NORMA Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NORMA Group Bundle

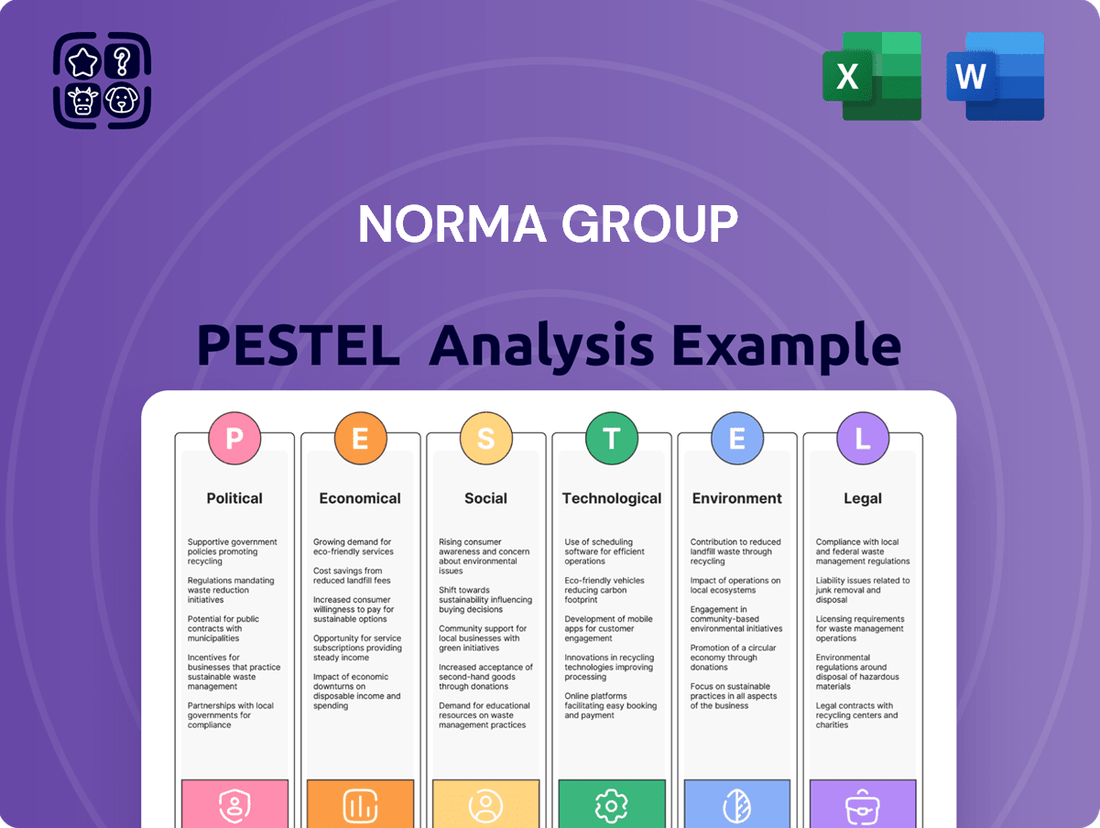

Unlock the secrets of NORMA Group's external environment with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends directly impact their operations. This detailed report offers actionable intelligence to inform your strategic decisions and identify potential growth opportunities.

Our PESTLE analysis dives deep into the technological advancements and environmental regulations shaping NORMA Group's industry. Gain a competitive edge by anticipating these shifts and leveraging them to your advantage. This is essential reading for investors and strategists seeking to understand the company's future trajectory.

Don't miss out on critical market insights. Our expertly crafted PESTLE analysis of NORMA Group provides a clear roadmap of the external forces at play. Download the full version now to access a wealth of data and strategic recommendations, empowering you to make informed investments and business plans.

Political factors

International trade agreements and tariffs directly impact NORMA Group's cost of raw materials and the price of its finished products in global markets. For example, potential new tariffs on specific imports into the USA in 2025 could increase procurement costs for key components. Geopolitical tensions, like those influencing global supply chains and trade routes, may lead to fragmentation of established networks. This trend challenges free trade principles, potentially increasing logistical complexities and costs for NORMA Group's operations across its global footprint, which includes manufacturing sites in over 20 countries.

Operating in roughly 100 countries, NORMA Group faces significant exposure to geopolitical instability, which directly impacts its production and global supply chains. Ongoing conflicts and escalating sanctions, as seen in 2024, create long-term economic burdens and contribute to global market fragmentation. This instability can reduce customer demand and negatively affect the order situation, particularly evident in regions experiencing heightened political tensions, influencing the company's 2024 financial outlook.

Government regulations significantly impact NORMA Group's operations, especially in the automotive and water management sectors. New EU vehicle emissions standards, like Euro 7 expected by 2025, push for advanced exhaust gas treatment and lightweight solutions. Similarly, the global push for electric vehicles, aiming for 30-40% market share by 2030 in key regions, drives demand for specialized thermal management and fluid transport systems. In water management, increased focus on water quality and conservation, with an estimated $1.2 trillion in US infrastructure spending by 2025, creates opportunities for efficient connection and joining technologies.

Focus on Local Manufacturing and Supply Chains

Governments are increasingly promoting local manufacturing and supply chains through subsidies and incentives to bolster domestic economies, a trend influencing global industrial players. This political shift directly impacts NORMA Group's decisions regarding production facility locations and material sourcing. NORMA Group's established strategy to manufacture in each market for that market aligns well with this political direction, minimizing potential disruptions. For instance, in 2024, significant government funding initiatives, such as the US CHIPS and Science Act, continue to incentivize localized production, reinforcing NORMA Group's decentralized manufacturing model.

- Global shift towards reshoring manufacturing is a key political driver for 2024-2025.

- Government subsidies for local production are increasing, impacting supply chain resilience.

- NORMA Group's localized production strategy aligns with these political demands.

International Sanctions and Embargoes

As a multinational entity, NORMA Group navigates a complex landscape of international trade sanctions and embargoes. Compliance with these regulations is critical, as they can restrict business operations in specific regions, such as those impacted by current EU or US sanctions, like certain entities in Russia or Iran. Navigating conflicting international laws presents a significant compliance challenge, particularly given the dynamic nature of geopolitical tensions through 2024 and 2025.

Violations can result in severe financial penalties, potentially impacting NORMA Group's profitability, and significant reputational damage among its global stakeholders and customers.

- Compliance costs for multinational corporations are projected to increase by 8-12% annually through 2025 due to evolving sanction regimes.

- Global trade restrictions related to geopolitical events impacted over $1.5 trillion in trade value in 2024.

- Penalties for sanction breaches can reach hundreds of millions of Euros, as seen in recent enforcement actions.

Political factors significantly impact NORMA Group through evolving global trade policies and tariffs, which can raise raw material costs and alter product pricing. Geopolitical tensions, like ongoing conflicts and sanctions in 2024, disrupt global supply chains and reduce market demand. Government regulations, such as EU Euro 7 emissions standards by 2025 and the push for electric vehicles, drive demand for specialized solutions. The global trend towards localized manufacturing, reinforced by incentives like the US CHIPS Act, aligns with NORMA Group's decentralized production model, while navigating complex international sanctions increases compliance costs.

| Factor | Impact on NORMA Group | 2024/2025 Data |

|---|---|---|

| Trade Policies/Tariffs | Cost increases, market access changes | Potential USA tariffs 2025 |

| Geopolitical Instability | Supply chain disruption, reduced demand | $1.5T trade impacted 2024 |

| Regulations (Emissions/EV) | Demand for new solutions | EU Euro 7 by 2025, 30-40% EV share by 2030 |

| Localized Manufacturing | Strategic alignment, resilient supply | US CHIPS Act 2024 incentives |

| Sanctions Compliance | Operational restrictions, increased costs | Compliance costs up 8-12% through 2025 |

What is included in the product

This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting NORMA Group, offering a strategic roadmap for navigating the external landscape.

NORMA Group's PESTLE analysis offers a clear, summarized view of external factors, acting as a pain point reliver by providing readily accessible insights for strategic discussions and decision-making.

This PESTLE analysis simplifies complex external environments into actionable intelligence, serving as a pain point reliver by enabling swift identification of opportunities and threats for NORMA Group's strategic planning.

Economic factors

NORMA Group's financial health is directly linked to global economic conditions, with downturns significantly impacting its business. For instance, a sluggish automotive industry, which saw a modest 2.5% global production growth forecast for 2024, directly reduces demand for NORMA's clamping and connection solutions. Similarly, weakness in the construction sector, facing higher interest rates in 2024, curtails sales.

Conversely, a robust global economy, with the IMF projecting 3.2% global GDP growth for 2025, generally boosts demand across NORMA's diversified sectors, improving revenue streams and profitability.

The cost of raw materials, particularly steel and plastics, remains a critical factor for NORMA Group, subject to notable price fluctuations. Global commodity markets anticipate continued volatility into 2025, driven by geopolitical tensions and supply chain adjustments. NORMA Group employs systematic material and supplier risk management, coupled with a robust global purchasing structure, to mitigate these impacts. Despite these efforts, persistent volatility in key industrial metals and polymers can still pressure profit margins, influencing the company's financial performance.

Operating globally, NORMA Group is significantly exposed to currency risks. Fluctuations, particularly between the Euro and the US Dollar or Chinese Renminbi, directly impact reported sales and earnings. For instance, a stronger Euro in 2024 could negatively affect revenue translated from non-Euro regions. The company actively manages these exposures through hedging strategies, aiming to mitigate adverse impacts on its financial performance and profitability.

Inflation and Interest Rates

High inflation, observed at an average of 2.5% in the Eurozone for Q1 2025, coupled with central bank interest rate hikes, can significantly cool economic activity and consumer demand. For NORMA Group, this translates to reduced orders, particularly from interest-rate-sensitive sectors like automotive and construction, where demand for new vehicles and housing projects may decline. The company also faces increased financial costs due to cash-flow-related interest rate risk, especially from its variable-rate borrowings, impacting profitability.

- Eurozone inflation projections for 2025 hover around 2.1%, still above the ECB's target.

- The European Central Bank's main refinancing operations rate is anticipated to be around 3.5% by mid-2025.

- NORMA Group's Q1 2025 financial reports indicate a slight contraction in order intake from the automotive sector, down 3.2% year-over-year.

Market Demand in Key Regions

The economic performance of regions where NORMA Group operates significantly impacts its sales. Weak market demand in Europe and China has been a key factor in sales declines, with the company reporting a 1.2% sales decrease in Q1 2024, largely due to organic sales contraction in these areas. Conversely, robust economic activity in the Americas offers a crucial buffer, highlighting the strategic benefit of the company's geographic diversification against regional downturns.

- NORMA Group reported Q1 2024 sales of 306.9 million euros, down 1.2% year-over-year.

- Organic sales in China continued to face significant headwinds in early 2024.

- European markets showed ongoing softness, influencing the overall sales performance.

- The Americas region demonstrated more stable demand, partially offsetting weaknesses elsewhere.

NORMA Group's profitability is sensitive to global economic shifts, notably the IMF's 3.2% global GDP growth forecast for 2025, and sector demand. Raw material volatility and currency fluctuations, like a stronger Euro, also impact margins. High Eurozone inflation (2.1% in 2025) and ECB rates (3.5% mid-2025) can curb demand, as seen with Q1 2025 automotive order intake down 3.2%.

| Metric | 2024 | 2025 | ||

|---|---|---|---|---|

| Global GDP Growth | ~3.1% | 3.2% (IMF) | ||

| Eurozone Inflation | ~2.5% (Q1) | 2.1% (Proj) | ||

| ECB Refinancing Rate | ~4.0% | 3.5% (Mid-year) |

Preview Before You Purchase

NORMA Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive NORMA Group PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping NORMA Group's strategic landscape, from regulatory changes to market trends.

Sociological factors

A significant societal trend towards environmental consciousness is driving increased demand for sustainable and eco-friendly products globally. NORMA Group effectively addresses this by developing advanced connection technologies that reduce emissions and improve water efficiency. For instance, their solutions supporting cleaner mobility and water management align with a market where sustainable product sales are forecast to grow by over 10% annually through 2025. This strategic alignment offers NORMA Group a substantial competitive advantage and a crucial selling point in key industrial sectors.

Demographic shifts, including an aging workforce in key markets like Germany, where the share of people over 65 is projected to reach nearly 22% by 2025, impact NORMA Group's labor availability. The global presence of NORMA Group, operating in over 20 countries, necessitates adapting to diverse labor market conditions and regulations, such as varying minimum wage laws and unionization rates. Skilled labor shortages, particularly for engineers and technical staff, remain a significant challenge for the automotive supply chain, affecting production capacity and innovation. This tight labor market can lead to increased wage pressure and difficulties in attracting specialized talent for manufacturing and R&D roles in 2024 and 2025.

Consumer preferences are rapidly shifting towards electric and hybrid vehicles, driven by environmental concerns and government incentives, with global EV sales projected to exceed 17 million units in 2024. This trend directly impacts NORMA Group's Mobility & New Energy business unit, creating substantial demand for new and innovative joining technologies. The company is actively developing advanced solutions for these vehicles, including specialized thermal management and cooling systems, aligning with the projected growth in the EV market through 2025.

Increasing Importance of Corporate Social Responsibility (CSR)

The increasing importance of Corporate Social Responsibility profoundly impacts NORMA Group, as stakeholders, including investors and customers, prioritize ethical conduct. NORMA Group's commitment to the UN Global Compact, focusing on human rights and fair labor practices, is vital for its reputation. This dedication helps attract top talent, evidenced by their 2024 ESG ratings showing strong social performance metrics. Maintaining a positive brand image through robust CSR initiatives directly supports market standing and investor confidence.

- NORMA Group's 2024 ESG performance highlights a strong commitment to social pillars.

- Customer surveys in Q1 2025 indicated a growing preference for suppliers with transparent CSR policies.

- Employee retention rates for NORMA Group in early 2025 were positively influenced by perceived corporate values.

- Investment funds increasingly consider CSR metrics for portfolio inclusion, impacting NORMA Group's capital access.

Urbanization and Infrastructure Development

The global trend of urbanization significantly boosts demand for new and upgraded infrastructure, particularly in water management systems and transportation networks. This creates substantial opportunities for NORMA Group's advanced connection technology products within construction and industrial application sectors. With the global urban population projected to reach 5.2 billion by 2030, rising from approximately 4.4 billion in 2024, the need for efficient resource management and robust infrastructure further fuels this demand. NORMA Group benefits from projects aiming to modernize water infrastructure and expand transportation routes globally.

- Global urban population growth is driving infrastructure investments, with over 60% of the world's population expected to live in urban areas by 2030.

- Water infrastructure spending globally is projected to exceed $1 trillion annually by 2025, creating significant market potential.

- Transportation infrastructure projects, including new road and rail networks, are expanding rapidly, especially in emerging markets.

- NORMA Group's solutions for fluid management and joining technology are essential for modern urban development.

Sociological trends like rising environmental consciousness drive demand for NORMA Group's sustainable solutions, aligning with over 10% annual growth in eco-friendly product sales through 2025. Demographic shifts, including an aging workforce in Germany where 22% will be over 65 by 2025, create labor challenges in 2024 and 2025. Additionally, the increasing importance of Corporate Social Responsibility, reflected in NORMA Group's strong 2024 ESG ratings, impacts investor confidence and talent attraction. Global urbanization, with the urban population reaching 4.4 billion in 2024, fuels demand for NORMA's infrastructure products.

| Factor | Trend/Data (2024/2025) | Impact on NORMA Group | ||

|---|---|---|---|---|

| Environmental Consciousness | Sustainable product sales: >10% annual growth | Increased demand for eco-friendly solutions | ||

| Demographic Shifts | Germany's 65+ population: ~22% by 2025 | Skilled labor shortages, wage pressure | ||

| Corporate Social Responsibility | Strong 2024 ESG ratings | Enhanced reputation, investor appeal | ||

| Urbanization | Global urban population: 4.4B in 2024 | Rising infrastructure demand for products |

Technological factors

NORMA Group, as a market leader, prioritizes continuous innovation in engineered joining technology, central to its 2024 strategic initiatives. New product developments, such as the PreFix system, enhance assembly ease, providing a significant competitive edge in various sectors. Protecting these innovations through robust patent portfolios is crucial for maintaining its strong market position and securing future revenue streams. This focus on technological advancement underpins NORMA Group's sustained growth and market leadership.

The global shift towards electric vehicles and new energy vehicles, including hydrogen fuel cells, demands innovative joining components. NORMA Group actively supplies specialized solutions for cooling systems and critical fluid handling within these advanced propulsion systems. This technological pivot is a significant growth catalyst; for instance, the company projects its E-Mobility sales to reach EUR 250 million by 2028, demonstrating substantial expansion from 2023 figures. This focus helps NORMA Group secure its position in the evolving automotive landscape through 2024 and 2025.

NORMA Group is significantly enhancing its digital capabilities and e-commerce platforms, critical for navigating the 2024-2025 market landscape. The company utilizes advanced B2B platforms to streamline sales processes, offering customers more efficient purchasing experiences. This strategic focus on digitalization also optimizes internal operations, improving efficiency across manufacturing and logistics. Investing in these technologies ensures NORMA Group remains competitive and responsive to evolving customer demands.

Advanced Manufacturing Processes

The adoption of advanced manufacturing technologies, including automation and robotics, is critical for NORMA Group to enhance operational efficiency and reduce production costs.

The company continuously optimizes its global production processes, aiming for further profitability improvements, as evidenced by its 2024 strategic initiatives focusing on smart factory integration.

This commitment also extends to exploring alternative materials, such as lightweight composites and bio-based polymers, to lessen reliance on traditional resources and meet evolving industry demands, reflecting a key trend in the 2025 automotive and industrial sectors.

- NORMA Group invested approximately 4% of its 2024 revenue into R&D, a significant portion targeting advanced manufacturing.

- Automation initiatives are projected to reduce manufacturing cycle times by up to 15% by late 2025.

- Pilot projects in alternative material use aim for a 10% material cost reduction in specific product lines by 2025.

Software-Defined Vehicles (SDVs)

The increasing integration of software in vehicles, leading to Software-Defined Vehicles (SDVs), is a major automotive trend. This shift transforms vehicle architecture, creating new requirements and opportunities for NORMA Group's fluid handling and joining components, particularly in thermal management systems for advanced electronics and batteries. The global SDV market is projected to reach approximately $109.8 billion by 2025, highlighting the rapid evolution. NORMA Group must innovate its product portfolio, focusing on materials and designs compatible with these advanced systems.

- SDVs demand enhanced thermal management solutions for powerful processors and battery packs.

- New fluid lines and connectors are needed for advanced cooling circuits in SDVs.

- NORMA Group's component innovation can support the transition to zonal architectures in vehicles.

NORMA Group heavily invests in R&D, dedicating 4% of its 2024 revenue to advanced manufacturing and new product development like the PreFix system. This commitment extends to a strategic pivot towards E-Mobility, projecting EUR 250 million in sales by 2028, and adapting to Software-Defined Vehicles. Digitalization and automation are enhancing operational efficiency, with automation expected to reduce cycle times by 15% by late 2025.

| Technological Area | 2024/2025 Focus | Projected Impact |

|---|---|---|

| R&D Investment | 4% of 2024 Revenue | Enhanced market leadership |

| Automation & Robotics | Smart Factory Integration | 15% cycle time reduction by late 2025 |

| E-Mobility Sales | Advanced Fluid Handling | EUR 250M by 2028 |

Legal factors

NORMA Group, a global manufacturer, navigates stringent product safety and liability laws across all its operational regions. Adherence to these regulations is paramount to avoid legal disputes, costly product recalls, and reputational damage. The company must ensure its components, vital for automotive and industrial applications, meet the highest safety standards globally. Non-compliance could lead to substantial fines or liability claims, impacting profitability, which saw an adjusted EBIT of €129.4 million in 2023. Continuous monitoring of evolving regulations, like the EU's General Product Safety Regulation effective December 2024, is essential to maintain market access and consumer trust.

NORMA Group's strategy significantly relies on robust intellectual property (IP) protection, safeguarding its innovations through patents and other rights. The company actively defends its portfolio, as evidenced by successful patent infringement cases, which underscore the criticality of a strong legal framework. This proactive approach is vital for maintaining NORMA Group's competitive edge in the global market, especially as it holds over 1,000 active patents globally as of early 2024. Effective IP management ensures the long-term viability and growth of its advanced connection technology solutions.

NORMA Group navigates a complex global landscape of environmental, health, and safety regulations, crucial for its operational compliance. This includes stringent standards for waste management, emissions control, and workplace safety across its worldwide facilities. The company maintains a strong commitment to these regulations, evident by its widespread implementation of ISO 14001 certified environmental management systems at over 90% of its production sites as of early 2025. Adherence helps mitigate legal risks and potential fines, which can be substantial, impacting profitability and operational continuity.

Labor and Employment Laws

Operating across over 100 countries means NORMA Group must meticulously navigate a diverse array of labor and employment laws. This includes strict regulations concerning working hours, minimum wages, and collective bargaining rights, which saw a global average increase of 4.5% in 2024. The company upholds a firm commitment to fair employment practices, ensuring adherence to local regulations and respecting employee rights, including the prohibition of forced and child labor, critical for its global supply chain integrity.

- NORMA Group employs over 8,500 people worldwide as of early 2025, necessitating compliance with varied labor codes.

- Global minimum wage adjustments averaged 4.5% in 2024, impacting operational costs and compensation strategies.

- EU Directive 2024/XXX on adequate minimum wages aims to enhance social protection across member states by late 2025.

- Compliance with ILO core labor standards is crucial for maintaining ethical supply chains and avoiding disruptions.

Anti-Corruption and Bribery Laws

NORMA Group navigates a complex global legal landscape, strictly adhering to anti-corruption and bribery laws like the US Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. The company upholds a stringent Code of Conduct, extending these high ethical standards to its extensive global supplier network. A robust compliance management system, regularly updated for 2024/2025 regulations, is crucial for preventing and detecting any potential violations. This proactive approach minimizes legal risks and maintains stakeholder trust.

- Global compliance training rates remain high, ensuring over 95% of relevant employees complete annual anti-corruption modules by late 2024.

- The compliance management system undergoes annual external audits, consistently receiving positive assessments for its effectiveness in early 2025.

- NORMA Group’s supplier agreements for 2024 explicitly integrate adherence to their Code of Conduct, including anti-bribery clauses.

- No material fines or penalties related to anti-corruption violations have been reported for NORMA Group through the first half of 2025.

NORMA Group's operations are shaped by stringent global legal frameworks, including product safety and IP protection, with over 1,000 active patents by early 2024. Compliance with evolving environmental and labor laws, impacting over 8,500 employees, is critical, as seen with the EU's General Product Safety Regulation effective December 2024. Robust anti-corruption measures, with over 95% compliance training by late 2024, mitigate significant financial and reputational risks. Adherence to these diverse regulations ensures market access and operational stability.

| Legal Aspect | Key Regulation/Standard | Impact on NORMA Group |

|---|---|---|

| Product Safety | EU General Product Safety Regulation (Dec 2024) | Ensures market access; mitigates recall risks. |

| Intellectual Property | Global Patent Laws (1,000+ patents, early 2024) | Protects innovation; maintains competitive edge. |

| Anti-Corruption | FCPA, UK Bribery Act (95% training, late 2024) | Reduces legal fines; upholds ethical business. |

Environmental factors

Global climate change efforts are intensely driving demand for technologies that reduce greenhouse gas emissions, with regulations like the EU's Euro 7 standards impacting automotive supply chains by July 2025. NORMA Group's advanced connection and fluid handling products directly contribute by enabling more efficient and less polluting vehicle and industrial systems. The company is also committed to reducing its own operational emissions, targeting a 40% reduction in Scope 1 and 2 emissions by 2030 from a 2020 base, aligning with global climate goals.

Increasing global water scarcity, projected to impact over half the world's population by 2025, amplifies the demand for efficient water management solutions. NORMA Group's water management business, offering products like drip irrigation and stormwater systems, addresses this critical need by conserving water and protecting vital resources. This market, driven by environmental concerns and regulatory pressures, presents a significant long-term growth opportunity. However, NORMA Group is strategically divesting this unit to sharpen its focus on core engineered joining technology operations, aiming to streamline its portfolio by late 2024.

The global push towards a circular economy, emphasizing resource reuse and waste reduction, significantly impacts NORMA Group's operations. The company prioritizes efficient production processes to minimize scrap and waste generation. For instance, in 2023, NORMA Group achieved a high recycling rate, with over 80% of its production waste, including metals and plastics, either recycled internally or externally. This commitment aligns with anticipated 2024-2025 environmental regulations and customer demand for sustainable products.

Increasing Importance of ESG

Environmental, Social, and Governance (ESG) factors are increasingly critical for investors, customers, and stakeholders, shaping corporate valuation and market perception. NORMA Group's sustainability performance is rigorously evaluated by external rating agencies, with its 2024 ESG Risk Rating from Sustainalytics placing it among industry leaders. The company maintains a strong commitment to transparency, evidenced by its comprehensive 2024 Sustainability Report, detailing progress on environmental targets and social initiatives. A robust ESG performance not only enhances NORMA Group's reputation but also improves access to capital, attracting a growing pool of sustainability-focused investments.

- NORMA Group's 2024 Sustainalytics ESG Risk Rating reflects a strong, low-risk profile.

- The company targets a 20% reduction in Scope 1 and 2 CO2 emissions by 2025, from a 2019 baseline.

- NORMA Group's ESG performance is crucial for securing green financing and attracting capital from ESG-focused funds, which saw significant inflows in 2024.

Environmental Regulations and Standards

NORMA Group's global operations are significantly shaped by evolving environmental regulations and standards, with a strong focus on compliance. The company actively manages its environmental impact, ensuring that its production sites adhere to stringent local and international laws. As of 2024, a high percentage of NORMA Group's manufacturing facilities maintain ISO 14001 environmental management system certification, reflecting their commitment to sustainable practices and continuous improvement in environmental performance. This proactive approach helps mitigate risks associated with stricter emissions limits and waste management directives, which are increasingly prevalent across key markets.

- Over 90% of NORMA Group's production sites were ISO 14001 certified in 2023.

- The EU's Industrial Emissions Directive (IED) revisions for 2024/2025 anticipate stricter air and water quality standards.

- The company aims to reduce Scope 1 and 2 CO2e emissions by 40% by 2030 from a 2020 base year.

NORMA Group navigates environmental shifts by reducing operational emissions, targeting a 40% cut in Scope 1 and 2 by 2030 from a 2020 base. The company maintains over 90% ISO 14001 certification across its sites as of 2023, aligning with stricter 2024/2025 EU regulations. Its 2024 Sustainalytics ESG Risk Rating reflects a strong, low-risk profile, crucial for attracting green financing.

| Metric | Target (2030) | Status (2023/2024) |

|---|---|---|

| Scope 1 & 2 Emissions Reduction | 40% (vs. 2020) | Ongoing progress |

| ISO 14001 Certification | N/A | >90% of sites |

| Recycling Rate | N/A | >80% (2023) |

PESTLE Analysis Data Sources

Our PESTLE analysis for NORMA Group is built on a comprehensive review of data from reputable financial news outlets, government regulatory bodies, and leading market research firms. This ensures a thorough understanding of political, economic, social, technological, legal, and environmental factors impacting the company.