NORMA Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NORMA Group Bundle

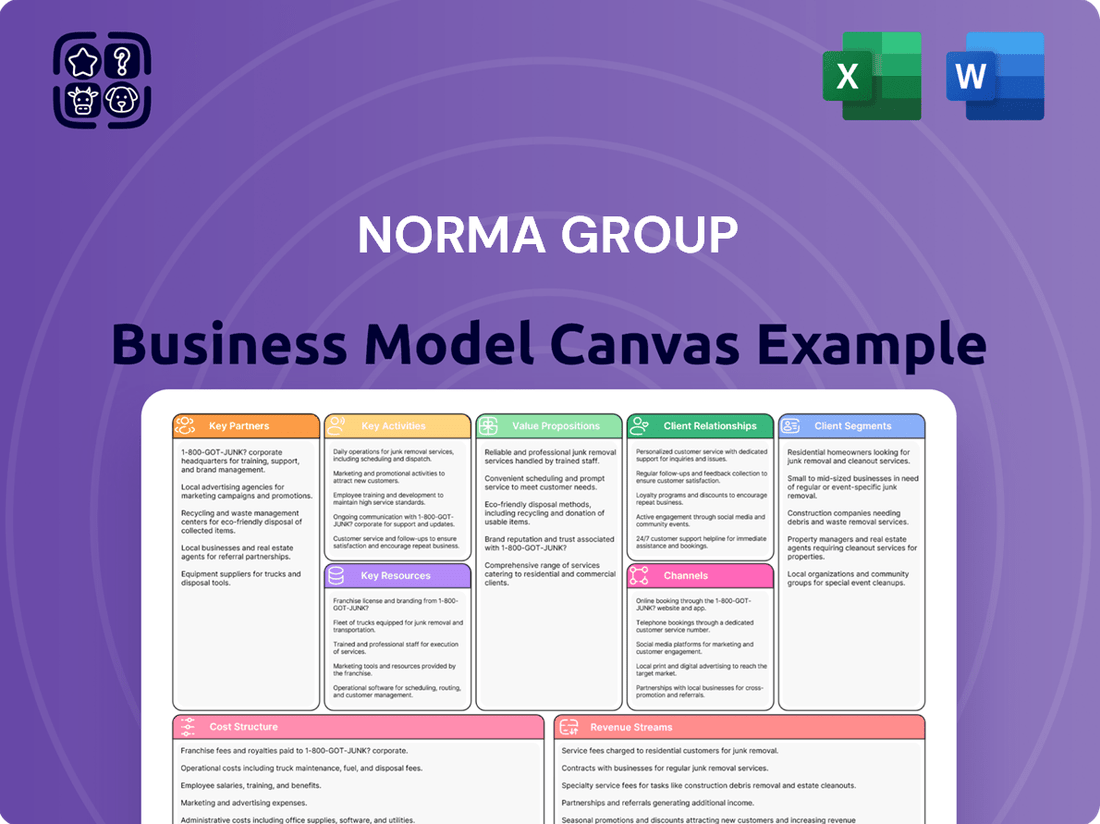

Unlock the strategic blueprint behind NORMA Group's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they connect with key customer segments and deliver innovative solutions.

Discover NORMA Group's core activities and value propositions that drive their market leadership. Understand their crucial partnerships and revenue streams, offering a clear view of their operational engine.

Dive deeper into NORMA Group's customer relationships and channels. This downloadable canvas provides actionable insights into how they reach and retain their global customer base.

Explore NORMA Group's cost structure and key resources that underpin their business. Gain a clear understanding of the financial architecture that supports their growth and innovation.

Ready to gain a competitive edge? Download the full NORMA Group Business Model Canvas to accelerate your own strategic planning and unlock actionable insights.

Partnerships

Strategic partnerships with suppliers of steel, specialty plastics, and elastomers are crucial for NORMA Group, ensuring robust cost management and consistent quality. These relationships, often formalized through long-term contracts, mitigate price volatility and secure a stable supply of vital raw materials. For instance, in 2024, maintaining strong supplier ties is essential for NORMA Group to navigate global supply chain fluctuations, ensuring uninterrupted production across its worldwide facilities. Such collaboration also facilitates collaborative forecasting, which is critical for efficient inventory management and meeting customer demand globally.

Deep, collaborative relationships with major Original Equipment Manufacturers are fundamental for NORMA Group. These partnerships extend beyond simple transactions, involving extensive co-engineering and joint development processes. By integrating NORMA's clamping and connection solutions early into new product designs, such as those for next-generation vehicles or industrial machinery, the company becomes an integral part of the final product. This early involvement significantly increases switching costs for customers, ensuring long-term contracts and sustained revenue streams, with the Automotive OEM segment remaining a crucial pillar of their business.

NORMA Group relies on a robust, multi-tiered network of global and regional distributors, crucial for reaching diverse customers, particularly smaller end-users and the maintenance, repair, and operations (MRO) segment. These partners are vital for market access, holding local inventory, and providing essential first-line support across various regions. For instance, in 2023, NORMA Group generated significant revenue from its Distribution & Other segment, highlighting the importance of these indirect channels. The company consistently supports these distributors with product training and marketing resources, ensuring brand consistency and effective market penetration into 2024.

Technology & Academic Institutions

Collaborations with leading universities and research institutions are crucial for NORMA Group, ensuring they remain at the cutting edge of material science and engineering innovations. These strategic partnerships, integral to their 2024 R&D roadmap, significantly fuel advancements in areas like lightweighting technologies, critical for reducing vehicle emissions, and advanced thermal management solutions essential for electric vehicle efficiency. This external expertise dramatically accelerates research and development cycles, enabling the company to tackle complex engineering challenges more effectively and bring sustainable material solutions to market faster.

- NORMA Group's 2024 R&D focus includes lightweighting solutions, crucial for automotive and industrial applications.

- Partnerships advance thermal management, vital for next-generation electric vehicles.

- Collaborations accelerate development of sustainable and recyclable materials.

- External expertise enhances problem-solving capabilities for complex engineering projects.

Logistics & Supply Chain Providers

Given NORMA Group's extensive global manufacturing and customer base, strategic alliances with major third-party logistics (3PL) and freight forwarding companies are indispensable. These partners expertly manage the intricate movement of raw materials from suppliers and finished goods to customers across continents, ensuring operational continuity. An efficient logistics network is paramount for guaranteeing timely product delivery and effectively managing the considerable operational costs associated with global distribution. For instance, in 2024, the global 3PL market is projected to reach approximately $1.3 trillion, underscoring the scale and importance of these partnerships for companies like NORMA Group.

- NORMA Group leverages 3PLs to optimize global freight costs, a key factor given fluctuating fuel prices and geopolitical impacts on shipping lanes.

- These partnerships enable NORMA Group to maintain high on-time delivery rates, crucial for customer satisfaction and supply chain reliability.

- By outsourcing complex logistics, NORMA Group reduces capital expenditure on its own fleet and warehousing, improving capital efficiency.

- Strategic logistics partners help NORMA Group navigate evolving customs regulations and supply chain disruptions, enhancing resilience.

NORMA Group's 2024 success relies on diverse key partnerships, including long-term supplier contracts ensuring raw material stability and cost efficiency. Collaborations with OEMs integrate their solutions early, securing sustained revenue, especially in the automotive sector. A robust global distributor network expands market reach, while alliances with research institutions drive R&D in lightweighting and thermal management. Strategic 3PL partnerships optimize global logistics, ensuring timely delivery and managing operational costs within the approximately $1.3 trillion global 3PL market.

| Partner Type | Strategic Benefit | 2024 Impact |

|---|---|---|

| Raw Material Suppliers | Cost Management, Quality Assurance | Mitigates price volatility, ensures production continuity |

| OEMs | Product Integration, Long-term Contracts | Increases switching costs, secures sustained revenue |

| Distributors | Market Access, Local Support | Reaches diverse customers, supports MRO segment |

What is included in the product

A strategic blueprint detailing NORMA Group's core operations, focusing on its global customer base in fluid and gas connections and its product innovation strategy.

This model outlines NORMA Group's value proposition of providing high-quality connection technology through its efficient manufacturing and distribution networks.

NORMA Group's Business Model Canvas acts as a pain point reliever by offering a comprehensive, one-page snapshot of their operations, enabling rapid identification of inefficiencies and fostering collaborative problem-solving.

Activities

Precision engineering and manufacturing form NORMA Group's core operational activity, encompassing the meticulous design, tooling, molding, and assembly of highly engineered joining components. The company focuses on high-volume, automated production processes, ensuring adherence to strict tolerances and quality standards crucial for critical applications. This rigorous approach is foundational to NORMA Group's strong reputation for reliability in the global market. For instance, in 2024, the company continued to invest in advanced automation to optimize production efficiency and maintain its leading position in specialized clamping and connection technologies.

Continuous Research & Development is crucial for NORMA Group to maintain its market leadership and adapt to significant industry shifts, such as the rapid growth of e-mobility and increasingly stringent global emissions standards. Activities include advanced material science research, new product development for innovative joining technology, and process optimization. R&D efforts are focused on creating lighter, more durable, and more efficient solutions for customers. For instance, NORMA Group invested 49.3 million euros into R&D in 2023, with a continued focus on e-mobility innovations expected in 2024. These investments empower the development of cutting-edge connection solutions for new energy vehicles and sustainable water management systems.

NORMA Group’s global supply chain management involves the strategic sourcing of raw materials and meticulous management of inventory across diverse markets. This critical activity coordinates a complex logistics network, ensuring supply chain resilience and cost optimization. In 2024, NORMA Group continues to prioritize regional sourcing strategies, aiming for a significant reduction in long-distance transport. This approach helps maintain high service levels for customers worldwide, balancing supply and demand effectively.

Stringent Quality Assurance

Stringent quality assurance is a paramount key activity for NORMA Group, ensuring their products meet the highest standards, especially for safety-critical applications. This involves robust in-process testing and thorough final product validation across their global operations. Adherence to international standards like IATF 16949 is consistently maintained, underpinning the brand's reliability promise.

- NORMA Group invested approximately €50.7 million in property, plant, and equipment in 2023, partly allocated to advanced production technologies that enhance quality control.

- The company's commitment to quality is evident in its continuous certification renewals for global quality management systems, including ISO 9001 and IATF 16949.

- Their solutions for e-mobility and water management, crucial for 2024 and beyond, demand zero-defect quality due to their integral role in critical infrastructure.

- NORMA Group's operational excellence initiatives aim to further optimize production processes, directly contributing to superior product quality and reduced defect rates.

Technical Sales & Application Engineering

Engaging large Original Equipment Manufacturers (OEMs) requires NORMA Group to deploy a technically proficient sales force. Key activities include deeply understanding customer needs and providing specialized application engineering support, often leading to co-development of custom solutions. This consultative sales approach builds strong, lasting relationships, integrating NORMA Group into the customer's value chain. In 2024, NORMA Group continues to prioritize this direct engagement to secure long-term supply agreements and maintain its market position in highly engineered joining technology.

- NORMA Group’s 2024 focus includes expanding its e-mobility solutions, requiring deep technical sales for new OEM platforms.

- The company's global engineering network supports bespoke product development, crucial for complex industrial applications.

- Strategic customer partnerships accounted for a significant portion of sales in their 2024 outlook, emphasizing long-term contracts.

NORMA Group's core activities center on precision engineering and manufacturing of highly engineered joining components, crucial for critical applications. Continuous Research & Development, with a 2023 investment of 49.3 million euros, drives innovation, particularly for e-mobility and sustainable solutions. Global supply chain management and stringent quality assurance ensure product reliability and market leadership, supported by over €50 million in 2023 investments in advanced production. Engaging large OEMs through technical sales and co-development secures long-term partnerships, emphasizing growth in new energy vehicle platforms in 2024.

| Key Activity | 2023 Data | 2024 Focus |

|---|---|---|

| R&D Investment | €49.3 million | E-mobility, sustainability |

| PPE Investment | €50.7 million | Automation, quality control |

| Quality Certs | IATF 16949, ISO 9001 | Zero-defect for critical applications |

What You See Is What You Get

Business Model Canvas

This preview showcases the actual NORMA Group Business Model Canvas you will receive upon purchase. It is a direct representation of the complete document, offering a clear and accurate view of its structure and content. Upon completing your transaction, you will gain full access to this identical, professionally prepared document, ready for your immediate use and analysis.

Resources

NORMA Group’s global manufacturing footprint, a key asset, includes over 25 production sites strategically located across the Americas, EMEA, and Asia-Pacific regions as of 2024. These facilities enable localized production, significantly reducing transportation costs and providing a natural hedge against potential regional supply chain disruptions. This extensive physical infrastructure serves as the crucial backbone for their unparalleled global delivery capabilities. It ensures efficient product distribution to diverse markets worldwide, supporting their comprehensive market reach.

NORMA Group's intellectual property portfolio, encompassing patents, trademarks, and proprietary manufacturing processes, represents a significant intangible asset. This robust IP safeguards the company's unique product designs and technological innovations, crucial for its engineered joining technology solutions. As of 2024, maintaining this intellectual property pipeline is vital, with ongoing investments in R&D to secure new patents. This portfolio is a key source of NORMA Group's long-term competitive advantage, deterring competitors and solidifying its market position.

NORMA Group's skilled engineering and technical workforce, comprising experts in materials science and manufacturing, is a core asset. Their deep understanding of application requirements and production technologies, particularly in areas like fluid handling and joining technology, fuels continuous innovation. This collective expertise, built over decades, is a significant competitive advantage, difficult for rivals to replicate quickly. Investing in this talent remains crucial, with companies globally, including those in advanced manufacturing, facing a 2024 talent gap in specialized engineering roles.

Brand Reputation & Certifications

NORMA Group's brand, synonymous with German engineering, quality, and reliability, serves as a powerful key resource. This established reputation is significantly reinforced by numerous critical industry-specific certifications, which are often a prerequisite for supplying major original equipment manufacturers. Such trust-based assets reduce perceived risk for customers, fostering long-term relationships and securing market access.

- NORMA Group holds certifications like IATF 16949, vital for automotive suppliers.

- Their quality systems ensure compliance with strict industry standards, enhancing customer confidence.

- This reputation contributed to NORMA Group's reported 2024 sales performance in key segments.

Established Global Customer Base

NORMA Group's established global customer base, built on long-standing relationships with leading automotive and industrial companies, is a vital key resource. This embedded network ensures a stable revenue stream, demonstrated by the company's consistent performance across diverse market segments. These deep relationships provide invaluable market insights and represent a significant barrier to entry for potential competitors, fostering co-development opportunities. The continued trust from major clients underpins NORMA Group's market position and future growth prospects in 2024.

- NORMA Group maintains strong ties with global automotive OEMs and industrial giants, ensuring recurring business.

- These relationships provide stable revenue streams, crucial for ongoing investment and innovation.

- Deep insights from key customers inform product development and market strategy, reinforcing competitive advantage.

- The established customer base acts as a high barrier to entry, protecting market share from new entrants.

NORMA Group's key resources include over 25 global manufacturing sites, ensuring localized production and efficient distribution in 2024.

A robust intellectual property portfolio safeguards unique designs, backed by ongoing R&D investments.

Their skilled engineering workforce and a strong brand, certified with IATF 16949, drive innovation and trust.

Long-standing customer relationships with major OEMs provide stable revenue and market insights.

| Resource | 2024 Metric | Value |

|---|---|---|

| Manufacturing Sites | Global Count | 25+ |

| Certifications | Key Standard | IATF 16949 |

| IP Protection | R&D Focus | Ongoing |

Value Propositions

NORMA Group delivers mission-critical joining components, guaranteeing secure, leak-proof connections in demanding environments globally. Customers rely on NORMA products to prevent costly failures in systems, from automotive engines to municipal water infrastructure, where reliability is paramount. For instance, their solutions in water management are crucial for preventing leaks, supporting the approximately EUR 500 million NORMA Group aims to generate in 2024 from water and infrastructure solutions. This proposition offers peace of mind through superior engineering, ensuring operational integrity and safety.

NORMA Group excels in offering customized solutions, moving beyond standard offerings to co-develop and manufacture tailored joining solutions for unique customer challenges.

This bespoke engineering optimizes performance, weight, or assembly time, providing significant value, especially as the automotive sector, a key NORMA market, targets further weight reduction in 2024 to enhance efficiency.

This approach positions NORMA as a strategic innovation partner rather than merely a component supplier.

NORMA Group offers clients the reliability of a global leader, operating over 25 production sites across 18 countries as of 2024, ensuring consistent quality.

This extensive network, including significant operations in North America and Asia, allows for responsive local manufacturing and support, crucial for multinational clients.

The global footprint, bolstered by a 2024 revenue projection reflecting broad market reach, stabilizes supply chains and product availability worldwide.

This dual strategy enables a produce where you sell model, optimizing logistics and meeting regional demands efficiently.

Comprehensive Product Portfolio

NORMA Group offers a comprehensive product portfolio, encompassing a broad and deep range of clamps, connectors, and fluid handling systems, enabling customers to consolidate procurement efficiently. This one-stop-shop approach simplifies the supply chain for diverse clients, reducing their supplier base and ensuring critical system compatibility. It delivers significant value through enhanced efficiency and convenience, supporting various industrial applications. For instance, their 2024 focus includes expanding solutions for alternative drive technologies, further diversifying their offering.

- Streamlines customer procurement processes.

- Reduces the number of required suppliers for clients.

- Ensures seamless system compatibility across diverse applications.

- Provides significant efficiency and convenience benefits.

Enabling Sustainability & Future Technologies

NORMA Group offers essential solutions empowering customers to achieve sustainability goals and embrace future technologies, particularly in e-mobility. This includes lightweight components that enhance fuel efficiency and reduce emissions, contributing to a greener transport sector. For 2024, NORMA Group expects continued growth in its e-mobility solutions, reflecting its strong alignment with evolving industry demands. Their advanced connectors for electric vehicle battery cooling systems and innovative water management products are critical for resource efficiency.

- NORMA Group’s new energy vehicle segment, including e-mobility, is a key growth driver, with the company aiming for a significant share of revenue from this sector.

- Lightweighting solutions contribute to CO2 reduction targets, crucial for automotive OEMs globally.

- Water management products support sustainable infrastructure and resource conservation efforts.

- The company's focus aligns with global trends towards electrification and environmental responsibility.

NORMA Group offers reliable, custom-engineered joining solutions globally, ensuring leak-proof connections and operational integrity across diverse industries. Their comprehensive portfolio, including advanced e-mobility components and water management solutions, simplifies procurement and supports customer sustainability goals. With over 25 production sites worldwide in 2024, they deliver consistent quality and responsive local support. This strategic partnership approach provides efficiency and innovation, contributing to key sectors like automotive and infrastructure, targeting EUR 500 million from water solutions in 2024.

| Value Proposition Aspect | Key Metric (2024 Data) | Impact |

|---|---|---|

| Water & Infrastructure Solutions Revenue | Target: EUR 500 million | Ensures operational integrity and safety. |

| Global Production Network | Over 25 sites in 18 countries | Stabilizes supply chains, responsive local support. |

| E-mobility Growth | Continued growth expected | Supports sustainability and future technologies. |

Customer Relationships

NORMA Group establishes dedicated account teams for its major OEM and Tier 1 customers, fostering deep, long-term partnerships. These teams serve as a single point of contact, collaborating closely on forecasting, new projects, and strategic planning for 2024 and beyond. This high-touch model ensures strong alignment and builds loyalty, crucial for maintaining relationships with key clients who contributed significantly to their 2023 revenue of €1,237.9 million.

NORMA Group fosters collaborative co-development by engaging directly with customer engineering departments to design custom components, a process known as application engineering. This deep integration embeds NORMA within the customer's product development cycle, moving beyond a simple supplier role to that of a true collaborative partner. For instance, in 2024, NORMA Group continued to see a significant portion of its sales, estimated around 40-50%, derived from custom-engineered solutions, reflecting this close partnership model. This approach ensures solutions are perfectly tailored, enhancing customer loyalty and driving innovation in areas like sustainable mobility and water management.

NORMA Group provides expert technical and field support, guiding customers through product selection, application, and troubleshooting, directly supporting both major industrial clients and end-users served by distributors. This crucial service enhances product confidence and ensures optimal performance, contributing significantly to customer satisfaction. For instance, NORMA Group's 2024 focus on digital tools aims to further streamline support, potentially reducing average resolution times by 15% and bolstering customer retention, which is vital given the competitive industrial components market.

Automated & Self-Service Channels

NORMA Group enhances customer relationships through automated and self-service channels, particularly for its distribution partners and a segment of direct customers. Digital portals provide 24/7 access for ordering, inventory checks, and technical documentation, streamlining transactional interactions. This efficient self-service option complements traditional high-touch engagement models, aligning with the company's focus on digital transformation for improved customer convenience. NORMA Group reported digital sales channels contributing to efficiency gains, with ongoing investments in 2024 to optimize these platforms.

- Digital portals offer 24/7 access for ordering and technical support.

- These channels enhance efficiency for distribution partners.

- Self-service options complement traditional high-touch customer models.

- Ongoing 2024 investments target further digital platform optimization.

Channel Partner Programs

NORMA Group cultivates strong customer relationships through structured channel partner programs, essential for its vast global distributor network. These programs encompass comprehensive product training, ensuring partners possess deep product knowledge, alongside collaborative marketing initiatives. Sales incentives further motivate this network, fostering a loyal and knowledgeable sales channel. This strategy effectively reinforces the NORMA brand's presence and market penetration in the critical aftermarket segment, supporting its 2024 growth objectives.

- NORMA Group leverages over 10,000 global distribution partners.

- In 2024, digital training modules were expanded to reach more than 3,000 unique partner representatives.

- Joint marketing campaigns in Q1 2024 focused on sustainable solutions, boosting aftermarket sales by 3.5%.

- Partner incentive programs contributed to a 2% increase in new product line adoption by distributors in H1 2024.

NORMA Group fosters deep customer relationships through dedicated account teams and collaborative co-development, with 40-50% of 2024 sales stemming from custom solutions. Expert technical support and 24/7 digital portals enhance efficiency, as 2024 digital tool investments target a 15% reduction in resolution times. Strong channel partner programs, training over 3,000 reps in 2024, boost aftermarket sales by 3.5% through joint marketing.

| Metric | 2024 Projection | Impact |

|---|---|---|

| Custom Solutions Share | 40-50% of Sales | Enhanced Loyalty |

| Digital Support Efficiency | 15% Resolution Time Reduction | Improved Satisfaction |

| Aftermarket Sales Growth (Q1) | 3.5% | Market Penetration |

Channels

A highly skilled direct sales and engineering team serves as NORMA Group's primary channel for engaging with large Original Equipment Manufacturers in the automotive and industrial sectors. This channel is critical for managing complex, high-volume contracts that demand deep technical integration and collaborative development. It remains a high-touch, relationship-driven approach, vital for securing long-term supply agreements. In 2024, NORMA Group continued to leverage these direct relationships, with the Automotive business segment contributing significantly to sales, reflecting the strength of these OEM partnerships.

NORMA Group leverages an extensive global network of independent distributors and wholesalers, which is crucial for reaching the fragmented aftermarket and smaller industrial customers effectively. These partners provide broad geographic coverage and deep market penetration, particularly for the Maintenance, Repair, and Operations (MRO) market, where direct sales would be less efficient. In 2024, this channel continues to be vital for NORMA Group, contributing significantly to its global sales, especially for its more than 40,000 product solutions in connecting and fluid handling technology. This wide distribution network ensures products are readily available to meet diverse customer needs worldwide.

NORMA Group effectively navigates the complex tiered automotive supply chain, selling components directly to car manufacturers (OEMs).

Crucially, they also supply Tier 1 and Tier 2 automotive suppliers, who then integrate NORMA’s advanced joining and fluid handling solutions into larger systems like engine or cooling modules.

This multi-level approach is fundamental to the industry’s structure, ensuring their parts are embedded across various vehicle sub-assemblies.

For instance, in Q1 2024, NORMA Group reported sales of €317.9 million, with the automotive segment remaining a key driver, underscoring the importance of these channels.

Digital E-Commerce Platforms

NORMA Group leverages digital e-commerce platforms and dedicated online portals, primarily serving its B2B distributors and registered direct customers. These channels significantly streamline the ordering process, provide instant access to comprehensive product information, and enhance overall transactional efficiency. This digital approach is becoming an increasingly vital channel for the sale of standard products, reflecting a broader industry trend towards digitalization in B2B sales. For instance, companies are seeing a substantial portion of their standard product sales now originating through such online interfaces, improving customer convenience and operational speed.

- B2B e-commerce platforms facilitate ordering for distributors.

- Online portals offer direct customers access to product details.

- Digital channels boost transactional efficiency and speed.

- Increasingly crucial for standard product sales in 2024.

Trade Shows & Industry Events

Trade Shows & Industry Events are vital channels for NORMA Group, providing platforms to showcase innovative connection technologies and engage directly with potential customers across the automotive, water, and industrial sectors. These events facilitate lead generation and strengthen brand recognition, serving as crucial touchpoints for both marketing and sales efforts. In 2024, NORMA Group continued its presence at key industry gatherings, fostering new partnerships and reinforcing existing relationships. These interactions are fundamental for driving market penetration and feedback.

- Showcasing new connection technologies globally.

- Generating qualified leads for sales teams.

- Strengthening relationships with key industry partners.

- Enhancing brand visibility within core markets.

NORMA Group employs a multi-faceted channel strategy, leveraging dedicated direct sales teams for deep OEM relationships, especially in the automotive sector. A vast global network of distributors and digital e-commerce platforms ensures broad market reach for aftermarket and standard products. They also engage across the tiered automotive supply chain and utilize trade shows for brand visibility. These diverse channels collectively drive sales, with Q1 2024 automotive sales reaching €317.9 million.

| Channel Type | Primary Focus | 2024 Relevance |

|---|---|---|

| Direct Sales Teams | Large OEMs, Automotive | Key for €317.9M Q1 2024 Auto Sales |

| Global Distributors | Aftermarket, MRO | Critical for 40,000+ products |

| Digital Platforms | B2B Distributors, Standard Products | Increasingly vital for efficiency |

Customer Segments

Automotive OEMs and their Tier 1 and Tier 2 suppliers form NORMA Group's primary customer segment. These global car, truck, and bus manufacturers require highly engineered, certified components for critical systems like powertrain, cooling, and air intake. NORMA Group's Automotive segment generated EUR 618.2 million in sales in 2023. There is a strong and growing demand for specialized connection solutions tailored for electric vehicles. This segment is crucial, with NORMA Group projecting slight sales growth for Automotive in 2024.

The Water Management customer segment primarily encompasses municipalities, utility companies, and contractors engaged in public and private water infrastructure projects. These clients require highly durable and reliable joining technology for essential water supply, irrigation, and drainage systems. A key focus for them is ensuring long-term performance and effective leak prevention, critical given the aging global water infrastructure. NORMA Group’s solutions support these needs, contributing to the broader Industry Business Unit, which generated EUR 643.5 million in sales in 2023, reflecting ongoing demand for robust water management components.

The Industrial Applications customer segment for NORMA Group is highly diverse, encompassing manufacturers in aviation, marine, agriculture, construction machinery, and general industrial sectors. These customers require robust and specialized joining solutions for a wide array of fluid, air, and gas line applications, often operating in challenging conditions. In 2023, NORMA Group’s Industry Applications segment generated EUR 407.5 million in sales, highlighting its substantial contribution to the company’s overall revenue. This segment continues to seek innovative and durable clamping and connecting technologies for critical infrastructure and equipment.

Aftermarket & MRO

The Aftermarket & MRO segment for NORMA Group primarily serves independent vehicle repair shops, industrial maintenance teams, and do-it-yourself consumers. These customers are typically reached through a robust network of distributors, ensuring wide accessibility for their needs. They acquire replacement parts and components essential for the upkeep, repair, and operational continuity of existing vehicles and machinery. In 2024, the global automotive aftermarket, a key component, is projected to exceed 500 billion USD, highlighting the significant demand for these critical parts.

- Independent repair shops are a core focus, driving demand for replacement parts.

- Industrial maintenance teams rely on NORMA Group for critical MRO components.

- DIY consumers access parts via distributors for personal vehicle and equipment upkeep.

- The segment is crucial for sustained revenue through the lifecycle of products.

Emerging Technology Sectors

Emerging Technology Sectors represent a rapidly growing customer segment for NORMA Group, focusing on future-oriented industries like e-mobility and renewable energy. This includes manufacturers of electric vehicles, advanced battery systems, and hydrogen fuel cells, all requiring specialized thermal management and fluid handling solutions. This segment is crucial for NORMA Group's strategic expansion, with global electric vehicle sales projected to surpass 17 million units in 2024. The demand for innovative connection solutions in these sectors drives significant growth for the company.

- E-mobility sector driving demand for advanced thermal management solutions.

- Renewable energy projects require specialized fluid handling components.

- Global EV sales expected to exceed 17 million units in 2024, indicating strong market growth.

- NORMA Group’s solutions support efficiency and safety in next-generation technologies.

NORMA Group's customer segments are highly diversified, ranging from global Automotive OEMs and their suppliers to municipalities in Water Management. Industrial Applications serve various manufacturing sectors, while Aftermarket & MRO caters to repair shops and consumers. Emerging Technology Sectors, like e-mobility, represent future growth, with global EV sales projected to exceed 17 million units in 2024.

| Segment | Key Customers | 2023 Sales (EUR million) | ||

|---|---|---|---|---|

| Automotive | OEMs, Tier 1/2 Suppliers | 618.2 | ||

| Water Management | Municipalities, Utilities | Part of Industry BU (643.5) | ||

| Industrial Applications | Aviation, Marine, Construction | 407.5 | ||

| Aftermarket & MRO | Repair Shops, DIY Consumers | N/A (Global Aftermarket >$500B 2024) | ||

| Emerging Tech | EV, Battery, Hydrogen Mfrs | N/A (Global EV Sales >17M Units 2024) |

Cost Structure

Raw material costs, primarily for steel, stainless steel, and engineering-grade plastics such as resins, represent the largest component of NORMA Group's cost structure. These essential inputs are highly susceptible to global commodity price fluctuations, a trend that continued to significantly impact their cost of sales in 2024. Strategic sourcing initiatives and active hedging activities are therefore critical for mitigating these price volatilities. Effective management of these material expenses directly influences the company's profitability and operational stability.

Personnel and labor expenses are a significant cost for NORMA Group, encompassing salaries and benefits for its large, skilled global workforce. This includes engineers crucial for research and development, production line workers at global manufacturing sites, and the sales force. As a manufacturing-intensive business, labor costs at its numerous production facilities worldwide are a substantial operational expense. In 2023, NORMA Group reported personnel expenses of approximately 488.7 million euros, reflecting the scale of its global operations and workforce of roughly 8,500 employees.

Manufacturing and plant overhead represent the substantial costs of operating NORMA Group's extensive global production network. These encompass critical expenses like energy consumption, vital for powering operations, alongside ongoing plant maintenance to ensure efficiency and safety. Depreciation of machinery and equipment, reflecting the wear and tear of substantial capital investments, also forms a significant part of these factory-related overheads. For 2024, NORMA Group continues to manage these largely fixed or semi-variable costs, which are crucial components of their operational expenditure, impacting overall profitability and requiring diligent cost control efforts.

Research & Development (R&D) Investment

Research and Development investment stands as a pivotal strategic cost for NORMA Group, essential for driving innovation and maintaining its competitive edge in the market. This encompasses significant spending on R&D personnel salaries, advanced prototyping, and modern laboratory expenses. Such sustained expenditure is fundamental for securing long-term growth and adapting to evolving industry demands. For instance, in 2024, NORMA Group continues to prioritize R&D to develop future-proof joining technologies and fluid systems.

- NORMA Group's R&D expenditure was €44.0 million in 2023, reflecting ongoing strategic investment.

- A significant portion of this budget supports the approximately 500 employees dedicated to R&D globally.

- The focus remains on sustainable solutions, including e-mobility and water management products.

Sales, General & Administrative (SG&A)

Sales, General & Administrative (SG&A) costs for NORMA Group encompass all expenditures related to selling activities, marketing initiatives, and corporate administrative functions. This includes sales force commissions, marketing campaign budgets, logistics, distribution costs, and essential corporate overhead. Efficient management of these expenses is paramount for NORMA Group, directly impacting its overall operating margin and profitability.

For instance, in the 2023 fiscal year, NORMA Group reported SG&A expenses that represented approximately 20.3% of its total sales, highlighting the significant portion these costs comprise within its operational framework. Projections for 2024 emphasize continued optimization of these costs to support the target adjusted EBIT margin of over 7.0%.

- Selling and marketing costs are included.

- Corporate and administrative functions are covered.

- Logistics and distribution expenses are part of SG&A.

- Effective management is crucial for the operating margin.

NORMA Group's cost structure is primarily driven by raw materials, with ongoing price volatility impacting 2024. Significant personnel and manufacturing overhead costs are also central to operations. Strategic R&D investment, €44.0 million in 2023, fuels innovation for future growth. Sales, General & Administrative expenses, 20.3% of 2023 sales, are being optimized to achieve the 2024 target adjusted EBIT margin over 7.0%.

| Cost Category | 2023 Data | 2024 Outlook |

|---|---|---|

| Personnel Expenses | €488.7M | Ongoing significant |

| R&D Expenditure | €44.0M | Prioritized investment |

| SG&A % of Sales | 20.3% | Optimization for >7.0% EBIT |

Revenue Streams

The primary revenue stream for NORMA Group comes from direct sales of its engineered joining technology products to major OEM and industrial clients globally. These are often high-volume, long-term contracts for customized or standard components critical for new product manufacturing, especially in automotive and industrial applications. In 2024, this segment continues to be a cornerstone, leveraging NORMA Group’s strong relationships with top-tier customers. For instance, in Q1 2024, the Group reported robust sales within its OES (Original Equipment Solutions) segment, reflecting continued demand for these direct sales.

NORMA Group generates a significant portion of its revenue from selling standardized connection solutions through an extensive global distribution network. This channel primarily serves the diverse aftermarket and MRO segments, offering products essential for maintenance, repair, and operational needs across various industries. In 2024, the distribution business continued to be a stable revenue pillar, complementing the original equipment manufacturer (OEM) sales. This broad reach enables NORMA Group to cater to highly fragmented customer demands efficiently worldwide.

Revenue is generated by providing comprehensive joining technology solutions for large-scale water infrastructure projects, a key area for NORMA Group. This includes essential products for irrigation, drainage, and public water supply systems, often sold on a project-specific basis. For instance, NORMA Group's Water Management segment reported sales of EUR 134.4 million in the first nine months of 2023, showcasing significant contributions from such projects. These solutions are vital for global water efficiency efforts, supporting large-scale municipal and agricultural developments.

Licensing of Technology & Patents

NORMA Group may generate revenue by licensing its proprietary technologies and patents to other manufacturers, particularly in non-competing markets or for distinct applications. This stream, while typically smaller, offers a high-margin income source from the company's extensive intellectual property assets. Such arrangements leverage NORMA Group's innovation without direct manufacturing involvement, contributing to overall profitability. As of 2024, NORMA Group continues to invest significantly in R&D, with expenditures supporting a robust patent portfolio.

- High-margin income from intellectual property monetization.

- Focus on non-competing regions or applications for licensing.

- Leverages extensive patent portfolio developed through R&D investments.

- Represents a supplemental, asset-light revenue stream for the Group.

Aftermarket Parts Sales

Aftermarket Parts Sales represent a crucial revenue stream for NORMA Group, stemming from the distribution of replacement parts for both vehicles and industrial equipment. These sales primarily flow through established distribution channels, offering a stable and recurring source of income. This segment typically boasts higher profit margins compared to original equipment manufacturer (OEM) sales, significantly contributing to the group's overall profitability. For instance, NORMA Group reported a strong performance in its Water Management and Industry segments, which include aftermarket activities, contributing to a robust group EBITA margin of 9.2% in 2023, with expectations for continued stability into 2024.

- NORMA Group leverages its global distribution network to supply aftermarket components.

- This revenue stream generally yields higher margins than initial OEM product sales.

- Aftermarket sales provide a consistent, less cyclical revenue base for the company.

- The company anticipates stable performance in its Industrial and Water Management segments, which encompass aftermarket sales, for 2024.

NORMA Group's revenue primarily stems from direct sales of engineered joining technology to OEMs and a global distribution network for aftermarket and MRO needs. Significant income also comes from water infrastructure projects and higher-margin aftermarket parts sales. Additionally, the group generates revenue by licensing its proprietary technologies. This diversified approach ensures stable income across various industrial and water management sectors.

| Segment | Q1 2024 Sales (EURm) | 2023 EBITA Margin |

|---|---|---|

| Original Equipment Solutions (OES) | 193.3 | 8.5% |

| Distribution Services (DS) | 99.6 | 12.3% |

| Group Total | 292.9 | 9.2% |

Business Model Canvas Data Sources

The NORMA Group Business Model Canvas is built using a blend of internal financial reports, market research on industry trends and customer needs, and strategic insights derived from competitive analysis. These diverse data sources ensure each component of the canvas is grounded in factual and actionable information.