NORMA Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NORMA Group Bundle

NORMA Group operates in a competitive landscape shaped by several key forces. Understanding the intensity of rivalry among existing competitors, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes is crucial for any strategic assessment. These forces collectively dictate the profitability and attractiveness of the markets NORMA Group serves.

The full Porter's Five Forces Analysis reveals the real forces shaping NORMA Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The cost of key raw materials for NORMA Group, like steel and various plastics, can experience significant volatility, directly impacting production expenses. Suppliers of these commodity-like materials generally hold low to moderate bargaining power as they are widely available from multiple global sources. However, broad market price fluctuations, such as the 2024 trends in steel markets showing slight increases in certain grades, can still exert pressure on NORMA Group's profit margins. Despite diverse sourcing, these price movements necessitate continuous cost management efforts.

NORMA Group's reliance on a limited number of specialized suppliers for highly engineered, patented components, particularly in high-specification automotive and industrial applications, significantly elevates supplier bargaining power. These unique products, essential for NORMA's advanced joining technology solutions, make switching costly and difficult. For instance, in 2024, the global automotive supply chain continues to see constraints in specialized chip and component availability, impacting companies like NORMA. This dependency could translate into higher input costs, affecting NORMA Group's profitability margins.

The criticality of a specific component to NORMA Group's final product directly influences supplier power. If a supplied part is a key performance differentiator for NORMA's advanced joining technology, the supplier of that part holds more leverage. NORMA Group mitigates this risk by maintaining an extensive global network, including over 25 production sites and numerous sales offices as of early 2024. This diversified operational footprint enables the company to broaden its sourcing base, reducing reliance on individual suppliers. Such strategic diversification enhances supply chain resilience against potential supplier-driven price increases or disruptions.

Switching Costs for NORMA Group

Switching costs significantly influence supplier bargaining power for NORMA Group. Changing suppliers for highly specialized components, like those for advanced thermal management systems in electric vehicles, involves substantial outlays for testing, qualification, and integration, potentially reaching millions of Euros in development and validation. These high costs empower incumbent suppliers of such critical inputs. Conversely, for standardized raw materials such as basic steel or rubber, switching costs are considerably lower, which diminishes the supplier's leverage.

- Specialized component validation costs: Often exceed €1 million per new component line.

- Lead times for new supplier qualification: Can range from 6 to 18 months.

- NORMA Group's diverse supplier base: Over 1,500 direct material suppliers globally as of early 2024.

- Impact on procurement strategy: Focus on dual-sourcing for critical inputs to mitigate risks.

Potential for Forward Integration

The potential for forward integration by NORMA Group's raw material suppliers remains low. It is highly improbable that large-scale steel or plastic producers would divert resources to enter the niche, specialized market of engineered joining technology, which requires significant expertise and specific manufacturing processes. This lack of a credible threat of suppliers moving into NORMA Group's core business helps to significantly constrain their bargaining power.

- In 2024, the global steel market focused on bulk production, not specialized component manufacturing.

- Plastic resin producers similarly prioritize high-volume raw material sales over downstream product integration.

- The high capital expenditure and distinct R&D required for engineered joining solutions deter raw material suppliers.

- NORMA Group’s established market position and intellectual property create barriers to entry for new players, including suppliers.

Supplier bargaining power for NORMA Group is mixed, low for commodity raw materials despite 2024 price fluctuations, but high for specialized, patented components due to significant switching costs exceeding €1 million and long qualification lead times of 6-18 months. NORMA Group mitigates this through its global network of over 1,500 direct material suppliers. The threat of forward integration by raw material suppliers into NORMA's niche market remains low.

| Factor | Impact on Supplier Power | 2024 Data Point |

|---|---|---|

| Raw Material Volatility | Low to Moderate | Steel market slight increases |

| Specialized Components | High | Automotive chip constraints |

| Switching Costs | High for specialized | >€1M per new component line |

| Supplier Base | Mitigated by diversity | >1,500 global suppliers |

What is included in the product

This analysis unpacks the competitive forces impacting NORMA Group, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the prevalence of substitutes.

Effortlessly visualize competitive intensity across all five forces, enabling NORMA Group to quickly identify and address strategic vulnerabilities.

Customers Bargaining Power

NORMA Group faces significant customer bargaining power due to its concentrated customer base, especially within the automotive industry. Large Original Equipment Manufacturers (OEMs) and Tier 1 suppliers, who make up a substantial portion of NORMA Group's sales, leverage their high-volume purchases to demand favorable pricing and contract terms. This pressure is amplified by the challenging market conditions in the automotive sector, as seen in early 2024 with fluctuating production volumes. For instance, the automotive business accounted for approximately 66% of NORMA Group's sales in 2023, underscoring this dependency.

Customers in the automotive and industrial sectors often demonstrate high price sensitivity, driven by intense competition within their own markets. They consistently push for cost reductions from suppliers, including NORMA Group, particularly for more standardized connection and fluid handling products where differentiation is less pronounced. This pressure can impact NORMA Group's margins; for instance, the company reported a Q1 2024 adjusted EBIT margin of 7.2%, reflecting ongoing pricing negotiations. Such dynamics highlight the substantial bargaining power customers wield, especially when seeking to optimize their supply chain costs in a volatile economic environment.

While NORMA Group’s highly engineered connection solutions are critical for the performance and safety of customer end products, they typically represent a small fraction of the total bill of materials. This often reduces the customer's direct focus on the price of these specific components, even with broader industry cost pressures observed across sectors like automotive in 2024. The company's innovative and high-quality solutions, reflecting its 2024 R&D investments, cultivate a significant degree of customer loyalty. This importance, despite low cost share, strengthens NORMA Group’s position.

Customer Switching Costs

Switching from NORMA Group's specialized joining technology presents substantial costs for customers, particularly in the automotive and industrial sectors. These expenses arise from rigorous testing and validation processes required for new components to meet stringent quality and performance standards. For instance, qualifying a new automotive part can take 18-36 months and incur millions in R&D and retooling, creating a strong lock-in effect for NORMA Group. This significantly enhances NORMA Group's bargaining position, as customers face high barriers to changing suppliers.

- New component validation can cost upwards of €500,000 per part in some complex industrial applications.

- Automotive supplier qualification cycles typically exceed 18 months, delaying new product launches.

- Retooling and engineering changes for alternative suppliers can add 10-25% to project costs.

- The cost of potential production line disruptions due to unproven components is a major deterrent.

Customer's Ability to Integrate Backward

The threat of backward integration, where a customer decides to produce joining technology components in-house, is generally low for NORMA Group. This is primarily due to the specialized expertise, advanced technology, and extensive patent protection associated with their high-performance products. However, very large automotive original equipment manufacturers (OEMs), like those with over 10 million vehicles produced annually in 2024, possess the significant capital and engineering resources to potentially develop their own solutions for specific, high-volume applications.

- Specialized engineering required for NORMA Group's complex joining solutions reduces customer's in-house production viability.

- NORMA Group holds over 1,000 active patents globally as of early 2024, protecting their innovative designs.

- Automotive OEMs would need substantial investment in R&D and manufacturing for backward integration.

- The high cost and long lead times for developing proprietary joining technologies deter most customers.

NORMA Group faces strong customer bargaining power from large OEMs, especially in the automotive sector, which made up 66% of 2023 sales. These customers exert price pressure, impacting NORMA's Q1 2024 adjusted EBIT margin of 7.2%. However, high switching costs, such as 18-36 month automotive qualification cycles, significantly limit customer options. The low threat of backward integration, supported by NORMA's over 1,000 active patents, further mitigates customer power.

| Factor | Impact | 2024 Data Point |

|---|---|---|

| Customer Concentration | High Bargaining Power | Automotive: 66% of 2023 sales |

| Price Sensitivity | Margin Pressure | Q1 2024 Adjusted EBIT: 7.2% |

| Switching Costs | Reduces Customer Power | Auto Qualification: 18-36 months |

| Backward Integration | Low Threat | Patents: Over 1,000 active |

What You See Is What You Get

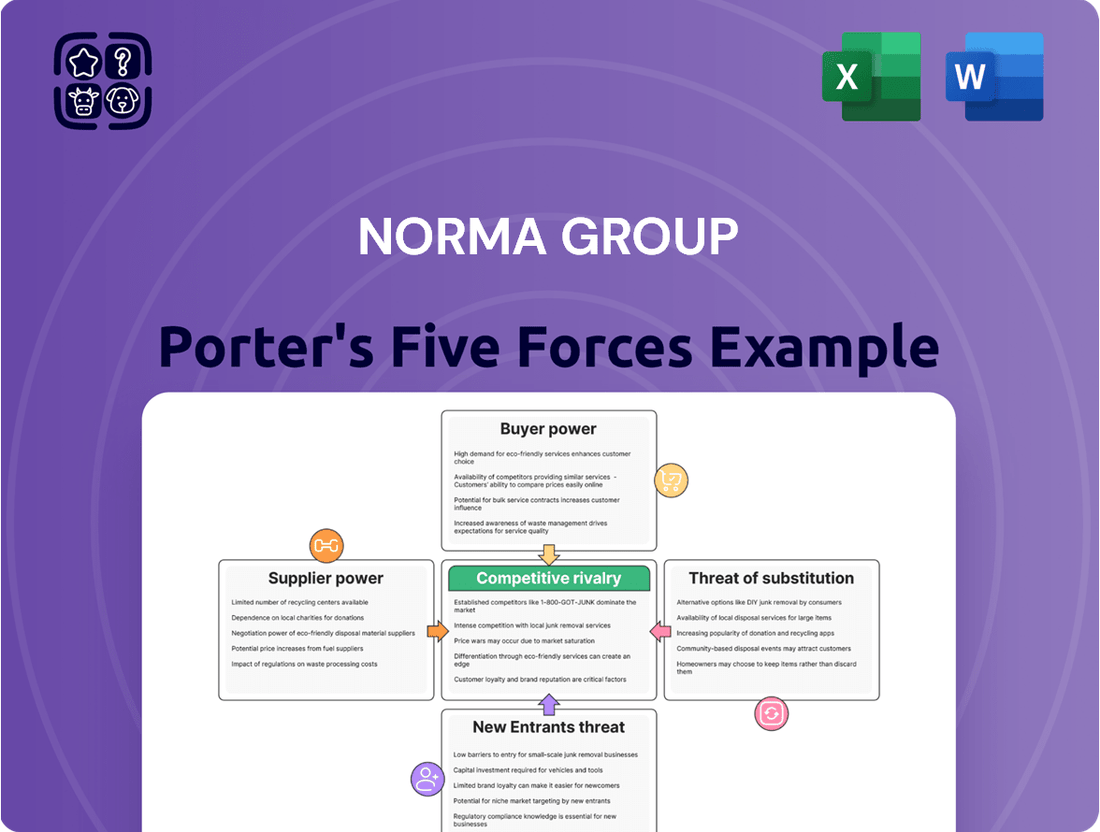

NORMA Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for NORMA Group, detailing the competitive landscape and strategic implications for the company. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file. This includes an in-depth examination of buyer and supplier bargaining power, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. The document you see here is exactly what you’ll be able to download after payment, providing actionable insights for understanding NORMA Group's market position and potential challenges.

Rivalry Among Competitors

The engineered joining technology market is quite fragmented, yet NORMA Group faces significant competition from established global players like Parker Hannifin, Eaton, and Gates Corporation. This intense rivalry, a core aspect of Porter's Five Forces, is driven by continuous innovation in product solutions, the pursuit of market share, and competitive pricing strategies across diverse applications. For instance, the global industrial hose market, a segment where joining technology is crucial, was valued at over $17 billion in 2024, highlighting the substantial revenue pools contested by these firms. Firms aggressively invest in R&D to offer lighter, more durable, and cost-effective joining solutions, influencing customer choices and maintaining high competitive pressure.

Slow market growth, particularly in the automotive and construction sectors, intensifies competitive rivalry. In 2024, economic headwinds in key markets like Europe and China have constrained overall demand. This sluggish development means companies must compete more aggressively for a smaller pool of available business. Weak customer demand directly impacts sales volumes, leading to increased pressure and potentially more aggressive pricing strategies among competitors.

NORMA Group's strategic decision to divest its water management business in 2024 underscores the high strategic stakes within its core joining technology segment. This move, aiming for enhanced focus, intensifies competitive rivalry as the company now directly confronts specialized peers. With a clear direction, NORMA Group is poised to engage in more aggressive market competition. This streamlined approach means that resources are concentrated on innovation and market share in its primary business, leading to heightened competitive pressures from established players.

Product Differentiation and Innovation

Competitive rivalry often centers on product innovation, superior quality, and the capacity to deliver highly customized solutions. NORMA Group leverages its extensive development expertise and patented technologies as a core strategy to distinguish itself from competitors in 2024. The company's consistent investment in research and development, evidenced by its robust patent portfolio, is crucial for maintaining a competitive edge. Defending these patents legally ensures its proprietary solutions, such as advanced joining technology, remain exclusive.

- NORMA Group’s R&D expenditure was approximately €45.7 million in 2023, showcasing ongoing innovation focus.

- The company holds over 1,000 active patents globally as of early 2024, protecting key product lines.

- Their pipeline includes new solutions for e-mobility and water management, targeting future growth markets.

- Customized engineering solutions contribute significantly to customer retention and market share.

Global Presence of Competitors

NORMA Group and its main competitors operate on a global scale, leading to intense competitive pressures across all major regions. This includes Europe, the Americas, and Asia-Pacific, where local and international players vie for market share in connection technology. NORMA Group's extensive global network of production and sales locations is essential to effectively compete worldwide, serving diverse industries like automotive and industrial applications. In 2024, the global market for connection technology continued to see significant activity, with companies strategically expanding their reach.

- NORMA Group's 2023 sales were EUR 1,224.2 million, demonstrating its global footprint.

- Key competitors include Parker Hannifin, Eaton, and Gates Corporation, all with strong international presence.

- The Asia-Pacific region is a major growth area, driving significant competitive investment.

- About 40% of NORMA Group's 2023 sales came from the Americas, highlighting regional competition.

The engineered joining technology market, valued at over $17 billion in 2024 for the industrial hose segment, faces intense competitive rivalry from global players like Parker Hannifin, Eaton, and Gates Corporation. This competition is heightened by slow market growth in 2024, particularly in Europe and China, compelling firms to aggressively pursue market share through pricing and innovation. NORMA Group actively competes by leveraging its over 1,000 active patents as of early 2024 and significant R&D investment, approximately €45.7 million in 2023, to offer advanced, customized solutions. Its global network supports its €1,224.2 million 2023 sales, with about 40% from the Americas, underscoring the widespread competitive pressure across regions.

| Metric | Value (2024 unless specified) | Context |

|---|---|---|

| Industrial Hose Market Value | Over $17 billion | Key segment for joining technology, showing market size. |

| NORMA Group R&D Expenditure | €45.7 million (2023) | Investment in innovation to maintain competitive edge. |

| NORMA Group Active Patents | Over 1,000 | Protecting proprietary solutions and differentiation. |

| NORMA Group Sales | €1,224.2 million (2023) | Demonstrates global footprint and scale of competition. |

| NORMA Group Sales from Americas | ~40% (2023) | Highlights regional competitive intensity. |

SSubstitutes Threaten

Alternative joining technologies like welding, soldering, or industrial adhesives represent potential substitutes for NORMA Group’s clamping and connection products. The suitability of these alternatives hinges on specific application needs, required performance characteristics, and the overall cost of implementation. For instance, while advanced adhesives saw significant growth in specific industrial sectors in 2024, their applicability is not universal. However, the threat of these substitutes, particularly for NORMA Group’s core stainless steel clamps, is generally considered unlikely to significantly disrupt their established market position.

For critical automotive and industrial applications, the reliability and performance of NORMA Group's engineered joining technology are paramount. Substitutes often fall short, unable to match the high level of security, durability, or resistance to vibration and temperature extremes required. This inherent performance gap significantly limits the threat posed by alternative solutions. NORMA Group's consistent focus on delivering high-quality, engineered solutions, as evidenced by its continued market leadership in 2024, effectively mitigates this competitive pressure.

While some substitute technologies might offer lower initial component costs for clamping and connection solutions, the overall total cost of application, including labor, specialized equipment, and potential for failure, can often be higher. NORMA Group’s engineered solutions, for example, often provide a total cost advantage due to their efficient and secure assembly, reducing installation time and mitigating risks. However, for less demanding applications, such as basic hose connections in non-critical systems, lower-cost, generic substitutes remain a viable and competitive threat in 2024, impacting market share in specific segments.

Customer's Willingness to Switch

Customers in critical sectors like automotive, which represented over 40% of NORMA Group’s sales in 2023, exhibit a low willingness to switch due to stringent quality standards and severe failure consequences. The company's established reputation for reliability, built over decades, serves as a significant barrier against unproven substitute technologies. Furthermore, NORMA Group's deep customer relationships and robust technical support, integral to their 2024 strategic focus on customer-centricity, solidify market positions and reduce the appeal of alternatives.

- NORMA Group's automotive segment revenue reached €537.4 million in 2023, underscoring its reliance on this high-quality sector.

- The cost of failure in automotive applications can include recalls, fines, and reputational damage, making switching to unproven substitutes highly risky for manufacturers.

- Long-term supply agreements and technical co-development projects with OEMs further entrench NORMA Group's products.

- The global market for connection technology is projected to grow, yet switching costs for established OEM relationships remain high.

Innovation in Substitute Technologies

Ongoing advancements in alternative technologies, such as new adhesive formulations or advanced welding techniques, could increase their attractiveness as substitutes. For instance, the global industrial adhesives market, valued at approximately USD 60 billion in 2023, continues to grow, posing an evolving threat to traditional joining solutions. NORMA Group must continue to innovate and improve its own products to maintain a competitive edge. The company's focus on research and development, with EUR 46.5 million invested in R&D during 2023, is crucial to counter these evolving substitute threats and ensure product superiority.

- Global industrial adhesives market reached approximately USD 60 billion in 2023.

- NORMA Group invested EUR 46.5 million in research and development during 2023.

- New welding techniques offer enhanced bonding strength and efficiency.

- Advanced polymer composites are emerging as lightweight alternatives to metal components.

The threat of substitutes for NORMA Group remains moderate, primarily limited in critical applications like automotive due to high performance requirements and significant switching costs. For instance, NORMA Group's 2023 automotive sales of €537.4 million highlight reliance on sectors valuing reliability over unproven alternatives. While generic, lower-cost substitutes impact less demanding segments, ongoing advancements in alternative joining technologies, such as the global industrial adhesives market valued at approximately USD 60 billion in 2023, necessitate continuous innovation by NORMA Group.

| Factor | Impact on NORMA Group | 2023/2024 Data |

|---|---|---|

| Performance Gap | Limits high-end substitution | Critical applications demand high reliability |

| Switching Costs | Low willingness to switch for OEMs | Automotive sales: €537.4M (2023) |

| Alternative Market Growth | Evolving threat in specific segments | Global industrial adhesives: ~$60B (2023) |

Entrants Threaten

Entering the engineered joining technology market requires significant capital investment in advanced manufacturing facilities and specialized machinery. These high upfront costs, often in the tens of millions of euros for a competitive scale, create a substantial barrier to entry for new companies. Establishing robust research and development capabilities, crucial for innovation in 2024, also adds considerably to the initial financial burden. Furthermore, building a global production and distribution network mirroring NORMA Group's expansive reach would be a major financial undertaking, effectively limiting new entrants.

NORMA Group's high level of technical expertise and extensive patent portfolio create a formidable barrier for new entrants. Developing comparable innovative products requires significant research and development investment, increasing entry costs for potential competitors. New companies face the challenge of either creating their own proprietary technologies or risking expensive patent infringement lawsuits. This intellectual property protection is a substantial deterrent, safeguarding NORMA Group's market position. The company's ongoing investment in R&D, consistently highlighted in its 2024 financial outlook, solidifies this competitive advantage.

NORMA Group benefits from deeply entrenched relationships with major customers across the automotive and industrial sectors, who consistently depend on the quality and reliability of its engineered joining technology products. For a new entrant, cultivating a comparable level of trust and brand recognition would be an exceptionally time-consuming and capital-intensive endeavor. This strong market position, solidified over decades and evidenced by NORMA Group's 2024 revenue projections of around EUR 1.2 billion, creates a significant barrier. Its established reputation as a global market leader provides a substantial competitive advantage, deterring potential new players.

Economies of Scale

NORMA Group, as a prominent global manufacturer, significantly benefits from extensive economies of scale across its purchasing, production, and distribution networks. These inherent cost advantages, stemming from its large operational footprint, allow the company to offer highly competitive pricing in the market. Consequently, new entrants, typically smaller in scale, face substantial hurdles in competing on price due to their inherently higher per-unit costs. This creates a formidable barrier, making it challenging for new players to effectively penetrate the market and achieve profitability.

- NORMA Group reported sales of €1,223.1 million in 2023, showcasing its significant global presence.

- Its extensive manufacturing network spans 26 facilities across 18 countries, optimizing production costs.

- The company's purchasing volume, exceeding €600 million annually, secures favorable supplier terms.

- Global distribution capabilities ensure efficient delivery, further reducing per-unit logistics expenses.

Stringent Industry Standards and Qualification Processes

New entrants into NORMA Group's core markets face a significant barrier due to the stringent industry standards and qualification processes. Products used in critical sectors like automotive, which constitutes a substantial portion of NORMA Group's business, must adhere to exceptionally high safety and quality benchmarks. The process for qualifying new components with major Original Equipment Manufacturers (OEMs) is remarkably long and rigorous, often spanning multiple years for critical parts. This means any potential newcomer would need to invest heavily in certifications and product validation, a challenge amplified by the industry's continuous evolution in 2024, including stricter emission and safety regulations. Navigating these complex qualification hurdles before supplying major customers deters many new competitors.

- Automotive safety standards, like ISO 26262 for functional safety, are mandatory for components.

- OEM qualification cycles for new parts can extend beyond 24 months, requiring extensive testing.

- New entrants face substantial R&D and certification costs, potentially exceeding millions of dollars.

- Supply chain reliability and established trust are critical, taking years for newcomers to build.

New entrants face formidable barriers due to high capital investment for advanced manufacturing and global distribution networks. NORMA Group's extensive patent portfolio and deeply entrenched customer relationships further complicate market entry. Stringent industry standards and lengthy qualification processes also deter new competitors. Additionally, the company's significant economies of scale make it challenging for newcomers to compete on price.

| Barrier Type | NORMA Group Strength (2024 Context) | Impact on New Entrants |

|---|---|---|

| Capital Investment | Global network spanning 26 facilities | Millions in upfront costs for competitive scale |

| Customer Relationships | Decades of trust, €1.2B 2024 revenue projection | Years to build comparable brand recognition |

| Industry Standards | Adherence to ISO 26262, OEM qualification cycles | 24+ months for product validation, high R&D |

Porter's Five Forces Analysis Data Sources

Our NORMA Group Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from annual reports, investor presentations, and industry-specific market research reports to capture the competitive landscape.