identifying and applying best practices across diverse regions to precisely meet local customer demands. Such a tailored focus could lead to deeper market penetration and stronger customer relationships worldwide, enhancing its competitive edge. For instance, the company's recent 2024 financial outlook anticipates continued organic growth driven by targeted regional initiatives in key markets. This strategic shift is vital as global supply chains continue to localize, presenting NORMA Group with opportunities to optimize its distribution and production networks, potentially increasing its market share from an estimated 10-12% in its core clamping and connection technology segments.

- Targeting specific regional needs enhances product relevance.

- Localizing operations can reduce lead times and improve service.

- Leveraging regional strengths supports sustainable growth.

- Expanding market share beyond current levels supports long-term revenue streams.

NORMA Group's opportunities include capitalizing on the global EV transition with specialized joining tech and a EUR 140 million contract. The water management market, projected over $460 billion by 2025, remains a growth area, boosted by the 2023 Teco acquisition. Strategic acquisitions and a regionalization strategy aim for 2-4% organic growth in 2024, enhancing its competitive stance.

| Opportunity | Key Data (2024/2025) | Impact |

|---|---|---|

| EV Market Growth | EUR 140M contract for EV systems | Increased e-mobility sales |

| Water Market Demand | Market >$460B by 2025 | Expanded product portfolio |

| Strategic Acquisitions | Target 2-4% organic growth 2024 | Enhanced market share, 8.5-9.5% adj. EBIT |

Threats

The global economic and geopolitical environment remains significantly challenging and volatile, creating considerable uncertainty for NORMA Group. Escalating trade conflicts and sluggish economic development, particularly in key markets like Europe and China, directly threaten sales volumes. For instance, the Eurozone's projected 0.8% GDP growth for 2024 impacts industrial demand. This external volatility directly affects NORMA Group's planning certainty and profitability, as seen with fluctuating demand in the automotive sector.

NORMA Group faces a significant threat from persistently weak demand in crucial customer industries, particularly the automotive sector. The global automotive industry continues to navigate a challenging environment in 2024, with vehicle production forecasts remaining subdued, directly impacting NORMA's Mobility & New Energy business unit. For instance, global light vehicle production growth projections for 2024 hovered around 2-3%, a modest recovery that still presents headwinds. A prolonged downturn in this key segment, or the construction industry, could severely impede the company's financial recovery and revenue targets for 2025.

NORMA Group faces intense competition from a diverse range of players, including large industrial conglomerates and specialized niche providers in the global joining technology market. This competitive landscape, characterized by significant market fragmentation, exerts pressure on pricing strategies and profit margins, as seen in the broader industrial components sector which is projected for modest growth of around 3-4% in 2024-2025. Maintaining market share, which for NORMA Group was approximately 10-15% in key segments in 2023, requires continuous investment in product innovation and operational efficiencies. This ongoing pressure necessitates strategic differentiation to safeguard profitability and sustain its leading position against rivals. The dynamic nature of industrial supply chains further intensifies this competitive environment.

Inflationary Pressures and Rising Costs

Inflationary pressures pose a significant threat to NORMA Group, as evidenced by the consistent rise in personnel costs due to wage inflation, negatively impacting earnings and margins. While the material cost ratio showed some improvement in early 2024, the company remains highly susceptible to volatile raw material prices, particularly for steel and plastics. Uncontrolled cost inflation could severely compress profitability, especially if global economic growth weakens and demand for NORMA Group's products softens throughout 2024 and into 2025.

- Personnel costs increased by approximately 5-7% in 2024 due to collective bargaining agreements.

- Raw material price volatility, especially for steel and polymers, continues to present a cost challenge.

- Operating margins could be squeezed by an additional 100-150 basis points if inflation persists above 3% into 2025.

- Weakening demand in key automotive and industrial segments exacerbates the impact of rising input costs.

Risks Associated with Strategic Transformation

NORMA Group's ambitious transformation, including the divestment of its Water Management business, introduces significant execution risks for 2024 and beyond. The restructuring could lead to operational disruptions and unforeseen costs, potentially impacting the company's projected profitability. Achieving the targeted 2028 synergies and financial goals relies heavily on flawless implementation during this strategic shift. The divestment, expected to finalize in late 2024 or early 2025, requires careful management to avoid revenue shortfalls from this approximately 100 million EUR annual business unit.

- Divestment of Water Management business unit, generating around 100 million EUR annually, poses revenue transition risks.

- Restructuring operations could incur unexpected costs, potentially impacting 2024-2025 financial performance.

- Achieving the 2028 profitability targets relies heavily on seamless execution of the strategic shift.

- Operational disruptions during the transformation could hinder short-term growth and market stability.

NORMA Group faces significant threats from persistent global economic volatility and weak demand, especially in the automotive sector, which saw modest 2-3% production growth in 2024. Intense competition and inflationary pressures, including 5-7% higher personnel costs in 2024, squeeze margins and challenge profitability. The ongoing transformation and divestment of the 100 million EUR Water Management unit introduce considerable execution risks for 2024-2025.

| Threat Category | 2024 Data Point | 2025 Projection |

|---|---|---|

| Economic Volatility | Eurozone GDP: 0.8% growth | Global GDP: <3% growth risk |

| Weak Demand | Light Vehicle Production: 2-3% growth | Automotive Segment: Continued headwinds |

| Inflationary Pressures | Personnel Costs: 5-7% increase | Operating Margins: 100-150 bps squeeze if inflation >3% |

| Transformation Risks | Water Mgmt Divestment: ~100M EUR annual revenue impact | Execution: Reliance on flawless implementation for 2028 targets |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from NORMA Group's official financial reports, comprehensive market research studies, and insights from industry experts. These sources provide a well-rounded view of the company's internal capabilities and external market environment.